1. Introduction

The Copernicus Climate Change Service (C3S) has confirmed that 2024 is the warmest year on record globally, marking the first calendar year in which the average global temperature exceeded 1.5 °C above pre-industrial levels [

1]. This development highlights a significant shortfall in meeting the targets set by the Paris Agreement in 2015, which aims to prevent such temperature increases. The key driver of climate change today remains dependence on fossil fuels, necessitating a phased transition to achieve the Europe’s goal of eliminating carbon emissions by 2050. To support this goal, some countries have adopted carbon tariffs to reduce both global and regional carbon emissions [

2]. At the same time, recent geopolitical events have demonstrated that diversifying energy sources is essential for mitigating climate change and ensuring energy security. This became particularly evident over the past few years when global gas prices experienced severe fluctuations due to the combined effects of the global pandemic and geopolitical tensions. For example, Europe’s gas-price markers indicate that natural gas prices skyrocketed from 67 to a record-breaking 340 EUR/MWh over the period February–August 2022 [

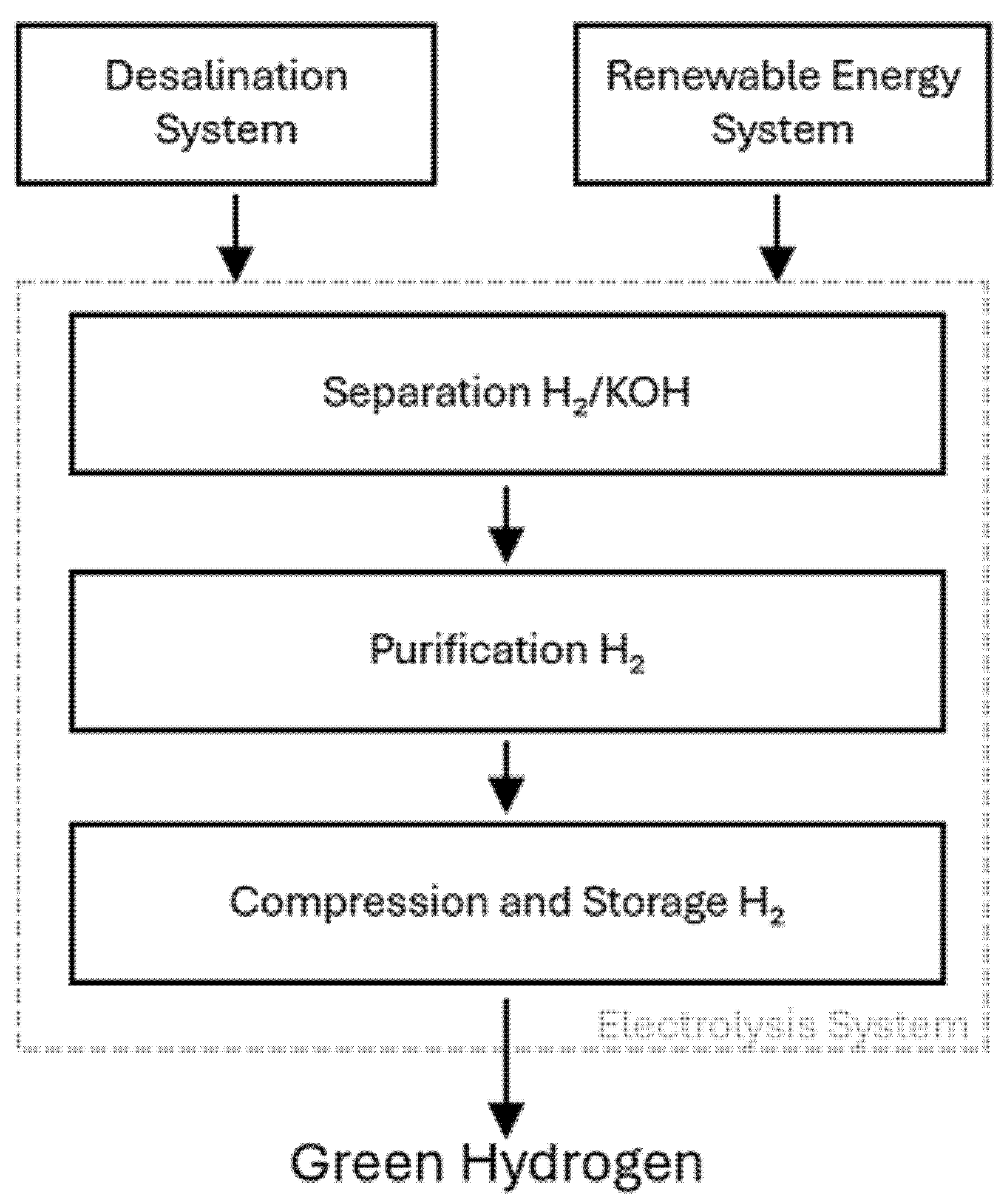

3], triggering a power crisis in energy-intensive industries, especially in energy-import-dependent countries like Lithuania. The energy surge led to unplanned industry halts, significant increases in production costs, and reduced market competition. These dual challenges can be addressed by diversifying fuel types and transitioning to alternative gases, such as zero-carbon fuels like green hydrogen and green ammonia obtained from renewable energy sources such as hydropower, solar power, wind power, or carbon-based renewable energy sources, such as synthetic natural gas (SNG) [

3,

4] and biomethane produced from renewable sources

Table 1.

Despite the rapid development of zero-carbon fuels like green hydrogen and ammonia, H

2 and NH

3 still face significant barriers to meeting current and projected energy needs and reducing dependence on fossil fuels. For comparison, global green hydrogen production in 2023 was approximately 31 million tons [

13], meeting only 2.3% of the total industrial energy demand of 166 EJ [

5]. The scale of hydrogen and ammonia production and the inadequacy of the infrastructure mean that its use as a primary energy source is limited for the time being, both in the industrial and transport sectors. Moreover, lower-carbon products are characterized by up to 34% higher average investment costs than carbon-based counterparts and are still not economically viable [

14]. There is a significant gap between the vision of sustainable energy and its realisation; thus, effective transitional solutions are needed. Considerable challenges exist in achieving fuel diversification by decarbonising technological processes to ensure sustainable production while reducing costs.

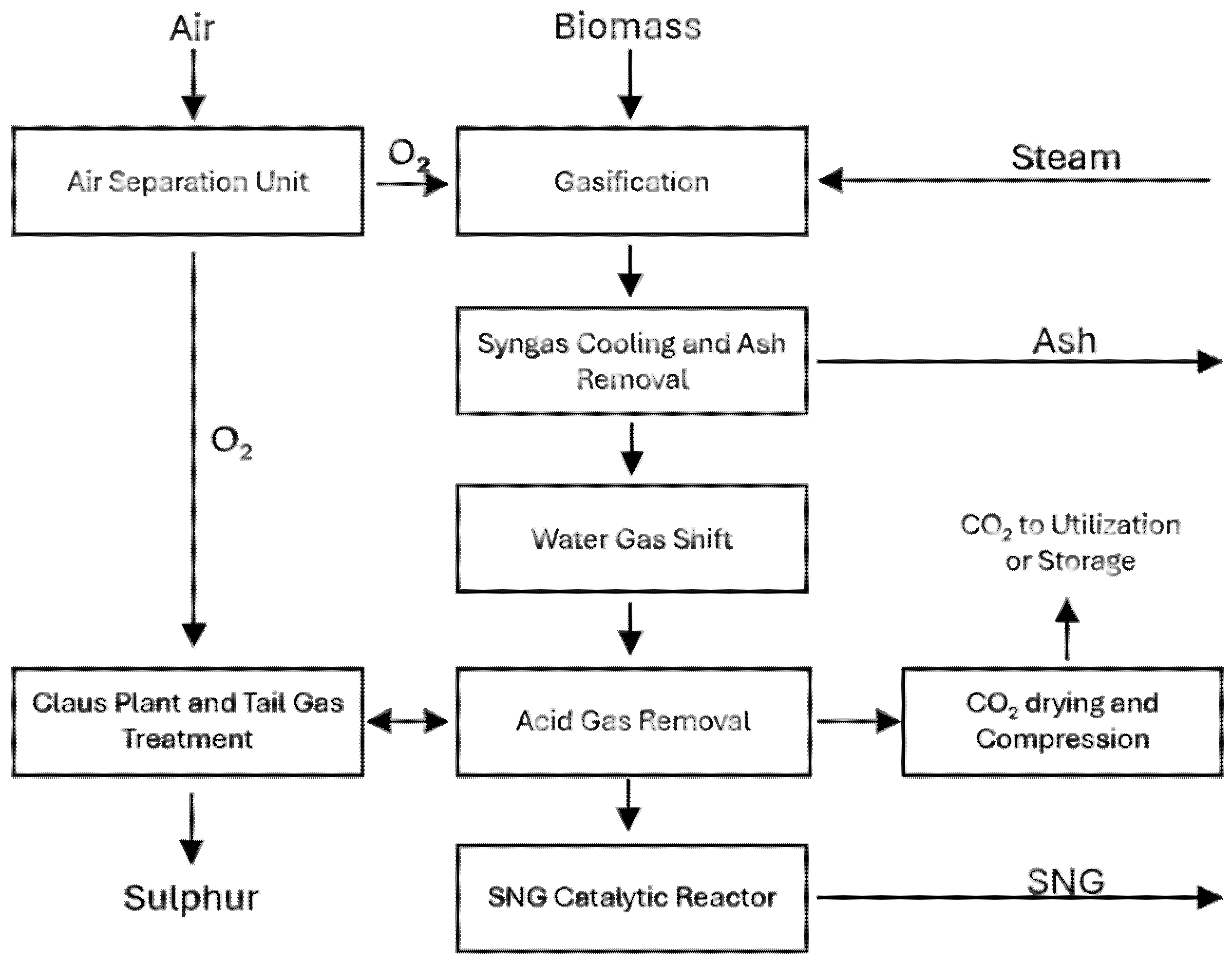

Synthetic natural gas (SNG) and biomethane are emerging intermediate energy sources that can help alleviate supply gaps in fossil fuels, hydrogen, and ammonia. SNG and biomethane, regarded as lower-carbon fuels, are produced from biomass. SNG is produced through a thermochemical process called gasification, in which biogenic residues and wastes are converted into synthetic gas (syngas). Syngas primarily consists of H2, CO, and CO2. An additional process called catalytic water–gas shift conversion is applied to upgrade syngas into synthetic biogas.

In contrast, biomethane is produced via anaerobic digestion. During the biodegradation of renewable raw materials and organic waste in oxygen-free conditions, a gas mixture consisting of 55–70% methane, 35–40% carbon dioxide, and trace amounts of N

2, H

2, O

2, H

2S, and water vapour known as biogas is produced [

15]. Biogas is then upgraded into biomethane through further processing, including cooling, drying, and purification. Both alternatives generally have a high calorific value, a consistent composition, and other desirable characteristics, such as low concentrations of impurities, water vapour, hydrogen sulphide, ammonia, etc. SNG and biomethane can be easily integrated into existing pipeline systems and used in industry, power generation, and transport, ensuring a smooth transition to fully renewable energy sources. The SNG and biomethane stream can be utilised in applications currently powered by natural gas without issue, as its volumetric composition and thermal characteristics (such as LHV and wobble index) are equivalent to those of natural gas [

4].

Natural gas is a hydrocarbon gas primarily composed of methane, with smaller amounts of other hydrocarbons, such as ethane, propane, and butane. It may also contain traces of non-hydrocarbon gases like carbon dioxide, nitrogen, and helium. In Lithuania, natural gas is one of the most-used fuels, ranking third (17.3%) in fuels used for primary energy consumption in 2023 [

16]. Because of its high calorific value, natural gas is considered a cleaner-burning fossil fuel, with CO

2 emissions of 515 kg/MWh of electricity produced, compared with 1020 kg/MWh for coal [

17]. Its versatility and wide availability make it suitable for various industrial processes in production, power generation, and heating. It covers 27.2% of the total energy demand in Lithuanian industry as a primary fuel [

16].

In recent years, there has been a notable increase in the number of research articles focusing on techno-economic and life-cycle analysis (LCA) of synthetic natural gas and biomethane, as well as their integration with carbon capture, utilisation, and storage (CCUS) technologies. In a study conducted by Cormos et al., the authors explored various aspects of SNG production from woody biomass, including process modelling and simulation, model validation, mass and energy-balance assessments, and LCA calculations for a 500 MW

th plant with a 60% CO

2-capture rate [

4]. The study concluded that integrating CO

2 removal into biomass gasification could yield negative carbon emissions of approximately 457 kg/MWh. However, the process costs remain higher than current EU natural gas prices, being estimated at around 53 EUR/MWh compared to Lithuania’s prevailing 44–45 EUR/MWh range [

18]. A techno-economic assessment of biomethane production was also conducted by Padi et al. [

3]. That study investigates the feasibility of biomethane production from cattle slurry and grass silage through an anaerobic process. The production cost was close to 72 EUR/MWh, with potential for distribution into the natural gas grid. The authors suggests that the recent surge in energy prices due to geopolitical factors could enhance the viability of distributed cattle-slurry–grass-silage biomethane systems (DCSGSB systems), as the natural gas market price directly influences the demand for such installations. Authors also emphasises that governmental subsidies that support the widespread adoption of these technologies remain crucial.

The future price range is challenging to predict, given the geopolitical factors. The economic feasibility and limited resources make future use of fossil fuels unfavourable. Alternative fuels, however, have various advantages and disadvantages across different dimensions. Natural gas derived from biomass is the most promising renewable energy source today. The reasons are its comparably high heating value and its compatibility with existing distribution networks and infrastructure like distribution pipelines and auxiliary equipment. Artificially produced natural gas is cleaner, more diverse, and strategically independent, making it a significantly superior fuel option.

Determining whether methane produced through anaerobic and thermochemical processes can be cost-competitive with natural gas remains essential. To address this question, a comprehensive analysis of the current industrial energy landscape, biomass potential, and techno-economic factors is required. The insights gained could inform future strategies for integrating renewable energy into energy-intensive sectors. While previous studies have primarily focused on the techno-economic and environmental performance of large-scale renewable gas production, this study uniquely evaluates the sector-specific potential and economic viability of synthetic natural gas (SNG) and biomethane as transitional fuels within Lithuania’s most energy-intensive industries. By dynamically assessing break-even conditions under real market scenarios and directly comparing these pathways with scenarios in which hydrogen is used, our analysis provides actionable insights for the practical deployment of lower-carbon gases during the critical transition to a low-carbon energy system.

3. Energy Consumption in Industry

Transitioning from conventional fuels to renewable energy sources is crucial to achieving the European Union’s climate-neutrality targets. Replacing natural gas with alternative gaseous fuels that do not contain carbon, such as hydrogen, will require significant financial resources and time to consolidate these resources and build the necessary infrastructure. In contrast, biomethane and synthetic natural gas are two methane-based renewable fuels that can meet industry demand and can be supplied through the existing natural-gas infrastructure to reduce greenhouse gas (GHG) emissions during the transition period.

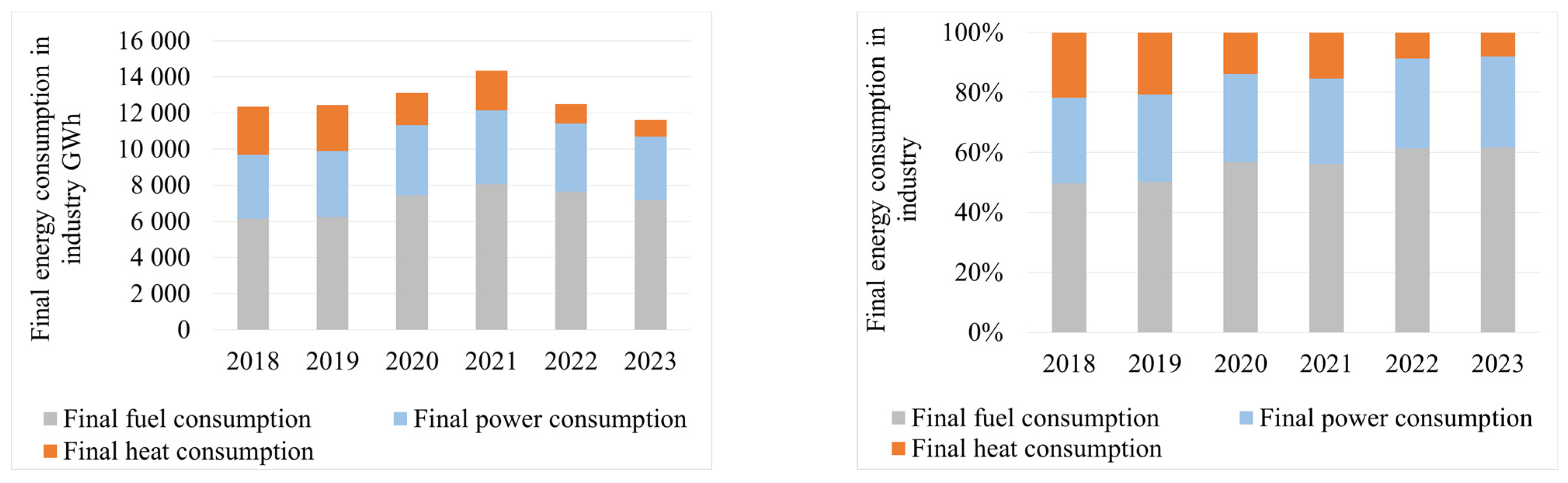

The Lithuanian industry’s final energy demand peaked in 2021, with a total final energy consumption of 1436 GWh in technological processes. Final fuel consumption in the industry, on average, accounts for around 50% of total energy consumption and reached the 60% mark in 2022 and 2023. Changes in the energy market have led to a slight decrease in heat consumption by businesses, with this figure reaching 2679 GW in 2018 and only 925 GWh in 2023 [

27]. This change in the final energy balance reflects the renewal of companies’ energy installations, which involved replacing on-site electricity and heat-generation units (

Figure 5).

Natural gas, firewood, wood residues for fuel, and other bituminous coal dominate final fuel consumption in the industry [

27]. The industry’s most intensively used fuels have declined slightly by a few percentage points each year, falling by 13% in 2023 compared to 2018. The use of wood residues for fuels increased by 3.4% in 2023 compared to 2018; natural gas decreased by 6.6% in the same time period; and other bituminous coal showed the most significant decrease: 49.9% (

Figure 6a).

The expenses associated with other fuels have increased steadily by a few percentage points each year and were 6.3% higher in 2023 than in 2018. Liquefied petroleum gas showed a significant (58%) increase between 2022 and 2023. Industrial companies looking for an alternative that is equivalent in quality to natural gas have turned to liquefied petroleum gas (

Figure 6b). There has been an increase in the cost of road-transport diesel in recent years, with this fuel costing 14.2% more in 2023 compared to the previous year.

The branches of the economy of the Republic of Lithuania are classified according to the Economic Activity Classification (hereinafter referred to as “EAC”) [

21]. The CESE is subdivided into up to 99 items [

28]. The primary energy-intensive industries stand out for their final energy consumption [

19]: food, beverages, and tobacco production accounted for 27%; other non-metallic mineral production accounted for 26%; chemicals and chemical production accounted for 22%; cement, lime, and plaster production accounted for 19%; paper and paper production accounted for 6% of total fuel consumption in the industry in 2022. According to the data provided by Statistics Lithuanian in 2022 on the final consumption of fuel, electricity, and heat in technological processes, three industries stand out:

production of food products, beverages, and tobacco products consumed 1460 GWh of final energy, of which 63% was used for fuel, 33% was used for electricity, and 4% was used for heat;

production of chemicals and chemical products consumed 1194 GWh of final energy, of which 49% was used for fuel, 24% was used for electricity, and 28% was used for heat;

manufacture of wood and wood and cork products consumed 734 GWh of final energy, of which 62% was used for fuel, 31% was used for electricity, and 7% was used for heat.

Energy types such as electricity are reflected in the statistics only in purchases from energy suppliers. Still, the electricity generated by the company’s PV power plants for technological needs has not yet been separately identified. The heat consumed in the industry is predominantly generated through fuel conversion, with only a minor portion being externally sourced, except in the chemical industry. Fuel diversification from standard natural gas to SNG and biomethane will reduce the need for fossil fuels and enable more efficient utilization of primary energy through by-unit CHP systems. In the chemical and food industries, natural gas accounts for 80% of the fuel balance; in the beverages and tobacco industries, natural gas accounts 76% of the fuel balance. Wood waste accounted for 87% of the fuel balance in the wood and wood-products industry in 2022. Fuel diversification would reduce fuel demand by enabling more efficient use of primary energy sources.

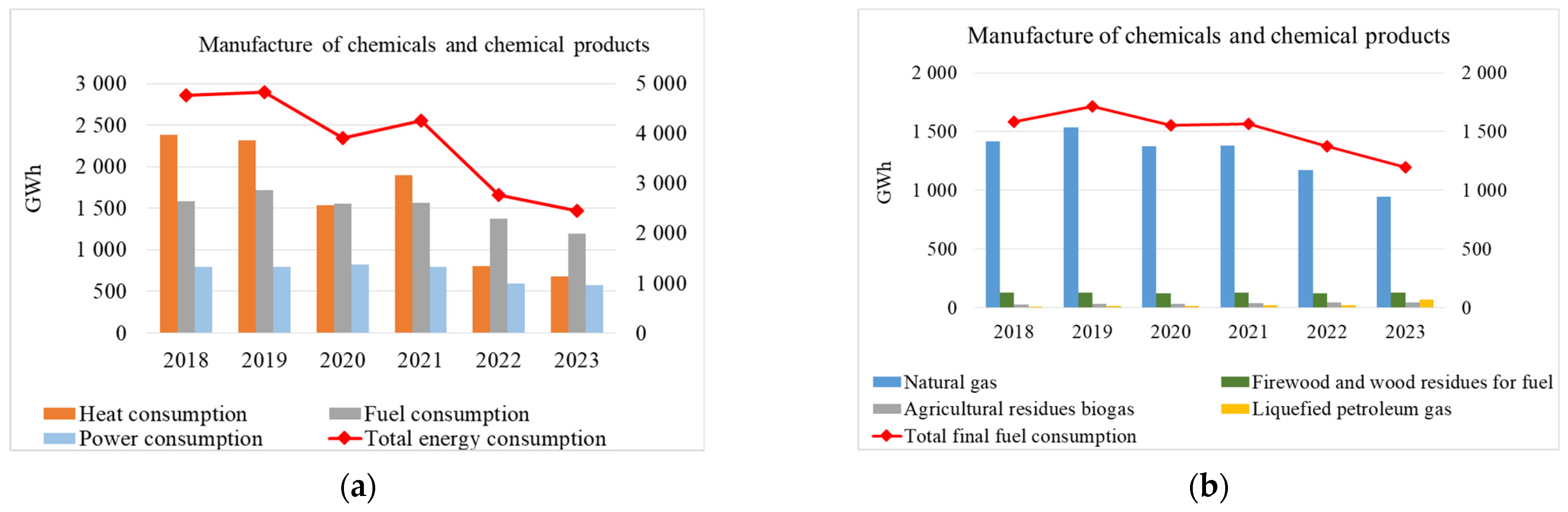

The chemical industry uses all three types of energy: fuel, heat, and electricity. Final energy consumption in the chemical industry decreased significantly between 2018 and 2023. Final energy consumption peaked in 2019, at 4833 GWh, while the final fuel consumption was only 1714 GWh (

Figure 7a).

Final energy consumption in industry in 2023 was down by 49% compared to the peak, and final fuel consumption in the industry was down 30%. In final fuel consumption, wood fuel consumption remained constant between 2018 and 2023, while natural gas consumption decreased by as much as 38% compared to the peak in 2019. The significant increase in LPG consumption contrasts with the change in natural-gas consumption, with a noticeable increase in 2023 as companies diversified their fuel mix and switched to LPG to stabilize production costs per unit of output. There was a 3.5-fold increase in 2023 compared to 2022, to 71.1 GWh from 20.3 GWh. Natural gas consumption in the chemical industry is declining by a few percentage points each year but will still reach 80% in 2022 (

Figure 7b). Energy consumption in the chemical and chemical products industry in 2022 averaged 19.9% in the EU and 25.2% in Lithuania of the total energy consumption in the industrial sector. The chemical industry uses mainly fossil fuels, so as much as a fifth of the energy consumption in this industry represents an opportunity for decarbonisation in this sector [

29].

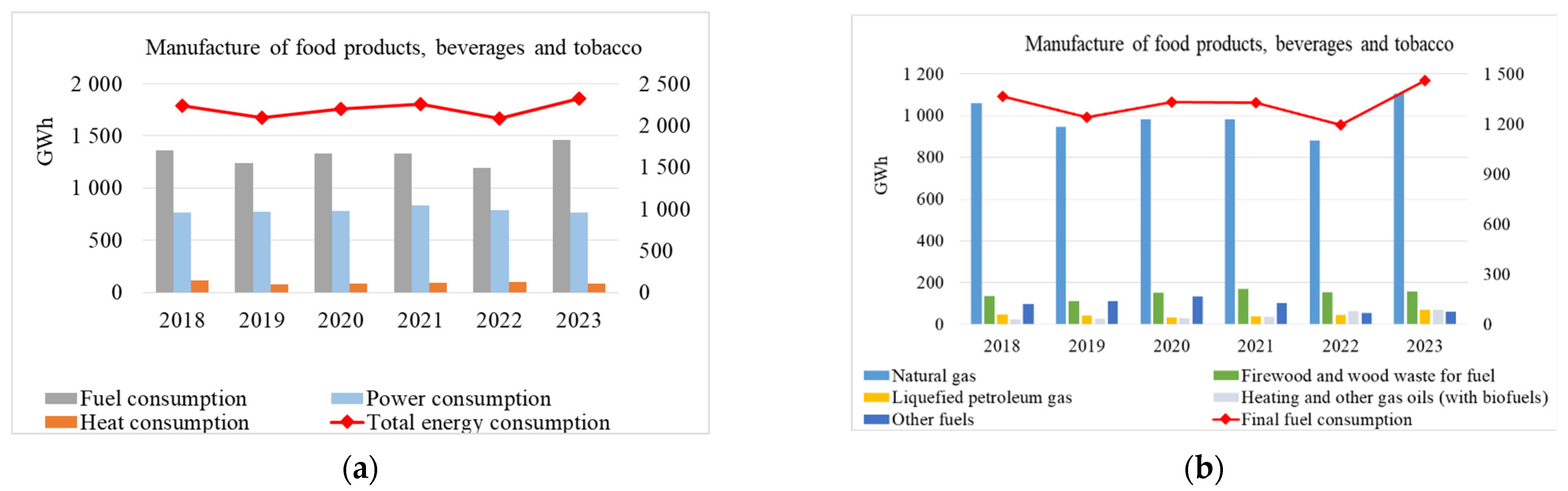

The food industry’s final energy consumption has evolved slightly, peaking at 2318 GWh in 2023. Final energy consumption and final fuel consumption in the food sector have evolved from year to year. Sill, compared to 2018, both final energy consumption and fuel consumption increased by 3% and 7%, respectively (

Figure 8a).

Natural gas accounts for the largest share of fuel consumption in the food, beverages, and tobacco industry, averaging 76% of the total fuel consumption. Other fuels account for only one-quarter of the food, beverages, and tobacco industry’s final fuel consumption (

Figure 8b). The energy consumption of the Lithuanian food and tobacco industry in 2022 was 19.1% of the industry’s total energy consumption, exceeding the EU average of 12.6% [

29]. Natural gas is the most-used fuel in this industry, and the industry thus offers opportunities for fuel diversification.

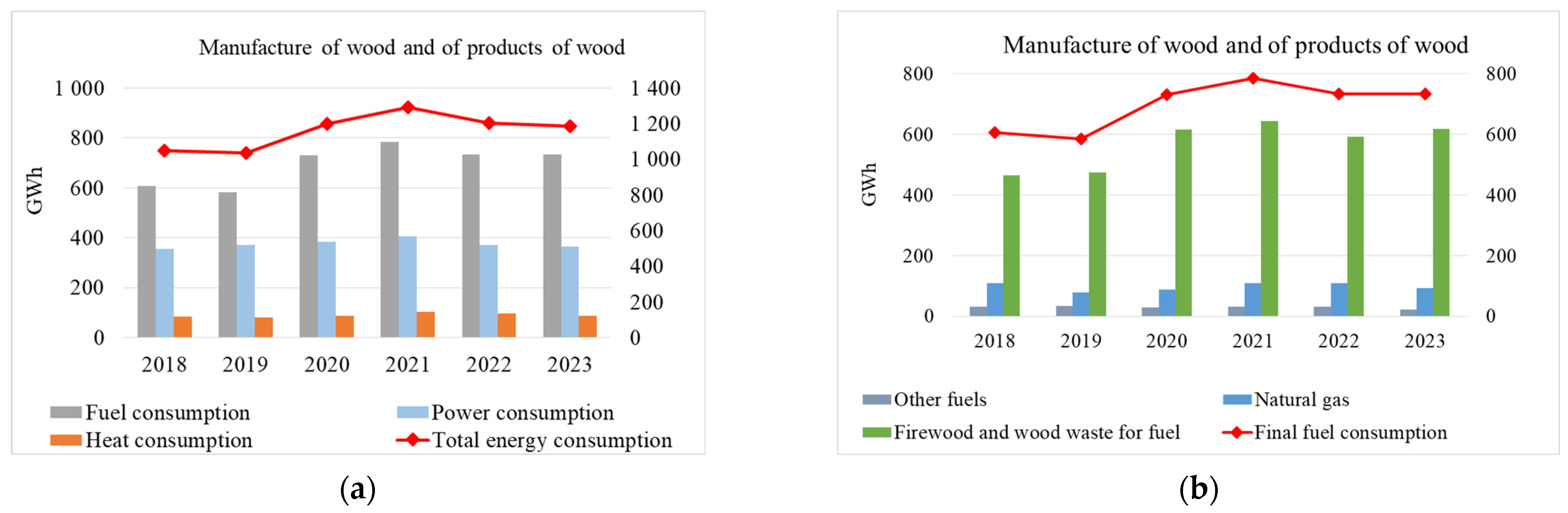

Production by the wood and wood-based-products industry has been increasing yearly, as is well illustrated by the upward trend in final energy consumption and fuel consumption. It should be noted that the COVID-19 pandemic saw reduced demand for wood and wood products, a change attributed to the slowdown in exports. In recent years, this trend in demand for wood and wood products, including furniture, paper, and its products, has continued. Exports of wood and wood products have declined by 16%. The decline in trade volumes reduced the positive trade balance from EUR 2.8 billion in 2022 to EUR 2.6 billion in 2023. The volume of exports of timber and timber-derived products dropped from EUR 5.1 billion in 2022 to EUR 4.3 billion in 2023. The share of this sector in total annual exports fell from 11.5% to 10.8% [

30]. The peak of energy and fuel consumption was 1292 GWh in 2022 and 784 GWh in 2023. The downward trend in the industry’s performance was driven by declining exports, with energy and fuel consumption decreasing by 8% and 6%, respectively, in 2022 compared to 2021 (

Figure 9).

In the wood and wood-products industry wood waste is the predominant fuel, accounting for an average of 600 GWh, or 82% of total fuel consumption; it otherwise becomes manufacturing-process waste. Natural gas made up only an average of about 14% or about 110 GWh in the last year. Other fuels, such as road-transport diesel and liquefied petroleum gas, make up only 5% of the total fuel consumption in the industry (

Figure 9b). Wood fuels account for the largest share of energy consumption in the Lithuanian wood industry, but energy costs account for as much as 10.8% of the industry’s total energy costs. In contrast, the EU average in this industry is only 4.8% of total energy costs [

29]. The fact that the energy consumption of the wood industry in Lithuania is almost twice as high as that of the wood industry in the EU shows the potential for efficiency improvements in the production process.

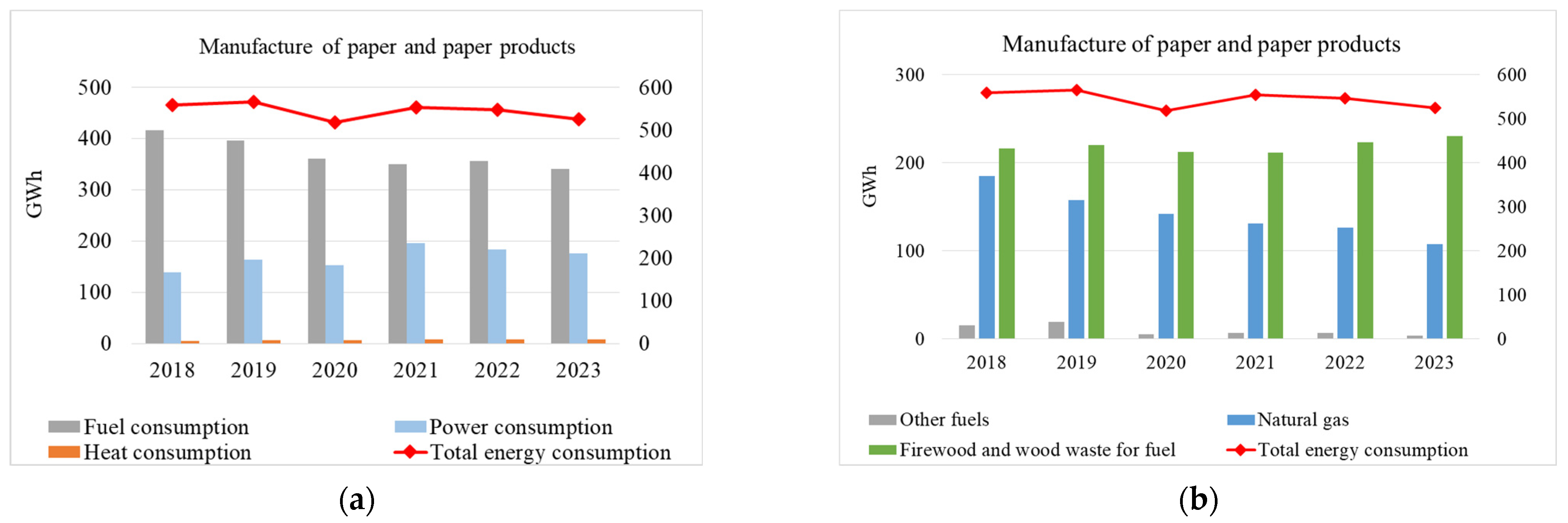

Peak final energy consumption in the paper industry was 565 GWh, reached a 2019; and the peak final fuel consumption, 416 GWh, was reached in 2018. The technology chain for the paper-production process uses three types of energy in total: fuel, electricity, and heat. A slight decrease in fuel consumption and an increase in electricity consumption can be observed in the final energy balance, for a reduction of 18% and a rise of 27%, respectively. Heat maintains a constant trend in use (

Figure 10a).

The share of renewable energy in final fuel consumption in the paper industry has significantly increased. The paper industry’s fuel and energy balance consisted of 68% wood waste fuel and 31% natural gas in 2022. Natural gas consumption decreased from 44% to 31%, while the share of wood and wood waste rose from 52% to 68% between 2018 and 2023 (

Figure 10b). The Lithuanian paper industry’s energy consumption accounted for 5.27% of its total energy consumption, compared to an EU average of 13.8% [

29]. The fact that the Lithuanian industry’s energy consumption is almost half that of the EU industry average is attributed to the narrow range of products produced.

The large share of natural gas and wood-waste fuel among all energy sources in these chosen industries opens the possibility of fuel diversification from fossil fuels to renewable fuels.

4. Biomass Potential

Lithuania and the other Baltic countries are striving to maximize the use of renewable energy to reduce energy dependence, enhance regional energy security, and complement European decarbonization plans. The market penetration of renewables reflects a positive trend in the number of producing consumers. District heating operators first tested the real-time market penetration of renewables in district heating systems operated in relatively small towns [

31]. Best practices in real-time energy-flow-management strategies are being transferred to electricity-grid operators to address the same challenges Ricardo et al. described for renewable energy sources and infrastructure development in Chile [

32]. Although it is difficult to link all challenges and their impacts in a changing downstream generation market, as in the quantile connectedness approach described by Liu et al. [

33], there are plans to expand the capacity for renewable-energy generation under stable market conditions. According to revised data from EPSO-G, the state-owned electricity transmission and exchange group, the permitted capacity for solar power plants reached 225 MW in 2021 and 1978 MW in 2024. The permitted capacity issued for wind power plants tripled from 623 MW in 2021 to 1741 MW in 2024 [

34]. However, biomass resources, which are renewed every year, are still underexploited. Lithuania’s most widely used biomass resources are wood, industrial wood waste, and logging residues. A major part of the biomass in Lithuania is used by district heating systems, which are widespread in Northern and Eastern Europe [

35]. Biomass stocks increased due to the increased total volume of accumulated stems. Processed data from the State Forest Enterprise show that the volume of stems accumulated in private and state forests steadily grew by 1.7% to 549.9 million m

3 between 2011 and 2020 [

36]. The total wood-fuel potential was around 367.6 million m

3 in 2020 (

Table 9). White alders and biscuits are challenging to consider as logging residues, as biscuits are left behind for ecological reasons and white alders are treated as forests. Due to economic inexpediency, stumps and roots are not yet used as fuel. Households use firewood, while fine-quality wood is allocated to the paper and furniture industry. The remaining logging residues ranged from 78.3 million m

3 in 2011 to 91.2 million m

3 in 2020.

The potential for logging residues is estimated from the total annual flow of wood-fuel feedstock from annual logging operations. The volume of logging residues increased by 22% between 2011 and 2020. Around 1.1 million m

3 of logging residues are generated annually, with an energy value of 2.28 TWh [

36].

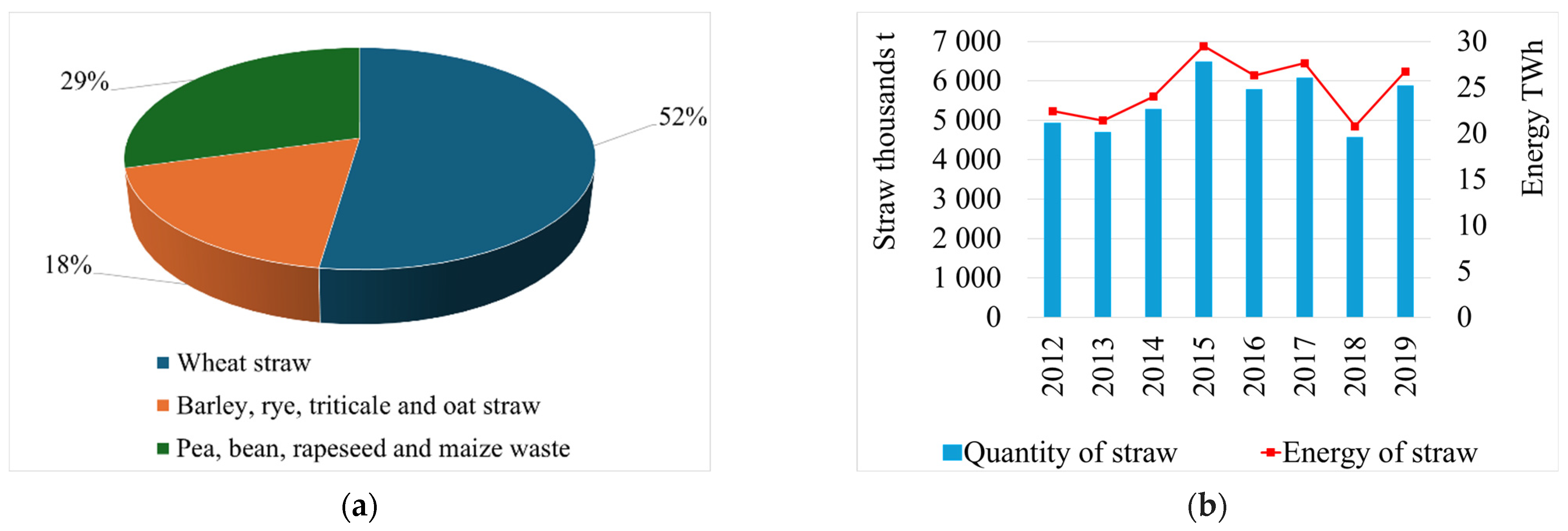

The most significant form of waste in agriculture is straw from crop production. The yield of straw is related to the yield of cereals. Research carried out by the research team of Tilvikienė et al. from the Lithuanian Centre for Agrarian and Forestry Sciences (LAMMC) shows that the total amount of straw in cereal fields in Lithuania in 2019 was about 5.88 million tonnes. Wheat straw accounted for 52%; rye, triticale, and oat straw accounted for 18%; and pea, bean, rapeseed, and maize waste accounted for 29% (

Figure 11a).

Fields generate up to 5 million tonnes of total crop-waste straw each year, with a theoretical potential of up to 24.8 TWh (

Figure 11b).

Lignin is a waste from discontinued industrial yeast-production process. Expert estimates put the trade volume of lignin blended with wood biomass at up to 30,000 tonnes per year, and the estimated potential is 0.5 million tonnes or 2.6 TWh of energy. Lignin has been traded on the biofuel exchange only since 2019. These biomass resources are examined in greater detail below, and a techno-economic assessment is included here.

4.1. Wood and Wood-Residues Potential in Lithuania

In 2022, firewood, forest logging, and agricultural residues accounted for 70.7% of Lithuania’s renewable energy structure. In power plants and boiler houses, biofuels were converted into 67.2% heat energy and 17.1% electricity [

27]. The National Forest Inventory data cover the period since 2003, when a complete inventory of the whole country was carried out using the sampling method. The plot-based forest inventory results in stand volumes that are 10–15% lower, which has led to a shift towards using the National Forest Inventory data. As a result, a sharp increase in timber volumes was observed between 1998 and 2003 [

27]. Mature-stands volume has increased from 113 million m

3 to 162 million m

3 since 2003, and the area has increased from 375 thousand ha to 465 thousand ha since 2003. According to the National Forest Inventory, the total volume of wood has increased from 453.4 million m

3 to 566.7 million m

3 since 2003. The most significant volume of timber accumulated in pine forests—232 million m

3. Since 2003, the volume of wood in these stands has increased by 52 million m

3. During this time, the volume of spruce forests increased from 75.8 million m

3 to 102.2 million m

3 [

27].

Statistics Lithuania is surveying forestry companies and farms to assess the volume of logging residues and wood waste generated in the sector. The data show that more logging residues than wood waste are generated. The amount of logging fell by as much as 60%, and the amount of wood waste fell by up to 72.5% between 2014 and 2022 [

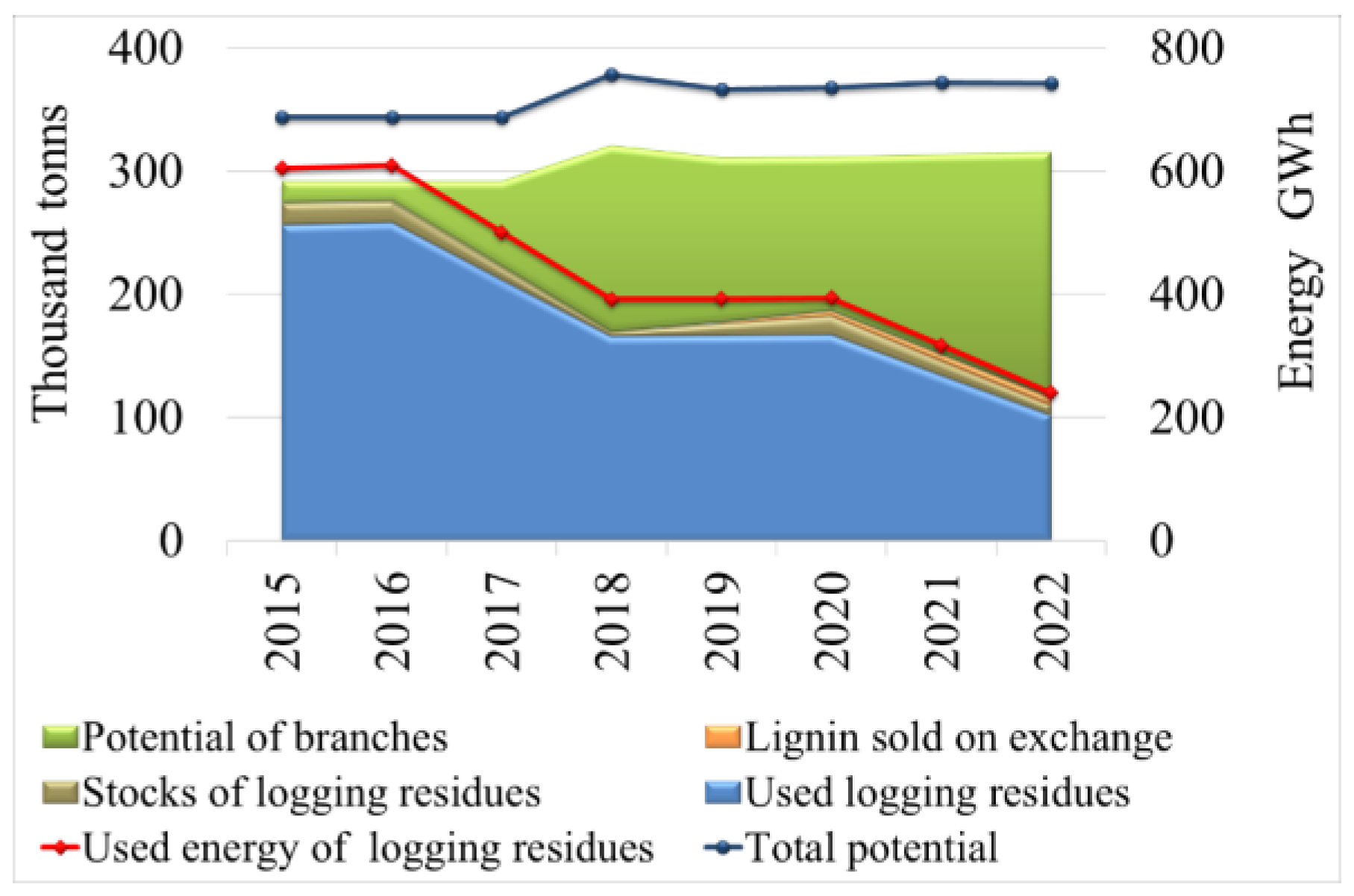

27]. Logging residues are burned, used for consumption, disposed of on-farm, and sold to consumers. There has been a significant decrease in incineration; use for own needs has practically disappeared; and the amount of residues sold to consumers has halved (

Figure 12a).

The downward trend in the use of logging residues reflects the associated import of cheaper timber from Belarus to the Lithuanian market. Imports of wood fuel from Belarus to Lithuania increased in 2016, reaching 401.2 thousand tons, and peaked in 2019 at 1053.3 thousand tons [

36]. The value of wood-fuel imports increased from EUR 10.5 million to EUR 46.4 million in 2019. As logging residues could not compete with cheap timber from a neighbouring country, the volume of logging-residue preparation decreased (

Figure 12b). The high volumes of wood-fuel imports are confirmed by statistics showing trade volumes between 2014 and 2022 ranging in value from USD 16 million to USD 51.9 million [

37].

The international biomass exchange “Baltpool” was established in 2012 to standardize biomass auctions in the Baltic Sea Region. Subsequently, it expanded its activities to organize heat auctions and administer public-interest service funds for the electricity sector [

38]. In Lithuania, representatives of “Baltpool” have proposed an amendment to the Law on Heat [

39]. The selected SM3D woodchip production specifies a moisture content of between 35% and 55%, an ash content of less than 5%, a fractional size of 3.16–63 mm, a small-particles fraction of less than 20%, a chlorine content of less than 0.02%. It is made from short-rotation plantations and logging residues. Wood-chip production is divided into six categories that differ in terms of moisture content, ash content, and fineness. The specifications for woodchip production are given in

Table 10.

SM3D is a biofuel made from timber trunks, residues from the timber industry, unharvested trees, dried energy crops, and dried residues from harvesting residues from forestry. Woodchip-production trade volumes have averaged 2000 thousand tones yearly for the last five years (

Figure 13a).

The amount of energy sold is approximately 5.7 TWh annually. The most-traded product is SM2-specification woodchips, with annual sales volumes averaging up to 1300 thousand tonnes annually. The second product of interest on the market is SM3. The average sales of SM3 were half those of SM2 in 2022, but sales volumes in recent years have been as high as 700 thousand tonnes per year [

38].

The logging residues consumed were declared and are reported in the statistics. Some of this biomass is left in the forest due to ecological requirements; some is laid in clearings; and some is left in the forest due to the excessive cost of the product. The technical potential of logging residues from mature-forest harvesting will be assessed. The average volume of mature tree branches is around 15% of the volume of the tree, according to the State Forest Service [

10]. It is assumed that only 7% of the branches can be technically extracted from the forest for subsequent use. Mature forests are harvested annually at an average rate of about 6.5 million m

3 of green trees, according to annual reports submitted to the State Forest Service under the supervision of the Ministry of Environment [

40,

41,

42].

The lignin accumulated in Lithuania is a by-product of the previous yeast production. Yeast production has ceased, and up to 0.5 million tonnes of lignin is stored. The lignin biofuel blend has a high moisture content of ~43%, a calorific value of ~19 GJ/t, an ash yield of ~8%, and a sulphur content of ~0.2% [

43]. The lignin biofuel blend is sold mainly in Lithuania, both directly to customers and via the biofuel exchange. Lignin has been traded on the biofuel exchange only since 2019 (

Figure 13b). Market participants have shown interest in lignin, and in 2023, trading volumes increased by as much as 60% compared to the previous year, reaching a trading volume of 16,000 tonnes/year, corresponding to as much as 38.6 GWh of energy [

38]. The increase in trade volume can be attributed to the increased demand due to the SURE scheme certificate awarded following the certification audit carried out at the company in February 2023 [

44].

The total amount of logging waste suitable for producing woodchip products is around 300 thousand tonnes annually. Forestry companies and other managers consume between 258 and 102 thousand tonnes of logging residues annually. The free technical potential left on the logging sites is between 16 and 165 thousand tonnes per year, depending on the year. This amount ranges from 83 MWh to 399 MWh per year, depending on the year (

Figure 14).

The potential of logging residues is also underexploited in Sweden. Swedish researchers estimated the ecological potential of the industries and arrived at a slightly higher potential of 21,120 GWh in 2020 [

45]. At the same time, the potential of the branches used in 2020 was only 7384 GWh. As in Lithuania, the potential of logging residues in Sweden is not fully exploited for energy needs. The free-economic-zone policy formulated by Minzhe Du’s team in the study is an effective liberalisation policy that promotes energy efficiency and exploits existing potential. However, free-trade zones must consider sustainable development that does not harm the environment [

2].

4.2. Agricultural Residues in Lithuania

In Lithuania, the area of land used for agriculture has declined slightly over the last five years, while the area of arable land has been increasing, accounting for 35% of Lithuania’s total land area (

Table 11).

The greatest amount of agricultural residues is generated by crop production. The amount of straw is related to the yield of cereals. Its yield depends on the type of cereal crop, the variety, climatic conditions, etc. Bužinskienė et al. has described in a paper a methodology for assessing primary agricultural residues [

46]. The researcher classified straw as direct agricultural waste and presented a method for evaluating the straw produced. The methodology considers the amount of straw generated based on the yield and type of cereals and rapeseed crops. Statistics Lithuania provides annual data on winter and summer cereal and rapeseed crop yields via interactive access. The production of grains in Lithuania has increased significantly in recent years [

27].

Statistics Lithuania generates data on the straw volumes generated every second year through a survey on straw volumes collected in agriculture; these data are available via interactive access. Agricultural companies, large farmers, and family farms declare the quantities of straw collected [

27]. The amounts reported of straw collected include straw from winter cereals (wheat, triticale, rye, barley), spring cereals (wheat, barley, triticale, rye), and winter and spring rapeseed crops. A coefficient can be used to represent the ratio of product to residue yield, allowing the estimation of the amount of straw generated by the harvested crop. These coefficients are presented by Bužinskienė et al. and Scarlat et al. in their papers [

46,

47].

The average quantity of straw left on the fields is 2263 thousand tonnes per year. Wheat straw was the most abundant, at 1533 thousand tonnes in 2015 and 1569 thousand tonnes in 2022, while rye straw was the least, at 37 thousand tonnes in 2022. Wheat-straw production was down by as much as 64% in 2022 compared to 2015, at only 86 thousand tonnes. The energy potential of straw left in the field is more than 10 thousand GWh annually, with a low of 7156 GWh in 2018 and a high of 12,785 GWh in 2022 (

Table 12).

4.3. Fluctuation of Feedstocks Price

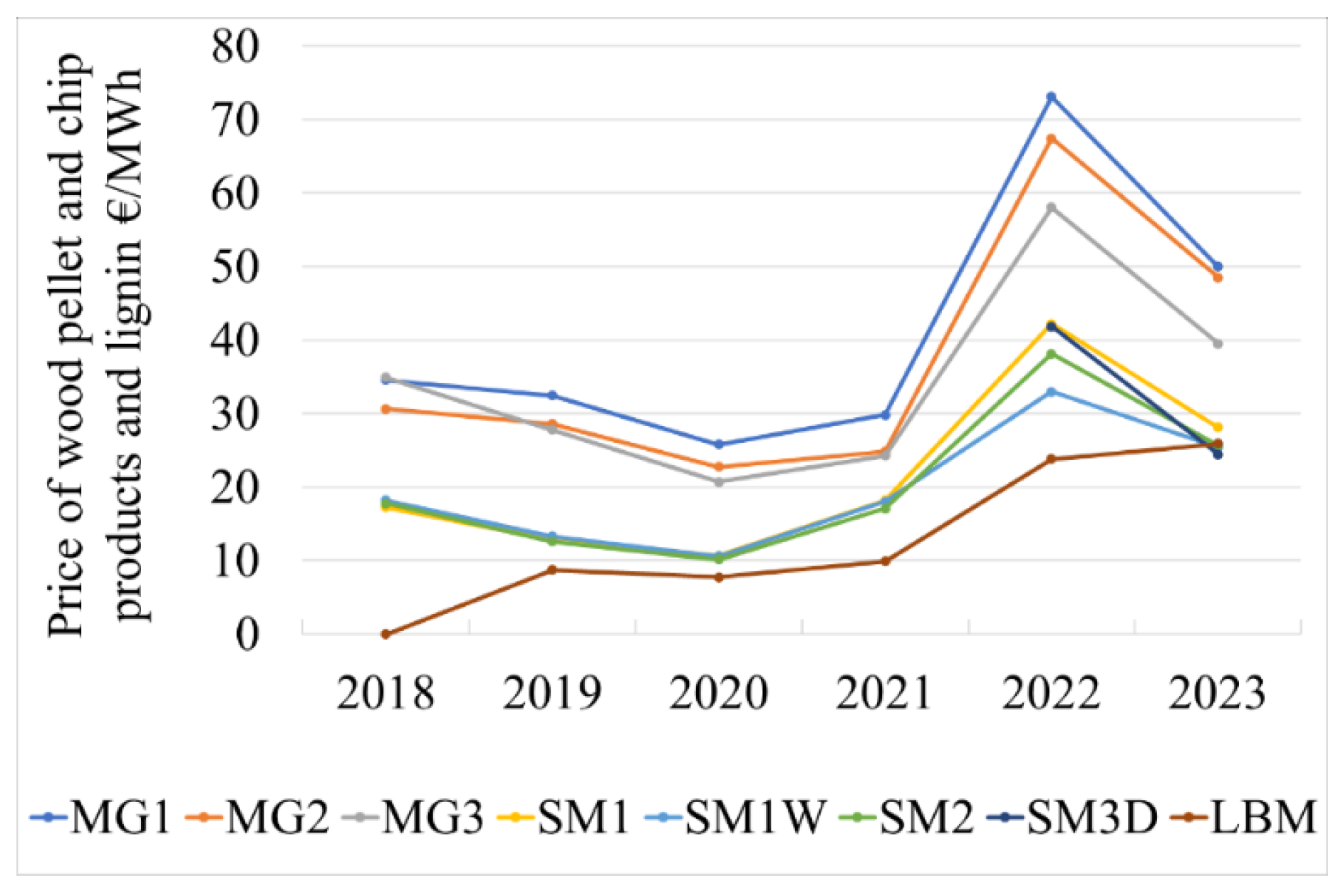

Trends in the market prices of energy resources and raw materials influence the penetration of alternative fuels in the energy market and their competitiveness. The competitiveness of synthetic natural gas and biomethane with natural gas is determined by the price of biomass feedstock, which fluctuates in line with prices of natural gas and other fuels. The annual analysis of biofuel prices shows a consistent increase in the price of wood pellets, woodchips, and lignin and biomass blends. In 2023, the prices of these products exhibited an upward trend. Specifically, wood-pellet production costs rose by up to 63% compared to the same period in the previous year, while woodchip-production costs increased by up to 55%. Conversely, biofuel prices showed a declining trend in 2023. However, over the broader period from 2018 to 2023, biofuel prices experienced an average increase of 47% (

Figure 15).

The price of the lignin and biomass blend showed little change between 2019 and the end of 2021 due to stable demand, and the price was kept between 9 EUR/MWh and 11 EUR/MWh. As market participants have shown interest in this type of biofuel, the price has shown an upward trend, from 13 EUR/MWh at the beginning of 2023 to a peak of 32 EUR/MWh in December 2022 [

38]. This price increase is linked to the general trend of rising energy prices in Lithuania and abroad. The prices of woodchip products and lignin blends fluctuate yearly for the same summer or winter season. The price of all wood products increased annually during the summer season, rising by an average of 27% in 2021 compared to the same period in the previous year. In 2022, due to the geopolitical upheaval resulting from the reduction in the supply of natural gas on the spot market, the prices of other energy resources also increased by as much as an average of 65% compared to the previous year. In the corresponding period in 2023, however, there was a 37% average decrease in the price of biomass products. Looking at the price dynamics of woodchip products from 2020 to 2023, one can see an average price increase of 60% (

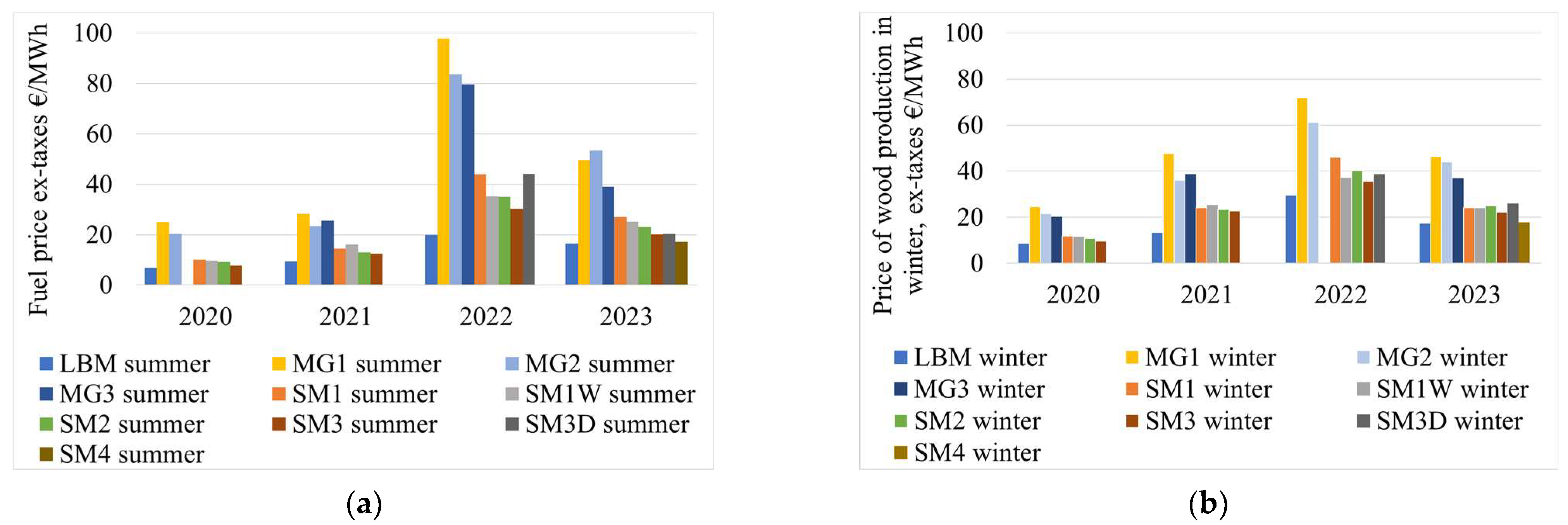

Figure 16).

The average price dynamics for woodchip products up to 2021 have followed the market trend of lower prices in summer and higher prices in winter (

Figure 16a). The average price of these products was 9 EUR/MWh in the summer season, 14 EUR/MWh in the winter season in 2020, and 14 EUR/MWh and 26 EUR/MWh in 2021. The changing geopolitical situation and decreased volumes of natural gas futures led to adjustments in biomass prices, resulting in a levelling or even an increase in the average summer vs. winter prices in 2022 and 2023. Accordingly, the average prices of wood products were 47 EUR/MWh in summer and 36 EUR/MWh in winter in 2022; these prices were 29 EUR/MWh and 28 EUR/MWh, respectively, in 2023 (

Figure 16b).

Cereal straw is the largest source of agricultural waste in Lithuania. Trends in straw fuel prices have evolved over the last five years. The price of straw fuel has been decreasing on average by 50% in May and June, except in 2023, and increasing by around 40% from July onwards, maintaining a similar price trend as in 2019–2021. A decrease in straw prices is observed from October to November 2021. Significant price increases can be observed from August onwards, with prices increasing by as much as 50% from July 2023 [

48].