1. Introduction

The notion of ‘

critical materials’ emerged in force in the last twenty years, being the target of several recent studies on the subject of material availability, such as, for instance, Graedel et al. (2015) [

1], Nassar et al. (2015) [

2], an OECD report (2019) [

3], Pitron (2020) [

4], Gielen (2021) [

5], Gielen and Papa (2021) [

6], CSS-UMichigan (2022) [

7], Smil (2014) [

8] and Devezas et al. (2017, 2022) [

9,

10], to mention a few. It is important to highlight that since then, there have been successive CRITICAL MATERIALS SUMMITs held, sponsored by the IEA, the most recent one having been held in July 2024 in Belgrade, where a Memorandum of Understanding for a strategic partnership between the EU and Serbia was signed.

The achievement of the goal of zero emissions by the middle of the 21st century, in line with the Paris Agreement and the intended Great Energy Transition, implies overcoming a bottleneck unprecedented in the entire history of the energy transitions that occurred in the past, because now, we have the problems of availability, costs of extraction and production, aggression to the environment, and geopolitical aspects related to the use of an immense range of materials indispensable for the full implementation of all the new energy alternatives—whether photovoltaic cells, wind turbines, or batteries of any type. This bottleneck can be reduced to a very simple question: Where do all the necessary materials for the so-called Green Transition come from?

The French journalist, author, and documentary maker Guillaume Pitron, a specialist in the geopolitics of raw materials, starts the second chapter of his book “

The Rare Metals War” by stating “

The technologies that we delight in calling ‘Green’ may not be as green as we think, they could have an enormously impact on the environment …” (Pitron, 2020, p. 34) [

4]. The author analyses deeply how humanity, in order to overcome the disruptive effects of fossil fuels on climate change, has developed new and supposedly cleaner and more efficient inventions—for example, wind turbines, solar panels, and electric batteries (which can connect to high-voltage ultra-performance grids)—but is absolutely unaware that the expected more sustainable world is largely dependent on rock-borne substances called rare metals. He tells us how humans have long mined primary metals, like iron, gold, silver, copper, lead, and aluminum. But in the last forty years or so, we have turned our sights to a bunch of lesser-known metals found in terrestrial rocks in infinitesimal amounts, a subset of some thirty raw materials with a shared characteristic—they are often associated with nature’s most abundant metals and are very difficult (and expensive) to refine and process. Pitron points out the fact that “

we have carved out a multitude of applications in two fundamental areas of the energy transition: supposedly ‘green’ technologies and digital technologies” and goes further, stating that we are assured that the convergence of the two will create a better world. The first examples of this convergence (wind turbines, solar panels, and electric cars) are packed with rare metals to produce decarbonized energy that travels through high-performance grids to enable power savings, but these grids (which also imply an immense need for copper and nickel) are also driven by digital technologies that are heavily dependent on these same metals.

The numbers associated with these new green material needs are mind-boggling (Pitron, 2020) [

4]. This author mentions, for instance, that 8.5 tons of rock are needed to produce a kilogram of vanadium, 50 tons for the equivalent in gallium, and a staggering 1200 tons for one simple kilogram of one of rarest of the rare earths—lutecium. Let us also consider the case of car batteries: a car battery for an electric car weighs about 500 kg, and its volume is the size of a suitcase. It contains about 12 kg of lithium, 30 kg of nickel, 20 kg of manganese, 15 kg of cobalt, 100 kg of copper, 200 kg of aluminum (whose production is extremely power-hungry), steel, and plastic. Inside, there are 6831 lithium-ion cells. It should be of concern that all of these components come from mining. For example, to make a car battery, you have to process 10 tons of brine to produce lithium, 15 tons of ore for cobalt, 2 tons of ore for nickel, and 12 tons of ore for copper. A total of 200 tons is dug up from the earth’s crust for a single battery. If we multiply 200 tons by the number of units needed to run the global fleet of vehicles (over 2 billion) electrically, we arrive at numbers simply far beyond the world’s extraction and production capacity (400 billion tons, or 250 billion cubic meters of soil!).

Within this context, the concept of ‘critical materials’ emerged in the last decade, ultimately a return to the discussion prevalent in the 1970s and 1980s about the limits to the extraction and exploitation of raw materials. There is still no consensus regarding a definition of a ‘critical material’; the concept is typically contextual. Material criticality can be assessed in terms of vulnerability to supply restrictions, supply risk, and environmental menaces (CSS-UMichigan, 2022) [

7].

In general, this concept applies to a set of minerals and metals that require a significant extraction effort and whose production is concentrated in a small number of countries where the quality of natural resources is decreasing, where there has been a massive increase in supply, and in which prices have shown large fluctuations that reflect imbalances between supply and demand.

Certain materials have been used in increasing quantities for decades or centuries, and their increasing supply faces no restrictions. For example, steel and concrete are not generally considered critical materials despite recent concerns about the availability of sand and gravel for concrete in some parts of the world. Aluminum is also not considered a critical material, despite the need for a massive increase in supply: its resource (bauxite) is available and widely distributed throughout the world.

A review of the literature mentioned at the beginning of this introduction suggests that there is little consensus on which materials are critical. But some materials are included in most evaluation studies, such as the following:

Not all critical materials are metals, like, for instance, graphite. Graphite is considered critical not because of its scarcity as a mineral resource but fundamentally because its exploitation is extremely aggressive to the environment and harmful to health. For some critical materials, the field of applications is limited. In other cases, their application is quite widespread. For example, the recent increased demand for lithium, cobalt, and nickel is closely related to the mass production of lithium-ion batteries. The search for neodymium and dysprosium is closely related to the production of permanent magnets in electric motors and generators. However, copper is of paramount importance in three application domains: in renewable energy production, in electrical grids, and in electrical end-use applications such as electric vehicles.

Meanwhile, there have been growing concerns regarding the reliability of the supply of some of the above-mentioned metals. One of the main factors contributing to these concerns is the fact that many of these metals are only recovered as by-products from a limited number of geopolitically concentrated ore deposits, making their supplies unable to respond to rapid changes in demand.

It is paramount to note that the primary concern regarding the future supply of the materials necessary to meet the demand for new energy sources and produce the panoply of new devices related to the new digital era concerns

mining. It is estimated that it will be necessary to multiply a thousand times the number of existing mines in order to meet the future demand for materials (World Bank, 2017) [

11].

Currently, the materials of greatest concern tend to have three basic characteristics: they are accessible mostly or entirely as by-products, they are used in very small quantities for highly specialized applications, and they have no effective substitutes. Additional reasons for concern regard a high geopolitical concentration of occurrences and exploration, as well as environmental implications.

The first case (by-products) is probably the main contributor to the currently observed concerns—a phenomenon referred to by scientists as companionality—as it regards the fact that some metals that occur in the continental crust in concentrations of less than 0.1% and seldom form viable deposits of their own (also coined as ‘minor’ metals) occur mostly interstitially in the ores of metals with similar physical and chemical properties. These ‘minor’ metals are thus recovered mostly as by-products during the processing of ‘major’ metals—their ‘hosts’ (Only 10 metals are considered as ‘major’ or primary metals, namely gold, aluminum, titanium, platinum, tin, iron, lead, nickel, copper, and zinc). The exploration of these by-product or companion metals is strongly dependent not only on the mining production of their host metals but also on whether the companion metals are interesting enough to recover rather than to be discarded without further processing.

This work aims to fulfill a two-fold objective in order to complement the existing literature on the criticality of materials needed for the energy transition: firstly, based on data on current consumption/production, to present a new quantitative method to estimate the time limit for the use of some of these critical materials when compared with estimates of their known reserves, and secondly, to reinforce the warning already made by many authors about the fact that their intensive use may not be as green as has been publicized, but rather on the contrary, that their massive exploitation has serious environmental and geopolitical implications.

It should be noted that this study does not intend to exhaust the discussion on the criticality of the range of materials chosen for the present analysis. The predictions presented are merely estimates based on the current conditions, “ceteris paribus”. It is clear that many alternatives exist in terms of the availability of these materials, such as recycling, the use of alternative materials, the exploration of new mineral reserves, etc., but these do not yet offer a clear answer to the problem of environmental damage or the energy resources required for intensive mining exploitation. Such in-depth analysis is beyond the scope of this study.

3. Prospective and Quantitative Analysis of the Main Critical Materials

As stated in the Introduction, the focus of this study is a prospective analysis of a given set of materials that are considered in most reports as the more critical, namely copper, cobalt, nickel, lithium, and rare earth metals.

3.1. Copper

The soft, malleable, and very ductile metal copper has been explored by humans since the remote Antiquity. By 4000 BC, it was the first metal to be cast into a shape in a mold, and by about 3500 BC, it was the first metal to be alloyed with another metal, tin, to create bronze, inauguring at that moment an important period of human civilization, the so-called Bronze Age. Its most important physical property, responsible for its widest range of applications, is its high thermal and electrical conductivity, the second highest (second to silver) among pure metals at room temperature.

As pointed out previously, copper is a primary metal and can be found in nature as a pure metal (native copper), but the vast majority of mineral ores currently in operation are copper sulfides, along with a few copper carbonates and oxides. Extraction from copper sulfides from open pit mines in porphyry deposits offers the largest copper content (about 0.4 to 1.0%) when compared with other non-sulfide ores. There are copper mining operations in several countries, but Chile is currently the top producer (a quarter of global production), soon followed by Peru and the Democratic Republic of Congo (DRC). (Production spread throughout the so-called ‘Copperbelt’, where ores with the highest copper content were found). The numbers for 2023 (USGS, 2024) [

16] indicate a worldwide production of about 22,000 thousand tons, with Chile producing ca. 5000 thousand tons, Peru 2600, DRC 2500, China 1700, USA 1100, and Russia 900. Kazakhstan is also an important producer, with about 600 thousand tons last year. Regarding consumption, China is currently the largest copper consumer, with a share of about 50%, corresponding to over 10 thousand tons, followed by the European Union distantly in second place.

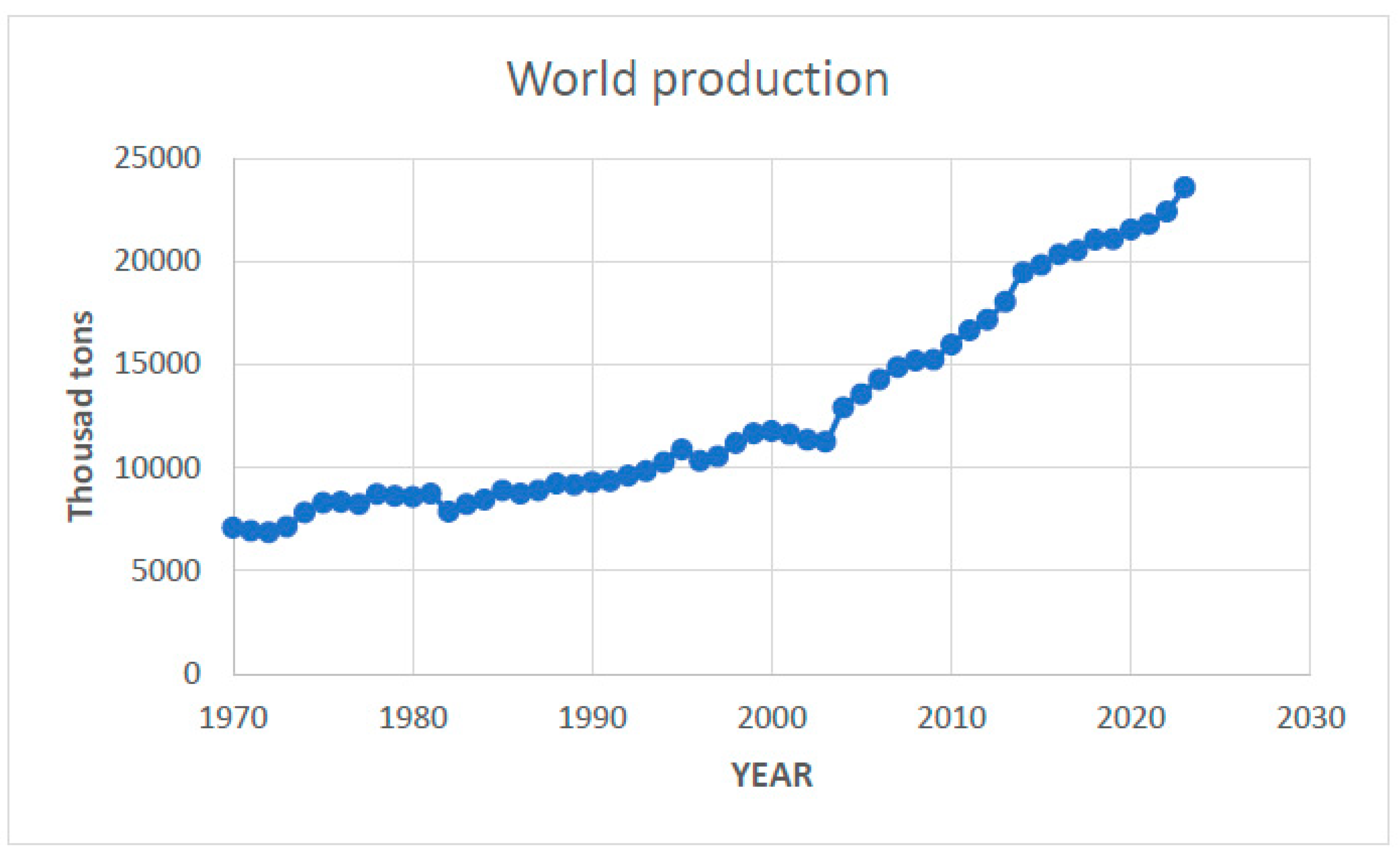

Figure 3 presents the unfolding of worldwide production since 1970. As can be observed, there are two growth phases: the first one is from 1970 until 2003, and then there is a steeper upward trend after 2004 that seems to further increase in 2022–2023.

Presently, most copper is used in electric equipment (ca. 44%, wiring, transformers, power transmission, and generation), industrial machinery (10%, heat exchangers), construction (20%, roofing and plumbing), appliances and electronics (14%), and some others, but its most intensive use has been in the construction of the immense distribution networks necessary to support the large number of wind and solar farms around the world, as well as in the sub-grids necessary for the domestic distribution of solar panels. Considering the recent demand necessary for the planned energy transition, some growth in production and consumption is to be expected in the coming years (Diaz et al, 2021) [

17].

Figure 3.

Worldwide copper production from 1970 to 2023 (data from Statista, 2023 [

18], and USGS, 2024 [

16]).

Figure 3.

Worldwide copper production from 1970 to 2023 (data from Statista, 2023 [

18], and USGS, 2024 [

16]).

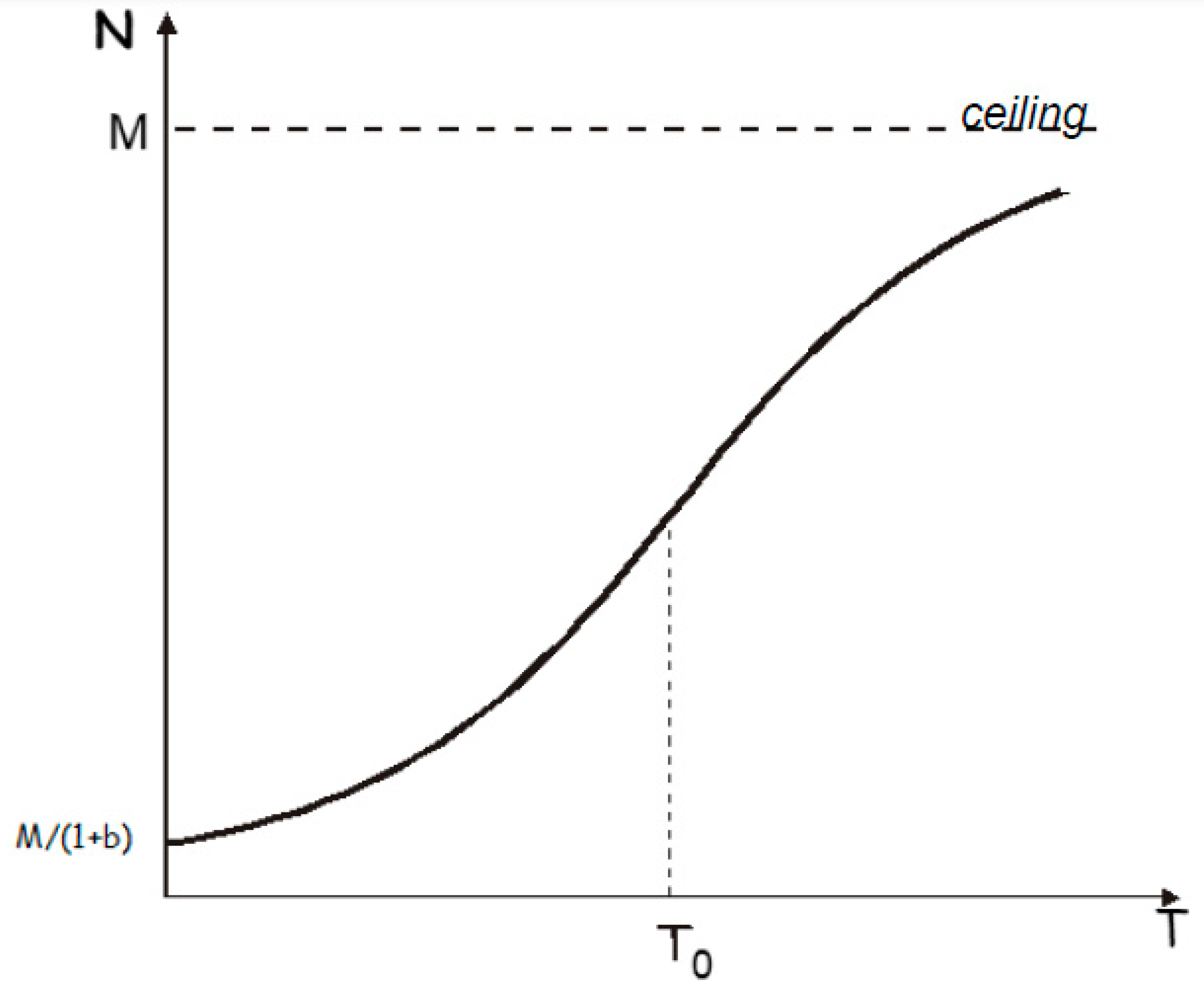

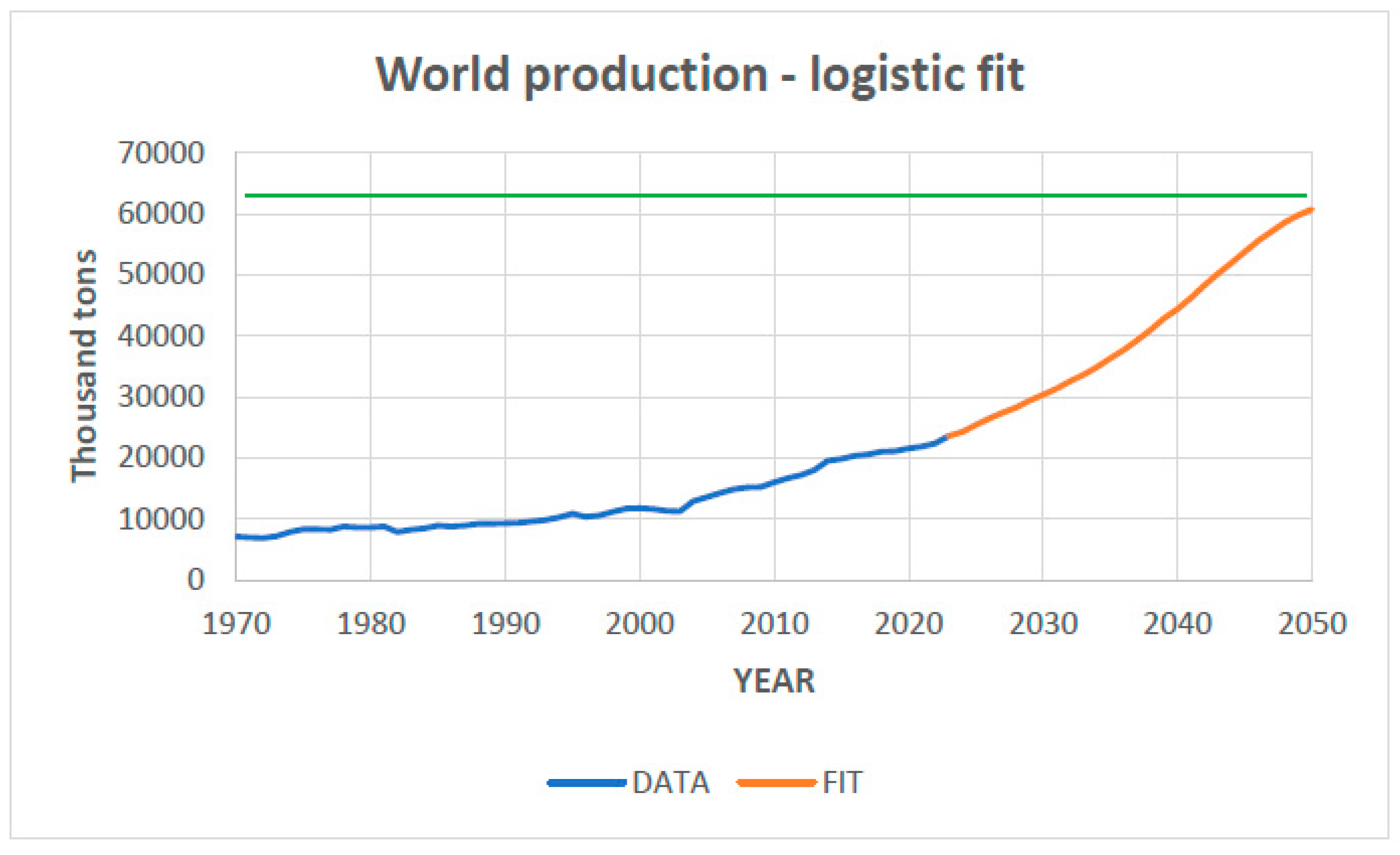

The logistic fit of the data from

Figure 3 is presented in

Figure 4, which indicates a ceiling value (

M) of about 63,000 thousand tons in 2060. This finding is supported by some authors, like for instance Venditti (2021) [

19], who states that copper is currently an “

Essential Metal for the Energy Transition”. This author points out that planetary demand for copper, both in the energy and transport sectors, is expected to double in the coming decades. New energy technologies require even more copper than conventional energy sources. Solar photovoltaic systems contain approximately 5 tons (t) per megawatt (MW) of copper, while grid energy storage facilities rely on 2.7 to 3.6 t per MW. This author estimates a significant jump in global demand for copper for alternative energy sources as a consequence of its widespread usage in electrical grids, batteries for EVs, wind turbines, solar panels, and EV charging infrastructures. He also points out that a gasoline car uses around 20 kg of copper, mainly as wiring, while a fully electric car has around 80 kg of copper, and notes that the demand for copper for charging electric vehicles is expected to increase by more than 1000% by 2030 compared to 2020.

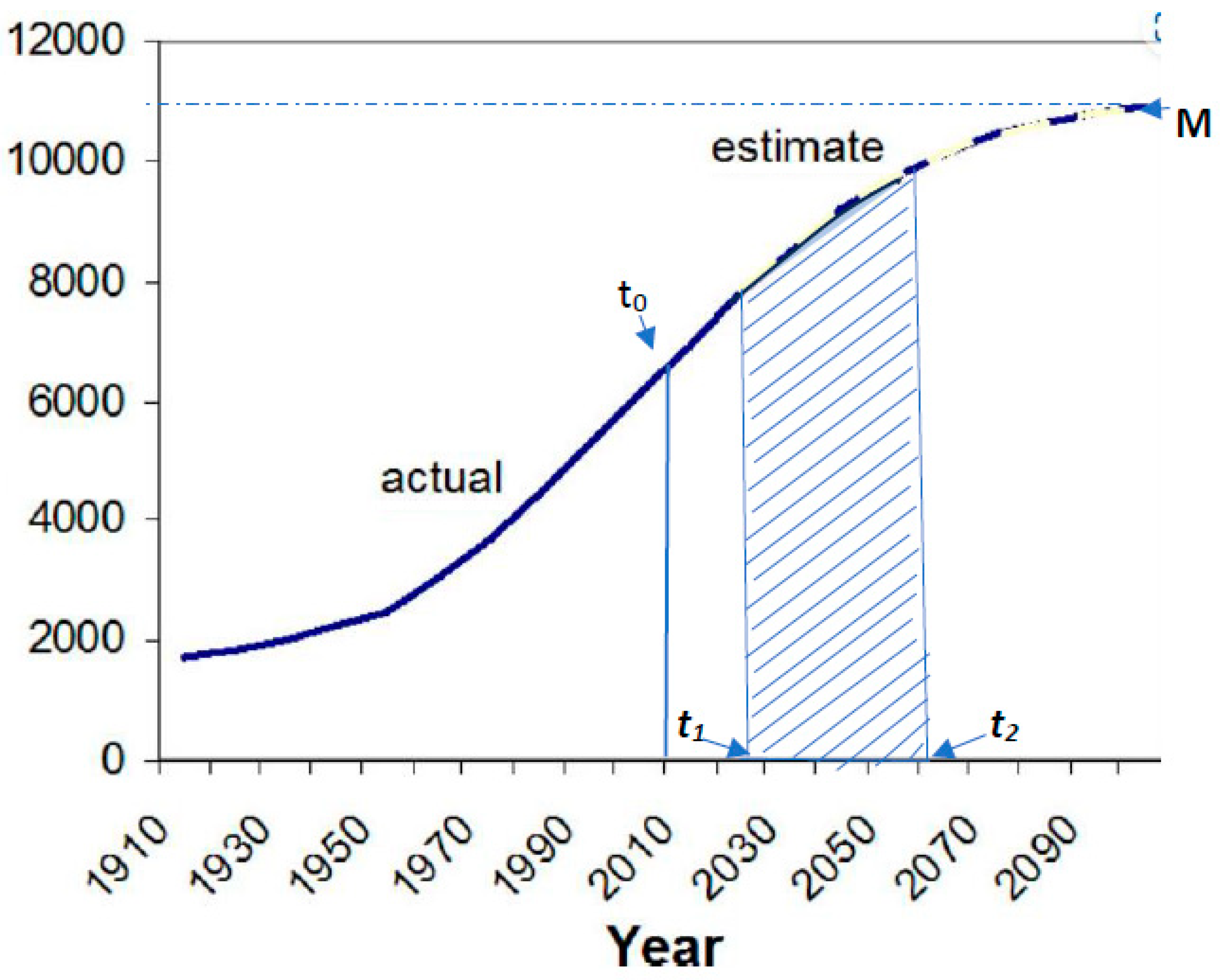

Figure 5 exhibits the cumulative production curve obtained from the results presented in

Figure 4 using the method described in the previous section (Equation (5) and

Figure 2).

The current existing copper reserves are estimated at around 890,000 thousand tons (Statista, 2023) [

18], which, considering the forecast shown in

Figure 5, would be enough for just 25 years from now, or perhaps a little longer, if we consider its ease of recycling (currently around 8700 thousand tons, i.e., around 1/3 of global production). Considering, then, the hypothesis of recycling at the level currently observed, the reserves could surpass the level of about 1 billion tons and postpone the depletion of the reserves for five more years, around 2050.

Therefore, copper is indeed a critical material, not for geopolitical reasons, but mainly due to the limited availability of easily accessible reserves. For this reason, the exploration of polymetallic marine nodules has been seriously considered. These nodules, located in the depths of the Pacific Ocean (at about 3000 to 6500 m below sea level), also contain other valuable metals such as cobalt and nickel. Adding to this, the continued melting of the sea ice in the Artic zone of the Earth has been speculated as an important source for the exploration of mineral deposits, including copper, rare earth, niobium, and other critical metals (Krivovichev, 2019) [

20], which can be seen as a possible way to overcome the bottleneck in the supply of strategic mineral deposits.

3.2. Cobalt

Figure 6 shows the world production of cobalt from 1995 to 2023, according to data from USGS (2022) [

21] and Statista (2023) [

18]. As can be seen, the growth in global production after 2007 is notable, as are the fluctuations between 2010 and 2021, followed in 2022–2023 by a renewed growth trend as in the case of copper.

The search for this material is not new, however. Cobalt played an important role all throughout the 20th century, mainly due to its use in alloying metals, particularly in the production of high-strength steel, as well as in various production branches like the ceramic industry, catalysts, magnets, etc. However, over the last fifteen years, battery production has been the main driving force of the demand for cobalt, being currently responsible for 55% of its production, where the other 45% is distributed to other areas, 19% of which is still dominated by the production of superalloys.

Currently, 130,000 metric tons of cobalt come from the Democratic Republic of Congo (DRC—65%), and only 10,000 from Indonesia (5%), 9000 (4.5%) from Russia, and 6000 (3%) from Australia, which gives us a clear idea about the geopolitical criticality of the metal.

Nevertheless, when the discourse focuses on the criticality of this metal, it is due to its mineral origin. Cobalt is a typical by-product metal—presently, 75% of its extraction comes from copper mining, while the other 25% comes from nickel mining. Additionally, its criticality is strongly related to two very important issues—geopolitical and environmental concerns. The vast majority of the known reserves are located in the Copperbelt, a mining area that includes part of Kantanga province in the Democratic Republic of Congo (DRC) that constitutes the mining of ore of a higher grade (3% cobalt) when compared to the global average of about 0.6% to 0.8%. But the mining activity in the DRC is largely controlled by two big Chinese companies, as well as other minor companies from Russia and the United Kingdom.

Supply risk exists in the extraction and refining phases of cobalt, mainly due to its by-product nature and the political instability of the supplying country. The main challenge arising from cobalt’s status as a by-product material lies in its dependence on the extraction of other metals, in particular copper and nickel, as already mentioned. This interdependence creates inherent vulnerabilities in the cobalt supply chain. Fluctuations in the demand for primary metals can have a direct impact on cobalt production, leading to supply shortages or surpluses, as is evident in the fluctuations of production appearing in

Figure 6.

Regarding environmental problems in cobalt exploration, it is necessary to consider the miserable and extreme poverty conditions in which mines are exploited in the DRC. Around 20% of the cobalt mined in the Copperbelt comes from artisanal or small-scale mines (ASM) (Ritchie, 2023) [

22], in which mining represents a very hazardous activity that can harm the eyes, skin, heart, and lungs. Particles emitted during cobalt mining have radioactivity due to the presence of uranium in copper ores. There are records of an alarming presence of radioactivity in the hazy air surrounding these mines, which also causes vision problems, vomiting, nausea, heart problems, and thyroid damage. Moreover, it is worth noting that non-artisanal mining activities, not only in the DRC but all over the world, are anything but environmentally friendly, as giant diesel-powered machines and trucks are used, and the question can be asked where the contribution to the decarbonization of the environment is that is expected to be achieved with the mass production of batteries.

Following the same procedure as described in the previous section for copper, we can estimate the ceiling value M for global production, as well as the accumulated production to be observed until 2050. These results are presented in

Figure 7 and

Figure 8.

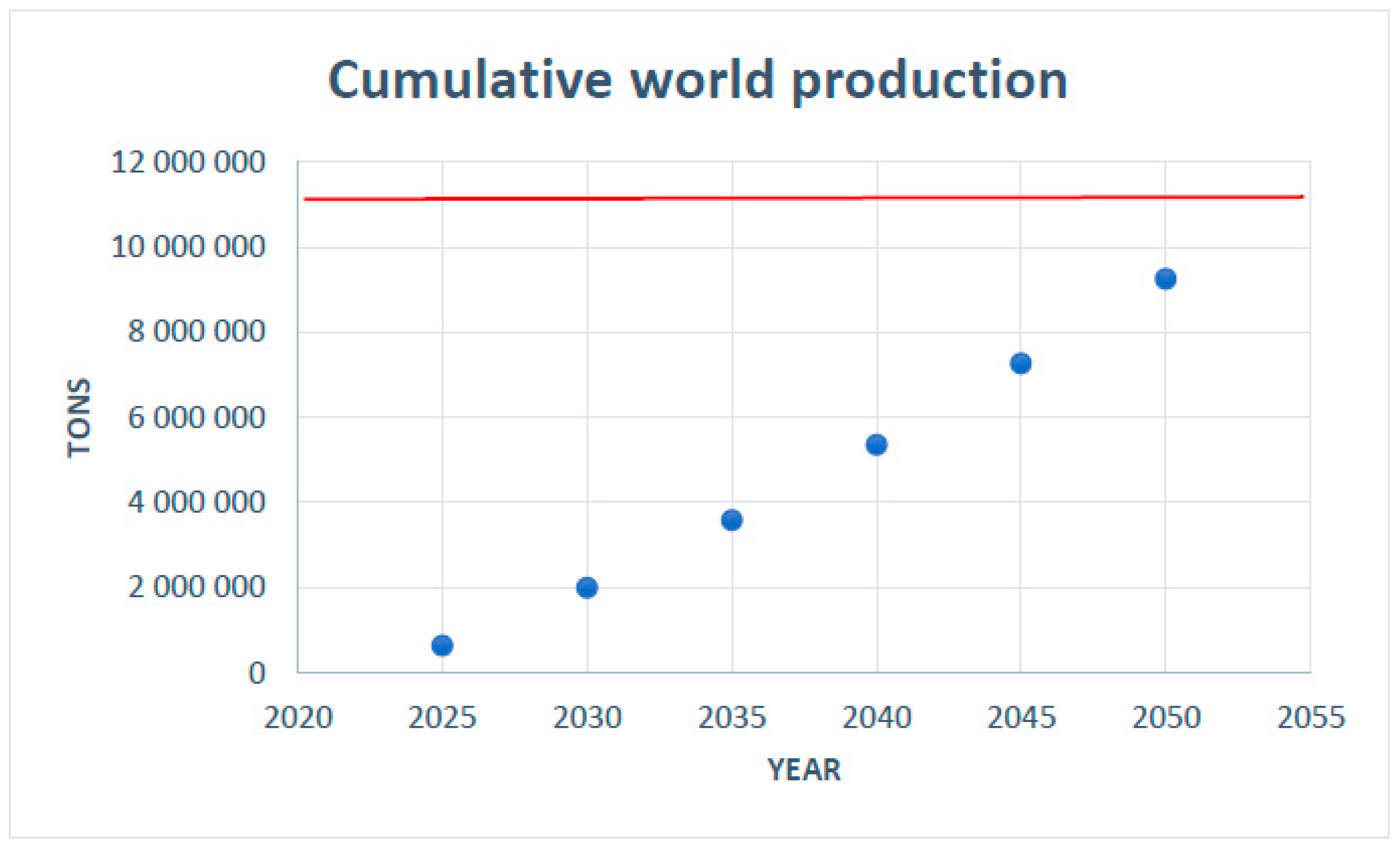

According to USGS (2022) [

21], the identified global reserves of terrestrial cobalt are about 11 million tons. Considering the forecast presented in

Figure 8, these reserves would be sufficient for more than 40 years. But considering the estimated global resources of about 25 million tons (USGS, 2022) [

21], we can state that depletion of cobalt is not a major issue in the near-future, even considering its growing intensive usage in the production of EV batteries.

To summarize, cobalt is a critical material, not as a consequence of an approaching depletion of resources, but mainly as a sequel to its by-product nature, for geopolitical reasons, and due to its currently observed very hazardous mining activity.

3.3. Nickel

In addition to copper, nickel is also a primary metal that can be found in nature as a native metal, and its ores have been mistaken for copper ores since the Antiquity. Some primeval bronzes cast in the Fertile Crescent around 3500 BC contain about 2% nickel, and cupro-nickel coins were used in China around 1400 BC. As mentioned previously, nickel ores are also explored to extract cobalt (ca. 25% of global cobalt production).

Since the beginning of the 20th century, nickel has been used to produce stainless steel, which now represents about 60% of world production. Other common uses include nickel-based and copper-based alloys (10%), plating (9%), other alloy steels (7%), foundries (3%, coins for instance), and more recently, rechargeable batteries (4%, but with projections of significant growth).

Figure 9 presents the unfolding of the global production of nickel since 1985.

It is evident that there was a jump in production after 2010 due to the widespread adoption of EVs with Ni-based Li-ion batteries. Between 2013 and 2016, a brief production decline was observed due to the production surplus observed, mainly due to the abandonment of Ni-Cd batteries all over the world during the previous years. After 2017, however, the rate of growth soared again.

Most mined nickel comes from two types of ores: laterite (a complex mixture of (Fe, Ni) hydroxides and silicates) and magmatic (Fe, Ni) sulfide deposits. Indonesia is the world leader, with 1600 thousand tons (45%), followed at a distance by the Philippines (330 thousand tons, 9%), Russia (220 thousand tons, 6%), New Caledonia (France) (190 thousand tons, 5%), Australia (160 thousand tons, 4.4%), and Canada (130 thousand tons, 3.6%). The two largest nickel mines are situated in Russia—the Kola MMC Mine (Murmansk) and the Sarawak Mine (south Sulawesi) (World Bank, 2017) [

11].

Nickel has been extensively used in batteries, firstly in nickel–cadmium batteries, whose adoption was abandoned in many countries after 2006, mainly in Europe, and largely substituted for longer-lasting nickel–metal hydride (NiMH) rechargeable batteries, which were introduced on the market in the 1980s, widely adopted in power tools and early digital cameras. Quickly, such adoption evidenced their potential for all types of portable devices, which are now part of our daily lives. Starting in the mid-1990s, the use of Li-ion batteries with nickel hydroxide cathodes emerged on the electric automobile market.

The major advantage of using nickel in batteries is that it helps deliver a higher energy density and greater storage capacity at a lower cost. Further advances in nickel-containing battery technology contributed to an increasing role in energy storage systems, helping make the cost of each kWh of battery storage more competitive. In tandem with this increasing market share, battery technology is also advancing, another reason why the proportion of nickel-containing Li-ion batteries in use is set to grow. Two of the most commonly used types of batteries, Nickel Cobalt Aluminum (NCA, the most used by Tesla) and Nickel Manganese Cobalt (NMC), use 56% and 33% nickel, respectively, but newer developments of NMC batteries are also approaching 80% nickel (Home, 2023) [

24].

As in the cases of copper and cobalt, applying logistic tool modeling, we can forecast the future demand of nickel, as well as the cumulative production expected until 2050. These results are presented in

Figure 10 and

Figure 11.

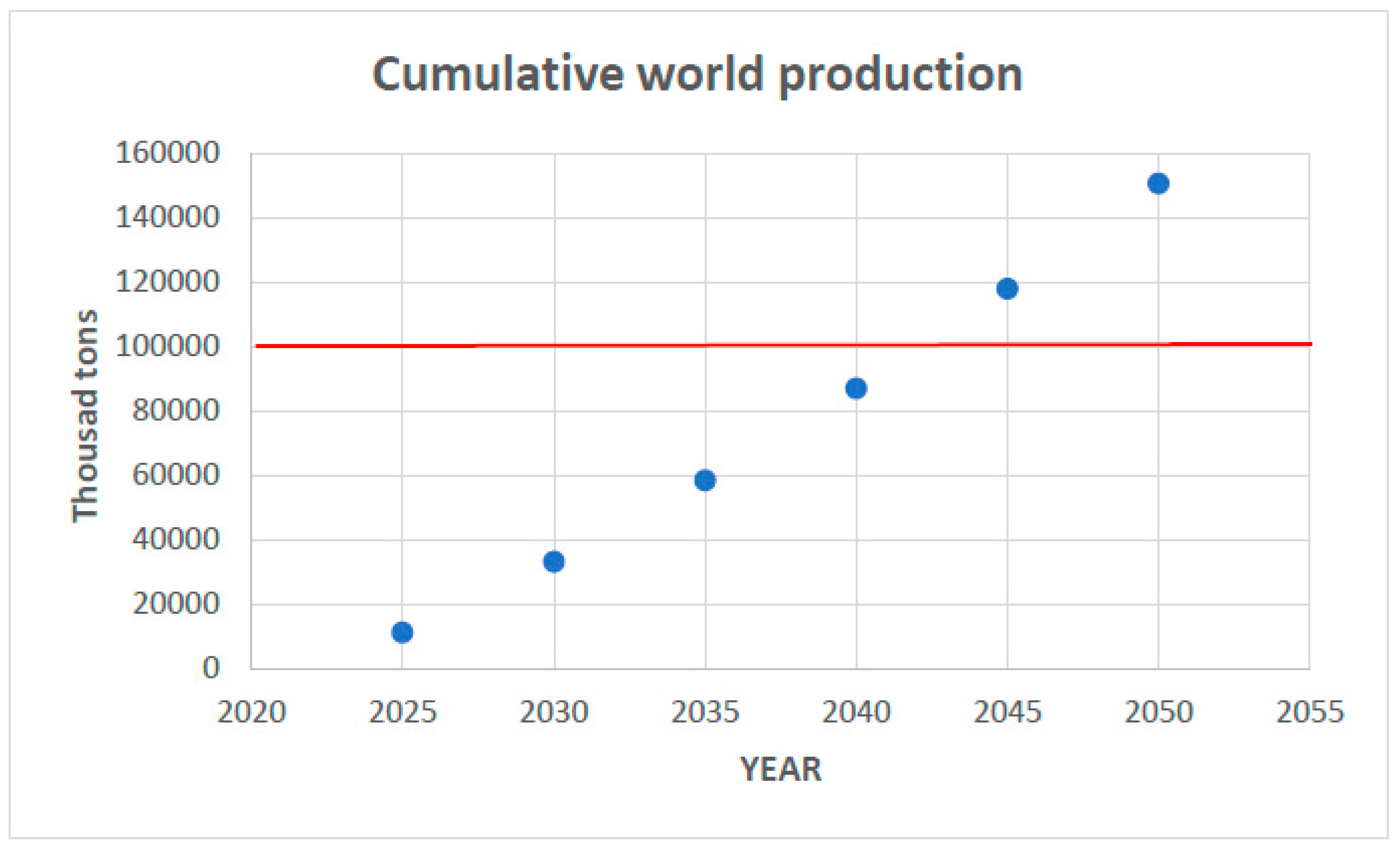

Estimates of global reserves of nickel, 60% laterites and 40% sulfide deposits, amount to 100 million metric tons (USGS, 2022) [

21], which, considering the forecasted results, would barely last for the next twenty years. If we consider the growing demand currently observed, the future supply situation is at serious risk, despite nickel, like copper, being an easily recyclable metal (currently ca. 350,000 tons of nickel is recovered from scrap, mainly used by the stainless steel industry).

As in the case of copper, the criticality of nickel is not of a geostrategic nature but is essentially due to the scarcity of mineral reserves with a good content (at least 1%) of the metal. This shortage is a serious threat to the future of electric cars, which recently led Elon Musk, CEO of Tesla, to state that “

the shortage of nickel supply will be the most worrying problem of future production expansion” (Junzhi, 2021) [

25]. For this reason, Tesla is planning in the near-future to put into use the new lithium-iron phosphate batteries.

3.4. Lithium

The case of lithium as a critical material is quite different from the other metals analyzed previously in this work, and experts’ opinions are quite divergent (Gielen, Papa, 2021) [

6], (CSS, U Michigan, 2022) [

7], (Graedel et al., 2015) [

1].

Lithium, the lightest metal in the universe, with a density of 0.53 g/cm3, as light as pine wood, does not occur freely in nature due to its very high reactivity and solubility and is widely distributed on Earth, being found in pegmatite minerals as well as in brines. At 20 mg lithium per kg on the Earth’s crust, lithium is the 25th most abundant element. But, although the number of known lithium-containing deposits and brines is large, most of them have too low metal concentrations, which mostly implies a very low commercial value.

What makes the case of lithium different from other ‘critical materials’ regards troubles related to handling and environmental issues, and consequently the rentability of its processing (Benchmark, 2023) [

26]. Moreover, like all alkali metals, lithium is highly reactive and flammable, and must be stored in a vacuum, inert atmosphere, or inert liquid (kerosene or mineral oil).

Until very recently, lithium and its compounds have had limited industrial applications, mainly as an oxide component in heat-resistant glass and ceramics, lithium grease lubricants, flux additives for iron and steel production, and more recently, in the development of advanced Al-Li alloys for the aeronautical industry. But the situation changed radically with the introduction in the market of Li-ion batteries for laptops, cell phones, and electric vehicles. Currently, 65% of global production is directed to the battery sector, 18% to ceramics and glasses, 5% lubricants and greases, 3% continuous casting processes, and 3% polymer additives, and the remaining 7% goes to the aerospace industry (GlobalData, 2023) [

27].

Figure 12 presents the global production of lithium in the time span of 1985–2023.

As we can see, global lithium production experienced a spectacular boost after 2015, mainly due to the push from the electric vehicle market. The drop in 2020 was a consequence of the COVID pandemic, and production quickly recovered in 2021. Production in 2023 (198,000 metric tons) presented an increase of 32% over 2022, with Australia presenting itself as the largest producer in the world (46.7%), followed by Chile (23.8%), China (18%), Argentina (5%), Brazil (2.6%), and Canada and Zimbabwe (1.8% each). Australia’s production comes primarily from hard rock mines (Greenbushe’s pegmatite), while the other producers rely mostly on extracting lithium from brines. According to GlobalData, lithium production is expected to increase at a CAGR (Compound Annual Growth Rate) of about 13% by 2030 (GlobalData, 2023) [

27].

The results of the application of logistic tool modeling to forecast the future demand of lithium, as well as the cumulative production expected until 2050, are presented in

Figure 13 and

Figure 14.

The US Geological Survey (USGS, 2022) [

21] estimated worldwide lithium reserves to be of the order of 20 million tons, but points out that such estimates are very difficult to calculate, mainly due to the fact that most lithium classification schemes were developed for mineral ore deposits, whereas brine is a fluid that cannot be treated with the same classification scheme due to large varying concentrations. Pegmatite ores are far richer (ca. 2.4% Li) than brines, which present very low concentrations (usually lower than 1%). According to this conservative estimate, there are reserves for at least another 50 years.

It is also important to note that there are many other very optimistic estimates about the immense potential reserves of hard rock ores in the DRC, Zimbabwe, and Afghanistan, and as brines in the so-called “Lithium Triangle”, involving three countries—Chile, Bolivia, and Argentina—with high-quality salt flats. Brine resources are more abundant than hard rock ores, but the technology currently in use to extract lithium from continental brine relies on open-air evaporation to concentrate salt, and in this way, large volumes of water containing lithium carbonate are lost, raising concerns about the overall sustainability of the process. Furthermore, the process is very slow (10 to 24 months), which means that brine exploration is not suitably responsive to short-terms change in demand, which can explain the sudden fall in production around 2020.

In Russia, there exists a large deposit in Kolmozerskoye (Murmansk region). In 2023, a joint venture was formed called Polar Lithium between Nornickel and Rosatom to develop this deposit, aiming to produce 45,000 tons of lithium per year by 2030 (Rosatom, 2023) [

29].

All in all, the lithium reserves are in fact gigantic, and one cannot speak about criticality involving shortage of the material. The trouble with lithium exploration regards a series of environmental and health-related issues. Environmental concerns include wildlife habitat degradation, potable water pollution (arsenic and antimony contamination), immense water consumption, and massive mining waste, including radioactive uranium and acid sulfuric discharge. Health concerns are a consequence of the fact that lithium metal is highly corrosive and requires special handling and transportation to avoid skin contact. Breathing lithium dust irritates the nose and throat and may cause pulmonary edemas. Add to that the fact that to keep up with the current expansion of demand, it will be necessary to increase by about six times ore and/or brine exploration by 2030.

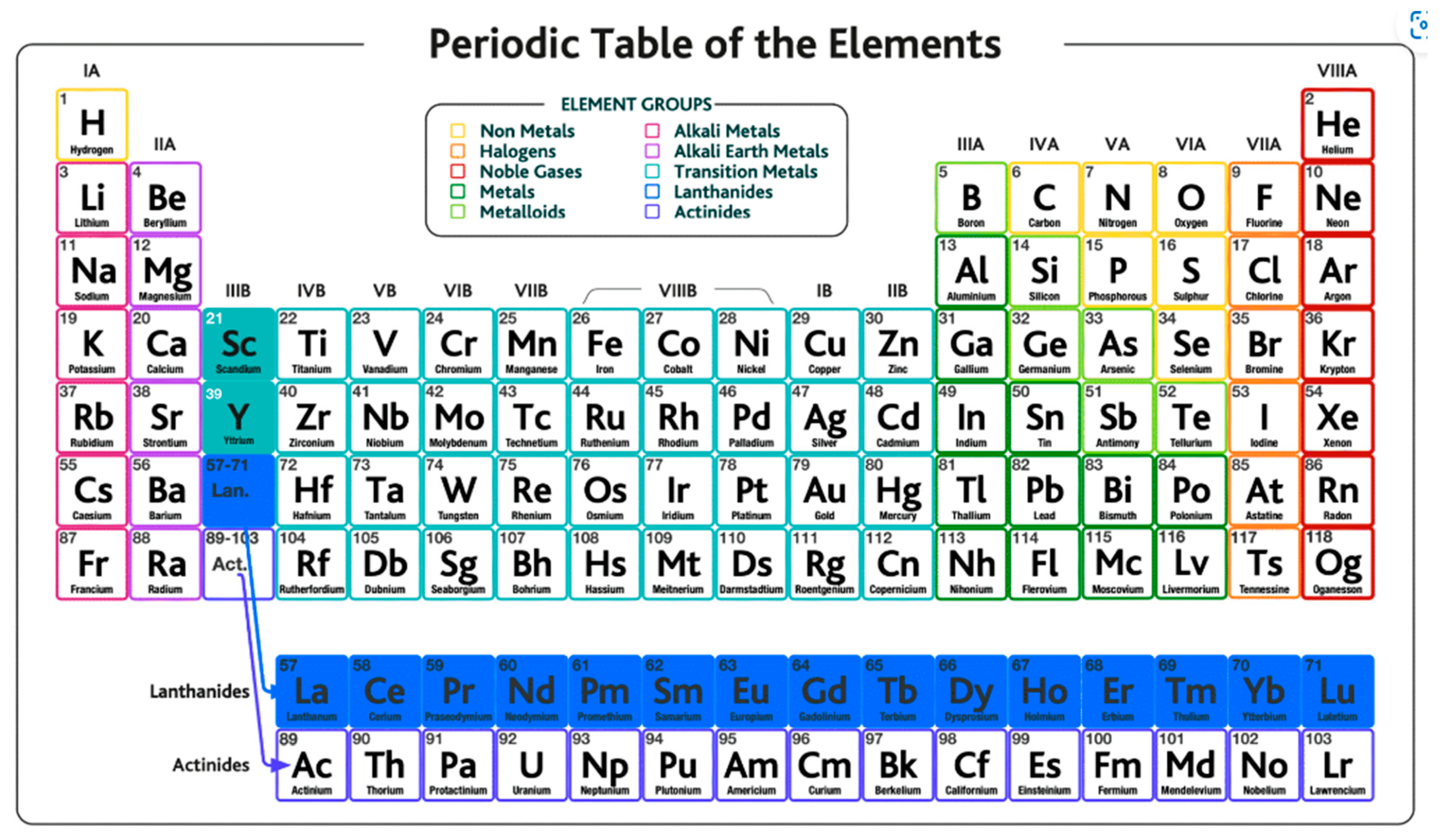

3.5. Rare Earth Metals

A large majority of new materials that are widely used in new digital technologies and in new devices necessary for the energy transition belong to the family of so-called rare earths, or more correctly, to the lanthanide family, the set of 15 elements shown highlighted blue in the periodic table presented in

Figure 15.

Scandium and yttrium (highlighted green in the picture) do not belong to the lanthanide family but are considered rare earths because they tend to occur in the same ore deposits as the lanthanides and exhibit very similar chemical properties. The term rare earth is in fact a misnomer because they are not rare or scarce materials. Instead, they are relatively abundant in the Earth’s crust—for instance, cerium is the 25th most abundant element, more than copper—and thulium and lutetium, the two least abundant rare earth elements, each have a crustal abundance nearly 200 times greater than gold and platinum. The designation as rare earth derives from the fact that these materials in practice are found spread thin across trace impurities, so obtaining these metals at a usable purity grade requires processing large amounts of ore at a great expense and effort. What is rare is to find them in concentrations high enough for economic extraction.

The rare earth metals are often found together. World resources are contained primarily in bastnasite (carbonate–fluoride minerals) and monazite sands (phosphate mineral). The former, with its main deposits in China and the United States, constitute the largest percentage of the Earth’s rare earth economic resources, while monazite deposits in Australia, Brazil, China, India, Malaysia, South Africa, Myanmar, Thailand, and the United States constitute the second largest segment. Also, loparite (a perovskite mineral) has been explored in Russia (Kola peninsula) as an important source of cerium and some lanthanides. There are currently 178 deposits widely distributed over the Earth (Zhou et al., 2017) [

31].

The most abundant rare earth metals are cerium, yttrium, lanthanum, and neodymium, with average abundances that are very similar to other commonly explored industrial metals like nickel, chromium, and zinc. But, as stated above, they are rarely found in economically extractable concentrations. Moreover, monazite sands are radioactive due to the presence of thorium and, in some deposits, uranium as well.

The rare earth metals are often found together, and for this reason, there is no single rare earth metal market; most statistics about their production consider all of them together, making it very difficult to find reliable data for the individual metals.

Figure 16 presents a recent statistic of global rare earth production.

As can be observed, we are now witnessing a significant increase in rare earth production, about 160% in the last six years. To understand the behavior of this curve, it is paramount to consider some details about the historical unfolding of rare earth metal consumption/production.

The demand for these materials started to grow significantly in the mid-1960s, when the first color TV sets entered the market. Europium was the essential material for producing color images. At this time, the Mountain Pass Mine (California, USA) began producing europium from bastnasite, containing ca. 0.1% of the metal, which made this mine the largest rare earth producer in the world and placed the United States as the leading producer. China began producing rare earth metals in the 1980s, and in the early 1990s, it became the world’s leading producer.

All throughout the 1990s and early 2000s, China regularly strengthened its grip on the world’s rare earth metal and oxide market and started selling rare earth at such low prices that in 2002, the Mountain Pass Mine, unable to compete, stopped operation, soon followed by many others throughout the world. Chinese domination reached a peak in 2010, when they controlled ca. 95% of the world’s production, and prices jumped over 500% in just a few years. The consequence was an awakening for rare earth consumption, which on the other hand allowed mining companies throughout the world to re-evaluate their prospects and explore new ones. This context explains the drop in production observed in the graph in

Figure 16 after 2010. Mountain Pass Mine restarted operation in 2012, as well as mines in Australia. However, production soared after 2017 following the increasing demand for some of the rare earth metals in the most diverse branches of advanced technologies.

Currently, the global production of about 350 thousand tons is dominated by China, with a share of 70%, followed by the USA (14%) and Australia (4%). Other important producers are Myanmar, Thailand, Vietnam, India, and Russia (NMR, 2024) [

32]. It is important to note that China currently completely dominates the market of rare earth metals, not only regarding mining and extraction but also in processing, being responsible for 85% of the world’s capacity for processing these materials.

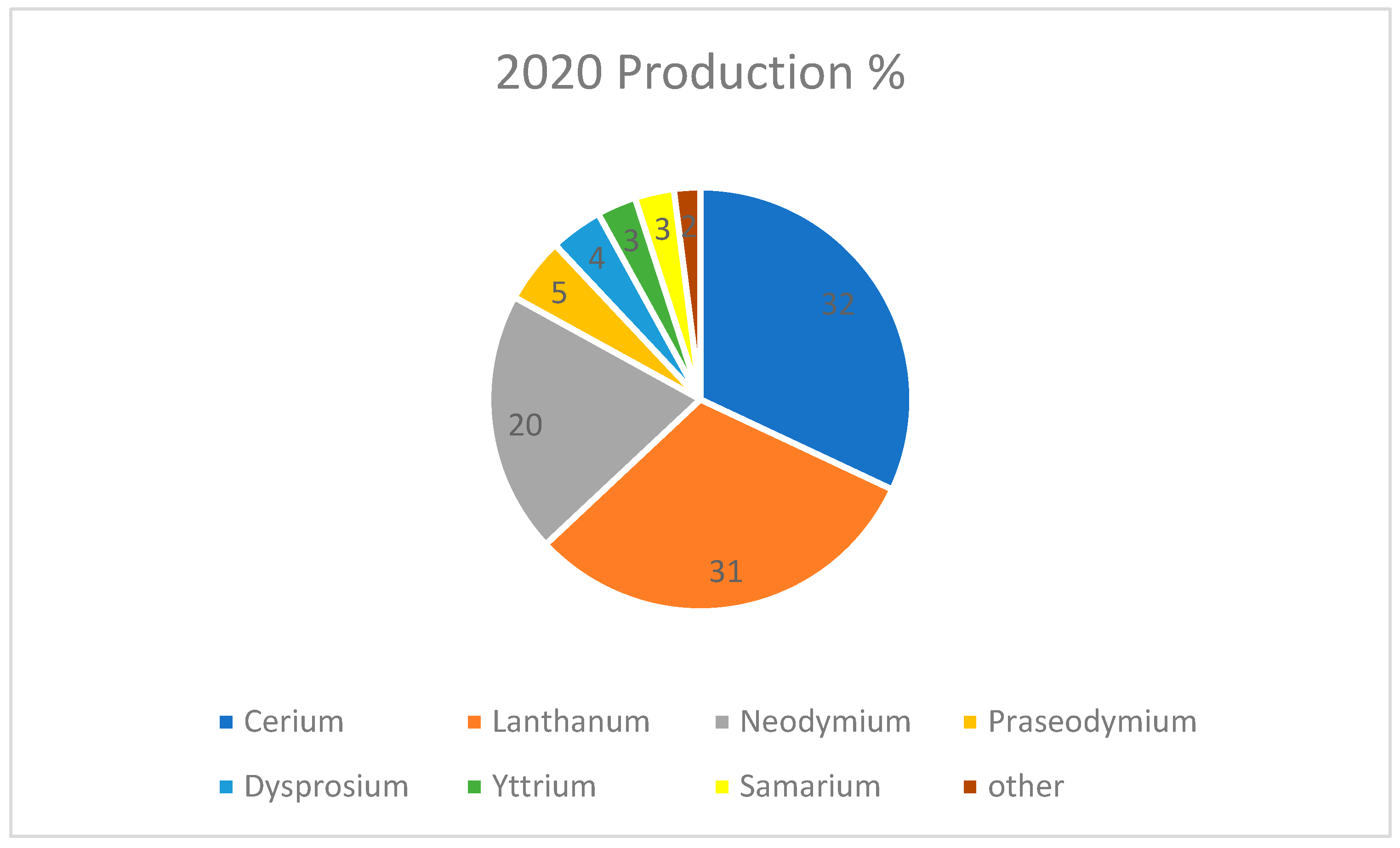

In 2020, cerium was the most produced rare earth metal, followed closely by lanthanum and neodymium [

34].

Figure 17 exhibits the breakdown of the most produced rare earths according to Techcet (2020) [

33]. But neodymium is the rare earth metal with the highest number of uses today, mainly in the field of strong and permanent magnets, used extensively in eco-energy applications like electric cars and wind turbines, as well as in all kinds of speakers we find in cell phones and laptops. Neodymium is foreseen to lead the global market in 2026.

Rare earth metals currently have a wide panoply of industrial applications, not only in traditional industrial branches but also with several new advanced digital and alternative energy generation capabilities.

Figure 18 presents a breakdown of their main applications in 2022.

Applying the logistic approach methodology as already performed in the previous sections, we can determine the production ceiling for the set of rare earth metals from the data presented in

Figure 16. The result is shown in

Figure 19.

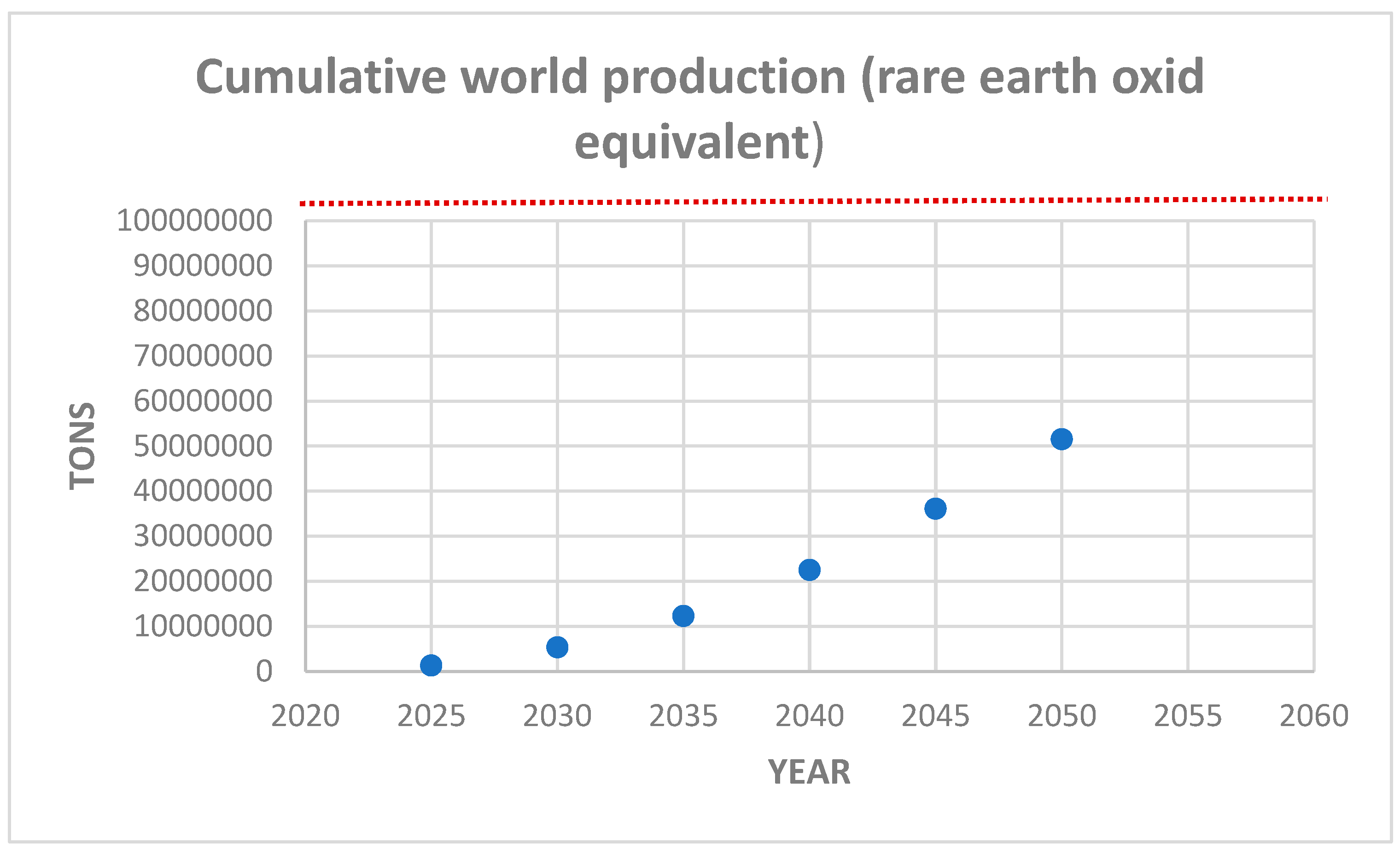

Based on this result, we can estimate the future cumulative demand, exhibited in

Figure 20.

The estimated global reserves, based on the current known mine exploration, amounts to about 100 million metric tons (USGS, 2022) [

21], which means that if demand continue to grow at this rate, and even if no efficient recycling method for the production of rare earth metals were developed, the known world reserves will be sufficient for the next 50 years. This estimation does not pose any concern about future production capacity. Moreover, other authors have presented more optimistic prognostics based on a larger estimation of global reserves (taking into account some not-yet-explored existing ores) of about 478 million tons and state that these resources are sufficient to meet the global demand for the next hundred years (Zhou et al., 2017) [

31].

Certainly, the rare earth market for applications in wind power, electric vehicles, and catalytic converters will face continuous growth to different degrees in the next years, with a significant demand for neodymium and dysprosium to be expected that will very probably not be satisfied by the current rate of production. This scenario allows us to state that neodymium and dysprosium may become critical materials to meet their growing demand for clean technologies during the next decades. On the other hand, with the growing market for LEDs (Light-Emitting Diodes), other forms of lighting sources like CFLs (Compact Fluorescent Lamps) and LFLs (Linear Fluorescent Lamps) will lose their markets over the next decade, and in this way, the demand for europium, terbium, and yttrium oxides will decrease in the lighting market.

To conclude, the criticality of rare earth metals is not related to the depletion of reserves or resources, but rather is fundamentally related to China’s large-scale dominance over the means of production and processing of these materials. Considering Russia’s immense Siberian reserves, this country will probably emerge as a significant rare earth producer in the coming years. Moreover, the competition with China has increased significantly, resulting in the USA and Japan also becoming core participants in the competition network (Xu et al., 2024) [

35]. Also worth mentioning is that the recently signed agreement for rare earth exploration in Ukrainian soil between Ukraine and the USA will bring new perspectives in the race for this class of materials.

4. Conclusions

The future availability of some key materials for the much-talked-about energy transition has led to heated discussions about their criticality. Among the materials considered most critical are copper, cobalt, nickel, lithium, and the collection of materials known as rare earths. The application of a forecasting method based on logistic equations allows a comparative forecast between available reserves or resources and future consumption of these materials in the coming decades. Combining this quantitative analysis with some considerations on the geopolitical and environmental aspects of their production leads us to the following considerations:

Copper: Considering the currently known reserves of this strategic material and its forecasted production/consumption in the next few decades, it is estimated that its depletion may occur within the next 25 to 30 years, even considering the level of recycling observed in recent years. Therefore, copper is indeed a critical material, not for geopolitical reasons, but mainly due to the limited availability of easily accessible reserves. For this reason, the exploration of polymetallic marine nodules has been seriously considered.

Cobalt: Comparing its forecasted production in the next few decades with the identified global reserves, it can be estimated that these will be sufficient for the next 40 years. Moreover, considering optimistic estimates about available resources, this time span may be even longer, leading to the conclusion that depletion is not a major issue in the near-future. On the other hand, cobalt is considered a critical material, not as a consequence of an approaching depletion of resources, but mainly as a sequel to its by-product nature, geopolitical reasons, and its currently observed very hazardous mining activity.

Nickel: The forecasted production consumption of nickel for the next decade indicates that the known reserves will probably be depleted within 20 years. Considering the rocketing demand for this material in the battery market, we can state that its future supply situation is at serious risk, despite nickel, like copper, being an easily recyclable metal. As in the case of copper, the criticality of nickel is not of a geostrategic nature but is essentially due to the scarcity of mineral reserves with a good content (at least 1%) of the metal. This shortage is a serious threat to the future of electric cars.

Lithium: This light metal is currently the basic material for the expanding market of electric cars. In spite of ever-growing demand, we have the fact that lithium reserves are in fact gigantic, and one cannot speak about criticality involving a shortage of the material. The trouble with lithium exploration regards a series of environmental and health-related issues. Environmental concerns include wildlife habitat degradation; potable water pollution (arsenic and antimony contamination); immense water consumption; massive amounts of mining waste, including radioactive uranium and acid sulfuric discharge; and a long list of serious health concerns. There has been some discussion about the need to expand lithium ore and/or brine exploration about six times over in order to satisfy the forecasted demand, but this whole discussion could fade away in the coming years as a result of the intense search for alternative materials, with the possibility of developing Na-ion batteries being worth a mention as they are much more efficient and pose a lower environmental risk.

Rare Earth metals: The forecasted production/consumption of this special set of materials when compared with the estimated global reserves points to the fact that there are no reasons for concern about a possible depletion, even if no efficient recycling method of producing rare earth metals is developed, at least for the next 50 years or more. Moreover, other authors have presented more optimistic prognostics based on other optimistic assessments and state that these resources are sufficient to meet the global demand for the next hundred years. The criticality of rare earth metals is not related to the depletion of reserves or resources, but are rather fundamentally related to China’s large-scale dominance over the means of production and processing of these materials. There are expectations of exploration of other potential rare earth resources in Russia, the USA, and Japan that will make these countries additional core participants in the competition network for rare earth metals.