1. Introduction

The world is experiencing an energy transition toward a low-carbon economy. As a result, over the past years, the large-scale deployment of renewables has been notable, especially for solar and wind. Considering the international agreements and targets for the reduction of greenhouse gas emissions, and the highly competitive prices that both sources have achieved in recent years, it may be concluded that solar and wind may soon become the predominant energy sources of the global economy. The main characteristics of solar and wind sources are (i) low generation cost; (ii) low predictability, meaning higher uncertainty about the generation; and (iii) intermittency or variability [

1,

2,

3]. This combination, together with the fast and large-scale expansion of these sources, raises a new challenge: the construction of a flexible system, favorable to the development of a grid capable of dealing with sharp variations in the generation curve.

The study of grid flexibility is not new, being a theme for research for many years. The definition of system flexibility varies with each study, indicating that there is not a universal definition [

2]. Before the deployment of variable renewable energy (VRE), flexibility was a feature needed to adjust the power production to the requirements created by the changes in demand, an uncertainty that had a high level of predictability. With the deployment of VRE, flexibility gained a more general and comprehensive definition as the ability of a system to quickly respond to fluctuations in the net demand [

4,

5]. During the past decade, flexibility was one of the main themes studied by energy planners. Compared to a system with high levels of predictability, the introduction of large amounts of VRE introduced more uncertainty, variability, and stochasticity.

When studying power systems, flexibility can be divided into sub-definitions, including power flexibility, energy flexibility, transfer capacity, and voltage control [

6]. These differences also relate to the time granularity of the requirement ranging from milliseconds (transient stability) to minutes, hours, and days. The understanding of this difference is especially important in large interconnected hydro systems, as is the case in Brazil, which has experienced the deployment of large quantities of VRE. In such systems, the expansion of flexibility needs to be planned considering all the system needs and not just the flexibility related to the medium-term capacity flexibility needed to balance the variability of the hydro resource. For example, a recent study made of the Colombian grid concluded that for low hydrology scenarios, the Colombian grid may not be flexible enough to balance the short-term flexibility needs required by the installation of large amounts of VRE [

7].

Reference [

2] brings an extensive review on the definitions of system flexibility, including the planning perspective (capacity and energy flexibility) and the operational flexibility (grid level disturbances). Most of the research focus on a system’s ability to quickly respond to fluctuations in the net demand [

4,

5]; the capability to provide supply–demand balance, maintain continuity in unexpected situations, and cope with uncertainty on supply–demand side [

7,

8]; or the use of automation solutions or schemes to balance the disturbances on grid level [

9,

10]. Although securing the reliability of the grid at all times is of upmost importance, and the study of system-level needs of flexibility are needed, when talking about power markets one can never exclude the economic component from the equation. For this reason, this paper defines flexibility similarly to [

1] and [

11] as the capability to maintain supply reliability at reasonable costs, even when dealing with uncertainties in demand and variability in generation. This definition embraces not only the technical capability of flexible resources to maintain grid reliability, but also inserts the economic perspective as it clearly states that flexibility addition must consider the reasonability of costs.

Although flexibility has an extensive catalog of published studies, the subject of this paper remains relevant these days and deserves further investigation. The reason is the rapid deployment of VRE and the new flexible solutions developed in the recent years such as energy storage, power-to-X, pumped hydro, and others. There are plenty of references showing the overall characteristics and impacts of large-scale development of VRE in power markets [

1], as well as several market-specific studies with the same aim, such as the British, Dutch, Danish, German, South Australian, Texan, and Norwegian cases [

12,

13,

14,

15,

16,

17], to mention only a few. It is already understood and a consensus within the literature that with the insertion of significant renewable energy in power systems, it becomes essential to understand and quantify the need for flexibility and to adapt the current way of planning and operations of power systems [

18].

Some examples of recent studies on flexibility can be highlighted, such as [

7], which quantifies the future need for flexibility in the Colombian grid between 2022 and 2030 and its impact on the existing hydro and thermal assets. Reference [

19] assessed the flexibility needs of the Spanish power system and the contribution of pumped hydro in providing the flexibility requirements by 2030. Other methods for quantification of flexibility are proposed in other recent studies, e.g., the use of real options to assess the investment value of flexibility and the use of dispatch models jointly with probability distribution of VRE generation to quantify the cascade flexibility of hydro plants located in China [

20,

21].

It is challenging to propose one single indicator for system flexibility. Reference [

22] reviewed the academic literature on flexibility and proposed a classification of the studies based on which question each publication tried to answer and contribute. Most of the available literature try to answer questions related to (i) how much flexibility is needed, (ii) how flexible is this technology, (iii) how flexible is a certain system, and (iv) which technology can best provide flexibility. Even though there is extensive literature studying power system flexibility, the question “What is the fair cost to install flexibility in the system?” or “Which technology is the best economic option to supply flexibility in the system” is still yet to be studied. This paper aims to open this discussion and propose a methodology to answer this question, with a focus on hydro systems due to a particularity of this type of systems.

There are multiple references on how hydro plants are capable of supplying flexibility to power systems [

23,

24,

25,

26,

27]. Reference [

25] investigated the importance of flexible hydropower in reducing the curtailment of VRE during the coal phase-out in China. Reference [

27] concluded that for VRE penetrations higher than 20%, flexibility needs to be installed and maintained in a hydro system, including backup sources of capacity. Construction of a hydro system requires additional sources of flexibility to increase the grid capabilities to adjust to variations in generation and to mitigate the risk of uncertainty in inflow conditions [

26].

In the past, before wind and solar become dominant sources in power systems, the flexibility required by a hydro system was needed to tackle uncertainties on the water availability for power generation, due to variability between wet and dry seasons. Nowadays, as wind and solar become relevant energy sources, essentially hydro systems also face the need to balance short-term variability of these sources in order to maintain reliability during times when wind and solar resources are scarce [

23]. Given these different types of flexibility needs, the challenge is how to evaluate the most economical flexibility solution to be installed in a hydro system, considering that certain solutions may be available to resolve each discrete need.

As previously mentioned, hydro power is highly flexible, but also highly seasonal between rainy and dry months and presents variability in yearly water availability. In hydrothermal systems, with storage capacity available, it is possible to optimize the electrical system with relative penetration of wind and solar energy using part of the flexibility of hydroelectric plants. However, given the uncertainty regarding the availability of water in the future and the environmental impact of operating hydroelectric plants to balance intermittency, expanding systemic becomes a challenging problem.

Water storage from hydro plants is an asset for a power system and helps the integration of large shares of VRE. However, in hydro systems with storage, a sequence of favorable rainy seasons may lead to low marginal costs of operation for prolonged periods of time, discouraging investments in other sources of flexibility. This is similar to the problem studied by [

28], which highlighted the problems in markets that were not volatile enough to support an efficient level of flexibility. This is the reason why the study of ways to secure adequate flexibility expansion in hydro systems is of such importance. In this paper, when referring to flexibility, the author means all flexibility required by the grid, including the needs for short-term balancing of VRE (ramps and unit commitment requirements and costs) and the medium-term flexibility to balance variations and uncertainties between rainy seasons and water availability. The aims are to propose a mechanism of evaluation that compares each flexibility solution to the system needs and to propose an economic evaluation to select the most economical solution for the requirements of the grid.

2. Economic Metrics in Power System Projects: A Review

In thermal generation-dominated systems, the increase in the granularity of the market liquidation prices is a good incentive for flexibility expansion. The concept is simple: high volatility in short periods of time drives investments in flexible solutions to explore and profit from these spikes. In hydro systems, the reality is different and, depending on the amount of rainfall, marginal prices can remain low for long periods of time, disincentivizing investments in flexible solutions. How would an investor in flexibility consider investing in a solution that may have no revenues and therefore returns during long periods of time?

Some studies raise the question whether pure energy markets are an efficient tool to expand flexibility [

16]. The solution, usually, is the creation of capacity markets, which remunerate the expansion of flexible capacity in power systems by a fixed payment to each MW of capacity that remains available. This is the case for Chile, the United Kingdom, Brazil, and others. Even though the existing capacity payment mechanism solves the resource adequacy problem and helps the expansion of flexible capacity, it fails to properly evaluate and incentivize the correct type and attributes of flexible solutions.

A simple capacity payment leads to investments in low-cost and low-quality flexibility, as in the case of the traditional peaking plant. A mechanism that evaluates flexibility by capacity payment and also considers variable costs, dynamic capabilities (such as ramping), unit commitment costs, generation levels, and the overall impact on the total system cost is needed. Further, as flexible assets may optimize the operation of the existing assets (by reducing costs of other plants operating outside of optimal technical and economic conditions), the methodology to value new flexibility resources must take into consideration how they will interact with other grid assets to capture potential benefits. Therefore, it is important to consider all of the metrics used to select projects in power systems and evaluate the challenges to use them to value flexibility.

2.1. The Levelized Cost of Electricity

One of the greatest examples of simplified metrics to value solutions in energy markets is the Levelized Cost of Electricity (LCOE). Widely used by agents in power systems, the formula evaluates different sources of generation by their own generation cost. In the past, when comparing candidate projects to system expansion, the project that presented the lowest LCOE was preferred for that specific power system. Among the costs to be considered in the LCOE are capital costs, financial costs, fixed and variable costs, in addition to fuel costs and taxes [

29]. LCOE also considers, at a certain level, the quality of the energy (in terms of technology and the availability) especially when it comes to renewable energy [

30].

Reference [

31] performed a detailed literature review about the LCOE and summarized the criticism in the application of this methodology, especially when it is used to assess the economic attractiveness of dispatchable technologies in comparison with variable (and non-dispatchable) energy resources. It is understood that the value of any technology in a power system not only relates to its own cost of generation but also to the ability to control the capacity and timing of when that generation occurs. According to this study [

31], a resource (A) with very low variable costs may have little value to a grid if this generation occurs during times of low demand. At the same time, another resource (B) with higher costs of generation may be a better option to the same grid because it can be generated during peaking times.

The conventional LCOE formulation fails to properly evaluate flexibility resources and their ability to be dispatchable. By the LCOE metric, two different sources, one able to be dispatched and other uncontrollable, with the same fixed and variable costs and capacity factors would have the same LCOE. Other metrics based on the original LCOE concept were later developed, in an attempt to capture the interactions between the candidates for expansion and the generation portfolio and in trying to value the benefit of projects that are expected to optimize the future operation of the system as whole. For example, the Brazilian Indice Custo Benefício (ICB) [

32] considered as expected generation (or Garantia Física) of a project not the average per se, but a proportional metric that takes into consideration also the time when the asset is used.

Even with the attempt to upgrade the formula, the attributes of flexibility are not currently measured by the LCOE or by other similar metrics. In his assessment of costs between renewable and dispatchable resources, Joskow [

33] concluded that use of simplified Levelized Cost comparisons between different technologies may lead to wrong decisions, since they do not take into consideration differences in the ability to produce energy in association with the electricity prices during the times when they are able to supply energy. The LCOE cannot be used to price a flexibility resource, because one of the attributes of a flexibility resource is the dispatchability and the LCOE would fail to capture this value from different flexibility candidates, since it does not measure the ability of a resource to generate electricity during scarcity times. In addition, the LCOE fails also to measure the system-level benefits of a resource, looking only at the standalone project level costs in the evaluation.

2.2. The Levelized Avoided Cost of Electricity

The need to consider system economic benefits together with the LCOE came with the large expansion of intermittent renewables [

31]. The levelized avoided cost of electricity (LACE) is then another metric commonly used in decision processes in power markets. LACE was first introduced by the IEA as a metric that represents a project’s value to a specific grid [

34,

35]. The avoided cost of electricity can be considered as the opportunity cost of not using conventional generation to meet the dynamic short-term balance needs of a power system, which can be replaced by the injection of one MW from a new generation plant added to the power grid, avoiding the MWh of the spinning reserve [

35].

An avoided cost from a power plant reflects the costs that would be incurred to provide the electricity displaced by a new generation project. These avoided costs can, then, be considered as a revenue stream from the new project to compensate for the investments and operational costs. The LACE formulation is commonly used to evaluate and compare costs and benefits between intermittent renewable resources with dispatchable renewable energy, such as solar CSP technology with energy storage. There is considerable literature available attempting to estimate the true value between non-dispatchable and dispatchable generation [

36,

37,

38,

39,

40,

41].

The levelized avoided cost of electricity is especially important when the deployment of variable energy is being studied by power grids [

42], but the current formulation was not created to assess the value of flexible assets. The general concept and idea of avoided cost can be used for the formulation of a new metric for the valuation of flexible assets, where both the costs and avoided costs of the flexible assets are weighted to rank the best flexibility candidates in each grid.

2.3. The Levelized Cost of Flexibility

One attempt to provide a similar LCOE to flexibility was proposed by the OECD/IEA [

1]. The Levelized Cost of Flexibility (LCOF) was proposed as a general and simplified metric that would give, as per the authors, an “estimate of the additional costs associated with making the generation or consumption of one MWh of electricity more flexible” [

1]. That publication was the first attempt to help system planners with figures and ideas on how to value different flexibility options in power systems. The OECD/IEA targeted to compare, in a general way, different types of flexible resources such as transmission, storage, flexible generation, retrofitting of existing inflexible plants, demand side management, and their cost to power systems.

The challenge with the LCOF is the same as with the LCOE: it looks only to the costs side of providing flexibility to a grid and fails to investigate the benefits of flexibility when installed in a grid. While proposing the new metric for flexibility in [

1], the authors also highlighted that the LCOF cannot be used as a tool to compare different resources to a grid alone, it needs to be integrated with a cost–benefit analysis of how that flexible resource, with its own costs, will impact the costs of operations of the entire grid. Even for the OECD/IEA, the LCOF is a metric that only paints part of the picture [

1] and needs to be integrated with a cost–benefit analysis of the entire system.

Each flexible option has its own costs and capabilities and, when installed in a grid, each resource will interact differently with the existing portfolio of generation. To complete the full assessment, it is also needed to couple the cost assessment of each flexible resource with its benefits when installed in a grid. In [

1], the OECD/IEA used the LCOF coupled with a cost–benefit comparison obtained by power system modeling. The net cost–benefit of a given flexibility technology studied was calculated dividing by the LCOF of each option itself [

42].

On a general level, this approach can give good indication to system planners on which type of flexible technology would bring greater return compared to the initial investment. On the downside, the metric proposed fails to give a tool to compare technologies on project level. Further, in the study mentioned above, all types of flexible technologies are studied and compared together, without any division or classification between technologies that can offer flexibility both from the supply side and demand side. Furthermore, the LCOF and the cost–benefit analysis presented by [

1] was not further detailed or formulated into a metric that could be used to contract real projects in flexible power markets.

2.4. The Net Cost Approach

To properly select different energy projects, with different characteristics, the idea of the net cost was suggested by [

43]. When a resource is to be added to a power system, the evaluation should consider not only its own costs, but also the potential savings that this new candidate brings to the system. As per [

43], the objective should be to minimize the present value of revenue requirement of the new project. In other words, when assessing candidates for the expansion of a power system, one needs to look into the overall system operation and not only the cost of the addition per se.

As defined by the authors, since the objective function is to minimize the overall cost of the electric system, new resources should be ranked and selected as per their net cost when added and not by their own costs. The total net cost can be calculated as the difference between the total cost added by the resource and the total avoided cost generated by the same resource when added.

In the study where the net cost concept is presented and detailed, the derivation of the net cost formulation is performed for several cases, including the net cost formulation for renewable and dispatchable conventional generation with or without the capacity adequacy constraint. We follow the same approach in this paper to propose a formulation of a net cost metric for flexible assets, using as starting point the derivation of net cost for dispatchable generation proposed by [

43].

3. Proposal for a Net Cost of Flexibility

As previously reviewed, not only there is little literature in the economic assessment of flexibility projects, but the traditional metrics also used to rank and select energy projects fail to capture the entire value that flexibility may add to a system. In this section, we will propose and detail a metric that tries to capture the benefits of flexibility in hydro markets. We start this section by reviewing the formulation of the reduced cost of conventional generation with capacity adequacy derived in Reference [

43]:

where

c is called by the author as the Reduced Cost of the Variable ($/MW-y), equivalent to the expected net cost of adding one additional preferred MW of conventional generation in a grid.

FCn is the Fixed Cost ($/MW-y) of the generation added.

μk is called the shadow value of capacity constraint, which can be simplified as the cost of a marginal peaker included in the portfolio to solve the capacity constraint problem.

CCn is the capacity credit of the resource added, which is the percentage of the installed capacity of a resource that the system can be rely upon during moments of higher demand. For flexible thermal assets, capacity credit is equivalent to 1.

αw represents the probability of a future w.

w is the variable that represents all the possible future scenarios of the operation modeled. In hydro systems, it can be understood as the w hydrology scenarios used together with each α probability of occurrence.

πn is defined as the shadow value of generation capacity limit for each generator. In other words, it can be understood as the expected change in variable cost if more capacity of a resource n is available in each future w and time t.

ϕn is the availability of the resource in each future w and time t.

In Reference [

43], the author considers the expected change in cost (

πn) for a conventional dispatchable resource: the difference between the average wholesale energy price and the variable cost of energy from the conventional power plant added to the system. This same approach cannot be used for flexible resources, since part of the savings generated by flexibility is a better optimization of the existing portfolio and the difference between market price and variable costs of the new asset will not discover this potential saving. Instead, to measure the expected impact in marginal cost of operation due to the addition of a flexible resource, the proposal of this paper is to measure the difference in the total market cost of operation before (

MCObase) and after (

MCOflex) a flexibility resource is added to the portfolio.

By comparing the two average market operational costs, we not only evaluate the savings related to the displacement of other technologies, but also capture the optimization created by the flexible resource in the grid. Applying the proposal of

πn (2) in Equation (1) and simplifying

μk as the cost of a peaker included in the portfolio to solve the capacity constraint problem, the expected net cost of flexibility (NCoF) can then be defined as per the following formulation:

The net cost formula proposed in Equation (3) is essentially the same as that proposed in [

43] for the conventional generation resource, with a practical difference: instead of using the difference between the wholesale price and the variable cost of the generator as the expected cost reduction of the new generation, it is being proposed the use of the difference between the expected wholesale price (marginal cost of operation) of the system without flexibility (

MCObase) and the wholesale price of the system after flexibility is added (

MCOflex). With this change, it is expected for the net cost to account for the benefits that a flexible resource generates in the existing portfolio, for example, avoided start costs, ramping, and spinning reserve costs of non-optimal generators. The proposed

NCoF formulation is a practical form to balance costs and benefits of flexible assets, not only for its own costs, but also for system-level benefits.

Moreover, the above formula not only can be used to value different flexibility candidates with more accuracy, but also can be used by system planners to select projects based on a competitive process. While the first part of Equation (3) (

FCn) considers the fixed costs related to the construction and operation of the flexibility candidate, the second part of the equation measures the system-level benefit of the technology used by the flexible candidate. Since each technology (or candidate for expansion) has its own features such as energy efficiency, internal losses, availabilities, ramp times, operational restrictions, and costs of start, stops, and minimum run times (if applicable), the second part of Equation (3) accounts for the estimated economic benefit of each flexible technology candidate based on these features.

where

Vflex is expressed as:

To further simplify the formula, the NCoF can then be proposed in Equation (4). While the Vflex, as shown in Equation (5), may be estimated for each flexible candidate, the first part of the formula may be assessed through a tendering process or auction. With this structure, energy planners can, at the same time, compare market costs of flexible candidates with an estimated benefit of each component when added to the system. The candidates with the lowest NCoF are the candidates that provide the best combination of costs and benefits and are the preferred ones to be contracted.

Differently from the classic models that assess only the cost and benefits by comparing fixed and variable costs from each resource, to measure the benefits from flexible assets, one needs to additionally consider the other costs that in the past were not considered important: start-up costs, modularity, minimum generation, ramps limits, spinning reserve needed, and other costs related to unit commitment for all plants that are part of the portfolio. This is the reason why the proposed methodology measures the benefits of each resource on the system level, instead of looking at each resource level.

To cope with the detailed requirements of this study, there is a need to use a power system model capable of simulating and optimizing power system operations with real-life short-term operational restrictions such as ramps, starts and stops, unit commitment costs, and others. The idea is to generate sub-hourly time series of marginal operational costs for the w number of scenarios simulated and the n number of alternative scenarios modeled. The short-term operational restrictions/capabilities are needed to assess the benefits of each flexibility option coping with the challenges of short-term variability of renewable energy. For the purpose of this study, the Plexos® 9.000 R08 model, a commercially available system modeling software, was selected as the modeling tool to generate the data series of market costs of operation.

Plexos® uses deterministic linear programming to optimize and solve the problem of minimizing the objective function of the cost of electricity, given the restrictions included in each scenario. The model can simulate all operational restrictions from generation technologies, including the ones most critical for the evaluation of flexibility. The Plexos® functionalities are adherent to the need of research, and the model is able to provide the results for this study, such as (i) optimization of the system expansion, in different time scales; (ii) calculation of the optimal system dispatch with sub-hourly time discretization; and (iii) the possibility of simulating different scenarios of stochastic sources, such as hydro, solar, and wind power.

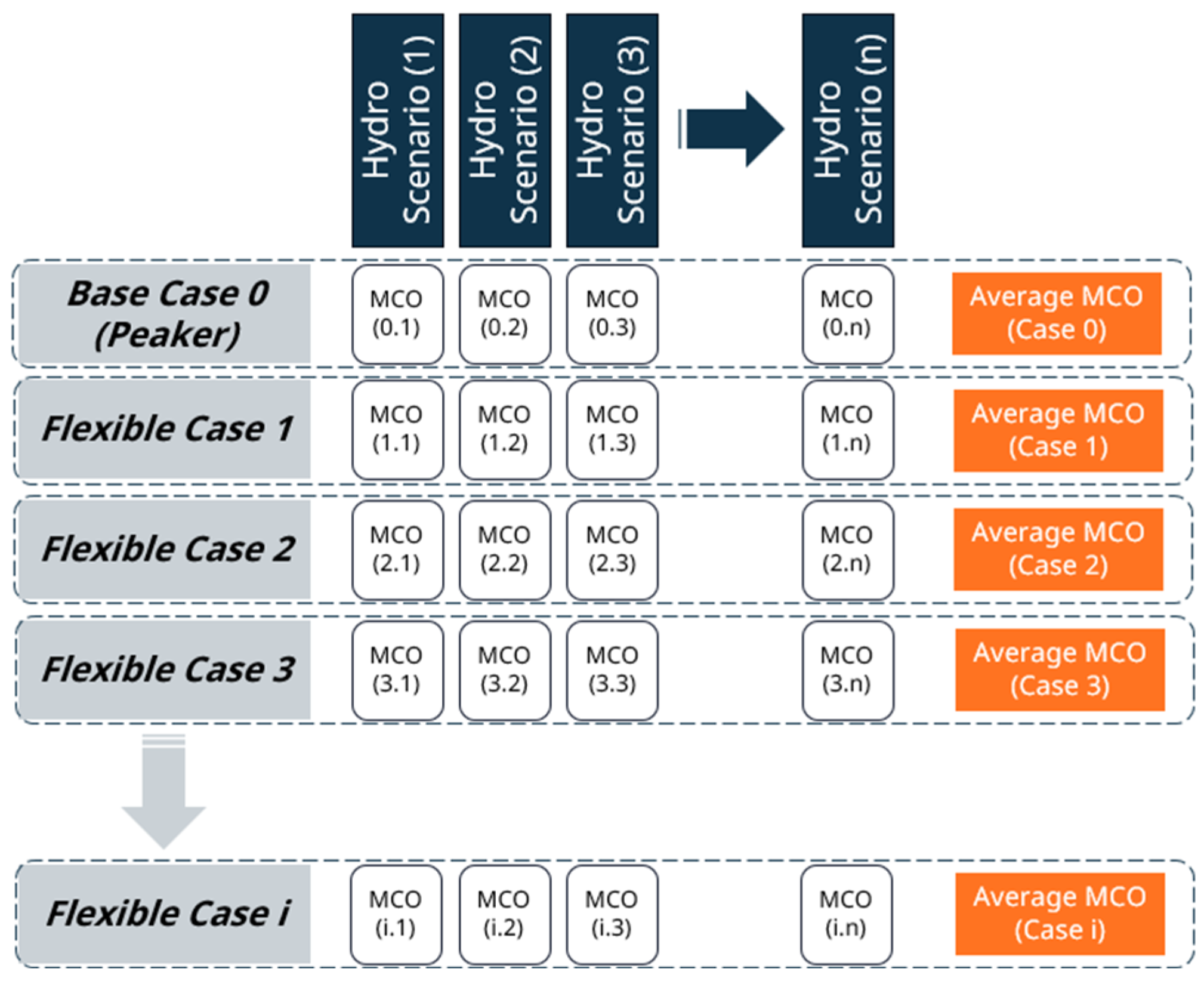

In this study, the future operation of a renewable but predominantly hydro system will be simulated and optimized considering a number

w of expected hydrology futures. Plexos

® is used to optimize this system on an hourly basis and generate series of marginal costs of operation (

MCO) for each

n alternative scenario simulated. The base case will consider no additional capacity added rather than the peaking capacity needed to resolve the capacity adequacy problem. Then, in each other case, a different type of flexibility will replace the peaking capacity with its own technical features. This change is expected to generate a difference in the

MCO of each scenario of hydrology and, as a result, generate a different average

MCO for the flexible resource.

Figure 1 shows a schematic flowchart of the Plexos simulations proposed for this study.

The Case for Brazil

As a major hydro system facing large-scale deployment of wind and solar, the Brazilian power system was selected as the simplified case study for this paper. Brazil recently reformed its power market with the creation of a regulated capacity market [

44], with minimum flexibility requirements [

45] for the candidate projects to the capacity expansion. The purpose of the Brazilian capacity reserve auction is to ensure the installation of necessary reserve capacity to meet the needs required by the grid, allowing consumers to be served all of the time, with reliability and security, even during critical periods [

44].

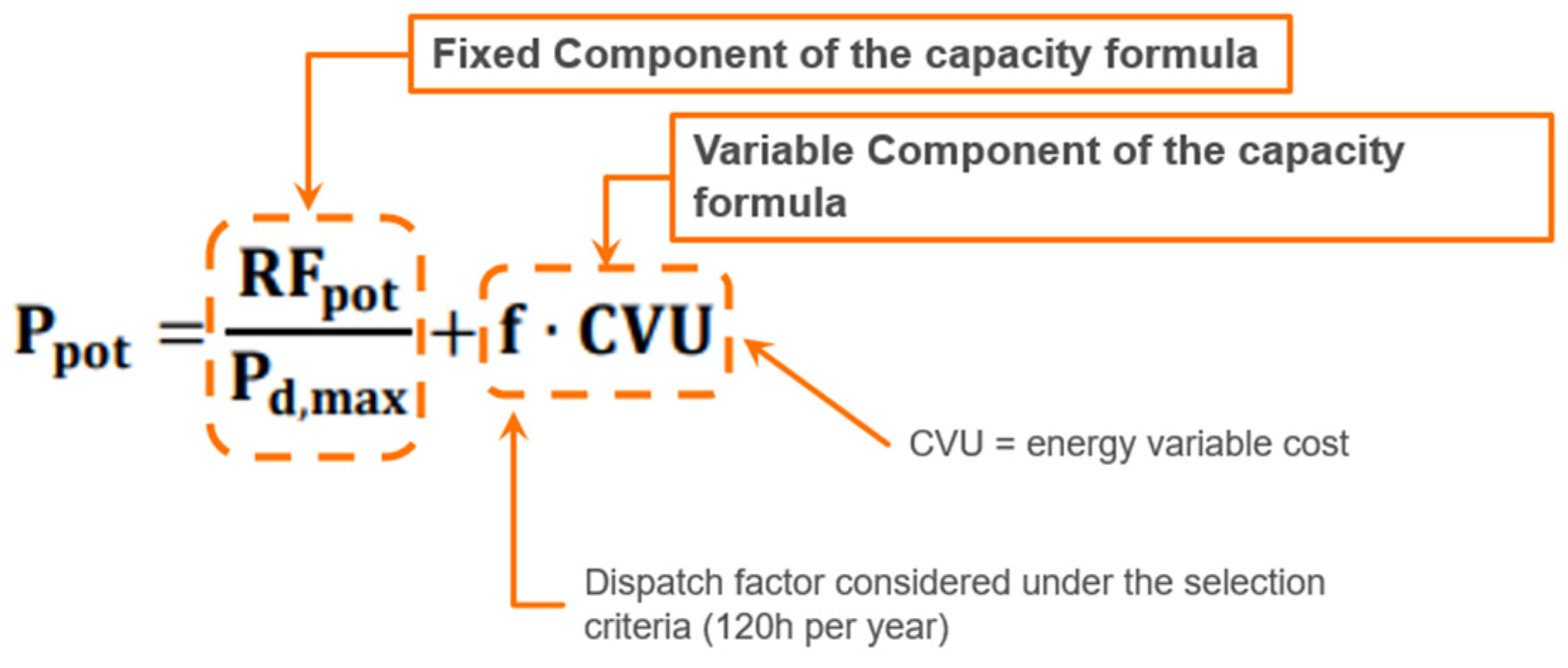

It is the role of the Brazilian planning office, Empresa de Pesquisa Energética (EPE), to identify and quantify the capacity needs under the Ten-Year Energy Expansion Plans (PDEs) and to contract power capacity to meet the general supply guarantee criteria established by the National Energy Policy Council (CNPE). The metric used to select projects in the Brazilian Reserve Capacity Auction follows the same principle of a typical capacity market, which is a simplified comparison between fixed costs of installation and operation with variable costs of operation. The expectation of low dispatch from the capacity plants drives the procurement towards technologies that require low fixed payments (typical peaking plants).

Figure 2 shows the details of the metric currently in use.

For the modeling work, the generation database used is the Brazilian expected system in 2031 (PDE 2031), published by the EPE [

47]. The details are shown in

Table 1. The hydro storage capacity is built in cascade but simplified and aggregated into major dams. Losses from evaporation and other water uses, such as irrigation, are inserted according to information from PDE 2031, varying each month, depending on the season and the amount of water available at each moment. Eighty-three hydro seasons from the past 83 years are used as hydro scenarios. Systemic restrictions to simulate the effects of an operational policy aiming in the preservation of a minimum level for the reservoirs are included. The results presented in the following section show the average of the simulation for the eighty-three hydrology scenarios.

Conventional thermal plants and their variable costs are inserted as per PDE 2031. Dynamic restrictions and capabilities such as start, stop, and ramping costs, availability, and minimum downtime and uptime of each technology are included in the database. Biomass and small hydro plants are modeled as fixed average daily generation, varying each month, considering the seasonality of each one of these sources. Hourly demand forecasts are estimated based on the current pattern and extrapolated considering the growth expected until 2031. Wind and solar sources are simulated according to the forecast of installed capacity as per the PDE 2031, and hourly profiles for these resources are simulated according to the information made available by EPE.

Table 2 summarizes the assumptions used in the model for this case study.

The PDE 2031 indicates the need of additional 14 GW of flexible capacity to be added to the Brazilian grid by 2031. The target of this case study is to test if the consideration of system benefits brings additional value to the competition between candidate projects to provide flexible capacity. Scenarios are built considering only three different types of thermal flexible technologies that could serve these 14 GW: (i) Scenario Base—Peaker; (ii) Scenario 1—Flexible Generation A; (iii) Scenario 2—Flexible Generation B; and (iv) Scenario 3—Flexible Generation C. Each of these types of flexible generation presents a different dynamic feature and is available existing technology that could offer flexibility in power markets. Technical data from these three different technologies are summarized in

Table 3 below.

For the base scenario and each of the flexible alternative scenarios, 83 system operation simulations are made, one for every past hydrology available. Each of these simulations will generate a corresponding total cost of operation that will be linked to the hydrology and the flexible alternative. For the purpose of the case study and the use of the NCoF formulation, this paper will present the results of each flexible alternative as the average of the 83 hydrology scenario simulations.

4. Results and Discussion

As expected, results from the dynamic simulations for the year 2031 show different total marginal costs of operation for each flexibility option modeled. Considering that the base renewable mix system is the same in all scenarios and the capacity requirement problem is solved by installing the necessary peaking capacity in order to avoid capacity constraint, the differences between each scenario derive exclusively from the differences between the characteristics of each technology used as the flexible option and how they interact relative to the other resources of the portfolio.

Results are illustrated in

Table 4 and are shown as the average costs of all 83 scenarios of hydrology simulated for each flexible technology, broke down in fuel costs, variable O&M, and balancing costs (starting, stopping, and ramping the flexible resource). Since the short-term simulations are performed within 30 min granularity, there is no impact in cost related to start time. Numbers refer to one year of system operation (year 2031) and are illustrated as per MW of flexible capacity installed in 2031 to facilitate the understanding.

Looking at the results at a first glance, it should be noted the differences between the Scenario Base, where a typical peaking technology is the reference flexible technology, and all the other scenarios where other characteristics such as thermal efficiency and balancing costs are also part of the evaluation. When more parameters are evaluated together, at a system level, it becomes clear that a hydro system that values only fixed costs for flexible capacity may not be moving towards the most optimal capacity mix of technologies. The results presented in

Table 2 are averaged and these differences become even greater for drier years.

Before initiating the discussion of the differences between each scenario and the NCoF/Vflex, it is worth highlighting two important details of the raw results. Even for hydro systems, where the source is capable of coping with certain flexibility requirements, fuel costs from power plants installed as back up of the hydro system remain a relevant premise and should have an important consideration when contracting flexibility in power markets if that flexibility is from a generation resource. While the Ppot formula values the variable portion of the new flexible capacity only during 120 h per year, the Plexos simulation show an average capacity factor for the flexible capacity closer to 1000 h per year.

Another highlight is the difference between the balancing costs related to each technology. It should be expected that, as more variable renewable is installed in a hydro grid, the more important the cost will become in the system. Even with a moderate participation of renewables in an essentially hydro system such as in Brazil, certain flexible technologies can result in double the costs of other systems. Considering that a capacity plant has a lifetime that can be measured in decades, energy authorities must address this asymmetry to avoid future unnecessary costs.

Another important highlight is in the utilization of each technology available in Plexos. Depending on the type of characteristics available as a flexible resource, the model utilizes each in a different way. As example,

Figure 3 shows one random week of the grid dispatch for options A and C in a typical average year of hydrology. As may be noted, even for scenarios with average hydrology, flexible capacity is needed to cope with variations in renewable generation (especially the solar ramp) and option A results in more starts and dispatch time than the similar option C. This can be explained because option A presents better thermal efficiency and lower start-up cost when compared to option C.

Depending on the hydro scenario studied, one particular characteristic of a flexible technology might be more important than other. For example,

Figure 4 shows how the flexible resource A is utilized in terms of Capacity Factor (% of time) and number of starts depending on the hydro scenario studied. It is important to highlight that both can present variations depending on the amount of renewable resource available, but while the number of starts remains relatively stable (about 100 starts per year on average), there is an asymmetry when the capacity factor (or utilization factor) is analyzed. As expected, in dry years, the flexible capacity shifts from short-term balancing and peaking to hydro system balancing, utilized during the months with water scarcity.

Figure 3 and

Figure 4 provide useful visualizations of how the flexibility resources are used by the system depending on the water availability. For example, even though the number of starts of the resource remains relatively stable for any given hydrology scenario (

Figure 4b), except for the extreme wet scenarios, the utilization factor of the flexible resource grows linearly as the hydro generation is limited in drier years. This is an indication that the flexible resource shifts its use from sub-hourly balancing (high number of starts for low utilization factor) to hydro power balancing (same number of starts and high utilization factor).

These results show how important it is to assess the value of the flexible resource on the system level, evaluating all possible aspects of the grid operation and potential utilization for the flexibility. Consequently, for major hydro power systems, a flexible resource is used not only to balance the intermittency of VRE but is also important to balance hydro power in drier years. A flexible resource that provides a combination of low variable costs (advantageous in drier years) and enhanced dynamic features such as fast starts with no additional costs may optimize the overall system costs better than other technologies. The only way to evaluate and estimate the system-level value of the flexible resource is through a metric that measures costs and benefits, such as the NCOF.

Utilizing the average yearly marginal costs of operation for each of the studied technologies, it is possible to use Equation (5) and estimate the corresponding

Vflex for that specific technology. An

FCpesak cost equivalent to 126,482

$/MW-year equivalent is used to the fixed cost per year of a natural gas peaker, per Reference [

34]. It should be noted that the

MCO numbers already consider the availabilities of all technologies, and the results are presented as the average of 83 hydro scenarios, which contemplate the probabilities of

w futures into the

MCO. Therefore, the premises

αw and

ϕn(w,t) are already considered to be incorporated in the

MCO averages for each of the alternatives. The

Vflex is presented in monetary value per MW year and are shown in

Table 5.

As previously noted, each flexibility option drives to a different system marginal cost of operation and, therefore, different Vflex. Scenarios that present the higher numbers of Vflex should be understood to be those that most benefit the system. The use of short-term modeling capabilities to estimate future market impacts of the installation of certain flexible technologies can be seen as a practical approach that leads to a useful metric for system planners. The Vflex is a parameter capable of reflecting future operational impacts for known technologies and can be used to compare candidate technologies for future flexibility expansion.

How do the differences in the Vflex between technologies impact a system? It can be used to compare fixed costs between each flexibility candidate. For example, the difference between the Brazil metric currently used to value flexible capacity (the Ppot from Section The Case for Brazil) and modeling the combination of a fixed cost component and market benefit component of the same candidate (reflected by the Vflex) creates a suitable evaluation metric that can be considered more balanced and more beneficial to the consumers. Instead of comparing all candidates basically by their respective fixed costs, system planners now have a tool to measure possible benefits and decide upon the candidate that presents the lowest net cost of all flexibility candidates, which can be considered as the best cost–benefit.

Even though the Vflex can be understood as the parameter that synthesizes all system benefits of the studied flexible technology, it cannot be used solely to define the optimal candidate to be installed. The benefits should be analyzed together with the additional fixed costs of the candidate. The projects with lowest combined Vflex and fixed costs (NCoF) should be the ones that minimize overall expected system costs on the long run. While the Vflex is a static component that can be calculated for each technology that is candidate for expansion, the fixed costs of each candidate can be discovered through a public tendering process, making the NCoF a dynamic metric that is able to compare any type of flexible project.

The

NCoF produces an evaluation metric able to compare true costs with expected benefits, achieving the aim of this paper. Differently from the other metrics highlighted in

Section 2—such as the LCOE—which measure candidates’ own costs and fail to assess how each candidate will interact and affect the entire portfolio, the

NCoF is a metric that aims to gauge candidates’ own costs with an expected measure of the benefits. However, to estimate such benefits, it is required for the planning authority to have proper simulation tools and computational capacity to run an extensive number of future scenarios in order to better estimate how the future system is going to behave. This last point can be understood as a disadvantage of the proposed methodology.

5. Conclusions

The large-scale expansion of variable energy sources in electrical systems raises the need to build flexibility. This challenge is especially important in hydro-based systems, where the seasonality between rainy seasons can impact marginal prices for prolonged periods of time, disincentivizing investment in flexible resources by market participants. Metrics currently used for selecting resources fail to capture benefits from the flexibility added by each candidate. This paper proposes a new metric to value flexibility in power systems: the net cost of flexibility. The NCoF attempts to capture all costs and benefits involved when assessing the best candidates and technologies to provide flexibility in power markets.

The NCoF can be split into two sub-parameters: (i) fixed portion of the formula that reflects all of the minimum fixed revenues necessary to build and maintain the flexible asset in the grid and (ii) the parameter that values the benefit of each candidate based on the underlying technology and dynamic features (Vflex). While the Vflex can be assessed through computational power system modeling, the fixed part can be discovered though a public tendering process. The NCoF metric is a useful tool for energy authorities as it enables the framework for a technology neutral procurement process for system flexibility.

In the case study, the Brazil 2031 system was modeled in Plexos and different types of technologies are evaluated as the potential candidates for flexibility expansion. The objective of the study was to test whether a metric that captures system-level benefits of flexibility would be a suitable option instead of using the typical and simplified balance between project fixed and variable costs. Four scenarios of technologies were modeled in Plexos and the average costs of operation for each scenario were obtained and compared.

The first conclusion of the study is that typical capacity markets, where fixed costs are the only metric to select candidates, can benefit from adding other parameters into the evaluation. The net cost approach showed the hidden value of thermal efficiency, variable O&M, and balancing costs that certain technologies can unlock and save for a hydroelectric system. The use of the Vflex and the NCoF can lead to an expansion of flexible capacity that is closer to the optimal path, rather than to the uncertainty related to total system operational costs.

Moreover, for hydro markets, it became clear that the same flexible asset can supply the system with multiple products and may be used by the grid to supply both short-term flexibility (peaking during ramps caused by variable renewables) and medium-term flexibility (hydro balance during dry seasons). Since fuel cost is still relevant in certain dry hydro years, when assessing the value and contracting flexible capacity to a hydro grid, the planning authority must account all possible scenarios and address the proper probabilities into each possible hydro season to try to avoid underestimating the utilization factor of the flexible resource. If the planner underestimates the expected dispatch when contracting the resource, the grid may be impacted with higher costs in a possible future dry year.

For each expected hydro season, different outcomes in terms of utilization of the flexible resource may be expected. As observed, while starts and stops of the flexible resource remain similar for the spectrum of hydro seasons simulated, the fuel costs become highly relevant in dry years, due to the higher capacity factor of the flexible asset. This observation is an important argument in favor of the net cost approach to value flexible resources in hydro systems. Energy authorities must analyze and value all important aspects and impacts that each candidate adds to the system, instead of looking at the technology costs or only at the capacity cost itself, as is currently the case in pure capacity mechanisms.

This study can be further detailed for different technologies and for other parameters that were not included in the present paper. For instance, due to simplification, this paper limited the technology analysis to three flexible generation options (referred to as A, B, and C). There are other technologies that can supply flexibility to power systems, including retrofitting of existing plants, pumped hydro, and battery storage. As example, battery storage and pumped hydro are proven solutions and may be economically beneficial to power markets if tested. Moreover, the options studied were limited to natural gas flexible capacity plants, and other mineral or renewable fuels can be modeled in the future, including multi-fuel options.

The case study starts with the premise that flexibility is needed and known and that the NCoF is needed to value flexibility expansion candidates. Another way forward is the incorporation of the flexibility parameter (Vflex) in the energy procurement processes. For example, when contracting the energy for the future, planning authorities could already measure how that specific source would impact future flexibility needs. By anticipating future impacts (and costs), future flexibility needs and overall costs might be minimized. This is another route of study that could be built on the current work.

The present research can also be further developed to consider other aspects in terms of flexibility. For instance, the possibility to include costs related CO2 emissions in the calculation; attributing a cost for the emissions is an interesting path and might be the trigger to help systems achieve net zero emissions. Even considering that in big hydroelectric systems, emissions are less impactful (given most of the electricity is generated by renewables), the inclusion of emissions in the valuation might incentivize the installation of renewable fuels or in technologies capable of utilizing multiple fuel types including renewable fuels.