Risk Spillovers between China’s Carbon and Energy Markets

Abstract

:1. Introduction

2. Literature Review

3. The Model and Data

3.1. Model

3.2. Data

4. Empirical Results and Analysis

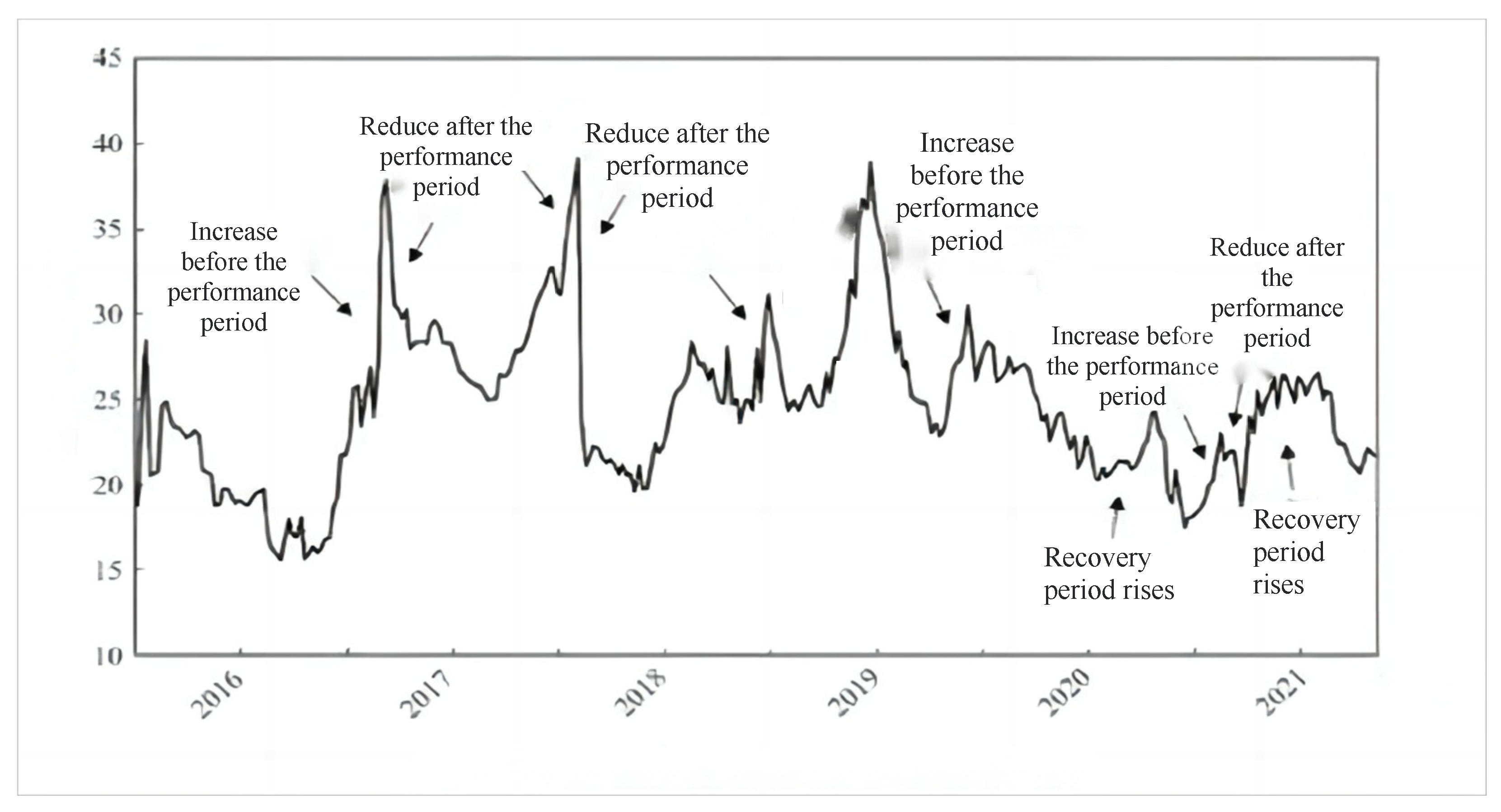

4.1. Return Spillovers

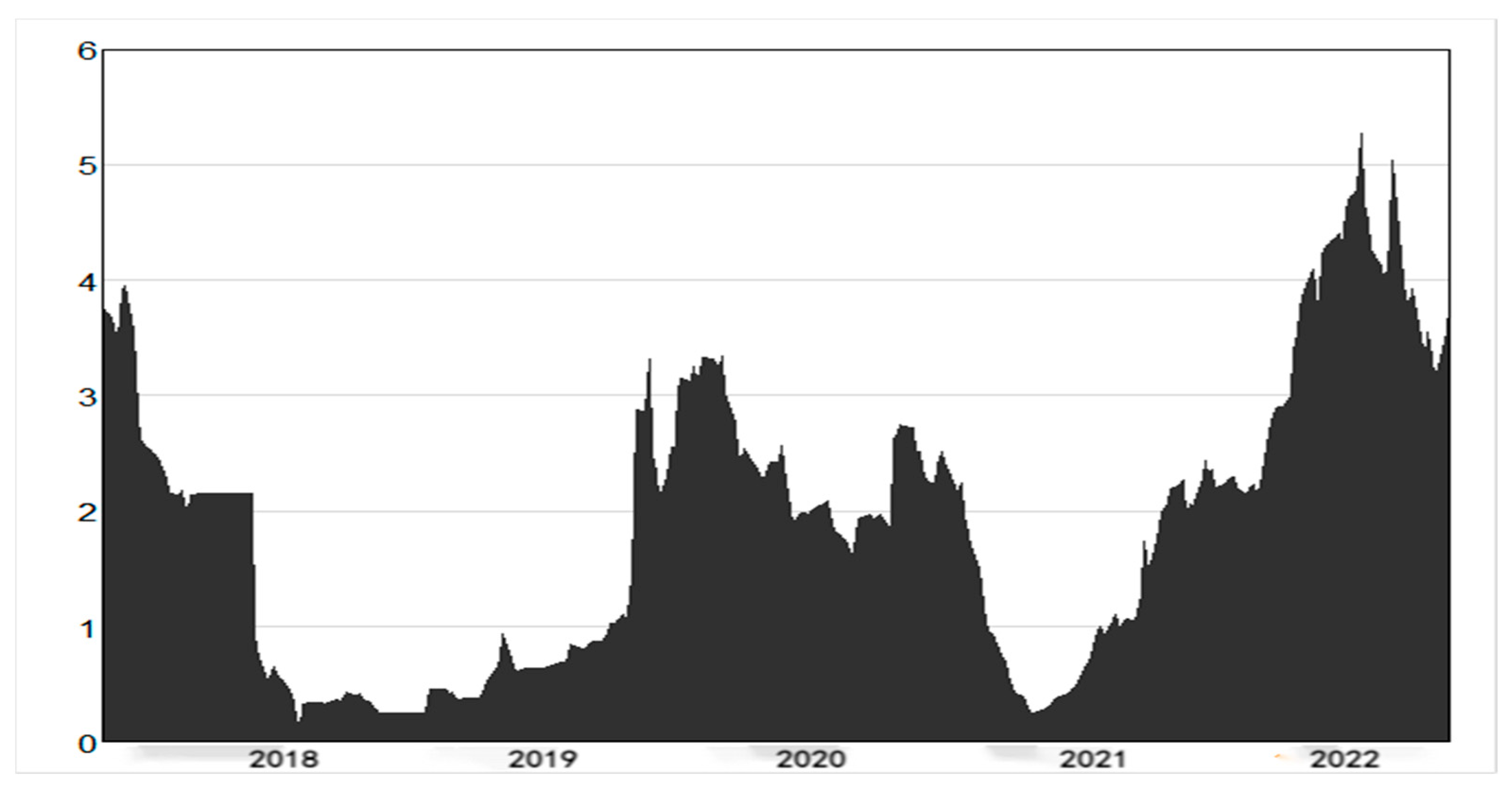

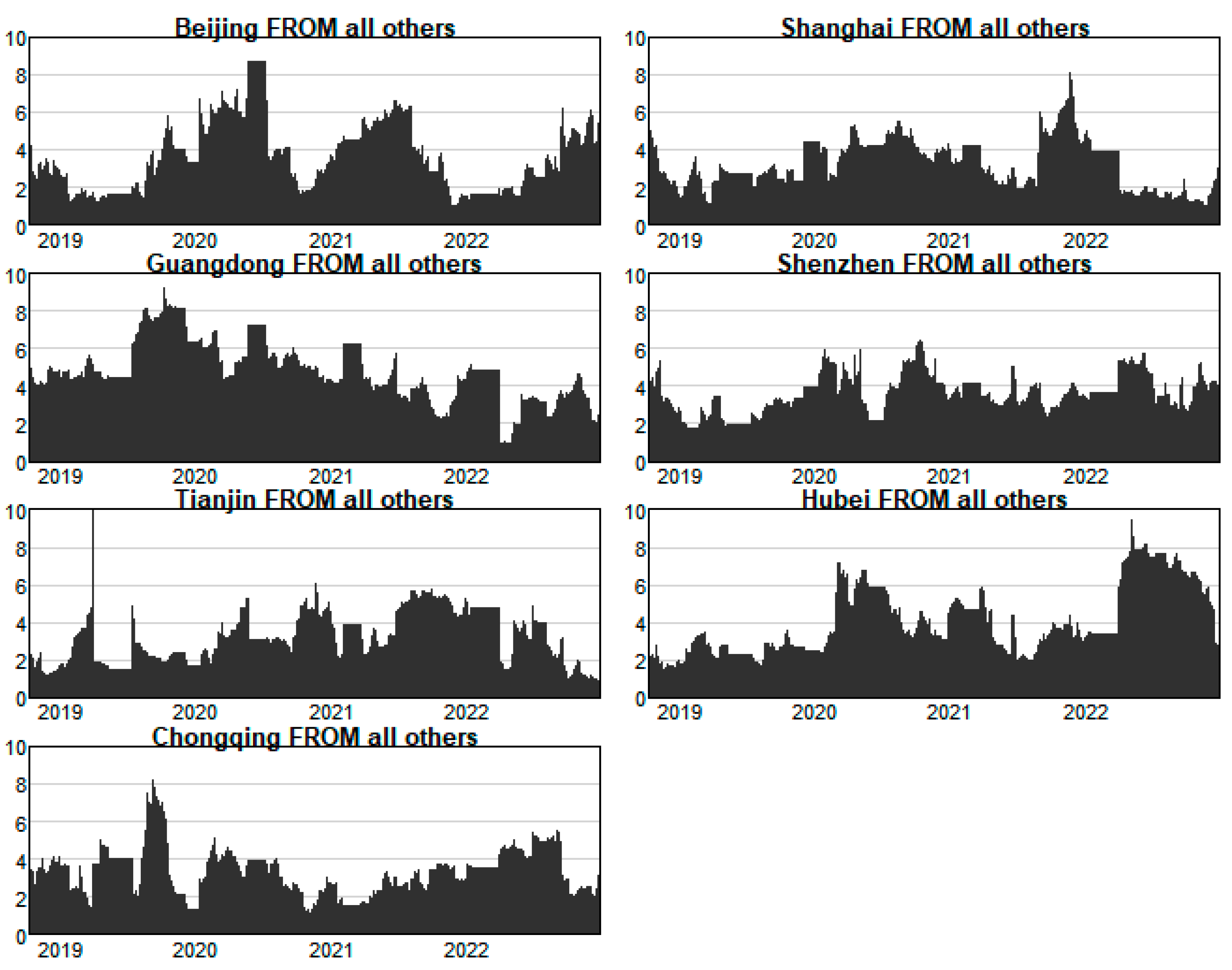

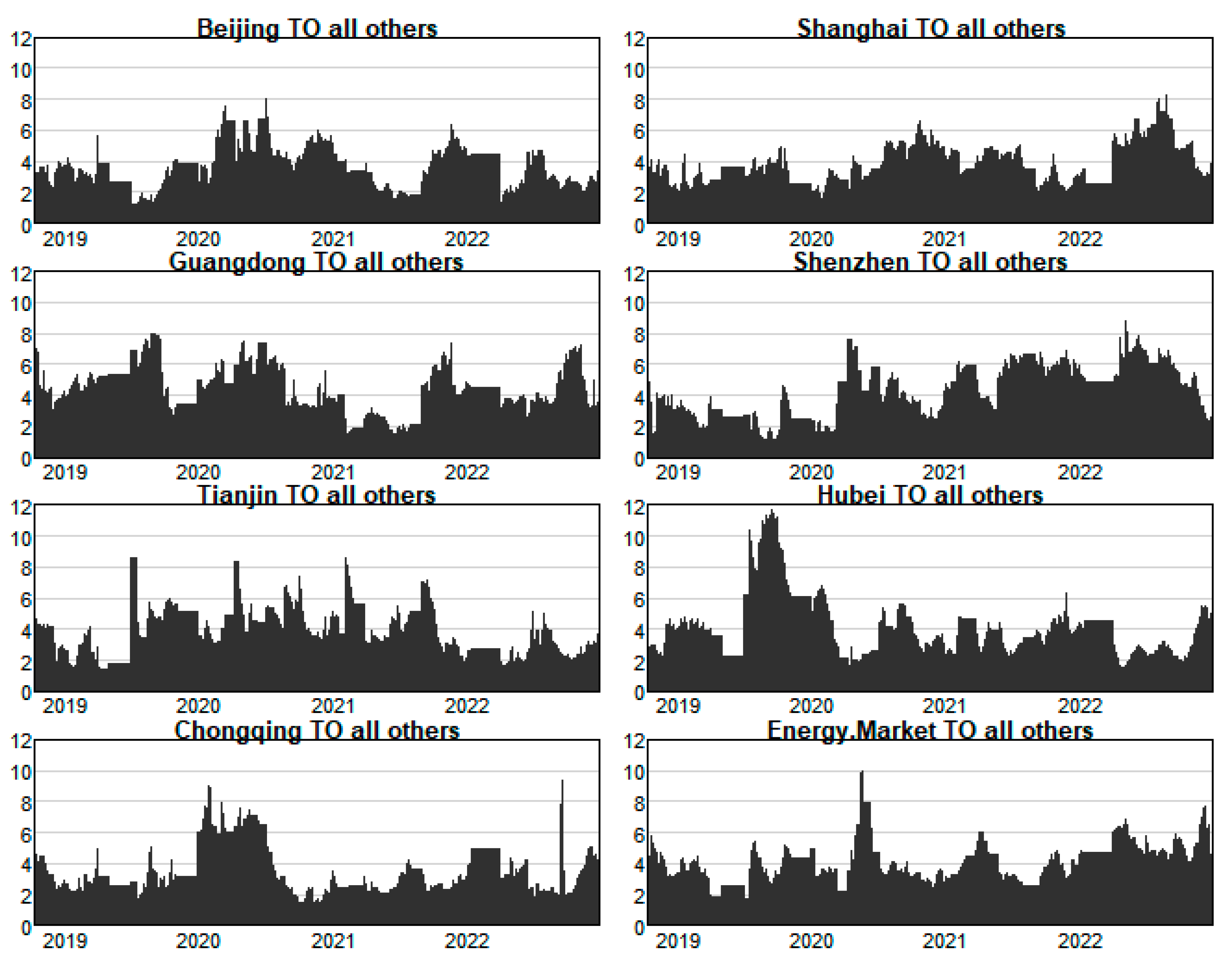

4.2. Volatility Spillovers

4.3. Predicted Output Values for the Short Term and Long Term

4.4. Risk from Energy Markets to the Carbon Market (Coal, Oil, and Gas)

5. Conclusions and Strategy Suggestions

5.1. Conclusions

5.2. Strategy Suggestions

- (1)

- Establishing a unified national carbon market is imperative. Currently, China’s carbon emission trading market is still in its nascent stage and lacks a comprehensive framework and robust mechanisms. There is a need to enhance risk identification, early warning systems, and control mechanisms for effective management.

- (2)

- Harnessing the power of policy guidance and market mechanisms at the national level is crucial. The carbon market should be at the forefront, with a focus on stabilizing market prices and aligning environmental concerns with the country’s economic and social development goals. The government should assume the roles of policy guidance, administrative services, and market supervision to mitigate and control the risks associated with the carbon market.

- (3)

- Strengthening market operations, supervision, and law enforcement is essential. Currently, China’s carbon market requires enhancements in operational mechanisms, technical specifications, legislation, and law enforcement practices. It is vital to improve the binding nature and enforceability of the legal framework governing the carbon market, as well as establish a robust foundation for enforcement actions and well-trained personnel. This will ensure compliance and foster a fair and efficient national carbon market, thereby mitigating risks and spillover effects (Ministry of Ecology and Environment: Report on the First Compliance Cycle of the National Carbon Emission Trading Market, 3 January 2023).

- (4)

- Promote the vibrancy of financial instruments. The financial sector’s diverse range of products and trading activities can enhance the carbon market’s price discovery mechanism, stabilize carbon prices, and improve carbon asset management capabilities, thereby strengthening the ability to mitigate and address carbon market risks. This can be achieved through various financial derivatives, such as carbon financial asset portfolios, carbon futures, carbon options, and carbon asset securitization. In China, the limited number of participants in the carbon financing market and the relative scarcity of financial products and liquidity have hindered the financing capacity and flexibility of enterprises’ carbon assets. To address this, carbon market support tools, such as carbon indices and carbon insurance, play a crucial role in improving investors’ understanding of carbon market prices and providing investment guarantees. These tools also serve as important means to enhance the creditworthiness of the carbon market. Furthermore, enterprises can be incentivized to strengthen technological innovation in energy conservation and emissions reduction, as well as a transition from high-carbon energy utilization to low-carbon energy sources. This can be achieved through the income effect and substitution effect, encouraging enterprises to adopt low-carbon new energy sources instead of high-carbon energy, thereby reducing greenhouse gas emissions. Additionally, supporting enterprise development through the purchase of carbon credits ensures that energy emissions are regulated, contributing to the control of carbon emissions and promoting environmental protection alongside economic and social development.

- (5)

- Enhance the capabilities for identifying, assessing, and managing risks while continuously improving early warning systems. Carbon market risks stem from both demand-side and supply-side factors. It is crucial to expedite the development of a comprehensive top-level design for the carbon market, establish a fair and efficient national unified carbon market that accommodates regional diversification, and ensure the fairness and efficiency of the carbon quota allocation system. This should be accompanied by the establishment of robust carbon trading and offset mechanisms, rationalization of quota storage and liquidity mechanisms, and enhancement of the carbon market’s capacity for adjustment. Additionally, a multi-level supervision mechanism should be implemented effectively, including the enforcement of penalty mechanisms and the strengthening of information disclosure mechanisms. To mitigate information asymmetry and reduce uncertainties in carbon market prices and transactions, it is essential to improve the enterprise credit evaluation system and implement comprehensive risk management throughout the entire process. By conducting qualitative and quantitative analyses to identify systemic risks, a robust carbon market risk early warning system can be established. This system will enable effective prediction and formulation of risk control programs, thereby preventing and addressing inter-industry risk spillovers.

- (6)

- Exploit the self-regulatory function of the carbon market to incentivize participation and enhance the liquidity of carbon allowances. Encourage enterprises to enhance energy efficiency through technological innovation and foster the growth of non-fossil-fuel enterprises and industries. By improving energy efficiency and accelerating the shift in energy demand structure, effective carbon asset management can be achieved. In the short term, the rise in carbon prices may increase production costs and reduce the competitiveness of enterprises. However, in the long run, enterprises should proactively enhance their carbon asset management capabilities and expedite the transition on the energy demand side, driven by the income effect and substitution effect. As an emerging financial market, the carbon market plays a crucial role in regulating the consumption of fossil fuels within environmentally sustainable limits, promoting the development of low-carbon energy sources, and facilitating the green transformation of the development model. Investors in the carbon market can optimize asset allocation, stabilize portfolio returns, and minimize risk signals transmitted to the market. This can be achieved by leveraging information from risk early warning systems and risk assessment systems, enabling effective risk mitigation and control (The People’s Bank of China, et al.: Knowledge of the Opinions on the Construction of a Green Financial System. 21 August 2016).

- (7)

- Promote the transformation and upgrading of the energy supply and demand structure. China should enhance its cooperation and integration with the international carbon market. This can be achieved by optimizing the energy structure, reducing reliance on coal and fossil fuels, and promoting industrial optimization and upgrading. It is crucial to prevent the blind development of industries with high energy consumption and high emissions. China can learn from the carbon market trading rules of the European Union, as well as domestic and international risk early warning systems. By identifying and understanding the factors, causes, and transmission paths of risks, a comprehensive risk early warning system can be established using big data information. This will improve the ability to identify and warn investors of risks in the carbon market, preventing risk spillover from the carbon market to the energy market. Furthermore, strengthening China’s participation in the international carbon market will help to build the image of China as a responsible global power. It will also contribute to the establishment of effective mechanisms to address global warming. By actively addressing climate change and taking responsibility for reducing greenhouse gas emissions, China can enhance its reputation as a responsible major country and contribute to global efforts to combat global warming.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Balcılar, M.; Demirer, R.; Hammoudeh, S. Risk spillovers across the energy and carbon markets and hedging strategies for carbon risk. Energy Econ. 2016, 54, 159–172. [Google Scholar] [CrossRef]

- Wang, Y.; Guo, Z. The dynamic spillover between carbon and energy markets: New evidence. Energy 2018, 149, 24–33. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Mobin, S.M.; Azmat, R. Impact of Improper Household Solid Waste Management on Environment: A Case Study of Karachi City, Pakistan. Asian J. Chem. 2015, 27, 4523–4526. [Google Scholar] [CrossRef]

- Osborn, D.; Datta, A. Institutional and policy cocktails for protecting coastal and marine environments from land-based sources of pollution. Ocean. Coast. Manag. 2006, 49, 576–596. [Google Scholar] [CrossRef]

- Bento-Silva, J.S.; de Andrade, W.M.; Ramos, M.A.; Ferraz, E.M.N.; Souto, W.D.M.; de Albuquerque, U.P.; Araújo, E.D.L. Students’ perception of urban and rural environmental protection areas in Pernambuco, Brazil. Trop. Conserv. Sci. 2015, 8, 813–827. [Google Scholar] [CrossRef]

- Huang, Y.; Zhou, Z.; Huang, J. The management efficiency of rural ecological environment in different regions. J. Arid Land Resour. Environ. 2015, 29, 75–80. [Google Scholar]

- Zhu, Q.Y.; Sun, C.Z.; Zhao, L.S. Effect of the marine system on the pressure of the food–energy–water nexus in the coastal regions of China. J. Clean. Prod. 2021, 319, 1–12. [Google Scholar] [CrossRef]

- Wang, S.; Jia, M.; Zhou, Y. Impacts of changing urban form on ecological efficiency in China: A comparison between urban agglomerations and administrative areas. J. Environ. Plan. Manag. 2019, 8, 128753. [Google Scholar] [CrossRef]

- Wang, S.; Wang, X.L.; Lu, F. The impact of collaborative innovation on ecological efficiency—Empirical research based on China’s regions. Technol. Anal. Strateg. Manag. 2020, 32, 242–256. [Google Scholar] [CrossRef]

- Liu, S.; Fan, F.; Zhang, J.Q. Are Small Cities More Environmentally Friendly? An Empirical Study from China. Int. J. Environ. Res. Public Health 2019, 16, 727. [Google Scholar] [CrossRef] [PubMed]

- Ke, H.Q.; Dai, S.Z. Does innovation efficiency inhibit the ecological footprint? An empirical study of China’s provincial regions. Technol. Anal. Strateg. Manag. 2021, 33, 1959910. [Google Scholar] [CrossRef]

- Ke, H.Q.; Dai, S.Z.; Yu, H.C. Spatial effect of innovation efficiency on ecological footprint: City-level empirical evidence from China. Environ. Technol. Innov. 2021, 22, 101536. [Google Scholar] [CrossRef]

- Sun, C.Z.; Yan, X.D.; Zhao, L.S. Coupling efficiency measurement and spatial correlation characteristic of water-energy-food nexus in China. Resour. Conserv. Recycl. 2021, 164, 105151. [Google Scholar] [CrossRef]

- Yu, H.C.; Liu, Y.; Liu, C.L. Spatiotemporal Variation and Inequality in China’s Economic Resilience across Cities and Urban Agglomerations. Sustainability 2018, 10, 4754. [Google Scholar] [CrossRef]

- Fan, F.; Cao, D.; Ma, N. Is Improvement of Innovation Efficiency Conducive to Haze Governance? Empirical Evidence from 283 Chinese Cities. Int. J. Environ. Res. Public Health 2020, 17, 6095. [Google Scholar] [CrossRef] [PubMed]

- Xie, J.; Sun, Q.; Wang, S.H.; Li, X.P. Does Environmental Regulation Affect Export Quality? Theory and Evidence from China. Int. J. Environ. Res. Public Health 2020, 17, 8237. [Google Scholar] [CrossRef]

- Ke, H.Q.; Yang, W.Y.; Liu, X.Y. Does Innovation Efficiency Suppress the Ecological Footprint? Empirical Evidence from 280 Chinese Cities. Int. J. Environ. Res. Public Health 2020, 17, 6826. [Google Scholar] [CrossRef]

- Fan, F.; Zhang, K.K.; Dai, S.Z. Decoupling analysis and rebound effect between China’s urban innovation capability and resource consumption. Technol. Anal. Strateg. Manag. 2021, 33, 1979204. [Google Scholar] [CrossRef]

- Bekele, W.; Drake, L. Soil and water conservation decision behavior of subsistence farmers in the Eastern Highlands of Ethiopia: A case study of the Hunde-Lafto area. Ecol. Econ. 2003, 46, 437–451. [Google Scholar] [CrossRef]

- Reddy, V.R.; Behera, B. Impact of water pollution on rural communities: An economic analysis. Ecol. Econ. 2006, 58, 520–537. [Google Scholar] [CrossRef]

- Howley, P.; Yadav, L.; Hynes, S.; Donoghue, C.O.; Neill, S.O. Contrasting the attitudes of farmers and the general public regarding the ‘multifunctional’ role of the agricultural sector. Land Use Policy 2014, 38, 248–256. [Google Scholar] [CrossRef]

- Saitou, T. The Logic of Liberty: Michael Polanyi’s Theory of Liberty. Chuo Law Rev. 2000, 107, 185–220. [Google Scholar]

- Hodge, I. Beyond agri-environmental policy: Towards an alternative model of rural environmental governance. Land Use Policy 2001, 18, 99–111. [Google Scholar] [CrossRef]

- Sun, Y.; Zhao, Y.P.; Cui, Y. Rural Ecological Environment Governance in China: Efficiency Evaluation and Improvement Strategy. Qinghai Soc. Sci. 2019, 3, 53–59. [Google Scholar]

- Fan, F.; Lian, H.; Liu, X. Can environmental regulation promote urban green innovation Efficiency? An empirical study based on Chinese cities. J. Clean. Prod. 2020, 287, 125060. [Google Scholar] [CrossRef]

- Zhang, J.Q.; Wang, S.; Yang, P.L. Analysis of Scale Factors on China’s Sustainable Development Efficiency Based on Three-Stage DEA and a Double Threshold Test. Sustainability 2020, 12, 2225. [Google Scholar] [CrossRef]

- Fan, F.; Dai, S.Z.; Zhang, K.K. Innovation agglomeration and urban hierarchy: Evidence from Chinese cities. Appl. Econ. 2021, 53, 6300–6318. [Google Scholar] [CrossRef]

- Wang, X.L.; Wang, L.; Wang, S. Marketisation as a channel of international technology diffusion and green total factor productivity: Research on the spillover effect from China’s first-tier cities. Technol. Anal. Strateg. Manag. 2021, 33, 491–504. [Google Scholar] [CrossRef]

- Zhang, J.Q.; Chen, T.T. Empirical Research on Time-Varying Characteristics and Efficiency of the Chinese Economy and Monetary Policy: Evidence from the MI-TVP-VAR Model. Appl. Econ. 2018, 50, 3596–3613. [Google Scholar] [CrossRef]

- Yang, W.Y.; Fan, F.; Wang, X.L. Knowledge innovation network externalities in the Guangdong-Hong Kong-Macao Greater Bay Area: Borrowing size or agglomeration shadow? Technol. Anal. Strateg. Manag. 2021, 33, 1940922. [Google Scholar] [CrossRef]

- Wang, S.; Zhang, J.Q. The symbiosis of scientific and technological innovation efficiency and economic efficiency in China—An analysis based on data envelopment analysis and logistic model. Technol. Anal. Strateg. Manag. 2019, 31, 67–80. [Google Scholar] [CrossRef]

- Wang, Z.; Zong, Y.; Dan, Y.; Jiang, S.J. Country risk and international trade: Evidence from the China-B & R countries. Appl. Econ. Lett. 2021, 28, 1784–1788. [Google Scholar]

- Fan, F.; Lian, H.; Wang, S. Can regional collaborative innovation improve innovation efficiency? An empirical study of Chinese cities. Growth Chang. 2020, 51, 440–463. [Google Scholar] [CrossRef]

- Yu, H.C.; Zhang, J.Q.; Zhang, M.Q. Cross-national knowledge transfer, absorptive capacity, and total factor productivity: The intermediary effect test of international technology spillover. Technol. Anal. Strateg. Manag. 2021, 33, 1915476. [Google Scholar] [CrossRef]

- Bosikov, I.I.; Martyushev, N.V.; Klyuev, R.V.; Savchenko, I.A.; Kukartsev, V.V.; Kukartsev, V.A.; Tynchenko, Y.A. Modeling and Complex Analysis of the Topology Parameters of Ventilation Networks When Ensuring Fire Safety While Developing Coal and Gas Deposits. Fire 2023, 6, 95. [Google Scholar] [CrossRef]

- Gu, Z.; Liu, Z.; Wang, Z.; Shen, R.; Qian, J.; Lin, S. Study on characteristics of methane explosion flame and pressure wave propagation to the non-methane area in a connected chamber. Fire Mater. 2021, 46, 639–650. [Google Scholar] [CrossRef]

- Qiao, S.; Zhao, C.; Quan, K. Research on Time-Varying Two-Way Spillover Effects Between Carbon and Energy Markets. Front. Energy Res. 2021, 12, 199–218. [Google Scholar]

- Klyuev, R.V.; Morgoev, I.D.; Morgoeva, A.D.; Gavrina, O.A.; Martyushev, N.V.; Efremenkov, E.A.; Mengxu, Q. Methods of Forecasting Electric Energy Consumption: A Literature Review. Energies 2022, 15, 23. [Google Scholar] [CrossRef]

- Ma, Y.S.; Chen, F.; Wang, Q. Evaluation on the coordinated development level of rural economy and agricultural ecological environment—A case study of Huanggang City, Hubei Province. Jiangsu Agric. Sci. 2016, 44, 597–599. [Google Scholar]

- Cai, L. The beneficial Influence of Population Migration and Flow on the Ecosystem of Environment. Ecol. Econ. 2006, 44–47. [Google Scholar]

- Xiao, Z.L.; Du, X.Y. Convergence in China’s high-tech industry development performance: A spatial panel model. Appl. Econ. 2017, 49, 5296–5308. [Google Scholar]

- Fan, F.; Zhang, X.R.; Yang, W.Y. Spatiotemporal Evolution of China’s ports in the International Container Transport Network under Upgraded Industrial Structure. Transp. J. 2021, 60, 43–69. [Google Scholar] [CrossRef]

- Xiao, Y.T. Analysis of the Mechanism and Countermeasure of Social Capital Affecting Rural Ecological Environment Governance. Theor. Investig. 2018, 113–119. [Google Scholar]

- Shi, L.; Jin, Z.H. Research on Optimization of Efficiency of Financial Support for Agriculture in China’s Rural Revitalization. Contemp. Econ. Res. 2021, 103–112. [Google Scholar]

- Liu, N.; Fan, F. Threshold effect of international technology spillovers on China’s regional economic growth. Technol. Anal. Strateg. Manag. 2020, 32, 923–935. [Google Scholar] [CrossRef]

- Tang, H.Y.; Zhang, J.Q. High-speed rail, urban form, and regional innovation: A time-varying difference-in-differences approach. Technol. Anal. Strateg. Manag. 2022, 34, 2026322. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. On the network topology of variance decompositions: Measuring the connectedness of financial firms. J. Econom. 2014, 182, 119–134. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Gabauer, D. Refined Measures of Dynamic Connectedness based on Time-Varying Parameter Vector Autoregressions. J. Risk Financ. Manag. 2020, 13, 84. [Google Scholar] [CrossRef]

- Fan, F.; Zhang, X.R. Transformation effect of resource-based cities based on PSM-DID model: An empirical analysis from China. Environ. Impact Assess. Rev. 2021, 91, 106648. [Google Scholar] [CrossRef]

- Wang, J.S. Analysis on the protection and governance of rural ecological environment in the construction of New Countryside. Agric. Econ. 2017, 36–37. [Google Scholar]

- Wang, S.; Wang, J.; Wei, C.; Wang, X.; Fan, F. Collaborative innovation efficiency: From within cities to between cities—Empirical analysis based on innovative cities in China. Growth Chang. 2021, 52, 1330–1360. [Google Scholar] [CrossRef]

- Fan, F.; Du, D.B. The Measure and the Characteristics of Temporal-spatial Evolution of China Science and Technology Resource Allocation Efficiency. J. Geogr. Sci. 2014, 24, 492–508. [Google Scholar] [CrossRef]

- Easton, D.; Klonoski, J.R. A Systems Analysis of Political Life. West. Political Q. 1967, 20, 737. [Google Scholar]

- Yuan, X.L.; Wu, Q.; Li, C.P. Study on the Impact of Changes in local Fiscal Expenditure on Environmental Pollution in China. J. Beijing Univ. Technol. Soc. Sci. Ed. 2019, 19, 72–83. [Google Scholar]

- Xie, J.; Liu, L. Present situation and Countermeasures of social organization participation in environmental governance. Environ. Prot. 2013, 41, 21–23. [Google Scholar]

| Carbon Market | Variable | Mean Value | Standard Deviation | Minimum Value | Maximum Value | Skewness | Kurtosis | JB Statistic | ADF Trace Statistic |

|---|---|---|---|---|---|---|---|---|---|

| Beijing | Return | 0.0025 | 0.0295 | −0.1298 | 0.1834 | 0.8697 | 11.9360 | 7241.4953 *** | −22.189 *** |

| Shanghai | 0.0025 | 0.0343 | −0.1159 | 0.3643 | 4.1816 | 43.9120 | 435,637.9111 *** | −22.019 *** | |

| Guangdong | 0.0184 | 0.1003 | −0.1609 | 1.2222 | 6.8721 | 68.9707 | 20,391.8219 *** | −18.844 *** | |

| Shenzhen | 0.0416 | 0.1768 | −0.2281 | 2.0433 | 6.4619 | 59.4070 | −17.465 *** | ||

| Tianjin | 0.0009 | 0.0174 | −0.0977 | 0.2143 | 4.8494 | 70.4897 | −16.381 *** | ||

| Hubei | 0.0008 | 0.0154 | −0.0855 | 0.0832 | −0.3251 | 11.8631 | 436,340.7191 *** | −21.896 *** | |

| Chongqing | 0.0027 | 0.0466 | −0.1667 | 0.1992 | 0.2011 | 6.4314 | −15.367 *** | ||

| Beijing | Volatility | 0.0180 | 0.0318 | 0.0000 | 0.3026 | 3.3376 | 22.2667 | −12.550 *** | |

| Shanghai | 0.0247 | 0.1821 | 0.0000 | 3.3175 | 17.0259 | 306.2195 | −18.747 *** | ||

| Guangdong | 0.3182 | 2.4024 | 0.0000 | 42.7835 | 15.9799 | 279.5159 | −17.824 *** | ||

| Shenzhen | 0.9918 | 7.6705 | 0.0000 | 134.1203 | 15.3668 | 261.0747 | −16.251 *** | ||

| Tianjin | 0.0087 | 0.0655 | 0.0000 | 1.1480 | 15.4196 | 263.2136 | −18.332 *** | ||

| Hubei | 0.0073 | 0.0146 | 0.0000 | 0.1739 | 5.6689 | 53.5639 | −15.164 *** | ||

| Chongqing | 0.0284 | 0.0453 | 0.0000 | 0.2914 | 2.1499 | 8.0544 | −9.320 *** |

| Carbon Market | Beijing | Shanghai | Guangdong | Shenzhen | Tianjin | Hubei | Chongqing | Internal Spillover |

|---|---|---|---|---|---|---|---|---|

| Beijing | 98.44 | 0.41 | 0.2 | 0.74 | 0.02 | 0.09 | 0.09 | 1.56 |

| Shanghai | 0.05 | 97.1 | 1.1 | 1.46 | 0.03 | 0.08 | 0.17 | 2.9 |

| Guangdong | 0.15 | 1.75 | 95.99 | 0.14 | 0.15 | 1.58 | 0.24 | 4.01 |

| Shenzhen | 0.99 | 1.34 | 0.2 | 96.72 | 0.18 | 0.44 | 0.12 | 3.28 |

| Tianjin | 0.56 | 0.2 | 0.2 | 0.16 | 98.32 | 0.17 | 0.39 | 1.68 |

| Hubei | 0.2 | 0.68 | 5.8 | 0.26 | 0.2 | 92.01 | 0.85 | 7.99 |

| Chongqing | 0.04 | 1.4 | 0.28 | 1.04 | 0.26 | 0.22 | 96.75 | 3.25 |

| External spillover | 1.99 | 5.79 | 7.79 | 3.8 | 0.85 | 2.59 | 1.86 | 24.67 |

| Net spillover | 99.43 | 98.9 | 98.78 | 97.51 | 99.17 | 94.6 | 98.61 |

| Carbon Market | Beijing | Shanghai | Guangdong | Shenzhen | Tianjin | Hubei | Chongqing | Internal Spillover |

|---|---|---|---|---|---|---|---|---|

| Beijing | 95.03 | 0.47 | 0.80 | 0.20 | 1.20 | 2.05 | 0.25 | 5.00 |

| Shanghai | 3.24 | 18.58 | 0.08 | 0.05 | 71.63 | 5.88 | 0.54 | 81.40 |

| Guangdong | 6.24 | 0.33 | 92.53 | 0.18 | 0.24 | 0.26 | 0.22 | 7.50 |

| Shenzhen | 3.00 | 0.05 | 0.19 | 96.49 | 0.18 | 0.05 | 0.04 | 3.50 |

| Tianjin | 2.31 | 0.95 | 0.10 | 0.14 | 89.63 | 6.22 | 0.66 | 10.40 |

| Hubei | 0.58 | 0.23 | 0.22 | 0.12 | 0.31 | 97.12 | 1.42 | 2.90 |

| Chongqing | 0.14 | 0.92 | 2.46 | 0.42 | 5.26 | 2.14 | 88.66 | 11.30 |

| External spillover | 15.50 | 2.90 | 3.90 | 1.10 | 78.80 | 16.60 | 3.10 | 17.40 |

| Net spillover | 10.50 | −78.50 | −3.60 | −2.40 | 68.50 | 13.70 | −8.20 |

| Predictive Value | Posterior Stage | Posterior 2 Stage | Posterior 3 Stage | Posterior 4 Stage | Posterior 5 Stage | Posterior 6 Stage | Posterior 7 Stage | Posterior 8 Stage | Posterior 9 Stage | Posterior 10 Stage | Posterior 11 Stage | Posterior 12 Stage |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean value | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 |

| Standard deviation | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 |

| Minimum value | −0.141 | −0.141 | −0.141 | −0.141 | −0.141 | −0.141 | −0.141 | −0.141 | −0.141 | −0.141 | −0.141 | −0.141 |

| Maximum value | 0.616 | 0.616 | 0.616 | 0.616 | 0.616 | 0.616 | 0.616 | 0.616 | 0.616 | 0.616 | 0.616 | 0.616 |

| Skewness | 1.396 | 2.010 | 2.326 | 2.488 | 2.572 | 2.614 | 2.636 | 2.648 | 2.654 | 2.657 | 2.658 | 2.659 |

| Kurtosis | 23.799 | 30.431 | 32.963 | 33.931 | 34.300 | 34.441 | 34.495 | 34.515 | 34.523 | 34.526 | 34.527 | 34.528 |

| Predictive Value | Posterior Stage | Posterior 2 Stage | Posterior 3 Stage | Posterior 4 Stage | Posterior 5 Stage | Posterior 6 Stage | Posterior 7 Stage | Posterior 8 Stage | Posterior 9 Stage | Posterior 10 Stage | Posterior 11 Stage | Posterior 12 Stage |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean value | 1.487 | 1.487 | 1.487 | 1.487 | 1.487 | 1.487 | 1.487 | 1.487 | 1.487 | 1.487 | 1.487 | 1.487 |

| Standard deviation | 0.200 | 0.200 | 0.200 | 0.200 | 0.200 | 0.200 | 0.200 | 0.200 | 0.200 | 0.200 | 0.200 | 0.200 |

| Minimum value | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| Maximum value | 26.020 | 26.020 | 26.020 | 26.020 | 26.020 | 26.020 | 26.020 | 26.020 | 26.020 | 26.020 | 26.020 | 26.020 |

| Skewness | 10.707 | 10.707 | 10.707 | 10.707 | 10.707 | 10.707 | 10.707 | 10.707 | 10.707 | 10.707 | 10.707 | 10.707 |

| Kurtosis | 105.825 | 137.216 | 147.295 | 150.531 | 151.570 | 151.903 | 152.010 | 152.045 | 152.056 | 152.059 | 152.060 | 152.061 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hwang, Q.; Yao, M.; Li, S.; Wang, F.; Luo, Z.; Li, Z.; Liu, T. Risk Spillovers between China’s Carbon and Energy Markets. Energies 2023, 16, 6820. https://doi.org/10.3390/en16196820

Hwang Q, Yao M, Li S, Wang F, Luo Z, Li Z, Liu T. Risk Spillovers between China’s Carbon and Energy Markets. Energies. 2023; 16(19):6820. https://doi.org/10.3390/en16196820

Chicago/Turabian StyleHwang, Qianrui, Min Yao, Shugang Li, Fang Wang, Zhenmin Luo, Zheng Li, and Tongshuang Liu. 2023. "Risk Spillovers between China’s Carbon and Energy Markets" Energies 16, no. 19: 6820. https://doi.org/10.3390/en16196820

APA StyleHwang, Q., Yao, M., Li, S., Wang, F., Luo, Z., Li, Z., & Liu, T. (2023). Risk Spillovers between China’s Carbon and Energy Markets. Energies, 16(19), 6820. https://doi.org/10.3390/en16196820