Decarbonization Pathways in Selected MENA Countries: Panel Evidence on Transport Services, Renewable Energy, and the EKC Hypothesis

Abstract

1. Introduction

2. Literature Review

3. Research Area

4. Data Methodology

4.1. Data Description

4.2. Methodology

4.2.1. Panel Data—Unit Root Tests

4.2.2. Panel Data—Cointegration Tests

4.2.3. FMOLS and DOLS Estimators for Long-Run Relationships

5. Results

5.1. Panel Unit Root and Cointegration Test Results

5.2. FMOLS and DOLS Estimation Results

5.3. Granger Causality Test Results

6. Conclusions-Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Alshaikh, S.A.; Akeel, H.; Alzayer, J.; Darandary, A.; Drine, I.; Durani, F.; Zebran, A. Economic Diversification in the Mena region. G20 Insights Policy Brief. 2020. Available online: https://www.global-solutions-initiative.org/publication/economic-diversification-in-the-mena-region/ (accessed on 20 September 2025).

- Aloughani, M. Decarbonization and renewables in the Gulf cooperation council (GCC): A critical review. Int. J. Renew. Energy Res. 2024, 14, 595–612. [Google Scholar] [CrossRef]

- Ouedraogo, N.S. Transition pathways for North Africa to meet its (intended) nationally determined contributions ((I) NDCs) under the Paris Agreement: A model-based assessment. Clim. Policy 2020, 20, 71–94. [Google Scholar] [CrossRef]

- Al-Ayouty, I. Economic Complexity and Renewable Energy Effects on Carbon Dioxide Emissions: A Panel Data Analysis of Middle East and North Africa Countries. J. Knowl. Econ. 2024, 15, 12006–12025. [Google Scholar] [CrossRef]

- Ghaderi, Z.; Saboori, B.; Khoshkam, M. Revisiting the environmental Kuznets curve hypothesis in the MENA region: The roles of international tourist arrivals, energy consumption and trade openness. Sustainability 2023, 15, 2553. [Google Scholar] [CrossRef]

- Kong, C.; Zhang, J.; Ntarmah, A.H.; Kong, Y.; Zhao, H. Carbon neutrality in the Middle East and North Africa: The roles of renewable energy, economic growth, and government effectiveness. Int. J. Environ. Res. Public Health 2022, 19, 10676. [Google Scholar] [CrossRef]

- UNCTAD. Review of Maritime Transport United Nations Conference on Trade and Development. Available online: https://unctad.org/webflyer/review-maritime-transport-2023 (accessed on 25 September 2025).

- World Bank. Middle East and North Africa Economic Update: Growth in Turbulent Times. Available online: https://www.worldbank.org/en/region/mena/publication/mena-economic-monitor (accessed on 25 September 2025).

- Saidi, S. Freight transport and energy consumption: What impact on carbon dioxide emissions and environmental quality in MENA countries? Econ. Change Restruct. 2021, 54, 1119–1145. [Google Scholar] [CrossRef]

- World Bank. Climate Action: A Catalyst for Egypt’s Prosperity and Sustainable Growth; World Bank: Washington, DC, USA, 2024; Available online: https://www.worldbank.org/en/news/feature/2024/11/25/climate-action-a-catalyst-for-egypt-s-prosperity-and-sustainable-growth?utm_source (accessed on 25 September 2025).

- IRENA. Pan-Arab Renewable Energy Strategy 2030: Roadmap of Actions; IRENA: Abu Dhabi, United Arab Emirates, 2024; Available online: https://cleanenergy4africa.org/the-pan-arab-renewable-energy-strategy/?utm_source (accessed on 25 September 2025).

- Salahuddin, M.; Gow, J.; Ozturk, I. Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew. Sustain. Energy Rev. 2015, 51, 317–326. [Google Scholar] [CrossRef]

- Zoundi, Z. CO2 emissions, renewable energy and the Environmental Kuznets Curve, a panel cointegration approach. Renew. Sustain. Energy Rev. 2017, 72, 1067–1075. [Google Scholar] [CrossRef]

- Michailidis, M.; Zafeiriou, E.; Kantartzis, A.; Galatsidas, S.; Arabatzis, G. Governance, Energy Policy, and Sustainable Development: Renewable Energy Infrastructure Transition in Developing MENA Countries. Energies 2025, 18, 2759. [Google Scholar] [CrossRef]

- Carnegie Endowment. Just Energy Transitions: Lessons from Oman and Morocco; Carnegie Endowment: Washington, DC, USA, 2024; Available online: https://carnegieendowment.org/research/2024/05/morocco-oman-energy-transition-oil-exporting-renewable?lang=en&utm_source (accessed on 25 September 2025).

- World Economic Forum. Prioritizing Sustainability in MENA; WEF: Geneva, Switzerland, 2024; Available online: https://www.weforum.org/publications/prioritizing-sustainability-in-mena-mapping-critical-environmental-issues-for-regional-businesses/ (accessed on 25 September 2025).

- Dechamps, P. The IEA World Energy Outlook 2022–a brief analysis and implications. Eur. Energy Clim. J. 2023, 11, 100–103. [Google Scholar] [CrossRef]

- IMF. Morocco RSF Arrangement—Staff Report; IMF: Washington, DC, USA, 2024; Available online: https://www.imf.org/en/Publications/CR/Issues/2024/11/25/Morocco-Second-Review-Under-The-Arrangement-Under-the-Resilience-and-Sustainability-558830 (accessed on 25 September 2025).

- Appiah-Otoo, I.; Chen, X. Exploring the Environmental Impact of Information and Communication Technologies, Population, Economic Growth, and Energy Consumption in MENA Countries. Environ. Model. Assess. 2024, 29, 1003–1021. [Google Scholar] [CrossRef]

- Schoenmaker, D.; Schramade, W. Financing Environmental and Energy Transitions for Regions and Cities: Creating Local Solutions for Global Challenges. Paper for an OECD/EC Workshop on Financing Environmental and Energy Transitions. 18 October 2019. Available online: https://ssrn.com/abstract=3599981 (accessed on 25 September 2025).

- Guillemette, Y.; Château, J. Long-term Scenarios: Incorporating the Energy Transition. In OECD Economics Department Working Papers; OECD Publishing: Paris, France, 2018. [Google Scholar] [CrossRef]

- RCREEE. Arab Future Energy Index (AFEX) 2023 Summary; Regional Center for Renewable Energy and Energy Efficiency: Cairo, Egypt, 2023; Available online: https://rcreee.org (accessed on 25 September 2025).

- El Hafdaoui, H.; Khallaayoun, A.; Al-Majeed, S. Renewable energies in Morocco: A comprehensive review and analysis of current status, policy framework, and prospective potential. Energy Convers. Manag. 2025, X, 100967. [Google Scholar] [CrossRef]

- Egyptian Environmental Affairs Agency. National Environmental Report; EEAA: Cairo, Egypt, 2024. Available online: https://www.eeaa.gov.eg/Uploads/Reports/Files/20230802183320389.pdf?utm_source (accessed on 25 September 2025).

- Oman Vision 2040 Secretariat. Green Mobility Roadmap; Government of Oman: Muscat, Oman, 2024; Available online: https://oman.om/en/home-top-level/eparticipation/oman-vision-2040 (accessed on 25 September 2025).

- International Renewable Energy Agency (IRENA). Renewable Energy Outlook: Lebanon; IRENA: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Algeria. National Inventory Report 2023—Submission under the United Nations Framework Convention on Climate Change (UNFCCC); United Nations Framework Convention on Climate Change (UNFCCC): Bonn, Germany, 2023; Available online: https://unfccc.int/documents/636691 (accessed on 25 September 2025).

- Al-Rawashdeh, R.; Jaradat, A.Q.; Al-Shboul, M. Air pollution and economic growth in MENA countries: Testing EKC hypothesis. Environ. Res. Eng. Manag. 2014, 70, 54–65. [Google Scholar] [CrossRef]

- Gray, N.; McDonagh, S.; O’Shea, R.; Smyth, B.; Murphy, J.D. Decarbonising ships, planes and trucks: An analysis of suitable low-carbon fuels for the maritime, aviation and haulage sectors. Adv. Appl. Energy 2021, 1, 100008. [Google Scholar] [CrossRef]

- OECD. Economic Surveys: Morocco 2024; OECD Publishing: Paris, France, 2024. [Google Scholar] [CrossRef]

- Zumbraegel, T.; Sons, S. Gulf aid goes green: Reflecting on the geopolitics of environmental sustainability assistance in Arab monarchies. J. Gulf Stud. 2024, 1, 145–167. [Google Scholar] [CrossRef]

- Kober, T.; Schiffer, H.W.; Densing, M.; Panos, E. Global energy perspectives to 2060–WEC’s World Energy Scenarios 2019. Energy Strategy Rev. 2020, 31, 100523. [Google Scholar] [CrossRef]

- UNDP. Sustainable Cities Programme–Lebanon; UNDP: Beirut, Lebanon, 2023; Available online: https://lebanon.un.org/en/sdgs/11/key-activities?utm_source (accessed on 25 September 2025).

- Wang, Q.; Zhang, Y.; Li, R. Achieving Sustainable Development: Bridging Economic Growth and Environmental Resilience Through EKC and LCC. Sustain. Dev. 2025, 33, 7629–7656. [Google Scholar] [CrossRef]

- Amoatey, P.; Al-Hinai, A.; Al-Mamun, A.; Baawain, M.S. A review of recent renewable energy status and potentials in Oman. Sustain. Energy Technol. Assess. 2022, 51, 101919. [Google Scholar] [CrossRef]

- El-Katiri, L. The Sustainability of Saudi Arabian Fiscal Policy; Oxford Institute for Energy Studies: Oxford, UK, 2016. [Google Scholar]

- International Monetary Fund (IMF). Economic Prospects for the MENA Region; IMF: Washington, DC, USA, 2020. [Google Scholar]

- Kingdom of Saudi Arabia. Vision 2030; Government of Saudi Arabia: Riyadh, Saudi Arabia, 2016. [Google Scholar]

- UAE Ministry of Energy. UAE Energy Strategy 2050; Government of the United Arab Emirates: Abu Dhabi, United Arab Emirates, 2017. [Google Scholar]

- Government of Egypt. Sustainable Development Strategy: Egypt Vision 2030; Government of Egypt: Cairo, Egypt, 2016. [Google Scholar]

- World Bank. MENA Economic Update: Trading Together; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Economic and Social Commission for Western Asia (ESCWA). Building Forward Better: Social and Economic Recovery in the Arab Region; United Nations: Beirut, Lebanon, 2021. [Google Scholar]

- Zafeiriou, E.; Galatsidas, S.; Moulogianni, C.; Sofios, S.; Arabatzis, G. Evaluating Enteric Fermentation-Driven En-vironmental Kuznets Curve Dynamics: A Bayesian Vector Autoregression Comparative Study of the EU and Least Developed Countries. Agriculture 2024, 14, 2036. [Google Scholar] [CrossRef]

- Zafeiriou, E.; Kyriakopoulos, G.L.; Andrea, V.; Arabatzis, G. Environmental Kuznets curve for deforestation in Eastern Europe: A panel cointegration analysis. Environ. Dev. Sustain. 2023, 25, 9267–9287. [Google Scholar] [CrossRef]

- Zafeiriou, E.; Sofios, S.; Partalidou, X. Environmental Kuznets curve for EU agriculture: Empirical evidence from new entrant EU countries. Environ. Sci. Pollut. Res. 2017, 24, 15510–15520. [Google Scholar] [CrossRef]

- Zafeiriou, E.; Azam, M.; Garefalakis, A. Exploring environmental–economic performance linkages in EU agriculture: Evidence from a panel cointegration framework. Manag. Environ. Qual. Int. J. 2023, 34, 469–491. [Google Scholar] [CrossRef]

- Zafeiriou, E.; Galatsidas, S.; Arabatzis, G.; Tsiantikoudis, S.; Batzios, A. Environmental degradation by energy–economic growth interlinkages in EU agriculture. Energies 2023, 16, 3900. [Google Scholar] [CrossRef]

- Zafeiriou, E.; Mallidis, I.; Galanopoulos, K.; Arabatzis, G. Greenhouse gas emissions and economic performance in EU agriculture: An empirical study in a non-linear framework. Sustainability 2018, 10, 3837. [Google Scholar] [CrossRef]

- Razi, F.; Dincer, I. Renewable Energy Development and Hydrogen Economy in MENA Region: A Review. Renew. Sustain. Energy Rev. 2022, 168, 112763. [Google Scholar] [CrossRef]

- Alarafati, H.K. Mapping Carbon Emissions Implications of Trade Among the GCC Countries. Doctoral Dissertation, Khalifa University of Science, Abu Dhabi, United Arab Emirates, 2023. [Google Scholar]

- Food and Agriculture Organization of the United Nations. The State of Food and Agriculture 2021; Food and Agriculture Organization of the United Nations: Rome, Italy, 2021. [Google Scholar]

- United Nations Development Programme. Facing Multiple Crises: COVID-19–Impact on Vulnerable Households and Enterprises in Jordan; United Nations Development Programme: New York, NY, USA, 2020. [Google Scholar]

- The World Bank. Climate and Development: An Agenda for Action; The World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Economic and Social Commission for Western Asia. World Development Challenges Report 2019; Economic and Social Commission for Western Asia: Beirut, Lebanon, 2019. [Google Scholar]

- Elasha, B. Climate Change Impacts and Responses in the Arab Region: A Review; Economic and Social Commission for Western Asia: Beirut, Lebanon, 2010. [Google Scholar]

- Economic and Social Commission for Western Asia. World Development Challenges Report 2022; Economic and Social Commission for Western Asia: Beirut, Lebanon, 2022. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Economic Growth and the Environment. Quart. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Leal, P.H.; Marques, A.C. The evolution of the environmental Kuznets curve hypothesis assessment: A literature review under a critical analysis perspective. Heliyon 2022, 8, e11521. [Google Scholar] [CrossRef] [PubMed]

- Apergis, N.; Payne, J.E. Renewable and Non-Renewable Energy Consumption-Growth Nexus: Evidence from a Panel Error Correction Model. Energy Econ. 2012, 34, 733–738. [Google Scholar] [CrossRef]

- Androniceanu, A.; Georgescu, I. The impact of CO2 emissions and energy consumption on economic growth: A panel data analysis. Energies 2023, 16, 1342. [Google Scholar] [CrossRef]

- Gereffi, G.; Lim, H.C.; Lee, J. Trade policies, firm strategies, and adaptive reconfigurations of global value chains. J. Int. Bus. Policy 2021, 4, 506. [Google Scholar] [CrossRef]

- Sadorsky, P. Do Urbanization and Industrialization Affect Energy Intensity in Developing Countries? Energy Econ. 2013, 37, 52–59. [Google Scholar] [CrossRef]

- Stern, D.I. The Rise and Fall of the Environmental Kuznets Curve. World Dev. 2004, 32, 1419–1439. [Google Scholar] [CrossRef]

- Lau, L.S.; Choong, C.K.; Eng, Y.K. Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: Do foreign direct investment and trade matter? Energy Policy 2014, 68, 490–497. [Google Scholar] [CrossRef]

- Lau, L.S.; Yii, K.J.; Ng, C.F.; Tan, Y.L.; Yiew, T.H. Environmental Kuznets curve (EKC) hypothesis: A bibliometric review of the last three decades. Energy Environ. 2025, 36, 93–131. [Google Scholar] [CrossRef]

- Ang, J.B. CO2 emissions, energy consumption, and output in France. Energy Policy 2007, 35, 4772–4778. [Google Scholar] [CrossRef]

- Esteve, V.; Tamarit, C. Threshold cointegration and nonlinear adjustment between CO2 and income: The Environmental Kuznets Curve in Spain, 1857–2007. Energy Econ. 2012, 34, 2148–2156. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H.; Shabbir, M.S. Environmental Kuznets curve hypothesis in Pakistan: Cointegration and Granger causality. Renew. Sustain. Energy Rev. 2012, 16, 2947–2953. [Google Scholar] [CrossRef]

- Shahbaz, M.; Sinha, A. Environmental Kuznets curve for CO2 emissions: A literature survey. J. Econ. Stud. 2019, 46, 106–168. [Google Scholar] [CrossRef]

- Shahbaz, M. Globalization–emissions nexus: Testing the EKC hypothesis in Next-11 Countries. Glob. Bus. Rev. 2022, 23, 75–100. [Google Scholar] [CrossRef]

- Oladunni, O.J.; Olanrewaju, O.A.; Lee, C.K. The Environmental Kuznets Curve (EKC) Hypothesis on GHG emissions: Analyses for transportation industry of South Africa. Discov. Sustain. 2024, 5, 302. [Google Scholar] [CrossRef]

- Farooq, A.; Anwar, A.; Ahad, M.; Shabbir, G.; Imran, Z.A. A validity of environmental Kuznets curve under the role of urbanization, financial development index and foreign direct investment in Pakistan. J. Econ. Adm. Sci. 2024, 40, 288–307. [Google Scholar] [CrossRef]

- Wang, H.; Zhang, Z.; Zhang, Z. The dynamic impact of trade on environment. J. Econ. Surv. 2024, 38, 1731–1759. [Google Scholar] [CrossRef]

- Acaravci, A.; Ozturk, I. On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 2010, 35, 5412–5420. [Google Scholar] [CrossRef]

- Aydin, M.; Sogut, Y.; Erdem, A. The role of environmental technologies, institutional quality, and globalization on environmental sustainability in European Union countries: New evidence from advanced panel data estimations. Environ. Sci. Pollut. Res. 2024, 31, 10460–10472. [Google Scholar] [CrossRef] [PubMed]

- Al-Mulali, U.; Saboori, B.; Ozturk, I. Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 2015, 76, 123–131. [Google Scholar] [CrossRef]

- Azmin, N.A.M.; Ahmad, Z.; Mahmood, R.; Zahari, A.S.M.; Hendar, H. The Dynamic Linkages between CO2 Emissions, Energy Consumption and Economic Factors in ASEAN Countries. Conf. Ser. Earth Environ. Sci. 2022, 1102, 012038. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. Multivariate Granger Causality between CO2 Emissions, Energy Consumption, FDI and GDP: Evidence from a Panel of BRIC Countries. Energy 2011, 36, 685–693. [Google Scholar] [CrossRef]

- Fu, Q.; Álvarez-Otero, S.; Sial, M.S.; Comite, U.; Zheng, P.; Samad, S.; Oláh, J. Impact of renewable energy on economic growth and CO2 emissions—Evidence from BRICS countries. Processes 2021, 9, 1281. [Google Scholar] [CrossRef]

- Onafowora, O.A.; Owoye, O. Bounds testing approach to analysis of the environment Kuznets curve hypothesis. Energy Econ. 2014, 44, 47–62. [Google Scholar] [CrossRef]

- Jebli, M.B.; Youssef, S.B. The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew. Sustain. Energy Rev. 2015, 47, 173–185. [Google Scholar] [CrossRef]

- Ben Jebli, M.; Ben Youssef, S.; Apergis, N. The dynamic linkage between renewable energy, tourism, CO2 emissions, economic growth, foreign direct investment, and trade. Lat. Am. Econ. Rev. 2019, 28, 2. [Google Scholar] [CrossRef]

- Osabuohien, E.S.; Efobi, U.R.; Gitau, C.M.W. Beyond the environmental Kuznets curve in Africa: Evidence from panel cointegration. J. Environ. Policy Plan. 2014, 16, 517–538. [Google Scholar] [CrossRef]

- Yehya, A.A.K.; Nguyen, T.T.; Wiehle, M.; Buerkert, A. Drivers of urbanization effects in five countries of the MENA region–a review. J. Land Use Sci. 2024, 19, 304–320. [Google Scholar] [CrossRef]

- Bajja, S.; Radoine, H.; Celik, A.; Dakyaga, F.; Damrah, S. Human capital and manufacturing activities under environmentally-driven urbanization in the MENA region. Front. Environ. Sci. 2024, 11, 1322789. [Google Scholar] [CrossRef]

- Business Monthly. Egyptian International Motors, Chinese BAIC To Build EVs Plant In. 2024. Available online: https://businessmonthlyeg.com/egyptian-international-motors-chinese-baic-to-build-evs-plant-in-egypt/ (accessed on 25 September 2025).

- Abdelati, M.H. Towards Sustainable Transportation in Egypt: An Analysis of Current Challenges and Future Opportunities. J. Int. Soc. Sci. Eng. 2025, 7, 16–28. [Google Scholar] [CrossRef]

- OECD. Green Growth Policy Review of Egypt 2024; OECD Publishing: Paris, France, 2024. [Google Scholar] [CrossRef]

- Charabi, Y.; Al Nasiri, N.; Al Awadhi, T.; Choudri, B.S.; Al Bimani, A. GHG emissions from the transport sector in Oman: Trends and potential decarbonization pathways. Energy Strategy Rev. 2020, 32, 100548. [Google Scholar] [CrossRef]

- Stambouli, A.B.; Kitamura, Y.; Benmessaoud, M.T.; Yassaa, N. Algeria’s journey towards a green hydrogen future: Strategies for renewable energy integration and climate commitments. Int. J. Hydrogen Energy 2024, 58, 753–763. [Google Scholar] [CrossRef]

- Edoo, M.N.; King, R.T.A. 100% renewable energy system for the island of Mauritius by 2050: A techno-economic study. Smart Energy 2025, 19, 100199. [Google Scholar] [CrossRef]

- Al-Mamari, I.; Al Ruhaili, S.; Al Naamani, E.; Heidari, M. Insight into Future Directions for the Utilization of Green Hydrogen in Oman. In Proceedings of the 2nd GCC International Conference on Industrial Engineering and Operations Management, Muscat, Oman, 1–3 December 2024. [Google Scholar] [CrossRef]

- Leal-Arcas, R.; Almashloum, S.; Jazzar, R.; Saleh, N.B.; Almunifi, R. Energy policy of Oman: Pursuing decarbonization. Energies 2025, 18, 1270. [Google Scholar] [CrossRef]

- Qasem, R.H.M.; Scholz, M. Climate change impact on resources in the MENA region: A systematic and critical review. Phys. Chem. Earth Parts A/B/C 2025, 139, 103936. [Google Scholar] [CrossRef]

- Gehring, J.C.; Cand, B.M. The Sustainable Energy Imperative: A Future Generations Perspective on Technologies Leading the Clean Energy Transition. 2024. Available online: https://www.energy.cam.ac.uk/blog/blog-sustainable-energy-imperative-future-generations-perspective-technologies-leading-clean (accessed on 25 September 2025).

- Dinda, S. Environmental Kuznets Curve: An Envelope of Technological Progress. 2004. Available online: https://mpra.ub.uni-muenchen.de/id/eprint/28092 (accessed on 25 September 2025).

- Apergis, N.; Ozturk, I. Testing environmental Kuznets curve hypothesis in Asian countries. Ecol. Indic. 2015, 52, 16–22. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Choi, I. Unit root tests for panel data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.W. A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica 1993, 61, 783–820. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.; Chu, C.-J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Westerlund, J.; Breitung, J. Lessons from a Decade of IPS and LLC. Econom. Rev. 2013, 32, 547–591. [Google Scholar] [CrossRef]

- Park, J.Y. Canonical cointegrating regressions. Econometrica 1992, 60, 119–143. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Bai, J.; Ng, S. Panel unit root tests with cross-section dependence: A further investigation. Econom. Theory 2010, 26, 1088–1114. [Google Scholar] [CrossRef]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Pedroni, P. Fully modified OLS for heterogeneous cointegrated panels. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels; Emerald Group Publishing Limited: Bingley, UK, 2001; pp. 93–130. [Google Scholar]

- Hamit-Haggar, M. Greenhouse gas emissions, energy consumption and economic growth: A panel cointegration analysis from Canadian industrial sector perspective. Energy Econ. 2012, 34, 358–364. [Google Scholar] [CrossRef]

- Pedroni, P. Fully Modified OLS for Heterogeneous Cointegrated Panels and the Case of Purchasing Power Parity; Department of Economics, Indiana University: Bloomington, IN, USA, 1996. [Google Scholar]

- Kao, C.; Chiang, M.H. On the estimation and inference of a cointegrated regression in panel data. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels 2001; Baltagi, B.H., Ed.; Emerald Group Publishing: Leeds, UK, 2001; pp. 179–222. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Granger, C. Some recent development in a concept of causality. J. Econ. 1988, 39, 199–211. [Google Scholar] [CrossRef]

- Phillips, P.C. Fully modified least squares and vector autoregression. Econom. J. Econom. Soc. 1995, 63, 1023–1078. [Google Scholar] [CrossRef]

- Merlin, M.L.; Chen, Y. Analysis of the factors affecting electricity consumption in DR Congo using fully modified ordinary least square (FMOLS), dynamic ordinary least square (DOLS) and canonical cointegrating regression (CCR) estimation approach. Energy 2021, 232, 121025. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Churchill, S.A.; Paramati, S.R. The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renew. Energy 2017, 111, 157–167. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R.; Dogan, E. The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Βig 10 electricity generators. Renew. Energy 2018, 123, 36–43. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Tang, C.F.; Ozturk, I. Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ. Sci. Pollut. Res. 2015, 22, 14891–14900. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J. The effects of Internet usage, financial development and trade openness on economic growth in South Africa: A time series analysis. Telemat. Inform. 2016, 33, 1141–1154. [Google Scholar] [CrossRef]

- Dilanchiev, A.; Umair, M.; Haroon, M. How causality impacts the renewable energy, carbon emissions, and economic growth nexus in the South Caucasus Countries? Environ. Sci. Pollut. Res. 2024, 31, 33069–33085. [Google Scholar] [CrossRef]

- Youssef, A.B.; Dahmani, M.; Mabrouki, M. Decoupling carbon emissions and economic growth in Tunisia: Pathways to sustainable development. In Handbook on Energy and Economic Growth; Edward Elgar Publishing: Cheltenham, UK, 2024; pp. 103–127. [Google Scholar]

- Touitou, M. The relationship between economic growth, energy consumption and CO2 emission in the Middle East and North Africa (Mena). Folia Oeconomica Stetin. 2021, 21, 132–147. [Google Scholar] [CrossRef]

- Manu, E.K.; Asongu, S.A. Renewable energy, innovations and environmental sustainability in Sub-Saharan Africa: The Environmental Kuznets Curve, policy thresholds and thresholds for complementary policies. Renew. Energy 2025, 249, 123197. [Google Scholar] [CrossRef]

| Country | Transport CO2 Emissions (% of total) | Per Capita Transport CO2 (tons) | Renewable Electricity Share (%) | EV Penetration Rate (%) |

|---|---|---|---|---|

| Morocco | 23% | 0.9 | 42% | 2.1 |

| Egypt | 15.8% | 1.4 | 22% | 0.5 |

| Oman | 19% | 2.7 | 11% | 1.8 |

| Algeria | 21% | 1.5 | <5% | 0.3 |

| Lebanon | 25% | 1.3 | <3% | <0.1 |

| Mauritius | 14.9% | 1.1 | 28% | 3.2 |

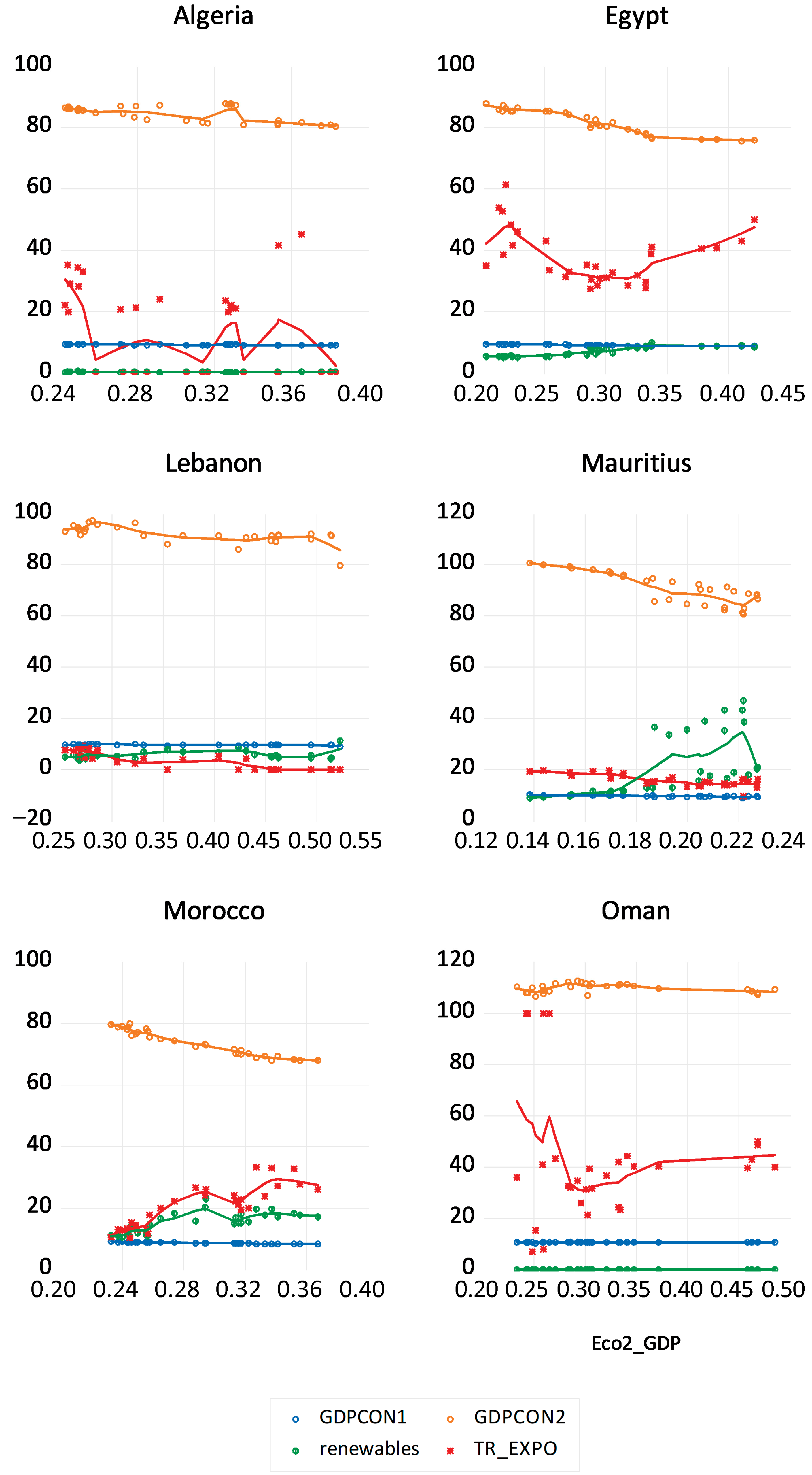

| GDPCON1 | ECO2_GDP | Renewables | TR_EXPO | |

|---|---|---|---|---|

| Mean | 9.397386 | 0.295680 | 8.362720 | 22.51979 |

| Median | 9.309852 | 0.284998 | 5.910000 | 19.80842 |

| Maximum | 10.60192 | 0.522801 | 47.06783 | 100.0000 |

| Minimum | 8.234913 | 0.138225 | 0.000000 | 0.000000 |

| Std. Dev. | 0.625313 | 0.081234 | 9.438161 | 18.64803 |

| Skewness | 0.348634 | 0.742166 | 1.803104 | 1.578419 |

| Kurtosis | 2.422393 | 3.314176 | 6.795193 | 7.527432 |

| Jarque-Bera | 6.148604 | 17.26460 | 205.5617 | 228.4745 |

| Probability | 0.046222 | 0.000178 | 0.000000 | 0.000000 |

| Sum | 1691.530 | 53.22235 | 1505.290 | 4053.563 |

| Sum Sq. Dev. | 69.99194 | 1.181223 | 15,945.12 | 62,247.06 |

| Observations | 180 | 180 | 180 | 180 |

| Correlation | GDPCON1 | GDPCON2 | Renew | TR_EXPO | ECO2_GDP |

| GDPCON1 | 1.000000 | ||||

| GDPCON2 | 0.999301 | 1.000000 | |||

| RENEW | −0.457914 | −0.457442 | 1.000000 | ||

| TR_EXPO | 0.214932 | 0.228864 | −0.180676 | 1.000000 | |

| ECO2_GDP | −0.031434 | −0.024414 | −0.321657 | −0.112513 | 1.000000 |

| ECO2_GDP | GDPCON1 | Renewables | TR_EXPO | |

|---|---|---|---|---|

| Breusch-Pagan LM | 215.95 *** (0.000) | 251.26 *** (0.0000) | NA | 81.54 *** (0.000) |

| Pesaran scaled LM | 36.689 *** (0.000) | 43.136 *** (0.0000) | NA | 12.15 *** (0.000) |

| Bias-corrected scaled LM | 36.586 *** (0.000) | 43.03 *** (0.000) | NA | 12.04 *** (0.0000) |

| Pesaran CD | 4.506 *** (0.0000) | 14.69 *** (0.0000) | NA | 0.839225 (0.4013) |

| Carbon Emissions | GDPcon1 | GDPcon2 | Renewables | TRexpo | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Non-cross-sectionally dependent unit root tests | ||||||||||

| Level | First Diff. | Level | First Diff. | Level | First Diff. | Level | First Diff. | Level | First Diff. | |

| Levin, Lin and Chu t * | −1.079 | −4.455 *** (0.000) | 1.861 *** (0.969) | −0.801 (0.212) | 1.72217 (0.96) | −0.932 (0.176) | 0.501 (0.692) | −4.558 *** (0.000) | -0.470 (0.319) | −4.375 *** (0.00) |

| Im, Pesaran and Shin W-stat | 1.34052 0.12126 | −5.72 *** (0.00) | −0.68 (0.2484) | −4.07 *** (0.000) | 0.31953 0.6253 | −4.012 *** (0.00) | −0.09757 (0.46) | −4.53 *** (0.000) | −1.03096 (0.15) | −6.60 *** (0.000) |

| ADF-Fisher Chi-square | 1.84363 (0.97) | 53.1 *** (0.000) | 4.21580 (0.98) | 42.32 *** (0.000) | 13.8661 0.31 | 41.8 *** (0.000) | 8.643 (0.567) | 37.7 *** (0.000) | 19.2545 * (0.0826) | 61.64 *** (0.000) |

| PP-Fisher Chi-square | −8.355 −0.09 | 126.1 *** (0.000) | 17.1788 (0.1430) | 105.6 *** (0.000) | 21.5334 ** (0.043) | 102.18 *** (0.00) | 16.9821 * (0.075) | 111.7 *** (0.000) | 23.45 * (0.024) | 321.24 *** (0.00) |

| Cross-sectionally dependent unit root tests | ||||||||||

| Bai and NG-Panic | −1.691 (0.09) | 1.737 *** (0.082) | −1.039 (0.29) | Inf *** (0.000) | 1.008 (0.313) | 2.89 *** (0.004) | 6.3544 (0.999) | Inf *** (0.00) | −1.75 (0.08) | 9.812 *** (0.000) |

| Pesaran -CIPS | −1.848 ≥ 0.10 | −3.72 *** < (0.01) | −1.077 ≥ 0.10 | −2.259* < 0.10 | 0.5016 ≥ 0.10 | −2.164 * < 0.10 | −1.69 ≥ 0.10 | −2.738 ***< 0.01 | −1.418 *< 0.10 | −2059 *** < 0.01 |

| Alternative Hypothesis: Common AR Coefs. (Within-Dimension) | |||||

|---|---|---|---|---|---|

| Weighted | |||||

| Statistic | Prob. | Statistic | Prob. | ||

| Panel v-Statistic | −1.431950 | 0.9239 | −0.800103 | 0.7882 | |

| Panel rho-Statistic | 1.723443 | 0.9576 | 1.101340 | 0.8646 | |

| Panel PP-Statistic | 1.197190 | 0.8844 | −0.300100 | 0.3821 | |

| Panel ADF-Statistic | −0.164569 | 0.4346 | −1.897748 | 0.0289 | |

| Alternative Hypothesis: Individual AR Coefs. (Between-Dimension) | |||||

| Statistic | Prob. | ||||

| Group rho-Statistic | 1.284895 | 0.9006 | |||

| Group PP-Statistic | −0.770325 | 0.2206 | |||

| Group ADF-Statistic | −2.092631 | 0.0182 | |||

| Hypothesized | Fisher Stat. * | Fisher Stat. * | ||

|---|---|---|---|---|

| No. of CE(s) | (from Trace Test) | Prob. | (from Max-Eigen Test) | Prob. |

| None | 126.7 | 0.0000 | 91.53 | 0.0000 |

| At most 1 | 50.35 | 0.0000 | 26.23 | 0.0034 |

| At most 2 | 29.86 | 0.0009 | 16.86 | 0.0775 |

| At most 3 | 19.69 | 0.0324 | 12.41 | 0.2584 |

| At most 4 | 15.28 | 0.1221 | 15.28 | 0.1221 |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| GDPCON1 | −3.785578 *** | 1.095444 | −3.455748 | 0.0009 |

| GDPCON2 | 0.192848 *** | 0.057937 | 3.328563 | 0.0014 |

| RENEWABLES | −0.006349 *** | 0.001456 | −4.359853 | 0.0000 |

| TR_EXPO | −0.001188 ** | 0.000533 | −2.227317 | 0.0291 |

| R-squared | 0.979744 | Mean dependent var | 0.287121 | |

| Adjusted R-squared | 0.961201 | S.D. dependent var | 0.078510 | |

| S.E. of regression | 0.015465 | Sum squared resid | 0.016980 | |

| Long-run variance | 0.000178 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| GDPCON2 | −0.219509 *** | 0.059668 | −3.678818 | 0.0004 |

| RENEWABLES | −0.008405 *** | 0.001034 | −8.131598 | 0.0000 |

| GDPCON1 | 3.993197 *** | 1.139407 | 3.504628 | 0.0007 |

| TR_EXPO | −0.000998 *** | 0.000222 | −4.490533 | 0.0000 |

| R-squared | 0.935897 | Mean dependent var | 0.287817 | |

| Adjusted R-squared | 0.921577 | S.D. dependent var | 0.086497 | |

| S.E. of regression | 0.024223 | Sum squared resid | 0.055154 | |

| Long-run variance | 0.000180 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| GDPCON1 does not Granger Cause ECO2_GDP | 174 | 5.38553 | 0.0215 |

| ECO2_GDP does not Granger Cause GDPCON1 | 0.22641 | 0.6348 | |

| GDPCON2 does not Granger Cause ECO2_GDP | 174 | 5.65462 | 0.0185 |

| ECO2_GDP does not Granger Cause GDPCON2 | 0.41733 | 0.5191 | |

| RENEWABLES does not Granger Cause ECO2_GDP | 174 | 2.59004 | 0.1094 |

| ECO2_GDP does not Granger Cause RENEWABLES | 0.37279 | 0.5423 | |

| TR_EXPO does not Granger Cause ECO2_GDP | 174 | 1.63224 | 0.2031 |

| ECO2_GDP does not Granger Cause TR_EXPO | 0.52930 | 0.4679 | |

| GDPCON2 does not Granger Cause GDPCON1 | 174 | 1.51288 | 0.2204 |

| GDPCON1 does not Granger Cause GDPCON2 | 1.76762 | 0.1854 | |

| RENEWABLES does not Granger Cause GDPCON1 | 174 | 5.77376 | 0.0173 |

| GDPCON1 does not Granger Cause RENEWABLES | 3.59725 | 0.0596 | |

| TR_EXPO does not Granger Cause GDPCON1 | 174 | 2.70462 | 0.1019 |

| GDPCON1 does not Granger Cause TR_EXPO | 3.08963 | 0.0806 | |

| RENEWABLES does not Granger Cause GDPCON2 | 174 | 5.69126 | 0.0181 |

| GDPCON2 does not Granger Cause RENEWABLES | 3.38093 | 0.0677 | |

| TR_EXPO does not Granger Cause GDPCON2 | 174 | 2.77569 | 0.0975 |

| GDPCON2 does not Granger Cause TR_EXPO | 3.29735 | 0.0711 | |

| TR_EXPO does not Granger Cause RENEWABLES | 174 | 0.05041 | 0.8226 |

| RENEWABLES does not Granger Cause TR_EXPO | 0.67076 | 0.4139 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Michailidis, M.; Kantartzis, A.; Arabatzis, G.; Zafeiriou, E. Decarbonization Pathways in Selected MENA Countries: Panel Evidence on Transport Services, Renewable Energy, and the EKC Hypothesis. Energies 2025, 18, 5571. https://doi.org/10.3390/en18215571

Michailidis M, Kantartzis A, Arabatzis G, Zafeiriou E. Decarbonization Pathways in Selected MENA Countries: Panel Evidence on Transport Services, Renewable Energy, and the EKC Hypothesis. Energies. 2025; 18(21):5571. https://doi.org/10.3390/en18215571

Chicago/Turabian StyleMichailidis, Michail, Apostolos Kantartzis, Garyfallos Arabatzis, and Eleni Zafeiriou. 2025. "Decarbonization Pathways in Selected MENA Countries: Panel Evidence on Transport Services, Renewable Energy, and the EKC Hypothesis" Energies 18, no. 21: 5571. https://doi.org/10.3390/en18215571

APA StyleMichailidis, M., Kantartzis, A., Arabatzis, G., & Zafeiriou, E. (2025). Decarbonization Pathways in Selected MENA Countries: Panel Evidence on Transport Services, Renewable Energy, and the EKC Hypothesis. Energies, 18(21), 5571. https://doi.org/10.3390/en18215571