The Technical Efficiency of Polish Energy Sector Companies of Different Sizes

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

- Inputs:

- x1—Operating costs (PLN 1000);

- x2—The value of fixed assets (PLN 1000),

- Outputs:

- y1—Sales revenue (PLN 1000).

4. Results

4.1. Technical Efficiency of the Analized Energy Companies

4.2. Changes in Total Factor Productivity (Malmquist Index) of Analyzed Energy Companies

5. Discussion

6. Conclusions

- Small and medium-sized energy companies can exhibit levels of efficiency that are comparable to those of larger enterprises. This finding indicates that entities of varying sizes can coexist within the energy market. A prerequisite for such coexistence is the utilization of appropriate production technology that is adapted to the planned scale of production. Analysis of the relationship between energy production technology and enterprise efficiency requires further detailed research.

- The surveyed enterprises exhibited low technical efficiency (TE) levels, with a significant proportion recording TE scores below 0.3. This suggests considerable potential for improving technical efficiency across many enterprises and highlights the need to identify the underlying causes of inefficiency. Addressing this issue poses a challenge for enterprise managers and represents a crucial aspect in shaping energy policy mechanisms and tools.

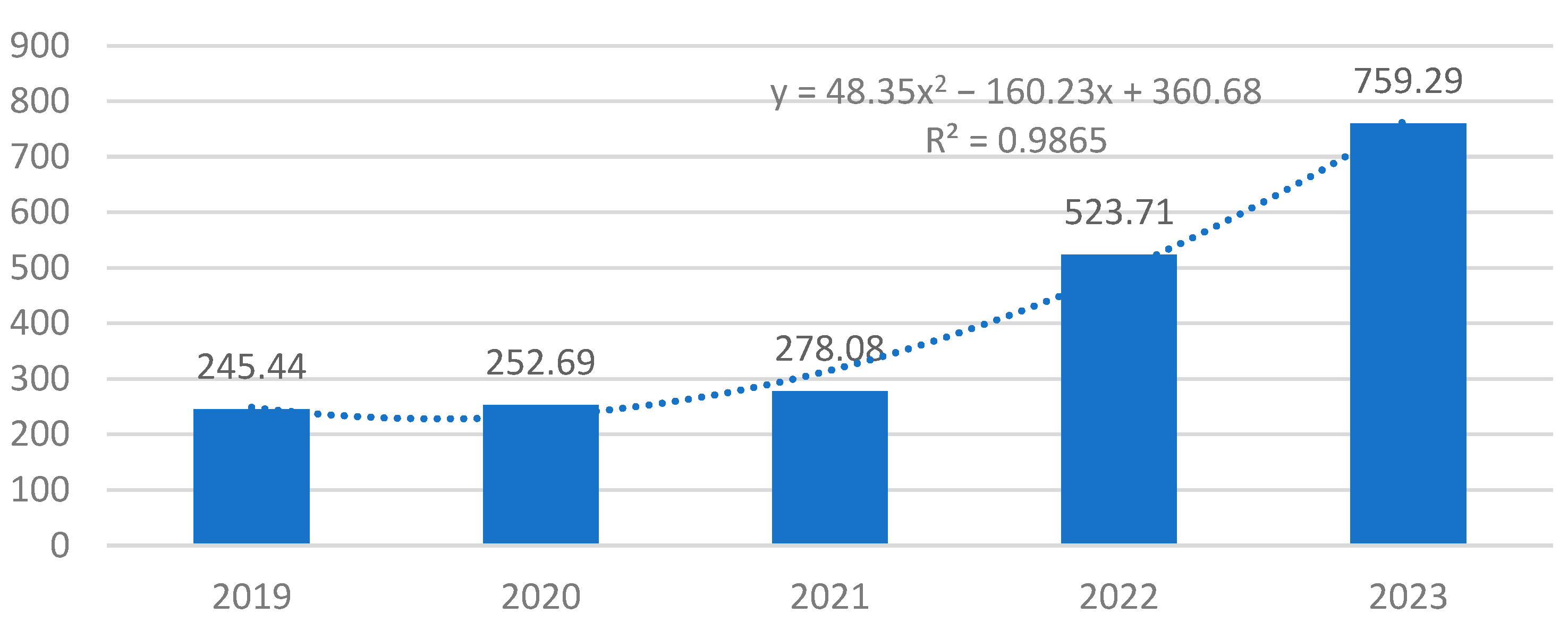

- The best results for both technical efficiency (TE) and the Malmquist index were recorded in 2022. This may have resulted from favorable macroeconomic conditions, particularly the sharp increase in energy prices. Consequently, the surveyed companies experienced a more dynamic growth in sales revenues than in operating costs. This underscores the significant role of macroeconomic conditions in shaping the efficiency of energy companies.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| BCC-DEA | Banker, Charnes, and Cooper model of Data Envelopment Analysis |

| CRSs | Constant returns to scale |

| DEA | Data Envelopment Analysis |

| DEA-CCR | Data Envelopment Analysis—Charnes, Cooper, Rhodes model |

| DESA | Data envelopment scenario analysis |

| DMU | Decision-making units |

| EFFCH | Changes in technical efficiency |

| EMIS | Emerging Markets Information Service |

| ROA | Return on total assets |

| ROE | Return on equity |

| ROI | Return on investment |

| ROS | Return on sales |

| SBM-DEA | Slacks-based measure DEA |

| SE-DEA | Superefficiency data envelopment analysis |

| TE | Technical efficiency |

| TECHCH | Technological change |

| TFP | Total factor productivity |

| TFPCH | Total factor productivity change |

| VRS | Variable returns to scale |

Appendix A

References

- Borozan, D.; Starcevic, D.P. European energy industry: Managing operations on the edge of efficiency. Renew. Sustain. Energy Rev. 2019, 116, 109401. [Google Scholar] [CrossRef]

- Bąk, I.; Tarczyńska-Łuniewska, M.; Barwińska-Małajowicz, A.; Hydzik, P.; Kusz, D. Is Energy Use in the EU Countries Moving toward Sustainable Development? Energies 2022, 15, 6009. [Google Scholar] [CrossRef]

- Borozan, D.; Starcevic, D.P. In Search of the New EU Energy Reforms: Assessing the Financial Performance of the EU Energy Companies. In Entrepreneurship, Business and Economics; Bilgin, M., Danis, H., Eds.; Eurasian Studies in Business and Economics; Springer: Cham, Switzerland, 2016; Volume 3/2, pp. 231–246. [Google Scholar] [CrossRef]

- Batrancea, L.M.; Tulai, H. Thriving or Surviving in the Energy Industry: Lessons on Energy Production from the European Economies. Energies 2022, 15, 8532. [Google Scholar] [CrossRef]

- Misztal, A.; Kowalska, M.; Fajczak-Kowalska, A. The Impact of Economic Factors on the Sustainable Development of Energy Enterprises: The Case of Bulgaria, Czechia, Estonia and Poland. Energies 2022, 15, 6842. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Kubatko, O.; Prokopenko, O.; Järvis, M. Managing energy efficiency and renewable energy in the residential sector: A bibliometric study. Probl. Perspect. Manag. 2023, 21, 511–527. [Google Scholar] [CrossRef]

- Jurgilewicz, M.; Delong, M.; Topolewski, S.; Pączek, B. Energy security of the Visegrad Group Countries in the natural gas sector. J. Secur. Sustain. Issues 2020, 10, 547–555. [Google Scholar] [CrossRef]

- Jurgilewicz, M.; Lorek, M.; Ovsepyan, A.; Kubiak, M. The Police’s role in the field of improving functioning fuel sector as an element of energy safety management in Poland. WSEAS Trans. Bus. Econ. 2020, 17, 656–663. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Trypolska, G.; Sokhan, I.; Koshel, V. Research trends on development of energy efficiency and renewable energy in households: A bibliometric analysis. Environ. Econ. 2023, 14, 13–27. [Google Scholar] [CrossRef]

- Chudy-Laskowska, K.; Rokita, S. Profitability of Energy Sector Companies in Poland: Do Internal Factors Matter? Energies 2024, 17, 5135. [Google Scholar] [CrossRef]

- Chai, J.; Fan, W.; Han, J. Does the Energy Efficiency of Power Companies Affect Their Industry Status? A DEA Analysis of Listed Companies in Thermal Power Sector. Sustainability 2020, 12, 138. [Google Scholar] [CrossRef]

- Jurgilewicz, M.; Kozicki, B.; Piwowarski, J.; Grabowska, S. Contemporary challenges for the economic security of enterprises in Poland. J. Secur. Sustain. 2022, 12, 71–80. [Google Scholar] [CrossRef]

- Dobrovolska, O.; Günther, S.; Chernetska, O.; Dubrova, N.; Kachula, S. Environmentally related taxes and their influence on decarbonization of the economy. Environ. Econ. 2024, 15, 174–189. [Google Scholar] [CrossRef]

- Canback, S.; Samouel, P.; Price, D. Do Diseconomies of Scale Impact Firm Size and Performance? A Theoretical and Empirical Overview. Icfai J. Manag. Econ. 2006, 4, 27–70. [Google Scholar]

- Bain, J.S. Economies of Scale, Concentration, and the Condition of Entry in Twenty Manufacturing Industries. Am. Econ. Rev. 1954, 44, 15–39. [Google Scholar]

- Amato, L.; Wilder, R.P. The Effects of Firm Size on Profit Rates in U. S. Manufacturing. South. Econ. J. 1985, 52, 181. [Google Scholar] [CrossRef]

- Hallam, A. Economies of Size and Scale in Agriculture: An Interpretive Review of Empirical Measurement. Appl. Econ. Perspect. Policy 1991, 13, 155–172. [Google Scholar] [CrossRef]

- Kamiński, J. The development of market power in the Polish power generation sector: A 10-year perspective. Energy Policy 2012, 42, 136–147. [Google Scholar] [CrossRef]

- Helman, U. Market power monitoring and mitigation in the US wholesale power markets. Energy 2006, 31, 877–904. [Google Scholar] [CrossRef]

- Jorge-Vazquez, J.; Kaczmarek, J.; Knop, L.; Kolegowicz, K.; Alonso, S.L.N.; Szymla, W. Energy transition in Poland and Spain against changes in the EU energy and climate policy. J. Clean. Prod. 2024, 468, 143018. [Google Scholar] [CrossRef]

- Pietrzak, M.; Domagała, J.; Chlebicka, A. Competitiveness, Productivity, and Efficiency of Farmers’ Cooperatives: Evidence from the Polish Dairy Industry. Probl. Agric. Econ. 2023, 376, 1–25. [Google Scholar] [CrossRef]

- Bigioi, A.D.; Bigioi, C.E. Governance and Performance in Romanian Energy Companies. Energies 2023, 16, 5041. [Google Scholar] [CrossRef]

- Domagała, J. Economic and Environmental Aspects of Agriculture in the EU Countries. Energies 2021, 14, 7826. [Google Scholar] [CrossRef]

- Kusz, D.; Kusz, B. Farm Size and Technical Efficiency of the Agricultural Sector in the European Union (EU-27). Scientific Papers. Series “Management, Economic Engineering in Agriculture and Rural Development”. 2024, Volume 24, pp. 577–586. Available online: https://managementjournal.usamv.ro/pdf/vol.24_2/Art64.pdf (accessed on 2 March 2025).

- Pietrzak, M.; Pietrzak, P.; Baran, J. Efficiency assessment of public higher education with the application of data envelopment analysis: The evidence from Poland. Online, J. Appl. Knowl. Manag. 2016, 4, 59–73. [Google Scholar] [CrossRef]

- Wysokiński, M.; Domagała, J.; Gromada, A.; Golonko, M.; Trębska, P. Economic and energy efficiency of agriculture. Agric. Econ. 2020, 66, 355–364. [Google Scholar] [CrossRef]

- Goto, M.; Tomikawa, T.; Sueyoshi, T. Efficiency and Mergers and Acquisitions of Electric Utility Companies. Energies 2024, 17, 1972. [Google Scholar] [CrossRef]

- Barbecho, F.C.; Sarmiento, J.P. Exploring Technical Efficiency in Water Supply Evidence from Ecuador: Do Region Location and Management Type Matter? Sustainability 2023, 15, 6983. [Google Scholar] [CrossRef]

- Maradin, D.; Draženović, B.O.; Čegar, S. The Efficiency of Offshore Wind Energy Companies in the European Countries: A DEA Approach. Energies 2023, 16, 3709. [Google Scholar] [CrossRef]

- Kočišová, K. Application of the DEA on the measurement of efficiency in the EU countries. Agric. Econ. 2015, 61, 51–62. [Google Scholar] [CrossRef]

- Alberca, P.; Parte, L. Operational efficiency evaluation of restaurant firms. Int. J. Contemp. Hosp. Manag. 2018, 30, 1959–1977. [Google Scholar] [CrossRef]

- Grofčíková, J.; Musa, H.; Lorincová, S. Factors affecting financial performance in the waste management industry: A comparative analysis of pre- and post-COVID-19 periods. J. Int. Stud. 2024, 17, 195–218. [Google Scholar] [CrossRef]

- Wang, Z.; Xue, W.; Li, K.; Tang, Z.; Liu, Y.; Zhang, F.; Cao, S.; Peng, X.; Wu, E.Q.; Zhou, H. Dynamic combustion optimization of a pulverized coal boiler considering the wall temperature constraints: A deep reinforcement learning-based framework. Appl. Therm. Eng. 2025, 259, 124923. [Google Scholar] [CrossRef]

- Kusz, D.; Bąk, I.; Szczecińska, B.; Wicki, L.; Kusz, B. Determinants of Return-on-Equity (ROE) of Biogas Plants Operating in Poland. Energies 2023, 16, 31. [Google Scholar] [CrossRef]

- Banker, R.D.; Chang, H.-H.; Majumdar, S.K. A framework for analyzing changes in strategic performance. Strat. Manag. J. 1996, 17, 693–712. [Google Scholar] [CrossRef]

- Wiech, B.A.; Kourouklis, A.; Johnston, J. Understanding the components of profitability and productivity change at the micro level. Int. J. Prod. Perform. Manag. 2020, 69, 1061–1079. [Google Scholar] [CrossRef]

- Li, Y.; Yang, X.; Ma, S. The Efficiency Measurement and Spatial Spillover Effect of Green Technology Innovation in Chinese Industrial Enterprises. Sustainability 2025, 17, 3162. [Google Scholar] [CrossRef]

- Xu, D.; Huang, B.; Shi, S.; Zhang, X. A Configurational Analysis of Green Development in Forestry Enterprises Based on the Technology–Organization–Environment (TOE) Framework. Forests 2025, 16, 744. [Google Scholar] [CrossRef]

- Lian, W.; Xue, Z.; Ma, G.; Zeng, F. The Impact of Digital Village Construction on the Comprehensive Efficiency of Eco-Agriculture: An Empirical Study Based on Panel Data from 53 Counties in Fujian Province. Sustainability 2025, 17, 3840. [Google Scholar] [CrossRef]

- Huong, L.T.T.; Van Duy, L.; Hoa, B.P.K.; Nga, B.T.; Van Phuong, N. Does Formal Contract Farming Improve the Technical Efficiency of Livestock Farmers? A Case Study of Fattening Pig Production in Hanoi, Vietnam. Sustainability 2025, 17, 3557. [Google Scholar] [CrossRef]

- Kumar, K.S.D.; Kumar, J.P.S. Efficiency assessment and trends in the insurance industry: A bibliometric analysis of DEA application. Insur. Mark. Co. 2024, 15, 83–98. [Google Scholar] [CrossRef]

- Zuluaga-Ortiz, R.; DelaHoz-Dominguez, E.; Camelo-Guarín, A. Academic efficiency of engineering university degrees and its driving factors. A PLS-DEA approach. J. Int. Stud. 2022, 15, 107–121. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Ivanová, E.; Grmanová, E. Digital transformation and ICT sector performance in EU countries. Probl. Perspect. Manag. 2023, 21, 48–58. [Google Scholar] [CrossRef]

- Mendoza-Mendoza, A.; Casseres, D.M.; De La Hoz-Domínguez, E. Evaluating the Financial Performance of Colombian Companies: A Data Envelopment Analysis Without Explicit Inputs and Technique for Order Preference by Similarity to the Ideal Solution Approach. J. Risk Financial Manag. 2024, 17, 568. [Google Scholar] [CrossRef]

- Coelli, T.; Rao, P.; O’Donnell, C.J.; Battese, G.E. An Introduction to Efficiency and Productivity Analysis; Kluwer Academic: Hingham, MA, USA, 2005. [Google Scholar]

- Abdikadirova, A.; Sembiyeva, L.; Temirkhanov, Z.; Popov, A.I.; Suchikova, Y. Evaluating the nexus of funding and scientific output in Kazakhstan. Knowl. Perform. Manag. 2024, 8, 17–31. [Google Scholar] [CrossRef]

- Majid, M.S.A.; Azhari, A.; Faisal, F.; Fahlevi, H. What determines the co-operatives‘ productivity in Indonesia? A-two stage analysis. Econ. Sociol. 2022, 15, 56–77. [Google Scholar] [CrossRef]

- wiakala-Małys, A.; Lagowski, P.; Durbajlo-Mrowiec, M.; Kuzminski, L.; Rolczynski, T. Efficiency evaluation of using resources by hospital units. Eur. Res. Stud. J. 2020, 23, 1177–1196. [Google Scholar]

- Färe, R.; Grosskopf, S. Network DEA. Econ. Lett. 2000, 66, 17–23. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Network DEA: A slacks-based measure approach. Eur. J. Oper. Res. 2009, 197, 243–252. [Google Scholar] [CrossRef]

- Lozano, S. Alternative SBM Model for Network DEA. Comput. Ind. Eng. 2015, 82, 33–40. [Google Scholar] [CrossRef]

- Choi, K.; Kim, J. Measuring Hotel Service Productivity Using Two-Stage Network DEA. Sustainability 2024, 16, 8995. [Google Scholar] [CrossRef]

- Zhang, Z.; Xu, Y. Evaluation of Water—Energy—Food—Economy Coupling Efficiency Based on Three-Dimensional Network Data Envelopment Analysis Model. Water 2022, 14, 3133. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, K. Energy efficiency of China’s industry sector: An adjusted network DEA (data envelopment analysis)-based decomposition analysis. Energy 2015, 93, 1328–1337. [Google Scholar] [CrossRef]

- Xu, T.; You, J.; Li, H.; Shao, L. Energy Efficiency Evaluation Based on Data Envelopment Analysis: A Literature Review. Energies 2020, 13, 3548. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.; Poh, K. A survey of data envelopment analysis in energy and environmental studies. Eur. J. Oper. Res. 2008, 189, 1–18. [Google Scholar] [CrossRef]

- Maradin, D.; Cerović, L. Possibilities of Applying the DEA Method in the Assessment of Efficiency of Companies in the Electric Power Industry: Review of Wind Energy Companies. IJEEP 2014, 4, 320–326. [Google Scholar]

- Kusz, D.; Nowakowski, T.; Kusz, B. The Capacity of Power of Biogas Plants and Their Technical Efficiency: A Case Study of Poland. Energies 2024, 17, 6256. [Google Scholar] [CrossRef]

- Ślusarz, G.; Gołębiewska, B.; Cierpiał-Wolan, M.; Gołębiewski, J.; Twaróg, D.; Wójcik, S. Regional Diversification of Potential, Production and Efficiency of Use of Biogas and Biomass in Poland. Energies 2021, 14, 742. [Google Scholar] [CrossRef]

- Agrell, P.J.; Bogetoft, P. Economic and environmental efficiency of district heating plants. Energy Policy 2005, 33, 1351–1362. [Google Scholar] [CrossRef]

- Athanassopoulos, A.D.; Lambroukos, N.; Seiford, L. Data envelopment scenario analysis for setting targets to electricity generating plants. Eur. J. Oper. Res. 1999, 115, 413–428. [Google Scholar] [CrossRef]

- Ratner, S.; Ratner, P. Developing a Strategy of Environmental Management for Electric Generating Companies Using DEA-Methodology. Adv. Syst. Sci. Appl. 2017, 17, 78–92. [Google Scholar] [CrossRef]

- Arcos-Vargas, A.; Núñez-Hernández, F.; Villa-Caro, G. A DEA analysis of electricity distribution in Spain: An industrial policy recommendation. Energy Policy 2017, 102, 583–592. [Google Scholar] [CrossRef]

- Blázquez-Gómez, L.; Grifell-Tatjé, E. Evaluating the regulator: Winners and losers in the regulation of Spanish electricity distribution. Energy Econ. 2011, 33, 807–815. [Google Scholar] [CrossRef]

- Liu, W.B.; Wongchai, A.; Yotimart, D.; Peng, K.C. Productive Performance Analysis in Taiwan Energy Companies: Application of DEA Malmquist Index. Adv. Mater. Res. 2012, 616–618, 1354–1357. [Google Scholar] [CrossRef]

- Ueasin, N.; Wongchai, A. Operating Efficiency Analysis of Energy Industries in Taiwan. Adv. Mater. Res. 2013, 869–870, 612–620. [Google Scholar] [CrossRef]

- Kim, T.W.; Jo, S.H. Measuring efficiency of global electricity companies using data envelopment analysis model. Korean Resour. Econ. Rev. 2000, 9, 349–371. [Google Scholar]

- Rączka, J. Explaining the performance of heat plants in Poland. Energy Econ. 2001, 23, 355–370. [Google Scholar] [CrossRef]

- Chen, Y.; Song, J. The Technological Innovation Efficiency of China’s Renewable Energy Enterprises: An Estimation Based on a Three-Stage DEA Model. Sustainability 2023, 15, 6342. [Google Scholar] [CrossRef]

- Yilmaz, I. A Hybrid DEA–Fuzzy COPRAS Approach to the Evaluation of Renewable Energy: A Case of Wind Farms in Turkey. Sustainability 2023, 15, 11267. [Google Scholar] [CrossRef]

- Panayiotis, G.; Hanias, M.; Kourtis, E.; Kourtis, M. Data Envelopment Analysis (DEA) and Financial Ratios: A Pro-Stakeholders’ View of Performance Measurement for Sustainable Value Creation of the Wind Energy. Int. J. Econ. Bus. Adm. 2020, VIII, 326–350. [Google Scholar] [CrossRef][Green Version]

- Zhang, P.; Lu, B.; Qu, Y.; Ibrahim, H.; Ding, H. Efficiency Measurement and Trend Analysis of the Hydrogen Energy Industry Chain in China. Sustainability 2025, 17, 3140. [Google Scholar] [CrossRef]

- Alexander, S.S. The Effect of Size of Manufacturing Corporation on the Distribution of the Rate of Return. Rev. Econ. Stat. 1949, 31, 229. [Google Scholar] [CrossRef]

- Hymer, S.; Pashigian, P. Firm Size and Rate of Growth. J. Political Econ. 1962, 70, 556–569. [Google Scholar] [CrossRef]

- Evans, D.S. The Relationship Between Firm Growth, Size, and Age: Estimates for 100 Manufacturing Industries. J. Ind. Econ. 1987, 35, 567. [Google Scholar] [CrossRef]

- Dahmash, F.N. Size Effect on Company Profitability: Evidence from Jordan. Int. J. Bus. Manag. 2015, 10, p58. [Google Scholar] [CrossRef]

- Ruwanti, G.; Chandrarin, G.; Assih, P. The influence of corporate governance in the relationship of firm size and leverage on earnings management. Int. J. Innov. Sci. Res. Technol. 2019, 4, 142–147. [Google Scholar]

- Romer, P.M. Increasing Returns and Long-Run Growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Geroski, P.A. An Applied Econometrician’s View of Large Company Performance. Rev. Ind. Organ. 1998, 13, 271–294. [Google Scholar] [CrossRef]

- Samoilikova, A.; Korpysa, J.; Vasylieva, T.; Filep, B. Business—Education collaboration in R&D investment: Analysis of development gaps and critical points using MAR-splines. J. Int. Stud. 2023, 16, 57–71. [Google Scholar] [CrossRef]

- Dogan, M. Does Firm Size Affect The Firm Profitability? Evidence from Turkey. Res. J. Financ. Account. 2013, 4, 53–60. [Google Scholar]

- Almena, A.; Lopez-Quiroga, E.; Fryer, P.J.; Bakalis, S. Towards the decentralisation of food manufacture: Effect of scale production on economics, carbon footprint and energy demand. Energy Procedia 2019, 161, 182–189. [Google Scholar] [CrossRef]

- Niresh, J.A.; Velnampy, T. Firm Size and Profitability: A Study of Listed Manufacturing Firms in Sri Lanka. Int. J. Bus. Manag. 2014, 9, 57. [Google Scholar] [CrossRef]

- Abeyrathna, S.; Priyadarshana, A. Impact of Firm size on Profitability (Special reference to listed manufacturing companies in Sri Lanka). Int. J. Sci. Res. Publ. (IJSRP) 2019, 9, 561–564. [Google Scholar] [CrossRef]

- Kartikasari, D.; Merianti, M. The Effect of Leverage and Firm Size to Profitability of Public Manufacturing Companies In Indonesia. Int. J. Econ. Financ. Issues 2016, 6, 409–413. [Google Scholar]

- Williamson, O.E. Hierarchical Control and Optimum Firm Size. J. Political Econ. 1967, 75, 123–138. [Google Scholar] [CrossRef]

- Diaz, M.A.; Sanchez, R. Firm size and productivity in Spain: A stochastic frontier analysis. Small Bus. Econ. 2008, 30, 315–323. [Google Scholar] [CrossRef]

- Tao, F.; Guo, J.W.; Yang, S.X. Technical Efficiency of Chinese Power Generation and Its Determinants in the Period of Electric-system Transition. China Ind. Econ. 2008, 1, 68–76. [Google Scholar]

- Radlińska, K. Some Theoretical and Practical Aspects of Technical Efficiency—The Example of European Union Agriculture. Sustainability 2023, 15, 13509. [Google Scholar] [CrossRef]

- Silberston, A. Economies of Scale in Theory and Practice. Econ. J. 1972, 82, 369. [Google Scholar] [CrossRef]

- Yildiz, O.; Bozkurt, Ö.Ç.; Kalkan, A.; Ayci, A. The Relationships between Technological Investment, Firm Size, Firm Age and the Growth Rate of Innovational Performance. Procedia Soc. Behav. Sci. 2013, 99, 590–599. [Google Scholar] [CrossRef][Green Version]

- Serrano, A.L.M.; Saiki, G.M.; Rosano-Penã, C.; Rodrigues, G.A.P.; Albuquerque, R.d.O.; Villalba, L.J.G. Bootstrap Method of Eco-Efficiency in the Brazilian Agricultural Industry. Systems 2024, 12, 136. [Google Scholar] [CrossRef]

- Lipsey, R.G. Economies of Scale in Theory and Practice. Simon Fraser University, Harbour Centre 515 West Hastings Street Vancouver, Canada. 2000. Unpublished Paper. Available online: https://rlipsey.com/wp-content/uploads/2018/05/Sacle.pdf (accessed on 27 January 2025).

- Matejun, M. Barriers to Development of High-Technology Small and Medium-Sized Enterprises; Lodz University of Technology Press: Lodz, Poland, 2008. [Google Scholar]

- Available online: https://cas.emis.com/ (accessed on 17 December 2024).

- Barney, J.B. Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view. J. Manag. 2001, 27, 643–650. [Google Scholar] [CrossRef]

- Halkos, G.E.; Tzeremes, N.G. Productivity efficiency and firm size: An empirical analysis of foreign owned companies. Int. Bus. Rev. 2007, 16, 713–731. [Google Scholar] [CrossRef]

- Cullmann, A.; von Hirschhausen, C. Efficiency analysis of East European electricity distribution in transition: Legacy of the past? J. Prod. Anal. 2008, 29, 155–167. [Google Scholar] [CrossRef]

- Barros, C.P.; Peypoch, N. Technical efficiency of thermoelectric power plants. Energy Econ. 2008, 30, 3118–3127. [Google Scholar] [CrossRef]

- Lan, X.; Li, Z.; Wang, Z. An investigation of the innovation efficacy of Chinese photovoltaic enterprises employing three-stage data envelopment analysis (DEA). Energy Rep. 2022, 8, 456–465. [Google Scholar] [CrossRef]

- Jukka, L.; Satu, V.; Samuli, H.; Jarmo, P. Data Envelopment Analysis in the benchmarking of electricity distribution companies. In Proceedings of the 17th International Conference on Electricity Distribution (CIRED), Barcelona, Spain, 12–15 May 2003. [Google Scholar]

- Sun, H.; Geng, C. Financing Efficiency of China’s New Energy Industry Based on DEA Model and Its Influencing Factors. Rev. De Cercet. şi Interv. Socială 2018, 63, 181–199. [Google Scholar]

- Xie, Z. Financing Efficiency Evaluation of Chinese New Energy Enterprises based on Three-stage DEA-Malquist. Adv. Econ. Bus. Manag. Res. 2019, 91, 495–501. [Google Scholar] [CrossRef]

- Commission Recommendation of 6 May 2003 Concerning the Definition of Micro, Small and Medium-Sized Enterprises (Text with EEA Relevance) (Notified Under Document Number C(2003) 1422). Available online: https://eur-lex.europa.eu/eli/reco/2003/361/oj (accessed on 1 April 2025).

- Kuncová, M.; Hedija, V.; Fiala, R. Firm Size as a Determinant of Firm Performance: The Case of Swine Raising. Agris on-line Pap. Econ. Informatics 2016, 08, 77–89. [Google Scholar] [CrossRef]

- Fiala, R.; Hedija, V. The Relationship Between Firm Size and Firm Growth: The Case of the Czech Republic. Acta Univ. Agric. Silvic. Mendel. Brun. 2015, 63, 1639–1644. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Jamasb, T.; Pollitt, M. International benchmarking and regulation: An application to European electricity distribution utilities. Energy Policy 2003, 31, 1609–1622. [Google Scholar] [CrossRef]

- Available online: https://economics.uq.edu.au/cepa/software (accessed on 7 January 2024).

- Chudy-Laskowska, K.; Sobolewski, M.; Stępień, K. Analiza Efektywności Banków w Polsce w Latach 1996–2007. (Analysis of Banks Efficiency in Poland in 1996–2007); Oficyna Wydawnicza Politechniki Rzeszowskiej: Rzeszów, Poland, 2012. [Google Scholar]

- Coelli, T.J. A Guide to DEAP Version 2.1: A Data Envelopment Analysis (Computer) Program; CEPA Working Papers No. 8/96; Department of Econometrics, University of New England: Armidale, NSW, Australia, 1996. [Google Scholar]

- Malmquist, S. Index numbers and indifference surfaces. Trab. Estad. 1953, 4, 209–242. [Google Scholar] [CrossRef]

- Caves, D.W.; Christensen, L.R.; Diewert, W.E. The Economic Theory of Index Numbers and the Measurement of Input, Output, and Productivity. Econometrica 1982, 50, 1393–1414. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Roos, P. Malmquist Productivity Indexes: A Survey of Theory and Practice. In Index Numbers: Essays in Honour of Sten Malmquist; Färe, R., Grosskopf, S., Russell, R.R., Eds.; Springer: Dordrecht, The Netherlands, 1998. [Google Scholar] [CrossRef]

- Tone, K. Malmquist productivity index: Efficiency change over time. In Handbook on Data Envelopment Analysis; Cooper, W.W., Seiford, L.M., Zhu, J., Eds.; Kluwer Academic Publishers: New York, NY, USA; Boston, MA, USA; Dordrecht, The Netherlands; London, UK; Moscow, Russia, 2004; pp. 203–227. [Google Scholar]

- Färe, R.; Grosskopf, S.; Norris, M.; Zhang, Z. Productivity Growth, Technical Progress, and Efficiency Change in Industrialized Countries. Am. Econ. Rev. 1994, 84, 66–83. [Google Scholar]

- Sueyoshi, T.; Aoki, S. A use of a nonparametric statistic for DEA frontier shift: The Kruskal and Wallis rank test. Omega 2001, 29, 1–18. [Google Scholar] [CrossRef]

- Energy Regulatory Office in Poland. Available online: https://www.ure.gov.pl/pl/energia-elektryczna/ceny-wskazniki/7853,Srednia-cena-energii-elektrycznej-dla-gospodarstw-domowych.html (accessed on 31 January 2025).

- Energy Regulatory Office in Poland. Available online: https://www.ure.gov.pl/pl/energia-elektryczna/ceny-wskazniki/7852,Srednia-cena-sprzedazy-energii-elektrycznej-na-rynku-konkurencyjnym-roczna-i-kwa.html (accessed on 31 January 2025).

- Balitskiy, S.; Bilan, Y.; Strielkowski, W. Energy security and economic growth in the European Union. J. Secur. Sustain. Issues 2014, 4, 123–130. [Google Scholar] [CrossRef]

- Niedziółka, D.; Czyżak, P. The economic security of power plants. E3S Web Conf. 2017, 14, 01007. [Google Scholar] [CrossRef]

- Franc-Dąbrowska, J.; Mądra-Sawicka, M.; Milewska, A. Energy Sector Risk and Cost of Capital Assessment—Companies and Investors Perspective. Energies 2021, 14, 1613. [Google Scholar] [CrossRef]

- Jasiniak, M.; Pastusiak, R.; Starzyński, W. Struktura kapitału a efektywność funkcjonowania przedsiębiorstw sektora energetyki w krajach Europy. Przedsiębiorczość I Zarządzanie 2014, 15, 53–63. [Google Scholar]

- Iovino, F.; Migliaccio, G. Energy companies and sizes: An opportunity? Some empirical evidences. Energy Policy 2019, 128, 431–439. [Google Scholar] [CrossRef]

- Rheynaldi, P.K.; Endri, E.; Minanari, M.; Ferranti, P.A.; Karyatun, S. Energy Price and Stock Return: Evidence of Energy Sector Companies in Indonesia. Int. J. Energy Econ. Policy 2023, 13, 31–36. [Google Scholar] [CrossRef]

- Thakur, T.; Deshmukh, S.G.; Kaushik, S.C. Efficiency evaluation of the state owned electric utilities in India. Energy Policy 2006, 34, 2788–2804. [Google Scholar] [CrossRef]

- Fachrudin, K.A.; Ihsan, M.F. The Effect of Financial Distress Probability, Firm Size and Liquidity on Stock Return of Energy Users Companies in Indonesia. Int. J. Energy Econ. Policy 2021, 11, 296–300. [Google Scholar] [CrossRef]

- Chen, T.-Y. An assessment of technical efficiency and cross-efficiency in Taiwan’s electricity distribution sector. Eur. J. Oper. Res. 2002, 137, 421–433. [Google Scholar] [CrossRef]

- Bai, X.; Song, Y. Technical efficiency and its upgrade orientation of thermal Power industry in provinces of China--based on the analysis of three-stage DEA model. J. Financ. Econ. 2008, 10, 15–25. [Google Scholar]

- Steinbrunner, P. Is larger really better? Productivity and firm size in European electricity generation sectors. J. Clean. Prod. 2024, 446, 141382. [Google Scholar] [CrossRef]

- Coto-Millán, P.; de la Fuente, M.; Fernández, X.L. Determinants of the European electricity companies efficiency: 2005–2014. Energy Strat. Rev. 2018, 21, 149–156. [Google Scholar] [CrossRef]

- Ahlqvist, V.; Holmberg, P.; Tangerås, T. A survey comparing centralized and decentralized electricity markets. Energy Strat. Rev. 2022, 40, 100812. [Google Scholar] [CrossRef]

- González, F.F.; Webb, J.; Sharmina, M.; Hannon, M.; Braunholtz-Speight, T.; Pappas, D. Local energy businesses in the United Kingdom: Clusters and localism determinants based on financial ratios. Energy 2022, 239, 122119. [Google Scholar] [CrossRef]

- Jorge, M.L.; Madueño, J.H.; Sancho, M.P.L.; Martínez-Martínez, D. Development of corporate social responsibility in small and medium-sized enterprises and its nexus with quality management. Cogent Bus. Manag. 2016, 3, 1228569. [Google Scholar] [CrossRef]

- Pollitt, M.G. The European Single Market in Electricity: An Economic Assessment. Rev. Ind. Organ. 2019, 55, 63–87. [Google Scholar] [CrossRef]

| Authors | Methods | Units | Inputs | Outputs |

|---|---|---|---|---|

| Borozan and Starcevic [1] | Bootstrap DEA | 28 EU energy companies | Total asset Number of employees Gross investment | Revenues GHG emissions |

| Chai et al. [11] | SBM–DEA model (the efficiency evaluation, including positive and negative output) | 17 companies in China’s thermal power sector | Employment (persons) Clean energy installed Capacity (10,000 kWh) Coal power installed Capacity (10,000 kWh) | Total power generation Sulfur dioxide emissions NOx emissions Soot emissions |

| Kusz et al. [59] | DEA-CCR Malmquist index | 43 agricultural biogas plants | Raw materials and consumables used Employee benefit expense The value of fixed assets | Total operating revenue |

| Ślusarz et al. [60] | DEA-CCR | 16 voivodeships | Consumption of biogas Consumption of biomass | Total production of heat from biogas and biomass |

| Agrell and Bogetoft [61] | DEA model with extensions Malmquist index | 310 and 253 heat plants and combined heat and power plants | Primary energy input from different sources Secondary heat input from different sources Total carbon dioxide CO2 emission Expenditures for operation, maintenance, administration, and metering Expenditures for primary and secondary energy Expenditure for primary fuel | Net delivered thermal energy Delivered electric energy Number of subscribed connection points of the distribution system Revenue from sales of electricity Length of distribution network |

| Athanassopoulos et al. [62] | DESA model | Micro-scenario planning at the level of individual production plants | Fuel Controllable costs Capital expenditure | Energy produced Availability Accidents Emissions of pollution |

| Maradin et al. [29] | DEA-CCR | 47 offshore wind energy companies | Tangible fixed assets Cash and cash equivalent Current assets | EBIT (earnings before interest and taxes) |

| Ratner and Ratner [63] | Input-oriented DEA-CCR Malmquist index | 24 electric generating companies—first stage 11 power plants—second stage | Atmospheric emissions Solid waste Freshwater consumption | Generated electricity |

| Arcos-Vargas et al. [64] | Input-oriented CCR-DEA and VRS-DEA | 102 small-scale electricity distributors | Remuneration assets | Distributed energy Points of supply Amount of energy not supply |

| Blázquez-Gómez and Grifell-Tatjé [65] | DEA-CCR | 8 electricity distributors | High-voltage distribution networks Medium-voltage distribution networks Low-voltage distribution networks Transformation capacity of the substations for high-to-high voltage, high-to-medium voltage, in addition to medium-to-low transformation facilities | Number of consumers supplied by each distributor High and medium-voltage electricity supplied Low-voltage electricity supplied |

| Liu et al. [66] | DEA Malmquist index | 8 energy companies | Liability/asset ratio Solvency current ratio Average inventory turnover Total asset turnover | Operating income to paid-in capital Profit before tax to paid-in capital Net profit to sales Earnings per share |

| Ueasin and Wongchai [67] | SE-DEA (superefficiency data envelopment) | 8 energy companies | Liability/asset ratio Solvency current ratio Average inventory turnover Total asset turnover | Operating income to Paid-in capital Profit before tax to paid-in capital Net profit to sales Earnings per share |

| Kim and Jo [68] | DEA-CCR | 51 electricity companies | Number of employees installed capacity | Revenue Profit Electricity |

| Rączka [69] | DEA-BCC | 41 heat plants | Labor, fuel and pollution | Heat production |

| Chen and Song [70] | Three-stage DEA | 315 renewable energy businesses | The total number of technical professionals employed annually The total R&D investment | Number of patents granted to the company each year Increase in intangible assets |

| Yilmaz [71] | DEA-CCR | 10 wind power plants | Number of wind turbines Investment cost Distance from the grid | Electricity production Daily production time |

| Curtis [72] | DEA-CCR | 12 wind farms | Total assets | Revenues EBIT |

| Zhang et al. [73] | Three-stage DEA | 30 companies engaged in hydrogen energy | The number of employees The main business cost The fixed assets | The main business income The net profit |

| Statistics | Total | Group I (Small) | Group II (Large) |

|---|---|---|---|

| Net sales revenue | |||

| Mean | 2590.41 | 361.90 | 38,989.45 |

| Median | 50.51 | 48.66 | 29,127.80 |

| Coefficient of variation (%) | 381.70 | 223.86 | 49.22 |

| Operating costs | |||

| Mean | 2120.60 | 295.31 | 31,933.74 |

| Median | 29.23 | 24.99 | 33,716.74 |

| Coefficient of variation (%) | 455.36 | 251.54 | 96.50 |

| Fixed assets | |||

| Mean | 2370.54 | 298.40 | 36,215.50 |

| Median | 95.25 | 91.90 | 29,439.23 |

| Coefficient of variation (%) | 409.75 | 201.80 | 66.14 |

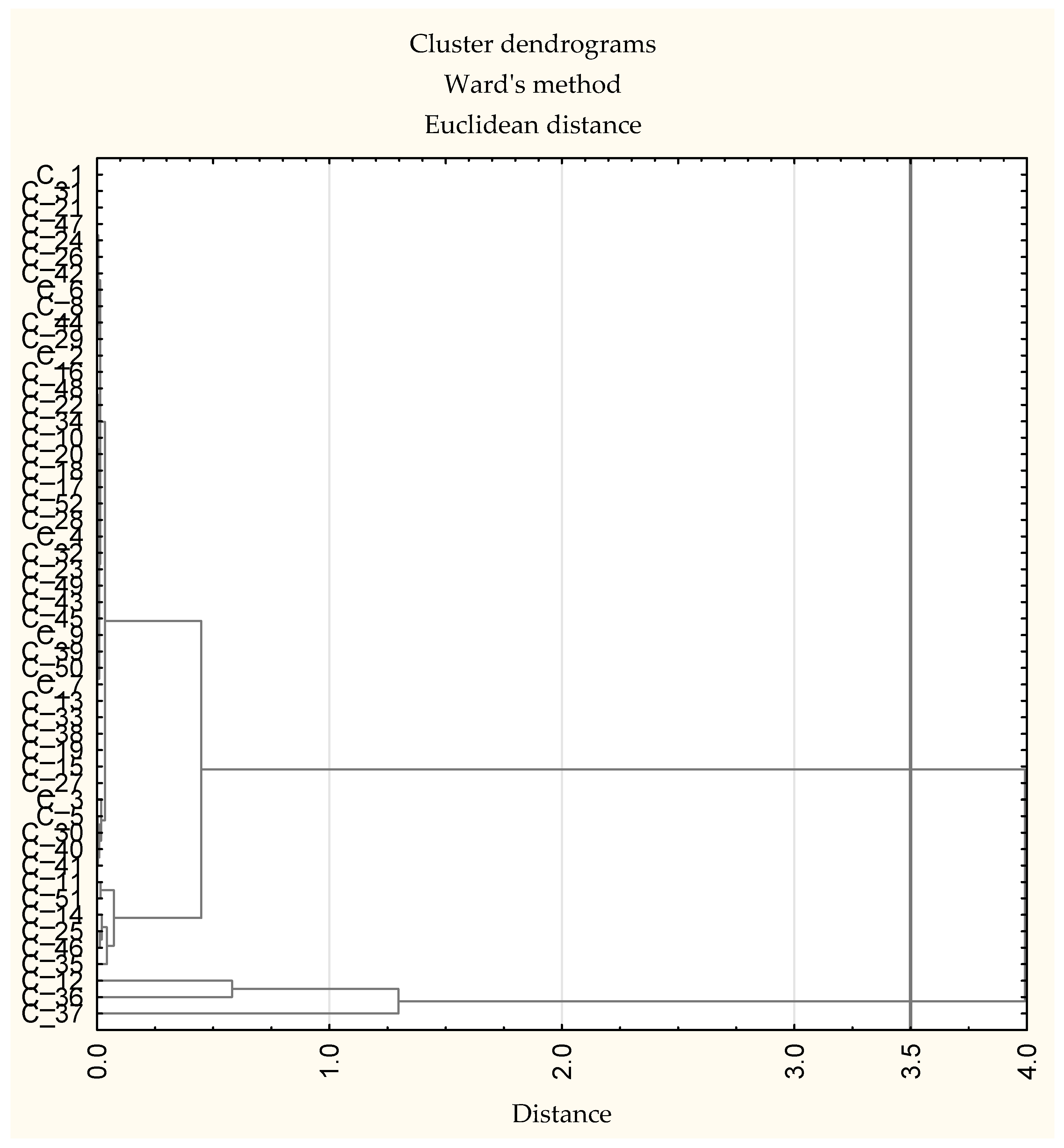

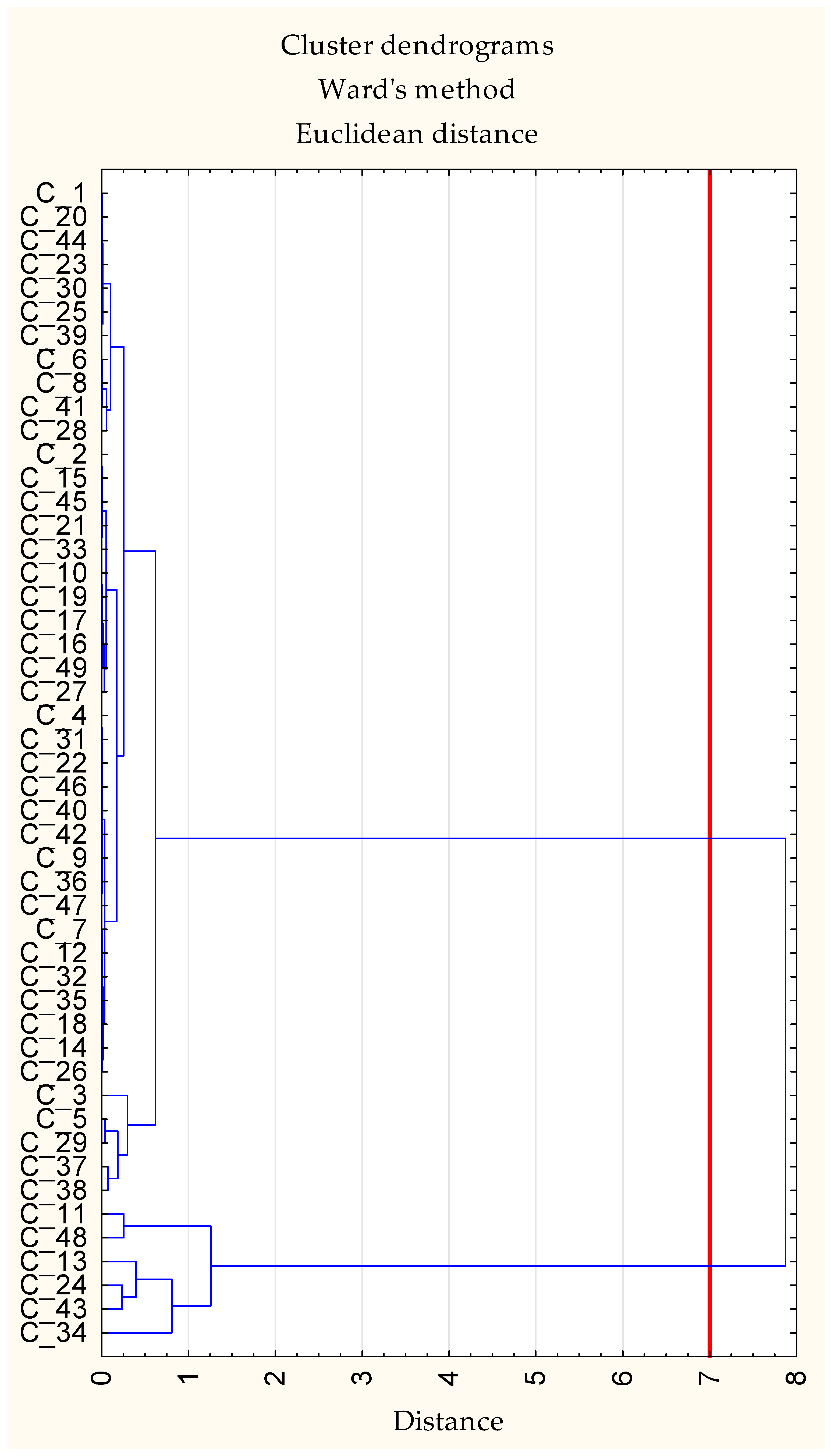

| Statistics | Total | Group IA (Small) | Group IB (Medium) | Group II (Large) |

|---|---|---|---|---|

| Number of DMU | 51 | 42 | 6 | 3 |

| Net sales revenue | ||||

| Mean | 2590.41 | 85.0 | 234.6 | 38,989.45 |

| Median | 50.51 | 43.6 | 202.9 | 29,127.80 |

| Coefficient of variation (%) | 381.70 | 170.24 | 36.66 | 49.22 |

| Operating costs | ||||

| Mean | 2120.60 | 44.4 | 209.3 | 31,933.74 |

| Median | 29.23 | 19.6 | 174.3 | 33,716.74 |

| Coefficient of variation (%) | 455.36 | 158.16 | 43.64 | 96.50 |

| Fixed assets | ||||

| Mean | 2370.54 | 107.9 | 166.3 | 36,215.50 |

| Median | 95.25 | 87.0 | 151.2 | 29,439.23 |

| Coefficient of variation (%) | 409.75 | 104.89 | 54.63 | 66.14 |

| Statistics | Total | Groups | p-Value | ||

|---|---|---|---|---|---|

| IA (Small) | IB (Medium) | II (Large) | |||

| 2019 | |||||

| Mean | 0.135 | 0.134 | 0.039 | 0.347 | |

| Median | 0.076 | 0.087 | 0.031 | 0.024 | 0.052 |

| Coefficient of variation (%) | 169.01 | 156.01 | 45.29 | 162.73 | |

| 2020 | |||||

| Mean | 0.137 | 0.137 | 0.032 | 0.353 | |

| Median | 0.065 | 0.084 | 0.032 | 0.030 | 0.011 |

| Coefficient of variation (%) | 175.04 | 163.68 | 15.56 | 158.96 | |

| 2021 | |||||

| Mean | 0.134 | 0.133 | 0.034 | 0.352 | |

| Median | 0.074 | 0.085 | 0.033 | 0.030 | 0.027 |

| Coefficient of variation (%) | 175.47 | 164.06 | 21.38 | 159.19 | |

| 2022 | |||||

| Mean | 0.162 | 0.160 | 0.071 | 0.369 | |

| Median | 0.102 | 0.124 | 0.062 | 0.056 | 0.082 |

| Coefficient of variation (%) | 133.39 | 122.02 | 24.26 | 148.09 | |

| 2023 | |||||

| Mean | 0.138 | 0.128 | 0.091 | 0.365 | |

| Median | 0.072 | 0.072 | 0.073 | 0.050 | 0.750 |

| Coefficient of variation (%) | 161.08 | 157.61 | 57.66 | 150.88 | |

| Groups | IA (Small) | IB (Medium) | II (Large) |

|---|---|---|---|

| 2020 | |||

| IA (small) | 0.012 | 0.817 | |

| IB (medium) | 0.012 | 1 | |

| II (large) | 0.817 | 1 | |

| 2021 | |||

| IA (small) | 0.028 | 1 | |

| IB (medium) | 0.028 | 1 | |

| II (large) | 1 | 1 | |

| Characteristics | Total | Group IA (Small) | Group IB (Medium) | Group II (Large) |

|---|---|---|---|---|

| 2019 | ||||

| Efficient DMUs (number of units) | 2 | 1 | 0 | 1 |

| Efficiency scores (% of units) | ||||

| Less than 0.1 | 67.31 | 62.79 | 100.0 | 66.67 |

| 0.1 ≤ TE < 0.3 | 23.08 | 27.91 | - | |

| 0.3 ≤ TE < 0.5 | 1.92 | 2.33 | - | |

| 0.5 ≤ TE < 0.7 | 1.92 | 2.33 | - | |

| 0.7 ≤ TE < 0.9 | - | - | - | |

| 0.9 ≤ TE < 1 | 1.92 | 2.33 | - | |

| TE = 1 | 3.85 | 2.33 | 33.33 | |

| 2020 | ||||

| Efficient DMUs (number of units) | 3 | 2 | 0 | 1 |

| Efficiency scores (% of units) | ||||

| Less than 0.1 | 73.08 | 69.77 | 100.0 | 66.67 |

| 0.1 ≤ TE < 0.3 | 19.23 | 23.26 | - | |

| 0.3 ≤ TE < 0.5 | - | - | - | |

| 0.5 ≤ TE < 0.7 | - | - | - | |

| 0.7 ≤ TE < 0.9 | 1.92 | 2.33 | - | |

| 0.9 ≤ TE < 1 | - | - | - | |

| TE = 1 | 5.77 | 4.65 | 33.33 | |

| 2021 | ||||

| Efficient DMUs (number of units) | 3 | 2 | 0 | 1 |

| Efficiency scores (% of units) | ||||

| Less than 0.1 | 73.08 | 69.77 | 100.0 | 66.67 |

| 0.1 ≤ TE < 0.3 | 19.23 | 23.26 | - | |

| 0.3 ≤ TE < 0.5 | - | - | - | |

| 0.5 ≤ TE < 0.7 | 1.92 | 2.33 | - | |

| 0.7 ≤ TE < 0.9 | - | - | - | |

| 0.9 ≤ TE < 1 | - | - | - | |

| TE = 1 | 5.77 | 4.65 | 33.33 | |

| 2022 | ||||

| Efficient DMUs (number of units) | 3 | 2 | 0 | 1 |

| Efficiency scores (% of units) | ||||

| Less than 0.1 | 48.08 | 41.86 | 83.33 | 66.67 |

| 0.1 ≤ TE < 0.3 | 44.23 | 51.16 | 16.67 | - |

| 0.3 ≤ TE < 0.5 | 1.92 | 2.33 | - | |

| 0.5 ≤ TE < 0.7 | - | - | - | |

| 0.7 ≤ TE < 0.9 | - | - | - | |

| 0.9 ≤ TE < 1 | - | - | - | |

| TE = 1 | 5.77 | 4.65 | 33.33 | |

| 2023 | ||||

| Efficient DMUs (number of units) | 3 | 2 | 0 | 1 |

| Efficiency scores (% of units) | ||||

| Less than 0.1 | 76.92 | 76.74 | 83.33 | 66.67 |

| 0.1 ≤ TE < 0.3 | 15.38 | 16.28 | 16.77 | - |

| 0.3 ≤ TE < 0.5 | 1.92 | 2.33 | - | |

| 0.5 ≤ TE < 0.7 | - | - | - | |

| 0.7 ≤ TE < 0.9 | - | - | - | |

| 0.9 ≤ TE < 1 | - | - | - | |

| TE = 1 | 5.77 | 4.65 | 33.33 | |

| Characteristics | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| Net sales revenue | 1.175 | 1.121 | 1.475 | 1.345 |

| Operating costs | 0.986 | 1.125 | 1.466 | 1.400 |

| Statistics | Total | Group IA (Small) | Group IB (Medium) | Group II (Large) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| effch | techch | tfpch | effch | techch | tfpch | effch | techch | tfpch | effch | techch | tfpch | |

| 2020 | ||||||||||||

| Mean | 1.071 | 1.074 | 1.137 | 1.08 | 1.091 | 1.163 | 0.911 | 0.965 | 0.867 | 1.274 | 1.051 | 1.301 |

| Median | 1.003 | 1.031 | 1.023 | 0.993 | 1.039 | 1.036 | 1.013 | 0.913 | 0.925 | 1.279 | 0.914 | 1.325 |

| Coefficient of variation (%) | 46.18 | 23.44 | 46.39 | 41.12 | 24.37 | 48.68 | 24.40 | 11.94 | 19.74 | 21.35 | 22.61 | 9.41 |

| 2021 | ||||||||||||

| Mean | 1.011 | 1.069 | 1.082 | 1.001 | 1.074 | 1.084 | 1.049 | 1.015 | 1.065 | 0.982 | 1.105 | 1.087 |

| Median | 0.988 | 1.063 | 1.030 | 0.962 | 1.081 | 1.026 | 1.048 | 1.007 | 1.053 | 0.988 | 1.005 | 0.993 |

| Coefficient of variation (%) | 21.72 | 7.24 | 23.31 | 23.82 | 6.76 | 25.21 | 6.90 | 1.88 | 7.93 | 2.15 | 15.63 | 17.34 |

| 2022 | ||||||||||||

| Mean | 1.663 | 0.721 | 1.162 | 1.606 | 0.736 | 1.156 | 2.109 | 0.575 | 1.223 | 1.582 | 0.801 | 1.122 |

| Median | 1.617 | 0.723 | 1.068 | 1.530 | 0.757 | 1.067 | 1.913 | 0.549 | 1.078 | 1.855 | 0.552 | 1.044 |

| Coefficient of variation (%) | 32.21 | 21.12 | 30.35 | 33.32 | 16.73 | 31.89 | 18.30 | 10.33 | 27.40 | 31.88 | 53.79 | 13.58 |

| 2023 | ||||||||||||

| Mean | 0.861 | 1.232 | 1.051 | 0.786 | 1.248 | 0.976 | 1.365 | 1.175 | 1.600 | 0.920 | 1.115 | 1.030 |

| Median | 0.785 | 1.221 | 0.960 | 0.740 | 1.277 | 0.936 | 1.068 | 1.158 | 1.165 | 0.891 | 1.070 | 0.954 |

| Coefficient of variation (%) | 56.94 | 9.99 | 57.66 | 49.49 | 9.69 | 52.07 | 66.39 | 10.11 | 67.22 | 7.625 | 7.89 | 15.73 |

| Period | Total | Group IA (Small) | Group IB (Medium) | Group II (Large) |

|---|---|---|---|---|

| 2021 to 2020 | 0.670 | 0.871 | 0.046 | 0.109 |

| 2022 to 2021 | 0.259 | 0.378 | 0.600 | 0.285 |

| 2023 to 2022 | 0.046 | 0.024 | 0.601 | 0.109 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kusz, B.; Kusz, D.; Jurgilewicz, O.; Jurgilewicz, M.; Kozicki, B.; Topolewski, S. The Technical Efficiency of Polish Energy Sector Companies of Different Sizes. Energies 2025, 18, 2534. https://doi.org/10.3390/en18102534

Kusz B, Kusz D, Jurgilewicz O, Jurgilewicz M, Kozicki B, Topolewski S. The Technical Efficiency of Polish Energy Sector Companies of Different Sizes. Energies. 2025; 18(10):2534. https://doi.org/10.3390/en18102534

Chicago/Turabian StyleKusz, Bożena, Dariusz Kusz, Oktawia Jurgilewicz, Marcin Jurgilewicz, Bartosz Kozicki, and Stanisław Topolewski. 2025. "The Technical Efficiency of Polish Energy Sector Companies of Different Sizes" Energies 18, no. 10: 2534. https://doi.org/10.3390/en18102534

APA StyleKusz, B., Kusz, D., Jurgilewicz, O., Jurgilewicz, M., Kozicki, B., & Topolewski, S. (2025). The Technical Efficiency of Polish Energy Sector Companies of Different Sizes. Energies, 18(10), 2534. https://doi.org/10.3390/en18102534