Abstract

With rising urgency around carbon emissions and climate change, electrification has emerged as a central focus in traditionally combustion-reliant industries. With increasing regulatory restrictions on automotive and smaller off-highway markets (<25 hp), the heavy equipment industry faces growing pressures to adopt hybrid and fully electric solutions. Current literature primarily addresses technical electrification challenges, leaving a gap in understanding industry perspectives. This study explores trends, challenges, and expectations of electrification from industry representatives’ viewpoints, using data from 84 surveys conducted at the CONEXPO/CONAGG trade show and sentiment analysis of 100 interview notes gathered through an NSF Innovation Corps workshop. Results indicate substantial uncertainty toward electrification, with key limitations including power-to-weight ratios, high costs, maintenance, leakage concerns, and reliability of electronic components. The majority (77%) preferred traditional hydraulic systems due to familiarity and reliability, though concerns over maintenance and environmental impact remain prevalent. Participants anticipate a gradual industry transition, projecting widespread adoption of hybrid solutions in 10–15 years and longer timelines for fully electric systems. Effective adoption of greener technologies is likely through industry-wide standards and financial incentives. This study emphasizes the industry’s cautious yet gradually increasing openness to electrification amidst persistent technological and economic challenges.

1. Introduction

Climate change and sustainability are among the top global challenges over recent decades [1]. Greenhouse gases trap heat and increase atmospheric temperatures, directly impacting these challenges. Over the past two centuries, greenhouse gases have increased significantly due to utilization of natural resources for energy [2]. While few countries have reached carbon neutrality to date, there is a global effort to reach carbon neutrality as soon as 2050 [3].

The transportation sector is one of the largest emitters of greenhouse gases. Emissions from this sector are derived from burning petroleum and diesel fuels for internal combustion engines [2]. Internal combustion engines have relatively low efficiencies, averaging less than 40 percent. Thus, approximately 60 percent or more of the energy utilized does not directly contribute to the vehicle’s propulsion [4]. Many of these losses are caused by thermal losses in the combustion process and heat transfer expelled through the exhaust [5]. Various solutions have been proposed for reaching carbon neutrality in the United States, many of which involve increasing energy efficiency, using clean, renewable energy, and adopting electrified machines [6].

Technological advances in batteries and electric motors have begun to evoke potential for the transition to electrified vehicles, promoting more efficient energy consumption, less maintenance, and the elimination of tailpipe emissions [4]. While electrified on-highway vehicles are becoming more common for smaller engines and passenger automobiles, the heavy equipment industry still faces substantial challenges in electrifying large on-highway and off-highway vehicles. Challenges in electrifying medium to large heavy equipment machines stem from the inherently demanding duty cycles for offroad machines compared to passenger vehicles and small offroad machines. Heavy equipment machines are often used for long hours in remote locations and intensive conditions. While the advances in electric motors have increased, the power densities of hydraulic systems are still magnitudes higher in comparison [7]. Electric vehicles convert over 60% of the grid energy to the wheels, whereas petroleum-based engines only convert 20% of the energy from gasoline to propel the vehicle [8].

As there have not been any regulations restricting the production of new internal combustion engines for larger equipment (>25 hp) in the heavy equipment industry, the adoption of new technologies will likely be dictated by the customer market. Thus, it is important to understand how welcome this transition will be perceived in the industry. This study examines survey data and interview notes from representatives in the heavy equipment industry to better understand the current state and challenges of the heavy equipment industry. A thematic analysis and sentiment analysis of the survey data and interview notes are conducted. Among the proposed solutions, electrification holds significant potential to positively influence the heavy equipment industry; however, successful implementation will require advancements in energy-efficient technologies and overcoming current performance and cost-related challenges.

1.1. Background

Concerns about climate change and air pollution have begun to raise awareness for energy conservation and the need for more efficient technologies and systems in various industries. The Environmental Protection Agency (EPA) reports that the transportation and industry sectors in the United States combined make up over half of the total greenhouse gas emissions by economic sector [9]. The transportation sector is making strides to increase the efficiency of modern vehicles with the development of hybrid and electric passenger vehicles. Fully electric vehicles have the advantage of benefiting from renewable energy sources, promoting renewable resources such as solar and wind energy production, which is cleaner and much more efficient than energy produced from fossil fuels [10]. Electrified vehicles can thus reduce carbon emissions at the point of use, significantly decreasing air pollution. While electrification seems promising for many solutions, including future passenger vehicles, various challenges exist for larger off-highway equipment. For decades, internal combustion engines and hydraulics have been used as the primary propulsion solution for heavy equipment machines. However, conventional heavy mobile hydraulic machines in the heavy equipment industry are notorious for having low efficiencies, averaging only 21% in overall efficiency [11]. Further research has explored methods to improve these efficiencies by increasing the performance and efficiency of pumps [12,13,14,15,16,17].

1.1.1. Internal Combustion Regulations in the United States

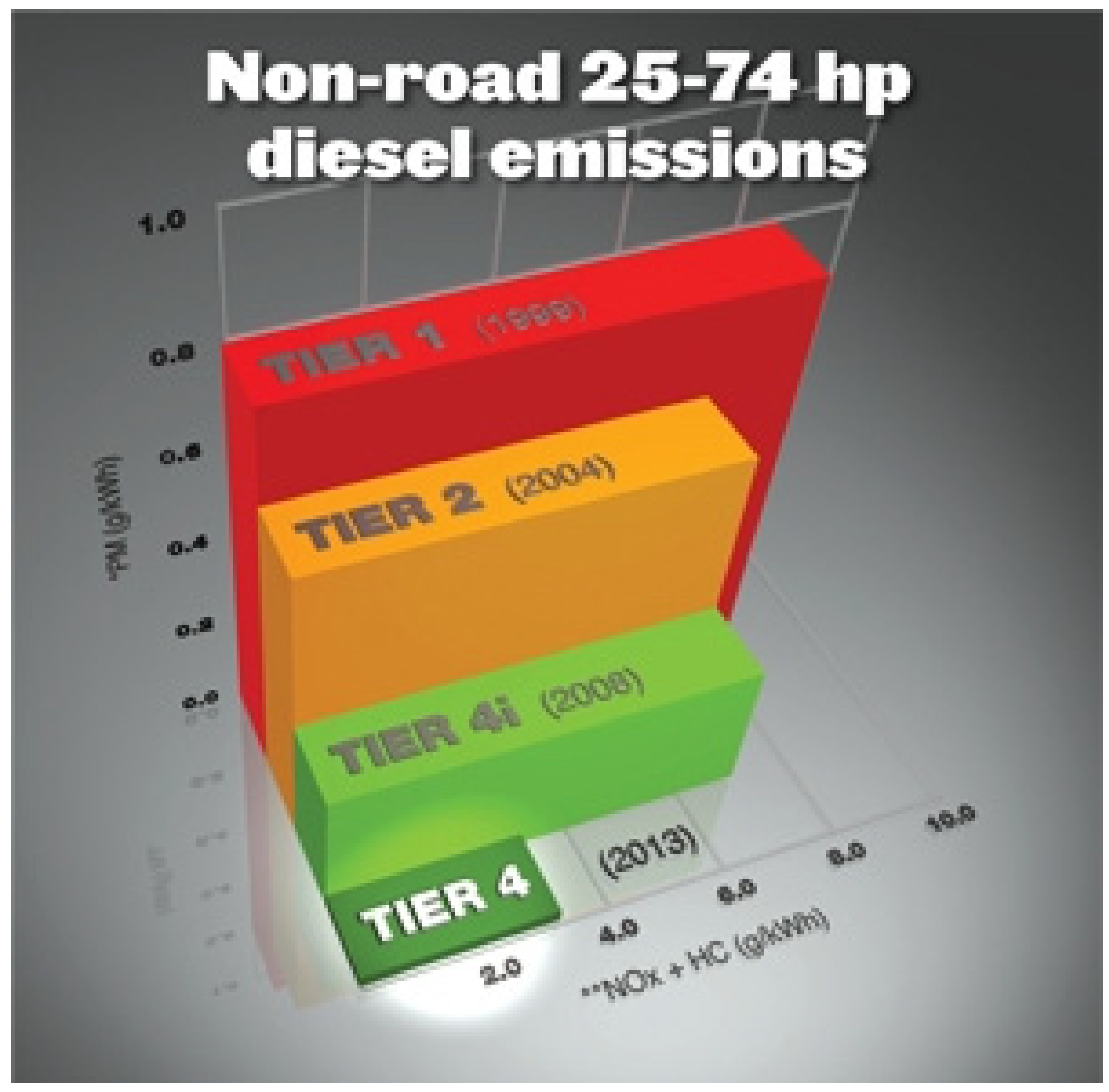

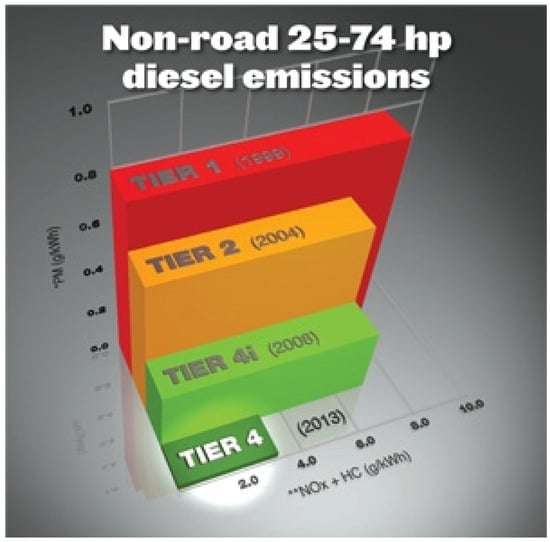

In the United States, federal policies regulate vehicle emissions standards, including heavy equipment machines, through the National Clean Air Act (CAA) of 1970 [9]. Figure 1 shows the progression of EPA Tier standards for non-road diesel engines, outlining increasingly stringent emission limits aimed at reducing pollutants from heavy equipment. These standards directly influence the design and operation of machinery by setting specific thresholds for nitrogen oxides, particulate matter, and other harmful emissions.

Figure 1.

Emission tiers for non-road diesel engines, adapted from [18]. ** indicates the combined emission limits of Nitrogen Oxides (NOx) and Hydrocarbons (HC) measured in grams per kilowatt-hour (g/kWh).

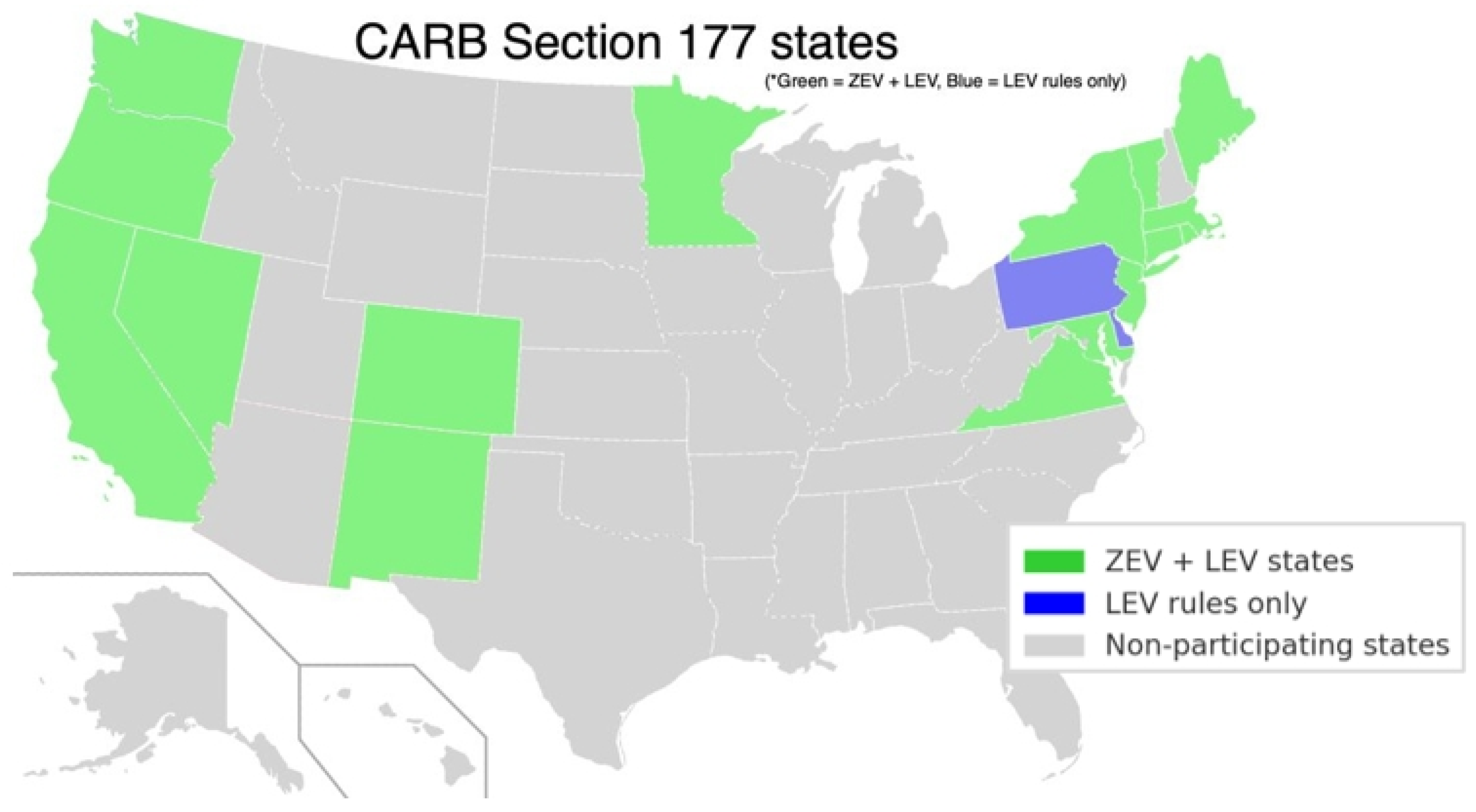

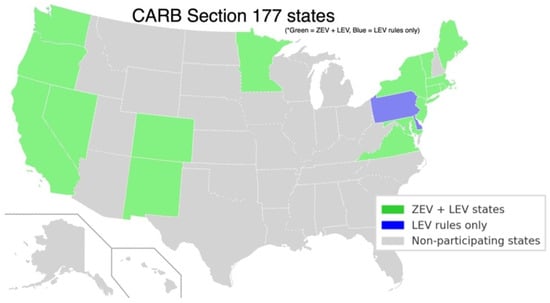

Currently, heavy equipment engine manufacturers are responsible for meeting Tier 4 emissions for both compression and spark-ignited internal combustion engines in the United States [19,20]. California, however, suffers from the highest air pollution and emissions in any state. While each state is required to meet these federal emissions, California is the only state permitted to develop its own emission standards, surpassing the federal standards. The California Air Resources Board (CARB) is responsible for developing these regulations. Due to high vehicle emissions, in 2021, California began the development of Tier 5 emission standards to further reduce nitrogen oxide and particulate matter by 50–90% [21,22]. California has also implemented bans on selling new small petroleum engines for the offroad industries, 25 hp or less, after 1 January 2024 to further reduce emissions from small engines [22]. Under the Advanced Clean Cars II regulations, new gasoline car sales will also be banned in the automotive market as of 2035. Of the 49 other states in the United States, 15 states, highlighted in Figure 2, have adopted California’s Zero Emission Vehicle (ZEV) program. These 16 states make up approximately 40 percent of the new car sales [23].

Figure 2.

Map of Section 177 states adopting Zero Emission Vehicle (ZEV) and Low Emission Vehicle (LEV) standards. Adapted from [23]. * indicates the color legend specifying that green represents states adopting both ZEV and LEV standards, while blue represents states adopting LEV rules only.

1.1.2. Market Drivers for Electric Systems in Heavy Equipment

Without future bans or regulations on large equipment, market drivers play an important role in the transition to electrified systems. Lajunen et al. [24] found that one of the long-term major driving forces for hybrid and electric powertrains will be increased opportunities for automation as they allow for more precise control over the equipment, enabling higher productivity and mitigating human error. Various studies have been conducted to discuss the state of the heavy equipment industry and the challenges of electrifying it. Many of these studies utilize available technologies, trends in the industry, and data acquired from online resources to evaluate the state of the industry. Beltrami et al. [25] focused their research on the compact off-highway market, more specifically excavators and front-end loaders. These researchers use various techniques to evaluate the state of the compact off-highway market, utilizing available data from online resources via relevant websites, articles, and trade magazines to evaluate the feasibility and trends in terms of power-to-weight ratios, operational runtime, and power in relation to the operating weight of the vehicles. Un-Noor et al. [26] broke down the challenges and state of technology for various heavy equipment machines and the current state of the art while discussing different challenges for electrification and opportunities for recovering energy through regenerative braking. In this review, the researchers found that excavators and off-highway trucks have been among the most appealing vehicles for electrification. While typical industry surveys generally rely on structured, quantitative data collection methods that capture predefined responses, the NSF I-Corps interviews employed in this study were specifically structured to facilitate open-ended, exploratory discussions. This allowed for capturing detailed qualitative insights and nuanced perceptions from industry stakeholders, which are often absent or less evident in traditional survey methodologies.

2. Materials and Methods

Two studies were conducted to learn about the state of the fluid power industry, focusing on the industry’s mindsets towards electrification and their sentiment toward the current challenges relating to this transition. The first study discussed in this article was a survey given to various industry representatives at the CONEXPO/CONAGG trade show. The second study analyzes the results of a commercialization workshop used to learn more about the preferences of the fluid power industry regarding electrification within the industry, and the final study included open-ended interview questions given to participants through a National Science Foundation (NSF) workshop used to learn more about the state of the industry.

2.1. CONEXPO/CONAGG Survey

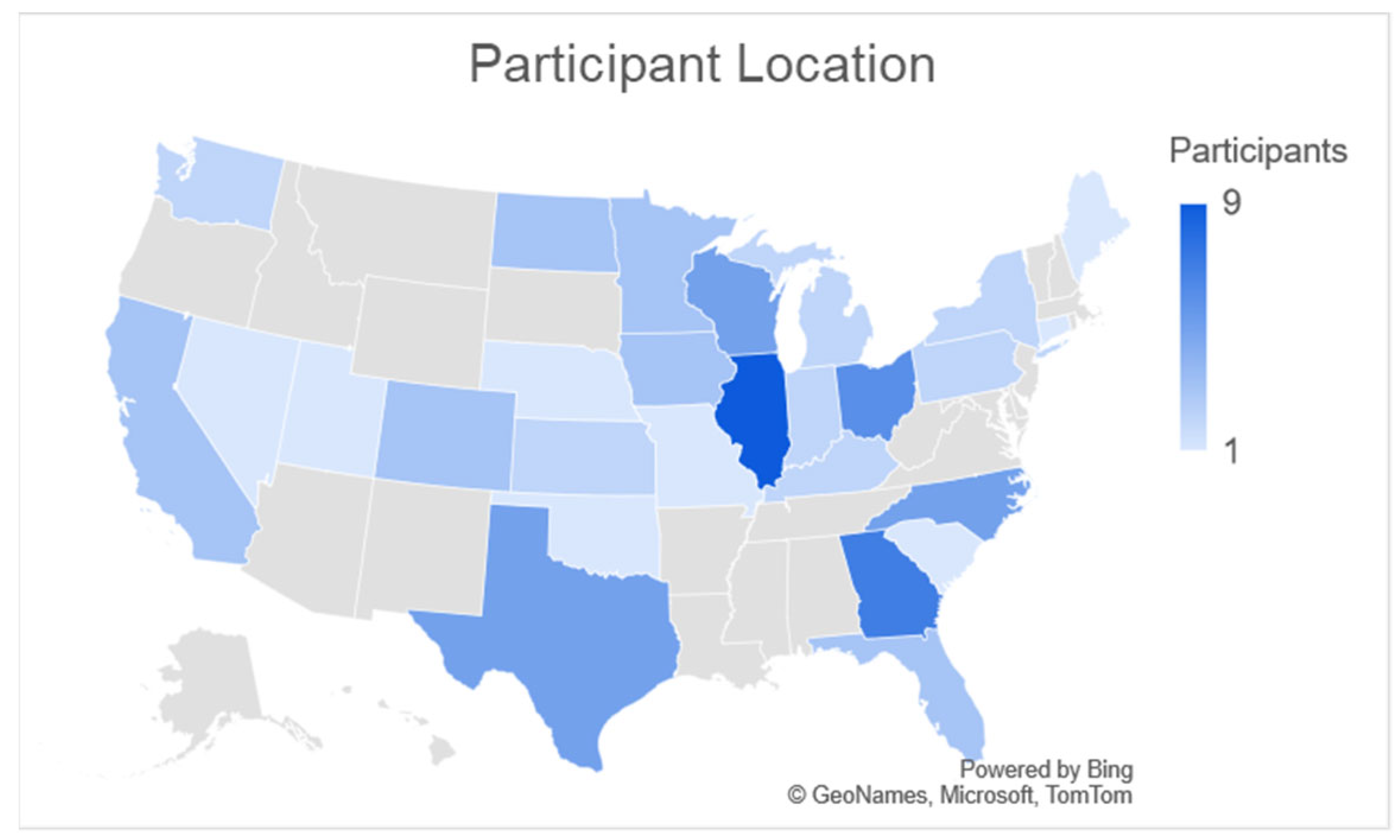

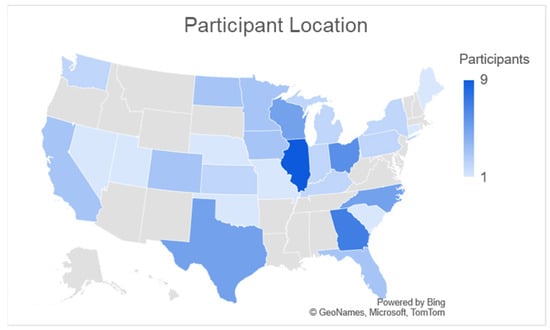

The researchers attended the CONEXPO/CONAGG heavy equipment show in the United States to interview event participants and learn more about the heavy equipment industry. Participants were given surveys that asked about their perceptions of fluid power and the industry’s electrification trends. Participants were asked to provide their information, including job titles and phone numbers, to help classify the distribution of the data. Table 1 shows the distribution of data based on the participants’ occupations. The data was grouped into five categories: Business Development, Engineering and applications, Executive/Management, Product Management, and Sales/Marketing. The highest number of participants were from Sales/Marketing. A map was created to show the participants’ locations, shown in Figure 3. This information is important because it provides more context to the distribution of the participants by state.

Table 1.

Job classification and frequency of interviewed participants.

Figure 3.

Participant locations across the United States for the CONEXPO/CONAGG heavy equipment show interviews. The color intensity represents the number of participants per state, with darker shades indicating a higher number of participants.

Participants were selected from the CONEXPO/CONAGG trade show based on their direct involvement, expertise, and decision-making influence within the heavy equipment industry. The inclusion criteria targeted professionals across various key occupational backgrounds, including Business Development, Engineering and Applications, Executive Management, Product Management, and Sales/Marketing, to ensure representation across critical functions that directly influence technological adoption and industry trends. The distribution of sample size across these occupations was guided by the proportion of each occupational group’s presence at the trade show, aiming for a balanced representation of industry perspectives while considering practical constraints inherent in collecting detailed qualitative data from industry professionals.

Although this study includes detailed participant job classifications and geographic distribution through participant location maps, information regarding company size or precise application sectors (such as agriculture, construction, or mining) was not collected. These demographic factors could further refine interpretation and provide additional insights into sector-specific sentiments.

2.2. NSF I-Corps Survey

Surveys were conducted to better understand the trends of electrification in the heavy equipment industry and the challenges that might be faced for commercialization. Table 2 lists the survey questions asked to the participants. The first question (Q1) was asked to understand the main priorities of the industry and if electrification is a solution that fits within the main concerns of the market. Questions two through four (Q2–Q4) help us better understand the challenges modern systems face as well as the potential benefits of the systems in comparison to conventional hydraulic systems. The fifth question (Q5) was used to better understand the timeframe for the transition to electric-hydraulic systems. The sixth question (Q6) was used to better understand the industries’ feelings toward emissions in the heavy equipment industry. The seventh question (Q7) was used to better understand the limitations of improving fuel efficiency and reducing emissions. The final question (Q8) was asked to learn from the industry the most effective methods for promoting the adoption of emission-reducing technology. These questions combined help identify the current state of the market and the potential paths moving toward a cleaner industry.

Table 2.

The list of questions asked to the participants.

2.3. NSF I-Corps Interview Notes

The National Science Foundation (NSF) sponsors an Innovation Corps (I-Corps) program to help innovators and entrepreneurs learn and apply tools for customer discovery and commercialization. The workshop participants are challenged to interview 100 candidates from industries related to proposed innovation. The workshop’s primary goal is to learn and investigate the challenges of a respective sector through customer discovery interviews and see if their innovation supports them. During the workshop, a business canvas model is developed and analyzed to help pioneers evaluate the commercial viability of innovations.

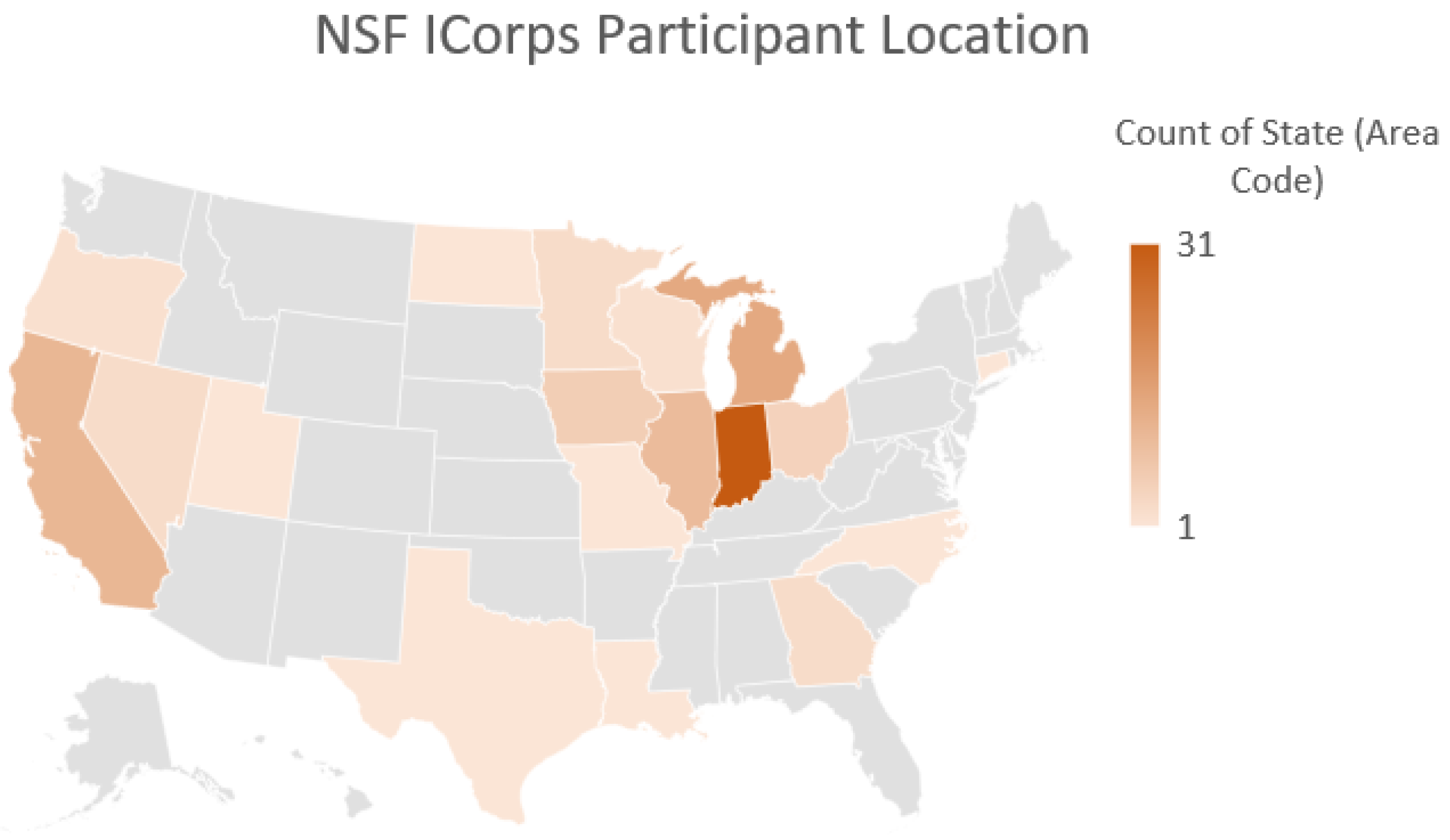

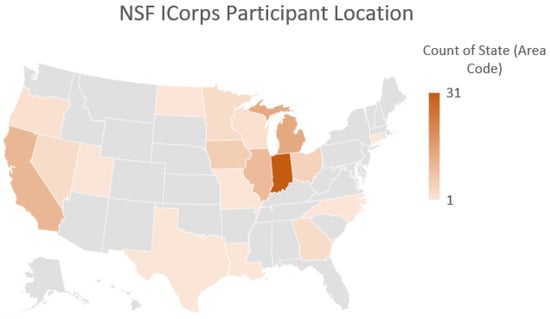

Researchers from Purdue University attended the Fall 2023 National I-Corps workshop, evaluating the potential of a novel technology supporting the revolution of modern heavy equipment machines. Interviews were conducted across the United States to provide more insight into the industry’s challenges. Like the participant survey data, a frequency plot was generated to highlight the participant locations, as shown in Figure 4. The two regions with the largest population of interviews were the Midwest and the West Coast. The Midwest was interviewed primarily for the sake of the high density of fluid power/heavy equipment industries. However, California and surrounding states on the West Coast were targeted to learn more about the challenges the industry faces.

Figure 4.

Participant locations across the United States for the NSF Innovation Corps interviews. The color intensity represents the number of participants per state, with darker shades indicating a higher number of participants.

To perform sentiment analysis, the GPT-3.5 Turbo model was fine-tuned by providing a representative subset of the interview statements, manually labeled with sentiment categories (positive, neutral, negative) as the ground truth. Specifically, 60% of the statements were used as training data, with sentiment labels assigned by multiple researchers to ensure reliability and consistency. The remaining 40% were reserved as a test set to evaluate the accuracy of the model. To address potential biases, multiple researchers independently verified the labeled sentiments, and consensus was reached through group discussion to minimize subjective interpretations. This structured process enhanced the reliability and objectivity of the sentiment analysis results.

3. Results

The results from these interactions are broken down into two segments. The first results discussed in this article were acquired from surveys of willing participants at the CONEXPO/CONAGG trade show. The results of this workshop are broken down and interpreted using traditional data visualization. The second section discusses interview notes acquired during an NSF I-Corps workshop. The sentiment of these interview notes was analyzed using a GPT 3.5 Turbo model.

3.1. CONEXPO/CONAGG Survey Results

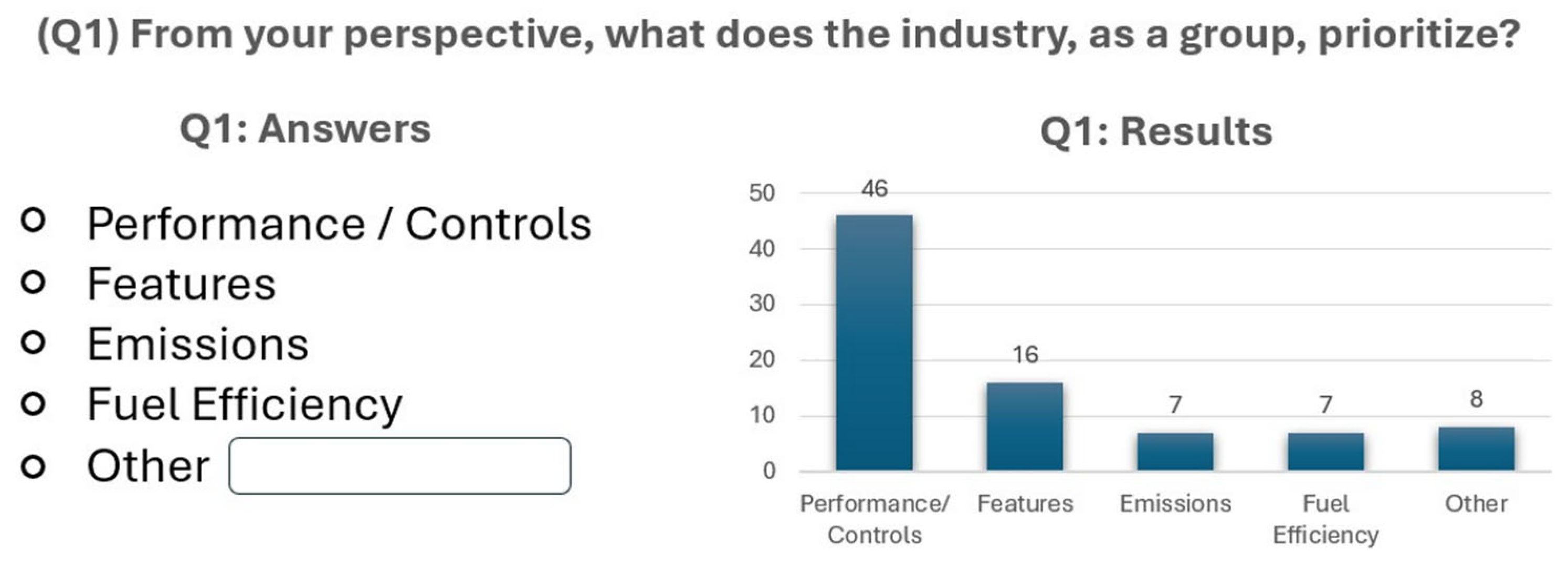

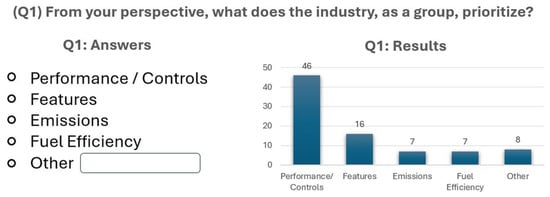

In the spring of 2023, researchers attended the CONEXPO/CONAGG trade show to better understand the current state of the market and how industry members felt about green technologies. These results are broken down into bar charts and pie graphs used to learn more about the common trends in the industry. The first question participants were asked was used to identify the main priorities of the industry. This question was used to help determine the main interests of the industry to help identify what drives the market and what consumers are most impressed by. Participants were provided with four multiple-choice answers for convenience, with the option of writing their own answers if needed. The results (Figure 5) showed that a large portion of the market was concerned with performance and controls over all other options. The survey found that features, fuel efficiency, and emissions were less favorable parameters.

Figure 5.

Industry prioritization of performance criteria among heavy equipment professionals surveyed at the 2023 CONEXPO/CONAGG trade show.

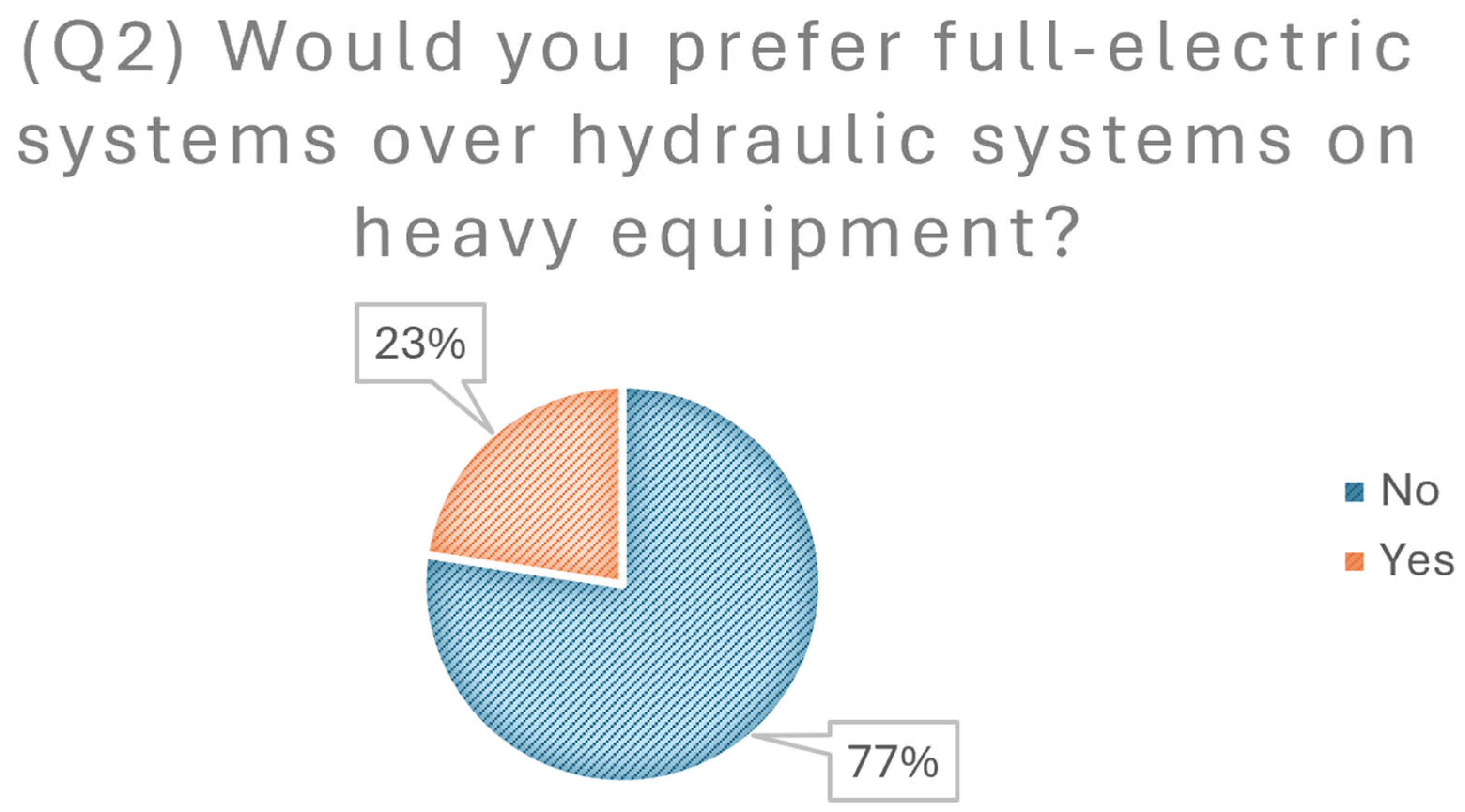

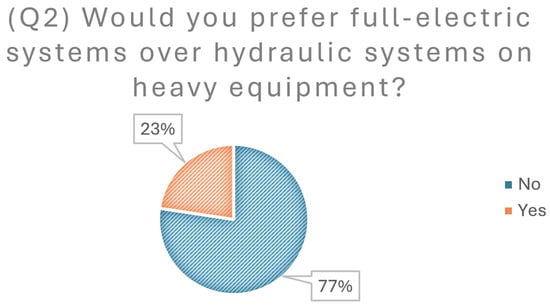

The next question asked of participants relates to their feelings towards fully electrified systems. Given the trends of electrification in the transportation sector, international regulations, and bans being imposed on small internal combustion engines, there is expected to be a shift towards electrification in the future. However, unless the future legislature restricts the sale of internal combustion engines for heavy equipment, the electrified market will be influenced by customer demand. The survey results, shown in Figure 6, found that participants currently do not prefer electrified systems over hydraulic systems.

Figure 6.

Preferences for fully electric versus hydraulic systems among industry representatives surveyed at the 2023 CONEXPO/CONAGG trade show.

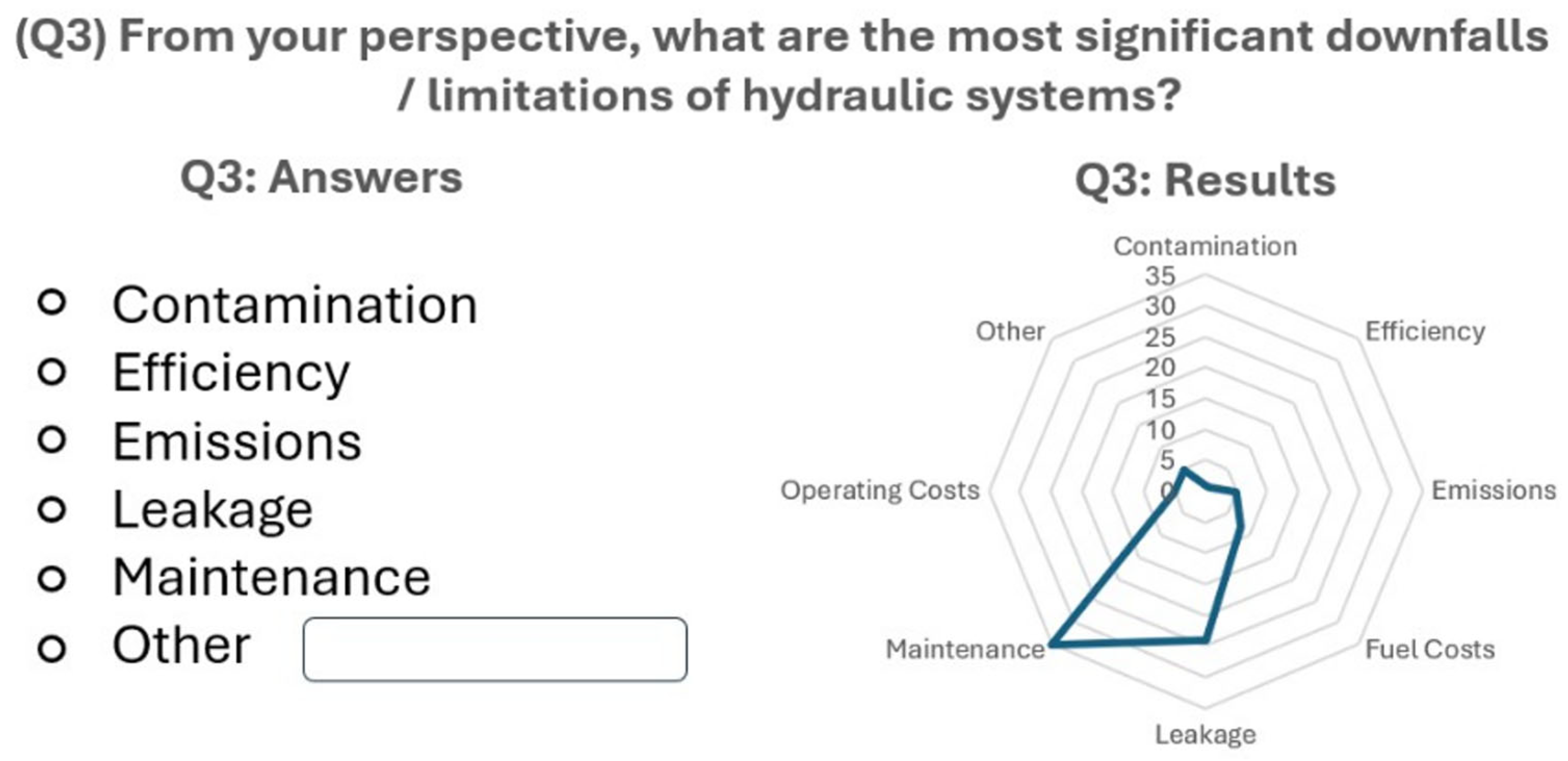

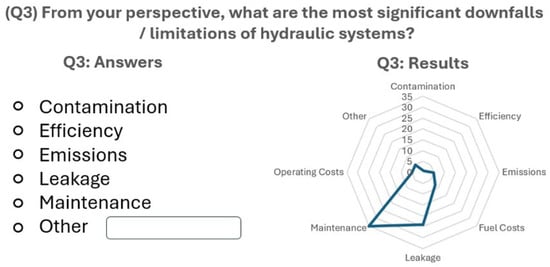

Two questions were asked to identify the downfalls and limitations of hydraulic and electrified systems from the industry’s perspective, highlighting the major challenges each system faces moving forward. Participants indicated that the most significant downfall of current hydraulic systems was maintenance, closely followed by leakage concerns (Figure 7). Although leakage is a well-known limitation inherent to fluid power applications, several participants suggested adopting environmentally friendly fluids as a potential solution to mitigate environmental impacts, reflecting growing industry interest in addressing these inherent system limitations.

Figure 7.

Identified limitations of hydraulic systems according to industry professionals surveyed at the 2023 CONEXPO/CONAGG trade show.

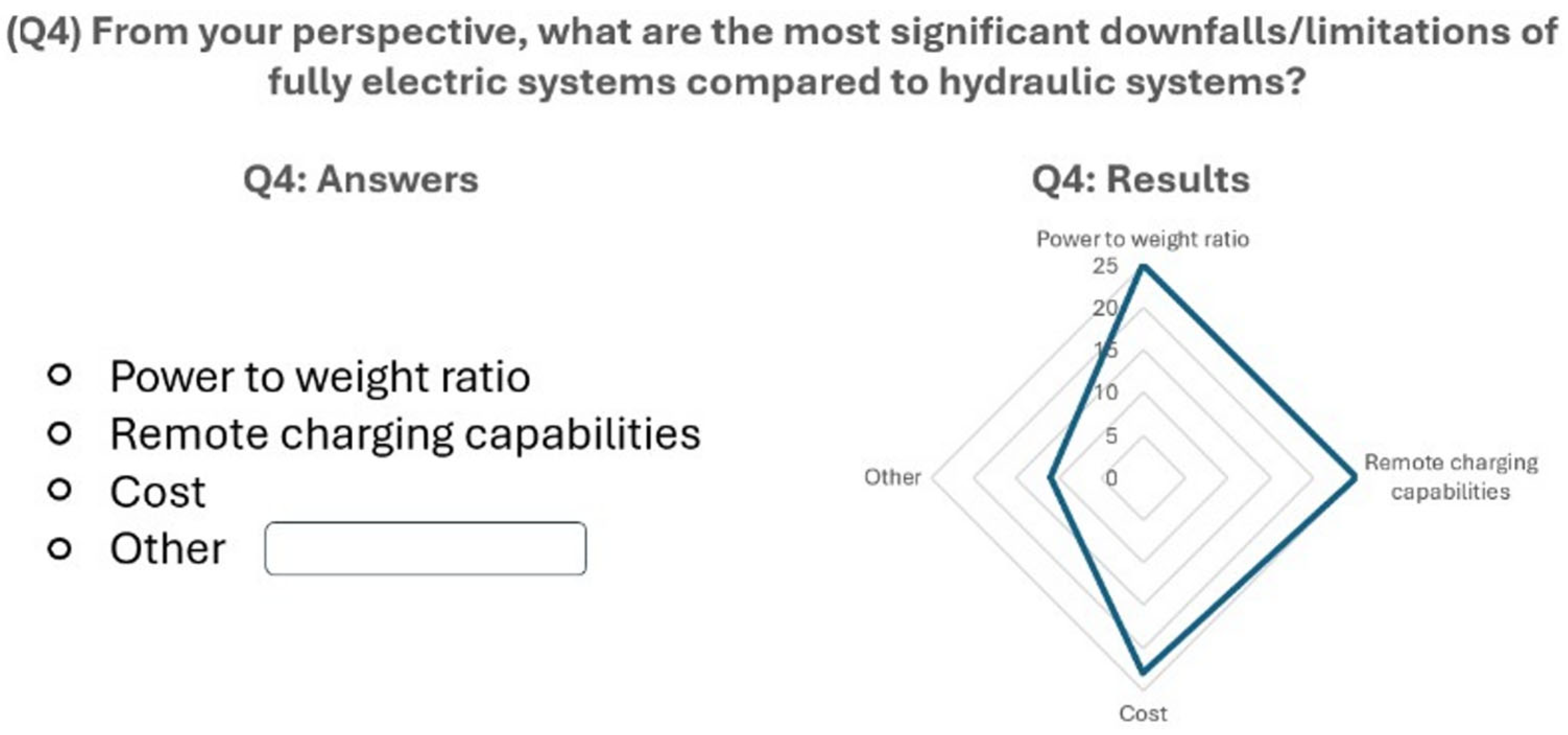

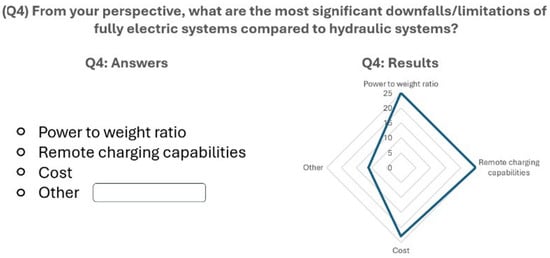

The study found that power-to-weight ratios, remote charging capabilities, and initial costs were fairly evenly distributed challenges concerning electrification (Figure 8). While power-to-weight ratios and costs are major challenges faced today, it is assumed that more advanced battery technologies, regeneration, and more efficient technologies would go hand in hand in helping bring down the cost of these systems.

Figure 8.

Key limitations of fully electric systems identified by participants at the 2023 CONEXPO/CONAGG trade show.

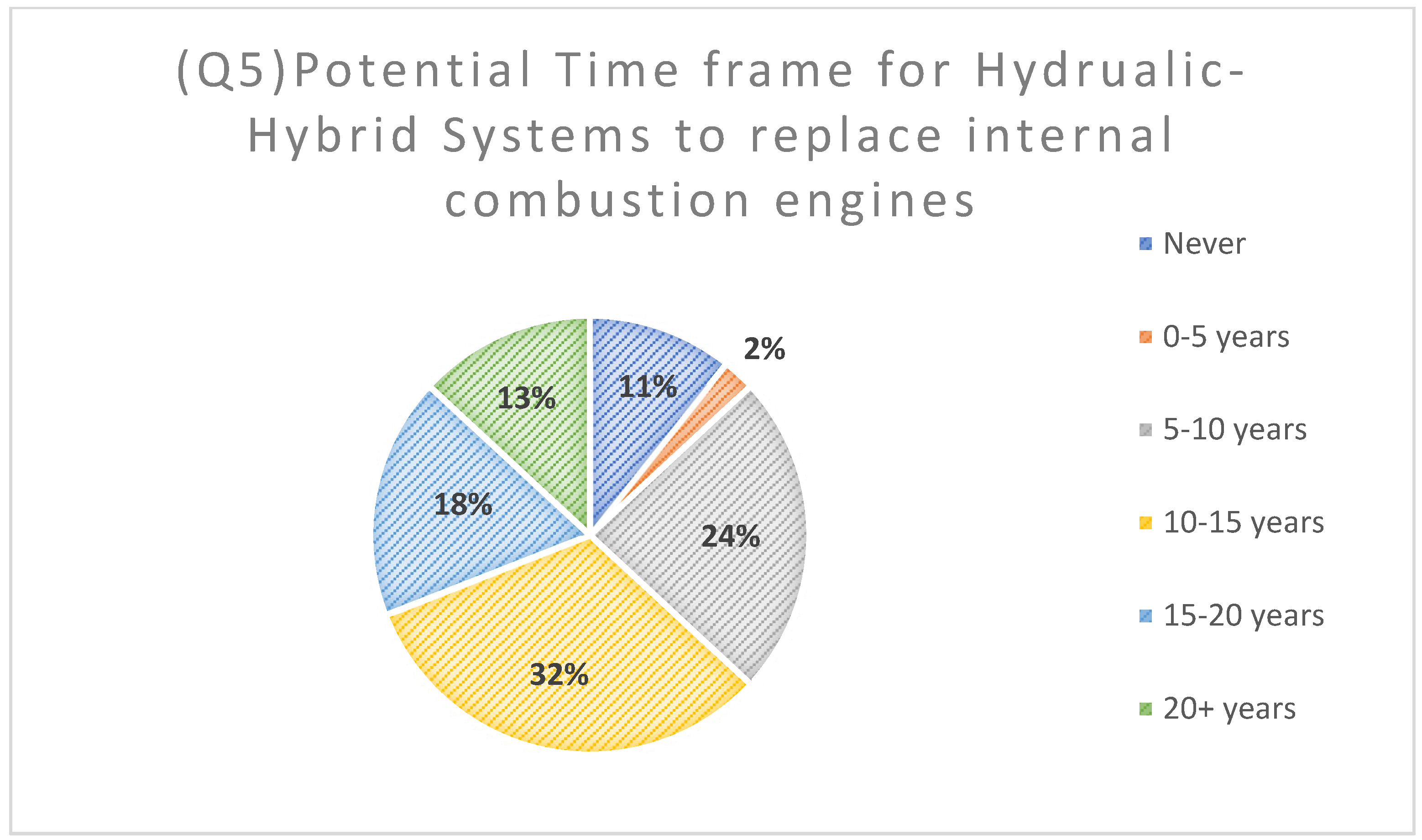

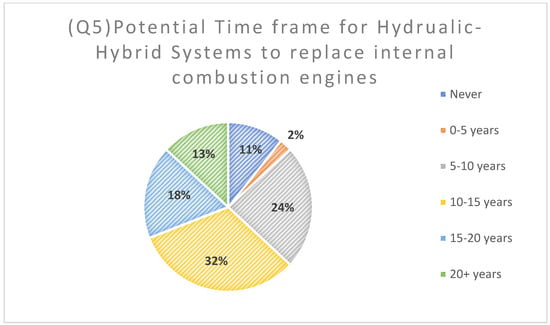

Figure 9 shows that participants believe the time frame for the transition to electric-hydraulic hybrid systems from internal combustion engines could take some time. The highest percentage of participants (32%) believed there would be a shift from conventional internal combustion engines/hydraulic systems to electric motors/hydraulic systems in the next 10–15 years for heavy equipment machines 75 hp and greater. The next largest group of participants believed there could be a shift in the next 5–10 years. However, 13% of participants believed a shift would not occur for the next 20+ years. Only 2% of participants agreed that the transition could be achieved in 0–5 years.

Figure 9.

Anticipated timeframe for transitioning from conventional to electric-hydraulic hybrid systems for heavy equipment (>75 hp).

It is important to note that participants’ estimated timeframe of 10–15 years for widespread hybrid adoption should be considered within the context of existing regulatory trajectories, such as California’s Advanced Clean Cars II regulations and proposed Tier 5 standards. Given these stringent regulations, there could be potential misalignments between industry expectations and regulatory timelines, potentially indicating risks of industry under-preparation or slower-than-required technological transition. Further alignment between industry readiness and regulatory frameworks may thus be critical to ensuring timely and effective adoption of electrification technologies.

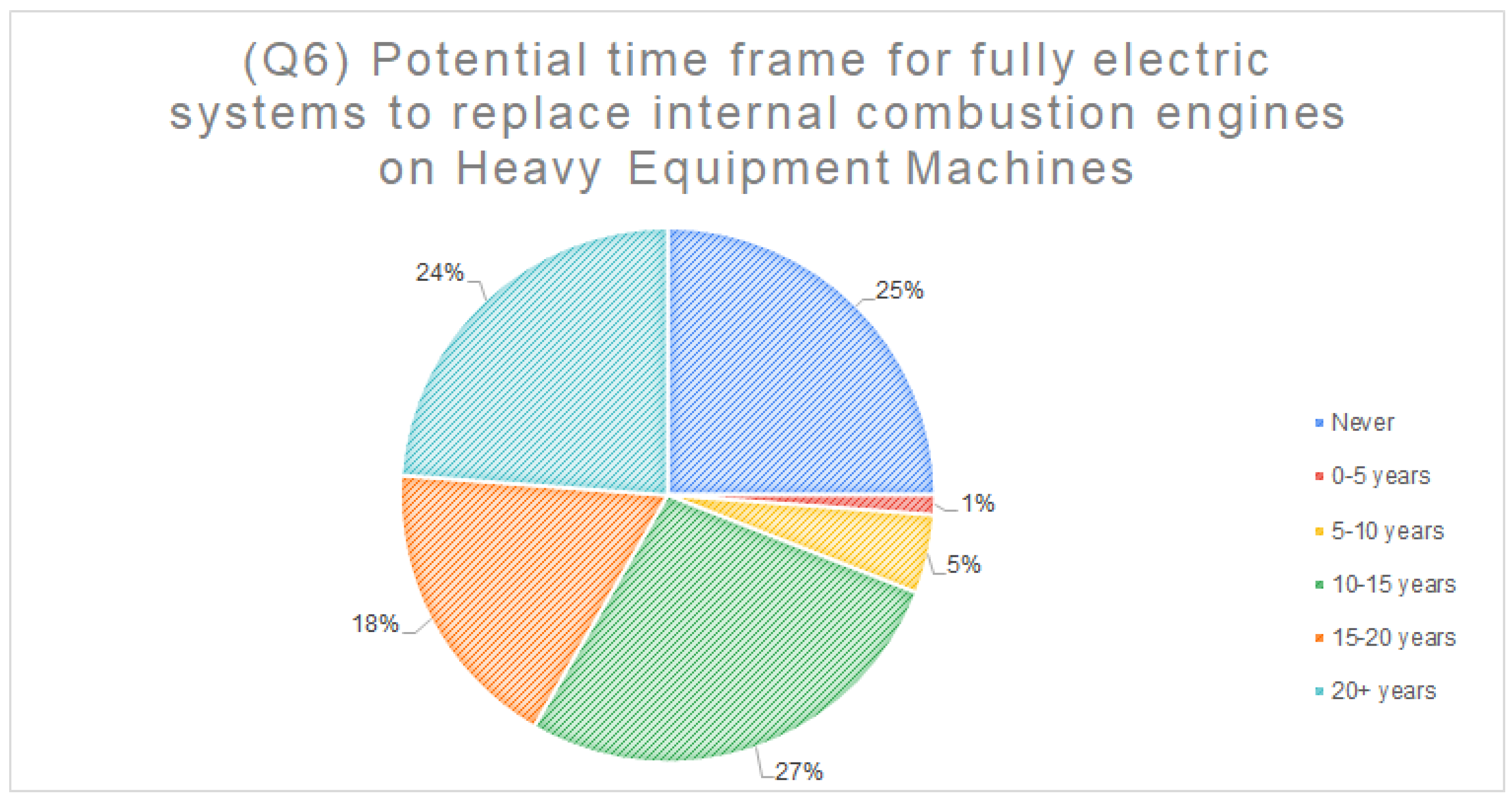

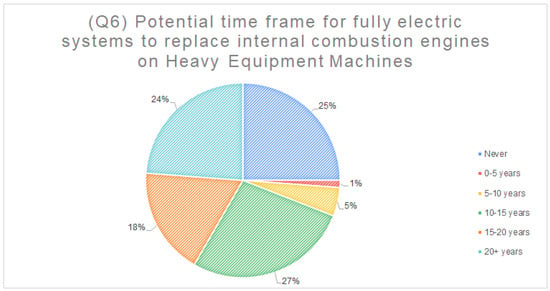

To learn more about the timeline for the transition to fully electric systems for large equipment, participants were asked when they believed a fully electric system would replace all hydraulics on large mobile hydraulic equipment (Figure 10). The data shows that few participants believed this transition could happen in the next 0–10 years. However, a large majority of participants believed we could see a transition in the next 10–15 years.

Figure 10.

Expected timeline for transitioning to fully electric systems on heavy equipment (>75 hp).

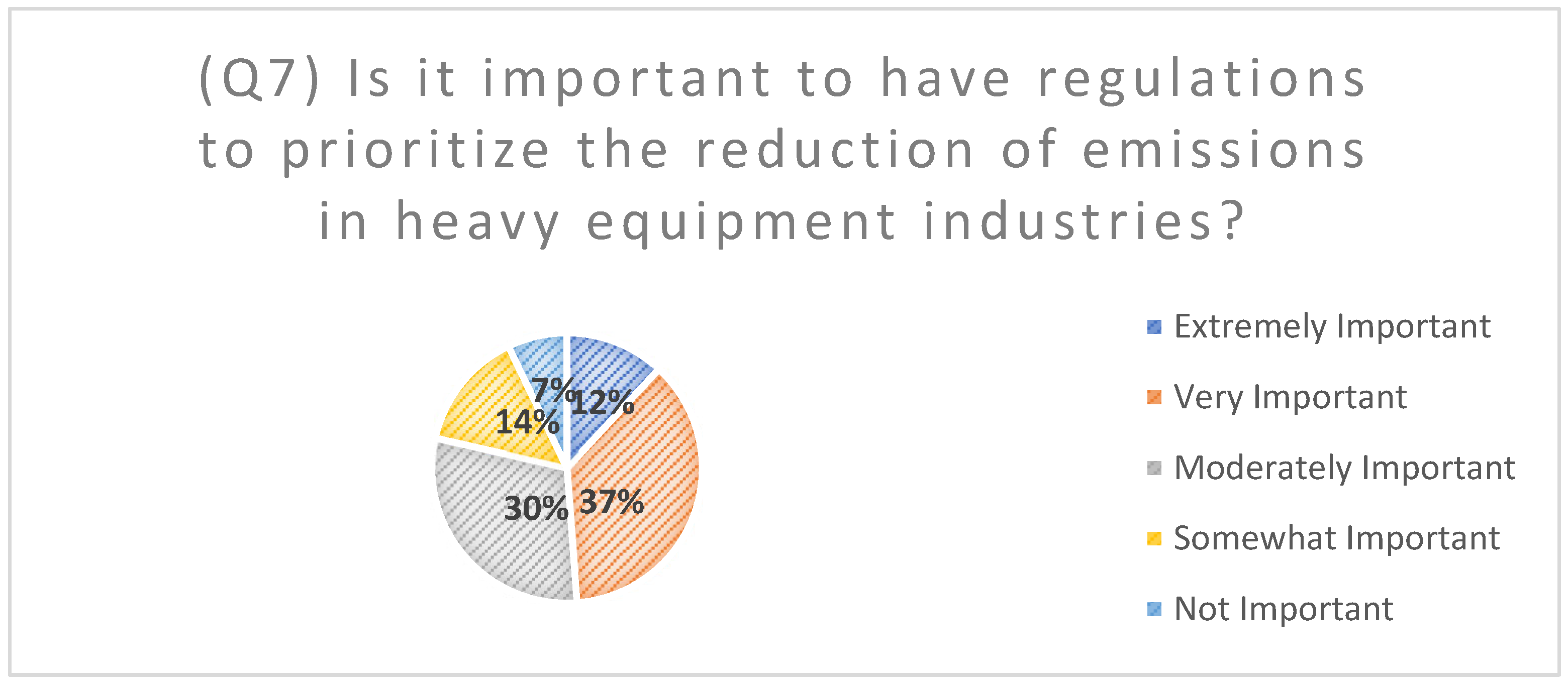

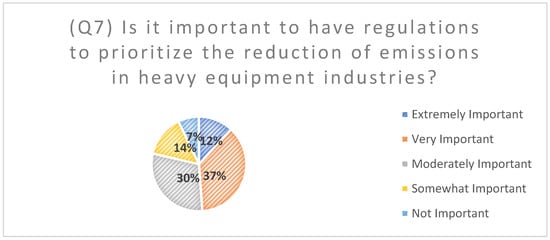

The next question asked to participants related to regulations to prioritize the reduction of emissions. This question was asked to help understand how industry representatives feel about regulations and how they would potentially react to future regulations that could require hybrid or electric machines. Participants were provided five options equated on a Likert scale: Not Important (1), Somewhat Important (2), Moderately Important (3), Very Important (4), and Extremely Important (5). When asked whether it was important to prioritize the reduction of emissions in the heavy equipment industry, the results showed that 93% of participants believed that regulations were at least somewhat important (Figure 11). While only 12% of participants agreed that emission regulations were extremely important, 37% believed they were very important. A total of 30% of participants chose that regulations are moderately important, while 14% of participants believed that these regulations are somewhat important. Only 7% of participants chose that prioritizing reducing emission standards was unimportant.

Figure 11.

Industry perspectives on the importance of emission regulations.

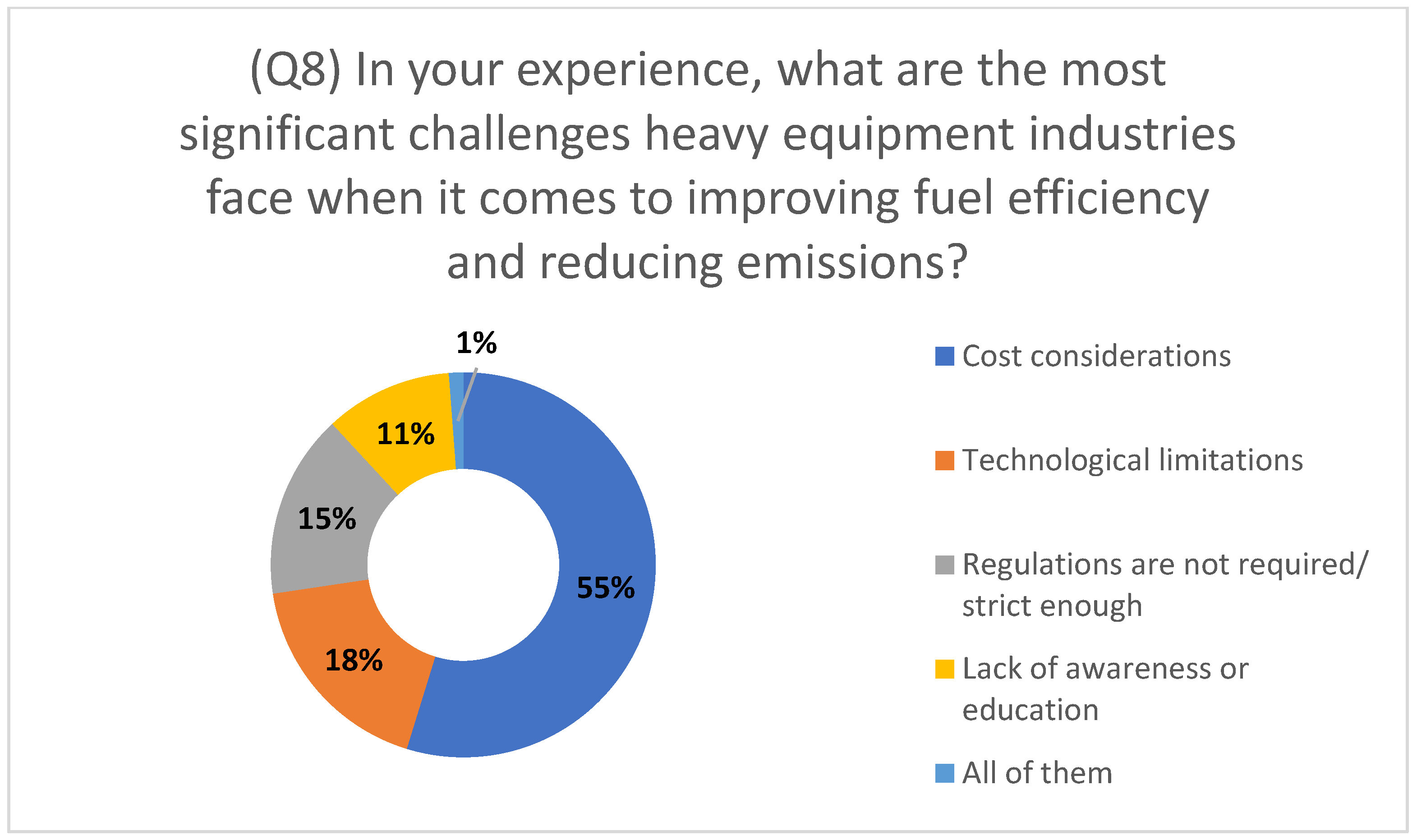

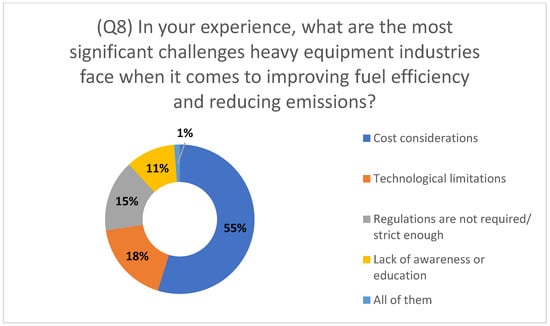

Improving fuel efficiency and reducing emissions on current equipment can be challenging when regulations do not set the standard. To better understand the challenges of improving modern equipment features, participants were asked about the major challenges in reaching these goals. The results (Figure 12) showed that 55% of participants referenced technological limitations as one of the major challenges. Investing in modern equipment can be expensive, and there are generally few retrofitting options for updating older equipment’s powertrains to more efficient ones. A total of 18% of participants believed that technological limitations were the most significant challenge, while 15% of participants believed it was related to the regulations not being strict enough. Finally, 11% of participants believed that the lack of awareness or education regarding fuel efficiency and emissions was the most significant challenge.

Figure 12.

Major challenges identified by industry representatives are related to improving fuel efficiency and reducing emissions from heavy equipment.

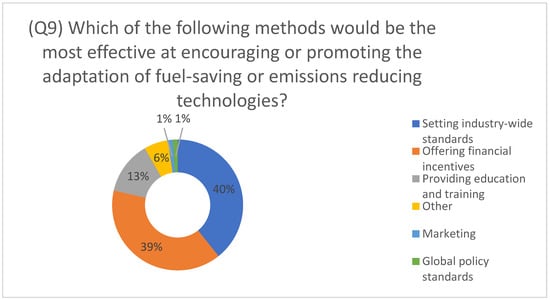

The final question asked of participants was to learn more about effective ways more efficient technologies could be promoted to help encourage manufacturers and end users to buy fuel-saving and emission-reducing technologies. The results, shown in Figure 13, show that the top two options selected were setting industry-wide standards (40%) and offering financial incentives (39%). Providing education and training on fuel efficiency and emission-reducing equipment was less favorable, but 13% of participants selected it, which shows some significance. Finally8% of the participants selected other, marketing, and global policy standards.

Figure 13.

Most effective strategies for promoting the adoption of fuel-saving and emission-reducing technologies.

3.2. NSF Innovation Corps Results

In the spring of 2023, researchers participated in an NSF Innovation Corps workshop to evaluate the commercial viability of a new technology for the heavy equipment industry. Contacts from the workshop were acquired via unsolicited calls to rental companies and dealerships, various fluid power conferences, the con-expo workshop, and personal connections in the industry.

During the workshop, 100 interviews were conducted with heavy equipment and fluid power representatives. During these interviews, representatives were asked various questions that helped them understand the needs of the industry. While the questions each week changed relative to the learnings of the workshop, one main question was utilized as an icebreaker question for each interview: what are the major challenges for future fluid power products (excavators/wheel loaders/lifts)? Notes from this conversation were recorded during the interview. While transcripts would more accurately result and potentially provide more insight, it was assumed that interviewees would be less likely to participate in the interviews or be less forthcoming with their true feelings if they felt they could be quoted. Thus, the interviewers did their best to capture the essence of the conversation and emotion in their notes by capturing keywords and phrases that were used in the conversation that expressed emotion or intensity.

To begin preprocessing the data, each interview note was split into separate full sentences and sentence fragments using Excel. Each sentence was first categorized to distinguish whether the sentences referenced diverse areas of the industry; for example, sentences may reference challenges regarding the market, supply chain, technology, etc. A thematic analysis was then manually conducted on the interview notes to determine major themes in the data. For sentences with multiple themes, various themes were created.

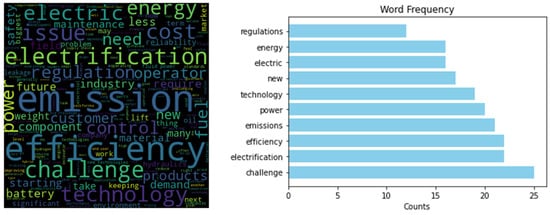

Sentences that did not directly reference the category were classified based on the previous sentences in the interview. Sentiment analysis was conducted on each sentence/statement in the interview notes using a generative pre-trained transformer. A GPT 3.5 Turbo model was fine-tuned to help determine the sentiment of each statement and potential bias in the analysis. This model also provides a platform for future interviews to remove bias from the interviews. The model was tuned to 60% of the data and tested on 40%. The results showed that the model performed well, with an accuracy of approximately 78% in the ground truth values. Word clouds were generated for responses to the major themes: electrification, efficiency, emissions, and regulations. Figure 14 presents a word cloud summarizing commonly cited challenges in the fluid power industry, offering an intuitive visualization of the most frequently discussed concerns among industry representatives. This visualization method effectively highlights the relative prominence and recurrence of specific industry issues such as electrification, cost, and technological reliability, aligning closely with our objective to qualitatively understand and communicate industry perspectives.

Figure 14.

Commonly cited challenges in the fluid power industry based on thematic analysis of NSF I-Corps interview data.

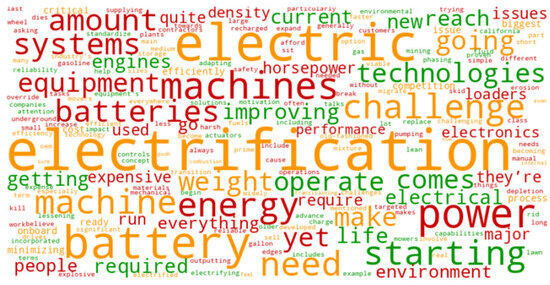

Electrification was one of the most frequently mentioned topics during the interviews within the heavy equipment industry. While electrification was expressed as a major challenge, the overall sentiment regarding electrification was mostly neutral. Positive sentiments focused on aspects such as energy efficiency, advancements in battery technology, and new innovations like automation. This neutral-to-positive sentiment was somewhat contrary to interviewer observations, who noted significant industry concerns about current battery technologies and their limitations in meeting demanding field requirements. Nonetheless, a deeper analysis suggests that industry professionals remain cautiously optimistic about future advancements. Participants expressed neutral views regarding broader industry challenges, such as market competition and technological readiness. Negative sentiments specifically addressed concerns over technology capabilities, notably performance, horsepower limitations, and increased equipment weight (Figure 15). Additional negative feedback related to high costs, the reliability of electronic components, and environmental impacts. Although precise future costs remain uncertain, industry professionals generally anticipate increased capital costs due to expensive large-scale batteries and electric motors compared to relatively inexpensive internal combustion engines. Many end users also raised concerns about electronic reliability in harsh operational conditions and the high expenses associated with maintenance and diagnostics.

Figure 15.

Word cloud of sentiments regarding electrification in the heavy equipment industry, highlighting positive, neutral, and negative aspects identified by participants in NSF I-Corps interviews.

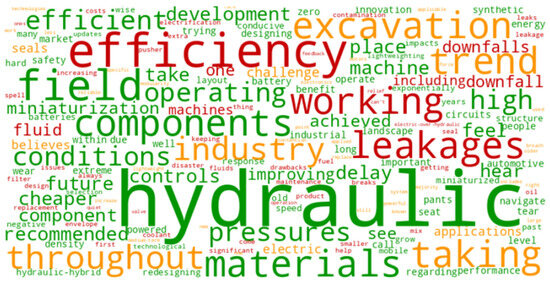

Participants were also partial to hydraulic systems, showing an overall more positive sentiment towards their use of heavy equipment machines. Figure 16 visualizes positive sentiments towards traditional hydraulic systems, demonstrating the industry’s comfort level and familiarity with existing hydraulic technology. Such visualization enhances the interpretability of qualitative data by highlighting the dominant and recurring positive sentiments. This indicates that, while participants accept electrical systems, they still feel more comfortable with hydraulic systems despite some of their downfalls. They also seem to have fewer negative emotions towards hydraulic components than electrical components in terms of cost. The less favorable parts of hydraulic systems include the common downfalls inherent to most fluid power systems, including low efficiencies and leakages.

Figure 16.

Positive attributes and perceived benefits of hydraulic systems, according to NSF I-Corps interviewees.

Regulations, emissions, and efficiency are other themes that were strongly present in the data. Since these topics are closely related, they were grouped in the word plot shown in Figure 17. The analysis shows that participants were more negative towards emissions overall. This is believed to be because the industry is challenged by users who do not prefer emission-reducing technologies on their equipment due to the reliability and costs of the technology. However, participants generally supported reducing emissions to help the environment. This word cloud also indicated a strong neutral sentiment on regulations. While many participants were positive about what regulations help achieve, regulations can make business more challenging and sales more difficult when it requires emission-reducing equipment that is less desirable by customers. Lastly, the sentiment towards efficiency was also strongly neutral. This suggests that while some participants were happy about the current efficiency of their machines, others were equally unhappy about their machines.

Figure 17.

Sentiment analysis results from NSF I-Corps interviews reflect industry views on regulations, emissions, and efficiency.

4. Discussion

Two studies were conducted to comprehensively analyze the current state and needs of the heavy equipment industry concerning electrification trends and challenges. The first study employed surveys collected at the CONEXPO/CONAGG trade show to gauge industry perceptions. The second study involved a detailed sentiment analysis of interview notes from a National Science Foundation Innovation Corps workshop.

The results from the first study revealed several notable industry trends. Regarding industry priorities, participants predominantly preferred performance and control over features, emissions, and fuel efficiency. The data showed a strong preference (77%) for traditional hydraulic systems over fully electric systems, highlighting a significant comfort level with existing technologies. However, major drawbacks identified for hydraulic systems included maintenance requirements and fluid leakage concerns, underscoring ongoing environmental and operational issues. Conversely, fully electric systems were criticized evenly for issues such as unfavorable power-to-weight ratios, high initial costs, and challenges related to remote charging infrastructure. Participants generally agreed on a cautious and gradual shift toward electric-hydraulic hybrid solutions, anticipating that this transition would primarily occur within the next 10–15 years. A similar but even more conservative timeline was indicated for the adoption of fully electric systems. Concerning emissions, the majority (93%) acknowledged their importance, with 37% rating emissions regulations as very important and 12% as extremely important. The principal challenge identified for improving fuel efficiency and reducing emissions was technological limitations, followed by the high costs associated with adopting modern, efficient equipment, limited retrofitting options for existing equipment, and insufficient regulatory enforcement. When asked about promoting the adoption of fuel-saving and emission-reducing technologies, setting industry-wide standards and providing financial incentives emerged as the most effective strategies, selected by 40% and 39% of respondents, respectively. Educational initiatives were deemed less impactful, yet still relevant at 19%.

Insights from the second study reinforced industry uncertainty regarding the electrification of heavy equipment, reflecting cautious optimism tempered by significant concerns. Major challenges cited frequently included power limitations, horsepower availability, vehicle weight considerations, substantial upfront costs, and the reliability of electronic components under harsh operational conditions. Despite these challenges, there was a positive sentiment regarding electrification’s potential efficiency improvements. Overall, however, there was greater confidence and positive sentiment towards traditional hydraulic systems, suggesting that while the industry acknowledges the long-term potential of electrification, the familiarity and established reliability of hydraulic technologies remain strongly preferred at present.

The findings underscore the industry’s immediate priority, which should be enhancing hydraulic system efficiencies and reducing environmental impacts, such as leakages, through innovative fluid technologies and improved hydraulic architectures. Progress in these areas will likely facilitate greater acceptance of hybrid solutions as stepping stones toward fully electric systems, ultimately driving the industry toward more sustainable practices. Future research could explore targeted technological advancements to overcome current electrification barriers and evaluate the long-term economic impacts of transitioning to electric and hybrid systems.

The findings presented suggest several potential underlying factors influencing industry perspectives and preferences identified in our surveys. The strong preference for hydraulic systems over fully electric solutions likely stems from familiarity, perceived reliability, and existing infrastructure tailored toward traditional systems. Concerns over cost, power-to-weight ratios, and electronic reliability could reflect current technological limitations and uncertainties about battery performance and charging infrastructure, particularly under demanding operational conditions typical of heavy equipment usage. Industry caution regarding electrification could be influenced by limited regulatory pressure for immediate transition in larger (>25 hp) heavy equipment sectors, contrasting sharply with smaller equipment and automotive segments where regulations are stricter. Recognizing these influencing factors provides essential context for interpreting survey responses and highlights critical areas, such as technological innovation, infrastructure investment, and regulatory alignment, for facilitating future industry transition toward electrification.

5. Conclusions

This study provided valuable insights into industry perspectives on electrifying heavy equipment, highlighting key trends, challenges, and opportunities. Despite recognizing significant challenges such as power-to-weight ratios, costs, reliability of electronic components, and infrastructure limitations, industry professionals expressed cautious optimism toward electrification, particularly hybrid systems. Traditional hydraulic technologies currently remain favored due to their familiarity, reliability, and lower perceived risk. Industry-wide standards and financial incentives emerged as crucial factors for driving the adoption of greener technologies. Moving forward, targeted advancements in battery technologies, hybrid architectures, and environmentally friendly hydraulic solutions will be essential to facilitate the industry’s transition toward sustainable electrification.

Author Contributions

Conceptualization, K.P., F.E.B. and J.L.; methodology, K.P., F.E.B., T.S. and J.L.; software, K.P. and T.S.; validation, K.P.; formal analysis, K.P. and T.S.; investigation, K.P., F.E.B., T.S. and J.L.; resources, F.E.B. and J.L.; data curation, K.P., F.E.B. and J.L.; writing—original draft preparation, K.P.; writing—review and editing, K.P., F.E.B., T.S. and J.L.; supervision, F.E.B., T.S. and J.L.; project administration, F.E.B.; funding acquisition, F.E.B. and J.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Science Foundation, grant number 2322261.

Data Availability Statement

Data can be available upon request from the corresponding authors.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- The Millennium Project. 15 Global Challenges. 2024. Available online: https://www.millennium-project.org/15-global-challenges (accessed on 1 May 2025).

- U.S. Environmental Protection Agency. Sources of Greenhouse Gas Emissions. Available online: https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions (accessed on 21 April 2025).

- Dong, H.; Fujita, T.; Geng, Y.; Dong, L.; Ohnishi, S.; Sun, L.; Dou, Y.; Fujii, M. A review on eco-city evaluation methods and highlights for integration. Ecol. Indic. 2015, 60, 1184–1191. [Google Scholar] [CrossRef]

- NRDC. Electric Vehicle Basics. Available online: https://www.nrdc.org/bio/madhur-boloor/electric-vehicle-basics (accessed on 1 May 2025).

- Rentar. Efficient Engines: Thermodynamics and Combustion Efficiency. Available online: https://rentar.com/efficient-engines-thermodynamics-combustion-efficiency (accessed on 1 May 2025).

- Williams, J.H.; Jones, R.A.; Haley, B.; Kwok, G.; Hargreaves, J.; Farbes, J.; Torn, M.S. Carbon-neutral pathways for the United States. AGU Adv. 2021, 2, e2020AV000284. [Google Scholar] [CrossRef]

- Tanaka, Y.; Sakama, S.; Nakano, K.; Kosodo, H. Comparative study on dynamic characteristics of hydraulic, pneumatic and electric motors. Fluid Power Syst. Technol. 2014. [Google Scholar] [CrossRef]

- Liu, Z.; Hao, H.; Cheng, X.; Zhao, F. Critical issues of energy efficient and new energy vehicles development in China. Energy Policy 2018, 115, 92–97. [Google Scholar] [CrossRef]

- U.S. Environmental Protection Agency. Evolution of the Clean Air Act. 21 November 2023. Available online: https://www.epa.gov/clean-air-act-overview/evolution-clean-air-act (accessed on 5 June 2024).

- Albatayneh, A.; Assaf, M.N.; Alterman, D.; Jaradat, M. Comparison of the overall energy efficiency for internal combustion engine vehicles and electric vehicles. Rigas Teh. Univ. Zinat. Raksti 2020, 24, 669–680. [Google Scholar] [CrossRef]

- Love, L.J.; Lanke, E.; Alles, P. Estimating the Impact (Energy, Emissions and Economics) of the US Fluid Power Industry; Oak Ridge National Laboratory: Oak Ridge, TN, USA, 2012. [Google Scholar] [CrossRef]

- Pate, K.; Marschand, J.R.; El Breidi, F.; Salem, T.; Lumkes, J. Design and Sensitivity Analysis of Mechanically Actuated Digital Radial Piston Pumps. Process 2024, 12, 504. [Google Scholar] [CrossRef]

- Pate, K.; Azzam, I.; El Breidi, F.; Marschand, J.R.; Lumkes, J.H. Digitalization of Radial Piston Pumps through Internal Mechanically Actuated Designs. Actuators 2023, 12, 425. [Google Scholar] [CrossRef]

- Azzam, I.; Hwang, J.; El Breidi, F.; Lumkes, J.; Salem, T. Automated method for selecting optimal digital pump operating strategy. Expert Syst. Appl. 2023, 227, 120509. [Google Scholar] [CrossRef]

- Azzam, I.; Pate, K.; Garcia-Bravo, J.; El Breidi, F. Energy Savings in Hydraulic Hybrid Transmissions through Digital Hydraulics Technology. Energies 2022, 15, 1348. [Google Scholar] [CrossRef]

- Hradecký, J.M.; Bubák, A.; Dub, M. Evaluation Methodology of Rotary Flow Dividers Used as Pressure Intensifiers with Creation of a New Pressure Multiplying Efficiency. Energies 2022, 15, 2293. [Google Scholar] [CrossRef]

- Muzzioli, G.; Montorsi, L.; Polito, A.; Lucchi, A.; Sassi, A.; Milani, M. About the Influence of Eco-Friendly Fluids on the Performance of an External Gear Pump. Energies 2021, 14, 799. [Google Scholar] [CrossRef]

- Toro. EPA Tier 4. Available online: https://www.toro.com/en/customer-support/tier-4/what-is-tier-4 (accessed on 5 June 2024).

- U.S. Environmental Protection Agency. Regulations for Emissions from Heavy Equipment with Spark-Ignition Engines. Available online: https://www.epa.gov/regulations-emissions-vehicles-and-engines/regulations-emissions-heavy-equipment-spark-ignition (accessed on 5 June 2024).

- U.S. Environmental Protection Agency. Regulations for Emissions from Heavy Equipment with Compression-Ignition (Diesel) Engines. Available online: https://www.epa.gov/regulations-emissions-vehicles-and-engines/regulations-emissions-heavy-equipment-compression (accessed on 5 June 2024).

- DieselNet: Engines & Clean Transportation. Available online: https://dieselnet.com (accessed on 5 June 2024).

- California Air Resource Board, CARB Approves Updated Regulations Requiring Most New Small Off-Road Engines Be Zero Emission by 2024. Available online: https://ww2.arb.ca.gov/news/carb-approves-updated-regulations-requiring-most-new-small-road-engines-be-zero-emission-2024 (accessed on 8 June 2024).

- Dow, J. California’s 2035 Gas Ban Finalized—Why It’s Huge, Even If We Want Sooner. Electrek. 25 August 2022. Available online: https://electrek.co/2022/08/25/ca-finalizes-2035-gas-car-ban-a-huge-deal-but-why-not-sooner (accessed on 12 June 2024).

- Lajunen, A.; Sainio, P.; Laurila, L.; Pippuri-Mäkeläinen, J.; Tammi, K. Overview of Powertrain Electrification and Future Scenarios for Non-Road Mobile Machinery. Energies 2018, 11, 1184. [Google Scholar] [CrossRef]

- Beltrami, D.; Iora, P.; Tribioli, L.; Uberti, S. Electrification of compact off-highway vehicles—Overview of the current state of the art and trends. Energies 2021, 14, 5565. [Google Scholar] [CrossRef]

- Un-Noor, F.; Wu, G.; Perugu, H.; Collier, S.; Yoon, S.; Barth, M.; Boriboonsomsin, K. Off-road construction and agricultural equipment electrification: Review, challenges, and opportunities. Vehicles 2022, 4, 780–807. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).