Abstract

Policymakers are looking at renewable energy as a substitute for traditional fossil fuels due to the growing concern about climate change and sustainable development. However, in the case of Asian countries, nothing is known about how ICT trade and financial globalization affect renewable energy consumption. To fill this gap, we have gathered data across 24 Asian economies, and a dynamic panel data approach known as GMM panel VAR is applied. The key outcomes of the GMM panel VAR underscore that ICT trade, financial globalization, and GDP favorably impact the current renewable energy consumption. Furthermore, the panel causality results indicate bidirectional causality between ICT trade, financial globalization, and renewable energy consumption. These findings have policy-relevant implications, highlighting the significance of financial liberalization and ICT-enabled trade in promoting renewable energy usage in Asian nations.

1. Introduction

National development these days is largely dependent on the production and utilization of energy. There are several measures used to estimate a country’s overall development, and per capita energy utilization is one such measure. Two important aspects of energy are its price and accessibility, which significantly influence the lifestyles and living standards of the common public [1]. However, the deficiency of energy in a nation can be detrimental to its industrial and economic progress. For a long time, non-renewable or conventional energy sources, particularly coal and petroleum, have been the primary drivers of economic performance [2]. Despite their significance in fueling the economic growth of nations, a significant ecological price in the form of global warming and climate change is also attached to the unsustainable use of these resources [3,4]. Therefore, nations need more cost-effective, sustainable, and eco-friendly sources of energy to boost economic growth without giving up on their environmental objectives [5]. Since renewable energy sources require a huge sum of investment in their development stage, financial globalization and digital trade are vital in fulfilling this need [6].

The world has experienced rapid economic expansion, financial opening up, and capital stock build-up over the past 40 years due to numerous economic changes and political shifts, a few of which continue to take place today [7]. Implementation of a green energy strategy can be successful only if certain economic and technological problems are overcome. When compared to conventional energy sources, one of the most significant hurdles in the generation of renewable energy is its high initial cost [8]. Due to the difference in the initial investment of both energy sources, it is not very attractive for public and private investors to invest in renewable energy [9]. Financial liberalization may help to overcome the financial hurdle and facilitate the generation of renewable energy by promoting the pooling of funds from different countries of the world [10]. Consequently, the burden on public and private businesses will be reduced if they need support to fund such projects. Financial liberalization facilitates the transfer of technology and expertise from one nation to another, which fosters the development of renewable sources [11]. The nexus between financial liberalization and renewable energy consumption can be expressed through several mechanisms. Firstly, easy access to foreign capital and investments can improve the flow of funds toward renewable energy ventures and infrastructure [12]. Secondly, financial liberalization can make it easier for countries to share technological knowledge between them, ensuring the implementation of efficient and sophisticated renewable energy options [13]. Thirdly, several factors such as market growth, trade developments, and policy learning are significantly boosted by the process of financial globalization [14]. In light of these mechanisms, we can state with certainty that financial liberalization plays a critical role in boosting renewable energy development. Therefore, a significant research question that has emerged in the contemporary era is whether financial globalization has a significant role in affecting renewable energy consumption in Asian economies and in which direction these effects move, i.e., positive or negative.

On the other hand, ICT trade encompasses the import and export of various ICT products, including hardware, software, and services. The cross-border exchange of these technologies plays a crucial role in shaping the technological infrastructure and capabilities of nations, potentially influencing their energy consumption patterns [15]. As nations strive to strike a balance between economic growth and environmental conservation, policymakers face critical decisions regarding energy policies and trade regulations [16]. The literature reveals that ICT trade can influence renewable energy consumption through several economic mechanisms. Firstly, ICT trade involves the import and export of technology-related goods and services, including renewable energy technologies. When countries engage in ICT trade, they gain access to advanced renewable energy technologies developed by other nations. This technological transfer and diffusion can accelerate the adoption of renewable energy sources in importing countries, as they can leverage the knowledge and expertise embedded in these technologies to enhance their renewable energy infrastructure [17]. Secondly, ICT trade leads to cost reductions in renewable energy technologies. When countries trade ICT products, it fosters competition and increases efficiency in the ICT sector. As a result, the cost of ICT components used in renewable energy systems, such as smart grids, monitoring systems, and energy storage solutions, decreases. Lower costs make renewable energy more economically viable and competitive compared to conventional fossil fuel-based energy sources [18]. Thirdly, ICT trade opens up new markets for renewable energy technologies. When countries engage in ICT trade, they increase economic ties and facilitate investment flows. This attracts foreign investments in the renewable energy sector, leading to the development of new projects and the expansion of renewable energy capacity. Lastly, ICT trade leads to the development of green supply chains for renewable energy technologies. When countries integrate sustainability into their supply chain practices, it enhances the environmental performance of the entire renewable energy sector, making it more attractive to environmentally-conscious consumers and investors. In what ways does ICT trade contribute to the growth of renewable energy?

There are various reasons for choosing Asia as the study area. Asia is the largest continent in terms of population and area, and the biggest contributor to global GHG discharges. Therefore, to protect the ecosystem, policy experts in the continent have stressed increasing the utilization and production of alternative energy sources that are green and clean. A report by the IRENA highlighted the development made by Asian economies in promoting the use of renewable energy sources [19]. Indeed, China is the largest CO2 emitter in the world, and it is also the biggest investor in renewable energy technologies and infrastructure, such as hydro, wind, and solar projects [20]. After adoption of an aggressive renewable energy policy, India has also increased its investment in the development of renewable energy ventures [21]. Since the nuclear mishap at Fukushima, policymakers in Japan have turned their attention toward increasing the generation of renewable energy sources, particularly solar, wind, and biomass. Among the Southeast Asian economies, the most noticeable investments in renewable energy projects have been made by Thailand, Vietnam, and the Philippines [22]. In general, the route adopted by these nations to expand their energy mix and to reduce their dependence on traditional energy sources includes ecological regulations, tax rebates, and renewable energy investments. This trend of rising investment in renewable energy is an indication of a more sustainable future for Asia in particular and the world in general. Given the significance of renewable energy in creating a clean and green future for upcoming generations, Asia’s commitment to enhance investment in the renewable energy sector in the whole region requires massive support from the financial industry. Therefore, it is vital to estimate the role of financial globalization and ICT trade in boosting renewable energy sources in the long-run and whether these factors may enhance the reliance on imported fuels or foreign capital [4].

Contemporary empirical works have separately considered renewable energy consumption and financial globalization in different contexts and overlooked the nexus between them [23,24]. The available works often overlook the varied economic, political, and organizational arrangements of Asian economies in favor of focusing on global trends or particular nations outside of Asia [25]. In addition, it is necessary to investigate how financial globalization and ICT trade affect renewable energy consumption in Asian nations, including the part played by financial regulations, capital flows, investment frameworks, and access to global financial markets [26]. The research problem in this study revolves around the influence of financial globalization and digital trade on renewable energy consumption in Asia, which has not been studied in the previous literature. The existing literature lacks a comprehensive exploration of how these two factors affect the utilization and adoption of renewable energy sources in the Asian context. Previous studies have primarily focused on either digital trade or financial globalization separately, without examining the simultaneous dynamics of financial globalization, digital trade, and renewable energy consumption. Additionally, despite the Asian region’s fundamental role in global sustainability efforts, prior studies have not explored how financial globalization and ICT trade contribute to the shift toward renewable energy in Asia. Thus, the primary objective of the current analysis is to examine the effect of financial globalization and digital trade on renewable energy consumption in Asia.

Hence, this analysis aims to close the aforementioned loopholes in the available empirical works. Some new additions of this analysis to the available empirical works are as follows: First, there has never been any research on how financial globalization and ICT trade affect the usage of renewable energy. Second, this is the first study to examine the relationship between financial globalization, ICT trade, and renewable energy consumption in Asia, despite the significance of Asia in the sustainable future of the world and its progress in the renewable energy sector, ICT development, and financial sector. Third, an additional value of this research is performing a regional analysis within Asia to address the heterogeneity due to cultural and organizational diversities between countries situated in different parts of the continent. Fourth, the key contribution of the study lies in its novel approach of using the GMM-PVAR method to examine the nexus between the concerned variables. The GMM-PVAR method is an advanced econometric technique that effectively addresses issues related to endogeneity and potential biases in panel data analysis. The GMM-PVAR results reveal that renewable energy consumption, financial globalization, ICT trade, and GDP are favorably dependent on their past values. Furthermore, the past values of financial globalization, ICT trade, and GDP positively impact the current renewable energy consumption, while the lagged values of financial globalization, ICT trade, and renewable energy consumption positively influence the current GDP value. The causality tests indicate that the renewable energy consumption granger causes financial globalization, ICT trade, and GDP. Similarly, the financial globalization, ICT trade, and GDP grangers cause renewable energy consumption. Last but not least, empirical estimates from the study will help in formulating useful policies to boost investment in green energy development and improve the comprehension of the factors that stimulate sustainable energy transitions in the region.

The remaining portion of the study follows this structure: Section 2 delves into a review of the related literature, and Section 3 encompasses the materials and methods. Section 4 reports the empirical results and their interpretation, and Section 5 concludes the study with limitations and policy implications.

2. Literature Review

The establishment of green energy innovations promotes sustainability in terms of economic and ecological growth. As per the UN agenda (2030) for sustainable development, the increased consumption of renewable energy is critical for achieving the objectives of environmental and economic sustainability side by side. According to SDG 13 of Climate Action, renewable energy significantly cuts carbon and other harmful emissions by replacing energy sources that are carbon-intensive and dirty, and thus significantly boosts environmental performance [4]. In addition, the adoption of renewable energy technologies may help to achieve SDG 15 (Life on Land) by safeguarding ecosystems and controlling environmental dilapidation throughout their use [4]. Another crucial factor that must be considered is the accessibility and cost-effectiveness of energy. Promoting renewable energy consumption may produce safe and continuous electricity to poor areas, furthering SDG 7 (Affordable and Clean Energy) and leading to enhanced energy access and reduced energy poverty. Further, the expansion of renewable energy technologies, as per SDG 3 (Good Health and Well-Being), causes air pollution to drop, hence improving people’s overall health [5]. Consequently, the development of the renewable energy sector may control energy security risks, reduce the use of dirty energy, and boost environmental quality by curbing the carbon footprint [6].

The effect of financial globalization and ICT trade on the proliferation of renewable energy demand has not received sufficient consideration from empirical work, and the dearth of research from academia makes it difficult to grasp how these determinants are related. In the existing body of empirical evidence, different proxies have been used for renewable energy, including renewable energy consumption/demand, renewable energy production/investment, renewable energy technologies, etc., while different measures related to the financial sector are used as regressors, such as financial development, financial streams, and foreign direct investment [27].

Given the dearth of research looking at financial globalization as a potential predictor of renewable energy consumption, it is necessary to use the closest analyses to examine the pertinent literature and the linkage between the two variables. For example, Kim and Park [28] looked at how financial growth affected renewable energy sources. The authors used OLS to examine the nexus in 30 nations from 2000 to 2013. They came to the conclusion that financial expansion encourages expenditures in clean energy by lowering financing expenses and resolving difficulties with “moral hazard and adverse selection”. This effect is particularly significant for more capital-intensive energies and hence more reliant on outside money. Employing panel data from 137 nations, Best [29] used numerous variables related to finance to support the claim that financial capital aids in transitioning to a more expensive form of energy. Furthermore, his empirical results showed that, in advanced economies, switching from energy means powered by fossil fuels to contemporary renewable energy means (particularly wind) is simplified by an elevated degree of financial resources. Bank private credit and domestic private debt securities provide extra financing for wind energy. Likewise, to this point, Ji and Zhang [30] investigated the stock market data of China from 1990 to 2014. According to their research, financial development has a significant role and accounts for about 42% of the unpredictability in green energy.

Additionally, Anton and Nucu [31] carefully examined how financial development affected clean energy demand for 28 EU member states. Their study of the fixed effect panel data showed that financial growth had a favorable influence on renewable energy demand. Additionally, they discovered that the growth of the financial markets had no effect on renewable energy in new European countries. From 2004 to 2014, Mazzucato and Semieniuk [32] examined the effects of public and private finance on renewable energy initiatives in China, Kenya, Spain, the U.S., and Kenya. Despite the fact that both sources looked to be important, the authors advised that a more precise differentiation between financing providers would be necessary to properly comprehend their significance. The research also noted that funding from public investors had become a more important factor for advancement of clean energy technologies in rich nations and that this factor alone was responsible for the expansion of “asset finance” in that context. Public actors tend to choose riskier technology than private investors. According to Almeshqab and Ustun [33], public funding helped renewable energy initiatives that could not obtain private financing, while public policies seemed to have had a minor effect on increasing the private sector’s ability to raise capital. The effects of FDI, alternative energy, free trade, carbon production, and economic development on energy consumption in European nations were studied by Wang et al. [34]. According to their findings, financial growth caused FDI to have a favorable effect on the usage of renewable energy. The latter increased both private and public capital stocks, lowered financing costs, sparked economic growth, and thus increased renewable energy use. These findings supported those of Kim and Park [28]. Other authors, including Le and Ozturk [35], as well as Si et al. [36] and Fotio et al. [12], support the argument that increased financial globalization results in lower financing costs for households and businesses, which in turn boosts economic activity and, consequently, energy use. The rise in the demand for energy induces households and businesses to look for alternative, reliable, and green sources, increasing their renewable energy consumption. Thus financial globalization indirectly aids in the consumption of renewable energy sources.

Murshed [37] explored the relationship between ICT trade and renewable energy in South Asia. The research found a significant positive relationship between the growth of ICT imports and the utilization of renewable energy in the country. The results suggested that the import of ICT products has a spillover effect on the diffusion of renewable energy technologies, contributing to a more sustainable energy landscape. Fang et al. [38] analyzed the effects of ICT trade liberalization on renewable energy deployment. The study found that countries with more open ICT trade policies tend to have higher levels of renewable energy consumption. The findings emphasized the potential of ICT trade liberalization as an effective policy lever for promoting renewable energy adoption in the region. Wang et al. [39] noted that an increase in ICT exports leads to greater investments in renewable energy projects and vice versa. Their research underscored the importance of synergistic policies to bolster both ICT trade and renewable energy initiatives. Ahmed and Le [40] concluded that ICT trade appears to influence renewable energy consumption positively.

This analysis of research on closely related subjects shows that there are still many unresolved issues. The lack of research examining the effect of financial globalization and ICT trade on renewable energy is the initial and primary vacuum in the available literature. In fact, studies mainly concentrate on the impacts of financial development on energy consumption, except for the analysis that has already been mentioned. Thus, the potential connection between financial liberalization, ICT trade, and eco-friendly energy is currently unstudied. The narrow methodological range of current research is a further deficit that simply results from the abundance of empirical studies. For instance, Panel VAR analysis was not previously considered. Lastly, the analysis between financial liberalization, ICT trade, and clean energy in this group of countries (selected Asian economies) was not performed earlier. The research aimed to test the following hypothesis:

Hypothesis 1.

Financial globalization positively impacts the progress of renewable energy.

Hypothesis 2.

ICT trade contributes positively to the growth of renewable energy.

3. Materials and Methods

3.1. Data and Descriptive Analysis

The goal of this research is to scrutinize the correlation between financial globalization, ICT trade, and renewable energy consumption in Asian countries. A total of 24 nations are selected as our study area and the data spans from 1996 to 2021. The response variable is renewable energy consumption (REC), proxied by the total amounts of nuclear, renewable, and other sources quantified by quad Btu, while the data are received from the Energy Information Administration (EIA) (accessed on 1 August 2023, from https://www.eia.gov/international/data/world/total-energy/total-energy-consumption). The main regressors are financial globalization (FG) and information and communications technology trade (ICTT). Financial globalization (FG) is quantified by means of the financial globalization index offered by the Konjunkturforschungsstelle (KOF) (accessed on 1 August 2023, from https://kof.ethz.ch/en/forecasts-and-indicators/indicators/kof-globalisation-index.html). ICTT is quantified as the ICT goods trade as % of total goods trade. To investigate the impact of financial globalization and ICT trade on REC, we incorporate GDP per capita as a control variable into our model. Previous research suggested that GDP significantly influences REC. For example, Li and Ullah [41] underlined the encouraging effect of economic growth on REC. Lv et al. [42] recognized a favorable link between GDP and REC. GDP per capita constant is employed to allow useful evaluations. We collected the data series for ICT and GDP variables from World Development Indicators (WDI) (accessed on 1 August 2023, from https://databank.worldbank.org/source/world-development-indicators). Table 1 displays complete information regarding the descriptive statistics of the data selected for the analysis. The averages or means and standard deviations are presented for REC (Mean: 0.651; SD 2.225); FG (Mean: 3.971; SD 0.463); ICTT (Mean: 2.506; SD 1.924), and GDP (Mean: 8.358; SD 1.246).

Table 1.

Statistical description.

3.2. Methodology

3.2.1. GMM Estimation of Panel VAR Model

The research employs estimation methods involving essential steps carried out in a specific sequence based on the growth rate. A flexible framework of the Panel VAR model is applied to address fixed effects in the cross-country impacts of REC, FG, ICTT, and GDP in Asian countries. This approach treats all variables as endogenous and is widely utilized in the literature. The PVAR model provides advantages over standard VAR and panel data modeling techniques, effectively handling endogeneity issues and improving estimation efficiency [43]. Additionally, the panel VAR permits the assessment of connections among the concerned variables via impulse response functions (IRFs), enabling panel Granger causality analysis to identify causal relationships between variables. The method is particularly useful when dealing with simultaneity problems that are common in economic and financial models. Below is the equation representing the panel VAR model with fixed effects:

where Yit represents a vector of dependent variables with dimension N × 1, πj denotes an N × N matrix of autoregressive coefficients, δi is the unobserved individual heterogeneity, and μit is a vector of error terms. In this context, (i = 1, ….., N) denotes the specific country, while (t = 1,….., N) represents the time period. The current study employs a 4-dimensional VAR model, which theoretically poses challenges in terms of the degree of freedom. It helps mitigate the consequences of reduced degrees of freedom and significantly widens the confidence interval for the IRFs. Given the unreliable coefficients of VAR for policy decisions, IRFs are essential and more dependable.

For estimating our model, we adopt the approach introduced in [44,45], in which the proposed estimators were based on the standard VAR model in Equation (1), employing the GMM. The purpose is to attain consistent estimates of the VAR, as recently demonstrated by Usman et al. [46]. Considering that error terms in a dynamic equation exhibit serial correlation, they proposed the use of the forward orthogonal deviation to address this concern, which is a technique well known among researchers. In this method, the mean of future observations in the sample is subtracted from every observation, resulting in the transformation of variables and error terms as follows:

where Yit and μit denote the altered vectors of dependent variables and the white noise disturbance term, respectively. T is the number of years from 1996 to 2021. Moreover, i, s, and wt respectively highlight the “countries, lag order, and non-singular weighting matrix”. This alteration, as per Hayakawa [47], has inbuilt qualities of the real error term. If the original error term displays homoscedasticity and lacks serial correlation, the transformed term will also exhibit these attributes. In pursuit of the study’s objectives, we utilized the GMM technique to estimate Equation (1), following recent usage [48]. As mentioned earlier, the estimates of the VAR might not be dependable. Therefore, we constructed IRFs to scrutinize the relationships between renewable energy, financial globalization, ICT trade, and GDP in Asia.

3.2.2. Panel VAR Granger Causality Analysis

We conduct a panel VAR Granger causality analysis to examine the causative link between the variables, considering that the panel series utilized in this research are all integrated of order one (I(1)) and cointegrated. This causality analysis is essential for policymakers. Panel VAR Granger causality allows researchers to infer causal relationships between variables in panel data settings, aiding policymakers in understanding economic and environmental dynamics. It addresses endogeneity issues and provides valuable insights for designing effective policies to achieve desired outcomes. For panel VAR Granger causality, the study follows the approach of Hartwig [49], as follows:

where m represents the lag length, and it and vit are the error terms assumed to be white noise. ϑi and ψi represent individual fixed effects, which are constant for each individual and time period. The parameters i and t refer to the specific country and time period, as previously defined. We determine the predictive power between the difference of variable Y and the difference of variable X by examining if the lagged variable Y provides information about variable X. Conversely, we also investigate if the difference of variable X has predictive power for variable Y. The null hypothesis regarding causality in Panel VAR is stated as follows:

The null hypothesis, which signifies the non-existence of the causative link between excluded and equation variables, is verified on the basis of χ2-stat (Chi-square).

4. Empirical Results and Discussion

The pairwise relationships between the four variables REC, FG, ICTT, and GDP are shown in the correlational matrix in Table 2. Each cell in the table represents the correlation coefficient between the appropriate row and column variables. The correlation coefficients fall between −1 and 1, with −1 denoting a complete negative connection between the two variables, 1 denoting a positive correlation, and 0 denoting no link. The significance of the correlation analysis lies in its capability to expose the direction and strength of linear associations between key variables. Examining these correlation coefficients provides a valuable understanding of how variations in one variable are associated with variations in others. By looking at the outcomes, we can see that all variables are positively associated with one another, as shown by a correlation coefficient of 1. The inter-variable correlations between REC, FG, and GDP are weakly positive, but those between FG, ICTT, and GDP are moderately positive. When compared to other connections, the link between FG and ICTT stands out as being particularly substantial. These results help to comprehend the variables’ possible interconnection within the dataset by offering useful insights into the degree of linear relationships among them. These findings imply that the variables are not perfectly correlated to each other because the coefficient values lie between −1 to +1.

Table 2.

Correlational matrix.

The reported findings in Table 3 show the variance inflation factor (VIF) values for the FG, ICTT, and GDP variables. VIF is a metric used to evaluate multicollinearity in regression models. It gauges how much predictor variable correlations increase a regression coefficient’s variance. VIF values of more than 10 are often seen as indicators of problematic multicollinearity. The findings show that all three variables have VIF values that are much below the cutoff of 10. This demonstrates that the regression model’s predictor variables do not exhibit significant multicollinearity. Correlations with other variables very slightly affect the variance of each regression coefficient, as shown by the VIF values of 1.91 for FG, 1.80 for ICTT, and 1.42 for GDP. All the values in the “1/VIF” column are virtually less than one. This column contains the reciprocal of the VIF values. In conclusion, the regression model’s lack of substantial multicollinearity problems is supported by the mean VIF across all variables, which is 1.71.

Table 3.

Results of VIF.

Table 4 presents the results of ADF and IPS panel unit root tests. These tests are often used in panel analysis to check for a unit root. The results of the unit root tests under various hypotheses are shown in the columns with labels “I(0)” and “I(1)”. “I(0)” represents a stationary variable (one without a unit root), whereas “I(1)” implies a non-stationary variable (one with a unit root). Based on the results shown in Table 4, we observe that all REC, FG, ICTT, and GDP variables are I(1), i.e., stationary at first difference. The unit root test results help us to select the appropriate model.

Table 4.

Results of unit root.

After verifying the unit root process in our panel data, the next step is to estimate the suitable lag length. This step is necessary before the application of GMM-PVAR regression and the Granger causality test. To that end, we have applied three criteria: MBIC, MAIC, and MQIC principles. The rule of thumb for selecting the appropriate lag length is to choose the minimum statistical value. Table 5 shows that the statistical values (−57.96 MBIC, −8.496 MAIC, −27.98 MQIC) against the first lag order are minimum in all three criteria, confirming that the best lag length for GMM-PVAR is 1.

Table 5.

Lag order selection criteria.

The findings in Table 6 show the estimated coefficients and their corresponding probability for a PVAR model using the GMM estimation method. Four models are estimated for four different dependent variables: REC, FG, ICT, and GDP. These variables depend on their own lag values and those of other variables. In the first model, where REC is the dependent variable, the estimates of RECt−1, FGt−1, ICTTt−1, and GDPt−1, are positive—a 1% surge in RECt−1, FGt−1, ICTTt−1, and GDPt−1 causes REC to improve by 1.047%, 0.645%, 0.071%, and 0.469%, respectively.

Table 6.

Results of the GMM-PVAR model.

The findings shows that financial globalization has a favorable impact on REC. The findings align with Hypothesis 1. Paramati et al. [50] favored these outcomes, revealing that financial globalization permits countries to enter into international capital markets and they are able to attract FDI inflows. The availability of capital with ease increases the provision of money for renewable energy ventures, including the development of solar power plants and wind farms. Financial globalization, as per Hasan and Du [51], facilitates the transfer of technology between different nations by promoting the sharing of ideas, information, and skills. These factors lead to the development of renewable energy technology and improved production techniques in the host country. Qin et al. [52] highlighted the fact that financial globalization is helpful in fostering trade and collaboration between the global markets, making the cross-border flow of goods and services related to renewable energy a lot easier. As a result of financial globalization, manufacturers and sellers from the renewable energy sector are capable of selling their items in a more diversified and expanded global market, leading to a rise in the investment and production of renewable ventures to fulfill export demand. Thus, an expanded market size may cause REC to rise significantly. Moreover, Wang et al. [39], revealed that a nation may come across efficient global practices and standards with regard to renewable laws and guidelines due to financial globalization. The growing collaboration between nations helps them to share their valuable experiences regarding the implementation of efficient policy outlines to foster the growth of renewable energy industries. Rasoulinezhad and Saboori [53] observed that financial globalization may bolster REC. They believed that financial liberalization enhances the accessibility of eco-friendly financial items, such as green bonds, investment funds, and clean energy financing approaches. These financial instruments attract investments specifically targeted at renewable energy projects. By leveraging financial globalization, countries can tap into global green finance markets, mobilize capital, and channel it toward renewable energy initiatives, ultimately boosting REC.

ICT trade plays a significant role in increasing REC. The results substantiate Hypothesis 2. This finding is supported by Murshed [37], who noted that ICT trade enables countries to collaborate and share knowledge in renewable energy adoption. It promotes international cooperation, allowing nations to learn from successful renewable energy initiatives and implement them in their own countries. This also means that ICT trade facilitates access to renewable energy technologies and solutions worldwide. Countries import advanced and cost-effective renewable energy technologies, equipment, and expertise from other nations, thus accelerating the deployment of renewable energy projects [54]. ICT trade allows for the development of online renewable energy marketplaces, making it easier for consumers and businesses to purchase renewable energy products and services [11]. This increased accessibility drives greater demand for renewable energy solutions.

These outcomes are corroborated by Alsagr [55], who confirmed that GDP and renewable energy consumption move in the same direction because higher GDP expands the availability of financial resources in a country, allowing the nation to diversify its energy mix and increase REC by investing more in renewable energy technologies and deployment. Moreover, Solaun and Cerdá [56] contended that control of environmental pollution and carbon emissions is imperative to increasing green financial activities. In this context, financial organizations are vital as they show more interest in providing funds for investing in green energy projects and deployment. Green financial products and services (green bonds, investments, insurance) are gaining popularity, which are vital in providing funds for green investments and thus expediting REC.

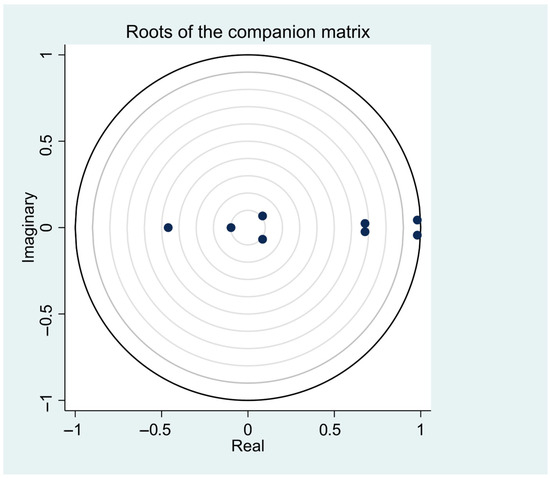

Similarly, in the GDP model, a 1% growth in RECt−1, FGt−1, ICTTt−1, and GDPt−1 escalates GDP by 0.452%, 0.062%, 0.710%, and 0.963%, respectively. However, in the FG and ICT models, the estimated coefficients of FGt−1, ICTTt−1, and GDPt−1 are significant and positive, while the estimated coefficient of RECt−1 is insignificant. More appropriately, a 1% escalation in FGt−1, ICTTt−1, and GDPt−1 helps increase FG by 1.088%, 0.276%, and 0.537%, respectively, and ICT by 0.111%, 0.832%, and 0.249%, respectively. In general, these outcomes infer that current values of REC, FG, ICT, and GDP are not only promoted by their own past values but also by the past values of other selected variables. Additionally, Figure 1 illustrates the results of the stability conditions. The results indicate that the framework is stable.

Figure 1.

Graph of stability condition.

The Granger causality test results between four variables—REC, FG, ICTT, and GDP—are shown in Table 7. The estimates presented in Table 7 infer that Granger causality is confirmed between REC and FG, REC and ICTT, and REC and GDP. This implies that the REC granger causes FG, ICTT, and GDP. Similarly, the FG, ICTT, and GDP grangers cause REC. In addition, Granger causality is also confirmed between FG—ICTT, GDP, ICTT—FG, GDP, GDP—FG, and ICTT. These results reveal that any policy shift that causes a change in renewable energy consumption will also bring a change in financial globalization. Likewise, a change in renewable energy consumption leads to a change in ICT trade and national income, implying that renewable energy consumption is crucial in impacting ICT Trade and national income. Moreover, the policy shift that impacts ICT trade will also impact REC, FG, and GDP, suggesting that ICT trade is a vital factor that can impact renewable energy consumption, financial globalization, and national income. Lastly, if some policy changes have an impact on GDP, such changes also impact REC, FG, and ICTT, suggesting that a change in national income will also bring a change in renewable energy consumption, financial globalization, and ICT trade. These results indicate a bidirectional causative link between all of these factors, suggesting that any change in one factor will cause a change in other factors, and the reverse is also true. For instance, a change in REC causes a change in FG, while a change in FG causes a change in REC.

Table 7.

Granger causality tests.

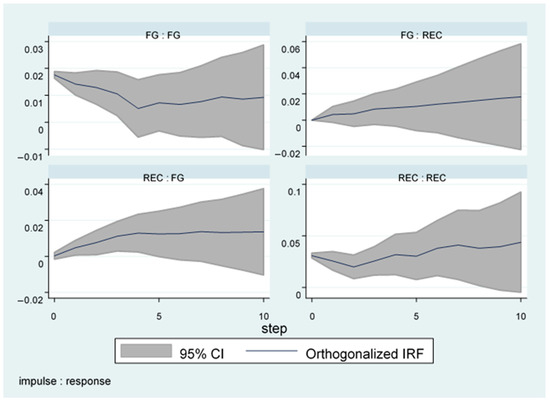

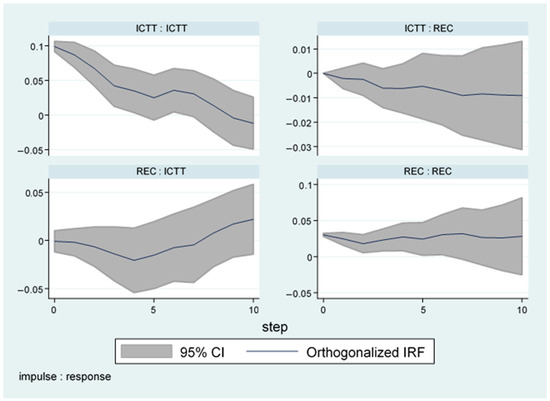

The PVAR model features many regression coefficients, making interpretation of the ongoing connection between variables challenging over the next several decades. As a result, an impulse response graph is employed to visually depict how variables will interplay over the course of the next 10 periods. It accurately captures the future development pattern by measuring one factor’s short-term and independent influence on another factor after being influenced by one unit standard deviation. In Figure 2, the positive effects of FG show unstable behavior, i.e., first it rises and then it falls, and later on, it starts to increase again. This implies that FG influences the future period unfavorably in the initial stage, but as time passes, FG influences the latter period favorably. However, in Figure 3, the positive effects of ICTT fell over the course of the next ten periods, while the positive effects of GDP started to fall in the next few periods, but after the 5th period, it became constant. In all of these figures, the IRFs of REC is positive and rising.

Figure 2.

FG: REC.

Figure 3.

ICTT: REC.

On the other hand, in Figure 2, FG has a positive effect when it is impacted by REC, which reaches the maximum value in the first phase, indicating that FG promotes REC, and the favorable effect of the current FG value on REC in the first period reaches the maximum value and then becomes constant. However, REC has favorable effects when it is affected by FG, which gradually rises over time. As can be seen in Figure 3, ICTT has negative effects in the initial phase, which diminishes and becomes positive, when REC impacts it. The negative effect is at its minimum value between 0–5 periods, and then it starts to increase and become favorable in the latter stages. In contrast, the unfavorable effects of REC gradually increase when ICTT impacts it.

5. Conclusions

The transition to renewable energy is now a global imperative driven by climate change concerns and the imperative to curb greenhouse gas emissions. Comprehending the factors that promote REC has become vital for nations to boost energy security and lessen their reliance on conventional and dirty energy sources. Out of many known factors, financial globalization, which boosts the connection among economies in the financial markets to ease the process of international transactions, has emerged as a catalyst for REC. Another important factor that can influence renewable energy consumption is ICT trade. This study focuses on exploring the impact of financial globalization and ICT trade on REC within the framework of Asian economies, characterized by a broad variety of economic sectors and various levels of financial globalization and ICT trade, which makes it an ideal region as a study area for inspecting the connection between financial integration, ICT trade, and renewable energy demand. This analysis explains the possible role of financial globalization and ICT trade in fostering and triggering the green energy transformation in Asia. Indeed, the available empirical works do not provide any information regarding the financial globalization, ICT trade, and REC nexus in selected Asian nations. Therefore, this research work scrutinizes the effect of financial globalization and ICT trade on REC in Asian countries by utilizing the GMM-PVAR method. The key outcomes of the GMM-PVAR underscore that renewable energy consumption, financial globalization, ICT trade, and GDP are favorably dependent on their past values. In addition, the past values of financial globalization, ICT trade, and GDP favorably impact the current value of renewable energy consumption. Similarly, the current GDP values are positively influenced by the lagged values of financial globalization, ICT trade, and renewable energy consumption. In contrast, only the past GDP and ICT trade values promote the current financial globalization, and only the past GDP and financial globalization values promote the current ICT trade. Regarding the causative links between the variables, renewable energy consumption grangers cause financial globalization, ICT trade, and GDP. Similarly, financial globalization, ICT trade, and GDP grangers cause renewable energy consumption.

5.1. Policy Implications

From these outcomes, we can deduce some important policy suggestions for governments, policy experts, and energy strategists. These suggestions are valuable in devising strategies that seek to hasten the transition toward renewable energies and encourage sustainable economic growth. First and foremost, our outcomes highlight the positive link between current and past values of renewable energy consumption, financial globalization, ICT trade, and GDP. Thus, we suggest that policy experts must focus on improving ties with other countries in the financial sphere to promote financial globalization and integration. In this way, countries may lure foreign investors who have access to a pool of financial resources and are ready to invest in risky and costly renewable energy projects. Further, we advise policymakers to design policies in a way that encourages investment in green energy deployment by offering financial incentives, simplifying administrative procedures, and developing a smooth and well-functioning environment for green investment.

Secondly, our findings infer that the past values of financial globalization and ICT trade favorably impact the current value of renewable energy consumption; hence it is imperative for central authorities to design a broad and foolproof renewable energy policy. In this regard, policy experts should set clear-cut objectives and design policies that can encourage green energy implementation, including “renewable portfolio standards, feed-in tariffs, and tax incentives”. In addition, it is crucial to encourage R&D-related activities in the renewable energy sector to support innovation and technological development within the sector, leading to a rise in renewable energy capabilities. Such a favorable policy structure will help boost REC.

Thirdly, our findings demonstrate the significant impact of digital trade on renewable energy consumption; hence governments should actively engage in and promote international digital trade agreements to facilitate the exchange of technology, expertise, and resources related to renewable energy. Collaborative efforts can enhance the accessibility and affordability of sustainable renewable energy technologies.

Fourthly, in light of the favorable effect of financial globalization on REC, cooperation between governments and the financial sector has become crucial for the development of novel financial products and services and mechanisms that would smooth investments in renewable energy. To support renewable energy projects, various green finance initiatives can be implemented, including the establishment of green bonds, sustainable investment funds, and green banks, which offer specialized funding options. There must be financial and technical support for renewable energy deployment, including encouraging access to capital at an affordable rate, offering guarantees, and mitigating investment risks. For that to happen, governments must assimilate policies regarding renewable energy into the existing financial set-up.

Fifthly, in order to foster REC, it is crucial to enhance energy efficiency measures in addition to the production of renewable energy. Moreover, it is also the need of the hour that policymakers should give importance to energy efficiency strategies, support energy valuations and conservation efforts, and offer rewards for the utilization of energy-efficient technologies and techniques. Adopting energy-efficient procedures and technologies may significantly lower the energy demand, help accomplish renewable energy objectives, and boost sustainable REC.

Sixthly, policymakers should facilitate the import and export of renewable energy technologies through digital trade agreements. This can enable countries to gain access to advanced and cost-effective renewable energy solutions, accelerating their transition toward clean energy sources. Creating a supportive trade environment, including reducing trade barriers and tariffs for renewable energy technologies, can incentivize technology transfer and diffusion. Seventhly, policymakers should encourage knowledge-sharing platforms and international collaborations to facilitate the exchange of best practices, policies, and research related to renewable energy and ICT integration. By learning from successful experiences in other countries, nations can design more effective policies and strategies for sustainable energy development.

Last but not least, authorities must address hurdles and potential threats that are attached to financial globalization and the production of renewable energy. This encompasses the task of overseeing and controlling changes in currency rates, instability in the market, and possible economic weaknesses. It is essential for governments to provide mechanisms to reduce risks and offer assistance to renewable energy projects in times of economic decline. Furthermore, it is crucial to establish policies that guarantee a just and comprehensive shift, taking into account the societal and economic consequences of adopting renewable energy. This includes addressing issues such as the development of employment opportunities, implementing retraining initiatives, and ensuring equal access to the advantages of renewable energy.

Lastly, policymakers must underscore the potential risks as well as provide solutions to tackle these risks, which the nation has to bear in the case of financial globalization and renewable energy adoption. This involves controlling unwanted currency value variations, vulnerabilities in markets, and any economic precariousness. Therefore, it is imperative for governments to offer procedures that might mitigate risks and provide assistance to renewable energy initiatives in times of economic recession.

Furthermore, it is also vital to design policies that foster a just and inclusive transformation by taking into account the socioeconomic consequences of utilizing renewable energy, including employment opportunities, retraining initiatives, and guaranteeing equal access to renewable energy to reap its complete benefits.

5.2. Limitations and New Directions

We should acknowledge certain limitations of this study. First of all, this study carries out an empirical examination of 24 Asian economies and covers the period up to 2021. Future studies with a longer dataset can further test the long-term sustainability of these relationships. Secondly, the study covers multiple Asian economies, each with its unique characteristics. Country-specific factors not captured by the model may confound the relationships examined. A comparative analysis can be performed with other countries outside Asia. Moreover, a comparison can be made between developing and developed economies. Such a study will be helpful in the formulation of more appropriate policy suggestions. Thirdly, although the explanatory power of our study is quite good, there is still a gap for other factors, such as economic openness and green ICT. Future research needs to focus on exploring how economic openness and green ICT influence renewable energy consumption. Moreover, investigating the relationship between clean energy usage and financial globalization should consider a time-varying context instead of assuming a constant parameter. By adopting alternative methodologies and broadening the scope to encompass different sets of countries, conflicting results may arise in the existing empirical literature. As a result, researchers should prioritize the development of innovative techniques to obtain distinct and more reliable empirical findings, which can aid in designing more effective economic policies.

Author Contributions

Conceptualization, Methodology, Original draft, Software, Writing—review & editing, C.F.; Formal analysis, Investigation, Writing—review & editing, A.U. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

| ICT | Information and communications technology |

| GMM | Generalized method of moment |

| VAR | Vector autoregressive |

| GDP | Gross domestic product |

| GHG | Greenhouse gas |

| IRENA | International renewable energy agency |

| CO2 | Carbon dioxide |

| PVAR | Panel vector autoregression |

| SDG | Sustainable development goal |

| OLS | Ordinary least squares |

| UN | United Nations |

| EU | European Union |

| FDI | Foreign direct investment |

| REC | Renewable energy consumption |

| FG | Financial globalization |

| ICTT | Information and communications technology trade |

| KOF | Konjunkturforschungsstelle |

| EIA | Energy information administration |

| WDI | World development indicators |

| SD | Standard deviation |

| IRFs | Impulse response functions |

| VIF | Variance inflation factor |

| ADF | Augmented Dickey–Fuller |

| IPS | Im, Pesaran, and Shin |

| Prob | Probability |

References

- Bai, X.; Wang, K.T.; Tran, T.K.; Sadiq, M.; Trung, L.M.; Khudoykulov, K. Measuring China’s green economic recovery and energy environment sustainability: Econometric analysis of sustainable development goals. Econ. Anal. Policy 2022, 75, 768–779. [Google Scholar] [CrossRef]

- Chao, T.; Yunbao, X.; Chengbo, D.; Bo, L.; Ullah, S. Financial integration and renewable energy consumption in China: Do education and digital economy development matter? Environ. Sci. Pollut. Res. 2023, 30, 12944–12952. [Google Scholar] [CrossRef]

- Omer, A.M. Energy, environment and sustainable development. Renew. Sustain. Energy Rev. 2008, 12, 2265–2300. [Google Scholar] [CrossRef]

- Chien, F.; Hsu, C.C.; Ozturk, I.; Sharif, A.; Sadiq, M. The role of renewable energy and urbanization towards greenhouse gas emission in top Asian countries: Evidence from advance panel estimations. Renew. Energy 2022, 186, 207–216. [Google Scholar] [CrossRef]

- Lohani, S.P.; Gurung, P.; Gautam, B.; Kafle, U.; Fulford, D.; Jeuland, M. Current status, prospects, and implications of renewable energy for achieving sustainable development goals in Nepal. Sustain. Dev. 2023, 31, 572–585. [Google Scholar] [CrossRef]

- Irandoust, M. The renewable energy-growth nexus with carbon emissions and technological innovation: Evidence from the Nordic countries. Ecol. Indic. 2016, 69, 118–125. [Google Scholar] [CrossRef]

- Koengkan, M.; Fuinhas, J.A.; Vieira, I. Effects of financial openness on renewable energy investments expansion in Latin American countries. J. Sustain. Financ. Invest. 2020, 10, 65–82. [Google Scholar] [CrossRef]

- Al-Shetwi, A.Q. Sustainable development of renewable energy integrated power sector: Trends, environmental impacts, and recent challenges. Sci. Total Environ. 2022, 822, 153645. [Google Scholar] [CrossRef] [PubMed]

- Lei, W.; Ozturk, I.; Muhammad, H.; Ullah, S. On the asymmetric effects of financial deepening on renewable and non-renewable energy consumption: Insights from China. Econ. Res. -Ekon. 2022, 35, 3961–3978. [Google Scholar] [CrossRef]

- Xu, L.; Ullah, S. Evaluating the impacts of digitalization, financial efficiency, and education on renewable energy consumption: New evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 53538–53547. [Google Scholar] [CrossRef] [PubMed]

- Zhang, L.; Saydaliev, H.B.; Ma, X. Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals. Renew. Energy 2022, 193, 991–1000. [Google Scholar] [CrossRef]

- Fotio, H.K.; Nchofoung, T.N.; Asongu, S.A. Financing renewable energy generation in SSA: Does financial integration matter? Renew. Energy 2022, 201, 47–59. [Google Scholar] [CrossRef]

- Ghazouani, T. Dynamic impact of globalization on renewable energy consumption: Non-parametric modelling evidence. Technol. Forecast. Soc. Chang. 2022, 185, 122115. [Google Scholar] [CrossRef]

- Jahanger, A.; Usman, M.; Murshed, M.; Mahmood, H.; Balsalobre-Lorente, D. The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: The moderating role of technological innovations. Resour. Policy 2022, 76, 102569. [Google Scholar] [CrossRef]

- Zhou, L.; Xia, Q.; Sun, H.; Zhang, L.; Jin, X. The role of digital transformation in high-quality development of the services trade. Sustainability 2023, 15, 4014. [Google Scholar] [CrossRef]

- Sohail, M.T.; Ullah, S.; Majeed, M.T. Effect of policy uncertainty on green growth in high-polluting economies. J. Clean. Prod. 2022, 380, 135043. [Google Scholar] [CrossRef]

- Wei, X.; Ren, H.; Ullah, S.; Bozkurt, C. Does environmental entrepreneurship play a role in sustainable green development? Evidence from emerging Asian economies. Econ. Res.-Ekon. 2023, 36, 73–85. [Google Scholar] [CrossRef]

- Anyaoha, K.E.; Zhang, L. Transition from fossil-fuel to renewable-energy-based smallholder bioeconomy: Techno-economic analyses of two oil palm production systems. Chem. Eng. J. Adv. 2022, 10, 100270. [Google Scholar] [CrossRef]

- IRENA Renewable Energy Statistics 2021. 2021. Available online: https://irena.org/publications/2021/Aug/Renewable-energy-statistics-2021 (accessed on 1 August 2023).

- Hu, Z. Towards solar extractivism? A political ecology understanding of the solar energy and agriculture boom in rural China. Energy Res. Soc. Sci. 2023, 98, 102988. [Google Scholar] [CrossRef]

- Kumar, A.; Pal, D.; Kar, S.K.; Mishra, S.K.; Bansal, R. An overview of wind energy development and policy initiatives in India. Clean Technol. Environ. Policy 2022, 24, 1337–1358. [Google Scholar] [CrossRef]

- Sakti, A.D.; Rohayani, P.; Izzah, N.A.; Toya, N.A.; Hadi, P.O.; Octavianti, T.; Harjupa, W.; Caraka, R.E.; Kim, Y.; Avtar, R. Spatial integration framework of solar, wind, and hydropower energy potential in Southeast Asia. Sci. Rep. 2023, 13, 340. [Google Scholar] [CrossRef] [PubMed]

- Wang, S.; Sun, L.; Iqbal, S. Green financing role on renewable energy dependence and energy transition in E7 economies. Renew. Energy 2022, 200, 1561–1572. [Google Scholar] [CrossRef]

- Li, C.; Umair, M. Does green finance development goals affects renewable energy in China. Renew. Energy 2023, 203, 898–905. [Google Scholar] [CrossRef]

- Usman, A.; Ozturk, I.; Ullah, S.; Hassan, A. Does ICT have symmetric or asymmetric effects on CO2 emissions? Evidence from selected Asian economies. Technol. Soc. 2021, 67, 101692. [Google Scholar] [CrossRef]

- Ng, T.H.; Tao, J.Y. Bond financing for renewable energy in Asia. Energy Policy 2016, 95, 509–517. [Google Scholar] [CrossRef]

- Chudik, A.; Pesaran, M.H. Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J. Econom. 2015, 188, 393–420. [Google Scholar] [CrossRef]

- Kim, J.; Park, K. Financial development and deployment of renewable energy technologies. Energy Econ. 2016, 59, 238–250. [Google Scholar] [CrossRef]

- Best, R. Switching towards coal or renewable energy? The effects of financial capital on energy transitions. Energy Econ. 2017, 63, 75–83. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D. How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 2019, 128, 114–124. [Google Scholar] [CrossRef]

- Anton, S.G.; Nucu, A.E.A. The effect of financial development on renewable energy consumption. A panel data approach. Renew. Energy 2020, 147, 330–338. [Google Scholar] [CrossRef]

- Mazzucato, M.; Semieniuk, G. Financing renewable energy: Who is financing what and why it matters. Technol. Forecast. Soc. Chang. 2018, 127, 8–22. [Google Scholar] [CrossRef]

- Almeshqab, F.; Ustun, T.S. Lessons learned from rural electrification initiatives in developing countries: Insights for technical, social, financial and public policy aspects. Renew. Sustain. Energy Rev. 2019, 102, 35–53. [Google Scholar] [CrossRef]

- Wang, S.; Wen, J.; Yang, X.; Deng, P.; Wang, N. Impacts of Digital Trade Restrictiveness on Green Technology Innovation: An Empirical Analysis. Emerg. Mark. Financ. Trade 2023, 59, 2079–2101. [Google Scholar] [CrossRef]

- Le, H.P.; Ozturk, I. The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ. Sci. Pollut. Res. 2020, 27, 22680–22697. [Google Scholar] [CrossRef] [PubMed]

- Si, D.K.; Li, X.L.; Huang, S. Financial deregulation and operational risks of energy enterprise: The shock of liberalization of bank lending rate in China. Energy Econ. 2021, 93, 105047. [Google Scholar] [CrossRef]

- Murshed, M. An empirical analysis of the non-linear impacts of ICT-trade openness on renewable energy transition, energy efficiency, clean cooking fuel access and environmental sustainability in South Asia. Environ. Sci. Pollut. Res. 2020, 27, 36254–36281. [Google Scholar] [CrossRef] [PubMed]

- Fang, H.; Huo, Q.; Hatim, K. Can Digital Services Trade Liberalization Improve the Quality of Green Innovation of Enterprises? Evidence from China. Sustainability 2023, 15, 6674. [Google Scholar] [CrossRef]

- Wang, X.; Chen, G.; Afshan, S.; Awosusi, A.A.; Abbas, S. Transition towards sustainable energy: The role of economic complexity, financial liberalization and natural resources management in China. Resour. Policy 2023, 83, 103631. [Google Scholar] [CrossRef]

- Ahmed, Z.; Le, H.P. Linking Information Communication Technology, trade globalization index, and CO2 emissions: Evidence from advanced panel techniques. Environ. Sci. Pollut. Res. 2021, 28, 8770–8781. [Google Scholar] [CrossRef]

- Li, W.; Ullah, S. Research and development intensity and its influence on renewable energy consumption: Evidence from selected Asian economies. Environ. Sci. Pollut. Res. 2022, 29, 54448–54455. [Google Scholar] [CrossRef]

- Lv, Z.; Liu, W.; Xu, T. Evaluating the impact of information and communication technology on renewable energy consumption: A spatial econometric approach. Renew. Energy 2022, 189, 1–12. [Google Scholar] [CrossRef]

- Yuan, C.; Chen, R. Policy transmissions, external imbalances, and their impacts: Cross-country evidence from BRICS. China Econ. Rev. 2015, 33, 1–24. [Google Scholar] [CrossRef]

- Kiviet, J.F. On bias, inconsistency, and efficiency of various estimators in dynamic panel data models. J. Econom. 1995, 68, 53–78. [Google Scholar] [CrossRef]

- Bun, M.J.; Carree, M.A. Bias-corrected estimation in dynamic panel data models. J. Bus. Econ. Stat. 2005, 23, 200–210. [Google Scholar] [CrossRef]

- Usman, O.; Alola, A.A.; Saint Akadiri, S. Effects of domestic material consumption, renewable energy, and financial development on environmental sustainability in the EU-28: Evidence from a GMM panel-VAR. Renew. Energy 2022, 184, 239–251. [Google Scholar] [CrossRef]

- Hayakawa, K. Improved GMM estimation of panel VAR models. Comput. Stat. Data Anal. 2016, 100, 240–264. [Google Scholar] [CrossRef]

- Aslan, A.; Ocal, O.; Ozsolak, B.; Ozturk, I. Renewable energy and economic growth relationship under the oil reserve ownership: Evidence from panel VAR approach. Renew. Energy 2022, 188, 402–410. [Google Scholar] [CrossRef]

- Hartwig, J. Is health capital formation good for long-term economic growth?–Panel Granger-causality evidence for OECD countries. J. Macroecon. 2010, 32, 314–325. [Google Scholar] [CrossRef]

- Paramati, S.R.; Ummalla, M.; Apergis, N. The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ. 2016, 56, 29–41. [Google Scholar] [CrossRef]

- Hasan, M.M.; Du, F. Nexus between green financial development, green technological innovation and environmental regulation in China. Renew. Energy 2023, 204, 218–228. [Google Scholar] [CrossRef]

- Qin, L.; Hou, Y.; Miao, X.; Zhang, X.; Rahim, S.; Kirikkaleli, D. Revisiting financial development and renewable energy electricity role in attaining China’s carbon neutrality target. J. Environ. Manag. 2021, 297, 113335. [Google Scholar] [CrossRef] [PubMed]

- Rasoulinezhad, E.; Saboori, B. Panel estimation for renewable and non-renewable energy consumption, economic growth, CO2 emissions, the composite trade intensity, and financial openness of the commonwealth of independent states. Environ. Sci. Pollut. Res. 2018, 25, 17354–17370. [Google Scholar] [CrossRef] [PubMed]

- Fu, H.; Huang, P.; Xu, Y.; Zhang, Z. Digital trade and environmental sustainability: The role of financial development and ecological innovation for a greener revolution in China. Econ. Res.-Ekon. 2023, 36, 2125889. [Google Scholar] [CrossRef]

- Alsagr, N. Financial efficiency and its impact on renewable energy investment: Empirical evidence from advanced and emerging economies. J. Clean. Prod. 2023, 401, 136738. [Google Scholar] [CrossRef]

- Solaun, K.; Cerdá, E. Climate change impacts on renewable energy generation. A review of quantitative projections. Renew. Sustain. Energy Rev. 2019, 116, 109415. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).