Abstract

The study investigated the changes that occurred in the Mexican power sector before, during, and after the COVID-19 pandemic and its repercussions on the electricity sector and energy sustainability goals. The study was based on the variability of the installed capacity, consumption, generation, and demand of the National Electric System (SEN), covering the period from 2017 to 2021. The data were collected from the Development of the National Electric System (PRODESEN), the Ministry of Energy, the National Energy Balance, and the government’s official website. The results indicated that installed capacity and generation increased by 22.83% and 27.86%, respectively, despite the pandemic. This growth was attributed to clean energy, mainly from photovoltaic solar and wind sources. Another finding was that the gross domestic product (GDP), consumption, and demand were seriously affected by COVID-19. They had a fall of 8.2%, 2.2%, and 4.4%, respectively, which translates into a significant economic lag and a slowdown in energy self-sufficiency and the Mexican Energy Transition (TEM). Moreover, the objective of generating 35% and 40% of electrical energy through clean energy will be achieved by 2031 and 2035, instead of 2021 and 2035, respectively.

1. Introduction

In March 2020, the WHO declared an outbreak of the SARS-CoV-2 virus, known as COVID-19, which had a profound impact on the lifestyles of each country [1]. Since its appearance, each country has taken a wide range of measures to stop its spread, some of which include social distancing, strict confinement, and the cessation of non-essential economic activities, among others [2,3,4,5]. As a consequence, there were serious repercussions not only on health but also on economic indicators, energy use, and CO2 emissions. From an economic point of view, the crisis caused by the pandemic produced a drop in the GDP [6,7,8]; an impact on trade levels [9,10,11]; the loss of millions of jobs [12,13]; and increases in the levels of poverty and inequality in various scopes [14,15]. From the energy point of view, there was an imbalance in prices, investments, and patterns of generation, consumption, and demand for energy, mainly in oil, gas, and electricity [16,17,18]. Finally, from an environmental point of view, CO2 emissions were reduced, but climate targets were delayed in most countries [19,20].

The electricity sector, being one of the fundamental pillars of human activities, has been the focus of attention due to its rapid changes in generation, consumption, and demand as a result of the pandemic. Early attempts to track the evolution of electricity changes reported that electricity consumption decreased by 4.5% in 2020 and increased by 5% in 2021, in the context of the global pandemic. Countries like China presented an increase in electricity consumption of 2.2% and 5.2% in 2020 and 2021, respectively. However, India, the United States, Russia, and the European Union reduced electricity consumption by 5.6%, 8.6%, 4%, and 6.8% in 2020, and, in 2021, they increased electricity consumption by 4.7%, 4.7%, 9%, and 4.5%, respectively [20,21]. Electricity consumption also increased in many regions, except for the Middle East (−0.4%) and the Pacific (−2.5%). In relation to electricity demand, the International Energy Agency reported that global electricity demand fell by around 1% in 2020, decreasing more markedly in the first months of 2020. Eliminating climatic variations, in 2020, China’s demand fell by more than 10% in February. In Germany, France, and the United Kingdom, it fell by more than 15% and, in Spain and Italy, even more than 25%. Similarly, India presented a reduction of 20% in electricity demand during March and April. In Japan and Korea, where COVID-19 cases were fewer than in Europe, demand fell by around 8% in May [22,23,24].

Recently, some studies have been performed on the impact of the pandemic on the power sector due to lockdown and restrictive measures on economic activities. For example, Carvalho et al. [25] analysed the effect of energy consumption trends on the Brazilian energy system and its subsystems (Northeast, North, South, and Southeast–Midwest). Between 1 January and 27 May 2020, this study employed joinpoint analysis to calculate energy consumption trends. The results showed that the Southeast–Midwest and South subsystems had the most pronounced drops: −20% and −18%, respectively. The North and Northeast subsystems presented a less marked decrease, −14% and 7%, respectively. Ref. [26] analysed how the COVID-19 pandemic influenced Poland’s power demand and Czosnyka’s electricity consumption. The authors compared the energy consumption of 2018 and 2019 using an individual dynamics index with a variable basis.

The results showed a noticeable drop in demand, especially in the second half of March, when most restrictions came into force. Ghian et al. [27] discussed the effects of the COVID-19 outbreak on the electricity sector. In particular, the consequences on load profiles, electricity consumption, and market prices in Italy, including the environmental aspects, were examined. It was observed that the reduction in overall consumption did not affect the generation but rather the amount of energy supplied by conventional sources. Morva et al. [28] focused on changes in electricity consumption patterns and the share of renewables in energy balance in the Ukrainian and Hungarian energy sectors. The authors found that mobility in the retail industry, the size of the stay-at-home population, and slower commercial activity are the key indicators affecting electricity consumption. Soava et al. [29] analysed the impact of the COVID-19 pandemic on economic growth and electricity consumption in Romania, using a time series for the indicators GDP, domestic electricity consumption, household electricity consumption, and non-household electricity consumption from 2007 to 2020. The results confirmed that the COVID-19 pandemic severely impacted electric energy consumption and GDP in the first half of 2020, but this was followed by a slight recovery. All these studies report electricity demand and electricity consumption patterns in the most affected countries during a short period.

The objective of this study is to analyse the impact of the generation of, consumption of, and demand for electric energy before, during, and after the COVID-19 pandemic in Mexico. The novelty of this study revolves around the variations of electrical energy in 2017–2021 in conventional and clean energies, as well as the different regions of the Mexican SEN. It also includes a discussion of the repercussions of COVID-19 on the electricity sector and the implications for energy sustainability goals.

The remainder of the paper is organised as follows. In Section 2, the methods used to estimate the impact of installed capacity, generation, consumption, and demand are presented. In Section 3, we show a general description of the Mexican SEN in detail. Section 4 explains the main results of the statistical analysis in terms of installed capacity, generation, consumption, and demand for electrical energy. In Section 5, we present the repercussions of COVID-19 on the electricity sector. Finally, in Section 6, discussion and conclusions are provided.

2. Methodology

We conducted this review to gain an understanding of the changes in the power sector in pre- to post-COVID-19-pandemic periods. This review was performed following the guidelines proposed by Keele et al. [30] and Stapic et al. [31], which include several stages: (i) development of a review protocol; (ii) the search process for relevant publications; (iii) identification of inclusion and exclusion criteria; (iv) quality assessment; and (v) data extraction and synthesis.

Two research questions were formulated to discuss the aim of this review. The first question is directed at the effects of COVID-19 on the power sector: ‘Which were the changes in the power sector in pre- to post-COVID-19 pandemic?’ The second question is directed at the repercussions of COVID-19 pandemic: ‘What were the repercussion post-COVID-19 pandemic in the electrical sector and energy sustainability goals?’

The literature search was carried out by searching for relevant articles published on Elsevier (www.sciencedirect.com), Google Scholar (scholar.google.com), official websites, and others. The keywords used were related to synonyms and their acronyms of ‘COVID-19’, National Electric System’, ‘power sector’, ‘electricity demand’, ‘installed capacity’, ‘electricity consumption’, ‘electricity generation’, and ‘lockdown’. The search words were connected by Boolean operators.

We analysed data collected from the annual publication of the PRODESEN report, which is published by the Secretary of Energy (SENER), along with other databases such as the National Energy Balance, data belonging to the CENACE, and the official government websites. Since the COVID-19 pandemic is still a new phenomenon, there is limited national information and research to reference on the topic. Therefore, we focused on the most up-to-date and relevant materials. This study is limited by the reliance on data from the sources mentioned above, which may limit the generalizability of the findings to other regions or countries. In the analysis, we compared the installed capacity, generation, consumption, and demand during the post-COVID-19 period from 2017 to 2021. In order to follow the trend of changes in each period, the data were grouped by years, type of technology, electricity consumption by sectors (medium business, residential, big industry, commercial, agricultural and services), and region of the National Electrical System. Note that seasonal variability, holidays, and weather conditions were not taken into consideration in the analysis. We checked the correlation between the value level in the period preceding the period considered using Equation (1). The analysis was performed in Microsoft Excel and verified with González’s results [30].

where is the value level over the period considered, is the value level in the period immediately preceding the period.

3. Mexican National Electric System (SEN)

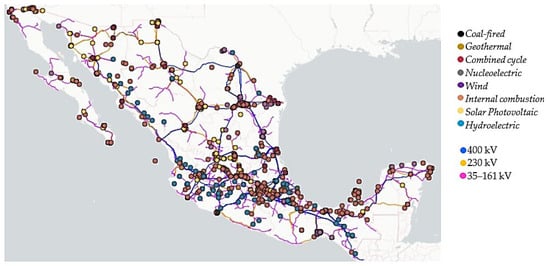

The SEN is made up of transmission lines, general distribution networks, power plant equipment, and installation in Mexico. It is divided into nine control regions and an isolated electrical system [32], as shown in Figure 1: (1) Central, (2) Eastern, (3) Western, (4) Northwest, (5) North, (6) Northeast, (7) Baja California, (8) Peninsular, (9) Baja California Sur, and (10) Mulegé System. All these regions share resources and capacity reserves, responding to the demands for and operating situations of electricity. Most of these regions are interconnected, forming the SIN. Baja California is the only region that operates with the Western Interconnection of the United States, overseen by WEC, through two transmission lines connected at a voltage level of 230 kV in alternating current. Baja California Sur and Mulegé are electrically isolated from each other, as well as from the SIN and Baja California.

The SEN is controlled by the CFE, and its technical operator is the CENACE [33,34]. One of the functions of the CENACE is to monitor in real time the generation of, demand for, and consumption of energy that is registered in the electrical system. Another function is to develop strategies, goals, and objectives for planning, retirement, expansion, distribution, and modernisation of the SEN through PRODESEN [35,36].

Figure 1.

Regions of the National Electrical System: (1) Central, (2) Eastern, (3) Western, (4) Northwest, (5) North, (6) Northeast, (7) Baja California, (8) Peninsular, (9) Baja California Sur, and (10) Mulegé System [37].

The SEN is made up of electrical networks at different voltage levels [37]:

- (i)

- National Transmission Network (RNT): This network is made up of the electrical networks that transport energy to the RGDs and the end users, as well as the interconnections to foreign electrical systems determined by the SENER. It includes tensions equal to or greater than 69 kV;

- (ii)

- General Distribution Networks (RGDs): These networks are used to distribute electrical energy to the general public. They are made up of medium-voltage electrical networks, whose electrical supply occurs at levels greater than 1 kV and less than 69 kV, as well as low-voltage electrical networks in which the electrical supply is equal to or less than 1 kV;

- (iii)

- Private Networks: These electrical networks are not part of the RNT or the RGDs.

The following map (Figure 2) shows the power plants that are in operation in Mexico differentiated by the type of technology installed, as well as the National Transmission Network (RNT) deployed in the country with its different voltage levels (from 69 kV to 400 kV).

Figure 2.

Map of the National Electrical System by type of technology and the National Transmission Network [38].

4. Results

4.1. Installed Capacity

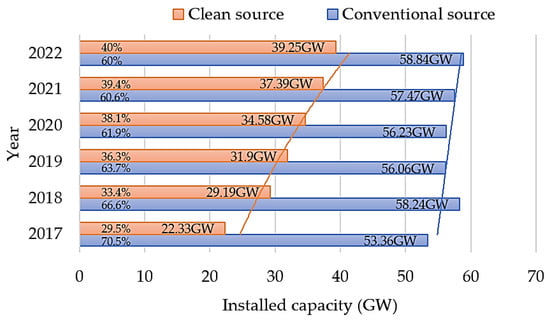

In the last five years, Mexico has increased its total installed capacity from 75.7 GW to 98.1 GW, which is equivalent to 22.83% [39]. To achieve this, the government established short- and medium-term goals to generate electricity from clean energy and promoted Structural Reforms, which allowed the modernisation of the electricity and oil industry [40]. In particular, the goals are focused on the participation of clean energies, and it will reach 25%, 30%, and 35% in 2018, 2021, and 2024, respectively [41]. As a result, the installed capacity of clean sources increased from 22.33 GW to 29.25 GW (23.66%) from 2017 to 2021, while conventional sources increased their capacity at a slow rate, going from 53.36 GW to 58.84 GW (9.31%), as shown in Figure 3.

Figure 3.

Installed capacity from 2018 to 2022.

In 2018, the installed capacity was 87.44 GW, presenting a strong growth of 13% compared to 2017 (75.7 GW), as shown in Table 1. In this year, the biggest change was seen in the clean sources, which presented increases in the solar photovoltaic source and wind source of 95.3% (0.21 GW to 4.43 GW) and 36.41% (from 4.19 GW to 6.59 GW), respectively (Figure 3), with less growth reported for hydroelectric and geothermal sources. Part of the growth was due to the Energy Transition Law and the three electricity auctions held to date. This has allowed 39 solar plants to operate in 11 states, including the largest plant in Latin America and the second largest in the world, located in Viesca, Coahuila [42,43]. In relation to the conventional sources, the major changes were seen in the combined cycle, which increased from 28.08 GW to 33.72 GW, corresponding to 16.73%, followed by coal-fired sources, which increased from 5.38 GW to 5.51 GW (2.4%), and internal combustion, with a 1.8% increase, while the thermoelectric source presented a reduction of 6.98%.

Table 1.

Evolution of installed capacity from 2017 to 2022 [39].

From 2018 to 2019, installed capacity kept increasing moderately (0.6%), implying a less rich growth than in 2018 due to the pandemic. According to PRODESEN 2018–2032 [44], conventional energy decreased by 3.7% and clean sources increased by 8.5% of the installed capacity. The major reduction came from thermoelectric sources, which decreased by 12% due to the effects of the COVID-19 pandemic and the cancellation of four new power plant projects [45]. In relation to clean sources, the investment in installed capacity in photovoltaic sources meant that it passed wind power to become the sixth-largest source of energy based on its capacity, after the combined cycle (34.28 GW), hydroelectric (12.67 GW), thermoelectric (8.23 GW), wind (8.13 GW), and turbogas (5.75 GW). Photovoltaic energy had a growth of 21.31%, reaching 5.63 GW, while wind technology had an increase of 18.9% in installed capacity.

In 2020, the installed capacity presented an increment of 3.14% despite the contingency. The increase in installed capacity was mainly in clean sources, which increased by 7.7%, while conventional energy had a weak growth of 0.3%. In the case of conventional sources, thermoelectric energy had a reduction from 8.23 GW to 7.48 GW, representing 9.1%. This negative impact could be attributed to the three transient failures that occurred in the 400 kV network and caused the simultaneous disconnection of the 400 kV double circuit and the interruption of the electricity supply in Yucatan [46]. As a result, internal combustion and combined cycle technologies compensated for the supply of electrical energy, going from 1.66 GW to 1.77 GW (6.2%) and from 34.28 GW to 35.15 GW (2.4%), respectively. In the case of clean sources, photovoltaic sources experienced an increase in their installed capacity of 25.4% compared to 2019, investments in wind resources had an increase of 8.2%, and the bioenergy source had an increase of 3.8%.

In the post-pandemic period (2020–2022), the installed capacity raised to 94.87 GW, which represented an increase of 4.27% with respect to 2020. According to Figure 3, both conventional and clean sources increased by 2.2% and 7.5% from 2020 to 2021 and by 2.3% and 4.7% from 2021 to 2022, respectively. During 2020 and 2021, the combined cycle increased its capacity by 4.7%. However, the thermoelectric industry continued to fall from 7.48 GW to 7.16 GW (−4.3%). Also, turbogas and internal combustion showed a decrease in installed capacity, going from 5.75 GW to 5.66 GW (−1.6%) for turbogas and from 1.77 GW to 1.69 GW (−4.5%) for internal combustion. The wind, bioenergy, and photovoltaic industries had slight increases in the installed capacity of 21.1%, 3.8%, and 2.6%, respectively. In 2022, the installed capacity of clean energy plants such as photovoltaic, wind, and bioenergy plants continued to grow by 3.7%, 9.6%, and 18.3%, respectively. Also, an increase of 9.2% in installed capacity was reported for the combined cycle and 2.9% for internal combustion.

4.2. Generation

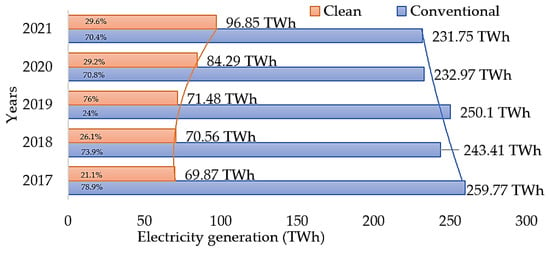

According to CENACE data, in the last six years, the electricity generation in Mexico decreased by 0.17%, going from 229.16 TWh in 2017 to 328.59 TWh in 2022 [47]. This growth is almost entirely attributed to the increase in electricity generation through clean technologies. As shown in Figure 4, between 2017 and 2021, the generation with clean sources increased by 27.86%, from 69.87 TWh to 96.85 TWh, while power generated from fossil sources grew by 20.9592%, going from 259.77 TWh to 328.59 TWh, due to the pandemic.

Figure 4.

Electricity generation from 2017 to 2021 in Mexico.

During the pre-pandemic period (2017–2018), total power generation was 313.16 TWh in 2018, with a decrease of 4.6% compared to 2017 (329.16 TWh). The largest decreases in electricity generation were around conventional sources, which presented a reduction of 1.6% (from 259.77 TWh to 243.41 TWh). The energy generated in power plants operated by internal combustion registered the greatest drop, going from 4.01 TWh to 2.59 TWh (35.41%). In the same sense, turbogas sources presented a reduction of 26% (from 12.85 TWh to 9.51 TWh), followed by coal-fired sources with a reduction of 10.47% (from 30.55 TWh to 27.35 TWh). Finally, the energy generated in thermal power plants and by the combined cycle fell by 8.04% and 0.83%, respectively, as shown in Table 2. The decrease in generation from conventional resources is mainly attributed to the increasing availability of cleaner, more efficient, and cheaper plants [42].

On the contrary, the clean energies grew by 1.6%, going from 69.87 TWh to 70.56 TWh. Specifically, clean sources (solar photovoltaic and wind) presented the highest growth rates in 2018. Between 2017 and 2018, the solar photovoltaic source increased by 89.29%, going from 334 GWh to 3.211 TWh, while wind sources grew by 17.09%, going from 10.620 TWh to 12.435 TWh. The increase in these two technologies responded to the development of the MEM and, fundamentally, to the long-term electricity auctions held between 2015 and 2017 [48]. Similarly, bioenergy sources increased electricity generation by 5.58%.

During the COVID-19 pandemic (2019–2020), electricity generation achieved 321.58 TWh, increasing by 2.36% with respect to 2018. The clean energies with the highest growth rates were photovoltaic and wind energy, with 67.76% and 25.65%, respectively. Opposite to this, hydroelectric plants had a significant reduction of 26.77% from 32.23 TWh to 23.6 TWh due to water scarcity and increased droughts in the country in this year [49]. In addition to this, nucleoelectric and bioenergy sources decreased by 15.58% and 6.17%, respectively. In the case of conventional sources, internal combustion increased by 18.78%, from 2.58 TWh to 3.18 TWh. Similarly, turbogas and the combined cycle had an increment of 12.8% and 6.6%, respectively, while coal-fired sources had a reduction of 20.97%, going from 27.35 TWh to 21.61 TWh.

In addition, it can be noted that generation fell by 1.3% from 321.58 TWh to 317.27 TWh with respect to 2019 (Figure 4). According to the PRODESEN report [44], clean resources were the main source of electricity production in Mexico, generating 15.19% more energy than in 2019, while conventional energy had a reduction of 6.85%. Regarding conventional energy, the electric generation with the combined cycle slightly increased by 5.5%, going from 175.51 TWh to 185.64 TWh, compensating for decreases in other energy sources. The energy generated in conventional thermal power and coal-fired plants registered the greatest decrease (about 42%). Turbogas also decreased from 10.90 TWh to 8.66 TWh (20.58%). Internal combustion sources had a reduction of 10.86%, going from 3.19 TWh to 2.84 TWh. Despite the health emergency caused by the coronavirus, clean sources grew by 15.2%, from 71.48 TWh to 84.29 TWh, during this period. In particular, the solar photovoltaic source registered an increase from 9.96 TWh to 15.84 TWh, corresponding to 37.1%. Wind and bioenergy sources increased by about 15%, from 16.73 TWh to 19.7 TWh and 1.87 TWh to 2.2 TWh, respectively. Similarly, hydroelectric sources increased by 11.99%, from 23.6 TWh to 26.82 TWh (Table 2).

Table 2.

Evolution of the generation of electricity from 2018 to 2023 [44,50,51,52,53].

Table 2.

Evolution of the generation of electricity from 2018 to 2023 [44,50,51,52,53].

| Technology | Pre-COVID-19 | COVID-19 | Post-COVID-19 | ||

|---|---|---|---|---|---|

| Year | 2017 | 2018 | 2019 | 2020 | 2021 |

| Combined cycle | 165.25 | 163.88 | 175.51 | 185.64 | 186.72 |

| Thermoelectric | 42.78 | 39.34 | 38.02 | 22.41 | 22.19 |

| Coal-fired | 30.55 | 27.35 | 21.61 | 12.53 | 8.70 |

| Turbogas | 12.85 | 9.51 | 10.90 | 8.66 | 11.15 |

| Internal combustion | 4.01 | 2.59 | 3.19 | 2.84 | 2.12 |

| Hydroelectric | 31.85 | 32.23 | 23.20 | 26.82 | 34.72 |

| Wind | 10.62 | 12.44 | 16.73 | 19.70 | 21.07 |

| Geothermal | 6.04 | 5.06 | 5.06 | 4.57 | 4.24 |

| Solar photovoltaic | 0.344 | 3.211 | 9.96 | 15.84 | 20.19 |

| Bioenergy | 1.88 | 1.99 | 1.87 | 2.21 | 1.59 |

| Nucleoelectric | 10.88 | 13.2 | 10.88 | 10.86 | 11.61 |

| Efficient cogeneration | 6.93 | 2.42 | 3.38 | 4.29 | 3.42 |

| Regenerative brakes | 0.004 | 0.004 | 0.004 | 0.004 | 0.004 |

| Total (TWh) | 329.16 | 313.98 | 321.58 | 317.27 | 328.59 |

After a 1.3% drop due to the COVID-19 pandemic in 2020, power generation rebounded by 3.44% in 2021, as shown in Figure 4. Specifically, hydraulic and solar photovoltaic sources presented the highest growth rates during the period analysed. Hydraulic sources grew by 22.76%, going from 26.82 TWh to 34.71 TWh, while photovoltaic energy grew by 21.6%, going from 15.84 TWh to 20.19 TWh. Wind and nucleoelectric energy also increased by about 6.4%. However, bioenergy and geothermal sources fell by 27.68% and 7.25%, going from 2.21 TWh to 1.59 TWh and from 4.57 TWh to 4.24 TWh, respectively. On the other hand, conventional energy presented a slight reduction of 0.5%, from 232.97 TWh to 231.75 TWh. This decrease is mainly attributed to the coal-fired source, which had a reduction from 12.53 TWh to 8.7 TWh, equivalent to 30.6%, and internal combustion, which had a reduction from 2.84 TWh to 2.12 TWh (25.4%). Contrarily, turbogas sources increased by 22.3% from 8.67 TWh to 11.15 TWh.

4.3. Consumption

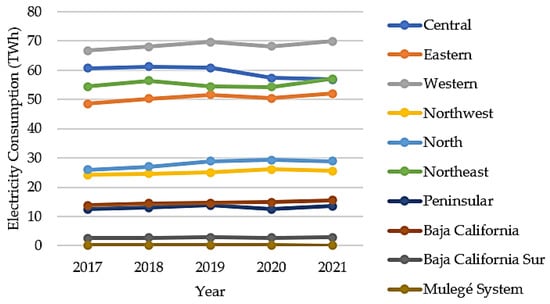

From 2017 to 2021, Mexico increased its total electricity consumption from 309.73 TWh to 322.54 TWh, which is equivalent to 3.97% [50,51,52,53]. Figure 5 shows the evolution of the annual gross consumption of electricity by control area in the period of 2017 to 2021, where it can be distinguished that the areas with the highest gross consumption of electric power in the country are the Western, Central, and Northeastern areas, while the regions with the lowest consumption are Baja California Sur, Peninsular, and Baja California.

Figure 5.

Evolution of electricity consumption from 2017 to 2021 in Mexico.

During the pre-pandemic period (2017–2018), the gross national consumption of the SEN registered an increase of 318.24 TWh, which meant a growth of 2.7% compared to the consumption of 2017, which was 309.73 TWh (Table 3). In general, all the regions showed moderate growth. The northern regions of the country (North, Northeast, and Northwest) grew by 3.8%, 3.5%, and 1.6%, respectively, caused by high temperatures in the summer months. Eastern and Western regions also had a growth of 3.4% and 2.1%, and the Central region had less participation in electricity consumption (1%). During the year, in the months of May to October, 54.5% of gross consumption was presented, while, in the remaining months, it was 45.5%.

Table 3.

Evolution of the electricity consumption from 2017 to 2021 [44,50,51,52,53].

In the COVID-19 pandemic (2019–2020), the national gross consumption of the SEN continued to rise to 324,927 TWh, which meant an increase of 2.1% compared to the consumption of 2018. Most of the regions showed growth in electricity consumption, except for the Central and Northeast regions. They had a fall of 0.72% and 5.6%, respectively. Opposite to this, the North and Peninsular regions registered an increase of about 6.4% in their electricity consumption. Eastern, Western, and Baja California Sur regions increased the national gross consumption by between 2.1% and 2.7%. A slight growth in electricity generation was presented by the Northeast (1.2%) and Baja California (0.5%). During the year, in the months of May to October, 54.6% of gross consumption was presented, while it was 45.4% in the remaining months.

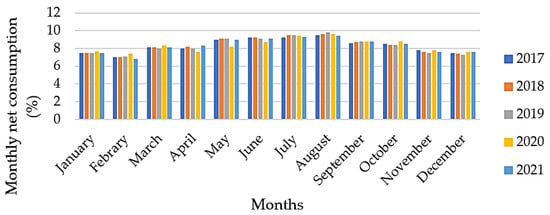

In 2020, the national gross consumption was 315.97 TWh, which meant a decrease of 2.76% compared to the consumption of 2019. This decrease was caused by the health contingency caused by COVID-19, which caused the suspension of productive activities throughout the country. In this period, the Northwest region presented a positive growth rate of 4.6%, from 24.97 TWh to 26.1 TWh. Similarly, Mulegé, Baja California, and the North region increased electrical consumption by 2.6%, 2.2%, and 1.5%, despite the contingency. In Table 3, it is shown that the Peninsular regions reduced their energy consumption by 9.9%, followed by the Central (5.6%) and Northeast regions (5.5%). Similarly, Eastern and Western regions decreased their consumption by about 2.4%. As shown in Figure 6, in the first quarter of 2020 (from January to March), Mexico increased electricity consumption when the first case of COVID-19 was detected. After this first diagnosis, the number of patients increased exponentially. In response to this global outbreak, the Ministry of Health established the “Sana Distancia” programme, through which sanitary and social distancing measures came into action to reduce contagion. As a result, the electricity consumption was reduced from April to September. In the remaining months, energy consumption presented a slight rebound. This increase may be the result of greater use of energy in homes due to the decrease in temperature or the decision of some businesses to resume activities despite the pandemic.

Figure 6.

Monthly consumption from 2017 to 2021 in Mexico.

In the post-pandemic period (2020–2021), the national consumption of the SEN amounted to 322.54 TWh, which means an increase of 3.5% compared to the consumption of 2020. This increase is a reflection of the rising recovery of the country’s economy after the ravages caused by the health contingency, which caused the suspension of some productive activities throughout the country. In this period, the Peninsular, Northeast, Baja California, and Baja California Sur were the zones that showed a greater recovery, presenting rates of 7.8%, 5.1%, 3.9%, and 3.9%, respectively. The Eastern zone showed moderate growth in the order of 3.1%, going from 50.44 TWh to 52.07 TWh. However, Northwest, North, and Central regions continued to decrease their consumption by 2.1%, 1.2%, and 1%, respectively.

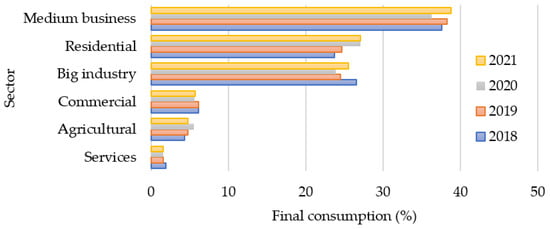

The sectors that reported the most changes in electricity consumption during the pandemic were medium business, residential, and big industry [53,54,55]. In 2018, the highest growth in electricity consumption was reported in medium business, with 37.6%, followed by big industry, with 26.6%, and residential, with 23.7%. The number of users with electricity services in 2018 amounted to 43.4 million. In 2019, the agricultural and services sectors increased their consumption by 10.4% and 15.8%, respectively, while big industry reduced its final consumption by 7.9%. In 2020, the agricultural sector presented the highest growth, 12.7%, followed by the residential sector with 8.9%. Derived from the strategies to contain the spread of COVID-19, the commercial and medium business sectors decreased their electricity consumption by 8.2% and 5.2%. In 2021, medium business and big industry presented the highest growth in electricity consumption, 6.5% and 6.4% compared to 2020, respectively. On the contrary, the agricultural sector had a fall of 12.7% in this year, as shown in Figure 7.

Figure 7.

Electricity consumption by sectors.

4.4. Demand

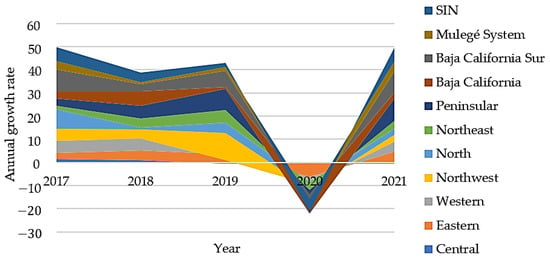

According to PRODESEN 2017–2031 [44], in the pre-pandemic period, the gross integrated demand of the SIN registered a value of 45.17 TWh/h, which is equivalent to a growth of 4.3% compared to the 43.32 MWh/h of 2017 (Table 4). In 2018, all the regions increased their electricity demand. Mainly, the Western and Peninsular regions had an increase of 5.4%, achieving 10.37 TWh/h and 2.25 TWh/h, respectively. The regions with the lowest demand were the Central and North regions, with 1.1% (8.81 TWh/h) and 0.7% (4.64 TWh/h), respectively.

Table 4.

Evolution of the gross integrated demand from 2017 to 2021 [47,52,53,54,55].

During the pandemic period (2019–2020), the demand continued to rise by 1.7% with respect to 2018, going from 45.17 TWh/h to 45.95 TWh/h. The greatest recovery in electricity demand was in the Northwest region, with an increase of 5.31 TWh/h, equivalent to 11.6%, followed by the Northeast region with 5.5% (9.71 TWh/h) and the Eastern region with 4.3% (7.92 TWh/h), while the Western and Central regions had reductions during the last week of April of 2.7% and 0.6%, respectively. In 2020, it was observed that most of the regions decreased their electricity demand due to social confinement and economic paralysis caused by the coronavirus, as shown in Figure 8. The Peninsular region’s demand fell by 10.3%, achieving an electricity demand of 2.01 TWh/h, followed by the Eastern region, which had a decrease of 5.8%, going from 7.92 TWh/h to 7.45 TWh/h. The North region slightly increased its demand by 2.6%, arriving at 4.98 TWh/h.

Figure 8.

Annual growth rate of demand from 2017 to 2021.

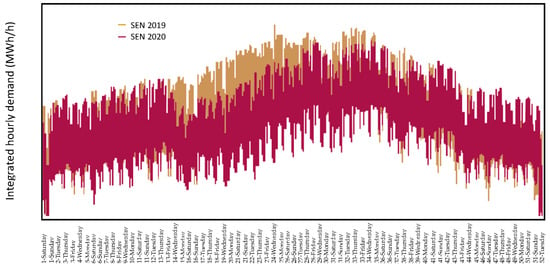

In relation to the hourly behaviour of the SEN demand, it can be seen that, as of 30 March 2020 (week 14), the date that the immediate suspension of non-essential activities in Mexico was ordered, there was a significant drop in the peak of demand up to week 38 compared to 2019. Figure 9 shows that the maximum demands on business days and on weekends decreased with respect to the usual pattern registered in previous years [52].

Figure 9.

Hourly profile of demand of the SEN from 2019 to 2020 [54].

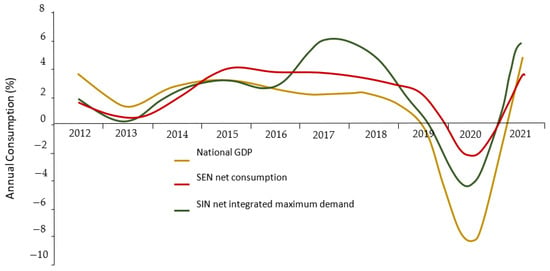

Mobility restrictions and the decrease in economic activities not only affected electricity demand but also GDP and SEN net consumption. The GDP in 2020 presented a lower annual variation than in 2019, with a decrease in the order of −8.2%, while gross consumption registered a decrease of −2.8%, a rate lower than that registered in 2019, 2.1% (Figure 10). This collapse is worrying because it is the deepest in almost ninety years. Its magnitude surpassed that of the global financial crisis of 2009 and that of the debacles of 1995, 1986, and 1983, and is only surpassed by that of the Great Depression in 1932, when it was calculated that GDP fell by 14.8% [52].

Figure 10.

Evolution of national GDP, consumption, and net maximum integrated demand from 2017 to 2021 [52].

In the post-pandemic period, demand began to increase by up to 4%. The Peninsular and Eastern regions showed the highest increases, 9.6% and 5.3%, respectively, and, with less participation, the Central region achieved 8.29 TWh/h (−0.6%), as shown in Table 4.

5. Repercussions of the Pandemic on the Electricity Sector and Future Directions

The energy sector has proven to be very resilient in the face of high levels of uncertainty and risk because it is anchored to oil prices and the economy. However, the crisis caused by COVID-19 has generated new challenges that the sector must face. On the one hand, the electricity industry faces a significant decrease in electricity demand, despite the increase in domestic energy consumption. On the other hand, the Mexican government has suspended clean energy projects, specifically, wind and solar power plant projects, indefinitely to guarantee the efficiency, quality, reliability, continuity, and safety of the SEN [54,55]. This has opened the possibility of the CENACE rejecting future requests for interconnection with renewable energy projects and has given priority to expanding the list of must-run plants to include CFE plants based on diesel or fuel oil.

The COVID-19 pandemic forced the Mexican government to implement measures to reinforce the role of the CFE and PEMEX [56]. Since 2019, the CENACE has cancelled long-term generation auctions, which were a mechanism for private investment in the Mexican electricity sector. Likewise, they cancelled the transmission tenders to interconnect Baja California, which, until now, has remained isolated from the SEN [57]. During 2020, the CRE increased transmission rates for conventional and renewable interconnection contracts. On 3 May 2020, the pre-operational tests of 17 photovoltaic and wind power plants, 754 wind and 1572 solar, with a total capacity of 2326 MW, were suspended, putting an equivalent of USD 2 billion in investment in uncertainty. The combination of these actions has left USD 44 billion of investment and 81,500 jobs in Mexico at risk [58].

On the other hand, the Mexican electrical system underwent substantial changes in its operation. In periods after 2019, the power plants first operated from lowest to highest cost, and the price was set with the variable costs of the last plant that dispatched the demand. Currently, power plants are not based on their generation cost, but are ordered as follows: (1) hydroelectric plants (CFE), (2) thermal and renewable plants from the CFE, (3) combined cycle plants, PIESs, in legacy contract with the CFE, (4) private renewable plants, and (5) private combined cycle plants [59,60]. The above has had an impact on the increase in generation costs of the electrical system because CFE plants are, on average, more expensive and inefficient than private generators. Consumers would face higher electricity costs, higher greenhouse gas emissions from the system, and violations of international treaties to which Mexico has subscribed.

6. Discussion and Conclusions

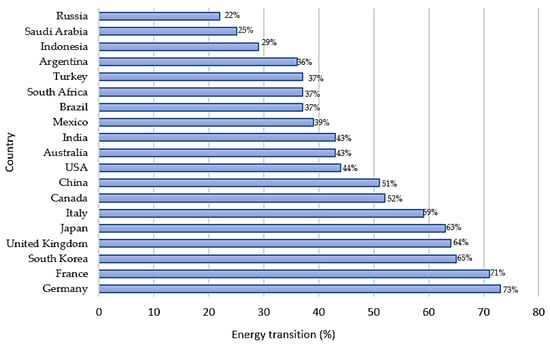

The purpose of this study was to gain a better understanding of the changes in electricity energy before, during, and after the COVID-19 pandemic in Mexico. The changes observed in the last five years have reflected a transformation in the matrix composition of electrical energy. Mexico has strongly promoted the development of renewable energies, especially electricity generated from the sun and wind. As a result, Mexico is among the top 12 countries in the world with the highest investment in clean sources, as shown in Figure 11.

Figure 11.

Monitoring of G20 policies in energy transition in 2021 [61].

Since 2017, Mexico has begun to make efforts to reform its energy sector, which has allowed a renewed dynamism in the national solar and wind industry. From the results, it is clear that Mexico has increased its total capacity by 22.83% from 2017 to 2021. During this period, renewable energies were the only source of electricity that managed to increase its installed capacity by 43.1%, while conventional sources have gradually grown by 9.31%, despite the health emergency due to the coronavirus. The increase in demand for renewable energy—mainly solar and wind—was also experienced worldwide, according to IEA data. Countries such as Argentina (72%, 62%), Brazil (70%, 11%), and Chile (21%, 32%) increased their solar and wind energy installation capacity [62]. Despite the growth in the installation capacity of wind and solar energy, global efforts remain insufficient to achieve the goals of SDG 7 (“achieving affordable, secure, sustainable and modern energy for all”) by 2030. According to the report ‘Monitoring SDG 7: Report on progress in energy’ [63], before the onset of the COVID-19 crisis, significant achievements had been made in several aspects of Sustainable Development Goal (SDG) 7. These include a notable reduction in the number of people without access to electricity around the world, a significant increase in renewable energy for electricity generation, and improvements in energy efficiency. Currently, there are 675 million people around the world who do not have access to electricity [64], which will require stronger political commitment, long-term energy planning, more private financing, and appropriate regulatory and fiscal incentives to drive faster adoption of new technologies.

In terms of electricity generation, in Mexico, it grew by 4.3% in the last six years, going from 319.4 TWh in 2017 to 333.8 TWh in 2022. The electricity generation of clean sources grew by 27.86% after three years of the energy policy promoted by the present administration. This growth is almost entirely attributed to the increase in electricity generation through clean technologies, which experienced a slight stagnation in 2019, while conventional energies had a reduction of 10% in electricity generation. Between 2019 and 2020, both conventional energy and clean energy had a slight stagnation or reduction in electricity generation. The results showed that conventional energies had a reduction of 10% in electricity generation. The most affected technology was thermoelectric, with a 41.1% reduction, and coal-fired, with a 42% reduction, while electricity generation of combined cycle, wind, and solar photovoltaic sources increased by 11.8%, 49.59%, and 98.3% in this period, respectively. Electricity production also grew in the rest of the Asian countries (especially in South Korea, Malaysia, Thailand, and Japan) and in Latin America (+1.9%, it grew in Brazil, in Canada (+2%), and in Australia (+1.9%)), while it remained stable in Africa, as growth in Algeria and Egypt was offset by the fall in production in South Africa. On the contrary, electricity generation contracted by 2.8% in Europe and 27% in Ukraine due to the war [65]. The increases in the share of clean generation in the country’s total electricity generation are a consequence of the investment climate and the current legal and regulatory framework, which has benefited in the reduction of greenhouse gas emissions.

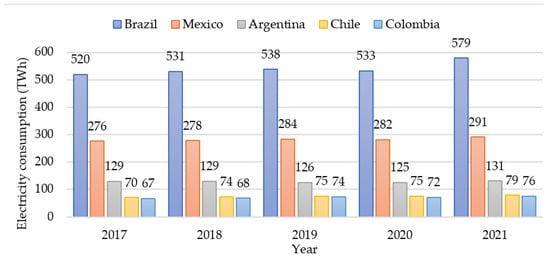

With the arrival of the pandemic, the population’s energy consumption changed completely. Mexican electricity consumption registered a gradual rise of 3.979%, passing from 309.73 TWh to 322.54 TWh. The declaration of the state of alarm, the suspension of daily activities, except those related to the sale of essential products, and confinement resulted in a decrease in electricity consumption of about 2.7%, and, in 2021, a growth of 2% was recorded, which translates into an economic recovery. Electricity consumption recovered by 6.1% in Latin America, with growth of 8.6% in Brazil, 3.1% in Mexico, 4.6% in Argentina, 5% in Chile, and 5.3% in Colombia [66], as shown in Figure 12. Meanwhile, the maximum electricity consumption reduction rates in France, Germany, Italy, Spain, the United Kingdom, China, and India during the blockade period were more than 10% compared to 2019. The sectors most affected by these restrictions were those related to medium business and big industry. One interesting finding is that the residential sector maintained electricity consumption during 2020 and 2021. Due to lower energy consumption, it is observed that carbon dioxide emissions in 2020 were reduced by more than a tenth (18.7%) compared to the previous years and was incremented post COVID-19 [67].

Figure 12.

Electricity consumption in Latin America from 2017 to 2021 [66].

The impact of COVID-19 largely explains the drop in electricity demand. In Mexico, GDP, net consumption, and maximum net integrated demand were seriously affected during the year 2020. GDP fell by 8.2% in 2020, and the consumption and demand decreased by 2.2% and 4.4%, respectively. The most affected region was the Peninsular region, with a drop in demand of 10.3%, followed by the Eastern region, with a decrease of 5.8%. It suggests a significant reduction in the generation of new jobs and an economic setback. On the other hand, reductions in electricity demand have resulted in renewables accounting for a greater proportion of electricity supply because their production is largely unaffected by demand, while demand for electricity generated from all other sources (coal, gas, and nuclear energy) was reduced.

The results above show that Mexico is going through a gradual transition towards the de-carbonisation of economic activities with the goal that the energy consumed comes from clean energy. It is noteworthy that the actions of the energy policy to eliminate competition in the energy market and strengthen PEMEX and the CFE, as well as the goals of CO2 reduction by 2024, have been delayed. The projections of the SENER affirm that the objective of generating 35% of energy through clean technologies by 2024 will not be reached until 2031 and that the target of generating 40% of energy through clean technologies by 2032 will be reached by 2035 [68].

According to PRODESEN 2022–2036 projections, it is estimated that, in a period of four years, the installed capacity of the SEN will increase by 20.425 GW, going from 89.89 GW in 2022 to 110.315 GW in 2026, which implies a growth average of an additional 5.106 GW per year [69]. This annual average, however, is equivalent to 3.4 times the new capacity that was installed in 2022 (1483 GW). If the new installed capacity contemplated in PRODESEN 2023–2037 is compared with that of the previous year’s edition, the increase is considerable. The reports presented by IMCO [68] mention that the CFE, which is solely responsible for expanding renewable generation capacity, currently does not have specific renewable generation projects in its project portfolio to expand the installed capacity at the rate that the country requires. Therefore, Mexico cannot successfully address the challenge of the energy transition that has been established.

Moreover, it is projected that distributed generation will grow by 338% between 2022 and 2037, which will increase the installed capacity of distributed generation by 8829 GW, going from 2613 GW in 2022 to 11,442 GW in 2037 under a baseline scenario. This implies that, in 2037, distributed generation will contribute around 15.54 TWh of electrical energy, a figure that is equivalent to 3.1% of the estimated total net consumption in 2023 (479,987 TWh). However, the preliminary draft of DACG on distributed generation threatens to limit the growth of this modality [70].

Based on the overview of the impacts of the COVID-19 pandemic on the electricity sector, point-by-point observations are highlighted as follows:

- (i)

- Structural changes in the energy sector have been observed, which have allowed an increment of 22.83% in total capacity of solar and wind technology in Mexico in 2017–2021;

- (ii)

- Compared to 2017, the renewable energies presented an increase of 43.1% and 4.3% in installed capacity and in electricity generation, respectively, despite the health emergency due to COVID-19. On the contrary, the conventional energies had a reduction of 10% in electricity generation. The most affected technologies were thermoelectric and coal-fired. Also, electricity consumption presented a decrement of 2.7% during the COVID-19 pandemic;

- (iii)

- The GDP, net consumption, and maximum net integrated demand were seriously affected during the year 2020, with contractions of 8.2%, 2.2%, and 4.4%, respectively;

- (iv)

- The goals of CO2 reduction by 2024 have significant delays. The objectives of generating 35% of energy through clean technologies by 2024 will not be reached until 2031 and generating 40% of the energy through clean technologies by 2032 will be reached by 2035.

The electricity sector in Mexico faces various current challenges after the health crisis. Mexico must work synergistically to meet the goals proposed for 2030 in the Paris Agreement. It is necessary for the country to align its budget with well-defined and concrete planning so that the commitments made to an international platform are fulfilled. This opens the opportunity to propose a comprehensive planning strategy in the medium and long term, aimed at addressing the energy needs that ensure a decent life for the entire population, and in which the participation of end users is considered. Taking into account that Mexico has been in the stage of geological decline in hydrocarbon production for thirteen years, a greater diversification of generation sources must be considered along with a policy of saving electrical energy.

There are other opportunities in different areas to support the country’s energy transition, some of which involve the manufacturing and distribution of wind and photovoltaic equipment in the country. In the photovoltaic sector, Mexico has a large maquila industry where it exports photovoltaic cells, mainly to the United States and the Netherlands; however, the wind sector is limited only to exports to the United States. For this reason, the opportunity could be opened to include wind equipment manufacturers in the projects proposed by the Mexican government. On the other hand, the public administration could resume projects related to the public sector. An example would be the eight renewable energy projects, of which five are from the photovoltaic area, mentioned by PRODESEN 2019–2033 as well as projects derived from long-term auctions, which represent a total of 7.56 MW of installed capacity and which are stopped or in the process of being built [50].

The pandemic not only took human lives and weakened energy sectors around the world but also opened a window of opportunity for new practices at social and economic levels. In this context, the opportunities offered in research relate to social, economic, environmental, political, and educational impacts, among others. Several lines of future research deserve greater attention, among which the energy–socio-economic–environmental analyses of the energy transitions and post-COVID-19 period stand out, along with the structural adjustment in the CO2 reduction objectives established in the Paris Agreement and green recovery measures post COVID-19 that enable the energy transition.

Author Contributions

L.S.-C.: writing—original draft, methodology, formal analysis, software, investigation; C.Á.-M.: writing—review and editing, supervision, investigation; L.-A.P.-G.: information search, figure and table editing; R.L.-P.: review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Acknowledgments

The authors acknowledge financial support from CONAHCYT (México), TecNM projects, Cátedras CONAHCYT, and PRODEP through ITLAG-CA-10.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

| Acronyms | Description (Spanish) | Description (English) |

| CENACE | Centro Nacional de Control de Energía | National Center for Energy Control |

| CFE | Comisión Federal de Electricidad | Federal Electricity Commission |

| DACG | Disposiciones administrativas generales | General Administrative Provisions |

| GSP | Producto Interno Bruto | Gross Domestic Product |

| IMCO | Centro de Investigación de Políticas Públicas | Public Policy Research Center |

| MEM | Mercado Eléctrico Mayorista | Wholesale Electricity Market |

| PEMEX | Petróleos Mexicanos | Mexican Oil |

| PRODESEN | Programa para el Desarrollo del Sistema Eléctrico Nacional | Development of the National Electric System |

| RGD | Redes Generales de Distribución | General Distribution Networks |

| RNT | Red Nacional de Transmisión | National Transmission Network |

| SEN | Sistema Eléctrico Nacional | National Electric System |

| SENER | Secretaría de Energía | Mexican Ministry of Energy |

| SIN | Sistema Interconectado Nacional | National Interconnected System |

| TEM | Transición Energética Mexicana | Mexican Energy Transition |

| WHO | Organización Mundial de la Salud | World Health Organization |

References

- Daemi, H.B.; Kulyar, M.F.-E.; He, X.; Li, C.; Karimpour, M.; Sun, X.; Zou, Z.; Jin, M. Progression and Trends in Virus from Influenza A to COVID-19: An Overview of Recent Studies. Viruses 2021, 13, 1145. [Google Scholar] [CrossRef]

- Yezli, S.; Khan, A. COVID-19 social distancing in the Kingdom of Saudi Arabia: Bold measures in the face of political, economic, social and religious challenges. Travel Med. Infect. Dis. 2020, 37, 101692. [Google Scholar] [CrossRef]

- Acuña-Zegarra, M.A.; Santana-Cibrian, M.; Velasco-Hernandez, J.X. Modeling behavioral change and COVID-19 containment in Mexico: A trade-off between lockdown and compliance. Math. Biosci. 2020, 325, 108370. [Google Scholar] [CrossRef]

- Fana, M.; Tolan, S.; Torrejón, S.; Brancati, C.U.; Fernández-Macías, E. The COVID Confinement Measures and EU Labour Markets; Publications office of the European Union: Luxembourg, 2020. [Google Scholar]

- Sun, K.S.; Lau, T.S.M.; Yeoh, E.K.; Chung, V.C.H.; Leung, Y.S.; Yam, C.H.K.; Hung, C.T. Effectiveness of different types and levels of social distancing measures: A scoping review of global evidence from earlier stage of COVID-19 pandemic. BMJ Open 2022, 12, e053938. [Google Scholar] [CrossRef]

- Maliszewska, M.; Mattoo, A.; Van Der Mensbrugghe, D. The Potential Impact of COVID-19 on GDP and Trade: A Preliminary Assessment; World Bank Policy Research Working Paper, No. 9211; World Bank: Washington, DC, USA, 2020.

- Wang, B.; Yang, Z.; Xuan, J.; Jiao, K. Crises and opportunities in terms of energy and AI technologies during the COVID-19 pandemic. Energy AI 2020, 1, 100013. [Google Scholar] [CrossRef]

- Basak, P.; Abir, T.; Al Mamun, A.; Zainol, N.R.; Khanam, M.; Haque, R.; Milton, A.H.; Agho, K.E. A Global Study on the Correlates of Gross Domestic Product (GDP) and COVID-19 Vaccine Distribution. Vaccines 2022, 10, 266. [Google Scholar] [CrossRef] [PubMed]

- Baldwin, R.E.; Tomiura, E. Thinking ahead about the Trade Impact of COVID-19; Centre for Economic Policy Research: London, UK, 2020. [Google Scholar]

- Barbero, J.; de Lucio, J.J.; Rodríguez-Crespo, E. Effects of COVID-19 on trade flows: Measuring their impact through government policy responses. PLoS ONE 2021, 16, e0258356. [Google Scholar] [CrossRef] [PubMed]

- Kooli, C. COVID-19: Challenges and opportunities. Avicenna 2021, 2021, 5. [Google Scholar] [CrossRef]

- Palomino, J.C.; Rodríguez, J.G.; Sebastian, R. The COVID-19 shock on the labour market: Poverty and inequality effects across Spanish regions. Reg. Stud. 2023, 57, 814–828. [Google Scholar] [CrossRef]

- Sonfield, A.; Frost, J.J.; Dawson, R.; Lindberg, L.D. COVID-19 job losses threaten insurance coverage and access to reproductive health care for millions. Health Aff. Forefr. 2020. [Google Scholar] [CrossRef]

- Ahmed, F.; Ahmed, N.; Pissarides, C.; Stiglitz, J. Why inequality could spread COVID-19. Lancet Public Health 2020, 5, e240. [Google Scholar] [CrossRef]

- Wiwad, D.; Mercier, B.; Piff, P.K.; Shariff, A.; Aknin, L.B. Recognizing the Impact of COVID-19 on the Poor Alters Attitudes Towards Poverty and Inequality. J. Exp. Soc. Psychol. 2020, 93, 104083. [Google Scholar] [CrossRef]

- Gollakota, A.R.; Shu, C.-M. COVID-19 and energy sector: Unique opportunity for switching to clean energy. Gondwana Res. 2022, 114, 93–116. [Google Scholar] [CrossRef]

- Elavarasan, R.M.; Shafiullah, G.; Raju, K.; Mudgal, V.; Arif, M.; Jamal, T.; Subramanian, S.; Balaguru, V.S.; Reddy, K.; Subramaniam, U. COVID-19: Impact analysis and recommendations for power sector operation. Appl. Energy 2020, 279, 115739. [Google Scholar] [CrossRef] [PubMed]

- Zhong, H.; Tan, Z.; He, Y.; Xie, L.; Kang, C. Implications of COVID-19 for the electricity industry: A comprehensive review. CSEE J. Power Energy Syst. 2020, 6, 489–495. [Google Scholar] [CrossRef]

- Saadat, S.; Rawtani, D.; Hussain, C.M. Environmental perspective of COVID-19. Sci. Total Environ. 2020, 728, 138870. [Google Scholar] [CrossRef]

- Sikarwar, V.S.; Reichert, A.; Jeremias, M.; Manovic, V. COVID-19 pandemic and global carbon dioxide emissions: A first assessment. Sci. Total. Environ. 2021, 794, 148770. [Google Scholar] [CrossRef]

- Mastoi, M.S.; Munir, H.M.; Zhuang, S.; Hassan, M.; Usman, M.; Alahmadi, A.; Alamri, B. A Critical Analysis of the Impact of Pandemic on China’s Electricity Usage Patterns and the Global Development of Renewable Energy. Int. J. Environ. Res. Public Health 2022, 19, 4608. [Google Scholar] [CrossRef]

- Wang, Q.; Li, S.; Jiang, F. Uncovering the impact of the COVID-19 pandemic on energy consumption: New insight from difference between pandemic-free scenario and actual electricity consumption in China. J. Clean. Prod. 2021, 313, 127897. [Google Scholar] [CrossRef]

- Bhattacharya, S.; Banerjee, R.; Liebman, A.; Dargaville, R. Analysing the impact of lockdown due to the COVID-19 pandemic on the Indian electricity sector. Int. J. Electr. Power Energy Syst. 2022, 141, 108097. [Google Scholar] [CrossRef]

- World Energy Primary Production. Available online: https://yearbook.enerdata.net/total-energy/world-energy-production.html (accessed on 28 June 2023).

- Carvalho, M.; Delgado, D.B.d.M.; Lima, K.M.; Cancela, M.C.; Siqueira, C.A.; Souza, D.L.B. Effects of the COVID-19 pandemic on the Brazilian electricity consumption patterns. Int. J. Energy Res. 2021, 45, 3358–3364. [Google Scholar] [CrossRef]

- Czosnyka, M.; Wnukowska, B.; Karbowa, K. Electrical energy consumption and the energy market in Poland during the COVID-19 pandemic. In Proceedings of the 2020 Progress in Applied Electrical Engineering (PAEE), Koscielisko, Poland, 21–26 June 2020. [Google Scholar] [CrossRef]

- Ghiani, E.; Galici, M.; Mureddu, M.; Pilo, F. Impact on Electricity Consumption and Market Pricing of Energy and Ancillary Services during Pandemic of COVID-19 in Italy. Energies 2020, 13, 3357. [Google Scholar] [CrossRef]

- Morva, G.; Diahovchenko, I. Effects of COVID-19 on the electricity sectors of Ukraine and Hungary: Challenges of energy demand and renewables integration. In Proceedings of the 2020 IEEE 3rd International Conference and Workshop in Óbuda on Electrical and Power Engineering (CANDO-EPE), Budapest, Hungary, 18–19 November 2020. [Google Scholar] [CrossRef]

- Soava, G.; Mehedintu, A.; Sterpu, M.; Grecu, E. The Impact of the COVID-19 Pandemic on Electricity Consumption and Economic Growth in Romania. Energies 2021, 14, 2394. [Google Scholar] [CrossRef]

- Keele, S. Guidelines for Performing Systematic Literature Reviews in Software Engineering. 2007. Available online: https://www.researchgate.net/profile/Barbara-Kitchenham/publication/302924724_Guidelines_for_performing_Systematic_Litera-tu-re_Reviews_in_Software_Engineering/links/61712932766c4a211c03a6f7/Guidelines-for-performing-Systematic-Literature-Reviews-in-Software-Engineering.pdf (accessed on 16 January 2024).

- Stapic, Z.; López, E.G.; Cabot, A.G.; de Marcos Ortega, L.; Strahonja, V. Performing Systematic Literature Review in Software Engineering. Central European Conference on In-Formation and Intelligent Systems. Faculty of Organization and Informatics Varazdin. 2012. Available online: https://www.researchgate.net/profile/Zlatko-Stapic/publication/267770597_Performing_systematic_literature_review_in_software_engineering/links/5485a8e40cf24356db610a9d/Performing-systematic-literature-review-in-software-engineering.pdf (accessed on 16 January 2024).

- PAMRNT 2021–2035. Available online: https://www.cenace.gob.mx/Docs/10_PLANEACION/ProgramasAyM/Programa%20de%20Ampliaci%C3%B3n%20y%20Modernizaci%C3%B3n%20de%20la%20RNT%20y%20RGD%202021%20-%202035.pdf (accessed on 12 January 2024).

- CENACE. Available online: https://www.cenace.gob.mx/CENACE.aspx (accessed on 21 March 2023).

- Vásquez, P.; Cepeda, J.; Echeverría, D.; Ramos, V. Diagnóstico Situacional para la implementación de un proceso de Gestión de Conocimiento en el Operador Nacional de Electricidad CENACE. Rev. Téc. Energía 2017, 13, 222–232. [Google Scholar] [CrossRef]

- National Program for Sustainable Use. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5679748&fecha=16/02/2023 (accessed on 21 March 2023).

- Zenón, E.; Rosellón, J. Optimal transmission planning under the Mexican new electricity market. Energy Policy 2017, 104, 349–360. [Google Scholar] [CrossRef]

- SEN Infrastructure. Available online: https://base.energia.gob.mx/prodesen22/Capitulo5.pdf (accessed on 12 January 2024).

- National Electrical System—Energy and Climate Change. Available online: https://energia.conacyt.mx/planeas/electricidad/sistema-electrico-nacional (accessed on 17 January 2024).

- National Energy Balance 2018–2025. Available online: https://www.gob.mx/cms/uploads/attachment/file/528054/Balance_Nacional_de_Energ_a_2018.pdf (accessed on 16 January 2024).

- Energetic Reform. 2017. Available online: https://www.gob.mx/cms/uploads/attachment/file/10233/Explicacion_ampliada_de_la_Reforma_Energetica1.pdf (accessed on 16 January 2024).

- Sector Program Derived from the National Development Plan 2019–2024. Available online: https://www.gob.mx/cms/uploads/attachment/file/575834/Programa_Sectorial_de_Bienestar.pdf (accessed on 20 January 2024).

- Progress in Clean Energies. 2017. Available online: https://www.gob.mx/cms/uploads/attachment/file/354379/Reporte_de_Avance_de_Energ_as_Limpias_Cierre_2017.pdf (accessed on 8 May 2023).

- Energías Alternativas, Retos y Oportunidades en México. Available online: https://realestatemarket.com.mx/articulos/infraestructura-y-construccion/27581-energias-alternativas-retos-y-oportunidades-en-mexico\#:~:text=El\%202018%20fue%20el%20mayor,capacidad%20instalada%20respecto%20a%202017 (accessed on 8 May 2023).

- PRODESEN 2018–2032. Available online: https://www.gob.mx/cms/uploads/attachment/file/331770/PRODESEN-2018-2032-definitiva.pdf (accessed on 15 May 2023).

- Annual Report 2019 CFE. Available online: https://www.cfe.mx/finanzas/reportes-financieros/Informe%20Anual%20Documentos/Informe%20Anual%202019%20V12%20a%20portal.pdf (accessed on 15 May 2023).

- CENACE. Fallas del Sistema Nacional CENACE, Fallas del Sistema Nacional. Available online: https://www.cfe.mx/finanzas/reportes-financieros/Informe%20Anual%20Documentos/Informe%20Anual%202019%20V12%20a%20portal.pdf (accessed on 8 May 2023).

- CENACE. Report of the Energy Generated by Type. Available online: https://www.cenace.gob.mx/Paginas/SIM/Reportes/EnergiaGeneradaTipoTec.aspx (accessed on 17 June 2023).

- Secretaria de Energía, Informe Pormenorizado Sobre el Desempeño y las Tendencias de la Industria Eléctrica Nacional 2017 Informe Sobre la Participación de las Energías Renovables en la Generación de Electricidad en México, al 31 de Diciembre de 2013. Available online: https://www.gob.mx (accessed on 14 June 2023).

- Instituto Mexicano de la Competitividad. Available online: https://imco.org.mx/wp-content/uploads/2023/02/Situacion-del-agua-en-Mexico (accessed on 19 June 2023).

- PRODESEN 2019–2033. Available online: https://www.cenace.gob.mx/Docs/16_MARCOREGULATORIO/Prodecen//10%202019-2033%20Cap%C3%ADtulos%201%20al%206.pdf (accessed on 12 June 2023).

- PRODESEN 2020–2034. Available online: https://www.cenace.gob.mx/Docs/16_MARCOREGULATORIO/Prodecen//12%202020-2034%20Cap%C3%ADitulos%201%20al%206.pdf (accessed on 12 June 2023).

- PRODESEN 2021–2035. Available online: https://www.cenace.gob.mx/Docs/16_MARCOREGULATORIO/Prodecen//14%202021-2035%20Cap%C3%ADtulos%201%20al%206.pdf (accessed on 12 June 2023).

- PRODESEN 2022–2036. Available online: https://www.cenace.gob.mx/Docs/16_MARCOREGULATORIO/Prodecen//15%202022-2036%20Cap%C3%ADtulos%207%20al%209%20y%20Anexos.pdf (accessed on 12 June 2023).

- DOF. 2020. Available online: https://www.cenace.gob.mx/Docs/16_MARCOREGULATORIO/SENyMEM/(DOF%202020-05-15%20SENER)%20Pol%C3%ADtica%20de%20Confiabilidad.pdf (accessed on 18 January 2024).

- Avila, S.; Deniau, Y.; Sorman, A.H.; McCarthy, J. (Counter)mapping renewables: Space, justice, and politics of wind and solar power in Mexico. Environ. Plan. E Nat. Space 2021, 5, 1056–1085. [Google Scholar] [CrossRef]

- Tetreault, D. Extractive Policies in Mexico Under López Obrador: Bargains for Whom? In Extractive Bargains: Natural Resources and the State-Society Nexus; Springer International Publishing: Cham, Switzerland, 2023; pp. 171–192. [Google Scholar] [CrossRef]

- Percino-Picazo, J.C.; Llamas-Terres, A.R.; Viramontes-Brown, F.A. Analysis of Restructuring the Mexican Electricity Sector to Operate in a Wholesale Energy Market. Energies 2021, 14, 3331. [Google Scholar] [CrossRef]

- INFOSEN. Available online: https://infosen.senado.gob.mx/sgsp/gaceta/64/2/2020-06-03-1/assets/documentos/PA_MORENA_Padierna_industria_electrica.pdf (accessed on 18 January 2024).

- Changes to the Electrical Sector. 2021. Available online: https://imco.org.mx/wp-content/uploads/2021/03/20210326_Los-cambios-al-sector-ele%CC%81ctrico_documento.pdf (accessed on 18 January 2024).

- DOF. 2020. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5596374&fecha=08/07/2020#gsc.tab=0 (accessed on 23 January 2024).

- Public Policy Research Center IMCO 2022a. Available online: https://imco.org.mx/wp-content/uploads/2022/09/La-energia-que-queremos_Documento.pdf (accessed on 11 July 2023).

- Energia Para el Future. 2021. Available online: https://blogs.iadb.org/energia/es/las-cifras-que-marcaron-el-ritmo-de-la-matriz-energetica-de-la-region-durante-el-covid-19/ (accessed on 11 July 2023).

- IEA. Available online: https://www.iea.org/reports/tracking-sdg7-the-energy-progress-report-2023 (accessed on 18 January 2024).

- The United Nation Correspond. Available online: https://theunitednationscorrespondent.com/global-energy-access-gap-persists-675-million-people-without-electricity-2-3-billion-people-reliant-on-harmful-cooking-fuels/ (accessed on 18 January 2024).

- Enerdata. Available online: https://datos.enerdata.net/electricidad/estadisticas-mundiales-produccion-electricidad.html/ (accessed on 23 January 2024).

- Statistical Yearbook 2023 ENERDATA. Available online: https://datos.enerdata.net/electricidad/datos-consumo-electricidad-hogar.html (accessed on 11 July 2023).

- Per Capita Carbon Dioxide (CO2) Emissions from Fossil Fuels in Mexico from 2015 to 2022. Available online: https://www.statista.com/statistics/1068457/carbon-dioxide-emissions-per-capita-mexico/ (accessed on 23 January 2024).

- Public Policy Research Center IMCO. Available online: https://imco.org.mx/prodesen-refleja-una-falta-de-compromiso-del-estado-mexicano-con-el-medio-ambiente/ (accessed on 7 July 2023).

- Mexican Institute of Competitiveness. Available online: https://imco.org.mx/wp-content/uploads/2022/06/Nota-informativa_Prodesen_22010603.pdf (accessed on 7 July 2023).

- Prodesen 2023–2037. Available online: https://imco.org.mx/el-prodesen-2023-2037-incrementa-artificialmente-las-cifras-de-generacion-de-energia-limpia-en-mexico/ (accessed on 11 July 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).