A Strategic Hydrogen Supplier Assessment Using a Hybrid MCDA Framework with a Game Theory-Driven Criteria Analysis

Abstract

1. Introduction

- This study introduces a unique integrated framework combining MCDA tools based on the Bayesian BWM, Fuzzy AHP, and EWM to assess supplier selection in the HSC.

- Both the fuzzy logic and Bayesian approach are further integrated to account for uncertainty and variability in expert judgments, improving the reliability of decision-making in the complex environments of the supplier selection process.

- The objective-based and subjective-based weighting methods are considered to create a comprehensive approach, providing a more accurate, flexible, and balanced approach to enhance the robustness of the decision-making process.

- The game theory-based approach is used to synchronize criteria weights derived from different methods, minimizing conflicts and biases, and ensuring a more balanced and stable outcome.

- The TODIM method incorporates the prospect theory to account for decision-makers’ risk preferences, which offers a more psychologically realistic supplier ranking. In addition, a comparative evaluation and sensitivity analysis are conducted to provide valuable insights into the effectiveness of the proposed framework.

2. Literature Review

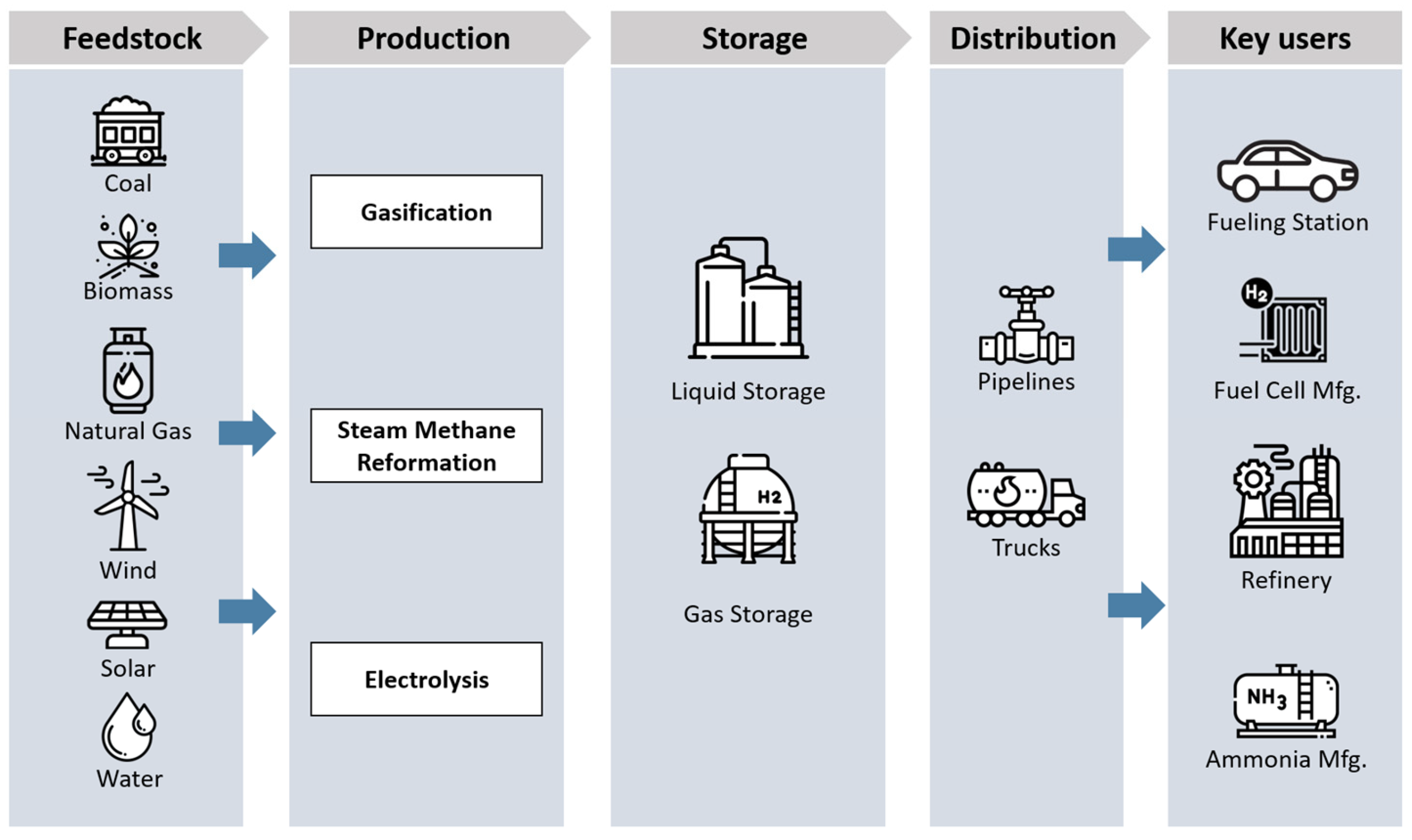

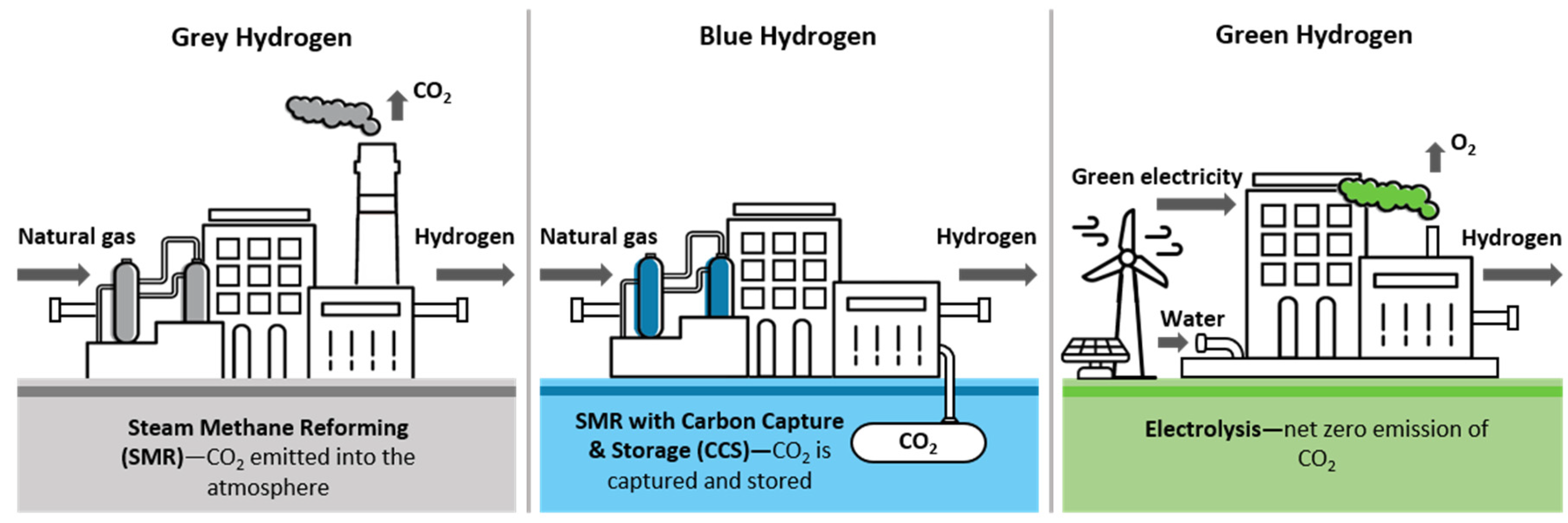

2.1. Managing the Hydrogen Supply Chain

2.2. Supplier Selection Problem in the HSC

3. Research Methodology

3.1. Methodological Flow

3.2. Bayesian BWM

3.3. Fuzzy AHP

3.4. EWM

3.5. TODIM

3.6. Game Theory Approach

4. Case Study and Results

4.1. Supplier Selection Criteria in HSC

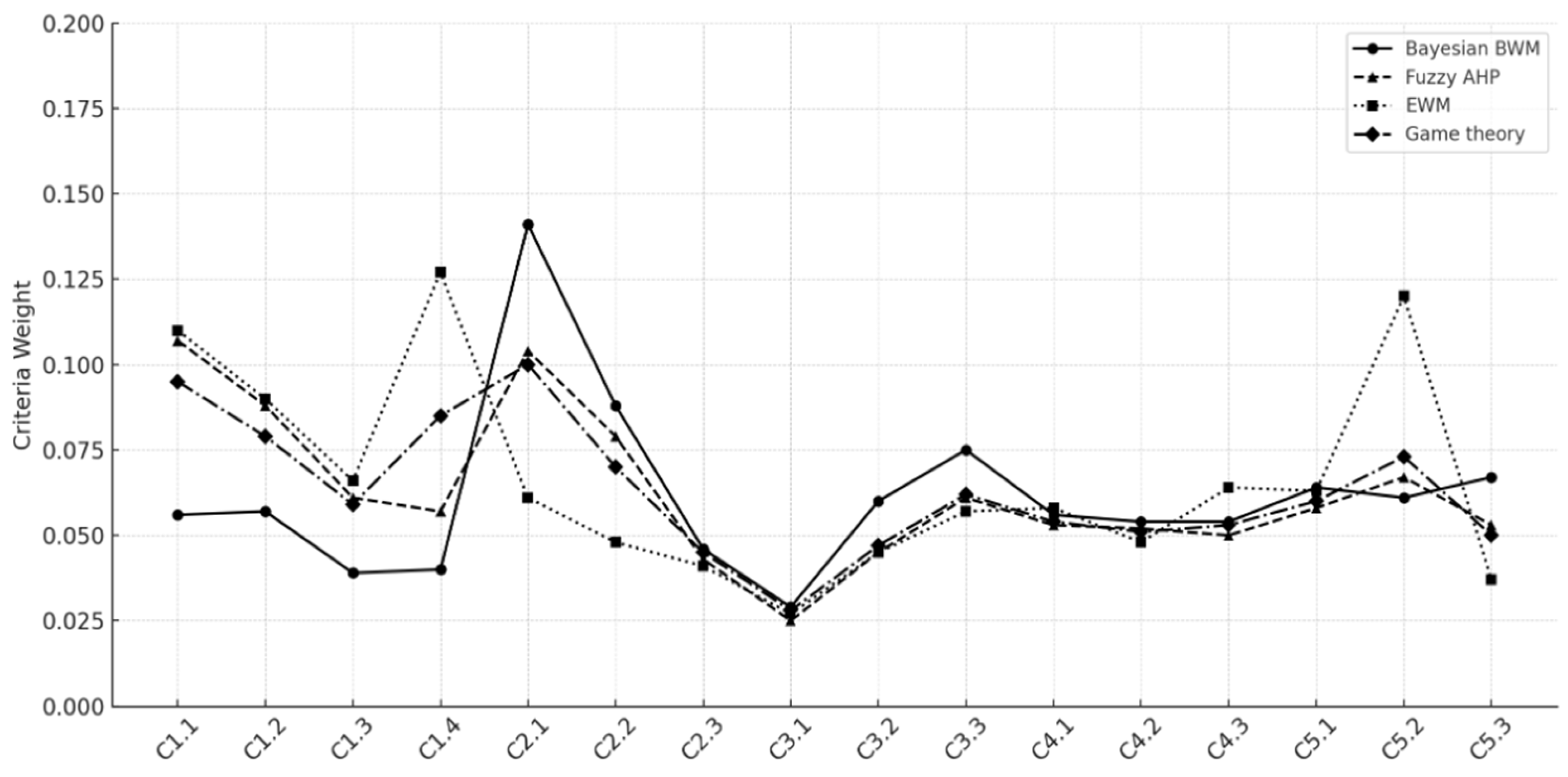

4.2. Results for the Criteria Weight Evaluation

4.3. Results for the Supplier Ranking Using TODIM

5. Sensitivity Analysis and Managerial Insights

5.1. Sensitivity Analysis of the Loss Aversion Parameter

5.2. Sensitivity Analysis of Criteria Weights

5.3. Managerial Insights and Practical Limitations

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kim, C.; Cho, S.H.; Cho, S.M.; Na, Y.; Kim, S.; Kim, D.K. Review of hydrogen infrastructure: The current status and roll-out strategy. Int. J. Hydrogen Energy 2023, 48, 1701–1716. [Google Scholar] [CrossRef]

- Monteiro, E.; Brito, P.S.D. Hydrogen supply chain: Current status and prospects. Energy Storage 2023, 5, e466. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Global Hydrogen Review 2024. 2024. Available online: https://www.iea.org/reports/global-hydrogen-review-2024 (accessed on 15 August 2024).

- Sultan, M.; Akram, M. An extended multi-criteria decision-making technique for hydrogen and fuel cell supplier selection by using spherical fuzzy rough numbers. J. Appl. Math. Comput. 2024, 71, 1843–1886. [Google Scholar] [CrossRef]

- Quitzow, R.; Nunez, A.; Marian, A. Positioning Germany in an international hydrogen economy: A policy review. Energy Strat. Rev. 2024, 53, 101361. [Google Scholar] [CrossRef]

- Hydrogen Council. Hydrogen Insights 2023. An Update on the State of the Global Hydrogen Economy. 2023. Available online: https://hydrogencouncil.com/en/hydrogen-insights-2023/ (accessed on 15 August 2024).

- Ransikarbum, K.; Chanthakhot, W.; Glimm, T.; Janmontree, J. Evaluation of sourcing decision for hydrogen supply chain using an integrated multi-criteria decision analysis (MCDA) tool. Resources 2023, 12, 48. [Google Scholar] [CrossRef]

- Hasankhani, M.; van Engelen, J.; Celik, S.; Diehl, J.C. Unveiling complexity of hydrogen integration: A multi-faceted exploration of challenges in the Dutch context. J. Clean. Prod. 2024, 434, 139927. [Google Scholar] [CrossRef]

- Li, F.; Liu, D.; Sun, K.; Yang, S.; Peng, F.; Zhang, K.; Guo, G.; Si, Y. Towards a future hydrogen supply chain: A review of technologies and challenges. Sustainability 2024, 16, 1890. [Google Scholar] [CrossRef]

- Azadnia, A.H.; McDaid, C.; Andwari, A.M.; Hosseini, S.E. Green hydrogen supply chain risk analysis: A european hard-to-abate sectors perspective. Renew. Sustain. Energy Rev. 2023, 182, 113371. [Google Scholar] [CrossRef]

- Ransikarbum, K.; Aydın, N.; Janmontree, J.; Zadek, H. Analysis of solar and wind farm area using technique for order of preference by similarity to ideal solution. E3S Web Conf. 2025, 610, 01001. [Google Scholar] [CrossRef]

- Janmontree, J.; Zadek, H.; Ransikarbum, K. Analyzing solar location for green hydrogen using multi-criteria decision analysis. Renew. Sustain. Energy Rev. 2025, 209, 115102. [Google Scholar] [CrossRef]

- Ransikarbum, K.; Zadek, H.; Janmontree, J. Evaluating Renewable Energy Sites in the Green Hydrogen Supply Chain with Integrated Multi-Criteria Decision Analysis. Energies 2024, 17, 4073. [Google Scholar] [CrossRef]

- Zhao, W.; Ma, J.; Wang, Z.; Li, Y.; Zhang, W. Potential hydrogen market: Value-added services increase economic efficiency for hydrogen energy suppliers. Sustainability 2022, 14, 4804. [Google Scholar] [CrossRef]

- Li, H.; Cao, X.; Liu, Y.; Shao, Y.; Nan, Z.; Teng, L.; Peng, W.; Bian, J. Safety of hydrogen storage and transportation: An overview on mechanisms, techniques, and challenges. Energy Rep. 2022, 8, 6258–6269. [Google Scholar] [CrossRef]

- Ma, N.; Zhao, W.; Wang, W.; Li, X.; Zhou, H. Large scale of green hydrogen storage: Opportunities and challenges. Int. J. Hydrogen Energy 2024, 50, 379–396. [Google Scholar] [CrossRef]

- Xie, Z.; Jin, Q.; Su, G.; Lu, W. A Review of hydrogen storage and transportation: Progresses and challenges. Energies 2024, 17, 4070. [Google Scholar] [CrossRef]

- Ding, B.; Li, Z.; Li, Z.; Xue, Y.; Chang, X.; Su, J.; Sun, H. Cooperative Operation for Multiagent Energy Systems Integrated with Wind, Hydrogen, and Buildings: An Asymmetric Nash Bargaining Approach. IEEE Trans. Ind. Inform. 2025. early access. [Google Scholar] [CrossRef]

- Xuan, A.; Sun, Y.; Liu, Z.; Zheng, P.; Peng, W. An ADMM-based tripartite distributed planning approach in integrated electricity and natural gas system. Appl. Energy 2025, 388, 125660. [Google Scholar] [CrossRef]

- Handique, A.J.; Peer, R.; Haas, J.; Osorio-Aravena, J.C.; Reyes-Chamorro, L. Distributed hydrogen systems: A literature review. Int. J. Hydrogen Energy 2024, 85, 427–439. [Google Scholar] [CrossRef]

- Niemsakul, J.; Hiranmahapol, S.; Janmontree, J.; Zadek, H.; Ransikarbum, K. Analysis of barriers for hydrogen-fueled logistics under integrated sustainability: A DEMATEL-TOWS framework. J. Clean. Prod. 2025, 513, 145720. [Google Scholar] [CrossRef]

- Reuß, M.; Dimos, P.; Léon, A.; Grube, T.; Robinius, M.; Stolten, D. Hydrogen road transport analysis in the energy system: A case study for Germany through 2050. Energies 2021, 14, 3166. [Google Scholar] [CrossRef]

- Bolz, S.; Thiele, J.; Wendler, T. Regional capabilities and hydrogen adoption barriers. Energy Policy 2024, 185, 113934. [Google Scholar] [CrossRef]

- Trencher, G.; Edianto, A. Drivers and barriers to the adoption of fuel cell passenger vehicles and buses in Germany. Energies 2021, 14, 833. [Google Scholar] [CrossRef]

- Guan, Y.; Liu, Z.; Du, Y.; Xu, D. Evaluating batteries for renewable energy storage: A hybrid MCDM framework based on combined objective weights and uncertainty-preserved COPRAS. J. Renew. Sustain. Energy 2023, 15, 044102. [Google Scholar] [CrossRef]

- Park, S.-G.; Park, J.-H.; Kim, J.-Y.; Lee, S.; Hwang, M.-H. Innovative framework for selecting sustainable hydrogen refueling station sites: Integrating resilience and interdependence. Int. J. Hydrogen Energy 2025, 140, 678–693. [Google Scholar] [CrossRef]

- Alavi, B.; Tavana, M.; Mina, H. A dynamic decision support system for sustainable supplier selection in circular economy. Sustain. Prod. Consum. 2021, 27, 905–920. [Google Scholar] [CrossRef]

- Shekarian, E.; Ijadi, B.; Zare, A.; Majava, J. Sustainable supply chain management: A comprehensive systematic review of industrial practices. Sustainability 2022, 14, 7892. [Google Scholar] [CrossRef]

- Xie, Z.; Tian, G.; Tao, Y. A multi-criteria decision-making framework for sustainable supplier selection in the circular economy and industry 4.0 era. Sustainability 2022, 14, 16809. [Google Scholar] [CrossRef]

- Hjeij, D.; Bicer, Y.; bin Saleh Al-Sada, M.; Koç, M. Hydrogen export competitiveness index for a sustainable hydrogen economy. Energy Rep. 2023, 9, 5843–5856. [Google Scholar] [CrossRef]

- Bique, A.O.; Maia, L.K.K.; Grossmann, I.E.; Zondervan, E. Design of hydrogen supply chains under demand uncertainty—A case study of passenger transport in Germany. Phys. Sci. Rev. 2023, 8, 741–762. [Google Scholar] [CrossRef]

- Singh, R.R.; Zindani, D.; Maity, S.R. A novel fuzzy-prospect theory approach for hydrogen fuel cell component supplier selection for automotive industry. Expert Syst. Appl. 2024, 246, 123142. [Google Scholar] [CrossRef]

- Alipour, M.; Hafezi, R.; Rani, P.; Hafezi, M.; Mardani, A. A new Pythagorean fuzzy-based decision-making method through entropy measure for fuel cell and hydrogen components supplier selection. Energy 2021, 234, 121208. [Google Scholar] [CrossRef]

- Hashemi, S.H.; Karimi, A.; Tavana, M. An integrated green supplier selection approach with analytic network process and improved Grey relational analysis. Int. J. Prod. Econ. 2015, 159, 178–191. [Google Scholar] [CrossRef]

- Sarkis, J.; Dhavale, D.G. Supplier selection for sustainable operations: A triple-bottom-line approach using a Bayesian framework. Int. J. Prod. Econ. 2015, 166, 177–191. [Google Scholar] [CrossRef]

- Badri Ahmadi, H.; Hashemi Petrudi, S.H.; Wang, X. Integrating sustainability into supplier selection with analytical hierarchy process and improved grey relational analysis: A case of telecom industry. Int. J. Adv. Manuf. Technol. 2017, 90, 2413–2427. [Google Scholar] [CrossRef]

- Faisal, M.N.; Al-Esmael, B.; Sharif, K.J. Supplier selection for a sustainable supply chain: Triple bottom line (3BL) and analytic network process approach. Benchmarking Int. J. 2017, 24, 1956–1976. [Google Scholar] [CrossRef]

- Luthra, S.; Govindan, K.; Kannan, D.; Mangla, S.K.; Garg, C.P. An integrated framework for sustainable supplier selection and evaluation in supply chains. J. Clean. Prod. 2017, 140, 1686–1698. [Google Scholar] [CrossRef]

- Lu, H.; Jiang, S.; Song, W.; Ming, X. A rough multi-criteria decision-making approach for sustainable supplier selection under vague environment. Sustainability 2018, 10, 2622. [Google Scholar] [CrossRef]

- Hendiani, S.; Mahmoudi, A.; Liao, H. A multi-stage multi-criteria hierarchical decision-making approach for sustainable supplier selection. Appl. Soft Comput. 2020, 94, 106456. [Google Scholar] [CrossRef]

- Roy, S.A.; Ali, S.M.; Kabir, G.; Enayet, R.; Suhi, S.A.; Haque, T.; Hasan, R. A framework for sustainable supplier selection with transportation criteria. Int. J. Sustain. Eng. 2020, 13, 77–92. [Google Scholar] [CrossRef]

- Fallahpour, A.; Wong, K.Y.; Rajoo, S.; Fathollahi-Fard, A.M.; Antucheviciene, J.; Nayeri, S. An integrated approach for a sustainable supplier selection based on Industry 4.0 concept. Environ. Sci. Pollut. Res. 2021, 1–19. [Google Scholar] [CrossRef]

- Nguyen, T.-L.; Nguyen, P.-H.; Pham, H.-A.; Nguyen, T.-G.; Nguyen, D.-T.; Tran, T.-H.; Le, H.-C.; Phung, H.-T. A novel integrating data envelopment analysis and spherical fuzzy MCDM approach for sustainable supplier selection in steel industry. Mathematics 2022, 10, 1897. [Google Scholar] [CrossRef]

- Dua, R.; Guzman, A.F. A perspective on emerging energy policy and economic research agenda for enabling aviation climate action. Energy Res. Soc. Sci. 2024, 117, 103725. [Google Scholar] [CrossRef]

- Govindan, K.; Kannan, D.; Jørgensen, T.B.; Nielsen, T.S. Supply Chain 4.0 performance measurement: A systematic literature review, framework development, and empirical evidence. Transp. Res. Part E Logist. Transp. Rev. 2022, 164, 102725. [Google Scholar] [CrossRef]

- Anussornnitisarn, P.; Nivasanon, C.; Kim, N.; Ransikarbum, K. Sustainable technology selection in additive manufacturing: An integrated fuzzy decision analysis framework. Int. J. Adv. Manuf. Technol. 2025, 138, 1177–1196. [Google Scholar] [CrossRef]

- Rezaei, J. Best-worst multi-criteria decision-making method. Omega 2015, 53, 49–57. [Google Scholar] [CrossRef]

- Mohammadi, M.; Rezaei, J. Bayesian best-worst method: A probabilistic group decision making model. Omega 2020, 96, 102075. [Google Scholar] [CrossRef]

- Rezaei, J. Best-worst multi-criteria decision-making method: Some properties and a linear model. Omega 2016, 64, 126–130. [Google Scholar] [CrossRef]

- Liang, F.; Brunelli, M.; Rezaei, J. Consistency issues in the best worst method: Measurements and thresholds. Omega 2020, 96, 102175. [Google Scholar] [CrossRef]

- Liu, Y.; Eckert, C.M.; Earl, C. A review of fuzzy AHP methods for decision-making with subjective judgements. Expert Syst. Appl. 2020, 161, 113738. [Google Scholar] [CrossRef]

- Majumder, P.; Balas, V.E.; Paul, A.; Baidya, D. Application of improved fuzzy best worst analytic hierarchy process on renewable energy. PeerJ Comput. Sci. 2021, 7, e453. [Google Scholar] [CrossRef]

- Wattanasaeng, N.; Ransikarbum, K. Sustainable planning and design for eco-industrial parks using integrated multi-objective optimization and fuzzy analytic hierarchy process. J. Ind. Prod. Eng. 2024, 41, 256–275. [Google Scholar] [CrossRef]

- Saaty, T.L. Decision making with the analytic hierarchy process. Int. J. Serv. Sci. 2008, 1, 83–98. [Google Scholar] [CrossRef]

- van Laarhoven, P.; Pedrycz, W. A fuzzy extension of Saaty’s priority theory. Fuzzy Sets Syst. 1983, 11, 229–241. [Google Scholar] [CrossRef]

- Chanthakhot, W.; Ransikarbum, K. Integrated IEW-TOPSIS and fire dynamics simulation for agent-based evacuation modeling in industrial safety. Safety 2021, 7, 47. [Google Scholar] [CrossRef]

- Song, Q.; Wang, Z.; Wu, T. Risk analysis and assessment of water resource carrying capacity based on weighted gray model with improved entropy weighting method in the central plains region of China. Ecol. Indic. 2024, 160, 111907. [Google Scholar] [CrossRef]

- Zhu, S.; Shi, X.; Yang, C.; Bai, W.; Wei, X.; Yang, K.; Li, P.; Li, H.; Li, Y.; Wang, G. Site selection evaluation for salt cavern hydrogen storage in China. Renew. Energy 2024, 224, 120143. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Llamazares, B. An analysis of the generalized TODIM method. Eur. J. Oper. Res. 2018, 269, 1041–1049. [Google Scholar] [CrossRef]

- Tian, X.; Li, W.; Liu, L.; Kou, G. Development of TODIM with different types of fuzzy sets: A state-of the-art survey. Appl. Soft Comput. 2021, 111, 107661. [Google Scholar] [CrossRef]

- Puppo, B.; Leles, M.; Mozelli, L.; Sbruzzi, E. A Multicriteria decision trading system based on prospect theory: A risk return analysis of the TODIM method. Processes 2022, 10, 609. [Google Scholar] [CrossRef]

- Ibrahim, M.A.R.; Jaini, N.I.; Khalif, K.M.N.K. A comprehensive review of hybrid game theory techniques and multi-criteria decision-making methods. J. Phys. Conf. Ser. 2021, 1988, 012056. [Google Scholar] [CrossRef]

- Lu, X.; Ren, S.; Cui, Y.; Yin, X.; Chen, X.; Zhang, Y.; Moghtaderi, B. A novel site selection approach for Co-location of petrol-hydrogen fueling stations using a game theory-based multi-criteria decision-making model. Int. J. Hydrogen Energy 2025, 106, 1443–1461. [Google Scholar] [CrossRef]

- Altman, E.I. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Risman, A.; Mulyana, B.; Silvatika, B.A.; Sulaeman, A.S. The effect of digital finance on financial stability. Manag. Sci. Lett. 2021, 11, 1979–1984. [Google Scholar] [CrossRef]

- S&P Global. 2025. Available online: https://www.spglobal.com/en (accessed on 15 August 2024).

- Grand View Research. Hydrogen Generation Market Size, Share & Trends Analysis Report. 2025. Available online: https://www.grandviewresearch.com/industry-analysis/hydrogen-generation-market (accessed on 15 August 2024).

- Busch, P.; Kendall, A.; Lipman, T. A systematic review of life cycle greenhouse gas intensity values for hydrogen production pathways. Renew. Sustain. Energy Rev. 2023, 184, 113588. [Google Scholar] [CrossRef]

- OSHA. 2025. Available online: https://www.osha.gov/recordkeeping (accessed on 15 August 2024).

- Han, Y.; Chong, W.K.; Li, D. A systematic literature review of the capabilities and performance metrics of supply chain resilience. Int. J. Prod. Res. 2020, 58, 4541–4566. [Google Scholar] [CrossRef]

- World Bank. Political Stability and Absence of Violence/Terrorism: Percentile Rank. 2023. Available online: https://data.worldbank.org/indicator/ (accessed on 15 August 2024).

- Shekhovtsov, A. How strongly do rank similarity coefficients differ used in decision making problems? Procedia Comput. Sci. 2021, 192, 4570–4577. [Google Scholar] [CrossRef]

- Sałabun, W.; Urbaniak, K. A new coefficient of rankings similarity in decision-making problems. In Computational Science—ICCS 2020, Proceedings of the 20th International Conference, Amsterdam, The Netherlands, 3–5 June 2020; Springer: Cham, Switzerland, 2020; pp. 632–645. [Google Scholar] [CrossRef]

- Dezert, J.; Tchamova, A.; Han, D.; Tacnet, J.-M. The SPOTIS rank reversal free method for multi-criteria decision-making support. In Proceedings of the 2020 IEEE 23rd International Conference on Information Fusion (FUSION), Rustenburg, South Africa, 6–9 July 2020; pp. 1–8. [Google Scholar]

- Więckowski, J.; Kizielewicz, B.; Shekhovtsov, A.; Sałabun, W. RANCOM: A novel approach to identifying criteria relevance based on inaccuracy expert judgments. Eng. Appl. Artif. Intell. 2023, 122, 106114. [Google Scholar] [CrossRef]

- Shekhovtsov, A. Evaluating the performance of subjective weighting methods for multi-criteria decision-making using a novel weights similarity coefficient. Procedia Comput. Sci. 2023, 225, 4785–4794. [Google Scholar] [CrossRef]

| Study | Methodology | Uncertainty | Context | Main Criteria |

|---|---|---|---|---|

| Hashemi et al. [34] | ANP, GRA | Green supplier selection | (2) Economic, Environmental | |

| Sarkis and Dhavale [35] | Monte Carlo Markov Chain | Bayesian framework | Sustainable supplier selection | (3) Economic, Social, Environmental |

| Badri Ahmadi et al. [36] | AHP, Improved GRA | Sustainable supplier selection | (3) Economic, Social, Environmental | |

| Faisal et al. [37] | ANP | Sustainable supplier selection | (3) Economic, Social, Environmental | |

| Luthra et al. [38] | AHP, VIKOR | Sustainable supplier selection | (3) Economic, Social, Environmental | |

| Lu et al. [39] | ELECTRE | Rough set theory | Sustainable supplier selection | (3) Economic, Social, Environmental |

| Hendiani et al. [40] | Best–Worst Method | Fuzzy | Sustainable supplier selection | (3) Economic, Social, Environmental |

| Roy et al. [41] | AHP, PROMETHEE | Fuzzy | Sustainable supplier selection | (4) Economic, Social, Environmental, Transportation |

| Alipour et al. [33] | Entropy, SWARA, COPRAS | Pythagorean fuzzy | Hydrogen context | (4) Economic, Organization, Supply risk, Technological capability |

| Fallahpour et al. [42] | Best–Worst Method | Fuzzy Inference System | Sustainable supplier selection | (3) Economic, Social, Environmental |

| Nguyen et al. [43] | DEA, AHP, WASPAS | Spherical Fuzzy | Sustainable supplier selection | (3) Economic, Social, Environmental |

| Xie et al. [29] | Entropy, SWARA, COPRAS | Sustainable supplier selection | (3) Economic, Social, Environmental | |

| Hjeij et al. [30] | AHP, Expert Interview | Hydrogen context | (5) Resource availability, Political status, Economic potential, Knowledge, Adaptability | |

| Singh et al. [32] | TODIM | Fuzzy | Hydrogen context | (7) Economic, Product, Organization, Green initiatives, Supply risk, Technology, Socio-cultural |

| This Study | BWM, AHP, TODIM, Game Theory | Bayesian, Fuzzy | Hydrogen context | (5) Economic, Environmental, Social, Operational capacity and efficiency, Risk management |

| Criteria | Description (Basis of Data Collection) |

|---|---|

| C1: Economic | |

| C1.1: Cost | The suppliers’ provided price indices for hydrogen products (price of standard 50 L; hydrogen 3.0 cylinder) |

| C1.2: Financial stability | The ability of a company to keep its financial standing stable (financial stability score from [65,66]; company reports) |

| C1.3: Range of hydrogen quality | The quantity of hydrogen products (number of quality grades offered; purity levels; types of applications; and data obtained from company websites) |

| C1.4: Market share | The percentage of total sales of the supplier in the hydrogen market (company reports and a literature review, such as [67,68]) |

| C2: Environmental | |

| C2.1: Carbon footprint | The greenhouse gases produced by the supplier in carbon dioxide equivalent (company reports; Combined Internal Heat and Power (CIHP); and [69]) |

| C2.2: Renewable energy use | The renewable energy used in the hydrogen production process by the supplier (percentage of renewable energy and company sustainability reports) |

| C2.3: Resource efficiency | The supplier’s ability to manage waste and water in compliance with regulations (resource efficiency index and company sustainability reports) |

| C3: Social | |

| C3.1: Community engagement | The supplier’s contribution to community development and employment (charitable contributions and company sustainability reports) |

| C3.2: Labor practices | Suppliers’ policies regarding fair wages and working environment (combined diversity, employee turnover, and training data; and company reports and estimated data) |

| C3.3: Occupational health | Policies and practices that ensure the safety of workers in production and health (Total Recordable Case Frequency (TRCF) [70]) |

| C4: Operational capacity and technology | |

| C4.1: Production capacity | The hydrogen that a company can produce in a time frame and operation scale (company reports and a literature review) |

| C4.2: Distribution network | The supplier’s logistics and infrastructure capabilities in HSC (CAPEX data as a percentage of revenue and company reports) |

| C4.3: Technological innovation | The current technology and research and development for hydrogen production (innovation capability score, and company reports and estimation) |

| C5: Risk management | |

| C5.1: Supply chain resilience | The ability of the supplier to predict, plan, and manage HSC disruptions (literature review; company reports and estimation; and [71]) |

| C5.2: Geopolitical risk | The risks and uncertainties arising out of political and geographical factors (geopolitical risk index computed from regional revenue and [72]) |

| C5.3: Regulatory compliance | The degree a company complies with standards, safety, and operational risks (rating score based on the number of ISO documents and certificates held) |

| Criteria (Units) | A1 | A2 | A3 | A4 | A5 | A6 | A7 |

|---|---|---|---|---|---|---|---|

| C1: Economic | |||||||

| C1.1 (Price per cylinder in EUR) | 42.31 | 140 | 135.6 | 120 | 150 | 150 | 67.61 |

| C1.2 (Financial stability score) | 11.82 | 7.92 | 8.06 | 8.5 | 5.06 | 5.11 | 6.04 |

| C1.3 (Quality score) | 4.32 | 4.22 | 3.56 | 3.89 | 2.67 | 2.67 | 3.89 |

| C1.4 (Percentage of market share) | 0.022 | 1.200 | 1.670 | 0.001 | 0.061 | 0.001 | 1.110 |

| C2: Environmental | |||||||

| C2.1 (CIHP converted to a 1–10 rating) | 5 | 7 | 6 | 6 | 5 | 5 | 7 |

| C2.2 (Percentage of renewable energy) | 30 | 43 | 23 | 39 | 45 | 40 | 55 |

| C2.3 (Resource efficiency index) | 16.67 | 5.35 | 5.68 | 15 | 7.62 | 1.04 | 4.42 |

| C3: Social | |||||||

| C3.1 (Percentage of charitable contributions) | 50 | 38 | 71 | 50 | 61 | 50 | 50 |

| C3.2 (Average labor practice score of 1–10) | 7.90 | 8.80 | 8.40 | 8.80 | 9.60 | 8.50 | 8.40 |

| C3.3 (Total recordable case frequency: TRCF) | 1.40 | 0.80 | 1.50 | 1.40 | 2.42 | 2.42 | 1.50 |

| C4: Operational capacity and technology | |||||||

| C4.1 (Annual production in a 1–10 rating) | 5 | 8 | 9 | 4 | 6 | 3 | 8 |

| C4.2 (Percentage of CAPEX from revenue) | 15.79 | 14.29 | 41.46 | 4.01 | 7.26 | 0.54 | 12.29 |

| C4.3 (Innovation capability score) | 4.00 | 4.72 | 4.92 | 3.50 | 4.15 | 4.25 | 5.17 |

| C5: Risk management | |||||||

| C5.1 (Supply chain resilience score) | 0.226 | 0.340 | 0.387 | 0.271 | 0.312 | 0.234 | 0.397 |

| C5.2 (Geopolitical risk index) | 4.88 | 5.26 | 4.89 | 6.12 | 4.97 | 5.81 | 5.24 |

| C5.3 (Regulatory compliance score) | 8.00 | 9.00 | 9.00 | 8.75 | 8.75 | 8.25 | 9.13 |

| Main Criteria Weight | C1 | C2 | C3 | C4 | C5 | |

|---|---|---|---|---|---|---|

| W | 0.1874 | 0.2589 | 0.1751 | 0.1785 | 0.2001 | |

| Probability matrix | C1 | 0 | 0.2277 | 0.5597 | 0.5425 | 0.4441 |

| C2 | 0.7723 | 0 | 0.8149 | 0.8034 | 0.7234 | |

| C3 | 0.4402 | 0.1851 | 0 | 0.4852 | 0.3816 | |

| C4 | 0.4575 | 0.1966 | 0.5148 | 0 | 0.3981 | |

| C5 | 0.5559 | 0.2766 | 0.6184 | 0.6019 | 0 |

| Sub-Criteria Weight Under C1 | C1.1 | C1.2 | C1.3 | C1.4 | |

|---|---|---|---|---|---|

| W | 0.3009 | 0.3103 | 0.1997 | 0.1891 | |

| Probability matrix | C1.1 | 0 | 0.4730 | 0.8246 | 0.8547 |

| C1.2 | 0.5270 | 0 | 0.8479 | 0.8711 | |

| C1.3 | 0.1754 | 0.1521 | 0 | 0.5521 | |

| C1.4 | 0.1453 | 0.1289 | 0.4479 | 0 | |

| Sub-criteria weight under C2 | C2.1 | C2.2 | C2.3 | ||

| W | 0.5369 | 0.2805 | 0.1826 | ||

| Probability matrix | C2.1 | 0 | 0.9279 | 0.9851 | |

| C2.2 | 0.0721 | 0 | 0.8206 | ||

| C2.3 | 0.0149 | 0.1794 | 0 | ||

| Sub-criteria weight under C3 | C3.1 | C3.2 | C3.3 | ||

| W | 0.2132 | 0.3281 | 0.4587 | ||

| Probability matrix | C3.1 | 0 | 0.1695 | 0.0494 | |

| C3.2 | 0.8305 | 0 | 0.2140 | ||

| C3.3 | 0.9506 | 0.7860 | 0 | ||

| Sub-criteria weight under C4 | C4.1 | C4.2 | C4.3 | ||

| W | 0.3163 | 0.3417 | 0.3420 | ||

| Probability matrix | C4.1 | 0 | 0.4346 | 0.4345 | |

| C4.2 | 0.5654 | 0 | 0.5005 | ||

| C4.3 | 0.5655 | 0.4995 | 0 | ||

| Sub-criteria weight under C5 | C5.1 | C5.2 | C5.3 | ||

| W | 0.3504 | 0.2902 | 0.3594 | ||

| Probability matrix | C5.1 | 0 | 0.6630 | 0.4803 | |

| C5.2 | 0.3370 | 0 | 0.3188 | ||

| C5.3 | 0.5197 | 0.6812 | 0 |

| Main Criteria Weight | C1 | C2 | C3 | C4 | C5 | |

|---|---|---|---|---|---|---|

| W | 0.3202 | 0.2399 | 0.1215 | 0.1447 | 0.1738 | |

| Sub-criteria weight under C1 | C1.1 | C1.2 | C1.3 | C1.4 | ||

| W | 0.3476 | 0.2614 | 0.2080 | 0.1830 | ||

| Sub-criteria weight under C2 | C2.1 | C2.2 | C2.3 | |||

| W | 0.4305 | 0.3534 | 0.2161 | |||

| Sub-criteria weight under C3 | C3.1 | C3.2 | C3.3 | |||

| W | 0.2052 | 0.3353 | 0.4595 | |||

| Sub-criteria weight under C4 | C4.1 | C4.2 | C4.3 | |||

| W | 0.3236 | 0.3520 | 0.3244 | |||

| Sub-criteria weight under C5 | C5.1 | C5.2 | C5.3 | |||

| W | 0.3332 | 0.3748 | 0.2920 |

| Criteria | Bayesian BWM | Fuzzy AHP | EWM | Game Theory |

|---|---|---|---|---|

| C1: Economic | ||||

| C1.1 | 0.0564 | 0.1076 | 0.1074 | 0.0938 |

| C1.2 | 0.0582 | 0.0816 | 0.0763 | 0.0730 |

| C1.3 | 0.0374 | 0.0646 | 0.0581 | 0.0545 |

| C1.4 | 0.0355 | 0.0553 | 0.1257 | 0.0806 |

| C2: Environmental | ||||

| C2.1 | 0.1390 | 0.1074 | 0.0626 | 0.0964 |

| C2.2 | 0.0726 | 0.0871 | 0.0382 | 0.0620 |

| C2.3 | 0.0473 | 0.0523 | 0.0438 | 0.0472 |

| C3: Social | ||||

| C3.1 | 0.0373 | 0.0245 | 0.0407 | 0.0350 |

| C3.2 | 0.0575 | 0.0408 | 0.0422 | 0.0459 |

| C3.3 | 0.0802 | 0.0561 | 0.0587 | 0.0637 |

| C4: Operational capacity and technology | ||||

| C4.1 | 0.0565 | 0.0480 | 0.0466 | 0.0496 |

| C4.2 | 0.0610 | 0.0516 | 0.0689 | 0.0616 |

| C4.3 | 0.0611 | 0.0477 | 0.0391 | 0.0475 |

| C5: Risk management | ||||

| C5.1 | 0.0701 | 0.0584 | 0.0609 | 0.0627 |

| C5.2 | 0.0580 | 0.0661 | 0.0937 | 0.0760 |

| C5.3 | 0.0719 | 0.0509 | 0.0371 | 0.0505 |

| Method Pair | WSC Value | WSC Average |

|---|---|---|

| Bayesian BWM vs. Fuzzy AHP | 0.8453 | 0.8228 |

| Bayesian BWM vs. EWM | 0.7646 | |

| Fuzzy AHP vs. EWM | 0.8585 | |

| Bayesian BWM vs. Game Theory | 0.8621 | |

| Fuzzy AHP vs. Game Theory | 0.9238 | 0.8953 |

| EWM vs. Game Theory | 0.9000 |

| Criteria (Game Theory-Based Weight) | A1 | A2 | A3 | A4 | A5 | A6 | A7 |

|---|---|---|---|---|---|---|---|

| C1.1 (0.0938) | 0.3168 | 0.0957 | 0.0988 | 0.1117 | 0.0894 | 0.0894 | 0.1982 |

| C1.2 (0.0730) | 0.2251 | 0.1508 | 0.1535 | 0.1619 | 0.0964 | 0.0973 | 0.1150 |

| C1.3 (0.0545) | 0.1713 | 0.1673 | 0.1412 | 0.1542 | 0.1059 | 0.1059 | 0.1542 |

| C1.4 (0.0806) | 0.0054 | 0.2952 | 0.4108 | 0.0003 | 0.0150 | 0.0003 | 0.2730 |

| C2.1 (0.0964) | 0.122 | 0.1707 | 0.1463 | 0.1463 | 0.122 | 0.122 | 0.1707 |

| C2.2 (0.0620) | 0.1091 | 0.1564 | 0.0836 | 0.1418 | 0.1636 | 0.1455 | 0.2 |

| C2.3 (0.0472) | 0.0332 | 0.1033 | 0.0973 | 0.0369 | 0.0726 | 0.5316 | 0.1251 |

| C3.1 (0.0350) | 0.1351 | 0.1027 | 0.1919 | 0.1351 | 0.1649 | 0.1351 | 0.1351 |

| C3.2 (0.0459) | 0.1308 | 0.1457 | 0.1391 | 0.1457 | 0.1589 | 0.1407 | 0.1391 |

| C3.3 (0.0637) | 0.1476 | 0.2584 | 0.1378 | 0.1476 | 0.0854 | 0.0854 | 0.1378 |

| C4.1 (0.0496) | 0.1163 | 0.186 | 0.2093 | 0.093 | 0.1395 | 0.0698 | 0.186 |

| C4.2 (0.0616) | 0.1651 | 0.1494 | 0.4335 | 0.0419 | 0.0759 | 0.0056 | 0.1285 |

| C4.3 (0.0475) | 0.1303 | 0.1537 | 0.1602 | 0.114 | 0.1351 | 0.1384 | 0.1683 |

| C5.1 (0.0627) | 0.1044 | 0.1568 | 0.1786 | 0.125 | 0.1439 | 0.108 | 0.1832 |

| C5.2 (0.0760) | 0.1313 | 0.1415 | 0.1316 | 0.1646 | 0.1337 | 0.1563 | 0.141 |

| C5.3 (0.0505) | 0.1314 | 0.1478 | 0.1478 | 0.1437 | 0.1437 | 0.1355 | 0.15 |

| A1 | A2 | A3 | A4 | A5 | A6 | A7 | |

|---|---|---|---|---|---|---|---|

| A1 | 0 | −0.3128 | −0.5256 | 0.2830 | 0.3270 | 0.1823 | −0.3357 |

| A2 | 0.3128 | 0 | −0.2128 | 0.5958 | 0.6398 | 0.4951 | −0.0229 |

| A3 | 0.5256 | 0.2128 | 0 | 0.8086 | 0.8527 | 0.7079 | 0.1899 |

| A4 | −0.2830 | −0.5958 | −0.8086 | 0 | 0.0441 | −0.1007 | −0.6187 |

| A5 | −0.3270 | −0.6398 | −0.8527 | −0.0441 | 0 | −0.1448 | −0.6628 |

| A6 | −0.1823 | −0.4951 | −0.7079 | 0.1007 | 0.1448 | 0 | −0.5180 |

| A7 | 0.3357 | 0.0229 | −0.1899 | 0.6187 | 0.6628 | 0.5180 | 0 |

| Alternatives | Overall Dominance Degree | Prospect Value | Rank |

|---|---|---|---|

| A1 | −0.3818 | 0.3836 | 4 |

| A2 | 1.8078 | 0.7504 | 3 |

| A3 | 3.2975 | 1.0000 | 1 |

| A4 | −2.3627 | 0.0517 | 6 |

| A5 | −2.6712 | 0.0000 | 7 |

| A6 | −1.6578 | 0.1698 | 5 |

| A7 | 1.9682 | 0.7773 | 2 |

| Alternatives | Prospect Value ( = 1.0) | Rank ( = 1.0) | Rank (2.0) | Rank (3.0) | Rank (4.0) | Rank (5.0) |

|---|---|---|---|---|---|---|

| A1 | 0.3836 | 4 | 3 | 3 | 3 | 3 |

| A2 | 0.7504 | 3 | 2 | 2 | 2 | 2 |

| A3 | 1.0000 | 1 | 1 | 1 | 1 | 1 |

| A4 | 0.0517 | 6 | 5 | 5 | 5 | 5 |

| A5 | 0.0000 | 7 | 7 | 6 | 6 | 6 |

| A6 | 0.1698 | 5 | 6 | 7 | 7 | 7 |

| A7 | 0.7773 | 2 | 4 | 4 | 4 | 4 |

| Criteria | Scenario 1 (C1 Focus) | Scenario 2 (C2 Focus) | Scenario 3 (C3 Focus) | Scenario 4 (C4 Focus) | Scenario 5 (C5 Focus) |

|---|---|---|---|---|---|

| C1.1 | 0.2500 | 0 | 0 | 0 | 0 |

| C1.2 | 0.2500 | 0 | 0 | 0 | 0 |

| C1.3 | 0.2500 | 0 | 0 | 0 | 0 |

| C1.4 | 0.2500 | 0 | 0 | 0 | 0 |

| C2.1 | 0 | 0.3333 | 0 | 0 | 0 |

| C2.2 | 0 | 0.3333 | 0 | 0 | 0 |

| C2.3 | 0 | 0.3333 | 0 | 0 | 0 |

| C3.1 | 0 | 0 | 0.3333 | 0 | 0 |

| C3.2 | 0 | 0 | 0.3333 | 0 | 0 |

| C3.3 | 0 | 0 | 0.3333 | 0 | 0 |

| C4.1 | 0 | 0 | 0 | 0.3333 | 0 |

| C4.2 | 0 | 0 | 0 | 0.3333 | 0 |

| C4.3 | 0 | 0 | 0 | 0.3333 | 0 |

| C5.1 | 0 | 0 | 0 | 0 | 0.3333 |

| C5.2 | 0 | 0 | 0 | 0 | 0.3333 |

| C5.3 | 0 | 0 | 0 | 0 | 0.3333 |

| Base Scenario | Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | Scenario 5 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rank | Prospect Value | Rank | Prospect Value | Rank | Prospect Value | Rank | Prospect Value | Rank | Prospect Value | Rank | |

| A1 | 4 | 0.8324 | 3 | 0.0000 | 7 | 0.3592 | 4 | 0.3359 | 4 | 0.0000 | 7 |

| A2 | 3 | 0.8136 | 4 | 0.3106 | 3 | 1.0000 | 1 | 0.4672 | 2 | 0.7376 | 3 |

| A3 | 1 | 1.0000 | 1 | 0.1176 | 5 | 0.7390 | 2 | 1.0000 | 1 | 0.8487 | 2 |

| A4 | 6 | 0.2644 | 5 | 0.1135 | 6 | 0.4615 | 3 | 0.0596 | 6 | 0.6181 | 4 |

| A5 | 7 | 0.0270 | 6 | 0.1756 | 4 | 0.3297 | 6 | 0.2320 | 5 | 0.5061 | 5 |

| A6 | 5 | 0.0000 | 7 | 1.0000 | 1 | 0.0000 | 7 | 0.0000 | 7 | 0.3053 | 6 |

| A7 | 2 | 0.8750 | 2 | 0.4329 | 2 | 0.3489 | 5 | 0.4566 | 3 | 1.0000 | 1 |

| WS Coefficient | 0.928 | 0.569 | 0.678 | 0.901 | 0.788 | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Janmontree, J.; Shinde, A.; Zadek, H.; Trojahn, S.; Ransikarbum, K. A Strategic Hydrogen Supplier Assessment Using a Hybrid MCDA Framework with a Game Theory-Driven Criteria Analysis. Energies 2025, 18, 3508. https://doi.org/10.3390/en18133508

Janmontree J, Shinde A, Zadek H, Trojahn S, Ransikarbum K. A Strategic Hydrogen Supplier Assessment Using a Hybrid MCDA Framework with a Game Theory-Driven Criteria Analysis. Energies. 2025; 18(13):3508. https://doi.org/10.3390/en18133508

Chicago/Turabian StyleJanmontree, Jettarat, Aditya Shinde, Hartmut Zadek, Sebastian Trojahn, and Kasin Ransikarbum. 2025. "A Strategic Hydrogen Supplier Assessment Using a Hybrid MCDA Framework with a Game Theory-Driven Criteria Analysis" Energies 18, no. 13: 3508. https://doi.org/10.3390/en18133508

APA StyleJanmontree, J., Shinde, A., Zadek, H., Trojahn, S., & Ransikarbum, K. (2025). A Strategic Hydrogen Supplier Assessment Using a Hybrid MCDA Framework with a Game Theory-Driven Criteria Analysis. Energies, 18(13), 3508. https://doi.org/10.3390/en18133508