Biomethane as a Fuel for Energy Transition in South America: Review, Challenges, Opportunities, and Perspectives

Abstract

1. Introduction

2. Biomethane Development and Regulatory Frameworks in South American Countries

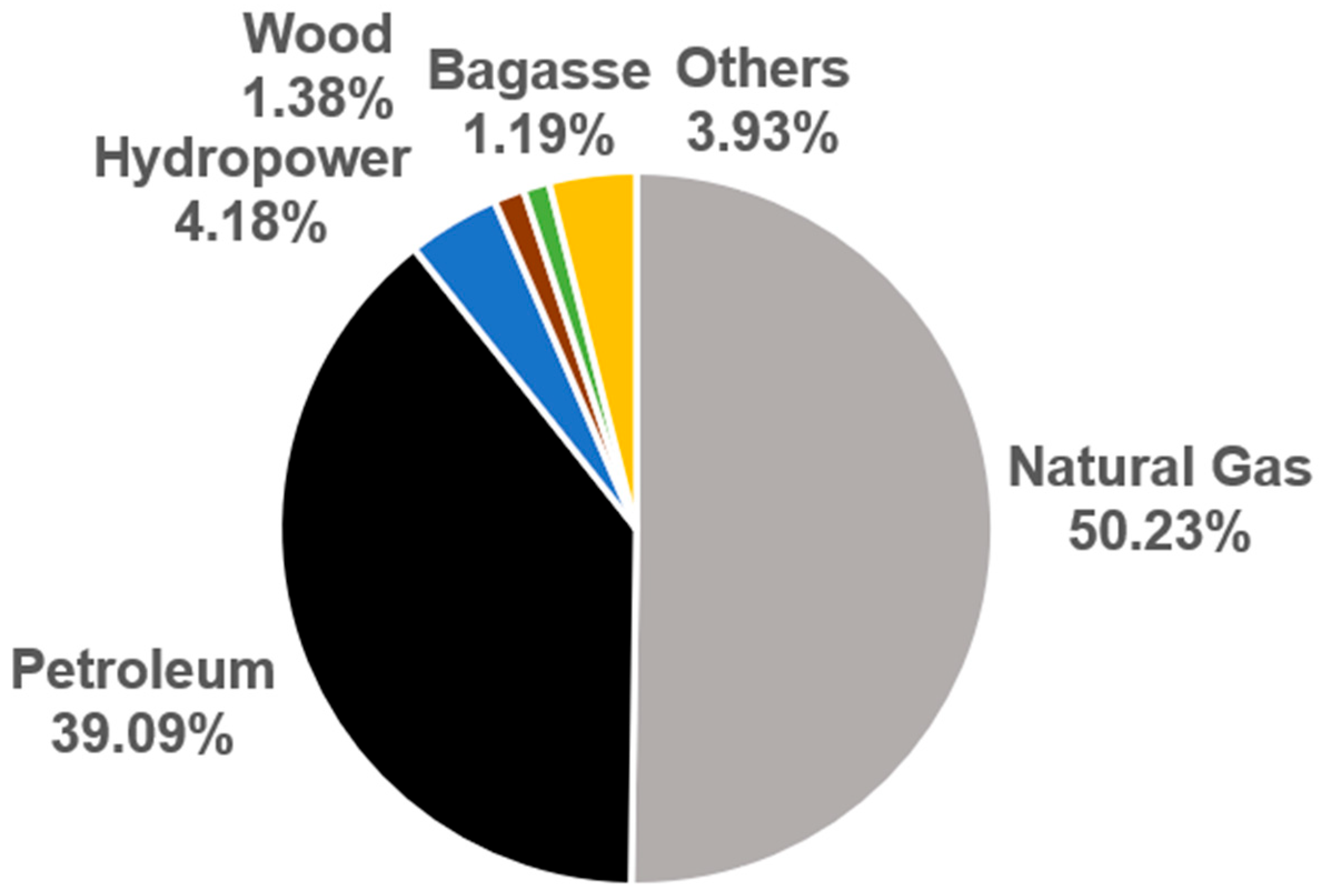

2.1. Argentina

2.2. Bolivia

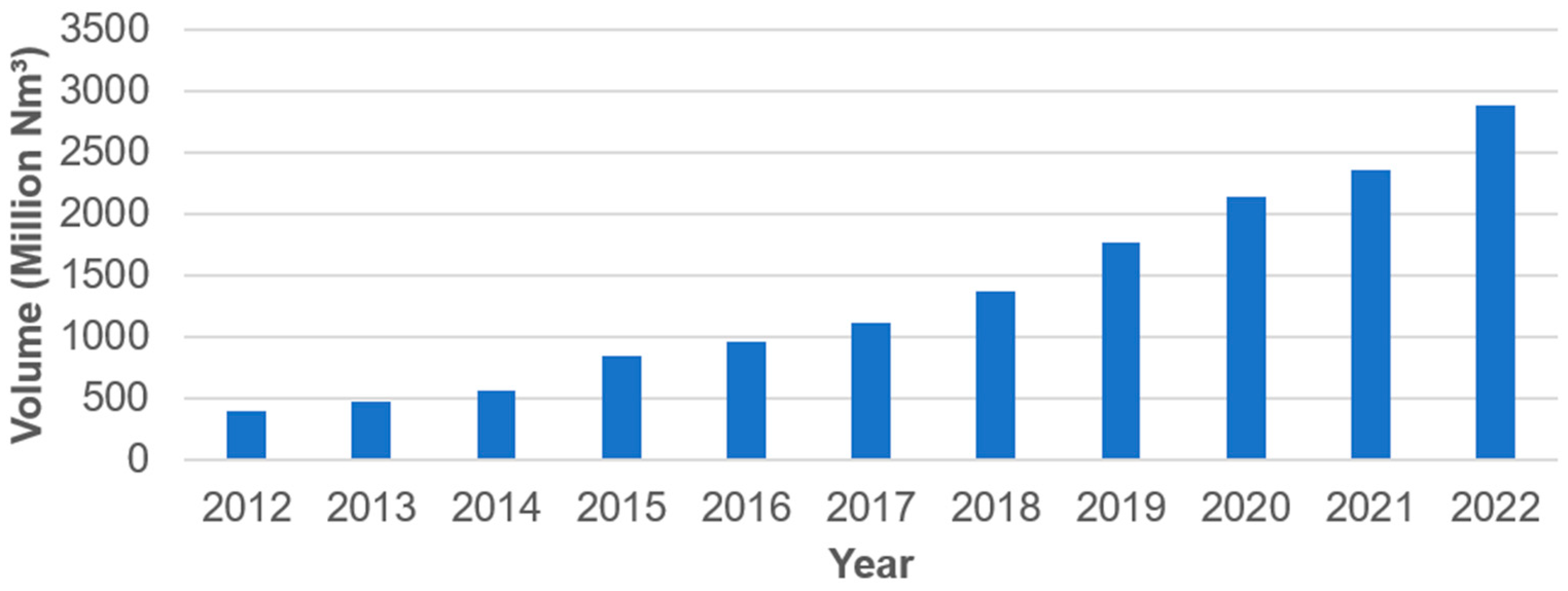

2.3. Brazil

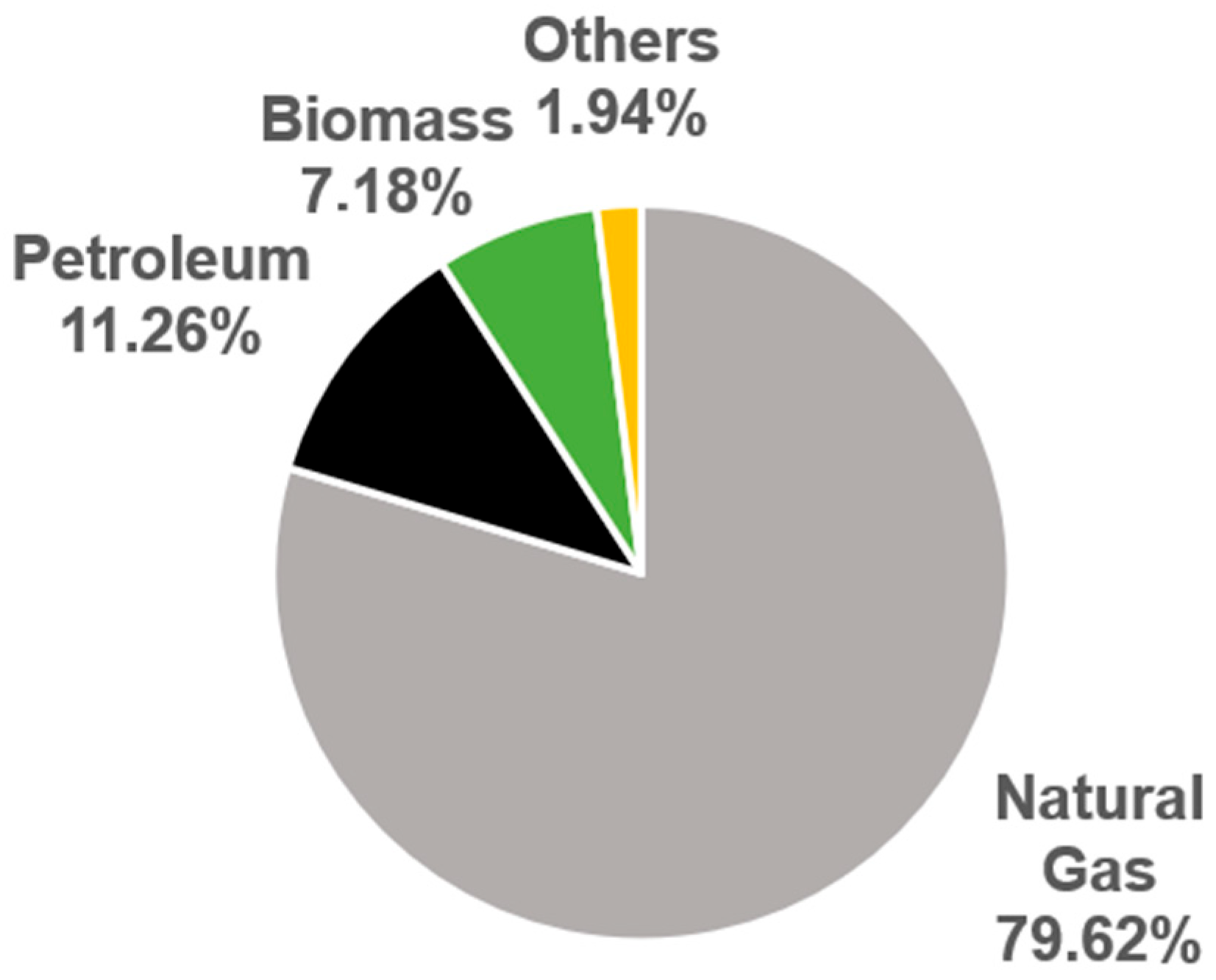

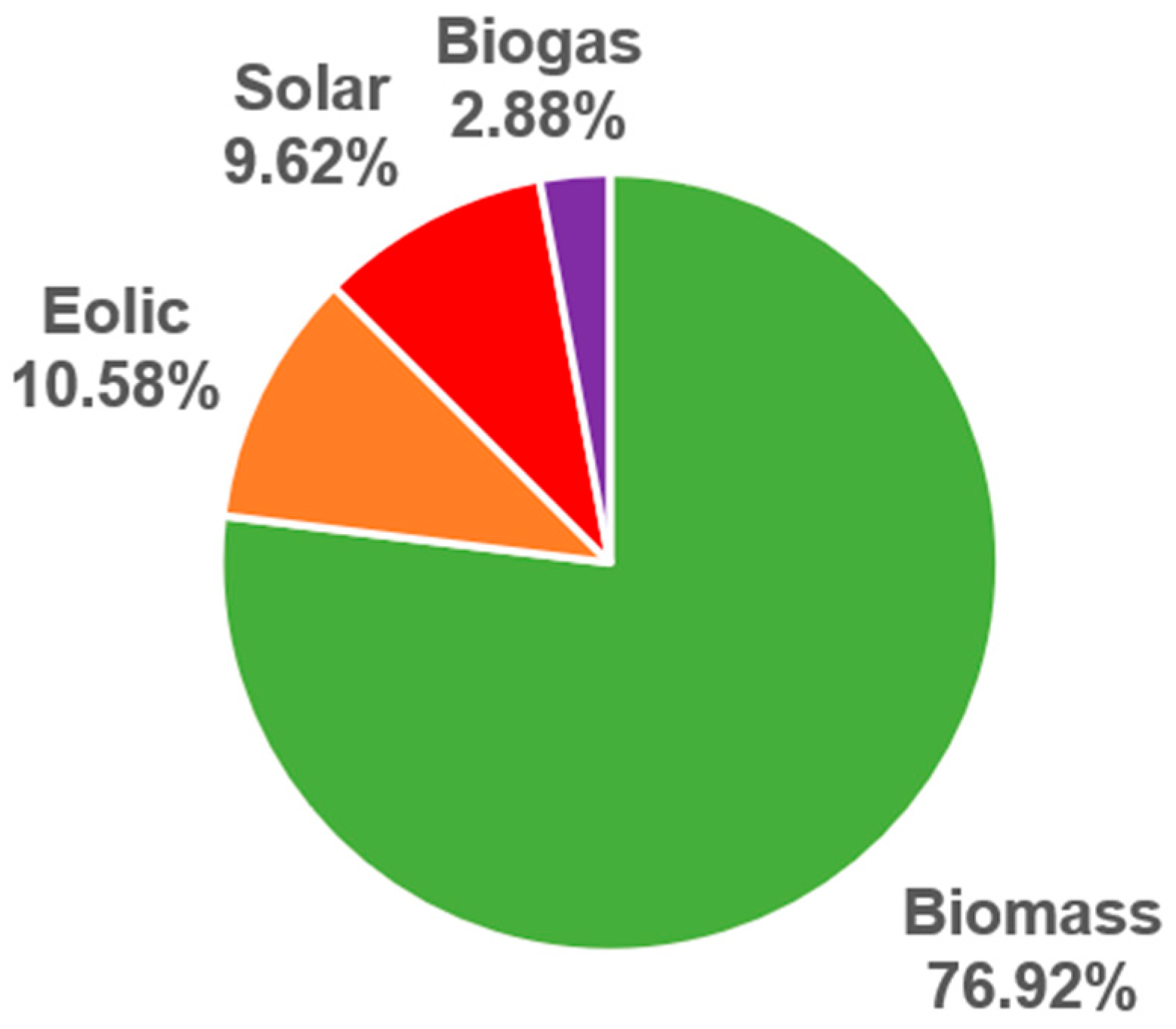

2.4. Chile

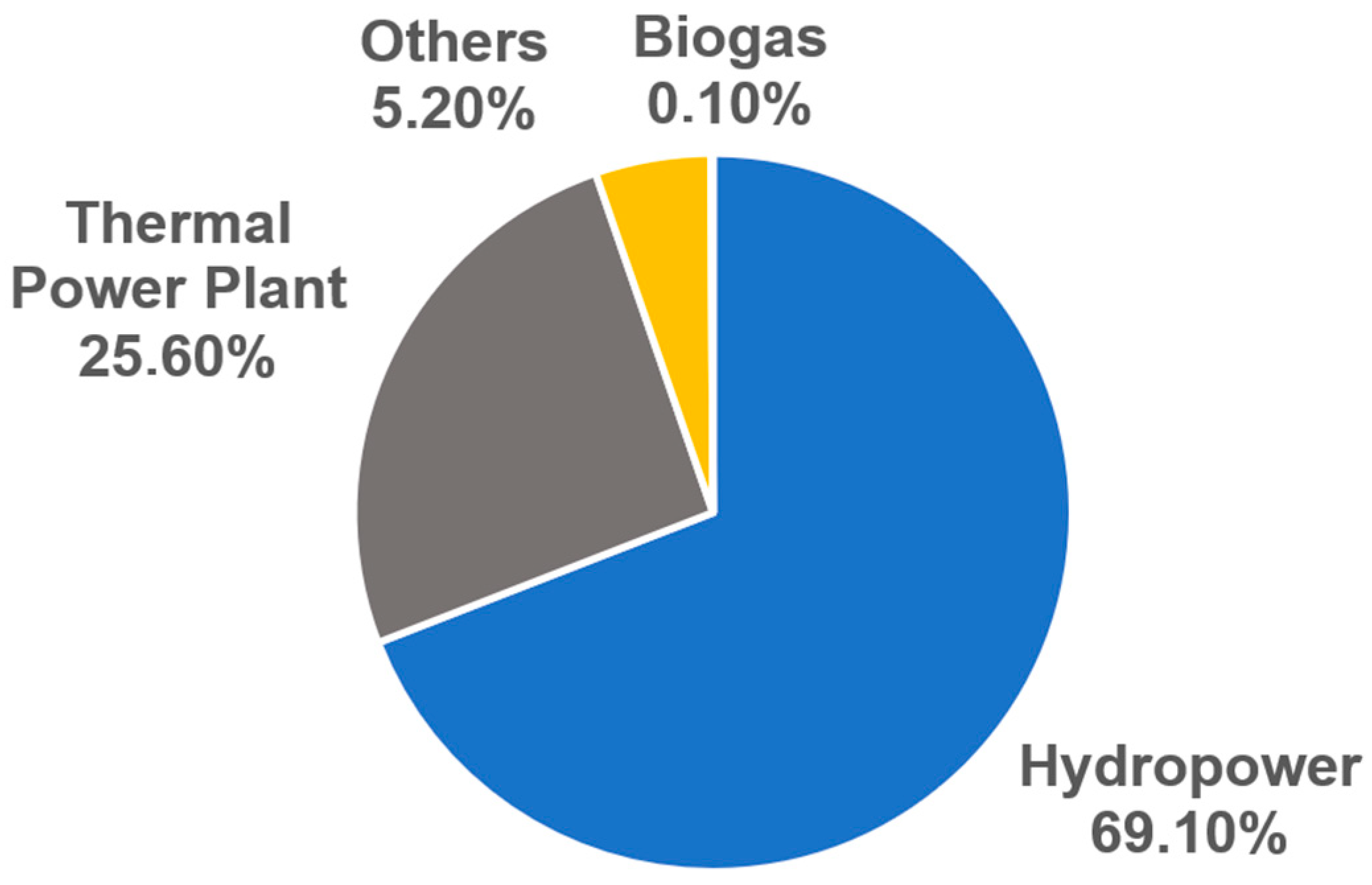

2.5. Colombia

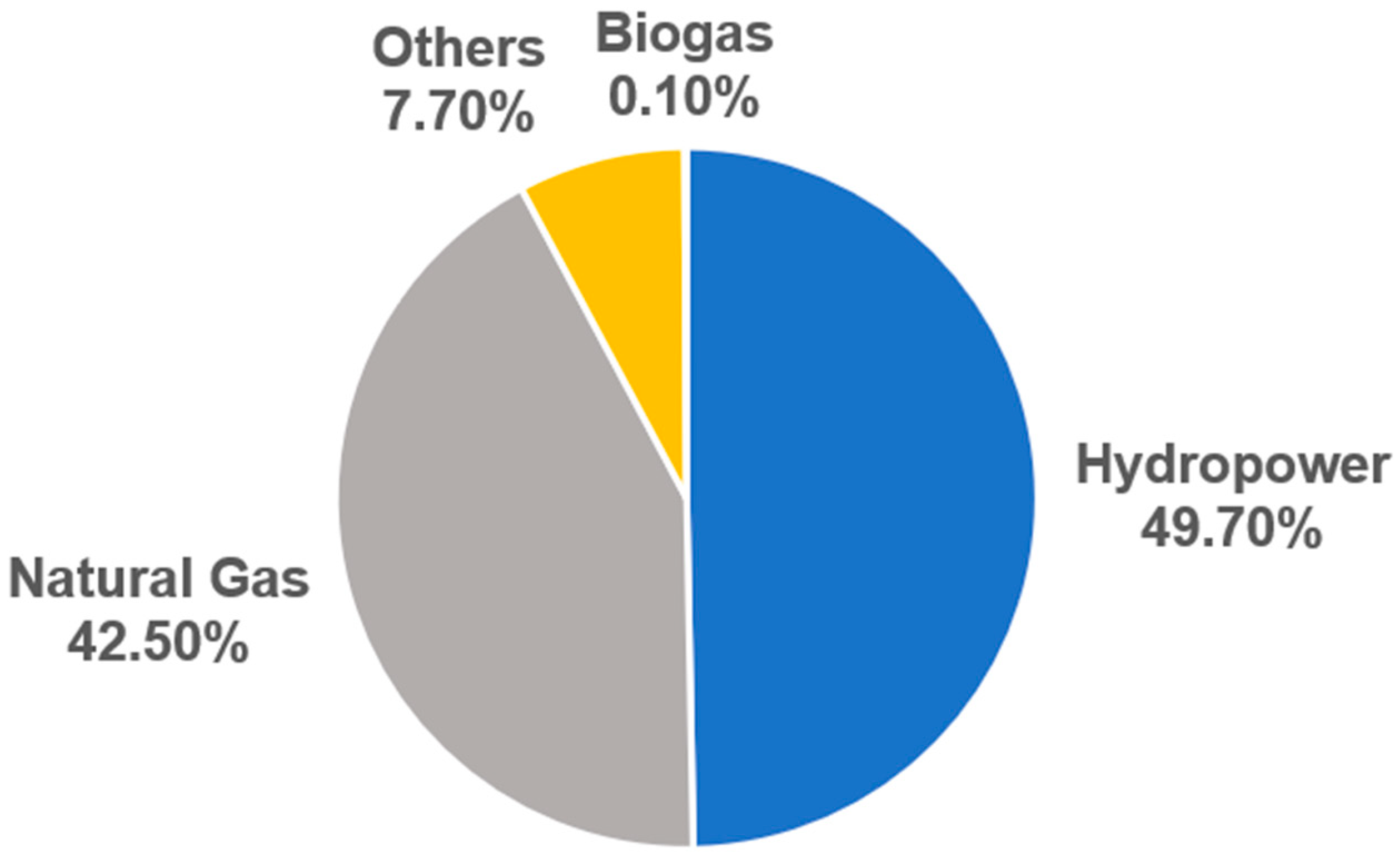

2.6. Ecuador

2.7. Guyana

2.8. Paraguay

2.9. Peru

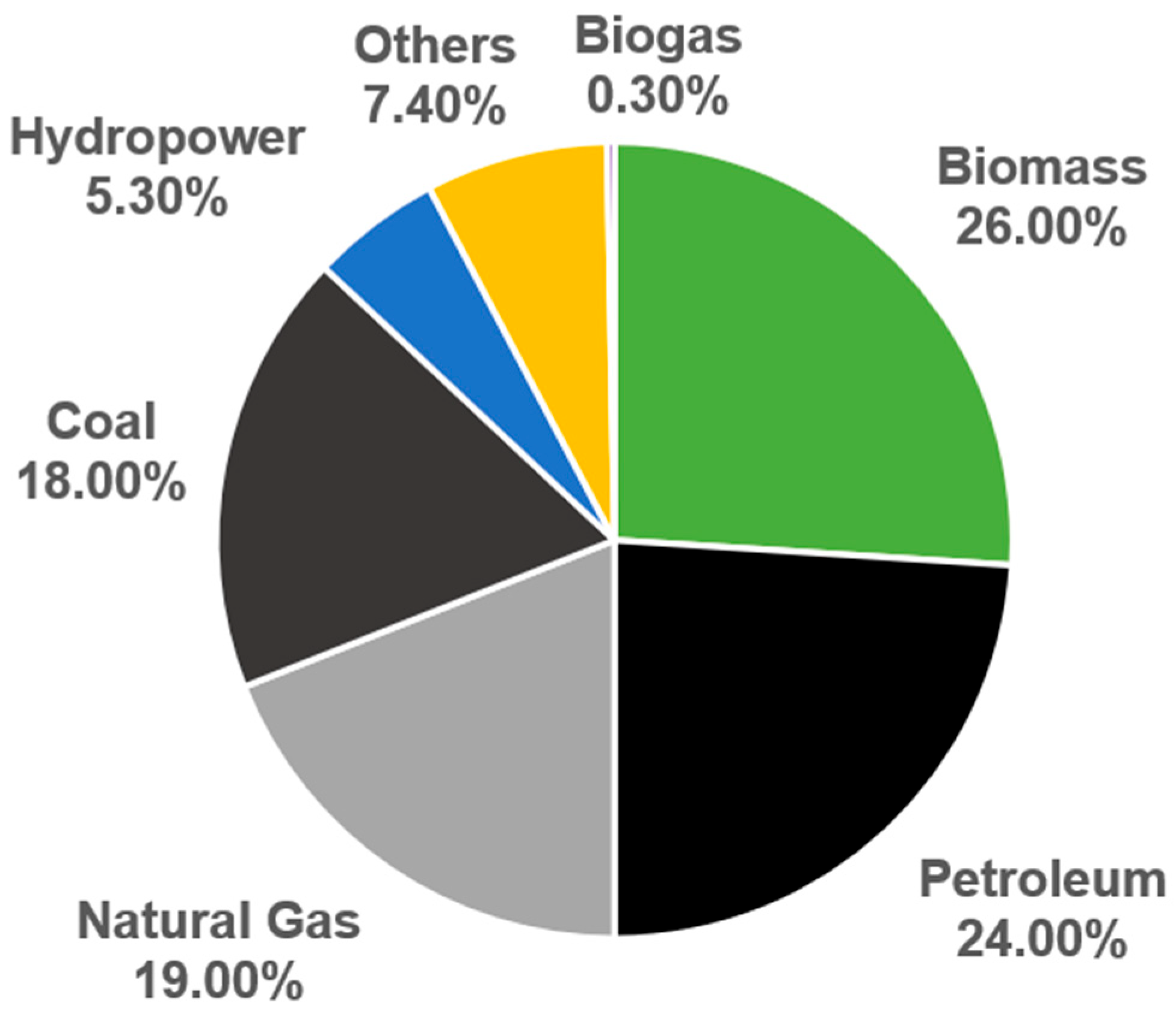

2.10. Suriname

2.11. Uruguay

2.12. Venezuela

3. Current Status of the Biomethane Sector

3.1. Global Biomethane Production: Key Players

3.2. Biomethane for Sustainable Transport

3.3. Biomethane—A Renewable and Circular Resource

4. Discussion

4.1. Key Regulatory Advances in South America

4.2. Lack of Legislation on Waste Collection

4.3. Tax Incentives

4.4. Biomethane Potential in South America

4.5. Political and Social Drivers of the Biomethane Sector

4.6. Future Challenges

- Implementation of legislation that encourages the collection and separation of organic waste.

- Establishment of emission reduction targets and carbon credit systems.

- The creation of financial and tax incentives for biogas plants.

- Expansion of infrastructure for biomethane injection into the natural gas grid.

- Development of public–private partnerships for financing biogas projects.

- Development of environmental education initiatives and promotion of the circular economy to raise public awareness about the significance of biomethane.

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| ANP | Brazilian National Agency of Petroleum, Natural Gas, and Biofuels |

| bcm | Billion cubic meters |

| BNG | Bio-natural gas |

| bTDC | Before top dead center |

| CH4 | Methane |

| CNG | Compressed natural gas |

| CO | Carbon monoxide |

| CO2 | Carbon dioxide |

| COP21 | 21st Conference of the Parties in Paris |

| GHG | Greenhouse gas |

| HCs | Unburned hydrocarbons |

| H2S | Hydrogen sulfide |

| ICEs | Internal combustion engines |

| LNG | Liquefied natural gas |

| MBT | Maximum brake torque |

| N2 | Nitrogen |

| NO | Nitrogen monoxide |

| NOx | Nitrogen oxides |

| O2 | Oxygen |

| SI | Spark ignition |

| UPME | Mineral energy planning unit |

| USA | United States of America |

| USW | Urban solid waste |

References

- Guo, H.; Zhou, S.; Shreka, M.; Feng, Y. Effect of Pre-Combustion Chamber Nozzle Parameters on the Performance of a Marine 2-Stroke Dual Fuel Engine. Processes 2019, 7, 876. [Google Scholar] [CrossRef]

- Global Monitoring Laboratory. Trends in Atmospheric Carbon Dioxide (CO2). Available online: https://gml.noaa.gov/ccgg/trends/monthly.html (accessed on 31 January 2025).

- Liu, J.; Dumitrescu, C.E. 3D CFD Simulation of a CI Engine Converted to SI Natural Gas Operation Using the G-Equation. Fuel 2018, 232, 833–844. [Google Scholar] [CrossRef]

- Chen, Y.; Wolk, B.; Mehl, M.; Cheng, W.K.; Chen, J.Y.; Dibble, R.W. Development of a reduced chemical mechanism targeted for a 5-component gasoline surrogate: A case study on the heat release nature in a GCI engine. Combust. Flame 2017, 178, 268–276. [Google Scholar] [CrossRef]

- Szulejko, J.E.; Kumar, P.; Deep, A.; Kim, K.H. Global warming projections to 2100 using simple CO2 greenhouse gas modeling and comments on CO2 climate sensitivity factor. Atmos. Pollut. Res. 2016, 8, 136–140. [Google Scholar] [CrossRef]

- Li, Y.; Yang, F.; Linxun, X.; Liu, J.; Wang, J.; Duan, X. Influences of the control parameters and spark plug configurations on the performance of a natural gas spark-ignition engine. Fuel 2022, 324, 124728. [Google Scholar] [CrossRef]

- Bhasker, J.P.; Porpatham, E. Effects of compression ratio and hydrogen addition on lean combustion characteristics and emission formation in a Compressed Natural Gas fuelled spark ignition engine. Fuel 2017, 208, 260–270. [Google Scholar] [CrossRef]

- Zhang, S.; Li, Y.; Wang, S.; Zeng, H.; Liu, J.; Duan, X.; Dong, H. Experimental and numerical study the effect of EGR strategies on in-cylinder flow, combustion and emissions characteristics in a heavy-duty higher CR lean-burn NGSI engine coupled with detail combustion mechanism. Fuel 2020, 276, 118082. [Google Scholar] [CrossRef]

- Chłopek, Z.; Lasocki, J.; Sar, H. Study of dynamic and ecological properties of automotive bifuel engine. Int. J. Energy Environ. Eng. 2022, 13, 1–10. [Google Scholar] [CrossRef]

- IEA. Renewables 2023; IEA: Paris, France, 2023; Available online: https://www.iea.org/reports/renewables-2024 (accessed on 13 December 2024).

- Kwon, E.C.; Song, K.; Kim, M.; Shin, Y.; Choi, S. Performance of small spark ignition engine fueled with biogas at different compression ratio and various carbon dioxide dilution. Fuel 2017, 196, 217–224. [Google Scholar] [CrossRef]

- Porpatham, E.; Ramesh, A.; Nagalingam, B. Investigation on the effect of concentration of methane in biogas when used as a fuel for a spark ignition engine. Fuel 2008, 87, 1651–1659. [Google Scholar] [CrossRef]

- Chandra, R.; Vijay, V.K.; Subbarao, P.M.V.; Khura, T.K. Performance evaluation of a constant speed IC engine on CNG, methane enriched biogas and biogas. Appl. Energy 2011, 88, 3969–3977. [Google Scholar] [CrossRef]

- Muhajir, K.; Badrawada, I.G.; Susastriawan, A.A.P. Utilization of biogas for generator set fuel: Performance and emission characteristics. Biomass Convers. Biorefinery 2019, 9, 695–698. [Google Scholar] [CrossRef]

- Hotta, S.K.; Sahoo, N.; Mohanty, K.; Kulkarni, V. Ignition timing and compression ratio as effective means for the improvement in the operating characteristics of a biogas fueled spark ignition engine. Renew. Energy 2020, 150, 854–867. [Google Scholar] [CrossRef]

- Sadiq, R.; Iyer, R.C. Experimental investigations on the influence of compression ratio and piston crown geometry on the performance of biogas fuelled small spark ignition engine. Renew. Energy 2020, 146, 997–1009. [Google Scholar] [CrossRef]

- Jung, C.; Park, J.; Song, S. Performance and NOx emissions of a biogas-fueled turbocharged internal combustion engine. Energy 2015, 86, 186–195. [Google Scholar] [CrossRef]

- Byun, J.S.; Park, J. Predicting the performance and exhaust NOx emissions of a spark ignition engine generator fueled with methane based biogases containing various amounts of CO2. J. Nat. Gas Sci. Eng. 2015, 22, 196–202. [Google Scholar] [CrossRef]

- Karlsson, H.; Gåsste, J.; Åsman, P. Regulated and Non-regulated Emissions from Euro 4 Alternative Fuel Vehicles. SAE Tech. Pap. 2008; 12. [Google Scholar] [CrossRef]

- Lim, C.; Kim, D.; Song, C.; Kim, J.; Han, J.; Cha, J.S. Performance and emission characteristics of a vehicle fueled with enriched biogas and natural gases. Appl. Energy 2015, 139, 17–29. [Google Scholar] [CrossRef]

- Subramanian, K.A.; Mathad, V.C.; Vijay, V.K.; Subbarao, P.M.V. Comparative evaluation of emission and fuel economy of an automotive spark ignition vehicle fuelled with methane enriched biogas and CNG using chassis dynamometer. Appl. Energy 2013, 105, 17–29. [Google Scholar] [CrossRef]

- Lee, S.; Yi, U.H.; Jang, H.; Park, C.; Kim, C. Evaluation of emission characteristics of a stoichiometric natural gas engine fueled with compressed natural gas and biomethane. Fuel 2021, 220, 119766. [Google Scholar] [CrossRef]

- Porpatham, E.; Ramesh, A.; Nagalingam, B. Effect of compression ratio on the performance and combustion of a biogas fuelled spark ignition engine. Fuel 2012, 95, 247–256. [Google Scholar] [CrossRef]

- Roubaud, A.; Roethlisberger, R.P.; Favrat, D. Lean-Burn Cogeneration Biogas Engine with Unscavenged Combustion Prechamber: Comparison with Natural Gas. Int. J. Appl. Thermodyn. 2002, 5, 169–175. [Google Scholar]

- Midkiff, K.C.; Bell, S.R.; Rathnam, S.; Bhargava, S. Fuel Composition Effects on Emissions From a Spark-Ignited Engine Operated on Simulated Biogases. J. Eng. Gas Turbines Power 2001, 123, 132–138. [Google Scholar] [CrossRef]

- Pinto, G.M.; da Costa, R.B.R.; de Souza, T.A.Z.; Rosa, A.J.A.C.; Raats, O.O.; Roque, L.F.A.; Frez, G.V.; Coronado, C.J.R. Experimental investigation of performance and emissions of a CI engine operating with HVO and farnesane in dual-fuel mode with natural gas and biogas. Energy 2023, 277, 127648. [Google Scholar] [CrossRef]

- Tiago, G.A.O.; Rodrigo, N.P.B.; Lourinho, G.; Lopes, T.F.; Gírio, F. Systematic and Bibliometric Review of Biomethane Production from Biomass-Based Residues: Technologies, Economics and Environmental Impact. Fuels 2025, 6, 8. [Google Scholar] [CrossRef]

- Marcucci, S.M.P.; Rosa, R.A.; Lenzi, G.G.; Balthazar, J.M.; Fuziki, M.E.K.; Tusset, A.M. Biogas Overview: Global and Brazilian Perspectives with Emphasis on Paraná State. Sustainability 2025, 17, 321. [Google Scholar] [CrossRef]

- Veronezi, D.; Soulier, M.; Kocsis, T. Energy Solutions for Decarbonization of Industrial Heat Processes. Energies 2024, 17, 5728. [Google Scholar] [CrossRef]

- Machado, M.V.d.S.; Ávila, I.; de Carvalho, J.A., Jr. Bibliometric Analysis of Renewable Natural Gas (Biomethane) and Overview of Application in Brazil. Energies 2024, 17, 2920. [Google Scholar] [CrossRef]

- Renato, N.d.S.; Oliveira, A.C.L.d.; Ervilha, A.M.T.; Antoniazzi, S.F.; Moltó, J.; Conesa, J.A.; Borges, A.C. Replacing Natural Gas with Biomethane from Sewage Treatment: Optimizing the Potential in São Paulo State, Brazil. Energies 2024, 17, 1657. [Google Scholar] [CrossRef]

- Cormos, C.C.; Dragan, M.; Petrescu, L.; Cormos, A.M.; Dragan, S.; Bathori, A.M.; Galusnyak, S.C. Synthetic natural gas (SNG) production by biomass gasification with CO2 capture: Techno-economic and life cycle analysis (LCA). Energy 2024, 312, 133507. [Google Scholar] [CrossRef]

- Lisauskas, A.; Striūgas, N.; Jančauskas, A. Lower-Carbon Substitutes for Natural Gas for Use in Energy-Intensive Industries: Current Status and Techno-Economic Assessment in Lithuania. Energies 2025, 18, 2670. [Google Scholar] [CrossRef]

- Padi, R.K.; Douglas, S.; Murphy, F. Techno-economic potentials of integrating decentralised biomethane production systems into existing natural gas grids. Energy 2023, 283, 128542. [Google Scholar] [CrossRef]

- Bai, A.; Balogh, P.; Nagy, A.; Csedő, Z.; Sinóros-Szabó, B.; Pintér, G.; Prajapati, S.K.; Singh, A.; Gabnai, Z. Economic Evaluation of a 1 MWel Capacity Power-to-Biomethane System. Energies 2023, 16, 8009. [Google Scholar] [CrossRef]

- López-Aguilera, A.; Morales-Polo, C.; Victoria-Rodríguez, J.; Cledera-Castro, M.d.M. Assessment of Biomethane Production Potential in Spain: A Regional Analysis of Agricultural Residues, Municipal Waste, and Wastewater Sludge for 2030 and 2050. Sustainability 2025, 17, 4742. [Google Scholar] [CrossRef]

- Ministerio de Economía, Argentina. Balance Energético Nacional de la República Argentina, Año 2023. Available online: https://www.argentina.gob.ar/sites/default/files/balance_2023_v0_h.xlsx (accessed on 24 February 2025).

- Grupo Ad Hoc de Biocombustíveis do Mercosul. Relatório de Biogás e Biometano do Mercosul; CIBiogás: Foz do Iguaçu, Brazil, 2017; Volume 1, ISSN 2526-9534. [Google Scholar]

- Argentinean Senate and Chamber of Deputies. Ley 2006, 26, 093. Available online: https://www.argentina.gob.ar/normativa/nacional/ley-26093-116299/texto (accessed on 12 May 2024).

- Argentinean Senate and Chamber of Deputies. Ley 2006, 26, 190. Available online: https://www.argentina.gob.ar/normativa/nacional/ley-26190-123565/texto (accessed on 8 May 2024).

- Argentinean Senate and Chamber of Deputies. Ley 2016, 27, 191. Available online: https://www.argentina.gob.ar/normativa/nacional/253626/texto (accessed on 13 May 2024).

- Gutman, D. Biogas in Argentina: Turning an Environmental Problem into a Solution. Available online: https://www.globalissues.org/news/2021/05/11/27798 (accessed on 10 January 2024).

- Government of Argentina, Ministry of the Interior. Ambiente Entregó $ 87 Millones Para la Gestión de Residuos y la Captación de Biogás en Gualeguaychú. Available online: https://www.argentina.gob.ar/noticias/ambiente-entrego-87-millones-para-la-gestion-de-residuos-y-la-captacion-de-biogas-en (accessed on 10 January 2024).

- Government of Argentina, Ministry of the Interior. Cabandié Recorrió la Planta de Biogás em Fachinal Provincia de Misiones. Available online: https://www.argentina.gob.ar/noticias/cabandie-recorrio-la-planta-de-biogas-en-fachinal-provincia-de-misiones (accessed on 11 January 2024).

- Government of Argentina, Ministry of Economy. Biogás: La Argentina Avanza Para Lograr la Neutralidad de Carbono. Available online: https://www.argentina.gob.ar/noticias/biogas-la-argentina-avanza-para-lograr-la-neutralidad-de-carbono (accessed on 10 July 2024).

- Herrero, J.M.; Chipana, M.; Cuevas, C.; Paco, G.; Serrano, V.; Zymla, B.; Heising, K.; Sologuren, J.; Gamarra, A. Low cost tubular digesters as appropriate technology for widespread application: Results and lessons learned from Bolivia. Renew. Energy 2014, 71, 156–165. [Google Scholar] [CrossRef]

- Herrero, J.M. Experiencia de transferencia tecnológica de biodigestores familiares em Bolivia. Livest. Res. Rural. Dev. 2007, 19, 192. [Google Scholar]

- Lönnqvist, T.; Sandberg, T.; Birbuet, J.C.; Olsson, J.; Espinosa, C.; Thorin, E.; Grönkvist, S.; Gómez, M.F. Large-scale biogas generation in Bolivia—A stepwise reconfiguration. J. Clean. Prod. 2018, 180, 494–504. [Google Scholar] [CrossRef]

- Ministerio de Hidrocarburos y Energías, Bolívia. Balance Energético Nacional 2019–2023. Available online: https://www.mhe.gob.bo/wp-content/uploads/2024/07/Revista-Resumen-Ejecutivo-9-web.pdf (accessed on 27 August 2024).

- Bautista, J.P.V.; Calvimontes, J. Evaluation of landfill biogas potential in Bolivia to produce electricity. Rev. Investig. Desarro. 2017, 1, 55–62. [Google Scholar] [CrossRef]

- Ministerio de Medio Ambiente y Agua, Bolivia. Diagnóstico de la Gestión de Resíduos Sólidos em Bolivia. Available online: https://www.anesapa.org/data/files/DiagnosticoResSol2010.pdf (accessed on 3 July 2024).

- Aue, G. The Possibilities for Biogas in Bolivia: Symbioses Between Generators of Organic Residues, Biogas Producers and Biogas Users. Master’s Thesis, KTH-Royal Institute of Technology, Stockholm, Sweden, 2010. [Google Scholar]

- EPE. Panorama do Biometano 2023. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-781/Panorama%20de%20Biometano.pdf (accessed on 22 August 2024).

- Brazilian Senate and Chamber of Deputies. Available online: https://www.planalto.gov.br/ccivil_03/_ato2007-2010/2010/lei/l12305.html (accessed on 24 January 2025).

- Brazilian Senate and Chamber of Deputies. Available online: https://www.planalto.gov.br/ccivil_03/_Ato2019-2022/2020/Lei/L14026.htm#art11 (accessed on 24 January 2025).

- Brazilian Senate and Chamber of Deputies. Available online: http://www.planalto.gov.br/ccivil_03/_ato2015-2018/2017/lei/L13576.htm (accessed on 24 January 2025).

- Brazilian Senate and Chamber of Deputies. Available online: https://www.planalto.gov.br/ccivil_03/_Ato2023-2026/2024/Lei/L15082.htm (accessed on 24 January 2025).

- Brazilian Senate and Chamber of Deputies. Available online: https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2022/decreto/d11003.htm (accessed on 24 January 2025).

- Brazilian Senate and Chamber of Deputies. Available online: https://www.planalto.gov.br/ccivil_03/_ato2023-2026/2024/lei/l14993.htm (accessed on 24 January 2025).

- Agência Nacional do Petróleo, Gás Natural e Biocombustíveis. Painel Dinâmico de Produtores de Biometano. Available online: https://www.gov.br/anp/pt-br (accessed on 14 March 2025).

- CIBiogás. Panorama do Biogás No Brasil 2021; Tech Rep 001/2022, 001/2022; CIBiogás: Foz do Iguaçu, Brazil, 2022. [Google Scholar]

- Itaipu Binacional. Home. Available online: https://www.itaipu.gov.br/ (accessed on 21 January 2025).

- Sabesp. Home. Available online: https://www.sabesp.com.br/site/Default.aspx (accessed on 11 January 2025).

- Auma Energia. Home. Available online: https://www.aumaenergia.com.br/ (accessed on 12 November 2023).

- Embrapa. Home. Available online: https://www.embrapa.br/ (accessed on 13 January 2024).

- Orizon—Valorização de resíduos. Home. Available online: https://orizonvr.com.br/ (accessed on 5 January 2024).

- Zeg. Home. Available online: https://zeg.com.br/ (accessed on 12 December 2024).

- Vibra. Home. Available online: https://www.vibraenergia.com.br/ (accessed on 13 December 2024).

- ANP. RESOLUÇÃO ANP Nº 906/2022. Available online: https://atosoficiais.com.br/anp/resolucao-n-906-2022-dispoe-sobre-as-especificacoes-do-biometano-oriundo-de-produtos-e-residuos-organicos-agrossilvopastoris-e-comerciais-destinado-ao-uso-veicular-e-as-instalacoes-residenciais-e-comerciais-a-ser-comercializado-em-todo-o-territorio-nacional?origin=instituicao (accessed on 16 August 2024).

- National Congress, Chile. Ley 2005;20.018. Available online: https://www.bcn.cl/leychile/navegar?idNorma=238139 (accessed on 10 October 2024).

- National Congress, Chile. Ley 2008;20.527. Available online: https://www.bcn.cl/leychile/navegar?i=1029298&f=2011-09-06&p= (accessed on 10 October 2024).

- National Congress, Chile. Ley 2008;20.268. Available online: https://www.bcn.cl/leychile/navegar?idNorma=272719 (accessed on 10 October 2024).

- National Congress, Chile. Ley 2018;21.118. Available online: https://www.bcn.cl/leychile/navegar?idNorma=1125560 (accessed on 10 October 2024).

- Comisión Nacional de Energía, Chile. Anuario estadístico de energía. 2023. Available online: https://www.cne.cl/nuestros-servicios/reportes/informacion-y-estadisticas/ (accessed on 21 January 2025).

- Ministerio de Energía, Chile. Cadastro de Plantas de Biogás, Fecha de Actualización: Diciembre de 2017, Versión 2. Available online: https://autoconsumo.minenergia.cl/wp-content/uploads/2017/08/Registro-de-Instalaciones-Biogas-dic2017.pdf (accessed on 23 January 2025).

- CycleØ. CycleØ and HAM Group to Build the First BioLNG Plant in Chile. Available online: https://www.cycle0.com/first-biolng-plant-in-chile (accessed on 13 January 2024).

- UNAL, TECSOL. Estimación Del Potencial de Conversión a Biogás de la Biomasa en Colombia y su Aprovechamiento: Informe Final; UNAL, TECSOL: Bogotá, Colombia, 2018. [Google Scholar]

- UPME. Análisis preliminar del Plan Indicativo de Abastecimiento de Bioenergía Región Pacífico Colombia. 2025. Available online: https://docs.upme.gov.co/SIMEC/Hidrocarburos/Publicaciones_SIPG/Analisis_preliminar_PIBE_Pacifico_22-04-2025.pdf (accessed on 12 May 2025).

- Contreras, M.D.; Barros, R.S.; Zapata, J.; Chamorro, M.V.; Arrieta, A.A. A Look to the Biogas Generation from Organic Wastes in Colombia. Int. J. Energy Econ. Policy 2020, 10, 54. [Google Scholar] [CrossRef]

- Superintendence of Home Public Services, Colombia. Informe de Seguimiento a Sitios de Disposición Final. Available online: https://www.superservicios.gov.co/sites/default/files/inline-files/Informe-Nacional-de-Disposicion-Final-de-Residuos-Solidos-2022.pdf (accessed on 31 May 2024).

- Huevos Kikes. Home. Available online: https://www.huevoskikes.com/ (accessed on 25 January 2025).

- Biogás Colombia. Home. Available online: http://www.biogas.com.co (accessed on 25 January 2025).

- Energy and Gas Regulatory Commission, Colombia. CREG-056. 2009. Available online: https://gestornormativo.creg.gov.co/gestor/entorno/docs/resolucion_creg_0056_2009.htm (accessed on 10 February 2025).

- National Congress, Colombia. Ley 2014;1.715. Available online: https://www.funcionpublica.gov.co/eva/gestornormativo/norma.php?i=57353 (accessed on 22 February 2025).

- Energy and Gas Regulatory Commission, Colombia. CREG-240. 2016. Available online: https://gestornormativo.creg.gov.co/gestor/entorno/docs/resolucion_creg_0240_2016.htm (accessed on 22 February 2025).

- Ministry of Energy and Mines, Ecuador. Balance Energético Nacional. 2023. Available online: https://www.recursosyenergia.gob.ec/wp-content/uploads/2024/08/BEN_2023-final_compressed.pdf (accessed on 12 May 2025).

- Jara, M.A.P.; Castro, M.; Samaniego, M.R.P.; Abad, J.L.E.; Ruiz, E. Electricity sector in Ecuador: An overview of the 2007–2017 decade. Energy Policy 2018, 113, 513–522. [Google Scholar] [CrossRef]

- Government of Ecuador. Constitución de la República Del Ecuador. 2008. Available online: https://www.oas.org/juridico/pdfs/mesicic4_ecu_const.pdf (accessed on 22 February 2025).

- Government of Ecuador. Código Orgánico de Organización Territorial, Autonomía y Descentralización. 2010. Available online: https://www.oas.org/juridico/pdfs/mesicic4_ecu_org.pdf (accessed on 22 February 2025).

- Coelho, S.T.; Bouille, D.H.; Recalde, M.Y. Municipal Solid Waste Energy Conversion in Developing Countries: Chapter Four—WtE Best Practices and Perspectives in Latin America; Elsevier: Amsterdam, The Netherlands, 2020; pp. 107–145. [Google Scholar]

- National Electricity Council, Ecuador. CONELEC—004/11, 2011. Available online: https://wind-works.org/wp-content/uploads/2022/12/CONELEC_004-11_ERNC.pdf (accessed on 30 May 2025).

- Guyana Energy Agency. Bio-Digester Information and Construction Manual for Small Farmers. Available online: https://gea.gov.gy/downloads/Biodigester-Manual.pdf (accessed on 10 June 2024).

- Guyana Energy Agency. Biogas: An Alternative Energy Source. Available online: https://gea.gov.gy/2014/04/02/biogas-an-alternative-energy-source/ (accessed on 2 February 2024).

- US Department of Energy. Guyana: Energy Snapshot. Available online: https://www.energy.gov/eere/articles/guyana-island-energy-snapshot-2020 (accessed on 2 February 2024).

- Santos, J.P.; Krogt, S.V.; Vargas, H. Potencial de Producción Energética a Partir del Biogás de Residuos Agroindustriales en Paraguay; Revista RedBioLAC: Assunción, Paragay, 2019. [Google Scholar]

- Municipal Board of the City of Asunción, Paraguay. Ord. Nº 9/22. 2022. Available online: https://www.asuncion.gov.py/wp-content/uploads/2022/08/ord-09-22.pdf (accessed on 7 September 2024).

- National Congress, Paragay. Ley 2023, 6, 977. Available online: https://www.bacn.gov.py/leyes-paraguayas/11281/ley-n-6977-regula-el-fomento-generacion-produccion-desarrollo-y-la-utilizacion-de-energia-electrica-a-partir-de-fuentes-de-energias-renovables-no-convencionales-no-hidraulicas (accessed on 7 September 2024).

- National Congress, Paragay. Proyecto de Ley 3198/2018-CR; National Congress, Paragay: Assunción, Paragay, 2018. [Google Scholar]

- Ministry of Energy and Mines, Paragay. Balance Energético Nacional. 2021. Available online: https://minasyenergia.mopc.gov.py/index.php?option=com_content&view=article&id=2069 (accessed on 17 September 2024).

- Ministry of Energy and Mines, Peru. Balance Energético Nacional. 2022. Available online: https://www.gob.pe/institucion/minem/informes-publicaciones/5575775-balance-nacional-de-energia-2022 (accessed on 17 September 2024).

- Alvarez, Y.C.; Borges, R.J.; Vidal, C.D.P.; Leon, F.M.C.; Buendia, J.S.P.; Nolasco, J.A.S. Design Improvements and Best Practices in Small-Scale Biodigesters for Sustainable Biogas Production: A Case Study in the Chillon Valley, Perú. Energies 2025, 18, 338. [Google Scholar] [CrossRef]

- Abbasi, T.; Tauseef, S.M.; Abbasi, S.A. Biogas Energy; Springer Science & Business Media: Cham, Switzerland, 2011; Volume 2. [Google Scholar]

- Reyes, J.M.; Ramirez, S.B. Estimación del potencial energético técnico a partir de biomasa residual agroindustrial y pecuario en el Perú. Rev. Innov. Transf. Product. 2022, 3, e004. [Google Scholar] [CrossRef]

- Ministry of Environment, Peru. Ley 2018;30.754. Available online: https://www.gob.pe/institucion/presidencia/normas-legales/355750-30754 (accessed on 23 September 2024).

- Cuéllar, A.D.; Webber, M.E. Cow power: The energy and emissions benefits of converting manure to biogas. Environ. Res. Lett. 2008, 3, 034002. [Google Scholar] [CrossRef]

- Singh, B.; Szamosi, Z.; Siménfalvi, Z.; Rosas-Casals, M. Decentralized biomass for biogas production. Evaluation and potential assessment in Punjab (India). Energy Rep. 2020, 6, 1702–1714. [Google Scholar] [CrossRef]

- US Department of Energy. Suriname: Energy Snapshot. Available online: https://www.energy.gov/eere/articles/suriname-island-energy-snapshot-2020 (accessed on 2 February 2024).

- Marconi, P.; Rosa, L. Role of biomethane to offset natural gas. Renew. Sustain. Energy Rev. 2023, 187, 113697. [Google Scholar] [CrossRef]

- Universidad de la Republica Uruguay. Potencial de Producción de Biogás en Uruguay. Instituto de Ingeniería Química—Facultad de Ingeniería. 2013. Available online: https://www.gub.uy/ministerio-industria-energia-mineria/sites/ministerio-industria-energia-mineria/files/documentos/publicaciones/02%20-%20Potencial%20de%20producci%C3%B3n%20de%20biog%C3%A1s%20y%20optimizaci%C3%B3n%20energ%C3%A9tica%20de%20reactores%20anaerobios.pdf (accessed on 9 September 2024).

- Iagua. Uruguay Recupera Metano Generado en Los Sistemas de Tratamiento de Aguas Residuales Industriales. Available online: https://www.iagua.es/noticias/ministerio-ambiente-uruguay/uruguayrecupera-metano-generado-sistemas-tratamiento-aguas (accessed on 3 February 2025).

- Ministry of Industry, Energy and Mining, Uruguay. Balance Energético. 2020. Available online: https://ben.miem.gub.uy/descargas/1balance/1-1-Libro-BEN2020.pdf (accessed on 3 February 2025).

- National Assembly, Venezuela. Ley Orgánica de Energías Renovables No Convencionales Impulsará Nueva Cultura. Available online: https://www.asambleanacional.gob.ve/noticias/leyorganica-de-energias-renovables-no-convencionales-impulsara-nueva-cultura (accessed on 3 November 2024).

- Antón, D.B.R.; García, M.E.D. Control del biogás de vertedero en Venezuela y el resto del mundo. Entre los acuerdos de Kioto y Paris. Prospectiva 2021, 19, 3. [Google Scholar] [CrossRef]

- Ramírez, P. Propuesta de estrategias para la gestión integral de la basura: Municipio sucre, estado miranda. Terra 2015, 31, 93–120. [Google Scholar]

- Soler, Y.R. Simulación de la Contaminación Generada Como Lixiviado y Biogás a Través Del Programa Moduelo 2.0 en el Relleno Sanitario de La Paragüita del Municipio Juan José Mora Estado Carabobo. Bachelor’s Thesis, Universidad de Carabobo, Carabobo, Venezuela, 2009. [Google Scholar]

- PDVSA. Gas Directo Para el Relleno Sanitario la Bonanza. Available online: http://www.pdvsa.com/index.php?option=com_content&view=article&id=2303:4325&catid=10&Itemid=589&lang=es (accessed on 3 November 2024).

- AquaLimpia Engineering. Home. Available online: https://www.aqualimpia.com/ (accessed on 5 November 2024).

- IEA. Gas Market Report, Q1-2025; IEA: Paris, France, 2025; Available online: https://www.iea.org/reports/gas-market-report-q1-2025 (accessed on 13 February 2025).

- European Commission. REPowerEU—2 Years on. Available online: https://energy.ec.europa.eu/topics/markets-and-consumers/actions-and-measures-energy-prices/repowereu-2-years_en#produce-clean-energy (accessed on 13 February 2025).

- European Parliament and the Council of The European Union. Directive 2008/98/Ec of The European Parliament and of The Council. Available online: https://eur-lex.europa.eu/eli/dir/2008/98/oj/eng (accessed on 13 February 2025).

- European Parliament and the Council of The European Union. Directive (Eu) 2018/2001 of The European Parliament and of The Council. Available online: https://eur-lex.europa.eu/eli/dir/2018/2001/oj/eng (accessed on 15 February 2025).

- European Parliament and the Council of The European Union. Communication from The Commission to the European Parliament, The European Council, The Council, The European Economic and Social Committee and The Committee of The Regions. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52022DC0230 (accessed on 15 February 2025).

- European Parliament and the Council of The European Union. Directive (Eu) 2023/2413 of The European Parliament and of The Council. Available online: https://eur-lex.europa.eu/eli/dir/2023/2413/oj/eng (accessed on 16 February 2025).

- United States Environmental Protection Agency. Renewable Fuel Standard Program. Available online: https://www.epa.gov/renewable-fuel-standard-program (accessed on 17 February 2025).

- California Air Resources Board. Low Carbon Fuel Standard. Available online: https://ww2.arb.ca.gov/es/our-work/programs/low-carbon-fuel-standard/about (accessed on 17 February 2025).

- United States Department of Energy. Inflaction Reduction Act of 2022. Available online: https://www.energy.gov/lpo/inflation-reduction-act-2022 (accessed on 17 February 2025).

- California Public Utilities Commission. Decision Implementing Senate Bill 1440 Biomethane Procurement Program. Available online: https://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M454/K335/454335009.PDF (accessed on 23 February 2025).

- United States Environmental Protection Agency. Final Renewable Fuels Standards Rule for 2023, 2024, and 2025. Available online: https://www.epa.gov/renewable-fuel-standard-program/final-renewable-fuels-standards-rule-2023-2024-and-2025 (accessed on 17 February 2025).

- United States Congress. Renewable Natural Gas Incentive Act of 2023. Available online: https://www.congress.gov/bill/118th-congress/house-bill/2448 (accessed on 23 February 2025).

- Noussan, M.; Negro, V.; Prussi, M.; Chiaramonti, D. The potential role of biomethane for the decarbonization of transport: An analysis of 2030 scenarios in Italy. Appl. Energy 2024, 355, 122322. [Google Scholar] [CrossRef]

- Orecchini, F.; Santiangeli, A.; Zuccari, F. Biomethane use for automobiles towards a CO2-neutral energy system. Clean Energy 2021, 5, 124–140. [Google Scholar] [CrossRef]

- Meena, P.K.; Pal, A.; Gautam, S. Investigation of combustion and emission characteristics of an SI engine operated with compressed biomethane gas, and alcohols. Environ. Sci. Pollut. Res. 2022, 31, 10262–10272. [Google Scholar] [CrossRef] [PubMed]

- Aggarangsi, P.; Moran, J.; Koonaphapdeelert, S.; Tippayawong, N. Performance comparison of biomethane, natural gas and gasoline in powering a pickup truck. Biofuels 2022, 13, 957–964. [Google Scholar] [CrossRef]

- Noussan, M. The Use of Biomethane in Internal Combustion Engines for Public Transport Decarbonization: A Case Study. Energies 2023, 16, 7995. [Google Scholar] [CrossRef]

- Milojević, S.; Stopka, O.; Orynycz, O.; Tucki, K.; Šarkan, B.; Savić, S. Exploitation and Maintenance of Biomethane-Powered Truck and Bus Fleets to Assure Safety and Mitigation of Greenhouse Gas Emissions. Energies 2025, 18, 2218. [Google Scholar] [CrossRef]

- Henke, I.; Cartenì, A.; Beatrice, C.; Di Domenico, D.; Marzano, V.; Patella, S.M.; Picone, M.; Tocchi, D.; Cascetta, E. Fit for 2030? Possible scenarios of road transport demand, energy consumption and greenhouse gas emissions for Italy. Transp. Policy 2024, 159, 67–82. [Google Scholar] [CrossRef]

- Thiruvengadam, A.; Besch, M.; Padmanaban, V.; Pradhan, S.; Demirgok, B. Natural gas vehicles in heavy-duty transportation-A review. Energy Policy 2018, 122, 253–259. [Google Scholar] [CrossRef]

- Di Domenico, D.; Napolitano, P.; Di Maio, D.; Beatrice, C. Assessment of Charge Dilution Strategies to Reduce Fuel Consumption in Natural Gas-Fuelled Heavy-Duty Spark Ignition Engines. Energies 2025, 18, 2072. [Google Scholar] [CrossRef]

- Lima Uchoa Filho, F.E.; Marques Sampaio, H.C.; de Freitas Moura Júnior, C.F.; de Oliveira, M.L.M.; Van Griensven Thé, J.; Rocha, P.A.C.; Bueno, A.V. Radiation and Combustion Effects of Hydrogen Enrichment on Biomethane Flames. Processes 2025, 13, 1048. [Google Scholar] [CrossRef]

- Hasche, A.; Krause, H.; Eckart, S. Hydrogen admixture effects on natural gas-oxygen burner for glass-melting: Flame imaging, temperature profiles, exhaust gas analysis, and false air impact. Fuel 2025, 387, 134397. [Google Scholar] [CrossRef]

- Al-ajmi, R.; Qazak, A.H.; Sadeq, A.M.; Al-Shaghdari, M.; Ahmed, S.F.; Sleiti, A.K. Numerical investigation of the potential of using hydrogen as an alternative fuel in an industrial burner. Fuel 2025, 385, 134194. [Google Scholar] [CrossRef]

- Meisterl, K.; Sastre, S.; Puig-Ventosa, I.; Chifari, R.; Martínez Sánchez, L.; Chochois, L.; Fiorentino, G.; Zucaro, A. Circular Bioeconomy in the Metropolitan Area of Barcelona: Policy Recommendations to Optimize Biowaste Management. Sustainability 2024, 16, 1208. [Google Scholar] [CrossRef]

- Sihlangu, E.; Luseba, D.; Regnier, T.; Magama, P.; Chiyanzu, I.; Nephawe, K.A. Investigating Methane, Carbon Dioxide, Ammonia, and Hydrogen Sulphide Content in Agricultural Waste during Biogas Production. Sustainability 2024, 16, 5145. [Google Scholar] [CrossRef]

- Rasheed, T.; Anwar, M.T.; Ahmad, N.; Sher, F.; Khan, S.U.-D.; Ahmad, A.; Khan, R.; Wazeer, I. Valorisation and Emerging Perspective of Biomass Based Waste-to-Energy Technologies and Their Socio-Environmental Impact: A Review. J. Environ. Manag. 2021, 287, 112257. [Google Scholar] [CrossRef] [PubMed]

- Lovrak, A.; Pukšec, T.; Grozdek, M.; Duić, N. An integrated Geographical Information System (GIS) approach for assessing seasonal variation and spatial distribution of biogas potential from industrial residues and by-products. Energy 2022, 239, 122016. [Google Scholar] [CrossRef]

- Mesthrige, T.G.; Kaparaju, P. Decarbonisation of Natural Gas Grid: A Review of GIS-Based Approaches on Spatial Biomass Assessment, Plant Siting and Biomethane Grid Injection. Energies 2025, 18, 734. [Google Scholar] [CrossRef]

- Venslauskas, K.; Navickas, K.; Rubežius, M.; Žalys, B.; Gegeckas, A. Processing of Agricultural Residues with a High Concentration of Structural Carbohydrates into Biogas Using Selective Biological Products. Sustainability 2024, 16, 1553. [Google Scholar] [CrossRef]

- Fiorentino, G.; Zucaro, A.; Cerbone, A.; Giocoli, A.; Motola, V.; Rinaldi, C.; Scalbi, S.; Ansanelli, G. The Contribution of Biogas to the Electricity Supply Chain: An Italian Life Cycle Assessment Database. Energies 2024, 17, 3264. [Google Scholar] [CrossRef]

- Kozuch, A.; Cywicka, D.; Adamowicz, K.; Wieruszewski, M.; Wysocka-Fijorek, E.; Kiełbasa, P. The Use of Forest Biomass for Energy Purposes in Selected European Countries. Energies 2023, 16, 5776. [Google Scholar] [CrossRef]

- Forfora, N.; Azuaje, I.; Vivas, K.A.; Vera, R.E.; Brito, A.; Venditti, R.; Kelley, S.; Tu, Q.; Woodley, A.; Gonzale, R. Evaluating biomass sustainability: Why below-ground carbon sequestration matters. J. Clean. Prod. 2024, 439, 140677. [Google Scholar] [CrossRef]

- Pawłowska, M.; Zdeb, M.; Bis, M.; Pawłowski, L. State and Perspectives of Biomethane Production and Use—A Systematic Review. Energies 2025, 18, 2660. [Google Scholar] [CrossRef]

- Miltner, M.; Makaruk, A.; Harasek, M. Review on available biogas upgrading technologies and innovations towards advanced solutions. J. Clean. Prod. 2017, 161, 1329–1337. [Google Scholar] [CrossRef]

| Company | Location | Raw Material | Authorization Date | Authorized Biomethane Production (Nm3/day) | Current Production (Nm3/day) |

|---|---|---|---|---|---|

| Adecoagro Vale do Ivinhema S.A. | Ivinhema-MS | Sugarcane and USW | 12/2024 | 8000 | 0 |

| Cocal Energia S.A. | Narandiba-SP | Agroforestry Waste | 07/2022 | 27,112 | 22,000 |

| Cri Geo Biogás S.A. | Elias Fausto-SP | Agroforestry Waste | 02/2025 | 23,694 | 0 |

| Engep Ambiental LTDA | Jambeiro-SP | USW | 03/2023 | 30,000 | 30,040 |

| Essencis Biometano S.A. | Caieiras-SP | USW | 09/2024 | 67,200 | 51,869 |

| Gás Verde S.A. | Seropédica-RJ | USW | 07/2020 | 204,000 | 387,298 |

| Geo Elétrica Tamboara Bioenergia LTDA. | Tamboara-PR | Agroforestry Waste | 12/2024 | 31,200 | 0 |

| GNR Dois Arcos Valorização de Biogás LTDA. | São Pedro da Aldeia-RJ | USW | 07/2020 | 16,000 | 32,554 |

| GNR Fortaleza Valorização de Biogás LTDA. | Caucaia-CE | USW | 01/2020 | 110,000 | 118,542 |

| Metagás Biogás e Energia S.A. | São Paulo-SP | USW | 06/2022 | 30,000 | 7574 |

| Raízen-Geo Biogás Costa Pinto LTDA. | Piracicaba-SP | USW | 08/2024 | 130,368 | 20,965 |

| Zeg Biogás Aroeira SPE LTDA | Tupaciguara-MG | Agroforestry Waste | 03/2025 | 16,912 | 0 |

| Company | Location | Biomethane Production Capacity (Nm3/day) | Estimated Completion Date |

|---|---|---|---|

| AE H&T SPE LTDA. | Harmonia-RS | 11,712 | 03/2026 |

| Agric Adubos E Gestão De Resíduos Industriais E Comerciais S.A. | Campos Novos-SC | 31,440 | 08/2025 |

| Atvos Biometano Santa Luzia S.A. | Nova Alvorada do Sul-MS | 110,101 | 12/2026 |

| Bioenergia Santa Cruz LTDA. | Américo Brasiliense-SP | 75,000 | 07/2025 |

| Biometano São Leopoldo S.A. | São Leopoldo-RS | 36,744 | 06/2026 |

| Biometano Sul S.A. | Minas do Leão-RS | 70,000 | 06/2025 |

| Biometano Verde Paulínia S.A. | Paulínia-SP | 225,840 | 12/2025 |

| CH4 Energia S.A. | Sabará-MG | 72,000 | 06/2026 |

| Cocal Energia Ppt Participações Ltd.a. | Paraguaçu Paulista-SP | 54,000 | 07/2025 |

| Folhito Ltd.a | Estrela-RS | 10,000 | Construction completed. The authorization process is ongoing. |

| Ga Energia S.A. | Sabará-MG | 36,000 | 08/2026 |

| Geo Agrovale Biogás Ltd.a. | Juazeiro-BA | 55,000 | 08/2025 |

| Geriba Energy Gas Desc S.A. | Descalvado-SP | 3360 | 04/2026 |

| H2A Soluções Ambientais Ltd.a | Rio Verde de Goiás-GO | 4320 | Construction completed. The authorization process is ongoing. |

| H2A Soluções Ambientais Ltd.a. Scp | Videira-SC | 6720 | 04/2026 |

| H2A Soluções Ambientais Ltd.a. Scp 1 | Videira-SC | 20,000 | 10/2025 |

| H2A Soluções Ambientais Ltd.a. Scp 2 | Papanduva-SC | 6720 | 08/2025 |

| H2A Soluções Ambientais Ltd.a. Scp 3 | Papanduva-SC | 6720 | 11/2025 |

| Mele Biogás Brasil LTDA. | Toledo-PR | 24,756 | 09/2026 |

| Orizon Itapevi Limitada | Itapevi-SP | 32,400 | 09/2026 |

| Orizon Biometano Jaboatão Dos Guararapes Limitada | Jaboatão dos Guararapes-PE | 162,000 | Awaiting schedule update. |

| Orizon Biometano Rosario Do Catete Limitada | Rosário Do Catete-SE | 60,000 | 05/2027 |

| Orizon Biometano Tremenbé Limitada | Tremenbé-SP | 43,200 | 12/2026 |

| Scalon & Cerchi Ltd.a | Sacramento-MG | 10,800 | Awaiting schedule update. |

| Scbio Energias Renováveis Spe Ltd.a. | Campos Novos-SC | 4320 | Awaiting schedule update. |

| Spe Bioo Paraná Ltd.a. | Toledo-PR | 36,000 | 07/2026 |

| Spe Bioo Passo Fundo Ltd.a. | Passo Fundo-RS | 36,000 | 12/2026 |

| Spe Central De Tratamento Integrado Resíduo Zero Ltd.a. | Triunfo-RS | 36,000 | Construction completed. The authorization process is ongoing. |

| Translurean Transportes Ltd.a. | Carambeí-PR | 31,440 | 01/2027 |

| Tropical Biogás Ltd.a. | Edéia-GO | 17,300 | 03/2026 |

| Uisa Geo Biogás S.A | Nova Olímpia-MT | 27,600 | 01/2026 |

| Uvb Marca Ltd.a. | Cariacica-ES | 25,000 | 07/2025 |

| Valorgás Energia Igarassu I Aluguel De Equipamentos Para Sistema De Valorização Energética E Manutenção Spe Ltd.a. | Igarassu-PE | 45,760 | 10/2026 |

| Valorgás Feira De Santana Ltd.a. | Feira de Santana-BA | 21,400 | 11/2026 |

| Zeg Biogás Pindorama Spe Ltd.a. | Penedo-AL | 60,000 | 12/2026 |

| Location | Start | Capacity | Source |

|---|---|---|---|

| Patos de Minas-MG | 2016 | 4995 kW of electricity production | [64] |

| Foz do Iguaçu-PR | 2017 | 70 m3/day (consumption in the internal fleet) | [62] |

| Concórdia-SC | 2018 | Consumption in the internal fleet | [65] |

| Franca-SP | 2018 | Consumption in the internal fleet | [63] |

| Paulínia-SP | 2022 | 110,000 Nm3/day | [66] |

| São Mateus-SP | 2021 | 90,000 Nm3/day | [67,68] |

| Characteristic | Unit | Limit | ||

|---|---|---|---|---|

| North | Northeast | Central-West, Southeast, and South | ||

| Higher heating value | MJ/m3 | 34.00–38.40 | 35.00–43.00 | |

| kWh/m3 | 9.47–10.67 | 9.72–11.94 | ||

| Wobbe Index | MJ/m3 | 40.50–45.00 | 46.50–53.50 | |

| Methane, min. | % mol. | 90.00 | ||

| Ethane | % mol. | note | ||

| Propane | % mol. | note | ||

| Butanes and heavier | % mol. | note | ||

| Oxygen, max. | % mol. | 0.80 | ||

| CO2, max. | % mol. | 3.00 | ||

| CO2 + O2 + N2, max. | % mol. | 10.00 | ||

| Total sulfur, max. | mg/m3 | 70.00 | ||

| Hydrogen sulfide (H2S), max. | mg/m3 | 10.00 | ||

| Water dew point at 1 atm, max. | °C | −39.00 | −45.00 | |

| Hydrocarbon dew point | °C | 15.00 | 0.00 | |

| Legislation | Year | Description | Source |

|---|---|---|---|

| Waste Framework Directive (WFD) (EC/2009/98) | 2009 | Makes separate collection of organic waste mandatory starting in 2024 | [119] |

| Renewable Energy Directive II (RED II) (EU/2018/2001) | 2018 | Requires fuel suppliers to include a minimum share of renewable energy in the transport sector, including biomethane. | [120] |

| REPowerEU plan (COM/2022/230) | 2022 | Set the target of producing 35 billion Nm3 of biomethane per year by 2030 to reduce fossil fuel imports. | [121] |

| Renewable Energy Directive III (RED III) (EU/2023/2413) | 2023 | Expanded the final use of biomethane, making its use less restrictive. | [122] |

| Legislation | Year | Type | Description | Source |

|---|---|---|---|---|

| Renewable Fuel Standard (RFS) program | 2005 | Federal | Establishes a minimum of renewable fuels in transportation sector fuel. | [124] |

| California Low Carbon Fuel Standard (LCFS) | 2011 | State: California | Sets a 20% reduction in carbon intensity in the transportation sector by 2030. | [125] |

| Inflation Reduction Act (IRA) | 2022 | Federal | Establishes investment credits and protection for renewable fuel projects initiated before 2025, with a duration of 10 years. | [126] |

| California Renewable Gas Standard (RGS) procurement program D.22-25-025 | 2022 | State: California | Establishes a mandatory target for purchasing biomethane from landfills for gas utilities. | [127] |

| Set Rule Implementation (RFS) | 2023 | Federal | Updated targets for the years 2023–2025. | [128] |

| Renewable Natural Gas Incentive Act | 2023 | Federal | Introduction of a credit of 1 USD/gallon of biomethane used in heavy-duty vehicles. | [129] |

| Legislation | Year | Description |

|---|---|---|

| Chinese Rural Household Biogas State Debt Project | 2003 | Aimed to reduce pollution from agricultural wastes and solve energy shortage in rural areas. |

| Working Plan of Upgrading and Transforming Rural Biogas Projects | 2015 | Promoted BNG pilot projects by the central government for the first time. |

| Guidelines for Promoting Development of the Biomethane Industry | 2019 | Targeted 10 bcm (billion cubic meters) by 2025 and 20 bcm by 2030. |

| 14th Five-Year Plan for the Development of Renewable Energy | 2021–2025 | Introduced support for large-scale biomethane industry. |

| Legislation | Expected Timeframe | Countries |

|---|---|---|

| Mandatory selective waste collection and/or sanitary landfills | Medium to long term | Brazil and Chile |

| Minimum share of biofuels in the transport sector and/or energy matrix | Short, medium, and long term | Argentina, Brazil, and Chile |

| Investment and/or utilization credits for biomethane | Short to medium term | Brazil and Ecuador |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vidigal, L.P.V.; de Souza, T.A.Z.; da Costa, R.B.R.; Roque, L.F.d.A.; Frez, G.V.; Pérez-Rangel, N.V.; Pinto, G.M.; Ferreira, D.J.S.; Cardinali, V.B.A.; Solferini de Carvalho, F.; et al. Biomethane as a Fuel for Energy Transition in South America: Review, Challenges, Opportunities, and Perspectives. Energies 2025, 18, 2967. https://doi.org/10.3390/en18112967

Vidigal LPV, de Souza TAZ, da Costa RBR, Roque LFdA, Frez GV, Pérez-Rangel NV, Pinto GM, Ferreira DJS, Cardinali VBA, Solferini de Carvalho F, et al. Biomethane as a Fuel for Energy Transition in South America: Review, Challenges, Opportunities, and Perspectives. Energies. 2025; 18(11):2967. https://doi.org/10.3390/en18112967

Chicago/Turabian StyleVidigal, Luís Pedro Vieira, Túlio Augusto Zucareli de Souza, Roberto Berlini Rodrigues da Costa, Luís Filipe de Almeida Roque, Gustavo Vieira Frez, Nelly Vanessa Pérez-Rangel, Gabriel Marques Pinto, Davi José Souza Ferreira, Vítor Brumano Andrade Cardinali, Felipe Solferini de Carvalho, and et al. 2025. "Biomethane as a Fuel for Energy Transition in South America: Review, Challenges, Opportunities, and Perspectives" Energies 18, no. 11: 2967. https://doi.org/10.3390/en18112967

APA StyleVidigal, L. P. V., de Souza, T. A. Z., da Costa, R. B. R., Roque, L. F. d. A., Frez, G. V., Pérez-Rangel, N. V., Pinto, G. M., Ferreira, D. J. S., Cardinali, V. B. A., Solferini de Carvalho, F., de Carvalho, J. A., Jr., Mattos, A. P., Hernández, J. J., & Coronado, C. J. R. (2025). Biomethane as a Fuel for Energy Transition in South America: Review, Challenges, Opportunities, and Perspectives. Energies, 18(11), 2967. https://doi.org/10.3390/en18112967