Considering Differentiated Pricing Mechanisms for Multiple Power Levels

Abstract

1. Introduction

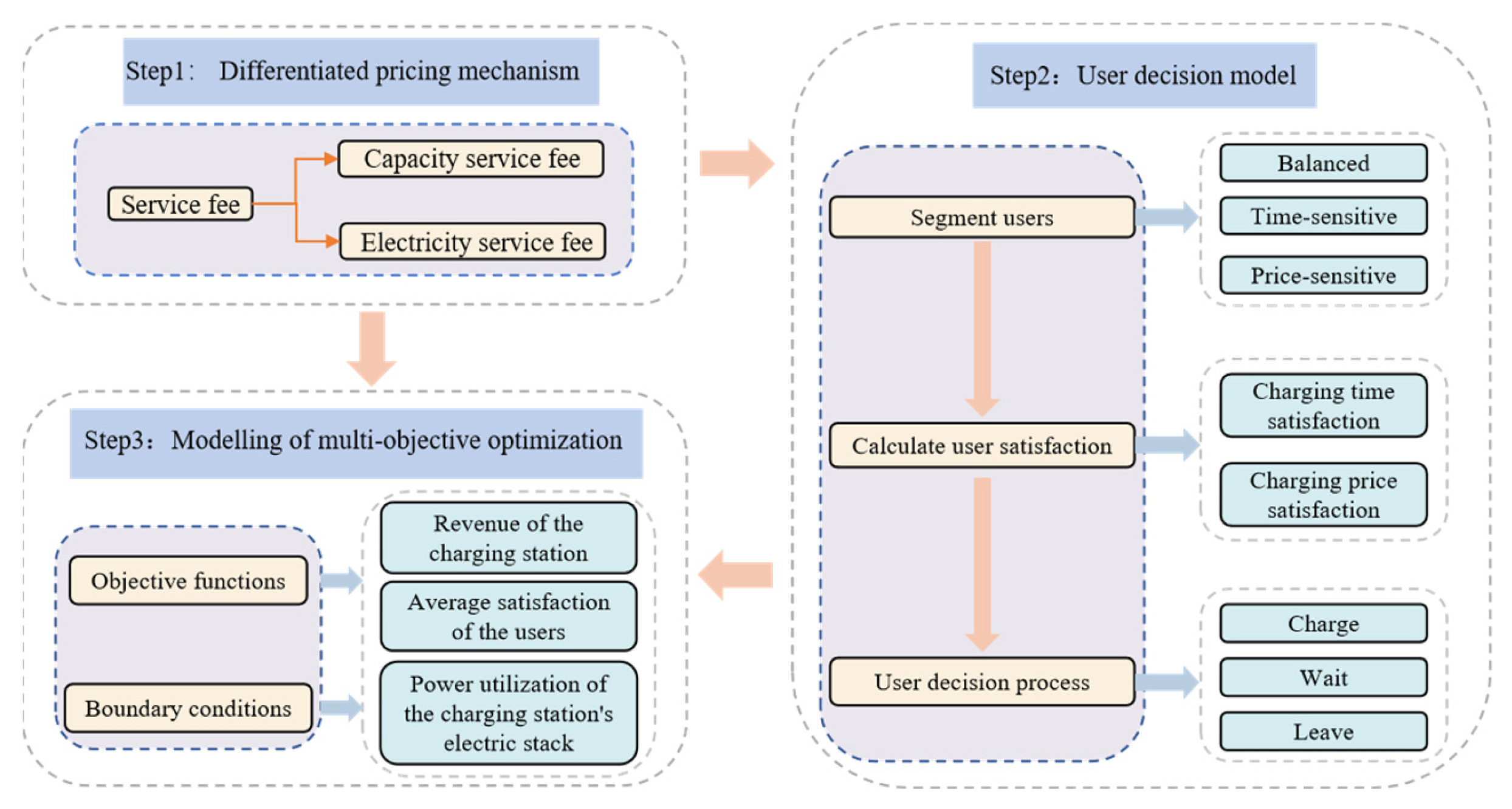

2. The Simulation Model for Differentiated Pricing of Multi-Power-Level Charging Facilities

2.1. Differentiated Pricing Model Framework

2.2. Differentiated Pricing Mechanism

2.2.1. Capacity Service Fee

2.2.2. Electricity Service Fee

2.3. User Decision Model

2.3.1. User Classification Based on Charging Preference

- Price-sensitive

- Time-sensitive

- Balanced

2.3.2. Modeling of Comprehensive User Satisfaction

- Satisfaction with expected charging prices

- First, the charging price satisfaction is “1”, when C0 = ;

- Second, the charging price satisfaction varies with the price difference -C0, and the greater the price difference, the greater the change in charging price satisfaction, when C0 ≤ < nC0;

- Third, the charging price satisfaction is “0”, when ≥ nC0.

- 2.

- Satisfaction with expected charging time

- First, when the user chooses the most compatible charging post without queuing, ΔT1 = 0, ΔT2 = Tc, and the highest charging time satisfaction is “1”;

- Second, when the user has to queue or does not have the most compatible charging post, or both, ΔT increases and charging time satisfaction decreases, and the larger ΔT is, the lower the charging time satisfaction is;

- Third, the charging time satisfaction is “0”, when ΔT = ΔTmax=.

- 3.

- Modeling of comprehensive user satisfaction

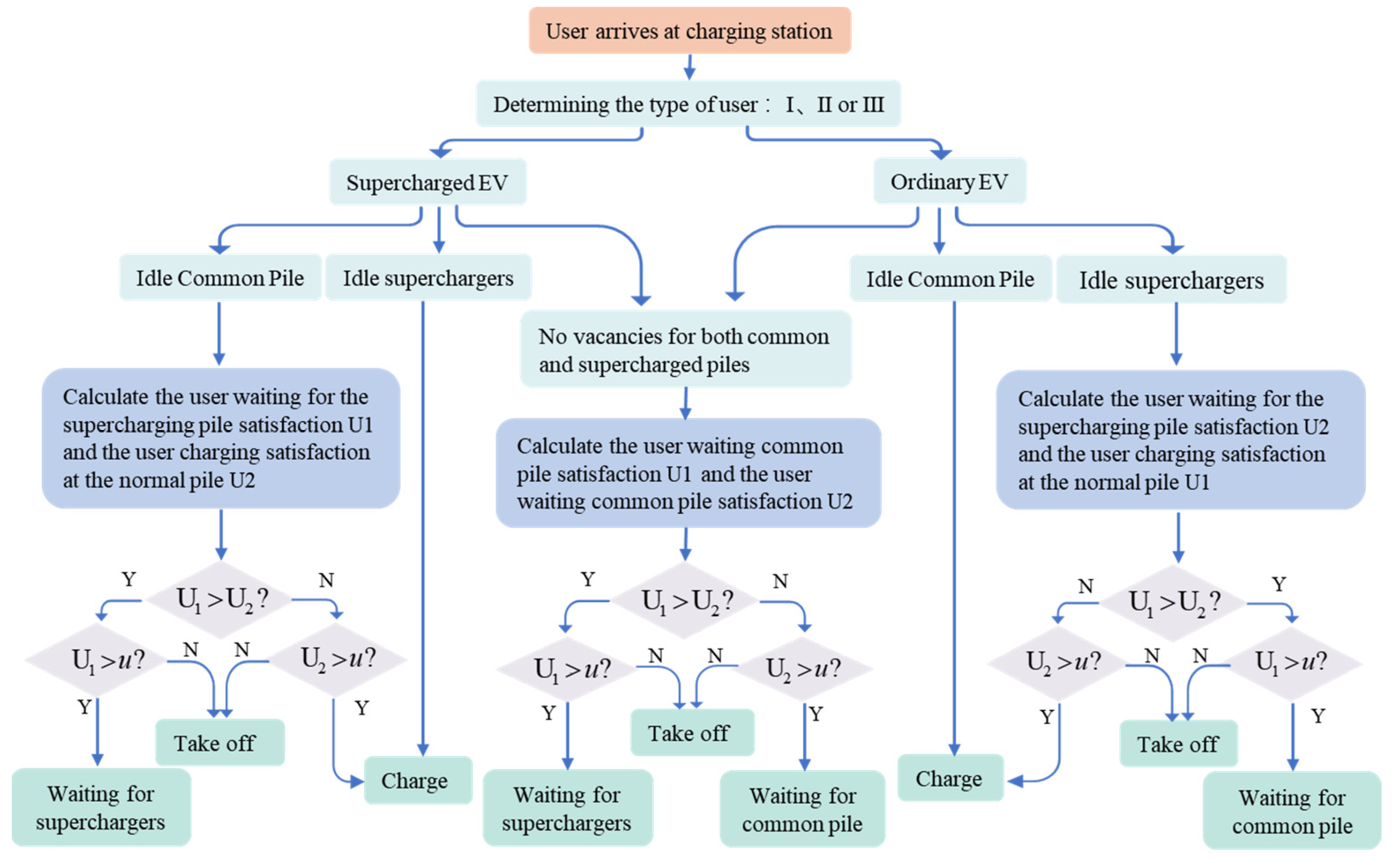

2.3.3. User Decision Process

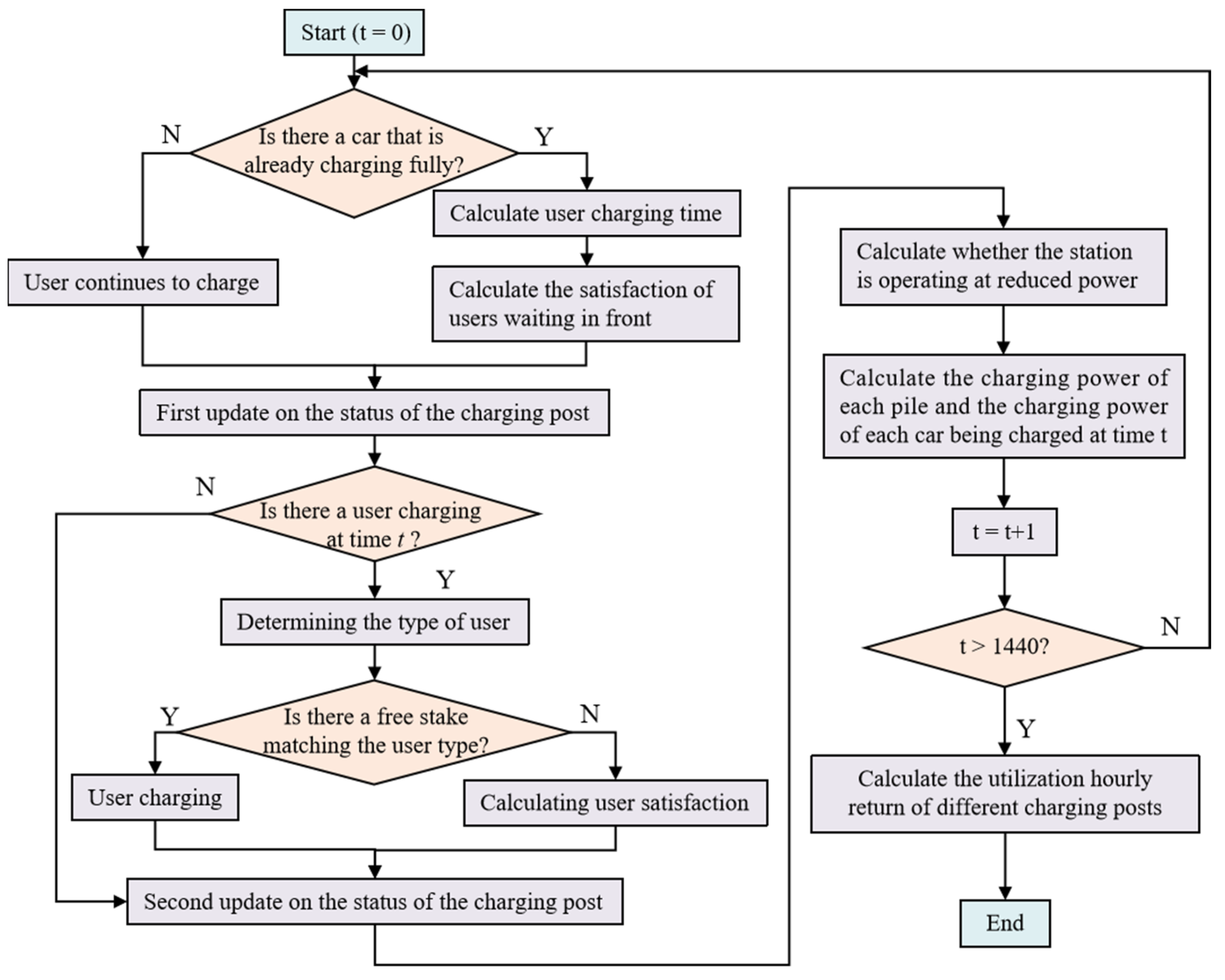

2.4. Simulation Steps

2.5. Modeling of Multi-Objective Optimization

2.5.1. The Objective Functions and Boundary Conditions

- The objective functions

- The objective functions is established with the goal of maximizing the average satisfaction of the users as follows:

- The objective function is established with the objective of maximizing the revenue of the charging station as follows:

- The objective function is established with the goal of maximizing the power utilization of the charging station’s electric stack as follows.

- 2.

- The boundary conditions

- The optimized charging station revenues should not be lower than pre-adjustment revenues, represented as follows:

- The optimized charging station power utilization should not be lower than the pre-adjustment utilization, represented as follows:

- The optimized average user satisfaction should not be lower than the pre-adjustment satisfaction, represented as follows.

2.5.2. Multi-Objective Optimization Algorithms

3. Case Study

3.1. Case Setting

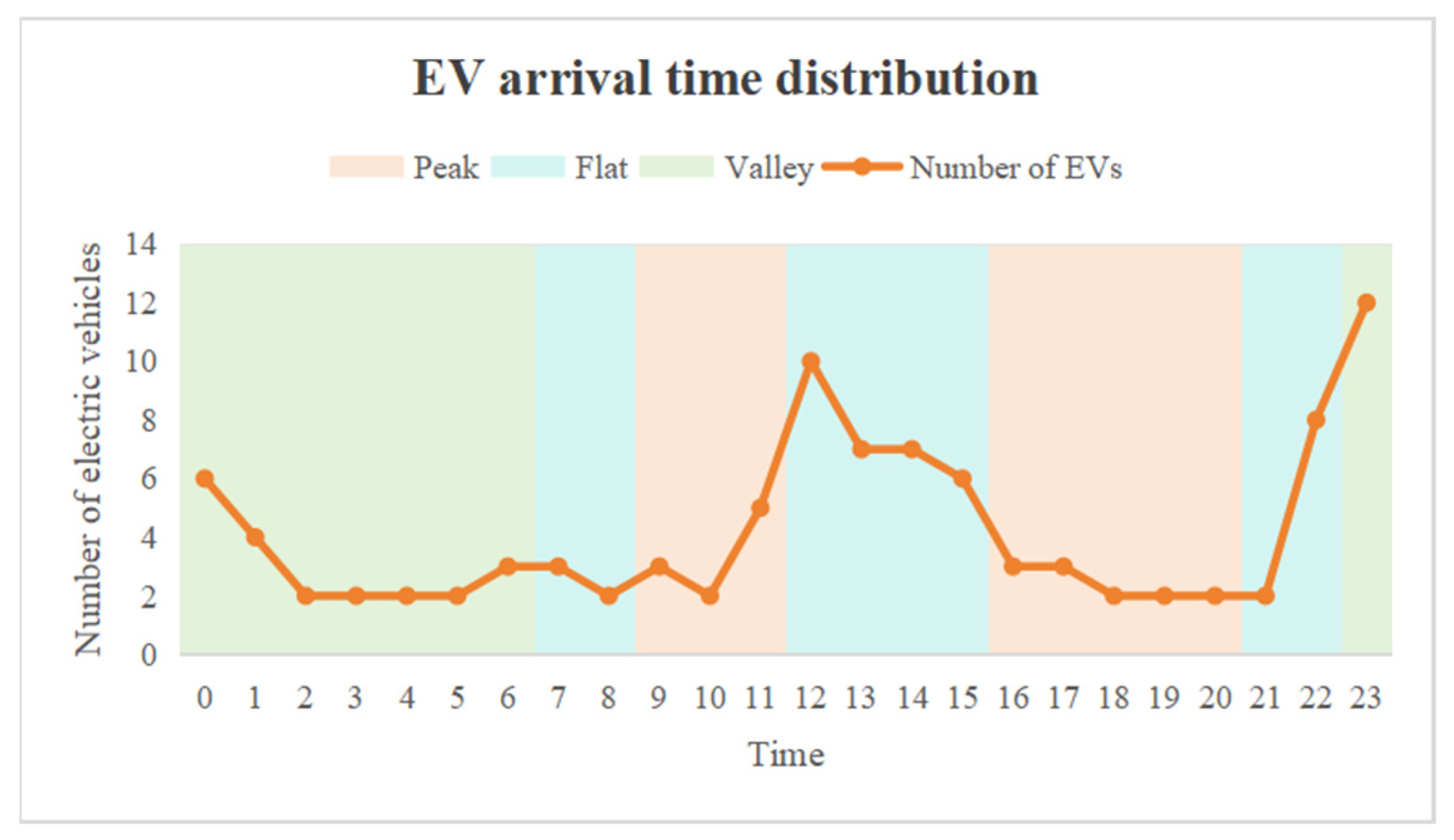

3.1.1. Case Base Data Setting

3.1.2. User Decision Boundary Condition Setting

- For price-sensitive users, if the total time exceeds Tc,p + 30 min, the users directly choose to leave;

- For time-sensitive users, if the total cost exceeds 2C0, the users directly choose to leave;

- For balanced users, no conditions are attached.

3.2. Optimization Results and Comparison

3.2.1. Comparison of the Occupancy of Supercharger Piles by Ordinary Vehicles

3.2.2. Comparison of the Results of the Two Models

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Teng, Y.; Hu, T.; Wei, Z. Electric Vehicle Charging Tariff Pricing Analysis. J. Transp. Syst. Eng. Inf. Technol. 2008, 3, 126–130. [Google Scholar]

- Shi, L.; Wu, W.; Zeng, L. PPP Pricing Model and Application for Electric Vehicle Charging Services. Price Theory Pract. 2015, 8, 94–96. [Google Scholar]

- Zhang, J. Study on Electric Vehicle Charging Price Pricing Mechanism. Price Theory Pract. 2018, 09, 135–138. [Google Scholar]

- Liu, J.; Jia, Z.; Xiang, Y. Pricing model for electric vehicle charging service charge under ubiquitous power IoT. Adv. Eng. Sci. 2020, 4, 33–41. [Google Scholar]

- Chen, Z.; Liu, Y.; Zhou, T. Optimal time-sharing charging pricing strategy for electric vehicles considering mobility characteristics. Electr. Power Autom. Equip. 2020, 4, 96–102. [Google Scholar]

- Yang, J.; Gou, F.; Huang, Y. A time-sharing tariff formulation strategy for electric vehicle charging in residential neighborhoods based on uncertainty measurement. Power Syst. Technol. 2018, 42, 96–102. [Google Scholar]

- Luo, M.; Zhao, W.; Lin, G. Study on Electric Vehicle Orderly Charging Tariff Based on Grid Peak-Valley Time-of-Use Tariff Linkage. Electr. Energy Manag. Technol. 2015, 24, 78–82. [Google Scholar]

- Cui, J.; Cui, W.; Zhou, N. Research on Pricing Model and Strategy of Electric Vehicle Orderly Charging and Discharging Based on Multiple Perspectives. Proc. CSEE 2018, 15, 4438–4450. [Google Scholar]

- Yang, J. Study on the Optimization of Electric Vehicle Public Charging Station Site Selection and Service Charge Pricing Strategy. Master’s Thesis, Xidian University, Xi’an, China, 2021. [Google Scholar]

- Xin, M.; Li, Y.; Zhang, Y. Electric Vehicle Charging Service Charge Pricing Strategy Taking into Account Grid Peak and Valley Operation. Shanghai Energy Conserv. 2018, 8, 612–618. [Google Scholar]

- Gao, Y.; Wang, C.; Lv, M. Optimal Peak-to-Valley Tariff Modelling for Electric Vehicles Accounting for Owner Satisfaction. Electr. Power Autom. Equip. 2014, 34, 8–13. [Google Scholar]

- He, J.; Chen, J.; Huang, J. Study on Orderly Charging of Electric Vehicles Based on Regional Peak-Valley Time-of-Use Tariffs. Electr. Meas. Instrum. 2018, 55, 23–29. [Google Scholar]

- Luo, J. Research on Charging Pricing Strategy for Public Fast Charging Stations. Master’s Thesis, Southeast University, Nanjing, China, 2022. [Google Scholar]

- Sun, X. Research on Electric Vehicle Charging Tariff Period Classification Method and Orderly Charging Strategy. Master’s Thesis, Beijing Jiaotong University, Beijing, China, 2014. [Google Scholar]

- Yuan, W.; Huang, J.; Zhang, Y. Competitive charging station pricing for plug-in electric vehicles. IEEE Trans. Smart Grid. 2015, 8, 627–639. [Google Scholar]

- Su, S.; Li, P.; Yan, H. Pricing method for charging service fee duopoly alliance based on Hotelling model. Power Syst. Prot. Control. 2019, 47, 133–142. [Google Scholar]

- Wei, Q. Research and Simulation of Real-Time Tariff Strategies for Charging Stations in V2G Scenarios. Master’s Thesis, Beijing University of Posts and Telecommunications, Beijing, China, 2016. [Google Scholar]

- Deng, X.; Jie, Y.; Zhang, Y. Research on dynamic pricing strategy of electric vehicle charging considering bilateral interests. Mod. Electron. Technol. 2023, 46, 124–128. [Google Scholar]

- Zhang, J. Study on Electric Vehicle Orderly Charging Strategy and Charging Facilities Planning. Master’s Thesis, Taiyuan University of Technology, Taiyuan, China, 2018. [Google Scholar]

- Yang, Y.; Qin, S.; Zheng, F. A study of charging pricing strategies for electric vehicle charging stations. Zhejiang Electr. Power 2018, 37, 58–62. [Google Scholar]

- Yu, S.; Du, Z.; Chen, L. Optimal Regulation Strategy of Electric Vehicle Charging and Discharging Based on Dynamic Regional Dispatching Price. Front. Energy Res. 2022, 10, 873262. [Google Scholar]

- Yang, J.; Chen, J.; Chen, L. A Regional Time-of-Use Electricity Price Based Optimal Charging Strategy for Electrical Vehicles. Energies 2016, 9, 670. [Google Scholar]

| Pricing Mechanisms | Electricity Fee | Charging Service Fee | |

|---|---|---|---|

| Traditional pricing mechanism | M | N | |

| Differentiated pricing mechanism | M | Capacity service fee | R |

| Electricity service fee | D | ||

| User Types | Price Satisfaction Preference Coefficients | Time Cost Satisfaction Preference Coefficients |

|---|---|---|

| Ⅰ | 0.8 | 0.2 |

| Ⅱ | 0.2 | 0.8 |

| Ⅲ | 0.5 | 0.5 |

| Conventional Pricing Model | Differentiated Pricing Model | |

|---|---|---|

| Capacity service charge weights | 0.000 | 0.280 |

| Charging station revenue (yuan/day) | 3181.200 | 3522.800 |

| Charging station power utilization | 0.193 | 0.207 |

| User satisfaction | 0.836 | 0.843 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, L.; Yin, Q.; Liu, X.; Zu, G. Considering Differentiated Pricing Mechanisms for Multiple Power Levels. Energies 2024, 17, 4771. https://doi.org/10.3390/en17194771

Li L, Yin Q, Liu X, Zu G. Considering Differentiated Pricing Mechanisms for Multiple Power Levels. Energies. 2024; 17(19):4771. https://doi.org/10.3390/en17194771

Chicago/Turabian StyleLi, Lili, Qingyu Yin, Xiaonan Liu, and Guoqiang Zu. 2024. "Considering Differentiated Pricing Mechanisms for Multiple Power Levels" Energies 17, no. 19: 4771. https://doi.org/10.3390/en17194771

APA StyleLi, L., Yin, Q., Liu, X., & Zu, G. (2024). Considering Differentiated Pricing Mechanisms for Multiple Power Levels. Energies, 17(19), 4771. https://doi.org/10.3390/en17194771