Debt Sustainability Assessment in the Biogas Sector: Application of Interest Coverage Ratios in a Sample of Agricultural Firms in Italy

Abstract

1. Introduction

- The first research question concerns the structure of investments and sources of financing to understand the levels of debt, and the types of debt distinct in nature, resorted to by firms in the sector (RQ1).

- The second research question concerns the analysis of the interest coverage ratios (ICRs), i.e., indices that verify the financial sustainability of firms’ access to credit [73,74], applied to the firms in the sample to verify whether the firms are able to pay the cost of debt (RQ2a), are able to repay the financial debt (RQ2b), and are able to jointly repay the financial debt and pay the cost of debt (RQ2c).

- After applying the ICRs, this research develops two other research questions, which concern the analysis of the correlation between ICRs (RQ3) and the verification of the statistically significant difference between ICRs (RQ4).

2. Materials and Methods

3. Results

3.1. Main Result for RQ1

3.2. Main Result for RQ2

3.3. Main Result for RQ3

3.4. Main Result for RQ4

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| AP | accounts payable |

| AR | accounts receivable |

| aTΠt | profit after taxes |

| bTΠt | profit before taxes |

| CCC | cash conversion cycle |

| CF | cash flow |

| current ratio | total current asset divided by total current liabilities |

| EBIT | earnings before interest and taxes |

| EBITDA | earnings before interest, tax, depreciation and amortization |

| FAI | investment in fixed asset |

| FCFE | free cash flow to equity |

| AR | total company debt divided by total shareholders’ equity |

| INV | value of inventories stock |

| L | labor costs |

| M | cost for raw materials |

| MC | monetary cost (MC = M + S + R +L + O) |

| NWC | net working capital (NWC = AR + INV − AP) |

| O | others operative costs |

| OCF | operating cash flow |

| UFCF | unlevered free cash flow |

| R | cost for rent and leasing |

| S | costs for services |

| T | turnover (sales) |

| Tm | income tax |

Appendix A

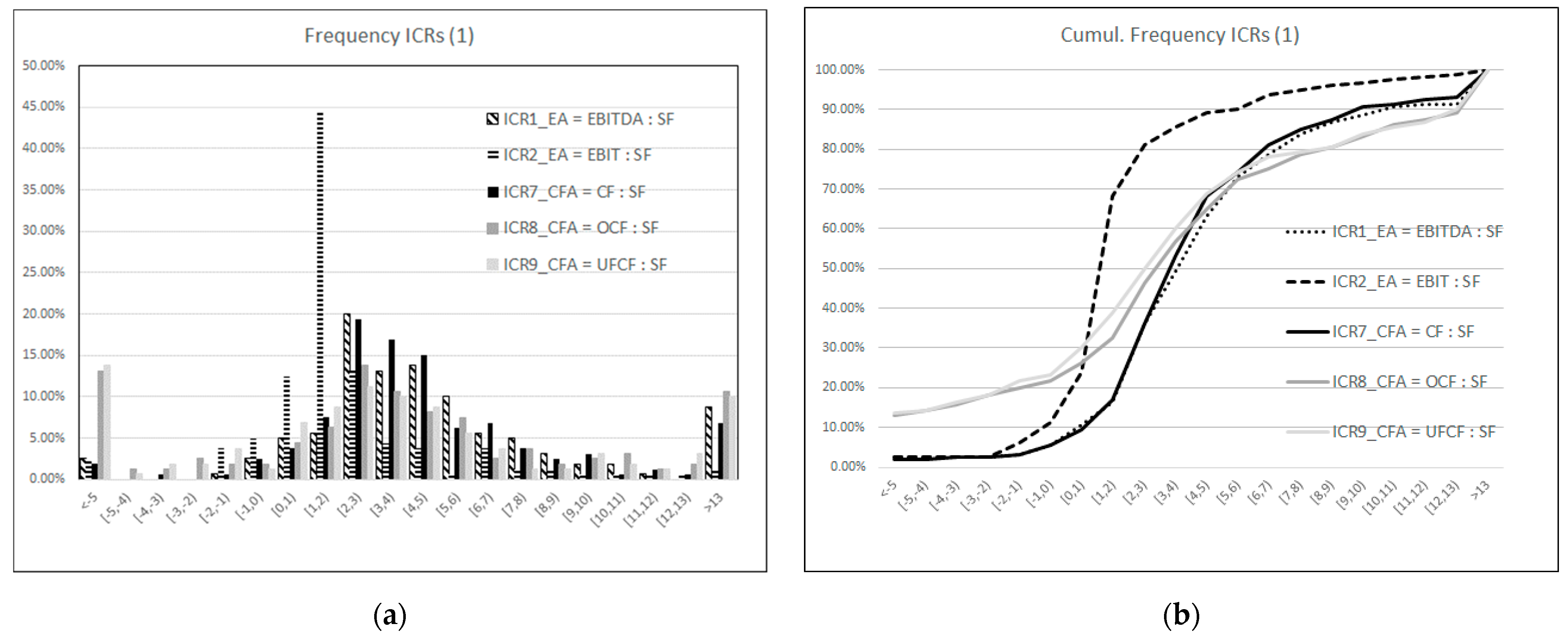

| Range | ICR1_EA = EBITDA : SF | ICR2_EA = EBIT : SF | ICR7_CFA = CF : SF | ICR8_CFA = OCF : SF | ICR9_CFA = UFCF : SF |

|---|---|---|---|---|---|

| <−5 | 4 | 4 | 3 | 21 | 22 |

| [5, −4) | 0 | 0 | 0 | 2 | 1 |

| [−4, −3) | 0 | 0 | 1 | 2 | 3 |

| [−3, −2) | 0 | 0 | 0 | 4 | 3 |

| [−2, −1) | 1 | 6 | 1 | 3 | 6 |

| [−1, 0) | 4 | 8 | 4 | 3 | 2 |

| [0, 1) | 8 | 20 | 6 | 7 | 11 |

| [1, 2) | 9 | 71 | 12 | 10 | 14 |

| [2, 3) | 32 | 21 | 31 | 22 | 18 |

| [3, 4) | 21 | 7 | 27 | 17 | 16 |

| [4, 5) | 22 | 6 | 24 | 13 | 14 |

| [5, 6) | 16 | 1 | 10 | 12 | 9 |

| [6, 7) | 9 | 6 | 11 | 4 | 6 |

| [7, 8) | 8 | 2 | 6 | 6 | 2 |

| [8, 9) | 5 | 2 | 4 | 3 | 2 |

| [9, 10) | 3 | 1 | 5 | 4 | 5 |

| [10, 11) | 3 | 1 | 1 | 5 | 3 |

| [11, 12) | 1 | 1 | 2 | 2 | 2 |

| [12, 13) | 0 | 1 | 1 | 3 | 5 |

| >13 | 14 | 2 | 11 | 17 | 16 |

| Tot. | 160 | 160 | 160 | 160 | 160 |

| Range | ICR1_EA = EBITDA : SF | ICR2_EA = EBIT : SF | ICR7_CFA = CF : SF | ICR8_CFA = OCF : SF | ICR9_CFA = UFCF : SF |

|---|---|---|---|---|---|

| <−5 | 2.50% | 2.50% | 1.88% | 13.13% | 13.75% |

| [5, −4) | 0.00% | 0.00% | 0.00% | 1.25% | 0.63% |

| [−4, −3) | 0.00% | 0.00% | 0.63% | 1.25% | 1.88% |

| [−3, −2) | 0.00% | 0.00% | 0.00% | 2.50% | 1.88% |

| [−2, −1) | 0.63% | 3.75% | 0.63% | 1.88% | 3.75% |

| [−1, 0) | 2.50% | 5.00% | 2.50% | 1.88% | 1.25% |

| [0, 1) | 5.00% | 12.50% | 3.75% | 4.38% | 6.88% |

| [1, 2) | 5.63% | 44.38% | 7.50% | 6.25% | 8.75% |

| [2, 3) | 20.00% | 13.13% | 19.38% | 13.75% | 11.25% |

| [3, 4) | 13.13% | 4.38% | 16.88% | 10.63% | 10.00% |

| [4, 5) | 13.75% | 3.75% | 15.00% | 8.13% | 8.75% |

| [5, 6) | 10.00% | 0.63% | 6.25% | 7.50% | 5.63% |

| [6, 7) | 5.63% | 3.75% | 6.88% | 2.50% | 3.75% |

| [7, 8) | 5.00% | 1.25% | 3.75% | 3.75% | 1.25% |

| [8, 9) | 3.13% | 1.25% | 2.50% | 1.88% | 1.25% |

| [9, 10) | 1.88% | 0.63% | 3.13% | 2.50% | 3.13% |

| [10, 11) | 1.88% | 0.63% | 0.63% | 3.13% | 1.88% |

| [11, 12) | 0.63% | 0.63% | 1.25% | 1.25% | 1.25% |

| [12, 13) | 0.00% | 0.63% | 0.63% | 1.88% | 3.13% |

| >13 | 8.75% | 1.25% | 6.88% | 10.63% | 10.00% |

| Tot. | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Range | ICR1_EA = EBITDA : SF | ICR2_EA = EBIT : SF | ICR7_CFA = CF : SF | ICR8_CFA = OCF : SF | ICR9_CFA = UFCF : SF |

|---|---|---|---|---|---|

| <−5 | 2.50% | 2.50% | 1.88% | 13.13% | 13.75% |

| [5, −4) | 2.50% | 2.50% | 1.88% | 14.38% | 14.38% |

| [−4, −3) | 2.50% | 2.50% | 2.50% | 15.63% | 16.25% |

| [−3, −2) | 2.50% | 2.50% | 2.50% | 18.13% | 18.13% |

| [−2, −1) | 3.13% | 6.25% | 3.13% | 20.00% | 21.88% |

| [−1, 0) | 5.63% | 11.25% | 5.63% | 21.88% | 23.13% |

| [0, 1) | 10.63% | 23.75% | 9.38% | 26.25% | 30.00% |

| [1, 2) | 16.25% | 68.13% | 16.88% | 32.50% | 38.75% |

| [2, 3) | 36.25% | 81.25% | 36.25% | 46.25% | 50.00% |

| [3, 4) | 49.38% | 85.63% | 53.13% | 56.88% | 60.00% |

| [4, 5) | 63.13% | 89.38% | 68.13% | 65.00% | 68.75% |

| [5, 6) | 73.13% | 90.00% | 74.38% | 72.50% | 74.38% |

| [6, 7) | 78.75% | 93.75% | 81.25% | 75.00% | 78.13% |

| [7, 8) | 83.75% | 95.00% | 85.00% | 78.75% | 79.38% |

| [8, 9) | 86.88% | 96.25% | 87.50% | 80.63% | 80.63% |

| [9, 10) | 88.75% | 96.88% | 90.63% | 83.13% | 83.75% |

| [10, 11) | 90.63% | 97.50% | 91.25% | 86.25% | 85.63% |

| [11, 12) | 91.25% | 98.13% | 92.50% | 87.50% | 86.88% |

| [12, 13) | 91.25% | 98.75% | 93.13% | 89.38% | 90.00% |

| >13 | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

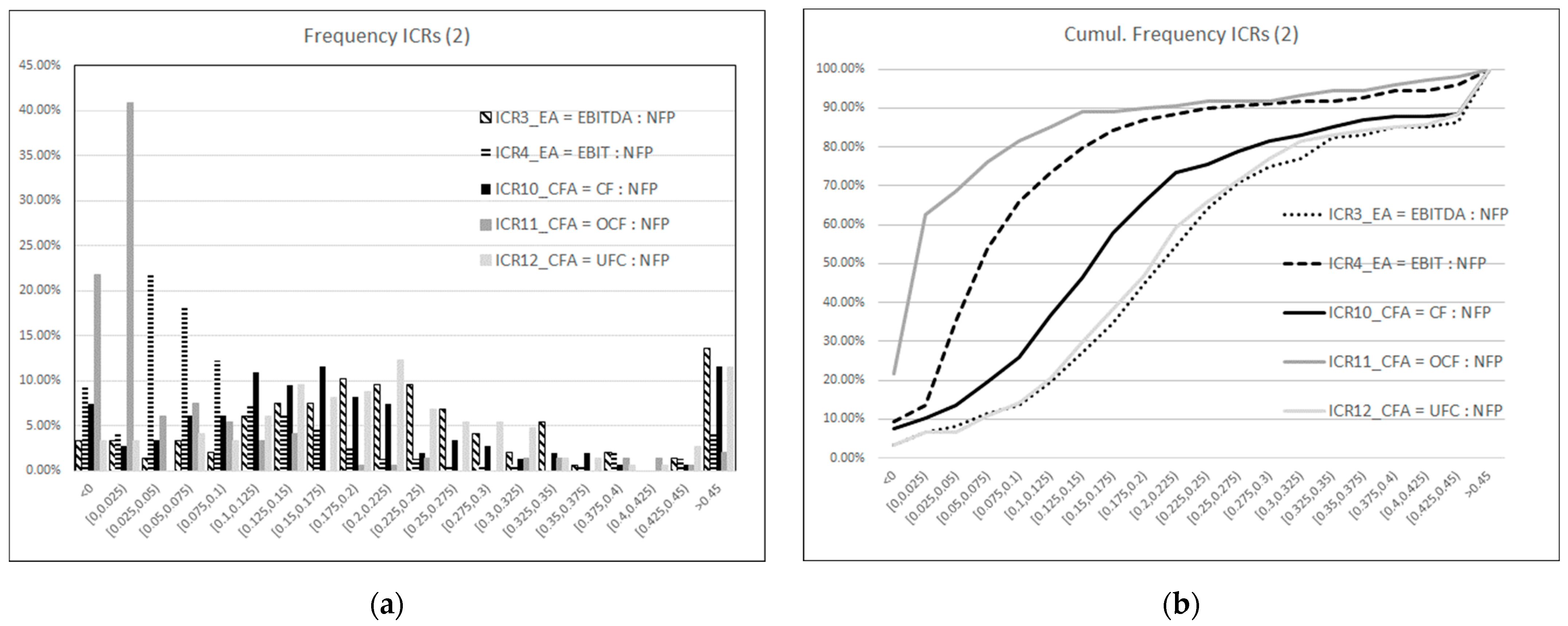

| Range | ICR3_EA = EBITDA : NFP | ICR4_EA = EBIT : NFP | ICR10_CFA = CF : NFP | ICR11_CFA = OCF : NFP | ICR12_CFA = UFC : NFP |

|---|---|---|---|---|---|

| <0 | 5 | 14 | 11 | 32 | 5 |

| [0.0, 0.025) | 5 | 6 | 4 | 60 | 5 |

| [0.025, 0.05) | 2 | 32 | 5 | 9 | 0 |

| [0.05, 0.075) | 5 | 27 | 9 | 11 | 6 |

| [0.075, 0.1) | 3 | 18 | 9 | 8 | 5 |

| [0.1, 0.125) | 9 | 11 | 16 | 5 | 9 |

| [0.125, 0.15) | 11 | 9 | 14 | 6 | 14 |

| [0.15, 0.175) | 11 | 7 | 17 | 0 | 12 |

| [0.175, 0.2) | 15 | 4 | 12 | 1 | 13 |

| [0.2, 0.225) | 14 | 2 | 11 | 1 | 18 |

| [0.225, 0.25) | 14 | 2 | 3 | 2 | 10 |

| [0.25, 0.275) | 10 | 1 | 5 | 0 | 8 |

| [0.275, 0.3) | 6 | 1 | 4 | 0 | 8 |

| [0.3, 0.325) | 3 | 1 | 2 | 2 | 7 |

| [0.325, 0.35) | 8 | 0 | 3 | 2 | 2 |

| [0.35, 0.375) | 1 | 1 | 3 | 0 | 2 |

| [0.375, 0.4) | 3 | 3 | 1 | 2 | 1 |

| [0.4, 0.425) | 0 | 0 | 0 | 2 | 1 |

| [0.425, 0.45) | 2 | 2 | 1 | 1 | 4 |

| >0.45 | 20 | 6 | 17 | 3 | 17 |

| Tot. | 147 | 147 | 147 | 147 | 147 |

| Range | ICR3_EA = EBITDA : NFP | ICR4_EA = EBIT : NFP | ICR10_CFA = CF : NFP | ICR11_CFA = OCF : NFP | ICR12_CFA = UFC : NFP |

|---|---|---|---|---|---|

| <0 | 3.40% | 9.52% | 7.48% | 21.77% | 3.40% |

| [0.0, 0.025) | 3.40% | 4.08% | 2.72% | 40.82% | 3.40% |

| [0.025, 0.05) | 1.36% | 21.77% | 3.40% | 6.12% | 0.00% |

| [0.05, 0.075) | 3.40% | 18.37% | 6.12% | 7.48% | 4.08% |

| [0.075, 0.1) | 2.04% | 12.24% | 6.12% | 5.44% | 3.40% |

| [0.1, 0.125) | 6.12% | 7.48% | 10.88% | 3.40% | 6.12% |

| [0.125, 0.15) | 7.48% | 6.12% | 9.52% | 4.08% | 9.52% |

| [0.15, 0.175) | 7.48% | 4.76% | 11.56% | 0.00% | 8.16% |

| [0.175, 0.2) | 10.20% | 2.72% | 8.16% | 0.68% | 8.84% |

| [0.2, 0.225) | 9.52% | 1.36% | 7.48% | 0.68% | 12.24% |

| [0.225, 0.25) | 9.52% | 1.36% | 2.04% | 1.36% | 6.80% |

| [0.25, 0.275) | 6.80% | 0.68% | 3.40% | 0.00% | 5.44% |

| [0.275, 0.3) | 4.08% | 0.68% | 2.72% | 0.00% | 5.44% |

| [0.3, 0.325) | 2.04% | 0.68% | 1.36% | 1.36% | 4.76% |

| [0.325, 0.35) | 5.44% | 0.00% | 2.04% | 1.36% | 1.36% |

| [0.35, 0.375) | 0.68% | 0.68% | 2.04% | 0.00% | 1.36% |

| [0.375, 0.4) | 2.04% | 2.04% | 0.68% | 1.36% | 0.68% |

| [0.4, 0.425) | 0.00% | 0.00% | 0.00% | 1.36% | 0.68% |

| [0.425, 0.45) | 1.36% | 1.36% | 0.68% | 0.68% | 2.72% |

| >0.45 | 13.61% | 4.08% | 11.56% | 2.04% | 11.56% |

| Tot. | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Range | ICR3_EA = EBITDA : NFP | ICR4_EA = EBIT : NFP | ICR10_CFA = CF : NFP | ICR11_CFA = OCF : NFP | ICR12_CFA = UFC : NFP |

|---|---|---|---|---|---|

| <0 | 3.40% | 9.52% | 7.48% | 21.77% | 3.40% |

| [0.0, 0.025) | 6.80% | 13.61% | 10.20% | 62.59% | 6.80% |

| [0.025, 0.05) | 8.16% | 35.37% | 13.61% | 68.71% | 6.80% |

| [0.05, 0.075) | 11.56% | 53.74% | 19.73% | 76.19% | 10.88% |

| [0.075, 0.1) | 13.61% | 65.99% | 25.85% | 81.63% | 14.29% |

| [0.1, 0.125) | 19.73% | 73.47% | 36.73% | 85.03% | 20.41% |

| [0.125, 0.15) | 27.21% | 79.59% | 46.26% | 89.12% | 29.93% |

| [0.15, 0.175) | 34.69% | 84.35% | 57.82% | 89.12% | 38.10% |

| [0.175, 0.2) | 44.90% | 87.07% | 65.99% | 89.80% | 46.94% |

| [0.2, 0.225) | 54.42% | 88.44% | 73.47% | 90.48% | 59.18% |

| [0.225, 0.25) | 63.95% | 89.80% | 75.51% | 91.84% | 65.99% |

| [0.25, 0.275) | 70.75% | 90.48% | 78.91% | 91.84% | 71.43% |

| [0.275, 0.3) | 74.83% | 91.16% | 81.63% | 91.84% | 76.87% |

| [0.3, 0.325) | 76.87% | 91.84% | 82.99% | 93.20% | 81.63% |

| [0.325, 0.35) | 82.31% | 91.84% | 85.03% | 94.56% | 82.99% |

| [0.35, 0.375) | 82.99% | 92.52% | 87.07% | 94.56% | 84.35% |

| [0.375, 0.4) | 85.03% | 94.56% | 87.76% | 95.92% | 85.03% |

| [0.4, 0.425) | 85.03% | 94.56% | 87.76% | 97.28% | 85.71% |

| [0.425, 0.45) | 86.39% | 95.92% | 88.44% | 97.96% | 88.44% |

| >0.45 | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

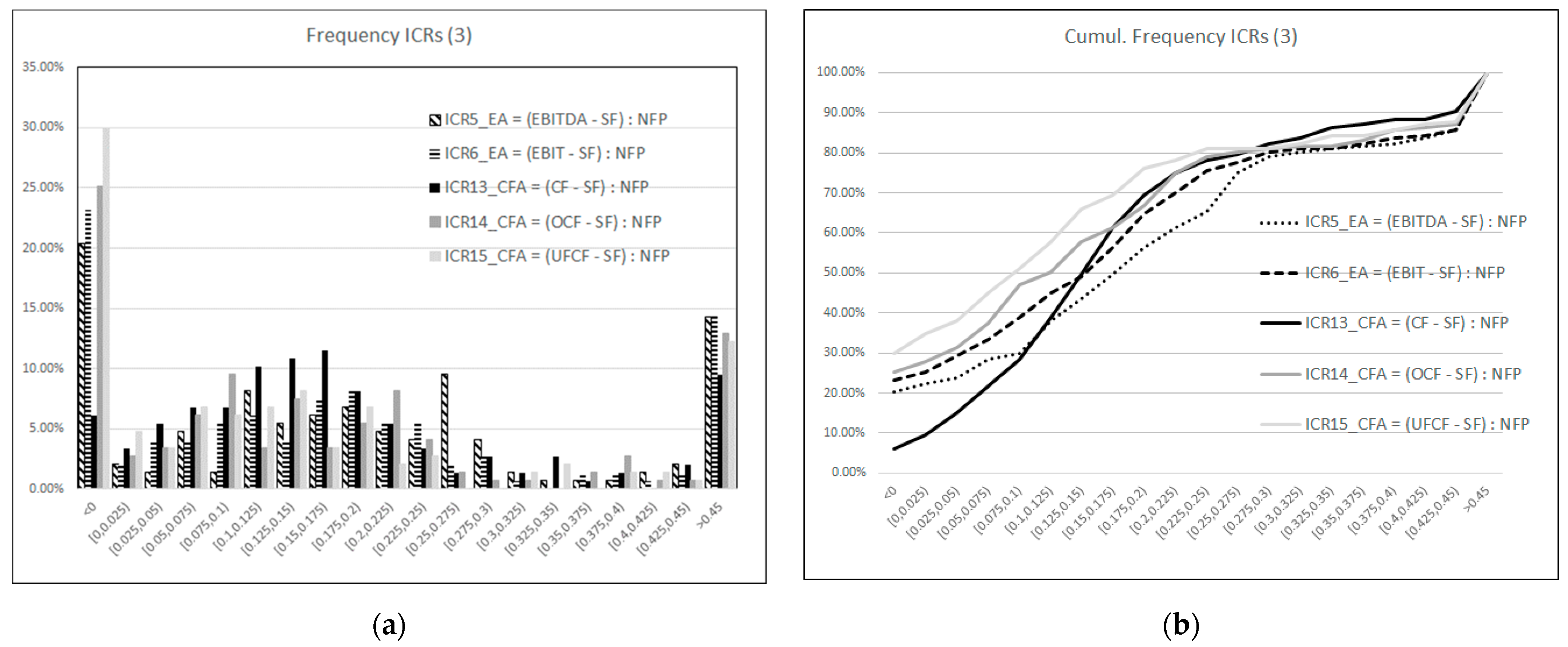

| Range | ICR5_EA = (EBITDA − SF) : NFP | ICR6_EA = (EBIT − SF) : NFP | ICR13_CFA = (CF − SF) : NFP | ICR14_CFA = (OCF − SF) : NFP | ICR15_CFA = (UFCF − SF) : NFP |

|---|---|---|---|---|---|

| <0 | 30 | 34 | 9 | 37 | 44 |

| [0.0, 0.025) | 3 | 3 | 5 | 4 | 7 |

| [0.025, 0.05) | 2 | 6 | 8 | 5 | 5 |

| [0.05, 0.075) | 7 | 6 | 10 | 9 | 10 |

| [0.075, 0.1) | 2 | 8 | 10 | 14 | 9 |

| [0.1, 0.125) | 12 | 9 | 15 | 5 | 10 |

| [0.125, 0.15) | 8 | 6 | 16 | 11 | 12 |

| [0.15, 0.175) | 9 | 11 | 17 | 5 | 5 |

| [0.175, 0.2) | 10 | 12 | 12 | 8 | 10 |

| [0.2, 0.225) | 7 | 8 | 8 | 12 | 3 |

| [0.225, 0.25) | 6 | 8 | 5 | 6 | 4 |

| [0.25, 0.275) | 14 | 3 | 2 | 2 | 0 |

| [0.275, 0.3) | 6 | 4 | 4 | 1 | 0 |

| [0.3, 0.325) | 2 | 1 | 2 | 1 | 2 |

| [0.325, 0.35) | 1 | 0 | 4 | 0 | 3 |

| [0.35, 0.375) | 1 | 2 | 1 | 2 | 0 |

| [0.375, 0.4) | 1 | 2 | 2 | 4 | 2 |

| [0.4, 0.425) | 2 | 1 | 0 | 1 | 2 |

| [0.425, 0.45) | 3 | 2 | 3 | 1 | 1 |

| >0.45 | 21 | 21 | 14 | 19 | 18 |

| Tot. | 147 | 147 | 147 | 147 | 147 |

| Range | ICR5_EA = (EBITDA − SF) : NFP | ICR6_EA = (EBIT − SF) : NFP | ICR13_CFA = (CF − SF) : NFP | ICR14_CFA = (OCF − SF) : NFP | ICR15_CFA = (UFCF − SF) : NFP |

|---|---|---|---|---|---|

| <0 | 20.41% | 23.13% | 6.12% | 25.17% | 29.93% |

| [0.0, 0.025) | 2.04% | 2.04% | 3.40% | 2.72% | 4.76% |

| [0.025, 0.05) | 1.36% | 4.08% | 5.44% | 3.40% | 3.40% |

| [0.05, 0.075) | 4.76% | 4.08% | 6.80% | 6.12% | 6.80% |

| [0.075, 0.1) | 1.36% | 5.44% | 6.80% | 9.52% | 6.12% |

| [0.1, 0.125) | 8.16% | 6.12% | 10.20% | 3.40% | 6.80% |

| [0.125, 0.15) | 5.44% | 4.08% | 10.88% | 7.48% | 8.16% |

| [0.15, 0.175) | 6.12% | 7.48% | 11.56% | 3.40% | 3.40% |

| [0.175, 0.2) | 6.80% | 8.16% | 8.16% | 5.44% | 6.80% |

| [0.2, 0.225) | 4.76% | 5.44% | 5.44% | 8.16% | 2.04% |

| [0.225, 0.25) | 4.08% | 5.44% | 3.40% | 4.08% | 2.72% |

| [0.25, 0.275) | 9.52% | 2.04% | 1.36% | 1.36% | 0.00% |

| [0.275, 0.3) | 4.08% | 2.72% | 2.72% | 0.68% | 0.00% |

| [0.3, 0.325) | 1.36% | 0.68% | 1.36% | 0.68% | 1.36% |

| [0.325, 0.35) | 0.68% | 0.00% | 2.72% | 0.00% | 2.04% |

| [0.35, 0.375) | 0.68% | 1.36% | 0.68% | 1.36% | 0.00% |

| [0.375, 0.4) | 0.68% | 1.36% | 1.36% | 2.72% | 1.36% |

| [0.4, 0.425) | 1.36% | 0.68% | 0.00% | 0.68% | 1.36% |

| [0.425, 0.45) | 2.04% | 1.36% | 2.04% | 0.68% | 0.68% |

| >0.45 | 14.29% | 14.29% | 9.52% | 12.93% | 12.24% |

| Tot. | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Range | ICR3_EA = EBITDA : NFP | ICR4_EA = EBIT : NFP | ICR10_CFA = CF : NFP | ICR11_CFA = OCF : NFP | ICR12_CFA = UFC : NFP |

|---|---|---|---|---|---|

| <0 | 20.41% | 23.13% | 6.12% | 25.17% | 29.93% |

| [0.0, 0.025) | 22.45% | 25.17% | 9.52% | 27.89% | 34.69% |

| [0.025, 0.05) | 23.81% | 29.25% | 14.97% | 31.29% | 38.10% |

| [0.05, 0.075) | 28.57% | 33.33% | 21.77% | 37.41% | 44.90% |

| [0.075, 0.1) | 29.93% | 38.78% | 28.57% | 46.94% | 51.02% |

| [0.1, 0.125) | 38.10% | 44.90% | 38.78% | 50.34% | 57.82% |

| [0.125, 0.15) | 43.54% | 48.98% | 49.66% | 57.82% | 65.99% |

| [0.15, 0.175) | 49.66% | 56.46% | 61.22% | 61.22% | 69.39% |

| [0.175, 0.2) | 56.46% | 64.63% | 69.39% | 66.67% | 76.19% |

| [0.2, 0.225) | 61.22% | 70.07% | 74.83% | 74.83% | 78.23% |

| [0.225, 0.25) | 65.31% | 75.51% | 78.23% | 78.91% | 80.95% |

| [0.25, 0.275) | 74.83% | 77.55% | 79.59% | 80.27% | 80.95% |

| [0.275, 0.3) | 78.91% | 80.27% | 82.31% | 80.95% | 80.95% |

| [0.3, 0.325) | 80.27% | 80.95% | 83.67% | 81.63% | 82.31% |

| [0.325, 0.35) | 80.95% | 80.95% | 86.39% | 81.63% | 84.35% |

| [0.35, 0.375) | 81.63% | 82.31% | 87.07% | 82.99% | 84.35% |

| [0.375, 0.4) | 82.31% | 83.67% | 88.44% | 85.71% | 85.71% |

| [0.4, 0.425) | 83.67% | 84.35% | 88.44% | 86.39% | 87.07% |

| [0.425, 0.45) | 85.71% | 85.71% | 90.48% | 87.07% | 87.76% |

| >0.45 | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

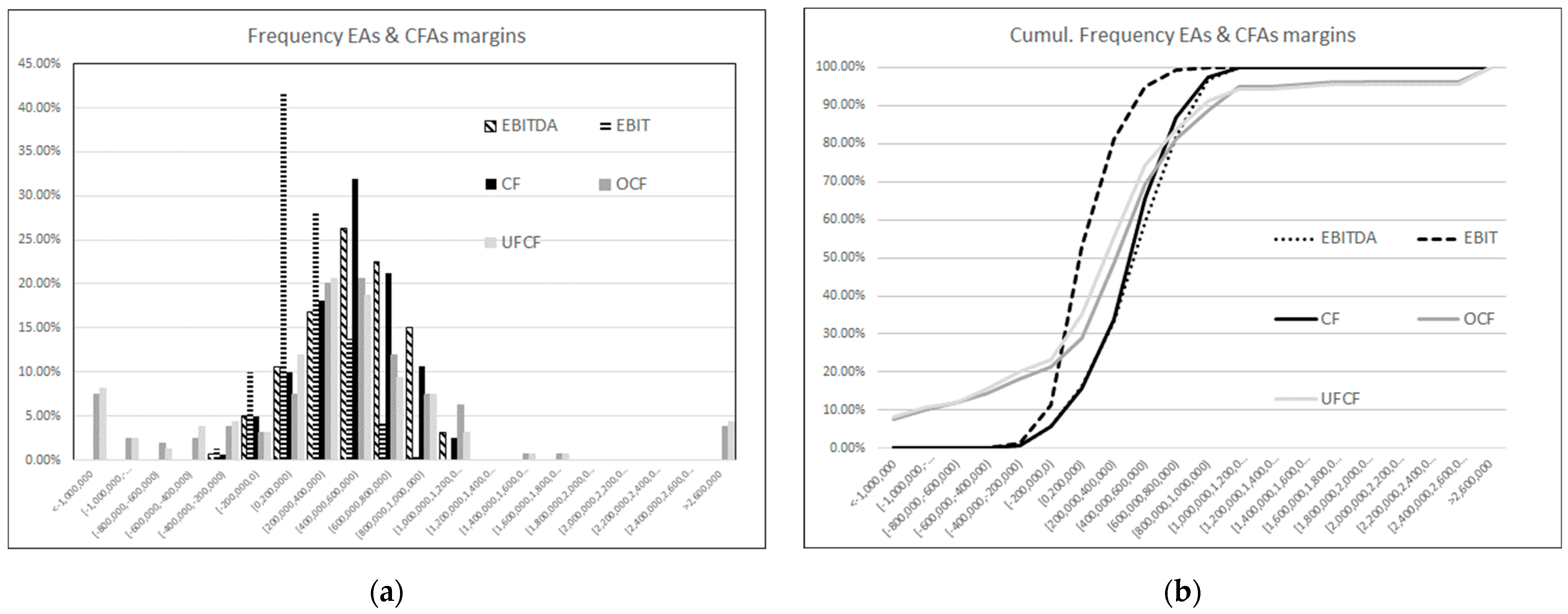

| Range | EBITDA | EBIT | CF | OCF | UFCF |

|---|---|---|---|---|---|

| <−1,000,000 | 0 | 0 | 0 | 12 | 13 |

| [−1,000,000, 800,000) | 0 | 0 | 0 | 4 | 4 |

| [−800,000, −600,000) | 0 | 0 | 0 | 3 | 2 |

| [−600,000, −400,000) | 0 | 0 | 0 | 4 | 6 |

| [−400,000, −200,000) | 01 | 2 | 1 | 6 | 7 |

| [−200,000, 0) | 8 | 16 | 8 | 5 | 5 |

| [0, 200,000) | 17 | 67 | 16 | 12 | 19 |

| [200,000, 400,000) | 27 | 45 | 29 | 32 | 33 |

| [400,000, 600,000) | 42 | 22 | 51 | 33 | 30 |

| [600,000, 800,000) | 36 | 7 | 34 | 19 | 15 |

| [800,000, 1,000,000) | 24 | 1 | 17 | 12 | 12 |

| [1,000,000, 1,200,000) | 5 | 0 | 4 | 10 | 5 |

| [1,200,000, 1,400,000) | 0 | 0 | 0 | 0 | 0 |

| [1,400,000, 1,600,000) | 0 | 0 | 0 | 1 | 1 |

| [1,600,000, 1,800,000) | 0 | 0 | 0 | 1 | 1 |

| [1,800,000, 2,000,000) | 0 | 0 | 0 | 0 | 0 |

| [2,000,000, 2,200,000) | 0 | 0 | 0 | 0 | 0 |

| [2,200,000, 2,400,000) | 0 | 0 | 0 | 0 | 0 |

| [2,400,000, 2,600,000) | 0 | 0 | 0 | 0 | 0 |

| >2,600,000 | 0 | 0 | 0 | 6 | 7 |

| Range | EBITDA | EBIT | CF | OCF | UFCF |

|---|---|---|---|---|---|

| <−1,000,000 | 0.00% | 0.00% | 0.00% | 7.50% | 8.13% |

| [−1,000,000, 800,000) | 0.00% | 0.00% | 0.00% | 2.50% | 2.50% |

| [−800,000, −600,000) | 0.00% | 0.00% | 0.00% | 1.88% | 1.25% |

| [−600,000, −400,000) | 0.00% | 0.00% | 0.00% | 2.50% | 3.75% |

| [−400,000, −200,000) | 0.63% | 1.25% | 0.63% | 3.75% | 4.38% |

| [−200,000, 0) | 5.00% | 10.00% | 5.00% | 3.13% | 3.13% |

| [0, 200,000) | 10.63% | 41.88% | 10.00% | 7.50% | 11.88% |

| [200,000, 400,000) | 16.88% | 28.13% | 18.13% | 20.00% | 20.63% |

| [400,000, 600,000) | 26.25% | 13.75% | 31.88% | 20.63% | 18.75% |

| [600,000, 800,000) | 22.50% | 4.38% | 21.25% | 11.88% | 9.38% |

| [800,000, 1,000,000) | 15.00% | 0.63% | 10.63% | 7.50% | 7.50% |

| [1,000,000, 1,200,000) | 3.13% | 0.00% | 2.50% | 6.25% | 3.13% |

| [1,200,000, 1,400,000) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| [1,400,000, 1,600,000) | 0.00% | 0.00% | 0.00% | 0.63% | 0.63% |

| [1,600,000, 1,800,000) | 0.00% | 0.00% | 0.00% | 0.63% | 0.63% |

| [1,800,000, 2,000,000) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| [2,000,000, 2,200,000) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| [2,200,000, 2,400,000) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| [2,400,000, 2,600,000) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| >2,600,000 | 0.00% | 0.00% | 0.00% | 3.75% | 4.38% |

| Tot. | 100.00% | 100.00% | 100.00% | 100.00% | 100.0% |

| Range | EBITDA | EBIT | CF | OCF | UFCF |

|---|---|---|---|---|---|

| <−1,000,000 | 0.00% | 0.00% | 0.00% | 7.50% | 8.13% |

| [−1,000,000, 800,000) | 0.00% | 0.00% | 0.00% | 10.00% | 10.63% |

| [−800,000, −600,000) | 0.00% | 0.00% | 0.00% | 11.88% | 11.88% |

| [−600,000, −400,000) | 0.00% | 0.00% | 0.00% | 14.38% | 15.63% |

| [−400,000, −200,000) | 0.63% | 1.25% | 0.63% | 18.13% | 20.00% |

| [−200,000, 0) | 5.63% | 11.25% | 5.63% | 21.25% | 23.13% |

| [0, 200,000) | 16.25% | 53.13% | 15.63% | 28.75% | 35.00% |

| [200,000, 400,000) | 33.13% | 81.25% | 33.75% | 48.75% | 55.63% |

| [400,000, 600,000) | 59.38% | 95.00% | 65.63% | 69.38% | 74.38% |

| [600,000, 800,000) | 81.88% | 99.38% | 86.88% | 81.25% | 83.75% |

| [800,000, 1,000,000) | 96.88% | 100.00% | 97.50% | 88.75% | 91.25% |

| [1,000,000, 1,200,000) | 100.00% | 100.00% | 100.00% | 95.00% | 94.38% |

| [1,200,000, 1,400,000) | 100.00% | 100.00% | 100.00% | 95.00% | 94.38% |

| [1,400,000, 1,600,000) | 100.00% | 100.00% | 100.00% | 95.63% | 95.00% |

| [1,600,000, 1,800,000) | 100.00% | 100.00% | 100.00% | 96.25% | 95.63% |

| [1,800,000, 2,000,000) | 100.00% | 100.00% | 100.00% | 96.25% | 95.63% |

| [2,000,000, 2,200,000) | 100.00% | 100.00% | 100.00% | 96.25% | 95.63% |

| [2,200,000, 2,400,000) | 100.00% | 100.00% | 100.00% | 96.25% | 95.63% |

| [2,400,000, 2,600,000) | 100.00% | 100.00% | 100.00% | 96.25% | 95.63% |

| Tot. | 100.00% | 100.00% | 100.00% | 100.00% | 100.0% |

References

- Lanfranchi, M.; Giannetto, C.; Abbate, T.; Dimitrova, V. Agriculture and the social farm: Expression of the multifunctional model of agriculture as a solution to the economic crisis in rural areas. Bulg. J. Agric. Sci. 2015, 21, 711–718. [Google Scholar]

- Zarbà, C.; Chinnici, G.; La Via, G.; Bracco, S.; Pecorino, B.; D’Amico, M. Regulatory elements on the circular economy: Driving into the agri-food system. Sustainability 2021, 13, 8350. [Google Scholar] [CrossRef]

- Stillitano, T.; Falcone, G.; Iofrida, N.; Spada, E.; Gulisano, G.; De Luca, A.I. A customized multi-cycle model for measuring the sustainability of circular pathways in agri-food supply chains. Sci. Total Environ. 2022, 844, 157229. [Google Scholar] [CrossRef]

- European Commission; Directorate—General for Energy. Biomass. Available online: https://energy.ec.europa.eu/topics/renewable-energy/bioenergy/biomass_en#:~:text=Biomass%20is%20derived%20from%20organic,and%20lower%20greenhouse%20gas%20emissions (accessed on 8 December 2023).

- Tamburini, E.; Gaglio, M.; Castaldelli, G.; Fano, E.A. Is bioenergy truly sustainable when land-use-change (LUC) emissions are accounted for? The case-study of biogas from agricultural biomass in Emilia-Romagna region, Italy. Sustainability 2020, 12, 3260. [Google Scholar] [CrossRef]

- Murano, R.; Maisano, N.; Selvaggi, R.; Pappalardo, G.; Pecorino, B. Critical issues and opportunities for producing biomethane in Italy. Energies 2021, 14, 2431. [Google Scholar] [CrossRef]

- Cucchiella, F.; D’Adamo, I.; Gastaldi, M. An economic analysis of biogas-biomethane chain from animal residues in Italy. J. Clean. Prod. 2019, 230, 888–897. [Google Scholar] [CrossRef]

- Patrizio, P.; Chinese, D. The Impact of Regional Factors and New Bio-Methane Incentive Schemes on the Structure, Profitability and CO2 Balance of Biogas Plants in Italy. Renew. Energy 2016, 99, 573–583. [Google Scholar] [CrossRef]

- Licciardo, F. Accesso al Credito e Strumenti Finanziari per lo Sviluppo Rurale in Italia; Rete Rurale Nazionale—MiPAAF: Rome, Italy, 2020; ISBN 9788833850894.

- European Commission; Directorate—General Agriculture and Rural Development. Financial Needs in the Agriculture and Agri-Food Sectors in Italy. 2020. Available online: https://www.fi-compass.eu/sites/default/files/publications/financial_needs_agriculture_agrifood_sectors_Italy.pdf (accessed on 20 August 2023).

- Yan, Q.; Wan, Y.; Yuan, J.; Yin, J.; Balezentis, T.; Streimikiene, D. Economic and Technical Efficiency of the Biomass Industry in China: A Network Data Envelopment Analysis Model Involving Externalities. Energies 2017, 10, 1418. [Google Scholar] [CrossRef]

- Gustafsson, M.; Anderberg, S. Biogas Policies and Production Development in Europe: A Comparative Analysis of Eight Countries. Biofuels 2022, 13, 931–944. [Google Scholar] [CrossRef]

- Winquist, E.; van Galen, M.; Zielonka, S.; Rikkonen, P.; Oudendag, D.; Zhou, L.; Greijdanus, A. Expert Views on the Future Development of Biogas Business Branch in Germany, the Netherlands, and Finland until 2030. Sustainability 2021, 13, 1148. [Google Scholar] [CrossRef]

- Bai, D.; Jain, V.; Tripathi, M.; Ali, S.A.; Shabbir, M.S.; Mohamed, M.A.A.; Ramos-Meza, C.S. Performance of Biogas Plant Analysis and Policy Implications: Evidence from the Commercial Sources. Energy Policy 2022, 169, 113173. [Google Scholar] [CrossRef]

- Iotti, M.; Bonazzi, G. Assessment of biogas plant firms by application of annual accounts and financial data analysis approach. Energies 2016, 9, 713. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The Impacts of Government R&D Subsidies on Green Innovation: Evidence from Chinese Energy-Intensive Firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar]

- Vitolla, F.; L’Abate, V.; Petruzzella, F.; Raimo, N.; Salvi, A. Circular Economy Disclosure in Sustainability Reporting: The Effect of Firm Characteristics. Sustainability 2023, 15, 2200. [Google Scholar] [CrossRef]

- McCauley, D.; Heffron, R. Just transition: Integrating climate, energy and environmental justice. Energy Policy 2018, 119, 1–7. [Google Scholar] [CrossRef]

- Pretty, J. Agricultural sustainability: Concepts, principles and evidence. Philos. Trans. R. Soc. B Biol. Sci. 2008, 363, 447–465. [Google Scholar] [CrossRef]

- Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC. Available online: https://knowledge4policy.ec.europa.eu/glossary-item/biomass_en#:~:text=Biomass%20is%20organic%2C%20non%2Dfossil,%3B%20municipal%20solid%20waste%3B%20biofuels (accessed on 10 November 2023).

- Valenti, J.F.; Porto, S.M.C.; Selvaggi, R.; Pecorino, B. Evaluation of biomethane potential from by-products and agricultural residues co-digestion in southern Italy. J. Environ. Manag. 2018, 223, 834–840. [Google Scholar] [CrossRef]

- Debkowska, K.; Dymek, L.; Kutwa, K.; Perlo, D.; Perlo, D.; Rogala, W.; Ryciuk, U.; Szewczuk-Stepien, M. The Analysis of Public Funds Utilization Efficiency for Climate Neutrality in the European Union Countries. Energies 2022, 15, 581. [Google Scholar] [CrossRef]

- Valenti, F.; Selvaggi, R.; Pecorino, B.; Porto, S.M. Bioeconomy for sustainable development of biomethane sector: Potential and challenges for agro-industrial by-products. Renew. Energy 2023, 215, 119014. [Google Scholar] [CrossRef]

- Soldati, C.; De Luca, A.I.; Iofrida, N.; Spada, E.; Gulisano, G.; Falcone, G. Ecosystem services and biodiversity appraisals by means of life cycle tools: State-of-art in agri-food and forestry field. Agric. Food Secur. 2023, 12, 33. [Google Scholar] [CrossRef]

- Broberg Viklund, S.; Lindkvist, E. Biogas production supported by excess heat—A systems analysis within the food industry. Energy Convers. Manag. 2015, 91, 249–258. [Google Scholar] [CrossRef]

- Malorgio, G.; Marangon, F. Agricultural business economics: The challenge of sustainability. Agric. Food Econ. 2021, 9, 6. [Google Scholar] [CrossRef]

- European Biogas Association. About Biogas and Biomethane. Available online: https://www.europeanbiogas.eu/about-biogas-and-biomethane/ (accessed on 8 December 2023).

- Ingrassia, M.; Bacarella, S.; Bellia, C.; Columba, P.; Adamo, M.M.; Altamore, L.; Chironi, S. Circular economy and agritourism: A sustainable behavioral model for tourists and farmers in the post-COVID era. Front. Sustain. Food Syst. 2023, 7, 1174623. [Google Scholar] [CrossRef]

- Banja, M.; Jégard, M.; Motola, V.; Sikkema, R. Support for biogas in the EU electricity sector: A comparative analysis. Biomass Bioenergy 2019, 128, 105313. [Google Scholar] [CrossRef]

- Arru, B.; Furesi, R.; Pulina, P.; Sau, P.; Madau, F.A. The Circular Economy in the Agri-food system: A Performance Measurement of European Countries. Econ. Agro-Aliment. 2022, 24, 1–35. [Google Scholar] [CrossRef]

- Galli, F.; Cavicchi, A.; Brunori, G. Food waste reduction and food poverty alleviation: A system dynamics conceptual model. Agric. Hum. Values 2019, 36, 289–300. [Google Scholar] [CrossRef]

- Eurostat. Shedding Light on Energy in the EU. 2023. Available online: https://ec.europa.eu/eurostat/web/interactive-publications/energy-2023#renewable-energy (accessed on 23 December 2023).

- Bonazzi, G.; Iotti, M. Evaluation of investment in renovation to increase the quality of buildings: A Specific Discounted Cash Flow (DCF) Approach of Appraisal. Sustainability 2016, 8, 268. [Google Scholar] [CrossRef]

- Qu, K.; Chen, X.; Wang, Y.; Calautit, J.; Riffat, S.; Cui, X. Comprehensive energy, economic and thermal comfort assessments for the passive energy retrofit of historical buildings—A case study of a late nineteenth-century Victorian house renovation in the UK. Energy 2021, 220, 119646. [Google Scholar] [CrossRef]

- Schneider-Marin, P.; Lang, W. Environmental costs of buildings: Monetary valuation of ecological indicators for the building industry. Int. J. Life Cycle Assess 2020, 25, 1637–1659. [Google Scholar] [CrossRef]

- Eurostat Statistics. Database. Available online: https://ec.europa.eu/eurostat/web/energy/database (accessed on 20 December 2023).

- International Energy Agency (IEA). Europe. Available online: https://www.iea.org/regions/europe (accessed on 23 December 2023).

- European Union (UE). Energy Statistical Datasheets for the EU Countries. Available online: https://data.europa.eu/data/datasets/information-on-energy-markets-in-eu-countries-with-national-energy-profiles?locale=en (accessed on 27 December 2023).

- Kusz, D.; Bąk, I.; Szczecińska, B.; Wicki, L.; Kusz, B. Determinants of Return-on-Equity (ROE) of Biogas Plants Operating in Poland. Energies 2023, 16, 31. [Google Scholar] [CrossRef]

- Zabolotnyy, S.; Melnyk, M. The Financial Efficiency of Biogas Stations in Poland. In Renewable Energy Sources: Engineering, Technology, Innovation; Mudryk, K., Werle, S., Eds.; Springer: Cham, Switzerland, 2018. [Google Scholar] [CrossRef]

- Mohd Chachuli, F.S.; Ahmad Ludin, N.; Mat, S.; Sopian, K. Renewable Energy Performance Evaluation Studies Using the Data Envelopment Analysis (DEA): A Systematic Review. J. Renew. Sustain. Energy 2020, 12, 062701. [Google Scholar] [CrossRef]

- Klimek, K.; Kapłan, M.; Syrotyuk, S.; Bakach, N.; Kapustin, N.; Konieczny, R.; Dobrzyński, J.; Borek, K.; Anders, D.; Dybek, B.; et al. Investment model of agricultural biogas plants for individual farms in Poland. Energies 2021, 14, 7375. [Google Scholar] [CrossRef]

- Nurgaliev, T.; Koshelev, V.; Müller, J. Simulation Model for Biogas Project Efficiency Maximization. BioEnergy Res. 2023, 16, 1084–1098. [Google Scholar] [CrossRef]

- Nurgaliev, T.; Koshelev, V.; Müller, J. Risk Analysis of the Biogas Project. BioEnergy Res. 2023, 16, 2574–2589. [Google Scholar] [CrossRef]

- Scarlat, N.; Dallemand, J.F.; Fahl, F. Biogas: Developments and perspectives in Europe. Renew. Energy 2018, 129, 457–472. [Google Scholar] [CrossRef]

- Sica, D.; Esposito, B.; Supino, S.; Malandrino, O.; Sessa, M.R. Biogas-based systems: An opportunity towards a post-fossil and circular economy perspective in Italy. Energy Policy 2023, 182, 113719. [Google Scholar] [CrossRef]

- Noussan, M.; Negro, V.; Prussi, M.; Chiaramonti, D. The potential role of biomethane for the decarbonization of transport: An analysis of 2030 scenarios in Italy. Appl. Energy 2024, 355, 122322. [Google Scholar] [CrossRef]

- Consorzio Italiano Biogas. Pubblicazioni. Available online: https://www.consorziobiogas.it/pubblicazioni-2/ (accessed on 6 January 2024).

- Bartolini, F.; Gava, O.; Brunori, G. Biogas and EU’s 2020 targets: Evidence from a regional case study in Italy. Energy Policy 2017, 109, 510–519. [Google Scholar] [CrossRef]

- Eyl-Mazzega, M.A.; Mathieu, C.; Boesgaard, K.; Daniel-Gromke, J.; Denysenko, V.; Liebetrau, J.; Cornot-Gandolphe, S. Biogas and Bio-Methane in Europe: Lessons from Denmark, Germany and Italy; National INIS Centre: Paris, France, 2019; ISBN 979-10-373-0025-6.

- Benato, A.; Macor, A. Italian biogas plants: Trend, subsidies, cost, biogas composition and engine emissions. Energies 2019, 12, 979. [Google Scholar] [CrossRef]

- European Parliament. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources. 2018. Available online: https://eur-lex.europa.eu/eli/dir/2018/2001/oj (accessed on 8 December 2023).

- IEA Paris. Outlook for Biogas and Biomethane: Prospects for Organic Growth. 2020. Available online: https://www.iea.org/reports/outlook-for-biogas-and-biomethane-prospects-for-organic-growth (accessed on 8 December 2023).

- Bonazzi, G.; Iotti, M. Evaluation of biogas plants by the application of an internal rate of return and debt service coverage approach. Amer. J. Environ. Sci. 2014, 11, 35–45. [Google Scholar] [CrossRef]

- Cheng, S.; Lohani, S.P.; Rajbhandari, U.S.; Shrestha, P.; Shrees, S.; Bhandari, R.; Jeuland, M. Sustainability of large-scale commercial biogas plants in Nepal. J. Clean. Prod. 2024, 434, 139777. [Google Scholar] [CrossRef]

- Bedana, D.; Kamruzzaman, M.; Rana, M.J.; Mustafi, B.A.A.; Talukder, R.K. Financial and Functionality Analysis of a Biogas Plant in Bangladesh. Heliyon 2022, 8, e10727. [Google Scholar] [CrossRef]

- Li, C.; Ba, S.; Ma, K.; Xu, Y.; Huang, W.; Huang, N. ESG Rating Events, Financial Investment Behavior and Corporate Innovation. Econ. Anal. Policy 2023, 77, 372–387. [Google Scholar] [CrossRef]

- Liu, G.; Hamori, S. Can One Reinforce Investments in Renewable Energy Stock Indices with the ESG Index? Energies 2020, 13, 1179. [Google Scholar] [CrossRef]

- Tedioli, F. La Produzione di Energia da Fonti Rinnovabili Quale Attività Connessa a Quella Agricola. Available online: https://www.tedioli.com/fonti-rinnovabili-attivita-agricola/ (accessed on 8 December 2023).

- Giarè, F.; Ricciardi, G.; Ascani, M. Italian legislation on social farming and the role of the agricultural holding. Ital. Rev. Agric. Econ. 2020, 75, 45–64. [Google Scholar] [CrossRef]

- Rondinone, N. L’imprenditore agricolo esercente attività commerciale nel nuovo diritto concorsuale. Riv. Dirit. Commer. Dirit. Gen. Obblig. 2014, 112, 443–513. [Google Scholar]

- Mozzarelli, M. Impresa (agricola) e fallimento. Anal. Giuridica Econ. 2014, 1, 85–102. [Google Scholar] [CrossRef]

- Carmignani, S. Imprenditore agricolo e prospettive di riforma delle procedure concorsuali. Dirit. Agroaliment. 2018, 3, 531–547. Available online: https://usiena-air.unisi.it/handle/11365/1066677?mode=complete (accessed on 9 December 2023).

- Mauro, M. Imprenditore agricolo e crisi di impresa. Dirit. Giurisprud. Agrar. Aliment. Ambiente 2018, 4, 1–15. Available online: https://flore.unifi.it/retrieve/deb742ad-a319-4379-872a-f08b6f7ba399/13%20Imprenditore%20agricolo%20e%20crisi%20di%20impresa.pdf (accessed on 9 December 2023).

- Gruziel, K.; Raczkowska, M. The Taxation of Agriculture in the European Union Countries. Probl. World Agric. 2018, 18, 162–174. [Google Scholar] [CrossRef][Green Version]

- Kovalchuk, I.; Melnyk, V.; Novak, T.; Pakhomova, A. Legal regulation of agricultural taxation. Eur. J. Sustain. Dev. 2021, 10, 479. [Google Scholar] [CrossRef]

- Van Kooten, G.C.; Orden, D.; Schmitz, A. Use of subsidies and taxes and the reform of agricultural policy. In The Routledge Handbook of Agricultural Economics; Routledge: New York, NY, USA, 2018; pp. 355–380. ISBN 978-1-315-62335-1. [Google Scholar]

- Ishlah, R.N.M.; Natsir, K. The Effect of Financial Performance, Tax Avoidance, and Investment Opportunity Set on Firm Value in The Agricultural Sector. Int. J. Appl. Econ. Bus. 2023, 1, 673–683. Available online: https://lintar.untar.ac.id/repository/penelitian/buktipenelitian_10190049_3A130723221238.pdf (accessed on 9 December 2023).

- Agenzia Entrate Circolare n. 44 del 14/05/2002. Available online: https://def.finanze.it/DocTribFrontend/getPrassiDetail.do?id={30DCAD7A-54A6-4EA2-B05F-91E207C4BCF7} (accessed on 23 December 2023).

- Agenzia Entrate Circolare n. 44 del 15/11/2004. Available online: https://def.finanze.it/DocTribFrontend/getPrassiDetail.do?id=%7BC557CF06-2EC1-40EA-9699-1B4AC3B7501B%7D (accessed on 23 December 2023).

- Agenzia Entrate Circolare n. 46/E/2007. Available online: https://def.finanze.it/DocTribFrontend/getPrassiDetail.do?id=%7BC2985FE4-1446-4973-9117-CF26BC76DAE0%7D (accessed on 23 December 2023).

- Agenzia Entrate Circolare n. 6/E/2006. Available online: https://def.finanze.it/DocTribFrontend/getPrassiDetail.do?id={A358678A-31A5-4453-9838-D16AF7C2C4DA} (accessed on 23 December 2023).

- Iotti, M.; Bonazzi, G. Application of ICRs with a net financial position (NFP) repayment approach in the Parma PDO ham sector. J. Food Agric. Environ. 2015, 13, 109–114. [Google Scholar]

- Bräuning, F.; Joaquim, G.; Stein, H.; Federal Reserve Bank of Boston. Interest Expenses, Coverage Ratio, and Firm Distress. 2023 Series—Current Policy Perspectives. Available online: https://www.bostonfed.org/publications/current-policy-perspectives/2023/interest-expenses-coverage-ratio-and-firm-distress.aspx (accessed on 11 October 2022).

- Autorità di Regolazione per Energia Reti e Ambiente (ARERA). Ricerca Operatori. Available online: https://www.arera.it/area-operatori/ricerca-operatori (accessed on 10 September 2023).

- Bauman, M.P. Forecasting operating profitability with DuPont analysis Further evidence. Rev. Account. Financ. 2014, 13, 191–205. [Google Scholar] [CrossRef]

- Jin, Y. DuPont Analysis, Earnings Persistence, and Return on Equity: Evidence from Mandatory IFRS Adoption in Canada. Account. Perspect. 2017, 16, 205–235. [Google Scholar] [CrossRef]

- Bunea, O.-I.; Corbos, R.-A.; Popescu, R.-I. Influence of some financial indicators on return on equity ratio in the Romanian energy sector—A competitive approach using a DuPont-based analysis. Energy 2019, 189, 116251. [Google Scholar] [CrossRef]

- Davidson, W. Analysis of Profitability Using the DuPont Analysis. In Financial Statement Analysis; Davidson, W., Ed.; John Wiley & Sons: Hoboken, NJ, USA, 2020. [Google Scholar] [CrossRef]

- Anderson, M.; Soonchul, H.; Volkan, M.; Dongning, Y. Earnings prediction with DuPont components and calibration by life cycle. Rev. Account. Stud. 2023, 1–35. [Google Scholar] [CrossRef]

- Altman, E.I. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Altman, E.I.; Haldeman, R.G.; Narayanan, P. ZETATM analysis. A new model to identify bankruptcy risk of corporations. J. Bank. Financ. 1977, 1, 29–54. [Google Scholar] [CrossRef]

- Altman, E.I.; Saunders, A. Credit risk measurement: Developments over the last 20 years. J. Bank. Financ. 1997, 21, 1721–1742. [Google Scholar] [CrossRef]

- Barboza, F.; Kimura, H.; Altman, E.I. Machine learning models and bankruptcy prediction. Expert Syst. Appl. 2017, 83, 405–417. [Google Scholar] [CrossRef]

- Altman, E.I.; Balzano, M.; Giannozzi, A.; Srhoj, S. The Omega Score: An improved tool for SME default predictions. J. Intern. Counc. Small Bus. 2023, 4, 362–373. [Google Scholar] [CrossRef]

- MacCarthy, J. Using Altman Z-score and Beneish M-score models to detect financial fraud and corporate failure: A case study of Enron Corporation. Int. J. Financ. Acc. 2017, 6, 159–166. [Google Scholar] [CrossRef]

- Altman, E.J. An emerging market credit scoring system for corporate bonds. Emerg. Mark. Rev. 2005, 6, 311–323. [Google Scholar] [CrossRef]

- Suranta, E.; Satrio, M.A.B.; Midiastuty, P.P. Effect of Investment, Free Cash Flow, Earnings Management, Interest Coverage Ratio, Liquidity, and Leverage on Financial Distress. Ilomata Intern. J. Tax Account. 2023, 4, 283–295. [Google Scholar] [CrossRef]

- Demerjian, P.R. Uncertainty and debt covenants. Rev. Account. Stud. 2017, 22, 1156–1197. [Google Scholar] [CrossRef]

- Adler, K. Financial covenants, firm financing, and investment. 2020. Available online: https://ssrn.com/abstract=3728683 (accessed on 11 March 2024). [CrossRef]

- Chodorow-Reich, G.; Falato, A. The Loan Covenant Channel: How Bank Health Transmits to the Real Economy. J. Financ. 2022, 77, 85–128. [Google Scholar] [CrossRef]

- Jensen, M.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 4, 305–360. [Google Scholar] [CrossRef]

- Bradley, M.; Roberts, M. The structure and pricing of corporate debt covenants. Q. J. Financ. 2015, 5, 1–37. [Google Scholar] [CrossRef]

- Chava, S.; Roberts, M. How Does Financing Impact Investment? The Role of Debt Covenants. J. Financ. 2008, 63, 2085–2121. [Google Scholar] [CrossRef]

- Mansi, S.A.; Qi, Y.; Wald, J.K. Bond covenants, bankruptcy risk, and the cost of debt. J. Corp. Financ. 2021, 66, 101799. [Google Scholar] [CrossRef]

- Ma, Z.; Stice, D.; Williams, C. What’s my style? Supply-side determinants of debt covenant inclusion. J. Bus. Financ. Account. 2022, 49, 461–490. [Google Scholar] [CrossRef]

- Gray, S.; Mirkovic, A.; Ragunathan, V. The determinants of credit ratings: Australian evidence. Aust. J. Manag. 2006, 31, 333–354. [Google Scholar] [CrossRef]

- Jiang, X.; Packer, F. Credit Ratings of Chinese Firms by Domestic and Global Agencies: Assessing the Determinants and Impact. J. Bank. Financ. 2019, 105, 178–193. [Google Scholar] [CrossRef]

- Gupta, R. Financial Determinants of Corporate Credit Ratings: An Indian Evidence. Int. J. Financ. Econ. 2021, 28, 1622–1637. [Google Scholar] [CrossRef]

- Bonazzi, G.; Iotti, M. Comparative applications of income and financial analysis for tomato processing firms in Italy. Agroalimentaria 2015, 21, 113–131. Available online: https://www.redalyc.org/pdf/1992/199243361008.pdf (accessed on 10 September 2023).

- Iotti, M.; Bonazzi, G. EBITDA/EBIT and cash flow based ICRs: A comparative approach in the agro-food system in Italy. Financ. Asset Invest. 2014, 3, 19–31. [Google Scholar] [CrossRef]

- Elyasiani, E.; Zhang, L. CEO entrenchment and corporate liquidity management. J. Bank. Financ. 2015, 54, 115–128. [Google Scholar] [CrossRef]

- Chang, L.; Gan, X.; Mohsin, M. Studying corporate liquidity and regulatory responses for economic recovery in COVID-19 crises. Econ. Anal. Policy 2022, 76, 211–225. [Google Scholar] [CrossRef]

- Barbier, P.J.A. Financial return on equity (FROE): A new extended dupont approach. Acad. Account. Financ. Stud. J. 2020, 24, 1–8. Available online: https://www.proquest.com/openview/69e7f8b77d48bd5491f9f813c16795a3/1?cbl=29414&pq-origsite=gscholar (accessed on 8 December 2023).

- Das, S. Cash flow ratios and financial performance: A comparative study. Accounting 2019, 5, 1–20. [Google Scholar] [CrossRef]

- Gonçalves, R.; Lopes, P. Firm-specific Determinants of Agricultural Financial Reporting. Procedia Soc. Behav. Sci. 2014, 110, 470–481. [Google Scholar] [CrossRef]

- Lefter, V.; Roman, A.G. IAS 41 Agriculture: Fair value accounting. Theor. Appl. Econ. 2007, 5, 15–22. Available online: https://www.ectap.ro/ias-41-agriculture-fair-value-accounting-viorel-lefter_aureliana-geta-roman/a215/ (accessed on 8 December 2023).

- Bozzolan, S.; Laghi, E.; Mattei, M. Amendments to the IAS 41 and IAS 16-implications for accounting of bearer plants. Agric. Econ. 2016, 62, 160–166. [Google Scholar] [CrossRef]

- Organismo Italiano di Contabilità (OIC). Principio Contabile n. 10: Il Rendiconto Finanziario. Available online: https://www.fondazioneoic.eu/?p=11281 (accessed on 8 December 2023).

- Kovalenko, O.; Yashchenko, L.; Verbytskyi, S. Applied aspects of analysis and cash-flow management of agricultural enterprises. Sci. J. Cahul State Univ. Bogdan Petriceicu Hasdeu Econ. Eng. Stud. 2020, 8, 26–31. [Google Scholar]

- Junior, R.C.; Gameiro, A.H. Cash flow in an agribusiness restructuring process. J. Agric. Stud. 2020, 8, 589–609. [Google Scholar] [CrossRef]

- Isakson, S.R. Food and finance: The financial transformation of agro-food supply chains. In New Directions in Agrarian Political Economy; Routledge: Abingdon, UK, 2017; pp. 109–136. ISBN 9781315689661. [Google Scholar]

- Mabandla, N.Z.; Makoni, P.L. Working capital management and financial performance: Evidence from listed food and beverage firms in South Africa. Acad. Account. Financ. Stud. 2019, 23, 1–10. [Google Scholar]

- Wang, Z.; Akbar, M.; Akbar, A. The Interplay between Working Capital Management and a Firm’s Financial Performance across the Corporate Life Cycle. Sustainability 2020, 12, 1661. [Google Scholar] [CrossRef]

- Jaworski, J.; Czerwonka, L. Which Determinants Matter for Working Capital Management in Energy Industry? The Case of European Union Economy. Energies 2022, 15, 3030. [Google Scholar] [CrossRef]

- Özkaya, H.; Yaşar, Ş. Working capital management in the food and beverage industry: Evidence from listed European firms. Agric. Econ. 2023, 69, 78–88. [Google Scholar] [CrossRef]

- Robinson, T.R. International Financial Statement Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2020; ISBN 978-1-119-62805-7. [Google Scholar]

- Naceur, S.B.; Marton, K.; Roulet, C. Basel III and bank-lending: Evidence from the United States and Europe. J. Financ. Stab. 2018, 39, 1–27. [Google Scholar] [CrossRef]

- Grundke, P.; Kühn, A. The impact of the Basel III liquidity ratios on banks: Evidence from a simulation study. Q. Rev. Econ. Financ. Financ. 2020, 75, 167–190. [Google Scholar] [CrossRef]

- Kim, K.N.; Katchova, A.L. Impact of the Basel III bank regulation on US agricultural lending. Agric. Financ. Rev. 2020, 80, 321–337. [Google Scholar] [CrossRef]

- Mulandi, B.; Kisaka, S. Factors influencing credit access for firms in the biogas sub sector in kenya. Int. J. Financ. 2013, 2, 1–17. [Google Scholar] [CrossRef]

- Mateescu, C.; Dima, A.D. Critical analysis of key barriers and challenges to the growth of the biogas sector: A case study for Romania. Biomass Convers. Biorefinery 2022, 12, 5989–6002. [Google Scholar] [CrossRef]

- European Commission; Directorate—General Agriculture and Rural Development. Survey on Financial Needs and Access to Finance of EU Agri-Food Micro, Small and Medium-Sized Enterprises. 2023. Available online: https://www.fi-compass.eu/library/market-analysis/survey-financial-needs-and-access-finance-eu-agri-food-micro-small-and (accessed on 25 February 2024).

- D’Alpaos, C. Methodological approaches to the valuation of investments in biogas production plants: Incentives vs market prices in Italy. Valori Valutazioni 2017, 19, 53–63. Available online: https://siev.org/wp-content/uploads/2020/02/19_05_DAlpaos_Eng.pdf (accessed on 10 August 2023).

- Zabolotnyy, S.; Wasilewski, M. The Concept of Financial Sustainability Measurement: A Case of Food Firms from Northern Europe. Sustainability 2019, 11, 5139. [Google Scholar] [CrossRef]

- Govender, I.; Thopil, G.A.; Inglesi-Lotz, R. Financial and economic appraisal of a biogas to electricity project. J. Clean. Prod. 2019, 214, 154–165. [Google Scholar] [CrossRef]

- Trypolska, G.; Kyryziuk, S.; Krupin, V.; Wąs, A.; Podolets, R. Economic feasibility of agricultural biogas production by farms in Ukraine. Energies 2021, 15, 87. [Google Scholar] [CrossRef]

- Tonrangklang, P.; Therdyothin, A.; Preechawuttipong, I. The financial feasibility of compressed biomethane gas application in Thailand. Energy Sustain. Soc. 2022, 12, 1–12. [Google Scholar] [CrossRef]

- EU-Project H2020 SYSTEMIC. Biogas Finance from the Perspective of the Banking Sector. Available online: https://systemicproject.eu/wp-content/uploads/Biogas-finance-from-the-perspective-of-the-banking-sector-2021.pdf (accessed on 24 December 2023).

- Bouwens, J.; De Kok, T.; Verriest, A. The prevalence and validity of EBITDA as a performance measure. Comptab. Contrôle-Audit 2019, 25, 55–105. Available online: https://www.cairn.info/revue-comptabilite-controle-audit-2019-1-page-55.htm (accessed on 10 December 2023). [CrossRef]

- Nissim, D. EBITDA, EBITA, or EBIT? Columbia Business School Research Paper No. 17–71. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2999675 (accessed on 10 December 2023).

- Demerjian, P.R.; Owens, E.L.; Sokolowski, M. Lender Capital Management and Financial Covenant Strictness. Account. Rev. 2023, 98, 149–172. [Google Scholar] [CrossRef]

- Yousuf, A.; Khan, M.R.; Pirozzi, D.; Ab Wahid, Z. Financial sustainability of biogas technology: Barriers, opportunities, and solutions. Energy Sources Part B Econ. Plan. Policy 2016, 11, 841–848. [Google Scholar] [CrossRef]

- Raucci, D.; Agostinone, S.; Carnevale, M. Technical and economic evaluation of renewable energy production in the Italian agricultural firm: Financing a biogas plant investment. World Rev. Entrep. Manag. Sustain. Dev. 2019, 15, 513–538. [Google Scholar] [CrossRef]

- Box, T.; Davis, R.; Hill, M.; Lawrey, C. Operating performance and aggressive trade credit policies. J. Bank. Financ. 2018, 89, 192–208. [Google Scholar] [CrossRef]

- Wang, B. The cash conversion cycle spread. J. Financ. Econ. 2019, 133, 472–497. [Google Scholar] [CrossRef]

- Attari, M.A.; Raza, K. The optimal relationship of cash conversion cycle with firm size and profitability. Int. J. Acad. Res. Bus. Soc. Sci. 2012, 2, 189. Available online: https://hrmars.com/papers_submitted/9056/the-optimal-relationship-of-cash-conversion-cycle-with-firm-size-and-profitability.pdf (accessed on 8 December 2023).

- Lin, Q.; Lin, X. Cash conversion cycle and aggregate stock returns. J. Financ. Mark. 2021, 52, 100560. [Google Scholar] [CrossRef]

- Letout, S.; Georgakaki, A. Role of Corporate Investors in the Funding and Growth of Clean Energy Tech Ventures; European Commission: Brussels, Belgium, 2024; JRC135443. [Google Scholar]

- Pauly, M.V. The economics of moral hazard: Comment. Amer. Econ. Rev. 1968, 58, 531–537. Available online: https://www.jstor.org/stable/1813785 (accessed on 10 October 2023).

- Marshall, J.M. Moral Hazard. Amer. Econ. Rev. 1976, 66, 880–890. Available online: https://www.jstor.org/stable/1827499 (accessed on 10 October 2023).

- Rowell, D.; Connelly, L.B. A history of the term “moral hazard”. J. Risk Insur. 2012, 79, 1051–1075. [Google Scholar] [CrossRef]

- Fischer, R.; Toffolo, A. Game theory-based analysis of policy instrument consequences on energy system actors in a nordic municipality. Heylon 2024, 10, E25822. [Google Scholar] [CrossRef] [PubMed]

- REGATRACE (REnewable GAs TRAde Centre in Europe). Guidebook on Securing Financing for Biomethane Investments. Available online: https://www.regatrace.eu/wp-content/uploads/2020/12/REGATRACE-D6.2.pdf (accessed on 8 December 2023).

- U.S. Environmental Protection Agency. The AgSTAR Project Development Handbook. Available online: https://www.epa.gov/agstar/agstar-project-development-handbook (accessed on 8 December 2023).

- Ball, R.; Nikolaev, V.V. On earnings and cash flows as predictors of future cash flows. J. Acc. Econ. 2022, 73, 101430. [Google Scholar] [CrossRef]

| Indicators | Mean EUR | Mean %TA | Median EUR | Stand. Dev. | Skewness g1 | Kurtosis g2 |

|---|---|---|---|---|---|---|

| A | 181 | 0.00% | 0 | 1670 | 9.95 | 103.17 |

| FAI | 3,456,535 | 67.22% | 3,545,633 | 1,574,913 | −0.30 | −0.18 |

| WC+_TOT | 1,441,004 | 28.02% | 1,369,951 | 666,303 | 0.96 | 1.31 |

| L | 244,615 | 4.76% | 247,261 | 168,572 | 0.66 | 0.24 |

| TA | 5,142,336 | 100.00% | 5,073,237 | 1,751,374 | −0.03 | −0.33 |

| E | 323,060 | 6.28% | 63,528 | 559,473 | 1.80 | 2.78 |

| WC−_TOT | 1,953,298 | 37.98% | 1,514,912 | 1,304,276 | 1.30 | 1.41 |

| FD | 2,865,978 | 55.73% | 2,866,649 | 1,686,850 | 0.24 | −0.21 |

| TS | 5,142,336 | 100.00% | 5,073,237 | 1,751,374 | −0.03 | −0.33 |

| Indicators | Mean EUR | Mean %TA | Median EUR | Stand. Dev. | Skewness g1 | Kurtosisg2 |

|---|---|---|---|---|---|---|

| FAI | 3,456,535 | 117.39 | 3,545,633 | 1,574,913 | −0.30 | −0.18 |

| NWC | −512,114 | −17.39 | −319,740 | 1,285,753 | −0.80 | 2.70 |

| NIC | 2,944,422 | 100.00 | 3,027,341 | 1,714,646 | 0.12 | −0.24 |

| E | 323,060 | 10.97 | 63,528 | 559,473 | 1.80 | 2.78 |

| NFP | 2,621,362 | 89.03 | 2,564,045 | 1,679,489 | 0.30 | −0.14 |

| TNS | 2,944,422 | 100.00 | 3,027,341 | 1,714,646 | 0.12 | −0.24 |

| Indicators | Mean EUR | Mean %VP | Median EUR | Stand. Dev. | Skewness g1 | Kurtosis g2 |

|---|---|---|---|---|---|---|

| (+) VP | 2,040,565 | 100.00 | 2,235,027 | 527,982 | −2.04 | 3.81 |

| (−) MC | −1,526,005 | −74.78 | −1,608,769 | 418,869 | 1.08 | 1.46 |

| (=) EBITDA | 514,560 | 25.22 | 525,560 | 297,575 | −0.23 | −0.28 |

| (−) D + A | −299,662 | 14.69 | −335,707 | 153,858 | 0.72 | −0.42 |

| (=) EBIT | 214,897 | 10.53 | 181,528 | 206,987 | 0.35 | 0.24 |

| (+/−) SF | −137,762 | −6.75 | −132,628 | 86,381 | −0.33 | −0.49 |

| (=) bTΠ | 77,135 | 3.78 | 18,235 | 200,880 | 0.24 | 1.62 |

| (+/−) T | −19,798 | −0.97 | −10,920 | 43,619 | −0.01 | 3.52 |

| (=) aTΠ | 57,337 | 2.81 | 6318 | 170,602 | 0.44 | 2.48 |

| Indicators | Mean € | Median € | Stand. Dev. | Skewness g1 | Kurtosis g2 |

|---|---|---|---|---|---|

| (+) CF | 494,762 | 502,813 | 274,525 | −0.23 | −0.28 |

| (+/−) Δ±NWC | −233,452 | −102,403 | 1,092,799 | −1.24 | 6.87 |

| (=) OCF | 261,310 | 412,681 | 1,187,955 | −1.10 | 5.82 |

| (+/−) Δ±FAI | −78,710 | −38,928 | 614,067 | 4.78 | 43.27 |

| (=) UFCF | 182,600 | 290,779 | 1,332,646 | −1.25 | 6.56 |

| (+/−) SF | −138,734 | −133,652 | 85,043 | −0.31 | −0.49 |

| (=) FCFE | 43,866 | 203,926 | 1,341,386 | −1.37 | 6.64 |

| Indicators | Indicator Value ≥ 0 (Absolute Value) | Indicator Value < 0 (Absolute Value) | Indicator Value ≥ 0 (Relative Value) | Indicator Value < 0 (Relative Value) |

|---|---|---|---|---|

| EBITDA | 151 | 9 | 94.38% | 5.63% |

| EBIT | 142 | 18 | 88.75% | 11.25% |

| aTΠ | 119 | 41 | 74.38% | 25.63% |

| CF | 151 | 9 | 94.38% | 5.63% |

| OCF | 126 | 34 | 78.75% | 21.25% |

| UFCF | 123 | 37 | 76.88% | 23.13% |

| FCFE | 113 | 47 | 70.63% | 29.38% |

| NFP | 147 | 13 | 91.88% | 8.13% |

| NWC | 51 | 109 | 31.88% | 68.13% |

| Indicators | Observ. n. | Mean | Median | Stand. Dev. | Skewness g1 | Kurtosis g2 | Shapiro–Wilk Test |

|---|---|---|---|---|---|---|---|

| ICR1_EA | 160 | −42.6839 | 4.0451 | 586.3646 | −12.6355 | 159.7655 | W-Stat = 0.0578 alfa = 0.0500 Not-Normal |

| ICR2_EA | 160 | −47.6612 | 1.1286 | 600.4990 | −12.6123 | 159.3582 | W-Stat = 0.0582 alfa = 0.0500 Not-Normal |

| ICR3_EA | 147 | 0.5125 | 0.2157 | 3.0445 | 12.0261 | 145.3875 | W-Stat = 0.0597 alfa = 0.0500 Not-Normal |

| ICR4_EA | 147 | 0.2253 | 0.0644 | 1.4414 | 11.9811 | 144.6449 | W-Stat = 0.0585 alfa = 0.0500 Not-Normal |

| ICR5_EA | 147 | 0.3692 | 0.1579 | 1.9980 | 11.9020 | 143.3417 | W-Stat = 0.0586 alfa = 0.0500 Not-Normal |

| ICR6_EA | 147 | 0.0820 | 0.0063 | 0.4049 | 10.4680 | 119.9076 | W-Stat = 0.0885 alfa = 0.0500 Not-Normal |

| ICR7_CFA | 160 | −30.2396 | 3.8455 | 425.9275 | −12.6213 | 159.5172 | W-Stat = 0.0953 alfa = 0.0500 Not-Normal |

| ICR8_CFA | 160 | −1151.5075 | 3.3679 | 13,654.968 | −12.5707 | 158.6128 | W-Stat = 0.1079 alfa = 0.0500 Not-Normal |

| ICR9_CFA | 160 | −1153.5149 | 3.0413 | 13,669.692 | −12.5689 | 158.5796 | W-Stat = 0.2282 alfa = 0.0500 Not-Normal |

| ICR10_CFA | 160 | 0.4862 | 0.2045 | 2.8656 | 12.0262 | 145.3880 | W-Stat = 0.0884 alfa = 0.0500 Not-Normal |

| ICR11_CFA | 147 | 0.4488 | 0.1749 | 3.2678 | 11.3890 | 135.2668 | W-Stat = 0.1544 alfa = 0.0500 Not-Normal |

| ICR12_CFA | 147 | 0.3205 | 0.1542 | 1.8588 | 8.2226 | 80.8334 | W-Stat = 0.2939 alfa = 0.0500 Not-Normal |

| ICR13_CFA | 147 | 0.3429 | 0.1528 | 1.8193 | 11.8860 | 143.0776 | W-Stat = 0.1099 alfa = 0.0500 Not-Normal |

| ICR14_CFA | 147 | 0.3055 | 0.1260 | 2.2499 | 10.5465 | 122.5286 | W-Stat = 0.2177 alfa = 0.0500 Not-Normal |

| ICR15_CFA | 147 | 0.1772 | 0.0927 | 1.1016 | 4.4881 | 37.1519 | W-Stat = 0.4797 alfa = 0.0500 Not-Normal |

| Indicators | Indicator Value ≥ 0 (Absolute Value) | Indicator Value < 0 (Absolute Value) | Indicator Value ≥ 0 (Relative Value) | Indicator Value < 0 (Relative Value) |

|---|---|---|---|---|

| ICR1_EA | 143 | 17 | 89.38% | 10.63% |

| ICR2_EA | 122 | 38 | 76.25% | 23.75% |

| ICR7_CFA | 145 | 15 | 90.63% | 9.38% |

| ICR8_CFA | 119 | 41 | 74.38% | 25.63% |

| ICR9_CFA | 114 | 46 | 71.25% | 28.75% |

| ICR1_EA | ICR2_EA | ICR7_CFA | ICR8_CFA | ICR9_CFA | ||

|---|---|---|---|---|---|---|

| ICR1_EA | Corr. Spearman ρ | 1.000 | - | - | - | - |

| Sig. (2-tailed) | - | - | - | - | - | |

| ICR2_EA | Corr. Spearman ρ | 0.656 ** | 1.000 | - | - | - |

| Sig. (2-tailed) | <0.001 | - | - | - | - | |

| ICR7_CFA | Corr. Spearman ρ | 0.995 ** | 0.628 ** | 1.000 | - | - |

| Sig. (2-tailed) | <0.001 | <0.001 | - | - | - | |

| ICR8_CFA | Corr. Spearman ρ | 0.690 ** | 0.668 ** | 0.687 ** | 1.000 | - |

| Sig. (2-tailed) | <0.001 | <0.001 | <0.001 | - | - | |

| ICR9_CFA | Corr. Spearman ρ | 0.598 ** | 0.589 ** | 0.593 ** | 0.886 ** | 1.000 |

| Sig. (2-tailed) | <0.001 | <0.001 | <0.001 | <0.001 | - |

| ICR3_EA | ICR4_EA | ICR5_EA | ICR6_EA | ICR10_CFA | ICR11_CFA | ICR12_CFA | ICR13_CFA | ICR13_CFA | ICR15_CFA | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| ICR3_EA | Corr. Spearman ρ | 1.000 | - | - | - | - | - | - | - | - | - |

| Sig. (2-tailed) | - | - | - | - | - | - | - | - | - | - | |

| ICR4_EA | Corr. Spearman ρ | 0.659 ** | 1.000 | - | - | - | - | - | - | - | - |

| Sig. (2-tailed) | <0.001 | - | - | - | - | - | - | - | - | - | |

| ICR5_EA | Corr. Spearman ρ | 0.980 ** | 0.604 ** | 1.000 | - | - | - | - | - | - | - |

| Sig. (2-tailed) | <0.001 | <0.001 | - | - | - | - | - | - | - | - | |

| ICR6_EA | Corr. Spearman ρ | 0.617 ** | 0.890 ** | 0.629 ** | 1.000 | - | - | - | - | - | - |

| Sig. (2-tailed) | <0.001 | <0.001 | <0.001 | - | - | - | - | - | - | - | |

| ICR10_CFA | Corr. Spearman ρ | 0.996 ** | 0.620 ** | 0.977 ** | 0.578 ** | 1.000 | - | - | - | - | - |

| Sig. (2-tailed) | <0.001 | <0.001 | <0.001 | <0.001 | - | - | - | - | - | - | |

| ICR11_CFA | Corr. Spearman ρ | 0.714 ** | 0.614 ** | 0.718 ** | 0.612 ** | 0.711 ** | 1.000 | - | - | - | - |

| Sig. (2-tailed) | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | - | - | - | - | - | |

| ICR12_CFA | Corr. Spearman ρ | 0.687 ** | 0.644 ** | 0.673 ** | 0.585 ** | 0.679 ** | 0.938 ** | 1.000 | - | - | - |

| Sig. (2-tailed) | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | - | - | - | - | |

| ICR13_CFA | Corr. Spearman ρ | 0.974 ** | 0.567 ** | 0.995 ** | 0.591 * | 0.979 ** | 0.712 ** | 0.662 ** | 1.000 | - | - |

| Sig. (2-tailed) | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | - | - | - | |

| ICR14_CFA | Corr. Spearman ρ | 0.691 ** | 0.584 ** | 0.710 ** | 0.615 ** | 0.687 ** | 0.993 ** | 0.924 ** | 0.703 ** | 1.000 | - |

| Sig. (2-tailed) | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | - | |

| ICR15_CFA | Corr. Spearman ρ | 0.663 ** | 0.614 ** | 0.662 ** | 0.583 ** | 0.656 ** | 0.933 ** | 0.994 ** | 0.650 ** | 0.930 ** | 1.000 |

| Sig. (2-tailed) | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | - |

| Couple of Values | T-Wilcoxon for Paired Sample Stand. Stat. | Observ. | Sig. 2-Tailed |

|---|---|---|---|

| Couple_01: ICR2_EA − ICR1_EA | −10.868 a | 160 observations ICR2_EA < ICR1_EA; 157 observ. ICR2_EA > ICR1_EA; 0 observ. ICR2_EA = ICR1_EA; 3 observ. | <0.001 ** |

| Couple_02: ICR7_CFA − ICR1_EA | −7.874 a | 160 observations ICR7_CFA < ICR1_EA; 130 observ. ICR7_CFA > ICR1_EA; 17 observ. ICR7_CFA = ICR1_EA; 13 observ. | <0.001 ** |

| Couple_03: ICR8_CFA − ICR1_EA | −4.028 a | 160 observations ICR8_CFA < ICR1_EA; 105 observ. ICR8_CFA > ICR1_EA; 54 observ. ICR8_CFA = ICR1_EA; 1 observ. | <0.001 ** |

| Couple_04: ICR9_CFA − ICR1_EA | −5.055 a | 160 observations ICR9_ CFA < ICR1_EA; 119 observ. ICR9_CFA > ICR1_EA; 41 observ. ICR9_CFA = ICR1_EA; 0 observ. | <0.001 ** |

| Couple_05: ICR7_CFA − ICR2_EA | −10.313 b | 160 observations ICR7_CFA < ICR2_EA; 11 observ. ICR7_CFA > ICR2_EA; 148 observ. ICR7_CFA = ICR2_EA; 1 observ. | <0.001 ** |

| Couple_06: ICR8_CFA − ICR2_ EA | −3.557 b | 160 observations ICR8_CFA < ICR2_EA; 48 observ. ICR8_CFA > ICR2_EA; 112 observ. ICR8_CFA = ICR2_EA; 0 observ. | <0.001 ** |

| Couple_07: ICR9_CFA − ICR2_ EA | −2.679 b | 160 observations ICR9_CFA < ICR2_EA; 54 observ. ICR9_CFA > ICR2_EA; 105 observ. ICR9_CFA = ICR2_EA; 1 observ. | <0.007 ** |

| Couple_08: ICR8_CFA − ICR7_CFA | −3.344 a | 160 observations ICR8_CFA < ICR7_CFA; 97 observ. ICR8_CFA > ICR7_CFA; 61 observ. ICR8_CFA = ICR7_CFA; 2 observ. | <0.001 ** |

| Couple_09: ICR9_CFA − ICR7_CFA | −4.705 a | 160 observations ICR9_CFA < ICR7_CFA; 116 observ. ICR9_CFA > ICR7_CFA; 44 observ. ICR9_CFA = ICR7_CFA; 0 observ. | <0.001 ** |

| Couple_10: ICR9_CFA − ICR8_CFA | −8.893 a | 160 observations ICR9_CFA < ICR_8; 136 observ. ICR9_CFA > ICR_8; 13 observ. ICR9_CFA = ICR_8; 11 observ. | <0.001 ** |

| Couple_11: ICR4_EA − ICR3_EA | −10.410 a | 94 observations ICR4_EA < ICR3_EA; 144 observ. ICR4_EA > ICR3_EA; 0 observ. ICR4_EA = ICR3_EA; 3 observ. | <0.001 ** |

| Couple_12: ICR10_CFA − ICR3_EA | −8.368 a | 94 observations ICR10_CFA < ICR3_EA; 123 observ. ICR10_CFA > ICR3_EA; 11 observ. ICR10_CFA = ICR3_EA; 13 observ. | <0.001 ** |

| Couple_13: ICR11_CFA − ICR3_EA | −4.456 a | 94 observations ICR11_CFA < ICR3_EA; 99 observ. ICR11_CFA > ICR3_EA; 47 observ. ICR11_CFA = ICR3_EA; 1 observ. | <0.001 ** |

| Couple_14: ICR12_CFA − ICR3_EA | −6.049 a | 94 observations ICR12_CFA < ICR3_EA; 114 observ. ICR12_CFA > ICR3_EA; 33 observ. ICR12_CFA = ICR3_EA; 0 observ. | <0.001 ** |

| Couple_15: ICR10_CFA − ICR4_CFA | −10.363 b | 160 observations ICR10_CFA < ICR_4; 5 observ. ICR10_CFA > ICR_4; 140 observ. ICR10_CFA = ICR_4; 2 observ. | <0.001 ** |

| Couple_16: ICR11_CFA − ICR4_CFA | −3.908 b | 147 observations ICR11_CFA < ICR_4; 42 observ. ICR11_CFA > ICR_4; 105 observ. ICR11_CFA = ICR_4; 0 observ. | <0.001 ** |

| Couple_17: ICR12_CFA − ICR4_CFA | −2.586 b | 147 observations ICR12_CFA < ICR_4; 50 observ. ICR12_CFA > ICR_4; 96 observ. ICR12_CFA = ICR_4; 1 observ. | <0.010 * |

| Couple_18: ICR11_CFA − ICR10_CFA | −3.665 a | 147 observations ICR11_CFA < ICR10_CFA; 91 observ. ICR11_CFA > ICR10_CFA; 54 observ. ICR11_CFA = ICR10_CFA; 2 observ. | <0.001 ** |

| Couple_19: ICR12_CFA − ICR10_CFA | −5.712 a | 147 observations ICR12_CFA < ICR10_CFA; 111 observ. ICR12_CFA > ICR10_CFA; 36 observ. ICR12_CFA = ICR10_CFA; 0 observ. | <0.001 ** |

| Couple_20: ICR12_CFA − ICR11_CFA | −9.075 a | 147 observations ICR12_CFA < ICR11_CFA; 130 observ. ICR12_CFA > ICR11_CFA; 9 observ. ICR12_CFA = ICR11_CFA; 8 observ. | <0.001 ** |

| Couple_21: ICR6_EA − ICR5_EA | −10,410 a | 147 observations ICR6_EA < ICR5_EA; 144 observ. ICR6_EA > ICR5_EA; 0 observ. ICR6_EA = ICR5_EA; 3 observ. | <0.001 ** |

| Couple_22: ICR13_CFA − ICR5_EA | −8366 a | 147 observations ICR13_CFA < ICR5_EA; 123 observ. ICR13_CFA > ICR5_EA; 11 observ. ICR13_CFA = ICR5_EA; 13 observ. | <0.001 ** |

| Couple_23: ICR14_CFA − ICR5_EA | −4455 a | 147 observations ICR14_CFA < ICR5_EA; 99 observ. ICR14_CFA > ICR5_EA; 47 observ. ICR14_CFA = ICR5_EA; 1 observ. | <0.001 ** |

| Couple_24: ICR15_CFA − ICR5_EA | −6048 a | 147 observations ICR15_CFA < ICR5_EA; 114 observ. ICR15_CFA > ICR5_EA; 33 observ. ICR15_CFA = ICR5_EA; 0 observ. | <0.001 ** |

| Couple_25: ICR13_CFA − ICR6_EA | −10,363 b | 147 observations ICR13_CFA < ICR6_EA; 5 observ. ICR13_CFA > ICR6_EA; 140 observ. ICR13_CFA = ICR6_EA; 2 observ. | <0.001 ** |

| Couple_26: ICR14_CFA − ICR6_EA | −3907 b | 147 observations ICR14_CFA < ICR6_EA; 42 observ. ICR14_CFA > ICR6_EA; 105 observ. ICR14_CFA = ICR6_EA; 0 observ. | <0.001 ** |

| Couple_27: ICR15_CFA − ICR6_EA | −2586 b | 147 observations ICR15_CFA < ICR6_EA; 50 observ. ICR15_CFA > ICR6_EA; 96 observ. ICR15_CFA = ICR6_EA; 1 observ. | <0.010 * |

| Couple_28: ICR14_CFA − ICR13_CFA | −3663 a | 147 observations ICR14_CFA < ICR13_CFA; 91 observ. ICR14_CFA > ICR13_CFA; 54 observ. ICR14_CFA = ICR13_CFA; 2 observ. | <0.001 ** |

| Couple_29: ICR15_CFA − ICR13_CFA | −5711 a | 147 observations ICR15_CFA < ICR13_CFA; 111 observ. ICR15_CFA > ICR13_CFA; 36 observ. ICR15_CFA = ICR13_CFA; 0 observ. | <0.001 ** |

| Couple_30: ICR15_CFA − ICR14_CFA | −9.075 a | 147 observations ICR15_CFA < ICR14_CFA; 130 observ. ICR15_CFA > ICR14_CFA; 9 observ. ICR15_CFA = ICR14_CFA; 8 observ | <0.001 ** |

| Couple_31: ICR5_EA − ICR3_EA | −10.410 a | 147 observations ICR15_CFA < ICR14_CFA; 144 observ. ICR15_CFA > ICR14_CFA; 0 observ. ICR15_CFA = ICR14_CFA; 3 observ | <0.001 ** |

| Couple_32: ICR6_EA − ICR3_EA | −10.446 a | 147 observations ICR15_CFA < ICR14_CFA; 145 observ. ICR15_CFA > ICR14_CFA; 0 observ. ICR15_CFA = ICR14_CFA; 2 observ | <0.001 ** |

| Couple_33: ICR13_CFA − ICR10_CFA | −10.410 a | 147 observations ICR15_CFA < ICR14_CFA; 144 observ. ICR15_CFA > ICR14_CFA; 0 observ. ICR15_CFA = ICR14_CFA; 3 observ | <0.001 ** |

| Couple_34: ICR14_CFA − ICR11_CFA | −10.410 a | 147 observations ICR15_CFA < ICR14_CFA; 144 observ. ICR15_CFA > ICR14_CFA; 0 observ. ICR15_CFA = ICR14_CFA; 3 observ | <0.001 ** |

| Couple_35: ICR15_CFA − ICR12_CFA | −10.446 a | 147 observations ICR15_CFA < ICR14_CFA; 148 observ. ICR15_CFA > ICR14_CFA; 0 observ. ICR15_CFA = ICR14_CFA; 2 observ | <0.001 ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Iotti, M.; Manghi, E.; Bonazzi, G. Debt Sustainability Assessment in the Biogas Sector: Application of Interest Coverage Ratios in a Sample of Agricultural Firms in Italy. Energies 2024, 17, 1404. https://doi.org/10.3390/en17061404

Iotti M, Manghi E, Bonazzi G. Debt Sustainability Assessment in the Biogas Sector: Application of Interest Coverage Ratios in a Sample of Agricultural Firms in Italy. Energies. 2024; 17(6):1404. https://doi.org/10.3390/en17061404

Chicago/Turabian StyleIotti, Mattia, Elisa Manghi, and Giuseppe Bonazzi. 2024. "Debt Sustainability Assessment in the Biogas Sector: Application of Interest Coverage Ratios in a Sample of Agricultural Firms in Italy" Energies 17, no. 6: 1404. https://doi.org/10.3390/en17061404

APA StyleIotti, M., Manghi, E., & Bonazzi, G. (2024). Debt Sustainability Assessment in the Biogas Sector: Application of Interest Coverage Ratios in a Sample of Agricultural Firms in Italy. Energies, 17(6), 1404. https://doi.org/10.3390/en17061404