EU Energy Markets and Renewable Energy Sources—Are We Waiting for a Crisis?

Abstract

1. Introduction

2. Energy Markets

3. Energy Market Participants

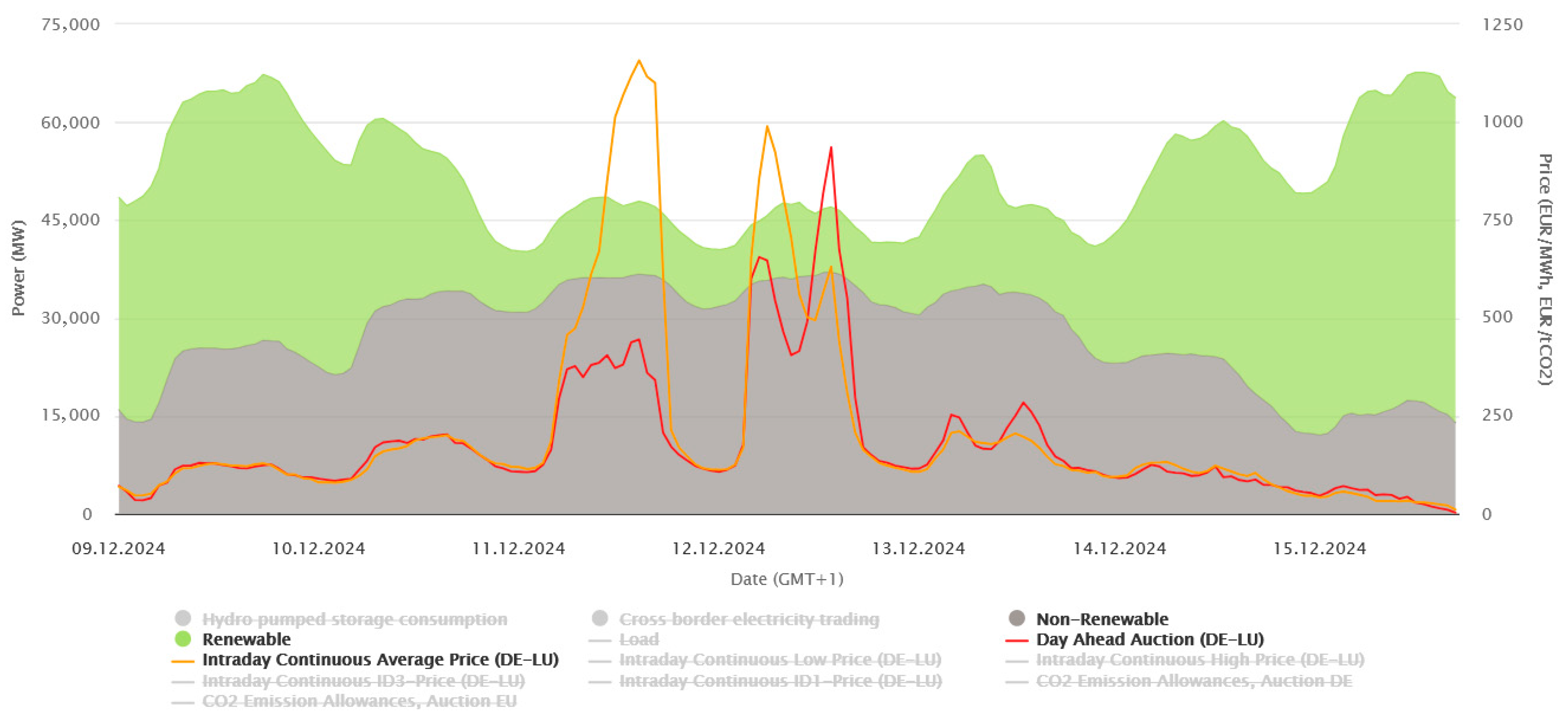

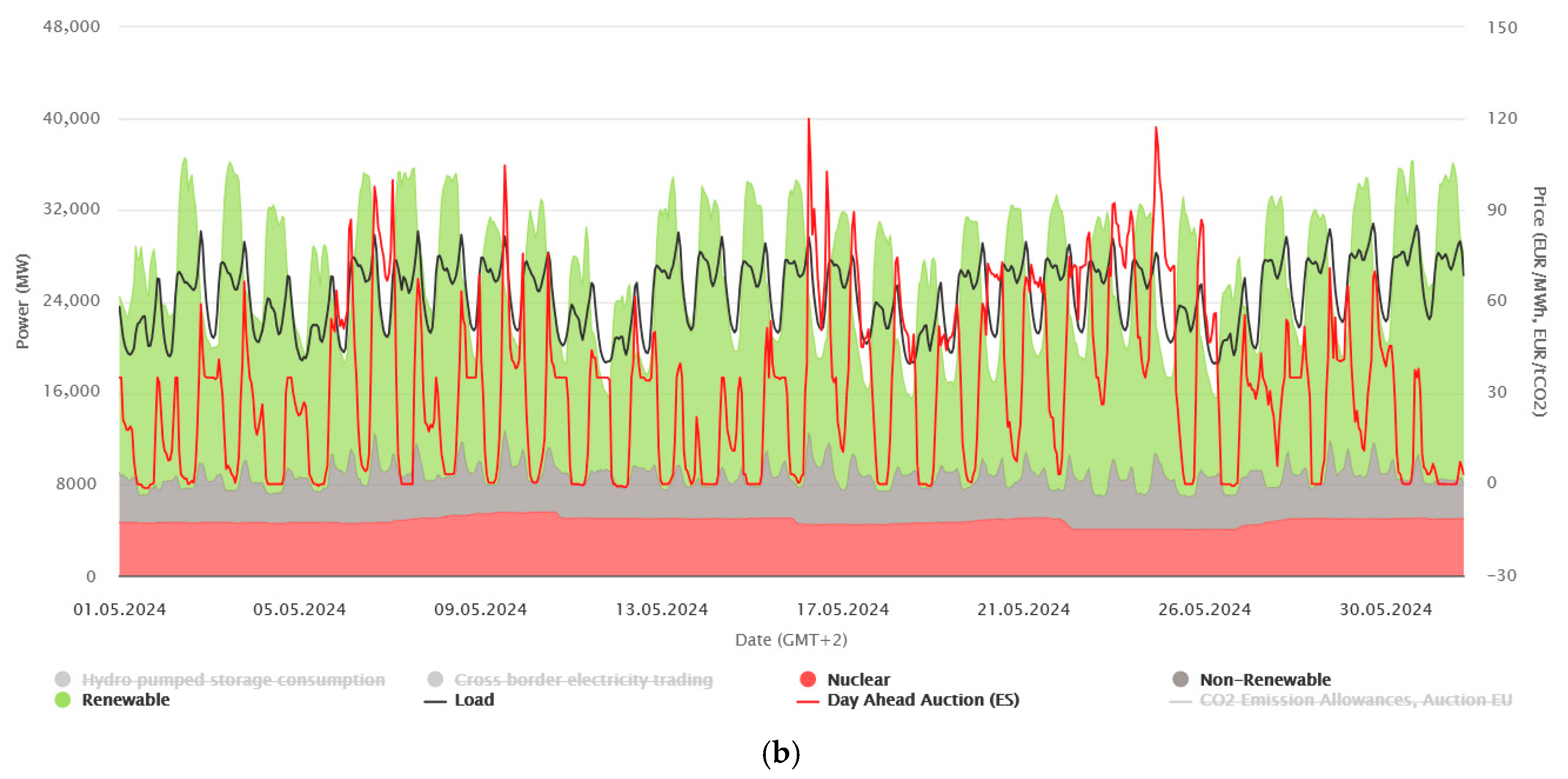

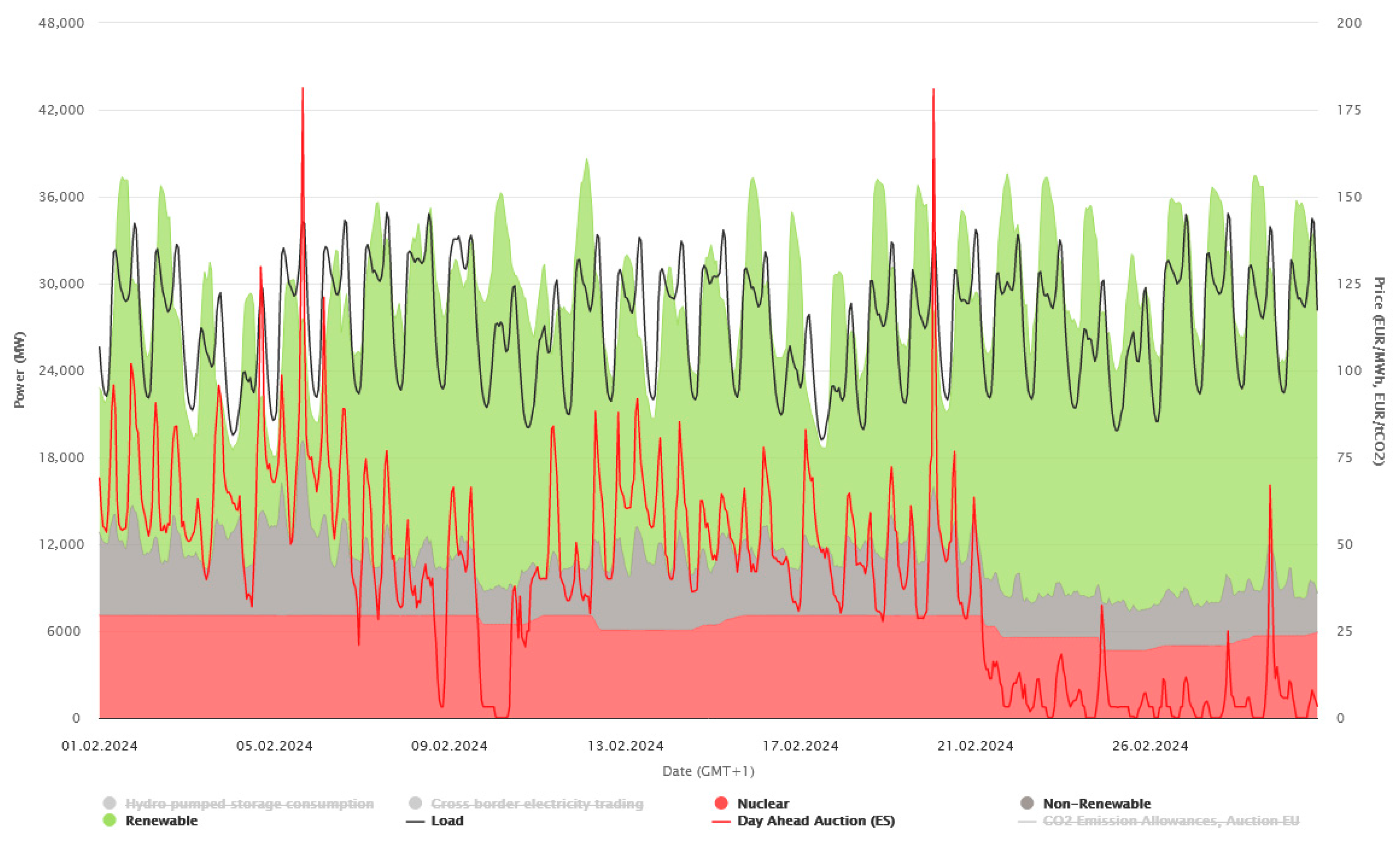

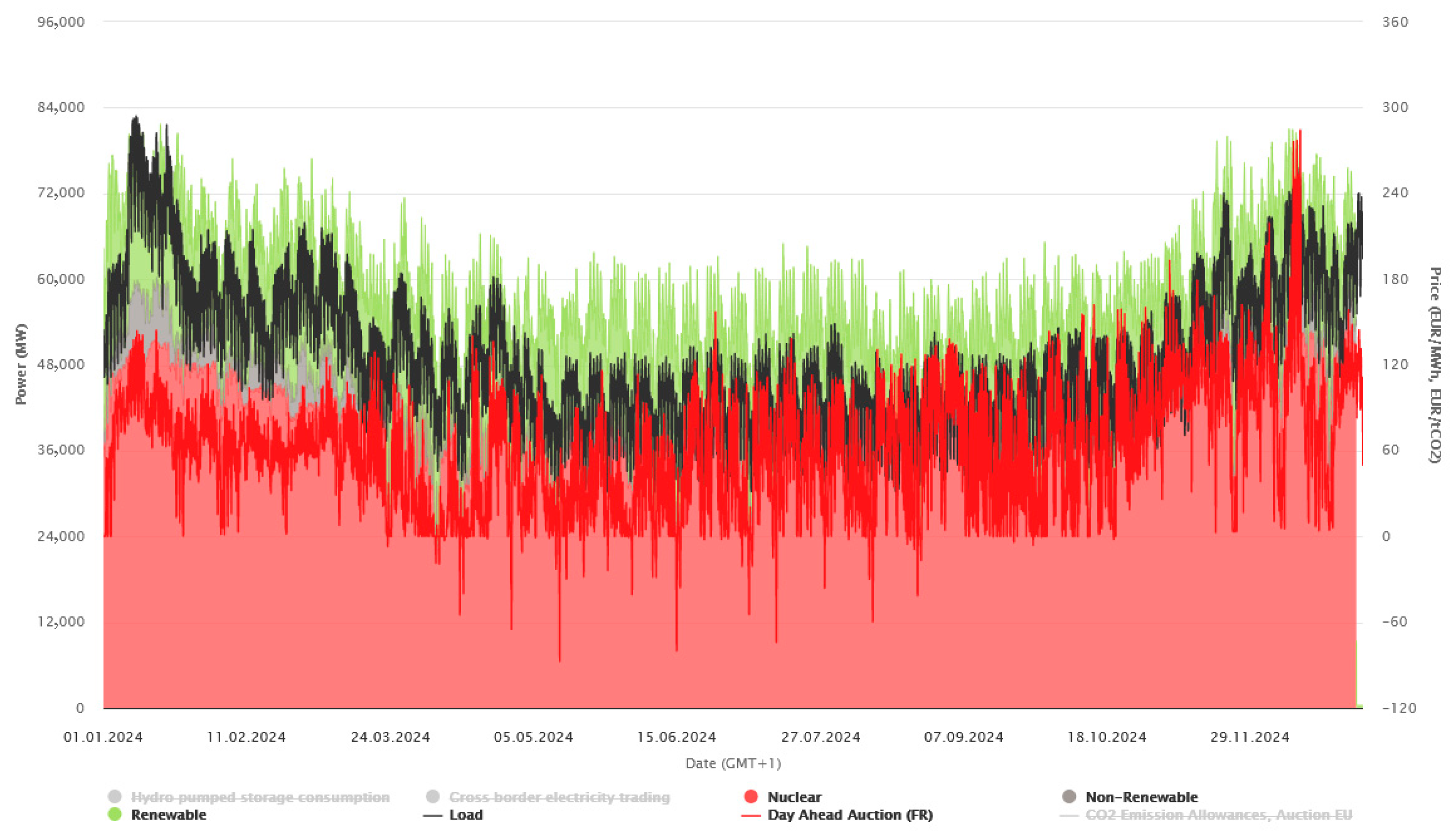

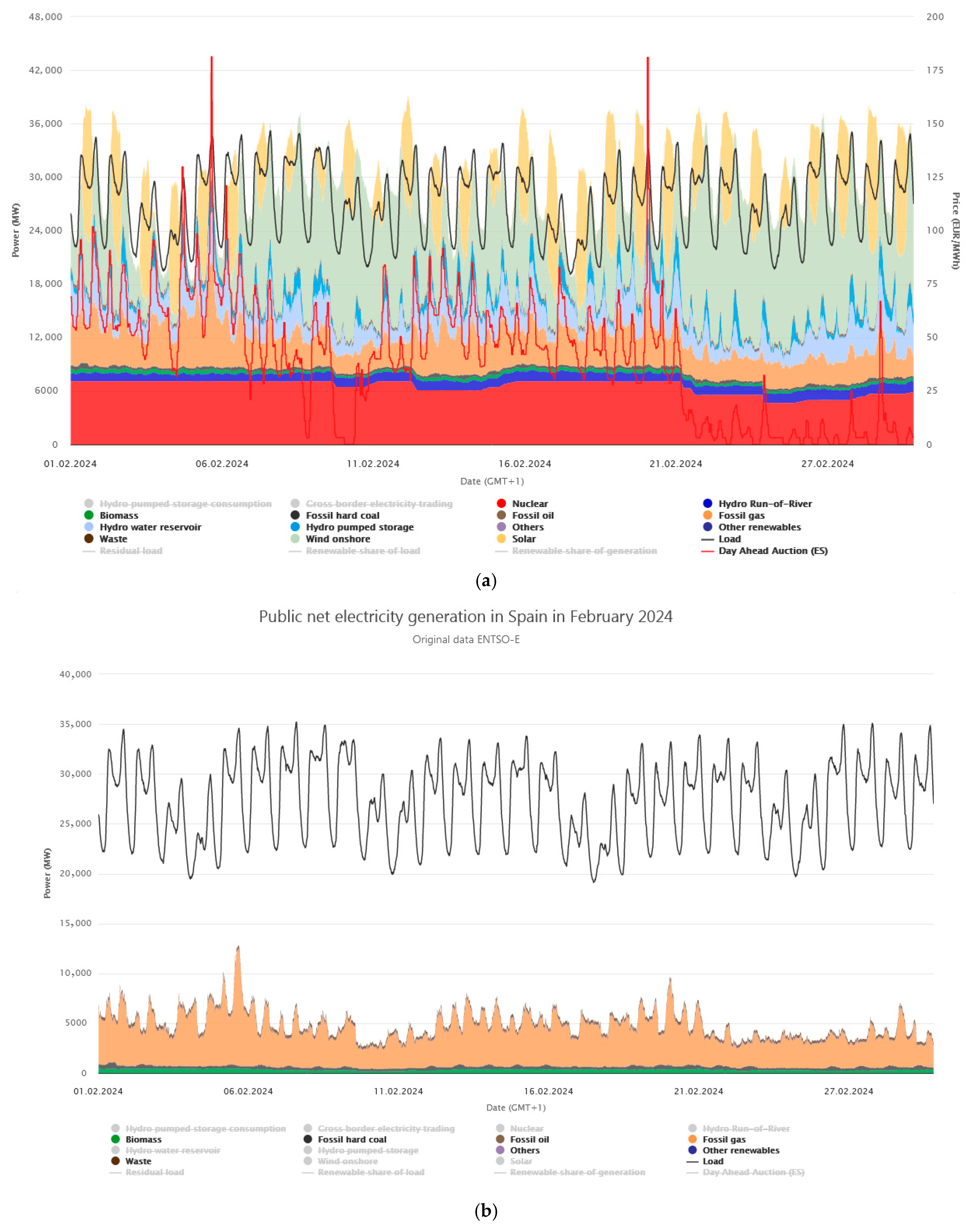

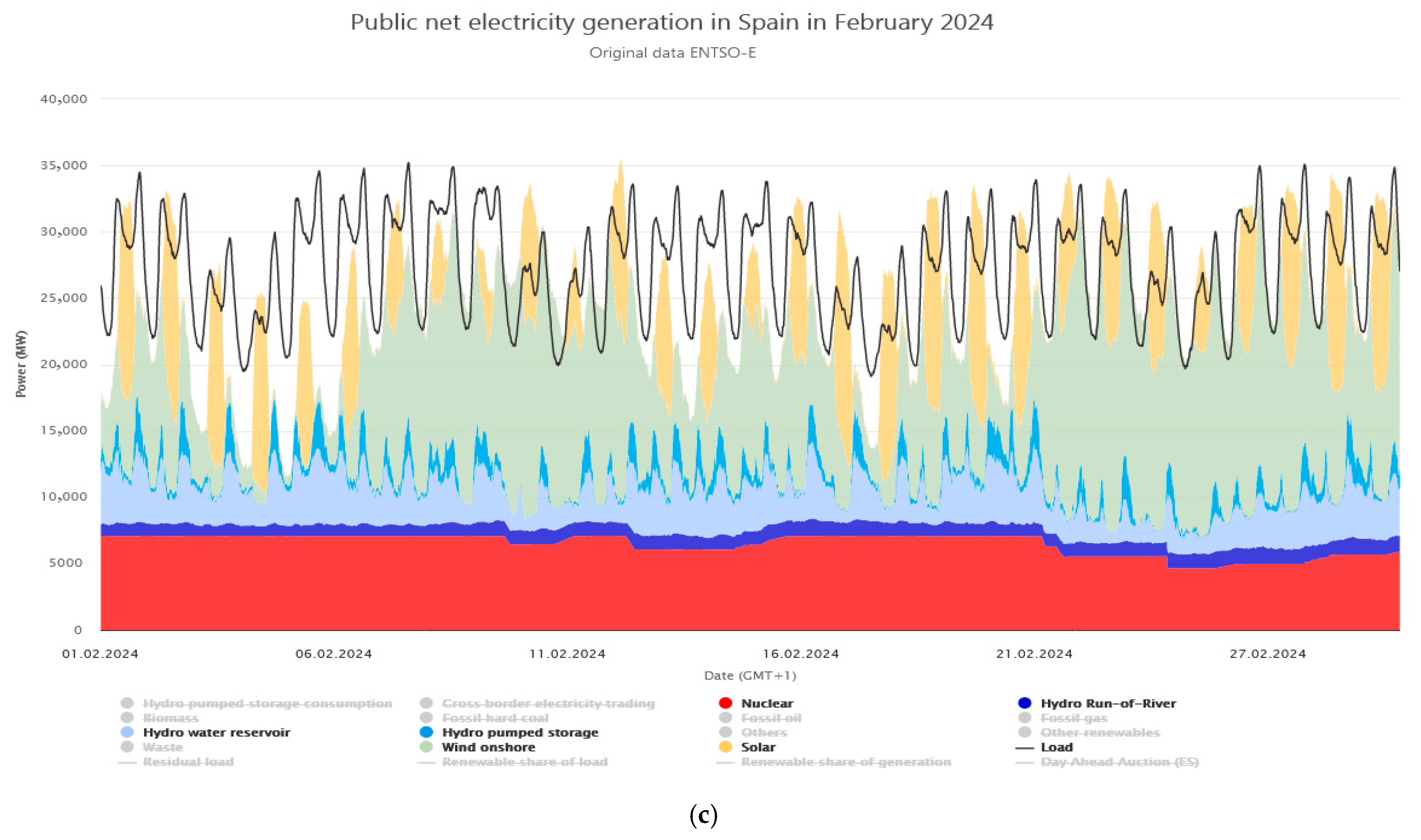

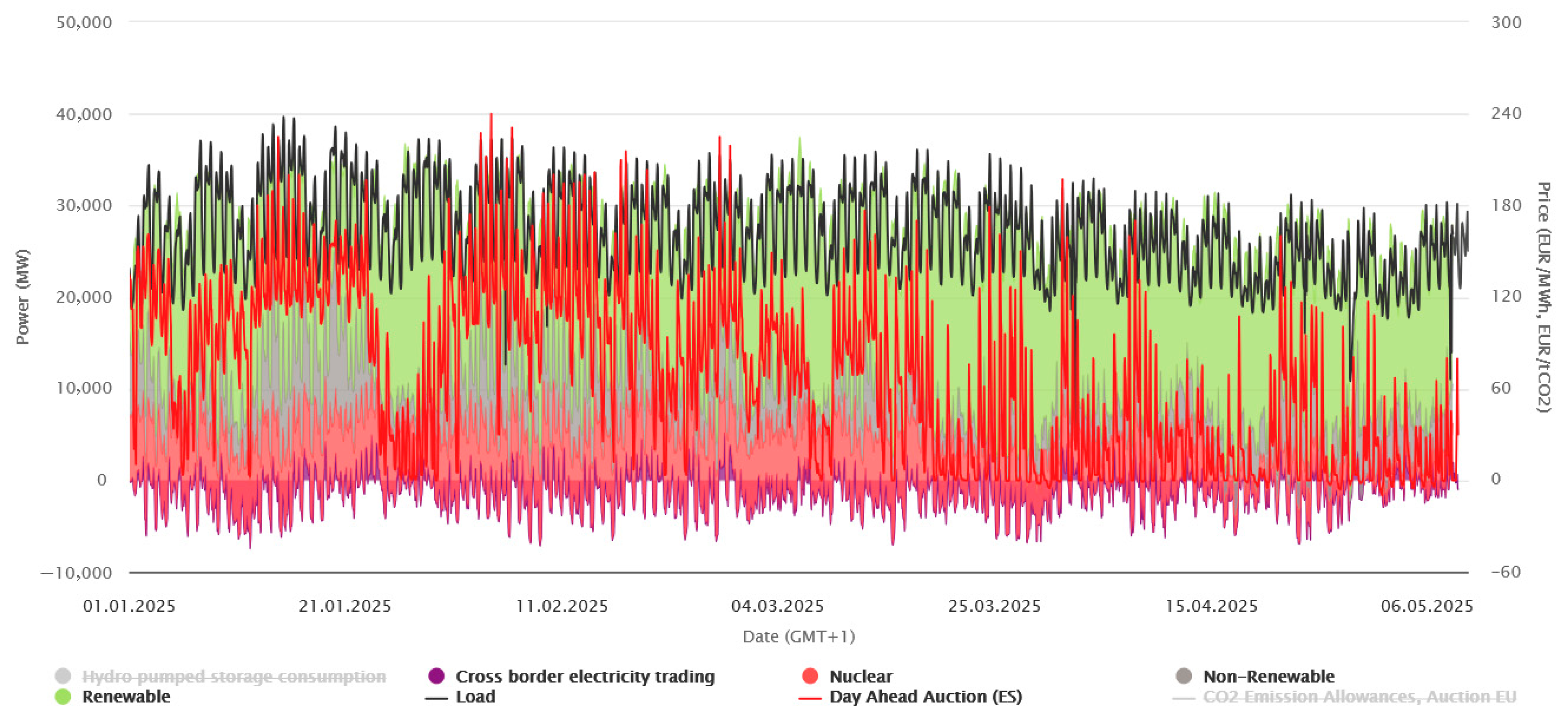

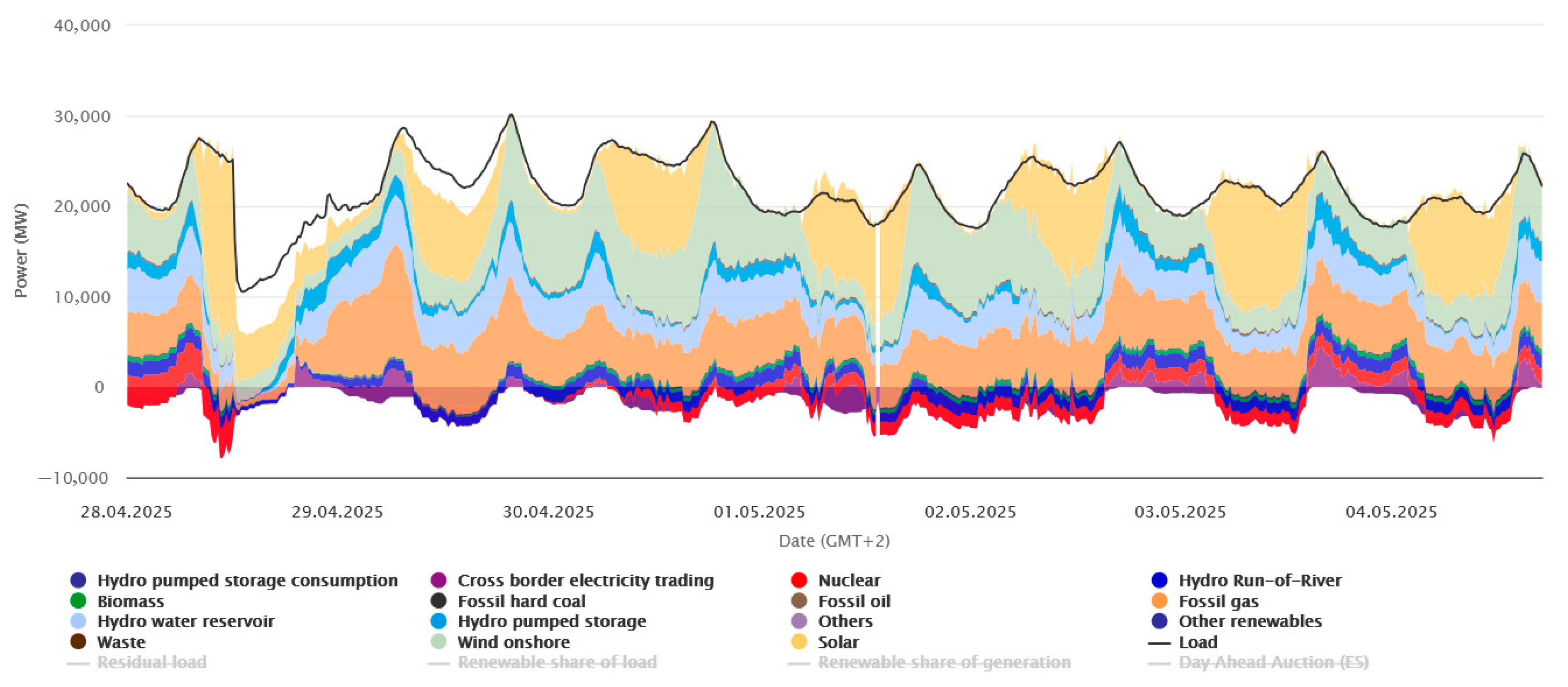

4. Price Level Situation in Spain: A Short Description

- (1)

- The duration of the incident is ignored.

- (2)

- A low price benefits buyers but could pose a risk to the financial stability of electricity producers.

5. The Situation in Spain—Towards an Analysis

- Electricity is produced in combination with another process, and this is what determines the dynamics.

- Gas power plants operate using the Rankine cycle (gas–steam units or even fired with gas instead of coal), and the limitations of the steam element determine the dynamics of the source.

- Current gas prices are so low that their cost situation becomes comparable to nuclear power plants, PV, or wind farms.

6. Structure of the Costs

- The source declares a price of 0 for energy and sells the entire production; makes money if the price of the most expensive selected supplier is higher than its costs, and records losses when it is lower.

- The source declares a “satisfactory” price for energy, this price is higher than the most expensive selected supplier; it does not sell anything and is forced to stop generating, so it may incur additional costs of regulation and shutdown.

- The source declares a “satisfactory” price and sells all production (the most expensive supplier was more expensive); it makes money, but competitors also make money.

- The source declares a “satisfactory” price and sells part of the production; either it makes money or not (not only the price but also the sales volume counts); competitors make more money (they sell all production).

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Directive (EU) 2019/944. Available online: http://data.europa.eu/eli/dir/2019/944/oj (accessed on 8 May 2024).

- Regulation (EU) 2019/943 of the European Parliament and of the Council of 5 June 2019 on the internal market for electricity. Available online: http://data.europa.eu/eli/reg/2019/943/oj (accessed on 8 May 2024).

- Regulation (EU) 2019/941 of the European Parliament and of the Council of 5 June 2019 on risk-preparedness in the electricity sector and repealing Directive 2005/89/EC. Available online: http://data.europa.eu/eli/reg/2019/941/oj (accessed on 8 May 2024).

- Regulation (EU) 2019/942 of the European Parliament and of the Council of 5 June 2019 establishing a European Union Agency for the Cooperation of Energy Regulators. Available online: http://data.europa.eu/eli/reg/2019/942/oj (accessed on 8 May 2024).

- Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the promotion of the use of energy from renewable sources. Available online: http://data.europa.eu/eli/dir/2018/2001/oj (accessed on 8 May 2024).

- Szafranski, A. Instrumenty prawne regulacji cen energii elektrycznej. Forum Prawnicze 2023, 2, 3–20. [Google Scholar] [CrossRef]

- Hancher, L.; de Hauteclocque, A.; Huhta, K.; Sadowska, M. Capacity Mechanisms in the EU Energy Markets: Law, Policy, and Economics; Oxford University Press: Melbourne, Australia, 2022; p. 512. [Google Scholar]

- Zhang, G.; Zhong, H.; Tan, Z.; Cheng, T.; Xia, Q.; Kang, C. Texas electric power crisis of 2021 warns of a new blackout mechanism. CSEE J. Power Energy Syst. 2022, 8, 1–9. [Google Scholar] [CrossRef]

- Busby, J.W.; Baker, K.; Bazilian, M.D.; Gilbert, A.Q.; Grubert, E.; Rai, V.; Rhodes, J.D.; Shidore, S.; Smith, C.A.; Webber, M.E. Cascading risks: Understanding the 2021 winter blackout in Texas. Energy Res. Soc. Sci. 2021, 77, 102106. [Google Scholar] [CrossRef]

- Littlechild, S.; Kiesling, L. Hayek and the Texas blackout. Electr. J. 2021, 34, 106969. [Google Scholar] [CrossRef]

- Popik, T.; Humphreys, R. The 2021 Texas Blackouts: Causes, Consequences, and Cures. J. Crit. Infrastruct. Policy 2021, 2, 47–73. [Google Scholar] [CrossRef]

- Clark-Ginsberg, A.; DeSmet, D.; Rueda, I.A.; Hagen, R.; Hayduk, B. Disaster risk creation and cascading disasters within large technological systems: COVID-19 and the 2021 Texas blackouts. J. Contingencies Crisis Manag. 2021, 29, 445–449. [Google Scholar] [CrossRef] [PubMed]

- Wu, D.; Zheng, X.; Menati, A.; Smith, L.; Xia, B.; Xu, Y.; Singh, C.; Xie, L. How much demand flexibility could have spared texas from the 2021 outage? Adv. Appl. Energy 2022, 7, 100106. [Google Scholar] [CrossRef]

- Leng, A.X. The Analysis of Texas’ Rotating Blackout Incident and Its Enlightenment to the Reform of China Power Grid. Power Gener. Technol. 2021, 42, 151–159. [Google Scholar] [CrossRef]

- Oberg, K.; Srinivas, A.; Rahman, F.; Wang, Z.; Ranganathan, P. Strengthening Grid Resilience: Lessons from the Texas Power Blackout and Implications. In 2023 North American Power Symposium (NAPS); NAPS: Asheville, NC, USA, 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Prete, C.L.; Rosellon, J. What happened in Texas? Understanding the February 2021 blackouts and learning lessons to prepare the grid for extreme weather events: An introduction. Econ. Energy Environ. Policy 2023, 12, 2. [Google Scholar]

- Lee, C.C.; Maron, M.; Mostafavi, A. Community-scale big data reveals disparate impacts of the Texas winter storm of 2021 and its managed power outage. Humanit. Soc. Sci. Commun. 2022, 9, 335. [Google Scholar] [CrossRef]

- Flores, N.M.; McBrien, H.; Do, V.; Kiang, M.V.; Schlegelmilch, J.; Casey, J.A. The 2021 Texas Power Crisis: Distribution, duration, and disparities. J. Expo. Sci. Environ. Epidemiol. 2023, 33, 21–31. [Google Scholar] [CrossRef]

- Grineski, S.E.; Collins, T.W.; Chakraborty, J. “Cascading disasters and mental health inequities”: Winter Storm Uri, COVID-19 and post-traumatic stress in Texas. Soc. Sci. Med. 2022, 315, 115523. [Google Scholar] [CrossRef]

- Bomar, J. Keep Austin Safe: Studying Mutual Aid Organizing Following the 2021 Texas Energy Crisis. Undergraduate Research Scholars Program. 2022. Available online: https://hdl.handle.net/1969.1/196505 (accessed on 8 March 2025).

- Stenclik, D.; Bloom, A.; Cole, W.; Stephen, G.; Acevedo, A.F.; Gramlich, R.; Dent, C.; Schlag, N.; Milligan, M. Quantifying Risk in an Uncertain Future: The Evolution of Resource Adequacy. IEEE Power Energy Mag 2021, 19, 29–36. [Google Scholar] [CrossRef]

- Kalecki, M. Theory of Economic Dynamics: An Essay on Cyclical and Long Run Changes in Capitalist Economy; Allen and Unwin: London, UK, 1954. [Google Scholar]

- Kaldor, N. A classificatory note on the determinateness of equilibrium. Rev. Econ. Stud. 1934, 1, 122–136. [Google Scholar] [CrossRef]

- Mickens, R. Difference Equations: Theory and Applications; Chapman and Hall/CRC: Boca Raton, FL, USA, 1990. [Google Scholar]

- Pingle, M. Introducing Dynamic Analysis Using Malthus’s Principle of Population. J. Econ. Educ. 2003, 34, 3–20. [Google Scholar] [CrossRef]

- Masrur, H.; Khan, K.R.; Abumelha, W.; Senjyu, T. Efficient Energy Delivery System of the CHP-PV Based Microgrids with the Economic Feasibility Study. Int. J. Emerg. Electr. Power Syst. 2020, 21, 20190144. [Google Scholar] [CrossRef]

- Acemoglu, D.; Verdier, T. The Choice Between Market Failures and Corruption. Am. Econ. Rev. 2000, 90, 194–211. [Google Scholar] [CrossRef]

- Roth, A.E. The Economist as Engineer: Game Theory, Experimentation, and Computation as Tools for Design Economics. Econometrica 2002, 70, 1341–1378. [Google Scholar] [CrossRef]

- Cicala, S. Imperfect Markets versus Imperfect Regulation in US Electricity Generation. Am. Econ. Rev. 2022, 112, 409–441. [Google Scholar] [CrossRef]

- Valarezo, O.; Gómez, T.; Chaves-Avila, J.P.; Lind, L.; Correa, M.; Ziegler, D.U.; Escobar, R. Analysis of New Flexibility Market Models in Europe. Energies 2021, 14, 3521. [Google Scholar] [CrossRef]

- Wesseh, P.K.; Chen, J.; Lin, B. Electricity price modeling from the perspective of start-up costs: Incorporating renewable resources in non-convex markets. Front. Sustain. Energy Policy 2023, 2, 1204650. [Google Scholar] [CrossRef]

- Hommes, C.; Li, K.; Wagener, F. Production delays and price dynamics. J. Econ. Behav. Organ. 2022, 194, 341–362. [Google Scholar] [CrossRef]

- Sinha, S. Are large complex economic systems unstable? Sci. Cult. 2010, 76, 454–458. [Google Scholar]

- Klein, M.; Bar-Yam, Y. Handling Resource Use Oscillation in Multi-agent Markets. In Agent-Mediated Electronic Commerce V. Designing Mechanisms and Systems. AMEC 2003. Lecture Notes in Computer Science; Faratin, P., Parkes, D.C., Rodríguez-Aguilar, J.A., Walsh, W.E., Eds.; Springer: Berlin/Heidelberg, Germany, 2004; Volume 3048. [Google Scholar] [CrossRef]

- Zhuang, K.; Jia, G. Sustained oscillation induced by time delay in a commodity market model. Adv. Differ. Equ. 2017, 2017, 56. [Google Scholar] [CrossRef]

- Rozporządzenie Ministra Klimatu i Środowiska z Dnia 27 Września 2022 r. Zmieniające Rozporządzenie w Sprawie Szczegółowych Warunków Funkcjonowania Systemu Elektroenergetycznego. Available online: https://dziennikustaw.gov.pl/DU/2022/2007 (accessed on 8 May 2024).

- Available online: https://www.pse.pl/obszary-dzialalnosci/wymiana-miedzysystemowa/rynek-dnia-biezacegoon-line (accessed on 8 May 2024).

- Available online: https://pap-mediaroom.pl/biznes-i-finanse/wyznaczanie-ceny-energii-na-towarowej-gieldzie-energii-czyli-jak-dziala-mechanizm (accessed on 8 May 2024).

- Lam, L.H.; Ilea, V.; Bovo, C. European day-ahead electricity market coupling: Discussion, modeling, and case study. Electr. Power Syst. Res. 2018, 155, 80–92. [Google Scholar] [CrossRef]

- Shah, D.; Chatterjee, S. A comprehensive review on day-ahead electricity market and important features of world’s major electric power exchanges. Int. Trans. Electr. Energ. Syst. 2020, 30, e12360. [Google Scholar] [CrossRef]

- Dourbois, G.A.; Biskas, P.N.; Chatzigiannis, D.I. Novel Approaches for the Clearing of the European Day-Ahead Electricity Market. IEEE Trans. Power Syst. 2018, 33, 5820–5831. [Google Scholar] [CrossRef]

- Tsaousoglou, G.; Giraldo, J.S.; Paterakis, N.G. Market Mechanisms for Local Electricity Markets: A review of models, solution concepts and algorithmic techniques. Renew. Sustain. Energy Rev. 2022, 156, 111890. [Google Scholar] [CrossRef]

- Benini, M.; Marracci, M.; Pelacchi, P.; Venturini, A. Day-ahead market price volatility analysis in deregulated electricity markets. In Proceedings of the IEEE Power Engineering Society Summer Meeting, Chicago, IL, USA, 21–25 July 2002; Volume 3, pp. 1354–1359. [Google Scholar] [CrossRef]

- De Vos, K. Negative Wholesale Electricity Prices in the German, French and Belgian Day-Ahead, Intra-Day and Real-Time Markets. Electr. J. 2015, 28, 36–50. [Google Scholar] [CrossRef]

- Zhao, H.; Zhao, J.; Qiu, J.; Liang, G.; Wen, F.; Xue, Y.; Dong, Z.Y. Data-Driven Risk Preference Analysis in Day-Ahead Electricity Market. IEEE Trans. Smart Grid 2021, 12, 2508–2517. [Google Scholar] [CrossRef]

- Andrianesis, P.; Liberopoulos, G.; Kozanidis, G.; Papalexopoulos, A.D. Recovery mechanisms in day-ahead electricity markets with non-convexities—Part I: Design and evaluation methodology. IEEE Trans. Power Syst. 2013, 28, 960–968. [Google Scholar] [CrossRef]

- Andrianesis, P.; Liberopoulos, G.; Kozanidis, G.; Papalexopoulos, A.D. Recovery mechanisms in day-ahead electricity markets with non-convexities—Part II: Implementation and numerical evaluation. IEEE Trans. Power Syst. 2013, 28, 969–977. [Google Scholar] [CrossRef]

- Philpott, A.; Pettersen, E. Optimizing demand-side bids in day-ahead electricity markets. IEEE Trans. Power Syst. 2006, 21, 488–498. [Google Scholar] [CrossRef]

- Cramton, P. Electricity Market Design. In Oxford Review of Economic Policy; Oxford University Press: Melbourne, Australia, 2017; Volume 334, pp. 589–612. Available online: https://www.jstor.org/stable/48539475 (accessed on 10 March 2025).

- Viehmann, J. Risk premiums in the German day-ahead Electricity Market. Energy Policy 2011, 39, 386–394. [Google Scholar] [CrossRef]

- Caruso, E.; Dicorato, M.; Minoia, A.; Trovato, M. Supplier risk analysis in the day-ahead electricity market. IEE Proc.-Gener. Transm. Distrib. 2006, 153, 335–342. [Google Scholar] [CrossRef]

- Giabardo, P.; Zugno, M.; Pinson, P.; Madsen, H. Feedback, competition and stochasticity in a day ahead electricity market. Energy Econ. 2010, 32, 292–301. [Google Scholar] [CrossRef][Green Version]

- Algarvio, H.; Lopes, F.; Couto, A.; Estanqueiro, A. Participation of wind power producers in day-ahead and balancing markets: An overview and a simulation-based study. WIREs Energy Environ. 2019, 8, e343. [Google Scholar] [CrossRef]

- Pape, C.; Hagemann, S.; Weber, C. Are fundamentals enough? Explaining price variations in the German day-ahead and intraday power market. Energy Econ. 2016, 54, 376–387. [Google Scholar] [CrossRef]

- Jåstad, E.O.; Trotter, I.M.; Bolkesjø, T.F. Long term power prices and renewable energy market values in Norway—A probabilistic approach. Energy Econ. 2022, 112, 106182. [Google Scholar] [CrossRef]

- Ishizaki, T.; Koike, M.; Yamaguchi, N.; Ueda, Y.; Imura, J.-I. Day-ahead energy market as adjustable robust optimization: Spatio-temporal pricing of dispatchable generators, storage batteries, and uncertain renewable resources. Energy Econ. 2020, 91, 104912. [Google Scholar] [CrossRef]

- Newbery, D.M. High renewable electricity penetration: Marginal curtailment and market failure under “subsidy-free” entry. Energy Econ. 2023, 126, 107011. [Google Scholar] [CrossRef]

- Godoy-González, D.; Gil, E.; Gutiérrez-Alcaraz, G. Ramping ancillary service for cost-based electricity markets with high penetration of variable renewable energy. Energy Econ. 2020, 85, 104556. [Google Scholar] [CrossRef]

- Hedman, K.W.; Ferris, M.C.; O’NEill, R.P.; Fisher, E.B.; Oren, S.S. Co-Optimization of Generation Unit Commitment and Transmission Switching With N-1 Reliability. IEEE Trans. Power Syst. 2010, 25, 1052–1063. [Google Scholar] [CrossRef]

- Hedman, K.W.; O’Neill, R.P.; Fisher, E.B.; Oren, S.S. Optimal Transmission Switching With Contingency Analysis. IEEE Trans. Power Syst. 2009, 24, 1577–1586. [Google Scholar] [CrossRef]

- Schiffer, J.; Seel, T.; Raisch, J.; Sezi, T. Voltage Stability and Reactive Power Sharing in Inverter-Based Microgrids With Consensus-Based Distributed Voltage Control. IEEE Trans. Control. Syst. Technol. 2016, 24, 96–109. [Google Scholar] [CrossRef]

- Morison, K.; Wang, L.; Kundur, P. Power system security assessment. IEEE Power Energy Mag. 2004, 2, 30–39. [Google Scholar] [CrossRef]

- Thomas, A.G.; Tesfatsion, L. Braided Cobwebs: Cautionary Tales for Dynamic Pricing in Retail Electric Power Markets. IEEE Trans. Power Syst. 2018, 33, 6870–6882. [Google Scholar] [CrossRef]

- Billewicz, K. Skuteczność DSR—Między bodźcem a reakcją. Prz. Elektrotech. 2012, 9a, 308–314. [Google Scholar]

- Jabłońska, M. Aktualne trendy w badaniach nad reakcją strony popytowej oraz możliwości ich implementacji w warunkach krajowych. Rynek Energii 2011, 3, 81–86. [Google Scholar]

- Faruqui, A.; Sergici, S. Household response to dynamic pricing of electricity: A survey of 15 experiments. J. Regul. Econ. 2010, 38, 193–225. [Google Scholar] [CrossRef]

- Muratori, M.; Rizzoni, G. Residential Demand Response: Dynamic Energy Management and Time-Varying Electricity Pricing. IEEE Trans. Power Syst. 2016, 31, 1108–1117. [Google Scholar] [CrossRef]

- Ito, K. Do Consumers Respond to Marginal or Average Price? Evidence from Nonlinear Electricity Pricing. Am. Econ. Rev. 2014, 104, 537–563. [Google Scholar] [CrossRef]

- Edelstein, P.; Kilian, L. How sensitive are consumer expenditures to retail energy prices? J. Monet. Econ. 2009, 56, 766–779. [Google Scholar] [CrossRef]

- Paterakis, N.G.; Erdinc, O.; Bakirtzis, A.G.; Catalao, J.P.S. Optimal Household Appliances Scheduling Under Day-Ahead Pricing and Load-Shaping Demand Response Strategies. IEEE Trans. Ind. Inform. 2015, 11, 1509–1519. [Google Scholar] [CrossRef]

- Missaoui, R.; Joumaa, H.; Ploix, S.; Bacha, S. Managing energy Smart Homes according to energy prices: Analysis of a Building Energy Management System. Energy Build. 2014, 71, 155–167. [Google Scholar] [CrossRef]

- Kilian, L. The Economic Effects of Energy Price Shocks. J. Econ. Lit. 2008, 46, 871–909. [Google Scholar] [CrossRef]

- He, W.; King, M.; Luo, X.; Dooner, M.; Li, D.; Wang, J. Technologies and economics of electric energy storages in power systems: Review and perspective. Adv. Appl. Energy 2021, 4, 100060. [Google Scholar] [CrossRef]

- Albertus, P.; Manser, J.S.; Litzelman, S. Long-Duration Electricity Storage Applications, Economics, and Technologies. Joule 2020, 4, 21–32. [Google Scholar] [CrossRef]

- Buczaj, M.; Sumorek, A.; Buczaj, A. Funkcjonowanie magazynów energii jako układów ograniczających koszty zakupu energii elektrycznej. Przegląd Elektrotech. 2024, 1. [Google Scholar] [CrossRef]

- Schmidt, O.; Hawkes, A.; Gambhir, A.; Staffell, I. The future cost of electrical energy storage based on experience rates. Nat. Energy 2017, 2, 17110. [Google Scholar] [CrossRef]

- Zakeri, B.; Syri, S. Electrical energy storage systems: A comparative life cycle cost analysis. Renew. Sustain. Energy Rev. 2015, 42, 569–596. [Google Scholar] [CrossRef]

- Keles, D.; Dehler-Holland, J. Evaluation of photovoltaic storage systems on energy markets under uncertainty using stochastic dynamic programming. Energy Econ. 2022, 106, 105800. [Google Scholar] [CrossRef]

- Available online: https://rhomotion.com/news/global-bess-deployments-surpass-expectations-in-2024/ (accessed on 26 May 2025).

- Available online: https://www.infolink-group.com/energy-article/energy-storage-topic-global-energy-storage-market-review-outlook (accessed on 26 May 2025).

- Available online: https://about.bnef.com/blog/global-energy-storage-market-records-biggest-jump-yet/ (accessed on 26 May 2025).

- Available online: https://oko.press/ryby-umieraja-wisla-sola (accessed on 8 May 2025).

- Available online: https://lifeinkrakow.pl/w-miescie/7314,w-ciagu-kilku-minut-woda-w-wisle-opadla-o-metr-zginelo-tysiace-ryb-to-sie-powtarza#google_vignette (accessed on 8 May 2025).

- Available online: https://dziennikpolski24.pl/krakow-niepokojace-spadki-poziomu-wody-w-rejonie-stopnia-przewoz-w-wisle-gina-ryby/ar/c1-18074177 (accessed on 8 May 2025).

- Technical and Economic Aspects of Load Following with Nuclear Power Plants. Available online: https://www.oecd-nea.org/upload/docs/application/pdf/2021-12/technical_and_economic_aspects_of_load_following_with_nuclear_power_plants.pdf (accessed on 8 May 2025).

- Barough, A.S.; Shoubi, M.V.; Skardi, M.J.E. Application of Game Theory Approach in Solving the Construction Project Conflicts. Procedia-Soc. Behav. Sci. 2012, 58, 1586–1593. [Google Scholar] [CrossRef]

- Cressman, R. Evolutionary stability for two-stage hawk-dove games. Rocky Mt. J. Math. 1995, 25, 1. [Google Scholar] [CrossRef]

- Available online: https://eur-lex.europa.eu/legal-content/PL/ALL/?uri=celex:32003R0001 (accessed on 8 May 2025).

- Hylton, K.N. Antitrust Law: Economic Theory and Common Law Evolution; Books. 89; Cambridge University Press: Cambridge, UK, 2003; Available online: https://scholarship.law.bu.edu/books/89 (accessed on 7 March 2024).

- Borenstein, S. The Trouble With Electricity Markets: Understanding California’s Restructuring Disaster. J. Econ. Perspect. 2002, 16, 191–211. [Google Scholar] [CrossRef]

- Joskow, P.L.; Kahn, E. A Quantitative Analysis of Pricing Behavior in California’s Wholesale Electricity Market During Summer 2000. Energy J. 2002, 23, 1–35. [Google Scholar] [CrossRef]

- Budhraja, V.S. California’s Electricity Crisis. IEEE Power Eng. Rev. 2002, 22, 6–14. [Google Scholar] [CrossRef]

- Trehan, N.K. Lessons learned from California’s experience on electric power deregulation. In Proceedings of the IECEC ‘02. 2002 37th Intersociety Energy Conversion Engineering Conference, Washington, DC, USA, 29–31 July 2002; pp. 784–790. [Google Scholar] [CrossRef]

- Son, Y.S.; Baldick, R.; Lee, K.-H.; Siddiqi, S. Short-term electricity market auction game analysis: Uniform and pay-as-bid pricing. IEEE Trans. Power Syst. 2004, 19, 1990–1998. [Google Scholar] [CrossRef]

- Energy-Charts. Available online: https://www.energy-charts.info/?l=en&c=EU (accessed on 26 May 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sieńko, T.; Szczepanik, J. EU Energy Markets and Renewable Energy Sources—Are We Waiting for a Crisis? Energies 2025, 18, 4201. https://doi.org/10.3390/en18154201

Sieńko T, Szczepanik J. EU Energy Markets and Renewable Energy Sources—Are We Waiting for a Crisis? Energies. 2025; 18(15):4201. https://doi.org/10.3390/en18154201

Chicago/Turabian StyleSieńko, Tomasz, and Jerzy Szczepanik. 2025. "EU Energy Markets and Renewable Energy Sources—Are We Waiting for a Crisis?" Energies 18, no. 15: 4201. https://doi.org/10.3390/en18154201

APA StyleSieńko, T., & Szczepanik, J. (2025). EU Energy Markets and Renewable Energy Sources—Are We Waiting for a Crisis? Energies, 18(15), 4201. https://doi.org/10.3390/en18154201