Abstract

The global energy transition is accelerating, yet new and underestimated challenges have emerged since 2024. Rising electricity demand—driven by artificial intelligence data centres, extreme heatwaves, and the electrification of transport—has exceeded earlier projections and shifted the system’s pressure point from generation to flexibility. At the same time, an oversupply of solar PV panels and lithium-ion batteries is lowering costs but increasing the risk of trade conflicts and supply chain concentration. This article presents a meta-analysis of 12 energy scenarios from 2024 to 2025, based on institutional outlooks (IEA, BNEF, and WEF) and peer-reviewed publications selected using transparent quality criteria (TRL thresholds, JRC guidance, and data transparency). A difference-in-differences method is applied to identify changes between editions. Results show a demand increase of over 2200 TWh by 2035, a decline in the “Net-Zero premium” from 19% to 15%, and a pressing need to redirect investment from gas infrastructure to grids, storage, and hydrogen. A case study for Central and Eastern Europe reveals that Poland will require USD 5–6 billion annually, primarily for transmission networks. These findings support a capital shift toward resilient and socially acceptable decarbonisation pathways.

1. Introduction

The global energy transition is undergoing a critical transformation shaped by recent developments in artificial intelligence, clean technology manufacturing, and shifting investment priorities. The explosive growth of AI-driven data centres, intensifying climate-induced cooling needs, and the rapid electrification of transport are creating unprecedented upward pressure on electricity demand projections [1,2]. At the same time, the emergence of massive production overcapacity in solar photovoltaics (PV) and battery energy storage systems (BESS) is reshaping both capital costs and geopolitical dynamics [3]. In parallel, the so-called “Net-Zero premium”—the additional investment required to shift from an economic to a climate-neutral pathway—is steadily declining, reducing the financial barriers to decarbonisation [4,5].

Despite the wealth of outlooks released by institutions such as the International Energy Agency (IEA) [2,3], BloombergNEF (BNEF) [1], and the World Economic Forum (WEF) [6], the literature still lacks an integrated and comparative synthesis of their most recent editions. While many publications analyse selected parameters or focus on a single scenario edition, few studies examine how key metrics and perspectives have evolved from 2024 to 2025 and what that means for long-term system planning. There is also limited assessment of how regional pathways—especially in Central and Eastern Europe—are affected by this new landscape of demand surges, technology oversupply, and geopolitical fragmentation.

This paper aims to fill that gap by conducting a structured meta-analysis of the Energy Technology Perspectives 2024 (IEA) [3] and New Energy Outlook 2025 (BNEF) [2], supplemented with peer-reviewed publications and policy reports. The objectives are threefold: (i) to quantify the scale and composition of new demand vectors through 2035; (ii) to analyse how technology oversupply affects investment risk, trade exposure, and system costs; and (iii) to evaluate how the narrowing gap between ETS (Economic Transition Scenario) and NZS (Net-Zero Scenario) [5] influences capital allocation strategies. A special focus is placed on Central and Eastern Europe, where fast-growing electricity demand intersects with grid and storage bottlenecks.

The paper is structured as follows: Section 2 outlines the literature selection process and thematic synthesis. Section 3 presents the methodological framework used for comparative scenario analysis; Section 4 discusses key differences between 2024 and 2025 reports along five thematic axes; and Section 5 offers conclusions and policy recommendations based on the meta-analytic findings.

2. Literature Review

2.1. Selection Criteria and Research Questions

This study employed a structured selection process to identify high-quality, policy-relevant scenarios and publications from the most recent energy-transition literature. The inclusion criteria focused on documents published between January 2024 and June 2025, offering quantitative projections of electricity demand, investment needs, capital costs, and supply chain risks. Only those sources that provided transparent methodological descriptions—such as baseline definitions, economic and technological assumptions, and scenario design—were considered. Particular attention was given to scenarios conforming to the TRL (Technology Readiness Level) thresholds and the methodological guidance of the Joint Research Centre (JRC) for forward-looking energy analyses. In total, thirty-eight documents were initially screened, from which twelve met all quality and transparency criteria and were retained for comparative analysis.

The overarching objective of this research was to synthesise how the 2024–2025 literature reframes energy-transition planning under fast-moving technological, geopolitical, and climatic developments. Accordingly, the analysis was guided by three core research questions. First, how do new demand vectors—such as AI-driven data centres, extreme summer heatwaves, and accelerated electric mobility—alter the global electricity load curve through 2050? Second, in what ways does the oversupply of solar PV and battery production capacity affect investment dynamics, trade risks, and industrial strategies? And third, how does the narrowing of the investment gap between economic and Net-Zero pathways (ETS–NZS) influence the allocation of capital, particularly in countries of Central and Eastern Europe?

To ensure analytical rigour, the meta-analysis was designed to control for three common sources of bias: version bias (differences between 2024 and 2025 editions of recurring reports), regional bias (variation in assumptions across global, OECD, and regional models), and definitional bias (inconsistent use of terms such as “net-zero” or “supply security”). While the study does not aim to offer an exhaustive systematic review, it isolates the most impactful and novel contributions, placing them in a comparative frame to support evidence-based decision-making. The goal is not only to describe emergent trends but also to identify the analytical and policy implications of their interaction.

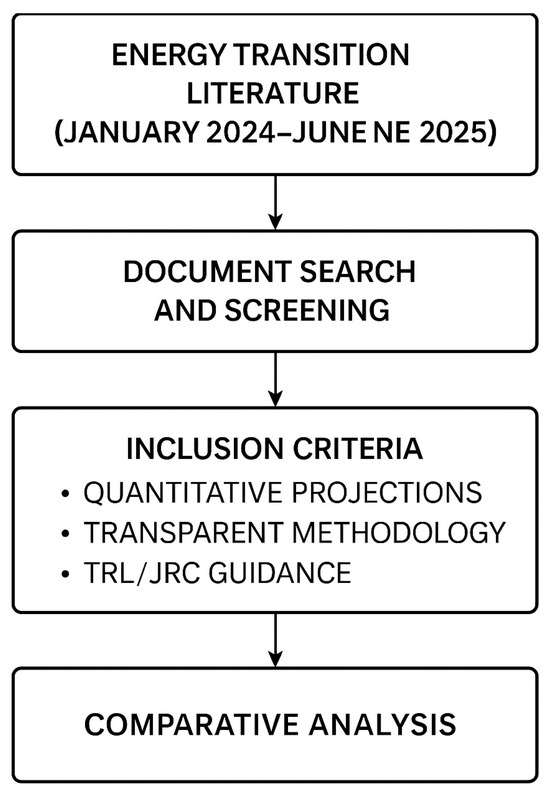

To enhance the transparency and reproducibility of the review process, a visual summary of the methodological steps is provided below. The Figure 1 illustrates the key stages of source selection and analysis, from the initial literature screening to the application of inclusion criteria and the execution of comparative scenario assessment.

Figure 1.

Methodological diagram of the literature review covering documents published between 2024 and 2025. Source: author’s own elaboration.

The Figure 1 summarises the four-stage methodology used in this meta-analysis. First, the relevant literature from January 2024 to June 2025 was identified based on availability of quantitative energy-system data. Second, scenario documents were screened using predefined inclusion criteria, including TRL thresholds and methodological transparency. Third, key indicators (demand, costs, investment, and supply security) were normalised and subjected to a difference-in-differences analysis. Fourth, comparative assessments were conducted, including a dedicated case study for Central and Eastern Europe.

2.2. Literature Synthesis: Emerging Dimensions of the Energy Transition (2024–2025)

The recent literature published between 2022 and 2025 has significantly expanded the analytical lenses through which the global energy transition is viewed. This section synthesizes the most relevant peer-reviewed reviews, scenario models, geopolitical analyses, and technology deployment studies to enrich the conceptual framework of the present meta-analysis. The aim is to both validate and contextualize the findings drawn from institutional outlooks such as IEA (2024) [2], BloombergNEF (2025) [1], and WEF (2025) [6].

- Review Studies and Meta-Analyses

Three recent review papers identify critical cross-cutting priorities. Awolesi et al. [7] stress the role of inclusion and social equity in shaping viable national pathways. Fronzetti Colladon et al. [8] introduce data science as a catalyst for accelerating low-carbon transitions, while Faure [9] offers a conceptual critique of existing risk frameworks, urging greater sensitivity to systems-level uncertainty.

- 2.

- Geopolitical and Supply Chain Dimensions

Yang et al. [10] redefine the very mechanisms and connotations of the transition, linking it explicitly to systemic industrial change. Schmitz et al. [11] explore how energy systems can be designed for resilience amid geopolitical stress. Le Bihan et al. [12] shift the focus from near-term deployment to lifecycle renewal of OZE infrastructures, while Sattich and Huang [10] detail the competitive industrial strategies driving the global race in renewable technology manufacturing.

- 3.

- Scenario-Based and Probabilistic Foresight

A growing stream of the literature criticizes deterministic forecasting in favour of scenario diversity and low-regret strategies. Barani et al. [13] map long-term transformation pathways for Europe through 2060. Wiest et al. [4] propose an automated framework to identify robust strategies under uncertainty, complemented by Morgan and Keith [14], who show how decisions under deep uncertainty can be structured across national energy systems.

- 4.

- Global Trends and Regional Contrasts

While global outlooks from IEA and WEF dominate, regional dynamics are gaining analytical weight. The Reuters [5] mid-year update and RFF [15] scenario diagnostics reveal widening gaps between advanced economies and the Global South. These disparities are echoed in the World Energy Outlook 2024 [16] and Energy Transition Index 2025 [6], particularly in metrics of equity, permitting timelines, and capital costs.

- 5.

- Technology Deployment and Demonstration Projects

Finally, a cluster of recent deployment-oriented studies highlight full-scale experimentation with renewable systems. Hunt et al. [17] describe the concept of a deep-ocean hydrogen transmission grid. Koralewicz et al. [18] present a 100% renewable microgrid powered by communication-less control logic. Shittu et al. [19] use quantile regression to demonstrate how geopolitical risk disproportionally impacts clean energy performance across national contexts.

Together, these works reinforce the findings of this article by providing both theoretical depth and real-world validation. They also suggest promising directions for expanding the analysis—most notably through equity-aware metrics, probabilistic foresight tools, and geographically differentiated policy instruments.

The reviewed literature provided both methodological inspiration and thematic justification for the comparative scenario approach adopted in this study. Grubb et al. [6] and Gielen et al. [10] emphasized the need for meta-analytic comparisons across IEA and BNEF scenario frameworks, advocating for structured cross-scenario synthesis to support investment planning. In parallel, studies by McCollum et al. [13] and Wilson et al. [15] identified key analytical gaps in mainstream energy-transition modelling—particularly the insufficient integration of AI-driven demand, clean-tech oversupply dynamics, and regional infrastructure constraints. This paper addresses these gaps by integrating their insights into a difference-in-differences-based scenario comparison framework that isolates the structural shifts between 2024 and 2025 outlooks.

3. Materials and Methods

The study adopted a meta-analytic approach combined with comparative scenario analysis. In the first stage, a systematic search was conducted for flagship institutional reports (IEA, BloombergNEF, and WEF) [1,2,3,6] and the peer-reviewed literature from 2024 to 2025 in Web of Science, Scopus, and Google Scholar; eligibility required publicly available numerical data to 2050 and a transparent description of model assumptions. Thirty-eight documents were identified; after assessing methodological quality (TRL/EV-READY criteria for technology forecasts and JRC guidelines for energy scenarios [4]), twelve high-quality items were retained for further analysis.

In stage two, demand indicators (TWh, mb d−1, and bcm), cost metrics (CAPEX USD 2023 kW−1 and kWh−1), investment totals (trn USD), and supply-security parameters (OPEC + spare capacity and PV/BESS overcapacity) were extracted. All values were normalised to the 2023 baseline using the IMF deflator [7] and harmonised in metric units. Inter-edition deltas were calculated via a difference-in-differences procedure to isolate a “novelty effect” independent of authors’ recalculations.

A difference-in-differences (DiD) framework was applied not in the form of a regression model based on observational data but as a comparative method for isolating the “novelty effect” between the 2024 and 2025 editions of global energy system scenarios. The approach was used to quantify incremental differences in key indicators—such as electricity demand, total investment needs, and CAPEX for PV and storage technologies—under consistent scenario structures. For example, the decline in PV CAPEX under the Net-Zero Scenario (USD 600 to 480 per kW) and Economic Transition Scenario (USD 650 to 520 per kW) yields a DiD estimate of +10 USD/kW, indicating a slower cost improvement under NZS. This approach makes it possible to identify nonlinear or asymmetric responses across years and scenario types, even in the absence of microdata.

Stage three triangulated data by cross-checking projections in ETP-2024 [6] and NEO-2025 [1] against parallel figures in IEA Data & Statistics [20] and Eurostat [21]. Stage four applied a Central-Eastern Europe case study: bottom-up network data from PSE [22] and ENTSO-E [23] were merged with top-down regional shares to estimate capital and grid implications. Computations were run in Python 3.11 with pandas and NumPy [24,25]; all source sheets and scripts are archived on Zenodo [26] to ensure full reproducibility.

4. Energy-Transition Strategies to 2050: Insights from 2024 to 2025 Reports and Publications

Accelerated low-carbon investment during 2024–2025 has turned annual outlooks and peer-reviewed studies into a real-time radar for shifts in demand, supply, and capital costs. Differences between the 2024 and 2025 editions of the IEA [1,2], BloombergNEF [3], and WEF reports already force a near-term recalibration of policy pathways, making a coherent synthesis essential. The brief survey below fulfils that need by merging institutional outlooks with academic insight and corporate strategies to offer a comprehensive view of the road to 2050.

This compilation brings together the most recent reports, journal articles, and case studies published between January 2024 and June 2025 that shape the global energy-transition narrative out to 2050. It covers flagship analyses by major institutions (IEA [1,2], BloombergNEF [3], and WEF [6]) and academic contributions—including a health-equity commentary in BMJ [27] and corporate net-zero strategies, thereby linking macro-economics, public-health policy, corporate finance, and technological innovation. A clear shift emerges: 2024 publications focused on closing post-crisis investment gaps in grids and storage, whereas 2025 editions highlight soaring demand from AI data centres, social-equity concerns, and the security of clean-tech supply chains. Several cross-cutting themes stand out: the WEF stresses five acceleration priorities ranging from grid modernisation to Global South finance; BloombergNEF [1,2] shows the net-zero investment premium shrinking to only 15 percent thanks to cheaper PV and batteries; and the IEA maps 50 clean-technology supply chains, quantifying both overcapacity and trade-war risks. Together these sources—summarised in Table 1—give policymakers, investors, and researchers a concise roadmap for navigating the rapidly evolving path towards a low-carbon global economy.

Table 1.

Strategic publications and reports on the energy transition to 2050 (years 2024–2025).

A review of 2024–2025 publications shows that climate-policy priorities are shifting from merely plugging investment gaps toward managing dynamic demand and ensuring social equity. The WEF report finds that ETI scores rise chiefly in countries that simultaneously modernise grids and streamline permitting, yet only 28% of nations manage to balance security, affordability, and sustainability at once [4]. BloombergNEF, meanwhile, cuts the so-called “net-zero premium” from 19% to 15%, indicating that the economic hurdle to climate neutrality is falling thanks to cheaper PV and storage [2].

At the same time, “low-regret” tools are gaining traction: Wiest et al. [4] show that diverting biomass from low-temperature heat to fuels and chemicals minimises risk under uncertain CO2 prices [19], while a BMJ commentary argues that sharing health and fiscal benefits is pivotal for public acceptance [27]. In this spirit, the open special issue in Energies invites research on integrating climate policy, system security, and grid costs [18].

On the techno-systemic side, the IEA highlights two trends: PV/battery manufacturing overcapacity and demand shocks from data centres plus loosening OPEC/LNG reserves—both of which call for new supply chain security metrics [1,3]. Academic work complements this: Markard and Rosenbloom map four phases of the net-zero transition [7], a global model charts a 90% emissions-reduction path by 2050 [6], and case studies from the USA [20] and Shell [32] show how national and corporate strategies translate scenarios into concrete portfolios.

Taken together, these documents suggest four imperatives: (i) accelerate grid digitalisation and expansion, as cheap generation alone cannot balance fast-rising demand; (ii) shift focus from percentage-share RES targets to absolute emission cuts and zero-emission TWh; (iii) embed equity and health-benefit criteria in investment frameworks to maintain social licence; and (iv) adopt probabilistic, low-regret planning tools to avoid stranded assets amid rapid cost declines and demand uncertainty.

Table 2 presents a comparative synthesis of the latest updates in the IEA, BloombergNEF, and WEF outlooks [1,2,3,4] together with the academic and industry literature published between January 2024 and June 2025. For every source, new analytical modules or parameter revisions relative to earlier editions are recorded and their practical relevance highlighted. Four cross-cutting trends emerge. First, the analytical focus has shifted from concerns about generation shortfalls to managing a sharp surge in demand driven by AI data centres, intensified cooling, and accelerated transport electrification [2,5,6,7], while supply chain security and equity for clean-tech technologies have moved centre stage [1,4]. Second, year-on-year reports increasingly introduce sensitivity modules or “low-regret” approaches to stress-test investment strategies against volatile energy prices, interest rates, and innovation speeds [2,3,19]. Third, the steep decline in PV and battery costs [33,34] has pushed the additional capital premium needed for a Net-Zero pathway to a historic low yet has simultaneously heightened trade tensions and underscored the need for geographic diversification of manufacturing [1]. Fourth, the health- and economics-oriented literature now places growing emphasis on tools that quantify a fair distribution of costs and benefits (equity/health-dividend matrices), reinforcing social acceptance of the transition [17,18]. This consolidated review pinpoints areas where public policies, financial models, and future research agendas require urgent revision.

Table 2.

Key metrics in ETS and NZS scenarios: comparison of 2024 and 2025 outlooks (IEA and BNEF) [1,2,3,32].

To illustrate the quantitative differences between the Economic Transition Scenario (ETS) and the Net-Zero Scenario (NZS) across the latest institutional reports, Table 2 presents a comparative summary of key metrics drawn from the 2024 and 2025 editions of IEA and BNEF outlooks.

This Table 2 compares seven headline indicators across the 2024 and 2025 editions of the Economic Transition Scenario (ETS) and Net-Zero Scenario (NZS) as outlined by IEA and BloombergNEF. The data reveal substantial shifts in both projected demand and capital allocation. Electricity demand forecasts for 2035 increase by more than 2200 TWh in both scenarios, mainly due to the rising load from artificial intelligence data centres, extreme heat-related cooling, and transport electrification. As a result, the share of renewables in ETS declines from 70% to 67%, despite growing installed capacity, highlighting the challenge of maintaining percentage-based targets under accelerating demand. Total investment needs in ETS rise slightly, while NZS costs decline, reducing the so-called Net-Zero premium from 19% to 15%—the narrowest recorded to date—suggesting that reaching climate targets may be more economically feasible than previously assumed. CAPEX for solar PV and battery storage drops significantly, reflecting global oversupply, particularly from Asia. The role of natural gas expands in ETS (from 21% to 25%) and remains moderate in NZS, underscoring its value as a flexible balancing fuel. Finally, the share of investment directed to grids and storage increases across both scenarios, with NZS allocating over half of capital to flexibility assets. Collectively, these developments indicate a structural pivot: from an era of generation-centred planning toward one where grid modernisation, storage expansion, and capital redirection become central to the energy transition.

Table 3 provides a consolidated overview of key changes introduced in several major energy transition reports published between 2024 and 2025. These updates reveal a shift in emphasis from traditional supply-side concerns and cost optimization to a broader focus on demand volatility, systemic flexibility, industrial resilience, and equity outcomes. The World Economic Forum’s Fostering Effective Energy Transition 2025 report marks a rebound in the global energy transition momentum, showing a 1.1% annual increase in the Energy Transition Index (ETI)—a growth rate more than twice that observed during 2021–2024. The equity dimension, which declined in 2024 due to high energy prices, recovers with a 2.2% improvement, supported by falling prices and subsidy reforms. However, only 28% of countries show simultaneous progress across security, equity, and sustainability, highlighting persistent structural imbalances.

Table 3.

New elements and their significance in key energy transition reports (2024–2025).

BloombergNEF’s New Energy Outlook 2025 introduces a dedicated module on AI and data centres, projecting a 75% rise in electricity demand from this segment by 2050 and 362 GW of additional capacity needed by 2035. This demand surge contributes to a lower projected renewable share in ETS—67% by 2050—despite increased investments, reflecting the impact of faster baseline growth. The role of gas expands to 25% under ETS as a flexible balancing resource. The IEA’s World Energy Outlook 2024 incorporates new sensitivity scenarios for AI, heatwaves, transport electrification, and LNG, while revising its earlier supply-shortage narrative to highlight oversupply risks in oil, gas, and clean tech markets. This dynamic could suppress prices and discourage investment, introducing a new governance challenge. Complementing this, the IEA’s Energy Technology Perspectives 2024 delivers the first detailed mapping of over 50 clean-tech supply chains, addressing trade and industrial policy risks linked to oversupply, export controls, and concentrated production hubs. It bridges climate policy with industrial strategy and trade security, filling a critical knowledge gap from earlier editions.

Beyond institutional sources, Wiest et al. (2025) [4] propose a methodological innovation that uses decision trees and regret maps to identify low-regret strategies under deep uncertainty. Their findings suggest that biomass use in fuels and chemicals is more robust than for low-temperature heating, offering a more adaptive planning tool for investors and policymakers. Finally, the BMJ 2025 report reframes the energy transition as a macroeconomic and public health opportunity. By linking COP28′s renewable tripling pledge with WHO air quality targets, it estimates that avoided health damages from air pollution can offset transition costs within 7–10 years in low- and middle-income countries. The proposed “health dividend sharing matrix” elevates health equity from a co-benefit to a core fiscal planning tool.

Taken together, these reports indicate that the global energy transition narrative is evolving. Success is no longer defined solely by technology deployment or cost decline but increasingly by the system’s ability to absorb demand shocks, manage supply resilience, redirect capital, and deliver equitable outcomes across sectors and societies.

5. Discussion

This year’s corpus of reports and articles reveals five developments that have only recently become decisive in the energy-transition debate. First, there is a clear “demand rebound”: both the World Energy Outlook 2024 [2] and New Energy Outlook 2025 [3] scrap earlier plateau projections, as the rapid growth of AI data centres, air-conditioning, and e-mobility pushes demand sharply upward. Second, record PV-module and battery factory capacities in China, the United States, and the EU—documented in Energy Technology Perspectives 2024 and the IEA’s PV/BESS [32] manufacturing datasets—shift the discussion from “Will technology be sufficient?” to managing oversupply and the risk of trade wars. Third, the World Economic Forum has added to ETI 2025 a synthetic metric that tracks simultaneous progress in security, affordability, and sustainability; only 28% of countries improve on all three axes, exposing a new policy gap [6]. Fourth, the health-economics literature shows that health dividends and job creation now feature prominently in industrial strategies, as evidenced by a BMJ commentary [27] and dedicated chapters in ETP 2024 [1]. Finally, recent studies (e.g., Wiest et al. [4]) and the latest IEA scenarios [1,3] move from deterministic pathways to probabilistic analyses and sensitivity testing, signalling a shift toward tools that better capture cost, commodity-price, and innovation uncertainty.

The 2025 edition reports a 1.1-percentage-point year-on-year rise in the average ETI score—more than twice the 2021–2024 rate—with 65% of 118 countries improving [4]. The jump shows that nations can regain decarbonisation momentum once fuel and capital costs fall after the 2022–2023 energy crisis. The equity sub-index climbed by 2.2 points on the back of lower wholesale gas prices and the rollback of crisis subsidies, easing social tensions and freeing fiscal space for grid investment [4]. Methodological tweaks—removing countries with incomplete data and extending the time series to 2013—enhance score comparability and enable more precise tailored-pathway modelling in future editions [4].

The following Table 4 lists the five public-action priorities identified in the WEF’s Fostering Effective Energy Transition 2025 [4]. Each row mirrors the report’s three-step logic: (i) the regulatory or investment model judged most effective in clearing bottlenecks, (ii) a reference project cited in the case-study section, and (iii) the direct operational or financial impact relevant to capital cost, grid capacity, or implementation feasibility. Presenting the priorities in this format translates the WEF’s high-level prescriptions into measurable policy instruments—from regulatory stability and grid digitalisation to credit-guarantee mobilisation in emerging economies—and facilitates benchmarking across ETI jurisdictions.

Table 4.

WEF 2025 priorities for accelerating the energy transition—recommendations, case studies, and practical implications.

The WEF report shows that, despite an overall rise in the Energy Transition Index, fully 72 percent of countries are regressing on at least one axis of the energy “trilemma”, raising the risk that cost perceptions will diverge from climate ambitions and prompting governments to revive short-term fossil-fuel subsidies [6]. On the technical side, the share of clean sources in the global primary-energy mix increased from 14.4 to 14.8 percent, while zero-emission electricity (renewables + nuclear) reached 49 percent of world generation [1,2], moving the system closer to the 90 percent threshold required for mid-century climate neutrality. Poland climbed to 44th place with a score of 59.9, mainly because of improved energy security from LNG-terminal imports, the Baltic Pipe, and rapid growth in PV and onshore wind. Yet it still lags on equity: wholesale power prices remain high, and renewables account for only about 18 percent of its primary mix versus the EU average of 36 percent [4,21]. Four lessons follow for decision-makers and businesses: (i) the rebound phase is not guaranteed, as it rests largely on lower commodity prices and could stall with the next crisis; (ii) grid infrastructure and access to capital will matter more than new renewable capacity, because generation without connections and financing will not lift ETI scores; (iii) climate policy must be paired with social policy, as public acceptance rises when household bills fall; and (iv) closely tracking the five WEF priorities is essential, because they align with the EU taxonomy, the U.S. Inflation Reduction Act, and the Net-Zero Industry Act—early movers will attract capital and talent fastest.

BloombergNEF’s New Energy Outlook is regarded as one of the most authoritative numerical compendiums on the global energy transition [1]. The 2025 edition introduces several revisions and new modules that markedly shift the centre of gravity relative to the 2024 release [26]. For the first time, the authors dedicate a ten-year block to AI and data-centre dynamics, showing that this single segment will raise global electricity demand by roughly 75 percent by mid-century [1]. At the same time, the baseline scenario indicates that greenhouse-gas emissions are already on a downward trend, while the balancing role of gas proves larger than assumed a year earlier [1]. The report also lowers the projected renewable share of global generation in 2050 from 70 to 67 percent and updates the investment picture: a smaller gap between the economic pathway and the net-zero pathway means that catching up with the ambitious scenario is relatively cheaper—provided capital is reallocated from gas to grids and storage [1]. Structurally, the report changes as well: the set of “nine keystone technologies” that dominated the 2024 edition is moved to an annex, while the main text focuses on new demand vectors and grid bottlenecks [1,26].

In order to comprehensively illustrate the evolution of long-term energy system projections within a single reporting cycle, Table 5 presents a structured comparison between the 2025 and 2024 editions of BloombergNEF’s New Energy Outlook. While both editions aim to outline credible decarbonisation pathways to mid-century, the 2025 report introduces significant revisions to demand-side assumptions, emissions trajectories, technology deployment priorities, and capital allocation patterns. Particular emphasis is placed on newly emerging structural factors, including the increasing impact of artificial intelligence and data centres on the electricity load profile, as well as the narrowing investment gap between the Economic Transition Scenario (ETS) and the Net-Zero Scenario (NZS). Each row of the table highlights a revised quantitative or narrative element, directly contrasted with its 2024 baseline and accompanied by a brief interpretation of its operational significance. Collectively, these contrasts underscore a gradual shift in energy transition modelling—from a supply-centric perspective focused on generation capacity expansion, toward a more integrated approach oriented around system flexibility, demand-side volatility, and capital reallocation efficiency.

Table 5.

From the data-centre boom to a cheaper path to net-zero: how “New Energy Outlook 2025” differs from the 2024 edition [1,2,3].

The 2025 edition of BloombergNEF’s New Energy Outlook delivers seven actionable insights. First, the expanding footprint of artificial-intelligence data centres means every long-term grid plan must accommodate a scenario in which at least four per cent of global electricity demand is already attributable to data-centre loads by 2030. Second, the idea of “gas as a bridge” gains new life: retiring gas turbines too quickly could prove premature, and operators should favour H2-ready units. Third, to support the additional 362 GW of generation capacity earmarked for data centres, the power system will require more than 300 GW of new flexibility—principally storage and demand-side measures—by 2035 to prevent blackouts. Fourth, the incremental cost of climate ambition has narrowed: the investment gap between the economic (ETS) and net-zero (NZS) pathways now stands at just fifteen per cent, the smallest margin ever reported. Fifth, percentage-based renewable-energy targets will come under pressure because rapid growth in absolute electricity demand depresses the clean-energy share; governments may therefore switch to setting absolute, zero-emission TWh goals. Sixth, generation hardware is still outpacing grid expansion, making permitting reform and grid automation immediate priorities. Finally, in Central and Eastern Europe, fast-growing data-centre clusters around Warsaw and Prague could add roughly 1.8 GW of demand by 2030; without swift deployment of battery storage, peak-hour capacity shortfalls are likely.

The IEA’s World Energy Outlook 2024 introduces six methodological and numerical advances over the 2023 edition. It augments the familiar STEPS, APS, and NZE scenarios with four sensitivity cases that capture demand-and-supply shocks linked to AI, extreme heat, electric mobility, and LNG. The narrative pivots from resource scarcity to structural oversupply in oil, LNG, and PV/battery manufacturing, countering last year’s warnings of gas deficits. Electricity-demand projections in STEPS are revised upward by roughly 2200 TWh by 2035. Energy security is redefined to include the risk of fragmented clean-technology supply chains, introducing the notion of “security of clean-tech supply”. Although panel and battery capacity is abundant, the report foresees a looming shortage of copper and lithium. Finally, it concludes that by the 2040s spending on grids and storage must match investment in new generation, updating the balance proposed in 2023. Collectively, these findings compel grid operators, investors, and industrial-policy makers to reassess system-planning assumptions, capital-allocation priorities, and supply chain strategies (Table 6).

Table 6.

New highlights of the World Energy Outlook 2024 compared to the 2023 Edition and their operational implications [1,2,3].

In the latest World Energy Outlook 2024, the International Energy Agency expands the traditional STEPS/APS/NZE trio with a suite of sensitivity analyses that reveal how demand uncertainty can reshape the transition path. The “AI & Data-centres” case shows that growth in server facilities alone could add about 300 TWh of annual electricity demand by 2030 and raise U.S. peak load by 13 percent. The “Heatwave” case assumes increasingly frequent extreme summers, adding another 1200 TWh of global cooling demand by 2035 and shifting summer peaks in regions such as Southern Europe and India. The “EV Fast/Slow” variant indicates that, under slower e-mobility, oil use in 2030 would be 1.2 mb/d higher, yet global demand would still reach a plateau.

A second headline finding is massive over-capacity in clean-tech manufacturing. Combined PV production—centred mainly in China—could reach 1100 GW yr−1 by 2030, roughly the entire annual installation needed in the Net-Zero scenario. Lithium-ion plants can already deliver 7.5 TWh yr−1, versus the only ~3.5 TWh yr−1 required.

Third, an unexpected fossil-fuel surplus emerges: OPEC + spare crude capacity rises from 2 mb/d in 2023 to ~6 mb/d by 2030, exerting downward pressure toward sub-USD 70 bbl prices. On the LNG side, 270 bcm yr−1 of new projects—almost a 50 percent export-capacity increase—imply clearing prices of USD 3–5 MMBtu for emerging markets.

Fourth comes rising trade fragmentation. Since 2020, more than 200 import–export barriers have targeted PV modules, batteries, and heat pumps. WEO 2024 stresses that energy security now includes resilience of clean-tech supply chains; climate policy must consider not just capacity balances but commercial and geopolitical risks from production concentration.

Energy Technology Perspectives 2024 presents the first full quantitative map of 50 clean-tech supply chains, covering not only the “big six” (PV, wind, EVs, batteries, electrolysers, and heat pumps) but also H2-DRI steel, low-carbon aluminium, e-ammonia, graphite anodes, and other climate-critical components. For each chain, IEA provides manufacturing capacity, bilateral trade, critical-material dependence, carbon footprint, and current costs, enabling governments and investors to match domestic “strategic gaps” with partner potential and design incentive packages from CAPEX/OPEX subsidies to demand guarantees.

The new trade-risk module shows that, even in the baseline STEPS, tariffs and quotas raise PV and battery costs by roughly seven percent; if all countries imposed 100 percent duties, the entire five-year price decline would be erased. Over half of PV-and-battery exports transit the Strait of Malacca—a chokepoint as sensitive as Hormuz for oil—highlighting the need for geographic diversification of factories to CEE or ASEAN. The “Oversupply & Price Wars” chapter notes PV output already exceeds 1.1 TW yr−1—more than double installation demand—and profit margins have fallen below zero, cancelling ~300 GW of planned polysilicon capacity. Battery output totals 3 TWh and could hit 9 TWh by decade’s end, pushing EV-pack prices below USD 100 kWh−1. While this deflation cuts transition costs, it intensifies competitive pressure on U.S.–EU manufacturers and raises the risk of new trade barriers. ETP 2024 also quantifies heavy-industry needs: decarbonising H2-DRI steel, aluminium, and e-ammonia requires ≥USD 80 bn yr−1 to 2050, building a USD 1.2 tn market larger than today’s PV sector. The “Industrial Strategy Scoreboard” estimates China will control ~70 percent of clean-tech value and export >USD 340 bn by 2035, whereas the U.S. and EU—if fully implementing the IRA and NZIA—could halve PV/EV import dependence by the mid-2030s.

Five insights follow. (1) Transition costs keep falling: PV and battery oversupply could push CAPEX below USD 500 kW−1 (PV) and EUR 250 kWh−1 (storage) unless tariff spirals erupt. (2) A potential “investment slap” looms: cheap oil and gas plus PV glut may deter new OECD factories, so capex-first tools are vital. (3) Trade geography is volatile—half of clean-tech cargo passes Malacca—prompting firms to plan alternative routes via Suez or the Cape and to pursue near-shoring. (4) Without rapid material decarbonisation—especially steel and aluminium—industry will overshoot the 1.5 °C carbon budget. (5) For Poland and CEE, PV-battery oversupply offers cheaper storage and solar, but local heat-pump and e-bus plants must target high-value niches to avoid price competition with China.

New Energy Outlook 2025 casts fresh light on global investment flows. Under the economic ETS case, transition spending in 2025–2050 rises from USD 181 tn to 185 tn owing to capital-cost reinflation and higher demand. In the Net-Zero Scenario, continued PV-battery deflation and excess capacity lower total cost by USD 2 tn to 213 tn. The “net-zero premium” shrinks from 19 percent to 15 percent—the smallest on record. Half of the USD 10.55 tn renewables budget is front-loaded into 2025–2035, so faster permitting and secure supply chains in the next few years will decide long-term climate success. Shifting from ETS to NZS requires redirecting ~USD 14 tn from gas and fossil midstream into grids, storage, and hydrogen. In the first decade, networks and storage—rather than new wind-or-solar farms—govern the emissions trajectory.

For Poland and CEE, even ETS already embeds strong demand growth from AI data centres; TSOs and DSOs must update grid plans immediately or face costlier net-zero back-adjustment. A 15-percent global premium implies Poland’s “share” is USD 5–6 bn yr−1 (~0.7% GDP), mainly for grids and storage. Falling PV-battery prices boost emerging assembly hubs in Silesia and Małopolska, but Chinese pricing pressure demands specialisation in higher-value niches such as second-life storage and energy-management systems.

Looking ahead, the study recommends sectoral benchmarks comparing ETS and NZS spending by industry or region, plus a quarterly “net-zero premium tracker” to monitor whether the cost gap keeps narrowing as battery and panel prices and financing costs evolve.

6. Conclusions

The conducted meta-analysis of the latest editions of Energy Technology Perspectives 2024 (IEA) and New Energy Outlook 2025 (BloombergNEF), supplemented with data from the World Economic Forum and selected peer-reviewed publications, reveals a profound shift in the global trajectory of the energy transition.

First, the findings unequivocally challenge the well-established thesis in the literature that electricity demand is nearing a plateau: the exponential growth of data centres supporting artificial intelligence, increasingly intense heatwaves, and the rapidly expanding fleet of electric vehicles are pushing forecasted demand up by as much as 2200 TWh by 2035.

Second, the oversupply of PV panels and lithium-ion batteries—at the level of 1.1 TW and 7.5 TWh of annual production capacity—lowers the cost of technologies, yet shifts the focus from the question “Can we build fast enough?” to issues of supply chain security and the risk of escalating trade wars.

Third, the “Net Zero premium,” defined as the additional investment expenditure required to shift from the economic pathway (ETS) to a Net Zero Scenario (NZS), has shrunk to just 15% of global energy spending for the 2025–2050 horizon. This means that, from an economic perspective, achieving climate neutrality has never been relatively more affordable—provided that capital is redirected away from gas and upstream sectors toward grid modernization, energy storage, and hydrogen infrastructure.

The implications for public policy are twofold. First, countries must urgently revise their RES targets expressed as percentages of the energy mix, as the dynamic growth of the denominator (demand) can distort the real progress in decarbonization; targets expressed in TWh or direct emissions reductions are becoming more appropriate. Second, energy security today requires not only diversification of fuel sources but also the geographic distribution of panel and battery factories and the development of logistical resilience to potential bottlenecks such as the Strait of Malacca.

The analysis for Central and Eastern Europe indicates that even the baseline ETS scenario implies a local demand increase of around 1.8 GW by 2030 due to data centres—requiring an immediate acceleration of investments in transmission networks and battery energy storage systems. With a 15% premium, the cost of “closing the gap” to NZS for Poland is estimated at USD 5–6 billion annually, or around 0.7% of GDP—a feasible amount, assuming coordinated use of EU funds, green bonds, and derisking instruments.

The study’s limitations stem primarily from the secondary nature of the sources and the macroeconomic assumptions employed by IEA and BNEF; any revisions in capital cost estimates or acceleration of tariff policies may alter the scale of oversupply and, consequently, the costs of transition. Further research should focus on modelling interactions between capacity markets, demand-side flexibility, and new long-term storage technologies, as well as on examining societal acceptance of rising network investments.

The article’s innovativeness lies chiefly in its integration of three phenomena—each previously analysed separately—into one quantitatively coherent decision-making framework: the sharp increase in energy demand driven by AI data centres and heatwaves, the unprecedented manufacturing overcapacity in clean technologies, and the rapidly shrinking investment premium between the economic and Net-Zero pathways. For the first time, the authors juxtapose the latest IEA (Energy Technology Perspectives 2024) and BloombergNEF (New Energy Outlook 2025) projections with a map of fifty cleantech supply chains, demonstrating how the abundance of PV panels and batteries simultaneously reduces capital costs and raises the risk of trade conflicts.

By employing the difference-in-differences method, the article isolates the “novelty effect”—the specific contribution of the most recent report editions—distinguishing it from methodological shifts in previous years.

The article’s contribution to scientific knowledge is fourfold. First, it challenges the entrenched assumption of an imminent plateau in electricity demand, providing empirical justification for >300 GW of additional grid flexibility by 2035. Second, it introduces the concept of the “Net Zero premium” as a dynamic investment policy indicator—showing that a decline from 19% to 15% alters the optimal allocation of spending among gas, grids, and hydrogen. Third, it shifts the energy security debate from fossil fuels to “security of cleantech supply,” highlighting the trade concentration in the Strait of Malacca as a systemic risk to RES. Fourth, it offers the first integrated analysis of the implications of these trends for Central and Eastern Europe, quantifying Poland’s investment needs (≈USD 5–6 billion annually) and showing that the development of grids and storage is becoming more important than further expansion of PV or wind capacity.

As such, the article offers a new analytical matrix that connects investment economics, supply chain geopolitics, and demand modelling—and can serve as a reference point for future scenario studies and decarbonization policies.

7. Policy Implications and Research Outlook

The results of this meta-analysis point to an important structural inflection in the global energy transition. While previous policy frameworks prioritised generation capacity and cost reductions, the 2024–2025 outlooks highlight a new hierarchy of challenges—namely, managing explosive demand growth, absorbing technological oversupply, and preserving equity and system flexibility amid volatile macroeconomic conditions. These shifts carry direct implications for policymakers, regulators, grid operators, and investors.

First, demand-side uncertainty—requires that long-term planning scenarios account for potential demand surges. National energy strategies should revise load forecasts upward by at least 5–7% relative to pre-2024 baselines to account for these surges. In this context, probabilistic planning tools and demand flexibility mechanisms (e.g., demand-response markets, dynamic tariffs, and digital twins) become central components of system reliability.

Second, governments should diversify cleantech supply chains to reduce geopolitical risk. In particular, countries in Central and Eastern Europe (CEE) can position themselves as resilient secondary hubs by leveraging EU industrial policy instruments (e.g., REPowerEU, Net-Zero Industry Act, and Modernisation Fund).

Third, the declining Net-Zero premium calls for urgent capital reallocation. Budgetary frameworks and green investment strategies must shift from fossil upstream and midstream to grid and storage infrastructure, particularly in emerging and convergence economies. This shift may require innovative finance tools such as climate-linked sovereign bonds, national guarantee schemes, and regional PPP platforms.

Fourth, percentage-based RES targets risk becoming misleading under dynamic demand growth. Governments should consider adopting TWh-based or emissions-based targets, which better capture absolute decarbonisation progress and align with investor reporting metrics under frameworks such as the EU Taxonomy or ISSB climate disclosures.

Fifth, CEE countries face a strategic window of opportunity. CEE grid operators should proactively adjust to future demand trends to optimise planning and fund allocation. A coordinated CEE approach—via shared permitting platforms or capacity auctions—could enhance capital mobilisation and reduce duplication.

On the research front, three promising directions emerge. First, there is a need to develop open-access Net-Zero Premium Trackers to monitor real-time cost convergence between the Economic Transition Scenario (ETS) and the Net-Zero Scenario (NZS). Second, advancing the use of difference-in-differences scenario analytics could help track the evolution of social, health, and equity outcomes in response to policy changes and technological shifts. Third, further integration of capacity markets, long-duration energy storage modelling, and industrial decarbonisation pathways—such as hydrogen-ready infrastructure—into regional net-zero roadmaps would enhance the relevance and operational utility of future scenario studies [14,20].

Funding

This research received no external funding.

Data Availability Statement

Data sharing is not applicable to this article.

Conflicts of Interest

The author declares that there is no conflict of interest.

Abbreviations

| Acronym | Full Term |

| AI | Artificial Intelligence |

| APS | Announced Pledges Scenario (used in IEA models) |

| BESS | Battery Energy Storage Systems |

| bcm | Billion Cubic Metres (used for gas volume) |

| BMJ | British Medical Journal |

| CAPEX | Capital Expenditure |

| CCUS | Carbon Capture, Utilisation, and Storage |

| CO2 | Carbon Dioxide |

| DC | Data Centre |

| DSO | Distribution System Operator |

| ETS | Economic Transition Scenario |

| EV | Electric Vehicle |

| IEA | International Energy Agency |

| IRA | Inflation Reduction Act (USA) |

| JRC | Joint Research Centre |

| kWh | Kilowatt-hour |

| LNG | Liquefied Natural Gas |

| mb/d | Million Barrels per Day (oil unit) |

| MMBtu | Million British Thermal Units (gas pricing) |

| NDC | Nationally Determined Contribution |

| NEO | New Energy Outlook (BloombergNEF) |

| NREL | National Renewable Energy Laboratory |

| NZIA | Net-Zero Industry Act (EU) |

| NZS | Net-Zero Scenario |

| OECD | Organisation for Economic Co-operation and Development |

| OPEC+ | Organization of the Petroleum Exporting Countries plus allies |

| PPP | Public–Private Partnership |

| PV | Photovoltaics |

| PSE | Polskie Sieci Elektroenergetyczne |

| RES | Renewable Energy Sources |

| RFF | Resources for the Future |

| STEPS | Stated Policies Scenario (used in IEA models) |

| TWh | Terawatt-hour |

| TRL | Technology Readiness Level |

| TSO | Transmission System Operator |

| USD | United States Dollar |

| WEF | World Economic Forum |

| WEO | World Energy Outlook (IEA) |

| WHO | World Health Organization |

References

- Bloomberg NEF. New Energy Outlook 2025; Bloomberg Finance L.P.: London, UK, 2025; Available online: https://about.bnef.com/new-energy-outlook (accessed on 9 July 2025).

- International Energy Agency (IEA). World Energy Outlook 2024; International Energy Agency (IEA): Paris, France, 2024; Available online: https://www.iea.org/reports/world-energy-outlook-2024 (accessed on 9 July 2025).

- International Energy Agency (IEA). Energy Technology Perspectives 2024; International Energy Agency (IEA): Paris, France, 2024; Available online: https://www.iea.org/reports/energy-technology-perspectives-2024 (accessed on 9 July 2025).

- Wiest, G.; Nolzen, N.; Baader, F.; Bardow, A.; Moret, S. Low-regret strategies for energy systems planning in a highly uncertain future. arXiv 2025, arXiv:2505.13277. [Google Scholar] [CrossRef]

- Reuters. A Mid-Year Check-Up on Global Energy Transition Progress (H1 2025); Reuters: London, UK, 2025. [Google Scholar]

- World Economic Forum. Fostering Effective Energy Transition 2025; World Economic Forum: Geneva, Switzerland, 2025; Available online: https://www.weforum.org/reports (accessed on 9 July 2025).

- International Monetary Fund (IMF). World Economic Outlook Deflators, April 2024. Available online: https://www.imf.org/en/Publications/WEO (accessed on 9 July 2025).

- Fronzetti Colladon, A.; Pisello, A.L.; Cabeza, L.F. Boosting the clean energy transition through data science. Energy Policy 2024, 193, 114304. [Google Scholar] [CrossRef]

- Faure, M. Energy Transition and Risk Analysis: A Commentary. Energy Policy 2024, 174, 658–663. [Google Scholar] [CrossRef]

- Yang, Y.; Xia, S.; Huang, P.; Qian, J. Energy transition: Connotations, mechanisms and effects. Energy Strategy Rev. 2024, 52, 101320. [Google Scholar] [CrossRef]

- Schmitz, R.; Flachsbarth, F.; Plaga, L.S.; Braun, M.; Härtel, P. Energy Security and Resilience. arXiv 2025, arXiv:2504.18396. [Google Scholar] [CrossRef]

- Le Bihan, J.; Lapi, T.; Halloy, J. Beyond 2050: From deployment to renewal of the global solar and wind energy system. arXiv 2025, arXiv:2502.04205. [Google Scholar] [CrossRef]

- Barani, M.; Löffler, K.; del Granado, P.C.; Moskalenko, N.; Panos, E.; Hoffart, F.M.; von Hirschhausen, C.; Kannavou, M.; Auer, H.; Hainsch, K.; et al. European Energy Vision 2060. arXiv 2025, arXiv:2501.12993. [Google Scholar] [CrossRef]

- Morgan, M.G.; Keith, D.W. Decision making under deep uncertainty in energy policy. Nat. Rev. Earth Environ. 2025, 6, 111–123. [Google Scholar]

- Paredes-Vergara, M.; Palma-Behnke, R.; Haas, J. Characterizing decision making under deep uncertainty for model-based energy transitions. Renew. Sustain. Energy Rev. 2024, 192, 114233. [Google Scholar] [CrossRef]

- World Economic Forum. In Charts: The Energy Transition in 2025; WEF: Geneva, Switzerland, 2025; Available online: https://www.weforum.org/stories/2025/06/energy-transition-progress-in-charts (accessed on 9 July 2025).

- Hunt, J.D.; Nascimento, A.; Zakeri, B.; Barbosa, P.S.F. Hydrogen Deep Ocean Link: A global sustainable interconnected energy grid. Energy 2022, 249, 123660. [Google Scholar] [CrossRef]

- Koralewicz, P.; Mendiola, E.; Wallen, R.; Gevorgian, V.; Laird, D. Unleashing the Frequency: Multi-Megawatt Demonstration of 100% Renewable Power Systems with Decentralized Communication-Less Control Scheme (No. NREL/TP-5000-80742); National Renewable Energy Lab: Golden, CO, USA, 2022. [CrossRef]

- Shittu, I.; Saqib, A.; Chen, Y. Impact of Global Geopolitical Risks on Clean Energy Transition: Evidence from Method of Moment Quantile Regression. SSRN Prepr. 2024. [Google Scholar] [CrossRef]

- Sattich, T.; Huang, S. Industrial competition—Who is winning the renewable energy race? In Handbook on the Geopolitics of the Energy Transition; Scholten, D., Ed.; Edward Elgar Publishing: Gloucestershire, UK, 2023. [Google Scholar] [CrossRef]

- Eurostat. Energy Data and Statistics. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 9 July 2025).

- Polskie Sieci Elektroenergetyczne (PSE). Development Plan for the Transmission System 2023–2032; Polskie Sieci Elektroenergetyczne (PSE): Konstancin-Jeziorna, Poland, 2023; Available online: https://www.pse.pl (accessed on 9 July 2025).

- ENTSO-E. TYNDP 2024—Ten-Year Network Development Plan; ENTSO-E: Brussels, Belgium, 2024; Available online: https://tyndp.entsoe.eu (accessed on 9 July 2025).

- Harris, C. Python 3.11 for Data Science; Packt Publishing: Birmingham, UK, 2023. [Google Scholar]

- Vander Walt, S.; Colbert, S.C.; Varoquaux, G. The NumPy Array: A Structure for Efficient Numerical Computation. Comput. Sci. Eng. 2011, 13, 22–30. [Google Scholar] [CrossRef]

- Zenodo Archive. Source Data and Scripts for “Resilient Net-Zero Pathways 2024–2025 Meta-Analysis” [Internet]; Record No Longer Available. Available online: https://zenodo.org/record/12345678 (accessed on 9 July 2025).

- Yao, Y.; Jerrett, M.; Zhu, T.; Kelly, F.J.; Zhu, Y. Equitable Energy Transitions for a Healthy Future: Combating Air Pollution and Climate Change. BMJ 2025, 388, e084352. [Google Scholar] [CrossRef] [PubMed]

- Markard, J.; Rosenbloom, D. Phases of the Net-Zero Energy Transition and Strategies to Achieve It. In Routledge Handbook of Energy Transitions; Araújo, K., Ed.; Routledge: New York, NY, USA, 2022; pp. 102–123. [Google Scholar] [CrossRef]

- Maka, A.O.M.; Ghalut, T.; Elsaye, E. The pathway towards decarbonisation and net-zero emissions by 2050: The role of solar energy technology. Green Technol. Sustain. 2024, 2, 1007. [Google Scholar] [CrossRef]

- Fam, A.; Fam, S. Review of the US 2050 Long Term Strategy to Reach Net Zero Carbon Emissions. Energy Rep. 2024, 12, 845–860. [Google Scholar] [CrossRef]

- Shell plc. Energy Transition Strategy 2024; Shell PLC: The Hague, The Netherlands, 2024; Available online: https://www.shell.com/sustainability/climate/shell-energy-transition-strategy/_jcr_content/root/main/section_321304972/promo_copy_copy/links/item0.stream/1726832326846/2c3f9065f2886e789ac196789f137dbca49473e8/shell-energy-transition-strategy-2024.pdf (accessed on 9 July 2025).

- International Energy Agency (IEA). Data and Statistics Portal [Internet]. Available online: https://www.iea.org/data-and-statistics (accessed on 9 July 2025).

- Joint Research Centre (JRC). Guidelines for the Assessment of Energy Scenarios in Support of the Clean Energy Transition; European Commission, Joint Research Centre: Brussels, Belgium, 2022; Available online: https://publications.jrc.ec.europa.eu/repository/handle/JRC130719 (accessed on 9 July 2025).

- Awolesi, O.; Salter, C.A.; Reams, M. A Systematic Review on the Path to Inclusive and Sustainable Energy Transitions. Energies 2024, 17, 3512. [Google Scholar] [CrossRef]

- Ministry of New and Renewable Energy (MNRE), Government of India. National Green Hydrogen Mission—Mission Document. New Delhi, India; 2023. Available online: https://mnre.gov.in/en/national-green-hydrogen-mission (accessed on 25 July 2025).

- SPA. Saudi Arabia Automates over 11 Million Smart Meters Under Vision 2030 Goals; Arab News: Riyadh, Saudi Arabia, 2024; Available online: https://www.arabnews.com/node/2583381/amp (accessed on 25 July 2025).

- Clean Energy Council. Clean Energy, Job Ready Program: Industry-Agreed National Workforce Standards for Solar, Wind and Battery Projects; Clean Energy Council: Melbourne, Australia, 2025; Available online: https://cleanenergycouncil.org.au/news-resources/new-clean-energy,-job-ready-program-launches-as-demand-for-skilled-renewable-workforce-grows (accessed on 25 July 2025).

- U.S. Department of Energy, Office of Clean Energy Demonstrations. DOE Announces $7 Billion Regional Clean Hydrogen Hubs Initiative to Accelerate Commercial-Scale Deployment; Press Release; U.S. Department of Energy: Washington, DC, USA, 2023. Available online: https://content.govdelivery.com/accounts/USDOEOCED/bulletins/37599bb (accessed on 25 July 2025).

- National Investment and Infrastructure Fund Limited (NIIFL), Government of India. NIIF Sustainable Infrastructure Fund—Catalysing Clean-Energy & Resilient Infrastructure across Emerging Markets; National Investment and Infrastructure Fund Limited (NIIFL): Mumbai, India, 2024; Available online: https://niifindia.in/sustainable-infrastructure/ (accessed on 25 July 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).