Abstract

The accelerating demand for climate action has underscored the need to link financial innovation with clean energy adoption. This study examines the interplay between green finance, renewable energy consumption, and CO2 emissions across 15 countries from 2013 to 2022. Green finance is proxied by green bond issuances and environmental protection expenditures, capturing both market-based and fiscal flows. Using panel econometric methods, including fixed effects with Driscoll–Kraay corrections, Prais–Winsten regressions with PCSE, and Feasible Generalized Least Squares (FGLS), the analysis accounts for heteroscedasticity, autocorrelation, and cross-sectional dependence. Results show how green finance significantly reduces emissions, both directly and indirectly, through its positive influence on renewable energy deployment. Renewable energy consumption shows a robust negative association with CO2 emissions, confirming its pivotal role in energy transition. A mediation analysis further demonstrates that renewable energy partially transmits the effect of green finance on environmental performance. The findings highlight the dual function of green finance in mobilizing investment and accelerating decarbonization, offering timely insights for policymakers seeking effective pathways toward sustainable, low-carbon economies.

1. Introduction

Climate change has become one of the defining policy and research challenges of the 21st century. Rising carbon dioxide (CO2) emissions, driven largely by fossil fuel dependence and industrial expansion, continue to accelerate global warming despite strong international commitments such as the Paris Agreement and the Sustainable Development Goals (SDGs) [1,2,3,4]. Achieving a low-carbon transition therefore requires not only technological innovation but also the redirection of financial resources toward environmentally sustainable activities. In this context, green finance, defined as financial mechanisms that mobilize capital for projects with positive environmental impacts, including market-based instruments (e.g., green bonds, sustainability-linked loans) and public environmental expenditures, has emerged as a potential catalyst for aligning capital markets with climate objectives [5,6]. Yet its effectiveness, scope, and inclusiveness remain contested.

While the issuance of green bonds, the expansion of ESG-aligned investment funds, and the growth of climate-related lending have attracted global attention, questions persist about whether these instruments mobilize sufficient long-term capital for renewable energy infrastructure and low-carbon technologies. Concerns about greenwashing, inconsistent adoption across countries, and the absence of standardized taxonomies have further complicated the policy debate. At the same time, the transition to renewable energy remains indispensable for achieving climate goals: replacing fossil fuels with cleaner energy sources reduces greenhouse gas emissions and supports energy security [7,8]. However, renewable technologies often require substantial upfront investment and long payback periods, underscoring the importance of financing mechanisms that can lower capital costs and mitigate risk.

Existing research has generally examined green finance and renewable energy in isolation, focusing either on the direct impact of financial flows on carbon emissions or on the macroeconomic and technological determinants of clean energy adoption. Only a limited number of studies investigate these factors jointly as part of an integrated sustainability nexus [9,10]. Moreover, most prior work concentrates on single-country or regional contexts, often neglecting cross-country heterogeneity in financial market development, governance quality, and policy frameworks. Empirical approaches also differ widely, and relatively few have explicitly explored whether renewable energy acts as a transmission channel through which green finance influences environmental performance [11,12,13].

This study seeks to fill these gaps by examining the interplay between green finance, renewable energy consumption, and CO2 emissions across 15 countries from 2013 to 2022. We focus on two complementary dimensions of green finance: (i) green bond issuances, representing market-driven capital flows, and (ii) public environmental protection expenditures, representing fiscal commitments. Our analysis applies robust panel econometric techniques, including fixed effects with Driscoll–Kraay standard errors, Prais–Winsten regressions with panel-corrected standard errors (PCSE), and Feasible Generalized Least Squares (FGLS), to account for heteroskedasticity, autocorrelation, and cross-sectional dependence. We further employ mediation analysis based on the Baron and Kenny (1986) [14] framework to test whether renewable energy serves as a conduit linking green finance to emission reductions.

This paper contributes to literature in three keyways. First, it provides one of the few comparatives, multi-country assessments of how both market-based and fiscal green finance instruments affect carbon mitigation. Second, it integrates a mediation perspective, offering evidence on whether renewable energy deployment transmits the impact of green finance to environmental outcomes. Third, it delivers policy-relevant insights by highlighting how institutional quality and financial market development shape the effectiveness of green finance instruments, informing strategies to reduce greenwashing and scale up private capital for decarbonization.

The remainder of the paper is structured as follows. Section 2 reviews the existing literature and identifies research gaps, Section 3 outlines the data and econometric methodology, Section 4 presents the empirical results and discussion, and Section 5 concludes with targeted policy recommendations and future research.

2. Existing Evidence and Research Gaps

2.1. Green Finance as a Catalyst for Decarbonization

A growing body of literature underscores the pivotal role of green finance in facilitating global CO2 reduction by channeling investments into renewable energy, improving energy efficiency, and supporting low-carbon innovation [15,16,17]. Li et al. (2021) [18] show that the expansion of green finance in China significantly reduced carbon emissions through clean energy deployment and stricter environmental investment standards. Similarly, Belgacem et al. (2023) [19], analyzing panel data from emerging economies, found a strong inverse relationship between green finance and CO2 emissions, with benefits most evident in contexts with developed green banking systems and robust regulatory oversight.

Green finance operates through several channels. One is capital reallocation, whereby instruments such as green bonds and sustainability-linked loans divert funds away from carbon-intensive sectors [5,7,20]. Wang and Zhang (2023) [21] demonstrate that this reallocation promotes clean energy adoption while discouraging fossil fuel dependence. Another pathway is enhanced energy efficiency. Yu et al. (2022) [22] report that regions with greater access to green financial products exhibit faster improvements in energy intensity, which translates into long-term emission reductions.

Nevertheless, findings are not uniform across regions. Nguyen et al. (2024) [23] note that Southeast Asia’s fragmented green finance policies and limited transparency weaken its impact, while Zhang et al. (2023) [24] observe that in African economies, immature financial markets and institutional weaknesses undermine short-term effects. These studies highlight the importance of governance and institutional quality in determining outcomes [25].

Cross-country studies reinforce these insights. Baştürk (2024) [26], using GMM on 48 economies, confirms a significant negative relationship between green finance and emissions, though limitations remain in capturing regional heterogeneity. Muchiri et al. (2025) [27] add that public environmental expenditure enhances the impact of green finance but does not fully account for cross-country institutional differences. Subnational evidence also enriches the debate: Guo et al. (2022) [28] find stronger effects in Chinese provinces with high institutional quality, while Meo and Abd Karim (2022) [29] show that the strength of the relationship varies across economic contexts using a quantile-on-quantile approach.

Recent contributions have expanded the scope of inquiry by incorporating new explanatory variables and methods. Elmonshid et al. (2024) [30] highlight that financial efficiency and renewable energy consumption jointly reduce emissions in GCC countries, while Sadiq et al. (2024) [31] stress the combined role of green finance, eco-innovation, and carbon taxes in BRICS. Li et al. (2024) and Chien and Hu [32,33] compare OECD and non-OECD nations, finding greater effectiveness of green finance and renewables in the former. Spatial analysis by Li et al. (2021) [18] reveals significant spillover effects across Chinese provinces, underscoring the value of regional collaboration. Complementary findings by Jamel and Zhang (2024) [34] link fintech, green finance, and innovation to meaningful emission reductions in advanced economies. Huang et al. (2024) [35] show that green finance accelerates adoption of green technologies, while Zhu and Li (2024) [36] propose integrating financial inputs into national carbon neutrality frameworks.

Further evidence from developing regions affirms these patterns. Al-Zubairi et al. (2025) [37] report that renewable energy and financial development lower emissions in Arab countries, although political stability alone is insufficient. Wang et al. (2025) [38] find that the digital economy amplifies the efficiency of green financial interventions, while Wiredu et al. (2025) [39] demonstrate that renewable energy and green finance jointly mitigate pollution, though life expectancy and urbanization have mixed effects depending on development levels. Guan et al. (2025) [40] confirm, via panel quantile regression, that green finance consistently reduces environmental degradation, especially in high-emission contexts.

Finally, sectoral and conceptual analyses further enrich the discourse. A 2025 Carbon Brief report documents a 1.6% decline in China’s CO2 emissions, attributing progress to large-scale clean energy investments facilitated by green finance. Fu et al. (2024) [41] emphasize the theoretical importance of aligning market incentives with environmental objectives but note persistent gaps in accountability and performance measurement.

2.2. Green Finance as an Enabler of Renewable Energy

Green finance has become a crucial driver of the global energy transition, directing investment toward renewable energy infrastructure and technological innovation. Empirical studies confirm that green financial instruments, such as green bonds, ESG-aligned investments, and climate-focused lending, facilitate the expansion of clean energy. For instance, Zhang et al. (2023) [24] and Wang and Dong (2021) [42] show that green finance flows significantly increase renewable energy investment and the share of renewables in national energy mixes, with policy support playing a crucial role in reducing financing costs and risks. Firm-level studies (Flammer, 2021; Tang & Zhang, 2020) [7,20] further demonstrate that green bonds stimulate post-issuance renewable energy investments and strengthen long-term sustainability commitments.

However, the effectiveness of green finance in promoting renewable adoption is not uniform. Evidence from sub-Saharan Africa [43] and Asian countries [44] suggests that weak institutions and fragmented policies limit outcomes, while reforms in China’s pilot zones [45] show the opposite, strong governance amplifies the impact of green finance on energy transition. Similarly, Nepal et al. (2022) [46] and Chen et al. (2024) [47] highlight the importance of regulatory oversight, financial openness, and tailored financing strategies.

A growing strand of research highlights renewable energy’s mediating role in the green finance emissions nexus. Studies across diverse contexts [24,31,46,48,49] confirm that green finance indirectly reduces CO2 emissions by accelerating renewable deployment. This mediation effect, however, is context-dependent, strengthened in economies with strong regulatory frameworks and financial systems. Complementary findings [34] also point to technological innovation as an additional intermediary.

2.3. Green Finance, Decarbonization and Renewable Energy: Gaps and Unanswered Questions

Collectively, the literature provides robust evidence that green finance can contribute to decarbonization by reallocating capital, fostering technological innovation, and improving energy efficiency. It also confirms that renewable energy benefits directly from green finance and may serve as a transmission channel linking financial flows to emission reductions. However, several gaps remain unresolved.

First, regional heterogeneity is a persistent challenge: While results are strong for China, OECD countries, and some emerging markets, findings are far less consistent in Africa, Southeast Asia, and politically fragile economies. This suggests that institutional quality, governance, and financial depth critically mediate outcomes. Second, most studies adopt single-country or regional perspectives, which limit generalizability and neglect the global interplay of financial flows, policy regimes, and cross-border spillovers. Third, empirical approaches vary widely from quantile regressions to spatial econometrics; few explicitly incorporate mediation analysis to test how renewable energy channels the effects of green finance on environmental outcomes. Finally, despite the growing role of green bonds and public environmental expenditures, little is known about their combined dynamics in shaping renewable energy development and long-term decarbonization. Conceptual contributions also warn that, without standardized taxonomies, accountability, and rigorous monitoring, the credibility of green finance may be undermined by greenwashing.

These gaps underscore the need for comparative, multi-country studies that integrate financial and environmental dimensions while systematically examining transmission mechanisms. Addressing these shortcomings, the present study investigates the joint role of green finance and renewable energy in reducing CO2 emissions across 15 countries over 2013–2022, applying robust econometric methods to account for heterogeneity, dependence, and mediation effects.

2.4. Theoretical Framework and Hypotheses Development

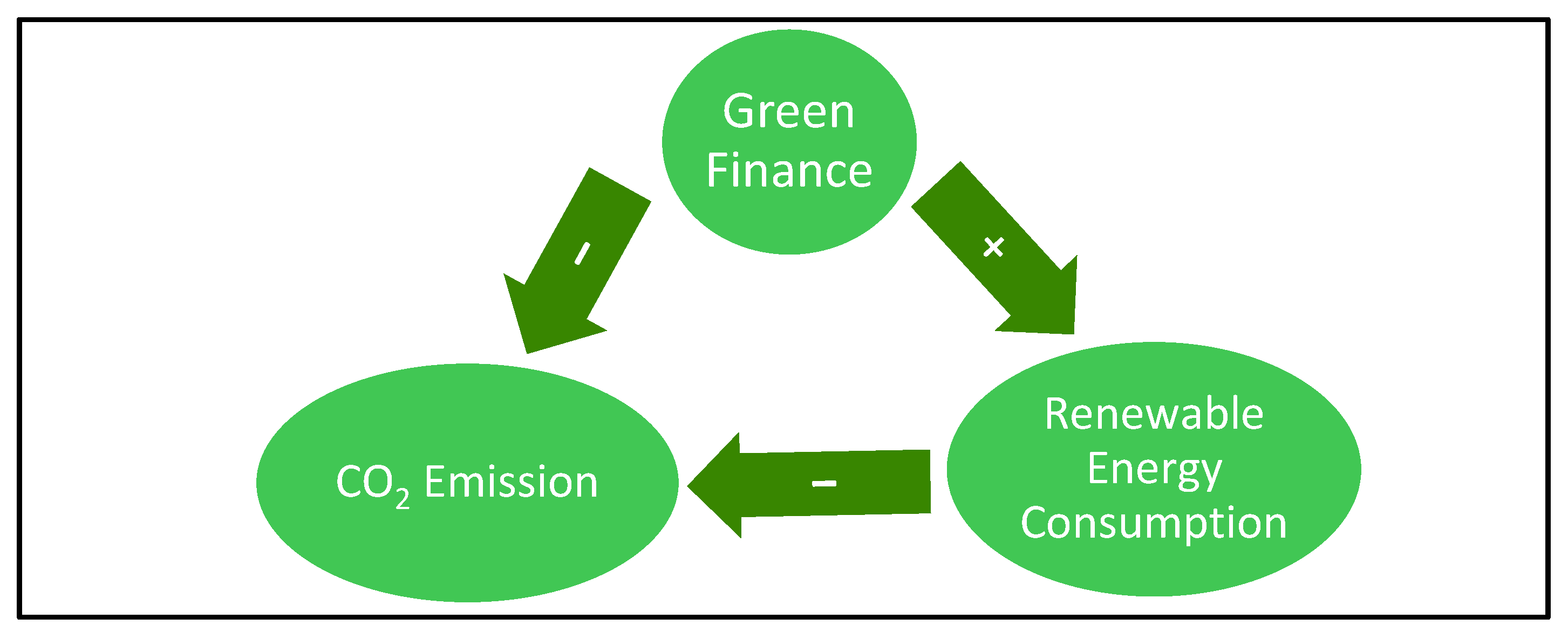

To examine the relationship between green finance, renewable energy use, and CO2 emissions, this study draws on a theoretical framework that integrates insights from environmental economics, finance, and energy transition disciplines. This framework outlines the conceptual foundations that justify the expected interactions among the key variables (Figure 1).

Figure 1.

Theoretical Framework. Source: Authors’ presentation.

First, the Environmental Kuznets Curve (EKC) hypothesis posits an inverted U-shaped relationship between environmental degradation and economic growth. In the early stages of development, industrialization and fossil fuel dependence tend to increase pollution levels. However, beyond a certain income threshold, emissions are expected to decline as economies adopt cleaner technologies, enforce stricter environmental regulations, and respond to rising environmental awareness [50]. Within this context, green finance can play a catalytic role by accelerating the EKC turning point. By channeling resources into ecologically sustainable projects, particularly renewable energy, green finance enables emission reductions even before economies reach high-income status.

Second, green finance theory highlights how financial systems can actively support sustainable development. Mechanisms such as green bonds, sustainability-linked loans, and ESG funds are explicitly designed to channel resources toward environmentally beneficial investments, including renewable energy infrastructure, energy efficiency, and pollution abatement [51]. The theoretical premise is that financial markets, through targeted flows, can help internalize environmental externalities and generate positive environmental spillovers [52]. By lowering financing costs and improving access to capital, green finance reduces investment barriers for clean technologies, enabling firms and governments to pursue projects that might otherwise be economically unviable.

Finally, energy transition theory provides the framework to explain how economies move away from fossil fuel dependency toward cleaner, renewable, and low-carbon energy systems. This perspective emphasizes the role of technological innovation, institutional support, and financial investment in facilitating such transitions [53]. Green finance directly contributes by funding the development, adoption, and scaling of renewable energy technologies. Access to green financial resources is therefore expected to expand renewable energy consumption, which in turn constitutes a central driver of long-term CO2 emissions reduction.

Grounded in the Environmental Kuznets Curve (EKC), green finance theory, and energy transition theory, we propose the following hypotheses. The EKC suggests that environmental degradation grows with early economic growth but falls once economies adopt cleaner technologies and stronger regulation [50]. Green finance theory argues that financial markets can accelerate this turning point by mobilizing capital toward low-carbon investments [51,52]. Energy transition theory emphasizes that financial support is critical for expanding renewable energy, which directly reduces emissions [53]. Building on these complementary perspectives, we conceptualize green finance as influencing emissions both directly and indirectly through renewable energy deployment. Specifically, green finance can reallocate capital away from carbon-intensive sectors, de-risk clean energy projects, lower the cost of capital for sustainable technologies, and facilitate technology diffusion. Recent empirical studies [16,18,19,21,24,27,30,54] support these transmission mechanisms, underscoring the importance of examining both market-based and fiscal green finance when assessing pathways to decarbonization.

Table 1 presents the proposed hypotheses along with their conceptual rationale.

Table 1.

Hypotheses Development.

3. Materials and Methods

3.1. Data and Variables

This study employs a balanced panel data covering 15 countries (Australia, Austria, China, P.R.: Hong Kong, China, P.R.: Mainland, Japan, United Kingdom, Denmark, France, Netherlands, Germany, Italy, New Zealand, Norway, Spain, Sweden) over the period 2013 to 2022, The selection of the 15 nations in this study was mostly based on the availability and consistency of green finance data, namely measures like green bond issuance and environmental protection expenditure, throughout the period 2013–2022. Many developing economies, especially in Africa, South Asia, and parts of the Middle East, lack continuous, standardized, and comparable records on these variables, which constrained the inclusion of a broader set of countries. Consequently, the sample is weighted toward advanced economies, with only limited representation from developing nations. This sample makeup guarantees the robustness and reliability of the econometric analysis but also imposes constraints on the external validity of the findings. The results should therefore be interpreted as most representative of economies with relatively developed financial markets, structured green finance frameworks, and established institutional capacity. Nevertheless, the insights provide an important benchmark, as advanced economies are often the first movers in implementing and institutionalizing green financial instruments.

The variables used in the analysis include CO2 Emissions (CO2), measured in metric tons per capita, which represent environmental degradation. Green Finance (GF): Captured using two proxies: green bond issuance (GBI and expenditure on environmental protection (EEP). Renewable Energy Consumption (REN): Measured as the share of renewable energy in total final energy consumption (%). Control variables include GDP per capita, the financial development index (FD), and government effectiveness (GE), which are commonly included in environmental and financial models. All core explanatory variables (CO2, green bond issuance (GBI), environmental protection expenditure (EEP), renewable energy consumption (REN), and GDP per capita (PGDP)) are expressed in natural logarithms to stabilize variance and allow elasticity interpretation. By contrast, Financial Development (FD) and Government Effectiveness (GE) are retained in their original level form, as these are index-based measures that are not normally log-transformed. Table 2 presents definitions of variables and corresponding data sources.

Table 2.

Variable definition and data sources.

The results of the descriptive statistics presented in Table 3 show the mean, standard deviation, minimum, and maximum values, providing insights into the distribution and variability of the dataset. CO2 emissions (lnCO2) exhibit moderate variation across countries, while green bond issuance (lnGBI) shows substantial dispersion with both negative and positive values, reflecting differences in market development. Renewable energy consumption (lnREN) and per capita GDP (lnPGDP) also demonstrate wide ranges, capturing heterogeneity in energy use and economic conditions. Control variables such as financial development (FD) and governance effectiveness (GE) display relatively smaller variation.

Table 3.

Descriptive Statistics.

3.2. Diagnostic and Pre-Estimation Tests

Prior to estimation, the study performed diagnostic checks to validate data quality and the appropriateness of the model. Multicollinearity was examined through the Variance Inflation Factor (VIF), with all values remaining below the threshold of 5, suggesting the absence of serious collinearity problems [57]. In addition, the presence of cross-sectional dependence, often encountered in macro-panel analyses, was assessed using Pesaran’s CD test [58].

3.3. Model Specification and Empirical Strategy

3.3.1. Baseline Panel Regression Models

To estimate the impact of green finance on CO2 emissions, the study begins with a linear panel regression model. The baseline specification is estimated using Fixed Effects (FE) and Random Effects (RE) estimators. The choice between them is guided by the Hausman specification test [59], which tests whether unobserved individual effects are correlated with the regressors. A significant result supports the FE model as a consistent estimator. The baseline models include country fixed effects to control unobserved time-invariant heterogeneity across nations. Year fixed effects are incorporated in robustness checks (Driscoll–Kraay and PCSE estimations) to account for global shocks and common time trends. The general model specification is

where and denote country and year, respectively.

The adoption of fixed-effects (FE) methodology, which accounts for unobserved, time-invariant variation across nations [60], will address potential endogeneity issues arising from the bidirectional causality between green finance, economic development, and environmental quality. Although advanced dynamic estimators like system-GMM [61,62] could address simultaneity more explicitly, their use is limited by the dataset’s limited time dimension (T = 10).

The inclusion of essential control factors such as GDP per capita, financial development, and government performance helps to reduce omitted variable bias.

3.3.2. Robustness Checks- Driscoll–Kraay Estimator

To ensure robustness under cross-sectional dependence, the study applied the Driscoll–Kraay standard error correction [63], which corrects for heteroskedasticity and are robust to both autocorrelation and cross-sectional dependence.

3.3.3. Robustness Check Panel-Corrected Standard Errors (PCSE) and Feasible Generalized Least Squares (FGLS) Estimation

Given the panel structure (T = 10), additional robustness checks were implemented using (i) Prais–Winsten regression with Panel-Corrected Standard Errors (PCSE) [64]. PCSE corrects for contemporaneous correlation and panel-specific AR(1) disturbances [64], and (ii) Feasible Generalized Least Squares (FGLS) estimation [60,65] improves efficiency under heteroskedastic and contemporaneously correlated error structures.

3.3.4. Mediation Analysis

To explore the indirect effects of green finance on CO2 emissions, the study conducts a mediation analysis following the steps proposed by Baron and Kenny (1986) [14]. Specifically, it tests whether renewable energy consumption (lnREN) mediates the relationship between green finance and CO2 emissions. Partial mediation is inferred if the coefficient of green finance in the third model is reduced relative to the first, while lnREN remains statistically significant [66]. The following regression steps were estimated:

If φ_1 < φ_3 and δ_1 is significant, this confirms partial mediation by renewable energy [67]. All mediation steps were conducted using FE estimation to control time-invariant unobserved heterogeneity. Statistical significance was assessed at the 1%, 5%, and 10% levels.

4. Empirical Results and Discussion

4.1. Diagnostic and Pre-Estimation Test Results

Table 4 shows that all variance inflation factors (VIFs) are well below the commonly used threshold of 5, indicating no serious multicollinearity concerns. The highest VIF is observed for lnPGDP (3.23), which remains within acceptable limits. The mean VIF is 1.90, suggesting a healthy degree of independence among explanatory variables. Preliminary diagnostic analysis using Pesaran’s CD test confirmed the presence of significant cross-sectional dependence among panel units (CD = 8.190, p < 0.01). The average absolute correlation across units was 0.374, suggesting moderate to strong inter-country spillovers. These findings validate the use of estimators such as Driscoll–Kraay and PCSE, which are robust to cross-sectional dependence in the panel structure.

Table 4.

Correlation Matrix and Variance Inflation Factor test.

4.2. Fixed and Random Effects Estimation Results

The Model selection was determined using the Hausman specification test, which assesses whether the Random Effects model is appropriate by testing if individual effects are uncorrelated with the explanatory variables. The test produced a chi-square value of 19.80 with a p-value of 0.003, leading to the rejection of the null hypothesis and supporting the use of the Fixed Effects estimator. While a warning was reported regarding the positive definiteness of the variance matrix, the significant test statistic supports the reliability of the FE model.

Table 5 presents the results of both the Fixed Effects and Random Effects models. The dependent variable is the natural logarithm of CO2 emissions (lnCO2). Across both models, key explanatory variables; including the Green Bond Issuances (lnGBI) and renewable energy consumption (lnREN) exhibit a statistically significant negative relationship with CO2 emissions, confirming the environmental benefits of green financial instruments and renewable energy deployment.

Table 5.

Random Effects and Fixed Effects Tests.

In the FE model, lnREN shows a strong negative coefficient (−0.281, p < 0.01), suggesting that a 1% increase in renewable energy consumption is associated with a 0.28% decrease in CO2 emissions. Similarly, lnGBI is negatively associated with emissions (coefficient = −0.030, p < 0.01), supporting the role of green finance in emission reduction. lnPGDP is positively related to emissions, indicating that economic growth may be associated with higher environmental degradation, in line with the early stage of the Environmental Kuznets Curve (EKC). Financial development and government effectiveness also show statistically significant positive coefficients, potentially indicating institutional development effects that merit further discussion. Expenditure on environment protection (lnEEP) has no significant impact on CO2 emissions.

4.3. Robustness Check Driscoll–Kraay Estimator Results

To ensure the robustness of the fixed effects estimation results, we applied the Driscoll–Kraay standard error correction, which accounts for potential cross-sectional dependence, autocorrelation, and heteroscedasticity. A default number of lags is used based on the sample size. As shown in Table 6, the core findings remain consistent with our baseline fixed effects model. Specifically, green bond issuances (lnGBI) and renewable energy consumption (lnREN) continue to exhibit a statistically significant and negative impact on CO2 emissions. At the same time, GDP per capita (lnPGDP), financial development, and government effectiveness display positive and significant relationships. This result may reflect that more effective governments manage larger and more complex economies and energy systems, which can initially be associated with higher emissions despite stronger institutional quality. The coefficient of expenditure on environmental protection (lnEEP) remains negative but statistically insignificant. These results support the reliability of our main findings and underscore the role of green finance and clean energy in promoting environmental sustainability.

Table 6.

Robustness Check Using Driscoll–Kraay Standard Errors.

Year fixed effects were used in the Driscoll-Kraay standard error correction model formulation to account for unobserved global shocks as well as frequent time effects like policy cycles and commodity price changes. Their inclusion had no significant impact on the major coefficients, confirming the results’ robustness (See Table 6).

4.4. Robustness Check PCSE and FGLS Estimation Results

To further verify the robustness of our main findings, this study employed the Prais–Winsten regression with panel-corrected standard errors (PCSE) and feasible generalized least squares (FGLS) estimation results, which adjust for heteroscedasticity, autocorrelation, and contemporaneous correlation across panels. This method is especially useful for datasets with relatively small-time dimensions and potential cross-sectional dependence.

As presented in Table 6, the results are broadly consistent with those obtained from the FE and Driscoll–Kraay estimations. Notably, lnREN continues to exhibit a strong and statistically significant negative relationship with CO2 emissions, reinforcing the environmental benefits of renewable energy deployment. lnGBI maintains a negative coefficient, although it is only marginally significant at the 10% level, indicating some variation in significance under different model assumptions. Interestingly, lnEEP becomes statistically significant in this specification, suggesting that its effectiveness may be more evident when accounting for cross-sectional correlations. One possible explanation is that such expenditures often involve long-term infra-structure projects, regulatory enforcement, or capacity-building initiatives whose effects on emissions may not materialize immediately within the short panel horizon analyzed (2013–2022). Moreover, in many countries, environmental spending is relatively small compared to total government expenditure and may be directed toward diverse areas (e.g., conservation programs, waste management, environmental education) that do not directly translate into measurable reductions in CO2 emissions.

Consistent with previous models, lnGDP remains positively associated with CO2 emissions, and GE retains a positive and statistically significant coefficient, underlining the potential influence of institutional quality on environmental outcomes. FD, however, loses statistical significance in the PCSE model.

These findings further substantiate the core conclusion that green finance and renewable energy consumption are key drivers in reducing carbon emissions, while also highlighting how model choice may influence the detected significance of institutional and fiscal factors.

The FGLS estimates (Table 7) further support the robustness of the main findings. lnREN has a strong negative impact on CO2 emissions, consistent across all specifications. Interestingly, under FGLS, lnEEP remains significant and negative, confirming its relevance in emissions mitigation. lnGBI continues to show a negative sign, though only weakly significant.

Table 7.

Panel-Corrected Standard Errors (PCSE) and Feasible Generalized Least Squares (FGLS) Estimation Results.

A notable divergence appears in the impact of FD, which exhibits a negative and statistically significant coefficient under FGLS, contrary to its positive association in the FE and Driscoll–Kraay models. This discrepancy could be attributed to differences in model assumptions and sensitivity to cross-sectional dependencies. In addition, this change in sign may reflect the superior ability of FGLS estimation to address heteroscedasticity, autocorrelation, and cross-sectional correlation. Once these econometric distortions are corrected, the underlying contribution of financial development to supporting cleaner technologies, innovation, and efficient resource allocation becomes more apparent. Thus, FGLS results may better capture the longer-term sustainability-enhancing effects of financial deepening. GE retains a positive and significant effect, while lnPGDP remains positively associated with emissions, suggesting that economic growth may still coincide with environmental degradation in the short term.

Together, these robustness checks confirm the validity of the core findings and highlight the environmental value of renewable energy and institutional quality in reducing CO2 emissions. They also indicate that the effects of green finance and financial development may be sensitive to the estimation technique used, warranting further exploration in future studies.

4.5. Mediation Analysis Results

To test the hypothesis that renewable energy consumption mediates the relationship between green finance and CO2 emissions, we employed the Baron and Kenny (1986) [14] method due to its interpretability and suitability for moderate-sized panel data using a three-step regression framework with fixed effects. This approach remains widely applied in recent green finance and energy transition research [46,68]. First, regressed lnCO2 on lnGBI, lnEEP, and the control variables. The coefficient of lnGBI was negative and statistically significant, indicating that green bond issuance is associated with reduced CO2 emissions. However, lnEEP was not statistically significant, suggesting that environmental expenditure policies alone do not significantly affect emissions within this model.

Next, regressed lnREN on lnGBI, lnEEP, and the control variables. The results show that lnGBI had a positive and significant effect on renewable energy consumption, suggesting that green bonds effectively channel funds toward renewable energy projects. Conversely, lnEEP was not statistically significant, indicating a limited direct impact on renewable energy deployment.

Finally, regressed lnCO2 on lnGBI, lnEEP, lnREN, and the controls. In this model, the coefficient of lnGBI decreased in magnitude (from −0.0482 to −0.0304) but remained statistically significant. lnREN was strongly significant and negatively associated with CO2 emissions, confirming its mediating role. Including renewable energy (lnREN) in the model reduces the absolute magnitude of the green bond issuance (lnGBI) coefficient, indicating partial mediation of the green finance–emissions relationship. lnEEP remained statistically insignificant.

These findings (Table 8) offer valuable insight into how green finance influences environmental outcomes. The partial mediation effect, approximately 37% of the total effect of green finance on CO2 emissions operates through renewable energy-indicates that green bond issuance not only has a direct impact on reducing CO2 emissions but also indirectly promotes decarbonization by encouraging renewable energy deployment. This result is consistent with prior studies highlighting the role of capital market instruments in lowering financing costs, de-risking renewable projects, and accelerating clean energy adoption [7,25]. The absence of a significant mediating effect through environmental protection expenditure may reflect the fact that such spending often targets regulatory compliance, pollution abatement, or conservation activities, which may reduce emissions through channels other than renewable energy consumption.

Table 8.

Mediation Analysis Results (Baron & Kenny Method).

Our findings align closely with the growing empirical consensus on the decarbonization role of green finance and renewable energy, yet they also reveal interesting contrasts across global contexts. In BRICS economies, Sadiq et al. (2024) [31] showed that green finance, eco-innovation, and carbon taxes jointly reduce CO2 emissions, but the magnitude of the effect is lower than what we observe, likely reflecting weaker financial depth and more heterogeneous policy enforcement. In contrast, OECD countries display a stronger and more systematic link between green finance and emission reductions; Li et al. (2019) [32] and Chien and Hu (2007) [33] report that well-developed financial markets and clear regulatory frameworks amplify the decarbonization benefits of green bonds and renewables, which is consistent with our sample of largely advanced economies. Evidence from China further supports our mediation results: studies such as Li et al. (2021) [18] and Huang et al. (2024) [35] confirm that green finance significantly boosts renewable energy investment and that renewables act as a transmission channel reducing emissions. These comparisons suggest that institutional quality, market maturity, and policy coherence are key to unlocking the full environmental potential of green finance. Our results therefore provide a benchmark for countries seeking to replicate the OECD and Chinese experience in contexts such as the BRICS, where governance gaps and limited market sophistication still constrain the effectiveness of sustainable financial instruments.

5. Conclusions and Policy Recommendations

This study provides new empirical evidence on the interplay between green finance, renewable energy consumption, and CO2 emissions across 15 countries from 2013 to 2022. By combining fixed effects with Driscoll–Kraay corrections, Prais–Winsten regressions with panel-corrected standard errors, and Feasible Generalized Least Squares estimations, the analysis addresses key econometric challenges such as heteroskedasticity, autocorrelation, and cross-sectional dependence. In addition, a mediation framework was applied to examine whether renewable energy serves as a transmission channel through which green finance reduces emissions.

The results consistently show that green bond issuance and renewable energy consumption significantly reduce CO2 emissions. The mediation analysis confirms that renewable energy partially transmits the effect of green finance to environmental outcomes, highlighting its central role in the decarbonization process. By contrast, environmental protection expenditure exhibits mixed significance across model specifications, suggesting that public spending may reduce emissions indirectly or with a time lag. Economic growth remains positively associated with emissions, underscoring the challenge of aligning growth with sustainability. Institutional quality, captured by government effectiveness, consistently supports better environmental performance, while the effect of financial development appears model-sensitive, emphasizing the need for further causal investigation.

The findings of this study provide several policy-relevant insights that can guide countries in strengthening the role of green finance to accelerate the low-carbon transition. A key priority for advanced economies is to expand and diversify green financial instruments by deepening green bond markets. This requires clear national taxonomies, mandatory disclosure standards, impact reporting, and the use of credit enhancement tools to reduce financing costs and attract long-term institutional investors. In contrast, developing economies may need to focus on using public guarantees, blended finance structures, and concessional funds to de-risk renewable energy investments and mobilize private capital.

Beyond traditional green bonds, policymakers should also encourage the adoption of innovative instruments such as sustainability-linked loans and transition bonds. These tools are particularly important for supporting firms in carbon-intensive sectors that are committed to credible decarbonization pathways. However, the effectiveness of these instruments depends heavily on the overall institutional environment. Strengthening governance frameworks, through transparent regulation, standardized reporting, and independent verification, is essential to build market credibility and reduce the risks of greenwashing.

Public policy should also work to make sure that public and private financial flows work better together. Instead of replacing private investment, public spending on the environment should help early-stage project development, build renewable energy pipelines, and co-finance important infrastructure. This method makes sure that public funds are used wisely to attract more private investment. Policy strategies must also be tailored to the specific needs of each country. Because countries have different levels of maturity in their financial markets, readiness of their institutions, and energy infrastructure, regulatory changes, tax breaks, and risk-sharing systems should be made to fit the needs and abilities of each country.

In practical terms, these policy instructions translate into four direct priorities: developing national green finance taxonomies and disclosure frameworks to ensure transparency; investing in the preparation and procurement of renewable energy project pipelines; deploying derisking tools, such as guarantees and mixed finance, to attract long-term capital; and ensuring complementarity between public funding and private green finance. Ultimately, maximizing the impact of green finance requires a coordinated strategic plan that leverages the strengths of public and private participants to scale investment and deliver a meaningful low-carbon transition.

6. Limitations and Future Research

While this study provides strong evidence on the relationship between green finance, renewable energy, and CO2 emissions, A range of limits should be acknowledged. First, the study is based on countries with relatively mature financial systems, which may limit the applicability of the findings to economies with less developed financial markets. Future research should therefore include a more varied set of countries from emerging and low-income countries to capture more diverse institutional and financial contexts.

Second, the study uses two indicators green bond issuance and environmental protection expenditure as a proxy for green finance. Although these are widely recognized measures, they represent only part of the green finance landscape. Other important channels, such as green private equity, climate-focused development finance, and innovative fintech-based instruments, were not captured and could provide a more comprehensive view of future studies. Third, green bond issuance is measured in absolute terms, which may affect cross-country comparability. Using relative indicators, such as issuance relative to GDP or per capita, could offer deeper insights into the scale and impact of green finance across different economies. Fourth, despite employing various estimation techniques to address heteroskedasticity, autocorrelation, and cross-sectional dependence, the study cannot completely eliminate concerns related to endogeneity and reverse causality. Future research could apply instrumental variable methods, dynamic panel models, or quasi-natural experimental designs to strengthen causal inference. Lastly, additional investigation would be advantageous from exploring potential non-linear or threshold effects and incorporating advanced mediation techniques, such as bootstrap-based analysis. Expanding the scope of data and methods would offer a richer and more nuanced understanding of how green finance influences decarbonization across varying institutional and market conditions.

Author Contributions

Conceptualization, M.E. and F.M.; methodology, M.E.; software, M.E.; validation, M.E., F.M. and L.A.; formal analysis, M.E. and F.M.; investigation, M.E., F.M. and L.A.; resources, M.E.; data curation, M.E.; writing—original draft preparation, M.E., F.M. and L.A.; writing—review and editing, M.E., F.M. and L.A.; visualization, F.M. and M.E.; supervision, F.M.; project administration, M.E. and F.M.; funding acquisition, M.E. All authors have read and agreed to the published version of the manuscript.

Funding

This research project was funded by the Princess Nourah bint Abdulrahman University Re-searchers Supporting Project Number (PNURSP2025R866), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia.

Data Availability Statement

The dataset was compiled from several publicly available databases. https://databank.worldbank.org/source/world-development-indicators; https://climatedata.imf.org/datasets/8e2772e0b65f4e33a80183ce9583d062_0/explore?utm; https://climatedata.imf.org/datasets/d22a6decd9b147fd9040f793082b219b_0/explore; https://legacydata.imf.org/?sk=f8032e80-b36c-43b1-ac26-493c5b1cd33b&utm&sid=1481126573525, accessed on 10 June 2025.

Acknowledgments

Princess Nourah bint Abdulrahman University Researchers Supporting Project Number (PNURSP2025R866), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Arias, P.; Bellouin, N.; Coppola, E.; Jones, R.; Krinner, G.; Marotzke, J.; Naik, V.; Palmer, M.; Plattner, G.-K.; Rogelj, J. Climate Change 2021: The Physical Science Basis; Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Technical Summary. 2021. Available online: https://www.ipcc.ch/report/ar6/wg1/ (accessed on 10 June 2025).

- The Paris Agreement. Report of the Conference of the Parties to the United Nations Framework Convention on Climate Change, 21st Session; HeinOnline: Getzville, NY, USA, 2015. [Google Scholar]

- UN General Assembly. Transforming Our World: The 2030 Agenda for Sustainable Development; UN General Assembly: New York, NY, USA, 2015. [Google Scholar]

- Luo, S.; Mabrouk, F. Nexus between natural resources, globalization and ecological sustainability in resource-rich countries: Dynamic role of green technology and environmental regulation. Resour. Policy 2022, 79, 103027. [Google Scholar] [CrossRef]

- OECD. Investing in Climate, Investing in Growth; OECD Publishing: Paris, France, 2017. [Google Scholar]

- Zhang, D.; Zhang, Z.; Managi, S. A bibliometric analysis on green finance: Current status, development, and future directions. Financ. Res. Lett. 2019, 29, 425–430. [Google Scholar] [CrossRef]

- Flammer, C. Corporate green bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar] [CrossRef]

- Climate Bonds Initiative. Green Bonds: Market Summary; Climate Bonds Initiative: London, UK, 2022. [Google Scholar]

- Taghizadeh-Hesary, F.; Yoshino, N. Sustainable solutions for green financing and investment in renewable energy projects. Energies 2020, 13, 788. [Google Scholar] [CrossRef]

- Wang, Y.; Zhi, Q. The role of green finance in environmental protection: Two aspects of market mechanism and policies. Energy Procedia 2016, 104, 311–316. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook; IEA: Paris, France, 2023. [Google Scholar]

- REN21. Renewables 2022 Global Status Report; REN21: Paris, France, 2022. [Google Scholar]

- World Bank. Mobilizing Private Finance for Development; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Choi, E.; Seiger, A. Catalyzing Capital for the Transition Toward Decarbonization: Blended Finance and Its Way Forward. 2020. Available online: https://sfi.stanford.edu/publications/catalyzing-private-investment/catalyzing-capital-transition-toward-decarbonization (accessed on 10 June 2025).

- Hu, M.; Sima, Z.; Chen, S.; Huang, M. Does green finance promote low-carbon economic transition? J. Clean. Prod. 2023, 427, 139231. [Google Scholar] [CrossRef]

- Strilchuk, Y.; Lavreniuk, V.; Sandul, M.; Bielinskyi, A. Green Finance and Decarbonization Policy Synergy; Liberty Publishing House: New York, NY, USA, 2025. [Google Scholar]

- Li, M.; Hamawandy, N.M.; Wahid, F.; Rjoub, H.; Bao, Z. Renewable energy resources investment and green finance: Evidence from China. Resour. Policy 2021, 74, 102402. [Google Scholar] [CrossRef]

- Belgacem, S.B.; Adam, N.A.; Khatoon, G.; Pawar, P.S. Do green finance, low-carbon energy transition, and economic growth help in environmental investment?: Empirical evidence from emerging economies in Asia. Geol. J. 2023, 58, 3259–3267. [Google Scholar] [CrossRef]

- Tang, D.Y.; Zhang, Y. Do shareholders benefit from green bonds? J. Corp. Financ. 2020, 61, 101427. [Google Scholar] [CrossRef]

- Wang, H.; Zhang, D. Examining the interplay between fossil fuel mining, sustainable growth, and economic prosperity. Resour. Policy 2023, 87, 104324. [Google Scholar] [CrossRef]

- Yu, M.; Zhou, Q.; Cheok, M.Y.; Kubiczek, J.; Iqbal, N. Does green finance improve energy efficiency? New evidence from developing and developed economies. Econ. Change Restruct. 2022, 55, 485–509. [Google Scholar] [CrossRef]

- Thi Nguyen, M.-L.; Huu Nguyen, T. Climate change and the financial performance of basic materials companies: Empirical evidence in Vietnam. J. Adv. Manag. Res. 2024, 21, 509–529. [Google Scholar] [CrossRef]

- Zhang, Q.; Adebayo, T.S.; Ibrahim, R.L.; Al-Faryan, M.A.S. Do the asymmetric effects of technological innovation amidst renewable and nonrenewable energy make or mar carbon neutrality targets? Int. J. Sustain. Dev. World Ecol. 2023, 30, 68–80. [Google Scholar] [CrossRef]

- Xiliang, Q.; Kuo, Y.-K.; Abourehab, M.A.; Mabrouk, F.; Ramirez-Asis, E.; Abdul-Samad, Z.; Makes, N. The impact of ICT, green finance, and CSR on sustainable financial performance: Moderating role of perceived organizational support. Econ. Res.-Ekon. Istraživanja 2023, 36, 2151489. Available online: https://www.tandfonline.com/doi/full/10.1080/1331677X.2022.2151489 (accessed on 10 June 2025). [CrossRef]

- Baştürk, M. Does green finance reduce carbon emissions? Global evidence based on system generalized method of moments. Sustainability 2024, 16, 8210. [Google Scholar] [CrossRef]

- Muchiri, M.K.; Erdei-Gally, S.; Fekete-Farkas, M. Nexus between green financing and carbon emissions: Does increased environmental expenditure enhance the effectiveness of green finance in reducing carbon emissions? J. Risk Financ. Manag. 2025, 18, 90. [Google Scholar] [CrossRef]

- Guo, C.; Wang, X.; Cao, D.; Hou, Y. The Impact of Green Finance on Carbon Emission—Analysis Based on Mediation Effect and Spatial Effect. Front. Environ. Sci. 2022, 10, 844988. [Google Scholar] [CrossRef]

- Meo, M.S.; Abd Karim, M.Z. The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanb. Rev. 2022, 22, 169–178. [Google Scholar] [CrossRef]

- Elmonshid, L.B.E.; Sayed, O.A.; Awad Yousif, G.M.; Eldaw, K.E.H.I.; Hussein, M.A. The impact of financial efficiency and renewable energy consumption on CO2 emission reduction in GCC economies: A panel data quantile regression approach. Sustainability 2024, 16, 6242. [Google Scholar] [CrossRef]

- Sadiq, M.; Chau, K.Y.; Ha, N.T.T.; Phan, T.T.H.; Ngo, T.Q.; Huy, P.Q. The impact of green finance, eco-innovation, renewable energy and carbon taxes on CO2 emissions in BRICS countries: Evidence from CS ARDL estimation. Geosci. Front. 2024, 15, 101689. [Google Scholar] [CrossRef]

- Li, Y.; Chiu, Y.-H.; Wang, L.; Liu, Y.-C.; Chiu, C.-R. A comparative study of different energy efficiency of OECD and non-OECD countries. Trop. Conserv. Sci. 2019, 12, 1–19. [Google Scholar] [CrossRef]

- Chien, T.; Hu, J.-L. Renewable energy and macroeconomic efficiency of OECD and non-OECD economies. Energy Policy 2007, 35, 3606–3615. [Google Scholar] [CrossRef]

- Jamel, M.; Zhang, C. Green finance, financial technology, and environmental innovation impact on CO2 emissions in developed countries. J. Energy Environ. Policy Options 2024, 7, 43–51. [Google Scholar]

- Huang, J.; He, W.; Dong, X.; Wang, Q.; Wu, J. How does green finance reduce China’s carbon emissions by fostering green technology innovation? Energy 2024, 298, 131266. [Google Scholar] [CrossRef]

- Zhu, H.; Li, D. A carbon emission adjustment model considering green finance factors in the context of carbon neutrality. IEEE Access 2024, 12, 88174–88188. [Google Scholar] [CrossRef]

- Al-Zubairi, A.; AL-Akheli, A.; Elfarra, B. The impact of financial development, renewable energy and political stability on carbon emissions: Sustainable development prospective for arab economies. Environ. Dev. Sustain. 2025, 27, 15251–15273. [Google Scholar] [CrossRef]

- Wang, Y.; Cui, L.; Zhou, J. The impact of green finance and digital economy on regional carbon emission reduction. Int. Rev. Econ. Financ. 2025, 97, 103748. [Google Scholar] [CrossRef]

- Wiredu, J.; Yang, Q.; Lu, T.; Sampene, A.K.; Wiredu, L.O. Delving into environmental pollution mitigation: Does green finance, economic development, renewable energy resource, life expectancy, and urbanization matter? Environ. Dev. Sustain. 2025, 97, 103748. [Google Scholar] [CrossRef]

- Guan, X.; Hassan, A.; Nassani, A.A. Investigating the Role of Environmental Taxes, Green Finance, Natural Resources, Human Capital, and Economic Growth on Environmental Pollution Using Panel Quantile Regression. Sustainability 2025, 17, 1094. [Google Scholar] [CrossRef]

- Fu, C.; Lu, L.; Pirabi, M. Advancing green finance: A review of climate change and decarbonization. Digit. Econ. Sustain. Dev. 2024, 2, 1. [Google Scholar] [CrossRef]

- Wang, Q.; Dong, Z. Does financial development promote renewable energy? Evidence of G20 economies. Environ. Sci. Pollut. Res. 2021, 28, 64461–64474. [Google Scholar] [CrossRef]

- Amoah, A.; Amoah, B.; Kwablah, E.; Asiama, R.K. Renewable energy transition and climate finance nexus in sub-Saharan Africa. Glob. Environ. Change Adv. 2025, 4, 100013. [Google Scholar] [CrossRef]

- Xu, L.; Wu, Y. Nexus between green finance, renewable energy and carbon emission: Empirical evidence from selected Asian economies. Renew. Energy 2023, 215, 118983. [Google Scholar] [CrossRef]

- Chen, R.; Zhang, Q.; Wang, J. Impact assessment of green finance reform on low-carbon energy transition: Evidence from China’s pilot zones. Environ. Impact Assess. Rev. 2025, 110, 107654. [Google Scholar] [CrossRef]

- Nepal, R.; Liu, Y.; Wang, J.; Dong, K. How does green finance promote renewable energy technology innovation? A quasi-natural experiment perspective. Energy Econ. 2024, 134, 107576. [Google Scholar] [CrossRef]

- Chen, J.M.; Umair, M.; Hu, J. Green finance and renewable energy growth in developing nations: A GMM analysis. Heliyon 2024, 10, e33879. [Google Scholar] [CrossRef]

- Xu, W.; Yuan, Q.; Chen, N.; Ye, J. Green Finance and Energy Structure Transition: Evidence from China. Sustainability 2025, 17, 4838. [Google Scholar] [CrossRef]

- Siddique, M.H.; Shafi, N.; Shaheen, W.A.; Bilal, M.J. Global dynamics of energy use, sustainability, and R&D: Unlocking green innovation through environmental regulations. Soc. Sci. Spectr. 2025, 4, 142–164. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- UN Environment Programme. Green Finance for Developing Countries: Needs, Concerns and Innovations; UN Environment Programme: Nairobi, Kenya, 2016. [Google Scholar]

- Campiglio, E. Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 2016, 121, 220–230. [Google Scholar] [CrossRef]

- Geels, F.W. Technological transitions as evolutionary reconfiguration processes: A multi-level perspective and a case-study. Res. Policy 2002, 31, 1257–1274. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Q. Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour. Policy 2021, 74, 102436. [Google Scholar] [CrossRef]

- Lin, Z.; Liao, X.; Jia, H. Could green finance facilitate low-carbon transformation of power generation? Some evidence from China. Int. J. Clim. Change Strateg. Manag. 2023, 15, 141–158. [Google Scholar] [CrossRef]

- Yao, Y.; Shen, Y.; Liu, K. Investigation of resource utilization in urbanization development: An analysis based on the current situation of carbon emissions in China. Resour. Policy 2023, 82, 103442. [Google Scholar] [CrossRef]

- Gujarati, D.N. Basic Econometrics; McGraw-Hill: New York, NY, USA, 2009. [Google Scholar]

- Pesaran, M.H.; Schuermann, T.; Weiner, S.M. Modeling regional interdependencies using a global error-correcting macroeconometric model. J. Bus. Econ. Stat. 2004, 22, 129–162. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification tests in econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Baltagi, B.H. Forecasting with panel data. J. Forecast. 2008, 27, 153–173. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econom. 1995, 68, 29–51. [Google Scholar]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar]

- Driscoll, J.C.; Kraay, A.C. Consistent covariance matrix estimation with spatially dependent panel data. Rev. Econ. Stat. 1998, 80, 549–560. [Google Scholar] [CrossRef]

- Beck, N.; Katz, J.N. What to do (and not to do) with time-series cross-section data. Am. Political Sci. Rev. 1995, 89, 634–647. [Google Scholar] [CrossRef]

- Parks, R.W. Efficient estimation of a system of regression equations when disturbances are both serially and contemporaneously correlated. J. Am. Stat. Assoc. 1967, 62, 500–509. [Google Scholar] [CrossRef]

- Zhao, X.; Lynch, J.G., Jr.; Chen, Q. Reconsidering Baron and Kenny: Myths and truths about mediation analysis. J. Consum. Res. 2010, 37, 197–206. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behav. Res. Methods Instrum. Comput. 2004, 36, 717–731. [Google Scholar] [CrossRef]

- Bilal, M.J.; Shaheen, W.A. Towards sustainable development: Investigating the effect of green financial indicators on renewable energy via the mediating variable. Renew. Energy 2024, 221, 119819. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).