Two-Stage Optimization Strategy for Market-Oriented Lease of Shared Energy Storage in Wind Farm Clusters

Abstract

1. Introduction

- (1)

- The participation sequence of shared energy storage in multiple application scenarios is clarified, and the driving force for wind farm clusters to participate in leasing services is analyzed from the perspective of assessment costs. Based on considering opportunity costs, a comprehensive pricing mechanism for leasing services of shared energy storage is formed, effectively guiding wind farm clusters to lease shared energy storage on demand.

- (2)

- Fully considering the autonomy and profitability of wind farm clusters and shared energy storage, a Stackelberg game model is introduced to characterize the energy sharing and interactive game between the two, and the time-varying leasing demand of wind farm clusters is transformed into a relaxation factor to optimize the leasing price mechanism of shared energy storage.

- (3)

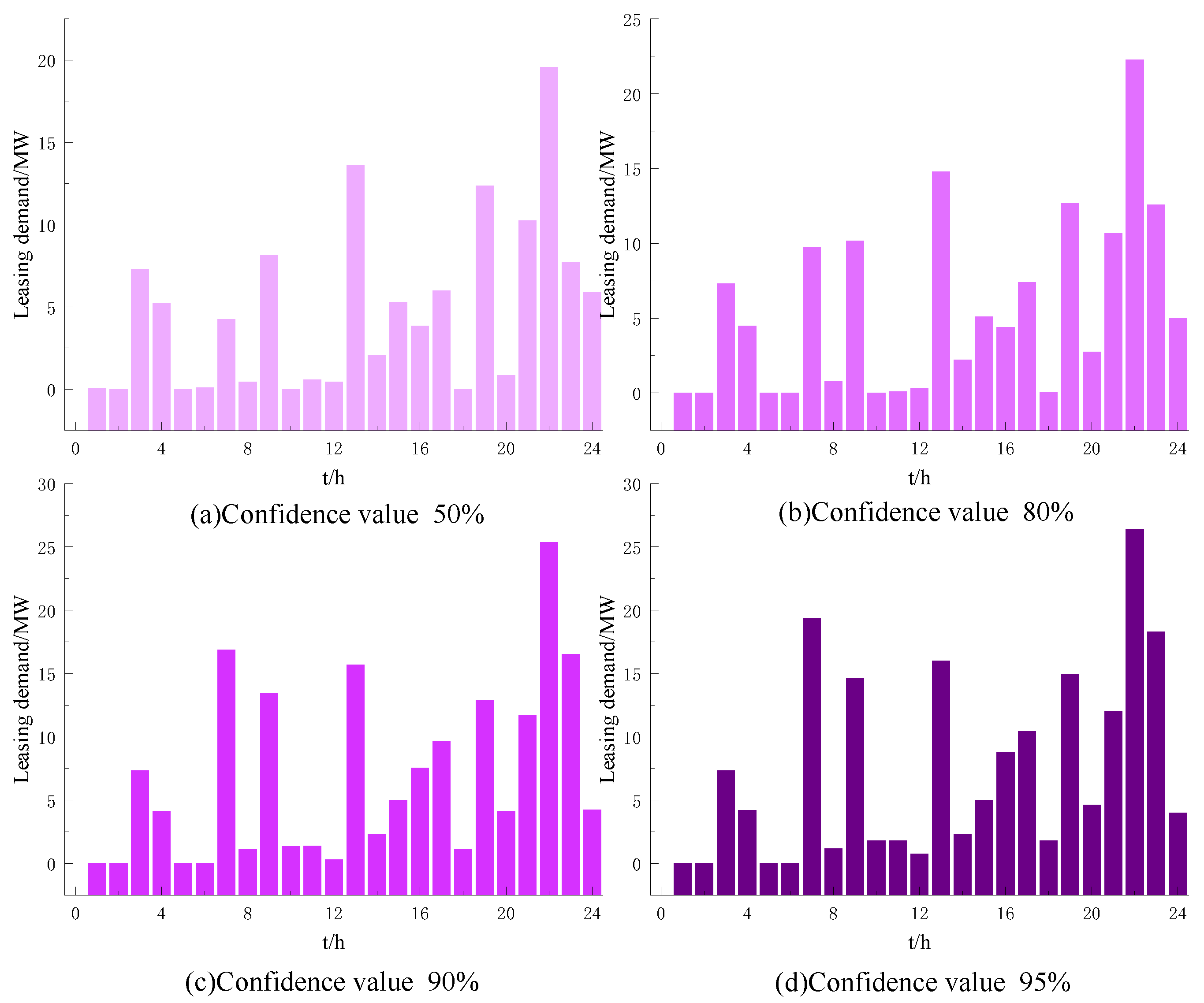

- A two-stage optimized operational model for day-ahead and real-time markets of shared energy storage is constructed, taking into account the operational characteristics of electric energy market and wind power output forecasting. Considering the multiple uncertainties of wind power output and market electric prices, confidence methods and improved robust optimization models are proposed in stages to reconstruct the optimization operation model of shared energy storage, effectively improving the accuracy of optimization scheduling decisions for shared energy storage.

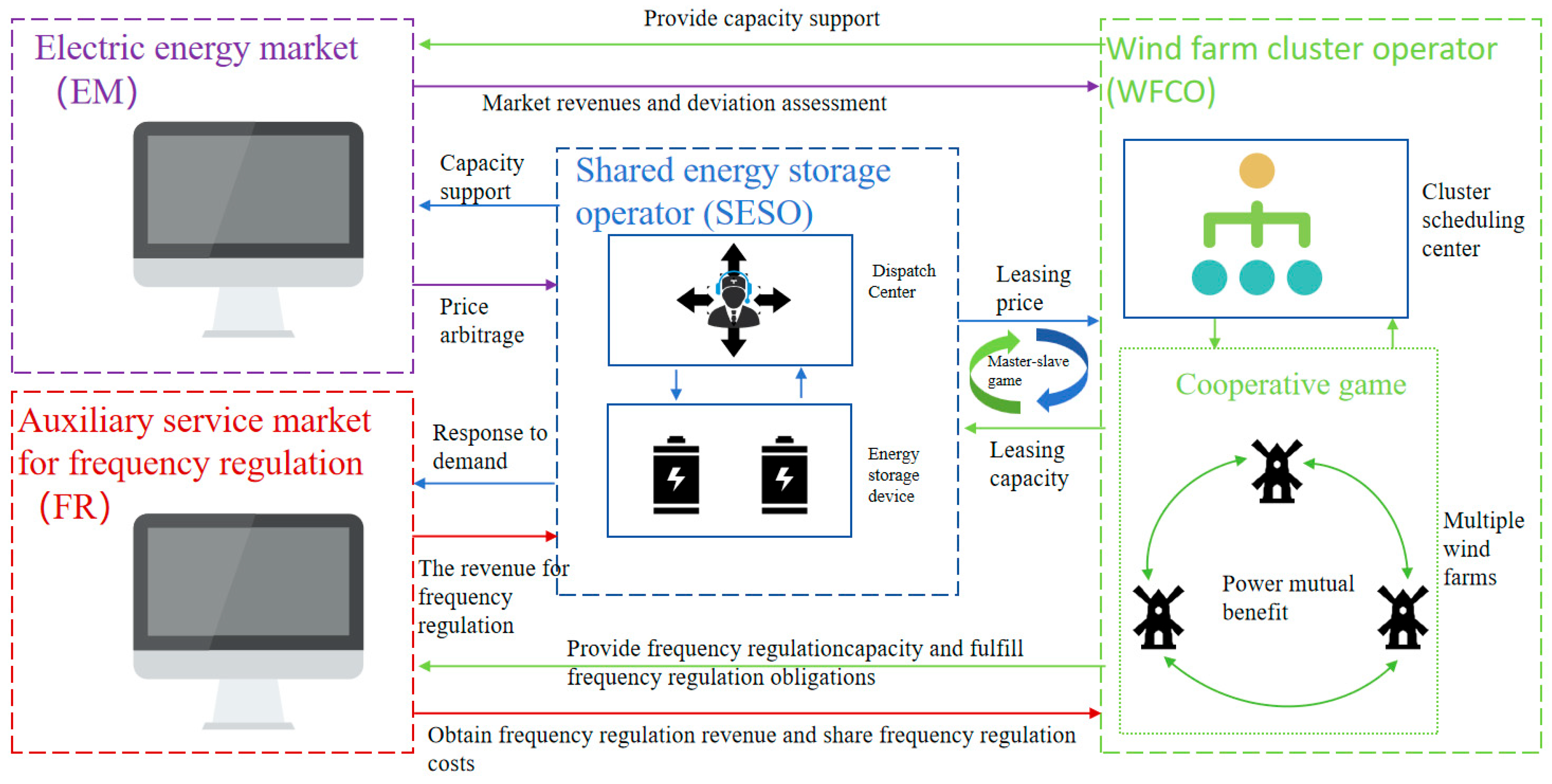

2. Operating Framework for Shared Energy Storage in Diverse Application Scenarios

2.1. Multi-Type Business Model of Energy Storage

2.2. Shared Energy Storage Operation Architecture in Multiple Scenarios

3. SESO Two-Stage Optimization Operation Strategy Considering Leasing Demand and Multiple Uncertainties

3.1. Price Formation Mechanism for Leasing Services of Shared Energy Storage

3.2. Two-Stage Operation Strategy for Shared Energy Storage Considering Multiple Uncertainties

3.2.1. Economic Operation Strategy of Shared Energy Storage in Day-Ahead Stage Based on Stackelberg Game Theory

- (1)

- Leader: SESO

- (2)

- Followers WFCO

3.2.2. Real-Time Rolling Optimization Strategy for Collaborative Operation of Shared Energy Storage Based on Improved Robust Optimization

4. Two-Stage Optimization Model for Market-Oriented Leasing of Shared Energy Storage

4.1. SESO Optimization Scheduling Model in Day-Ahead Stage

4.1.1. A Pricing Model for SESO Leasing Services Based on Stackelberg Game Theory

- (1)

- Participants: The participants in the Stackelberg game are WFCO and SESO, with a set of .

- (2)

- Strategy: The strategy of SESO is used to determine the leasing price and the interactive power of WFCO. The policy set of SESO may be represented by the following equation:

- (3)

- Revenue: The revenues of SESO and WFCO are calculated using Equations (2) and (10), respectively.

4.1.2. SESO Optimization Scheduling Model Considering Leasing Demand in Day-Ahead Stage

4.2. SESO Real-Time Rolling Optimization Scheduling Model

4.3. Solving Method

5. Validating Cases

5.1. Data Sources and Parameter Settings

- (1)

- Parameter settings for wind farm clusters

- (2)

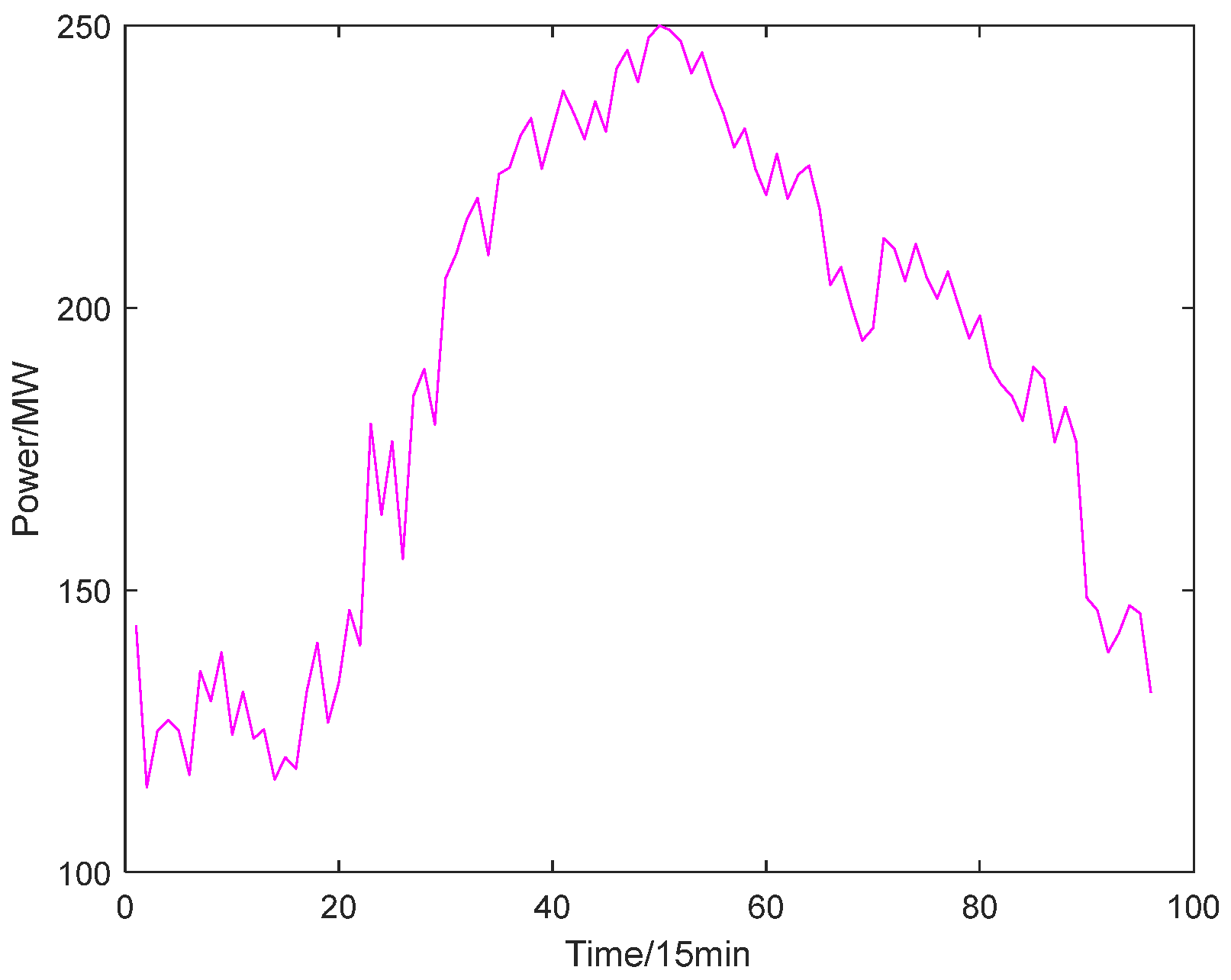

- Data setting for market electric prices

- (3)

- Parameter settings for shared energy storage

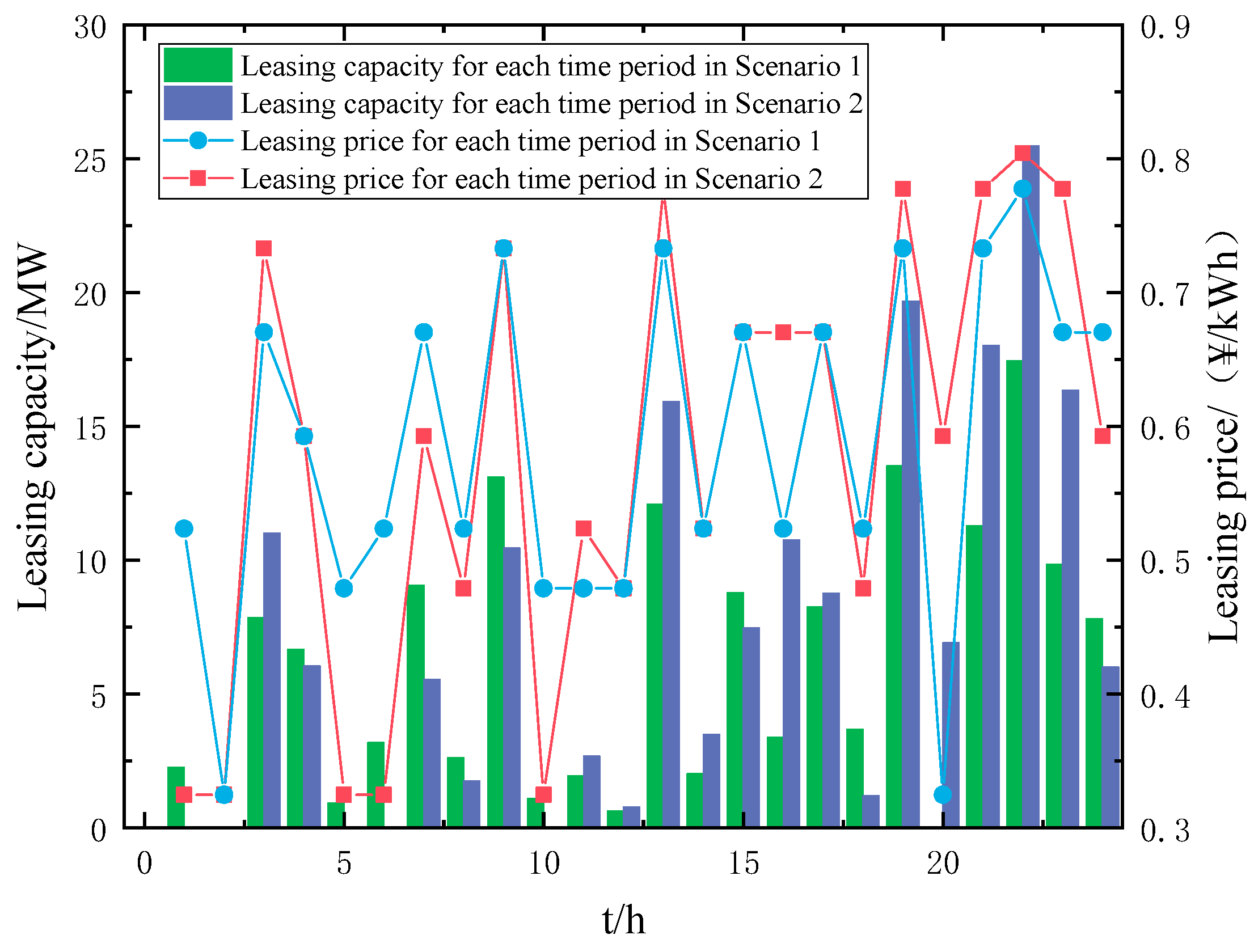

5.2. Strategic Analysis of the Economic Optimization Operation of Shared Energy Storage in the Day-Ahead Stage

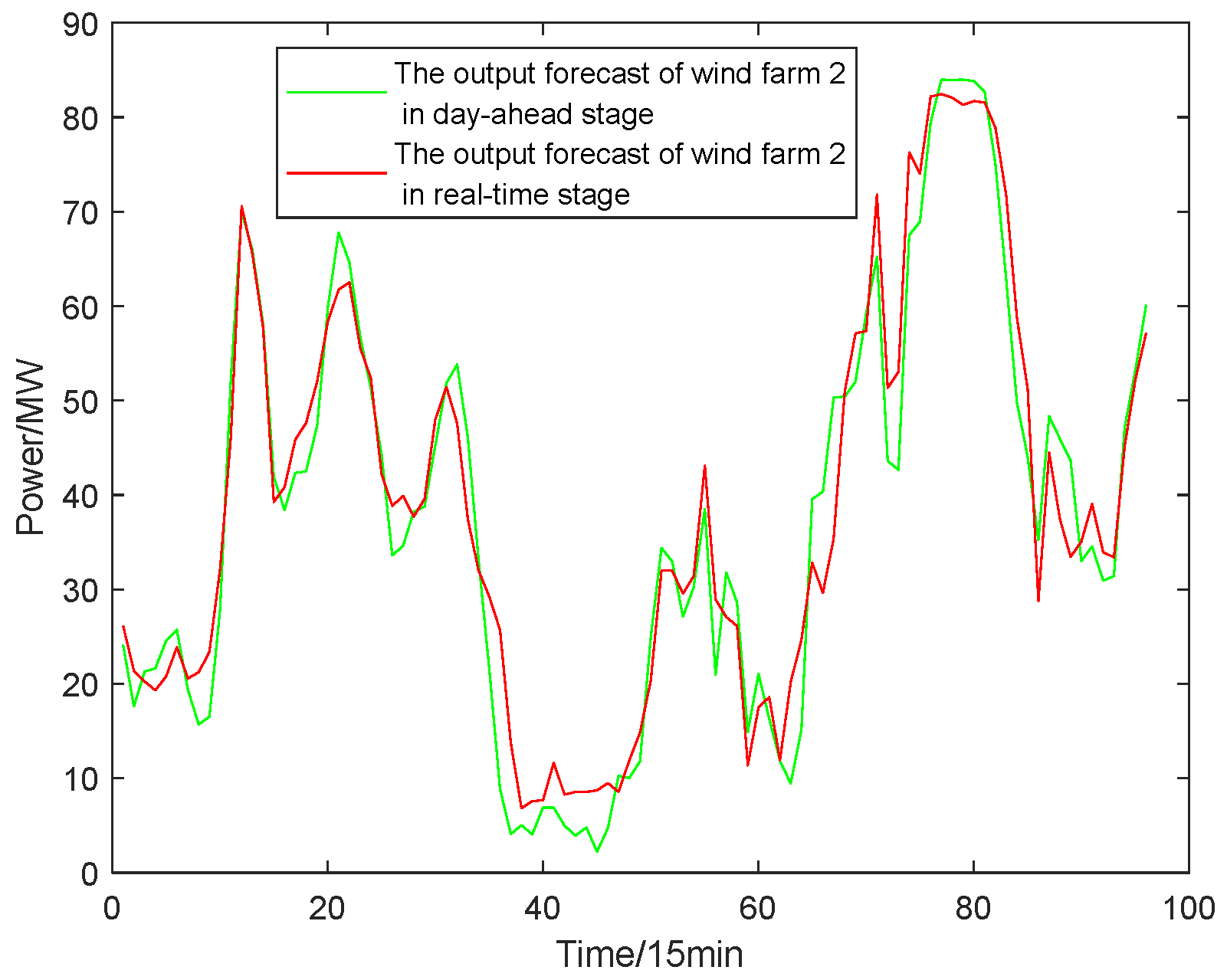

5.2.1. Leasing Demand Analysis Considering Uncertainty in Wind Power Output

5.2.2. SESO Revenue Analysis in Different Application Scenarios

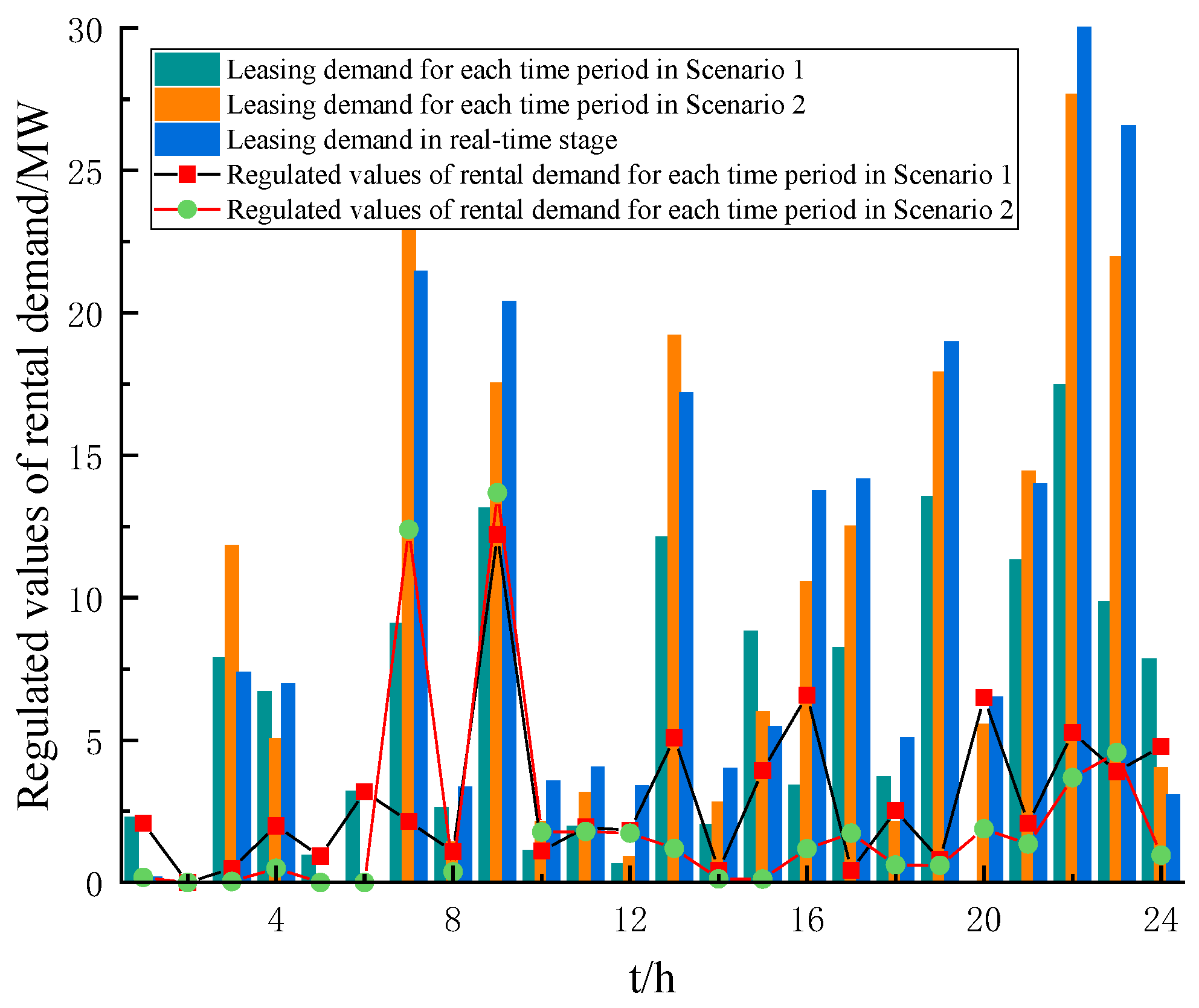

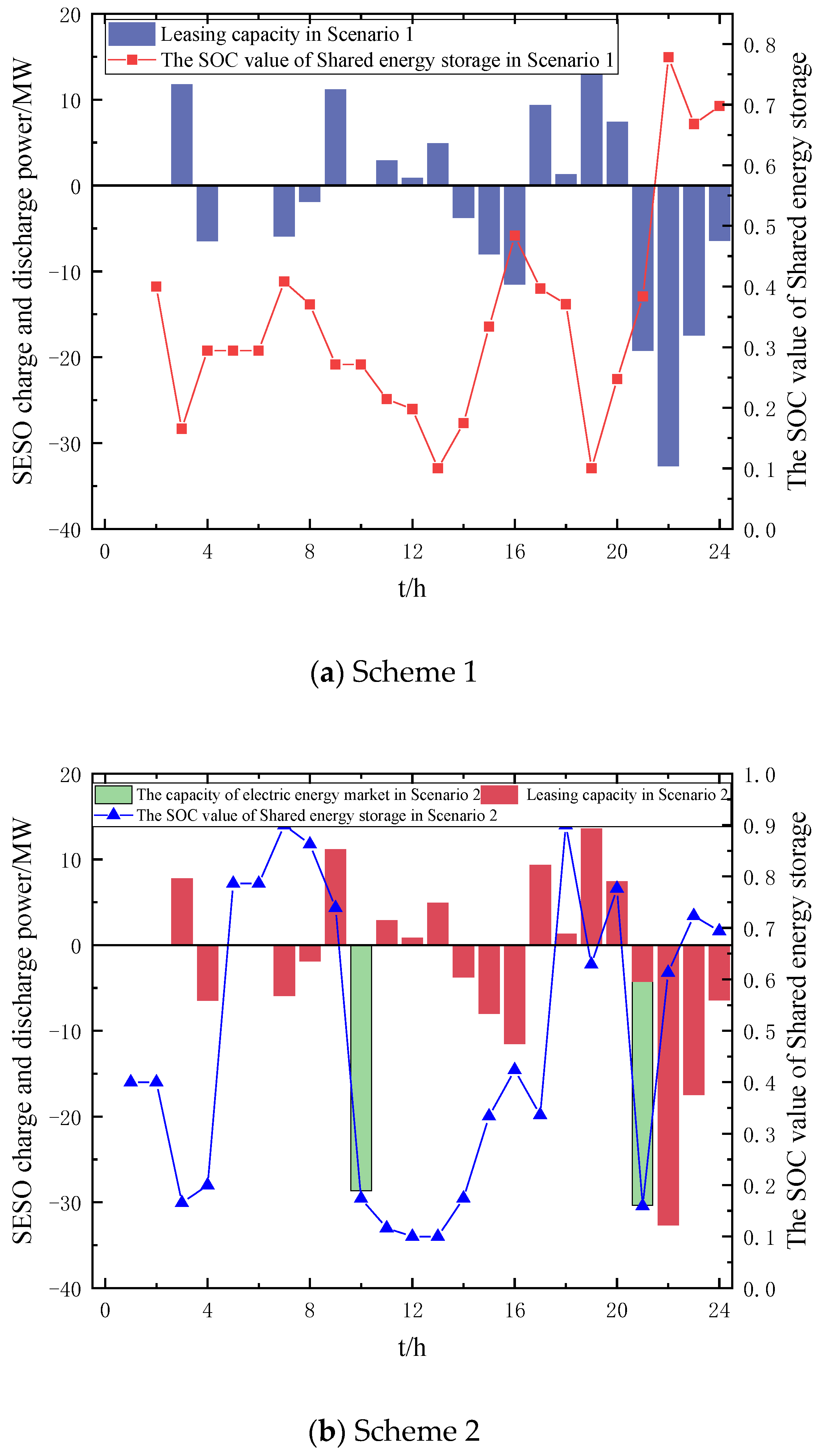

5.3. Rolling Optimization Strategy Analysis for Real-Time Shared Energy Storage

5.3.1. Rolling Regulation Analysis of WFCO Leasing Strategy

5.3.2. Rolling Regulation Analysis of SESO Charging and Discharging Strategy

6. Conclusions

- (1)

- Multiple application scenarios can effectively leverage the capacity support and rapid regulation value of shared energy storage. Compared with a single capacity leasing scenario, the utilization rate and economic benefits of shared energy storage in the multiple scenarios built in this paper increased by 52.87% and CNY 158,700, respectively, which is conducive to promoting wind power consumption and improving the economic benefits of shared energy storage.

- (2)

- A reasonable price formation mechanism is the key to increasing the willingness of shared energy storage to provide balanced services for various wind farms. The Stackelberg game model can effectively characterize the energy sharing and interactive game between capacity leasing parties. Compared to the fixed electricity price model, the Stackelberg game model constructed in this paper may increase the revenue of the wind farm by CNY 13,632, and the resulting leasing price signal can effectively map the leasing demand of WFCO in various periods.

- (3)

- In the process of forming leasing prices in the day-ahead stage, considering the uncertainty of wind power output can more accurately quantify the leasing demand of WFCO in various periods, effectively reducing the regulation value of WFCO leasing capacity in the real-time stage, thus forming a more distinct and accurate leasing price signal, which is conducive to guiding WFCO to lease shared energy storage capacity on demand.

- (4)

- The improved robust optimization method that integrates prediction results and scheduling decisions is adopted to determine the degree of deviation between wind power output and market electric prices in real-time prediction results with higher accuracy, resulting in a 2.1364% increase in SESO revenue compared to traditional robust optimization methods. This approach ensures the robustness of SESO’s real-time rolling charging and discharging plan while also considering economic benefits.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| Symbol | Definition |

| SES | shared energy storage |

| SESO | shared energy storage operators |

| WFCO | wind farm cluster operators |

| EM | the electric energy market |

| FRM | the frequency regulation market |

| the total leasing price of SESO during time period | |

| the capacity lease price of SESO during time period | |

| the mileage leasing price of SESO during time period | |

| the total operating revenue of SESO in the capacity lease scenario in the day-ahead stage | |

| the total charging and discharging mileage of WFCO in the day-ahead stage during time period | |

| the loss cost of SESO unit charging and discharging power | |

| the charging power of SESO for the capacity lease scenario during time period in the day-ahead stage | |

| the discharging power of SESO for the capacity lease scenario during time period in the day-ahead stage | |

| the rated charging power power of SESO | |

| the rated discharging power of SESO | |

| the state of charge values of SESO during time periods | |

| the charging efficiencies of SESO | |

| the discharging efficiencies of SESO | |

| the rated capacity of SESO | |

| the time interval, taken as 1 h in this paper | |

| the maximum SOC values pre-set by SESO | |

| the minimum SOC values pre-set by SESO | |

| the initial SOC value of SESO | |

| the SOC value at the end of one operating cycle (24 h) | |

| the total cost of WFCO in the day-ahead stage under capacity lease scenarios | |

| the assessment cost incurred by WFCO during grid connection in the day-ahead stage due to fluctuations in power generation | |

| the assessment cost formed by the prediction error of WFCO’s power generation in the day-ahead stage | |

| the unit assessment costs incurred by WFCO during grid connection due to fluctuations in power generation | |

| the unit assessment costs incurred due to forecast deviations in power generation | |

| the assessment capacity formed by the fluctuation of power generation during grid connection after WFCO leases SESO capacity in the day-ahead stage | |

| the assessment capacity formed by the prediction error of power generation. | |

| the maximum grid connected power of WFCO during time period | |

| the online power of WFCO during time period | |

| wind farm during time period in the day-ahead market | |

| wind farm during time period | |

| the maximum wind power curtailment of WFCO during time period in the day-ahead market | |

| the predicted power of WFCO in the day-ahead market during time period | |

| the predicted values of wind power output | |

| the predicted values of clearing prices in the electric energy market | |

| the predicted values of clearing prices in the frequency regulation market during the real-time stage | |

| the average predicted results of wind power output | |

| the average predicted results of clearing prices in the electric energy market | |

| the average predicted results of clearing prices in the frequency regulation market during the real-time stage | |

| the variances of the predicted results for wind power output | |

| the variances of the predicted results for clearing prices in the electric energy market | |

| the variances of the predicted results for clearing prices in the frequency regulation market during the real-time stage | |

| the upper and lower quantile point of the standard normal distribution | |

| the total operating revenue of SESO in multiple application scenarios during the day-ahead stage | |

| the total operating revenue of SESO in the market trading application scenario during the day-ahead stage | |

| the revenue obtained by SESO from the electric energy market in the day-ahead stage | |

| the revenue obtained by SESO from the frequency regulation market in the day-ahead stage | |

| the operational cost loss of SESO in the market trading application scenario during the day-ahead stage | |

| the cost of wind power curtailment charging for SESO in the day-ahead stage | |

| the predicted clearing prices for the electric energy market during time period | |

| the predicted clearing prices for the frequency regulation market during time period | |

| the pre-scheduled power of SESO in the electric energy market during time period | |

| the pre-scheduled power of SESO in the frequency regulation market during time period | |

| the charging power of SESO in the market trading scenario during time period in the day-ahead stage | |

| the discharging power of SESO in the market trading scenario during time period in the day-ahead stage | |

| the wind power charging price for SESO during time period in the day-ahead stage | |

| the abandoned wind power charging for SESO during time period in the day-ahead stage | |

| the total charging power of SESO during time period | |

| the total discharging power of SESO during time period | |

| an operator that means at least one of the left and right parameters will be 0 |

Appendix A

| Parameter Type | Parameter Values |

|---|---|

| Rated power/MW | 40 |

| Rated capacity/MWh | 40 |

| Charge/discharge efficiency | 0.95/0.95 |

| Initial value of SOC | 0.3 |

| Maximum/minimum value of SOC | 0.9/0.1 |

| Conversion factor | 0.85 |

| Unit operating cost loss/CNY/kWh | 0.1542 |

| Comprehensive frequency regulation performance indicators | 2.7 |

| Time | Mean Value | Variance |

|---|---|---|

| 1 | 34.2393 | 89.6526 |

| 2 | 19.2634 | 37.2033 |

| 3 | 24.9932 | 53.9232 |

| 4 | 52.2001 | 278.6746 |

| 5 | −15.3283 | 284.3623 |

| 6 | −26.8151 | 58.0981 |

| 7 | 94.1020 | 540.3911 |

| 8 | −8.7919 | 5.3743 |

| 9 | 60.7938 | 342.3677 |

| 10 | 32.8836 | 102.3540 |

| 11 | 21.7613 | 41.3698 |

| 12 | 18.6338 | 38.6720 |

| 13 | −6.7217 | 3.1433 |

| 14 | 33.1149 | 95.4252 |

| 15 | −33.4131 | 101.3509 |

| 16 | 5.4930 | 2.1563 |

| 17 | −30.7271 | 93.1988 |

| 18 | 40.8384 | 137.1739 |

| 19 | 58.4960 | 293.1762 |

| 20 | −22.7332 | 46.3279 |

| 21 | 35.3781 | 98.5644 |

| 22 | −36.4167 | 102.3767 |

| 23 | −33.6615 | 96.4484 |

| 24 | −1.2299 | 0.15367 |

| Time | Capacity Price | Mileage Price | ||

|---|---|---|---|---|

| Scenario 1 | Scenario 2 | Scenario 1 | Scenario 2 | |

| 1 | 0.3248 | 0.3248 | 0.1988 | 0 |

| 2 | 0.3248 | 0.3248 | 0 | 0 |

| 3 | 0.3248 | 0.3248 | 0.3455 | 0.4081 |

| 4 | 0.3248 | 0.3248 | 0.2678 | 0.2678 |

| 5 | 0.3248 | 0.3248 | 0.1542 | 0 |

| 6 | 0.3248 | 0.3248 | 0.1988 | 0 |

| 7 | 0.3248 | 0.3248 | 0.3455 | 0.2678 |

| 8 | 0.3248 | 0.3248 | 0.1988 | 0.1542 |

| 9 | 0.3248 | 0.3248 | 0.4081 | 0.4081 |

| 10 | 0.3248 | 0.3248 | 0.1542 | 0 |

| 11 | 0.3248 | 0.3248 | 0.1542 | 0.1988 |

| 12 | 0.3248 | 0.3248 | 0.1542 | 0.1542 |

| 13 | 0.3248 | 0.3248 | 0.4081 | 0.4527 |

| 14 | 0.3248 | 0.3248 | 0.1988 | 0.1988 |

| 15 | 0.3248 | 0.3248 | 0.3455 | 0.3455 |

| 16 | 0.3248 | 0.3248 | 0.1988 | 0.3455 |

| 17 | 0.3248 | 0.3248 | 0.3455 | 0.3455 |

| 18 | 0.3248 | 0.3248 | 0.1988 | 0.1542 |

| 19 | 0.3248 | 0.3248 | 0.4081 | 0.4527 |

| 20 | 0.3248 | 0.3248 | 0 | 0.2678 |

| 21 | 0.3248 | 0.3248 | 0.4081 | 0.4527 |

| 22 | 0.3248 | 0.3248 | 0.4527 | 0.4527 |

| 23 | 0.3248 | 0.3248 | 0.3455 | 0.4527 |

| 24 | 0.3248 | 0.3248 | 0.3455 | 0.2678 |

| Type | Mean Value | Variance |

|---|---|---|

| Wind power output/MW | 140.9584 | 604.6776 |

| Electric prices in electric energy market/CNY/kWh | 0.5492 | 0.187 |

| Electric prices in frequency regulation market/CNY/kWh | 10.5968 | 3.2643 |

References

- Anand, H.; Verma, A.; Narang, N.; Dhillon, J.S. A novel scheduling approach of stochastic cogeneration model in power system environment using improved civilized swarm search algorithm to reduce cost and carbon emission. J. Clean. Prod. 2024, 434, 140277. [Google Scholar] [CrossRef]

- Zhang, T.; Xin, L.; Wang, S.; Guo, R.; Wang, W.; Cui, J.; Wang, P. A novel approach of energy and reserve scheduling for hybrid power systems: Frequency security constraints. Appl. Energy 2024, 361, 122926. [Google Scholar] [CrossRef]

- Yin, L.; Lin, C. Matrix Wasserstein distance generative adversarial network with gradient penalty for fast low-carbon economic dispatch of novel power systems. Energy 2024, 298, 131357. [Google Scholar] [CrossRef]

- Dai, B.; Wang, H.; Li, B.; Li, C.; Tan, Z. Capacity model and optimal scheduling strategy of multi-microgrid based on shared energy storage. Energy 2024, 306, 132472. [Google Scholar] [CrossRef]

- Pu, Y.; Li, Q.; Huo, S.; Breaz, E.; Chen, W.; Gao, F. Optimal configuration for shared electric-hydrogen energy storage for multiple integrated energy systems with mobile hydrogen transportation. Renew. Energy 2024, 237, 121828. [Google Scholar] [CrossRef]

- Kalathil, D.; Wu, C.; Poolla, K.; Varaiya, P. The sharing economy for the electricity storage. IEEE Trans. Smart Grid 2019, 10, 556–567. [Google Scholar] [CrossRef]

- Dai, R.; Esmaeilbeigi, R.; Charkhgard, H. The utilization of shared energy storage in energy systems: A comprehensive review. IEEE Trans. Smart Grid 2021, 12, 3163–3174. [Google Scholar] [CrossRef]

- Kang, C.; Liu, J.; Zhang, N. A new form of energy storage in future power system: Cloud energy storage. Power Syst. Autom. 2017, 41, 2–8+16. [Google Scholar]

- Yan, D.; Chen, Y. Review of shared energy storage business model and pricing mechanism. Power Syst. Autom. 2022, 46, 178–191. [Google Scholar]

- Wang, X.; Zhang, Z.; Zhang, S.; Zhang, S. Power market game analysis considering new energy generators leasing shared energy storage. Power Grid Technol. 2024, 48, 3269–3277. [Google Scholar]

- Qiao, J.; Mi, Y.; Shen, J.; Lu, C.; Cai, P.; Ma, S.; Wang, P. Optimization schedule strategy of active distribution network based on microgrid group and shared energy storage. Appl. Energy 2024, 377, 124681. [Google Scholar] [CrossRef]

- Wang, D.; Fan, R.; Yang, P.; Du, K.; Xu, X.; Chen, R. Research on floating real-time pricing strategy for microgrid operator in local energy market considering shared energy storage leasing. Appl. Energy 2024, 368, 123412. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, J.; Zhao, Y.; Xu, B. Incorporate robust optimization and demand defense for optimal planning of shared rental energy storage in multi-user industrial park. Energy 2024, 301, 131721. [Google Scholar] [CrossRef]

- He, L.; Zhang, J. A Community Sharing Market with PV and Energy Storage: An Adaptive Bidding-Based Double-Side Auction Mechanism. IEEE Trans. Smart Grid 2021, 12, 2450–2461. [Google Scholar] [CrossRef]

- Gao, M.; Xiang, L.; Zhu, S.; Lin, Q. Scenario probabilistic data-driven two-stage robust optimal operation strategy for regional integrated energy systems considering ladder-type carbon trading. Renew. Energy 2024, 237, 121722. [Google Scholar] [CrossRef]

- Duan, J.; Gao, Q.; Xia, Y.; Tian, Q.; Qin, B. MMD-DRO based economic dispatching considering flexible reserve provision from concentrated solar power plant. Energy 2024, 308, 132875. [Google Scholar] [CrossRef]

- Gao, J.; Shao, Z.; Chen, F.; Lak, M. Robust optimization for integrated energy systems based on multi-energy trading. Energy 2024, 308, 132302. [Google Scholar] [CrossRef]

- Hu, J. Dynamic Output Feedback MPC of Polytopic Uncertain Systems: Efficient LMI Conditions. IEEE Trans. Circuits Syst. II Express Briefs 2021, 68, 2568–2572. [Google Scholar] [CrossRef]

- Wang, C.; Zhang, X.; Ling, K.; Xi, L.; Chen, R.; Wang, A.; Chu, S.; Tian, F.; Li, X. Two-stage adaptive robust optimal scheduling of microgrid based on interval probability uncertainty set. Proc. CSEE 2024, 44, 1750–1764. [Google Scholar]

- Song, X.; Zhang, H.; Fan, L.; Zhang, Z.; Peña-Mora, F. Planning shared energy storage systems for the spatio-temporal coordination of multi-site renewable energy sources on the power generation side. Energy 2023, 282, 128976. [Google Scholar] [CrossRef]

- Xu, X.; Li, G.; Yang, H.; Liu, D.; Wang, J.; Zhang, Z.; Zhao, L.; Zhang, X. Pricing method of shared energy storage bias insurance service based on large number theorem. J. Energy Storage 2023, 69, 107726. [Google Scholar] [CrossRef]

- Shukla, A.; Singh, S. Clustering based unit commitment with wind power uncertainty. Energy Convers. Manag. 2016, 111, 89–102. [Google Scholar] [CrossRef]

- Shi, Y.; Wang, L.; Chen, W.; Guo, C. Distributed robust energy storage unit commitment based on wind power prediction error clustering. Power Syst. Autom. 2019, 43, 3–12+121. [Google Scholar]

- Dong, W.; Wang, Q.; Yang, L. Coordinated dispatching model of virtual power plant and distribution company with wind, solar and water. Power Syst. Autom. 2015, 39, 75–81+207. [Google Scholar]

- Lu, S.; Gao, W.Z.; Liu, Y. HFTL-KD: A new heterogeneous federated transfer learning approach for degradation trajectory prediction in large-scale decentralized systems. Control. Eng. Pract. 2024, 153, 106098. [Google Scholar] [CrossRef]

- Liu, Q.; Shang, Z.; Lu, S.; Liu, Y.; Liu, Y.; Yu, S. Physics-guided TL-LSTM network for early-stage degradation trajectory prediction of lithium-ion batteries. J. Energy Storage 2024, 106, 114736. [Google Scholar] [CrossRef]

- Su, Y.; Teh, J.; Fang, S.; Dai, Z.; Wang, P. Two-stage optimal dispatch framework of active distribution networks with hybrid energy storage systems via deep reinforcement learning and real-time feedback dispatch. J. Energy Storage 2025, 108, 115169. [Google Scholar] [CrossRef]

| Different Scheme | Utilization Rate | SESO Revenue/CNY 10,000 | ||

|---|---|---|---|---|

| Leasing Revenue | Revenue from Electric Energy Market | Revenue from Frequency Regulation Market | ||

| Scheme 1 | 32.46% | 8.1673 | 0 | 0 |

| Scheme 2 | 35.89% | 8.4671 | 2.9561 | 0 |

| Scheme 3 | 85.33% | 8.9234 | 2.3798 | 15.7329 |

| Different Scenario | The Various Costs of WFCO/CNY 104 | Total Assessment Cost | ||

|---|---|---|---|---|

| Assessment Costs Caused by Fluctuations in Grid-Connected Power | Assessment Costs Caused by Prediction Deviation | Capacity Leasing Cost | ||

| Scenario 1 | 0.1431 | 0.6709 | 9.0827 | 9.8967 |

| Scenario 2 | 0.2355 | 0.8346 | 10.5534 | 11.6235 |

| Scenario 3 | 0.2188 | 0.8237 | 10.0183 | 11.0608 |

| Scenario 4 | 0.2272 | 0.8143 | 9.9319 | 10.9734 |

| Different Scenario | The Various Costs of WFCO/CNY 10,000 | Operation Cost | Total Operation Revenue | ||

|---|---|---|---|---|---|

| Capacity Leasing Revenue | Revenue from Electric Energy Market | Revenue from Frequency Regulation Market | |||

| Scenario 1 | 10.0183 | 2.1392 | 14.5265 | 7.1876 | 19.4964 |

| Scenario 2 | 10.0183 | 1.7904 | 12.7941 | 6.6382 | 17.9646 |

| Scenario 3 | 10.0183 | 1.9340 | 13.2876 | 6.8915 | 18.3484 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Wu, J.; Lei, Z. Two-Stage Optimization Strategy for Market-Oriented Lease of Shared Energy Storage in Wind Farm Clusters. Energies 2025, 18, 2697. https://doi.org/10.3390/en18112697

Liu J, Wu J, Lei Z. Two-Stage Optimization Strategy for Market-Oriented Lease of Shared Energy Storage in Wind Farm Clusters. Energies. 2025; 18(11):2697. https://doi.org/10.3390/en18112697

Chicago/Turabian StyleLiu, Junlei, Jiekang Wu, and Zhen Lei. 2025. "Two-Stage Optimization Strategy for Market-Oriented Lease of Shared Energy Storage in Wind Farm Clusters" Energies 18, no. 11: 2697. https://doi.org/10.3390/en18112697

APA StyleLiu, J., Wu, J., & Lei, Z. (2025). Two-Stage Optimization Strategy for Market-Oriented Lease of Shared Energy Storage in Wind Farm Clusters. Energies, 18(11), 2697. https://doi.org/10.3390/en18112697