Energy Transition 2024–2025: New Demand Vectors, Technology Oversupply, and Shrinking Net-Zero 2050 Premium

Abstract

1. Introduction

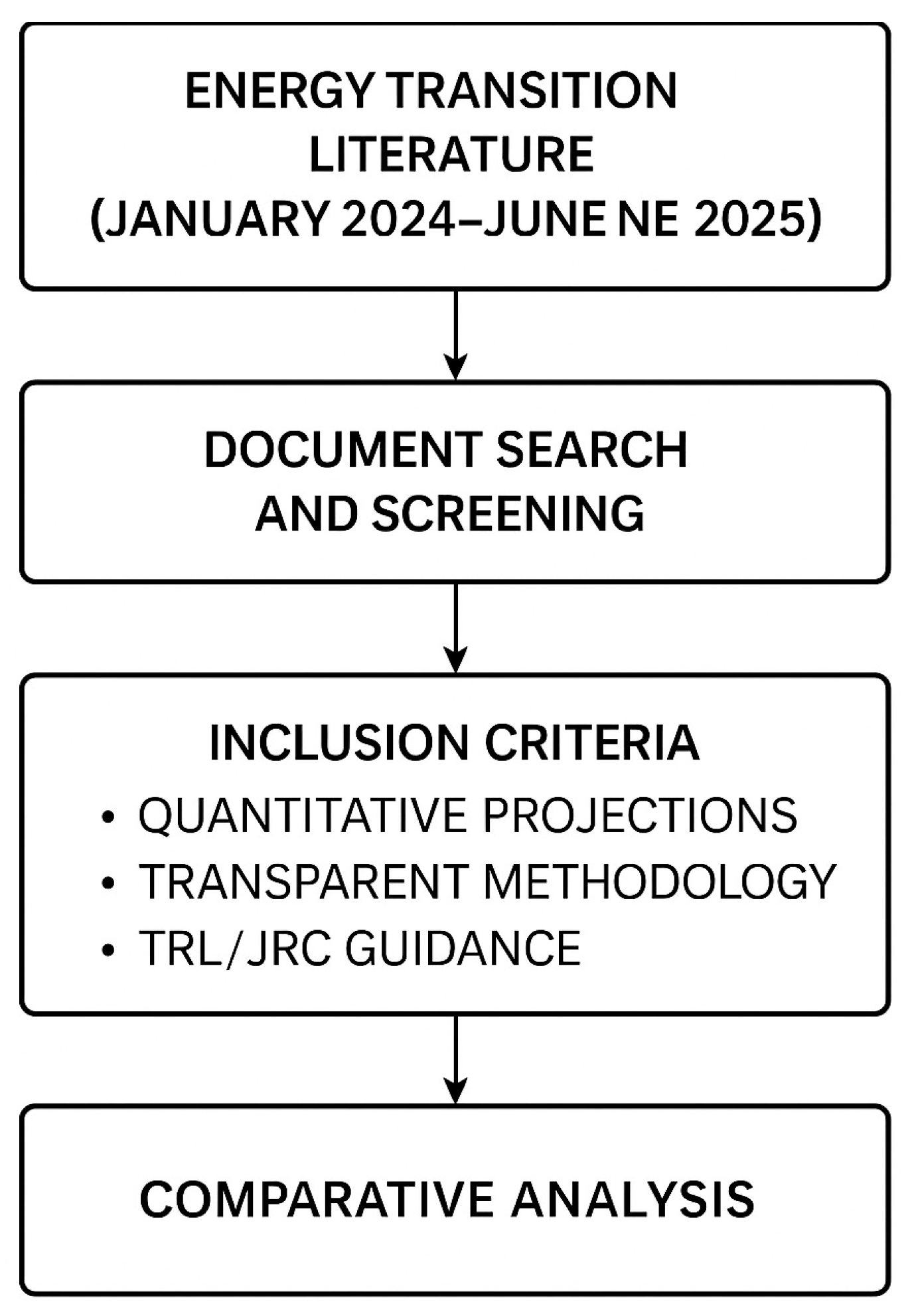

2. Literature Review

2.1. Selection Criteria and Research Questions

2.2. Literature Synthesis: Emerging Dimensions of the Energy Transition (2024–2025)

- Review Studies and Meta-Analyses

- 2.

- Geopolitical and Supply Chain Dimensions

- 3.

- Scenario-Based and Probabilistic Foresight

- 4.

- Global Trends and Regional Contrasts

- 5.

- Technology Deployment and Demonstration Projects

3. Materials and Methods

4. Energy-Transition Strategies to 2050: Insights from 2024 to 2025 Reports and Publications

5. Discussion

6. Conclusions

7. Policy Implications and Research Outlook

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| Acronym | Full Term |

| AI | Artificial Intelligence |

| APS | Announced Pledges Scenario (used in IEA models) |

| BESS | Battery Energy Storage Systems |

| bcm | Billion Cubic Metres (used for gas volume) |

| BMJ | British Medical Journal |

| CAPEX | Capital Expenditure |

| CCUS | Carbon Capture, Utilisation, and Storage |

| CO2 | Carbon Dioxide |

| DC | Data Centre |

| DSO | Distribution System Operator |

| ETS | Economic Transition Scenario |

| EV | Electric Vehicle |

| IEA | International Energy Agency |

| IRA | Inflation Reduction Act (USA) |

| JRC | Joint Research Centre |

| kWh | Kilowatt-hour |

| LNG | Liquefied Natural Gas |

| mb/d | Million Barrels per Day (oil unit) |

| MMBtu | Million British Thermal Units (gas pricing) |

| NDC | Nationally Determined Contribution |

| NEO | New Energy Outlook (BloombergNEF) |

| NREL | National Renewable Energy Laboratory |

| NZIA | Net-Zero Industry Act (EU) |

| NZS | Net-Zero Scenario |

| OECD | Organisation for Economic Co-operation and Development |

| OPEC+ | Organization of the Petroleum Exporting Countries plus allies |

| PPP | Public–Private Partnership |

| PV | Photovoltaics |

| PSE | Polskie Sieci Elektroenergetyczne |

| RES | Renewable Energy Sources |

| RFF | Resources for the Future |

| STEPS | Stated Policies Scenario (used in IEA models) |

| TWh | Terawatt-hour |

| TRL | Technology Readiness Level |

| TSO | Transmission System Operator |

| USD | United States Dollar |

| WEF | World Economic Forum |

| WEO | World Energy Outlook (IEA) |

| WHO | World Health Organization |

References

- Bloomberg NEF. New Energy Outlook 2025; Bloomberg Finance L.P.: London, UK, 2025; Available online: https://about.bnef.com/new-energy-outlook (accessed on 9 July 2025).

- International Energy Agency (IEA). World Energy Outlook 2024; International Energy Agency (IEA): Paris, France, 2024; Available online: https://www.iea.org/reports/world-energy-outlook-2024 (accessed on 9 July 2025).

- International Energy Agency (IEA). Energy Technology Perspectives 2024; International Energy Agency (IEA): Paris, France, 2024; Available online: https://www.iea.org/reports/energy-technology-perspectives-2024 (accessed on 9 July 2025).

- Wiest, G.; Nolzen, N.; Baader, F.; Bardow, A.; Moret, S. Low-regret strategies for energy systems planning in a highly uncertain future. arXiv 2025, arXiv:2505.13277. [Google Scholar] [CrossRef]

- Reuters. A Mid-Year Check-Up on Global Energy Transition Progress (H1 2025); Reuters: London, UK, 2025. [Google Scholar]

- World Economic Forum. Fostering Effective Energy Transition 2025; World Economic Forum: Geneva, Switzerland, 2025; Available online: https://www.weforum.org/reports (accessed on 9 July 2025).

- International Monetary Fund (IMF). World Economic Outlook Deflators, April 2024. Available online: https://www.imf.org/en/Publications/WEO (accessed on 9 July 2025).

- Fronzetti Colladon, A.; Pisello, A.L.; Cabeza, L.F. Boosting the clean energy transition through data science. Energy Policy 2024, 193, 114304. [Google Scholar] [CrossRef]

- Faure, M. Energy Transition and Risk Analysis: A Commentary. Energy Policy 2024, 174, 658–663. [Google Scholar] [CrossRef]

- Yang, Y.; Xia, S.; Huang, P.; Qian, J. Energy transition: Connotations, mechanisms and effects. Energy Strategy Rev. 2024, 52, 101320. [Google Scholar] [CrossRef]

- Schmitz, R.; Flachsbarth, F.; Plaga, L.S.; Braun, M.; Härtel, P. Energy Security and Resilience. arXiv 2025, arXiv:2504.18396. [Google Scholar] [CrossRef]

- Le Bihan, J.; Lapi, T.; Halloy, J. Beyond 2050: From deployment to renewal of the global solar and wind energy system. arXiv 2025, arXiv:2502.04205. [Google Scholar] [CrossRef]

- Barani, M.; Löffler, K.; del Granado, P.C.; Moskalenko, N.; Panos, E.; Hoffart, F.M.; von Hirschhausen, C.; Kannavou, M.; Auer, H.; Hainsch, K.; et al. European Energy Vision 2060. arXiv 2025, arXiv:2501.12993. [Google Scholar] [CrossRef]

- Morgan, M.G.; Keith, D.W. Decision making under deep uncertainty in energy policy. Nat. Rev. Earth Environ. 2025, 6, 111–123. [Google Scholar]

- Paredes-Vergara, M.; Palma-Behnke, R.; Haas, J. Characterizing decision making under deep uncertainty for model-based energy transitions. Renew. Sustain. Energy Rev. 2024, 192, 114233. [Google Scholar] [CrossRef]

- World Economic Forum. In Charts: The Energy Transition in 2025; WEF: Geneva, Switzerland, 2025; Available online: https://www.weforum.org/stories/2025/06/energy-transition-progress-in-charts (accessed on 9 July 2025).

- Hunt, J.D.; Nascimento, A.; Zakeri, B.; Barbosa, P.S.F. Hydrogen Deep Ocean Link: A global sustainable interconnected energy grid. Energy 2022, 249, 123660. [Google Scholar] [CrossRef]

- Koralewicz, P.; Mendiola, E.; Wallen, R.; Gevorgian, V.; Laird, D. Unleashing the Frequency: Multi-Megawatt Demonstration of 100% Renewable Power Systems with Decentralized Communication-Less Control Scheme (No. NREL/TP-5000-80742); National Renewable Energy Lab: Golden, CO, USA, 2022. [CrossRef]

- Shittu, I.; Saqib, A.; Chen, Y. Impact of Global Geopolitical Risks on Clean Energy Transition: Evidence from Method of Moment Quantile Regression. SSRN Prepr. 2024. [Google Scholar] [CrossRef]

- Sattich, T.; Huang, S. Industrial competition—Who is winning the renewable energy race? In Handbook on the Geopolitics of the Energy Transition; Scholten, D., Ed.; Edward Elgar Publishing: Gloucestershire, UK, 2023. [Google Scholar] [CrossRef]

- Eurostat. Energy Data and Statistics. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 9 July 2025).

- Polskie Sieci Elektroenergetyczne (PSE). Development Plan for the Transmission System 2023–2032; Polskie Sieci Elektroenergetyczne (PSE): Konstancin-Jeziorna, Poland, 2023; Available online: https://www.pse.pl (accessed on 9 July 2025).

- ENTSO-E. TYNDP 2024—Ten-Year Network Development Plan; ENTSO-E: Brussels, Belgium, 2024; Available online: https://tyndp.entsoe.eu (accessed on 9 July 2025).

- Harris, C. Python 3.11 for Data Science; Packt Publishing: Birmingham, UK, 2023. [Google Scholar]

- Vander Walt, S.; Colbert, S.C.; Varoquaux, G. The NumPy Array: A Structure for Efficient Numerical Computation. Comput. Sci. Eng. 2011, 13, 22–30. [Google Scholar] [CrossRef]

- Zenodo Archive. Source Data and Scripts for “Resilient Net-Zero Pathways 2024–2025 Meta-Analysis” [Internet]; Record No Longer Available. Available online: https://zenodo.org/record/12345678 (accessed on 9 July 2025).

- Yao, Y.; Jerrett, M.; Zhu, T.; Kelly, F.J.; Zhu, Y. Equitable Energy Transitions for a Healthy Future: Combating Air Pollution and Climate Change. BMJ 2025, 388, e084352. [Google Scholar] [CrossRef] [PubMed]

- Markard, J.; Rosenbloom, D. Phases of the Net-Zero Energy Transition and Strategies to Achieve It. In Routledge Handbook of Energy Transitions; Araújo, K., Ed.; Routledge: New York, NY, USA, 2022; pp. 102–123. [Google Scholar] [CrossRef]

- Maka, A.O.M.; Ghalut, T.; Elsaye, E. The pathway towards decarbonisation and net-zero emissions by 2050: The role of solar energy technology. Green Technol. Sustain. 2024, 2, 1007. [Google Scholar] [CrossRef]

- Fam, A.; Fam, S. Review of the US 2050 Long Term Strategy to Reach Net Zero Carbon Emissions. Energy Rep. 2024, 12, 845–860. [Google Scholar] [CrossRef]

- Shell plc. Energy Transition Strategy 2024; Shell PLC: The Hague, The Netherlands, 2024; Available online: https://www.shell.com/sustainability/climate/shell-energy-transition-strategy/_jcr_content/root/main/section_321304972/promo_copy_copy/links/item0.stream/1726832326846/2c3f9065f2886e789ac196789f137dbca49473e8/shell-energy-transition-strategy-2024.pdf (accessed on 9 July 2025).

- International Energy Agency (IEA). Data and Statistics Portal [Internet]. Available online: https://www.iea.org/data-and-statistics (accessed on 9 July 2025).

- Joint Research Centre (JRC). Guidelines for the Assessment of Energy Scenarios in Support of the Clean Energy Transition; European Commission, Joint Research Centre: Brussels, Belgium, 2022; Available online: https://publications.jrc.ec.europa.eu/repository/handle/JRC130719 (accessed on 9 July 2025).

- Awolesi, O.; Salter, C.A.; Reams, M. A Systematic Review on the Path to Inclusive and Sustainable Energy Transitions. Energies 2024, 17, 3512. [Google Scholar] [CrossRef]

- Ministry of New and Renewable Energy (MNRE), Government of India. National Green Hydrogen Mission—Mission Document. New Delhi, India; 2023. Available online: https://mnre.gov.in/en/national-green-hydrogen-mission (accessed on 25 July 2025).

- SPA. Saudi Arabia Automates over 11 Million Smart Meters Under Vision 2030 Goals; Arab News: Riyadh, Saudi Arabia, 2024; Available online: https://www.arabnews.com/node/2583381/amp (accessed on 25 July 2025).

- Clean Energy Council. Clean Energy, Job Ready Program: Industry-Agreed National Workforce Standards for Solar, Wind and Battery Projects; Clean Energy Council: Melbourne, Australia, 2025; Available online: https://cleanenergycouncil.org.au/news-resources/new-clean-energy,-job-ready-program-launches-as-demand-for-skilled-renewable-workforce-grows (accessed on 25 July 2025).

- U.S. Department of Energy, Office of Clean Energy Demonstrations. DOE Announces $7 Billion Regional Clean Hydrogen Hubs Initiative to Accelerate Commercial-Scale Deployment; Press Release; U.S. Department of Energy: Washington, DC, USA, 2023. Available online: https://content.govdelivery.com/accounts/USDOEOCED/bulletins/37599bb (accessed on 25 July 2025).

- National Investment and Infrastructure Fund Limited (NIIFL), Government of India. NIIF Sustainable Infrastructure Fund—Catalysing Clean-Energy & Resilient Infrastructure across Emerging Markets; National Investment and Infrastructure Fund Limited (NIIFL): Mumbai, India, 2024; Available online: https://niifindia.in/sustainable-infrastructure/ (accessed on 25 July 2025).

| Publication/Authors (Institution) | Brief Description and Key Findings |

|---|---|

| Fostering Effective Energy Transition 2025—World Economic Forum [16] | Annual report assessing the progress of 120 countries in transitioning to low-emission energy (Energy Transition Index, ETI). The 2025 edition highlights that 65% of countries improved their ETI scores, but only 28% progressed simultaneously across all three pillars: security, affordability, and sustainability. The authors identify five priorities for accelerating decarbonization, including grid modernization and streamlining permitting procedures. |

| New Energy Outlook 2025—BloombergNEF [1] | Scenarios for the development of energy, industry, transport, and buildings to 2050. The study presents a cost-optimal pathway to eliminate >95% of CO2 emissions from the global energy system, emphasizing the role of solar PV, wind, storage, and hydrogen after 2035. |

| Wiest G. et al. “Low-regret Strategies for Energy Systems Planning in a Highly Uncertain Future” [4] | Proposes a decision-making framework to identify “low-regret” strategies in energy systems planning. A case study on biomass shows that shifting its use from low-temperature heating to fuel and chemical production minimizes regret risk across various price and technology development pathways. |

| Equitable energy transitions for a healthy future”—BMJ [27] | A health policy commentary: ensuring a fair transition (distribution of costs and benefits) is crucial to avoid deepening social and health inequalities during the coal phase-out. |

| “World Energy Outlook 2024”—International Energy Agency [2] | Updates the global Net Zero Emissions (NZE) scenario to 2050 and shows that oversupply of PV manufacturing capacity allows for faster transformation —if network bottlenecks and supply chain constraints are addressed simultaneously. |

| “Energy Technology Perspectives 2024”—IEA [3] | Analysis of zero-emission industrial technologies (steel, aluminium, and ammonia). Required investments: an average of USD 80 billion/year until 2050, with a radical increase in demand for green materials. |

| Markard J., Rosenbloom D. “Phases of the Net-Zero Energy Transition and Strategies to Achieve It” [28] | Identifies four phases of the transition to net zero and five overarching strategies (electrification, efficiency, low-emission fuels, negative emissions, and demand reduction). |

| Maka A.O.M, Ghalut. T.; Elsaye. E. “The pathway towards decarbonisation and net-zero emissions by … 2050” [29] | Models a global emissions reduction path of 90% by 2050, with analysis of marginal CO2 costs and the need to increase investments in grids and storage. |

| Fam, A.; Fam, S. “Review of the US 2050 long-term strategy to reach net zero” [30] | Assessment of the five pillars of the U.S. strategy (power sector decarbonization, electrification, methane reduction, etc.) and the political and technological barriers. |

| “Shell Energy Transition Strategy 2024”—Shell plc [31] | An example of a corporate net-zero strategy to 2050; assumes a 20% reduction in emissions intensity by 2030 and 100% by 2050, with development of hydrogen and CCUS. |

| Metric | ETS 2024 (IEA) | NZS 2024 (IEA) | ETS 2025 (BNEF) | NZS 2025 (BNEF) | Comment |

|---|---|---|---|---|---|

| Electricity demand (TWh, 2035) | 31,400 | 33,200 | 33,600 | 35,800 | AI and cooling increase baseline by +2200 TWh |

| Share of renewables (%, 2050) | 70% | 85% | 67% | 85% | Drop in ETS due to faster demand growth |

| Total investment (USD trn, 2025–2050) | 181 | 215 | 185 | 213 | Net-Zero premium shrinks from 19% to 15% |

| PV CAPEX (USD/kW) | 650 | 600 | 520 | 480 | Oversupply lowers costs globally |

| BESS CAPEX (USD/kWh) | 300 | 270 | 250 | 220 | Lower costs under NZS due to scale-up |

| Share of gas in mix (%, 2050) | 21% | 14% | 25% | 17% | ETS 2025 shows larger gas role for flexibility |

| Grid/storage share in CAPEX (%) | 38% | 52% | 45% | 56% | NZS shifts capital toward flexibility |

| Report | What Is New/What Has Changed? | Why It Matters |

|---|---|---|

| WEF—Fostering Effective Energy Transition 2025 [6] | The first clear “rebound jump” since the pandemic: the average ETI score rises by 1.1% year-on-year (more than 2× faster than 2021–24). Energy “equity” returns—equity indicator +2.2% thanks to falling energy prices and subsidy reforms (in 2024, equity declined due to high prices). Coverage narrowed to 118 countries (previously 120) and 5 priorities added (AI, grid modernization, talent, commercialization in hard-to-abate sectors, and capital for the Global South). | The 2024 edition warned of a loss of momentum and introduced “tailored pathways” for the first time; 2025 reveals a rebound but highlights that only 28% of countries improve security, equity, and sustainability simultaneously—a signal of systemic imbalance. (weforum.org) |

| BloombergNEF [1]—New Energy Outlook 2025 | New 10-year “AI & Data-center surge” module—forecast that data centres will increase global electricity demand by 75% by 2050, requiring +362 GW of capacity by 2035. Base ETS shows structural emissions decline already from 2024 and a greater (25%) role for gas to meet rising demand for grid flexibility. Investments 2025–50: USD 10.55 trillion in renewables (2024 ETS version projected USD 9.8 trillion). | The 2024 edition focused on “9 key technologies” and the cost–ambition gap; 2025 shifts the focus to new demand (AI, cooling, and transport) and shows that, even in the economic scenario, the RES share in 2050 drops from 70% to 67%—a result of faster demand growth. (about.bnef.com) |

| EA—World Energy Outlook 2024 [2] | Sensitivity scenarios added for AI, heatwaves, e-mobility, and LNG—expanding the classic trio (STEPS/APS/NZE). Emphasis on oversupply: projected “surfeit” of oil, LNG, and PV/battery capacity in the second half of the decade; this reverses the shortage narrative from WEO 2022–23. Broader view of system security (trade fragmentation and supply chain risks). | WEO 2023 declared “the beginning of the end of the fossil fuel era” (peak demand before 2030). WEO 2024 maintains that trend but shows that supply abundance could depress prices and weaken investment incentives—a new political challenge. (iea.org) |

| IEA—Energy Technology Perspectives 2024 [3] | First complete bottom-up mapping of production and trade for 50 clean-tech supply chains, with analysis of countries’ industrial strategies. Expanded assessment of trade risks (tariffs and export controls) and material processing; ETP 2023 focused mainly on critical minerals and bottlenecks. New chapter on future “oversupply”—how oversupply of PV/batteries may reduce costs but also trigger trade wars. | Fills a data gap: ETP 2023 outlined the scale of investment but lacked detailed commodity flows; the 2024 edition provides the figures needed to design industrial policy linking climate, trade, and security. (iea.org) |

| Wiest G. et al. 2025—“Low-Regret Strategies …” [4] | Innovative methodology of “automated low-regret strategy identification” (decision trees + regret maps). First proof that using biomass in fuels/chemicals minimizes risk across a wide CO2 price spectrum, while current use for low-temp heat generates high “regret.” | So far, the literature has relied on deterministic scenarios; this new work offers an adaptive tool for planners and investors, shifting the debate from “one best path” to a portfolio of solutions resilient to uncertainty. |

| BMJ 2025—“Equitable Energy Transitions for a Healthy Future” [27] | Links COP28′s renewable tripling pledge with WHO 2030 health goals; calculates that health gains alone (less NO2/PM2.5) fully offset transition capital costs within 7–10 years for low/mid-income countries. Proposes a “health dividend” sharing matrix—a tool for finance ministries to evaluate policies. | Previous BMJ commentaries focused on heating-related health impacts; the 2025 edition elevates energy to a macroeconomic and fiscal issue, embedding equity into the 2025 NDC revision logic. |

| Priority 2025 | What the Report Recommends | Reference Project | Practical Implication |

|---|---|---|---|

| 1. Stable, adaptive regulation [6,35] | Regulatory frameworks that provide investors with long-term certainty yet can respond quickly to innovation. | National Green Hydrogen Mission (India, 2023)—incentives tailored to the strengths of individual states. | Lowers risk premium and cost of capital for renewables and hydrogen. |

| 2. Grid and storage modernisation [6,36] | Digital planning, loss reduction, and integration of distributed resources. | Saudi Arabia’s roll-out of 11 million smart meters in Saudi Arabia. | Unlocks renewable connections—the current main bottleneck. |

| 3. Investment in talent [6,37] | Align education and training with real labour-market demand. | Clean Energy Training Hubs (Australia). | Without skilled labour, PV-wind-battery deployment stalls. |

| 4. Commercialisation in hard-to-abate sectors [6,38] | Shorter pathway from pilot to commercial scale in steel, chemicals, and heavy transport. | Regional hydrogen hubs in the USA (USD 7 billion). | Heavy industry emits ~30% of CO2—net-zero impossible without decarbonising it. |

| 5. Capital for the Global South [6,39] | Guarantee packages, local bond markets, and PPP platforms. | National Investment & Infrastructure Fund (NIIF), India—de-risking mechanisms. | 70% of new clean-energy capacity to 2030 must be built in EMDEs—finance gap looms. |

| Area | What Is New in the 2025 Edition | Contrast with the 2024 Edition | Practical Implication |

|---|---|---|---|

| 1. “AI & Data-centre surge” module | First stand-alone 10-year block: +75% global electricity demand to 2050, with data centres rising from 4.5% of demand (2035) to 8.7% (2050). Requires +362 GW of new capacity by 2035; in the USA the DC share of demand jumps from 3.5% (2024) to 8.6% (2035). | 2024 treated data centres only marginally—lumped into “other loads”; no separate projections. | Rapid AI-server growth reshapes the load curve and forces quick decisions on system flexibility (batteries, gas, and demand-side management). |

| 2. Structural emissions decline from 2024 | ETS 2025 shows emissions already trending downward; −22% vs. 2005 by 2050. Gas demand grows by +25% (2024–2050) as a cheap balancing fuel for AI-driven peaks. | ETS 2024 assumed a near-term emissions plateau to ~2026 and only “modest” gas growth. | Indicates that “peak oil” and “peak coal” are imminent, but gas returns as a balancing fuel—prompting revaluation of CCUS assets and LNG contracts. |

| 3. Energy-mix adjustment | Renewables’ share of 2050 generation falls from 70% to 67%, even though PV-plus-wind capacity doubles from today. | ETS 2024 projected 70% RES in 2050 under moderate demand. | Surging demand (AI, cooling, and transport) flattens the percentage share of clean sources, though absolute output rises—crucial for percentage-based policy targets. |

| 4. New investment picture | Renewables only: USD 10.55 trn (2025–2050); half spent in 2025–2035. Whole system: ETS 185 trn and NZS 213 trn (15% gap). | 2024: ETS 181 trn and NZS 215 trn (19% gap); no separate RES split. | A smaller “net-zero premium” (15% vs. 19%) makes the NZS catch-up cheaper but demands precise capital shifts from gas to grids and storage. |

| 5. Shift in analytical priorities | 2025 focuses on new demand vectors (AI, cooling, and heavy transport) and grid bottlenecks; the “9 keystone technologies” are moved to an appendix. | The 2024 edition showcased the nine keystone technologies as the main bottlenecks. | Signals a move from asking “how to accelerate supply” to “can supply keep up with exploding demand”. |

| WEO 2024 Innovation | Brief Description | Contrast with WEO 2023 and Earlier | Practical Significance |

|---|---|---|---|

| 1. “AI & Data-centre surge” module | In addition to the classic STEPS/APS/NZE trio, four high-impact demand and supply “boosters” are introduced. The high-demand variant adds +1700 TWh of global electricity demand by 2035 (≈5%), two-thirds of which are due to air conditioning and data centres. | WEO 2023 worked only with policy-based scenarios; it did not account for sudden demand surges or sharp increases in LNG supply. | Grid operators and gas infrastructure investors receive upper-bound numbers that must be stress-tested in backup capacity and storage planning. |

| 2. Oversupply Narrative | The report declares a “surfeit” of oil and LNG from the mid-2020s, as well as overcapacity in PV and battery production (Chinese PV factories: 1100 GW/year capacity vs. 425 GW installed in 2023). | WEO 2023 warned that gas shortages and limited fossil fuel supply could lead to high prices—hence the message “end of the fossil fuel era.” | Cheaper raw materials = weaker investment incentive for renewables; governments need to introduce new motivators (e.g., permitting reforms, CAPEX subsidies) instead of relying on high prices as a trigger. |

| 3. Sharp Re-rating of Electricity Demand | In the baseline STEPS scenario, electricity demand in 2035 is +2200 TWh higher than projected in the 2023 edition—driven by AI, e-mobility, cooling, and light industry. | The 2023 edition suggested that electricity consumption would plateau after 2030 due to efficiency improvements. | RES share targets may decline (due to a larger denominator), so WEO recommends shifting to TWh-based or emission-based goals rather than percentage targets in the energy mix. |

| 4. Broader Framing of Energy Security | The report notes over 200 trade barriers on clean technologies since 2020 and introduces the concept of “security of clean-tech supply.” It forecasts a record 6 mb/d of spare capacity for OPEC + and 1600 bcm of global LNG capacity by 2030 (≈+50%). | WEO 2023 focused on gas and the Middle East; it did not address the risks of PV/BESS supply chain fragmentation. | Companies must prioritize risk over price—what matters is real-time access to modules, graphite, and lithium, not just their nominal cost. |

| 5. Critical Metals Gap | Despite PV/BESS oversupply, a shortage of copper and lithium emerges after 2030—existing projects cover less than 75% of needs in the STEPS scenario. | This issue had previously appeared only in sector-specific reports, not in the main WEO. | Emphasizes the need to prioritize recycling and geographic diversification (e.g., Chile and Africa), not just expanding production capacity. |

| 6. New Investment Cost Structure | The current RES: grid + storage CAPEX ratio is 1:0.6; by the 2040s, it must reach 1:1 to maintain system reliability. | WEO 2023 mentioned a 1:0.5 ratio, but without any time horizon. | TSOs and DSOs gain a solid rationale to accelerate CAPEX (including in Poland—grid capacity must double by 2035). |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wojtaszek, H. Energy Transition 2024–2025: New Demand Vectors, Technology Oversupply, and Shrinking Net-Zero 2050 Premium. Energies 2025, 18, 4441. https://doi.org/10.3390/en18164441

Wojtaszek H. Energy Transition 2024–2025: New Demand Vectors, Technology Oversupply, and Shrinking Net-Zero 2050 Premium. Energies. 2025; 18(16):4441. https://doi.org/10.3390/en18164441

Chicago/Turabian StyleWojtaszek, Henryk. 2025. "Energy Transition 2024–2025: New Demand Vectors, Technology Oversupply, and Shrinking Net-Zero 2050 Premium" Energies 18, no. 16: 4441. https://doi.org/10.3390/en18164441

APA StyleWojtaszek, H. (2025). Energy Transition 2024–2025: New Demand Vectors, Technology Oversupply, and Shrinking Net-Zero 2050 Premium. Energies, 18(16), 4441. https://doi.org/10.3390/en18164441