Abstract

Global modern renewable energy based on geothermal, wind, solar, and marine resources has grown rapidly over the last decades despite low energy density, intermittent supply, and other qualities inferior to those of fossil fuels. What is the explanation for this growth? The main drivers of growth are assessed using economic theories and verified with statistical data. From the neo-classic viewpoint that focuses on price substitutions, the growth can be explained by the shift from energy-intensive agriculture and industry to labour-intensive services. However, the energy resources complemented rather than substituted for each other. In the evolutionary idea, investments supported by policies enabled cost-reducing technological change. Still, policies alone are insufficient to generate the growth of modern renewable energy as they are inconsistent across countries and in time. From the behavioural perspective that is preoccupied with innovative entrepreneurs, the value addition of electrification can explain the introduction of modern renewable energy in market niches, but not its fast growth. Instead of these mono-causalities, the growth of modern renewable energy is explained by technology diffusion during the pioneering, growth, and maturation phases. Possibilities that postpone the maturation are pinpointed.

1. Introduction

Factors that drive the rapid growth of renewable energy are reviewed from an economic perspective. Global energy production increased by approximately 1.8% annually from 102 PWh in 1990 to 158 PWh in 2014. Meanwhile, traditional renewable energy based on hydro and bioenergy as well as fossil fuels based on coal, oil, and natural gas grew 1.5% to 2.8% annually across these resources; nuclear power was only 1.1%, and modern renewable energy based on geothermal, wind, solar, and marine resources grew 7.1% a year [1]. Wind and solar energy have expanded faster than other renewable energy sources, despite widely acknowledged deficiencies in their quality performance compared with fossil fuels. One major disadvantage is their lower energy density, measured in energy units (MJ) per mass (kg), or per space use (m2). This results in greater resource consumption for energy production. Another disadvantage is interruption and volatility. This causes means that energy supplies are affected by environmental conditions such as sunlight and weather, which hinder continuous energy consumption. The supplies of fossil fuels, traditional renewable energy as well as geothermal and marine resources provide continuity. Yet another deficiency is that wind and solar energy resources deliver mainly electric power, while 79% of global energy consumption is heat, and converting electric power into heat causes energy losses. After twenty-five years of expanding wind and solar energy, fast growth cannot be considered a statistical bias of a successful novelty, but a trend that will continue into the future [2]. This expectation is plausible considering the growing interests of stakeholders, measured by the increasing number of scientific publications; for example, nearly 55,000 papers were published solely on solar energy in 2021 [3].

It is puzzling what factors can drive the fast growth of modern renewable energy. This puzzle is difficult to explain from the conventional engineering perspective. From this point of view, energy technologies are influenced by the higher density of energy resources, which enables producers to improve their performance at lower costs [4]. Energy-dense resources are assumed to have been drivers of industrialisation and mass transportation during the last centuries [5]. Larger uses of energy-dense fossil fuels are considered to drive economic growth, as indicated by correlations of gross domestic product (GDP) and energy use across countries [6] and in time [7]. If the engineering idea is valid, higher energy density resources would be consumed; for example, more uranium, which is manifold energy denser than natural gas, which is thrice denser than 5 kWh (18 MJ) per kg biomass within traditional renewable energy [8]. However, wind and solar resources grew faster, despite having lower energy densities measured by the conversion of energy production per cubic meter into production per mass [9], although these conversions are disputable. A popular idea is that the growth of modern renewable energy is an anomaly driven by policies aimed at carbon density in energy resources, which reduces CO2 emissions and thereby mitigates climate change. Although this decarbonisation goal may impede the more effective use of energy resources, a global collusion driven by environmentalist interests is unrealistic due to the divergent interests across countries. It is necessary to have more plausible explanations. The economic perspective can provide more plausible explanations. Therefore, three main streams in economic thought are considered: the neoclassical (mainstream) theory, the evolutionary (institutional) one, and behavioural theory. This research raises questions about the ability of conventional economic theories to explain the rapid growth of wind and solar energy. It questions the neoclassic idea that resource prices drive the substitution of one resource for another, suggesting that energy resources tend to complement each other rather than replace them. It also indicates that investments in geothermal and marine energy have been small, and that their increase has not led to a significant increase in production, indicating a failure in technology development to date. The research also notes that larger investments do not necessarily lead to economies of scale with lower unit costs, and policies are not decisive in the production growth because they inconsistently use policy instruments. Examples of inconsistent uses are low taxes on carbon dioxide emissions and large subsidies for fossil fuels, which hinder the entry of renewable energy sources into the market as well as weak and even negative correlations between the feed-in tariffs in support of renewable energy and the production growth of renewable energy caused by those subsidies. Behavioural theory explains the entry of wind and solar energy, but not their fast growth. With regard to these shortcomings, an integration of economic theories is discussed.

Within these theories, the explanations focus on the technological change. Herewith, technologies are comprehended as tools for converting resources into valuable uses. Significant qualitative changes in the conversions are innovations, while their specific applications are adaptation; both can be scaled up towards larger production quantities. Herewith, innovations aiming at economic growth, well-being, and better environmental qualities are labelled as sustainable innovations. The general arguments in these theories are only briefly discussed, as they are covered in another publication on sustainable innovations [10]. This assessment aims to explain the growth of modern renewable energy based on the use of statistical data to verify theoretical expectations. Factors are defined that explain global growth, meaning the drivers of growth across various countries and the use of energy resources. This explanation underpins investments and policies aiming at sustainable development. The data are based mainly on the author’s book ‘Economics of Renewable Energy’ [11], while the interpretation of these data for verifying economic theories is entirely new. Regarding our focus on the explanations of the growth of renewable energy, there are also limitations to this research. Several issues are uncovered or only briefly touched. One untouched issue regards the effects and impacts of changing energy resources on economies, well-being, and environmental qualities, being the main pillars of sustainable development. Another limitation is that policies are touched upon insofar as policy instruments are assumed to drive changes in energy resources. Finally, technology forecasts cannot be found in this article, nor scenarios about changes in energy resources in the future.

Section 2 introduces the methodology used in this assessment. Section 3 defines the economists’ expectations about the drivers of modern renewable energy. The results cover the expectations and verifications of the neoclassical train of thought regarding resource substitutions, followed by the evolutionary ideas focused on investments, and behavioural theory about value addition due to entrepreneurial initiatives. Section 4 discusses those results integrates these explanations into the context of technology diffusion with particular attention to the factors that can drive the growth of renewable energy in the near future. Finally, Section 5 draws conclusions.

2. Materials and Methods

Revealed performances rather than policies and ideas were used to verify the theoretical expectations about the factors that drive the growth of modern renewable energy. Revealed was comprehended in the sense of experiences as observed in the statistical data and in thorough assessments globally and across countries. The term performance refers to adding value through energy services and resolving issues related to energy use, which can collide with each other. What is important is the energy consumption per income. Businesses in agriculture and industry are considered energy-intensive as they use a lot of energy to generate their income. For the convenience of the readers, the energy data are shown in power units (kWh), and the economic data in constant USD per year (USD), adjusted for inflation. The unit costs per kWh are known as the unit costs per energy unit. The terms production, consumption, and use of energy are interchangeable because they are in balance on the global scale, given that the storage of energy is negligible compared with energy production. Modern renewable energy is considered, particularly wind and solar energy.

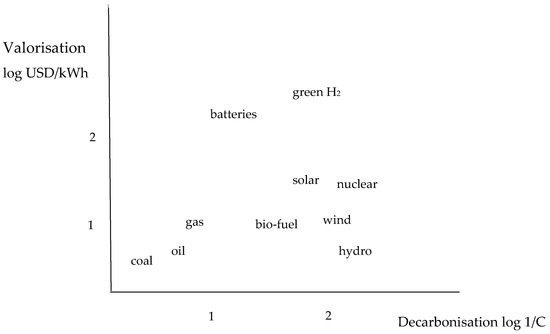

The value addition in energy use is defined as the sale price of energy services minus the purchase cost of energy resources multiplied by the scale of energy use. At a scale, value is added when cheaper energy resources are purchased or when higher-priced energy services are sold. For example, when coal replaces gas, electricity replaces heat. The investment costs per energy unit estimate this valuation of energy services. This estimate approximates the lifetime costs of using energy technology, which is a popular indicator in the USA called the levelised costs of energy [12]. The value is determined by the availability, convenience, safety, and other qualities associated with energy use. Various issues related to global energy use need resolution such as energy poverty, resource scarcity, health impacts, and area coverage. Currently, a global issue that is drawing policy attention is the reduction in carbon content in energy use, aiming to diminish CO2 emissions in order to minimise the greenhouse effect on the climate. Concerning mitigating climate change, the recommendation is to reduce the carbon density of energy resources throughout the life cycles of energy use. Renewable and nuclear energy are assumed to enhance decarbonisation because they contain less molecular weight of carbon per energy unit than fossil fuels [13]. This decarbonisation is measured as 1/kg mol C per kWh. Given that the valorisation of energy services does not necessarily match decarbonisation, they are considered separately, as shown in Figure 1.

Figure 1.

Quality performances of energy resources, developed by Yoram Krozer for the conceptualisation of changes in energy systems.

Figure 1 represents the valorisation and decarbonisation of energy resources during the 1990s, when the prices of fossil fuels were lower, while the costs of renewable energy were higher than in the 2020s. Meanwhile, the use of renewable energy can be cheaper than the use of fossil fuels, as illustrated in the winning tenders for solar power in the UAE and offshore wind in the Netherlands, both producers of fossil fuels. This figure is solely intended to illustrate the quality performances measured in the above-mentioned terms on the logarithmic scales. Value is added when electricity from the grid is served, and an even higher value is added when electricity is stored. This valorisation of energy services can complement the decarbonisation process with costly renewable and nuclear energy resources. Regarding that match, focus is on factors that generate value.

The theoretical expectations about drivers of modern renewable energy were compared with observations derived from several authoritative databases for verification. These were mainly the database of the International Energy Agency (IEA) [14], one from British Petroleum (BP) [15], the data from the World Bank (WB) [16], data from the Our World Data (OWD) [17], and the database of the International Renewable Energy Agency (IRENA) [18]. The averages of at least one decade were used to avoid biases caused by incidental observations. The period 1990 to 2015 was covered, which is sufficiently long ago to include changes in energy markets and policies, and sufficiently long ago to avoid biases caused by the hype in ideas. This assessment focused on the global scale and populous countries that consume a significant amount of energy, which are the USA, China, and the European Union, with the United Kingdom (EU28) being considered as one country. A brief mention is made of several other countries.

3. Results

3.1. Theoretical Expectations

Three main streams of economic thought regarding technological change were used to assess the factors that drive the growth of modern renewable energy. The first line of thought is neoclassical theory, the mainstream idea in economics, which focuses on substitutions of resources caused by resource prices, when these resources refer to capital, labour, and energy. Second, evolutionary thinking, also known as institutional theory, is preoccupied with investments that are assumed to drive cost-reducing technological change in energy. Finally, behavioural theory addresses entrepreneurial initiatives that aim to add value to energy services. For the verification of these theories based on data, their assumptions regarding the drivers of change, explanations of the growth of modern renewable energy and the validation methods are briefly indicated.

In neoclassical economic theory, it is assumed that the resource prices of energy, capital, and labour drive technologies. This price substitution is axiomatic: a larger demand increases prices, and vice versa, which generates substitution for lower-priced resources. Markets create technologies at the lowest resource prices when self-interest in market transactions is pursued. Such backstop technology in energy is assumed to be the energy-dense nuclear power [19], which aligns with the engineering viewpoint. The growth of modern renewable energy can be attributed to the shifts from energy-intensive agriculture and industry to labour-intensive services. As demand decreases, the prices of energy-dense resources will decrease. For the verification of this theory, we assessed whether those resource substitutions were observed, and if the demands and prices of energy-intensive resources decline.

In evolutionary theory, it is argued that cost-reducing technological changes reduce prices; the causality in neoclassical theory is reversed. The argumentation is that energy demands invoke innovations purposed to satisfy them, followed by investments in larger production scales along with adaptations of technologies, which reduce the production costs per energy unit. This assumption is that economies of scale drive the growth of energy technologies (Grübler et al., 1999) [20]. It is also argued that policies support innovations when they are costly through the inducement of investments, which generate an economy of scale, while investments are induced by policies [21]. This argument is validated regarding the effects of investments on cost reduction and the effects of public support on investments in renewable energy.

From a behavioural viewpoint, entrepreneurs pursue profits by adding value to qualities that meet demands. Therefore, they must overcome organisational hierarchies, unbalanced power and information in transactions, and other deficiencies posed by vested interests [22]. The key capability of entrepreneurs is finding opportunities for profitable value additions regarding uncertainties about rival suppliers, consumer preferences, and other risks of failure [23]. In the energy business, it is essential to find valuable energy services at acceptable unit costs. Along this train of thought, modern renewable energy would enable innovative services that are considered worth purchasing, resulting in cost-reducing technological changes. This explanation can hold if tangible value-adding energy services are defined, and profitable businesses based on modern renewable energy are indicated.

These drivers of modern renewable energy do not exclude each other. Modern renewable energy could grow thanks to the decreasing demand for energy compared with capital and labour as well as policies that induce investments and add value to energy services. Observations were used to verify these theoretical expectations, and then the drivers were integrated in the following sections.

3.2. Prices and Substitution

From the neoclassical economic perspective, changes in energy resources are driven by the prices of energy, capital, and labour resources, which are constituted through substitutions of resources in market transactions. A theoretical expectation is that the declining energy intensity of businesses would reduce demand for energy-intensive resources, which would generate the growth of modern renewable energy. A lower demand would decrease the prices of energy resources. It was assessed whether the energy intensity of economies declines and the prices of energy decrease.

3.2.1. Expansion of Services

A decline in global energy intensity has been observed. While the global population grew from 1800 to 2000 by 1.4% annually, energy use grew by 1.5%, and the gross domestic product (GDP) grew by 2.1%; these estimates are based on the OWD database with reference to the Maddison data [24]. During the 1900s, the global GDP accelerated to a 3% annual average while service businesses grew faster than agriculture and industries, as estimated with the PBL database [25]. As a result, the global share of services in GDP increased by 26% and reached nearly two-thirds of the global GDP by the late 1990s. Higher shares of services were found in high-income countries, but their shares hardly increased, and lower shares were found in mid-income and low-income countries, where they grew rapidly. Statistical data on the energy intensity of businesses are scarce, but the OECD database [26] provides such data for Belgium, Italy, Portugal, Slovenia, Sweden, Spain, and Switzerland between 2008 and 2018, based on which the annual average energy intensity was estimated. Nearly 25 kWh per USD was used in mining and quarrying, which was twice as much as in the production of electricity, gas, and air conditioning. The latter was five times more energy-intensive than manufacturing and agriculture, which were ten times more energy-intensive than construction and water businesses. In turn, these were 20 times more energy-intensive than the most energy-intensive services such as those in healthcare [27]. Regarding the shift in the composition of economies, shifts in energy resources are plausible.

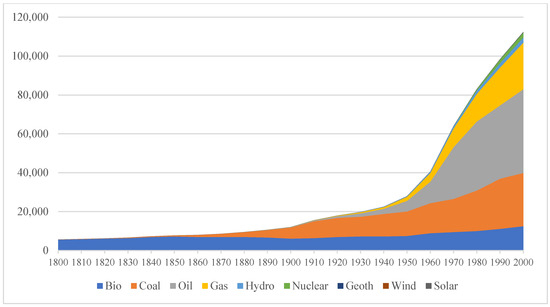

The idea of substitution is questionable because energy resources are complemented rather than replaced. As the global energy use increased nearly 20-fold from about 6 PWh (20 PJ) in 1800 to 113 PWh (405 EJ) in 2000, new energy resources were added to energy uses. Figure 2 shows the complementation with the OWD data excluding firewood, the muscle strength of animals and humans, and other local energy resources. While bioenergy usage hardly increased, coal usage grew from the mid-1800s to 1900, followed by larger uses of oil and gas as well as nuclear energy and modern renewable energy from the mid-1900s. Inter alia, other databases on energy use also show this complementation, but the Shift portal database shows earlier entries and larger uses of modern renewable energy [28].

Figure 2.

Global energy consumption in TWh.

The complementation of energy resources cannot be explained by hoarding and other temporary actions, given that the addition of energy resources continues for decades. This complementation mechanism can be explained by backward and forward links in energy services. Backward linkages refer to the dependency of the users on the suppliers vested in the past. When suppliers face the costs of equipment, management, and other expenses caused by the shifts in energy resources, they are reluctant to introduce changes. As the technological change that generates substitutions is delayed, incumbent interests in energy business develop innovation, which enables forward links through changes in production dedicated to specialised deliveries. An example of this specialisation in energy uses is the replacement of coal-based steam engines with oil-based internal combustion engines in movers as well as the use of larger coal in stationary production. An example within movers is the introduction of diesel as an energy resource for vehicles and shipping, next to biofuels, coal gas, gasoline, and others. Complementation tempers the substitutions of energy resources, which also obstructs policies aimed at the decarbonisation of energy resources.

3.2.2. Impacts of Fuel Prices

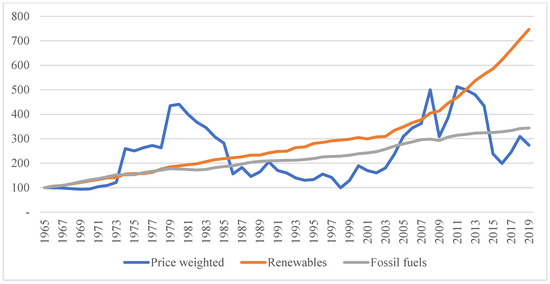

The effects of energy prices on the shift in energy resources are also disputable. The increase in coal use in the 1800s is argued to have been influenced by the high prices of fuelwood caused by depleted forests [28]. However, it has also been pointed out that wood prices remained low in the USA, while businesses used fuelwood alongside coal well into the 1900s [29]. More recently, the high international prices of fossil fuels during the 1970s and early 1980s had little impact on the composition of energy resources in the global economy, despite prompting the development of modern renewable energy. Similarly, higher fuel prices hardly reduced the use of fossil fuels, but enhanced renewable energy, as estimated for the period 1965 to 2019 with BP data; inter alia, these data differ from the IEA data. Figure 3 shows the indices of fuel prices in USD2019 weighted for the annual use of resources as well as the use of fossil fuels and renewable energy.

Figure 3.

Index of global energy prices and production (1965 = 100).

The average fuel prices weighted for the resources used mildly fluctuated around USD2019 0.1 per kWh from the late 1800s until 1974, which is equivalent to USD2019 20 per barrel of oil equivalent. Fuel prices began to fluctuate heavily from the mid-1970s onwards. The average fuel price tripled to USD2019 0.033 per kWh during the so-called oil crisis from 1974 to 1985, followed by a decline to the previous price level. In Asia, when economic growth kicked in, the annual average prices jumped to USD2019 0.040 per kWh from 2005 to 2015, when they declined to USD2019 0.026 per kWh. Thereafter, the prices declined even further with minor fluctuations, except for a short-term increase in 2022 after the Russian invasion of Ukraine. Throughout the forty-five years from the late 1960s to the late 2010s, the weighted prices tripled. While the prices of oil and gas have strongly fluctuated, coal prices evolved smoothly. Despite higher prices of fossil fuels, their global production tripled from 1965 to 2019, while the price peaks caused minor downward ripples in their production. Despite higher prices of natural gas, its use grew faster than that of oil and coal, and the growth of nuclear power stagnated after the 1980s, despite its high energy density. Meanwhile, the uses of renewable energy grew faster than fossil fuels throughout the periods of high and low prices, though these price peaks enhanced renewable energy. Within renewable energy, biomass and hydropower grew slowly, while manifold costlier wind and solar energy and liquid biofuels grew fast. High prices of fossil fuels hardly influenced energy resources, but they invoked modern renewable energy, particularly wind and solar energy.

In sum, the growth of modern renewable energy can be driven by the shift from energy-intensive agriculture and industry to labour-intensive services. However, the concept of price substitution is dubious given that energy resources complement each other rather than replace them, and prices have increased despite the decline in energy intensity, with little effect on the growth of renewable energy.

3.3. Cost-Reducing Change

In evolutionary thinking, the growth of energy resources is driven by cost-reducing technological change that is faster in modern renewable energy than in traditional ones, and in fossil fuels [30]. Lower unit costs are induced by investments in research and development aimed at effective applications, and in an economy of scale in production [31]. Policy support is expected to enhance these investments when modern renewable energy is more expensive than rival resources. An assessment was conducted to determine whether the investments generate economies of scale and if policies support it.

3.3.1. Larger Investments

Higher investments in production have generated economies of scale in modern renewable energy. This is supported by data on the global annual investments, installed capacity, and production of hydropower and bioenergy, which are considered traditional renewable energy as well as geothermal, wind, solar, and marine resources, which are defined as modern renewable energy. The period 2005 to 2015 covers when the prices of fossil fuels were high, while the unit costs of modern renewable energy exceeded these prices. The IRENA data were used. Its production data of hydro and bioenergy, shown in TWh (equivalent to billion kWh), differ from the IEA and BP, and the investment data in USD2019 billion were higher than that of another authoritative statistic [32]. The calculated investments per energy unit in USD2019 per kWh, based on IRENA data, were similar to the unit costs derived from projects across countries [33] and in the USA [34]. Table 1 shows the global annual investments and energy production at the beginning and the end of that period. The two-year averages were used to avoid bias caused by exceptional years. The installed capacities are not displayed because they are reflected in the energy production.

Table 1.

Investments, production, and unit costs in renewable energy during 2005 to 2015 (IRENA, 2025) [18].

Global investments and production were unevenly divided across these renewable energy resources. Annual investment in hydropower and bioenergy decreased, while the installed capacities and energy production increased. Hydropower was by far the largest renewable energy resource, and its unit cost was the lowest despite low, decreasing investments. Although investing in these mature technologies was not appealing, their unit costs decreased despite low investments, suggesting that larger investments are not necessary for cost-reducing technological changes. Investments in geothermal and marine energy were small, but their increase had a negligible impact on production, indicating failures in technology development thus far. Investments in wind and solar were manifold larger than in other renewable energy resources. Investments in wind energy grew 4-fold and solar energy 8-fold from 2005 to 2015, while their production grew 7 and 43 times, respectively. Their production increased more than proportionally to the investments, and the unit costs decreased more than proportionally to the production, as expected in the evolutionary theory based on the economies of scale. Investments in wind and solar energy also grew during low fuel prices from 2015 onward. Their scale approximates investments in fossil fuels in the early 2020s, when their unit costs approached price parity with fossil fuels [35]. Investments in wind and solar energy reduced their unit costs, but hardly decarbonised energy. They attracted 94% of all investments in renewable energy, but only covered 14% of all renewable energy production. Investments in electricity generation with wind and solar energy enabled them to reduce their unit costs towards price parity with fossil fuels. Although large-scale hydropower declined below the cheapest coal-based power plant, its use hardly increased. Apparently, larger investments in energy production do not necessarily generate economies of scale with lower unit costs, and the lowest unit costs are not decisive for production growth. Other factors are also relevant.

Whether larger investments in wind and solar energy will reduce their unit costs in the future is also debatable. The IRENA database and Lazard data suggest that there is a saturation of cost-reducing technological change at USD2019 0.02–0.05 per kWh across renewable energy resources. However, earlier forecasts of the saturation were incorrect. An authoritative report on Danish wind energy predicted saturation in the 2000s [36], but the IRENA trend revealed ongoing declines into the 2020s. Similarly, cost reduction in PV production in Japan would slow down to 5% in the 2000s [37], but the IRENA trend showed a 15% annual decrease 20 years later. Apparently, cost-reducing technological change continues when research and development are large and effective, and their applications are tuned to the customer demands and environmental conditions. It is also argued that solar energy’s unit costs will decrease as more photovoltaic cells are combined on panels, and investments generate economies of scale. These arguments refer to Moore’s law, which refers to cost reduction due to more transistors on integrated circuits, and even more to Wright’s law, which lowers unit costs as the production scale increases [38]. It is to be seen whether this idea holds true.

3.3.2. Policy Instruments

Policies support modern renewable energy as well as rival fossil fuels. Although policies are often assumed to encourage renewable energy, they often impede the entry of newcomers through subsidies, taxes, and other financial instruments as well as certifications, permits, and other non-financial instruments. A few hundred various financial instruments in support of environmental technologies, including renewable energy, can be found across countries [39], but only a few of them are addressed. These are CO2 taxes and emission trading, subsidies and tax exemptions for energy, and feed-in tariffs.

CO2 taxes aim to reduce these emissions caused by the combustion of fossil fuels, but when global taxes on fossil fuels are divided by fossil fuels, an insignificant average tax of currently USD 2 per ton of CO2 is found [40]. Only a few European countries impose taxes on the current USD 100 per ton of CO2, which is equivalent to the average high fuel prices. A larger emission can be expected by using the instrument of the CO2 emission ceiling with trading. As policies set a ceiling, large emitters reduce emissions by purchasing CO2 certificates from smaller emitters at a price. When CO2 emissions grow, the price increases, which encourages energy saving and renewable energy. Present emission prices around the current USD 80 per ton CO2 in the EU28, China, and several other countries provide that encouragement [41].

Contrary to the CO2-reducing instruments, many countries also support fossil fuels with subsidies and tax exemptions. The negative correlations between energy subsidies and GDP, and renewable energy uses with GDP and renewable energy use and GDP, across countries suggest that these instruments may discourage renewable energy. It is argued that lower energy prices reduce poverty, but no correlations have been found between high fuel prices and subsidies across countries. Furthermore, the highest subsidies are found in fuel-exporting countries with low domestic fuel prices [11]. Also, such subsidies do not alleviate energy poverty. Estimates across mid-income and low-income countries show that mainly higher income classes obtain benefits from subsidies, and not low income classes [42]. In addition to subsidies, many high-income countries impose taxes on energy use. The common practice is to charge high taxes per energy unit for small energy users and low ones for large users, while the largest users are exempt from these taxes. In effect, households and small-scale services pay up to 100 times more taxes per energy unit than large energy-intensive oil, chemical, and metal businesses [43]. In effect, the protection of energy-intensive agriculture and industry is given, while fossil fuels are subsidised.

Renewable energy is also supported both indirectly and directly. Indirectly, technology development is subsidised, and investors in start-up firms are exempted from taxes, which reduces the costs of innovators including ones in renewable energy. A widespread direct support of renewable energy is the price guarantee for delivering renewable energy to power grids, called feed-in tariffs. The OECD provides data on the feed-in tariffs for hydro, biomass, geothermal, solar, wind, and marine energy in 57 high-income and mid-income countries during the period 2000 to 2019. The data revealed 207 cases. When linked to the BP production data, they showed that the feed-in increased in 127 cases along with production increases in all of those cases. Reliable regressions in 123 cases of the increasing feed-in tariffs and production of solar, wind, and bioenergy showed few positive links. High positive correlations (R2 > 0.6) were found in 21 cases, while moderate positive correlations were found in 46 cases, and 56 cases exhibited negative correlations. Feed-in tariffs rarely generate renewable energy if policies support fossil fuels, as they usually do. Support for the production of renewable energy is found in the Czech Republic, Germany, and a few other EU countries with high feed-in tariffs [44]. Low feed-in tariffs for fossil fuels indicate wasteful public expenditures caused by inconsistent policies.

The overall result of the verification is that larger investments in modern renewable energy generate cost-reducing technological changes in wind and solar energy, but policies support fossil fuels as well as renewable energy.

3.4. Valorisation of Energy

From the behavioural perspective, the entrepreneurial search for profitable opportunities generates value-adding activities. Value addition in energy was achieved through increasing the use of electricity on the grid in addition to heat use throughout the 1900s, called electrification. While energy-intensive agriculture and basic industry mainly use fossil fuels for heating, processing in manufacturing and services use electricity for power. In addition, modern renewable energy enables value-adding activities off-grid because it is widely available at low energy density. This availability enables the distribution of production and applications, meaning the use of electricity without transmission on the power grid. Examples include small-scale wind power and concentrated solar power used on farms in the USA in the late 1930s, and small-scale applications in electronics, lighting, communication, satellites, and other distributed activities from the late 1970s onwards. Innovative services based on electricity would propel modern renewable energy.

3.4.1. Electrification

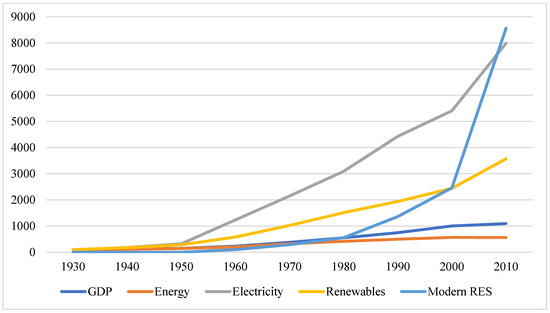

Electricity production, also known as power generation, continued to grow from the late 1890s onwards. Firstly, water resources were used in the USA, which was followed by the use of coal and other fuels from the 1920s onwards. The use of nuclear resources emerged in the 1950s, but its growth stagnated after the 1980s because it was costly and risky. From the 1980s onwards, modern renewable energy for electricity production grew. Figure 4 shows the changes from 1930 to 2010 in intervals of ten years. Indices for global GDP in USD2011 are based on Maddison data, and energy consumption in TW based on the OWD. Indices for electricity production, renewable energy, and modern energy in TWh are based on data from the United Nations [45] from 1930 to 1950 as well as data from BP and the World Bank from 1960 to 2010. Electricity in 1960 was interpolated due to missing data.

Figure 4.

Indices of GDP, energy, electricity, all renewables energy, and modern RES.

Over the last hundred years, the growth of global GDP has been somewhat faster than that of energy production. Meanwhile, electricity production grew twice as fast as income and accelerated after the Second World War. It accelerated even more during the 1990s to reach 21% of energy production in the 2020s. All renewable energy grew more slowly than electricity, though large-scale hydropower remained the cheapest power resource. Meanwhile, modern renewable energy grew faster than electricity, even accelerating after 2000 years during the high prices of fossil fuels. By 2024, modern renewable energy would cover about 10% of global electricity production, while nearly 50% would be used in Europe.

The valorisation of energy uses through electrification improved the energy performance of the global economy. This was measured by GDP per energy use in constant USD per kWh, based on the Maddison data for GDP and OWD data for energy. While the global energy performance per kWh in USD2011 has grown on average by 0.7% a year throughout the last 200 years, the global energy efficiency has improved by 0.4% on an annual average. This was assessed based on the conversion of energy resources into energy uses, which means that it was corrected for rebound effects [46]. Meanwhile, the remaining 0.3% growth in energy performance can largely be attributed to novel, value-adding business activities driven by electrification during the 1900s. In the future, the electrification of economies is expected to lead to higher values [47].

3.4.2. Value-Added Services

Global electricity production increased despite 3 to 10 times higher prices per kWh compared with heat excluding taxes and subsidies. As a result of higher prices, the value added of electricity sales in the EU28 in 2015 was nearly ninefold the USD2011 46 billion value added of gas sales [48]. The value added of electricity production in the EU and the USA even increased during the high international prices of fossil fuels from 2005 to 2015. Here, the sales prices of power to households increased faster than the prices of fossil fuel resources, although the sales prices to businesses increased as fast as the prices of fossil fuel resources. Higher electricity prices also prompted the search for cost-reducing technological changes. If investments were covered, wind and solar power could make this possible. In effect, the value added to household power sales was correlated to the use of renewable energy during 2005–2015 in the USA (R2 = 0.6) and in the EU28 (R2 = 0.5). In the EU28, the value added of electricity increased with higher shares of renewable energy in power uses. This is indicated by the increasing cross-country correlations of the electricity prices and these shares from 2004 (R2 = −0.11) to 2015 (R2 = +0.34). Large investments in the EU28 have generated nearly 15,000 new energy firms compared with only 1000 in the USA, according to estimates based on the birth rates of firms in the EU28 (Eurostat) and the USA (Census). These energy service companies in the EU pursued efficient power use through cheap renewable resources for electricity generation, local grid and storage, and electronic power balance. These technologies were introduced combined with demand management through performance agreements, flexible pricing, cooperative production, and other institutional arrangements [49].

The growth of modern renewable energy can largely be attributed to value-added electrification. Within this trend, there is a growing demand for distributed uses of power, which can be economically beneficial when policies support investments.

4. Discussion

Several factors are driving the growth of modern renewable energy sources. Shifts from energy-intensive agriculture and industry to energy-extensive services, along with the increasing prices of fossil fuels, were important. However, energy resources complement each other rather than substitute each other, as assumed in the neoclassical theory. Large investments in wind and solar energy generated cost-reducing technological change, as argued in evolutionary thinking, but policies were insufficiently consistent for the explanation of these investments during low fuel prices. Value addition due to electrification triggered investments, as assumed in behavioural theory, but higher energy prices also invoked a search for cost-reducing changes in wind and solar energy. Instead of these mono-causalities, the growth of modern renewable energy, particularly fast in wind and solar power, can be explained as a sequence of changes. This sequence refers to technology diffusion; it is the dissemination of novelties.

4.1. A Theory on Technology Diffusion

A popular idea regarding technology diffusion is that novelties are adopted in phases over time. During the introduction phase, shortly after launching an innovation, adoption is low because only a few innovators take the risk of buying a novelty without experience. When more positive experiences are gained, the adoption grows. During this growth phase, economies of scale in the production of novelty enable cost-effective technological change. As demand for that novelty is satisfied and rival supplies emerge, the adoption evolves towards a peak. The phases of decline and stagnation follow this phase of maturity. The novelty’s expected qualities drive the purchases during the innovation phase. This is followed by the growth phase, with the consideration of unit costs, and the maturity phase towards the peaking sale when price competition drives purchases [50]. The logistic function of the adoption rate in time, or the rate of change in time, was reformulated to incorporate this idea. This line of changes shows low adoption rates during the introduction phase, followed by higher rates during the growth phase, and a decline in adoption rates during the maturation phase [51]. The observed dissemination rates of energy technologies fit into this model [52]. Studies on the diffusion of technologies confirm these phases, but also show differences in the duration of phases, speed of diffusion, and maximum market coverage [53].

An interpretation of this diffusion model helps to define changes in modern renewable energy. When modern renewable energy was launched during high fuel prices in the late 1970s, innovators were found on farms and in remote areas. These were sites where wind and solar energy were available, but the grid was missing, and the fossil fuel supply was costly or not appreciated. These ‘market niches’ enabled take-off. From the 2000s onwards, large investments in production, driven by high fuel prices and supportive policies, generated cost-reducing technological changes in wind and solar power. Power generators adopted them, but the geothermal and marine technologies failed to reach this growth phase. As the unit costs of wind and solar power approached the unit cost of fossil fuels during the 2020s, the price competition in production emerged.

4.2. Experiences with Diffusion

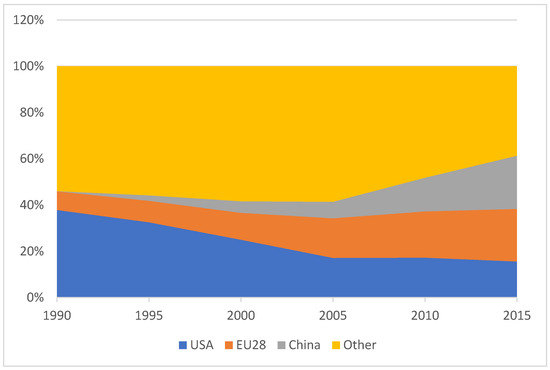

The innovation phase in niche markets, the growth phase due to investments in scaling up production, and price competition can be observed in the production of modern renewable energy across countries. They were observed as innovators in the USA, scaling up in the EU28, and price competition in China. Figure 5 shows their global shares in modern renewable energy based on the IEA data from 1990 to 2015.

Figure 5.

Countries’ share in modern renewable energy.

While the global production of modern renewable energy increased fivefold from 1990 to about 2330 TWh in 2025, the shares of countries changed. During the late 1980s, entrepreneurs in the USA, Japan, Sweden, Denmark, Spain, and a few other countries introduced large-scale wind and solar power. However, several countries failed in other resources. In particular, geothermal power in the Philippines, Indonesia, Mexico, and Italy failed, and marine energy in Portugal. While Japan turned away from modern renewable energy to nuclear power and India focused on coal, Chile, Uruguay, and other countries expanded their use of wind and solar power.

The introduction of large-scale modern renewable energy was pioneered by entrepreneurs in the USA, and nearly 38% of global production was covered by them in 1990. They had high self-esteem regarding forecasts by prominent consultants in the USA regarding an even larger share in the future (e.g., [54,55,56]). The USA’s share of global production decreased to half by 2005 due to other countries’ faster production growth. Growth was generated in the EU28 due to the combined interests of businesses and environmental organisations in support of feed-in tariffs. This composite interest generated a huge investment in production, which enabled businesses to reduce the unit costs of wind and solar energy. While global production grew by two-digit rates during high fuel prices in the mid-2000s, the EU28 captured an additional 15% of the global share. This reached 23% of the global production of modern renewable energy in 2015, when fuel prices dropped. As energy production with wind and solar energy approached price parity with fossil fuels during high-low fuel prices, this composite interest was dissolved, and feed-in tariffs were cut across the EU29 countries. Contrary to this, policies in China continue to provide feed-in tariffs and have introduced directives for the application and purchase of modern renewable energy. This policy expanded production from nil in 1990 to 23% share in 2015, at even lower costs than in the EU. Its leadership in solar panel production triggered price competition in modern renewable energy. Within a few decades after 1990, wind and solar energy evolved from the innovation phase in market niches to the growth phase driven by mainstream producers. Whether this growth phase continues or evolves towards maturation in the near future is subject to debate.

4.3. Expected Diffusion

An issue surrounds the possibility of generating renewable energy in the future. Therefore, sustainable innovations that complement technologies for the production of renewable energy are required. The diffusion of renewable energy encountered numerous barriers related to scarce technical deficiencies, human capacities, limitations in space, and other barriers reviewed in another publication [57]. Given such barriers, a slower growth of modern renewable energy was expected during the late 2000s. During that time, this slowdown would be caused by the decline in policy support along with the decreasing prices of fossil fuels [58]. However, the policy support and fuel prices increased. A study during the 2010s also expected a slowdown in cost-reducing technological change. This would be caused by the low energy density of wind and solar resources, the costly upgrade of the grid for intermittent power, and nil or negative power prices during wind and solar peaks. These obstacles would hinder valuable applications. Based on extrapolations of past trends with that diffusion model, the global capacity of solar and wind energy would peak in 2030 at 1.6–1.8 TW (billion kW). The capacity in 2030 would be four times that of 2024, but it would not be sufficient to meet future power demands or mitigate climate change [59]. These deficiencies impede growth, but they can be avoided. Excess wind and solar power during production peaks can be converted into chemicals. Intermittence in supplies can be countered by storage, and energy users can benefit from zero prices if they own local grids. These complementary sustainable innovations are emerging with large policy support in many countries. Forecasts about their future uses can be hypothesised based on past trends in value-adding applications. The conversion of energy into chemicals, storage of power, and distributed energy networks of producing consumers are briefly mentioned.

Excess wind and solar power during peak periods is converted into ammonia, methanol, hydrogen, or other chemicals. High-temperature heat to industries is provided by them, but the scale of conversions is small, and the unit costs of converted products are high. Large investments in the conversion of heat into hydrogen are envisaged. These are also subsidised because their realisation faces unprofitable production due to the lower purchase prices of heat than power. Unless these conversions receive significant, permanent subsidies during several decades of technology development and scaling-up, there will be a slow cost-reducing technological change that can be expected when investments are low. An alternative pattern is an accelerated electrification of industries. It receives support from policies and the power sector, but it is resisted by industries that face high costs of turning production away from heat-based energy-intensive fuels to electric power. Regarding the slow cost-reducing technological change of these conversions into chemicals, the electrification of several industries would be an attractive policy.

Furthermore, the growth of modern renewable energy is made possible by larger-scale and more flexible storage. The global storage capacity in 2020 was about 0.192 TWh, largely in open water reservoirs, as estimated by the U.S. Department of Energy database. This storage is designed to provide balanced power to the grid with continuous power generation based on fossil fuels and hydropower. In 2030, intermittent power generation with wind and solar energy will require up to 4 TWh of flexible storage for grid balancing [60]. The large increase in power storage with faster re-charging compared with water reservoirs is a major challenge. Nevertheless, it is achievable regarding various types and sizes of batteries for sale, but the grid can be more expensive despite the declining costs of energy storage in batteries. This is achievable given that the global capacity of batteries increased fifteen times between 2013 and 2019 to reach 3.2 GW [61]. During that period, the unit declined rapidly towards the current USD 160 per kWh storage in batteries [62]. Regarding fast cost-reducing technological changes and numerous novel storage technologies in research and development, sufficient large-scale and lower unit costs for electrification can be expected.

Given that solar and wind energy are available all over the world, consumers in businesses and households pursue local production and use them with distributed energy networks. Citizen participation in such networks is high and growing in Austria, Germany, and several other countries with a tradition of local energy production. For instance, in the 2010s, citizens in Germany owned 47% of all renewable energy assets [63]. As these ‘prosumers’ enjoy negligible power costs after investing in the local generation and distribution of power, such distributed energy networks expand. While global investments in large-scale power grids declined by −1% from 2014 to 2019, investments in distributed energy networks grew annually to reach 17% annual growth in 2019. The investments are growing, but only cover a small fraction of the global current USD 290 billion investments in the grid [64]. Fast cost-reducing technological change can be expected in the future regarding numerous novel applications in power storage and electronics for balancing distributed energy networks. More frequent disruptions in the transmission and distribution of power on the grid due to declining investments motivate the development of distributed energy networks, which mitigate blackouts.

The model of innovation diffusion expresses global changes in modern renewable energy, starting from their introduction in market niches in a few countries during the late 1980s, and growth due to investments supported by policies. Policies that enhance the electrification of industry, power storage, and distributed energy networks can ensure their continuation.

5. Conclusions

The economic perspective was used to assess the factors that drive the growth of wind and solar power in modern renewable energy. The economic viewpoint was adopted because engineering thinking, which focuses on high-density energy resources with constant energy supplies, cannot explain the increase in low-energy density resources that provide intermittent power without heat. To assess drivers of growth, three economic theories were considered: the neoclassic (mainstream) theory that is focused on resource substitutions through prices, the evolutionary (institutional) idea regarding cost-reducing technological change, and behavioural theory on the entrepreneurial search for high-value uses. These drivers were verified with observations through the use of statistical data, followed by the integration of these theories into the framework of innovation diffusion.

The faster growth of low-density, intermittent wind and solar energy than energy-dense, continuous fossil fuels was partly driven by economic shifts from energy-intensive agriculture and industry towards labour-intensive services. However, energy resources were rarely substituted but added as another as income grew, and high prices of fossil fuels hardly changed the use of energy resources while accelerating renewable energy production. As assumed in evolutionary theory, larger investments generate economies of scale with the decreasing unit costs of energy production, but significant investments cannot be explained by inconsistent support from policies across countries. A driver of these investments could be shifts towards higher value electricity generation, as assumed in behavioural theory. Within this shift, wind and solar power would meet the demands in remote areas and stand-alone activities, given that these resources can be found all over the Earth, though in low densities.

These ideas are integrated. It is assumed that technologies disseminate over time, starting with value-adding applications in market niches, followed by growing use by dominant interests until maturity, when demands are largely satisfied and rivals capture a market share. At some point in time, stagnation and decline are observed. Wind and solar power exhibit this pattern. It started with pioneering enterprises in the USA, followed by growth due to investments in the EU28 and China, which has driven price competition. This process can evolve towards maturity within a few decades, unless complementary innovations gain a larger scale. The electrification of manufacturing and transport can complement household uses if policies foster value-added services in businesses. In addition, power storage on and off grid can be enhanced to overcome intermittent power supplies. In addition, consumers who produce energy can enjoy negligible prices at peak power if distributed energy networks are enhanced, in addition to the vested institutional interests in power distribution.

The growth of modern renewable energy, particularly wind and solar power, can continue for many decades when sustainable innovations complement technologies in renewable energy, thereby enhancing the uses of renewable energy. This can be facilitated by expecting more consistent policies in support of sustainable innovations rather than subsidising incumbent interests.

Author Contributions

Conceptualisation, Y.K.; Methodology, Y.K.; Validation, Y.K., S.B. and F.C.; Formal analysis, Y.K.; Investigation, Y.K.; Resources, Y.K.; Data curation, Y.K.; Writing—original draft, Y.K.; Writing—review and editing, F.C.; Visualisation, Y.K.; Supervision, Y.K.; Project administration, S.B.; Funding acquisition, Y.K., S.B. and F.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

All data were collected from open source statistics with references in the text. All data can be made available on request.

Acknowledgments

We are grateful to Margaret Devignan of the Springer Nature for the publication of the book Economics of Renewable Energy, which was used as a data source for the economic assessment. We are also grateful to the two unknown referees for their comments.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- IEA. World Energy Balances. Available online: https://www.iea.org/reports/world-energy-balances-overview/world (accessed on 30 June 2025).

- IEA. Renewables 2024, Analysis and Forecasts to 2030; IEA: Paris, France, 2024. [Google Scholar]

- Guchhait, R.; Sarkar, B. Increasing Growth of Renewable Energy: A State of Art. Energies 2023, 16, 2665. [Google Scholar] [CrossRef]

- Hall, C.A.S. Will EROI be the Primary Determinant of Our Economic Future? The View of the Natural Scientist versus the Economist. Joule 2017, 20, 635–638. [Google Scholar] [CrossRef]

- Smil, V. Energy and Civilization, A History, 1st ed.; The MIT Press: Cambridge, MA, USA, 2019. [Google Scholar]

- Ayres, R.; Voudouris, V. The economic growth enigma: Capital, labour and useful energy? Energy Policy 2014, 64, 16–28. [Google Scholar] [CrossRef]

- Beaudreau, B.C.; Lightfoot, H.D. The physical limits to economic growth by R&D funded innovation. Energy 2015, 84, 45–52. [Google Scholar] [CrossRef]

- Engineering. Available online: https://www.engineeringtoolbox.com (accessed on 8 July 2025).[Green Version]

- Layton, B.E. A Comparison of Energy Densities of Prevalent Energy Sources in Units of Joules Per Cubic Meter. Int. J. Green Energy 2008, 5, 438–455. [Google Scholar] [CrossRef]

- Krozer, Y.; Nentjes, A. An Essay on Innovation for Sustainable Development. J. Int. Environ. Sci. 2006, 3, 163–174. [Google Scholar] [CrossRef][Green Version]

- Krozer, Y. Economics of Renewable Energy; Springer-Nature: Dordrecht, The Netherlands, 2022. [Google Scholar][Green Version]

- Usher, B. Renewable Energy; Columbia University Press: New York, NY, USA, 2019. [Google Scholar][Green Version]

- IPCC. Change, Renewable Energy Sources and Climate Change Mitigation; Cambridge University Press: New York, NY, USA, 2012. [Google Scholar][Green Version]

- IEA. Available online: https://www.iea.org/data-and-statistics (accessed on 8 July 2025).[Green Version]

- BP. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 8 July 2025).[Green Version]

- World Bank. Available online: https://data.worldbank.org/ (accessed on 14 July 2025).[Green Version]

- OWD. Available online: https://ourworldindata.org/ (accessed on 14 July 2025).[Green Version]

- International Renewable Energy Agency (IRENA). On installed Capacities, Production, Investments and Unit Costs from 2000 to 2019. Available online: https://www.irena.org/publications/2020/Jul/Renewable-energy-statistics-2020 (accessed on 21 July 2025).[Green Version]

- Nordhaus, W. The Allocation of Energy Resources, Brookings Papers on Economic Activity. 1973. Available online: www.brookings.edu/wp-content/uploads/1973/12/1973c_bpea_nordhaus_houthakker_solow.pdf (accessed on 10 July 2025).[Green Version]

- Grübler, A.; Nakićenović, N.; Victor, D.G. Dynamics of energy technologies and global change. Energy Policy 1999, 27, 247–280. [Google Scholar] [CrossRef]

- Mazzucato, M.; Semieniuk, G. Public financing of innovation: New Questions. Oxf. Rev. Econ. Policy 2017, 33, 24–48. [Google Scholar] [CrossRef]

- Cyert, R.M.; March, J.G. A Behavioural Theory of Organisational Objectives in The Economic Theory of Organisation the Firm; Cyert, R.M., Ed.; New York University Press: New York, NY, USA, 1988; pp. 125–150. [Google Scholar]

- Kirzner, I. Entrepreneurial Discovery and the Competitive Market Process: An Austrian Approach. J. Econ. Lit. 1997, 35, 60–85. [Google Scholar]

- Maddison Style Estimates of the Evolution of the World Economy. A New 2020 Update. Available online: https://www.rug.nl/ggdc/historicaldevelopment/maddison/releases/maddison-project-database-2020?lang=en (accessed on 14 July 2025).

- PBL. Netherlands Environmental Assessment Agency, Historic Database on Global Environment (HYDE). Available online: https://themasites.pbl.nl/tridion/en/themasites/hyde/index.html (accessed on 14 July 2025).

- OECD. 2025. Available online: https://www.oecd.org/en/data.html (accessed on 26 August 2025).

- Krozer, Y. Economic Growth and the Environment; Springer-Nature: Dordrecht, The Netherlands, 2025; forthcoming. [Google Scholar]

- Cipolla, C.M. Before the Industrial Revolution: European Society Economy 1000–1700; WW Norton & Co.: New York, NY, USA, 1993. [Google Scholar]

- Rosenberg, N. Energy Efficient Technologies. In Innovation, Resources and Economic Growth; Curzio, A.Q., Fortis, M., Zoboli, R., Eds.; Springer: Berlin/Heidelberg, Germany, 1994; pp. 63–82. [Google Scholar]

- Rubin, E.S.; Azevedo, I.M.L.; Jaramillo, P.; Yeh, S. A review of learning rates for electricity supply technologies. Energy Policy 2015, 86, 198–218. [Google Scholar] [CrossRef]

- Heuberger, C.F.; Rubin, E.S.; Staffell, I.; Shah, N.; Mac Dowell, N. Power capacity expansion planning considering endogenous technology cost learning. Appl. Energy 2017, 204, 831–845. [Google Scholar]

- BNEF. (Bloomberg, Frankfurt Business School and UNEP 2004–2018) on Investments in Renewable Energy. Available online: https://about.bnef.com/energy-transition-investment/ (accessed on 26 August 2025).

- Lazard. Lazard Levelized Cost of Energy Analysis—Version 13; Lazard: New York, NY, USA, 2019. [Google Scholar]

- NREL National Renewable Energy Laboratory. Levelized Cost of Energy Calculator. Available online: https://www.nrel.gov/analysis/tech-lcoe.html (accessed on 17 April 2021).

- IEA. Global Energy Review 2025; IEA: Paris, France, 2025. [Google Scholar]

- Krohn, S.; Morthorst, P.E.; Awerbuch, S. The Economics of Wind Energy; Risoe National Laboratory: Copenhagen, Denmark, 2009. [Google Scholar]

- Watanabe, C.H.; Griffy-Brown, C.H.; Zhu, B.; Nagamatsu, A. Inter–firm Technology Spillover and the “Virtous Cycle” of Photovoltaic development in Japan. In Technological Change and the Environment; Grübler, A., Nakicenovic, N., Nordhaus, W.D., Eds.; Resources for the Future: Washington, DC, USA, 2002; pp. 127–159. [Google Scholar]

- Doyne Farmer, J.; Lafond, F. How predictable is technological progress? Res. Policy 2016, 45, 647–665. [Google Scholar] [CrossRef]

- van Ermen, R. Comparison and Assessment of Funding Schemes for Development of New Activities and Investments in Environmental Technologies; rapport number 044370; Fundetec: Brussels, Belgium, 2007. [Google Scholar]

- O’Mahony, T. State of the art in carbon taxes: A review of the global conclusions. Green Financ. 2020, 2, 409–423. [Google Scholar] [CrossRef]

- Bayer, P.; Aklin, M. The European Union Emissions Trading System reduced CO2 emissions despite low prices. Proc. Nat. Acad. Sci. USA 2020, 117, 8804–8812. [Google Scholar] [CrossRef]

- Arze del Granado, F.J.; Coady, D.; Gillingham, R. The Unequal Benefits of Fuel Subsidies: A Review of Evidence for Developing Countries. World Dev. 2012, 40, 2234–2248. [Google Scholar] [CrossRef]

- Krozer, Y. Theories and Practices of Innovating for Sustainable Development; Springer: Berlin/Heidelberg, Germany, 2015; Chapters 10–11. [Google Scholar]

- CEER. Status Review of Renewable Energy and Energy Efficiency Support Schemes in EU; Council of European Energy Regulators: Brussels, Belgium, 2018. [Google Scholar]

- United Nations. World Energy Supplies in Selected Years, 1929–1950, Statistical Papers No 1. 1950. Available online: https://unstats.un.org/unsd/energy/yearbook/Series_J_No_1.World_Energy_Supplies-1929-1950.pdf (accessed on 24 May 2021).

- Fattouh, B.; Poudineh, R.; West, R. The rise of renewables and energy transition: What adaptation strategy exists for oil companies and oil-exporting countries? Energy Trans. 2019, 3, 45–58. [Google Scholar] [CrossRef]

- Griffith, S.; Calish, S. Mobilizing for a Zero Carbon America: Jobs, Jobs, Jobs, and More Jobs, Rewiring America. Available online: https://www.rewiringamerica.org/jobs-report (accessed on 28 December 2020).

- Eurostat. 2025. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 28 July 2025).

- Bertoldi, P.; Boza-Kiss, B. Analysis of barriers and drivers for the development of the ESCO markets in Europe. Energy Policy 2017, 107, 345–355. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 3rd ed.; The Free Press: New York, NY, USA, 1983. [Google Scholar]

- Bass, F.M. A New Product Growth for Model of Consumer Durables. Manag. Sci. 1969, 15, 215–227. [Google Scholar] [CrossRef]

- Marchetti, C.; Nakićenović, N. The Dynamics of Energy Systems and the Logistics Substitution Model; International Institute for Applied System Analysis: Laxemburg, Austria, 1979. [Google Scholar]

- Nakićenović, N. Diffusion of Pervasive Systems: A Case of Transport Infrastructures. In Diffusion of Technologies and Social Behaviour; Grübler, A., Nakićenović, N., Eds.; Springer: Berlin/Heidelberg, Germany, 1991. [Google Scholar]

- Asplund, R.W. Profiting from Clean Energy; Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Pernick, R.; Wilder, C. The Cleantech Revolution; Harper: New York, NY, USA, 2008. [Google Scholar]

- Siegel, J. Investing in Renewable Energy; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Negro, S.O.; Alkemade, F.; Hekkert, M.P. Why does renewable energy diffuse so slowly? A review of innovation system problems. Renew. Sustain. Energy Rev. 2012, 16, 3836–3846. [Google Scholar] [CrossRef]

- Usha Rao, K.; Kishore, V.V.N. A review of technology diffusion models with special reference to renewable energy technologies. Renew. Sustain. Energy Rev. 2010, 14, 1070–1078. [Google Scholar] [CrossRef]

- Hansen, J.P.; Narbel, P.A.; Aksnes, D.L. Limits to growth in the Renewable Energy Sector. Renew. Sustain. Energy Rev. 2017, 70, 760–774. [Google Scholar] [CrossRef]

- US-DOE. Energy Storage Grand Challenge Energy Storage Market, Technical Report; NREL/TP-5400-78461, DOE/GO-102020-5497; United States Department of Energy: Washington, DC, USA, 2020. [Google Scholar]

- IEA Storage. Energy Storage. Available online: https://www.iea.org/reports/energy-storage (accessed on 20 May 2021).

- IEA Batteries. Available online: https://www.iea.org/data-and-statistics/charts/evolution-of-li-ion-battery-price-1995-2019 (accessed on 20 May 2021).

- Yildiz, Ö. Financing renewable energy infrastructures via financial citizen participation—The case of Germany. Renew. Energy 2014, 68, 677–685. [Google Scholar] [CrossRef]

- IEA Smart Grid. Available online: https://www.iea.org/fuels-and-technologies/smart-grids (accessed on 22 May 2021).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).