1. Introduction

China has experienced rapid economic growth after initiating economic reforms and liberalization. According to the National Bureau of Statistics, starting at CNY 367.9 billion in 1978, approximately constituting 1.7% of the global economic share, it has currently exceeded the remarkable threshold of CNY one hundred trillion in 2020. Its global economic ratio has risen to approximately 17%, establishing itself as the world’s second-largest economy [

1]. Extensive economic growth, substantial utilization of various energy resources, and the exploitation of other natural resources have led to elevated energy consumption, resulting in environmental harm, resource depletion, and the release of carbon emissions [

2,

3]. According to the “Environmental Performance Index: 2022 Report”, China’s EPI index achieved an overall score of 28.40, positioning it in 160th place out of 180 countries and regions in 2022. At the same time, a poor environment can be detrimental to economic efficiency and public well-being [

4]. Consequently, environmentally sustainable policies have turned into a vital foundation for emerging economies [

5]. Enhancing energy efficiency is a necessary way for developing countries to diminish carbon emissions and combat climate change in developing nations. China is the same. In addition, because of its environmental friendliness, clean energy has been vigorously developed in recent years in various countries. Developing new energy and promoting the clean and efficient use of traditional energy such as coal is an important support for promoting China’s energy revolution and green and low-carbon development and an important measure to address climate change and promote the construction of ecological civilization. It is also a necessary road for China to achieve the “double carbon” goal and task and fulfill its foreign commitments. Since environmental concerns have emerged as a significant hindrance to China’s sustainable progress, our research integrated environmental constraints when evaluating energy efficiency and used green total factor energy efficiency (hereafter, GTFEE) as the main research indicator.

China’s economy has undergone rapid growth since the 1990s and has nearly completed its full integration into the global market. The gradual development of the financial sector in China has provided the essential economic backing for the nation to achieve its sustainable development goals. Lacking financial backing, China would be unable to attain its sustainable development goals. Financial development is usually defined as the deepening and broadening of the financial system and the improvement of financial markets. It encompasses many aspects, such as the number and size of financial institutions, innovation in financial products and services, the stability and transparency of financial markets, and the effectiveness of financial regulation. “The Fourteenth Five-Year Plan for China’s National Economic and Social Development (2021–2025)” indicates a commitment to further deepen financial reform and enhance financial regulation. Financial development has an impact on energy in three main ways: First, it facilitates capital market activities. A robust financial system enhances stock market activity, enabling investors to purchase energy-efficiency-related equipment at lower prices. This, in turn, enhances environmental efficiency in the long term [

6]. Furthermore, it reduces information costs and enhances the returns on investments through heightened capital inflow and production activities, resulting in savings and improved returns. This proves advantageous for capital-intensive initiatives, like environmental protection, fostering enhanced environmental quality [

7]. Second, it promotes the technological progress of enterprises. Academics have argued that the financial sector can finance investment in technologies with high energy input–output ratios [

8,

9]. Financial development and advances in green technology can improve energy efficiency. Ultimately, it is possible to increase the efficiency of energy consumption while adhering to environmental standards [

8,

10]. Third, it expands financing channels. Financial development is conducive to the expansion of the supply of financial resources and the enrichment and diversification of financial products, providing more financing funds and financing opportunities for renewable energy enterprises, expanding financing channels, and alleviating the role of financing constraints [

11]. With the increasing maturity of China’s market economy, financial support for the development of the renewable energy industry has gradually entered the market stage. Innovative financial products, together with traditional financial support, are driving the development of the renewable energy industry. General innovative financial products include green credit, green bonds, green finance, and carbon funds. Taking China as an example, venture capital, international organizations, private equity funds, and policy funds have focused on solving the financing difficulties of some renewable energy industries in China. Since the promulgation and implementation of the “Renewable Energy Law”, the Chinese government has introduced a series of policies to promote the development of renewable energy, such as the government promoting the improvement of the renewable energy subsidy mechanism, and the increase in government-led investment in this field has promoted the development of the renewable energy industry to a certain extent. The existing policy incentives mainly cover price incentives, economic incentives, research and development support, market development, and other incentives. In recent years, China’s green finance has developed vigorously, and a multi-level green financial product and market system, including green credit, green bonds, green insurance, green funds, and green trusts, is being formed. By the end of 2021, China’s domestic and foreign currency green credit balance reached CNY 15.9 trillion, and the outstanding balance of green bonds exceeded CNY 1.1 trillion. Overall, China’s green finance has made a leap forward, achieving a major shift from catching up to leading the world [

12].

Being the world’s largest energy consumer, China is in the stage of rapid industrialization. As the globe’s foremost energy consumer, China is in the phase of swift industrialization [

13,

14]. “The 13th five-year plan of national economic and social development of China (2016–2020)” emphasizes that green development can be achieved by adjusting the industrial structure (hereafter, IND). Therefore, improving the efficiency of green development through industrial restructuring has become a prominent issue in the field of sustainable development. After entering the 21st century, driven by multiple factors such as the upgrading of residents’ consumption, the reform of the financial system, such as the reform of the commercial housing system, and its integration into the global industrial chain through accession to the WTO, China’s economy, under the government’s domination and drive, has moved toward a mode of economic development driven by heavy industry, with urbanization and industrialization taking place side by side and economic development being driven by a large amount of investment. Investment has surpassed consumption as the most important factor driving GDP. The heavy-chemical industry sector, represented by real estate and infrastructure-related sectors, has rapidly developed [

15,

16], driving the rapid development of industries such as iron and steel, building materials, coal, petroleum, electric power, raw materials, etc. In 2015, marked by supply-side structural reform, China entered into a new round of structural adjustment, shifting from being factor-driven and investment-driven to innovation-driven, with the pursuit of high quality as the main focus. An innovation-driven and service-oriented new development model with the pursuit of high quality replacing the old development model of a heavy industry-driven economy [

17,

18]. China’s rapid economic development predominantly depends on an industrial structure with high energy consumption and diminished energy efficiency in comparison with the developed world [

19]. The “low-end lock-in” of the industrial supply chain and the irrational entrance and exit of industries impede the energy transition [

20]. The absence of alignment between the pace of industrial structure enhancement and the development of regional energy infrastructure has resulted in the squandering of resources [

21]. Furthermore, energy consumption and carbon emissions in crucial industrial sectors have consistently represented a significant share. There is a demand for more prudent decision making to promote a positive cycle in which a rational industrial structure fosters efficient energy utilization [

22]. In turn, enhanced energy efficiency drives industrial reformation and simultaneously enhances environmental standards [

23].

Currently, numerous scholars have conducted research on the relationship between finance, the environment, and other factors, unilaterally, and energy efficiency and energy consumption. Although they have drawn many different results and conclusions, there are few studies that have studied the impact of financial development (hereafter, FD) and the industrial structure, together, on GTFEE. Therefore, this paper places FD, IND, and GTFEE in the same research framework using the ARDL model. In the current economic development context, we believe that investigating this issue holds significant practical and theoretical significance.

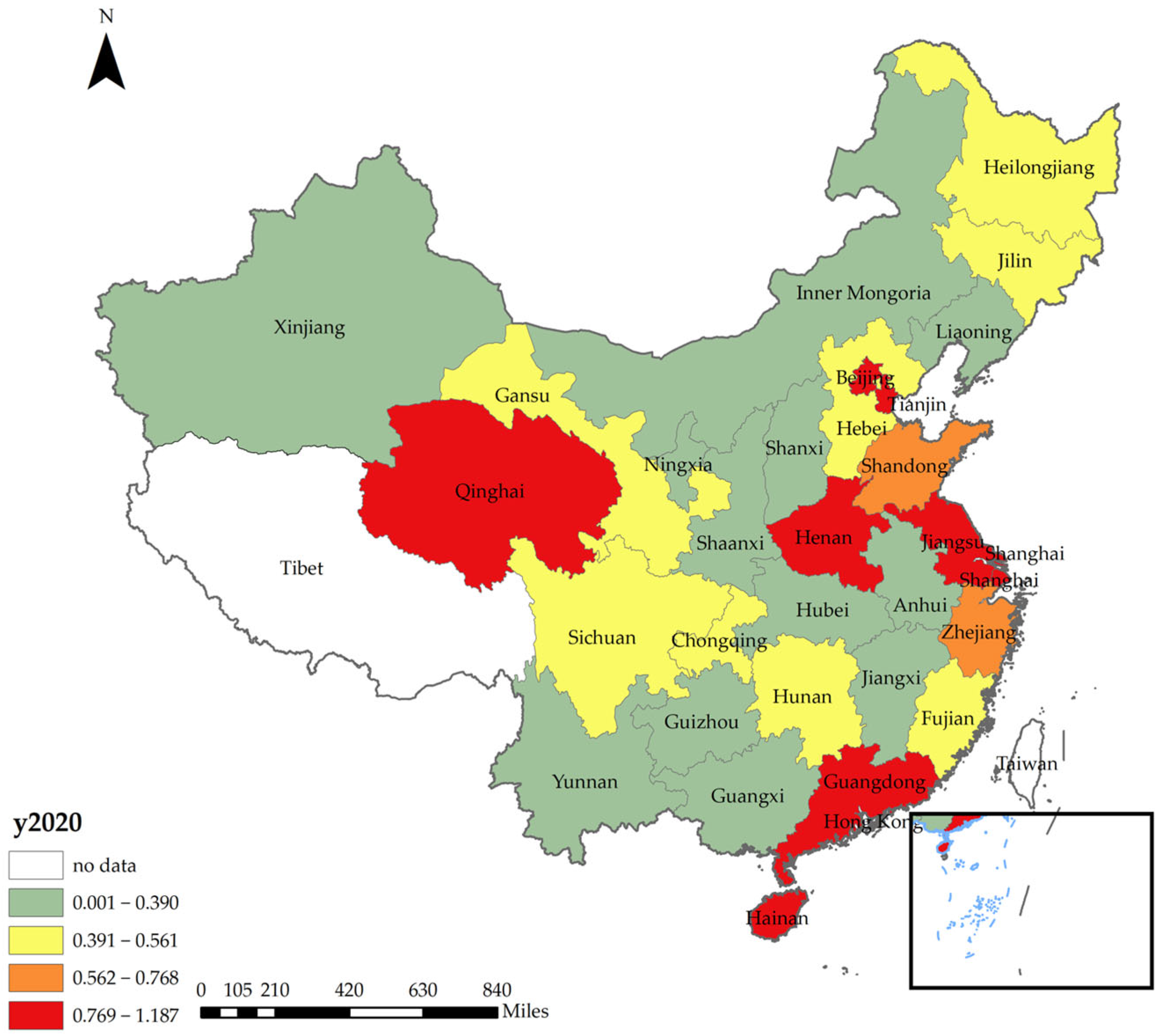

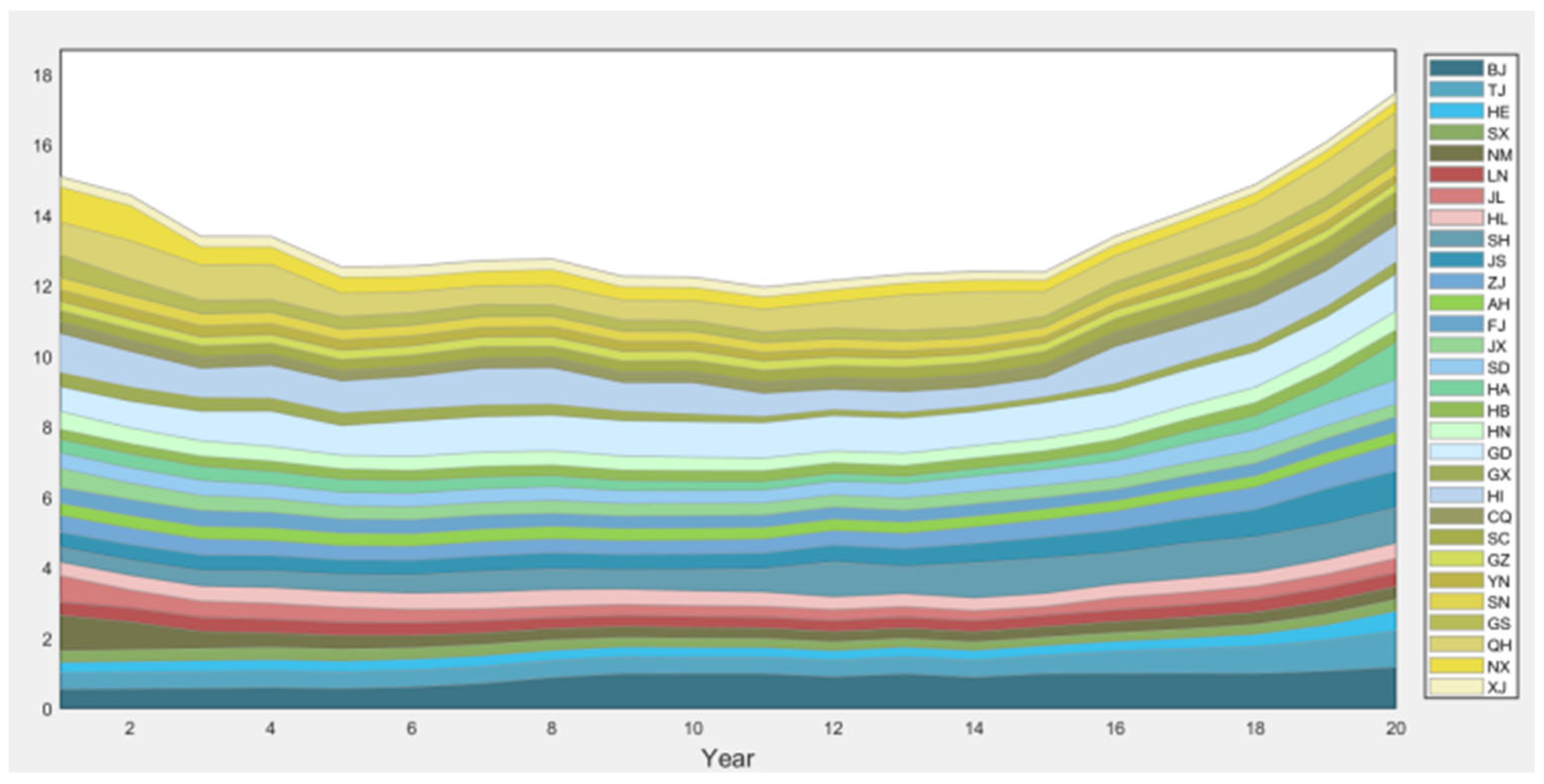

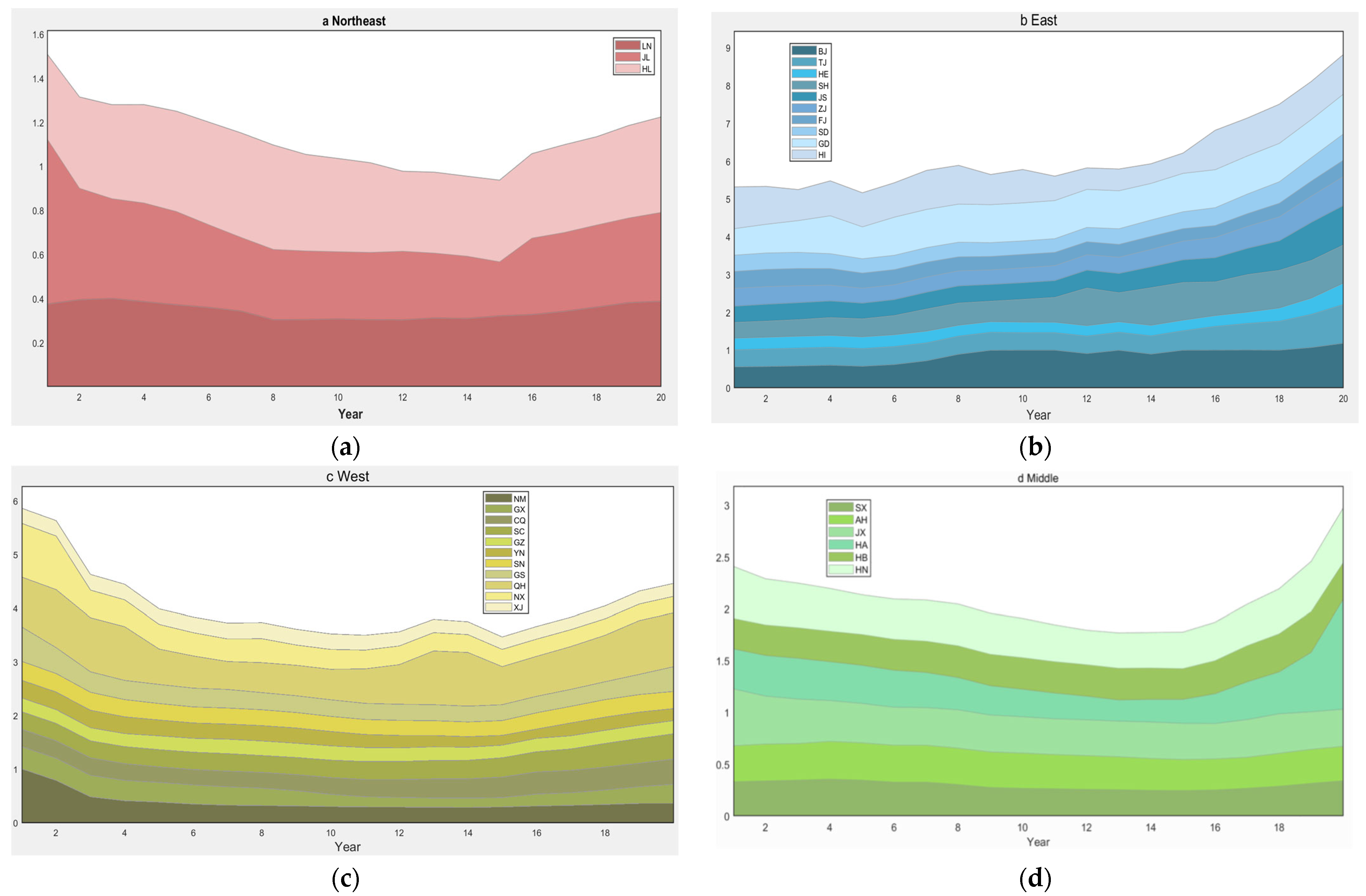

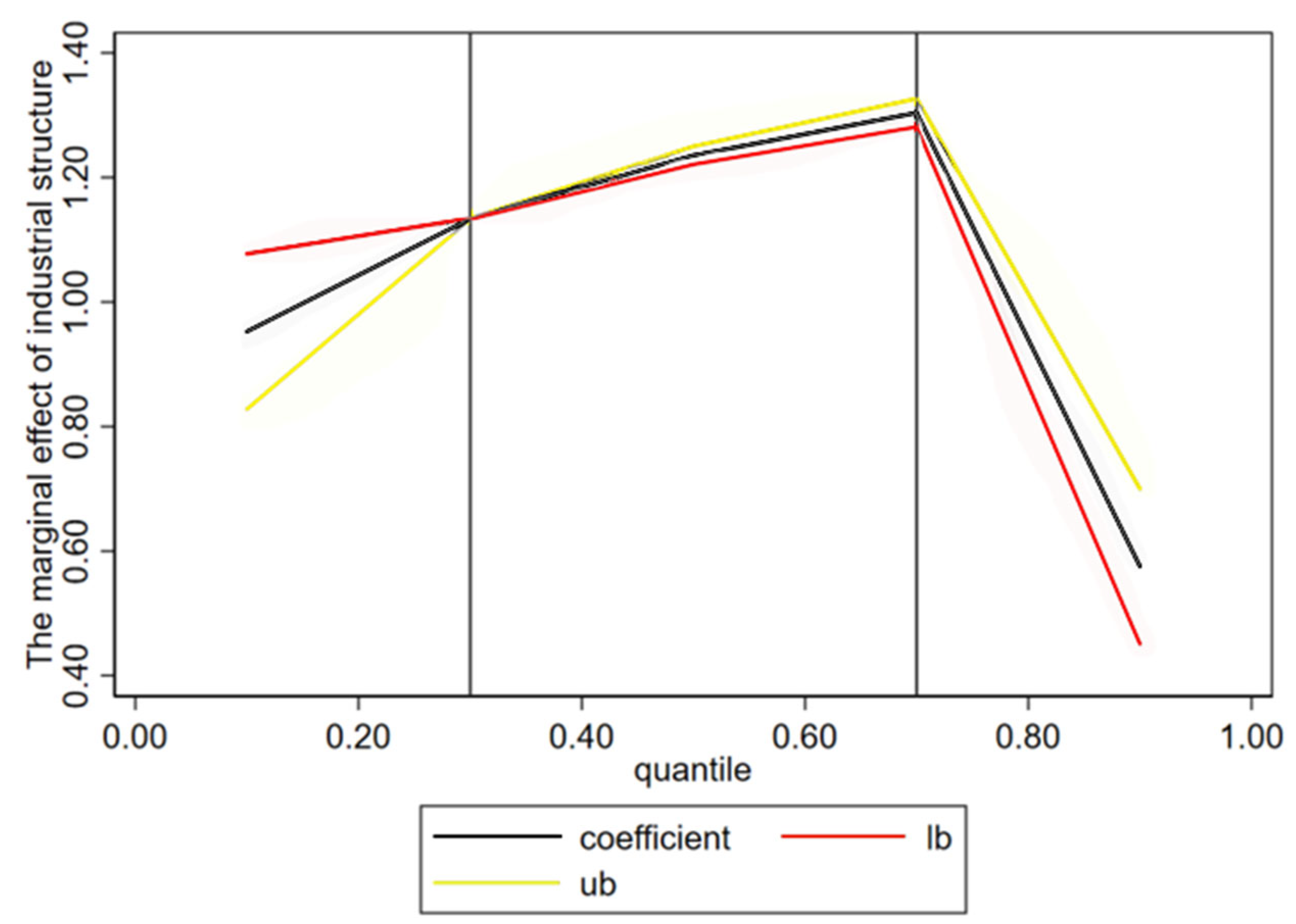

The primary content of this paper is outlined as follows. Firstly, we used the super-efficiency SBM-undesirable model to estimate the GTFEE value for 30 Chinese provinces from 2000 to 2020, taking environmental factors as undesired outputs, so the model measured energy efficiency more comprehensively than the original calculation and described its various distributions. Secondly, for a deeper understanding, this study included financial development and industrial structure in the model and used urbanization, shown as URBAN, government intervention, represented as GOV, and social consumption level, represented as CONSU, as control variables to more comprehensively measure the impacts of explanatory variables on GTFEE. Third, this paper used panel ARDL (PMG/DFE) and CS-ARDL to explore the long-term impacts of FD and IND on GTFEE and then applied Dumitrescu–Hurlin (DH) panel causality tests to determine the interconnections between the three. Finally, in order to analyze heterogeneity and further study the marginal effects of FD and IND under different degrees of GTFEE, this study adopted the QRPD model (quantile regression for panel data with non-additive fixed effects). This method characterized the dynamic evolutionary path of the marginal effects of financial and industrial factors during the progression of energy-oriented sustainable development.

The rest of this document is organized in the following manner.

Section 2 provides a succinct review of the current literature.

Section 3 evaluates and analyzes China’s GTFEE.

Section 4 provides a brief description of the estimation techniques and data used in this study.

Section 5 presents and discusses the empirical findings. Finally, in

Section 6, conclusions are drawn, and relevant policy implications are discussed.

2. Literature Review

2.1. Measurement of Energy Efficiency

The main measures of energy efficiency include single-factor energy efficiency (SFEE) and total-factor energy efficiency (TFEE). The former is a single-factor indicator, and its common indicator is energy intensity, usually referred to as energy consumption per unit of GDP. Nonetheless, a single factor neglects to account for the influences of other variables on the output. Consequently, the results of TFEE calculations are often biased and increasingly criticized by scholars. TFEE is defined as the optimal ratio of energy inputs to actual inputs required to achieve a given output in best production practice, with other factors of production held constant [

24]. Subsequently, TFEE has gained widespread acceptance. Compared with SFEE, TFEE takes into account the effects of interactions between various inputs within the economic framework of energy efficiency. It provides a more precise and objective measure of energy utilization in a region or country.

As the economy develops, scholars have increasingly recognized the significance of environmental protection. Pollution emissions from energy use should be carefully considered when assessing energy efficiency; otherwise, the results may be overstated [

25,

26]. Certain scholars have incorporated energy use and pollutant emissions into the TFEE structure, thus defining GTFEE [

27,

28]. When it comes to the specific methods of calculating GTFEE, data envelopment analysis (DEA) is the most widely used method to assess efficiency. The computation results obtained by various researchers reveal that energy efficiency when accounting for both desired and undesired outputs is notably lower than when only contemplating the desired output [

29,

30,

31].

2.2. Related Research on the Impact of Financial Development on GTFEE

On the one hand, the financial sector has been associated with the energy sector in the relevant literature [

32]. Financial development directly impacts the efficiency of energy utilization. Financial systems can have an impact on energy consumption by mobilizing savings, generating resources for growth, enhancing business trust, and expanding the scope of the economy [

33]. The degree of financial development exhibits a positive correlation with investments in energy and the consumption of energy [

34], exerting a significant impact on the energy–growth relationship [

35]. On the other hand, financial development has a close connection with green development and environmental concerns. Financial development can offer financial backing for green innovation, reduce information asymmetry, and enhance resource allocation efficiency [

36]. The enlargement of the financial sector can facilitate businesses in more efficiently accessing green financial resources at reduced expenses, thereby fostering green business outcomes and aiding companies in expanding their current green business scope while diminishing their dependence on conventional energy sources [

37]. Financial structure promotes the advancement of eco-friendly technology innovation, while financial magnitude and effectiveness exert an adverse impact on the innovation of green technologies [

38].

Certain scholars contend that the role of financial development does not follow a straightforward positive linear correlation. Instead, they propose a relationship between financial development and energy efficiency that takes the form of an inverted U shape, suggesting a noteworthy influence on energy utilization efficiency only when the degree of financial advancement surpasses a particular threshold [

39]. For example, within the context of Saudi Arabia, a non-linear inverted U-shaped correlation is observed between financial development and energy consumption [

40]. Financial development has stimulated economic activities in Lebanon, subsequently leading to increased energy consumption [

41]. The magnitude of financial institutions (FDS) notably hinders green growth (GG), whereas the extent of stock markets (STO) substantially fosters green growth (GG). A non-linear U-shaped connection is evident between the size of FDS and GG [

42]. It is evident that the existing research has either concentrated on the impact of financial development on energy efficiency and consumption or separately explored the connection between financial factors and sustainable development. Limited literature exists that incorporates green factors when examining the influence of financial progress on energy.

This also corresponds to relevant theories on the relationship between economic development and the environment. These include the environmental Kuznets (EKC) hypothesis, suggesting an inverted U-shaped relationship between environmental pollution and economic growth [

43,

44], which is based on the empirical observation that economic growth is associated with an increase in environmental degradation up to a turning point, after which the quality of the environment begins to improve [

45,

46]. The emergence of this inflection point leads to an inverted “U”-shaped pattern, which Panayotou called the EKC after the original Kuznets curve [

47,

48]. Similarly, there is the pollution paradise hypothesis (PPH), which states that firms in pollution-intensive industries tend to build factories in countries or regions with relatively low environmental standards [

49,

50,

51]. The specific transfer and substitution of trade and polluting industries from developed to developing regions in the PPH can also correspond to the declining interval in the environmental Kuznets curve (EKC) [

52,

53]. There is also the pollution halo hypothesis, Porter hypothesis, and so on [

54,

55].

2.3. Related Research on the Impact of Industrial Structure on GTFEE

In recent years, with the growing worldwide focus on environmental preservation and sustainable development, the investigation of the influence of the industrial structure on energy utilization has emerged as a prominent subject in the field of economics. Firstly, in a period of worldwide industrial transformation and an expanding energy crisis, alterations in the industrial structure are exerting a more substantial impact on the energy system. Unjustified alterations in structure may hinder the transition of the energy system toward sustainability [

56].

The efficiency of industrial energy is closely linked to the inter-sectoral structure [

57]. The industrial structure serves as the intermediary between industrial operations and energy efficiency, governing the allocation of production factors and the effectiveness of the conversion between input and output factors [

58,

59]. Previous research has indicated that the upgrading of the industrial structure, including the shift or relocation of energy-intensive sectors, constitutes a crucial approach for conserving industrial energy and reducing emissions, playing a role in achieving up to 70% of China’s emissions reduction target [

60]. The adjustment of the industrial structure is deemed one of the effective methods to achieve sustainable development [

61].

However, some scholars contend that there is diversity in how the industrial structure affects GTFEE. The enhancement of energy efficiency is influenced by the industrial structure but displays regional variations [

62]. There is a noticeable disparity in energy efficiency between cities, and the impact of the industrial structure on energy efficiency unfolds in a phased pattern [

63]. The optimization of an economy’s industrial structure needs to be followed by improvements in productivity and resource efficiency, leading to reductions in carbon emissions and, ultimately, to more environmentally sustainable economic growth [

64,

65]. Accelerating industrial upgrading and improving the utilization efficiency of energy resources are key measures for curbing carbon emissions in energy-abundant regions [

22]. In conclusion, prior research highlights the significance of industrial structure enhancement, particularly the transition away from energy-intensive industries, in accomplishing objectives related to sustainable development. However, it is important to recognize that there are differences in energy efficiency in different regions and that the impact of the industrial structure shows a phased approach.

2.4. Study on the Influences of Financial Development and Industrial Structure on GTFEE

The financial sector is a crucial element of contemporary service industries, and its degree of development is closely linked with industrial structural adjustments. Financial development assumes a catalytic role in resource allocation and the transformation of economic structures [

66]. Brown et al. have determined that improvements in the external financing environment for businesses can stimulate technological innovation, while the expansion and liberalization of securities markets can drive technological innovation at the enterprise level, thereby advancing industrial upgrading [

67]. Sasidharan et al. conducted a study on the financing environment of industrial enterprises in India from 1991 to 2011 and revealed that financial development has made corporate financing more accessible [

68]. This, in turn, has led to increased investments in research and development, thereby fostering corporate growth and structural upgrading. The research also indicated that financial development significantly enhanced the financing environment for infrastructure construction, thereby augmenting the service quality of the communication industry and propelling overall industrial upgrading [

69]. In the Chinese context, Lin and Zhao found that as financial development advanced and financial structures improved, the influence of innovation in driving industrial upgrading shifted from being inhibitory to stimulating, following a pattern of marginal increments [

70]. Within the constraints of efficiency and financial openness, the influence of innovation on industrial upgrading formed an inverted U-shaped relationship, where innovation initially promoted and later restrained the process. The expansion of the financial sector reduces financing transaction costs and mitigates information asymmetry, directing capital toward strategic emerging industries and new technological sectors [

71]. Industrial structural adjustment serves as an efficient pathway to achieve green economic growth by promoting the transfer of factors of production from non-clean industries to clean ones [

61]. In terms of spatial aspects, it is concluded that financial development and industrial optimization and upgrading yield positive spatial spillover effects, both contributing to improved resource utilization.

Throughout the domestic and international literature that has been investigated, we can see that scholars have conducted extensive research on the issues of financial development, industrial structure, and energy utilization efficiency. However, the following problems still exist: Firstly, when measuring the index of energy utilization efficiency, although scholars at home and abroad have gradually realized the pollution released by energy utilization into the environment, the undesired output of energy often focuses on a certain aspect of pollution, such as nitrogen oxides or CO2, which makes it difficult to portray the full picture of the environmental pollution produced by energy utilization. Secondly, logically, there is the possibility that financial development promotes the upgrading of the industrial structure, and changes in the industrial structure have an impact on energy efficiency, but fewer existing studies link the three together and lack the distinction between long-term and short-term impacts. Finally, although scholars at home and abroad have selected specific provinces, economic zones, city clusters, regions, and countries as the objects of study to explore the impact of the direction of financial development and the industrial structure on energy efficiency, the objects and scopes of the studies have been quite broad. However, when taking the whole country as the research object, regional heterogeneity has mostly been taken into account when considering heterogeneity, and the impact of this variable on energy efficiency in China has been studied by region. The analysis of heterogeneity is relatively singular.

Despite being influenced by various factors, it can be argued to some extent that financial development can enhance energy efficiency and promote green development by reducing information asymmetry, lowering financing transaction costs, and fostering green innovation. Additionally, the enlargement of financial magnitude and the enhancement of financial efficiency can facilitate industrial upgrading by improving resource allocation and stimulating innovative vitality. The adjustment of the industrial structure, accompanying technological advancements, though its impact on energy efficiency varies due to regional and temporal differences, remains a crucial factor in achieving sustainable energy development. Logically, there exists the possibility of financial development promoting industrial structural upgrades, which, in turn, affect GTFEE. However, there is currently limited empirical research confirming the relationships between these three factors. Hence, this study aimed to empirically test the impacts of increased financial development and industrial restructuring on energy utilization efficiency.

The main contributions of this paper can be summarized as follows: First, this paper cites a new research indicator, GTFEE, and includes exhaust gas, wastewater, solid waste, and carbon dioxide as undesired outputs when measuring this indicator, thus making the comprehensive evaluation of energy utilization efficiency more comprehensive than the indicators used in previous studies. Especially when clean and renewable natural resources are used for energy production, they emit little to no greenhouse gases or pollutants into the surrounding environment, so the selection of unexpected outputs therefore needs to be as comprehensive as possible to better reflect changes in energy efficiency, which is the point of GTFEE. Second, in terms of research methodology, this paper took the industrial structure as a mediating variable to explore the effects of financial development, the industrial structure, and their interaction terms on GTFEE. Via empirical research, we tested whether the improvement of the financial development level can have an impact on energy efficiency via the adjustment of the industrial structure and analyzed the impact in the long and short terms using the ARDL model. In addition, in terms of research content, this paper also discusses the evolutionary characteristics of the marginal effects of FD and IND using the QRPD model. Thus, it complements existing studies by examining more specifically the heterogeneity of GTFEE across different sub-locations. In conclusion, this study provides empirical evidence supporting the idea that China can harness the complementary advantages of financial development and industrial structural adjustment to promote the green utilization of energy, thereby advancing green development. These research findings not only contribute to theoretical innovations in the development of China’s green economic system but also offer valuable practical insights into China’s economic transformation.

6. Conclusions and Policy Implications

This article examined the correlation between financial development, the industrial structure, and GTFEE across diverse provinces, spanning the years 2000 to 2020, employing panel ARDL, CS-ARDL, the Dumitrescu–Hurlin panel causality test, the QRPD model, and heterogeneity regression of financial development under different fractions.

Firstly, the regression results of ARDL indicate a robust positive association between financial advancement, industrial composition, and GTFEE. That is, regarding the long-run relationship, financial development and the industrial structure have significantly positive effects on GTFEE in China. At the same time, the interaction term of IND and FD showed that financial development has a positive impact on the industrial structure. Furthermore, acting as an intermediate variable, it facilitates the enhancement of GTFEE. The elevation of the level of financial development can transmit its impact on the improvement of GTFEE via changes in the industrial structure. Subsequently, the results of the DH causality tests further corroborate this finding.

Secondly, the QRPD panel quantile regression revealed significant heterogeneity in the influences of financial advancement and industrial composition on GTFEE. Initially, financial development exerted a restraining effect, gradually weakening and transitioning into a promoting effect, but this facilitating effect also weakened with the growth of GTFEE. The industrial structure consistently played a promoting role. It is worth noting that the impact of the industrial structure was enhanced and then weakened. Finally, the panel PMG-ARDL heterogeneity regression results show that the long-term relationship between the industrial structure and GTFEE varies with the development of finance.

China is a significant emerging country amid a transitional period. The slowdown of global economic growth and prevailing international concerns have exacerbated the obstacles encountered by China in its efforts to reshape its economy. In response to the research in this paper, this paper makes the following recommendations.

In order to completely harness the potential of the financial system, the government ought to create a conducive institutional atmosphere that promotes financial growth and puts into effect a series of robust actions. While maintaining efficient risk management, emphasis should be placed on expanding the scope of finance and giving thoughtful attention to the diversification of financial institutions. This will aid in constructing a stable financial infrastructure and encouraging healthy competition within the national financial system, ultimately improving financial effectiveness [

106,

107].

The transition of the industrial framework needs to be seen as a protracted modification process. The secondary sector, specifically heavy industry, should utilize advanced technology sectors to drive the advancement of other industries. Therefore, the government should leverage information technology to modernize traditional sectors and employ market mechanisms to regulate urbanization. This includes accelerating the development of key emerging industries and nurturing the expansion of contemporary service sectors [

107,

108].

Optimizing the industrial structure not only enhances GTFEE but also serves as a conduit for the transmission of financial development’s improving influence on GTFEE. Consequently, when the government embarks on industrial restructuring, it must incorporate financial development into its overarching strategy. Particular attention should be placed on the pivotal role of the financial sector and the creation of a favorable financial environment. This approach will capitalize on financial development’s supportive impact on adjustments to the industrial structure, ultimately fostering GTFEE enhancement and the realization of a low-carbon, high-efficiency development trajectory for the Chinese economy.

The improvement of energy efficiency in the western, central, and northeastern regions should be accelerated to narrow the gap with the east. The western and northeastern regions should capitalize on their own development advantages, and since these regions are rich in resources, they should pay attention to environmental protection while exploiting resources and strictly control the emissions of enterprises, so as not to allow environmental pollution to expand. Secondly, the western and northeastern regions should make good use of their advantages in tourism, relying on their geographical environment and special scenic spots and monuments, which are different from those in the central and eastern regions, to attract tourists and enhance their development.

We should learn from the valuable experience of the development process in the eastern regions. Against the backdrop of the relatively backward development of the western and northeastern regions, we should tilt the focus of development toward the western and northeastern regions and adopt the policy of one-on-one assistance from the more developed regions in the east to the backward ones so that the western and northeastern regions can be provided with the basic soil conditions for development as soon as possible and assisted in the establishment of the beginnings of a sound path for development, thereby enhancing energy efficiency.