1. Introduction

Global carbon dioxide emissions have exhibited a persistent upward trend over the past decade. In response, the Chinese government has actively committed to carbon reduction, pledging to attaining carbon peak neutrality goals [

1]. As the world’s largest energy producer and consumer, China’s substantial energy consumption has resulted in significant environmental challenges [

2]. To address these issues, the government has vigorously promoted energy transition, achieving notable progress. According to the “China Power Industry Annual Development Report 2025,” the nation’s total power generation in 2024 reached 1008.69 billion kilowatt–hours, with hydropower contributing 142.57 billion kilowatt–hours, marking a year-on-year growth of 10.9%, accounting for 14.1% of total generation.

Nevertheless, resource allocation inefficiencies persist owing to incomplete market-oriented reforms in the energy sector. Factor prices often deviate from their marginal products, impairing the market’s self-correcting mechanism for achieving optimal resource allocation. This leads to efficiency losses and energy misallocation [

3] which, in the case of hydropower, not only constrains improvements in energy utilization efficiency but also impedes the achievement of China’s dual carbon objectives. Against this backdrop, digital economy has risen as a pivotal catalyst for low-carbon development, playing an increasingly important role in supporting carbon emission reduction targets.

The existing literature has explored how digital economic development influences various forms of factor misallocation, including capital [

4], labor [

5], urban–rural factors [

6], innovation resources [

7], and financial mismatches [

8]. Research within energy-related studies primarily branches into two directions: one involves examining the role of the digital economy in overall energy consumption and efficiency, and the other involves investigating causes and spatial attributes of energy misallocation. For instance, studies such as those by Wang and Shao (2023) [

9] and Mohsin et al. (2021) [

10] suggest that digital economy development can significantly reduce energy consumption. Dzwigol et al. (2021) [

11], however, found that, while Internet development increases energy consumption, it negatively affects the structure and intensity of energy use. Xie and Ma (2024) [

12] identified a curvilinear association between energy consumption and digital economy. Additional scholars, including Zhang et al. (2024) [

13], Cao et al. (2021) [

14], Awan et al. (2021) [

15], and Tomazzoli et al. (2022) [

16], conclude that Internet technology markedly enhances energy efficiency. In contrast, Kwilinski (2024) [

17] revealed a nonlinear relationship where digital economic development initially boosts and later inhibits total factor energy efficiency.

Concurrently, research on energy mismatch underscores that distortions in capital and intermediate product markets, government intervention, and energy policy intensity are key drivers of misallocation [

18,

19]. Yu et al. (2024) [

20] and Afshan et al. (2022) [

21] demonstrated that distortions in energy structure significantly inhibit improvements in carbon emission efficiency, environmental efficiency, and energy efficiency. Cheng et al. (2024) [

22] emphasized that insufficient technological innovation leads to more severe energy mismatch in western provinces compared to eastern and central regions. Thus, energy factor misallocation has become a critical issue in resource allocation research [

23].

Despite these contributions, several research gaps remain. Few studies have specifically examined whether digital economic development can mitigate misallocation in hydropower resources. Moreover, existing work has insufficiently explored the temporal dynamics and spatial heterogeneity in how the digital economy influences energy factors, both theoretically and empirically.

To address these gaps, this paper utilizes panel data from 30 provincial-level regions in China from 2000 to 2023 (excluding Tibet, Hong Kong, Macao, and Taiwan due to data availability) to analyze both linear and nonlinear relationships, as well as time-lag effects, between digital economy development and hydropower resource misallocation. Drawing on the empirical evidence, we formulate targeted policy interventions aimed at guiding future digital economy development and optimizing hydropower resource allocation in China.

2. Theoretical Analysis and Hypothesis

China’s present energy mix is unable to meet the upgrading demands of the consumer end, leading to hydropower resource mismatch, which has become a constraint on high-quality development. The advancement of digital economy can drive digital transformation of the hydropower market, thereby injecting new momentum into the efficient allocation of hydropower resources.

Overall, digital economic development can mitigate hydropower resource misallocation through specific mechanisms that enhance market efficiency and operational precision. The core economic channels include (1) real-time information discovery and price signal enhancement; (2) predictive optimization of asset utilization; and (3) reduction in cross-regional arbitrage costs.

In terms of production and market operation, the digital economy fundamentally alters decision-making paradigms. Firstly, IoT sensors and smart meters deployed in dams, grids, and consumption terminals generate massive real-time data on water inflow, reservoir levels, turbine efficiency, and electricity load. Big data analytics processes this information to create highly accurate, short-term forecasts of both supply and demand. This drastically reduces the information asymmetry between producers, grid dispatchers, and consumers. Grid operators can now make economic dispatch decisions based on near-perfect information, allocating hydropower to maximize its utilization during peak demand hours, thereby displacing more expensive and often more polluting fossil fuel generators [

24].

Secondly, digital twin technology creates virtual replicas of hydropower plants, allowing operators to run simulations and optimize scheduling and maintenance plans without risking physical assets or output. AI algorithms can calculate the most economically efficient time to generate power based on real-time electricity market prices, a concept known as arbitrage. This enables plant managers to decide whether to release water to generate high-value electricity now or to store it for future, potentially more profitable opportunities. This enhances the price responsiveness of hydropower generation, a critical step in correcting misallocation driven by non-price administrative directives [

25].

Thirdly, blockchain-based platforms facilitate P2P energy trading and verify green energy origins, fostering a transparent market mechanism. This creates a transparent and trustworthy market mechanism for hydropower, allowing producers to capture a premium for their renewable output and giving consumers a verifiable choice to support green energy. This market differentiation more accurately reflects the social and environmental value of hydropower, guiding investment and consumption decisions towards a more efficient equilibrium.

In terms of lifestyle, from a behavioral economics perspective, the digital economy provides “nudges” that help strengthen residents’ awareness of lowering energy use and cutting emissions, encouraging them to adopt a low-carbon and environmentally friendly lifestyle. Benefiting from the advances in digital economy, people’s access to knowledge has become more diverse and simplified [

26], making them more likely to pay attention to issues including resource waste and global warming. Energy conservation and ecological protection policies have been promoted more deeply and effectively through the internet, thereby gradually enhancing people’s awareness of energy conservation in their daily lives. Simultaneously, the accelerated growth of online voice and video conferencing has enabled people to achieve the goal of remote working through digital technology without leaving their homes. In addition, the number of people who shop online and use electronic payment methods has increased significantly, which has reduced the need for transportation and thereby reduced unnecessary resource consumption [

27]. In summary, digital technologies inject critical economic signals and operational flexibility into the hydropower sector. This enhances the role of the market’s “invisible hand” in the hydropower sector, leading to optimized resource allocation and reduced mismatch. This study therefore proposes Hypothesis 1.

Hypothesis 1: Digital economic development helps reduce the level of mismatch in hydropower resources.

The path dependence theory lays a crucial theoretical groundwork for hypothesizing the time-dynamic nature of the effects stemming from digital economy on hydropower misallocation [

28]. This theory posits that past technological and institutional choices create self-reinforcing mechanisms, leading to inertia that locks systems into established development trajectories [

29]. In China’s hydropower sector, this lock-in is evident in three key areas, creating significant barriers to rapid digital integration: (1) Technological and Infrastructural Lock-in. The massive sunk costs in existing mega-project infrastructure (e.g., Three Gorges and Xiluodu) create a powerful economic disincentive for radical technological change. These systems, designed around pre-digital control paradigms, exhibit high asset specificity, meaning their value is tied to the existing technological setup. Retrofitting them with integrated digital systems incurs significant switching costs and poses risks to the reliability of critical national infrastructure, leading to a preference for incremental over disruptive innovation. (2) Institutional Inertia. The sector’s governance is characterized by centralized planning and vertical management under state-owned utilities, with operational rules and market mechanisms designed for the traditional model, often clashing with the decentralized, agile nature of digital technologies. (3) Organizational Rigidity. Operational culture and expertise are deeply rooted in conventional power engineering, creating a human capital mismatch and risk aversion towards data-driven approaches.

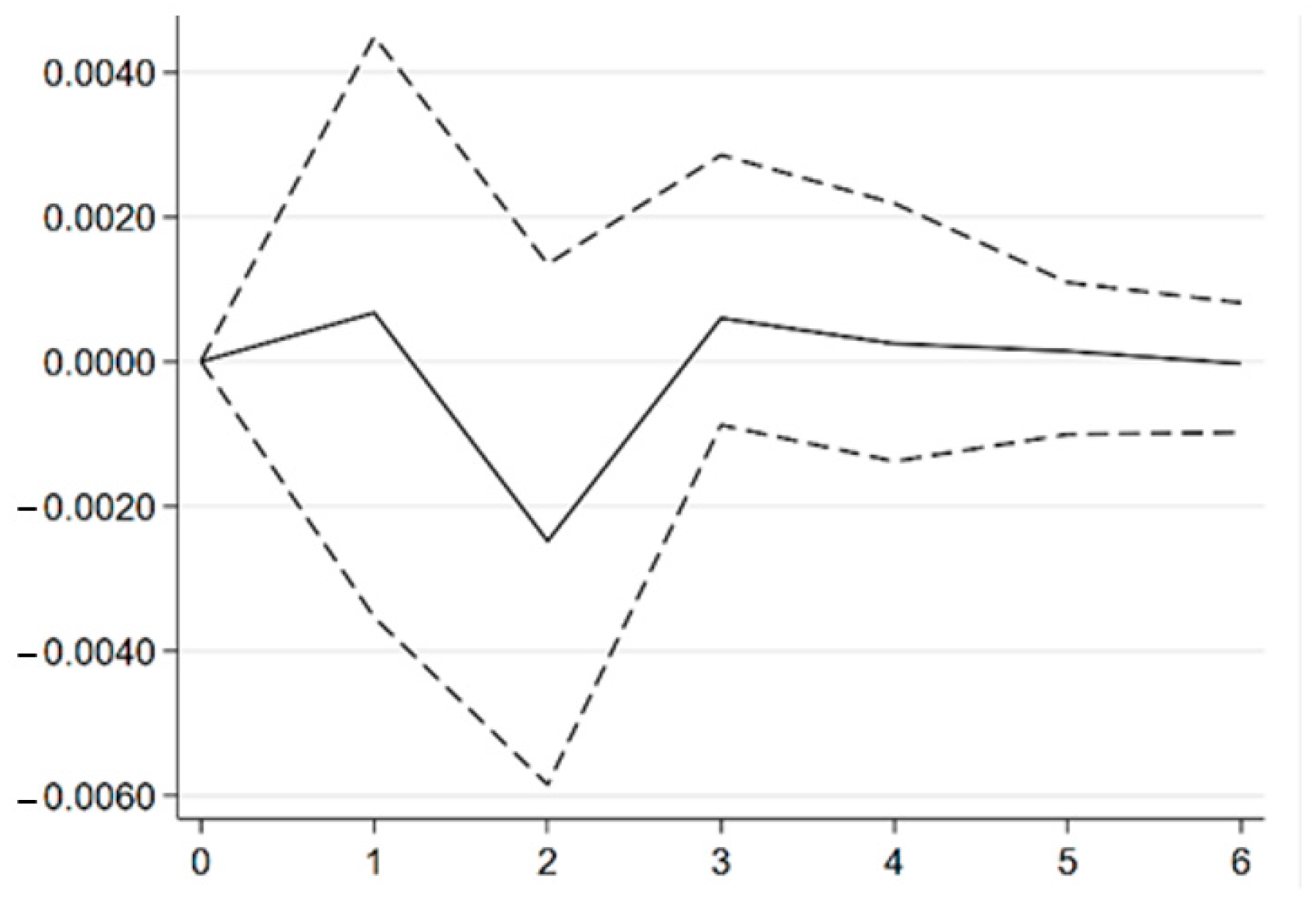

This combination of infrastructural, institutional, and behavioral inertia means that the effect of digital economic development on optimizing resource distribution follows a complex adoption curve rather than an immediate adjustment. The diffusion of innovation typically follows an S-shaped pattern where early experimentation and piloting gradually build toward critical mass. This process involves not only technical integration but also the slow evolution of supportive governance mechanisms and skill sets. Therefore, we anticipate a discernible time lag between the impetus of digital economic development and its peak effect on mitigating hydropower mismatch. The initial phase may show limited impact as the sector undergoes necessary learning and adaptation, followed by an accelerating effect as digital solutions become more integrated. This temporal pattern aligns with both path dependence theory and innovation diffusion models. Accordingly, Hypothesis 2 is formally proposed.

Hypothesis 2: Although digital economic development helps to correct the mismatch of hydropower resources, the correction effect has a time lag due to the influence of path dependence theory.

The comparative advantage theory offers a robust framework for understanding the anticipated spatial heterogeneity in the mitigating influence of digital economic development on hydropower mismatch [

30,

31]. At its core, this theory suggests that regions can improve overall economic efficiency by specializing in activities where they hold a relative advantage, even in the absence of an absolute one, thereby maximizing output through optimal resource allocation across different localities. When applied to the digital transformation of the hydropower sector, this theory helps explain why the effectiveness of digital tools varies significantly across regions. The application of digital economy tools to optimize hydropower allocation is not a one-size-fits-all solution; its effectiveness is contingent upon a region’s inherent capacity to absorb and leverage these technologies. From an economics perspective, this capacity can be understood through the lens of endowment structures and factor proportions. Highly industrialized regions typically possess a superior endowment of complementary factors: advanced physical infrastructure (e.g., stable power grids, IoT sensor networks, and cloud computing facilities), a highly skilled workforce capable of deploying and maintaining digital systems, abundant financial capital for technological upgrades, and institutional environments conducive to innovation and risk-taking [

32]. These factors collectively enhance the region’s “comparative advantage” in implementing digital solutions, as posited by the Heckscher–Ohlin theory, which emphasizes that regions export goods and services that intensively use their abundant factors. Here, industrialized regions are abundant in the capital and human capital necessary for digital adoption, thereby experiencing higher returns and more efficient resource reallocation when integrating digital technologies. Conversely, less industrialized regions face comparative disadvantages due to factor scarcity—particularly in human capital and technological infrastructure—which constrains their ability to effectively deploy and utilize digital tools. The diminishing marginal returns on digital investments in these regions further exacerbate spatial disparities. In economics terms, the initial investment in digital technology in a low-industrialization context may yield minimal gains due to insufficient absorptive capacity, high adaptation costs, and lack of technical expertise. This aligns with the concept of appropriate technology, which suggests that technologies must match local factor supplies to be effective. In regions where industrialization is low, digital solutions may not be “appropriate” without prior investments in foundational infrastructure and skills. Moreover, digital tools become more valuable as more users and systems adopt them. In highly industrialized regions, the dense concentration of firms, research institutions, and digitally literate users accelerates learning and innovation spillovers, creating a virtuous cycle of increasing returns. Meanwhile, less developed regions struggle to achieve the critical mass required for these network effects to take hold, resulting in a slower and less effective diffusion of digital technologies. Thus, the marginal benefit of digital economic development is expected to vary significantly across regions with different industrialization levels. Industrialized regions not only possess the requisite factor endowments but also exhibit stronger dynamic gains from digital integration, including innovation spillovers, economies of scale, and enhanced market linkages. Less industrialized regions, however, may suffer from a “digital divide” that limits their ability to correct resource misallocation, at least in the short to medium term. This spatial heterogeneity, deeply rooted in structural economic disparities, underscores the importance of tailoring digital economy policies to regional comparative advantages to achieve equitable and efficient outcomes in hydropower allocation. In summary, this study proposes Hypothesis 3.

Hypothesis 3: The extent to which digital economic development mitigates hydropower resource misallocation depends on regional industrialization levels and demonstrates significant spatial variation.

5. Discussion and Implications

5.1. Discussion

This study extends the application of path dependence theory from institutional and technological evolution to resource allocation. It empirically demonstrates that historical legacy issues within energy systems create inertia, thereby delaying the digital economy’s ability to correct the hydropower resource misallocation. Furthermore, it deepens the application of Comparative Advantage Theory by introducing a region’s level of industrialization as a threshold variable. This provides a new perspective for rationally employing digital technologies to address hydropower resource misallocations across different regions.

Empirical discussions reveal that digital economic development significantly alleviates hydropower resource misallocation, which aligns with studies such as [

9,

10,

11,

12,

13,

14,

15,

16], demonstrating digitalization’s positive role in enhancing energy efficiency. However, by introducing the critical dimension of temporal dynamics, this study uncovers a time-lag effect in how digital economic development influences the hydropower resource mismatch. This provides a detailed explanation of some scholars’ view that enhancing resource allocation efficiency remains challenging within the digital economy [

42,

43]. The short-term ineffectiveness of digital policies may reflect a broader phenomenon of path dependence.

Secondly, guided by the comparative advantage theory, this paper uses the level of industrialization to analyze the spatial heterogeneity in the effects of digital economic development. This finding supports conclusions drawn by Ulucak (2021) [

44] and Cheng et al. (2024) [

22], both of whom emphasized that gains from technological advancement are not automatically distributed evenly. Building on this, our study highlights that the level of industrialization serves as a critical threshold condition, providing a theoretical basis and empirical evidence for explaining when and where digital economy policies are most likely to successfully correct the misallocation of hydropower resources.

5.2. Policy Implications

This study offers significant theoretical, practical, and social contributions. Theoretically, it extends the path dependence theory and Comparative Advantage Theory into the domain of resource allocation, illustrating how historical technological and institutional inertia delay the benefits of digitalization and how regional factor endowments shape the effectiveness of digital economy policies. The findings advocate for differentiated policy interventions: regions with higher industrialization levels should pursue deep digital integration, while less industrialized regions should focus on strengthening foundational infrastructure and digital literacy to enhance absorptive capacity. Socially, by mitigating hydropower misallocation, this research supports China’s dual carbon goals, promotes energy conservation, reduces emissions, and facilitates the transition toward a more efficient, equitable, and sustainable energy governance model. In summary, the following policy implications are proposed:

- (1)

Digital infrastructure should be expanded to enhance the foundation for digital economic development. Comprehensive coverage of digital infrastructure across the region should be promoted to ensure that local residents enjoy a better digital life. The digital economy should be used to eliminate information transmission barriers and shorten the distance of resource transmission to alleviate the problem of hydropower resource mismatch resulting from market information asymmetry. Growing number of Internet users enables faster and more convenient transmission of information and knowledge. Digital technology can promote initiatives and policies related to energy conservation and emission reduction and encourage people to adopt a green and low-carbon lifestyle.

- (2)

The hydropower industry’s issue of technical path lock-in should be addressed through timely and appropriate measures. In the short term (lagging by one period), given that the potential of the digital economy remains partially untapped, efforts should focus on breaking free from existing technical path dependencies. Policy guidance can be used to encourage hydropower companies to pilot digital technology adaptation projects, thereby shortening the application adaptation period for digital technology in the hydropower sector and laying the groundwork for its future impact. In the medium to long term, as the negative effects of the digital economy peak, we should take advantage of the momentum to promote large-scale application. We should boost dedicated investment in the digital transformation of hydropower and improve the accuracy of water resource allocation.

- (3)

The estimated industrialization threshold of 0.256 is not merely a statistical artifact but carries significant practical meaning. It serves as a critical quantitative benchmark that distinguishes between two distinct phases of regional economic structure. A region with an industrialization level (LOI) below 0.256 typically relies on a more traditional economic mix, potentially with a larger agricultural or nascent service sector. Its industrial base is likely less mature, with limited advanced manufacturing, weaker technological absorption capacity, and less developed supporting infrastructure. Conversely, a region with an LOI exceeding 0.256 has reached a stage of more advanced industrialization, characterized by a denser aggregation of industrial enterprises, more complex supply chains, greater capital intensity, and a more robust foundation in physical and human capital.

In policy terms, this threshold provides a clear, data-driven answer to the following question: “Which type of digital economy policy should be prioritized for optimizing hydropower allocation?” Our findings indicate that the corrective influence of the digital economy is markedly stronger in regions that have crossed this developmental threshold (LOI ≥ 0.256). For these regions, policymakers can confidently promote deep-integration digital policies, the adoption of AI-powered predictive maintenance, and the implementation of real-time data-driven resource dispatch systems. These regions possess the necessary ecosystem to effectively absorb and utilize such advanced technologies.

For regions still below the threshold (LOI < 0.256), the policy focus must be fundamentally different. In this study, the marginal returns on advanced digital applications are lower. Instead, policy should prioritize building foundational capacities by strengthening basic grid and water network infrastructure, enhancing digital literacy, promoting the intelligent transformation of traditional industries, and fostering market-oriented reforms to improve the business environment. Prematurely investing in advanced digital tools in these regions may lead to inefficient capital allocation and poor outcomes.