1. Introduction

The electricity industry is experiencing several technological, policy, and economic changes that promise to drastically change the way electricity is generated, transported, and consumed. Renewable generation is becoming a larger portion of generation portfolios due to the need to reduce carbon emissions from the electricity sector and the falling costs of wind and solar technologies. At the same time, customers are investing in on-site generation, which triggers a shift from the traditional hub-and-spoke model of electricity generation to a more distributed model where generation occurs closer to where the electricity is consumed.

While previous research has investigated the environmental and efficiency implications of these shifts, the distributional consequences are only now being recognized. High-income households appear more likely to adopt rooftop photovoltaic (PV) systems than low- and middle-income (LMI) households [

1,

2,

3,

4,

5]. Borenstein [

6] finds that, while high-income consumers in California are more likely to purchase solar, the effect of income began to diminish after 2011. Borenstein speculates that the income effect may be correlated with home size and electricity consumption and that a particularly high top marginal electric rate may be an especially large incentive for high-income Californians to purchase rooftop solar. Even when income levels are controlled for race and ethnicity, they are strong predictors of solar purchases, with Black and Hispanic households being less likely to purchase solar, suggesting that socioeconomic variables aside from income may also explain variation in solar demand [

7,

8].

PV adoption inequity is worrisome for two reasons. First, LMI households face high energy burdens that could be alleviated by low-cost PV systems [

9,

10,

11]. Second, if PV adoption forces utilities to raise residential rates to cover the fixed cost of their generation and transmission assets, LMI households will face disproportionately higher energy bills [

12,

13]. PV adoption inequity could be explained by low-income households employing higher discount rates when they value future electricity savings from solar panels [

14,

15]. A wide body of research exists estimating elasticities of demand for durable goods, including for energy efficiency investments and for solar panels specifically. Many of these studies control for income levels and report estimates for coefficients on consumer income. These estimates are typically not meant to be causal, as omitted variables may shift both income and demand for energy-efficient durables. These estimates do tend to show that lower-income consumers are less likely to invest in energy-efficient durables, including solar panels. Income-skewed adoption could also be explained by credit constraints, lower homeownership rates, housing characteristics, language barriers, and solar system information availability that act as barriers to adoption in LMI areas [

4,

8,

12,

16,

17,

18].

Subsidies, net metering, leasing programs, and property-tax benefits (e.g., PACE) designed to lower the up-front costs of adoption have increased adoption overall but have had mixed results on adoption in low-income areas. Subsidies have not generally improved PV adoption equity because high-income households are more likely to take advantage of them [

6,

19,

20]. While net metering increases the incentive to invest in rooftop PV by providing a payment for excess electricity generated, there are also concerns that these programs may have inadvertently led to LMI households subsidizing solar adoption by high-income households, a process known as cross-subsidization [

21]. Property-assessed clean energy (PACE) loans are backed by property taxes and do not require income verification, which expands the set of customers who are able to obtain financing for rooftop PV. In PACE programs, municipalities lend money to consumers for energy efficiency investments, which is then repaid to the municipality through property tax assessments. Importantly, these loans account for the energy savings of energy efficiency upgrades when determining a consumer’s creditworthiness, expanding the set of consumers who are able to make energy efficiency investments. While property tax incentives may help spur the adoption of solar, property tax rates may increase or decrease solar adoption, depending on whether the value of solar investments is included in property tax assessments. If solar investments are not included in property tax assessments, as is the case in California for instance, then home-owners may view solar as a better home investment than an addition or upgrade which might increase their tax burden. There is evidence that fuel savings are fully capitalized into home prices [

22], implying that electricity savings from solar investments may also be capitalized into home prices. Other evidence, such as [

23], suggests that property taxes are capitalized into home prices, especially if the supply of new homes is inelastic. Together, these results imply that an investment into a rooftop solar system would be more attractive to a consumer than a similarly sized home improvement investment, which might increase the homes’ tax assessment.

Using difference-in-differences analysis, Kirkpatrick and Bennear [

24] show that implementing PACE financing increases solar installations for owner-occupied households by 108%. Other studies suggest that the availability of third-party leasing options may have alleviated adoption inequity [

25,

26]. These results suggest that credit constraints, which are more binding for lower-income consumers, may dampen solar demand. O’Shaughnessy et al. [

27] discusses a variety of financing options that may incentivize LMI consumers to adopt solar, and finds that incentives targeted at low-income communities, solar leasing options, and creative financing programs have expanded the adoption of solar in low-income communities.

This study uses a high-resolution dataset of solar adoption to investigate distributed solar generation uptake among low-income neighborhoods. We first document that rooftop solar adoption is lower in low-income census tracts across the country, even in locations where there is an economic argument for adopting rooftop solar. We then investigate whether these low adoption rates are associated with several incentive programs designed to increase solar adoption among low-income households. We find that across income categories, net metering is associated with a larger increase in adoption than property tax incentives. We also find that all programs are associated with higher adoption in LMI areas. However, only low-income assistance programs are associated with a smaller gap between low- and high-income solar adoption. Property-tax benefits and net metering, which are far more prevalent across the U.S., are associated with an increase in the gap between low- and high-income solar adoption. When we consider a stricter definition of a low-income census tract (median income is below 80% of area median income), even low-income assistance programs are unable to close the gap between low- and high-income solar adoption. This result suggests that low-income assistance is not reaching the poorest areas.

We extend the literature on solar adoption inequity in two ways. First, our dataset covers the entire contiguous U.S. at the census tract level, allowing us to investigate the implications of policies in previously understudied locations at a finer-grained level of geographic detail relative to other studies. Our data are a cross-sectional snapshot of the U.S. in 2015, limiting our ability to make causal claims about the effects of PV incentive policies, which would be possible by observing trends in adoption before and after policies were implemented. However, while every state has PV incentive programs in place, most of the previous casual effects research focuses on areas with high rates of solar adoption, such as California and Massachusetts. The presence of PV adoption inequity in these areas suggests that these samples tend to have higher incomes than the rest of the U.S. For example, no study on PV adoption incentives has been performed in the U.S. South—a region with some of the highest poverty rates in the country. By omitting areas with lower PV adoption rates, existing studies may be overestimating the amount of PV adoption attributable to these incentive programs and underestimating the degree of PV adoption inequity across the nation. Rather than limiting our focus to well-studied high PV adoption areas, we contribute descriptive estimates of the association between different PV incentive policies and LMI adoption for the entire U.S. Knowing where these relationships arise will help prioritize future research to verify the direction the causality runs in these relationships.

Second, we account for state-level variation in the number of residential solar adoption incentive programs. Many studies of PV adoption equity focus on the impact of a single PV incentive program. However, over half of the 48 contiguous U.S. states have more than one PV incentive program in place, including all states that have low-income assistance programs. This makes it difficult to attribute uptake to any one policy. For example, California has both a property tax benefit program, net metering, and a low-income assistance program. Many current PV owners may have been less likely to adopt had only one policy been in place. However, it is unclear how much of California’s adoption should be attributed to the low-income assistance program versus the property tax benefit or net metering. Some of the effects commonly attributed to low-income assistance programs may have only emerged because other incentive programs were also in place.

2. Methods and Data

We utilize the DeepSolar dataset, which provides a cross-section of census tract-level rooftop solar adoption compiled using a machine learning-based image classification tool that identifies solar photovoltaic panels from satellite images of most of the continental US [

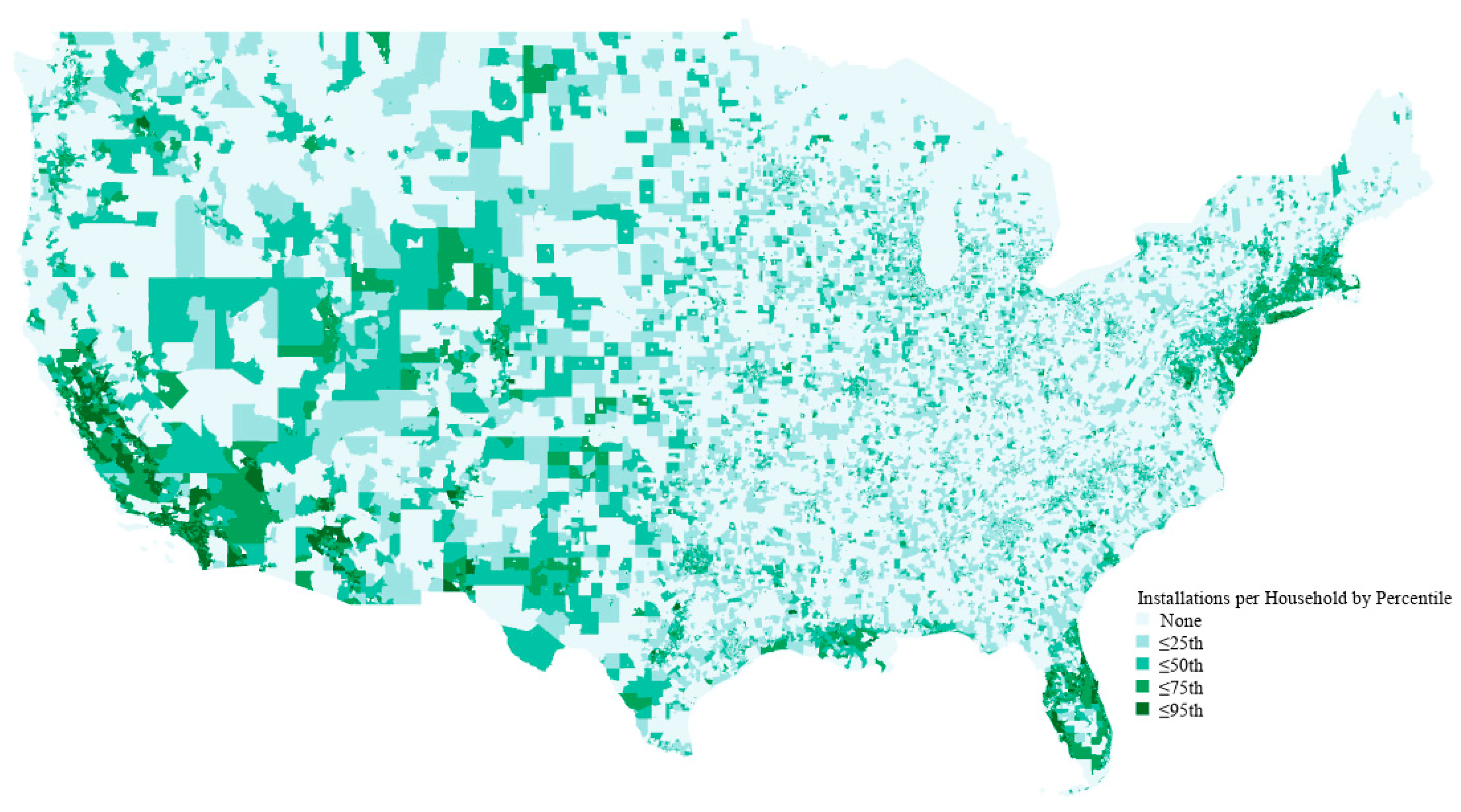

5]. We focus our analysis on the 1.25 million distributed residential installations in the dataset, which accounts for 87% of all solar installations identified. We calculate the adoption rate of residential rooftop solar panels (residential systems per household) in each census tract across the contiguous U.S. (see

Figure 1). Darker shades indicate a higher adoption rate. The highest adoption rates are found in California, Nevada, Arizona, Florida, Massachusetts and New Jersey. However, there are still small dark green spots scattered in most states, suggesting variation in adoption rates within each state.

Our major explanatory variable of interest is policies that incentivize solar adoption. The presence of state-wide solar incentive programs (net metering, property tax benefits, low-income assistance) was obtained from the Database of State Incentives for Renewables & Efficiency (DSIRE,

https://www.dsireusa.org/, accessed on 20 January 2022), the Clean Energy States Alliance’s directory of state low- and moderate-income clean energy programs (

https://www.cesa.org/resource-library/resource/directory-of-state-low-and-moderate-clean-energy-programs/, accessed on 12 December 2021) and public utility commission documents. While local solar incentive programs are becoming increasingly important, only four city-level programs were in place by 2015 across all states [

28,

29]. Our policy variables do include policies enacted by transmission utilities that service each state. Low-income assistance programs include any solar incentive program designed specifically for LMI customers and include subsidies, rebates, low-interest loans, production-based incentives, and leasing programs with preferential terms granted to LMI participants. See

Appendix A for a list of the LIA policies we considered in our analysis. We did not include electricity bill assistance programs for low-income households. However, several of the states that have solar incentive programs for LMI customers also have electricity bill assistance programs for LMI customers. Because reducing electricity bills is often a primary motivation for adopting rooftop solar, these electricity bill assistance programs could be depressing solar adoption among LMI households. The Low Income Home Energy Assistance Program (LIHEAP), which is a federal program that provides resources to assist families with energy costs, became available in all 50 states after our study period. Because the DeepSolar data captures solar adoptions as of 2015, we only consider policies that were in place by 2015.

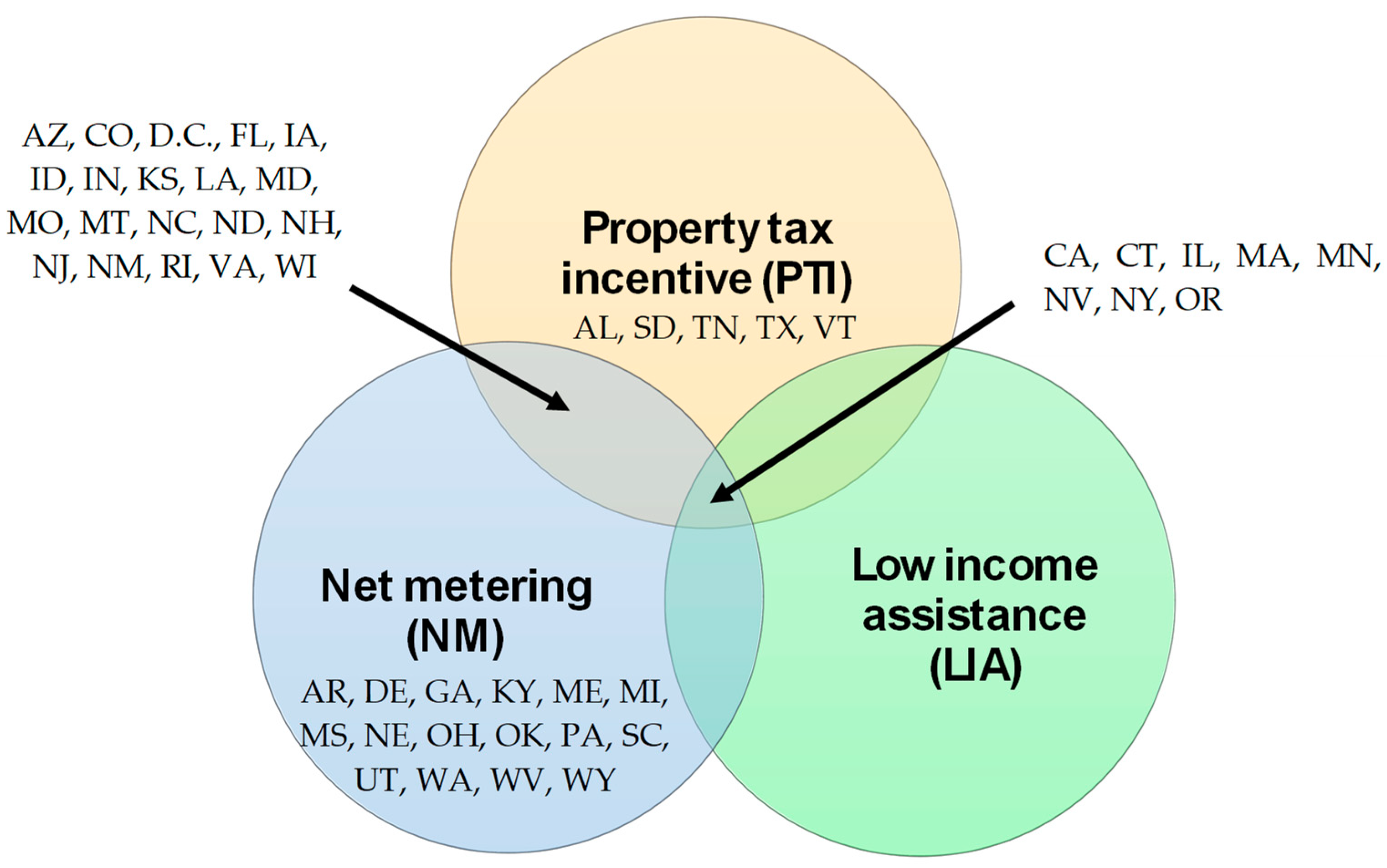

Because the specific terms and eligibility requirements of these policies vary across states, we group policies into three general categories: net metering (NM), property tax incentives (PTI), and low-income assistance (LIA). Net metering programs ensure that solar customers are compensated for any excess electricity they generate from their solar system. Since the benefits of net metering can vary across states depending on the cost of electricity, we also collect electricity price data from the SEEDS-II dataset. Property tax incentives ensure that property taxes will not rise as a result of installing a rooftop solar system. Since the benefits customers receive from property tax incentives depend on the magnitude of property taxes paid in each state, we collected the 5-year average (2011–2015) property tax amounts from the American Community Survey. Finally, low-income assistance programs are designed to help LMI households adopt rooftop solar systems and close the gap between low- and high-income adoption. These programs offer a variety of incentives to low-income applicants, including lower installation fees, subsidies, affordable loans that lower the upfront and ongoing costs, higher prices received for generated electricity sold back to the grid, and leasing options for solar panels. See

Appendix A for additional details of each type of policy included in each state.

Figure 2 shows the presence of solar system assistance policies in different states. Net metering programs are the most prevalent. Twenty states have both property tax benefits and net metering programs. All the states that have low-income assistance programs in place also have the other two programs in place.

We also utilize census-tract level data on other variables commonly associated with rooftop PV adoption, including socioeconomic factors (e.g., income, age, and education) from the US census and climate data (e.g., heating degree days, solar radiation) from the NASA Surface Meteorology and Solar Energy dataset (

https://power.larc.nasa.gov/, accessed on 20 January 2022). Income is another particularly important variable of interest, given our interest in PV adoption in low-income communities. We define low, medium, and high-income census tracts based on the comparison between their median income and the area median income (AMI). AMI is the median income of a metropolitan area and non-metropolitan county, based on the American Community Survey. Low-income census tracts are defined as census tracts whose median income is below 80% of the AMI, which comprise 33% of all census tracts. Medium-income census tracts are defined as census tracts whose median income is between 80% and 120% of the AMI and comprise 43% of all census tracts. Census tracts whose income is above 120% of the AMI are considered high-income census tracts. The U.S. Department of Housing and Community Development uses a similar low-income definition, and we obtain the AMI data directly from the Federal Housing Financing Agency’s Low-income Areas file.

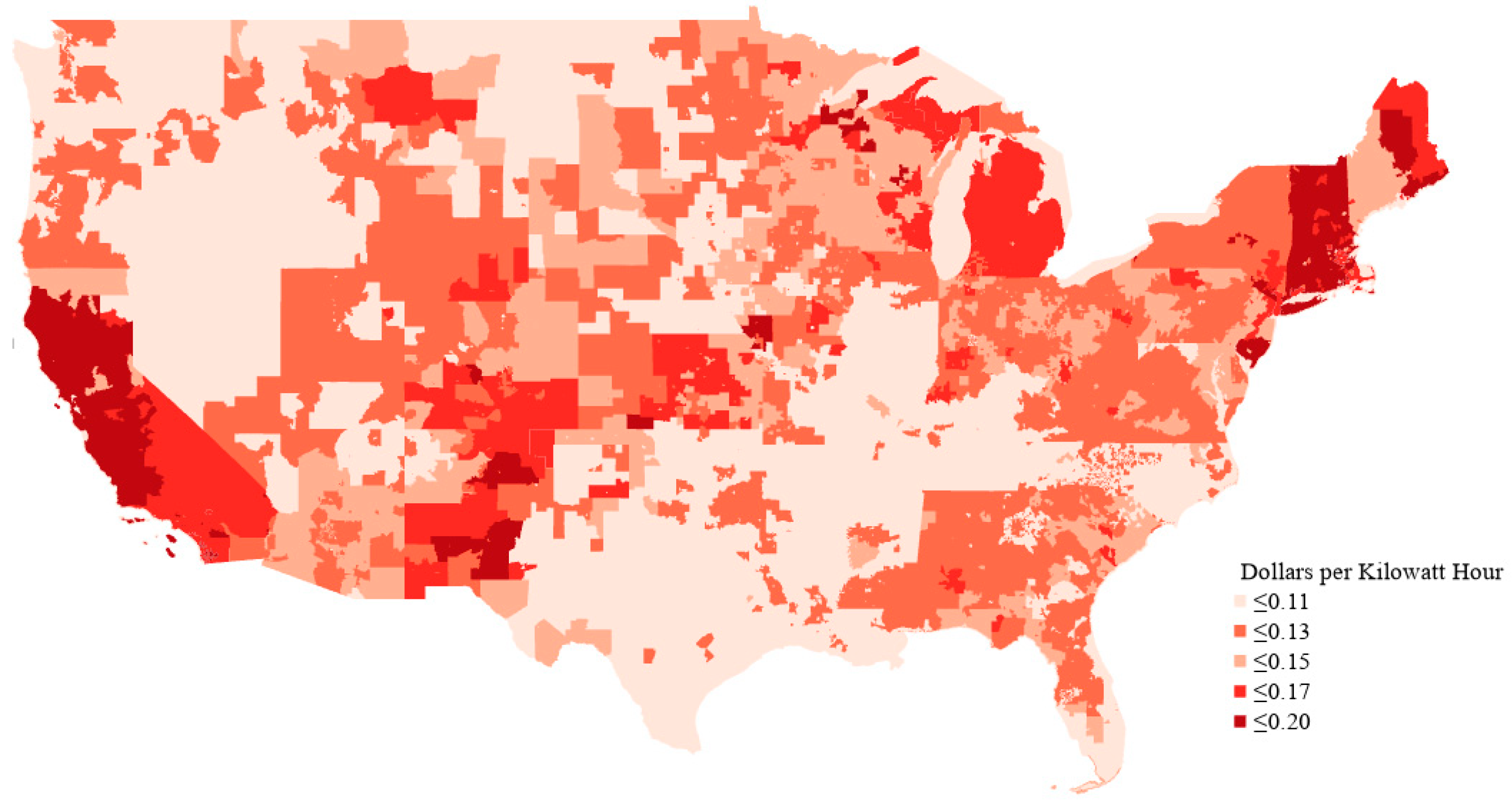

We also draw information from the SEEDS-II dataset provided by the National Renewable Energy Laboratory (NREL), which includes information about the average cost of electricity (USD/kWh), homeownership, and location classifications among rural, suburban, and city. Electricity price is another potentially important confounding factor in our analysis since adoption rates tend to be higher in places with higher electricity prices.

Figure 3 displays the average annual electricity prices across the continental U.S., with darker shades indicating higher prices. There are clear patterns in the figure: electricity prices are higher in California, Arizona, Colorado, the Great Lakes region, the Northeast, Georgia, and Florida, and relatively low in Washington, Idaho, Nevada, and Texas. In-state variation in electricity prices is not large.

In summary, the combined dataset includes (1) our outcome variable- residential rooftop solar adoption- at the census tract level, (2) the presence of three state-wide incentive policies (net metering program, property tax program, low-income assistance programs), (3) electricity price, (4) structural and environmental factors that influence the productivity of rooftop solar systems (solar radiation, suitable rooftop area, heating degree days), and (5) other socio-demographic variables that could affect solar adoption such as education level, homeowner rate, employment rate, age distribution, and population density. In order to make the variables more meaningful and comparable across census tracts, we converted many of the socio-demographic variables to rates. For example, we calculated the homeownership rate by dividing the number of homeowners by the total number of households. We also obtained the portion of the over-55-year-old population from the age distribution. We regress our outcome variable on other variables of interest using ordinary least squares (OLS) with a natural logarithm transformation of the adoption rate. A more detailed description of our statistical analysis is presented in

Section 4.

4. Model of Solar Adoption Rates

We use our dataset to answer several policy questions. First, do census tracts with more PV incentive programs have higher residential rooftop solar adoption rates? Second, how much additional solar adoption is associated with each type of policy? Third, which policies are associated with an increase in the solar adoption differentials in

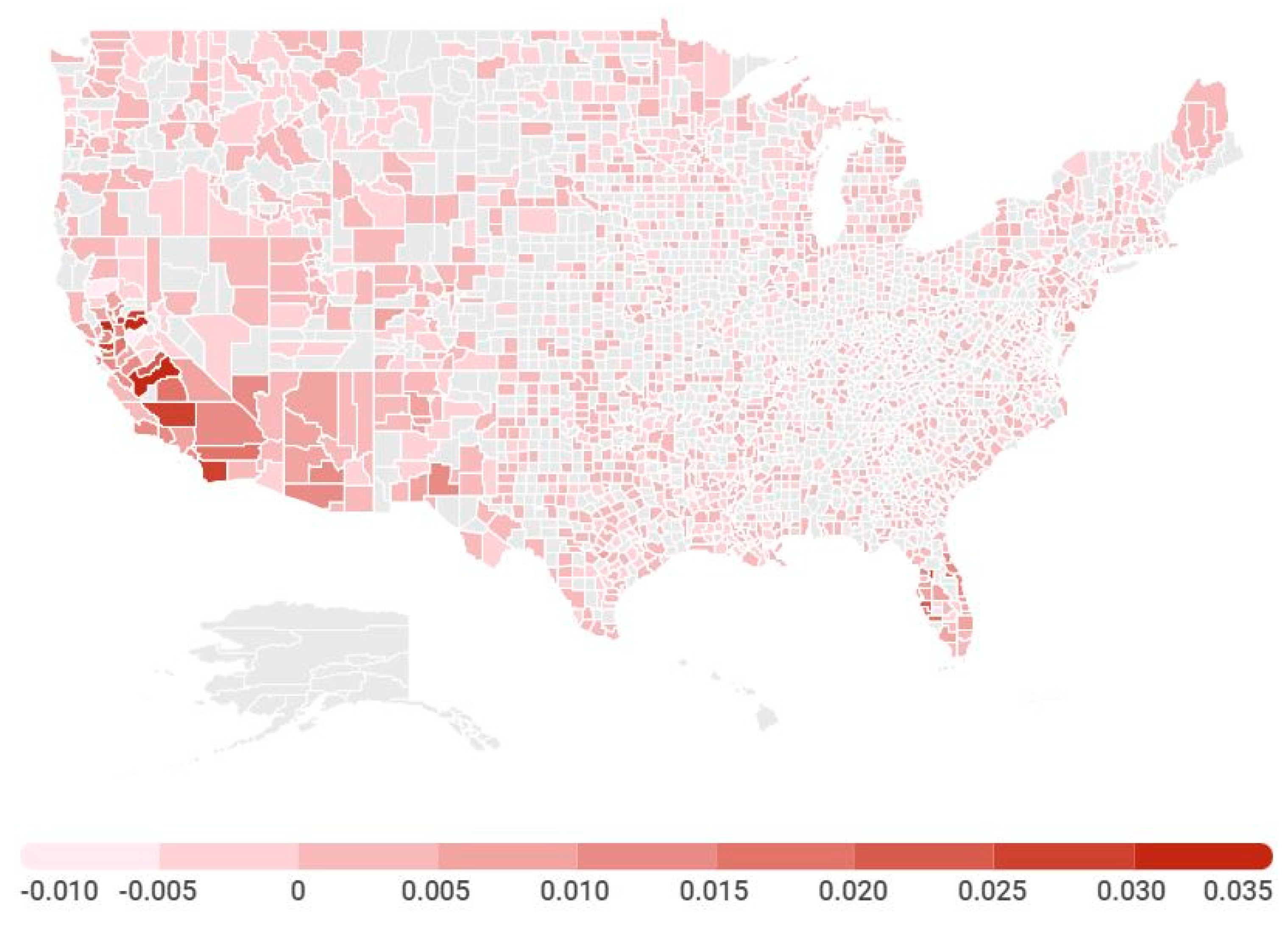

Figure 4?

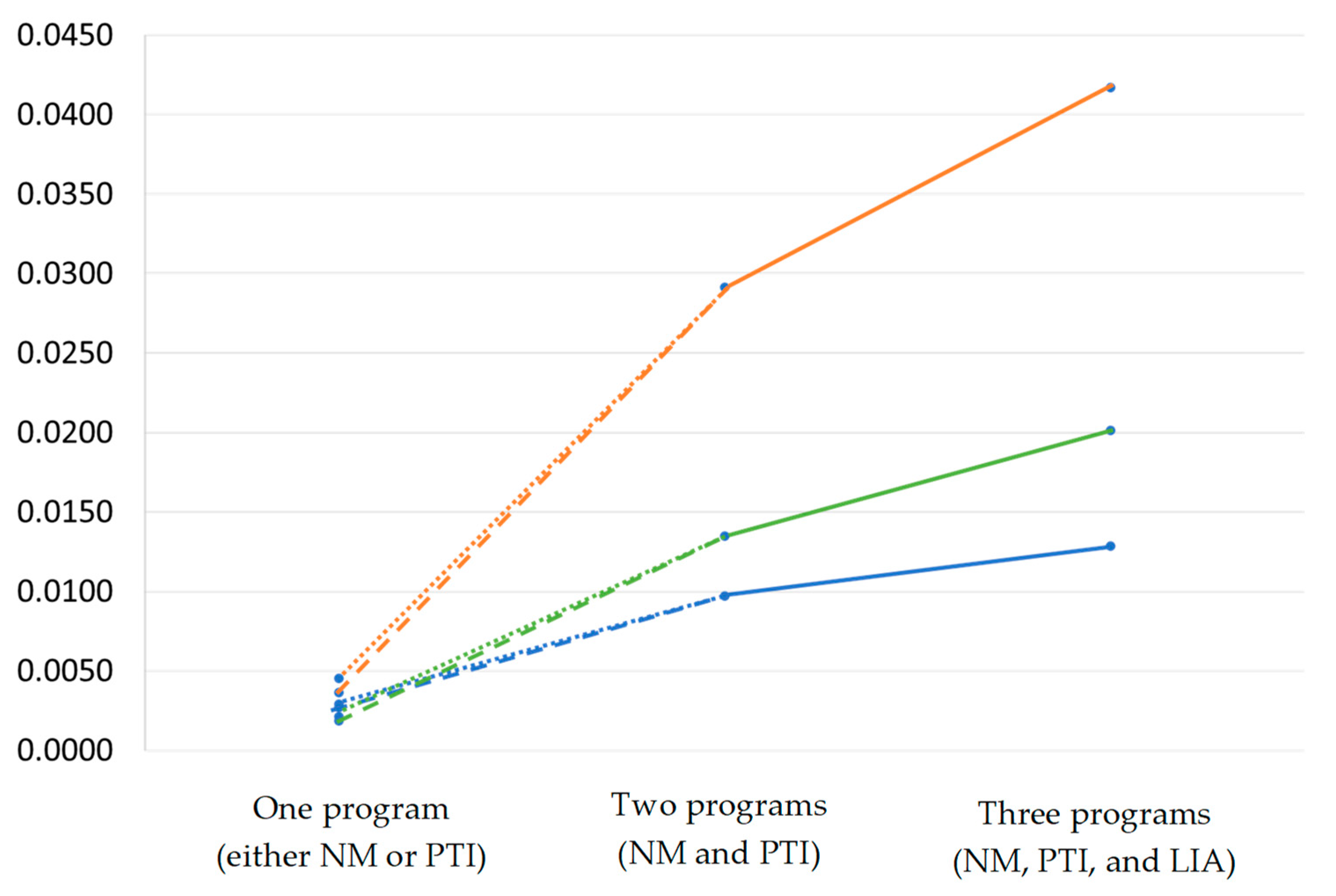

Figure 5 shows that the adoption rate increases as the number of incentive programs are added. States with one program have lower adoption rates (<0.005) than states that have three incentive programs. Further, this relationship is more pronounced among high-income census tracts. Adding a second incentive program in high-income areas increases the adoption rate by roughly 2.5 percentage points depending on whether that second policy is a PTI or NM. A second program is associated with a far smaller increase in LMI areas. Adding an LIA program is associated with a much larger increase in high-income areas. This could arise because high-income census tracts also contain LMI households that are eligible for these programs or because high-income states are more likely to adopt LIA programs. A simple comparison of adoption rates across income categories suggests that adoption inequity grows as more solar incentive policies are enacted. When one program is in place, high-income adoption rates are 52–84% higher than LMI adoption rates. With three programs in place, high-income adoption rates are three times higher than LMI adoption rates. This simple comparison of adoption rates suggests a policy tradeoff often highlighted in the literature; incentive policies can increase adoption rates but at the expense of adoption equity.

However, inferring the impact of state-level incentive policies by comparing adoption rates is misleading for two reasons. First, states differ in other ways that are likely correlated with solar adoption. For example, states with three programs may also be areas with high electricity prices and solar radiation, making it unclear how much (if any) of the increase in adoption rates between states with two and three programs is actually correlated to the presence of the program itself. Critically, the incentive programs themselves interact with these other variables in interesting ways. For example, property tax programs will be most impactful in areas where homeownership rates and property taxes are high.

Second, the relationship between adoption and an incentive program depends on the suite of other solar incentive programs available. For example, NM may be associated with a larger increase in adoption in a state where it is the only incentive program (e.g., Georgia and Wyoming) compared to a state where PTIs are also present (e.g., Arizona and Virginia). LIA programs always exist in the presence of other programs, which could overestimate their influence if households tend to bundle the low-income assistance program with property tax incentives or net metering.

To account for changes in variables that likely influence solar adoption and vary across states, we regress the log of the solar adoption rate against the three policy variables (net metering, property tax benefits, and low-income assistance) while controlling for other potentially important variables like electricity price, property taxes, census tract-level socio-demographic variables, and climate-solar radiation variables. To determine whether the relationship between adoption and incentive programs varies by income, we interact each policy variable with a dummy variable that indicates whether a census tract is classified as low or medium income. As a baseline, we define LMI as the census tracts whose median income is below 120% of the area median income (AMI). We also consider a stricter definition of LMI as census tracts whose median income is below 80% of the area median income (AMI). We estimate these relationships using OLS and cluster the standard errors at the state level. We apply the model to all 48 states and Washington, D.C. See

Table 2 for summary statistics of all independent variables.

To highlight the differences in state-level LIA policies, we consider two specifications of the model. Model 1 lumps all states with an LIA program into a single dummy variable to provide an estimate of the change in adoption rates associated with LIA programs overall. Model 2 substitutes the single dummy variable for LIA presence for individual dummy variables for each state that has an LIA program in place. Model 2 provides an estimate of the change in adoption rates associated with LIA programs in each state.

We also apply the model to three state subsamples to indicate the degree of selection bias our national-level dataset may alleviate and to track the magnitude of the adoption gap with different combinations of policies. These subsets represent groups of comparable states that may be plausibly compiled by analysts to isolate the effect of a given policy. For instance, states considering adding a second policy will likely consider other similar states with two or fewer policies (columns 2 and 3 in

Table 2). Likewise, low-income assistance programs never exist without both property tax and net metering programs. Analysts interested in whether low-income assistance programs lead to higher solar adoption will likely focus their attention on the states that have property tax and net metering programs in place (fourth column in

Table 2). These subsets also represent the reality that solar adoption data are generally more available in high-adoption states like California, Arizona, and New York, which have multiple policies in place. In general, our sample of the contiguous U.S. has lower electricity prices, lower property taxes, and lower population density than the states with two or more programs that have been the focus of previous studies.

Because the adoption rate is positively skewed in general as well as in each income group, a natural log transformation is applied to the solar adoption rate. We added a small number to the adoption rate (0.001) before taking the natural log in order to keep those census tracts which have a zero-adoption rate. Our results are qualitatively unchanged when we vary this adjustment factor between 0.01 and 0.00001.

5. Results

Linear regression results for our contiguous U.S. sample of 65,501 census tracts (all 48 contiguous states and Washington, D.C.) are reported in

Table 3, and the percent change in adoption associated with each policy is presented in

Table 4. Because the adoption rate is log-transformed, each coefficient can be interpreted as the percent change in the adoption rate associated with a one-unit change in the variable. As expected, solar radiation, homeownership rate, and education are significant and positively correlated with adoption. Because cooling is a primary driver of residential electricity use in most of the U.S., heating degree days are significant and negatively correlated with adoption. Senior rate, employment rate, and population density are also important predictors of solar adoption in most areas.

When LMI is defined as less than 120% AMI (columns 1 and 2 in

Table 3), property tax and net metering programs are positively correlated with solar adoption, but the effect of these programs is more pronounced in high-income census tracts. For Model 1, the presence of NM programs is associated with a 90 percent increase in the adoption rate in high-income census tracts but only a 58 percent increase (0.897 − 0.314 = 0.583) for low-income census tracts. That NM is associated with an increase in the adoption gap is consistent with the smaller coefficient on electricity price for LMI census tracts. The presence of PTI programs was associated with a 29 percent increase in the adoption rate for high-income census tracts and a six percent increase for low-income census tracts. Thus, adding an NM and PTI program is associated with a 32 and 23 percentage point increase in the adoption gap, respectively. Adding NM increases the adoption gap more than adding PTI programs. In other words, programs that are associated with larger increases in solar adoption in LMI census tracts are also associated with the largest adoption gaps.

In contrast, the presence of LIA programs is associated with a 30 percent increase in the adoption rate for high-income census tracts and a 36 percent increase (0.302 + 0.062 = 0.364) for low-income census tracts—a six percentage point decrease in the adoption gap. These effects are also rather large. By comparison, a one-standard-deviation increase (USD0.036) in electricity price is correlated with a 24 percent increase in the adoption rate for high-income census tracts and a 20 percent increase for low-income census tracts. While all three policies are associated with more solar adoption in LMI census tracts, only the LIA programs are associated with a smaller gap in solar adoption between low- and high-income households. These results are reassuring since these programs are designed to provide a disproportionate incentive to low-income households.

Model 2 reveals that these overall results on LIA programs hide important differences in LIA programs across states. LIA programs in California, Nevada, Oregon, and New York are associated with large increases in PV adoption in LMI census tracts, but these increases were smaller than in high-income census tracts, resulting in an increase in the PV adoption gap. In contrast, the LIA programs in Connecticut and Massachusetts were associated with increases in PV adoption in LMI census tracts without widening the adoption gap. These results mirror the regional differences in the solar adoption gap presented in

Figure 4. LIA programs in two states with relatively low levels of solar adoption were associated with decreases in adoption in LMI census tracts.

The coefficient on LMI is positive and significant, indicating that the adoption rate is higher in low-income census tracts when none of the incentive policies are present (i.e., a negative adoption gap). In other words, with no solar incentive programs in place, overall solar adoption rates would be lower, but adoption would be higher in LMI census tracts.

5.1. Stricter Definition of LMI

These results are sensitive to the definition used to define a low-income census tract. The eligibility of low-income assistance programs is different across states. Out of the eight states that have low-income assistance programs in our study, CA, IL, MA, and NY used 80% AMI or lower as the standard for eligibility, while NV and OR used a lower threshold (e.g., 60% AMI). However, defining a low-income census tract is difficult since these eligibility criteria are for households while our analysis is at the census tract level. Medium-income census tracts may be comprised of many low-income households that would be eligible for these programs.

To address this concern, we re-fit all the models with a stricter definition of low-income defined as census tracts whose median income is below 80% of the AMI (i.e., medium-income census tracts are no longer classified as low-income). Full regression results are presented in columns 3 and 4 in

Table 3. Three key differences arise relative to the results with a more strict definition of LMI.

First, the presence of NM and PTI is associated with a smaller increase in adoption in high- and medium-income census tracts. These incentive programs are associated with larger increases in adoption rates in medium-income tracts than in low-income tracts. Thus, the stricter definition of low-income, which moved medium-income tracts from the low- to high-income category, lowers the amount of adoption associated with these policies in the low-income tracts. Medium-income census tracts also have lower adoption rates than high-income tracts, which also works to dampen the amount of adoption associated with all policies in high-income tracts. While not terribly surprising, it is important to remember that stricter definitions of low-income areas will generally lower the amount of adoption that can be associated with a policy for all income categories.

Second, while PTI continues to correspond with adoption in high- and medium-income tracts, it is associated with a decrease in adoption in low-income tracts. Specifically, PTI corresponds with a 3.5 percent reduction in the solar adoption rate in low-income tracts. Thus, the tradeoff between adoption rates and the adoption gap associated with PTI we witnessed with the less strict definition of LMI disappears. General equilibrium effects in the housing market could be one possible explanation for this result. Property tax incentives may increase the demand for homes with solar panels, driving up prices that preclude homeownership by low-income residents.

Third, LIA programs are no longer associated with a smaller adoption gap between low- and high-income groups. Specifically, the interaction term LIA × LMI is not statistically different from zero. Thus, the presence of LIA programs is associated with a 37 percent increase in the adoption rate for all census tracts, regardless of whether they are high-income or low-income. The results from Model 2 provide some clues for this result. The LIA program in Massachusetts is no longer associated with a decreasing adoption gap, and the LIA program in New York no longer generates differential impacts in this low-income category.

5.2. State Subsamples

Table 5 presents the regression results for our three state subsamples with our baseline definition of LMI (<120%AMI). Results for the three state subsamples with our stricter definition of LMI are qualitatively similar and are available upon request. Subsampling the data to account for the uneven presence of incentive policies across states results in slightly higher estimates of adoption associated with each incentive program. For example, columns 2 and 3 in

Table 5 indicate the additional solar adoption associated with adding NM and PTI in the 21 states that have one policy in place. The additional adoption associated with adding an NM program in a low-income census tract that only has a PTI program is five percentage points higher than the estimates from the full sample of all 49 contiguous U.S. states and Washington, D.C. For this subsample of 21 states, the adoption gap associated with NM implementation is also two percentage points larger than the full sample of states. Adding a PTI program in a low-income census tract that only has NM is associated with an adoption that is five percentage points higher than the estimates from our full sample of all states. The adoption gap associated with PTI implementation is two percentage points lower than the full sample of states. Column 4 in

Table 5 indicates the additional solar adoption associated with adding LIA in the 20 states that have two policies in place. The additional adoption associated with adding an LIA program in a low-income census tract that already has NM and PTI is nine percentage points higher than the estimates from the full sample of all 48 contiguous U.S. states and Washington, D.C. The adoption gap associated with LIA implementation is two percentage points lower than the full sample of states.

6. Conclusions and Policy Implications

The electricity sector is simultaneously undergoing decarbonization and decentralization. Solar energy is now the cheapest source of electricity generation in many parts of the country, and many customers are choosing to forgo the traditional centralized generation model in favor of distributed generation located closer to where it is consumed. However, there is increasing evidence that not all utility customers experience the benefits of distributed solar energy. Existing research that assesses the causal effect of solar incentive programs tends to focus on areas with high solar penetration. Since these areas tend to have higher average incomes than the rest of the U.S., it is unclear whether these results translate to other areas of the U.S. where incomes are much lower. To our knowledge, this is the first study to document the relationship between solar incentive programs and low-income solar adoption across the contiguous U.S.

We find that net metering and property tax incentives are both associated with increased solar adoption in LMI census tracts across the U.S. However, policymakers considering these solar incentive programs should be aware of the increase in the adoption gap between high- and low-income neighborhoods. Surprisingly, increases in low-income adoption rates may coincide with equity concerns if equity is judged based on differences between low- and high-income adoption. Overall, LIA programs avoid this tradeoff by increasing solar adoption rates in low-income census tracts more than in high-income census tracts. However, there is considerable variation in the amount of LMI adoption associated with LIA programs across states.

Our conclusions change slightly if concerned about solar adoption only in the lowest income areas (i.e., those areas where the average income is less than 80% of AMI). With this stricter definition of low-income areas, all incentive programs are associated with smaller increases in adoption. In fact, property tax incentives deter solar adoption in these lowest-income areas. Low-income assistance programs continue to spur adoption in low-income areas, but they are no longer able to close the solar adoption gap. This suggests that, while low-income assistance is more effective among middle-income census tracts, they are not reaching the poorest areas.

While these findings highlight relationships between solar incentive programs and solar adoption in areas that have been overlooked in the existing literature, there remain several important areas of future work. First, our cross-sectional data of the U.S. are unable to identify the causal impacts of solar adoption in each state. Utilities only begin to collect solar adoption statistics when adoption begins to impact their load forecasts. In most of the U.S., utilities are just now beginning to track this data. As more utilities collect time-series data on solar adoption within their service area, causal impacts of solar incentive programs will be possible across the U.S. Our results are a first step. Knowing where relationships between solar incentive programs and low-income solar adoption exist will help researchers prioritize future research that can identify which direction causality runs in these relationships. Our dataset also does not account for the amount of incentives these programs provide. Collecting data on the size of the incentives and any qualifications or restrictions associated with these incentive programs will provide policymakers and utilities with an even clearer picture of the effectiveness of these policies.