Abstract

Under the global context of climate governance and sustainable development, low-carbon energy transition has become a strategic imperative. As a critical force in resource allocation, the financial system’s impact on energy transition has attracted extensive academic attention. This paper presents the first comprehensive literature review on energy transition research in the context of financial development. We develop a “Financial Functions-Energy Transition Dynamics” analytical framework to comprehensively examine the theoretical and empirical evidence regarding the relationship between financial development (covering both traditional finance and emerging finance) and energy transition. The understanding of financial development’s impact on energy transition has progressed from linear to nonlinear perspectives. Early research identified a simple linear promoting effect, whereas current studies reveal distinctly nonlinear and multidimensional effects, dynamically driven by three fundamental factors: economy, technology, and resources. Emerging finance has become a crucial driver of transition through technological innovation, risk diversification, and improved capital allocation efficiency. Notable disagreements persist in the existing literature on conceptual frameworks, measurement approaches, and empirical findings. By synthesizing cutting-edge empirical evidence, we identify three critical future research directions: (1) dynamic coupling mechanisms, (2) heterogeneity of financial instruments, and (3) stage-dependent evolutionary pathways. Our study provides a theoretical foundation for understanding the complex finance-energy transition relationship and informs policy-making and interdisciplinary research.

1. Introduction

Energy systems serve as the foundational support for the modern industrial economy. During production and consumption processes, particularly through the use of fossil fuels, they generate carbon emissions that constitute one of the principal drivers of global climate change. Currently, fossil fuels still dominate the global energy system, accounting for over 80% of total energy consumption [1]. Substantial fossil fuel consumption poses multifaceted challenges to human societies. Governments worldwide have acknowledged the urgency of the low-carbon energy transition and responded by establishing appropriate legal frameworks [2]. Examples include Germany’s Coal Phase-out Act, which mandates complete termination of coal-fired power generation by 2038 at the latest. Such measures aim to accelerate energy restructuring and reduce reliance on high-emission sources. Similarly, China’s Energy Law (Draft) establishes policy mandates to advance the energy transition, prioritizing development and utilization of renewable resources to accelerate the shift toward a cleaner energy structure. South Africa implemented the Carbon Tax Act, introducing a graduated carbon tax scheme for coal-fired power enterprises. This economic instrument aims to guide companies in reducing carbon emissions and facilitate the green transition of the energy sector. Furthermore, at the 28th Conference of the Parties (COP28) to the United Nations Framework Convention on Climate Change (UNFCCC), the inaugural Global Stocktake under the Paris Agreement was finalized. After intensive negotiations, the UAE Consensus was adopted. On energy transition, this consensus advocates advancing energy system transformation through just, orderly, and equitable principles, calling for a transition away from fossil fuels in energy systems [3].

However, the substantial investment costs and accompanying risks associated with energy transition warrant particular concern, with the most immediate and critical barrier being the massive financing gap during this transition [4]. A study on European energy transition financing mechanisms demonstrates that even technologically viable transition pathways may face implementation challenges without adequate financial support [5]. To effectively advance the energy transition, it is imperative to establish a robust and efficient financial system [6].

Financial development—manifested through the optimization of financial systems—enhances the overall capacity of the energy transition sector via multiple pathways: expanding capital supply channels, optimizing investment mechanisms, enhancing risk mitigation capabilities, fostering market development, and stimulating innovation [7,8]. Empirical studies indicate that financial development facilitates energy transition through capital allocation and innovation incentives [9,10]. Green finance has emerged as a particularly effective tool in this regard. Conversely, other research suggests that financially driven economic growth may expand industrial scale and increase fossil energy consumption, potentially inhibiting energy transition [11,12].

The relationship between financial development and energy transition has become a prominent research focus in recent years. Through a systematic review of the literature published before May 2025, this study aims to (1) synthesize existing findings and clarify the relationship between financial development and energy transition, including its transmission mechanisms, thereby providing a scientific basis for policymakers; (2) examine emerging finance (e.g., digital finance, green finance) whose impacts on energy transition lack robust theoretical frameworks and require systematic empirical integration. This study analyzes how these emerging finance affect energy transition through specific pathways and mechanisms, thereby improving current theoretical frameworks. The proposed comprehensive analytical framework provides new theoretical perspectives and policy insights for understanding the finance-energy transition relationship. To structure the analytical framework, this review is organized along four thematic pillars:

- Conceptual Frameworks and Quantification Metrics for Financial Development and Energy Transition;

- Current Research Landscape and Key Findings on the Finance-Energy Transition Nexus;

- Multidimensional Transmission Mechanisms and Implementation Pathways;

- Emerging Financial Models in Transition Governance.

The contributions of this study are threefold. First, it presents the first systematic literature review examining energy transition through the lens of financial development, addressing a critical gap in existing reviews that predominantly focus on energy transition itself while neglecting financial dimensions. This enriches the theoretical framework at the intersection of financial development and energy transition. By establishing the “Financial Functions-Energy Transition Dynamics” analytical framework, we integrate fragmented empirical studies into a coherent theoretical system, providing a clear roadmap for future research.

Second, this study systematically evaluates core concepts and quantitative measurement approaches for both financial development and energy transition. Through comparative analysis of different scholars’ definitions and measurements, we clarify theoretical boundaries while assessing the applicability and limitations of existing methods, offering methodological guidance for subsequent empirical work.

Third, based on systematic analysis of existing literature, we propose a targeted future research agenda. Integrating insights from field experts and our findings, we identify three priority research gaps: (1) dynamic coupling mechanisms between financial development and energy transition; (2) heterogeneous effects of different financial instruments on energy transition; and (3) evolutionary pathways of financial support across development stages. This agenda not only directs academic attention to the most pressing questions but also ensures future research focuses on areas with the greatest practical significance.

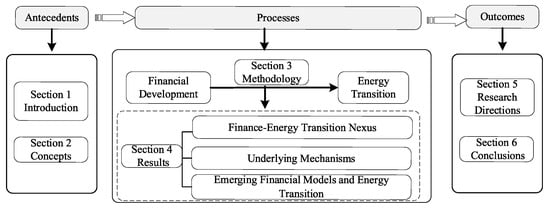

Figure 1 presents the structural framework of this paper. Specifically, Section 1 introduces the research background and research objectives. Section 2 systematically reviews core conceptual definitions and measurement approaches. Section 3 presents the research methodology. Section 4 reports the main findings. Section 5 identifies future research directions. Section 6 summarizes the conclusions.

Figure 1.

Research Framework (Source: Authors’ own work).

2. Conceptual Foundations

In systematic reviews, a critical first step is to define key concepts. This section explains two core constructs, namely “energy transition” and “financial development,” and summarizes standardized measurement metrics for related variables. This conceptual groundwork provides essential support for subsequent analysis.

2.1. Energy Transition

The concept of “energy transition” was first articulated in Reference [13], which demonstrated that industrial economies’ overreliance on fossil fuels would accelerate resource depletion and ecological degradation. To achieve energy security and environmental sustainability, the global energy system must transition from a fossil-dominant paradigm to renewable-centric infrastructure. The “Global Energy Transition” report [14] defines energy transition as systemic transformations spanning the entire energy value chain. Carley and Konisky [15] conceptualize it as the phased substitution of dominant energy resources or portfolios. Ullah et al. [16] emphasize its role as a critical pathway to environmental sustainability and social equity through decarbonization. Other scholars expand this framework to encompass sociotechnical transitions [17], economic system restructuring [18], and spatial-temporal dynamics [19]. Grubler [20] identifies three dimensional attributes of energy transitions: (1) scale (total energy throughput), (2) composition (energy mix), and (3) performance (energy efficiency and environmental impacts). In subsequent work, Grubler [21] synthesizes three core principles: (1) Final energy demand serves as the primary transition driver, (2) Transitions typically unfold over 80–130 years, and (3) Technological diffusion at scale constitutes the fundamental change agent.

Energy transition currently lacks a universally accepted definition. To establish a monitoring framework for its progress and guide evidence-based policy refinement, a quantitative evaluation system must be developed. This paper systematically reviews three core quantitative indicators (These three core indicators represent the most commonly used parallel proxy variables in the literature (non-composite measures). It should be noted that none of them can fully capture the multidimensional characteristics of energy transition.) widely employed to characterize energy transition, with their measurement methodologies detailed as follows:

- (1)

- Energy Consumption Structure

The energy consumption structure directly reflects the decarbonization degree of energy utilization. Its transformation constitutes both a core indicator and key driver of energy transition [22]. Existing studies primarily employ the following measurement approaches:

- The first approach characterizes energy structure transition through the share of clean energy in total energy consumption or fossil fuel consumption [22,23,24].

- The second approach constructs an energy consumption structure index based on the consumption shares of coal, petroleum, natural gas, and other energy sources, calculated using the spatial vector angle method [25].

- The third approach establishes a comprehensive evaluation system incorporating three dimensions—socioeconomic benefits, energy planning, and environmental performance—to assess the low-carbon transition degree of energy systems [26].

- (2)

- Energy Efficiency

Improving energy efficiency is a key pathway to advancing the energy transition. It also helps reduce resource depletion, lessen environmental pollution, and ease the impacts of climate change [27]. In physics, energy efficiency quantifies the ratio of exergy output to primary energy input, primarily reflecting the thermodynamic performance of conversion technologies and serving as a core parameter in engineering analyses. From an economic perspective, it evaluates the relationship between energy consumption and economic output. This is carried out using both single-factor and total-factor measurement frameworks. Single-factor metrics (e.g., energy intensity [28,29])—defined as energy consumption per unit GDP—face methodological critiques for omitting multifactorial production dynamics (labor, capital, and their substitution elasticities) [30]. To address these analytical gaps, Hu and Wang [31] conceptualized total-factor energy efficiency (TFEE) as the ratio of theoretically minimal energy input to actual consumption, accounting for production frontier constraints. Consequently, nonparametric TFEE measurement via Data Envelopment Analysis (DEA) [32,33,34] and Stochastic Frontier Analysis (SFA) [35,36] has become predominant (see cited references for technical implementations).

- (3)

- Renewable Energy Development

Renewable energy development constitutes the cornerstone of global energy transition and green growth [37]. As the dominant component of clean energy, renewables significantly mitigate environmental impacts while supporting sustainable socioeconomic development [38,39]. Climate stabilization requires breaking the link between energy systems and fossil fuel dependence. As a result, the current phase of the energy transition demands a fundamental shift toward carbon-neutral energy structures. Consequently, scaling renewable energy deployment has emerged as both a strategic imperative and technical necessity for achieving global net-zero emissions [40,41]. Strunz [42] highlights the pivotal role of renewable energy in Germany’s Energiewende (energy transition). Scholarly assessments typically employ two primary indicators: (1) regional renewable energy consumption ratio (relative to total final energy demand) [43,44], and (2) renewable electricity generation capacity (measured in GW and annual output) [45].

This study conceptualizes energy transition as a fundamental structural transformation of global/regional energy systems, characterized by a paradigm shift from fossil fuel dominance to renewable energy-based systems. This multidimensional process encompasses three critical aspects: (1) the resource dimension, manifested through changes in primary energy composition; (2) the technological dimension, propelled by innovations in energy technologies; and (3) the socioeconomic dimension, requiring careful balancing of environmental sustainability, social equity, and economic viability considerations. To quantify energy transition progress, we propose measuring through a comprehensive indicator system incorporating structural, efficiency, and technological dimensions.

2.2. Financial Development

Financial development constitutes a central theme in economic and financial research. Goldsmith’s [46] seminal work defined it as a dynamic optimization process of financial structures, manifested through financial instrument innovation, institutional evolution, and scale-structure adjustments. Within this theoretical framework, measuring financial development levels essentially equates to assessing financial structure maturity. The academic community primarily conceptualizes financial development through two distinct theoretical frameworks: The service theory views financial development as the coordinated evolution of financial instruments, institutions, and markets. This evolution supports real economic growth by improving resource allocation efficiency, strengthening risk management, and accelerating the diffusion of technology [47]. The functional theory defines financial development as the gradual improvement of key financial functions. These functions include payment clearing, risk transfer, and capital allocation. Its core characteristics are reflected in enhanced transaction efficiency, greater information transparency, and stronger corporate governance mechanisms [48]. In aggregate, financial development manifests primarily through sustained improvements in financial scale/depth, structural/functional optimization, and service efficiency. Emerging domains like digital finance and green finance are currently reshaping its developmental paradigm.

Current empirical research on finance-energy transition nexus primarily employs three classes of financial development metrics: (1) Unidimensional indicators assess regional financial development through singular dimensions—scale (e.g., institutional loan balance/GDP), structure (e.g., stock trading volume/bank loans), or efficiency (e.g., loan-to-deposit ratio) [45,49,50]. While computationally straightforward, these indicators inherently sacrifice comprehensiveness by focusing on isolated facets of financial systems. (2) Composite indices integrate multidimensional indicators of financial intermediation and markets through principal component analysis or entropy weighting methods [51,52]. While enabling comprehensive assessment, these indices face data availability constraints. (3) The IMF Financial Development Index [53,54,55], leveraging standardized cross-national data, has been widely adopted in international comparative studies examining financial development and energy transition linkages.

Financial development refers to the dynamic upgrading process of a financial system through innovative instruments, institutional optimization, and market structure improvements. This process is characterized by three key dimensions: (1) scale expansion, (2) structural optimization, and (3) efficiency enhancement. Fundamentally, it enhances financial resource allocation efficiency to simultaneously achieve three objectives: economic growth promotion, economic stability maintenance, and social welfare improvement. For quantifying regional financial development levels, we recommend a comprehensive measurement approach that integrates these three dimensions into a unified indicator system.

3. Methodology

3.1. Systematic Literature Review

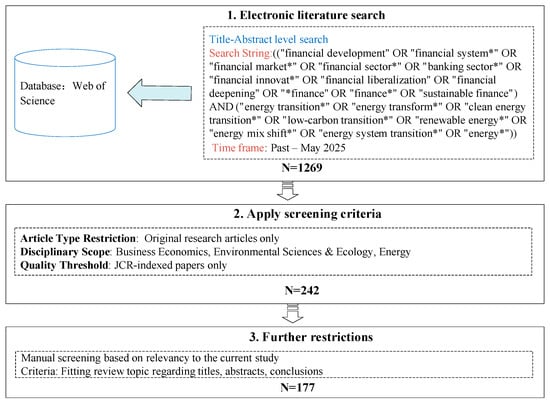

To systematically examine research advancements in finance-energy transition nexus, this study employs the Systematic Literature Review (SLR) methodology in 2025. SLR constitutes a rigorous literature evaluation process that follows transparent and reproducible research protocols for objective literature retrieval, quality assessment, and comprehensive synthesis [56]. This study adopts the methodology and procedures established by Kraus et al. [56], which include the following steps: (1) Define search boundaries; (2) Construct Boolean search strings; and (3) Specify temporal coverage parameters. This study retrieved data exclusively from the Web of Science Core Collection database, specifically including the Science Citation Index Expanded (SCI-EXPANDED) and Social Sciences Citation Index (SSCI) sub-databases. To avoid temporal limitations in covering research within this field, we did not apply a sample window and included papers published before May 2025 in our sample. The initial search employed the title keyword combination “financial development” AND “energy transition” to precisely retrieve literature addressing both core domains concurrently, yielding 15 highly relevant papers. To enhance the coverage breadth of the systematic literature review, an expanded search was conducted by broadening the search scope to incorporate the title keyword pair “finance*” AND “energy*”. While this approach may retrieve some marginally relevant studies, it effectively expands the literature pool to reduce the likelihood of overlooking critical research. The specific keyword combination strategies are as follows: ((“financial development” OR “financial system” OR “financial market” OR “financial sector” OR “banking sector” OR “financial innovat” OR “financial liberalization” OR “financial deepening” OR “finance” OR “finance” OR “sustainable finance”) AND (“energy transition” OR “energy transform” OR “clean energy transition” OR “low-carbon transition” OR “renewable energy” OR “energy mix shift” OR “energy system transition” OR “energy*”)). The expanded search yielded 1269 candidate publications.

Subsequently, we screened the sample literature using the following criteria:(1) Only original research articles were retained, while reviews and non-academic publications were excluded. (2) Discipline restrictions: Business Economics OR Environmental Sciences & Ecology OR Energy. (3) To ensure a quality threshold, papers not indexed in the Journal Citation Reports (JCR) were excluded (To mitigate publication bias and ensure research quality, this study exclusively included publications from JCR-indexed journals, which are characterized by more rigorous peer-review processes and higher academic reliability.), guaranteeing the credibility and reliability of our analysis. Based on the above criteria, we obtained 242 relevant publications. To refine the sample literature, this study conducted a manual screening process by reviewing titles, abstracts, and conclusions, applying subjective judgment to exclude ineligible publications from the subsample. Specifically, the exclusion criteria were: (1) studies failing to systematically examine the synergistic relationship between financial development and energy transition within a unified theoretical framework, and (2) publications lacking substantial academic contributions to this research topic. Through multiple screening rounds, the final refined sample comprised 177 journal articles, which were systematically cataloged in an Excel data extraction template. The complete literature search process is illustrated in Figure 2.

Figure 2.

Literature search process (Source: Authors’ own work).

3.2. Descriptive Results

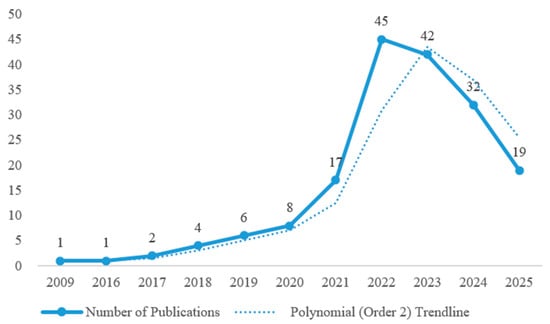

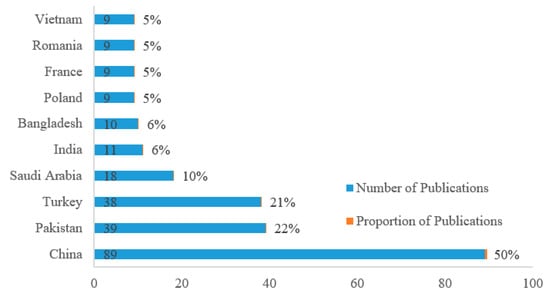

Figure 3 illustrates the annual distribution of articles published in the sampled literature from 2016 to 2025. As demonstrated in Figure 3, the past decade has witnessed a sustained increase in scholarly attention at the nexus of financial development and energy transition, reaching its peak in 2022 with 45 publications. Scholars from China accounted for the largest share (n = 89, 50.0% of total), followed by Pakistan (n = 39) and Turkey (n = 38), each exceeding the 30-article threshold. Figure 4 maps the geographical distribution of researcher contributions at national level.

Figure 3.

Annual publication trends, 2009–May 2025 (Source: Authors’ own work).

Figure 4.

Publication contributions of the top 10 countries (Source: Authors’ own work).

Leveraging bibliometric analysis of publication records and citation indicators, we identified key contributors to the field. Table 1 profiles the top 10 most productive authors. Muhammad Usman emerges as the most productive author (h-index = 57), with 5 high-impact publications garnering 1089 total citations (218 citations/paper). Journal-specific publication frequency analysis revealed a decentralized distribution, with no dominant source journal emerging. Renewable Energy published the largest share of included studies.

Table 1.

Top 10 authors by number of publications.

4. Results

This section systematically reviews core research advancements in financial development and energy transition. The focus includes: (1) causal relationships between financial development and energy transition, (2) underlying mechanisms driving these relationships, and (3) identification of three primary research hotspots in the field.

4.1. Finance-Energy Transition Nexus

Existing literature primarily examines three dimensions: energy consumption, energy efficiency, and renewable energy development. The subsequent analysis proceeds to dissect each of these dimensions in detail.

4.1.1. Financial Development and Energy Consumption

Numerous scholars have conducted in-depth investigations into the relationship between financial development and energy consumption. However, these studies have yielded divergent conclusions. Several studies indicate that financial development stimulates energy demand. The reasons are multifaceted: From the corporate perspective, financial development allows firms to access capital at lower costs. This, in turn, helps them establish new production lines, acquire large-scale equipment, expand hiring, and scale up their overall operations. These capital-intensive activities inevitably lead to increased energy consumption as they accompany higher production output and operational activity [57,58]. From the consumer perspective, financial deepening expands access to consumer credit. This increased access encourages the purchase of more durable goods and directly raises energy demand through changes in household consumption patterns [59]. Numerous empirical studies have confirmed a significant association between financial development and energy consumption. Researchers have conducted in-depth investigations of this relationship using diverse econometric methods and sample data. Table 2 presents selected research findings from relevant studies in this field. Sadorsky [60] demonstrated that financial development significantly stimulates energy consumption using panel data from 22 emerging economies (1990–2006). Al-Mulali and Lee [61] corroborated this finding in GCC countries, where 94% of energy consumption relies on oil/gas—reinforcing the policy imperative for enhanced energy efficiency. Ma & Fu [62] analyzed panel data from 120 countries, demonstrating that financial development significantly increases energy consumption in developing countries but shows negligible effects in developed nations. They recommend mitigating this effect through optimized credit allocation, such as increased financing for high-tech industries. Country-level analyses further corroborate this long-run equilibrium relationship. Empirical studies in Tunisia [63], Malaysia [64], and Saudi Arabia [65] uniformly demonstrate positive effects of financial development on energy consumption.

Table 2.

Empirical Analyses of Financial Development Impacts on Energy Consumption.

Another strand of research posits that financial development may suppress energy consumption. A well-developed financial system helps lower financing costs. This reduction eases financial constraints for companies and supports technological upgrades. It also encourages the adoption of energy-efficient equipment. Furthermore, financial development incentivizes firms to increase R&D investments in green innovation, accelerating the development of energy-saving products and consequently reducing aggregate energy consumption [66,67]. Assi et al. [68] demonstrate through an analysis of the top 28 countries in economic freedom (1996–2017) that financial development significantly reduces gasoline consumption. In a complementary study, Farhani and Solarin [69] utilize a U.S. dataset spanning 1973–2014 to reveal short-term energy consumption growth effects from financial development, while identifying a long-term inhibitory impact on energy demand.

Recent advances in microdata availability and econometric methodologies have enabled researchers to identify a nonlinear dynamic relationship between financial development and energy consumption. Using a panel smooth transition regression (PSTR) model to analyze 21 transition economies, Yue et al. [52] found pronounced nonlinear effects of financial development on energy consumption, with statistically significant nonlinear parameters. This nonlinearity is further corroborated by Wang & Gong [70], who identify threshold effects governing the financial development-energy consumption nexus. Xie et al. [71] addressed the technical challenges of modeling dynamic and nonlinear effects through their innovative dynamic semi-parametric additive panel model. Their empirical findings reveal that while both aggregate financial development and financial market development exhibit significant inverted U-shaped relationships with energy consumption, the development of financial institutions demonstrates a direct mitigating effect on energy consumption pressure. Yu et al. [72] demonstrated significant spatial spillover effects of financial development on energy consumption in China. Their results indicate that a 1% increase in neighboring regions’ energy consumption leads to a 0.41% rise in local energy consumption through financial development channels. Notably, an EU-focused study [73] reveals that the relationship between financial development and energy consumption is contingent upon the specific indicators used to measure financial development. When using bank-centric indicators, the data reveals an inverted U-shaped relationship. In contrast, stock market-related metrics show no statistically significant link with energy consumption trends.

The divergent findings in existing studies regarding the relationship between financial development and energy consumption primarily stem from two key factors. First, methodological evolution has significantly influenced research conclusions: early studies relying on time-series data with linear models often identified linear relationships, whereas recent research employing panel data and advanced econometric approaches (e.g., dynamic semi-parametric models, spatial econometrics) has revealed complex nonlinear patterns. This methodological divergence suggests that simplistic linear specifications may obscure the true dynamic mechanisms through which financial development affects energy consumption. Notably, these nonlinear findings are strongly correlated with the stages of financial deepening: in developing countries with less mature financial systems, credit expansion primarily supports scale-intensive industries (as shown in Ma & Fu’s 120-country analysis), driving rigid growth in energy consumption. However, when financial development surpasses certain thresholds (e.g., Wang & Gong’s estimated financial efficiency critical value of 1.53), energy-efficient enterprises gradually gain financial access, allowing the constraining effects of financial development on energy consumption to emerge.

Second, developmental stage differences constitute another crucial explanatory factor. Studies focusing on developed economies consistently demonstrate energy consumption reduction effects from financial development, attributable to three mechanisms: (1) mature financial markets’ superior capital allocation to energy-saving technologies and cleaner production; (2) stringent environmental regulations internalizing green standards into financial systems; and (3) high R&D intensity promoting energy efficiency gains. Conversely, in emerging economies undergoing industrial expansion, financial development more likely increases energy demand through production capacity effects. This developmental heterogeneity indicates pronounced threshold effects—the direction of financial development’s impact may reverse once economies cross certain developmental stages.

4.1.2. Financial Development and Energy Efficiency

Theoretical analyses suggest that financial development significantly enhances energy efficiency. Specifically, high-polluting and energy-intensive enterprises often face higher financing costs and tighter credit constraints. These pressures create incentives for them to pursue technological innovations that reduce emissions and lower energy consumption [74]. Developed financial systems, such as capital markets, rely on efficient information disclosure and monitoring mechanisms. These mechanisms help reduce financing constraints on corporate innovation activities. As a result, they support the commercialization of energy-efficient technologies. Moreover, the risk management function of financial markets enables enterprises to hedge against technological uncertainties inherent in energy efficiency investments, thereby accelerating the diffusion of clean technologies [75,76]. Finally, from an evolutionary perspective of financial structure, the diversified development of financial institutions fosters a differentiated division of labor within the service system [77,78]. Different types of financial institutions have comparative advantages in areas such as business scope, client structures, financing models, and risk management. By leveraging these strengths, they can accurately match the varied financing needs of enterprises at different stages of development. This diverse financial ecosystem improves the efficiency of capital allocation. It also strengthens risk-sharing mechanisms and enhances the role of financial institutions as information intermediaries. Together, these functions provide tailored financial support throughout the different stages of a company’s lifecycle. Ultimately, this dynamic drives energy efficiency improvements through technological progress.

However, empirical studies have revealed a complex relationship between financial development and energy efficiency. Representative research findings are summarized in Table 3. Using time-series data from Bangladesh spanning 1976–2014, Pan et al. [79] found that financial development exerts a long-term negative impact on energy intensity (an inverse indicator of energy efficiency), suggesting that financial deepening significantly enhances energy utilization efficiency. Similarly, Chen et al. [80] confirmed the significant inhibitory effect of financial development on energy intensity, supporting the use of financial system development as a policy tool to improve national energy efficiency. In contrast, Canh et al. [81] reached an opposing conclusion through their analysis of 81 economies: while financial development generally exacerbates energy intensity, its positive effect emerges when using the sub-indicator of financial efficiency. Atta et al. [34] found a positive but nonlinear threshold effect in their study of Belt and Road economies. Their results show that financial development promotes energy efficiency only in countries with relatively low levels of financial development. Yao et al. [82] further showed, through their analysis of BRICS and N-11 countries, that the positive impact of financial development on energy efficiency is significantly moderated by factors such as corruption levels.

Table 3.

Empirical Analyses of Financial Development and Energy Efficiency.

Empirical studies on the relationship between financial development and energy efficiency have yielded mixed findings, which can be analyzed through two key dimensions. First, sample heterogeneity and varying stages of financial development represent primary sources of divergence. Canh et al. [81]’s study of 81 economies revealed that while financial development generally increases energy intensity, specific components like financial efficiency demonstrate energy efficiency improvements. This finding highlights the limitations of traditional indicators (e.g., M2/GDP), suggesting that mere financial scale expansion may stimulate energy-intensive investments, whereas enhanced financial efficiency genuinely supports energy-saving innovations. Mills et al.’s threshold analysis of Belt and Road economies further confirms this pattern, showing that financial development only promotes energy efficiency below certain levels; beyond critical thresholds, “financial overdepth” may divert capital from productive uses, ultimately hindering efficiency gains. Second, the omission of crucial moderating variables exacerbates result discrepancies. Yao et al. [82] particularly emphasized corruption’s moderating role: in high-corruption environments, financial resources tend to flow to inefficient sectors, disrupting the financial development-energy efficiency linkage, whereas green credit policies effectively channel capital to energy-saving technologies in low-corruption countries. However, most existing studies share a critical limitation—their analytical frameworks typically exclude key variables like institutional quality and energy price marketization, restricting the generalizability and cross-context applicability of their conclusions.

This analysis demonstrates that the financial development-energy efficiency relationship exhibits distinct context-dependent characteristics, calling for future research to systematically account for developmental stages and critical moderating factors.

4.1.3. Financial Development and Renewable Energy Development

Facing the dual challenges of climate change and sustainable development imperatives, renewable energy development has become a pivotal component of global energy transitions. Existing studies identify four dominant determinants of renewable energy growth: policy support [83], technological innovation [84], environmental constraints [85,86], and economic incentives [87].

Unlike conventional fossil fuels (coal, oil, and natural gas), renewable energy projects exhibit greater financial dependency [88], attributable to their capital-intensive nature, substantial upfront investment requirements, and protracted payback periods with inherent market risks. Financial development primarily supports the growth of renewable energy industries through three channels: (1) expanding the scale of capital supply via diversified financing channels; (2) reducing project financing costs by utilizing innovative risk management instruments; and (3) establishing long-term capital allocation mechanisms to specifically alleviate the lifecycle financing challenges faced by the sector.

Empirical studies consistently demonstrate that financial support serves as a critical driver for renewable energy development. Representative findings in this field are summarized in Table 4. Xu et al. [89] found that renewable energy development exhibits a capital threshold effect, requiring critical investment scale to achieve substantial progress. Kempa et al. [90], using firm-level data from OECD countries, demonstrated that financial development significantly lowers the financing costs for renewable energy enterprises. They also found that it enhances the efficiency of research and development in renewable energy technologies. Demirtas et al. [91] demonstrated that the efficiency and market depth of financial institutions play a positive role in promoting renewable energy in the UK. Meanwhile, Ji & Zhang [92] quantified that financial support contributes 42.42% to China’s renewable energy development. Horky& Fidrmuc [93] demonstrated that developed capital markets significantly contribute to renewable energy development. Their study recommends advancing the financialization of renewable energy markets while strengthening regulatory support for banking institutions, thereby facilitating the evolution of sustainable energy business models. A study focusing on African countries by Dimnwobi et al. [94] reveals that financial sector development effectively promotes Nigeria’s transition to clean energy. The researchers recommend that financial institutions develop innovative green financing channels to support sustainable growth of renewable energy sources.

Table 4.

Empirical Analyses of Financial Development and Renewable Energy Development.

While existing studies have confirmed the positive role of financial support in renewable energy development, several critical issues require further investigation. First, the heterogeneous mechanisms of financial support remain insufficiently explained. Although Xu et al. [89]’s capital threshold effect suggests potential nonlinear impacts, most current studies still employ linear models that fail to capture the financial system’s complex dynamics. For instance, the 42.42% contribution rate estimated by Ji & Zhang [92] may vary significantly across countries at different development stages—developed nations with mature financial systems (e.g., OECD countries) achieve greater financing cost reductions, while developing countries (e.g., Nigeria) show limited efficiency due to shallow financial markets.

Second, geographical limitations in research samples constrain the generalizability of findings. Current empirical analyses primarily focus on OECD countries or select emerging economies, with inadequate attention to low-income nations and regions with distinct energy resource endowments (e.g., Sub-Saharan Africa). This sampling bias risks overgeneralizing conclusions about financial support’s universal effectiveness. Notably, while Horky & Fidrmuc [93]’s study of developed capital markets and Dimnwobi et al. [94]’s Nigeria research share similar directional findings, their policy pathways differ fundamentally: the former relies on market-based instruments like green bonds, whereas the latter requires targeted lending from policy banks. These differences underscore the importance of context-specific financial support policies.

4.2. Underlying Mechanisms

The interactive relationship between financial development and energy transition exhibits multidimensional complexity, yet existing research has reached a fundamental consensus: the evolution of financial systems exerts a significant positive driving effect on energy transition. This section will elucidate the mechanisms through which finance drives energy transformation, thereby deepening the comprehension of their dynamic interplay.

4.2.1. Development-Energy Nexus

Financial development’s role in fostering economic growth has become an academic consensus. As economies expand, this dynamic subsequently exerts multifaceted impacts on energy transition processes. Generally, economic growth is typically accompanied by the expansion of corporate production scales and accelerated industrialization, which together lead to a continuous surge in total energy consumption [95,96]. Leveraging mature technologies, stable supply chains, and lower costs, traditional fossil fuels have rapidly dominated the energy market, providing primary energy support for economic expansion. Consequently, initial economic development may create path dependencies that hinder low-carbon energy transition trajectories. However, rapid economic growth is often driven by capital accumulation and technological diffusion. This growth can accelerate industrial upgrading toward high-value-added sectors, which in turn supports the energy transition. For instance, the rising share of tertiary industries—characterized by technology-intensive production patterns—has effectively reduced energy intensity and enhanced overall energy efficiency [97]. Moreover, economic growth expands market scale, reducing the marginal costs of renewable energy, while knowledge spillover effects accelerate low-carbon technology diffusion. These dual dynamics create both technological and economic feasibility for clean energy development [98]. Therefore, this dual mechanism shows that the relationship between financial development and energy transition is not simply linear. Instead, it presents an asymmetric, phased pattern that can be described as “inhibition–coercion–empowerment.” During early economic development stages, scale expansion effects dominate, potentially delaying energy transition temporarily. However, when economic development crosses specific thresholds, technological innovation effects and structural optimization effects gradually become predominant, ultimately accelerating the transition toward a low-carbon energy system.

Furthermore, the Environmental Kuznets Curve (EKC) demonstrates that as economic growth raises income levels, public preference for environmental quality intensifies. This shift prompts consumers to favor green products and services [99], incentivizing firms to adjust production strategies and increase low-carbon product supply. Consequently, energy consumption transitions from pure “quantity” expansion to “quality” enhancement. Moreover, heightened environmental awareness among the public incentivizes governments to implement policy instruments such as green credit guidelines and renewable energy subsidies [100]. These interventions alter the relative profitability of clean energy compared to fossil-based systems. Consequently, they guide private capital flows toward low-carbon sectors. This policy-driven realignment not only modifies the cost–benefit calculus of energy investments but also creates institutional incentives that accelerate the decarbonization of energy infrastructure.

4.2.2. Technological Advancement

The development and utilization of renewable energy, along with improvements in energy efficiency, are fundamentally driven by technological advancement. Such technological innovation activities critically rely on financial system support [101]. Financial development has a profound impact on the energy transition by driving technological innovation. In the renewable energy sector, steady R&D investment and ongoing technological advances have substantially lowered the development and deployment costs of solar photovoltaics, wind power, and other clean energy sources. For example, the synergy between improved PV module efficiency and scaled production has led to a notable decline in power generation costs over the past decade [102]. These improved cost advantages have significantly increased the market competitiveness of renewable energy. As a result, countries around the world are accelerating the transition of their energy structures, gradually phasing out traditional fossil fuels and moving toward a greener energy system [103].

Furthermore, technological innovation establishes new developmental pathways for energy transition by enhancing energy utilization efficiency. For instance, in industrial production, digital monitoring systems and high-efficiency drive technologies precisely align with equipment energy consumption patterns, thereby mitigating energy waste inherent in traditional manufacturing paradigms. In transportation sectors, advancements such as lightweight materials, energy recovery devices, and hybrid powertrain architectures enable maximization of energy output per unit of electricity or fuel consumed. These innovations directly reduce society’s overall energy consumption. They also decrease reliance on fossil fuels like coal and petroleum. This shift enables energy systems to move from resource dependence to technology-driven models. Notably, developed financial markets enhance local enterprises’ technological capabilities and energy utilization efficiency (including clean energy capacity) by attracting high-quality foreign investment, increasing R&D expenditures, and reducing information asymmetry in investment and financing [104,105]. Consequently, financial development accelerates energy transition through technological innovation channels.

4.2.3. Resource Allocation

The financial system plays a pivotal role in resource allocation during energy transition processes. From a foundational perspective, financial development connects capital providers with capital demanders by improving liquidity and lowering financing costs. This connection creates more efficient mechanisms for matching capital supply and demand, which in turn enhances capital aggregation and improves allocation efficiency [106,107]. This resource allocation function is particularly critical in low-carbon transitions, especially in providing large-scale financing support for green energy industrialization and technological innovation. Financial markets can deliver stable capital supply to fund the R&D and industrialization of renewable energy technologies, enabling enterprises to achieve commercialization of clean technologies. Meanwhile, financial instruments like green credit use differentiated interest rate pricing to incentivize enterprises to optimize their energy consumption structures and enhance substitution efficiency toward cleaner energy sources [108,109]. At the capital reallocation level, the financial system optimizes resource allocation through differentiated credit policies and capital instruments. Specifically, commercial banks implement credit quota controls for high-carbon industries while establishing green approval channels for renewable energy projects like wind and solar power. Capital markets guide social capital toward strategic emerging industries by issuing carbon-neutral special treasury bonds and establishing new energy industry investment funds.

From the perspectives of risk diversification and information transmission, financial development helps diversify project risks (e.g., solar PV, wind power) through equity markets. This reduces equity financing costs for enterprises. Consequently, it increases investments in renewable energy industries characterized by high risks and long payback periods [110], thereby advancing energy transition. Taking solar PV and wind power projects as examples, these projects require massive initial investments with payback periods of 10–15 years, which often deter traditional financing channels due to risk aversion. Equity markets address this by introducing diversified investors (e.g., venture capital funds, green industry funds,) and risk hedging instruments (e.g., securitization of renewable energy project revenue rights). This risk-sharing mechanism distributes single-project risks across broader investor groups, thereby directly reducing corporate equity financing costs. Furthermore, the financial system reduces information asymmetry between capital suppliers and demanders by providing key information services such as credit ratings, environmental risk assessments, and project performance data. For instance, standardized green bond certification systems and third-party ESG rating reports enable investors to better identify the risk-return profiles of low-carbon projects. This information transparency mechanism directly enhances capital allocation efficiency [111,112].

At the macro-regulation level, financial development facilitates energy transition through the synergistic effects of policy guidance and market mechanisms. Regulatory authorities implement differentiated credit policies to direct financial resources toward green economic sectors. This approach effectively curbs the expansion of traditional energy-intensive industries while accelerating the phase-out of outdated production capacity [53]. Specifically, regulators have established green credit standards and environmental risk assessment frameworks. These measures compel commercial banks to incorporate environmental risks into lending decisions, thereby shifting credit allocation toward clean energy and energy-efficient industries. At the same time, a standardized and multi-tiered green financial system has been developed. This system incorporates innovative instruments such as green bonds and carbon financial derivatives, expanding the range of financing options for low-carbon technological upgrades. The price discovery function of capital markets further guides social capital toward low-carbon sectors.

4.3. Emerging Financial Models and Energy Transition

Under the backdrop of the rapid development of global climate governance, financial innovation has become a key driver in promoting energy transition. Current research shows that emerging financial models, such as financial agglomeration, digital finance, and green finance, are playing an increasingly important role in energy system transformation. These models reshape capital allocation logic, improve risk pricing mechanisms, and redefine industrial financing structures This transformation is not only a matter of technological innovation but also entails the restructuring of institutional rules, positioning it as a cutting-edge issue at the nexus of energy economics and finance. To capture the scope of this evolving field, this section applies a systematic literature review to trace how the three emerging financial domains shape the energy transition. Rather than listing findings, the review synthesizes insights across three analytical dimensions: theoretical foundations, action mechanisms, and policy impacts. Through this effort, the analysis aims to lay a solid intellectual foundation for constructing an integrated framework that supports a synergistic “finance–energy” transition.

4.3.1. Financial Agglomeration and Energy Transition

Financial agglomeration refers to the spatial concentration of regulatory bodies, financial institutions, and intermediaries. This concentration exerts significant impacts on regional energy transition by strengthening cooperative-competitive relationships among institutions and optimizing the allocation of financial resources [113,114]. Financial geography theory suggests that the spatial distribution of financial institution branches directly affects the accessibility of traditional financial services [115]. Higher distribution density of financial institutions in a region enhances enterprises’ ease of accessing financial resources [116]. For instance, enterprises in such areas can more readily obtain financial consulting services and process various financial operations in a timely manner, thereby strengthening their market participation capacity. Moreover, as the number of regional financial institutions increases, market competition intensifies. This drives financial institutions to adopt more market-oriented and customer-focused service models. Consequently, financing thresholds for market participants are lowered, further improving clients’ access to financial resources [117].

Porter’s research [118] reveals that close collaboration among banks, securities firms, and other financial institutions within a region generates economies of scale. Specifically: (1) Geographic concentration of financial institutions reduces time costs for enterprises seeking appropriate counterparties and lowers transaction-related expenses. (2) This concentration also accelerates the speed of financial information dissemination. More importantly, through economies of scale and spatial externalities, financial agglomeration not only drives innovation in financial products and services but also significantly enhances service specialization and resource allocation efficiency [119]. Ang [120] observes that as financial institutions form spatial clusters in specific regions, diversified financial institutions create collaborative networks. This significantly improves financial resource integration efficiency. However, considering that financial agglomeration shares general characteristics of industrial agglomeration while retaining unique financial sector features, its development level has an optimal threshold. Moderate financial agglomeration notably enhances resource allocation efficiency, whereas excessive agglomeration generates inhibitory effects [121]. Wang et al. [122] found an inverted U-shaped relationship between financial agglomeration and energy transition. Below a critical threshold, financial agglomeration improves energy efficiency. Beyond this threshold, it inhibits efficiency. Qu et al. [123] further demonstrated spatial heterogeneity in this relationship. Financial agglomeration significantly enhances energy efficiency in eastern China, central regions, and megacities. However, it reduces efficiency in western regions and shows no significant effect in small-medium cities.

4.3.2. Digital Finance and Energy Transition

Digital finance, emerging from the integration of technology and finance, has reshaped financial service models through technological innovation [124]. Digital finance leverages technologies like big data and artificial intelligence. It breaks the geographical limitations of traditional physical branches. This enables equal financial service access for users in remote areas [125]. By leveraging intelligent risk management systems, digital finance has significantly lowered service thresholds, enabling SMEs, long-tail customer segments, and other traditionally underserved groups to access increased financial inclusion [126]. This expansion of service scope has been achieved by reaching a broader range of users. It has also been supported by improved immediacy and convenience through digital tools such as mobile payments and online credit platforms [127].

As an innovative financial paradigm, digital finance is emerging as a core driving force in the energy transition process [128]. First, digital finance utilizes digital technologies to meet the multitiered financing needs of new low-carbon industries and renewable energy enterprises. It strictly controls credit allocation to high-energy-consumption and high-emission projects. This approach helps motivate enterprises to actively implement deep energy-saving renovations. It also accelerates the establishment of new energy systems. Ultimately, this promotes green energy transition and efficient utilization [128]. Second, digital technologies enable efficient and accurate matching between capital and the financing needs of green innovation entities. They help direct credit resources toward enterprises actively involved in green technology research and development, thereby easing financing constraints for green SMEs. In addition, they enhance these firms’ access to financial resources and improve overall financing efficiency [129]. Consequently, this stimulates market participants’ enthusiasm for green technology innovation. Finally, digital finance enables the allocation of financial resources across time and regions, enhancing access to financing for low-carbon energy industries in surrounding areas. This, in turn, creates new development opportunities for local enterprises seeking to upgrade their industrial structures. As a result, it supports green industrial growth and accelerates the regional energy transition [130].

Using panel data from 157 listed companies in China’s new energy sector, Wu and Huang [129] found that digital finance significantly improves the financial performance of new energy firms by alleviating financing constraints and optimizing capital allocation efficiency. Gu [131] further reveals that through intelligent investment-financing matching platforms, digital finance not only directly drives technological innovation in clean energy sectors but also generates technology spillover effects within the vertical division system of energy industry chains. Notably, Lin and Xie [132] demonstrate that a 1-unit increase in digital finance adoption correlates with a 0.03% enhancement in green investment intensity across the energy sector.

4.3.3. Green Finance and Energy Transition

Green finance refers to economic activities that utilize financial instruments and policies to support environmental improvement, climate change mitigation, and resource efficiency. Its core objective is to channel capital toward low-carbon and sustainable projects, thereby facilitating green transformation of the economy and society [133]. Green finance has emerged in response to growing challenges related to environmental pollution and the urgent need for emission reduction, reflecting a new demand for environmentally oriented financial services. It represents an evolving category within the financial sector, specifically designed to support environmental protection and accelerate the transition to low-carbon energy systems. By leveraging instruments such as green bonds and green credit, green finance channels capital toward environmentally friendly projects in renewable and low-carbon energy sectors. This not only promotes the green allocation of financial resources but also contributes to the optimization of economic structures, thereby driving forward the low-carbon energy transition. First, green finance provides investment and financing services for clean energy technology R&D and commercialization. It increases funding supply for innovation activities. This alleviates financing constraints for green technology innovation [134]. Second, green finance redirects capital from polluting industries to green low-carbon sectors. This promotes industrial structure upgrading toward low-carbon development. The reduced economic weight of energy-intensive industries decreases fossil fuel dependence. Consequently, it accelerates the transition to cleaner energy consumption structures [135]. Third, green finance reduces the barriers to green consumption through innovative green financial products (e.g., preferential interest rates for green loans, insurance subsidies for low-carbon products), guiding the transformation of social consumption patterns toward low-carbon development. This transition drives market-driven green transformation of manufacturing enterprises through demand-side market signal transmission mechanisms.

At the empirical level, Dogan et al. [136] established significant linkages between green finance and five renewable energy sources—biofuels, fuel cells, geothermal, solar, and wind power—demonstrating its catalytic role in renewable energy market expansion. Zheng et al. [137] further identified spatial spillover effects of green finance, fostering cross-regional renewable energy deployment. Alharbi et al. [138] quantitatively analyzed green finance’s impact across 44 economies, revealing its robust short- and long-term enhancement effects on renewable energy production, including both biomass-based and non-biomass-based energy. Collectively, these studies highlight green finance’s pivotal role in regional energy transitions. Subsequent research has expanded this understanding through multidimensional analyses, encompassing energy efficiency optimization [139], energy structure restructuring [140], and low-carbon consumption patterns [141]. Extensive evidence demonstrates green finance’s role in optimizing energy systems and advancing renewables.

5. Future Research Directions

Existing research has laid a solid theoretical and empirical foundation for understanding how financial development influences energy transition. However, many aspects still require deeper investigation. Future research may consider the following directions:

- (1)

- Research on the dynamic coupling mechanism between financial development and energy transition

The complex relationship between financial development and energy transition has emerged as a cutting-edge research area in contemporary economics. With intensifying global climate change and mounting pressures for green transition, understanding how financial systems influence energy transition becomes crucial for formulating effective environmental-economic policies. However, as previously discussed, empirical findings in the literature show significant divergences regarding this relationship. A primary reason lies in methodological limitations. Conventional studies often rely on linear regression models and time-series data, oversimplifying the intricate finance-energy nexus into unidirectional causality or linear associations.

In reality, financial systems facilitate energy transition through multiple functions including financing support, risk management, and information services, thereby promoting the development and deployment of low-carbon energy technologies. Financial innovations like green finance and carbon finance have created new financing channels and risk management tools for energy transition. Conversely, energy transition also contributes to financial development by creating new industries and market demands that generate fresh growth opportunities for the financial sector. The technological innovations and industrial upgrades during energy transition further drive the evolution of financial services.

Although recent studies have begun exploring nonlinear interaction features between these systems, our understanding of their dynamic coupling mechanisms remains inadequate. Future research should prioritize developing coupled finance-energy system models, employing system dynamics or complex network approaches to elucidate the co-evolution patterns of financial resource allocation, technology diffusion, and energy structure transformation. This research direction will not only help reconcile existing theoretical discrepancies but also provide a scientific foundation for designing targeted transition policies.

- (2)

- Heterogeneous Financial Instruments and Their Differential Impacts on Energy Transition Across Development Contexts

The conventional approach of treating financial systems as homogeneous entities fails to explain the complex phenomena observed in reality. With accelerating global financial innovation and diverging national energy transition pathways, systematically examining the differential impacts of various financial instruments across countries at different development stages carries significant theoretical and policy relevance. Cross-country comparative studies will be essential for revealing these differentiated effects.

Research design should combine case studies of representative nations with gradient grouping strategies. Sample selection must not only capture typical differences between developed and developing countries but also establish internally homogeneous country groups based on key indicators like financial market depth and energy structure. This ensures reliable and representative findings. Analytically, moving beyond traditional regression models, multilevel regression approaches should be innovatively employed to distinguish between national macro-level and market micro-level influences.

Notably, financial instrument innovations may affect local energy transitions directly while also altering neighboring regions’ transition processes through spatial spillovers. Zheng et al. [137] demonstrated significant spatial spillover effects of green finance on energy transition, providing critical insights into regional collaborative impacts. Future research should investigate how financial innovations in central cities influence surrounding areas’ energy efficiency through industrial value chains and capital flows, identifying the micro-level transmission mechanisms of these spatial spillovers. Such work would offer scientific support for regional financial integration policies.

- (3)

- Dynamic Pathways of Financial Support for Energy Transition Across Development Stages

Existing research has not yet fully elucidated the differential mechanisms of financial support for energy transition across different economic development levels. This knowledge gap is critical for establishing country-specific green financial systems. A new analytical framework is needed to examine how financial support pathways evolve with economic development, thereby revealing the differentiated characteristics and inherent evolutionary patterns of energy transition financing mechanisms in nations at varying development stages. This research direction requires moving beyond traditional static comparative analyses to adopt dynamic perspectives that investigate both path dependence and transition mechanisms in financial support systems.

Developed countries, benefiting from mature financial markets and sophisticated risk management tools, have established market-driven support models dominated by green financial instruments. These include widespread applications of complex tools like green bonds and carbon derivatives, where the key mechanism lies in directing substantial private capital toward renewable energy through price signals and risk-based pricing. In contrast, developing countries—particularly low-income nations—face constraints such as shallow financial markets and imperfect institutional environments. They often rely on development finance tools like policy banks, international development agencies, and government credit guarantees to overcome the “initial capital dilemma” in energy infrastructure investments. This divergence reflects profound connections between financial support mechanisms and economic development stages. Particularly noteworthy is that the evolution of financial support pathways does not follow a simple linear progression but rather exhibits complex, multi-stage and multi-path characteristics—a phenomenon warranting thorough academic attention and in-depth exploration.

6. Conclusions

This paper systematically reviews the literature on financial development and energy transition, tracing the conceptual evolution and connotations of both fields while summarizing their indicator construction and measurement methodologies. In terms of empirical research, existing studies primarily construct energy transition indicators through three dimensions—energy consumption structure, energy efficiency, and renewable/clean energy adoption—and conduct quantitative analyses. Regarding the measurement of financial development, scholars have predominantly adopted single indicators at the financial intermediation or financial market level as proxy variables. For global-level data analyses, constrained by data availability, the IMF’s Financial Development Index serves as an appropriate proxy for comparing financial development levels across economies.

In the context of global climate governance, energy transition has emerged as a strategic imperative for energy system evolution. While existing research confirms that financial development significantly promotes energy transition, their relationship exhibits inherent complexity. From a mechanistic perspective, financial development facilitates energy transition through three long-term pathways: development-driven effects, technological innovation, and resource allocation optimization. Specifically, these pathways operate via (1) promoting industrial restructuring and energy efficiency improvements; (2) reducing clean energy technology costs and accelerating their commercialization; and (3) channeling capital flows toward green industries while curbing high-carbon investments. It should be noted that the relative importance of each mechanism may vary depending on a country’s stage of development. This paper has not engaged in a discussion on this particular aspect. In-depth exploration of this issue necessitates subsequent empirical testing.

This paper reviews studies on emerging forms of financial development and energy transition, with key findings summarized as follows: (1) Financial agglomeration enhances financial efficiency through scale effects, information sharing, and optimized resource allocation, thereby promoting low-carbon energy investments and technological innovation. Notably, moderate financial agglomeration facilitates energy transition, while excessive concentration may produce inhibitory effects. (2) Digital finance improves the inclusiveness, equity, and accessibility of financial services, providing critical financial support for energy transition. (3) Green finance directs capital flows from high-carbon sectors to clean energy projects, optimizing energy structures and consumption patterns to advance regional energy transition. Collectively, while traditional finance emphasizes resource allocation optimization, innovative financial instruments like digital and green finance precisely target low-carbon initiatives. Their synergistic effects significantly accelerate regional energy transition processes.

This paper proposes the following strategies to enhance financial support for energy transition: First, a multi-tiered green finance system should be established, utilizing innovative financial instruments such as green credit and green bonds to channel capital precisely toward clean energy projects. Second, digital finance infrastructure development must be strengthened, leveraging fintech to improve green investment efficiency and alleviate financing constraints for small- and medium-sized low-carbon enterprises. Third, the spatial distribution of financial resources requires optimization to balance agglomeration effects—harnessing scale economies while mitigating potential downsides of excessive concentration—through coordinated development between regional financial hubs and local institutions to facilitate low-carbon technology diffusion. Fourth, differentiated policies should be implemented based on regional development stages, prioritizing inclusive finance in financially underdeveloped areas and strengthening green-tech finance integration in innovation-driven regions.

Author Contributions

S.F.: Data curation, Methodology, Software, Formal analysis, Writing—original draft, Writing—review and editing. Y.Z.: Conceptualization, Formal analysis, Writing—review and editing, Supervision. S.Z.: Validation, Writing—review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Beijing Municipal Social Science Foundation Key Projects (Grant number: 24JJA003).

Conflicts of Interest

The authors declare no conflicts of interest.

References

- BP Energy Outlook 2024. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2024.pdf (accessed on 5 May 2025).

- Zhang, Z.; Zhao, M.; Zhang, X.; Huang, Z.; Feng, Y. What is the causal relationship among geopolitical risk, financial development, and energy transition? Evidence from 25 OECD countries. Int. Rev. Financ. Anal. 2025, 104, 104288. [Google Scholar] [CrossRef]

- United Nations Framework Convention on Climate Change (UNFCCC). Outcomes of the Dubai Climate Change Conference. Available online: https://unfccc.int/cop28/outcomes (accessed on 5 May 2025).

- Liu, P.; Hei, Z. Strategic analysis and framework design on international cooperation for energy transition: A perspective from China. Energy Rep. 2022, 8, 2601–2616. [Google Scholar] [CrossRef]

- Polzin, F.; Sanders, M. How to finance the transition to low-carbon energy in Europe? Energy Policy 2020, 147, 111863. [Google Scholar] [CrossRef]

- Omri, A.; Ben Jabeur, S. Climate policies and legislation for renewable energy transition: The roles of financial sector and political institutions. Technol. Forecast. Soc. Change 2024, 203, 123347. [Google Scholar] [CrossRef]

- Egli, F.; Polzin, F.; Sanders, M.; Schmidt, T.; Serebriakova, A.; Steffen, B. Financing the energy transition: Four insights and avenues for future research. Environ. Res. Lett. 2022, 17, 051003. [Google Scholar] [CrossRef]

- Kim, J.; Park, K. Financial development and deployment of renewable energy technologies. Energy Econ. 2016, 59, 238–250. [Google Scholar] [CrossRef]

- Lee, C.-C.; Song, H.; An, J. The impact of green finance on energy transition: Does climate risk matter? Energy Econ. 2024, 129, 107258. [Google Scholar] [CrossRef]

- Javed, A.; Shabir, M.; Rao, F.; Uddin, M.S. Effect of green technological innovation and financial development on green energy transition in N-11 countries: Evidence from the novel Method of Moments Quantile Regression. Renew. Energy 2025, 242, 122435. [Google Scholar] [CrossRef]

- Soytas, U.; Sari, R. Energy consumption, economic growth, and carbon emissions: Challenges faced by an EU candidate member. Ecol. Econ. 2009, 68, 1667–1675. [Google Scholar] [CrossRef]

- Szirmai, A. Industrialisation as an engine of growth in developing countries, 1950–2005. Struct. Change Econ. Dyn. 2012, 23, 406–420. [Google Scholar] [CrossRef]

- Krause, F. Energie-Wende: Wachstum und Wohlstand ohne Erdöl und Uran. e. Alternativ-Bericht d. Öko-Instituts, Freiburg; S. Fischer: Frankfurt am Main, Germany, 1980. [Google Scholar]

- World Energy Council. Global Energy Transition. Available online: https://www.kearney.com/industry/metals-mining/energy-transition (accessed on 5 May 2025).

- Carley, S.; Konisky, D.M. The justice and equity implications of the clean energy transition. Nat. Energy 2020, 5, 569–577. [Google Scholar] [CrossRef]

- Ullah, A.; Nobanee, H.; Ullah, S.; Iftikhar, H. Renewable energy transition and regional integration: Energizing the pathway to sustainable development. Energy Policy 2024, 193, 114270. [Google Scholar] [CrossRef]

- Grubler, A.; Wilson, C.; Nemet, G. Apples, oranges, and consistent comparisons of the temporal dynamics of energy transitions. Energy Res. Soc. Sci. 2016, 22, 18–25. [Google Scholar] [CrossRef]

- Fouquet, R.; Pearson, P.J.G. Past and prospective energy transitions: Insights from history. Energy Policy 2012, 50, 1–7. [Google Scholar] [CrossRef]

- Bridge, G.; Bouzarovski, S.; Bradshaw, M.; Eyre, N. Geographies of energy transition: Space, place and the low-carbon economy. Energy Policy 2013, 53, 331–340. [Google Scholar] [CrossRef]

- Grubler, A. Transitions in energy use. Encycl. Energy 2004, 6, 163–177. [Google Scholar]

- Grubler, A. Energy transitions research: Insights and cautionary tales. Energy Policy 2012, 50, 8–16. [Google Scholar] [CrossRef]

- Zhu, H.; Cao, S.; Su, Z.; Zhuang, Y. China’s future energy vision: Multi-scenario simulation based on energy consumption structure under dual carbon targets. Energy 2024, 301, 131751. [Google Scholar] [CrossRef]

- Xu, Q.; Zhong, M.; Li, X. How does digitalization affect energy? International evidence. Energy Econ. 2022, 107, 105879. [Google Scholar] [CrossRef]

- Lu, L.; Liu, P.; Yu, J.; Shi, X. Digital inclusive finance and energy transition towards carbon neutrality: Evidence from Chinese firms. Energy Econ. 2023, 127, 107059. [Google Scholar] [CrossRef]

- Chen, Y.; Zhong, B.; Guo, B. Does energy-consuming right trading policy achieve a low-carbon transition of the energy structure? A quasi-natural experiment from China. Front. Environ. Sci. 2025, 12, 1502860. [Google Scholar] [CrossRef]

- Shen, Y.; Shi, X.; Zhao, Z.; Sun, Y.; Shan, Y. Measuring the low-carbon energy transition in Chinese cities. iScience 2023, 26, 105803. [Google Scholar] [CrossRef]

- Lv, Y.; Chen, W.; Cheng, J. Effects of urbanization on energy efficiency in China: New evidence from short run and long run efficiency models. Energy Policy 2020, 147, 111858. [Google Scholar] [CrossRef]

- Payne, J.E.; Truong, H.H.D.; Chu, L.K.; Doğan, B.; Ghosh, S. The effect of economic complexity and energy security on measures of energy efficiency: Evidence from panel quantile analysis. Energy Policy 2023, 177, 113547. [Google Scholar] [CrossRef]

- Doğan, B.; Ferraz, D.; Gupta, M.; Duc Huynh, T.L.; Shahzadi, I. Exploring the effects of import diversification on energy efficiency: Evidence from the OECD economies. Renew. Energy 2022, 189, 639–650. [Google Scholar] [CrossRef]

- Ang, B.W. Monitoring changes in economy-wide energy efficiency: From energy–GDP ratio to composite efficiency index. Energy Policy 2006, 34, 574–582. [Google Scholar] [CrossRef]

- Hu, J.-L.; Wang, S.-C. Total-factor energy efficiency of regions in China. Energy Policy 2006, 34, 3206–3217. [Google Scholar] [CrossRef]

- Zhang, W.; Pan, X.; Yan, Y.; Pan, X. Convergence analysis of regional energy efficiency in china based on large-dimensional panel data model. J. Clean. Prod. 2017, 142, 801–808. [Google Scholar] [CrossRef]

- Zhang, N.; Kong, F.; Yu, Y. Measuring ecological total-factor energy efficiency incorporating regional heterogeneities in China. Ecol. Indic. 2015, 51, 165–172. [Google Scholar] [CrossRef]