Assessing Risks on China’s Natural Gas Supply under Carbon Peaking Policies from Foreign–Domestic Perspectives

Abstract

1. Introduction

2. Literature Review

3. Challenges for China’s Natural Gas Supply

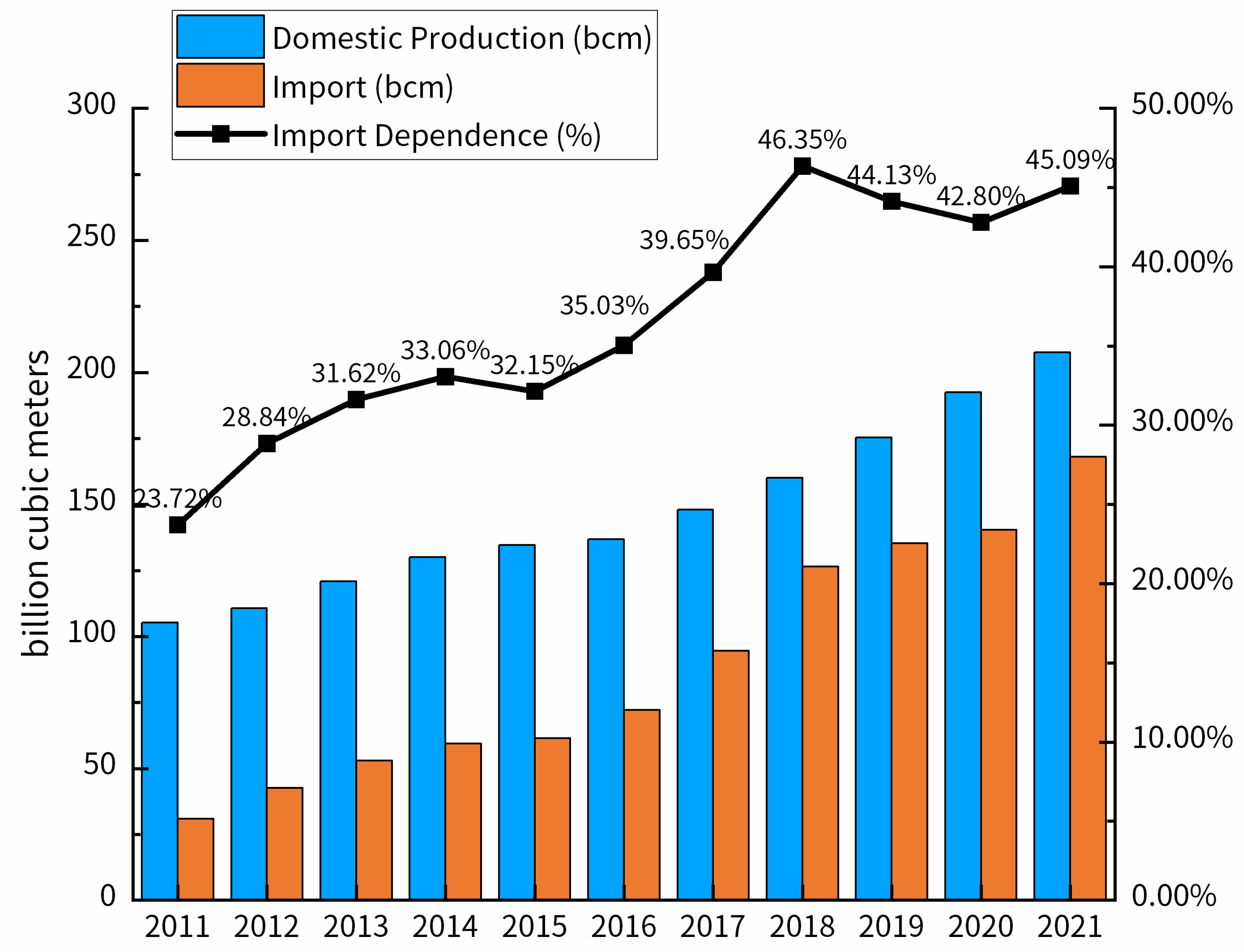

3.1. Imports

3.2. Domestic Resources

3.3. Markets, Disruptions, Policies, and Other Uncertainties

3.4. Infrastructure Failures

4. Fuzzy-AHP Methods

4.1. Construction of Hierarchy

4.2. Evaluation of Fuzzy Pairwise Comparison

- is the minimum value of n opinions, ;

- is the geometrical mean of n opinions, ;

- is the maximum value of n opinions, ;

- ; i, j = 1,…, m; k = 1,…, n.

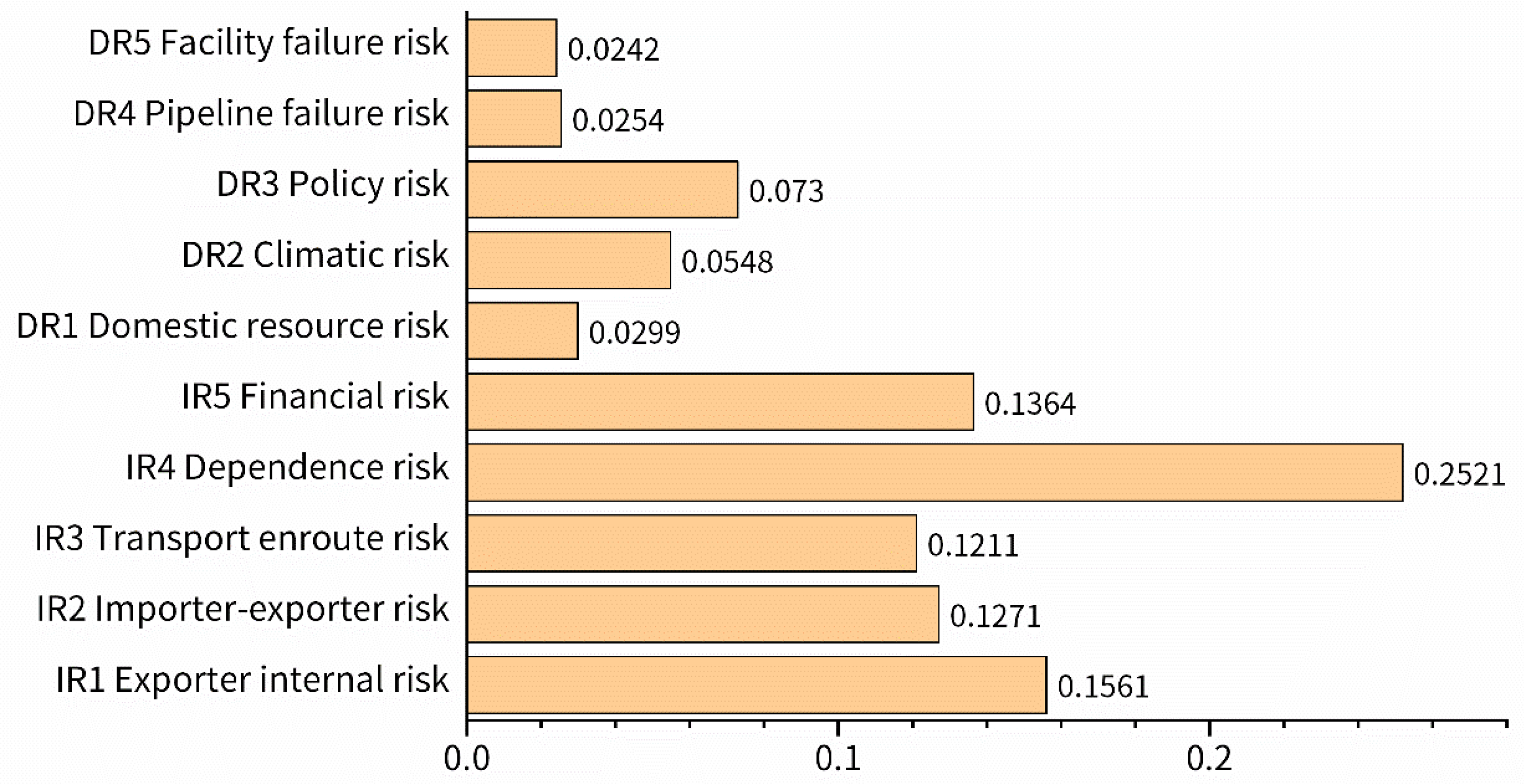

5. Results and Discussions

5.1. Imports

5.2. Domestic

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Opinions of 5 Evaluators

| Evaluator 1 | (CR = 0.04763) | |||||||||

| IR1 | IR2 | IR3 | IR4 | IR5 | DR1 | DR2 | DR3 | DR4 | DR5 | |

| IR1 | 1 | 3 | 2 | 1/2 | 2 | 6 | 3 | 3 | 5 | 6 |

| IR2 | 1/3 | 1 | 1/2 | 1/3 | 1 | 6 | 2 | 3 | 5 | 5 |

| IR3 | 1/2 | 2 | 1 | 1/4 | 1 | 5 | 4 | 2 | 4 | 4 |

| IR4 | 2 | 3 | 4 | 1 | 3 | 8 | 6 | 5 | 8 | 7 |

| IR5 | 1/2 | 1 | 1 | 1/3 | 1 | 7 | 2 | 3 | 5 | 6 |

| DR1 | 2/3 | 2/3 | 1/5 | 1/8 | 1/7 | 1 | 1/3 | 1/5 | 2 | 1 |

| DR2 | 1/3 | 1/2 | 1/4 | 2/3 | 1/2 | 3 | 1 | 2 | 3 | 3 |

| DR3 | 1/3 | 1/3 | 1/2 | 1/5 | 1/3 | 5 | 1/2 | 1 | 5 | 5 |

| DR4 | 1/5 | 1/5 | 1/4 | 1/8 | 1/5 | 1/2 | 1/3 | 1/5 | 1 | 1/2 |

| DR5 | 2/3 | 1/5 | 1/4 | 1/7 | 2/3 | 1 | 1/3 | 1/5 | 2 | 1 |

| Evaluator 2 | (CR = 0.06597) | |||||||||

| IR1 | IR2 | IR3 | IR4 | IR5 | DR1 | DR2 | DR3 | DR4 | DR5 | |

| IR1 | 1 | 2 | 2 | 1 | 1/3 | 5 | 3 | 2 | 5 | 7 |

| IR2 | 1/2 | 1 | 1/2 | 1/4 | 1 | 6 | 2 | 2 | 4 | 5 |

| IR3 | 1/2 | 2 | 1 | 1 | 1 | 5 | 4 | 1 | 3 | 4 |

| IR4 | 1 | 4 | 1 | 1 | 2 | 7 | 6 | 3 | 8 | 7 |

| IR5 | 3 | 1 | 1 | 1/2 | 1 | 6 | 3 | 1 | 6 | 5 |

| DR1 | 1/5 | 2/3 | 1/5 | 1/7 | 2/3 | 1 | 1/2 | 1/4 | 3 | 2 |

| DR2 | 1/3 | 1/2 | 1/4 | 2/3 | 1/3 | 2 | 1 | 1/2 | 1/2 | 3 |

| DR3 | 1/2 | 1/2 | 1 | 1/3 | 1 | 4 | 2 | 1 | 4 | 2 |

| DR4 | 1/5 | 1/4 | 1/3 | 1/8 | 2/3 | 1/3 | 2 | 1/4 | 1 | 2 |

| DR5 | 1/7 | 1/5 | 1/4 | 1/7 | 1/5 | 1/2 | 1/3 | 1/2 | 1/2 | 1 |

| Evaluator 3 | (CR = 0.06259) | |||||||||

| IR1 | IR2 | IR3 | IR4 | IR5 | DR1 | DR2 | DR3 | DR4 | DR5 | |

| IR1 | 1 | 1/2 | 2 | 1/2 | 2 | 4 | 1 | 2 | 4 | 6 |

| IR2 | 2 | 1 | 4 | 1/2 | 1/2 | 6 | 2 | 3 | 5 | 5 |

| IR3 | 1/2 | 1/4 | 1 | 1/4 | 1 | 4 | 5 | 2 | 3 | 4 |

| IR4 | 2 | 2 | 4 | 1 | 3 | 6 | 6 | 5 | 7 | 6 |

| IR5 | 1/2 | 2 | 1 | 1/3 | 1 | 6 | 2 | 2 | 6 | 6 |

| DR1 | 1/4 | 2/3 | 1/4 | 2/3 | 2/3 | 1 | 1/2 | 1/3 | 2 | 1 |

| DR2 | 1 | 1/2 | 1/5 | 2/3 | 1/2 | 2 | 1 | 2 | 3 | 3 |

| DR3 | 1/2 | 1/3 | 1/2 | 1/5 | 1/2 | 3 | 1/2 | 1 | 4 | 5 |

| DR4 | 1/4 | 1/5 | 1/3 | 1/7 | 2/3 | 1/2 | 1/3 | 1/4 | 1 | 1 |

| DR5 | 2/3 | 1/5 | 1/4 | 2/3 | 2/3 | 1 | 1/3 | 1/5 | 1 | 1 |

| Evaluator 4 | (CR = 0.07193) | |||||||||

| IR1 | IR2 | IR3 | IR4 | IR5 | DR1 | DR2 | DR3 | DR4 | DR5 | |

| IR1 | 1 | 2 | 1 | 1 | 1/3 | 4 | 3 | 2 | 5 | 5 |

| IR2 | 1/2 | 1 | 2 | 1/4 | 1 | 5 | 2 | 2 | 4 | 6 |

| IR3 | 1 | 1/2 | 1 | 1 | 1/2 | 6 | 5 | 1 | 3 | 4 |

| IR4 | 1 | 4 | 1 | 1 | 2 | 6 | 6 | 3 | 9 | 8 |

| IR5 | 3 | 1 | 2 | 1/2 | 1 | 6 | 3 | 1 | 5 | 4 |

| DR1 | 1/4 | 1/5 | 2/3 | 2/3 | 2/3 | 1 | 1/2 | 1/4 | 4 | 2 |

| DR2 | 1/3 | 1/2 | 1/5 | 2/3 | 1/3 | 2 | 1 | 1/2 | 1/2 | 2 |

| DR3 | 1/2 | 1/2 | 1 | 1/3 | 1 | 4 | 2 | 1 | 5 | 4 |

| DR4 | 1/5 | 1/4 | 1/3 | 1/9 | 1/5 | 1/4 | 2 | 1/5 | 1 | 2 |

| DR5 | 1/5 | 2/3 | 1/4 | 1/8 | 1/4 | 1/2 | 1/2 | 1/4 | 1/2 | 1 |

| Evaluator 5 | (CR = 0.05582) | |||||||||

| IR1 | IR2 | IR3 | IR4 | IR5 | DR1 | DR2 | DR3 | DR4 | DR5 | |

| IR1 | 1 | 3 | 2 | 1/2 | 2 | 7 | 3 | 3 | 5 | 7 |

| IR2 | 1/3 | 1 | 1/2 | 1/3 | 1 | 6 | 2 | 3 | 5 | 6 |

| IR3 | 1/2 | 2 | 1 | 1/3 | 1/2 | 5 | 5 | 3 | 5 | 4 |

| IR4 | 2 | 3 | 3 | 1 | 3 | 9 | 6 | 5 | 8 | 7 |

| IR5 | 1/2 | 1 | 2 | 1/3 | 1 | 7 | 2 | 3 | 4 | 6 |

| DR1 | 1/7 | 2/3 | 1/5 | 1/9 | 1/7 | 1 | 1/2 | 1/5 | 3 | 1 |

| DR2 | 1/3 | 1/2 | 1/5 | 2/3 | 1/2 | 2 | 1 | 1 | 3 | 3 |

| DR3 | 1/3 | 1/3 | 1/3 | 1/5 | 1/3 | 5 | 1 | 1 | 4 | 5 |

| DR4 | 1/5 | 1/5 | 1/5 | 1/8 | 1/4 | 1/3 | 1/3 | 1/4 | 1 | 1/3 |

| DR5 | 1/7 | 2/3 | 1/4 | 1/7 | 2/3 | 1 | 1/3 | 1/5 | 3 | 1 |

References

- National Bureau of Statistics of China. China Energy Statistics Yearbook 2017; National Bureau of Statistics of China: Beijing, China, 2017.

- British Petroleum. Bp Statistical Review of World Energy—All Data (1965–2020); British Petroleum: London, UK, 2021. [Google Scholar]

- State Council of China. Air Pollution Prevention and Control Action Plan. Available online: http://www.gov.cn/zwgk/2013-09/12/content_2486773.htm (accessed on 5 April 2021).

- State Council of China 2018–2020. Three-Year Action Plan for Winning the Blue Sky Ware. Available online: http://www.gov.cn/zhengce/content/2018-07/03/content_5303158.htm (accessed on 5 April 2021).

- Mallapaty, S. How China Could Be Carbon Neutral by Mid-Century. Nature 2020, 586, 482–483. [Google Scholar] [CrossRef]

- Zhao, X.; Ma, X.; Chen, B.; Shang, Y.; Song, M. Challenges toward Carbon Neutrality in China: Strategies and Countermeasures. Resour. Conserv. Recycl. 2022, 176, 105959. [Google Scholar] [CrossRef]

- Chai, J.; Jin, Y. The Dynamic Impacts of Oil Price on China’s Natural Gas Consumption under the Change of Global Oil Market Patterns: An Analysis from the Perspective of Total Consumption and Structure. Energies 2020, 13, 867. [Google Scholar] [CrossRef]

- Cabalu, H. Indicators of Security of Natural Gas Supply in Asia. Energy Policy 2010, 38, 218–225. [Google Scholar] [CrossRef]

- Grais, W.; Zheng, K. Strategic Interpendence in the East-West Gas Trade: A Hierarchical Stackelberg Game Approach. Energy J. 1996, 17, 61–84. [Google Scholar] [CrossRef]

- Weisser, H. The Security of Gas Supply—A Critical Issue for Europe? Energy Policy 2007, 35, 1–5. [Google Scholar] [CrossRef]

- Percebois, J. The Supply of Natural Gas in the European Union—Strategic Issues. OPEC Energy Rev. 2008, 32, 33–53. [Google Scholar] [CrossRef]

- Abada, I.; Massol, O. Security of Supply and Retail Competition in the European Gas Market. Energy Policy 2011, 39, 4077–4088. [Google Scholar] [CrossRef]

- Doukas, H.; Flamos, A.; Psarras, J. Risks on the Security of Oil and Gas Supply. Energy Sources Part B Econ. Plan. Policy 2011, 6, 417–425. [Google Scholar] [CrossRef]

- Pavlović, B.; Ivezić, D.; Živković, M. Prioritization of Strategic Measures for Strengthening the Security of Supply of the Serbian Natural Gas Sector. Energy Policy 2021, 148, 111936. [Google Scholar] [CrossRef]

- Krikštolaitis, R.; Bianco, V.; Martišauskas, L.; Urbonienė, S. Analysis of Electricity and Natural Gas Security. A Case Study for Germany, France, Italy and Spain. Energies 2022, 15, 1000. [Google Scholar] [CrossRef]

- Geng, J.-B.; Ji, Q. Multi-Perspective Analysis of China’s Energy Supply Security. Energy 2014, 64, 541–550. [Google Scholar] [CrossRef]

- Cabalu, H.; Manuhutu, C. Vulnerability of Natural Gas Supply in the Asian Gas Market. Econ. Anal. Policy 2009, 39, 255–270. [Google Scholar] [CrossRef]

- Manuhutu, C.; Owen, A.D. Gas-on-Gas Competition in Shanghai. Energy Policy 2010, 38, 2101–2106. [Google Scholar] [CrossRef][Green Version]

- Vivoda, V. LNG Import Diversification in Asia. Energy Strategy Rev. 2014, 2, 289–297. [Google Scholar] [CrossRef]

- Dong, X.; Kong, Z. The Impact of China’s Natural Gas Import Risks on the National Economy. J. Nat. Gas Sci. Eng. 2016, 36, 97–107. [Google Scholar] [CrossRef]

- Kong, Z.; Lu, X.; Jiang, Q.; Dong, X.; Liu, G.; Elbot, N.; Zhang, Z.; Chen, S. Assessment of Import Risks for Natural Gas and Its Implication for Optimal Importing Strategies: A Case Study of China. Energy Policy 2019, 127, 11–18. [Google Scholar] [CrossRef]

- Zhang, L.; Bai, W. Risk Assessment of China’s Natural Gas Importation: A Supply Chain Perspective. SAGE Open 2020, 10, 2158244020939912. [Google Scholar] [CrossRef]

- Shaikh, F.; Ji, Q.; Fan, Y.; Shaikh, P.H.; Uqaili, M.A. Modelling an Optimal Foreign Natural Gas Import Scheme for China. J. Nat. Gas Sci. Eng. 2017, 40, 267–276. [Google Scholar] [CrossRef]

- Lu, W.; Su, M.; Fath, B.D.; Zhang, M.; Hao, Y. A Systematic Method of Evaluation of the Chinese Natural Gas Supply Security. Appl. Energy 2016, 165, 858–867. [Google Scholar] [CrossRef]

- Wang, L.; Xing, Y. Risk Assessment of a Coupled Natural Gas and Electricity Market Considering Dual Interactions: A System Dynamics Model. Energies 2022, 16, 223. [Google Scholar] [CrossRef]

- Praks, P.; Kopustinskas, V.; Masera, M. Monte-Carlo-Based Reliability and Vulnerability Assessment of a Natural Gas Transmission System Due to Random Network Component Failures. Sustain. Resilient Infrastruct. 2017, 2, 97–107. [Google Scholar] [CrossRef]

- Chellel, K.; Campbell, M.; Oanh Ha, K. Six Days in Suez: The Inside Story of the Ship That Broke Global Trade. Available online: https://www.bloomberg.com/news/features/2021-06-24/how-the-billion-dollar-ever-given-cargo-ship-got-stuck-in-the-suez-canal?utm_source=pocket-newtab (accessed on 20 December 2021).

- Shaikh, F.; Ji, Q.; Fan, Y. Assessing the Stability of the LNG Supply in the Asia Pacific Region. J. Nat. Gas Sci. Eng. 2016, 34, 376–386. [Google Scholar] [CrossRef]

- Pan, X.; Xu, H.; Song, M.; Lu, Y.; Zong, T. Forecasting of Industrial Structure Evolution and CO2 Emissions in Liaoning Province. J. Clean. Prod. 2021, 285, 124870. [Google Scholar] [CrossRef]

- Chen, M.; Li, N.; Mu, H. Assessment of a Low-Carbon Natural Gas Storage Network Using the FLP Model: A Case Study within China–Russia Natural Gas Pipeline East Line’s Coverage. J. Nat. Gas Sci. Eng. 2021, 96, 104246. [Google Scholar] [CrossRef]

- Liu, D.; Yamaguchi, K.; Yoshikawa, H. Understanding the Motivations behind the Myanmar-China Energy Pipeline: Multiple Streams and Energy Politics in China. Energy Policy 2017, 107, 403–412. [Google Scholar] [CrossRef]

- Dong, X.; Kong, Z. Risk Analysis of Natural Gas Imports in China from the Perspective of Supply Chain. Nat. Gas Ind. 2017, 37, 113–118. [Google Scholar] [CrossRef]

- Wu, G.; Wei, Y.M.; Fan, Y.; Liu, L.C. An Empirical Analysis of the Risk of Crude Oil Imports in China Using Improved Portfolio Approach. Energy Policy 2007, 35, 4190–4199. [Google Scholar] [CrossRef]

- Animah, I.; Shafiee, M. Application of Risk Analysis in the Liquefied Natural Gas (LNG) Sector: An Overview. J. Loss Prev. Process Ind. 2020, 63, 103980. [Google Scholar] [CrossRef]

- International Energy Agency. How Europe Can Cut Natural Gas Imports from Russia Significantly within a Year. Available online: https://www.iea.org/news/how-europe-can-cut-natural-gas-imports-from-russia-significantly-within-a-year (accessed on 1 August 2022).

- Rokicki, T.; Bórawski, P.; Szeberényi, A. The Impact of the 2020–2022 Crises on EU Countries’ Independence from Energy Imports, Particularly from Russia. Energies 2023, 16, 6629. [Google Scholar] [CrossRef]

- Sheppard, D.; Hume, N.; Mitchell, T. Mongolia Says Russia-China Gas Pipeline Will Break Ground in 2024. Available online: https://www.ft.com/content/f0080bf6-5e7d-44be-871f-a5d44dccf5c5 (accessed on 1 August 2022).

- Shiryaevskaya, A. Russian Gas Pivot Toward China Will Ease Europe’s Energy Crunch. Available online: https://www.bloomberg.com/news/articles/2022-07-29/russian-gas-pivot-toward-china-will-ease-europe-s-energy-crunch (accessed on 1 August 2022).

- China National Petroleum Coporation. 2019 China National Petroleum Coporation Yearbook; Petroleum Industry Press: Beijing, China, 2019; ISBN 9787518337569. [Google Scholar]

- Kollias, C.; Kyrtsou, C.; Papadamou, S. The Effects of Terrorism and War on the Oil Price–Stock Index Relationship. Energy Econ. 2013, 40, 743–752. [Google Scholar] [CrossRef]

- Do, Q.-T.; Shapiro, J.N.; Elvidge, C.D.; Abdel-Jelil, M.; Ahn, D.P.; Baugh, K.; Hansen-Lewis, J.; Zhizhin, M.; Bazilian, M.D. Terrorism, Geopolitics, and Oil Security: Using Remote Sensing to Estimate Oil Production of the Islamic State. Energy Res. Soc. Sci. 2018, 44, 411–418. [Google Scholar] [CrossRef]

- Lee, C. Oil and Terrorism. J. Confl. Resolut. 2018, 62, 903–928. [Google Scholar] [CrossRef]

- Wang, Z. The Impact of China’s WTO Accession on Patterns of World Trade. J. Policy Model. 2003, 25, 1–41. [Google Scholar] [CrossRef]

- Fan, H.; Gao, X.; Zhang, L. How China’s Accession to the WTO Affects Global Welfare? China Econ. Rev. 2021, 69, 101688. [Google Scholar] [CrossRef]

- Yeo, L.H. Impact of COVID-19 Pandemic on Asia-Europe Relations. Asia Eur. J. 2020, 18, 235–238. [Google Scholar] [CrossRef]

- Boylan, B.M.; McBeath, J.; Wang, B. US–China Relations: Nationalism, the Trade War, and COVID-19. Fudan J. Humanit. Soc. Sci. 2021, 14, 23–40. [Google Scholar] [CrossRef]

- Pan, G.; Korolev, A. The Struggle for Certainty: Ontological Security, the Rise of Nationalism, and Australia-China Tensions after COVID-19. J. Chin. Polit. Sci. 2021, 26, 115–138. [Google Scholar] [CrossRef]

- Yu, J.; Zheng, M.; Li, J.; Wu, X.; Guo, Q. Resource Potential, Exploration Prospects, and Favorable Direction for Natural Gas in Deep Formations in China. J. Nat. Gas Geosci. 2018, 3, 311–320. [Google Scholar] [CrossRef]

- Wei, J.; Fang, Y.; Lu, H.; Lu, H.; Lu, J.; Liang, J.; Yang, S. Distribution and Characteristics of Natural Gas Hydrates in the Shenhu Sea Area, South China Sea. Mar. Pet. Geol. 2018, 98, 622–628. [Google Scholar] [CrossRef]

- Ruan, X.; Li, X.-S.; Xu, C.-G. A Review of Numerical Research on Gas Production from Natural Gas Hydrates in China. J. Nat. Gas Sci. Eng. 2021, 85, 103713. [Google Scholar] [CrossRef]

- Song, Y.; Yang, L.; Zhao, J.; Liu, W.; Yang, M.; Li, Y.; Liu, Y.; Li, Q. The Status of Natural Gas Hydrate Research in China: A Review. Renew. Sustain. Energy Rev. 2014, 31, 778–791. [Google Scholar] [CrossRef]

- National Energy Administration of China. China Natural Gas Development Report (2020); Petroleum Industry Press: Beijing, China, 2020; ISBN 9787518341832. [Google Scholar]

- National Energy Administration of China. China Natural Gas Development Report (2019); Petroleum Industry Press: Beijing, China, 2019; ISBN 9787518335497. [Google Scholar]

- Liu, G.; Dong, X.; Kong, Z.; Jiang, Q.; Li, J. The Role of China in the East Asian Natural Gas Premium. Energy Strategy Rev. 2021, 33, 100610. [Google Scholar] [CrossRef]

- Lin, W.; Zhang, N.; Gu, A. LNG (Liquefied Natural Gas): A Necessary Part in China’s Future Energy Infrastructure. Energy 2010, 35, 4383–4391. [Google Scholar] [CrossRef]

- Liu, D.; Xu, H. A Rational Policy Decision or Political Deal? A Multiple Streams’ Examination of the Russia-China Natural Gas Pipeline. Energy Policy 2021, 148, 111973. [Google Scholar] [CrossRef]

- He, L. Chinese Coal Prices Hit Record High and Power Cuts Continue. Available online: https://edition.cnn.com/2021/10/11/economy/china-power-crunch-economy-intl-hnk/index.html (accessed on 18 January 2022).

- Jaganathan, J.; Rashad, M. Asia LNG Spot Price Surges by 40% to Record High. Available online: https://www.reuters.com/world/asia-pacific/asia-lng-spot-price-surges-by-40-record-high-2021-10-06/ (accessed on 18 January 2022).

- State Council of the People’s Republic of China. Reaching Carbon Emission Peak before 2030. Available online: http://www.gov.cn/zhengce/content/2021-10/26/content_5644984.htm (accessed on 15 July 2022).

- Liu, Z.; Deng, Z.; He, G.; Wang, H.; Zhang, X.; Lin, J.; Qi, Y.; Liang, X. Challenges and Opportunities for Carbon Neutrality in China. Nat. Rev. Earth Environ. 2022, 3, 141–155. [Google Scholar] [CrossRef]

- Jia, Z.; Lin, B. How to Achieve the First Step of the Carbon-Neutrality 2060 Target in China: The Coal Substitution Perspective. Energy 2021, 233, 121179. [Google Scholar] [CrossRef]

- Guo, Y.; Meng, X.; Meng, T.; Wang, D.; Liu, S. A Novel Method of Risk Assessment Based on Cloud Inference for Natural Gas Pipelines. J. Nat. Gas Sci. Eng. 2016, 30, 421–429. [Google Scholar] [CrossRef]

- Peng, X.; Yao, D.; Liang, G.; Yu, J.; He, S. Overall Reliability Analysis on Oil/Gas Pipeline under Typical Third-Party Actions Based on Fragility Theory. J. Nat. Gas Sci. Eng. 2016, 34, 993–1003. [Google Scholar] [CrossRef]

- Asadabadi, M.R.; Zwikael, O. The Ambiguous Proposal Evaluation Problem. Decis. Support Syst. 2020, 136, 113359. [Google Scholar] [CrossRef]

- van Laarhoven, P.J.M.; Pedrycz, W. A Fuzzy Extension of Saaty’s Priority Theory. Fuzzy Sets Syst. 1983, 11, 229–241. [Google Scholar] [CrossRef]

- Buckley, J.J. Fuzzy Hierarchical Analysis. Fuzzy Sets Syst. 1985, 17, 233–247. [Google Scholar] [CrossRef]

- Ekel, P.; Pedrycz, W.; Pereira, J., Jr. Dealing with Uncertainty of Information. In Multicriteria Decision-Making under Conditions of Uncertainty; Wiley: Hoboken, NJ, USA, 2019; pp. 275–290. [Google Scholar]

- Saaty, T.L. A Scaling Method for Priorities in Hierarchical Structures. J. Math. Psychol. 1977, 15, 234–281. [Google Scholar] [CrossRef]

- Tahri, M.; Maanan, M.; Tahri, H.; Kašpar, J.; Chrismiari Purwestri, R.; Mohammadi, Z.; Marušák, R. New Fuzzy-AHP Matlab Based Graphical User Interface (GUI) for a Broad Range of Users: Sample Applications in the Environmental Field. Comput. Geosci. 2022, 158, 104951. [Google Scholar] [CrossRef]

- Zheng, X. Russia Ratifies Agreement on Natural Gas Supply. Available online: https://www.chinadaily.com.cn/a/202306/08/WS64818101a31033ad3f7bb324.html (accessed on 13 June 2023).

- European Commission. In Focus: Reducing the EU’s Dependence on Imported Fossil Fuels. Available online: https://ec.europa.eu/info/news/focus-reducing-eus-dependence-imported-fossil-fuels-2022-apr-20_en (accessed on 27 September 2022).

- Halser, C.; Paraschiv, F. Pathways to Overcoming Natural Gas Dependency on Russia—The German Case. Energies 2022, 15, 4939. [Google Scholar] [CrossRef]

- Konopelko, A.; Kostecka-Tomaszewska, L.; Czerewacz-Filipowicz, K. Rethinking EU Countries’ Energy Security Policy Resulting from the Ongoing Energy Crisis: Polish and German Standpoints. Energies 2023, 16, 5132. [Google Scholar] [CrossRef]

- Li, Q.; Ye, M. China’s Emerging Partnership Network: What, Who, Where, When and Why. Int. Trade Polit. Dev. 2019, 3, 66–81. [Google Scholar] [CrossRef]

- Myers, M.; Barrios, R. How China Ranks Its Partners in LAC. Available online: https://www.thedialogue.org/blogs/2021/02/how-china-ranks-its-partners-in-lac/ (accessed on 24 September 2022).

- Ling, S.; Li, L. Strategic Relation between China and the United States: Histories, Experiences and Revelations. Contemp. World Social. 2018, 5, 166–173. [Google Scholar] [CrossRef]

- Girgin, S.; Krausmann, E. Analysis of Pipeline Accidents Induced by Natural Hazards: Final Report; Joint Research Centre: Ispra, Italy, 2014. [Google Scholar]

- Liang, Y.; Yang, F.; Yin, Z.; Chen, B. Accident Statistics and Risk Analysis of Oil and Gas Pipelines. Oil Gas Storage Transp. 2017, 36, 472–476. [Google Scholar]

- Wang, Y.; Lyu, Y.; Yang, W.; Sun, X.; Zhu, X. Review of Research for Accidents Occurred in Gas Transportation Pipeline in Home and Abroad. Process Equip. Pip. 2022, 59, 78–84. [Google Scholar]

| Authors | Risk Factors | Methods |

|---|---|---|

| Grais and Zheng (1994) [9] | Relationships among suppliers, transporters, and importers | Stackelberg game model |

| Weisser (2007) [10] | Source dependence, transit dependence, facility dependence, structural risks, natural disaster, political blackmail, terrorism, war, and civil unrest | Qualitative analysis |

| Percebois (2008) [11] | Long-term contract and geopolitical consideration | Qualitative analysis |

| Cabalu and Manuhutu (2009) [17] | Cost of gas import, gas intensity, gas consumption per capita, gas share in TPES, domestic gas production–consumption ratio, and geopolitical risk | Weighted index |

| Cabalu (2010) [8] | Gas intensity, net gas import dependency, domestic gas production–consumption rate, and geopolitical risk | Gas supply security index |

| Manuhutu and Owen (2010) [18] | Herfindahl–Hirschman Index | Qualitative analysis |

| Abada and Massol (2011) [12] | Natural gas supply disruption | Static Cournot game model |

| Doukas et al. (2011) [13] | Conflict, political instability, terrorism, export restriction, accident, weather condition, and monopolistic practice | Qualitative analysis |

| Vivoda (2014) [19] | Herfindahl–Hirschman Index | Qualitative analysis |

| Geng and Ji (2014) [16] | Natural gas market integration | Complex network theory |

| Dong and Kong (2016) [20] | Sea transport distance, pirate attack, political risk, and maritime transportation risks | AHP |

| Lu et al. (2016) [24] | Supply source, consumption sector, refining, and reserve sectors in a system | Network information analysis |

| Shaikh et al. (2017) [23] | Diversification, lower dependency, supplier export capacity, minimizing the import cost, transport distance, and political instability associated with each of the foreign natural gas suppliers | MOLP |

| Praks et al. (2017) [26] | Cost, country risk, shipping risk, and impact of extreme events | MOLP |

| Kong et al. (2019) [21] | Resource risk, political risk, transport risk, price volatility risk, purchasing power risk, and dependence risk | Weighted index |

| Zhang and Bai (2020) [22] | Dependence risk, transport risk, price risk, resource risk, financial risk, and international relationship risk | Fuzzy AHP–TOPSIS |

| Pavlović et al. (2021) [14] | Consumption, termination of supply, empty gas storage, and Herfindahl–Hirschman Index | Fuzzy AHP–HHI |

| Wang and Xing (2023) [25] | Coupled Natural Gas and Electricity Market | System dynamics |

| No. | Name | Affiliation | Research Interests |

|---|---|---|---|

| 1 | Prof. Zhang M. | China University of Mining and Technology | Energy economics |

| 2 | Prof. Sun C.L. | Chinese Academy of Sciences | Energy market, petrochemical industry |

| 3 | Prof. Ning Y.D. | Dalian University of Technology | Geopolitics, energy security |

| 4 | Prof. Li L.X. | China University of Geosciences | Energy modeling, risk analysis |

| 5 | Assoc. Prof. Li J.D. | China University of Petroleum | Carbon footprint, risk analysis |

| Criteria | Description |

|---|---|

| IR1 Exporter internal risk | Exporter’s own stability status, including political, economic, military, social, and diplomatic stabilities. An exporter with a stable political and social environment is generally perceived as less risky. |

| IR2 Importer–exporter risk | International relations between importers and exporters. Deteriorated or downgraded relations between countries can introduce risks to the trading environment. |

| IR3 Transport enroute risk | Enroute risks of NG transport, including transport distance, pirate and hijack risks, maritime traffic status, regional conflicts and confrontations, and extreme weather. |

| IR4 Dependence risk | The importer’s degree of dependence on exporters, which reflects the risks associated with the monopoly control of gas exporters over the importer’s gas imports. |

| IR5 Financial risk | Fluctuation of NG price, especially LNG price, which involves complexed global spot trades and futures trades. The pipeline NG price is usually determined in mid- or long-term contracts and has less frequent price fluctuations. |

| DR1 Domestic resource risk | NG resource depletion and exhaustion risks. |

| DR2 Climatic risk | Higher summer temperatures and lower winter temperatures result in larger NG demand, while bursts of adverse weather (such as wide-range freezing rain or snow in winter) could cause an abrupt increase in NG demand or even NG supply disruption. |

| DR3 Policy risk | The role of NG in China’s energy sector is unclear under the current emissions-peaking policy, and when emission peaks are reached, the role of NG is also unclear. With respect to meeting carbon neutrality goals, extracted NG could be excluded as a non-carbon-neutral fuel. |

| DR4 Pipeline failure risk | Most of China’s domestic underground pipelines are made of steel and are at risk from corrosion, earthquakes, excavation accidents, and other pipeline failures. |

| DR5 Facility failure risk | Risk of failures associated with NG supply facilities, including LNG terminals, NG gate stations, and NG storage facilities. |

| Number of Criteria (m) | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| Random Index (RI) | 0 | 0 | 0.58 | 0.9 | 1.12 | 1.24 | 1.32 | 1.41 | 1.45 | 1.49 | 1.51 |

| (1,1,1) | (0.5,1.783,3) | (1,1.741,2) | (0.333,0.977,2) | (4,5.073,7) | (1,2.408,3) | (2,2.352,3) | (4,4.782,5) | (5,6.153,7) |

| (0.333,0.561,2) | (1,1,1) | (0.5,1,4) | (0.5,0.871,1) | (5,5.785,6) | (2,2,2) | (2,2.551,3) | (4,4.573,5) | (5,5.378,6) |

| (0.5,0.574,1) | (0.25,2) | (1,1,1) | (0.5,0.758,1) | (4,4.959,6) | (4,4.573,5) | (1,1.644,3) | (3,3.519,5) | (4,4,4) |

| (1,1.516,2) | (2,3.104,4) | (1,2.169,4) | (2,2.551,3) | (6,7.108,9) | (6,6,6) | (3,4.076,5) | (7,7.975,9) | (6,6.971,8) |

| (0.5,1.024,3) | (1,1.149,2) | (1,1.32,2) | (1,1,1) | (6,6.382,7) | (2,2.352,3) | (1,1.783,3) | (4,5.144,6) | (4,5.335,6) |

| (0.143,0.26,0.667) | (0.2,0.524,0.667) | (0.2,0.266,0.667) | (0.143,0.36,0.667) | (1,1,1) | (0.333,0.461,0.5) | (0.2,0.242,0.333) | (2,2.702,4) | (1,1.32,2) |

| (0.333,0.415,1) | (0.5,0.5,0.5) | (0.2,0.219,0.25) | (0.333,0.425,0.5) | (2,2.169,3) | (1,1,1) | (0.5,1,2) | (0.5,1.465,3) | (2,2.766,3) |

| (0.333,0.425,0.5) | (0.333,0.392,0.5) | (0.333,0.608,1) | (0.333,0.561,1) | (3,4.129,5) | (0.5,1,2) | (1,1,1) | (4,4.373,5) | (2,3.981,5) |

| (0.2,0.209,0.25) | (0.2,0.219,0.25) | (0.2,0.284,0.333) | (0.2,0.339,0.667) | (0.25,0.37,0.5) | (0.333,0.683,2) | (0.2,0.229,0.25) | (1,1,1) | (0.333,0.922,2) |

| (0.143,0.283,0.667) | (0.2,0.324,0.667) | (0.25,0.25,0.25) | (0.2,0.431,0.667) | (0.5,0.758,1) | (0.333,0.361,0.5) | (0.2,0.251,0.5) | (0.5,1.084,3) | (1,1,1) |

| CR = 0.008 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | 1.766 | 1.621 | 0.705 | 1.072 | 5.287 | 2.204 | 2.426 | 4.641 | 6.077 |

| 0.566 | 1 | 1.625 | 0.349 | 0.810 | 5.643 | 2.000 | 2.525 | 4.537 | 5.439 |

| 0.617 | 0.615 | 1 | 0.543 | 0.754 | 4.980 | 4.537 | 1.822 | 3.760 | 4.000 |

| 1.419 | 2.869 | 1.842 | 1 | 2.525 | 7.304 | 6.000 | 4.038 | 7.987 | 6.986 |

| 0.933 | 1.234 | 1.326 | 0.396 | 1 | 6.441 | 2.426 | 1.891 | 5.072 | 5.167 |

| 0.189 | 0.177 | 0.201 | 0.137 | 0.155 | 1 | 0.439 | 0.254 | 2.851 | 1.410 |

| 0.454 | 0.500 | 0.220 | 0.167 | 0.412 | 2.279 | 1 | 1.125 | 1.608 | 2.633 |

| 0.412 | 0.396 | 0.549 | 0.248 | 0.529 | 3.930 | 0.889 | 1 | 4.437 | 3.741 |

| 0.215 | 0.220 | 0.266 | 0.125 | 0.197 | 0.351 | 0.622 | 0.225 | 1 | 1.044 |

| 0.165 | 0.184 | 0.250 | 0.143 | 0.194 | 0.709 | 0.380 | 0.267 | 0.957 | 1 |

| Country | Partnership of Friendship and Cooperation | Strategic Cooperation Partnership | Comprehensive Strategic Cooperation Partnership | Strategic Partnership | Comprehensive Strategic Partnership |

|---|---|---|---|---|---|

| Russia | 1996 | 2011 | 2019 | ||

| Khazakstan | 1993 | 2005 | 2011 | 2019 | |

| Turkmenstan | 2013 | 2018 | 2023 | ||

| Uzbekistan | 2005 | 2012 | 2016 | ||

| Kyrgyzstan | 2013 | 2017 | |||

| Tajikistan | 2007 | 2013 | 2017 | ||

| Malaysia | 1999 | 2004 | 2013 | ||

| Indonesia | 2005 | 2013 | |||

| India | 2005 | ||||

| Phillipines | 2005 | 2018 | |||

| Japan | 1998 | 2008 | |||

| South Korea | 1998 | 2008 | |||

| Qatar | 1988 | 2014 | |||

| Oman | 2018 | ||||

| Saudi Arabia | 2008 | 2016 | |||

| UAE | 2012 | 2018 | |||

| Germany | 2010 | ||||

| Australia | 2014 | ||||

| USA [76] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, M.; Li, N.; Mu, H. Assessing Risks on China’s Natural Gas Supply under Carbon Peaking Policies from Foreign–Domestic Perspectives. Energies 2024, 17, 845. https://doi.org/10.3390/en17040845

Chen M, Li N, Mu H. Assessing Risks on China’s Natural Gas Supply under Carbon Peaking Policies from Foreign–Domestic Perspectives. Energies. 2024; 17(4):845. https://doi.org/10.3390/en17040845

Chicago/Turabian StyleChen, Mengyang, Nan Li, and Hailin Mu. 2024. "Assessing Risks on China’s Natural Gas Supply under Carbon Peaking Policies from Foreign–Domestic Perspectives" Energies 17, no. 4: 845. https://doi.org/10.3390/en17040845

APA StyleChen, M., Li, N., & Mu, H. (2024). Assessing Risks on China’s Natural Gas Supply under Carbon Peaking Policies from Foreign–Domestic Perspectives. Energies, 17(4), 845. https://doi.org/10.3390/en17040845