1. Introduction

The transition to renewable energy has become a defining challenge of the 21st century, as nations work to combat climate change, enhance energy security, and promote sustainable economic growth. The Energy Strategy and Energy Union emphasize the need for a secure, competitive, and sustainable energy system within the European Union (EU), setting ambitious targets for renewable energy expansion. By 2030, renewable sources are expected to contribute 32% of the EU’s total energy mix [

1].

Among renewable sources, offshore wind energy stands out for its high efficiency and immense potential, making it a cornerstone of the energy transition. Offshore wind farms (OWFs) not only reduce carbon emissions, but also drive economic growth by fostering complex and specialized supply chains. These encompass component manufacturing, transportation logistics, installation, and maintenance, all of which create economic opportunities and stimulate regional development. Understanding the economic factors of offshore wind is essential for justifying investments and strengthening local supply chains [

2].

The Central Baltic Region is uniquely positioned to benefit from the growth of offshore wind energy, due to its favorable wind conditions and well-connected coastal infrastructure. Local ports play a crucial role in facilitating offshore wind operations, with their integration into supply chains proving essential for the efficiency and sustainability of these projects. In this context, Port Ustka stands out as a prospective hub for servicing offshore wind farms, offering both strategic location advantages and the potential for infrastructural development.

This study examines the impact of offshore wind farm supply chains on regional economic growth, with a focus on the strategic role of Port Ustka in the Central Baltic Region. By exploring the port’s capabilities, challenges, and opportunities, the paper aims to understand how its integration into offshore wind supply chains can drive regional economic and industrial growth. Additionally, a benchmarking analysis with leading offshore wind ports outside the Central Baltic Region has been incorporated to identify strategic pathways for Port Ustka’s further development.

To guide the analysis, the following research questions were developed:

RQ1: How do offshore wind farm supply chains contribute to the economic growth of the Central Baltic Region?

RQ2: What is the strategic importance of Port Ustka within offshore wind supply chains?

RQ3: What logistical and infrastructural advancements are needed to enhance the role of Port Ustka in the offshore wind energy sector?

RQ4: How does the integration of Port Ustka into offshore wind supply chains impact regional labor markets and industrial growth?

The remainder of this paper is structured as follows.

Section 2 provides the background for the analysis, including the development context of offshore wind energy in the Baltic Sea.

Section 3 outlines the applied research methodology, combining qualitative and quantitative approaches.

Section 4 presents the results of the study, including an analysis of the impact of offshore wind supply chains on regional development, a case study of selected ports in the Central Baltic Region, and an evaluation of infrastructural and logistical conditions at Port Ustka.

Section 5 discusses the findings in light of broader European offshore wind trends and best practices. Finally,

Section 6 concludes the study by summarizing key insights and offering policy recommendations.

2. Background of Analysis

In recent years, offshore wind farms (OWFs) have experienced exponential growth worldwide [

3]. While wind energy has been utilized on an industrial scale since the 1980s, offshore wind development gained momentum in the mid-2000s, evolving from pilot projects to large-scale deployment [

4]. Europe has played a leading role in this transformation, successfully operating offshore wind farms for years in countries such as the United Kingdom, Germany, the Netherlands, and Denmark. These countries benefit significantly from the clean energy produced by OWFs, which have become a cornerstone of their renewable energy strategies. As the pioneer and global leader in offshore wind energy, Europe hosts over 90% of all installed offshore wind farms within its maritime areas [

5]. Moreover, the development of offshore wind farm technology has become a strategic priority in achieving the goals of the European Green Deal of 2019 [

6].

The Baltic Sea region has emerged as a critical area for the development of offshore wind energy, driven by favorable natural conditions and the increasing need for renewable energy solutions. The Central Baltic Region, in particular, benefits from consistent wind patterns, shallow waters, and an existing maritime infrastructure, making it a prime location for offshore wind projects. Compared to onshore turbines, offshore wind farms (OWFs) achieve a higher capacity utilization rate, driven by stronger wind speeds and a greater number of windy days—approximately 90% of the year [

7]. The European Commission projects that the Baltic Sea region has the potential to generate 93 GW of offshore wind energy by 2050. According to a report by Wind Europe and PWEA, Poland accounts for an impressive 28 GW of this capacity, positioning it as the leading country in terms of potential among all Baltic Sea basin nations. Moreover, effective planning and maximized utilization of these resources could result in up to 65% of the offshore supply chain being sourced locally [

8].

As the demand for clean energy grows, the Baltic region has emerged as a focal point for investments in offshore wind farms, offering the potential to meet energy needs while driving regional economic growth. In Poland, offshore wind energy is a key pillar of the country’s energy transition, enhancing energy security and fostering economic development. Reflecting this strategic focus, Poland’s Energy Policy until 2040 sets ambitious targets, with its offshore wind capacity expected to reach 5.9 GW by 2030 and up to 11 GW by 2040 [

9].

Supply chains are at the heart of this development, playing a vital role in enabling the efficient construction, operation, and maintenance of offshore wind farms. These supply chains involve a complex network of activities, including the production of wind turbine components, transportation logistics, installation processes, and ongoing maintenance. Each stage of the supply chain offers opportunities for economic growth, particularly for coastal regions hosting ports that act as logistical hubs. Ports, therefore, are integral to the offshore wind industry, providing the infrastructure and services necessary for the efficient movement and assembly of components.

In the Central Baltic Region, local ports are uniquely positioned to capitalize on this growth. Ports such as Gdynia, Łeba, and Ustka are increasingly being integrated into the supply chains of offshore wind projects, leveraging their strategic locations and existing maritime expertise. Among these, Port Ustka stands out for its potential to serve as a dedicated service base for offshore wind farms. Its proximity to planned wind farm installations, coupled with opportunities for infrastructure development, positions it as a key player in supporting the regional supply chain.

The integration of Port Ustka into the offshore wind farm supply chain is a significant opportunity to enhance the port’s role in the regional economy. By expanding its infrastructure and capabilities, Ustka can not only meet the logistical demands of offshore wind projects, but also create new jobs, support local businesses, and contribute to sustainable development in the Central Baltic Region.

3. Materials and Methods

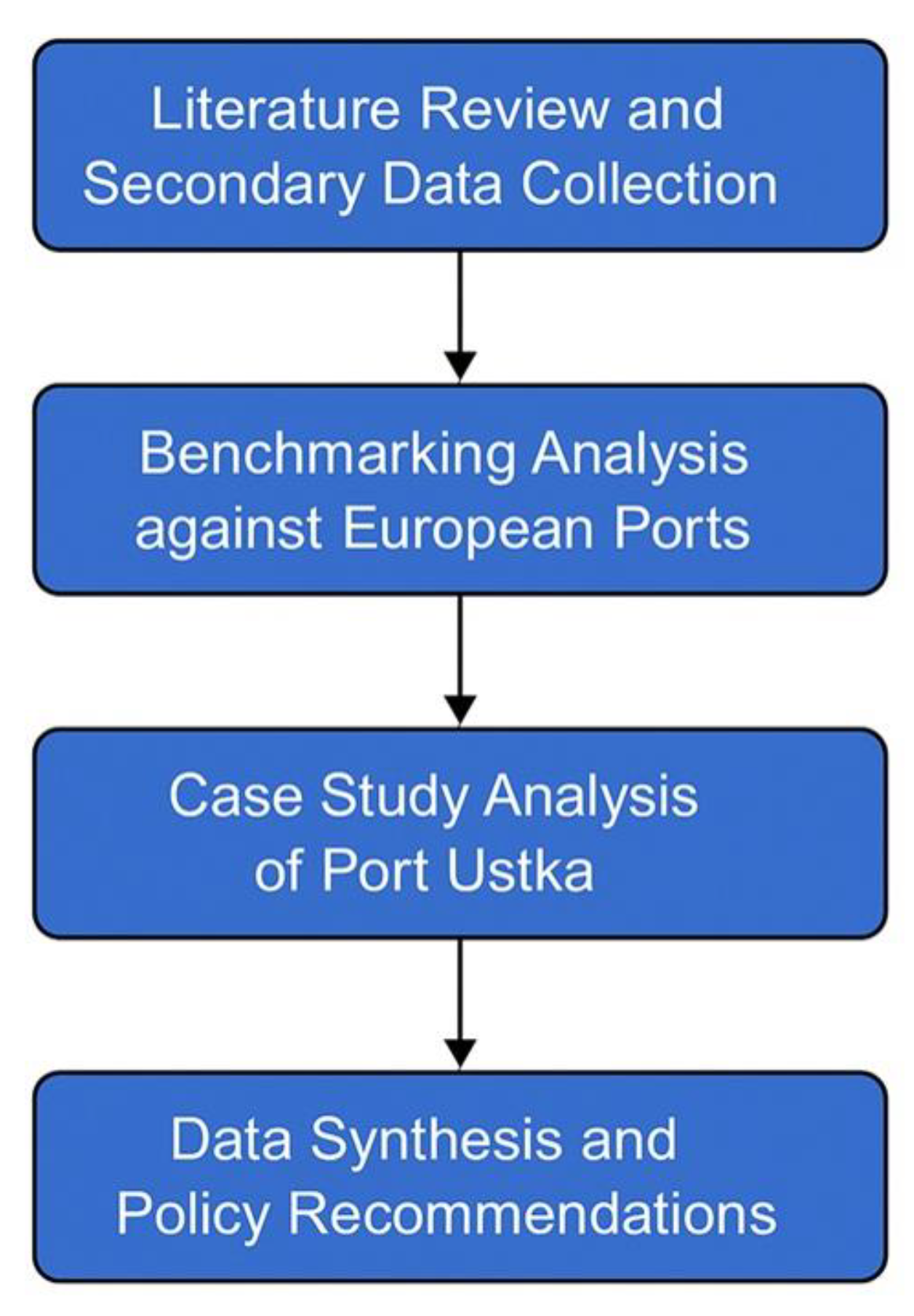

This research investigates the supply chain integration and port development associated with offshore wind farms, with a particular focus on the case study of Port Ustka. A combination of qualitative and quantitative methods was applied to achieve the research objectives.

Qualitative methods included case study analysis and content analysis of relevant policy documents, strategic plans, and industry reports. The selection criteria for these sources included their direct relevance to offshore wind supply chain development, publication date (after 2020), and authorship by recognized governmental, regulatory, or industry organizations (e.g., European Commission, Polish Ministry of Infrastructure, Polish Wind Energy Association). Policy documents and strategic materials were critically reviewed to identify the institutional and regulatory framework influencing port development and supply chain localization in the offshore wind sector.

Quantitative methods involved the collection and descriptive interpretation of numerical data regarding port infrastructure parameters, as well as offshore wind industry indicators (such as the projected share of local supply chain participation). Data were sourced from official port authority publications, national maritime administration databases, and verified industry reports. The focus remained on descriptive and comparative analysis to support the exploratory nature of the case study. Future research directions include the application of statistical and spatial techniques for a more detailed quantitative evaluation.

Following this methodological framework (

Figure 1), the case study of Port Ustka was conducted to assess the port’s readiness and strategic positioning for offshore wind sector servicing. Key port parameters, development projects, and logistic capabilities were analyzed. Furthermore, a benchmarking approach was employed to compare Port Ustka’s infrastructure and service capacity with those of leading offshore wind ports in Europe, providing a broader context for assessing competitiveness and identifying best practices. The benchmarking analysis compared Port Ustka to leading offshore wind ports such as those of Grimsby and Hull, selected based on their successful transformation into offshore wind service hubs through strategic infrastructure investments and public–private partnerships.

4. Results

4.1. The Role of Offshore Wind Farms in Regional Economy

4.1.1. Definition and Importance of Offshore Wind Farms in Energy Transition

A decline in energy resources has driven nations worldwide to prioritize the transition to low-carbon energy through renewable sources [

10]. Wind energy holds the largest share of renewable (low-emission) energy production in the EU, and forecasts suggest that it will continue to dominate in the coming decades [

11]. In 2023, Europe added a total of 18.3 GW of new wind energy capacity, including 14.5 GW from onshore installations and 3.8 GW from offshore projects [

12]. To meet decarbonization and net-zero targets, the growing adoption of low-carbon energy technologies has encouraged nations worldwide to prioritize renewable energy sources [

13,

14].

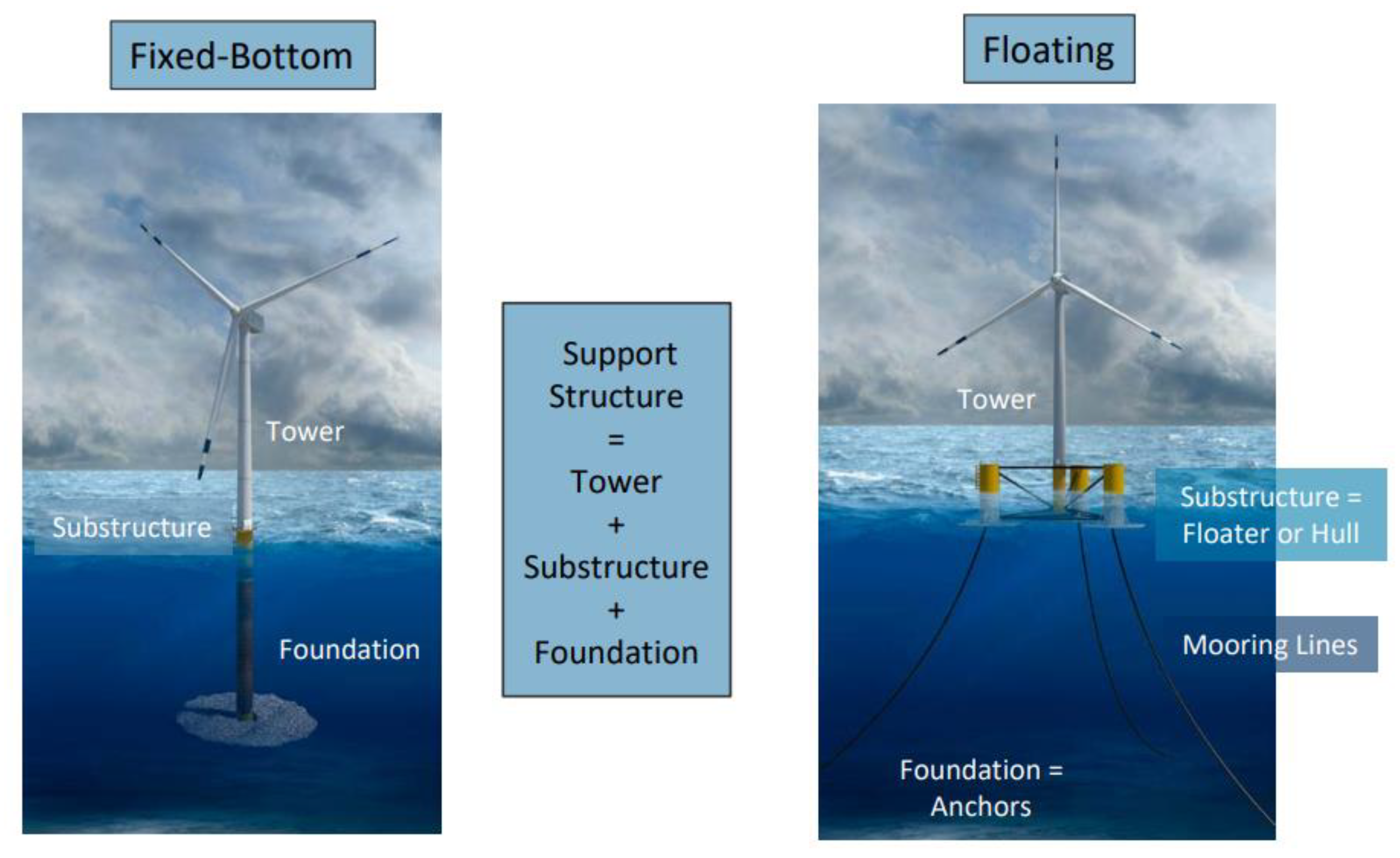

An offshore wind farm is a power plant that includes all the necessary infrastructure to harness wind energy, convert it into electricity, and transmit it to the main electricity grid. The primary components of an offshore wind farm are wind turbines, cables, and substations, with wind turbines being the most critical. These turbines act as generators that transform wind energy into electricity [

15]. Offshore wind energy systems can be categorized into two primary types: fixed and floating (

Figure 2).

Figure 2 is provided for illustrative purposes to facilitate understanding among interdisciplinary readers, particularly in the context of port infrastructure and logistics planning. Fixed systems are predominantly installed in shallow waters, while floating systems are designed for deeper waters exceeding 60 m [

16]. In practice, more than 99% of offshore wind turbines are installed on fixed-bottom support structures in waters shallower than 50 m [

17].

Offshore wind farms (OWFs) consist of clusters of wind turbines situated in marine areas where wind speeds are generally higher and more consistent than on land [

18]. OWFs are a cornerstone of the global energy transition, playing a vital role in reducing greenhouse gas emissions and decreasing reliance on fossil fuels. According to the International Renewable Energy Agency (IRENA), offshore wind farms can generate electricity on a much larger scale compared to onshore facilities, due to their strategic location in open sea areas, which face fewer spatial and environmental constraints [

19]. Additionally, they are integral to global efforts to meet renewable energy targets, decarbonize energy systems, and reduce dependence on imported fossil fuels [

20].

OWFs are playing an increasingly prominent role in the global energy landscape. Many countries, particularly in Europe, are investing heavily in offshore wind development as a means to achieve climate goals, stimulate economic growth, create jobs, and drive technological innovation. This growing focus underscores the importance of offshore wind farms in shaping a sustainable and resilient energy future.

Figure 2.

Fixed-bottom and floating substructures: technology options for offshore wind systems [

21].

Figure 2.

Fixed-bottom and floating substructures: technology options for offshore wind systems [

21].

4.1.2. The Potential of the Baltic Sea as a Source of Renewable Energy

The Baltic Sea has significant potential for offshore wind energy development, making it a crucial area for renewable energy investments in Europe. It offers excellent wind conditions, a strategic location, proximity to industrial centers, and relatively shallow waters, enhancing its suitability for offshore wind projects. The Central Baltic Region benefits from these favorable conditions, with planned OWF projects expected to drive substantial investments in energy infrastructure, job creation, and technological innovation. According to the International Energy Agency and the Global Wind Energy Council, some of the best conditions for offshore wind farm development worldwide are found in the North Sea, the Yellow Sea, the East China Sea, and the Baltic Sea.

The Baltic Sea borders nine countries: Poland, Germany, Russia, Latvia, Lithuania, Denmark, Finland, Sweden, and Estonia. While it is a semi-enclosed sea, it connects to the North Sea through the Kattegat and Danish straits. It is also the world’s largest brackish water body, with an average salinity of 7 PSU, compared to the much higher average salinity of ocean waters, at 35 PSU.

Geologically, the Baltic Sea is a glacial-shelf sea deeply embedded in the European continent. It was formed around 12,000 years ago during the retreat of the ice sheet to the north [

22]. Its unique coastline and seabed topography divide it into seven distinct regions: Kattegat, Øresund and the Belt Sea, the Proper Baltic Sea, the Gulf of Riga, the Gulf of Finland, the Bothnian Sea, and the Bothnian Bay [

23]. These regions vary in area, salinity, seabed topography, and coastline characteristics.

The Proper Baltic Sea is the largest of these regions, covering 209,930 km

2. Its deepest point is the Landsort Deep, reaching 459 m below sea level. Apart from this, several other deep areas exist where the seabed drops sharply, including the Gdańsk Deep, which ranks as the fifth-deepest. In contrast, the Øresund and Belt Sea is the shallowest region, with an average depth of just 14.3 m. Salinity levels also differ significantly, with the highest salinity found near the Danish straits, and the lowest in the Gulf of Bothnia [

23].

Wind conditions in the Baltic Sea are highly favorable for offshore wind energy production. The average wind speed ranges between 8 and 10 m per second, with prevailing winds coming from the southwest and west. According to Ørsted, wind conditions in the Baltic Sea enable energy generation approximately 90% of the time. Periods of insufficient or excessive wind speeds are relatively rare—only about 9% of the time is the wind too weak for efficient power generation, while just 1% of the time is it too strong [

24].

Notably, the Baltic Sea is one of the world’s shallowest seas, with an average depth of approximately 52.3 m. This relatively shallow depth further enhances its attractiveness for offshore wind farm investments, as it simplifies construction and reduces installation costs.

Table 1 presents key geographical and hydrological characteristics of the Baltic Sea.

Offshore wind energy development is governed by international maritime law, primarily the 1982 United Nations Convention on the Law of the Sea (UNCLOS), which defines territorial waters and Exclusive Economic Zones (EEZs). These legal distinctions determine how coastal nations exercise control over marine resources, including offshore wind farms [

25].

According to forecasts, the development potential of Polish offshore wind farms is expected to reach 28 GW by 2050, which accounts for one-third of the capacity that can be installed in the Baltic Sea. In Poland’s EEZ, which spans approximately 22.5 thousand square kilometers, the Spatial Development Plan for Polish Maritime Areas (approved in June 2021) has allocated about 2000 square kilometers for offshore wind energy projects [

26]. This designated area is estimated to have a generation capacity of 20 GW, with planned developments focusing on Ławica Odrzana, Ławica Słupska, and Ławica Środkowa.

4.1.3. OWF Supply Chains in Offshore Wind Energy

The supply chain of offshore wind farms (OWFs) is a complex and multi-stage process that involves various industries, stakeholders, and logistics networks. It comprises several critical phases, including planning, manufacturing, transportation and installation, operations and maintenance (O&M), and the end-of-life phase. Each of these phases requires coordination between multiple actors, including component suppliers, port authorities, logistics providers, and energy companies.

The offshore wind supply chain has become increasingly global, with major industry players sourcing components and expertise from multiple regions [

27]. Europe is one of the world’s leading regions in offshore wind turbine and foundation manufacturing, benefiting from a highly integrated supply chain supported by the European Union Free Trade Agreement, which facilitates the seamless movement of goods across member states’ borders [

28]. However, offshore wind deployment presents additional challenges, such as heavy-lift marine transport, subsea electrical grid connections, and harsh operating conditions requiring advanced remote monitoring systems.

The offshore wind energy supply chain follows a lifecycle model similar to that of onshore wind, but requires specialized infrastructure and logistics for marine-based installation, operations, and maintenance. It comprises five core phases, presented in

Figure 3.

The planning phase is critical for offshore wind farm development and involves project development and site surveys, which include resource assessments, environmental impact evaluations, landscape studies, and archeological and unexploded ordnance (UXO) assessments.

Once planning is complete, the manufacturing phase begins, focusing on the production of key components. Europe is home to two of the top five offshore wind turbine manufacturers, MHI Vestas and Siemens Gamesa Renewable Energy, further reinforcing its leadership in offshore wind technology [

30]. For offshore wind foundations, key producers include the Netherlands, Germany, and Denmark. Notably, these countries are also among the leaders in installed offshore wind capacity in Europe. Their strong manufacturing base and expertise in offshore wind infrastructure contribute significantly to the region’s dominance in renewable energy. Beyond these leading offshore wind manufacturers, Europe hosts several other major wind turbine producers, further strengthening its position as a global hub for wind energy technology. Among the most prominent companies are Areva (France), Enercon (Germany), Nordex (Germany), and Seawind (Netherlands) [

31].

The transportation [

32,

33] and installation phase is one of the most logistically demanding [

34] and cost-intensive in the offshore wind supply chain. Transportation logistics involve moving large wind turbine components from manufacturing sites to installation ports, and then to designated offshore locations. In most offshore wind projects, components are not directly transported from the manufacturing facility to the offshore site. Instead, they are first delivered to an installation port, where they undergo pre-assembly and temporary storage, before being loaded onto specialized vessels for transportation to the offshore wind farm site [

35]. Ports and onshore bases serve as strategic hubs within the supply chain [

36], supporting all wind farm operations.

Poland’s port infrastructure is well developed, with four key ports—Gdańsk, Gdynia, Szczecin, and Świnoujście—playing a crucial role in the national economy. These ports, along with smaller facilities, provide the necessary logistical support for offshore wind development. Ports in Władysławowo, Ustka, and Łeba are already being adapted as maintenance hubs for offshore wind farms. As offshore wind projects continue to expand, additional smaller ports are likely to be repurposed for maintenance operations, creating new opportunities for local communities and businesses while strengthening Poland’s role in the offshore wind supply chain [

37]. Consequently, selecting ports that are logistically well suited for this role is a crucial consideration [

38]. Specialized vessels, including jack-up rigs, floating cranes, and cable-laying ships, are required for installation, and their availability and efficiency significantly impact project timelines and costs [

5].

The operations and maintenance phase of a wind farm is the longest of all its lifecycle stages, as it requires servicing throughout its entire design lifespan. Operations include activities such as remote monitoring [

39], control, electricity sales, coordination, and back-office administration of wind farm operations, which account for a small portion of overall O&M expenditures. In contrast, maintenance activities, including the upkeep and repair of physical infrastructure and systems, represent the largest share of the total cost, risk, and effort in the O&M phase [

40].

The end-of-life phase also includes life extension, which involves enhancing the lifespan of existing offshore wind infrastructure through upgrades; repowering, which involves replacing outdated components to improve efficiency; and recycling [

41], which involves repurposing wind turbine materials to support sustainability initiatives.

The efficiency of the OWF supply chain heavily depends on well-integrated port infrastructure. In the Central Baltic Region, ports such as Gdynia, Łeba, and Ustka are developing their capacity to support offshore wind logistics.

4.1.4. The Economic Impact of Offshore Wind Farms on Regional Development—Case Studies from the Central Baltic Region

Offshore wind farms (OWFs) are not only a crucial element of the energy transition, but also a significant driver of regional economic development. Their impact extends beyond electricity generation (

Table 2), influencing job creation, industrial growth, supply chain expansion, and port infrastructure modernization.

The Central Baltic Region, with its strong maritime tradition and strategic location, is particularly well positioned to benefit from offshore wind energy investments. Offshore wind farms are already operating in the Baltic waters of Germany, Denmark, Sweden, and Finland (

Table 3). This table presents aggregated, country-level data that contextualize regional offshore wind development trends. In addition to Poland, Lithuania, Latvia, and Estonia are also pursuing this form of energy production. All of these countries cooperate under the European Union’s Baltic Energy Market Interconnection Plan (BEMIP) platform.

Germany has made significant progress in offshore wind energy development, with the offshore wind capacity in the North and Baltic Seas reaching 9.2 GW by the end of 2024, up from 8.5 GW in 2023. The German government has set a target to reach 15 GW of offshore wind capacity by 2030 [

42]. Breakthrough projects, such as the Baltic Eagle offshore wind farm in the Baltic Sea and the Gode Wind project in the North Sea, have contributed to this impressive growth. Germany hosts more than 1500 offshore wind power plants. As of 2023, the number of offshore sites connected to the power grid reached 1566, the highest recorded figure to date [

43]. In Germany alone, the offshore wind industry has generated approximately 25,000 jobs over the past decade, according to data from the Ministry of Economy and Energy and various industry studies [

44]. This job creation highlights the sector’s role in economic development, driving employment in engineering, construction, logistics, and maintenance. Ports in Bremerhaven and Cuxhaven have evolved into leading offshore wind industry hubs, featuring large-scale turbine manufacturing plants and logistics centers. Cuxhaven, in particular, plays a crucial role by providing logistical support for the construction and maintenance of wind farms in the North Sea.

Denmark has pioneered offshore wind energy since the 1990s, with an installed capacity of 2.6 GW in 2023. Offshore wind investments in Denmark have driven job creation, industrial growth, and export expansion, particularly through Ørsted, the world’s largest offshore wind developer. The Port of Esbjerg has emerged as Europe’s largest offshore wind hub, supporting over 10,000 direct and indirect jobs in the logistics, assembly, and maintenance of offshore wind components. Offshore wind now contributes nearly 3 percent of Denmark’s GDP, largely due to the export of wind turbine components and technological expertise.

Finland is exploring its offshore wind potential with projects like the Tahkoluoto Offshore Wind Farm, which currently has a capacity of 0.044 GW, with plans for significant expansion. The Finnish government aims to develop up to 16 GW of offshore wind power by 2040, potentially attracting investments exceeding €50 billion. This development is expected to create thousands of jobs and enhance energy security, contributing to regional economic growth. The Port of Pori plays a key role in supporting Finland’s offshore wind development, serving as a logistics and construction hub for projects such as the Tahkoluoto Offshore Wind Farm. Plans are underway to expand the port’s infrastructure to accommodate the growing demands of offshore wind logistics, further strengthening its strategic importance in the sector.

Since 1998, offshore wind energy has also been developed in Sweden, with a total installed capacity of 0.192 GW (primarily consisting of small wind farms). As part of its strategy to reduce CO

2 emissions and achieve a zero-emission state by 2050, Sweden is considering expanding its wind power capacity to 12 GW by 2040. Lillgrund is Sweden’s largest wind farm and the world’s third largest offshore wind farm. The wind farm generates 330 GWh of electricity annually, enough to power more than 60,000 households in Sweden. It is estimated that the development and operation of offshore wind could create up to 165,000 full-time equivalent jobs in Sweden between 2025 and 2050 [

45].

4.2. The Role of the Port of Ustka in OWF Supply Chains

4.2.1. The Current Infrastructure and Operational Characteristics of the Port

The Port of Ustka is one of the largest small ports on the Polish coast, situated in the town of Ustka, at the mouth of the Słupia River. Historically, it primarily served as a commercial cargo hub, with only limited involvement in fishing activities. After World War II, the port transitioned into a predominantly fishing-oriented facility, with minimal cargo operations. During this period, a production shipyard was also established, operating until February 2002 [

46].

While the port is now primarily focused on fishing activities, it still accommodates limited cargo handling operations [

47]. These include the trans-shipment of aggregate, grain, and other bulk materials or goods packed in big bags. Cargo handling can be carried out either directly between the ship and a truck, or with the option of temporary storage in the port’s storage yard. The trans-shipment quays are located in the western part of the port (Władysławowskie Quay), and have a total length of 160 m [

48].

The port covers a total area of 29.2934 hectares. Its size and infrastructure accommodate vessels with a draft of up to 4.0 m at average water levels, a maximum overall length of 60 m, and a width of 12 m [

49].

Table 4 illustrates the technical parameters and infrastructural characteristics of the Port of Ustka.

The infrastructure ensuring access to the Port of Ustka from the water includes several key hydrotechnical elements. The approach fairway extends 926 m in length, with a bottom width of 60 m and a depth of 6.5 m. The waterway, measuring 1175 m in length, is 24 m wide and has a depth of 5.5 m. An important navigational feature is the “Traverse of the Captain’s Office” turning basin, which has a width of 67 m and a depth of 5.5 m. Additionally, the port’s access system includes sedimentation basins located to the west, east, and along the Słupia River, as well as a designated anchorage area [

50].

The Port of Ustka has convenient road connections that enable efficient land transport. Access to the Port of Ustka is provided by Expressway S6 and National Road DK21. S6 is a key transportation route in northern Poland, ensuring fast connections between ports and other logistics centers. Meanwhile, DK21 directly links Ustka with Słupsk, which serves as a regional transport hub and provides access to the broader network of national and express roads.

The availability assessments and port infrastructure parameters show that Ustka is a favorable location for establishing an operations and maintenance base. Additionally, the port’s own parameters, including its approach channel, are advantageous and sufficient to meet investors’ needs [

51].

4.2.2. Ustka as a Strategic Service Base for Offshore Wind Farms

For the efficient management of offshore wind farms (OWFs), service ports are essential, enabling quick and safe access to the farm for necessary repairs and maintenance [

52]. The ports of Łeba and Ustka have been identified as the best locations for offshore wind farms planned in the first phase of offshore development within Poland’s Exclusive Economic Zone in the Baltic Sea.

The Port of Ustka has emerged as a strategically advantageous location for servicing offshore wind farm (OWF) projects. Situated on the northwestern and northeastern slopes of the Słupsk Bank, it provides optimal access to several major offshore wind developments, including FEW Baltic II, Bałtyk II, and Baltica 2. Recognizing this potential, both PGE Baltica and RWE F.E.W. Baltic II have selected Ustka as their service port, benefiting from its favorable infrastructure and geographic positioning.

PGE and the Danish company Ørsted, one of the global leaders in the offshore wind sector, are jointly constructing and operating the Baltica Offshore Wind Farm (MFW Baltica), with a total installed capacity of up to 2.5 GW. The project is being developed in two phases, with Baltica 3, reaching up to 1045.5 MW, scheduled for commissioning in 2026, followed by Baltica 2, with a capacity of up to 1497 MW, expected to be completed by 2027. To support this large-scale investment, PGE Baltica is currently developing an operations and maintenance (O&M) base in Ustka [

53]. The company plans a comprehensive redevelopment of the quays, and the construction of new underground infrastructure, new parking areas, and internal roads, as well as the development of office and social buildings and a warehouse. Operating 24/7, specialists will monitor the wind farms and equipment both at sea and on land. The base will provide technical and storage facilities, including spare parts, tools, service vessel berths, and office space. It will also coordinate routine and emergency maintenance [

54]. The base is expected to be operational by no later than 2027. The company selected Ustka as the location for its service base based on several key factors [

55]:

- –

Its proximity to offshore wind farm sites;

- –

The availability of port real estate;

- –

The navigational and technical conditions of the port;

- –

Local spatial development plans;

- –

The estimated investment costs;

- –

The future development plans of the port.

RWE has also identified Ustka as a key location for its offshore wind operations. The company is currently constructing the Baltic II offshore wind farm, which will be the first phase of its Baltic Sea development. RWE Renewables is preparing to build three offshore wind farms: Baltic I, Baltic II, and Baltic III. Baltic II, the first of these projects, will cover an area of approximately 41 square kilometers in waters with depths ranging from 30 to 50 m, located 55 km from Ustka. Similarly, RWE F.E.W. Baltic II selected Ustka as its service port due to the port meeting the following required criteria:

- –

The distance between the O&M port and the offshore wind farms;

- –

The existing port infrastructure;

- –

The local market for external services related to port infrastructure maintenance;

- –

Accessibility from the land side.

The main selection criterion for the investors was proximity to the wind farms, which is shown in

Table 5.

The port’s relatively short distances to major offshore wind farms (OWFs) facilitate efficient logistics and reduced transit times for Crew Transfer Vessels (CTVs) and supply ships, ultimately lowering operational costs and ensuring timely maintenance. While some OWFs, such as Grupa Baltex 5 (170 km) and PGE Baltica 1 (155 km), are located farther away, Ustka’s strategic position allows it to serve as a central hub, providing access to both nearby and moderately distant wind farms within Poland’s Exclusive Economic Zone in the Baltic Sea [

56].

The growing involvement of Ustka Port in the offshore wind sector is not only transforming its role, but also significantly impacting the economic development of the Central Baltic Region. The following section explores the economic benefits brought by offshore wind farms, focusing on job creation, industrial growth, and infrastructure investments.

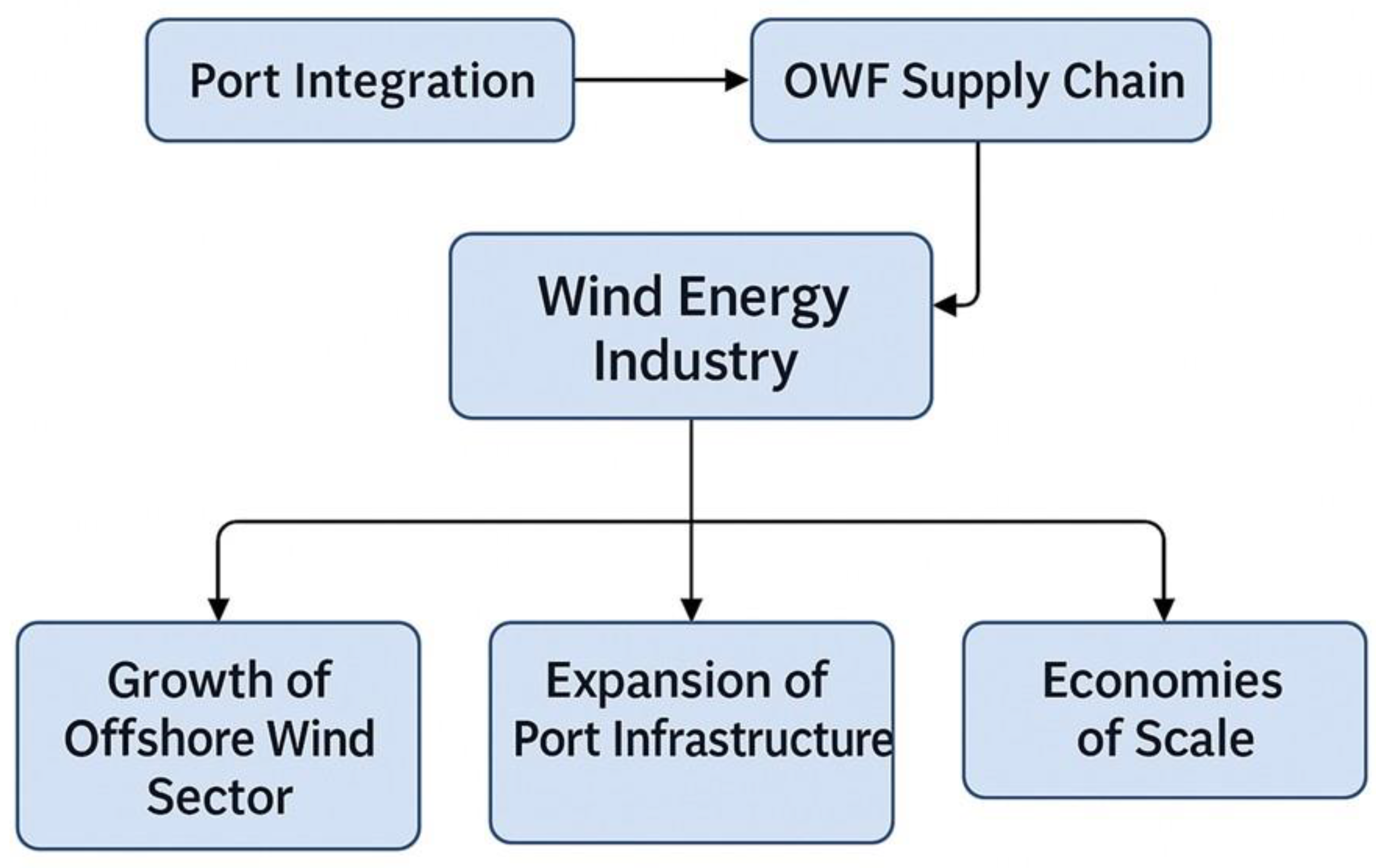

To summarize the strategic positioning of the Port of Ustka within the offshore wind logistics chain, the relationships between its infrastructure, location, and operational role are presented in

Figure 4.

This diagram illustrates the systemic relationships between port infrastructure, offshore wind farm (OWF) supply chains, and the broader offshore wind energy industry. It highlights how port integration and logistical readiness contribute to the growth of the offshore wind sector, the expansion of port infrastructure, and the realization of economies of scale. The diagram addresses the feedback mechanisms that reinforce the mutual development of both port systems and the renewable energy industry.

4.2.3. Key Industrial Investments in the Offshore Supply Chain in Poland

The development of offshore wind farms (OWFs) in the Baltic Sea within Poland’s Exclusive Economic Zone presents a significant opportunity for the growth of the domestic industry and the establishment of a local supply chain. The economic impact of offshore wind energy has been widely discussed in the literature [

57,

58]. However, most studies focus on onshore wind energy [

59]. This paper highlights how offshore wind farms are not only transforming Poland’s energy sector, but also generating new opportunities for regional economies, particularly in Ustka and surrounding areas.

A key aspect of offshore wind development is the engagement of industry leaders with local stakeholders. PGE and RWE Baltic II actively contribute to economic and community development in Ustka. The construction of the service base for PGE Baltica and RWE in Ustka is expected to create 200 jobs. In addition, PGE’s contributions include the following [

60]:

- –

Sponsorship of a class at the General and Technical Secondary School, specializing in mechanical engineering;

- –

Support for the Green Ustka program;

- –

Sponsorship and patronage of outdoor events.

Similarly, RWE Baltic II plays an important role in local engagement by participating in and organizing events in Ustka, including local festivals, sports competitions, and informational meetings for the local community. These initiatives ensure that offshore wind investments have a direct and positive impact on the people and businesses in the region.

Beyond local engagement, large-scale industrial investments are accelerating economic growth and job creation in key offshore wind hubs in Poland. According to a report by McKinsey, the offshore wind sector is projected to contribute PLN 60 billion to Poland’s GDP by 2030, create 77,000 new jobs, and generate PLN 15 billion in revenue for the state and local governments [

61].

Over 140 companies and institutions are actively engaged in the offshore wind energy supply chain in Poland, covering a wide range of activities, such as component manufacturing, infrastructure development, logistics, research, and certification [

62]. In the production sector, major players include GSG Towers, specializing in wind tower production; LM Wind Power Blades Poland, which manufactures wind turbine blades; and Bladt Industries Polska and ST3 Offshore, focusing on steel structures for turbine foundations. The construction of offshore infrastructure requires collaboration with leading engineering and construction firms, such as Mostostal Warszawa, Polimex-Mostostal, Hochtief Polska, and Budimex, which are responsible for steel structures and the development of installation ports. Shipbuilding companies also play a significant role, with Morska Stocznia Remontowa “Gryfia” and Remontowa Shipbuilding engaged in the construction and refurbishment of offshore service vessels.

Logistics and transportation are critical elements of the offshore wind supply chain. Key contributors include C.Hartwig Gdynia and Morska Agencja Gdynia, specializing in maritime transport, while PKP Polskie Linie Kolejowe ensures land-based transport of offshore wind components. Additionally, Polish port authorities, including those of Gdynia, Gdańsk, Szczecin, Świnoujście, Ustka, and Łeba, are actively investing in infrastructure development to support offshore wind farm logistics and installations.

PGE, as a leader in offshore wind energy, has taken steps to maximize domestic participation in the sector. The company has signed the Polish Offshore Wind Sector Deal, a sectoral agreement aimed at fostering collaboration among government authorities, investors, offshore wind farm operators, suppliers, financial institutions, and research entities. This initiative is designed to increase the share of domestic suppliers in the offshore wind supply chain to 20–30% during the first phase of the support system [

63]. In collaboration with Ørsted, PGE is working with companies such as Van Oord, Boskalis, and Polimex Mostostal to develop new installation terminals. One such key project is the Świnoujście terminal, which is being constructed by Budimex for land-based infrastructure and Porr for hydrotechnical infrastructure. This logistics hub will be a vital center for the transportation and installation of offshore wind turbines [

64].

Offshore projects also require investments in factories and manufacturing plants, ensuring supply chain continuity and strengthening the local supply network. Poland’s offshore wind energy development is driven by major industrial investments, particularly in the West Pomeranian and Pomeranian Voivodeships, which are emerging as key hubs for offshore wind manufacturing and logistics.

In the West Pomeranian Voivodeship, one of the largest projects is the Vestas factory in Szczecin, which began producing turbine components in early 2025, creating 700 jobs [

65]. Additionally, around the factory, three to four times more indirect jobs will be generated in local cooperating companies. Furthermore, the Spanish company Windar will open another manufacturing plant in Szczecin in 2026, further strengthening the local offshore supply chain.

In the Pomeranian Voivodeship, a key investment is the Baltic Towers factory, currently under construction on Wyspa Ostrów in Gdańsk, developed by ARP S.A., Baltic Towers Sp. z o.o., and the Spanish company GRI Renewable Industries [

66]. Starting in 2025, this facility will produce up to 150 wind turbine towers annually, including towers for 15 MW turbines. It is expected to provide employment for approximately 400 people, with additional benefits for local suppliers and subcontractors [

67].

With these strategic investments, both the West Pomeranian and Pomeranian Voivodeships are solidifying their roles as key hubs for offshore wind development in Poland and the broader Baltic Sea region.

5. Discussion

The findings of this study indicate that offshore wind farm (OWF) supply chains play a crucial role in the economic development of the Central Baltic Region, with Port Ustka serving as a strategic logistics and service hub. This section discusses the formulated research questions and presents their implications for the future development of port infrastructure and the offshore sector in Poland.

OWF supply chains generate significant multiplier effects in the regional economy. They encompass not only the development of shipbuilding and wind turbine component manufacturing industries, but also the creation of new jobs in the logistics and service sectors. Economic analysis shows that ports serving as operational centers for OWFs can stimulate economic growth through investments in port infrastructure, the expansion of technical services, and increased employment in related industries. This highlights the need to further develop local supply chains to maximize economic benefits and enhance the region’s competitiveness.

Port Ustka has been selected as a key service base for the Baltica 2 and Baltic II offshore wind farms, underscoring its strategic location and suitable infrastructure parameters. It is situated in close proximity to major offshore investments, enabling cost optimization and minimizing service response times. A key challenge for the port’s continued growth in the OWF sector is infrastructure modernization, including quay expansions, improved transportation access, and increased availability of specialized port services.

Although the current port infrastructure is functional, it requires investment to meet the increasing operational demands of the offshore industry. Key needs include modernization of quays to accommodate larger service vessels, development of storage facilities for wind turbine components, improvement of transport links to better connect the port with industrial centers, and implementation of digital solutions to optimize port logistics.

The expansion of the offshore sector in Ustka is generating new employment opportunities in the technical, logistics, and service industries. OWF projects support the growth of local businesses, increase demand for skilled engineering professionals, and contribute to the development of new educational programs related to maritime energy. Initiatives undertaken by investors, such as training programs and support for local technical schools, can lead to long-term economic and social growth in the region.

Achieving high local content levels in Poland’s offshore wind supply chain requires a coordinated strategy involving both government action and private sector engagement. Several critical pathways can facilitate this process.

Technology transfer programs are essential to promote knowledge sharing and access to advanced offshore wind technologies for Polish companies. Collaborative research and development (R&D) projects between universities, research institutions, and industry leaders can help bridge technological gaps, enabling domestic firms to meet international standards of offshore wind production.

Financial incentives for SMEs, such as grants, subsidized loans, or tax exemptions, are necessary to assist small- and medium-sized enterprises (SMEs) in entering and expanding within the offshore wind supply chain. Reducing financial barriers through national or regional programs is critical for enhancing the localization rate [

68].

Specialized workforce training and certification systems are fundamental. Establishing standardized offshore wind training curricula and certification frameworks, aligned with international standards such as the Global Wind Organisation (GWO) guidelines, can ensure the availability of a skilled and mobile workforce. Such initiatives improve employability, meet industry needs, and enhance the competitiveness of Polish labor in the offshore wind market.

Public–private cooperation frameworks, such as the Polish Offshore Wind Sector Deal, exemplify how strategic government–industry collaboration can set localization targets, facilitate supplier development, and promote transparent procurement practices. These frameworks create a structured environment that supports domestic supply chain growth [

69].

Regional development strategies also play a significant role in strengthening local offshore wind supply chains. In Poland, documents such as the “Pomeranian Voivodeship Development Strategy 2030” and the “Smart Specialization of Pomerania” prioritize the advancement of renewable energy sectors, including offshore wind. These frameworks aim to stimulate innovation, encourage collaboration between industry and academia, and provide targeted support to SMEs engaging in offshore projects [

70].

Despite these pathways, some obstacles remain. Technological capability gaps persist, as many Polish companies may lack experience in offshore-specific manufacturing of components such as turbines and foundations. International partnerships and joint ventures can help bridge these gaps. Supply chain fragmentation is another challenge. Without strategic coordination, Polish suppliers risk isolation from major contracting networks. Cluster initiatives and matchmaking platforms are essential to foster better integration. Limited access to financing also hampers growth. SMEs often struggle with the capital needed for certification, upskilling, and technological upgrades. Dedicated investment funds and EU-level programs, such as the European Investment Bank’s Green Transition Fund, could provide crucial support.

By systematically addressing these pathways and challenges, Poland can significantly increase local participation in the offshore wind supply chain, maximize economic benefits, and strengthen its position within the European offshore wind market. The examples of strategic collaboration outlined above demonstrate that increasing the localization rate requires more than policy declarations—it demands integrated action across technology, education, and finance. Without such an approach, Poland may face delays in realizing its 65% local content potential and risk missing associated economic development opportunities.

While the Central Baltic Region demonstrates strong potential, valuable insights can also be gained by comparing these findings with best practices from other offshore wind markets outside the Baltic Sea region. The United Kingdom’s offshore wind sector provides particularly valuable experiences. Over the past decade, ports such as those in Grimsby, Hull, and Great Yarmouth have been successfully transformed into leading offshore wind hubs. This transformation was driven by strong public–private partnerships, strategic investments in port infrastructure, and dedicated workforce development programs.

In particular, the Port of Grimsby, formerly known mainly for its fishing industry, has evolved into the largest offshore wind operations and maintenance (O&M) hub in Europe. Companies such as Ørsted have invested over GBP 14 million in the development of the East Coast Hub, which currently employs over 600 highly skilled professionals [

71]. Grimsby now plays a key role in supporting offshore wind farm operations in the North Sea. Similarly, the Port of Hull has become an important center for offshore wind component manufacturing, thanks to major investments by Siemens Gamesa, including the expansion of its blade production facility.

At the national level, the UK government has committed to increasing its installed offshore wind capacity to 60 GW by 2030. In April 2025, it announced a GBP 300 million investment in the domestic offshore wind supply chain, aiming to strengthen energy security and reduce reliance on fossil fuels [

72]. Furthermore, the UK offshore wind sector currently employs approximately 32,000 people, with projections indicating growth to over 120,000 jobs by 2030 [

73].

6. Conclusions

Based on the conducted analyses, it can be concluded that offshore wind farm (OWF) supply chains are a crucial factor in the economic development of the Central Baltic Region, and the role of local ports, such as Ustka, is steadily increasing. The integration of Port Ustka into the offshore sector contributes to job creation, infrastructure development, and the region’s growing competitiveness in the European renewable energy market. The key findings of this study include the following:

Port Ustka plays a crucial role in the OWF supply chain, and its strategic location enables efficient servicing of offshore wind farms in the Baltic Sea.

Modernization of port infrastructure is essential for further development and optimization of offshore-related operations. Investments in logistics, storage facilities, and digitalization will enhance the port’s efficiency.

Development of the local labor market and industry stems from the growing demand for specialized services in the offshore sector. Increasing the availability of skilled personnel through collaboration with educational institutions is necessary.

Poland has the potential to become a leader in OWF production and servicing in the Baltic region, but this requires continued regulatory support and strategic investments in supply chains and service ports.

In conclusion, the further development of Port Ustka in the offshore wind energy sector should be based on synergy between investors, public administration, and the education sector. The effective integration of the port into the OWF supply chain will strengthen Poland’s position in the offshore market and bring long-term economic benefits to the Central Baltic Region.

Lessons drawn from benchmarking with established offshore wind ports in the UK highlight the importance of coordinated investment strategies and workforce development in maximizing the potential of Port Ustka.

In addition to these general recommendations, it is proposed to implement specific policy measures to accelerate and optimize offshore port development. One initiative could be the establishment of a “Port–Industrial Park Synergy Fund” to support the integration of port infrastructure with adjacent industrial zones, thereby fostering the clustering of logistics, manufacturing, and maintenance services for the offshore sector. Furthermore, the creation of a “Wind Power Skills Certification System” would address critical workforce development needs by ensuring the availability of trained personnel for offshore wind operations. These measures should be supported by public–private partnerships and modeled after successful industry–education integration frameworks, such as that of the Port of Esbjerg in Denmark, which has demonstrated how coordinated action can enhance regional competitiveness and supply chain localization.

Furthermore, future strategies for port integration in the offshore wind sector should also consider the application of advanced digital tools, including AI-based forecasting models, to enhance operational efficiency and reliability [

74]. The use of machine learning methods for wind power prediction has proven effective in supporting energy planning and decision-making in dynamic environments.