1. Introduction

The growing physical impacts of climate change on energy systems and supply chains have been significantly increasing year after year, causing a substantial effect on energy production, distribution, and consumption worldwide. These observations underscore the urgent need to address the vulnerability of existing energy infrastructure and global supply chains to climate-related risks. Although political pressure to adhere to the 1.5 °C trajectory remains, evidence shows that the current state of the energy transition is insufficient to achieve this goal [

1]. Considering these trends, climate change must be a critical consideration in sustainable energy investment discussions.

Strategic investments in sustainable energy projects are paramount for countries to capitalize on the opportunities presented by breakthrough technologies, renewable energy adaptability, and energy efficiency. Such investments would foster competitiveness in sustainable energy markets and strengthen the management of climate-related risks, as well as contribute to the critical need for a global energy transition [

2,

3,

4,

5].

However, several challenges impede the clean energy transition, including regulatory barriers, lack of financial support, and public resistance [

6,

7]. To overcome these obstacles and promote sustainable energy investment projects, policymakers must take immediate action by implementing proactive measures that facilitate the adoption of renewable energy sources and energy-efficient technologies [

2,

8,

9]. Recent literature highlights the importance of multi-stakeholder collaboration in driving sustainable energy investments [

10,

11].

Sustainable energy investment decision-making is a complex process, made even more complicated when considering the complexities of sustainable energy projects per se, along with the technical, economic, and financial associated risks [

12,

13]. Indeed, sustainable energy projects involve multiple uncertainty factors for both project developers and financial institutions, such as the high transaction costs, energy prices, energy savings estimation, equipment performance, and the lack of a standardized procedure and regulatory framework [

14,

15,

16].

Addressing the multifaceted challenges posed by climate change and sustainable energy investments calls for the utilization of multi-criteria decision-making (MCDM) methods. These approaches have demonstrated their effectiveness in tackling complex issues that require the evaluation of multiple, often conflicting, criteria addressing various aspects that the specific problem includes [

17,

18,

19,

20,

21,

22,

23,

24]. By incorporating MCDM techniques, policymakers and stakeholders can make informed decisions that consider a diverse range of factors influencing the success and impact of sustainable energy investment projects.

Assessing a sustainable energy investment project requires the consideration of various factors from both the project developer’s and financial institutions’ perspectives. In this study, the Analytic Hierarchy Process (AHP) is employed to assess the significance of criteria that a project developer and a financial institution evaluate when considering a sustainable energy investment project. The AHP framework is a widely recognized tool for formulating and evaluating decisions, particularly adept at ranking alternatives and determining the weights of various criteria through pairwise comparisons [

25].

Researchers have used the AHP method to analyze subjects, such as the evaluation and selection of renewable energy resources [

26,

27,

28,

29,

30,

31], renewable energy cross-border cooperation opportunities and benefits [

23], designing energy systems [

32,

33], allocating energy research and development (R&D) resources [

34], environmental impact assessment [

35], and the evaluation of alternative decarbonization pathways towards the European energy transition of significant renewable energy resources [

36]. Nevertheless, the use of the AHP approach in evaluating the most important factors affecting the implementation of a sustainable energy project from both the developer’s and investor’s perspectives is still adequate and should be further investigated.

In the above framework, this paper’s scope is to assess the main criteria that project developers and financial institutions consider important and could endanger the successful implementation of sustainable energy projects and thus must be taken into consideration by the stakeholders involved. The analysis could allow project developers, financing institutions, and investors to set up their relevant strategies and thus handle these demanding investments.

Following this introductory section, the paper is structured as follows: in

Section 2, an overview of the sustainable energy project’s life cycle from both the project developer’s and investor’s perspectives is provided.

Section 3 presents the Materials and Methods, which involves the identification of the criteria and AHP formulation.

Section 4 concerns the data collection and pilot application for the case of project developers and investors. The results and discussion derived from the proposed methodology application are included in

Section 5. Finally, in

Section 6, necessary conclusions and further research directions are presented.

2. Sustainable Energy Investment Projects

As in all types of project life cycles, the life cycle of sustainable energy projects refers to the process of developing and implementing a sustainable energy investment project. In this paper, the analysis structure reflects some of the basic stages in the development of a sustainable energy investment project aiming at clearly defining the main aspects and relevant capacities that should be considered when assessing these projects from both project developer’s and financial institution’s perspectives, so as to secure funding or finance sustainable energy-related projects.

The following

Figure 1 demonstrates the main steps of the technical, economic, and financial development of sustainable energy investment projects from both developer’s and financial institutions’ perspectives [

37].

In particular, from a developer’s perspective, the first step, the development of a sustainable energy investment project, refers to the technical description of proposed measures and the projection of energy and cost savings, contractual arrangements, and the estimation of operations and maintenance costs throughout the project lifetime. As soon as the sustainable energy investment case has been defined, the implementation phase begins via several types of contracts, distinguishing the approach of energy efficiency project implementing from the financing model. Finally, during the operation phase, the Operations and Maintenance (O and M) plan will begin, while the performance of project is tracked through the implementation of the Measurement and Verification (M and V) plan, which is defined in the development phase.

From a financial institution’s perspective, a sustainable energy project can be divided into two distinct stages. The first stage, pre-financing, consists of three key components:

- i.

Origination: Potential projects may arise through collaboration with existing customers, partnerships with equipment vendors, or by engaging with energy consultants and Energy Service Companies (ESCOs).

- ii.

Underwriting: This process involves a thorough assessment of the project’s value and risks, ultimately leading to a decision on whether to lend or invest.

- iii.

Investment Decision: Based on the underwriting results, the financial institution decides whether to proceed with the investment or not.

The second stage, operations/servicing, comprises the following elements:

- i.

Investment Administration: Once the decision to invest is made, legal documentation for the loan or investment is prepared by the parties involved.

- ii.

Draw Down of Funds: Prior to the release of funds, new systems and equipment must undergo rigorous testing under various conditions to ensure optimal performance.

- iii.

Ongoing Servicing: For the life of the investment, the financial institution must manage and service the loan or investment in accordance with the terms outlined in the loan or investment agreements.

3. Materials and Methods

This section includes an overview of the framework used for the assessment of sustainable energy investment projects, as well as the most appropriate MCDM method selected for the specific problem. The key steps of the approach followed are illustrated in the

Figure 2 below.

3.1. The Criteria

Based on an extensive literature review, eight (8) different criteria have been identified to assess the aspects of sustainable energy projects from both a project developer’s and an investor’s/financing institute perspective. The criteria identified, along with their descriptions, are presented in the following paragraphs.

C1—Technical Complexity

The “Technical Complexity” criterion refers to technological elements of the installed equipment, including its performance, potential deviations from projected performance, and the reliability of the equipment supplier [

38]. Additionally, this criterion considers the Measurement and Verification (M and V) plan and its adherence to widely recognized standards, such as ISO 50015 [

39] or the International Performance Measurement and Verification Protocol (IPMVP), as well as the availability and market maturity of the required sustainable energy technology within the project [

40,

41,

42].

C2—Project Design

The “Project Design” category encompasses organizational aspects of a sustainable energy project, such as Operation and Maintenance (O and M) considerations, the establishment of a comprehensive maintenance plan for the installed equipment [

43], and the availability of equipment warranties. It also takes into account measures to address situations where the end-user lacks the experience necessary for smooth operation of the installed equipment, as well as the existence of contracts that appropriately allocate risks among third parties. Furthermore, this category evaluates the project’s overall design, considering factors such as clear role and responsibility definitions for involved stakeholders, the project’s resilience to climate-related risks, the project’s carbon footprint, life cycle emissions, potential for greenhouse gas reduction, availability of sufficient project information, and conducting design reviews [

42].

C3—Financial

This criterion encompasses the financial issues with regard to the cost of installation and operation, the capital cost, the estimation of revenue streams, the project’s financial viability and potential returns (payback period and Internal Rate of Return (IRR)), and the available financing options, while it also concerns the creditworthiness of the loan/financing applicant, the developer’s track record, financial stability, and experience in implementing similar projects, as well as the repayment risk factor [

41].

C4—Energy Market

The “Energy market” criterion concerns the volatility of the energy market in the country where the sustainable energy project will be developed. The energy prices and market dynamics, such as carbon pricing, emission limits, and renewable energy mandates and taxes volatility factors, are included in the context of this criterion concerning the unpredictability of energy prices and taxes, which can significantly impact the expected monetary savings of a sustainable energy project and thus its financial performance [

41,

42].

C5—Economic Situation

This criterion pertains to the macroeconomic conditions of the country where the sustainable energy project is being implemented and the potential economic impacts of climate change on the country’s macroeconomic conditions. It encompasses interest rate volatility, as reflected in ten-year government bond yields, which may lead to incorrect estimations of monetary savings due to changes in the cost of debt [

40]. Additionally, it accounts for currency risk, involving fluctuations in exchange rates that could impact installation or operational costs of the project, particularly for internationally active banks or investors [

44].

C6—Legislative and Regulatory Situation

The Legislative and Regulatory Situation concerns the legislative framework of the country where the sustainable energy investment project is implemented, and it could be a decisive factor for selecting the country of implementation [

42]. The criterion includes the understanding of government policies, incentives, and regulations, as well as climate change policies and regulation legislation addressing climate change adaptation, mitigation, and resilience supporting such sustainable energy projects [

40,

45].

C7—LocalStrategy and Commitments

This criterion is related to the fluctuations in the imposed national policies on local climate change strategies and action plans and the sustainable energy policy implementation, as well as the quality of the national sustainable energy policies. This criterion considers various elements, such as the intricacy of compliance with regulations and procedures. These may include obtaining project permits, navigating bureaucratic processes, or dealing with inadequate enforcement mechanisms [

42]. It also includes the project’s adaptation to local conditions, local community support, and stakeholder engagement, including its impact on the local environment and social license to operate [

46].

C8—Improved Services Availability

This criterion focuses on two key aspects: first, the accessibility of skilled technical workers with relevant experience, and second, the capacity to precisely predict the expected energy savings and potential carbon credits within the sustainable energy project [

47]. It is essential to recognize that various methods are employed for estimating energy savings, spanning from certified experts’ computational tools to empirical strategies and data from similar projects [

42,

47,

48]. Notably, the lower the human involvement in the assessment process, the lower the associated risk.

3.2. Evaluation of the Criteria: The AHP Approach

The selected multi-criteria decision-making (MCDM) method for addressing the complex issue at hand is the Analytic Hierarchy Process (AHP), introduced by Saaty in 1977 [

49]. AHP is designed to help decision-makers navigate intricate problems with multiple stakeholders and a diverse range of criteria. This method achieves a balance between quantitative and qualitative factors, allowing for the integration of tangible quantitative data and intangible qualitative judgments [

26]. The AHP method was chosen for its mathematical simplicity, flexibility, reliability, and robustness, along with its ability to manage both qualitative and quantitative attributes.

AHP is structured upon a well-defined mathematical foundation, facilitating the identification of eigenvectors that generate precise weights. It utilizes a validated numerical scale that captures individual preferences, considering tangible and intangible characteristics [

50,

51]. Through this process, individual preferences are transformed into a ratio scale using pairwise comparison matrices to establish the weights of criteria. For this study, Saaty’s nine-point scale was employed [

52], with the decision-making team using the scale provided in

Table 1 to determine the values of the pairwise comparison matrix elements.

Let C = {C

j |j = 1, 2, …, n} be the set of criteria (in this study n = 8). Considering the criteria, the pairwise comparison of the criterion with the criterion j yields a square matrix

where a

ij denotes the comparative importance of criterion i with respect to criterion j. In the matrix, a

ij = 1, when i = j and a

ji = 1/a

ij.

The calculation of the normalized matrix

follows. More specifically, the normalized matrix

is calculated by summation of each column and then dividing each element by the respective column total, where element c

ij is the normalized element.

Next, the mean of each row is calculated to obtain the normalized principal eigenvector, i.e.,

Here, several iterations are carried out by squaring the normalized matrix until the difference in principal eigenvectors in the previous and iterated matrix becomes almost zero or negative. This final iterated matrix gives the principal eigenvector (or priority vector), which is the weight of each criterion. The principal eigen value of matrix A has to be calculated and is called λ

max. It is calculated by multiplying the column sums of matrix A with the principal eigenvector (e), i.e.,

In the last step of this phase, the consistency index (CI) = (λmax − n)/(n − 1) is calculated. The Random Index (RI) for the number of criteria used in decision-making, which is eight (n = 8) for the case under consideration, is also obtained. The respective value is RI = 1.41. Finally, the consistency ratio (CR) = CI/RI is calculated. The ideal value of the CR coefficient should be zero, which is equivalent to the fact that the matrix is consistent. However, a CR of 0.10 (10%) or less is considered acceptable.

4. Application: Project Developers and Investors

This section focuses on employing the Analytic Hierarchy Process (AHP) method to determine the weights of the evaluation criteria. During this stage, the decision-maker, either the project developer or the investor/financial institution, is responsible for generating individual pairwise comparison matrices (

Table 2 and

Table 3) using Saaty’s nine-point scale [

52] in

Table 1.

4.1. Project Developer’s Perspective

Using Saaty’s nine-point scale (

Table 1), the decision-maker pairs comparisons of each of the criteria, which are depicted in

Table 2.

Then, the normalization of the pairwise comparison matrix follows (

Table 4).

The results obtained from the computations based on the pairwise comparison matrix provided in

Table 4 are presented in

Table 5, which includes the results of AHP for the case of project developers.

According to

Table 5, the consistency ratio (CR) of the pairwise comparison matrix is calculated as 0.097 < 0.1. Therefore, the weights of the criteria are considered consistent.

4.2. Investor’s Perspective

The matrix of pairwise comparison for the identified criteria as derived for the case of investors is presented in

Table 3.

Next, the normalized matrix of pairwise comparison of the criteria for investors/financial institutions is presented in

Table 6.

The results from the AHP application are provided in the following Table. The calculation of the degree of deviation from the theoretical value of the matrix Ci using the consistency index CI = 0.086, while the value of the consistency ratio CR = 0.061 < 0.1.

5. Results and Discussion

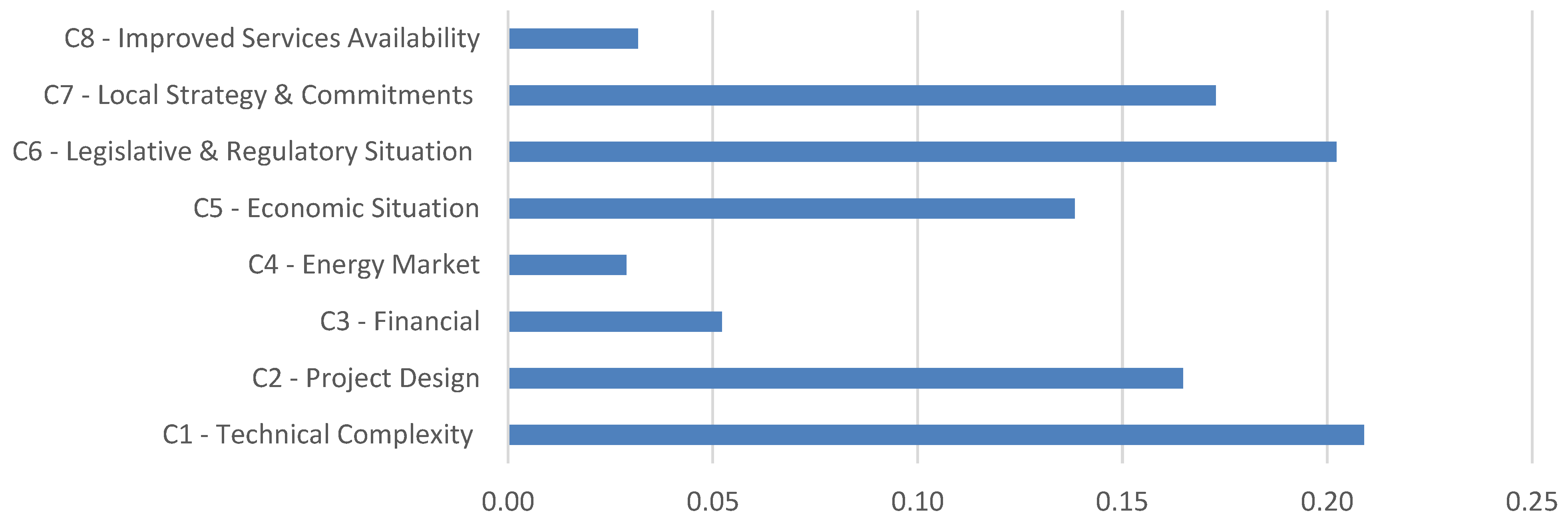

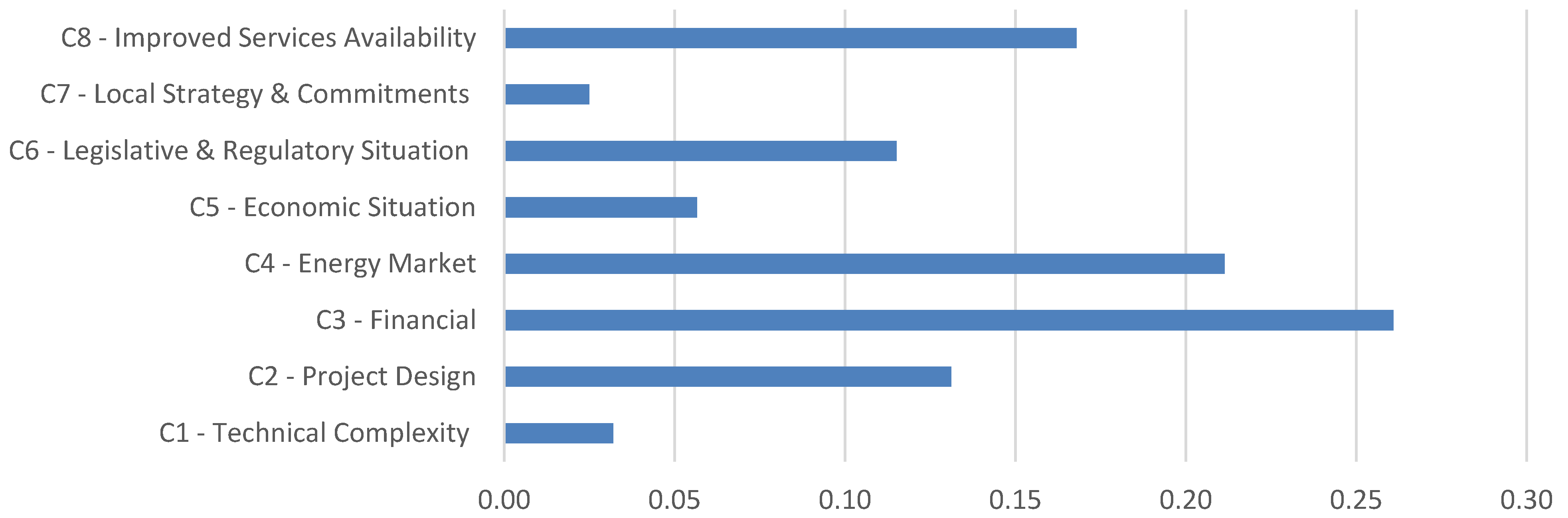

Following the application of the Analytic Hierarchy Process (AHP) method and the presentation of weights in

Table 5 and

Table 7 for both project developers and investors, the final ranking of criteria for each case is depicted in

Figure 3 and

Figure 4.

Upon examining the final ranking of criteria, it becomes clear that for project developers, the most significant criterion pertaining to the specific problem is criterion C1—Technical Complexity, followed by criterion C6—Legislative and Regulatory Situation. On the other hand, from an investor’s perspective, the most important criterion is C3—Financial criterion, follows by criterion C4—Energy Market. Project developers were also concerned about the current quality of the national sustainable energy policies and the project adaptation to the local environment (C7—Local Strategy and Commitments), but also, with almost equal importance, C2—Project Design criterion, while investors focused more on the availability of certified experts and improved services (C8), since for investors, it was important to select experienced and sufficiently competent project implementation teams, proven through some sort of documentation, when considering investing in sustainable energy projects.

Finally, it should be noted that when discussing financial and economic issues regarding a potential sustainable energy project with stakeholders, different but interesting perspectives were also given. Project developers emphasized developing multiple financing channels and designing payment plans, highlighting grants and subsidies, the benefits of project aggregation, and loan guarantee mechanisms. Financiers, on the other hand, focused on the importance of selecting well-established customers and carefully studying the credibility of the borrower, while also charging higher levels of interest rates.

6. Conclusions

This study employed the AHP to conduct a preference analysis, focusing on key factors influencing the decision in a sustainable energy project. The methodology was applied for project developers’ and investors’ points of view. The research highlights the need for stakeholders involved in sustainable energy project investments to recognize the diverse preferences and priorities across project developers and financial institutions. Decision-makers should be adaptable in their approaches, considering the specific needs and expectations of various stakeholders involved in the process of a sustainable energy project in order to accelerate such investments.

The emphasis of the survey and the assessment was to disentangle the complexity of the interrelations between factors that influence the competitiveness and financing outcomes of a sustainable energy project, with a specific emphasis on project developers’ as well as investors’ perspectives. The study provided an investor’s perspective by including requirements according to the characteristics and procedures of stages of a sustainable investment project life cycle so as to reflect investors’ concerns when considering sustainable energy and climate investments. Investment attractiveness, identification and utilization of financing options, and the implementation and monitoring of sustainable energy projects reflect key capacity categories that are relevant for investors and financing institutions when it comes to sustainable energy investments and project performance.

Features influencing the investment of a sustainable energy project from a project developer’s perspective include, but are not limited to, general regulatory framework conditions, the financial strength and creditworthiness of an investor, and specific capacities reflective of a project developer’s experience with implementing and monitoring an investment throughout its life cycle.

In summary, to comprehensively evaluate a sustainable energy project in the future, it would be essential to consider the perspectives of both project developers and investors and to guide a proactive policy action and decision-making to support and accelerate the clean energy transition. The research highlights the differing priorities and criteria that each stakeholder holds in assessing the viability and attractiveness of such projects. By separately addressing the concerns of project developers and investors, decision-makers can better align the project’s characteristics with the expectations and requirements of both parties. Recognizing these differing priorities, it becomes clear that a holistic evaluation of a sustainable energy project must consider the perspectives of both project developers and investors. This may involve assessing the project’s technical and regulatory aspects to address developers’ concerns while conducting a thorough financial analysis to appease investors’ demands. By addressing both stakeholders’ needs, decision-makers can ensure the project’s success by securing adequate financing and fostering a supportive development environment.

As a future research direction, examples of evidence could also facilitate such an assessment and survey, as well as best-case practices and real-life illustrations on how specific sustainable energy projects are being dealt with in a particular city or country context. Furthermore, the assessment of related policies and regulations playing a pivotal role in both de-risking and incentivizing sustainable energy investment could be complementary to the presented analysis.