1. Introduction

In recent years, hydrogen has emerged as an increasingly viable source of energy. Consequently, it has attracted considerable attention from researchers, policymakers, and industry. This surge in interest can be attributed to several factors. It is an abundant, sustainable, and renewable resource [

1,

2,

3,

4]. In addition, because the only byproduct of hydrogen combustion is water vapor, it is an inherently clean and environmentally friendly option for the generation of energy. Beyond that, it is highly versatile, able to be utilized across multiple sectors, including transportation, manufacturing, and electrical power generation [

5,

6,

7]. Its viability as a practical energy solution has also been lifted with advancements associated with fuel cells and electrolyzers. Despite this, significant challenges remain, including, but not limited to, production, storage, and infrastructure [

8,

9].

Unlike conventional hydrogen, which is derived mainly from fossil fuels, green hydrogen is generated through a process that separates hydrogen molecules from water using renewable, carbon-neutral electricity like wind or solar. For these reasons, green hydrogen has garnered optimism and attention as a versatile and environmentally friendly energy source [

1,

8,

9].

As a power source for the generation of electricity, the viability of hydrogen—including green hydrogen—lies in its flexibility and versatility. While typical green energy sources of electricity like wind or solar are challenged by their variability and unpredictability, hydrogen benefits from its capacity to store excess renewable energy (e.g., from wind or solar in the case of green hydrogen) for later use [

10,

11].

Predicting future demand is influenced by numerous uncertainties such as advancements in technology, market dynamics, policy support, and cost competitiveness [

12,

13,

14]. Despite the challenges, obtaining an accurate estimation of future demand for hydrogen is essential; a necessary ingredient for policymakers’ and others’ decisions about the planning and construction of hydrogen-based electricity-generating facilities.

The objective of this article is to provide a methodology for estimating the demand for hydrogen in power systems that currently rely on natural gas as a fuel source for electricity generation. Through a case study of electricity generated by natural gas-fired turbines in the province of Ontario, Canada, we assess future hydrogen requirements by assuming existing natural gas-powered turbines will be converted to hydrogen-fueled systems. Our methodology considers multiple factors, including the current amount of electricity generated from natural gas sources in our case study region. (We recognize that it is improbable that all natural gas-fired turbines can, or even should, be retrofitted to utilize hydrogen as a fuel source. Our aim in this analysis is to clarify certain aspects of the operational costs associated with such retrofitting efforts). We also consider historical trends and future growth. Ultimately, we present a comprehensive forecast of the quantity of hydrogen needed to substitute natural gas in Ontario. Our methodology may also be employed to assess substitution strategies in other regions or on a turbine-specific basis. We also extend our research to compare the future costs of hydrogen with natural gas.

Going forward, the article is laid out as follows. First, we provide an overview of the growing interest and applicability of hydrogen in a variety of applications, including transportation, industry, and electricity. Next, we describe the methodology we employ to estimate future hydrogen demand and its costs. Because the focus of our research is hydrogen as a source of fuel for the generation of electricity, we describe attributes of the turbines that currently burn natural gas and may subsequently be converted to hydrogen. In the

Section 4, we share the results of our inquiry. After that, we conclude by discussing the results and their implications. It includes an overview of the impediments to broader and more rapid adoption.

2. Current Perspectives on Green Hydrogen in the Electricity Sector

According to the International Energy Agency (IEA), 40 percent of global energy-related CO

2 emissions in 2022 came from the electrical power generation sector, followed by the transport (23 percent) and industry (23 percent) sectors [

15]. For each of these areas, hydrogen may represent a feasible replacement to traditional fossil fuels, attributes that support the transition of at least parts of the global energy supply system to a hydrogen-powered, more climate-neutral state [

1].

In the transportation sector, for example, many believe that hydrogen represents a viable alternative to conventional fuels, particularly in urban areas as doing so may allow for a significant reduction in greenhouse gases and air pollutant emissions [

2,

3,

4,

16]. In fact, in a comparative analysis of battery electric vehicles (BEVs) and hydrogen fuel cell vehicles (FCVs), Offer et al. found that FCVs presented several advantages over BEVs, including longer driving ranges and more rapid refueling [

6].

Meanwhile, hydrogen also holds potential in regions with high concentrations of industrial activity [

2,

17]. In heavy industries, including steel and cement manufacturing, hydrogen shows significant promise as a tool to support the reduction of CO

2 emissions [

4]. For example, in their study of the technical and economic feasibility of using renewable energy in steel production, Otto et al. [

10] concluded that green hydrogen supported considerable reductions in CO

2 emissions, findings that were echoed by Vogl et al. [

11] in their analysis of hydrogen direct reduction (HDR)—a system that involves passing hydrogen gas over metallic ore at high temperatures to extract metal to produce a high-purity product [

18].

Hydrogen can also be deployed for the generation of power via turbine combustion in the electricity sector, the specific focus of this research. For example, “power-to-gas”—a concept where surplus renewable energy is converted into a gaseous energy carrier, including hydrogen—is purported to deliver a flexible and sustainable energy system; one that a) is cost-effective and b) produces a lower carbon output [

6], characteristics that make it an attractive option for integrating renewable energy into various sectors [

19]. Consistent with that, Mukherjee et al. [

20] argue that a hydrogen-powered microgrid is already technically feasible, and economically competitive with conventional fossil-fuel-based systems. Beyond that, it has been demonstrated that hydrogen can be stored and used as a fuel or feedstock for various applications, including ammonia, chemicals, petrochemicals, synthetic fuels, glass manufacture, and metal processing [

21,

22,

23,

24,

25], helping to decarbonize sectors like transportation and industry [

26].

In the electricity sector, existing natural gas plants are a primary candidate for the transition to hydrogen as the source of energy. That said, several challenges remain. Recent studies have begun to empirically evaluate the retrofit of natural gas turbines for hydrogen combustion. For example, Freitag et al. [

27] model the performance and emissions of hydrogen-fueled retrofits, showing that while conversion is technically feasible, it introduces efficiency penalties and other challenges that must be addressed through combustor design. For example, the use of hydrogen as a fuel in gas turbines requires modifications to the combustion system to maintain turbine performance [

28]. Additionally, the hydrogen content of the fuel affects emission levels, with higher concentrations potentially leading to increased NOx emissions because of higher flame temperatures [

29]. Hydrogen combustion engines also tend to be less efficient than natural gas combustion engines because hydrogen has a lower volumetric energy density [

30]. It means a larger volume of hydrogen is needed to store the same amount of energy as a smaller volume of gas, necessitating larger and heavier storage tanks [

8,

31].

Beyond issues related to performance, the conversion of natural gas-powered turbines to hydrogen necessitates a host of safety-focused considerations. For example, as a highly flammable gas with a wide flammability range, hydrogen requires precise and elevated measures to ensure safe handling and storage [

32]. By its nature, hydrogen can also fragilize some materials, thus necessitating modified and often, upgraded components [

33,

34]. It is also colorless and odorless, requiring highly sensitive leak detection and monitoring systems [

35,

36]. Ultimately, these considerations require the recruitment of new personnel and/or elevated levels of training [

37]. These findings support the scenario-based approach adopted in this study and highlight the importance of policy and economic instruments in enabling hydrogen transitions.

Although the literature on hydrogen turbine retrofits and power-to-gas systems is expanding, detailed empirical case studies remain relatively scarce. Notable exceptions include Mitsubishi Power’s pilot projects in Japan, the Netherlands, and the United States, which demonstrate the technical feasibility and performance implications of retrofitting existing turbines for hydrogen combustion [

38].

The utility of hydrogen gas extends across various domains, and likewise, there are myriad techniques available for its synthesis. These include Steam Methane Reforming (SMR), Partial Oxidation of Hydrocarbons (POX), Biomass Gasification, Solar Water Splitting, and High-Temperature Water Splitting. It also includes Electrolysis, the method assumed in this study. Electrolysis uses electrical current to split water into hydrogen and oxygen [

11]. An electrolysis-based production process may not emit greenhouse gases and typically involves using renewable electricity to power an electrolyzer. Despite its promise as a clean energy carrier, green hydrogen production faces some challenges. One of which is the efficiency of electrolysis, which remains limited due to the performance and durability of current electrolyzers and electrocatalysts. These systems often suffer from energy losses and require costly materials, impacting scalability [

27,

28].

Another major barrier is access to renewable electricity. Green hydrogen relies on consistent, low-cost renewable energy sources such as solar and wind. However, their intermittent nature and uneven geographic distribution complicate continuous hydrogen generation and grid integration.

In the realm of climate-neutral energy systems, hydrogen holds significant potential and could play a prominent role. However, development of the optimal hydrogen supply pathway will depend on multiple factors. These include the availability of renewable energy, the cost and performance of hydrogen technologies, and demand from key sectors [

13,

16]. Research shows that the optimal path will also depend on a combination of favorable market conditions, and technological innovation [

14]. In the end, widespread deployment of hydrogen technologies will require significant investment and continued advancement in the development of tools to address the technical and economic challenges associated with large-scale production, storage, and transportation of a chemical element that exhibits considerable operational volatility [

14,

35,

39].

Therefore, even though many suggest that hydrogen will play a significant role in the world’s transition to a net-zero energy system, the challenges are less likely to be mitigated—and the advancements and benefits are unlikely to be realized—unless they are complemented by corroborating policy instruments. Research suggests that a hydrogen-supportive policy framework consists of several components. For starters, we are reminded that policy instruments supportive of elevated hydrogen proliferation should be designed to foster collaboration and interplay among governmental bodies, industry stakeholders, and the academic community [

40,

41,

42]. Others counsel that policy-related measures be driven by a series of economic considerations. In that regard, they first suggest that well-designed subsidy frameworks support research, development, and infrastructure investment [

43], the effect of which will be influenced by the size of the subsidies and their duration [

44]. Second, it is argued that the proliferation of green hydrogen-based power is also contingent on carbon pricing mechanisms, underpinned by clear, consistent, and elevated pricing being placed on the carbon generated [

43,

45]. The existence and extent of such policies notwithstanding, their aggregate effect will also rely on additional factors that may–or may not–be driven by policy. These include such items as the price of natural gas and the availability of low-carbon hydrogen [

45,

46]. Hence, an integrated policy approach is imperative, encompassing carbon pricing, research, hydrogen blending targets, and support for the production of low-carbon hydrogen.

Ultimately, even though hydrogen possesses significant potential to support the decarbonization of the global energy system, its successful integration is contingent upon numerous aspects requiring further study and attention. An essential factor that can enhance understanding and facilitate the transition of energy systems is obtaining greater precision in estimating hydrogen’s potential demand and a more robust understanding of its costs vis-à-vis alternative fuel sources. This encompasses determining the volume of hydrogen required and identifying the specific locations where demand exists. While several studies have attempted to estimate future hydrogen demand across various industries and processes, no comprehensive estimation is currently available within the context of energy systems. Addressing elements of this research gap is the primary objective of this paper. We do so by providing a detailed analysis of the potential demand for green hydrogen in the power sector, using site-specific data in a single jurisdiction. We turn our attention to that now.

3. Methods

As described, our primary goal is to estimate the total demand for hydrogen within the power sector in a specific jurisdiction. Additionally, we aim to provide a projection of the cost difference associated with that demand. Our purpose in doing so is to provide a framework that energy planners and policymakers, regardless of location, can employ to measure and evaluate hydrogen (focused on ‘green’ hydrogen) as a fuel for power generation. Doing so will enrich energy planners’ development of policy measures supportive of hydrogen’s future proliferation.

We do this via a case study of the Province of Ontario Canada. Ontario is an ideal location for doing so, a consequence of multiple factors related to its decarbonization goals and existing infrastructure. Relative to other locations in North America, Ontario has a comparatively clean electricity system, a position that was bolstered in 2014 when coal was eliminated from its electricity generation mix [

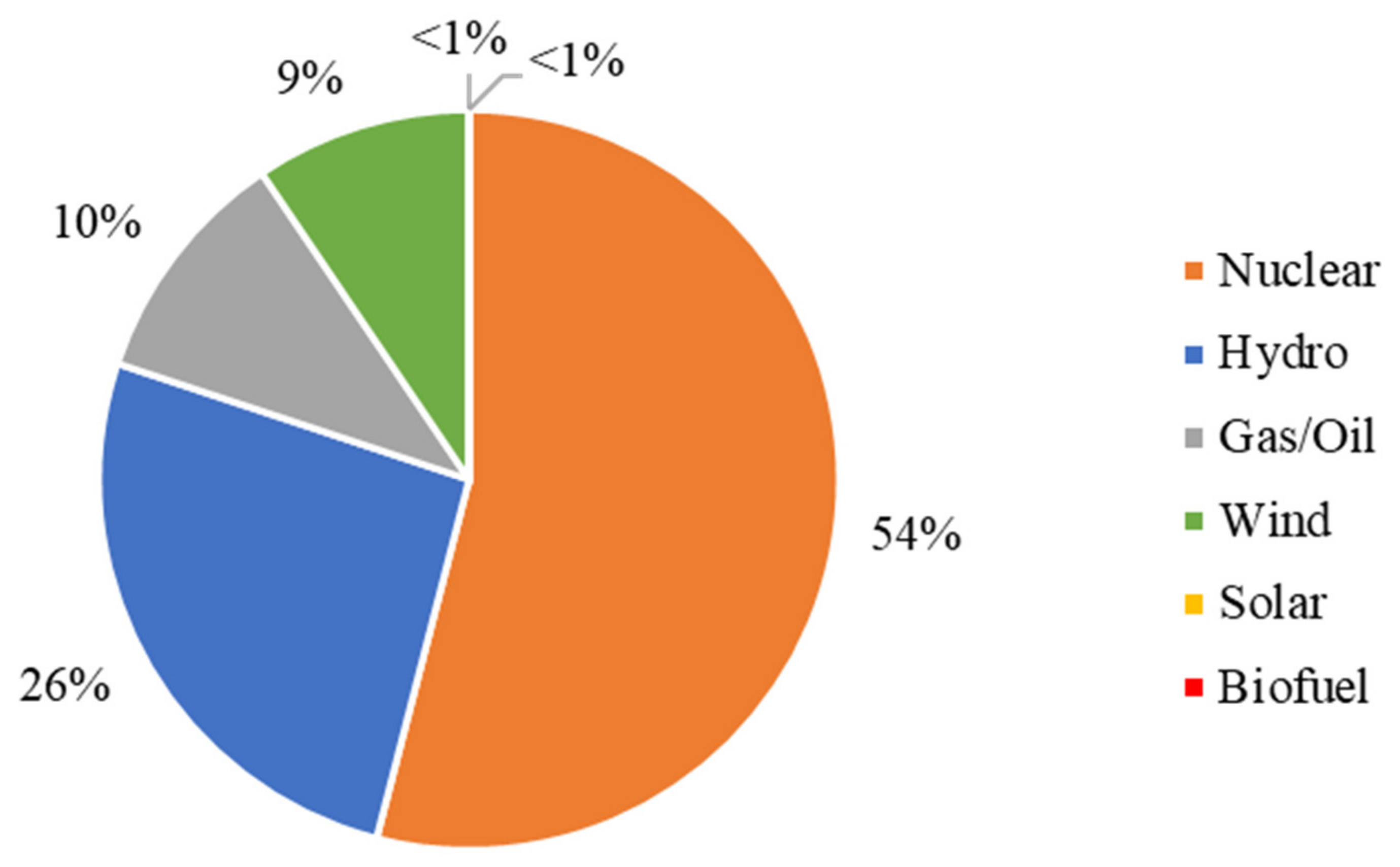

47]. Even so, as

Figure 1 below shows, carbon-producing natural gas accounted for approximately 10.4 percent of the province’s electrical energy output in 2022. Moreover, electricity production from the province’s existing natural gas generation fleet is expected to increase in future years, a consequence of nuclear refurbishments and retirements, as well as rising electricity demand [

1]. Hence, emissions generated by remaining gas units are forecasted to increase, an outcome that is at odds with the province’s decarbonization goals.

Our study assesses the demand for hydrogen as a replacement fuel for natural gas in electricity production turbines in Ontario over a 12-year timeframe, 2024–2035. We assume that the fuel source of all existing natural gas-powered turbines in Ontario will be converted to hydrogen. As described earlier, it is acknowledged that the retrofitting of all natural gas-fired turbines for hydrogen utilization is unlikely. This analysis seeks to elucidate key factors concerning the operational costs associated with potential retrofitting. To strengthen the methodological foundation of this study, we compare our approach with two widely recognized frameworks: the IEA’s Global Hydrogen Review and the US National Renewable Energy Laboratory’s (NREL’s) H2A model. The IEA’s Global Hydrogen Review provides a macro-level assessment of hydrogen production and demand trends, focusing on infrastructure development, policy, investment, and emissions across global and regional contexts [

48]. It is particularly useful for tracking progress toward climate goals and identifying policy gaps. However, it does not offer detailed, site-specific modeling for power systems. In contrast, the NREL’s H2A (Hydrogen Analysis) model, particularly the H2A-Lite version, offers a techno-economic analysis of hydrogen production technologies. It allows users to input assumptions about capital costs, feedstock prices, and system performance to generate cost breakdowns and emissions profiles [

49]. However, H2A is primarily designed for evaluating hydrogen production pathways rather than estimating demand from specific applications like electricity generation.

Our methodology differs in that it is operationally grounded and turbine specific. It estimates hydrogen demand by modeling the direct substitution of natural gas; in this case, in Ontario’s existing gas turbine fleet, using real-world efficiency scenarios and jurisdiction-specific electricity forecasts. This bottom-up, scenario-based approach complements the top-down perspectives of IEA and NREL by offering actionable insights for energy planners and infrastructure developers.

Our process consists of three phases:

3.1. Phase 1: Initial Assessment of Natural Gas Usage: (Establishing a Baseline)

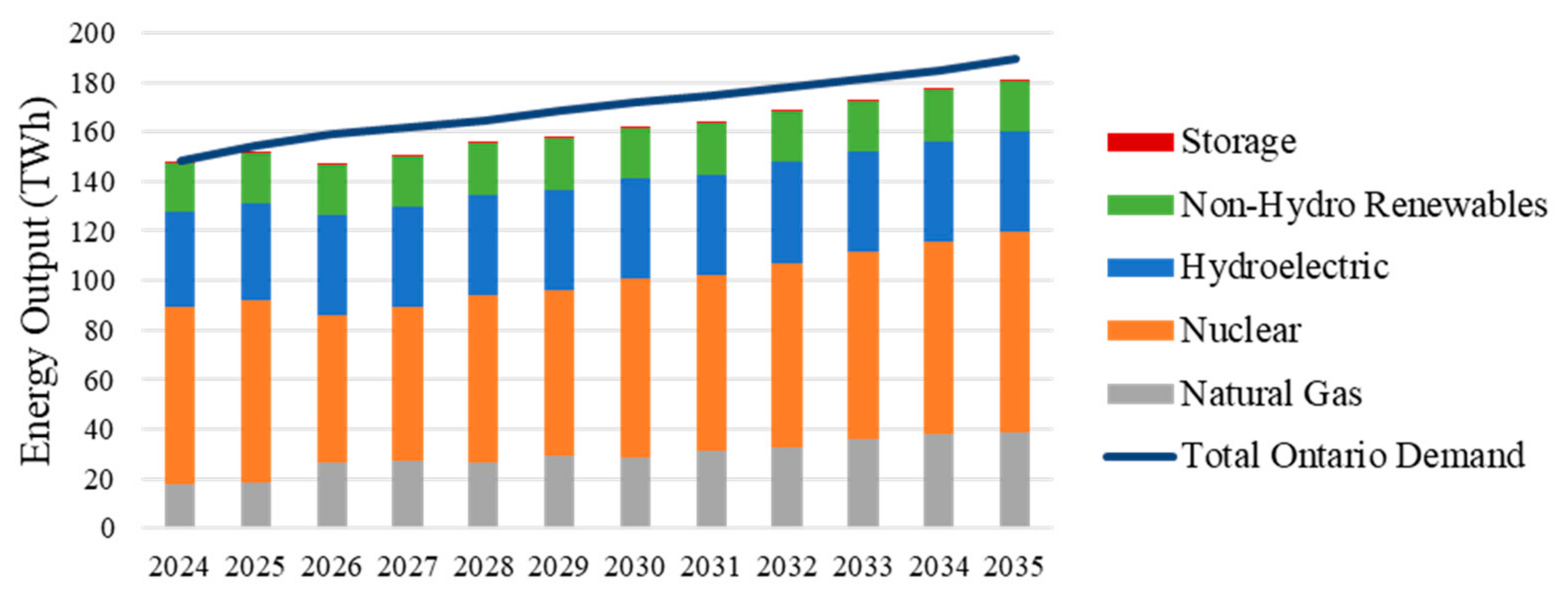

Here, we analyze the current energy output produced in Ontario using natural gas. For contextual purposes, we provide (via

Figure 2) estimates of the anticipated energy output of each fuel used (expressed in terawatt hours or TWh) during the period under study. As described, our focus is natural gas, Ontario’s remaining carbon-generating power source. Data from

Figure 2 shows that forecasted energy output from natural gas during the twelve-year period under study is projected to rise from 18 TWh in 2024 to 39 TWh in 2035, a rate of expansion more rapid than any other type of fuel. Total electricity generated by natural gas during that period is forecast to be 352 TWh.

3.2. Phase 2: Scenario Development

Next, we estimate the amount of hydrogen required to produce 1 MW of electricity. We assume that all current natural gas turbines will convert to hydrogen. Determining the amount of hydrogen needed to produce 1 MW of electricity in a gas turbine power plant requires:

Estimates of the efficiency or heat rate of the generator fleet that is employed (in our case, in the Province of Ontario) [

47,

50,

51]

The heat content of the fuel [the amount of heat energy available to be released when a specified physical unit of the fuel (e.g., a cubic meter of natural gas) is burned [

47,

51].

We calculate the amount of fuel needed to produce 1 MW of electricity using the following formula [

47,

51] (The heat rate of a turbine can be impacted by several factors. Notably, the turbine’s efficiency plays a significant role by converting a higher percentage of heat energy, resulting in a lower heat rate. Additionally, the temperature of the working fluid, the turbine’s design and technology, operating conditions, and control systems also influence the heat rate. Optimizing these factors can enhance the heat rate and overall efficiency of the turbine system [

52,

53], Natural gas has a heat content of 44 (MJ/kg). By comparison, hydrogen has a heat content of 120 (MJ/kg) [

54]):

Our analysis—and the assumptions we subsequently present—is reflective of the inventory of Ontario’s natural gas turbines. Key in that regard are the assumptions we develop concerning the efficiency of that fleet. There are three types of turbines:

- 1.

Combined Cycle Gas Turbine (CCGT)

This is the most common technology used in natural gas power plants in Ontario [

55]. CCGT produces electricity using both gas turbines and steam turbines. First, natural gas is combusted in a gas turbine to drive a generator to produce electricity. Then, the exhaust gases from the gas turbine pass through a steam generator to generate steam. Subsequently, the steam is directed to a steam turbine. That turbine also drives a generator, producing more electricity. This process results in improved efficiency and lower emissions compared to conventional gas-fired power plants [

56,

57]. A CCGT power plant typically attains an efficiency level of approximately 60 percent, with the gas turbine portion contributing around 40 percent and the steam turbine component providing an additional 20 percent [

58]. That said, even higher levels of gas turbine efficiency are also possible. For instance, GE Gas Power has successfully commissioned a combined-cycle power plant exhibiting a gross efficiency of 63.08 percent and has expressed intention to surpass the 65 percent threshold [

59].

- 2.

Simple Cycle Gas Turbine (SCGT)

SCGT produces electricity using a gas-powered turbine. Inside the turbine, the air is compressed and mixed with fuel (currently, natural gas). When the fuel-air mixture ignites, pressure is created as high-temperature gases expand. This causes the turbine’s blades to turn, thereby producing electricity. Because SCGT does not employ waste heat recovery, it is generally considered to be less efficient than CCGT or the Combined Heat and Power systems as described below [

60]. SCGT power plants typically achieve an efficiency level of 20 percent [

58].

- 3.

Combined Heat and Power (CHP)

Like CCGT, CHP involves the use of a gas turbine to produce electricity. Such systems also capture the waste heat generated during the process. CHP systems use the waste heat generated for hot water or steam while CCGT uses the waste heat produced from an initial electricity generation process to drive a second power generation engine or turbine, achieving dual electricity production from a single fuel. CHP systems, which are known for their efficient utilization of energy or fuel, make use of waste heat. Their electricity-only efficiency measured by heat rate ranges between 24% and 42% [

61].

As

Figure 2 captured, natural gas power plants play a pivotal role in meeting Ontario’s electricity requirements. At present, that process is concentrated. In 2022, for example, 12 natural gas power plants (of a total of 46) accounted for 97% of the energy generated from that fuel type Notably, the turbines driving these power plants are manufactured predominantly by General Electric (GE) and Siemens. These turbines reveal a spectrum of efficiency values, a consequence of turbine design and factors such as those describe in the Introduction.

One of the challenges associated with directly estimating the amount of fuel consumed by existing natural gas power plants is the confidentiality attached to the heat rate they achieve, a parameter that quantifies the amount of energy produced per unit of fuel for each turbine. However, as discussed above, turbine manufacturers (e.g., GE and Siemens) do provide heat rate specifications. That said, it is likely that real-world operation rates differ from the manufacturers’ expectations, a consequence of a range of factors, including equipment degradation, maintenance practices, and ambient conditions.

To address the limitations posed by real-world variability and the confidential nature of heat rates, this research employs a scenario-based approach to approximate fuel consumption. By developing scenarios representing both high and more typical heat rates achieved over Ontario’s full natural gas-powered fleet (rather than via individual turbines), we offer a range of potential fuel consumption values. These scenarios encompass the spectrum of operational possibilities, thereby offering more reliable insight into potential energy consumption patterns overall. This approach acknowledges the inherent uncertainties in real-world energy production while yielding meaningful insight for energy policymakers and other stakeholders. (Operators possessing access to turbine-specific or overarching natural gas consumption data may utilize our methodology to generate more accurate, site-specific estimates of anticipated hydrogen use.)

Based on the turbine efficiency data provided above, we devised three scenarios. The estimates consider levels of turbine efficiency of 40 percent, 50 percent and 65 percent.

Typical Heat Rate Scenario: In this scenario, all turbines are assumed to have a heat rate of 9 MJ per kWh, representing an efficiency level of approximately 40 percent, which is equivalent to the efficiency of an average simple cycle gas turbine [

28].

High Heat Rate Scenario: Here, all turbines are assumed to have a high heat rate (5.5 MJ per kWh), representing an efficiency level of approximately 65 percent, an uppermost level suggested by ongoing research in the sector [

59].

Sensitivity Scenario: In this scenario, all turbines are assumed to have a heat rate of 7.2 MJ per kWh, representing an efficiency level of approximately 50 percent. This intermediate case enhances robustness and provides a more representative estimate of real-world turbine performance.

3.3. Phase 3: Calculation of Future Hydrogen Demand and Costs

To determine the amount of hydrogen needed to sustain the natural gas-powered electricity generation forecast, we rely on data generated by IESO [

62,

63]. This involves extrapolating data from a 12-year period spanning the years 2024 to 2035. We base our projections on the anticipated energy volume (measured in TWh) generated using current estimates of natural gas resources in Ontario.

For the hydrogen cost projections, we use IEA’s estimates. If hydrogen is produced using renewable electricity, each kilogram is currently estimated to cost between USD 3 to USD 8 [

48]. These take on added relevancy when hydrogen cost is compared to the cost of the incumbent fuel source: natural gas. We do so by converting the cost of natural gas expressed in cubic meters to kilograms. To do so, we make several assumptions:

Energy content of natural gas = 52 MJ/kg [

64];

Cost of natural gas = CDN 34.78 ¢/m

3 [

65];

Density of natural gas = 0.8 kg/m

3 [

66].

To convert the cost of natural gas from ¢/m3 to ¢/kg, we divide the cost by the density:

Cost of natural gas per kg = Cost of natural gas per cubic m3/Density of natural gas;

Cost of natural gas per kg = 34.78 ¢/m3/0.8 kg/m3;

Therefore, the cost of natural gas per kg = CDN 43.475 ¢/kg (USD 32.40 ¢/kg).

4. Results

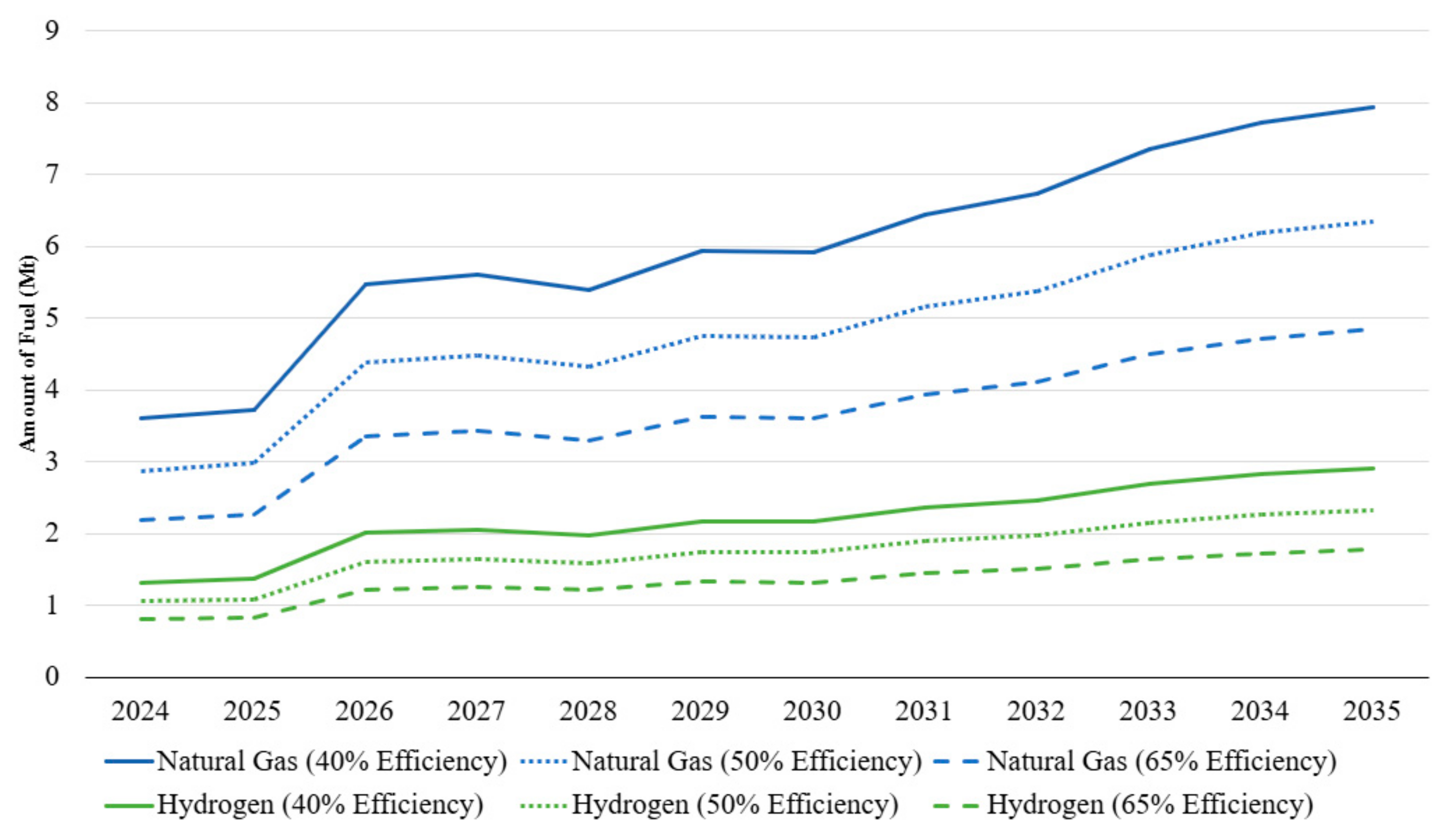

As described, our research focuses on three scenarios aimed at estimating the fuel requirements from 2024 to 2035. The objective is to determine the necessary fuel quantities to power turbines currently generating electricity via natural gas with hydrogen. The outcomes are provided in

Figure 3 below.

In 2022, Ontario produced less than 11 percent of its total energy using natural gas [

62], equivalent to 15.2 TWh of electricity. From there,

Figure 2 shows that a steady escalation ensues. By 2035, Ontario’s reliance on natural gas-generated electricity is projected to increase to 39 TWh, assuming existing resources (i.e., natural gas-powered turbines) continue to be available post-contract/commitment expiry [

63]. It should be cautioned that these projections do come with a certain level of uncertainty, a consequence of several factors. Such variables include future alterations in energy policy, technological advancements in the energy sector overall, deployment of new or redeployment of existing natural gas and non-natural gas-generated electricity, and changes in consumer behavior related to energy consumption.

Figure 3 shows the amount of fuel—both natural gas and hydrogen—required to generate the forecasted electrical energy levels captured in

Figure 2. The estimated amount of fuel required is provided in a standardized unit, Megatonnes (Mt), and is based on the specified fuel type (natural gas or hydrogen) and the turbine efficiency levels justified and described in

Section 3.2. The information captured in

Figure 3 offers insight into potential fuel requirements for power generation, considering different fuel types and turbine efficiencies over the 12-year period our research considers.

Figure 3 gives emphasis to the fact that hydrogen has a higher energy content per unit of weight compared to natural gas, meaning that it can generate more energy with less fuel.

Figure 3 plots the relationship between annual fuel consumption for six different scenarios over the twelve-year period our research considers: each line capturing how fuel consumption changes for each of the designated efficiency levels. The

y-axis denotes the amount of fuel consumed and is measured in Mt. It captures fuel consumption trends across multiple scenarios, facilitating a comparison of different fuel types and turbine efficiencies in relation to the level of electricity generation projected during the specified research period.

The first or top line in

Figure 3, depicted in solid blue, represents the annual fuel consumption for natural gas power plants operating at a turbine efficiency of 40%. The second and third lines, in different forms of dashed blue, illustrate the annual fuel consumption for natural gas power plants assuming a higher turbine efficiency of 50% and 65%. Combined, the three lines show how fuel consumption varies when the efficiency of the turbines is altered. The fourth line, in solid green, portrays annual fuel consumption for hydrogen fuel used in power plants operating at a 40% turbine efficiency. The fifth and sixth lines, represented in dashed green, show the annual fuel consumption for hydrogen-powered turbines with an efficiency of 50% and 65%. These lines highlight the impact of higher efficiency on the consumption of hydrogen as an energy source.

By 2035,

Figure 3 shows that, depending on the efficiency of turbines, 1.8 to 2.9 Mt of hydrogen will be required to meet Ontario’s energy needs. According to the IEA, if hydrogen is produced using renewable electricity, each kilogram is currently estimated to cost between USD 3 to USD 8 [

48]. Thus, the annual cost of hydrogen will lie between USD 5.4 billion (for 1.8 Mt assuming 65 percent efficiency at USD 3 per kilogram) and USD 23.2 billion (for 2.9 Mt at 40 percent efficiency at USD 8 per kilogram).

However, in regions with high amounts of renewable sources, the IEA suggests that the cost of hydrogen may fall to as low as USD 1.3 per kilogram by 2030 and USD 1 over the longer term [

48]. Assuming these reductions are achieved, and they are applicable to Ontario, by 2035, the cost of green hydrogen for producing 39 TWh of electricity that year will be between USD 1.8 billion (for 1.8 Mt assuming 65 percent efficiency at USD 1.0 per kilogram) and USD 3.77 billion (for 2.9 Mt assuming 40 percent efficiency at USD 1.3 per kilogram). (Note: these estimates do not encompass costs associated with the conversion of existing natural gas infrastructure to ensure compatibility with hydrogen.)

The hydrogen cost projections provided above take on added relevancy when they are compared to the costs of the incumbent fuel source: natural gas. We do so by converting the cost of natural gas expressed in cubic meters to kilograms. To do so, we make several assumptions:

Energy content of natural gas = 52 MJ/kg [

64];

Cost of natural gas = CDN 34.78 ¢/m

3 [

65];

Density of natural gas = 0.8 kg/m

3 [

66].

To convert the cost of natural gas from ¢/m3 to ¢/kg, we divide the cost by the density:

Cost of natural gas per kg = Cost of natural gas per cubic m3/Density of natural gas;

Cost of natural gas per kg = 34.78 ¢/m3/0.8 kg/m3.

Therefore, the cost of natural gas per kg = CDN 43.475 ¢/kg (USD 32.40 ¢/kg) (conversion rate from

$CDN to

$USD Bank of Canada using weekly average conversion rate for the period 25 September 2023–29 September 2023 [

67]).

Therefore, drawing from data contained in

Figure 3—and depending on the efficiency of turbines—which shows that between 4.9 and 7.9 Mt of natural gas will be required to meet Ontario’s anticipated 2035 requirements from its fleet of turbines (to generate 39 TWh of electricity), and assuming that current natural gas prices remain, the cost of natural gas may be calculated as follows:

Assuming 65 percent turbine efficiency:

Assuming 50 percent turbine efficiency:

Assuming 40 percent turbine efficiency:

Therefore, the cost premium for hydrogen over natural gas for the year 2035 (the final year of our study range and the year for which demand is projected to be highest), assuming the most optimistic basket of assumptions (65 percent turbine efficiency rate, 1.8 Mt of hydrogen/4.9 Mt of natural gas, USD 1 hydrogen per kilogram) is USD 241.6 million ($1.8 billion–$1.5584 billion). However, should the less optimistic assumptions manifest (40 percent turbine efficiency, the cost of hydrogen is USD 8 per kilogram), the single-year (in this case, 2035) premium for hydrogen over natural gas could be as high as USD 20.604 billion ($23.2 billion–$2.5596 billion).

5. Discussion

In recent years, green hydrogen—hydrogen developed from renewable energy sources like wind and solar—has generated growing attention. This is a consequence, in part, of the potential it holds as a viable replacement for natural gas in electricity generation. Interest in green hydrogen for that purpose arises because of a confluence of factors. For starters, it is a promising way to reduce carbon emissions [

1,

6,

9,

10]. It also offers flexibility and grid stability. That means, the process of converting renewable, yet intermittent energy sources like solar and wind into storable hydrogen makes hydrogen particularly suitable for addressing the current challenges linked to using non-storable fuel sources [

11,

12]. Additionally, the fact that global, national, and regional commitments surrounding Greenhouse Gas (GHG) emissions have yet to be realized, render the adoption of low-emission alternatives like green hydrogen increasingly urgent. The effect has been that both public and private actors, including energy utilities and governments, are demonstrating elevated interest in hydrogen [

1,

9,

10].

In Ontario, the focus of our case study, during the post-2000 period, a series of announcements were made, and several policy measures were implemented to enable the production and expansion of a low-carbon hydrogen economy. These include tax rebates, grants, the introduction of a carbon pricing mechanism, and funding for Research and Development. The province has also articulated a broader decarbonization strategy. Notwithstanding these traces of momentum, the transition to hydrogen as a source of electricity generation remains fraught. In Ontario, for example, no government-mandated targets have been established to promote the use of green hydrogen, and a hydrogen market does not yet exist. Moreover, regardless of location, systems to transmit hydrogen remain suboptimal [

14,

35]. Also, in both the production and transportation stages, hydrogen experiences significant energy loss [

68], a feature that necessitates extra energy sources, thus elevating cost. Beyond that, comprehension of the measures necessary to effectively repurpose existing natural gas infrastructure to hydrogen remains incipient. The effect in our study location, Ontario, is that its reliance on natural gas as a fuel source for the generation of electricity, both proportionally and overall, is projected to rise [

62,

69]. Therefore, considering the visible lack of progress—and consistent with the literature—it may be argued that for tangible progress to occur, more significant investment and clearer, more absolute targets and commitments are required [

43,

44,

45].

6. Conclusions

This article has sought to close gaps in our capacity to consider hydrogen in general and green hydrogen in particular as a potential source of fuel for the generation of electricity. In doing so, we make three contributions. First, we provide a methodology that energy planners, policymakers, researchers, and other stakeholders engaged in the energy sector can use to assess comparative fuel consumption patterns and requirements necessitated by the conversion of natural gas-powered turbines to hydrogen. Through our case study, we offer a procedure to assess the volume of hydrogen required to power a fleet of electricity-generating turbines, a method that is based on a combination of (a) projections of the aggregate amount of electricity to be generated (expressed in TWh), (b) estimates of the efficiency or heat rate of the fleet of turbines employed (in our case, in the Province of Ontario), and (c) the heat content of the fuel [the amount of heat energy available to be released when a specified physical unit of the fuel (e.g., a cubic meter of natural gas)] is burned.

As described, our case study is of Ontario’s existing fleet of natural gas-powered turbines. In Ontario, while data concerning the overall volume of electricity generated via natural gas is made available, data about specific turbines, including their efficiency and the volume of natural gas they consume is not. Drawing from our formula, energy planners and others having access to more detailed, granular data, including individual turbine efficiency rates and/or actual natural gas levels consumed may be better positioned to develop more accurate projections of future hydrogen requirements.

Second, building from our calculation of the volume of hydrogen necessary to produce current natural gas-sourced electricity and drawing from others’ assessments about future costs of hydrogen, we provide estimates of the quantity and cost of hydrogen gas required to transition Ontario’s currently planned natural gas-sourced electricity to hydrogen (as much as 39 TW annually by 2035). For our estimation, the volume of hydrogen required to replace natural gas as a fuel source for future electricity requirements varies only as a function of the levels of efficiency that the fleet of turbines can achieve (in our case, a range between 40 percent and 65 percent). Our calculations of potential future costs are based on hydrogen prices of between USD 1/kg and USD 8/kg, a wide spectrum. The lack of precision surrounding future hydrogen costs is influenced by multiple factors, including market fluctuations, technological advancements, and scales of production. While current hydrogen gas costs are at or beyond the uppermost levels of that range [

48], as hydrogen technologies and production methods gain wider acceptance, prices are projected to decrease. This cost reduction will stem from advancements in electrolysis and other production techniques, economies of scale, and the integration of renewable energy sources for hydrogen generation [

65].

As our case study of Ontario Canada shows, by 2035, the combination of turbine efficiency rates and hydrogen costs mean a comprehensive conversion of existing natural gas-powered turbines to hydrogen could result in annual hydrogen costs of between USD 1.8 billion and USD 23.2 billion. Clearly, the range is not inconsequential, particularly because based on current projections, natural gas/hydrogen would represent just 20.6 percent of the total electricity forecast to be generated that year (39 TWh of a total of 189 TWh). This contribution should be viewed in the context of Canada’s legislated commitment to achieve net-zero greenhouse gas emissions by 2050 under the Canadian Net-Zero Emissions Accountability Act. As part of this transition, decarbonizing dispatchable electricity sources, such as natural gas turbines, is essential.

Third—and the relevance of this is in large part a function of the values provided and described immediately above—we calculate the volume and cost of natural gas to produce the electricity assigned to that energy source. In 2035, for example, assuming (a) demand for electricity will reach 39 TWh, (b) natural gas requirements will be between 4.9 Mt and 7.9 Mt (based on turbine efficiency rates of 40 percent to 65 percent), and (c) natural gas prices are at levels captured in the

Section 4 above, we calculate that natural gas will cost between USD 1.5884 billion and USD 2.5596 billion. Thus, the annual cost premium for hydrogen over natural gas is less consequential when/if hydrogen drops to USD 1/kg (i.e., USD 241.6 million). However, should hydrogen prices remain high (i.e., USD 8/kg), the annual premium for hydrogen-generated electricity over natural gas could reach USD 20.604 billion in our case study location, a differential that may explain at least some of the reluctance of energy planners in places like the Province of Ontario to commit to high volume hydrogen-fueled electricity generation.

We emphasize the importance of future research in examining the complexities of transitioning from natural gas turbines to hydrogen fuel. Key areas for investigation include the feasibility of conversion across different turbine models, the economic implications of retrofitting existing infrastructure, the efficiency challenges of hydrogen storage, the effect of turbine degradation across different scenarios, and the uncertainties associated with geopolitics and evolving policy frameworks. Additionally, further emphasis on alternative fuel technologies—such as battery storage and biogas—as well as energy system integration strategies, would enable deeper understanding of the dynamics influencing the adoption of hydrogen as a fuel and its impact on system efficiency.

Considering the foregoing, even though hydrogen, in general, and green hydrogen, in particular, does hold promise as a fuel source for future electricity generation, significant challenges endure. The challenges are manifold and encompass various interconnected aspects, including production, infrastructure, safety, transportation, and the necessary policy measures to facilitate their advancement. Consequently, estimates regarding the future cost of hydrogen gas demonstrate substantial variation. Given the magnitude of the technological questions, cost-related disparities, and the need to ensure continuity of supply, policymakers and energy planners in regions such as Ontario have to date been reluctant to forsake conventional fuels like natural gas for the generation of electricity.