Governance, Energy Policy, and Sustainable Development: Renewable Energy Infrastructure Transition in Developing MENA Countries

Abstract

1. Introduction

2. Literature Review

2.1. Economic Growth (EG) and GDP Trends

2.1.1. EG—Morocco

2.1.2. EG—Egypt

2.1.3. EG—Oman

2.2. Carbon Emissions (CE) and Decarbonization Efforts

2.2.1. CE—Morocco

- Noor Ouarzazate Solar Complex—one of the largest solar plants globally.

- Expansion of wind energy capacity, particularly in Tangier and Tarfaya.

2.2.2. CE—Egypt

- Over 20 sustainability projects in the petroleum sector to reduce emissions.

- Commitment to the Global Methane Pledge to cut methane emissions.

- Green hydrogen and wind energy development to transition away from fossil fuels.

2.2.3. CE—Oman

2.3. Renewable Energy Investments

2.4. Economic Growth vs. Carbon Emissions

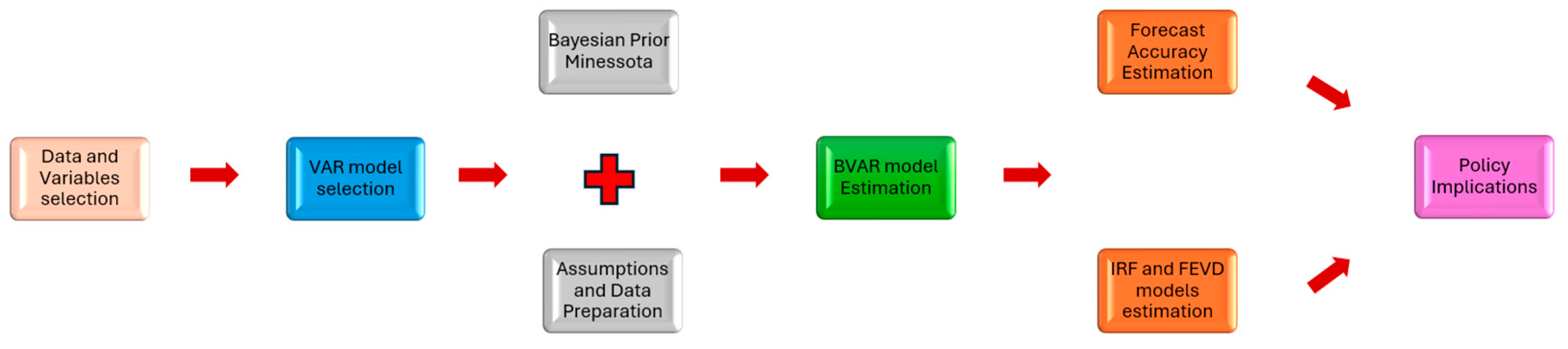

3. Methodology

4. Results and Discussion (RD)

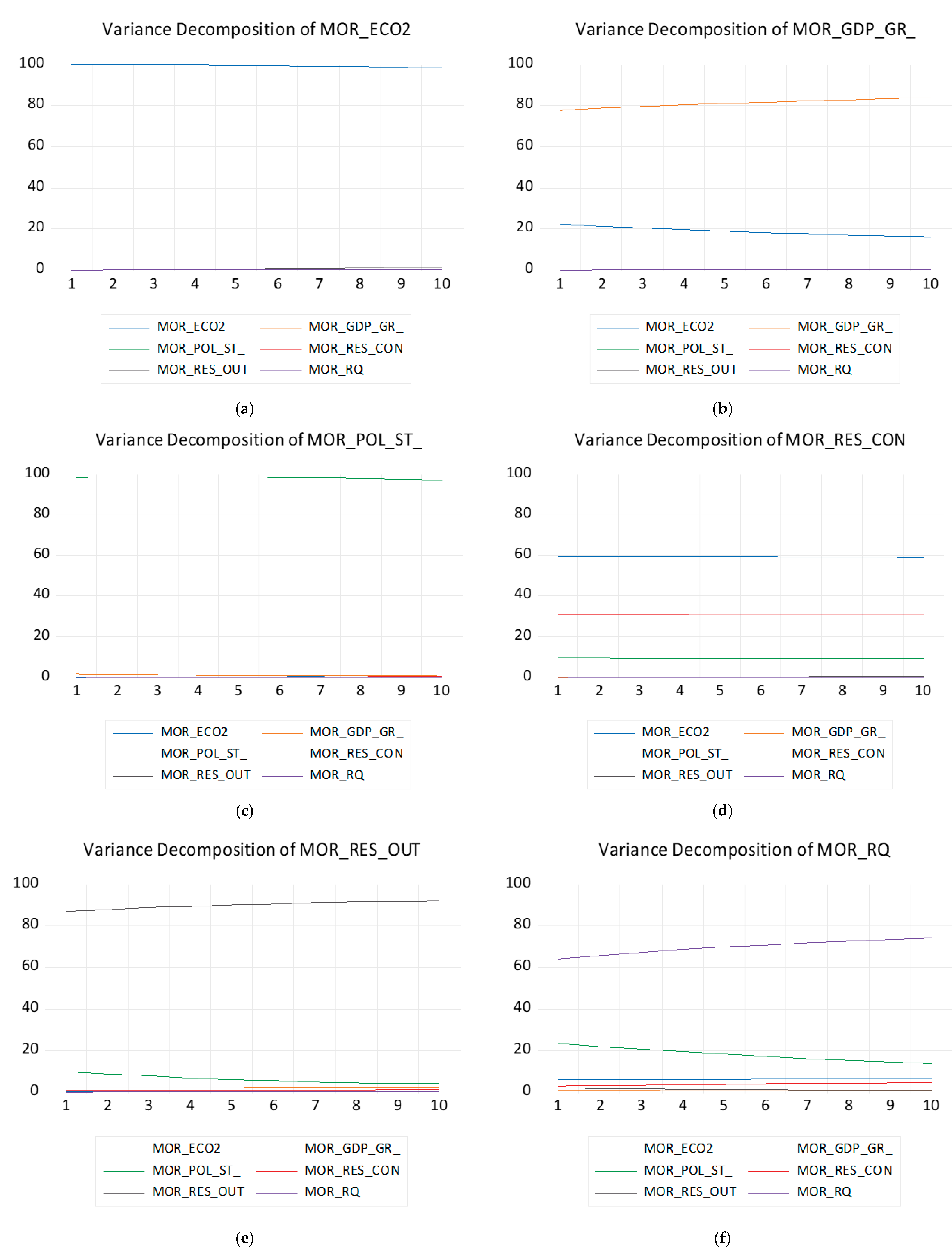

4.1. RD—Morocco

Policy Implications for Morocco

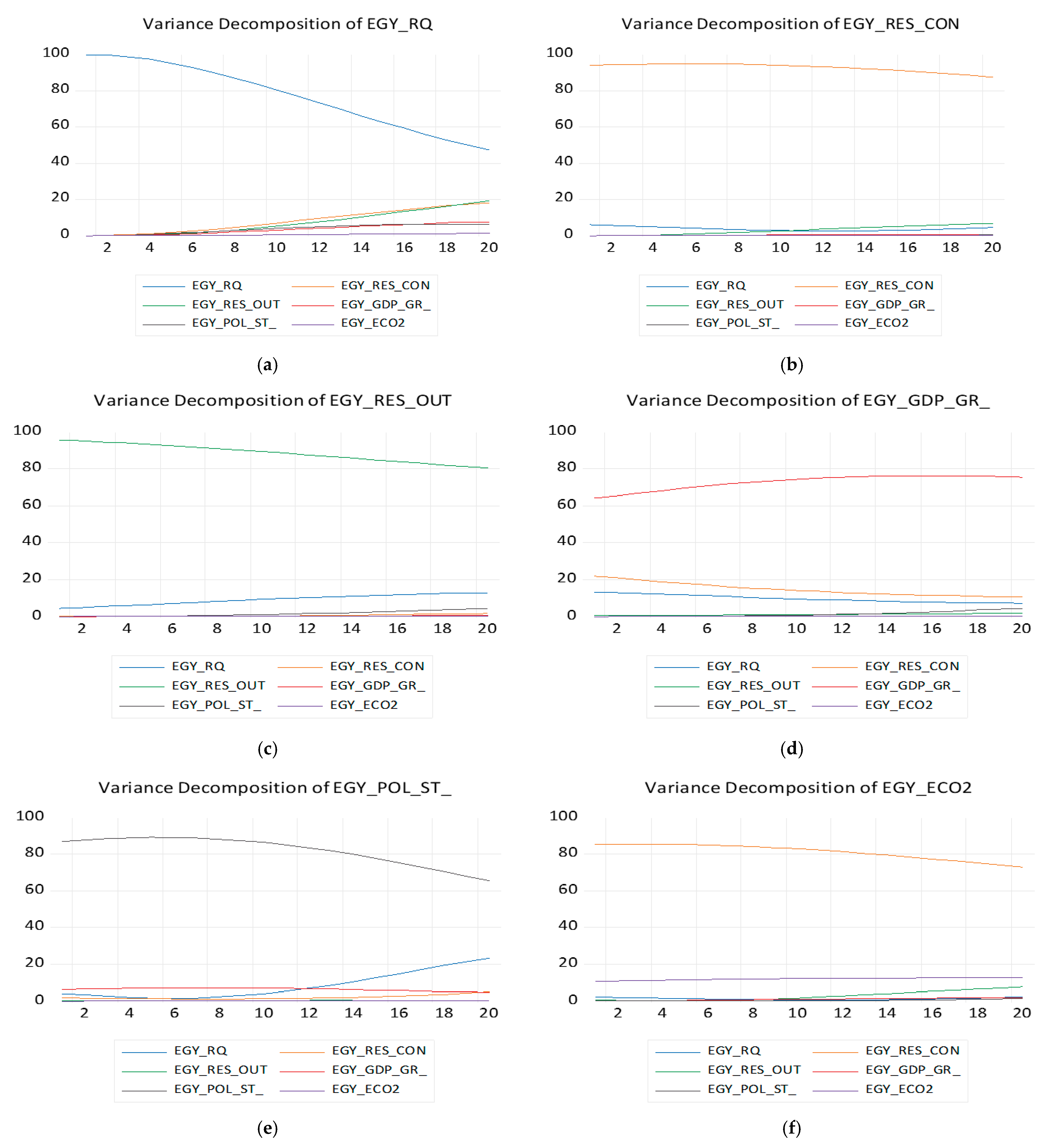

4.2. RD—Egypt

Policy Implications for Egypt

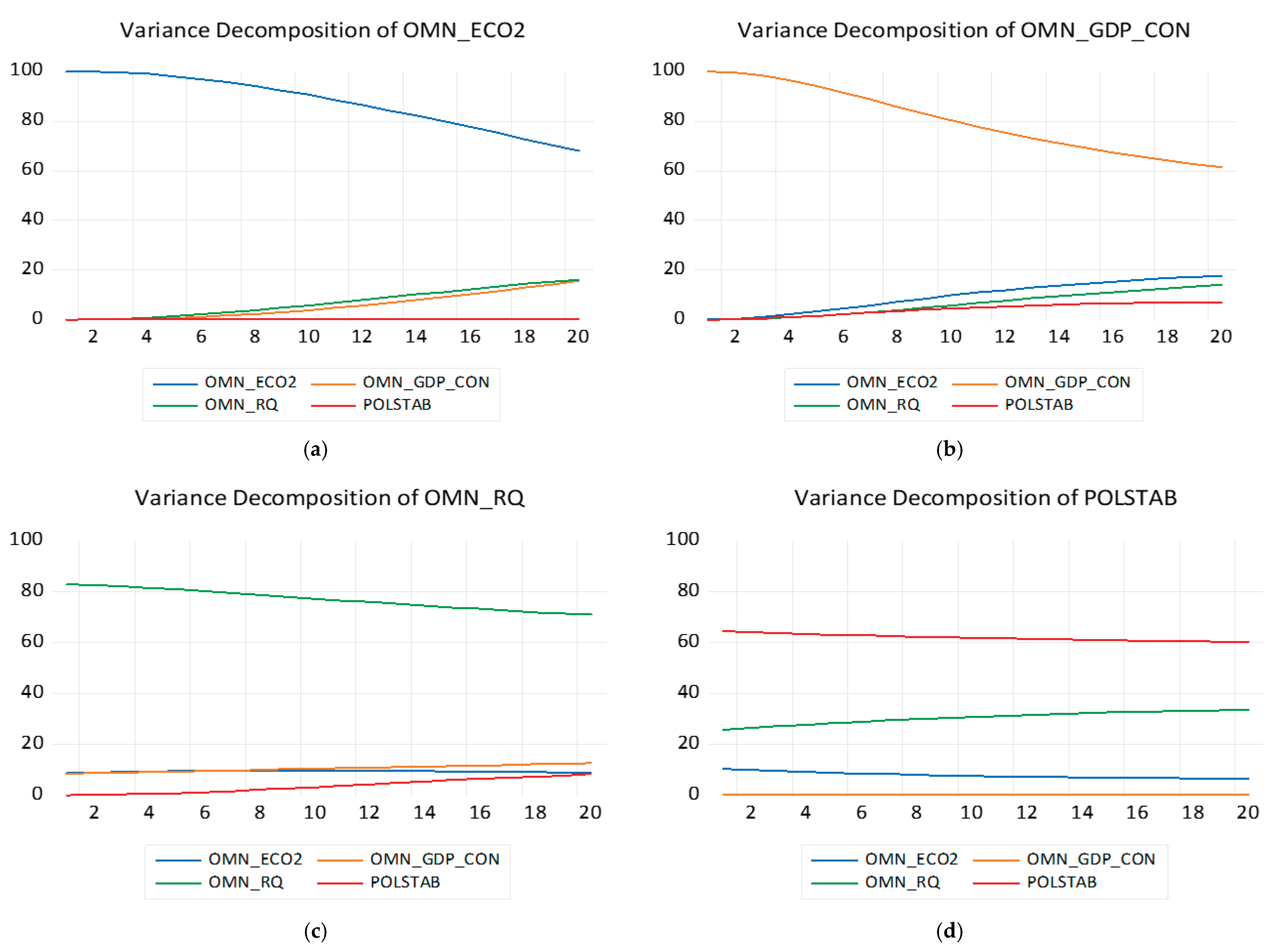

4.3. RD—Oman

Policy Implications for Oman

- Decoupling Economic Growth from Carbon Emissions: Implementing carbon pricing, promoting clean energy investments, and supporting low-carbon industries to reduce emissions without compromising economic growth.

- Strengthening Regulatory Frameworks: Enhancing institutional capacity, improving transparency, and enforcing environmental standards to create a more predictable and investor-friendly business environment.

- Leveraging Political Stability for Structural Reforms: Using Oman’s stable political context to drive long-term sustainability policies, including green infrastructure, climate resilience planning, and social welfare programs.

- Encouraging Private Sector Innovation: Providing financial incentives and regulatory support for clean technology startups and green businesses to diversify the economy and reduce oil dependency.

- Integrating Long-Term Sustainability Goals: Aligning national development strategies with global climate targets to ensure that short-term economic gains do not undermine long-term environmental and social stability.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Data Sources | Notes |

|---|---|---|

| CO2 Emissions (kg per PPP $ of GDP) | World Bank—World Development Indicators (WDI) [106] Global Carbon Atlas [107] Our World in Data [108] IEA (International Energy Agency)—Free datasets [109] | World Bank provides CO2 emissions by PPP GDP, while IEA has energy-related CO2 emissions. |

| Renewable Energy Consumption (% of Total Final Energy Consumption) | World Bank—WDI [106] IRENA (International Renewable Energy Agency) [110] IEA—Renewables Database [61] BP Statistical Review of World Energy [111] | World Bank and IRENA provide national-level data, while BP and IEA offer global/regional reports. |

| Renewable Electricity Output (% of Total Electricity Output) | World Bank—WDI [106] IRENA [110] IEA Electricity Statistics [112] US EIA (Energy Information Administration) [113] | IRENA and IEA provide country-level and sectoral breakdowns. |

| Regulatory Quality (World Bank Estimate) | World Bank—Worldwide Governance Indicators (WGI) [114] | Covers governance effectiveness, regulatory quality, and rule of law indicators. |

| Political Stability and Absence of Violence/Terrorism (World Bank Estimate) | World Bank—WGI [114] Global Peace Index (Institute for Economics and Peace) [115] Political Risk Map (Marsh McLennan) [116] | World Bank offers quantitative indicators, while Global Peace Index provides rankings and risk analysis. |

| GDP Growth (Annual %) | World Bank—WDI [114] IMF World Economic Outlook (WEO) [117] OECD Economic Outlook [118] UN Data [119] | IMF and OECD provide short-term and long-term GDP forecasts. |

References

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement. NBER Working Paper 1991, No. 3914. Available online: https://www.nber.org/papers/w3914 (accessed on 21 May 2025).

- Wang, Q.; Li, Y.; Li, R. Rethinking the Environmental Kuznets Curve Hypothesis across 214 Countries: The Impacts of 12 Economic, Institutional, Technological, Resource, and Social Factors. Humanit. Soc. Sci. Commun. 2024, 11, 292. [Google Scholar] [CrossRef]

- World Economic Forum. Prioritizing Sustainability in MENA: Mapping Critical Environmental Issues for Regional Businesses; White Paper; WEF: Geneva, Switzerland, 2024; Available online: https://www.weforum.org/publications/prioritizing-sustainability-in-mena-mapping-critical-environmental-issues-for-regional-businesses (accessed on 21 May 2025).

- United Nations Framework Convention on Climate Change (UNFCCC). Paris Agreement; UNFCCC: Paris, France, 2015; Available online: https://unfccc.int/sites/default/files/english_paris_agreement.pdf (accessed on 21 May 2025).

- United Nations Framework Convention on Climate Change (UNFCCC). Summary of COP29: Key Targets, Outcomes, and Results; UNFCCC: Baku, Azerbaijan, 2024; Available online: https://unfccc.int/cop29 (accessed on 21 May 2025).

- World Bank. Climate Action: A Catalyst for Egypt’s Prosperity and Sustainable Growth; World Bank: Washington, DC, USA, 2024; Available online: https://www.worldbank.org/en/news/feature/2024/11/25/climate-action-a-catalyst-for-egypt-s-prosperity-and-sustainable-growth (accessed on 21 May 2025).

- DNV. Energy Transition Outlook 2024; DNV: Høvik, Norway, 2024; Available online: https://www.dnv.com/energy-transition-outlook/ (accessed on 21 May 2025).

- International Energy Agency. World Energy Outlook 2024; IEA: Paris, France, 2024; Available online: https://www.iea.org/reports/world-energy-outlook-2024 (accessed on 21 May 2025).

- International Energy Agency. Renewables 2023; IEA: Paris, France, 2023; Available online: https://www.iea.org/reports/renewables-2023 (accessed on 21 May 2025).

- International Renewable Energy Agency; League of Arab States; Regional Center for Renewable Energy and Energy Efficiency. Pan-Arab Renewable Energy Strategy 2030: Roadmap of Actions for Implementation; IRENA: Abu Dhabi, United Arab Emirates, 2014; Available online: https://www.irena.org/publications/2014/Jun/Pan-Arab-Renewable-Energy-Strategy-2030-Roadmap-of-Actions-for-Implementation (accessed on 21 May 2025).

- Organisation for Economic Co-operation and Development. OECD Economic Surveys: Morocco 2024; OECD Publishing: Paris, France, 2024; Available online: https://www.oecd.org/en/publications/2024/09/oecd-economic-surveys-morocco-2024_d4786047.html (accessed on 21 May 2025).

- Mbarek, M.B. Energy Consumption, CO2 Emissions, and Economic Growth in Developed, Emerging, and Middle East and North Africa Countries. Energy 2019, 179, 232–245. [Google Scholar] [CrossRef]

- International Energy Agency. World Energy Outlook 2023; IEA: Paris, France, 2023; Available online: https://www.iea.org/reports/world-energy-outlook-2023 (accessed on 21 May 2025).

- Ntanos, S.; Skordoulis, M.; Kyriakopoulos, G.L.; Arabatzis, G.; Chalikias, M. Renewable Energy and Economic Growth: Evidence from European Countries. Sustainability 2018, 10, 2626. [Google Scholar] [CrossRef]

- Gorus, M.S.; Aydin, M. The Relationship Between Energy Consumption, Economic Growth, and CO2 Emission in MENA Countries: Causality Analysis in the Frequency Domain. Energy 2019, 168, 815–822. [Google Scholar] [CrossRef]

- Al-Ayouty, I. Economic Complexity and Renewable Energy Effects on Carbon Dioxide Emissions: A Panel Data Analysis of Middle East and North Africa Countries. J. Knowl. Econ. 2024, 15, 12006–12025. [Google Scholar] [CrossRef]

- Shehabi, M. Just Energy Transitions? Lessons From Oman and Morocco. Carnegie Endowment for International Peace, 30 May 2024. Available online: https://carnegieendowment.org/research/2024/05/morocco-oman-energy-transition-oil-exporting-renewable?lang=en (accessed on 21 May 2025).

- Moudene, K.; El-Oud, R.; Ejbari, R.; Amedjar, A. Renewable Energy and Economic Growth in Morocco. J. Hum. Resour. Sustain. Stud. 2023, 11, 401–413. [Google Scholar] [CrossRef]

- Erkut, B. Renewable Energy and Carbon Emissions: New Empirical Evidence from the Union for the Mediterranean. Sustainability 2022, 14, 6921. [Google Scholar] [CrossRef]

- International Energy Agency. World Energy Investment 2021; IEA: Paris, France, 2021; Available online: https://www.iea.org/reports/world-energy-investment-2021 (accessed on 21 May 2025).

- International Energy Agency. Renewable Energy Market Update—June 2023; IEA: Paris, France, 2023; Available online: https://www.iea.org/reports/renewable-energy-market-update-june-2023 (accessed on 21 May 2025).

- Omar, N.; Klose, J. The Response of CO2 Emissions to Macroeconomic Shocks: A Panel VAR Analysis. MAGKS Papers on Economics 2024, No. 05-2024. Available online: https://www.uni-marburg.de/en/fb02/research-groups/economics/macroeconomics/research/magks-joint-discussion-papers-in-economics/papers/2024/05-2024_klose.pdf (accessed on 21 May 2025).

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Dinda, S. Environmental Kuznets Curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- Stern, D.I. The rise and fall of the environmental Kuznets curve. World Dev. 2004, 32, 1419–1439. [Google Scholar] [CrossRef]

- Leal, M.C.; Marques, A.C. Renewable energy, economic growth and CO2 emissions: The role of policy. Renew. Energy 2022, 182, 119–128. [Google Scholar]

- Saini, A.; Singhania, M. Asymmetric link between renewable energy consumption and CO2 emissions across quantiles: Evidence from India. Resour. Policy 2019, 61, 592–603. [Google Scholar]

- Chang, T.; Gupta, R.; Inglesi-Lotz, R.; Simo-Kengne, B.D. Persistence of carbon emissions in the G7 countries: Evidence from a panel stationarity test with structural breaks. Energy Econ. 2017, 66, 198–207. [Google Scholar]

- Liobikienė, G. Renewable energy and CO2 emissions: The role of governance and country-specific factors. Renew. Sustain. Energy Rev. 2020, 121, 109689. [Google Scholar]

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Saidi, K.; Hammami, S. The impact of energy consumption and CO2 emissions on economic growth: Fresh evidence from dynamic simultaneous-equations models. Sustain. Cities Soc. 2015, 14, 178–186. [Google Scholar] [CrossRef]

- Isa, A.; Yilanci, V.; Ozturk, I. Economic growth and energy consumption nexus: Evidence from OECD countries. Energy Rep. 2015, 1, 96–102. [Google Scholar]

- Apergis, N.; Payne, J.E. Renewable energy consumption and economic growth: Evidence from a panel of OECD countries. Energy Policy 2010, 38, 656–660. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Saboori, B.; Ozturk, I. Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 2015, 76, 123–131. [Google Scholar] [CrossRef]

- Ben Jebli, M.; Ben Youssef, S.; Apergis, N. The dynamic linkage between renewable energy, output, carbon emissions and trade: Evidence from a panel of 20 developed and developing countries. Renew. Energy 2016, 83, 166–175. [Google Scholar]

- Acheampong, A.O.; Amponsah, M.; Boateng, E. Does renewable energy consumption contribute to environmental sustainability? Renew. Sustain. Energy Rev. 2019, 112, 853–868. [Google Scholar]

- Wang, Q.; Su, M.; Li, R. Toward a low-carbon economy: The role of technological innovation and renewable energy in reducing CO2 emissions. Energy Econ. 2020, 91, 104901. [Google Scholar]

- Popp, D. Induced innovation and energy prices. Am. Econ. Rev. 2002, 92, 160–180. [Google Scholar] [CrossRef]

- Baños, R.; Manzano-Agugliaro, F.; Montoya, F.G.; Gil, C.; Alcayde, A.; Gómez, J. Optimization methods applied to renewable and sustainable energy: A review. Renew. Sustain. Energy Rev. 2011, 15, 1753–1766. [Google Scholar] [CrossRef]

- Borunda, M.; Hernández, A.; Sánchez, J.A. Decision-making for renewable energy systems using Bayesian networks. Renew. Sustain. Energy Rev. 2016, 60, 940–951. [Google Scholar]

- Gallagher, K.S.; Grübler, A.; Kuhl, L.; Nemet, G.; Wilson, C. The energy technology innovation system. Annu. Rev. Environ. Resour. 2012, 37, 137–162. [Google Scholar] [CrossRef]

- Ge, J.; Xu, X.; Pang, J. Evaluating renewable energy policy: A review and future directions. Renew. Sustain. Energy Rev. 2019, 113, 109248. [Google Scholar]

- Genus, A.; Iskandarova, M. Enabling and constraining factors in the development of renewable energy in Russia: A contextual and comparative view. Energy Policy 2020, 140, 111404. [Google Scholar]

- Ozge, O.; Akbas, Y.E.; Gedik, R. Financial support schemes for renewable energy development: A comparative review. Renew. Sustain. Energy Rev. 2020, 119, 109589. [Google Scholar]

- Wang, Y.; Qin, Y.; Luo, X. Pricing policy and investment decision-making in renewable energy markets. Renew. Energy 2016, 94, 365–372. [Google Scholar]

- Cheng, C.C.J.; Yi, H. The impact of green product innovation on firm performance: The mediating role of green process innovation. J. Bus. Ethics 2017, 140, 531–543. [Google Scholar]

- Reza, A.; Esmaeilian, G.; Behdad, S.; Cai, W. Congestion management of power systems with high penetration of renewable energy. Renew. Sustain. Energy Rev. 2017, 70, 316–326. [Google Scholar]

- Liu, H.; Wang, L.; He, Y. Evaluating the policy effectiveness of China’s renewable energy development. Energy Policy 2018, 113, 356–366. [Google Scholar]

- Tsoutsos, T.; Stamboulis, Y. The sustainable diffusion of renewable energy technologies as an innovation system. Renew. Sustain. Energy Rev. 2005, 9, 625–638. [Google Scholar]

- Negro, S.O.; Alkemade, F.; Hekkert, M.P. Why does renewable energy diffuse so slowly? A review of innovation system problems. Renew. Sustain. Energy Rev. 2012, 16, 3836–3846. [Google Scholar] [CrossRef]

- Wüstenhagen, R.; Wolsink, M.; Bürer, M.J. Social acceptance of renewable energy innovation: An introduction to the concept. Energy Policy 2007, 35, 2683–2691. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation? Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Dagoumas, A.S.; Koltsaklis, N.E. Review of Models for Integrating Renewable Energy in the Generation Expansion Planning. Appl. Energy 2019, 242, 1573–1587. [Google Scholar] [CrossRef]

- Fontes, J.; Freires, F.G.M. A sustainable supply chain framework for the wind energy sector. Renew. Sustain. Energy Rev. 2018, 82, 333–344. [Google Scholar]

- Arouri, M.E.H.; Youssef, A.B.; M’henni, H.; Rault, C. Energy Consumption, Economic Growth, and CO2 Emissions in Middle East and North African Countries. Energy Policy 2012, 45, 342–349. [Google Scholar] [CrossRef]

- Cardarelli, R.; Koranchelian, T. (Eds.) Morocco’s Quest for Stronger and Inclusive Growth; International Monetary Fund: Washington, DC, USA, 2023; Available online: https://www.imf.org/en/Publications/Books/Issues/2023/09/22/Moroccos-Quest-for-Stronger-and-Inclusive-Growth-525734 (accessed on 21 May 2025).

- Omri, A. CO2 Emissions, Energy Consumption, and Economic Growth Nexus in MENA Countries: Evidence from Simultaneous Equations Models. Energy Econ. 2013, 40, 657–664. [Google Scholar] [CrossRef]

- International Monetary Fund. Morocco: Request for an Arrangement Under the Resilience and Sustainability Facility—Press Release; Staff Report; Supplement; Staff Statement; and Statement by the Executive Director for Morocco; IMF Country Report No. 2023/354; International Monetary Fund: Washington, DC, USA, 2023; Available online: https://www.imf.org/en/Publications/CR/Issues/2023/10/26/Morocco-Request-for-an-Arrangement-Under-the-Resilience-and-Sustainability-Facility-Press-540896 (accessed on 21 May 2025).

- Organisation for Economic Co-operation and Development. OECD Green Growth Policy Review of Egypt 2024; OECD Environmental Performance Reviews; OECD Publishing: Paris, France, 2024. [Google Scholar] [CrossRef]

- Maku, O.A.; Ikpuri, P.O. A Multivariate Analysis between Renewable Energy, Carbon Emission, and Economic Growth: New Evidences from Selected Middle East and North Africa Countries. Int. J. Energy Econ. Policy 2020, 10, 440–450. [Google Scholar] [CrossRef]

- International Energy Agency. Renewables 2024; IEA: Paris, France, 2024; Available online: https://www.iea.org/reports/renewables-2024 (accessed on 21 May 2025).

- Zhang, W.; Wang, Y.; Zeeshan, M.; Han, F.; Song, K. Super-twisting sliding mode control of grid-side inverters for wind power generation systems with parameter perturbation. Int. J. Electr. Power Energy Syst. 2025, 165, 110501. [Google Scholar] [CrossRef]

- Curtiss, K. Increasing the Energy Efficiency of Photovoltaic Cells by Modifying the Building Envelope. Doctoral Dissertation, Lawrence Technological University, Southfield, MI, USA, 2023. [Google Scholar]

- Zhao, H.; Zhu, B.; Jiang, B. Comprehensive assessment and analysis of cavitation scale effects on energy conversion and stability in pumped hydro energy storage units. Energy Convers. Manag. 2025, 325, 119370. [Google Scholar] [CrossRef]

- Sarantis, N.; Stewart, C. Univariate versus multivariate forecasts of inflation: An application of Bayesian VAR models. J. Forecast. 1995, 14, 109–134. [Google Scholar]

- Karlsson, S. Forecasting with Bayesian Vector Autoregressions. In Handbook of Economic Forecasting; Elsevier: Amsterdam, The Netherlands, 2013; Volume 2, pp. 791–897. [Google Scholar]

- Koop, G. Bayesian Econometrics; John Wiley & Sons: Chichester, UK, 2003. [Google Scholar]

- European Commission. The European Green Deal; European Commission Policy Paper; European Commission: Brussels, Belgium, 2019. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52019DC0640 (accessed on 21 May 2025).

- Bloor, C.; Matheson, T. Real-time conditional forecasts with Bayesian VARs: An application to New Zealand. North Am. J. Econ. Financ. 2011, 22, 26–42. [Google Scholar] [CrossRef]

- Narayan, P.K.; Popp, S. Size and Power Properties of Structural Break Unit Root Tests. Appl. Econ. 2013, 45, 721–728. [Google Scholar] [CrossRef]

- Yan, C.; Zhang, Y.; Li, Y.; Wang, Y. Co-movement between Carbon Emissions and Forex Market: A Tale of COVID-19 Outbreak and Russia-Ukraine Invasion. Energy Econ. 2022, 112, 106–120. [Google Scholar] [CrossRef]

- Tsioptsia, K.-A.; Zafeiriou, E.; Niklis, D.; Sariannidis, N.; Zopounidis, C. The Corporate Economic Performance of Environmentally Eligible Firms Nexus Climate Change: An Empirical Research in a Bayesian VAR Framework. Energies 2022, 15, 7266. [Google Scholar] [CrossRef]

- Banbura, M.; Giannone, D.; Reichlin, L. Large Bayesian vector auto regressions. J. Appl. Econom. 2010, 25, 71–92. [Google Scholar] [CrossRef]

- Litterman, R.B. Forecasting with Bayesian vector autoregressions—Five years of experience. J. Bus. Econ. Stat. 1986, 4, 25–38. [Google Scholar]

- Pesaran, M.H.; Shin, Y. Generalized impulse response analysis in linear multivariate models. Econ. Lett. 1998, 58, 17–29. [Google Scholar] [CrossRef]

- Brahmasrene, T.; Huang, J.; Sissoko, Y. Effect of economic growth on carbon dioxide emissions in China: Empirical evidence from the ARDL approach. Int. J. Econ. Financ. 2014, 6, 140–147. [Google Scholar]

- Ivanov, V.; Kilian, L. A practitioner’s guide to lag order selection for VAR impulse response analysis. Stud. Nonlinear Dyn. Econom. 2005, 9. Available online: https://www.degruyterbrill.com/document/doi/10.2202/1558-3708.1219/html (accessed on 21 May 2025). [CrossRef]

- Jakada, A.H.; Usman, O.; Alola, A.A.; Bekun, F.V. The impact of renewable energy consumption on environmental sustainability in Sub-Saharan Africa. Environ. Res. Public Health 2022, 19, 1–18. [Google Scholar]

- Lanne, M.; Nyberg, H. Generalized forecast error variance decomposition for linear and nonlinear multivariate models. J. Econ. Dyn. Control. 2016, 62, 2–15. [Google Scholar] [CrossRef]

- Kingdom of Morocco. National Energy Strategy; Government of Morocco: Rabat, Morocco, 2009.

- World Bank. Morocco: Noor Solar Power Plant Project; World Bank: Washington, DC, USA, 2025; Available online: https://projects.worldbank.org/en/projects-operations/project-detail/P131256 (accessed on 21 May 2025).

- International Energy Agency. Morocco 2020—Energy Policy Review; IEA: Paris, France, 2020. [Google Scholar]

- United Nations Framework Convention on Climate Change (UNFCCC). Morocco’s First Nationally Determined Contribution under the Paris Agreement; United Nations Framework Convention on Climate Change: Bonn, Germany, 2016. [Google Scholar]

- Kingdom of Morocco. Updated Nationally Determined Contribution (NDC); Government of Morocco: Rabat, Morocco, 2020.

- Ministère de l’Énergie, des Mines et de l’Environnement. National Energy Efficiency Strategy; Government of Morocco: Rabat, Morocco, 2019.

- Organisation for Economic Co-operation and Development. OECD Economic Surveys: Morocco 2021; OECD Publishing: Paris, France, 2021. [Google Scholar]

- World Bank. Morocco Economic Monitor—From Recovery to Acceleration; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Renewable Energy Policy Network for the 21st Century. Renewables 2020 Global Status Report; REN21 Secretariat: Paris, France, 2020. [Google Scholar]

- European Commission. EU–Morocco Relations: Factsheet; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Ministère de l’Énergie, des Mines et de l’Environnement. Stratégie Nationale de Développement Durable—Résumé Exécutif; Government of Morocco: Rabat, Morocco, 2019.

- United Nations Environment Programme. Emissions Gap Report 2020; UNEP: Nairobi, Kenya, 2020. [Google Scholar]

- World Bank Group. Climate Risk Profile: Morocco; World Bank: Washington, DC, USA, 2021. [Google Scholar]

- International Energy Agency. Global Energy Review 2020; IEA: Paris, France, 2020. [Google Scholar]

- El-Katiri, L. Morocco’s Green Energy Opportunity; OCP Policy Center: Rabat, Morocco, 2016. [Google Scholar]

- Saidi, K.; Hammami, S. The Impact of CO2 Emissions and Economic Growth on Energy Consumption in 58 Countries. Energy Rep. 2022, 8, 1048–1058. [Google Scholar] [CrossRef]

- Cherkaoui, M.; Medromi, H.; El Ghazi, M. Modelling and Assessing the Performance of Hybrid PV-CSP Plants for Baseload Power Generation in Morocco. Int. J. Photoenergy 2019, 2019, 5783927. [Google Scholar]

- Omri, A.; Nguyen, D.K. On the Determinants of Renewable Energy Consumption: International Evidence. Energy 2014, 72, 554–560. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Meadowcroft, J. What about the Politics? Sustainable Development, Transition Management, and Long-Term Energy Transitions. Policy Sci. 2009, 42, 323–340. [Google Scholar] [CrossRef]

- Scoones, I.; Leach, M.; Newell, P. The Politics of Green Transformations; Routledge: London, UK, 2015. [Google Scholar]

- International Renewable Energy Agency (IRENA). World Energy Transitions Outlook: 1.5 °C Pathway; IRENA: Abu Dhabi, United Arab Emirates, 2021; Available online: https://www.irena.org/publications/2021/Jun/World-Energy-Transitions-Outlook (accessed on 21 May 2025).

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. Governance Matters VIII: Aggregate and Individual Governance Indicators 1996–2008; World Bank Policy Research Working Paper No. 4978; World Bank: Washington, DC, USA, 2009. [Google Scholar] [CrossRef]

- World Bank. Sustainability Review 2023; The World Bank: Washington, DC, USA, 2023; Available online: https://openknowledge.worldbank.org (accessed on 21 May 2025).

- International Renewable Energy Agency (IRENA). World Energy Transitions Outlook 2022: 1.5 °C Pathway; IRENA: Abu Dhabi, United Arab Emirates, 2022; Available online: https://www.irena.org (accessed on 21 May 2025).

- World Bank. World Development Indicators; World Bank: Washington, DC, USA, 2025; Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 21 May 2025).

- Global Carbon Atlas. CO2 Emissions; Global Carbon Atlas. Laboratoire des Sciences du Climat et de l’Environnement (LSCE), Gif-sur-Yvette, France, 2025. Available online: http://www.globalcarbonatlas.org/en/CO2-emissions (accessed on 21 May 2025).

- Roser, M.; Ritchie, H.; Ortiz-Ospina, E. Our World in Data; Global Change Data Lab: Oxford, UK, 2025; Available online: https://ourworldindata.org/ (accessed on 21 May 2025).

- International Energy Agency. Data and Statistics; IEA: Paris, France, 2025; Available online: https://www.iea.org/data-and-statistics (accessed on 21 May 2025).

- International Renewable Energy Agency. Statistics; IRENA: Abu Dhabi, United Arab Emirates, 2025; Available online: https://www.irena.org/Statistics (accessed on 21 May 2025).

- BP. Statistical Review of World Energy; BP: London, UK, 2025; Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 21 May 2025).

- International Energy Agency. Electricity Information; IEA: Paris, France, 2023; Available online: https://www.iea.org/reports/electricity-information-2023 (accessed on 21 May 2025).

- U.S. Energy Information Administration. International Data; U.S. EIA: Washington, DC, USA, 2025. Available online: https://www.eia.gov/international/data/world (accessed on 21 May 2025).

- World Bank. Worldwide Governance Indicators; World Bank: Washington, DC, USA, 2025; Available online: https://info.worldbank.org/governance/wgi/ (accessed on 21 May 2025).

- Institute for Economics and Peace. Global Peace Index; IEP: Sydney, Australia, 2025; Available online: https://www.economicsandpeace.org/reports/ (accessed on 21 May 2025).

- Marsh McLennan. Political Risk Map; Marsh McLennan: New York, NY, USA, 2025; Available online: https://www.marsh.com/us/services/political-risk/insights/political-risk-map.html (accessed on 21 May 2025).

- International Monetary Fund. World Economic Outlook; IMF: Washington, DC, USA, 2025; Available online: https://www.imf.org/en/Publications/WEO (accessed on 21 May 2025).

- Organisation for Economic Co-operation and Development. OECD Economic Outlook; OECD Publishing: Paris, France, 2025; Available online: https://www.oecd.org/economic-outlook/ (accessed on 21 May 2025).

- United Nations. UN Data; United Nations: New York, NY, USA, 2025. Available online: https://data.un.org/ (accessed on 21 May 2025).

| Country | Renewable Energy Target | Major Projects | Challenges | Government Incentives | Investment Figures | Key Insights |

|---|---|---|---|---|---|---|

| Morocco | - 52% by 2030 [10,11] - 80% by 2050 | - Noor Ouarzazate Solar Complex (580 MW)—One of the world’s largest solar plants [11,21] - Midelt Hybrid Solar-Wind Project - Combining solar and wind energy | - Requires improved energy storage solutions to enhance grid stability. | - Sovereign green bonds to finance renewable projects - State subsidies for renewable energy development - Private investment encouraged via PPPs | - Noor Ouarzazate Solar Complex: $2.5 billion - Midelt Project: $2 billion | - Leads in renewable energy integration [9,18,60]. - 90% of fossil fuels are imported, being vulnerable to increasing energy security risks. - Morocco’s proactive environmental policies and clean energy investments have successfully limited emissions growth despite economic expansion. |

| Egypt | 42% by 2035 | - Benban Solar Park (1.8 GW)—One of the largest globally [11,16,21] - Gulf of Suez Wind Farm—Expanding wind capacity [10] | - High electricity demand still requires fossil fuel backup, slowing full-scale adoption. - The EKC hypothesis suggests emissions will decline with higher income levels, but targeted policy interventions are required | - Feed-in tariffs for renewable energy producers - Tax incentives for private sector investment in renewables - Public–private partnerships (PPPs) encouraged - 30% tax break for renewable energy investments | - Benban Solar Park: $4 billion - Wind energy projects: $1.5 billion+ | -Progressing but remains reliant on fossil fuels [6,57] -Grid enhancement is required to include renewable sources efficiently. -Hydrogen Economy Leader across MENA, securing partnerships for hydrogen-based ammonia production. |

| Oman | 10% by 2025, 35% by 2040 [11] | - Ibri Solar Plant (500 MW) [11] - Dhofar Wind Project (50 MW) [21] | - Policy and infrastructure gaps delay large-scale adoption. | - No subsidies for renewables, but tax exemptions for green projects - Foreign investment encouraged in hydrogen sector | - Green Hydrogen Projects: $140 billion planned by 2050 - Ibri Solar Plant: $400 million [8] | - Transition is slow, but hydrogen investments provide future potential [7,17]. - Lack of transmission infrastructure delays the relevant renewable integration. - Water scarcity, relying on energy-intensive desalination is a major obstacle. |

| Category | Morocco | Egypt | Oman |

|---|---|---|---|

| Economic Growth and Energy | Weak correlation—economic growth is independent of fossil fuel use | Negative correlation—more energy use does not always boost GDP | Positive correlation—energy use drives GDP growth |

| Carbon Emissions | Lower emissions growth, strong decarbonization efforts | Rising CO2 emissions linked to GDP growth | Highest CO2 per capita in MENA |

| Renewable Energy | Regional leader, major solar and wind projects, decoupling energy from GDP | Expanding solar and wind, green hydrogen investments | Hydrogen hub, solar and wind growth, surpassing 2030 targets |

| Policy Effectiveness | Most successful in green energy transition | The government is actively promoting renewables but still reliant on fossil fuels | Progressing towards renewables but remains highly carbon-intensive |

| Morocco | Egypt | Oman | Variable |

|---|---|---|---|

| MOR_ECO2 | EGY_ECO2 | OMN_ECO2 | CO2 Emissions (kg per PPP $ of GDP) |

| MOR_RES_CON | EGY_RES_CON | Renewable Energy Consumption (% of Total Final Energy Consumption) | |

| MOR_RES_OUT | EGY_RES_OUT | Renewable Electricity Output (% of Total Electricity Output) | |

| MOR_RQ | EGY_RQ | OMN_RQ | Regulatory Quality (World Bank Estimate) |

| MOR_POL_ST_ | EGY_POL_ST_ | OMN_POLSTAB | Political Stability and Absence of Violence/Terrorism (World Bank Estimate) |

| MOR_GDP_GR_ | EGY_GDP_GR_ | OMN_GDP_CON | GDP Growth (Annual %) |

| Variables | Break | ADF Test Results (Level) | ADF Test Results (First Differences) | Rank of Integration |

|---|---|---|---|---|

| MOR_ECO2 | 2018, 2019 | −2.6109 (0.865) | −17.9 (<0.01) *** | I(1) |

| MOR_GDP_GR_ | 2020 | −13.068 (<0.01) *** | = | I(0) |

| MOR_POL_ST_ | 2013, 2015 | −4.4312 * (0.052) ** | −7.6325 (<0.01) *** | I(1) |

| MOR_RES_CON | 2019, 2016 | −2.916 (0.7311) | −5.155 (0.05) ** | I(1) |

| MOR_RES_OUT | 2013, 2013 | −5.1555 * (0.0531) * | −6.483 (<0.01) *** | I(0) |

| MOR_ECO2 | MOR_GDP_GR_ | MOR_POL_ST_ | MOR_RES_CON | MOR_RES_OUT | MOR_RQ | |

|---|---|---|---|---|---|---|

| MOR_ECO2(−1) | 0.992440 (0.09496) | −1.797406 (4.96602) | −0.006910 (0.12397) | −0.235290 (5.30593) | −0.081109 (7.29555) | −0.000559 (0.13942) |

| MOR_ECO2(−2) | 0.000424 (0.04960) | 0.441436 (2.59165) | −0.004104 (0.06470) | 0.080032 (2.76879) | −0.018014 (3.80735) | −0.005751 (0.07276) |

| MOR_GDP_GR_(−1) | 5.29 × 10−5 (0.00182) | 0.915068 (0.09683) | 0.000384 (0.00239) | 0.006601 (0.10247) | −0.001537 (0.14091) | 0.000425 (0.00269) |

| MOR_GDP_GR_(−2) | 3.59 × 10−6 (0.00093) | 0.009264 (0.04967) | −0.000151 (0.00123) | −0.001067 (0.05254) | 0.002062 (0.07225) | −7.62 × 10−5 (0.00138) |

| MOR_POL_ST_(−1) | −0.005794 (0.07295) | −0.284033 (3.84961) | 0.959020 (0.09701) | −0.326851 (4.11271) | −1.762564 (5.65540) | −0.038827 (0.10808) |

| MOR_POL_ST_(−2) | −0.001742 (0.03724) | 0.149840 (1.96503) | −0.000275 (0.04954) | 0.102117 (2.09932) | −0.127685 (2.88680) | 0.003842 (0.05517) |

| MOR_RES_CON(−1) | 4.44 × 10−5 (0.00163) | −0.019414 (0.08625) | −0.000611 (0.00215) | 0.992634 (0.09294) | −0.005531 (0.12670) | −0.000195 (0.00242) |

| MOR_RES_CON(−2) | 1.68 × 10−5 (0.00087) | 0.008394 (0.04572) | −4.71 × 10−5 (0.00114) | −0.000932 (0.04933) | 0.002715 (0.06717) | 3.57 × 10−5 (0.00128) |

| MOR_RES_OUT(−1) | 0.000278 (0.00122) | −0.002691 (0.06417) | 4.16 × 10−5 (0.00160) | 0.010941 (0.06856) | 0.972347 (0.09514) | −0.000409 (0.00180) |

| MOR_RES_OUT(−2) | 6.93 × 10−5 (0.00063) | 0.003013 (0.03331) | −5.32 × 10−5 (0.00083) | 0.001709 (0.03559) | −0.005196 (0.04943) | −5.10 × 10−5 (0.00094) |

| MOR_RQ (−1) | −0.001348 (0.06454) | 0.135658 (3.40566) | 0.001012 (0.08502) | −0.134909 (3.63852) | −0.121144 (5.00319) | 0.964521 (0.09651) |

| MOR_RQ (−2) | 0.003100 (0.03310) | 0.099654 (1.74681) | 0.005674 (0.04361) | 0.268330 (1.86620) | −0.270890 (2.56621) | 2.60 × 10−5 (0.04953) |

| C | −0.019862 (0.05186) | 0.436770 (2.73316) | −0.001444 (0.06848) | −0.873271 (2.92249) | −1.081073 (4.01557) | 0.000197 (0.07675) |

| R-squared | 0.672774 | −1.365009 | −0.205207 | 0.749102 | 0.458590 | 0.126819 |

| Adj. R-squared | 0.018321 | −6.095027 | −2.615622 | 0.247306 | −0.624231 | −1.619543 |

| Variables | Break | ADF Test Results (Level) | ADF Test Results (First Differences) | Rank of Integration |

|---|---|---|---|---|

| EGY_ECO2 | 2019, 2020 | −3.65 (0.303) | −12.82 *** (<0.01) | I(1) |

| EGY_GDP_GR_ | 2010, 2011 | −4.474 ** (0.046) | −7.973 *** (<0.01) | I(1) |

| EGY_POL_ST_ | 2009 | −5.078 *** (<0.01) | - | I(0) |

| EGY_RES_CON | 2018, 2019 | −1.803565 >0.99 | −13.15 *** (<0.01) | I(1) |

| EGY_RES_OUT | 2015, | −1.781 (>0.99) | ||

| EGY_RQ | 2001, 2019 | −3.372 (0.459) | −3.978 ** (0.035) | I(1) |

| EGY_RQ | EGY_RES_CON | EGY_RES_OUT | EGY_GDP_GR_ | EGY_POL_ST_ | EGY_ECO2 | |

|---|---|---|---|---|---|---|

| EGY_RQ(−1) | 0.989280 (0.09329) | 0.147267 (0.87490) | 0.242005 (1.37354) | −0.248353 (0.98564) | −0.061265 (0.13423) | 0.002882 (0.03349) |

| EGY_RQ(−2) | −0.007828 (0.04916) | 0.048494 (0.46057) | 0.038165 (0.72302) | −0.046960 (0.51887) | −0.017188 (0.07066) | 0.001234 (0.01763) |

| EGY_RES_ CON(−1) | −0.003546 (0.00994) | 0.988608 (0.09487) | −0.010383 (0.14759) | −0.018307 (0.10591) | −0.001052 (0.01442) | −0.000281 (0.00360) |

| EGY_RES_ CON(−2) | −0.001030 (0.00519) | −0.000956 (0.04956) | −0.000967 (0.07703) | −0.005523 (0.05528) | −3.13 × 10−5 (0.00753) | 7.77 × 10−8 (0.00188) |

| EGY_RES_ OUT(−1) | −0.002786 (0.00577) | 0.017611 (0.05464) | 0.976505 (0.08642) | 0.001810 (0.06154) | −0.001844 (0.00838) | 0.000810 (0.00209) |

| EGY_RES_ OUT(−2) | −0.000660 (0.00322) | 0.004940 (0.03051) | −0.005023 (0.04835) | −0.000286 (0.03437) | −0.000596 (0.00468) | 0.000272 (0.00117) |

| EGY_GDP_GR_(−1) | 0.002054 (0.00897) | −0.011431 (0.08489) | −0.005481 (0.13327) | 0.970003 (0.09654) | 0.000924 (0.01302) | −0.000419 (0.00325) |

| EGY_GDP_GR_(−2) | 0.000341 (0.00460) | −0.002318 (0.04354) | 0.002175 (0.06834) | −0.006859 (0.04953) | −0.000144 (0.00668) | −0.000131 (0.00167) |

| EGY_POL_ ST_(−1) | 0.036276 (0.06211) | −0.050099 (0.58762) | 0.134221 (0.92251) | −0.060570 (0.66204) | 0.974766 (0.09091) | −0.000947 (0.02249) |

| EGY_POL_ ST_(−2) | 0.004793 (0.03328) | −0.008942 (0.31487) | 0.069822 (0.49430) | −0.039700 (0.35473) | −0.007523 (0.04877) | −2.42 × 10−5 (0.01205) |

| EGY_ECO2 (−1) | −0.099835 (0.25635) | −0.129800 (2.42565) | −0.050851 (3.80779) | −0.480708 (2.73231) | −0.037366 (0.37208) | 0.994735 (0.09366) |

| EGY_ECO2 (−2) | −0.030762 (0.13529) | −0.010146 (1.27998) | 0.012107 (2.00932) | −0.228431 (1.44198) | −0.003012 (0.19636) | −0.000441 (0.04948) |

| C | 0.134670 (0.14743) | −0.369081 (1.39446) | −0.080617 (2.18861) | 0.357698 (1.57114) | −0.065984 (0.21427) | −0.017164 (0.05339) |

| R-squared | 0.739651 | 0.723503 | 0.877415 | 0.197053 | 0.755126 | 0.792501 |

| Adj. R-squared | 0.218954 | 0.17050 | 0.632244 | −1.408840 | 0.265378 | 0.377502 |

| Variables | Break | ADF Test Results (Level) | ADF Test Results (First Differences) | Rank of Integration |

|---|---|---|---|---|

| OMN_GDP_CON | 2021, 2019 | −1.758 (>0.99) | −5.153540 *** (<0.01) | I(1) |

| OMN_ECO2 | 2007 | −4.824 ** (0.0325) | - | I(0) |

| OMN_RQ | 2002 | −7.418248 *** (<0.01) | - | I(0) |

| OMN _POLSTAB | 2014 | −4.659 * (0.0861) | −5.7 *** (0.01) | I(1) |

| OMN_ECO2 | OMN_GDP_CON | OMN_RQ | POLSTAB | |

|---|---|---|---|---|

| OMN_ECO2(−1) | 0.975027 (0.09532) | 4076.170 (5051.41) | 0.017967 (0.10716) | −0.004146 (0.09268) |

| OMN_ECO2(−2) | −0.005973 (0.04976) | −374.7045 (2634.76) | −0.004074 (0.05589) | −0.001942 (0.04834) |

| OMN_GDP_CON(−1) | 3.12 × 10−7 (1.8 × 10−6) | 1.029574 (0.09893) | 2.52 × 10−8 (2.1 × 10−6) | −2.82 × 10−8 (1.8 × 10−6) |

| OMN_GDP_CON(−2) | 7.18 × 10−8 (9.2 × 10−7) | 0.005895 (0.04990) | 6.72 × 10−9 (1.0 × 10−6) | 1.91 × 10−9 (9.1 × 10−7) |

| OMN_RQ(−1) | 0.031312 (0.08263) | 432.0333 (4419.38) | 0.955892 (0.09460) | 0.017585 (0.08109) |

| OMN_RQ(−2) | 0.013147 (0.04304) | 510.1810 (2301.61) | −0.008048 (0.04930) | −0.002245 (0.04223) |

| POLSTAB(−1) | 0.009791 (0.08713) | 3546.417 (4659.70) | −0.042558 (0.09886) | 0.952629 (0.08614) |

| POLSTAB(−2) | 0.000983 (0.04878) | 460.0289 (2608.84) | −0.008599 (0.05534) | −0.020531 (0.04832) |

| C | −0.051744 (0.11781) | −8052.580 (6316.94) | 0.039759 (0.13364) | 0.010881 (0.11571) |

| R-squared | 0.339079 | 0.519517 | 0.235897 | 0.703976 |

| Adj. R-squared | −0.248406 | 0.092421 | −0.443305 | 0.440843 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Michailidis, M.; Zafeiriou, E.; Kantartzis, A.; Galatsidas, S.; Arabatzis, G. Governance, Energy Policy, and Sustainable Development: Renewable Energy Infrastructure Transition in Developing MENA Countries. Energies 2025, 18, 2759. https://doi.org/10.3390/en18112759

Michailidis M, Zafeiriou E, Kantartzis A, Galatsidas S, Arabatzis G. Governance, Energy Policy, and Sustainable Development: Renewable Energy Infrastructure Transition in Developing MENA Countries. Energies. 2025; 18(11):2759. https://doi.org/10.3390/en18112759

Chicago/Turabian StyleMichailidis, Michail, Eleni Zafeiriou, Apostolos Kantartzis, Spyridon Galatsidas, and Garyfallos Arabatzis. 2025. "Governance, Energy Policy, and Sustainable Development: Renewable Energy Infrastructure Transition in Developing MENA Countries" Energies 18, no. 11: 2759. https://doi.org/10.3390/en18112759

APA StyleMichailidis, M., Zafeiriou, E., Kantartzis, A., Galatsidas, S., & Arabatzis, G. (2025). Governance, Energy Policy, and Sustainable Development: Renewable Energy Infrastructure Transition in Developing MENA Countries. Energies, 18(11), 2759. https://doi.org/10.3390/en18112759