Abstract

Citizen-driven approaches are promising to overcome the challenges in the energy transition of geographical islands. However, the economic profitability of related activities must be ensured to achieve the intrinsic and sustainable uptake of related solutions in an island’s communities. Here, we investigate the long-term (2020–2054) economic profitability of solar-based prosumption on islands belonging to the European Union (EU), soft-linking energy system modelling and actor-related cash-flow analysis. This combination considerably extends common assessments of the profitability of renewable energy technology and long-term projections of island energy systems. We base our case study on the French overseas territory of Mayotte, discussing household affordability and the socio-economic impact of prosumerism. These topics are relevant to transferability on non-EU islands. The profitability of investments in PV depends on (i) the size of the PV system, with larger systems (>9 kWp) profiting from lower specific investment costs compared to smaller systems; (ii) the time of investment, with more profitable investments to be expected in early periods; (iii) the level of decarbonization of the entire energy sector, with an ongoing decarbonization reducing the compensation or energy-saving possibilities; and (iv) the market behavior, with the practice of feeding in all electricity produced rather than self-consuming energy offering a higher expected return on investment under current feed-in-tariff (FiT) compensation schemes. We introduce various policy measures to improve solar rooftop PV profitability and discuss their trade-offs and effectiveness. While indirect subsidies via FiT are generally effective in improving PV profitability, they undermine efforts to incentivize decentralized self-consumption. From the perspective of harmonizing efforts in the energy transition of African and European islands, we recommend a careful evaluation of the trade-offs in relevant regulations required for the economic incentivization of prosumers to achieve compatibility with the principles of a citizen-driven and just energy transition. Particular attention must be paid to context-specific socio-economic characteristics, including low access to financial resources and non-financial access barriers, including legal status.

1. Introduction

1.1. Clean Energy Transitions on Islands

One of our global society’s greatest challenges is combating and mitigating the effects of climate change. The complex and interlinked effects of climate change include, inter alia, increased atmospheric temperature and rising sea levels, extreme weather events, the loss of ecosystems, reduced food security, increased damage to infrastructure, and additional mortality, provoking severe impacts including socio-economic and environmental crises, damaged livelihoods, damage to health, and the reduced security of people [1]. As a consequence, communities facing the effects of climate change are challenged in terms of acclimatizing to shifting environmental parameters and resource scarcity, which bears the potential to escalate conflicts and exacerbate displacement [2,3]. Island communities are among the most ‘vulnerable’ to climate change [4,5]—that is to a large degree due to being susceptible, or unable to cope with, the adverse effect of climate change, caused by the high sensitivity but low adaptivity of island systems towards change [6]. In particular, limited resource availability, geographical isolation, and direct exposure to various climate impacts (e.g., rising sea levels) result in island communities being uniquely vulnerable to climate change [4].

While the effects of climate change are diverse, its cause may be pinpointed to an imbalance in greenhouse gas (GHG) emissions—mainly carbon dioxide (CO2)—in the atmosphere, caused by increased anthropogenic emissions [7]. Consequently, countries around the world have agreed to minimize anthropogenic CO2 emissions to mitigate climate change, e.g., via the international treaty on climate change, as stipulated in the Paris Agreement [8]. Contributing about 70% of the total annual anthropogenic CO2 emissions [7], the energy sector (including electricity, heat, industries, and transport) plays a critical role in countries’ decarbonization efforts. Mitigating climate change significantly depends on the success of decarbonizing energy systems. Having recognized the crucial role of energy in solving pressing domestic (and international) challenges, islands and their communities have significantly increased their efforts to transform and decarbonize their energy systems. However, despite increasing recognition in research and funding schemes, many islands still lag behind in the energy transition, as the associated challenges are greater compared to those of their affiliated inland counterparts [5]. By today, many islands still rely on imported fossil fuels for energy supply, which jeopardizes energy security and increases the costs of energy supply [5]. Simultaneously, islands often suffer from poor grid infrastructure, which challenges the uptake of renewable energies [9,10]. Ironically, renewable energy sources are often abundant on islands, including solar power, hydropower, wind power, or biomass [11].

Having recognized the severe deficits and challenges of the energy transition (notably, in this study, we understand energy “transition” as a change in the complex socio-technical energy systems and environment and its impact on society, while “transformation” refers to changes when focusing on physical changes, i.e., in energy assets, according to [12]) on islands, various dedicated schemes and programmes have been put in place to focus on and support islands in their efforts to decarbonize their energy systems. For example, under the ‘Clean energy for EU islands’ initiative, the European Union (EU) provides a long-term framework, resources, and assistance in finance, technology, and regulation to help its islands generate their own sustainable, low-cost energy [13]. More recently, under the Africa–EU Energy Partnership (AAEP), African and European states announced their intention to join forces, harmonize approaches, and unlock synergies to promote the green energy transition on both African and European islands [14].

In the pursuit of suitable approaches for promoting the energy transition on islands, a citizen-driven energy transition seems to be a promising approach. While, in this context, the keywords citizen-driven energy transition, energy citizenship, or energy democracy and related concepts may exist in parallel (and are sometimes even used as synonyms) [15], a citizen-driven energy transition—opposed to a transition with centralized ownership and governance—suggests active citizen participation, such as adopting renewable energy technologies, joining energy communities, supporting local initiatives, and participating in policy decision-making [15]. While the unconditional positive impacts of participatory approaches and democratic decision-making in energy planning are also controversial [16], a general tonus prevails that the social transition associated with decentralized energy transitions provides the potential for reducing socio-economic inequalities, increasing justice, and delivering environmental and societal benefits [17]. While the concepts of a citizen-driven energy transition are becoming increasingly popular on the mainland (see, e.g., [15]), arguments for promoting a citizen-driven energy transition may be especially strong considering the special case of isolated islands. Due to historically evolved structures, such as the occasion institutional linkages of powerful stakeholders in the energy sector on islands with decision-making entities on the mainland and the low competition in energy markets, the current entities in the island energy sector are often emblematic of institutional carbon lock-in effects (see [18] et al., for an overview of carbon lock-in and related classifications), i.e., the conscious efforts of powerful economic, social, and political actors seeking to favour their interest against impending change [18]. Motivated by selfish benefits rather than by creating maximum social welfare [19], the unwillingness to rearrange institutional power structures often results in a reluctance towards the energy transition, and even towards ongoing electrification efforts [20]. Further, due to the low liquidity in the energy markets, only a few private market players are actively entering the market. It therefore may be seen as unlikely, or at least not efficient, to rely on the current actors to be responsible for the energy transition. The communities and local citizens on islands, in contrast, may even surpass their mainland counterparts in their willingness to take an active and responsible role in the energy transition. As of their specific setting, island communities are well known to have a strong sense of community/collective action—which has also been evidenced for the energy transition. For example, Ghanem et al. [21] as well as Schöne et al. [22] both detected that island inhabitants have a comparatively high interest in engaging with and motivation to actively engage in demand response (DR) mechanisms—this may be seen as a natural means of encouraging citizens to have a positive attitude and increase their involvement in climate change mitigation and the energy transition (snowball effect) in general [22]. Similarly, Otte et. al. [23] find high support for community energy projects on islands. Aside from the social and institutional perspectives, a citizen-driven energy transition—not necessarily but likely being facilitated by decentralized energy system and market solutions—may overcome the technical barriers in island energy systems, as the limited grid infrastructure suggest that decentralized energy generation and local self-consumption are viable and cost-efficient options. Small-scale assets, and rooftop solar PV, in particular, reduce the competition for the scarce land resources on many islands, as they use land that cannot be utilized for other purposes such as agriculture, or are mounted onto existing buildings. These systems, in turn, enable new forms of participation in the energy system, turning former consumers into so-called prosumers, i.e., generating and self-consuming electricity [24]. Thus, prosumerism may be of critical importance in achieving a successful citizen-driven energy transition on islands.

However, when citizens to decide to invest in renewable energies and become active in the energy transition, e.g., as prosumers, the economic viability of the investment is one essential motivation Evaluating the economic viability, and comparing alternatives, is complex. Time-dependent technology and market developments, individual financing conditions and capabilities, and potentially applicable regulations and policies must be carefully considered in order to determine the profitability of RES investments. Additionally, profitability alone does not necessarily imply that an investment is affordable, and affordability is further constrained by household income and status.

1.2. Ambition and Contribution to Research

Against this background, and in the view of an emerging collaboration between the African Union (AU) and EU to transition their island energy systems, we investigate the profitability of renewable investments and prosumerism, including self-consumption, on islands, respecting current regulations and economic incentives. We use the island of Mayotte as a case study, which—being located close to the coast of Madagascar but falling under EU legislation as a French oversea department—may, due to its specific socio-economic and political status (see Section 3.2.1), serve as a bridge to foster AEEP efforts in collaborating on energy transition of islands. Our research aims to evaluate the long-term economic viability of prosumerism based on rooftop photovoltaic (PV) systems. We also aim to identify the levers of economic viability and propose potential policies and regulations with which to improve profitability as a cornerstone of a citizen-driven energy transition on islands. Our specific research questions are as follows:

- Do solar rooftop PV systems for prosumption present a profitable investment option in Mayotte, both today and in the future? How is profitability influenced by the ongoing decarbonization?

- What are the technical, financial, and regulatory drivers of profitability?

- What policy measures can support the profitability of rooftop solar PV systems for prosumption, and which specifically consider issues of affordability and inclusion?

To answer our specific research questions, we develop a soft link between energy system modelling and actor-related cash-flow analysis. We rely on the E3-ISL energy system model [25] to obtain consistent alternative projections of Mayotte’s energy system and the associated electricity prices under differing parameters and policy assumptions according to business-as-usual or decarbonization scenarios. Using the outputs of energy system modelling (i.e., electricity price) and long-term projections for technology costs and feed-in tariffs in Mayotte, we analyse the profitability of investments in rooftop PV of different system sizes in the years 2020, 2025, 2030, 2035 and 2040 at differing levels of self-consumption.

Our work combines the strengths of detailed cash analysis and long-term energy system modelling, resulting in an innovative perspective on the economic viability of RETs on islands. While many related works investigate the economic profitability of RETs, including rooftop solar PV, through cash-flow analysis, only a few focus on the long-term viability of such investments beyond a single point in time. Furthermore, many studies employ considerable simplifications, assuming, for example, uniform electricity prices. At the same time, many long-term energy system models and projections have been made, investigating the energy transition pathways of certain countries, regions, or, more relevant to the present paper, islands. These long-term models, however, focus on the macro-level costs and benefits of the energy transition, including aggregated savings achieved through a shift to renewables, thereby omitting the perspective of individual micro-level investors. To our knowledge, our study is the first of its kind to combine these two perspectives for islands. For the specific case of Mayotte, only limited research has been conducted on its energy system and transition, focusing, among other issues, on a macro-level perspective [25,26]. Extending this work, our research adds an additional focus on the micro-level, which may inform the development of policy incentives on the island and beyond.

Our analysis illustrates the behaviour of energy market actors under changing regulatory and economic incentive structures and reveals the influence of various parameters on overall asset profitability (Section 3). We discuss the implications of our results and findings in terms of the broad concept of related themes in the energy transition, including the emerging challenge of the integration of (intermittent) renewables and self-consumption of electricity, as well as questions of broad citizen participation, affordability, and the distribution of the costs and benefits of the transition (Section 4).

2. Materials and Methods

We first describe the generalized and replicable methodological workflow of our analysis (Section 2.1) and detail the respective methods of each step in Section 2.1.1 and Section 2.1.2. In Section 2.2, we provide an overview of the data and assumptions used in our analysis. As some data are specific to the context of our case study, we provide a brief overview of Mayotte and its relevant particularities in Section 2.2.1, followed by an overview of data, assumptions, and projections (Section 2.2.2) and an explanation of the rationale behavior of prosumer and producer as assumed in our model (Section 2.2.3).

2.1. Methods

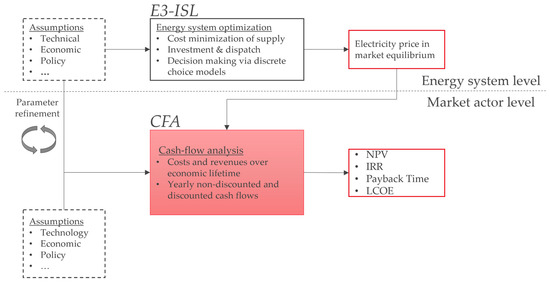

Our methodological workflow, as illustrated in Figure 1, soft-links energy system modeling (ESM) with cash-flow analysis (CFA). Energy system modeling (as described under Section 2.2.1) was conducted to obtain optimized energy system scenarios of Mayotte under alternative policy assumptions and compute the resulting electricity price under market equilibrium conditions for different periods until 2054. The electricity prices were subjected to the CFA in order to align the finanical analysis of micro-level prosumer investments with the long-term trajectories of Mayotte’s energy system development. The distinct steps of the workflow will be described in detail in the subsequent subsections.

Figure 1.

Overview of soft link of energy system modelling and cash-flow analysis.

2.1.1. Energy System Modeling

To obtain consistent projections of the required inputs for the CFA (i.e., the electricity price), we rely on the E3-ISL energy system model. An extensive description of the model is provided in [25]. Its application to studying the impact of alternative energy transition scenarios on the energy system, economy, and society of Mayotte is discussed in [26]. Below, we summarize the key model characteristics that are important for our analysis:

- E3-ISL was developed to obtain consistent projections of the energy system of Mayotte, including forecasting the energy demand by the main sectors (transport, buildings, industries), the fuel and technology mix by sector, planning the power supply sector, and assessing the emissions, energy, and economic consequences of certain political decisions or market developments. The model was specifically tailored to the characteristics of the non-interconnected island energy system of Mayotte, including significant seasonal load variability, high fuel prices, weak electricity grid, and poor energy infrastructure.

- E3-ISL projects electricity prices in the period 2025–2050, as derived from cost minimization on the supply side due to endogenous competition between various power-generating technologies and the price-elastic behaviours of energy consumers, which results in a market equilibrium.

- In our analysis, the base year of the model is set as 2020. The optimization is executed in 5-year time steps up to 2050. Thus, the model’s horizon reaches 2050.

- The results may be exported to a Microsoft Excel-based environment (e.g., Excel 2021, Version 2405), which provides a user-friendly intersection to allow for soft-linking with the CFA modelling, or further processing of results.

- The choices of actors (e.g., energy consumer for fuels used, investments) are determined by decision-making agents via discrete choice models. The choices are influenced by policy drivers (including fuel taxation, RES and energy efficiency targets, subsidies for technologies, regulatory instruments, behavioural changes, and emissions trading) that are set to be defined by the modeller, allowing for flexible scenario formulation.

In [26], five different decarbonization scenarios examining plausible alternative configurations of Mayotte’s energy–economy system were designed and developed with the E3-ISL model. The scenarios reflected the development of carbon-neutral transition pathways for Mayotte by 2050 or earlier. Differing in parameters and policy assumptions according to the distinct narratives co-developed with partners and stakeholders from Mayotte, the scenario analysis examined island-specific dynamics regarding various mitigation options, energy consumption trends, the degree of community activation, policy focus, and technology and investment requirements for achieving carbon neutrality. The current study builds on the E3-ISL projections of one specific decarbonization scenario (‘Decarb_Demand’), the effects of which are evaluated in comparison to a baseline scenario that simulates developments as they would occur under the continuation of the current conditions and policies. In line with the rationale of this paper, the decarbonization scenario ‘Decarb_Demand’ (from here on simply referred to as the ‘decarbonization scenario’) reflects consumer-driven decarbonization, setting relevant modelling parameters to simulate the active involvement of citizens and communities in the energy transition (e.g., via energy savings, demand response, V2G, car sharing, and a high rate of adoption of rooftop PVs), high electrification on the demand side, and related policies. The resulting energy system includes a significant share of rooftop solar PV assets, which presents a relevant pathway for Mayotte, an island with limited space and high solar yields.

As key results of the E3-ISL model, relevant to the computation of the economic viability of rooftop PV on Mayotte, we obtain the pre-tax electricity price, which in our analysis represents the wholesale electricity price, and the after-tax electricity price that consumers pay for each kWh they consume.

2.1.2. Cash-Flow Analysis

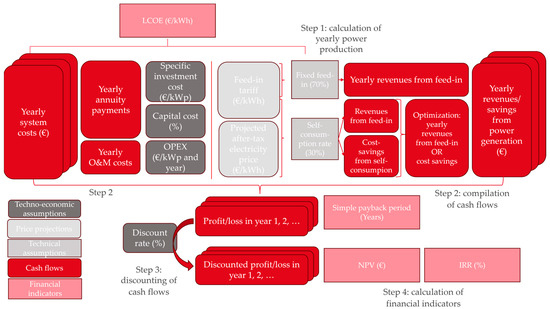

We conduct detailed analyses to assess the profitability of investments into power generation assets, i.e., roof-mounted solar PV systems, in Mayotte for two distinct market actors and the associated behavior: (i) prosumers, feeding at least a minimum share of electricity produced into the grid while eventually deciding to self-consume the remaining part; and (ii) producers, feeding the total amount of generated electricity into the grid to be compensated via feed-in-tariff or wholesale market prices (see Section 2.2.3 for a description of the rational behavior of prosumers and producers as assumed in our model). Using the energy system development pathways for the island developed by [26] allows for a comparison of investments over time and a detailed understanding of the medium- and long-term economic viability of prosumerism in Mayotte. The analysis covers multiple timeframes, examining a potential investment at the start of each five-year period of the E3-ISL model. Assuming an economic lifetime of assets of all generations of 15 years, we consider investments in the years 2020, 2025, 2030, 2035 and 2040 in the analysis, allowing us to conduct an analysis of all relevant cash flows. Figure 2 outlines the inputs, processes, and outputs of the cash-flow analysis of a single investment. This analysis is repeated for every possible investment case.

Figure 2.

Overview of assumptions, price projections, cash flows, and financial indicators used in the assessment.

The CFA conducted to evaluate the economic profitability follows four distinct steps:

- (1)

- Compilation of technical data: We first compile the technical data needed for the calculation of the yearly power generation of an asset, i.e., installed capacity, yearly runtime, and capacity factor. Technical assumptions are assumed to be constant over the asset’s lifetime as this feature is embedded in specific technological equipment.

The technical data assumed for prosumers and producers are identical, except for prosumers’ ability to self-consume. In line with the self-consumption rates of solar PV prosumers without storage observed in Europe [27], we assume a self-consumption rate of 30% for prosumers of all system sizes and time periods as a reference value. Notably, this assumed rate is a simplifying assumption, and actual self-consumption rates may vary according to total household consumption and the demand patterns and load curves of prosumer types. Larger prosumers, such as public buildings and offices, may consume energy during the day for their operations, resulting in a higher rate of self-consumption of solar-based electricity. Also, prosumers might optimize their systems in line with their consumption patterns by installing devices with lower solar PV capacities, resulting in the possibility of 100% self-consumption whenever economically attractive. Therefore, the self-consumption rate is varied within the sensitivity analysis (Section 3.2.2).

- (2)

- Compilation of cash flows: We compile all cash flows over an investment’s lifetime, based on the underlying technical data. This includes capital expenditure (specific investment cost) and cost of capital, operational expenditures (OPEX), and revenues from electricity sales or self-consumption. The data for each 5-year period are assumed for all years during the five-year period, e.g., the specific investment cost for rooftop solar PV in 2020 remains the same for systems installed in the years from 2021 to 2024. For our cash flows, we consider the following factors:

- The specific investment cost represents the total initial investment costs associated with purchasing and installing the power generation assets, such as construction, equipment, and infrastructure costs. It is a one-time cost that relates to the installed power capacity of assets and is thus expressed in €/kWp. The specific investment cost varies between system sizes and time periods (see Table A1), with lower costs for larger systems and systems installed in later time periods, as shown in Section 2.2.2.

- In line with the E3-ISL modelling assumptions, investors are assumed to take on a loan, on which they must pay interest, to finance the specific investment cost, i.e., the cost of capital (8.5% in the reference case, see Section 2.2.2).

- The loan is paid back as an annuity over the investment’s economic lifetime (15 years), resulting in same-sized yearly cash outflows that cover both the repayment of the specific investment cost and the interest rate.

- The OPEX of rooftop solar PV systems is only composed of fixed operation and maintenance (O&M) expenses, which represent the ongoing costs required to maintain and operate the power generation assets, such as expenses for regular maintenance and administrative costs. Fixed O&M costs are calculated based on the installed capacity, i.e., €/kW and year. These per-unit O&M costs are uniform across system sizes but are lower for systems installed in later time periods following the trend of the specific investment costs. The OPEX results in same-sized yearly cash outflows.

- No taxes are included in the analysis. At the time of writing, there is no VAT in Mayotte, and we assume a favorable framework where power generation by prosumers is not taxed. For power producers, taxes on electricity are profit-neutral, as they are passed on to final consumers.

- Finally, producer revenues finally are considered on a pre-tax basis, again in line with modelling assumptions, and assed based on the annual generated power sold to the end consumers of electricity. All power producers receive the pre-tax electricity price, calculated by the E3-ISL model for each unit sold, i.e., €/kWh. In E3-ISL, this price is calculated based on the total electricity costs divided by total energy generation, thereby recovering all system costs, including specific investment cost, OPEX, fuel, and carbon costs. It therefore varies by scenario, changing according to the energy system setup, the technology and investment mix, and the dispatch of power plants.

- The sum of annuity payments and yearly O&M costs result in the yearly system costs, while the sum of revenues from feed-in and electricity bill savings results in the yearly system revenues. The sum of costs and revenues results in the net cash flows, i.e., a profit or loss in a given year.

- (3)

- Discounting cash flows: We calculate the Discounted Present Value (DPV) of all cash flows from Step 2, serving as the basis for further financial indicator calculations, via Equation (1).where is the specific cash flow in year , and is the discount rate (8.5%, in line with [25,26]).

- (4)

- Calculation of financial key performance indicators (KPIs): Finally, we calculate a set of financial indicators, offering different perspectives for evaluating the economic viability of rooftop solar PV investments in Mayotte. In line with the related literature [28], the indicators include the Net Present Value (NPV), the Internal Rate of Return (IRR), the simple payback time, and the levelized cost of electricity (LCOE). All indicators relate to the economic lifetime of assets, which is set to 15 years for all rooftop solar PV systems, again in line with [25,26]. Since the technical lifetime of 20 or even 25 years exceeds the economic lifetime, additional profits might be made if an asset continues to operate after reaching its economic lifetime of 15 years. These additional profits are not considered in the profitability calculations but present an additional potential benefit for prosumers. The calculated KPIs, their purpose, and their interpretation are listed in Table 1.

Table 1. Key performance indicators used in our analysis to evaluate the profitability of investments: Levelized Costs of Electricity (LCOE), Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Time.

Table 1. Key performance indicators used in our analysis to evaluate the profitability of investments: Levelized Costs of Electricity (LCOE), Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Time.

2.2. Materials and Assumptions

We provide a brief overview of Mayotte and its relevant characteristics (Section 2.2.1), before presenting the data and assumptions adopted for our analysis (Section 2.2.2). In Section 2.2.3, we briefly introduce the considered market participants and their behaviour.

2.2.1. Case Study Description

Mayotte is a French overseas department located in the Indian Ocean between Madagascar and the coast of Mozambique. Formerly under French colonial rule, Mayotte’s citizens voted to remain part of the French Republic. While Mayotte gained the status of a French department in 2011, exceptions in governance and regulations remain (see below).

The two islands of Mayotte are inhabited by a mix of ethnic groups, with origins from Mayotte, Comoros, Madagascar, and the wider region, as well as mainland Europe. As of today, 300,000 people are officially registered in Mayotte, while another 200,000 are assumed to live on the island and not be registered. Within the population registered officially, the unemployment rate is 35%, compared to an average of about 9% in France at the same time. Some 70–84% of the people live below the poverty line. The overall gross domestic product (GDP) per capita of the island is USD 13,000, which is half of the GDP of the neighbouring island of La Réunion. As a consequence, young people—notably estimates state that half of the population is younger than 18 years old—will face significant (economic) challenges in the near future.

Currently, electricity production is 95% based on diesel generators, supplied by two power plants owned by the vertically operating supply and distribution company Electricité de Mayotte (EDM). The remaining 5% of electricity supply is generated by PV plants (23 MWp with a 4% annual growth rate). The remote location of Mayotte and its dependency on fossil fuel imports results in higher electricity generation costs. In May 2023, for example, generation costs in Mayotte were estimated at EUR 350 per MWh, with wholesale prices in France below EUR 80 per MWh in the same period. To shield consumers from high energy prices and support economic competitiveness, the French government cross-subsidizes the energy costs of non-interconnected zones via the public energy service charges (CSPEs). However, Mayotte offers great potential for a renewable energy transition, with abundant renewable resources, especially solar PV (up to 1850 kWh/m2 global horizontal irradiation) [29]. In particular, rooftop solar PV could contribute significantly to the full exploitation of Mayotte’s renewable energy potential. The systems would make use of existing rooftops, thereby relieving the considerable pressure on land resources, and could reduce the stress on the grid through local generation, distribution, and consumption, particularly in zones with the weakest grid connections and highest number of blackouts.

The potential benefits of Mayotte’s energy transition have been confirmed in previous studies. They include, among others, socio-economic (creation of jobs, sinking energy costs), environmental (emissions reductions, including in GHGs and air pollutants), trade (reduced energy import bill) and political (energy independence) benefits. For Mayotte, a demand-driven decarbonization scenario, building on citizen engagement and energy efficiency, was identified as a more economical approach for achieving carbon neutrality than decarbonization based purely on the (centralized) energy supply side, resulting in lower costs for the total system [26]. Previous studies [22,23] further found a high willingness on the part of Mayotte’s citizens to participate in the energy transition of the island, particularly as part of community energy initiatives.

2.2.2. Data, Assumptions and Projections

Technical Assumptions

The technology assumptions are based on [25], which in turn builds on the EU Reference Scenarios 2020 [30] and the ASSET study on technology pathways in decarbonization scenarios [31]. The resulting solar PV yield (1500 kWh/kWp/year) is in line with the assumptions of IRENA [32] and practitioners in Mayotte.

Specific Investment Cost

Macro-level energy system models for Europe typically use uniform assumptions to inform their scenario building (see, for example [30]). However, the specific investment costs typically decrease with larger system sizes based on fixed costs. Hence, for our micro-level analysis, we disaggregate the specific investment costs of PV assets according to system sizes, see Table A1. We further adjust the reference data [33] according to our case study. Given the remote geographical location of Mayotte and the associated longer transport routes and weaker supply chains, we apply a 30% markup on the respective specific investment cost to account for the higher costs observed for all goods on the island in terms of the currently observed specific investment cost for rooftop solar PV in mainland France. We further consider the pre-tax costs for all system sizes, since no VAT is applied in Mayotte. Adopting the same technology development trend as outlined in an asset study [31] for small-scale rooftop solar PV, we assume that accelerated innovation dynamics, economies of scale, and learning-by-doing effects will decrease the specific investment cost, as outlined in Table A1, resulting in specific costs reductions of 35%, 48%, and 57% by 2030, 2040, and 2050 respectively, compared to the reference value in 2020 (note that ref. [31] assumes a particularly strong period-on-period reduction for systems installed in the 2030 period).

Table A1 outlines the evolution of specific investment cost assumptions in the asset study, and for the different system sizes in the present study. As we consider systems at the upper end of each FiT/capacity category in the analysis, i.e., systems of 3, 9, 36, and 100 kWp, we always use the lower end of the (pre-tax) specific investment cost range indicated in [33] for each category. For some categories, particularly for systems of 9–36 kWp, the specific investment cost for smaller systems might thus be closer to that of the next lower category, e.g., around 2000 € per kWp for systems of 10–15 kWp.

Pre- and After-Tax Electricity Prices

The pre- and after-tax electricity prices for the cash-flow analysis are the result of the energy system scenario projections of the E3-ISL model [25,26] (see Section 2.1.1). The E3-ISL model considers the price-elastic behavior of energy consumers and seeks for an electricity market equilibrium, meaning that the balancing of electricity demand and supply is cleared by electricity prices. The prices, in turn, are calculated based on the total cost of the electricity system minus the electricity price subsidization currently in place in Mayotte and other non-interconnected zones. The subsidization is expressed with a negative profit rate in the model, which is used to calculate the end-user electricity price. According to the estimations in E3-ISL based on the real data discussed above, the subsidization rate of the power system costs of Mayotte (excluding grid costs) was almost −300% in 2015 and 2020.

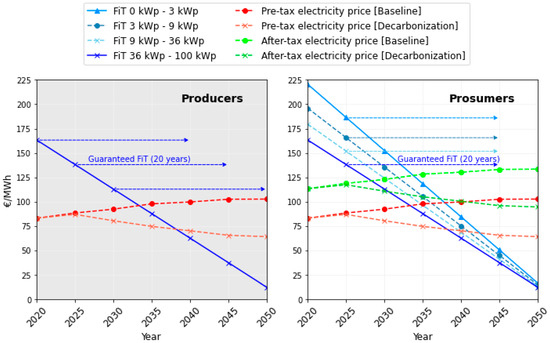

Based on these calculations, the model projects the pre-tax electricity price for every 5-year period. The electricity prices are projected to decline in the DD scenario relative to the baseline scenario, driven by the penetration of renewable energies in the power mix that replace the expensive diesel-based power generation. The cost-efficient RES stimulates a price reduction effect in the wholesale electricity market, propelled by the lower operating and fuel costs and the exemption from carbon taxes. The after-tax electricity prices represent the prices for end consumers. As is the case for the island today, the after-tax price is set to contain an excise tax of around 30%, but no VAT. The after-tax electricity price modelled for Mayotte is thus higher than the pre-tax price that producers are paid for their market sales. For the case of Mayotte, we further assume that prosumers do not pay taxes or levies on the power they produce, self-consume, and/or feed in. Figure 3 illustrates the projected electricity prices in alternative scenarios of E3-ISL model until 2050.

Figure 3.

Projected feed-in tariff on Mayotte for producers with 100 kWp PV systems (left), and prosumers with different PV sizes (right) and electricity price, as resulting from the energy system modeling.

FiT Projection

With the clean energy for all Europeans package and the revised Renewable Energy Directive, the EU is providing a framework for energy communities and self-consumption for adoption by its member states. France implemented regulations for energy communities and shared consumption comparatively swiftly. For Mayotte, as a French department and non-interconnected zone, the same rules should generally apply, but are typically adapted to the local context and implemented later than on the mainland.

At the time of writing this study, regulations for individual self-consumption have been introduced in Mayotte, while rules for collective self-consumption are not in place yet. EDM, as the sole utility on the island, enters into standardized contracts with respective prosumers and energy communities. One example of differing regulations in Mayotte relates to the compensation of surplus electricity fed into the grid by prosumers who partly self-consume. On mainland France, prosumers who feed in 100% of the produced electricity receive a guaranteed and fixed feed-in tariff (FiT). Prosumers who self-consume a share of the produced electricity and feed-in the remaining kWhs receive a lower FiT for this surplus. This FiT for partial self-consumption only amounts to around half of the FiT (€/kWh) for full feed-in. In Mayotte, this distinction is not in place, and the per-unit FiT for full and partial self-consumption is the same.

Generally, FiT compensation for solar PV in France is categorized according to system capacity into bands of <3, 3–9, 9–36, and 36–100 kWp, with lower FiTs for larger systems. In Mayotte and other non-interconnected zones, FiTs are higher than on the mainland due to the increased costs of solar PV investments in these remote areas. Completed solar PV projects can apply for the FiT in the respective period, which is then guaranteed for 20 years. The FiT is regularly updated according to French labor cost and manufacturing cost indices. Overall, 80% of the FiT remains constant, while 10% varies according the development of the labor cost index [34], and 10% varies according to the manufacturing cost index [35]. The FiT compensations are publicly available and are updated quarterly.

In this study, we include FiTs for rooftop solar PV in the analysis, assuming a continuation of Mayotte’s current FiT support schemes in the future, see Figure 3. Using quarterly data from feed-in tariffs for solar PV installations in Mayotte for the period ranging from 05/2017 to 12/2023 [36], we project the development of feed-in compensation until 2054. Data are available for the four system size categories (<3, 3–9, 9–36 and 36–100 kWp) under investigation, allowing us to project the evolution of the FiT for each class. The quarterly data are used as inputs for Excel’s FORECAST function, resulting in a projection of the quarterly FiT in each category. Quarterly estimates are then aggregated into yearly and 5-year means. Assuming a linear trend, the FiT for the four system size categories converges over time, nearing zero towards the end of the modelling horizon in 2054 (see Figure 2).

To fit the 5-year intervals of the E3-ISL model, the 5-year means of the FiTs is used in subsequent calculations and optimizations. Under these assumptions, a system below 3 kWp, installed in 2020, for example, receives the average FiT of 220.36 €/MWh for this 5-year period for 20 years. A system of the same size installed in 2024 receives the same average FiT, resulting in harmonized assumptions for all investments made in a 5-year period, even though the “real life” FiTs of the two systems differ. To simplify, we assume a constant FiT, and ignore the 20% indexed component of French FiTs.

2.2.3. Market Participants and Behavior

As a fundamental differentiation, we distinguish between two market participants: prosumers and producers. While prosumers can self-consume a certain amount of produced energy, and feed in a minimum fixed share of the energy produced, producers inject all generated electricity into the grid. While prosumers are compensated for the grid injection with an FiT (see Section 2.2.2), producers may decide between FiT compensation or selling the electricity at wholesale electricity prices (the pre-tax electricity price projected by the E3-ISL model). Often, wholesale markets are only accessible for utility-scale power plants, and not for small-scale, decentralised installations. Given these constraints, we only consider the participation of large rooftop solar PV systems ranging from 36 to 100 kWp as power producers in these markets.

We assume that market actors perfectly optimize their revenues. This implies that, in our model, producers may decide on receiving the FiT or the pre-tax electricity price projected by the E3-ISL model, depending on which is higher. Prevented from accessing wholesale markets, prosumers only receive the FiT as compensation for electricity injection into the grid. However, prosumers optimize their revenue by choosing between feed-in and self-consumption. By self-consuming electricity, prosumers achieve energy cost savings at the level of the after-tax electricity price, and thus self-consume once this electricity price exceeds the FiT. Underlying this optimization is the assumption that the amount of self-consumed electricity does not exceed the total power demand of the respective prosumer. Importantly, the FiT of each power plant is fixed over its lifetime, while electricity prices vary over time. By comparing the FiT with the development of electricity prices, it is thus possible to predict what will happen (i) when renewable power producers enter wholesale markets without FiT support, and (ii) when prosumers shift from power injection to self-consumption.

Observing the trends in Figure 3, we may conclude the followers:

- Producers: In 2035 and 2040 in the baseline and decarbonization scenarios, respectively, the FiT for newly installed systems is lower than the pre-tax electricity price over the following years. Hence, producers may switch to being compensated via the wholesale electricity price rather than FiT. While wholesale prices can exceed the FiT prices and thereby provide additional revenues, they are the result of energy market clearing and fluctuate over time. Producers can thus reasonably project electricity price developments and use these assumptions to inform investment decisions, but cannot plan for guaranteed compensation based on market prices. To achieve such certainty, a power purchasing agreement (PPA) or other form of guaranteed compensation beyond the FiT would be needed, which is beyond the scope of the current study.

- Prosumers: As long as the rate pf FiT compensation is higher than the electricity price, feeding in is always more attractive than self-consumption. Depending on the system size, and scenario (baseline or decarbonization), the point in time for a switch differs. As FiTs gradually decrease, self-consumption becomes more attractive the later a system is installed. This shift happens earlier in the baseline scenario, where the higher costs of (diesel-intense) power generation lead to higher and rising electricity prices, and thereby to more profitable self-consumption.

3. Results and Implications

Using the outlined method for cash-flow analysis, we conduct a detailed analysis of the profitability of rooftop solar PV systems of different sizes in Mayotte. In accordance with energy system modeling, we compare the outcomes under the baseline and decarbonization scenario, thereby highlighting the influence of decarbonization policies and the resulting electricity prices on system profitability. We first present economic key performance metrics when assuming prosumption or only production (Section 4.1). We then investigate the sensitivity of results towards a variation in technical and economic parameters in Section 4.2, focusing on very small systems of under 3 kWp installed capacity.

3.1. Profitability Analysis

First, we evaluate the cost recovery of an investment based on a comparison between secured compensation and costs (Section 3.1.1). We then analyze the (subjective) profitability of the investment, considering decision-making based on risk (Section 3.2.2). In both, we consider (i) the prosumer, i.e., eventually self-consuming a portion of energy produced (30%) when reasonable (see Section 2.2.3), and (ii) producers.

3.1.1. Evaluating Cost Recovery

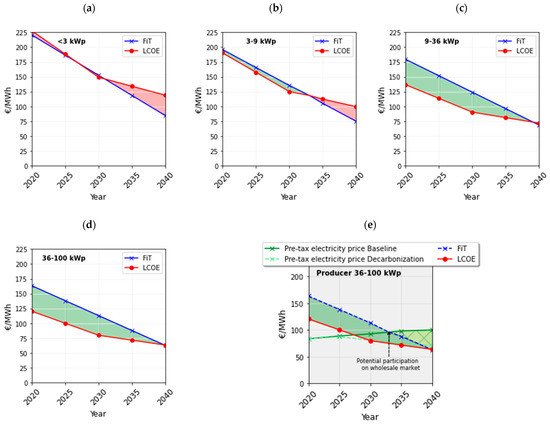

As an initial assessment of whether the investment is at least cost-recoverable, we compare the undiscounted LCOE with the guaranteed FiT in each case. Under the simple assumption of 100% feed-in of electricity and compensation via FiT—regardless of potential self-consumption or compensation via wholesale electricity prices—at least cost neutrality is achieved when the FiT exceeds the LCOE, with (non-discounted) positive cash flows for each unit of electricity produced and injected into the grid over a device’s lifetime result.

Figure 4a–d compare the FiT and LCOE for prosumers. The differences in LCOE and FiT are highlighted as colored shapes. They were red in cases where the LCOE exceeded the FiT—suggesting the profitability of a solar PV investment of a given size in this investment period is not guaranteed through an FiT—and green in the opposite cases. Analogously, Figure 4e compares the FiT and LCOE for producers. In addition, the pre-tax electricity prices for each scenario are included, representing a potential alternative compensation scheme for the producer. If the electricity price exceeds the FiT—suggesting a more profitable compensation scheme—the difference is indicated by a plaid shape.

Figure 4.

(a–d). FiT and LCOE for different PV sizes and prosumers. (e) FiT, LCOE, and pre-tax electricity price for producers with 36 to 100 kWp.

Focusing on prosumers, we observe the following:

- The cost recovery of the investment depends on the system size, due to the different ratio of FiT to LCOE in different system sizes. With increasing system size, the systems become more profitable—despite the lower FiT. This is due to the decreasing specific investment cost of PV with the increasing system size. According to our analysis, the smallest systems, <3 kWp, are currently not economically viable under the assumptions made. In contrast, according to our analysis, large systems, e.g., with a capacity of 36 kWp, can currently (2024) achieve a difference of around €40/MWh.

- The profitability of the investment depends on the timing of the investment. Both the projected FiT and LCOE are expected to decline in the future for all system sizes, but at different gradients. This could result in varying differences between FiT and LCOE. The trends for larger systems (>9 kWp) therefore show decreasing positive differences, neglecting possible adjustments to the FiT in future in line with the development of the LCOE (see Section 4 for a related discussion). For any size of system observed, the LCOE may exceed the FiT by 2040.

- As can be expected, the LCOE will asymptotically approach stagnation in the future due to limitations in the cost reduction of PV technology. In the case of systems below 9 kWp, we observe that the FiT could fall below the level of the LCOE in the future—if not readjusted (see, for example, from 2033 for systems between 3 and 9 kWp). Consequently, we can conclude that, in order to guarantee the profitability of the systems, either the FiT will have to be adjusted or additional compensation pathways will have to be opened up, i.e., participation in wholesale electricity markets.

The above observations equally relate to the behavior of producers. As they have the option of marketing the electricity at the pre-tax electricity price in addition to compensation via FiT, a possible point in time for participation in wholesale markets can be identified. This arises as soon as the pre-tax electricity price exceeds the FiT (notably, the FiT would be guaranteed, whereas the electricity price might vary and thus poses a more risky compensation scheme). As the wholesale electricity price is determined by the underlying energy mix, it is scenario-dependent. We observe that—in the event of progressive decarbonization—the electricity price could remain below the level it would reach if the status quo was to continue (baseline scenario). Correspondingly, there would later (approx. 2038 compared to 2033) be an economic incentive to sell the electricity on the wholesale market instead of FiT compensation. However, this incentive—the gap between the electricity price and LCOE—may be only little. This may lead to alternative uses of the electricity to feed-in applications and render compensation via the wholesale market attractive.

3.1.2. Evaluating Profitability

In the previous example, we looked at the relationship between LCOE and FiT to obtain a first indication of the economic viability of power production based on the use of rooftop solar PV to achieve cost recovery. This cost recovery, however, does not take into account the time value of money and does not reflect the considerations of rational investors. Beyond the guaranteed FiT compensation, prosumers and producers can achieve additional revenues through self-consumption (prosumers) or sale on wholesale markets (producers). Considering the perspective of investors and these additional revenue streams, we conduct a detailed profitability analysis assuming optimal market behavior, as explained in Section 2.2.3.

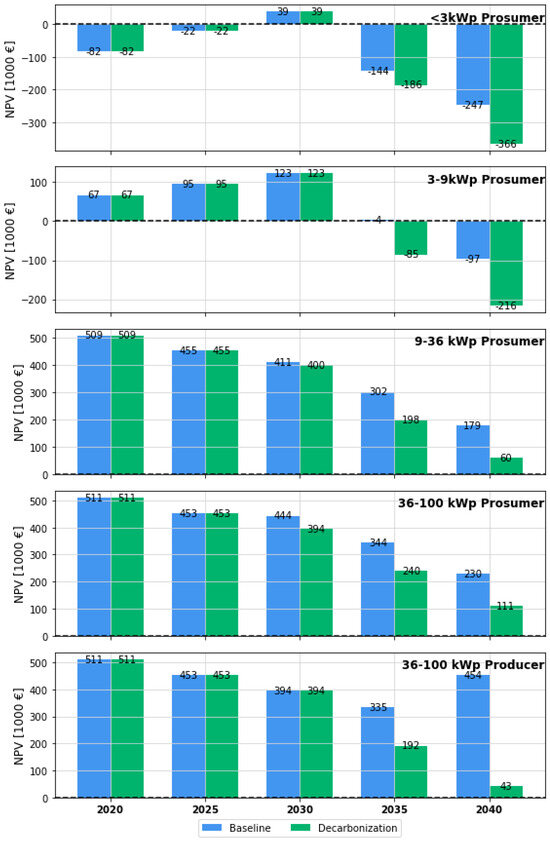

To enable system comparability across their size differences, we calculate all financial indicators that would be produced under the class-specific conditions—however, we “normalize” for a system size of 1 MW, as illustrated in Figure 5 for the NPV. Notably, the absolute values indicated under each system size do not represent the actual NPV for the given size but are only useful for a comparison of the profitability of system sizes. For the actual NPVs determined on the basis of actual system sizes, see Appendix A.

Figure 5.

NPV (EUR thousand) of rooftop solar PV for different prosumer classes over economic lifetime, with 1 MW installed capacity at 30% maximum self-consumption (prosumers).

First, we recognize that profitability depends on the stadium of decarbonization of the energy system. We observe higher NPVs when maintaining current policies, leading to lower decarbonization rates (baseline scenario) compared to an advanced decarbonization scenario. This is explained by higher electricity prices due to the continuation of diesel-fired generation projected, leading to higher revenues (for producers) and savings through self-consumption (for prosumers). Hence, we understand that investments in PV systems become less profitable with ongoing decarbonization. For producers, the NPVs strongly differ between scenarios for investments completed after 2030. With increasing RES penetration, wholesale electricity prices in the decarbonization scenario will decline over time (based on E3-ISL modelling results), resulting in lower revenues for producers. This exemplifies one form of a cannibalization effect, which is usually observed in electricity markets with a merit order. In such markets, higher RES penetration results in a shift in the merit order and lower wholesale prices, thus reducing the additional profits of RES producers. While no merit order exists in Mayotte, and therefore in the model, the electricity price is based on the development of total system costs. With a higher RES share in the power mix under the decarbonization scenario, the total power generation costs are reduced, resulting in lower electricity prices and the repeated cannibalization of RES profits through their higher penetration.

Second, the profitability of investments in PV depends on the system size of the PV asset. Large- and medium-sized systems, with their comparatively lower specific investment costs, are economically profitable under current FiTs and may remain profitable under projected FiTs and technology costs. Large systems of 36–100 kWp are particularly profitable, and, just as systems of 9–36 kWp, achieve positive NPVs over their economic lifetime in both scenarios and all investment periods. However, the NPVs of investments in these systems decrease in later periods.

Small and very small systems, on the other hand, are less profitable. Small systems (3–9 kWp) installed up until 2030 (decarbonization scenario) and 2035 (baseline scenario) will achieve positive NPVs. They thus present a viable investment option in the medium term, but become unattractive in later periods, when FiT and self-consumption revenues are too low to compensate for their still comparatively high specific investment cost. Systems under 3 kWp are never profitable, except for systems installed in the 2030 period. While the FiT compensation for smaller system sizes is higher than that of larger systems to account for their higher per-unit specific investment cost, this differentiation is not sufficient to ensure the profitability of very small systems under the given assumptions.

Third, the profitability of the investment is influenced by the behaviour of the respective market actors. Comparing the producers and prosumers of a 100 kWp system highlights the advantages and disadvantages prosumers are confronted with compared to utility-scale power generation systems. In the first periods, FiTs for 100 kWp systems are higher than electricity prices, and both producers and prosumers feed in all generated power. Systems installed in 2020 and 2025 (baseline and decarbonization scenarios) and 2030 (decarbonization scenario) therefore achieve the same NPVs for producers and prosumers. For solar PV systems built in later periods, a special situation emerges, presenting an advantage to prosumers compared to conventional producers. Wholesale prices remain below the FiT in these periods, and producers therefore receive the FiT for their generation. Prosumers, on the other hand, can self-consume a part of the produced electricity, since the retail prices exceed the FiT, increasing the economic attractiveness of their investment compared to that of conventional producers. This is the case for systems installed in 2030 and 2035 in the baseline scenario, and for 2035 and 2040 in the decarbonization scenarios.

For investments in the 2040 period in the baseline scenario, the effect reverses: lower FiTs and high (pre-tax) electricity prices render power sales at market prices, or self-consumption, the more profitable choice. This presents an advantage to conventional producers, who can sell all electricity generated at market prices, while prosumers can only self-consume 30% of the produced electricity in the reference case and must sell the remaining 70% at a less attractive FiT rate.

In addition to the NPV, we also consider the IRR, which indicates the expected return. This provides investors with a basis for decision-making—on the one hand, as a comparison with other possible investments and their IRRs, and on the other, as the IRR achieved must exceed the cost of capital in order to recover the costs of financing the operation. Table 2 outlines the IRR of each investment over its economic lifetime. Supporting the observations above, profitability varies considerably between the two scenarios, with the higher electricity prices in the baseline scenario compared to the decarbonization scenario resulting in a higher IRR of investments made after 2030. Also, the IRR shows larger systems to be profitable, while the profitability of medium-sized systems decreases in later periods. For small and very small systems, IRR is much lower, or even negative. From an investor’s perspective, installing these systems is not attractive, especially given the considerable costs of capital (8.5%) assumed in the models. Strictly speaking, an investment would only be worthwhile when the IRR exceeds this cost of capital. This is only the case for large systems in 2030 (baseline and decarbonization scenario) and 2035 (baseline scenario).

Table 2.

IRR (%) of rooftop solar PV investments for different prosumer classes over economic lifetime, 30% maximum self-consumption. Table notes: IRRs exceeding the assumed cost of capital of 8.5% can be considered attractive investments and are highlighted in bold. Red colour denotes negative values.

As an important additional decision-making criterion for investors, we calculate the simple payback time, which determines the period of time after which the undiscounted costs have been paid off. Table 3 outlines the simple payback periods of investments in solar PV assets in the reference case. In the reference case, the simple payback times vary in conjunction with the NPV of the respective investments. Payback times for large- and medium-sized systems are shorter than those for small and very small systems. For very small systems, payback times exceed the economic lifetime of the investment in most cases, pointing to insufficient economic viability. Particularly for assets installed in 2040, when FiTs are at low levels and electricity prices become an important component of cash flows, payback times are much shorter in the baseline scenario than in the decarbonization scenario.

Table 3.

Simple payback time (years) of rooftop solar PV investments for different prosumer classes over economic lifetime, with 30% maximum self-consumption. Red colour indicates a payback time of more than 15 years, thereby exceeding the economic lifetime of the asset.

3.2. Sensitivity Analysis

We perform sensitivity analysis to (i) cover for the parametric uncertainty of our models, and (ii) identify levers for increasing the profitability of small-scale PV in Mayotte, which can inform policy interventions and -support (see Section 4). The sensitivity analysis focuses on 3 kWp systems, since these very small systems present a low entry barrier for residential households to engage in RES investments and could thus enable widespread citizen participation in the energy transition. We rely on the NPV as the principal evaluation indicator for the (changing) profitability of an investment. We conduct two sensitivity analyses, with the first focusing on economic parameters (Section 3.2.1) and the second on the self-consumption rate of prosumers (Section 3.2.2). While we vary the respective parameter in focus, we maintain all other inputs as stated in the reference case (see Section 4.1).

3.2.1. Sensitivity towards Economic Parameters

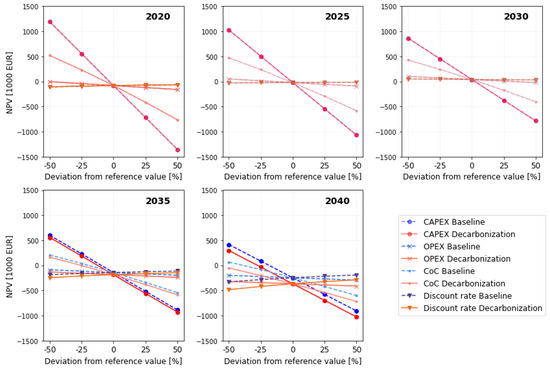

For the economic sensitivity analysis, we vary the specific investment cost, OPEX, the cost of capital, and the discount rate in a predefined corridor of ±50% deviation from the reference parameter value (see Section 2.2.2). Figure 6 illustrates the NPV after parameter variation for each of the five-year investment periods from 2020 up until 2040.

Figure 6.

Sensitivity analysis for the investment in a 3 kWp system under the assumption of 30% potential self-consumption for the baseline and decarbonization scenario. The values are set in relation to the reference parameters assumed in the reference case.

In all time periods considered, we identify the specific investment cost of PV as the dominant factor influencing the NPV, with the highest gradient over the relative deviation from the reference case. Thus, we see that even a small reduction in specific investment cost, e.g., by 10%, could result in a positive NPV today (2024). Reducing the specific investment cost by 25% is sufficient for ensuring a profitable NPV for all investment periods and in both scenarios, except for systems installed in 2040 in the decarbonization scenario. However, the influence of the specific investment cost on the NPV, visible in the gradient, decreases over time, corresponding to the projected declining specific technology costs. In the period 2035–2040, we observe a discrepancy in the influence of the specific investment cost on the NPV when considering different levels of the decarbonization of Mayotte´s energy system (in fact, this discrepancy is recognizable for all parameters, but is most obvious for the specific investment cost). The discrepancy is again caused by the higher electricity price in the baseline scenario, leading to higher electricity bill savings through prosumers’ self-consumption, and therefore to higher NPVs.

Strongly tied to the specific investment cost, the cost of capital represents the interest paid on the initial loan. Varying the cost of capital in a range from 4.25% (50% reduction) to 12.75% (50% increase) exerts a comparatively weaker effect on total NPV than variation in the specific investment cost. Notably, the effect of varying the cost of capital on the total NPV is not equal across the analysis corridor—represented in a non-linear gradient resulting from an exponential function—and relatively stronger in earlier time periods (see Figure 6). The profitability of an investment would only be reached when assuming a significant reduction in the cost of capital by 50%, except for investments in 2040 in the decarbonization scenario.

Similar to the specific investment cost, the OPEX for new investments is projected to steadily decline over time, from circa 19 €/kW and year for assets installed in 2020 to circa 9 €/kW and year for those installed in 2040. Compared to the effects of the specific investment cost and cost-of-capital variations on the NPV, the influence of varying the OPEX on the profitability of the investment proves considerably smaller. NPVs for a 3 kWp system remain negative, even after significant OPEX reductions, except in the 2025 period (see Figure 6). This demonstrates the significant difference between renewable energy investments and fossil fuel investments, with the former being capital-intensive while the latter are dominated by operation and maintenance (including fuel) costs.

We vary the discount rate between 4.25% (50% reduction) and 12.75% (50% increase). The influence of discount rate variation on the NPV remains comparatively modest, and none of the variations can render a project with a negative NPV in the reference case profitable.

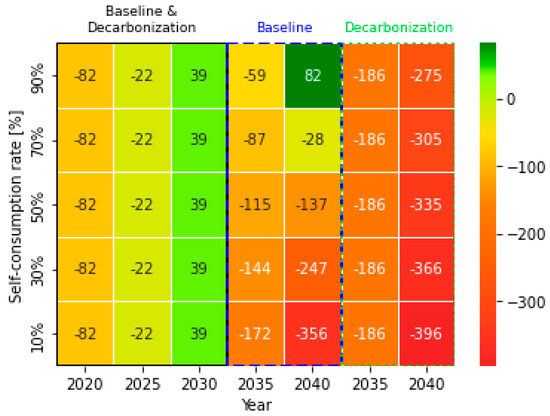

3.2.2. Sensitivity towards the Self-Consumption Rate

In the reference case, we assume a maximum self-consumption rate of 30% for all system sizes. This rate of maximum self-consumption presents the technical limit for the subsequent economic optimization of prosumers choosing between feed-in and self-consumption. In practice, prosumer self-consumption rates might vary considerably and deviate from the 30% assumed in the reference case. For example, prosumers can increase their self-consumption rate by choosing small system sizes that fit their consumption or by installing additional storage [37] (the cost of which is not included in the model). In the sensitivity analysis, we therefore vary the rate of self-consumption in intervals of 20 percentage points, i.e., investigating rates of 10%, 30%, 50%, 70%, and 90%, with the resulting NPV presented in Figure 7.

Figure 7.

NPV [EUR 1000] for the investment in a 3 kWp PV asset (1 MW installed capacity) under different levels of decarbonization and self-consumption rates.

For systems installed until 2030, feeding in the total energy produced is more attractive than partial self-consumption, as the FiT for these systems exceeds the after-tax electricity price at which electricity can be consumed throughout their lifetimes (see Figure 7). Therefore, considering optimal behavior of the prosumer, we observe no differences when varying the maximum self-consumption rate until the period 2030 (baseline scenario) and 2035 (decarbonization scenario). For systems installed in 2035 (baseline scenario) and 2040 (decarbonization scenario), self-consumption is more attractive than feed-in throughout their economic lifetime. Assuming a higher self-consumption rate results in a less negative NPV However, even assuming, a self-consumption rate of 90% does not render 3 kWp systems a profitable investment in most periods, except for systems installed in 2040 in the baseline scenario with 90% self-consumption.

4. Discussion

We use this section to accomplish the following:

- (i)

- Summarize the implications of our study in front of the relevant political and regulatory framework, thereby answering the specific research questions RQ1, RQ2 and RQ3 as stated in Section 1.2 (Section 4.1);

- (ii)

- Place our findings in the context of popular and recent concepts of citizen-driven energy transitions (Section 4.2);

- (iii)

- Critically reflect on the scope of application of the analysis and its findings and discuss transferability to other islands and remote settings (Section 4.3).

4.1. Implications of the Findings and Recommendations for Policy and Regulation

Reflecting on our first research question as to whether investments in solar PV on Mayotte are profitable, we can establish that the profitability depends on the following:

- (i)

- The size of the PV system: we considered different PV system sizes that substantially differed in their specific costs and applicable FiT. For smaller systems, e.g., <3 kWp, high specific investment costs cannot be compensated for with the higher FiT, jeopardizing their profitability. Without the PV cost reductions achieved through a growing solar PV industry in Mayotte or other beneficial factors, additional measures will be needed to support the profitability of these systems as a first prerequisite for economic incentives and likely their widespread adoption. For large- and medium-sized systems (9–100 kWp), the guaranteed FiT exceeds the LCOE in most investment periods, resulting in a positive return per kWh. Combined with appropriate insurance and financial solutions, this results in a secured positive return. This security presents a highly attractive opportunity for risk-averse actors, such as municipalities and other public or non-profit actors. In addition to the guaranteed financial returns obtained through feed-in tariffs, the self-consumption of the generated power can result in additional cost savings, increase autonomy from the electricity grid, and protect the respective prosumers from fluctuating energy prices [38]. Still, the financial returns of large- and medium-sized systems might not suffice for profit-oriented investors, as the IRR remains below the assumed discount rate of 8.5% pertaining for most investments. If decision-makers in Mayotte aim for a fast and widespread adoption of rooftop solar PV on the island, further support measures will be needed to increase the profitability and attract private capital. We argue, however, that different support schemes should be weighted and prioritized under consideration of their distributional impacts.

- (ii)

- The time of investment: our analysis considered the projections of declining specific investment costs of the PV assets and simultaneously decreasing FiT. Hence, we observe the profitability of investments in PV to be time-dependent. The more steeply falling gradient of the FiT compared to the declining costs of PV assets leads shrinking profitability for the same system size in future periods. As the specific costs of the PV assets are expected to asymptotically approach a stagnating positive minimum and the FiT—if not adjusted—can fall (linearly) towards 0, it could come to a point in the future where the costs of the PV system can no longer be covered by feeding electricity into the grid. Accordingly, alternative compensation routes would be necessary to provide an economic incentive to invest.

- (iii)

- The level of decarbonization of the entire energy sector: with the ongoing decarbonization of the energy sector of Mayotte, our energy system model predicts that the wholesale electricity prices will decrease. This, in turn, will decrease the potential compensation from selling electricity on the market as a producer and diminish prosumers’ energy bill savings. Ironically, these lower prices are the result of increasing RES penetration into the electricity system, exemplifying a cannibalization effect of RES revenues through their wide-scale deployment. Still, many investments in rooftop solar PV are profitable under decarbonization, allowing prosumers to participate in the energy transition and profit through economic benefits.

- (iv)

- The market behavior: in our analysis, we compare two types of market participants, distinguishing between producers and prosumers, the latter of which may partly self-consume electricity produced. Comparing the two market participants at the same system sizes, we identify that, under perfectly rational behavior, the prosumer would in fact feed in the entire electricity produced—acting as producer only—until 2035, as no economic incentive is given to self-consume electricity. In later periods, this reverses and self-consumption may become more advantageous compared to sole feed-in—however, this only applies when assuming that the market participant may be prevented from selling fed-in electricity at wholesale prices. Here, we observe that producers being compensated for injected electricity at the pre-tax electricity price can achieve higher economic gains compared to prosumers, given the electricity price remains high when still assuming a high share of fossil fuels in the energy mix.

Reflecting on the above, we identify (1) declining specific investment costs (technology improvements); (2) compensation as per regulation, i.e., FiT compensation levels; and (3) wholesale electricity prices influenced by the decarbonization level of the energy mix as major levers for the profitability of PV investments. The first is supported by our sensitivity analysis, which sheds light on the relatively high effect of specific investment costs on the profitability of PV investments, which may well be targeted by appropriate policies (see below). This finding is in line with the existing literature, which confirms the importance of initial outlay costs for the overall profitability of solar PV investments [39].

Having identified the specific levers influencing the profitability of investment in rooftop PV, we can discuss the targeted policy measures appropriate for improving the economic profitability of PV investment in Mayotte and other islands. We confine ourselves to primary measures that are intrinsically related to the energy sector, and specifically applicable to small-scale PV, excluding measures contributing to a broader enabling environment for solar PV. While the literature provides evidence on the appropriateness, effectiveness, and trade-offs of various regulations and policies aiming to improve the economics of solar rooftop PV (including research and development policies [40], quotas, and tradable green certificates [41], among others), our analysis supports the tonus of indirect subsidies via FiTs being a significant lever for improving the profitability of PV investments. However, the cost efficiency of FiTs compared to other incentives may be questionable, with mixed evidence in the literature (see for example [42]). Additionally, the incentive of FiTs to inject electricity into the grid may conflict with the technical desirable state of reducing grid utilization and potentially avoiding congestion or costly energy system management interventions. Against this background, we must additionally reflect on the conflict between FiT and—from the perspective of the aforementioned interest in reducing power grid utilization—desirable self-consumption. As our analysis shows, when maintaining an FiT compensation level higher than the after-tax electricity price level, prosumers will not be incentivized to self-consume some of their electricity. However, the dilemma of this analysis is that we find a higher FiT to be a prerequisite for the economic profitability of the investment in a PV system. Hence, we must consider alternative compensation schemes and associated enabling policies to maintain economic profitability while increasing self-consumption when considering ending FiT compensation.

Prosumption provides a unique opportunity to decentralize and localize power generation and consumption [43]. The local generation and consumption of renewable electricity provides benefits to the energy system as it reduces grid congestion, transmission and distribution losses, and the need for grid enforcements, while potentially increasing the RES share in electricity production. Beyond a swift and cost-effective deployment of renewables, increasing the share of self-consumption thus arises as an important energy policy goal. For prosumers, the possibility of consuming self-produced power provides autonomy, agency, and direct engagement in the energy transition. Self-consumption includes both individual and collective self-consumption in the same house or entity behind a (shared) meter, and distributed or virtual self-consumption over farther distances using the public grid [44]. Delocalized and virtual self-consumption allow prosumers to, for example, charge their EV at work using the electricity generated by a solar PV system at their home. However, prosumers may only self-consume the produced power when this option is economically attractive. To reach higher shares of self-consumption in the system, policymakers should thus ensure a conducive environment with relevant economic incentives.

Policies enabling self-consumption include net metering, net billing, and feed-in premiums [44]. Net metering facilitates the clearing of consumption and production and the associated compensations over longer time periods, thereby allowing prosumers to receive the retail electricity price for the electricity they feed into the grid or “save” on their electricity bill. With net billing, the compensation for electricity that is fed-in is lower. The choice of self-consumption policies impacts the sizing of solar PV assets [45], and has important distributional effects related to who finances the costs of the electricity grid and of RES deployment [46]. Net metering, in particular, has been criticized [47] for not incentivizing self-consumption but for unconditionally facilitating the profits of solar PV owners, which are paid by all electricity consumers, while reducing the revenues of utilities. Still, net metering presents an implicit incentive for investments in solar PV [48], and studies have shown that, even under a net metering system without specific incentives for self-consumption, households self-consume a considerable share of the generated electricity [49]. Aside from these specific self-consumption policies, solar PV profitability and self-consumption are also influenced by the tariff structure [50]. This highlights the complex interrelations, incentives, and distributional effects provided by different policy instruments and wider energy market regulation, all of which should be considered in policy design.

When incentivized for self-consumption, prosumers have additional options to maximize the self-consumption level. Aside from the installation of additional storage, shifting the electricity consumption patterns to periods with high electricity generation can significantly increase the share of electricity potentially designated for self-consumption [27]. Ideally, such behavior may be even incentivized by market-based approaches such as demand-side management (DSM) or demand response (DR) schemes. Such schemes may offer economic incentives to participants to shift or reduce energy consumption (see, e.g., [22,51,52]. Beyond economic compensation, however, additional benefits for consumers may be seen in an increased awareness and education for environmental concerns, and social cohesion [22].

Importantly, RES support through FiTs, which remains the most important policy instrument in Mayotte, directly oppose prosumers’ motivation to self-consume. To achieve the double goal of (i) securing the profitability of prosumers’ RES investments and (ii) incentivizing self-consumption, new policy measures are needed. For example, bonuses or premiums could be provided for every consumed unit if self-consumption is metered, thereby guaranteeing certain cost savings independently of the electricity price.

Besides these emerging policy instruments, existing barriers to self-consumption should be reduced and no additional hurdles should be introduced. In Mayotte, shared self-consumption is not possible due to a lack of legal provisions, and supporting regulations should be introduced to allow shared consumption by energy communities and other actors. Furthermore, taxes raised on self-consumed electricity and uniform grid charges negatively impact the business case for self-consumption and should thus be avoided if increased self-consumption is a policy goal.