1. Introduction

The liberalization of energy markets and the promotion of sustainable energy have introduced market uncertainties, affecting stakeholders’ decision-making processes. In the energy market, stochastic models are a specific class of mathematical approaches mainly used to take into account the challenges caused by managing uncertainties naturally arising when one aims to represent energy-characterizing variables and their dynamics correctly. Unlike deterministic models, where all input parameters are assumed to be known, stochastic models incorporate uncertainty in at least one input parameter, thus providing a more realistic framework for simulating the evolution of energy production and consumption and for describing the economic behaviours of energy-related assets.

Over the years, and increasingly in recent times because of both political and climatic factors, the need to accurately predict the aforementioned dynamics has become even more pressing. This need has led scientists belonging to a heterogeneous class of disciplines, from physics to mathematics, from climatology to artificial intelligence, to the development of increasingly sophisticated and precise models. Among them, solutions based on advanced tools specific to stochastic analysis in general and the theory of Stochastic Differential Equations (SDEs), in particular, have stood out. It is worth remembering that such models are typically characterized by not having explicit solutions. This lack has made it necessary to use considerable hardware resources, typically via the wise use of parallelization techniques, with specific reference to Graphical Processing Unit (GPU) structures interacting in real-time. In order to optimize computation flows, while at the same time containing execution times in the face of specific cost constraints, the development of hybrid SDE-based and Machine Learning (ML)-based schemes has been undertaken, with specific reference to the implementation of increasingly sophisticated neural networks (NNs).

In the present paper, we address the task of reviewing those stochastic methods that have shown their effectiveness in dealing with the dynamic analysis and forecasting of energy markets. In particular, we provide a comprehensive review of current trends in electricity market modelling, traversing from SDE to NN modelling, passing through Mean Field Games (MFGs). Indeed, as the demand for cleaner and more efficient energy solutions intensifies, understanding and adapting to the intricate dynamics of the market become increasingly crucial. By evaluating the strengths and limitations of existing models, this review aims to contribute to the ongoing discourse surrounding electricity market modelling, offering a roadmap for researchers, policy makers, and industry professionals keen on harnessing the potential of stochastic approaches.

Existing energy systems boast impressive strengths, being characterized by their ability to deliver reliable and consistent power to meet the demands of a growing global population. Centralized power generation has enabled economies of scale, efficient resource utilization, and stable energy supply. However, this centralized paradigm has limitations, especially as the world grapples with the urgent need for sustainable and resilient energy solutions. One notable limitation concerns the vulnerability of centralized power grids to natural disasters, cyber attacks, and other unforeseen events. Moreover, reliance on conventional fossil fuels has led to environmental concerns, prompting a paradigm shift towards renewable energy sources. The intermittent nature of renewable resources, such as solar and wind, adds a layer of complexity to the existing system. As we transition towards a more sustainable energy landscape, challenges in ensuring reliability, flexibility, and efficiency become apparent.

The generation, transmission, and distribution triad represents the core elements of energy markets. The landscape of power generation includes traditional sources like coal and natural gas alongside an increasing reliance on renewable sources such as solar, wind, and hydropower. Modelling the stochastic nature of renewable energy generation is a formidable task, considering the variability and intermittency associated with these sources. The transmission of electricity across vast networks involves intricacies related to load balancing, congestion management, and the integration of diverse energy sources. At the distribution level, these dynamics affect the delivery of electricity to end-users.

In exploring the energy landscape, we traverse the spectrum of SDEs while focusing on stochastic partial differential equations (SPDEs) to model standard financial instruments in energy markets. The strategy of market participants can be encapsulated through various mathematical models that leverage principles from economics, game theory, and optimization. To encompass the strategic interactions among market players, recognizing that energy markets are shaped not only by random fluctuations but also by the rational decision making of numerous participants, we focus on game theory models such as MFGs. MFGs capture the strategic interactions among rational agents seeking to optimize their objectives. This could involve generators determining bidding strategies, retailers optimizing procurement, and consumers adjusting their consumption patterns in electricity markets. MFGs are one of the most widespread models used to establish the Nash equilibrium. They are particularly relevant when modelling scenarios with many interchangeable market participants, such as consumers or small-scale generators, where individual actions collectively influence the market.

Another possibility relies on ML models, such as Reinforcement Learning (RL), which are RL techniques or use predictive analytics based on neural networks for forecasting market trends, electricity prices, and demand patterns. We harness the capabilities of NNs and sophisticated tools designed for pattern recognition and prediction. By leveraging the computational prowess of NNs, we aim to uncover hidden patterns, correlations, and trends within vast and intricate datasets. NNs become invaluable allies in forecasting energy trends, enhancing our ability to make informed decisions and predictions in an ever-evolving energy ecosystem.

Other models are based on optimization algorithms such as Linear Programming (LP) and Mixed-Integer Linear Programming (MILP), which are used to model the bid generation process, considering production costs, demand, and capacity limits as problem constraints.

The paper is organized as follows:

Section 2 shows our motivation and paper identification methodology; an overview of the energy modelling market applications and methods is presented in

Section 3. In

Section 4, we review more recent SDE-based methods to model energy features; in

Section 5, we focus on the most recent SPDEs method for financial contracts. In

Section 6, we introduce the MFG paradigm with a plethora of applications in the energy sector; in

Section 7, we present some key applications of ML and optimization algorithms in the energy sector. We conclude the article with

Section 8, outlining future directions.

2. Review Scope and Motivation

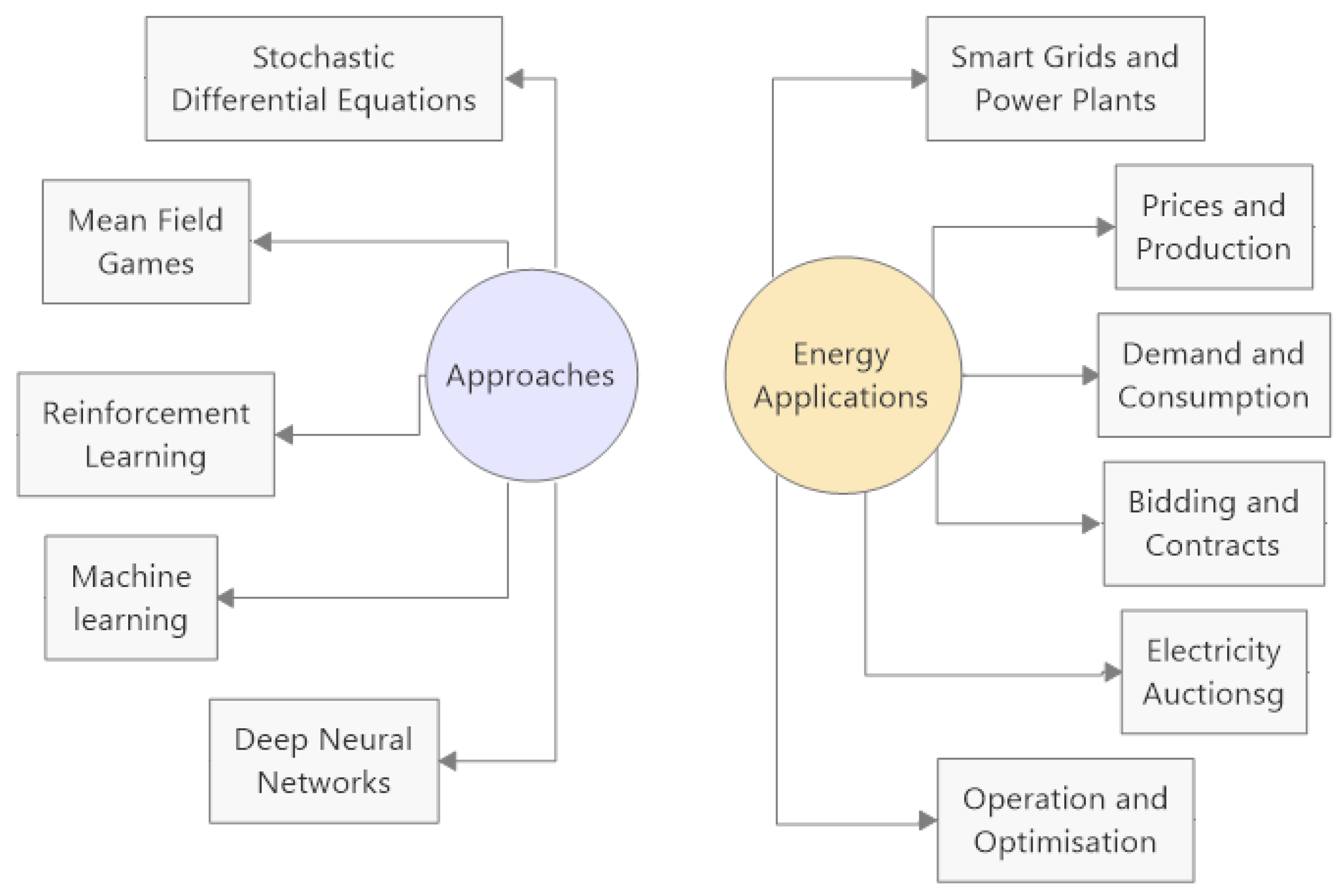

Our aim is to review the presence and application of SDEs in energy market analysis while exploring their intersection with ML and neural networks (NNs), given their increasingly central role in this domain. In particular, we encompass a wide array of applications and prominent methodologies discussed in the literature, as shown in

Figure 1. While many reviews exist, our goal is to provide a comprehensive one covering a wider perspective of energy modelling applications and approaches, providing the main concepts and theory behind them, and filling gaps left by previous analogous works. For example, in [

1,

2], the authors primarily focus on stochastic model classifications, while other works focus on specific applications or approaches [

3,

4,

5] without providing a complete analysis, or they adopt a bibliometric perspective (see, e.g., [

6]). Additionally, we explore emerging advancements, particularly in the context of AI-driven solutions, also discussing current trends and future directions within this rapidly evolving field.

As previously mentioned, our primary focus is to provide a broader perspective on the literature rather than merely citing a number of publications. Accordingly, we identify key papers across three main energy areas: SDEs, MFGs, and ML for energy. We also detail surveys covering these domains. For this review, we selected papers indexed in Scopus based on two main criteria: high impact (measured by citation count) and/or recent publication date.

3. Energy Modelling: Applications and Methods

Energy market modelling refers to the development and application of mathematical, computational, and statistical methods used to represent and analyze the dynamics of energy markets [

7]. It involves simulating interactions between key participants, such as electricity generators, consumers, regulatory bodies, etc., to forecast market outcomes like prices, demand, and system reliability. Energy market modelling involves applying techniques such as agent-based modelling, mathematical and econometric analysis, ML models, and optimization to support decision making in policy development, strategic planning, and investment in energy systems. This modelling process helps to assess the impact of various economic, technical, and regulatory factors on market stability, pricing, investment requirements, and overall efficiency [

8].

Figure 1 provides an overview of energy market applications and modelling methods, while

Table 1 reflects various energy market modelling applications along with applied methods. While the energy applications and example papers listed in

Table 1 will be discussed in detail later in this review, particularly in

Section 4,

Section 5,

Section 6 and

Section 7, this section provides a broader perspective on the reviewed methods. Our aim is to present an abstract definition of these methods, highlighting their classifications and core concepts.

3.1. Stochastic Methods

Stochastic methods are mathematical approaches used to model random processes and uncertainties, making them fundamental in analyzing the dynamic and often unpredictable nature of energy markets. By incorporating randomness and probability, these methods provide realistic insights into factors like price volatility, demand fluctuations, and supply constraints. Common stochastic methods include SDEs, geometric Brownian motion, jump-diffusion models, and mean-reverting processes. SDEs allow for modelling continuous price changes with embedded random fluctuations, while geometric Brownian motion is effective in simulating price paths that assume continuous growth combined with random shocks. Jump-diffusion models go further by accounting for sudden, significant changes, such as economic events or supply chain disruptions. Mean-reverting processes, such as the Ornstein–Uhlenbeck process, are especially useful for modelling variables that tend to oscillate around a stable long-term mean, as often observed in energy commodities like oil and gas prices.

Section 4 delves into the use of stochastic processes for energy modelling.

3.2. MFGs

Mean Field Game (MFG) models are a class of mathematical frameworks used to study the strategic interactions among a large number of agents or players in various settings, particularly in economics, finance, and game theory. The core idea behind MFGs is to model situations in which each agent’s decision making is influenced by the overall distribution of other agents’ strategies, while also taking into account their own individual state and actions. Common examples include applications in financial markets, where MFG models can simulate the behavior of numerous investors whose actions affect market prices and trends. MFG models often employ stochastic control and partial differential equations (PDEs) to define the evolution of an agent’s state over time, considering both individual incentives and overall system dynamics. In

Section 6, we review influential papers that apply MFG to energy modelling.

3.3. ML Methods

ML is a subfield of artificial intelligence (AI) mainly concerned with algorithms that aim to improve themselves through experience. The field can be rigorously classified into several main families based on the nature of the learning task and the structure of the data. Nevertheless, it is possible to individuate primary categories. The latter include supervised learning, unsupervised learning, reinforcement learning, semi-supervised learning, transfer learning, and deep learning, and each of these families encompasses a variety of methods characterized by specific mathematical frameworks. For the sake of completeness, let us quickly recall the standard definitions of the aforementioned ML main approaches.

3.3.1. Supervised Learning

Supervised learning deals with learning a function that maps inputs to outputs based on example input–output pairs. Formally, given a dataset

, where

and

, the goal is to find a function

that minimizes a loss function

. The latter can be expressed as an optimization problem:

where

is a hypothesis space of functions,

acts as a regularization term, and

controls the trade-off between the empirical loss and regularization. Typical methods belonging to supervised learning applications are those related to regression and classification tasks, e.g., in linear regression,

, and the loss function (being quite often the standard choice) can be the mean squared error:

3.3.2. Unsupervised Learning

Contrary to the supervised approach, unsupervised learning aims to find hidden structures or patterns in unlabeled data. Specifically, given data

, the objective is to model the underlying probability distribution

or to discover groupings in the data. A key problem in unsupervised learning is the clustering problem. A typical example are

k-means clustering related tasks, in which the goal is to partition the data into

k clusters by minimizing the within-cluster sum of squares:

being the centroid of cluster .

An alternative relevant method, which originally belongs to the traditional statistical field, is the principal component analysis (PCA) approach. The latter seeks a projection of the data onto a lower-dimensional space that maximizes the variance. Accordingly, the PCA tool solves the following:

subject to

, where

S is the sample covariance matrix,

, and

is the

identity matrix.

3.3.3. Reinforcement Learning

RL focuses on learning optimal policies through interactions with an environment. The problem is typically formalized as a Markov decision process (MDP), defined by the tuple

, where

is the set of states,

is the set of actions,

represents the state transition probability,

is the reward function, and

is the discount factor. It is worth mentioning that such an approach is strictly connected to one of the Markov chains. Indeed, the underlying structure of state transitions is supposed to follow the Markov property. Moreover, its functioning involves taking decisions that influence (the probability of) state transitions, hence generalizing the Markov chain approach to the one of making choices in the presence of stochastic noise. In particular, the above implies that the role played by the underlying probability filtration is limited to the present

-algebra, which practically implies that, given the present, the future does not depend on the past. Within this context, the objective is to find a policy

that maximizes the expected cumulative reward, as follows:

Typical tools in RL applications are based on value iteration and policy gradient methods. For example, in Q-learning, which is a so-called model-free RL algorithm and is also able to manage tasks characterized by stochastic transitions, the action-value function

is updated iteratively:

3.3.4. Semi-Supervised Learning

Semi-supervised learning leverages both labelled and unlabeled data. Indeed, given a small set of labelled data and a larger set of unlabeled data , the goal is to improve learning performance by exploiting the structure in .

Typically, authors apply minimization techniques based on a combined loss function:

where

is an unsupervised loss term, and

balances the contribution of the unlabeled data.

3.3.5. Transfer Learning

Transfer learning aims to transfer knowledge from a source task to a target task. Specifically, given a source domain

with task

and a target domain

with task

, the objective is to improve learning in

using information from

and

. Therefore, the task concerns finding a mapping

, such that

or adjusting the hypothesis space or regularization terms to reflect knowledge from the source domain.

3.3.6. Deep Learning

Typically seen as a subset of ML, deep learning (DL) employs neural networks with many layers to model complex patterns in data, where the (single) artificial neuron is defined by

where

is an activation function,

are weights, and

is a bias term.

DL-based networks are trained by minimizing a given loss function via optimization algorithms such as the stochastic gradient descent (SGD) one. A typical choice of gradient estimation method is the backpropagation algorithm, which computes gradients of the loss function with respect to the weights, as follows:

3.3.7. Probabilistic Models and Graphical Models

Probabilistic models represent uncertainty using probability distributions. Graphical models, such as Bayesian networks and Markov random fields, use graphs to encode dependencies among variables.

In a Bayesian network, the joint probability distribution over variables

is factorized according to the network structure:

where

denotes the parents of

in the graph. Accordingly, inferencing in this latter setting often involves computing marginal distributions or maximum a posteriori estimates. It is worth mentioning that such tasks can be rather computationally difficult, largely because of the summation over exponential numbers of states.

3.3.8. Online Learning

Online learning algorithms process data sequentially and update the model incrementally, aiming to minimize the so-called

regret representing the difference between the algorithm’s cumulative loss and that of the best-fixed predictor in hindsight. Specifically, given a sequence of loss functions

, the regret

is

3.3.9. Ensemble Methods

As the last approach we consider in this quick review of ML approaches, let us recall the family of ensemble methods defined by combining multiple models to improve predictive performance, essentially exploiting the best peculiarity of each model while aiming at closing the gap of the model

X by using the model

Y. Indeed, the general idea is to aggregate the predictions of individual models, often by averaging or voting. Therefore, from a mathematical point of view, we realise an ensemble predictor

defined by

where

are the individual models. As an example, the boosting technique formulates the ensemble as a weighted sum, then focuses on models correcting the errors of previous ones.

4. Stochastic Modelling of Electricity Prices and Production Quantities

SDEs are widely employed in modelling energy markets due to their ability to capture the inherent uncertainty and randomness in market dynamics [

57,

58]. In this section, we present prevalent trends in using SDEs for energy market modelling. These trends highlight the versatility of SDEs in accommodating the diverse and dynamic nature of energy markets, allowing researchers and practitioners to tailor models to specific characteristics and requirements.

4.1. Mean-Reverting Processes

A natural class of stochastic models widely employed to capture the dynamics of energy spot prices are Ornstein–Uhlenbeck models. These processes, characterized by mean-reverting behavior, are instrumental in modelling the tendency of energy prices to return to a long-term mean over time. Accordingly, we can recall the following SDE, which is instrumental in describing the stochastic evolution of electricity spot prices:

where

is the variable being modeled,

is the speed of reversion,

is the mean level,

is the volatility,

is a Wiener process, and

is the differential time.

Ornstein–Uhlenbeck processes often represent the baseline for modelling energy prices that exhibit mean-reverting behavior, such as natural gas or electricity spot prices. Many extensions of this model are present in the literature. For example, the work in [

11] presents a novel approach to modelling spot prices in energy markets using exponential non-Gaussian Ornstein–Uhlenbeck processes. The authors model spot prices in energy markets using an Ornstein–Uhlenbeck process driven by Levy processes instead of the classical geometric Brownian motion or mean reversion models caused by Brownian motion. This approach offers a more realistic representation of spot price dynamics, especially in capturing the large fluctuations typically observed in energy markets. Special attention is given to the normal inverse Gaussian (NIG) Levy process, which is used to model the increments in the Levy process in the spot price model. The NIG distribution is a four-parameter family of distributions and is part of the class of generalized hyperbolic distributions. This choice is motivated by the superior fit of the NIG distribution to financial log returns and its flexibility in capturing the heavy tails observed in energy market data. Moreover, the aforementioned paper discusses the pricing of derivatives in the context of energy markets, which are characterized as incomplete markets. The authors propose using the Esscher transform to derive equivalent martingale measures for evaluating forwards and options. This approach acknowledges the complexity and incompleteness of these markets, where the standard hedging approach used in other financial markets is not directly applicable. For the valuation of options, the paper calculates the characteristic function for the logarithmic spot price, which is crucial when applying numerical methods like the fast Fourier transform for option pricing. The characteristic function is derived under the probability measure modified by the market price of risk. Then, the authors investigate the condition for the exponential integrability of the Levy measure in the case of NIG-type Levy processes. It is shown that this condition is fulfilled for every

, where

are parameters of the NIG distribution. This analysis is essential for ensuring the existence of moments of the spot process, which are necessary for the valuation of forwards and options. The proposed model is more straightforward in fitting price data than alternative models described by stochastic differential equations. The normal inverse Gaussian distribution used for modelling the residuals in the Ornstein–Uhlenbeck process provides a more accurate representation of actual spot price dynamics in energy markets. Hence, the paper represents a significant advancement in the modelling of energy market spot prices by incorporating Levy processes and normal inverse Gaussian distribution, offering enhanced realism and flexibility compared to traditional models and also addressing the complexity of pricing derivatives in these markets, thus providing methodologies that are able to handle the inherent incompleteness and irregularities of energy markets.

4.2. Jump-Diffusion Models

Jump-diffusion models combine continuous diffusion processes with occasional jumps to account for sudden, discontinuous price movements. Paper [

19] addresses SDEs that feature a discontinuous drift coefficient and possibly a degenerate diffusion coefficient, which are relevant in applications like optimal control problems in energy markets. The authors prove the existence and uniqueness of robust solutions for these SDEs and examine the strong convergence order of the Euler–Maruyama (EM) scheme, achieving an optimal rate of 1/2. The SDE under consideration is a time-homogeneous jump-diffusion SDE, given by

where

,

are measurable functions,

,

is a standard Brownian motion, and

is a Poisson process on a filtered probability space that satisfies the usual conditions. The novelty in this work lies in allowing the drift coefficient

to be discontinuous at a finite number of points, a characteristic often seen in models for energy markets and financial markets in which control actions can introduce discontinuities. This contrasts with previous studies in which SDEs with discontinuous drift but without jumps have been explored extensively. In such cases, the SDE admits a unique, robust solution that is approximable with the EM scheme at a strong convergence order of 1/2 when the coefficients

are Lipschitz. Therefore, the primary contributions of the paper include the first existence and uniqueness result for jump-diffusion SDEs with discontinuous drift and the first approximation result for solutions to such SDEs. The authors employ a transform

G that ensures Lipschitz continuity, allowing the application of the Meyer–Itô formula to a transformed SDE. The transformed SDE has coefficients

which are Lipschitz, thereby ensuring the existence of a unique global strong solution. Specifically, the paper demonstrates that the original SDE (

15) has a unique global strong solution under certain assumptions.

4.3. Fractional Brownian Motion (fBm)

fBm is a generalization of standard Brownian motion that allows for long-range dependence and self-similarity. It can be used to model the price and volatility of energy prices, electricity loads, and variability in wind and solar power generation.

In [

16], the authors model power price dynamics:

is modelled as a sum of a deterministic trend of the evolution

and a stochastic process

X:

The process

is built as a superposition of two effects,

where the continuous process

models the base component; eanwhile,

corresponds to the jump process, describing the spiky behavior of the electricity prices.

follows an SDE driven by a fractional Brownian motion

,

with diffusion coefficient

, subject to mean reversion around a level zero, with strength

.

Fractional Brownian motion (fBm) with Hurst parameter

is a zero mean Gaussian process with covariance function given by

Moving from numerical simulations, the authors uncover some evidence that fBm-driven models may be more adequate for forecasting electricity prices than a standard Bm-driven model by achieving better scores for different loss functions.

A similar empirical approach for forecasting electricity price is also taken in [

13]. The aim is again to use fBm to capture the long-range dependent characteristics of the price action. Differing from [

16], where the Italian electricity price is considered, the datasets correspond to residential, commercial, and industrial monthly electricity prices for the US market. Among different methods used to estimate the Hurst exponent (variance time method, absolute value estimation method, or rescaled range (R/S) analysis method), the authors in [

13] use the R/S method to compute Hurst parameters, obtaining a reference value of

for residential use and higher values (

) for commercial and industrial uses.

4.4. Regime-Switching Models

Regime-switching models help capture structural changes in energy markets, such as shifts in supply–demand dynamics or policy changes. These models incorporate different regimes or states, each characterized by distinct parameters. The system switches between these regimes based on specific criteria.

where

is the underlying process,

are the parameters of the first regime,

are the parameters of the second regime, and

p is the switching probability.

In [

17], the authors explore the dynamics of electricity prices, mainly focusing on their volatile and jump-prone nature, contributing a novel regime jump model to better represent the dynamics of electricity prices, particularly addressing the need for a model that can separately identify mean reversion and jump behaviors. This approach provides a more accurate and nuanced understanding of electricity price movements, which are essential for effective risk management and financial modelling in electricity markets. It is worth mentioning that since electricity prices are known for their high volatility and frequent jumps attributed to factors like system breakdowns, demand shocks, and inelastic supply, such volatility is a key challenge in deregulated electricity markets, impacting pricing and portfolio and risk management. Consequently, the authors focus on modelling electricity price jumps, which are typically short-lived, with prices reverting to normal levels quickly, often within a day. Traditional stochastic jump models combined with mean-reversion are used to model these jumps. However, these models might fail to separate mean-reversion from jump behavior accurately. The basic model used is a standard random walk model with a drift parameter for the log of the daily electricity price. The model is expressed as

, where

and

represent the drift and volatility of the spot price, and

is a normally distributed error term. Then, to address the shortcomings of the stochastic jump models, the paper introduces a regime jump model. This model identifies three states: a normal state, an initial jump state, and a state representing the reversion to normal levels after a jump. The regime jump model is defined as

, where

is a latent variable indicating the regime, and

and

are the mean and variance for each regime. In contrast, the regime transitions are modelled using a Markov transition matrix, which specifies the probabilities of transitioning from one state to another. The model assumes that after a price jump, the process will move sequentially from the initial jump state to the reversion state and back to the normal state. Moreover, the authors applied the model to electricity price data from various markets. The volatility of electricity prices is significantly higher than that of other energy commodities like oil and natural gas. This high volatility emphasizes the need for a model, like a regime-jump one, to capture the dynamics of electricity prices accurately.

4.5. Hybrid Models

These models combine multiple SDE models or integrate SDEs with other modelling techniques to enhance predictive accuracy. Hybrid models offer a more flexible and adaptive approach, leveraging the strengths of different modelling paradigms to capture various aspects of energy market dynamics.

Ref. [

15] introduces an ambit stochastic model to study and predict electricity forward prices, focusing on the European Energy Exchange (EEX) market. The authors use ambit stochastic processes and fields to model electricity price dynamics, which are atypical price patterns such as large spikes, short-term volatility, and occasionally negative prices. Ambit processes were initially developed for studying turbulence, but due to their flexible structure, they are implemented in various areas, including finance, to model dynamic processes. Unlike other commodities, electricity cannot be traditionally stored and must be delivered to the grid immediately upon production. These unique characteristics make it crucial to develop ad hoc techniques for electricity trading, which the paper addresses. Ambit processes in the model can encapsulate unique market behaviors, such as leptokurtic return distributions, stochastic volatility, leverage effects, and the Samuelson effect, where the forward price volatility increases and converges to spot price volatility as the contract’s maturity approaches. The model is claimed to efficiently forecast the price of German monthly peak forward contracts under the conditions of the EEX market by correctly specifying ambit fields and processes that reflect observed market characteristics.

Another clear example of this approach is contained in [

18], which presents a comprehensive and innovative method for characterizing and utilizing energy flexibility in systems such as water towers and buildings. Overall, the paper makes significant contributions to the field of energy flexibility by providing a robust and generalizable model that integrates stochastic modelling, economic considerations, and practical applications in energy markets. As demonstrated in the paper, characterizing and utilizing energy flexibility effectively are crucial for optimizing renewable energy resources and achieving operational and economic efficiencies in energy systems. Interestingly, the research develops a generic model for characterizing energy flexibility, incorporating stochastic differential equations and state-space models. This model is vital for understanding and optimizing the operational response of energy-flexible consumers, especially in the context of increasing renewable energy sources and the need for

reduced emissions. Indeed, the model includes variables such as state of charge, baseline demand, energy price, and demand change, all normalized between 0 and 1 for simplicity, to then consider the following:

- -

State Equation: this element represents the state of charge of the energy-flexible system, with 0 indicating no stored energy and 1 indicating maximum stored energy.

- -

Demand Link to State of Charge and Price: This part of the model uses assumptions such as high prices reducing demand and vice versa and stored energy affecting demand. Non-linear functions derived from data, denoted f and g, are used to model the effects of state of charge and energy price, respectively.

- -

Demand and Observation Equation: This equation calculates the expected demand after modifying the baseline demand, with a parameter indicating the proportion of flexible overall demand. Then, the model is applied to case studies involving three water towers and the electrical heating requirements of a household, an office building, and a commercial building. These studies demonstrate the practical application and validity of the proposed model in real-world settings. Moreover, the authors also utilize energy flexibility on the day-ahead market of the Scandinavian power market Nord Pool. This involves using flexi orders to buy electricity at the cheapest price within a certain interval. This strategy aligns with the flexibility characteristics of the systems studied.

- -

Designing Price Signals for Control: The model also addresses the challenge of designing price signals to control the consumption of water towers and buildings according to the amount of energy bought. This involves solving an inverse problem to find a price signal that results in an expected demand close to the reference demand.

5. Stochastic Partial Differential Equations for Energy Contracts

Through a systematic review of the literature and notable research contributions, this chapter aims to elucidate the advancements made in the field of stochastic modelling for energy contracts. We will discuss critical methodologies, numerical techniques, and case studies that showcase the practical utility of SPDEs in addressing the challenges posed by the dynamic nature of energy markets.

As energy markets mature, the role of energy as a vital asset class for investments has grown exponentially. Diverse participants join traditional market actors, including speculators such as investment banks, hedge funds, and pension funds. Within these markets, the primary financial instruments are spots, futures, forward contracts, and options written on these contracts. The advent of organized markets necessitates the development of consistent stochastic models to describe the price evolution of these products, enabling analytical treatment for pricing derivatives.

Traditionally, electricity is usually labelled a “commodity”, although its non-storability profoundly affects the infrastructure and the organization of the electricity market.Financial power contracts are linked to some reference electricity spot prices whose market is open to speculators, since consumption or production of electricity is not required to participate in the market.

Energy-related spot prices exhibit distinct characteristics that set them apart from other commodities with a notable mean reversion towards a prominent feature, which is mean reversion towards a seasonally varying mean level, reflecting the cyclical nature of energy demand and supply. Additionally, energy markets often experience sharp, short-term price spikes resulting from imbalances between supply and demand. For instance, electricity spot prices can surge several hundred percent over brief intervals before returning to normal levels. As explained in

Section 4, Ornstein–Uhlenbeck processes are a type of mean-reverting SDE that can be used to incorporate a tendency for prices to revert to a long-term mean over time, reflecting the cyclical nature of energy markets.

In contrast to more classical commodity markets like agriculture and metals, energy-related futures contracts deliver the underlying spot price over a contracted period. Deriving futures prices from spot prices introduces complexities, relying on the choice of risk-neutral probability and the type of model employed. Technical challenges arise when calculating futures prices based on exponential spot models with a delivery period. However, arithmetic models are more feasible for analytical pricing in this context. The Heath–Jarrow–Morton approach suggests direct modelling of futures prices, but challenges persist in proposing arbitrage-free models that are simultaneously tractable from statistical and theoretical perspectives.

In [

26], the authors introduce a novel approach to valuing swing options in electricity markets, particularly addressing the incorporation of price spikes, by developing sophisticated mathematical models and numerical methods for pricing swing options in electricity markets, especially considering their stochastic nature and jumps in electricity prices. In particular, the paper considers the valuation of swing options, which are path-dependent financial products with multiple exercise rights. These options are unique due to the incorporation of spikes in the underlying electricity price, modelled as jump-diffusion processes. This approach is significant because it realistically captures the volatile nature of market electricity prices. The valuation of these swing options leads to a sequence of free boundary problems associated with a partial integral differential equation (PIDE). The PIDE is formulated as follows:

Moreover, the paper models swing options in electricity markets as financial products with multiple exercises of the American type, with two consecutive exercise dates separated by a constant refracting period . This period prevents the simultaneous exercising of all rights, which would otherwise be optimal. Accordingly, to solve the PIDEs, the authors propose a Crank–Nicolson characteristics time discretization scheme combined with a piecewise quadratic Lagrange finite element method. They explicitly treat the integral term in the PIDE with a suitable quadrature formula and address inequality constraints with an augmented Lagrangian active set technique. The paper details the discretization of the time derivative in the PIDE and the approximation of the integral term, which arises due to the presence of jumps in the electricity price. This approximation is achieved using the classical composite trapezoidal rule with a specific numerical integration procedure, and numerical results are then presented to validate the performance of these methods. It compares these results with examples from the existing literature, noting that this is the first paper to consider the numerical solution of the PIDE associated with a two-factor model for electricity prices.

Paper [

27] presents a comprehensive approach to hedging electricity swaptions using a Hilbert space-valued exponential jump-diffusion model, addressing the challenges of hedging in a market with inherent incompleteness due to the infinite-dimensional nature of the forward curve and a finite set of hedging instruments, primarily via its formulation and solution of the quadratic hedging problem under a risk-neutral measure. More specifically, it focuses on solving the quadratic hedging problem for European options on electricity swaps, known as electricity swaptions. In particular, the paper employs a Hilbert space-valued time-inhomogeneous exponential jump-diffusion process to model the forward curve, capturing the stylized features observed in electricity prices, such as the Samuelson effect of increasing volatilities near maturity, also introducing a general class of Hilbert space-valued exponential jump-diffusion models for this purpose. From a mathematical point of view, the forward curves are defined on a delivery period and are elements of a separable Hilbert space

, with

being the Lebesgue measure on the delivery period. The norm for each element in

H is defined in terms of an integral over the delivery period, where the primary stochastic process driving the model is an

H-valued additive process

, incorporating a drift term

, a volatility term

driven by a Wiener process, and a jump term

caused by a compensated random measure. Accordingly, the Hilbert space martingales are defined in the context of the forward curve

as an exponential of the driving process

X. The paper provides a solution to the quadratic hedging problem for European electricity swaptions within the latter scenario. This involves hedging an option that depends on an infinite-dimensional object (the forward curve) using a limited set of traded contracts (swaps with different delivery periods). In particular, the quadratic hedging minimizes the expected global quadratic hedging error, formulated as

where

is the portfolio value at time

T under strategy

. Moreover, the paper discusses the stochastic dynamics of swap rates. It derives the PIDE for the swaption price, which is crucial for determining an optimal hedging strategy, considering a portfolio of

n swap contracts. The value of this portfolio at time

t is a critical component of the hedging strategy, with an associated quadratic hedging error with a given strategy

, which is expressed as an integral involving a matrix-valued process

M, which represents the sensitivity of the traded swaps to changes in the stochastic processes driving the model.

Another example of SPDE application is contained in [

25], which introduces an infinite-dimensional approach to modelling forward price curves. In particular, the authors present a novel infinite-dimensional forward price dynamics model similar to the Heath–Jarrow–Morton framework in interest rate modelling, utilizing a first-order hyperbolic stochastic partial differential equation model for the dynamics of forward price curves. Accordingly, the approach is then applied under the risk-neutral measure and follows the Musiela parametrization, where time-to-maturity is a crucial parameter in the model. The forward price

at time

t for a contract with maturity

T is expressed as

, ensuring that

is a martingale for every maturity

T. Both additive and multiplicative models for forward price dynamics are explored, and the choice between these models depends on whether to model the dynamics of

g directly or its logarithm. Previous studies have justified alternative models for energy markets, leading to additive dynamics for forward and flow-forward price dynamics. Meanwhile, for the multiplicative model, the dynamics are assumed to follow

, and the forward price dynamics are based on a general infinite-dimensional stochastic process

, which can accommodate both additive and multiplicative models. Moreover, as a simple case, the paper considers a real-valued noise process

, where

W is a Brownian motion. The dynamics of

are then given by

Consequently, the obtained methods are particularly relevant for energy markets due to the complexity and specific characteristics of these markets, such as the delivery period of electricity forward contracts and the high-dimensional nature of noise sources affecting forward curves.

Alongside the SPDE method, another type of reference for the financial framework relies on [

28]. Risk management for energy retailers is addressed in the context of fluctuating wholesale electricity prices exploiting energy derivatives, particularly considering energy retailers who may risk bankruptcy due to price fluctuations in wholesale electricity. To mitigate this risk, the authors suggest trading in energy derivatives, specifically electricity options, carbon options, and green certificates. Accordingly, the main objective is to develop a strategy that maximizes the value of energy derivatives while minimizing risks arising from stochastic price fluctuations. To this end, the paper models the dynamic prices of electricity and carbon options using SDEs and the prices of green certificates using ordinary differential equations (ODEs). The problem of allocating initial funds to purchase each derivative, considering price volatility optimally, is formulated as a mean-variance portfolio selection problem in control theory, and the objective function is formulated to minimize the expected value of the portfolio minus a term that represents risk, given by the variance of the portfolio. The function is expressed as

The optimization problem is then transformed into an auxiliary problem to facilitate the application of the linear–quadratic (LQ) control method. In particular, the latter is stated as subject to the original constraints. Then, this transformed problem is solved using an LQ control approach. The solution involves solving a Riccati differential equation and obtaining the optimal control function that minimizes the objective function under the given constraints.

6. Bidding and Operation Strategy of the Market Participants

In the intricate landscape of electricity market modelling, a vital component of the model concerns the strategic behavior of market participants. The bidding and operational strategies employed by these participants play a pivotal role in shaping the dynamic equilibrium of the market.

6.1. MFG Applications in Electricity Markets

Mean Field Game (MFG) models provide a stylized quantitative representation of a power system featuring distributed local energy generation and storage. The model considers N nodes within the power grid, each characterized by state variables (e.g., local power production) and action variables (e.g., storage action). The nodes can also be partitioned into distinct groups where nodes within the same group share similar characteristics based on local net power production and storage or geographic proximity.

MFGs can be applied to model bidding strategies, production decisions, and price dynamics in electricity markets. MFG frameworks can incorporate learning dynamics, allowing agents to adapt their strategies over time based on the observed behavior of others, capturing the adaptive nature of market participants as they respond to changing market conditions.

In what follows, we shall consider some of the main MFG models typically employed in the electricity market modelling sector.

Supply and Demand Dynamics: MFGs can be applied to model the strategic behavior of electricity market participants, such as generators and consumers, in response to changing market conditions. Agents aim to optimize their production or consumption decisions based on the average behavior of the entire market. For example, in [

30], the authors characterize the state variable of each agent by the time evolution of its temperature, described with a linear ordinary differential equation. In addition, each agent is given a cost function that accounts for energy consumption and deviation of the agent’s temperature from the reference value. At the mean-field equilibrium, each agent adopts a bang-bang-like switching control with a threshold placed at the nominal temperature of deviation.

Strategic Bidding: Generators participate in auctions by strategically bidding to maximize profits. MFGs can capture the bidding strategies of multiple generators, considering the impact of their decisions on market prices and the behavior of other participants. In [

35], an electric power network with congestion is studied; energy consumers can strategically increase their bids on the day-ahead market in anticipation of payouts from the dispatch market to maximize individual welfare on the day-ahead market in anticipation of the dispatch market. This increase–decrease game for large populations of energy consumers is solved via a mean field game approach by proving the existence and uniqueness of the Nash equilibrium and the convergence of the proposed algorithm based on a Picard–Banach iteration scheme.

Market Price Formation: This refers to the formation of market prices over time. Agents strategically adjust their bidding or consumption patterns based on the observed market prices, and the model captures the resulting feedback loop. For example, in [

34], the solution of the MFG describes the market-clearing equilibrium for an electricity grid connecting consumers to energy producers. Moreover, a uniqueness condition is investigated, allowing numerical methods to be developed.

Renewable Energy Integration: With the increasing penetration of renewable energy sources, MFGs can help to model the strategic interactions among conventional and renewable energy producers. This includes decisions on production levels, pricing strategies, and integrating intermittent renewable resources. In [

36], the authors assess the evolution of future electricity markets under different incentive schemes by developing a proper MFG model with two classes of agents: renewable producers (e.g., wind), who generate electricity with a stochastic capacity factor at zero marginal cost, and conventional (gas) producers with a fixed capacity but a random running cost (depending in particular on the fuel cost and the

emission cost). Renewable producers aim to determine the optimal moment to enter the market by paying a sunk cost. In contrast, fossil fuel producers aim to determine the optimal moment to exit the market. This model is studied under different incentive schemes to understand the effect of these policy decisions on the entry and exit of the market players and the evolution of renewable penetration and electricity prices. A similar problem is also investigated in [

40]. Instead of considering an exit/entry game, the impact of the green transition in the presence of a carbon tax is studied according to two different models: an MFG with competitive producers reaching a Nash equilibrium and a mean field control (MFC) game where players cooperate to reach a social optimum. The authors show the existence and uniqueness of the solutions for both settings. Using a numerical scheme, they also propose a numerical approach based on a forward–backward stochastic differential equation (FBSDE) system in order to monitor the effect of a carbon tax on optimal and equilibrium decisions in both cases, arriving at quantifying the difference between the two approaches, i.e., the so-called Price of Anarchy.

Demand Response Modeling: MFGs can be used to model demand response programs where consumers adjust their electricity consumption patterns in response to market signals. The interactions among consumers in deciding when to shift their demand have been investigated, for example, in [

29], from the perspective of

n consumers linked by a demand-side management contract. The failure to deliver the service is penalized depending on the difference between the sum of the

n power consumption and the established target. This scenario is modelled as a non-zero-sum stochastic game whose asymptotic behavior corresponds to an MFG with penalties at random jump time and interaction on the control. The authors investigate the case with quadratic cost and linear pricing, whose mean field equilibrium is characterized by a decoupled system of forward–backward SDEs with jumps, involving a Riccati BSDE with jumps.

Transmission System Operations: MFGs can be applied to model the strategic behavior of transmission system operators in managing and optimizing the electricity grid for congestion management, reactive power control, and voltage regulation. In [

59], a quantitative model for a power system with distributed local energy generation is developed. The smart grid is modelled as a network connecting many nodes with their consumption, production, and storage. Following the MFG approach, each node is characterized by two state variables, local net production

and a battery level

, and a control variable

, which is the storage action. If

is positive or negative, it corresponds to electricity that the node sells to. Buys from the grid at the spot price. Nodes are divided into different groups in which each node may represent another agent type, being traditional consumers with no local production (

) or prosumers with local production and storage. Each node minimizes its own cost of electricity consumption by controlling the storage device where the spot price of electricity reflects the instantaneous global consumption, depending on the strategies of the nodes. Hence, the solution for this problem corresponds to Nash equilibria in a non-cooperative game setting.

6.2. Stochastic Algorithm for the Transition to Decentralization in Smart Grids and Power Plants

Until the late 1990s, the power system operated under a centralized and vertically integrated model, where massive utilities assumed the three significant services of generation, transmission, and distribution. However, critical changes have occurred, paving the way for a new scheme characterized by small-scale distributed generation and storage. This transition, prompted by technological innovation and environmental concerns, has caused the substantial integration of intermittent renewable energy sources. The rapid deployment of decentralized small-scale power generation aligns with advancements in local storage technologies, necessitating a thorough re-engineering of distribution networks, including tariff structures.

We divide this section according to different use cases and technologies.

6.2.1. Micro Grids (MGs)

Paper [

47] focuses on developing an optimal bidding strategy for MGs participating in energy and ancillary service markets. It introduces a novel approach through which MGs can participate in joint energy and ancillary service markets, especially considering flexible ramping products. The hybrid stochastic/robust optimization method and the detailed formulation of the objective function enable MGs to bid strategically in these markets, maximizing their revenues while managing the uncertainties inherent in renewable energy sources and market prices. Microgrids can integrate various distributed energy resources to offer energy and ancillary services to the bulk power system, including flexible ramping products. The paper then develops an optimal bidding strategy in order for MGs to assess their ramping capabilities in these markets. In particular, the authors consider a hybrid approach combining stochastic and robust optimization to address uncertainties in renewable generation and day-ahead market prices. Stochastic programming models the price scenarios in energy markets, while complete optimization addresses uncertainties in wind and photovoltaic power generation. Consequently, the MG’s bidding strategy aims to maximize total revenue expressed by the following objective:

Here, and represent the sets of decision and random variables; is the weight of price scenario s; , , and are the revenues from energy, reserve, and FRP markets, respectively; and is the operation cost. Specific equations determine the associated revenues from the energy and reserve markets, while revenues from FRPs are composed of upward and downward FRPs.

A similar approach for MG is also proposed by [

37]. That paper presents a cooperative market mechanism for multi-micro grids (MMGs). This model is designed to work for both grid-connected and isolated MMGs and accommodates various MG owners. It uses a cooperative approach to ensure the existence of the optimal solution, a feature not guaranteed by Nash equilibrium points in competitive strategies. The model considers various energy production units, including renewable resources (photovoltaic and wind), dispatchable energy resources, energy storage systems (ESSs), and a demand response program. The model is formulated as an MILP problem and solved using GAMS software (

https://www.gams.com/, accessed on 25 November 2024).

The terminology used in the paper includes various indices and parameters, such as the number of dispatchable units, renewable units, energy storage units, loads, MGs, purchase bid blocks, and sell bid blocks, among others. Accordingly, the objective is to minimize the operation costs of each MG, considering sell/buy bids based on economic aspects. The operation costs include dispatchable generators (DGs), renewable sources, flexible loads, curtailment, and critical load curtailment. The proposed model consists of the relationship between wind speed and the output power of wind turbines. The power output is directly proportional to the wind speed within certain intervals and drops to zero outside these intervals. Moreover, the output of the PV module is modelled as dependent on solar irradiance and ambient temperature, changing with each hour and scenario, and the market is cleared based on maximizing a function involving the number of microgrids, the number of purchase bid blocks, and the number of sell bid blocks for all time slots and scenarios.

6.2.2. Electric Vehicles (EVs)

Paper [

50] presents a novel stochastic optimization model for EV aggregators in day-ahead energy and ancillary service markets, especially considering the variability of wind energy. This model incorporates several uncertainties, including forecast errors of EV fleet characteristics, hourly loads, wind energy, and random outages of generating units and transmission lines. These uncertainties are represented by Monte Carlo simulation (MCS) scenarios. The authors use the conditional value-at-risk (CVaR) index to measure the risks that EV aggregators face due to these uncertainties, and the optimal bidding strategy of EV aggregators is formulated as a mathematical programming with equilibrium constraints (MPEC). In this formulation, the upper-level problem maximizes the aggregator’s CVaR, while the lower-level problem minimizes the system operation cost. Then, the bi-level MPEC problem is transformed into a single-level MILP problem. This transformation is achieved using the prime-dual formulation with linearized constraints, making the problem more tractable for computational purposes. After solving the resulting single-level MILP problem, the paper utilizes the PHA, a method known for its effectiveness in dealing with stochastic programming problems. Moreover, a game theoretical framework is developed in order to analyze the competition among EV aggregators. This approach adds a strategic layer to the model, considering the interactions and competitive behaviors of multiple aggregators in the market. The latter solutions are then validated through numerical studies on a modified six-bus system and the IEEE 118-bus system. The results demonstrate the effectiveness of the proposed approach and highlight the significant impact of the aggregator’s bidding strategies on the operation of stochastic electricity markets.

An interconnection between EVs and MGs is also studied in [

60], which focuses on developing a stochastic energy management algorithm for smart MGs for EVs. This algorithm addresses the complexities arising from the high integration of intermittent renewable energy resources like wind turbines (WTs) and photovoltaic (PV) units, especially when these MGs participate in an electricity market. The presented approach contributes to integrating multiple components and their uncertainties, applying game theory to model the market clearing price (MCP) and using advanced optimization techniques to minimize total cost while considering the interactions between MGs and the electricity market. The integration of intermittent renewable energy resources and the consideration of operational and reliability constraints in the proposed algorithm highlight the complexity and novelty of the study. From a stochastic analysis point of view, the authors consider distribution network operators (DNOs) and EVs. Indeed, the generated power of renewable energy resources and the consumed power of EVs are modelled, and their uncertainties are addressed using the Copula method. This approach allows for a comprehensive understanding of the variabilities and interdependencies in the output. The paper employs quantum particle swarm optimization to solve the objective function, aiming to find the optimal size of the components in the MGs and optimizing all microgrids to find the minimum total cost according to the corresponding objective function. The MGs then announce the power bids to the DNO, and the MCP is calculated. The process continues until Cournot equilibrium is achieved.

6.2.3. Virtual Power Plants (VPPs)

In [

38], the authors present a novel approach to optimizing the offering strategy of a VPP, integrating both stochastic and robust optimization techniques to handle uncertainties in market prices and wind power production, hence providing a sound approach to managing the complex and uncertain environment of energy markets, particularly for entities like VPPs that combine various energy resources and participate in multiple market segments. In particular, VPPs include a conventional power plant (CPP), a wind power (WP) unit, a storage facility, and a flexible load, and they participate in day-ahead (DA) and real-time (RT) markets as a single entity, aiming to optimize energy resources. The goal is to determine the optimal offering strategy of the VPP in the DA market, considering its participation in the RT market to balance power deviations. To achieve the latter goal, the paper proposes a stochastic adaptive robust optimization model, which is stochastic concerning market prices, using scenarios to represent their uncertainties. It is adaptive and robust concerning WP production, using confidence bounds to manage this uncertainty. The offering strategy problem for the VPP in the DA market is formulated as an MILP model. The model maximizes the following function:

where

and

are the DA and RT market prices,

and

are the powers sold in these markets, and

is the time step.

A similar perspective is also followed by [

49] for VVP. Their paper presents a multi-stage stochastic programming approach to optimizing the bidding strategy of a VPP operating in the Spanish electricity market. The VPP manages electricity produced in wind parks, participating in the day-ahead market and six staggered auction-based intraday markets. The novelty of this paper lies in its comprehensive treatment of uncertainty, both in electricity prices and wind energy production, and its application of a Markov decision process (MDP), which is solved using a variant of the stochastic dual dynamic programming algorithm. This approach is novel in integrating bidding on both the day-ahead and all intraday markets within a unified model, considering the dependency of decisions across these markets and the flow of information throughout the trading period. The model assumes that the VPP does not own dispatchable assets like storage plants, focusing instead on marketing the intermittent production of the wind power plants it manages. This decision is based on the limited storage capacity relative to intermittent production assets, the typical non-ownership of assets by VPPs, and the expectation that market participants will specialize in providing flexibility for balancing intermittent production. The model considers a daily independent stochastic optimization problem, allowing for speculative trading and statistical arbitrage between markets. The decision problem is formulated as a finite horizon discrete-time MDP, partitioning the state-space into an environmental state representing exogenous randomness (like spot prices and wind farm production forecasts) and a resource state reflecting the current trading position and bids for the next market. The model incorporates trading decisions that are made without knowledge of the market prices when bidding. The immediate reward in each stage is calculated based on the bids from the previous stage, and the resource state is used to evaluate quick profit and track the overall net position. Furthermore, the paper introduces the modelling of risk preferences through nested CVaR, a time-consistent extension of conventional CVaR that is suitable for dynamic settings. This approach replaces the model’s expectation operator, facilitating the inclusion of risk aversion in decision making. The nested CVaR is defined as a convex combination of expectation and CVaR, recursively integrating these combinations through the stages of the model. This method allows for solving the nested CVaR problem by considering worst-case expectations over specific probability measures.

One alternative possibility relies on blockchain-based methods for distributed power networks. A blockchain is a decentralized ledger that records sequences of real-time transactions, representing asset ownership at a particular time

t. Blockchains are often used as platforms for exchanging goods and services, maintained by a set of nodes in a decentralized network, with no reliance on a trusted central authority. In [

42], the possibility of implementing distributed power networks on the blockchain is investigated. Based on forecasted demand generated from the blockchain, each producer determines its production quantity, which is related to mismatch cost controlled by an auction mechanism with the prosumers on the blockchain. The consistent relationship between demand and supply provides a fixed-point system whose solution is a mean field-type equilibrium.

7. ML for Energy Modeling

The advent of new developments in ML applications in the energy marketing sector has sparked a wave of innovation, enabling a more sophisticated and data-driven understanding of energy market dynamics. The energy sector has traditionally grappled with forecasting, risk management, and decision-making complexities in a volatile environment. Artificial intelligence approaches, including supervised and unsupervised ML, neural networks, reinforcement learning, and adversarial generative models, have effectively expanded the horizons of possibilities in addressing challenges within the realm of energy marketing.

Artificial intelligence models have been extensively applied to resolve diverse energy marketing challenges. These applications span a broad spectrum, encompassing tasks such as forecasting energy demand and supply, predicting prices and understanding market dynamics, managing loads and implementing demand response strategies, integrating renewable energy sources, optimizing energy efficiency and consumption, overseeing asset management and predictive maintenance, and enhancing grid optimization and control mechanisms. Detailed reviews of ML models applied to different areas within the energy market can be found in [

61,

62] with a literature review and statistical analysis of the number of ML-based research works published.

This section reviews ML methodologies applied to different application areas within the energy market, as summarized in

Table 2.

7.1. Reinforcement Learning

Reinforcement learning [

82,

83] is a learning paradigm that maps situations to actions in order to maximize a numerical reward signal through repeated experience gained by interacting with the environment. The agent aims to develop a strategy that maximizes the expected cumulative reward over time by learning a policy that maps states to actions. The most common algorithms for RL include Q-learning, deep Q-networks (DQN), and policy gradient methods, such as REINFORCE and proximal policy optimization (PPO).

In a recent survey paper, [

84], the authors review model-free RL algorithms with an infinite horizon and discounted reward, focusing on some classical value-based and policy-based methods.

RL approaches to boosting market participants’ performance and the general effectiveness of power auctions have gained popularity in recent years. We will explore their main issues and techniques while summarizing the state of the art in RL for electricity auctions.

7.1.1. Model-Free Algorithms: Value-Based vs. Policy-Based Approaches

Model-free algorithms do not require knowledge about the underlying model and instead focus on directly optimizing the policy or other value parameters in a goal-oriented approach. They can be further divided into two categories: value-based approaches and policy-based approaches. Value-based methods aim to find accurate estimates of the state and/or state–action pair value functions and . One example of this approach is the well-known Q-learning algorithm. On the other hand, policy-based methods do not require estimating the value function. Instead, they use a parameterized policy representing a probability distribution of actions over states, with as a neural network. The policy is directly optimized by defining an objective function and using gradient ascent to reach an optimal point. An example of a policy-based method is the actor–critic algorithm.

Two networks are trained in the family of algorithms known as actor–critic. The critic evaluates the effectiveness of the action taken, i.e., it approximates the value function, whereas the actor approximates the policy and chooses which action to take.

7.1.2. Methodologies for RL in Electricity Auctions

In recent years, there has been increasing interest in applying reinforcement learning techniques to modelling day-ahead electricity markets, aiming to develop more accurate and effective strategies for market participants. In [

22], the authors model the electricity auction market using a

Q-learning algorithm, considering each supplier bidding strategy as a Markov decision problem where the agents learn, using experience, an optimal bidding strategy in order to maximize payoff. Although there are certain limits in application for actual case scenarios due to the use of simple synthetic datasets and Q-tables with discrete action–state pairings, this work still serves as a reference point.

This section presents a selection of RL methodologies applied to electricity auctions, along with their key contributions and limitations.

Q-learning is a popular model-free RL algorithm for learning optimal action–value functions in discrete state and action spaces [

85]. In a discrete Q-learning setting, we utilize a Q-table, which is a simple data structure that we use to keep track of the states, actions, and their expected rewards; the Q-table maps a state–action pair to a Q-value that represents the quality (hence the estimated optimal future value) of the selected action given a particular space that the agent will learn. At the start of the Q-learning algorithm, the Q-table is initialized to all zeros, indicating that the agent does not know anything about the world. This method relies on a trial-and-error procedure to learn each state–action pair’s expected reward and to update the Q-table with the new Q-value; this is called

exploration. Conversely, explicitly choosing the best-known action at a state is called

exploitation. Q-learning has been used in electricity auctions to learn bidding strategies for market participants, such as generators and retailers [

67]. However, the discrete nature of Q-learning can limit its applicability to auctions with large or continuous state and action spaces.

Deep Q-networks (DQN) extend Q-learning by using deep neural networks (NNs) to approximate the action–value function, enabling RL in large or continuous state spaces [

66]. DQN has been applied to electricity auctions for learning optimal bidding strategies in various market settings, such as day-ahead markets and real-time markets [

86]. However, DQN still assumes discrete action spaces and can be computationally expensive due to the use of deep neural networks. The idea is to exploit a neural network mapping states to (action, Q-value) pairs to approximate the state–action value function. The success of deep RL is based on the following features. The first introduces an experience replay mechanism in which every experience tuple

, composed of state transition, action selected, and reward received, is stored in a dataset and then randomly batched, avoiding the correlation between consecutive iterations. The second feature concerns the use of two NNs with the same architecture but different weights in the learning process. The first NN aims to approximate Q, the Q-network. Conversely, for every

n steps, the parameters from the leading network are copied to the target network that uses the following training loss function, defined as

with

and

being the parameters of the target network and the Q-network at iteration

i, respectively.

Policy gradient methods have been extended to use deep NNs, keeping the advantage of allowing for policies in the continuous action space. Policy gradient methods, such as REINFORCE and proximal policy optimization (PPO), directly optimize the policy by estimating the gradient of the expected cumulative reward [

69,

71]. These methods can handle continuous state and action spaces, making them suitable for electricity auctions with complex market dynamics. Applications of policy gradient methods in electricity auctions include learning optimal bidding strategies for generators and demand response aggregators [

87]. One limitation of policy gradient methods is that they may require many samples for stable learning.

Electricity auctions involve multiple agents with different objectives and learning dynamics, making them a natural fit for Multi-Agent Reinforcement Learning (MARL) approaches [

88]. MARL algorithms, such as independent Q-learning, multi-agent deep deterministic policy gradient (MADDPG), and centralized critics with decentralized actors (CCDAs), have been applied to learn coordinated bidding strategies for electricity auctions [

72]. Although MARL can capture complex agent interactions, it may suffer from scalability issues and instabilities in the learning process.

Actor–critic methods combine the advantages of policy gradient methods and value function approximation to improve the learning process [

89]. The actor is responsible for generating actions based on the current policy, while the critic learns to evaluate the policy by estimating the value function. In electricity auctions, actor–critic methods have been used to learn bidding strategies and demand response management, offering a balance between exploration and exploitation [

64].

Deep deterministic policy gradient (DDPG) is an off-policy algorithm that extends the idea of the actor–critic method to continuous action spaces [

65]. DDPG uses a deep neural network to approximate the policy and another deep neural network to approximate the value function. In the context of electricity auctions, DDPG has been applied to learn optimal bidding strategies for generators and energy storage systems in day-ahead markets and real-time markets [

73].

Monte Carlo tree search (MCTS) is a tree search algorithm that uses Monte Carlo simulations to estimate the expected value of actions in a given state [

90]. MCTS has been applied to electricity auctions to handle complex decision-making problems with large state spaces and uncertainty. For example, MCTS has been used to optimize bidding strategies in multi-stage electricity auctions, considering the uncertainty in future market conditions [

63].

Inverse reinforcement learning (IRL) aims to learn the underlying reward function of an expert agent by observing its behavior [

68]. In electricity auctions, IRL has been used to model the bidding behavior of market participants, allowing for the analysis of strategic interactions and the development of counter-strategies [

70]. By learning the reward function of other market participants, IRL can provide insights into their objectives and decision-making processes.

7.2. Supervised ML

Supervised learning techniques have been widely employed in energy market modelling, utilizing various algorithms such as support vector models (SVMs), Gaussian processes (GPs), gradient boosting decision trees (GBDTs), decision trees (DTs), and linear regression (LR) models.

Ref. [