3.2.1. Electricity Demand Function Model of Classified Users

In order to explore the correlation between the variables in

Table 2 and the electricity demands of classified users, we take the electricity consumption as the dependent variable and the influencing factors of electricity consumption as the independent variables. In the first step, we first create scatter plots between the dependent variable and each independent variable. It is found that there is no obvious curvilinear relationship between the average household size and residential electricity consumption, as well as between the commercial electricity price and commercial electricity consumption. However, there is a linear relationship between other variables and the electricity consumption of users. In the second step, we conduct a correlation analysis between the dependent variable and each independent variable, and the results are shown in

Table 3. As can be seen from

Table 3, per capita electricity consumption (

QRes) is highly correlated with the population size, average household size (

NHom), household electricity price of commercial (

PBus), and per capita disposable income (

IRes). The per capita electricity consumption of commercial electricity consumption (

QBus) is highly correlated with the commercial electricity price (

PBus) and the output value of the commercial industry (

GDPBus). The per capita electricity consumption of general industrial electricity consumption (

QInd) is highly correlated with the price of non-general industries (

PInd) and the output value of non-general industries (

GDPInd).

In the third step, according to the curve fit result, the categorized user electricity demand function model is constructed as follows:

In Formulas (1)–(3), , , and denote the per capita electricity consumption of residents, commercial electricity consumption, and general industrial electricity consumption; , , and are the household electricity prices of residential, commercial, and non-general–general industrial users, respectively; is the disposable income of the residents; is the average population size of the household; and are the commercial output value and the general (non-general) industrial output value, respectively; is a constant; is the elasticity coefficient; and is the random error term, in which denotes the three categories of residential, commercial, and general industry users. In order to avoid the issue of “pseudo-regression” and ascertain whether there is a causal and long-term stable relationship between the aforementioned variables and the corresponding dependent variables, the Cointegration and Granger causality tests must be performed.

3.2.2. The Improved Tiered Electricity Pricing Scheme Based on Precise Handling of Cross-Subsidies

This paper considers the careful management of cross-subsidies and green development as joint goals for the creation of a tiered electricity pricing structure, which contains three objectives: First, screening the target group and determining the accuracy of the subsidy targets based on the affordability of residents and the fairness of subsidies principle. Second, in accordance with the demands of green development and emission reduction targets, the degree of cross-subsidies for residents of various income levels or the extent of their reduction should be determined using the cost pricing principle in order to achieve a fine match between cross-subsidy handling policies and subsidy targets. Third, the effects of emission reduction should be measured in order to achieve the precise effects of promoting green consumption.

The analysis of the residential electricity demand function model shows that the primary driver of the demand growth is the rise in resident income.

Table 2 shows that in 2016, residents’ disposable income was 3.3 times higher than that of 2006, and per capita electricity consumption was 2.5 times higher than that of 2006. Moreover, residents’ affordability for the elimination or reduction of the cross-subsidy of electricity prices has increased significantly. There is a significant disparity in residents’ disposable income (

Table 1). High-income, upper-middle-income, middle-income, and lower-middle-income households are 10.72, 5.70, 3.72, and 2.29 times higher than low-income households, respectively.

This paper proposes the following design concept for the tiered electricity pricing improvement program (

Figure 1):

Using residents’ income as the primary parameter, Model (4) estimates the electricity consumption of various income levels based on the panel data of national or various provincial and municipal incomes (

) and the coefficient of residents’ income–demand elasticity (

). The objects of the cross-subsidy and the extent of the subsidy are then established in accordance with this estimated electricity consumption, which serves as the boundary electricity volume for each tier of the tiered electricity pricing system.

The price difference is ascertained in the second step. There are two methods that can be used. The price–demand elasticity coefficient () is used to predict the electricity savings after the tiered price difference is established based on the goal of reducing cross-subsidies. Second, the price differences that must be adjusted for each tier (typically the second and third tiers) are computed using the price–demand elasticity coefficient, and the target electricity savings for energy conservation are established in accordance with the emission reduction target.

The third step is to measure the total amount of emissions that can be reduced. Based on the electricity savings calculated by the first method, combined with the target electricity savings amount in the second method and the grid baseline emission factor, one can calculate the total amount of emissions that can be reduced. The formula is as follows:

where

is the amount of carbon emissions that can be reduced;

is the total population of residents;

represents the ratio of the number of residents subject to the

j-th tier of the electricity price to the total number of residents;

is the upper boundary electricity consumption of tiered

j;

is the upper boundary electricity consumption of tiered

j−1;

represents the variation value of the electricity price at the

j-th tier;

is the baseline electricity price of residents;

is the price–demand elasticity coefficient of residents; and

is the baseline emission factor of the power grid. Then, we can calculate the overall amount of emission reduction based on the baseline emission factor of the power grid, the projected energy-saving electricity consumption of the first method, or the energy-saving target electricity consumption of the second method.

The fourth step is the dynamic adjustment process. We can dynamically modify the price differentials and tiered electricity consumption at the end of the subsequent year or specific cycle in response to changes in relevant variables like the price elasticity, income growth, and emission reduction targets.

We used 2016 data as a base. Then we calculated the monthly average household (3.11 persons/household) and annual per capita electricity consumption for various income levels, from low to high. From low to high income levels, the data are as follows: 208 kWh/year∙person (54 kWh/month∙households), 385 kWh/year∙person (100 kWh/month∙households), 547 kWh/year∙person (142 kWh/month∙households), 744 kWh/year∙person (193 kWh/month∙households), and 1165 kWh/year∙person (302 kWh/month∙households), respectively. Of these, 20% of high-income groups consumed around 38.2% of the electricity, while 40% of upper-middle-income and high-income groups consumed 62.6%. The electricity consumption of high-income, upper-middle-income, middle-income, and lower-middle-income homes is 5.6, 3.6, 2.6, and 1.9 times higher than that of low-income households, respectively.

China has been implementing a tiered electricity pricing policy (No. 2617, [2011] of the National Development and Reform Commission) since 2004. Residential electricity is priced in three tiers, with the first tier covering 80% of residential users in each province and city and not adjusting prices. The price of each kWh should be raised by at least 5 cents in the second tier, which should cover 80% to 95% of residential users; the third tier, which covers 95% to 100% of residential users, should raise prices by roughly 0.3 CNY per kWh. Relevant scholars have determined that the current average of the first, second, and third tiers are 0–120 kWh/month·households, 120–400 kWh/month·households, and 400 kWh/month·households and above, based on the weighted average of 31 Chinese provinces and municipalities [

19]. Even 20% of high-income households (302 kWh/month) are not included in the tiered electricity price increase, according to a comparison between the model data and the current policy. Rather than designing the tiered electricity pricing policy based on the actual situation of the electricity consumption of various income levels, using the benefit coverage as the primary criterion will also result in a significant “leakage effect” of the cross-subsidy and decrease the effectiveness of income redistribution [

5,

19]. In actuality, the “rich ride on the poor” phenomenon in the current tiered electricity pricing policy is quite serious [

21], departing from the cross-subsidy tiered electricity pricing policy’s goal of the fairness and rationality of the universal service [

19,

21,

22].

In order to better achieve the equity and efficiency goals of the universal service policy, this paper considers the affordability of residents as the constraints of the tiered boundary electricity consumption and beneficiary groups, and implements a precise subsidy policy, with low-income, low-middle-income, and middle-income households as the target of the subsidy (with the number of users accounting for 60%, and the electricity consumption accounting for 37.4%), and with high-income and upper-middle-income households as the target of the cross-subsidy cancellation or reduction (with the number of users accounting for 40%, and electricity consumption accounting for 62.6%). Based on the electricity consumption of users at each income level, the first tier is set at 0–142 kWh/month·households and below; the second tier is set at 142–193 kWh/month ∙ households; and the third tier is set at 193 kWh/month∙households and above. This plan is more comprehensive than the current ladder electricity price classification, increases the electricity consumption limit of the first tier, raises the benefit coverage rate, and reflects equity; it also reduces the “leakage effect” and narrows the second-grade difference, lowers the third threshold tax, and increases the effectiveness of income redistribution [

19,

21]. In the event that further refinement is required, the electricity consumption of the tiered electricity pricing program is separated into five grades according to the measured tiered boundary electricity consumption.

3.2.3. The Mitigation Effect of Electricity Prices’ Cross-Subsidies

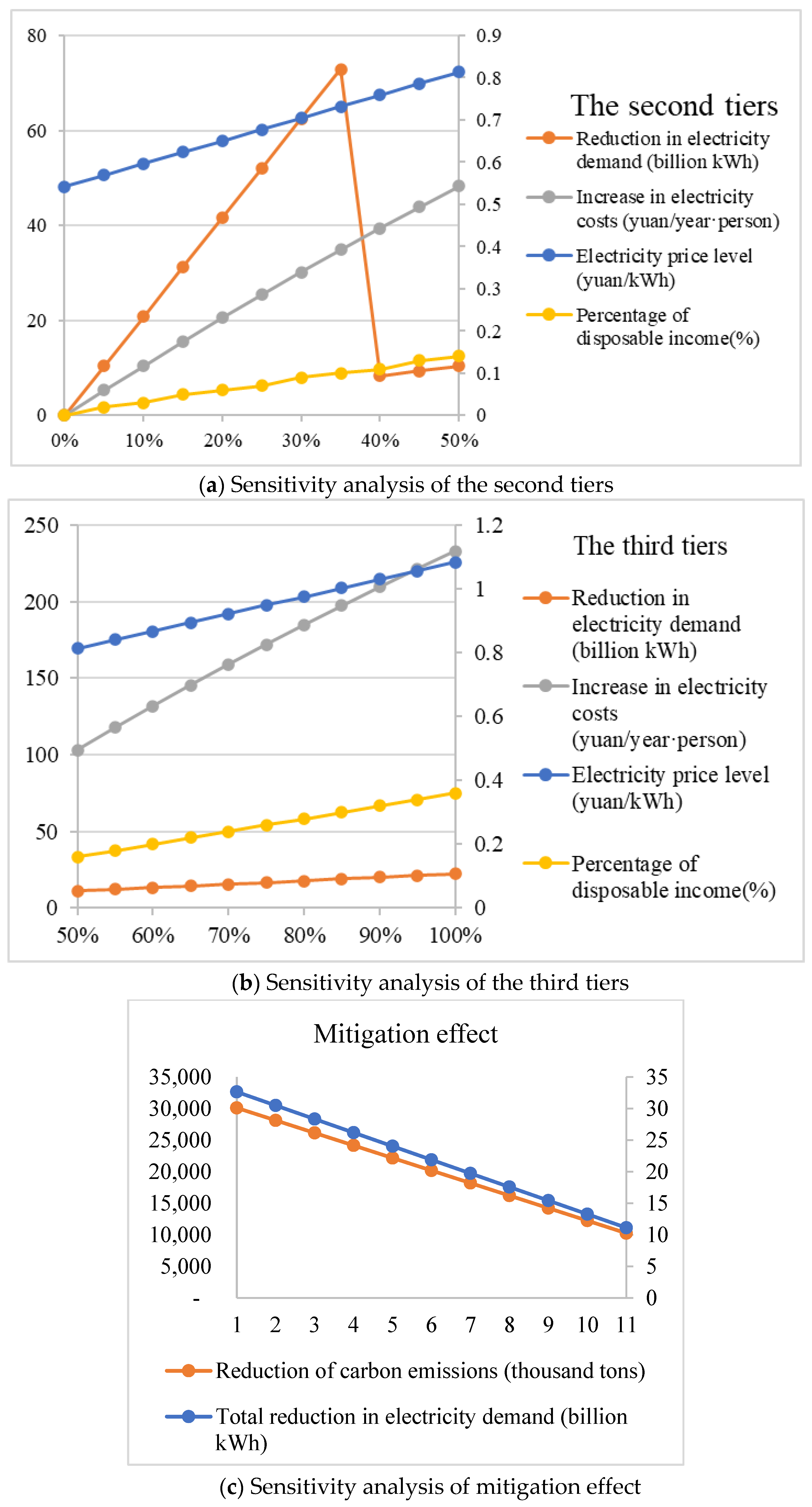

In order to further analyze the relationship between the reduction amount of carbon emissions and the degree of cross-subsidy cancellation, and to explore how much the degree of cross-subsidy cancellation should be determined under different carbon emission targets. We set the degree of cross-subsidy cancellation ESub as the independent variable and the reduction in carbon emissions as the dependent variable.

According to the internationally accepted cross-subsidy measurement model based on the price difference method, the determination of the cross-subsidy amount and the degree of cross-subsidy should satisfy the following formula:

where

and

represent the cross-subsidy amount and the degree of cross-subsidy for residential users, respectively.

represents the benchmark electricity price for residents. The benchmark electricity price for electricity consumption is the reference electricity price in the electricity market, serving as the basic standard of electricity prices, and it reflects the average production cost of electric energy.

is the actual electricity price of residents and

is the electricity consumption of residents. On this basis, the degree of the cross-subsidy of the tiered electricity pricing can be calculated, which is represented by Equation (7). It can be further introduced that

is the degree of cross-subsidy to be reduced under the policy objective, so the degree of elimination of the cross-subsidy is denoted by

, and from this, we can determine the correlation with the electricity price level

:

In addition, the residential price–demand elasticity

can be used to measure the reduction in the total electricity demand

, which means that there is a correlation between the total electricity demand reduction

and the degree of the cross-subsidy

.

On this basis, referring to the study of Liu Zimin et al. [

33], the following model was established by using

2018 software.

In model (10), is the reduction in carbon emissions due to the policy impact calculated in model (5); and , respectively, represent the electricity price levels under the second-tier and third-tier ladders determined by the policy; and , respectively, represent the total reduced electricity demand under the second-tier and third-tier ladders, both of which are affected by the price–demand elasticity of residents; and and , respectively, represent the total increased electricity bills per year under the second-tier and third-tier ladders. Through the sensitivity analysis of the impact of gradually canceling the degree of the electricity price cross-subsidy on residents’ affordability and the emission reduction effect, and in combination with Equation (10), we can determine the degree of the electricity price cross-subsidy that needs to be reduced according to the target emission reduction amount, thus reducing the net loss of social welfare caused by the electricity price cross-subsidy problem.