A Review of Carbon Pricing Mechanisms and Risk Management for Raw Materials in Low-Carbon Energy Systems

Abstract

1. Introduction

2. Raw Materials and Carbon Policies

2.1. Strategic Role of Raw Materials

2.2. Global Carbon Pricing Trends

- Carbon Border Adjustment Mechanism (CBAM): The European Union (EU) and other jurisdictions have implemented CBAMs, which impose tariffs based on the carbon content of imported goods, including raw materials. This mechanism shifts the carbon cost upstream, affecting trade competitiveness and encouraging cleaner production. Böhringer et al. [26] found that border adjustments can reduce emissions leakage and ease the burden of unilateral climate actions on domestic industries, though they offer limited global cost savings. Mattoo et al. [9] discussed the trade-offs between reducing leakage and avoiding protectionism, warning that ambiguities in WTO rules may lead to disputes. They recommended basing carbon taxes on the location of production through regional agreements. Abrell et al. [27] further supported the role of CBAMs in global emissions reduction through their analysis of their economic and environmental effects.

- Expansion of Emissions Trading Schemes (ETS): Schemes such as the EU-ETS and China’s national ETS are expanding their sectoral coverage and tightening emission caps. These policies impose additional costs on raw material extraction and processing. Zhang [15] examined China’s pilot schemes and emphasized the importance of participant education, rule enforcement, and financial treatment of allowances in promoting active carbon trading. Ellerman et al. [28] described the EU-ETS as a model for global replication, reporting emissions reductions of 10–20% in energy-intensive sectors.

- Green Trade and Investment Agreements: Modern trade agreements increasingly incorporate environmental, social, and governance (ESG) standards that require carbon disclosures and green certifications. These provisions impact raw material exporters by imposing stricter environmental criteria. Hufbauer et al. [29] explored the broader implications of digital trade and regulation, noting that regional regulatory differences influence the scope of green trade policies. Agreements like the US–Mexico–Canada Agreement (USMCA) already include climate-related clauses that affect supply chains and trade flows.

| Policy | Region | Target Sectors | Impact on Raw Materials |

|---|---|---|---|

| CBAM | EU | Imports of cement, steel, aluminum, fertilizers, electricity | Imposes carbon costs on imports, encouraging producers to decarbonize and affecting global trade flows. |

| EU-ETS | EU | Power, industry, aviation | Increases costs for energy-intensive processes and promotes investments in cleaner technologies. |

| National ETS | China | Power, expanding to cement, steel | Drives regulatory compliance and encourages industry investment in low-carbon alternatives. |

| Green Trade Agreements | USMCA, EU | Multisectoral with ESG requirements | Requires exporters to adhere to environmental standards, potentially excluding high-emission supply chains. |

| Carbon Taxes | Sweden, Canada, others | Energy, transport, industry | Provides direct financial incentives to reduce fossil fuel consumption and emissions in extraction and processing. |

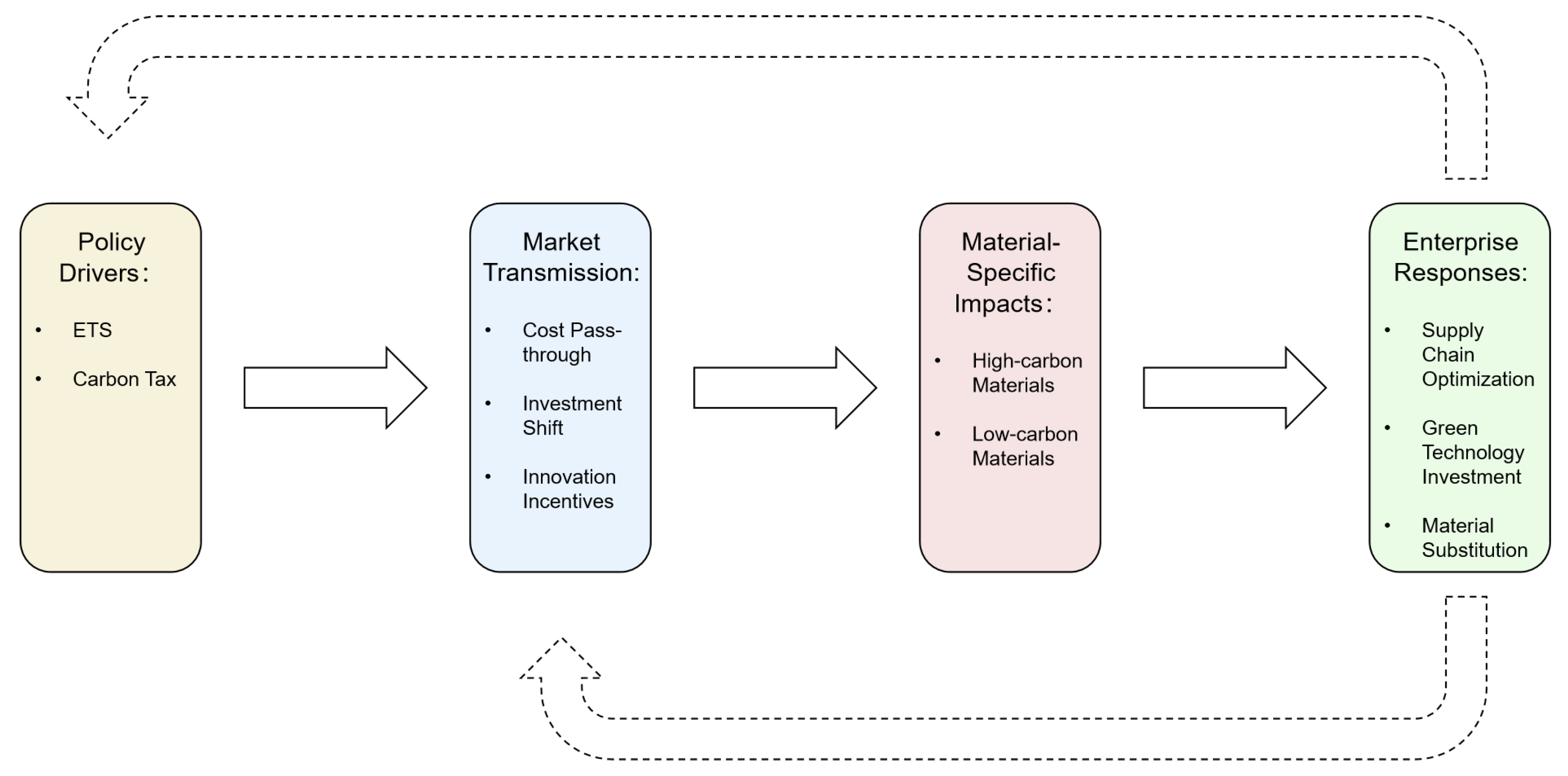

2.3. Integrated Framework for Pricing and Risk

3. Carbon Pricing Transmission Effects

3.1. Price Transmission Mechanisms

3.2. Systemic Risks Induced by Carbon Pricing

3.3. Macro Linkages

3.4. Carbon Pricing Efficacy for Risk Mitigation

- Carbon Taxes: A carbon tax imposes a fixed price on carbon emissions, providing firms with a predictable cost for emitting greenhouse gases. This creates a strong incentive to adopt cleaner technologies and improve production efficiency. By making carbon-intensive materials more expensive, it encourages the use of low-emission alternatives. However, its effectiveness depends on the tax rate and the availability of viable substitutes [8,71].

- ETS: ETSs establish a market where companies can trade emission allowances. Firms can buy or sell permits depending on their abatement costs, allowing them to reduce emissions in a cost-effective manner. By increasing the cost of high-emission materials, ETSs incentivize cleaner production. The flexibility of the system comes from fluctuating permit prices, which respond to market supply and demand [8,72].

- CBAM: A CBAM applies a tariff on carbon-intensive imports from countries with less stringent climate regulations. This helps prevent carbon leakage, where production shifts to regions with weaker environmental standards. By raising the cost of imported high-emission materials, CBAMs promote sourcing from cleaner producers and support investment in low-carbon production methods [73].

4. Financial Instruments and Risk Management Strategies

4.1. Carbon-Linked Financial Instruments

4.2. Corporate Strategies for Risk Mitigation

5. Challenges and Future Directions

- Priority 1: Estimate the price elasticity of critical materials such as lithium and rare earth elements under different carbon pricing scenarios.

- Priority 2: Develop integrated models that link material flow analysis with carbon market behavior.

- Priority 3: Conduct long-term studies on how firms adapt to different carbon pricing policies across regions.

- Immediate-term: Analyze how raw material prices respond to changes in carbon policy (linked to Challenge 2).

- Medium-term: Develop models for integrating carbon and commodity markets across borders (linked to Challenge 1).

- Long-term: Assess enterprise resilience strategies under evolving regulations (linked to Challenge 4).

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Olivetti, E.A.; Ceder, G.; Gaustad, G.G.; Fu, X. Lithium-ion battery supply chain considerations: Analysis of potential bottlenecks in critical metals. Joule 2017, 1, 229–243. [Google Scholar] [CrossRef]

- Elshkaki, A.; Graedel, T.E.; Ciacci, L.; Reck, B.K. Copper demand, supply, and associated energy use to 2050. Glob. Environ. Change 2016, 39, 305–315. [Google Scholar] [CrossRef]

- Nansai, K.; Nakajima, K.; Kagawa, S.; Kondo, Y.; Suh, S.; Shigetomi, Y.; Oshita, Y. Global flows of critical metals necessary for low-carbon technologies: The case of neodymium, cobalt, and platinum. Environ. Sci. Technol. 2014, 48, 1391–1400. [Google Scholar] [CrossRef] [PubMed]

- Banza Lubaba Nkulu, C.; Casas, L.; Haufroid, V.; De Putter, T.; Saenen, N.D.; Kayembe-Kitenge, T.; Musa Obadia, P.; Kyanika Wa Mukoma, D.; Lunda Ilunga, J.M.; Nawrot, T.S.; et al. Sustainability of artisanal mining of cobalt in DR Congo. Nat. Sustain. 2018, 1, 495–504. [Google Scholar] [CrossRef]

- Schmuch, R.; Wagner, R.; Hörpel, G.; Placke, T.; Winter, M. Performance and cost of materials for lithium-based rechargeable automotive batteries. Nat. Energy 2018, 3, 267–278. [Google Scholar] [CrossRef]

- Ma, L.; Song, M. Approaches to carbon emission reductions and technology in China’s chemical industry to achieve carbon neutralization. Energies 2022, 15, 5401. [Google Scholar] [CrossRef]

- Verde, S.F.; Borghesi, S. The international dimension of the EU emissions trading system: Bringing the pieces together. Environ. Resour. Econ. 2022, 83, 23–46. [Google Scholar] [CrossRef]

- Ahmad, M.; Li, X.F.; Wu, Q. Carbon taxes and emission trading systems: Which one is more effective in reducing carbon emissions?—A meta-analysis. J. Clean. Prod. 2024, 476, 143761. [Google Scholar] [CrossRef]

- Holmes, P.; Reilly, T.; Rollo, J. Border carbon adjustments and the potential for protectionism. Clim. Policy 2011, 11, 883–900. [Google Scholar] [CrossRef]

- Chevallier, J. Carbon futures and macroeconomic risk factors: A view from the EU ETS. Energy Econ. 2009, 31, 614–625. [Google Scholar] [CrossRef]

- Bolton, P.; Kacperczyk, M. Do investors care about carbon risk? J. Financ. Econ. 2021, 142, 517–549. [Google Scholar] [CrossRef]

- Nordhaus, W.D. To tax or not to tax: Alternative approaches to slowing global warming. Rev. Environ. Econ. Policy 2007, 1. [Google Scholar] [CrossRef]

- Bovenberg, A.L.; Goulder, L.H. Optimal environmental taxation in the presence of other taxes: General-equilibrium analyses. Am. Econ. Rev. 1996, 86, 985–1000. [Google Scholar]

- Yang, T.; Sun, Z.; Du, M.; Du, Q.; Li, L.; Shuwaikh, F. The impact of the degree of coupling coordination between green finance and environmental regulations on firms’ innovation performance: Evidence from China. Ann. Oper. Res. 2025, 347, 173–195. [Google Scholar] [CrossRef]

- Zhang, Z. Carbon emissions trading in China: The evolution from pilots to a nationwide scheme. Clim. Policy 2015, 15, S104–S126. [Google Scholar] [CrossRef]

- Gatzert, N.; Kosub, T. Risks and risk management of renewable energy projects: The case of onshore and offshore wind parks. Renew. Sustain. Energy Rev. 2016, 60, 982–998. [Google Scholar] [CrossRef]

- Mertens, J.; Dewulf, J.; Breyer, C.; Belmans, R.; Gendron, C.; Geoffron, P.; Goossens, L.; Fischer, C.; Du Fornel, E.; Hayhoe, K.; et al. From emissions to resources: Mitigating the critical raw material supply chain vulnerability of renewable energy technologies. Miner. Econ. 2024, 37, 669–676. [Google Scholar] [CrossRef]

- Grubler, A.; Wilson, C.; Bento, N.; Boza-Kiss, B.; Krey, V.; McCollum, D.L.; Rao, N.D.; Riahi, K.; Rogelj, J.; De Stercke, S.; et al. A low energy demand scenario for meeting the 1.5 C target and sustainable development goals without negative emission technologies. Nat. Energy 2018, 3, 515–527. [Google Scholar] [CrossRef]

- Creutzig, F.; Roy, J.; Lamb, W.F.; Azevedo, I.M.; Bruine de Bruin, W.; Dalkmann, H.; Edelenbosch, O.Y.; Geels, F.W.; Grubler, A.; Hepburn, C.; et al. Towards demand-side solutions for mitigating climate change. Nat. Clim. Change 2018, 8, 260–263. [Google Scholar] [CrossRef]

- Maham, M.; Rabia, C.; Anum, I.; Ahad, I.U. Critical and Strategic Raw Materials for Energy Storage Devices. Batteries 2025, 11, 163. [Google Scholar] [CrossRef]

- Koese, M.; van Nielen, S.; Bradley, J.; Kleijn, R. The dynamics of accelerating end-of-life rare earth permanent magnet recycling: A technological innovation systems approach. Appl. Energy 2025, 388, 125707. [Google Scholar] [CrossRef]

- Mudd, G.M. Global trends and environmental issues in nickel mining: Sulfides versus laterites. Ore Geol. Rev. 2010, 38, 9–26. [Google Scholar] [CrossRef]

- Sonter, L.J.; Ali, S.H.; Watson, J.E. Mining and biodiversity: Key issues and research needs in conservation science. Proc. R. Soc. B 2018, 285, 20181926. [Google Scholar] [CrossRef] [PubMed]

- Vidal, O.; Goffé, B.; Arndt, N. Metals for a low-carbon society. Nat. Geosci. 2013, 6, 894–896. [Google Scholar] [CrossRef]

- Ali, S.H.; Giurco, D.; Arndt, N.; Nickless, E.; Brown, G.; Demetriades, A.; Durrheim, R.; Enriquez, M.A.; Kinnaird, J.; Littleboy, A.; et al. Mineral supply for sustainable development requires resource governance. Nature 2017, 543, 367–372. [Google Scholar] [CrossRef]

- Böhringer, C.; Balistreri, E.J.; Rutherford, T.F. The role of border carbon adjustment in unilateral climate policy: Overview of an Energy Modeling Forum study (EMF 29). Energy Econ. 2012, 34, S97–S110. [Google Scholar] [CrossRef]

- Wilcoxen, P.; McKibbin, W.; Braathen, N.A.; Tao, H.; Levinson, A. The economic and environmental effects of border tax adjustments for climate policy. In Climate Change, Trade and Competitiveness; Brookings Institution Press: Washington, DC, USA, 2009. [Google Scholar]

- Ellerman, D. The EU Emission Trading Scheme: A Prototype Global System? In Post-Kyoto International Climate Policy: Implementing Architectures for Agreement; Aldy, J.E., Stavins, R.N., Eds.; Cambridge University Press: New York, NY, USA, 2010. [Google Scholar]

- Hufbauer, G.C.; Lu, Z.L. 19-14 Global E-Commerce Talks Stumble on Data Issues, Privacy, and More; Peterson Institute for International Economics: Washington, DC, USA, 2019. [Google Scholar]

- Hepburn, C.; O’Callaghan, B.; Stern, N.; Stiglitz, J.; Zenghelis, D. Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change? Oxf. Rev. Econ. Policy 2020, 36, S359–S381. [Google Scholar] [CrossRef]

- Guilhot, L. An analysis of China’s energy policy from 1981 to 2020: Transitioning towards to a diversified and low-carbon energy system. Energy Policy 2022, 162, 112806. [Google Scholar] [CrossRef]

- Stiglitz, J.E. Addressing climate change through price and non-price interventions. Eur. Econ. Rev. 2019, 119, 594–612. [Google Scholar] [CrossRef]

- Jakob, M.; Overland, I. Green industrial policy can strengthen carbon pricing but not replace it. Energy Res. Soc. Sci. 2024, 116, 103669. [Google Scholar] [CrossRef]

- Klenert, D.; Mattauch, L.; Combet, E.; Edenhofer, O.; Hepburn, C.; Rafaty, R.; Stern, N. Making carbon pricing work for citizens. Nat. Clim. Change 2018, 8, 669–677. [Google Scholar] [CrossRef]

- Mykytyuk, P.; Brych, V.; Manzhula, V.; Borysiak, O.; Sachenko, A.; Banasik, A.; Kempa, W.M.; Mykytyuk, Y.; Czupryna-Nowak, A.; Lebid, I. Efficient management of material resources in Low-Carbon construction. Energies 2024, 17, 575. [Google Scholar] [CrossRef]

- Bayer, P.; Aklin, M. The European Union emissions trading system reduced CO2 emissions despite low prices. Proc. Natl. Acad. Sci. USA 2020, 117, 8804–8812. [Google Scholar] [CrossRef] [PubMed]

- Lopez-Ruiz, G.; Castresana-Larrauri, J.; Blanco-Ilzarbe, J.M. Thermodynamic analysis of a regenerative brayton cycle using H2, CH4 and H2/CH4 blends as fuel. Energies 2022, 15, 1508. [Google Scholar] [CrossRef]

- De Ayala, A.; Solà, M.d.M. Assessing the EU energy efficiency label for appliances: Issues, potential improvements and challenges. Energies 2022, 15, 4272. [Google Scholar] [CrossRef]

- Pang, Q.; Li, M.; Yang, T.; Shen, Y. Supply chain coordination with carbon trading price and consumers’ environmental awareness dependent demand. Math. Probl. Eng. 2018, 2018, 8749251. [Google Scholar] [CrossRef]

- Steiner, B.; Münch, C.; Beckmann, M.; von der Gracht, H. Developing net-zero carbon supply chains in the European manufacturing industry—A multilevel perspective. Supply Chain. Manag. Int. J. 2024, 29, 164–181. [Google Scholar] [CrossRef]

- Victor, D.G. Global Warming Gridlock: Creating More Effective Strategies for Protecting the Planet; Cambridge University Press: Cambridge, UK, 2011. [Google Scholar]

- Ostrom, E. Governing the Commons: The Evolution of Institutions for Collective Action; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Keohane, R.O. After Hegemony: Cooperation and Discord in the World Political Economy; Princeton University Press: Princeton, NJ, USA, 2005. [Google Scholar]

- Goicoechea, N.; Abadie, L.M. Optimal slow steaming speed for container ships under the EU emission trading system. Energies 2021, 14, 7487. [Google Scholar] [CrossRef]

- Dominiak, A.; Rusowicz, A. Change of Fossil-Fuel-Related Carbon Productivity Index of the Main Manufacturing Sectors in Poland. Energies 2022, 15, 6906. [Google Scholar] [CrossRef]

- Muth, D. Pathways to stringent carbon pricing: Configurations of political economy conditions and revenue recycling strategies. A comparison of thirty national level policies. Ecol. Econ. 2023, 214, 107995. [Google Scholar] [CrossRef]

- Luderer, G.; Madeddu, S.; Merfort, L.; Ueckerdt, F.; Pehl, M.; Pietzcker, R.; Rottoli, M.; Schreyer, F.; Bauer, N.; Baumstark, L.; et al. Impact of declining renewable energy costs on electrification in low-emission scenarios. Nat. Energy 2022, 7, 32–42. [Google Scholar] [CrossRef]

- Pretel, C.; Linares, P. How Much Should We Spend to Fight against Climate Change? The Value of Backstop Technologies in a Simplified Model. Energies 2021, 14, 7781. [Google Scholar] [CrossRef]

- McCollum, D.L.; Krey, V.; Riahi, K.; Kolp, P.; Grubler, A.; Makowski, M.; Nakicenovic, N. Climate policies can help resolve energy security and air pollution challenges. Clim. Change 2013, 119, 479–494. [Google Scholar] [CrossRef]

- Mercure, J.F.; Pollitt, H.; Viñuales, J.E.; Edwards, N.R.; Holden, P.B.; Chewpreecha, U.; Salas, P.; Sognnaes, I.; Lam, A.; Knobloch, F. Macroeconomic impact of stranded fossil fuel assets. Nat. Clim. Change 2018, 8, 588–593. [Google Scholar] [CrossRef]

- Law, Y.K.; Fong, C.S. Emerging Markets’ Carbon Pricing Development: A Comparative Analysis of China and South Korea’s Experience. World 2025, 6, 58. [Google Scholar] [CrossRef]

- Löschel, A.; Lutz, B.J.; Managi, S. The impacts of the EU ETS on efficiency and economic performance—An empirical analyses for German manufacturing firms. Resour. Energy Econ. 2019, 56, 71–95. [Google Scholar] [CrossRef]

- Creti, A.; Jouvet, P.A.; Mignon, V. Carbon price drivers: Phase I versus Phase II equilibrium? Energy Econ. 2012, 34, 327–334. [Google Scholar] [CrossRef]

- Hintermann, B. Market power, permit allocation and efficiency in emission permit markets. Environ. Resour. Econ. 2011, 49, 327–349. [Google Scholar] [CrossRef]

- Dai, P.F.; Xiong, X.; Huynh, T.L.D.; Wang, J. The impact of economic policy uncertainties on the volatility of European carbon market. J. Commod. Mark. 2022, 26, 100208. [Google Scholar] [CrossRef]

- Tang, T.H.; Bao, H.X. Political uncertainty and carbon emission trading: Evidence from China. Cities 2024, 145, 104713. [Google Scholar] [CrossRef]

- Chevallier, J. Price relationships in crude oil futures: New evidence from CFTC disaggregated data. Environ. Econ. Policy Stud. 2013, 15, 133–170. [Google Scholar] [CrossRef]

- Jiang, Y.; Luo, L.; Xu, J.; Shao, X. The value relevance of corporate voluntary carbon disclosure: Evidence from the United States and BRIC countries. J. Contemp. Account. Econ. 2021, 17, 100279. [Google Scholar] [CrossRef]

- Liesen, A.; Figge, F.; Hoepner, A.; Patten, D.M. Climate change and asset prices: Are corporate carbon disclosure and performance priced appropriately? J. Bus. Financ. Account. 2017, 44, 35–62. [Google Scholar] [CrossRef]

- Overland, I. The geopolitics of renewable energy: Debunking four emerging myths. Energy Res. Soc. Sci. 2019, 49, 36–40. [Google Scholar] [CrossRef]

- Adediran, I.A.; Swaray, R. Carbon trading amidst global uncertainty: The role of policy and geopolitical uncertainty. Econ. Model. 2023, 123, 106279. [Google Scholar] [CrossRef]

- Li, R.; Wang, Q.; Li, X. Geopolitical risks and carbon emissions: The mediating effect of industrial structure upgrading. Humanit. Soc. Sci. Commun. 2025, 12, 790. [Google Scholar] [CrossRef]

- Helbig, C.; Wietschel, L.; Thorenz, A.; Tuma, A. How to evaluate raw material vulnerability—An overview. Resour. Policy 2016, 48, 13–24. [Google Scholar] [CrossRef]

- Slameršak, A.; Kallis, G.; O’Neill, D.W. Energy requirements and carbon emissions for a low-carbon energy transition. Nat. Commun. 2022, 13, 6932. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef]

- Blanchard, O.; Dell’Ariccia, G.; Mauro, P. Rethinking macroeconomic policy. J. Money Credit. Bank. 2010, 42, 199–215. [Google Scholar] [CrossRef]

- Benchora, I.; Leroy, A.; Raffestin, L. Is monetary policy transmission green? Econ. Model. 2025, 144, 106992. [Google Scholar] [CrossRef]

- Anastasiou, D.; Ballis, A.; Guizani, A.; Kallandranis, C.; Lakhal, F. Monetary policy impact on sustainability: Analyzing interest rates and corporate carbon emissions. J. Environ. Manag. 2024, 368, 122119. [Google Scholar] [CrossRef] [PubMed]

- Romer, C.D.; Romer, D.H. A new measure of monetary shocks: Derivation and implications. Am. Econ. Rev. 2004, 94, 1055–1084. [Google Scholar] [CrossRef]

- Trück, S.; Weron, R. Convenience Yields and Risk Premiums in the EU-ETS—Evidence from the Kyoto Commitment Period. J. Futur. Mark. 2016, 36, 587–611. [Google Scholar] [CrossRef]

- Luo, R.; Zhou, L.; Song, Y.; Fan, T. Evaluating the impact of carbon tax policy on manufacturing and remanufacturing decisions in a closed-loop supply chain. Int. J. Prod. Econ. 2022, 245, 108408. [Google Scholar] [CrossRef]

- Bersani, A.M.; Falbo, P.; Mastroeni, L. Is the ETS an effective environmental policy? Undesired interaction between energy-mix, fuel-switch and electricity prices. Energy Econ. 2022, 110, 105981. [Google Scholar] [CrossRef]

- Amendola, M. Winners and losers of the EU carbon border adjustment mechanism. An intra-EU issue? Energy Econ. 2025, 142, 108139. [Google Scholar] [CrossRef]

- Nazifi, F. Modelling the price spread between EUA and CER carbon prices. Energy Policy 2013, 56, 434–445. [Google Scholar] [CrossRef]

- Standar, A.; Kozera, A.; Jabkowski, D. The role of large cities in the development of low-carbon economy—The example of Poland. Energies 2022, 15, 595. [Google Scholar] [CrossRef]

- Ren, X.; Shao, Q.; Zhong, R. Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J. Clean. Prod. 2020, 277, 122844. [Google Scholar] [CrossRef]

- Cairns, R.D.; Lasserre, P. Reinforcing economic incentives for carbon credits for forests. For. Policy Econ. 2004, 6, 321–328. [Google Scholar] [CrossRef][Green Version]

- Christopher, M. Logistics and Supply Chain Management; Pearson: London, UK, 2022. [Google Scholar]

- Downar, B.; Ernstberger, J.; Reichelstein, S.; Schwenen, S.; Zaklan, A. The impact of carbon disclosure mandates on emissions and financial operating performance. Rev. Account. Stud. 2021, 26, 1137–1175. [Google Scholar] [CrossRef]

- Rimmel, G. Global reporting initiative. In Accounting for Sustainability; Routledge: London, UK, 2020; pp. 111–125. [Google Scholar]

- Busch, T.; Lewandowski, S. Corporate carbon and financial performance: A meta-analysis. J. Ind. Ecol. 2018, 22, 745–759. [Google Scholar] [CrossRef]

- Schaltegger, S.; Hörisch, J.; Freeman, R.E. Business cases for sustainability: A stakeholder theory perspective. Organ. Environ. 2019, 32, 191–212. [Google Scholar] [CrossRef]

- Vieira, L.C.; Longo, M.; Mura, M. From carbon dependence to renewables: The European oil majors’ strategies to face climate change. Bus. Strategy Environ. 2023, 32, 1248–1259. [Google Scholar] [CrossRef]

- Starks, L.T. Presidential address: Sustainable finance and ESG issues—Value versus values. J. Financ. 2023, 78, 1837–1872. [Google Scholar] [CrossRef]

- Pindyck, R.S. Climate change policy: What do the models tell us? J. Econ. Lit. 2013, 51, 860–872. [Google Scholar] [CrossRef]

- Stern, N. The Economics of Climate Change: The Stern Review; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Trigeorgis, L. Real Options: Managerial Flexibility and Strategy in Resource Allocation; MIT Press: Cambridge, MA, USA, 1996. [Google Scholar]

- Dixit, A.K.; Pindyck, R.S. Investment Under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Acemoglu, D.; Robinson, J.A. A theory of political transitions. Am. Econ. Rev. 2001, 91, 938–963. [Google Scholar] [CrossRef]

- Rodrik, D. Why do more open economies have bigger governments? J. Political Econ. 1998, 106, 997–1032. [Google Scholar] [CrossRef]

- Auffhammer, M.; Schlenker, W. Empirical studies on agricultural impacts and adaptation. Energy Econ. 2014, 46, 555–561. [Google Scholar] [CrossRef]

- Burke, M.; Hsiang, S.M.; Miguel, E. Global non-linear effect of temperature on economic production. Nature 2015, 527, 235–239. [Google Scholar] [CrossRef] [PubMed]

- Porter, M.; Van der Linde, C. Green and competitive: Ending the stalemate. In The Dynamics of the Eco-Efficient Economy: Environmental Regulation and Competitive Advantage; Wubben, E.F.M., Ed.; Edward Elgar Publishing: Cheltenham, UK, 1995; pp. 120–134. [Google Scholar]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Bridge, G.; Bouzarovski, S.; Bradshaw, M.; Eyre, N. Geographies of energy transition: Space, place and the low-carbon economy. Energy Policy 2013, 53, 331–340. [Google Scholar] [CrossRef]

| Material | Applications | Supply Risk | Price Volatility | Carbon Footprint |

|---|---|---|---|---|

| Lithium | Batteries for electric vehicles and energy storage | High | Medium | High |

| Cobalt | Battery cathodes in electric vehicles | Very High | High | Very High |

| Nickel | Battery components, industrial alloys | High | High | High |

| Rare Earths | Permanent magnets for wind turbines and motors | High | Medium | Medium |

| Copper | Electrical wiring and power infrastructure | Medium | Medium | Medium |

| Aluminum | Solar panel frames and lightweight structures | Medium | High | High |

| Policy Aspect | Carbon Tax | ETS | CBAM |

|---|---|---|---|

| Cost | Fixed and predictable carbon cost | Cost varies by market prices | Adds cost to imported goods based on emissions |

| Effect on Industry | Encourages cleaner technology | Encourages cleaner technology | Protects local industries from carbon-heavy imports |

| Political Feasibility | Faces opposition over economic effects | Faces opposition over economic effects | Faces challenges over trade and developing countries |

| Impact on Developing Countries | Less direct effect | Less direct effect | Raises concerns for exporters of carbon-heavy goods |

| Challenge | Description |

|---|---|

| Absence of a unified global carbon pricing system | Creates complexity in managing cross-border supply chains and harmonizing cost structures |

| High volatility in carbon markets | Reduces the reliability of carbon price signals for long-term investment decisions |

| Limited maturity of risk assessment models | Highlights the need for more advanced simulation tools and data-driven frameworks |

| Misalignment between policy development and market dynamics | Leads to regulatory delays that hinder timely responses to carbon-related risks |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, H.; Zhang, X.; Luo, C. A Review of Carbon Pricing Mechanisms and Risk Management for Raw Materials in Low-Carbon Energy Systems. Energies 2025, 18, 3401. https://doi.org/10.3390/en18133401

Sun H, Zhang X, Luo C. A Review of Carbon Pricing Mechanisms and Risk Management for Raw Materials in Low-Carbon Energy Systems. Energies. 2025; 18(13):3401. https://doi.org/10.3390/en18133401

Chicago/Turabian StyleSun, Hongbo, Xinting Zhang, and Cuicui Luo. 2025. "A Review of Carbon Pricing Mechanisms and Risk Management for Raw Materials in Low-Carbon Energy Systems" Energies 18, no. 13: 3401. https://doi.org/10.3390/en18133401

APA StyleSun, H., Zhang, X., & Luo, C. (2025). A Review of Carbon Pricing Mechanisms and Risk Management for Raw Materials in Low-Carbon Energy Systems. Energies, 18(13), 3401. https://doi.org/10.3390/en18133401