Abstract

This article compares potential revenue from electric storage in retail and wholesale electric markets. The retail value can be extracted when storage responds to time-of-day retail prices. The wholesale value is enabled by the recent US Federal Energy Regulatory Commission Order 2222, which requires regional transmission operators (RTOs) to allow distributed storage behind the meter to participate in wholesale electric markets. To quantify the value of these markets, we use realistic time-of-day rates and market prices in one RTO’s ancillary service market. Formulae are developed to estimate the value of behind-the-meter storage in wholesale and retail markets, using an example electric vehicle in a fleet setting. The formulae are also used to compare whether or not net metering is available and different charging rates. The aggregate national storage behind the retail meter is very large, given the projected growth of electric vehicles. Our findings indicate the revenue from wholesale markets can be significantly more than that of retail opportunities. However, the potential in either retail or wholesale markets is currently limited by both state policy and incomplete RTO implementation of FERC orders.

1. Introduction

To build a modern electric power grid, we must solve problems including reducing CO2 emissions and criteria pollutants, adapting the grid to support variable generation, and increasing reliability. Many of the solutions to these problems involve distributed storage. The focus of this article is on distributed storage using electric vehicles because EVs inherently have large batteries that are connected to the grid, and privately owned light vehicles are only used for transportation 4% of the time [1]. Their duty cycle for driving would mean that lithium-ion batteries, in today’s new EVs with capacity in the range of 70 kWh, could be available for distributed storage as much as the remaining 96% of the time. Thus, EVs promise a large, underutilized, distributed electric storage resource, potentially of value to utilities or to regional transmission operators (RTOs). The Federal Energy Regulatory Commission (FERC) would designate EVs used for grid storage as “distributed energy resources”, or DERs. RTOs use grid services markets, including services provided by EVs or other DERs, and are subject to regulation by FERC.

This article summarizes our work to understand how the RTO rule changes mandated by FERC Order 2222 [2] could facilitate interconnecting EVs as compliant DERs, and how to qualify for high-value RTO electricity markets. Such interconnection is needed to realize the wholesale value from EV batteries when parked. Participation of storage in RTO markets also better prepares the grid to manage ever larger amounts of variable generation. We itemize the rule changes required, based on our experience attempting to participate in these markets, and we show the relative revenue by developing formulae for renumeration across markets and conditions.

This article will calculate revenues to show that aggregated V2G DERs can earn significant revenue from providing grid services. The present work differs from recent V2G studies, for example, Aparicio and Grijalva [3] and Corinaldesi et al. [4], as our model calculates value across multiple markets and policy conditions: controlled charging and bidirectional arbitrage at the retail level, plus regulation in wholesale markets, the latter assuming RTO policies to comply with FERC Order 2222. Our formulas also calculate the effect of the policy variable of retail net energy metering (NEM) if offered when discharging to the grid. We choose to analyze the RTO “ancillary service” (A/S) markets, as they draw power in brief intervals, thus minimally affecting the battery state of charge. We consider how to qualify for diverse markets to interconnect under current rules and describe future interconnection under the expected FERC Order 2222-compliant RTO rules. We then compare the projected value of wholesale ancillary service markets with the value of different retail transactions. Both our discovery of undocumented barriers to DER storage participation, and our calculated financial value of EV storage, could guide regulators to make this untapped storage resource more available and could suggest business opportunities for private enterprise.

1.1. EV Capabilities Required for V2G, and for EVs as a DER

A vehicle-to-grid (V2G) system consists of an electric vehicle with an EV charger enabled to both charge and discharge to the grid, and with communications able to control that power flow at times useful to the grid. Bidirectional power flow is emphasized because it has over 12 times the value of simply controlling the speed and timing of charging alone [5]. We examine AC charging because it is much lower cost and more reliably maintains the connection over time in comparison to DC charging.

In order to base revenue calculations on realistic values, this article draws quantitative estimates from an actual EV outfitted with a bidirectional charger, with four-quadrant control, connected to a distributed energy resource aggregator (DERA) control system. A DERA control system, also defined by FERC, dispatches a group of EVs (or other DERs) to charge or discharge to satisfy market participation requirements and minimize battery wear, while ensuring sufficient charge for trips. The V2G charging station is outfitted with communications to send dispatch commands to DER V2G vehicles and return performance data from the EV to the DERA.

The DERA, defined In FERC and RTO regulatory language, Is what has also been called a virtual power plant. The U.S. Department of Energy defines virtual power plants as the following: “Virtual power plants, generally considered a connected aggregation of distributed energy resource (DER) technologies, offer deeper integration of renewables and demand flexibility, which in turn offers more Americans cleaner and more affordable power [6]”. DERs can be devices that provide energy storage, energy generation, or demand reduction in response to a signal.

Since many RTO grid services are paid according to the power response to a signal, higher revenue can be achieved if the charging electronics are capable of rapid response to commands to charge or discharge, and if more power is discharged per EV. By contrast, local electric markets are more often based on energy pricing, often varying by time of day, with no penalty to respond more slowly. Energy markets can be controlled by a signal from a DERA but also can function based on a simple detection of local time. DERA-based systems would also require DERs to respond with meter readings demonstrating response accuracy and speed, with all the DER responses aggregated by the DERA. For local retail power markets based on time-of-day energy price changes, the building meter from the local EDC may be sufficient to register the value of changes in consumption or of production and consumption.

Since the primary use of the EV is for transportation, an aggregator or DERA must always subordinate grid requests to required EV charging for an upcoming trip—in operation, our University of Delaware EV research and development group (hence, UD EV Group) has found that these rarely conflict. In other words, an EV owner, or a DER application, could examine the typical and worst-case energy consumption for daily vehicle use, consider unplanned trips, and calculate the amount of kWh required to be stored to travel the next day. This customer- and travel-specific stored energy requirement can be both a buffer to meet customer needs and a parameter to calculate EV power availability for a DERA.

A fleet of EVs with V2G, controlled by a DERA, can respond to requests for grid support as a group, while any individual EV can prioritize that driver’s individual needs. For tracking each vehicle’s needs and for differentially dispatching individual EVs, the EV must provide a unique identifier. For example, in the EV charging station communication standards J3068 [7] and IEC15118, this is provided by a digital signal over the charging cable when plugged in to a charging station. For V2G, the car’s ID can be used to determine which EVs to dispatch and the account to credit. For simple charging, the ID can identify the account to bill for charging, or the ID can even authorize whether an individual EV is allowed to charge in specific lots or at individual charging stations.

If policies are well constructed, EVs with V2G power and signaling could benefit many parties. Energy consumers gain the ability to charge their EVs at lower electric rates by timing charging to non-peak hours at the electric distribution company (EDC) level, as controlled load or time-of-day balancing at the EDC level, or as an ancillary service provider at the regional transmission operator (RTO) level. Grid operators (RTOs or EDCs) also gain the benefits of having more power management resources available, provided from a directly controlled battery power system they do not need to finance, construct, or maintain. In essence, by utilizing DERAs, the power system can enable aggregators to create virtual energy storage systems that act as any large conventional energy system would, yet without as much investment, construction, and maintenance as a conventional storage facility would require. The only thing that grid operators need to do is compensate EV owners for services provided at current rates. To illustrate the potential availability of new storage, a recent study estimated that global use of V2G technology could yield 18–30 TWh of storage by 2050 [8]. Xu et al. compared four scenarios of future grid 4-h storage need, with self-described “conservative” assumptions, found that in all years analyzed, 2030, 2040, and 2050, V2G in EVs was sufficient to meet the storage needs of the grid without added storage built only for grid purposes [8]. Short-term energy storage is defined as follows: “Short-term energy storage demand is typically defined as a 4-h storage system, referring to the ability of a storage system to operate at a capacity where the maximum power delivered from that storage over time can be maintained for 4 h”. In this article, we analyze short term storage because it “accounts for a majority of required storage capacity…” [8].

1.2. The Monetary Value of Energy Storage Used for Wholesale Grid Services

Grid service markets can be divided into those managed by RTOs in FERC-regulated wholesale markets, and those managed by EDCs in state-regulated retail markets. V2G can qualify to provide ancillary services and capacity as RTO services, but since EV storage does not create new energy, V2G cannot participate in energy markets. Ancillary services ensure the system remains stable and that power is continuously delivered [9]. Important ancillary services include regulation, spinning reserves, non-spinning reserves, black start, and load response [9]. Capacity is another RTO grid service generally not defined as an ancillary service, but it similarly provides injected power generation or demand reduction upon a signal from the RTO and could be provided by EVs.

We examine one RTO, PJM, to analyze specific rules and prices. In PJM, regulation has the function of keeping a stable grid frequency and balancing inter-regional power transfers. The regulation ancillary service market exists to perform this task [9]. Regulation consists of both upregulation and downregulation, abbreviated as RegUp and RegDown. When there is excess power on the grid, the RTO requests RegDown, signaling battery systems to charge or generators to ramp down. When there is not enough power on the grid, the RTO would request RegUp, signaling battery systems to discharge or generators to increase production.

Batteries are especially good at providing regulation because they can simply charge or discharge when they receive a signal. Response times for batteries to perform grid services are on the scale of seconds or 100′s of milliseconds rather than minutes as required for conventional generators; thus, batteries can more easily meet RTO reliability standards. Thermal power plants need time to ramp up or ramp down production. While those thermal generators can provide regulation services, due to their slow response, only 10% of those power facilities participate in any way in the regulation market [10]. To fill in the gap created by the inability of baseload generators to respond quickly to load events, they are commonly supplemented by inefficient and expensive peaking generators [10].

1.3. Retail Markets, On-Peak and Off-Peak Value of Energy

The other major type of market for V2G is the retail energy market. Retail markets are based on tariffs between EDCs (electric distribution companies, commonly called utilities), and monitored through a building or premises meter. EDCs buy electricity from generators on the RTO wholesale market and use it to supply the electricity needs of customers through time; the cost to acquire energy is passed on to customers via their electric bill.

At the end of 2017, the U.S. Energy Information Administration (EIA) determined that, of the 1187 GWs of capacity resources on the U.S. grid, 261 GWs were fossil fuel peaking capacity resources [11] (p. 2). Peak generators usually only operate for short periods of time. It is not uncommon to have a peak generator only activated and used a few times a year for intervals lasting an hour. They are used when peak load or generator failures occur. Every day, the grid has peaks and valleys centered around moments of time-determined activity among energy consumers. A typical daily load curve usually peaks in the afternoon between 5 and 7 p.m. when people are preparing dinner, using cooling or heating, and turning on lights [12]. Demand usually drops off after 8 p.m. and continues to fall until between 2 and 4 a.m. where the cycle then repeats. These use times are separated into on-peak and off-peak hours. On-peak hours generally occur on weekdays between 7 a.m. and 11 p.m. while off-peak hours occur from 11 p.m. to 7 a.m. on weekdays, all day on weekends, and on holidays [12]. These timeframes are not universal and can vary by EDC jurisdiction. In an analysis performed by the EIA in 2011, it was estimated that the power usage in the entire New England region fluctuates by as much as 5 GW of load throughout an average day in autumn [13].

Peak generators only generate energy during peak hours, and thus there is less time to recoup the capital cost, so the price must be higher for each kWh produced. Conversely, at the lowest demand hours of the day, only the lowest-cost generators need be used, making the cost per kWh the lowest of the day. Batteries provide an opportunity to charge during times of low cost and discharge during times of high cost. This operating mode is referred to as “energy arbitrage”. If the storage is located on the load side of a retail meter, and the metered premises is already on a time-of-use rate, arbitrage can be performed and reduce the energy bill by controlling charge and discharge by the rate at each time of day, without any direct signal. Further, the financial benefit to the owner of the storage is embedded in the time-of-use rate—there is no separate payment. If the discharge from storage is greater than load at times, power will flow from the premises and be “injected” into the grid, which requires interconnection for injection. Injection is also called backfeeding. Full credit of injected electric energy requires “net energy metering” (NEM) where the value of each kWh injected is credited against the value of an earlier kWh purchased. (This article will use NEM loosely to refer both to net kWh and net value, the latter considering that retail EDC value per kWh may differ at different times.) Since the only two approvals required for energy arbitrage are also needed for solar power behind a premises meter (injection and NEM), the regulatory and approval mechanisms for arbitrage are established in most jurisdictions, although they may require wording changes or utility commission approval. EV energy storage systems can have an efficiency of 85–95% for AC–DC–AC conversions [14], can have up to 8 h of potential discharge time at 6–10 kW, and can last around 5000 full charge discharge cycles before needing to be replaced [15].

Batteries do not generate power; they require charging before discharge and thus are always net loads due to efficiency loss; in EVs, they are net loads also due to energy used for driving. For controls, battery storage systems simply need to purchase energy during times when demands are lowest, then either stop charging or discharge when demand is highest. That is, for the peak and off-peak markets, the battery system (V2G or otherwise) can simply charge or discharge based on the local price at a given moment. It need not be controlled remotely, and if net metered by the EDC, the payment or compensation is automatically achieved via EDC billing.

1.4. FERC Order 2222 Seeks to Require RTOs to Allow DERAs in TSO Markets

As of this writing (spring 2024) the U.S. regional transmission operators (RTOs) lack rules that give customer-located DERs interconnection and deny access to most energy markets. Inertia by RTOs and perhaps other factors have caused DERs to be underutilized for efficient energy production. Given the potential of DERs being able to evelized energy production of renewables, the discouragement of them in the wider market both reduces the United States’ energy security and the ability of the country to provide non-CO2 electricity resources.

The Federal Energy Regulatory Commission (FERC) is the department of the federal government responsible for oversight of wholesale transfer of energy across the United States. Their duties include regulation of the transmission of natural gas, oil, and electricity during interstate commerce, ensuring the reliability of the interstate high-voltage system, and managing and investigating energy markets [16]. In essence, FERC is the ultimate adjudicator of the rules and guidelines for all RTOs, except the Electric Reliability Council of Texas (ERCOT), because of their federally appointed ability to oversee interstate energy sales and markets. Each RTO except ERCOT falls under this jurisdiction because each manages markets which produce energy that can be transported and consumed beyond the borders of a single state.

Recognizing the future potential of DER resources, FERC proposed and issued Order 2222 in September of 2020. Order 2222 has the explicit goal of opening the wider electrical grid and energy markets to the use of DERs. According to FERC’s statements, the order is intended to “usher in the electric grid of the future and promote competition in electric markets by removing the barriers preventing distributed energy resources (DERs) from competing on a level playing field in the organized capacity, energy and ancillary services markets run by regional grid operators” [17]. Under FERC definitions, DERs are individual devices with a nameplate capacity of 1–10,000 kW, can be located on an EDC distribution system, or behind a customer meter, and include any combination of electric storage, intermittent generation, distributed generation, demand response, energy efficiency, thermal storage, or electric vehicles and their charging equipment [17]. The goal of the order is to allow for non-traditional distributed energy management to operate simultaneously and compete with conventional on-demand generation methods. This opening of the wholesale market should decrease consumer costs due to competition. In addition, it will likely increase grid reliability, allow for increasing the number of platforms for energy technology innovation, and increase national security by reducing the impact of power line failure. Order 2222 also allows, and defines, DER aggregations. As previously explained, aggregations allow for individual DERs to combine to form a distributed energy resource aggregation (DERA). From the perspective of an administrator, the aggregation is a single generator regardless of how many components it comprises. There is no upper limit for the number of individual DERs that meet FERC standards to be combined into a DERA [2]. Order 2222 is intended to enable the use of batteries for DER and the potential cost-effectiveness of batteries shared with other purposes, such as EVs with V2G behind the meter.

Some prior work has examined the value of storage devices for grid services. For example, an NREL 2013 study compared spinning reserves, capacity, energy arbitrage, and regulation, finding that regulation was the most lucrative market 90% of the time [18]. The NREL study incorporated the market value of displacing conventional generation, as well as operational, upkeep, and efficiency costs, concluding that as batteries are scaled to smaller units, they can earn more net revenue [18].

1.5. Experience with Interconnection as Demand Response, Small Generator, or “DR with Injection”

Our UD EV Group has earned revenue in the A/S regulation market when registered as a demand response resource (DR) qualified for the regulation market. However, we were able to do so only via an odd precedent that allows injecting power only if a Muni substation meter is used as the meter for registration with PJM, rather than the retail premises meter. Originally, DR-interconnected resources provided grid services by turning off equipment during times of insufficient electricity—thus, for traditional DR, there was no interconnection concern with injection, and no need for net metering. Disadvantages of interconnection as DR include that the RTO prohibits injection from DR (except in Munis, as noted) and does not allow participating in other A/S markets besides regulation. (Technically, for DR we are in the “Regulation only” market, the “only” meaning that PJM provides no compensation for energy, only for power response.)

We were advised by PJM to interconnect as Small Generator (SG) to be permitted to inject power through the retail meter while providing grid services, and in addition to be able to participate in the reserves market and possibly others. PJM created SG registration for energy resources primarily producing energy, and typically connected to local distribution lines rather than behind a retail meter. Although this was a logical method to interconnect our V2G EVs, after a multi-year process requiring going through the registration queue designed for large generators, the legal department insisted that a storage device behind a retail meter was prohibited from registering as a small generator. Despite repeated requests, they could not provide any written rule or tariff that prohibited our approach. The University of Delaware retained two wholesale power-qualified attorneys who communicated with PJM legal, with the conclusion that although we might win a legal case, the additional time and cost was not justified given that another interconnection pathway was likely to be provided by PJM’s planned compliance with FERC Order 2222.

A different problem with SG registration was that many PJM departments were concerned about “double counting”—that PJM would pay for energy in the wholesale market, while via net metering, the local utility would also pay us for the same energy. We argued that with “regulation only”, we are paying the utility for net load in kWh, with no energy payment from PJM. That is, the utility meters and we are credited for injected kWh, and for the RTO, we meter and are credited for a response in kW. This transaction is not double counting because two different commodities are being transacted (accumulated kWh versus being ready to provide an exact number of kW at any time).

A third problem discovered with SG registration is related to our operation In a Muni; PJM was concerned with the Muni buying power from a transmission operator. When we reviewed the planned SG operation with the transmission operator staff, they claimed that each injection by an SG-registered resource within the Muni must be metered in kWh and time of day and reported to the transmission operator for them to carry out “reconciliation” with the Muni. We objected that no energy was being produced and that there would be no financial impact to the EDC if we purchased a kWh of electricity and then injected the same kWh later—and, that the cost of added metering and constant recordkeeping for each small injection would have been prohibitive. We also pointed out that we had been transacting exactly the same number of kWh back and forth between our DER and the Muni for several years in the regulation market under DR registration, and no one had ever raised the question of reconciliation; we just paid the appropriate net kWhs as metered to the Muni. For the new SG registration, we even offered to forgo EDC net metering and to bid A/S to PJM with a zero-energy price. That is, essentially, we would buy the kWh commodity, yet when discharging we would give the same kWhs away for free to the local EDC (which would be a commercial loser but of value as a demonstration of SG—see our later calculation to quantify the financial impact of operating without net metering). None of our offers were accepted, neither to the transmission operator nor to PJM legal. Finally, PJM legal cancelled our SG registration and pulled us from the queue, under written objection by UD council. This faulty process is documented in the comments of 6 Nov 2023, by the University of Delaware EV Group to FERC, on Docket ER22-962-005 in response to PJM’s second compliance filing regarding FERC Order 2222 [19].

Based on analysis of these barriers by PJM staff and PJM’s DER stakeholder group, PJM has suggested a new interconnection model, Demand Response with Distribution Injection (DrwDI), to comply with FERC Order 2222. PJM defines this model as follows: “The same as DR but also has Generation that is approved by the EDC to inject onto the distribution system”. [20]. Creating a registration model where behind-the-meter DERs are allowed to inject would create a streamlined interconnection process, because it derives from a DR model—which allows the resource to be behind the meter and provides response via load reduction but does not sell energy to PJM. The planned DrwDI model would explicitly allow injection of energy onto the distribution grid through a premises meter, yet not set up any expectation that energy is being sold to PJM. (With DR, like storage, no energy is produced by the DER behind the meter.) It is still necessary to register injection and follow an interconnection process to ensure line safety and power quality, a process that is already understood and can be certified, based on experience with solar generation behind the meter. The current proposal seems to be that DrwDI-registered resources would qualify for “A/S only” markets, that is, no energy payment and thus no concern about double counting (and we have advocated extending this to “capacity only”). A DrwDI interconnection, with market rules for A/S only, would resolve many of the above problems that we had to discover through experience. As we write, one remaining problem is that for all response markets except regulation, there has been a requirement for metering to be at the point of interconnection (the premises) yet be high time resolution with separate telemetry. For regulation, a submeter is allowed on the DER itself, which gives more precise readings and is much more cost-effective. Yet, this solution for other non-energy markets is being resisted. The reasoning for this is unclear to us—it may be that the EDC is a second party needing to maintain the meter’s accuracy or may be a concern with the user somehow altering readings by switching other equipment on or off at the same time. We feel neither of these concerns stand up to scrutiny, but so far, they remain barriers to cost-effective DER utilization.

The UD EV Group earlier commented on the language of FERC Order 2222 to ensure that it contains the needed requirement to allow DERs and DERAs, and more recently has worked with PJM to help ensure that PJM’s compliance with Order 2222 in fact permits such resources. If the interconnection, registration, and market participation rules of RTOs are modified to comply with Order 2222 (as PJM expects to do by 2026), and if new interconnection models become prevalent, the resulting low-cost storage will enable the United States to make rapid and cost-effective progress in meeting the goals of the renewable energy transition.

2. Materials and Methods

2.1. The Test Vehicles and Study Site at Delmarva Power

This section establishes the characteristics of the test site and V2G-enabled EVs that will later be used as a basis for revenue calculations. The EVs, Ford Mach-Es, mentioned in this section have begun service in the vehicle fleet of Delmarva Power, stationed at Delmarva’s New Castle Regional Office, in Newark, Delaware as part of a research project designed by the UD EV Group and implemented by Delmarva Power. These EVs are not yet registered or in operation at the time of this writing. Calculations are made based on the Mach-E “Select”, a model of Ford Mach-E, with a standard battery pack capacity of 75.70 kWh, denoted by the variable BC in calculations, and an average driving consumption rate of 329 Wh/mile [21]. These Mach-Es have been retrofitted by the UD EV Group with a 3-phase bidirectional, four-quadrant converter with a maximum power of 50 kW at 480 VAC charging or discharging. The standard for communication from EV to charging station is SAE J3068 (and by reference J3072). These standards provide positive identification of the EV and EVSE to each other, meet distributed energy interconnection requirements, enable and regulate a connected EV to engage in grid services, and provide safe signaling to switch into backup power when appropriate [8].

We made several simplifying assumptions in the case study analysis. Based on interviewing the site’s fleet personnel, we assumed usage of the EVs every weekday (261 days/year), without counting holidays. This affects how many days the EVs are available for grid services all day as well as how many days have a time-of-day peak load pricing. We assumed the vehicles were in use, driving or off-site, 9 a.m. to 5 p.m. every weekday, and assumed no maintenance time or other downtime. These operational assumptions were sufficient to make estimations and will later be able to be checked against actual operational data because this article’s case study electric utility fleet will in fact be operating vehicles having these characteristics and will be monitored for vehicle use and grid capability. Calculations use specifications of the actual EVs being used by this fleet; however, we have retrofitted them for 50 kW bidirectional AC charging and assume up to that level of power charging and discharging. This is an SAE standard charging system (SAE J3068, available from Nuvve Corp) but is not yet in common use—thus, we also calculate for a more common 10 kW charging and discharging rate. Also, this study only draws from tariffs for one US region to calculate pricing for both wholesale and retail electric rates—comparing within one region was sufficient to develop the formulas and sufficient to show representative financial renumeration for a range of grid services in our case study, under different technical and policy characteristics.

Backup power is a use case where neither revenue nor bill savings are earned. Power from a bidirectional charger with J3068 signaling could potentially allow for users to power their premises from the EV. No changes would need to be made to the bidirectional retrofit outlined in this article to enable this use case, other than the ability of the converter to set voltage and frequency. Because the value of uninterrupted power during grid failures or at remote sites is not a power market, backup power is mentioned here, but it is not assigned a monetary value.

We estimate the initial cost of the retrofit for the test vehicles, based on our parts cost and assuming small-scale serial production, is USD 11,000 per EV. When mass-produced by an OEM, we estimate that the added cost, without changing the charging power level, would be less than USD 525/EV, including components and labor for bidirectional charging, J3068 signaling, and small incremental cost to the charging station.

There are 4 EVs employed for this study, each with a nameplate capacity of 50 kW due to a high-power bidirectional charger and the 3-phase, J3068 connectors, cable, and EVSE. We have specified four EVs to be used in this case study because PJM requires 100 kW for market participation, so a planned capacity of 200 kW of EVs allow for times when some vehicles are away or charging, yet at least 100 kW will frequently be available. The case study EVs are used during the workday for Delmarva Power employees to travel to sites for managerial duties and inspections. Based on an initial interview with fleet personnel, these EVs are expected to be returned to the lot by the end of the business day at 5 p.m. and taken out for use at 9 a.m.

Based on interviews with the fleet operator for Delmarva Power’s New Castle Regional Office, the Ford Mach-Es can be expected to be driven 11,000 miles yearly or 30.1 miles per day (this estimate of miles per day includes weekends and is expressed this way to be consistent with off-peak pricing revenue for comparison; based on 5 days/week of driving, the EVs drive 42 miles per workday). Managers reported that the EVs are out 8 h/workday or 40 h/week.

Projecting EV use and drawing on published market values is a limitation of the present study in that we are not analyzing real vehicles, subject to human error (forgetting to plug in), equipment failures, etc. Although that must be acknowledged regarding the calculations reported here, the overall project’s next phase is to operate the EVs described here, in the PJM regulation market as described, which will give us empirical data to compare against the theoretical calculations of this article.

The three markets calculated in this analysis are energy bill savings without injection, arbitrage with injection, and wholesale frequency regulation. Bill savings and arbitrage have established predictable pricing that is based on EDC time of use energy rates. EDCs propose these retail rates, approved by the state public utility commission, thus not market-based. Regulation pricing is market-based, yet over time it is predictable; it is based on a payment for power availability model rather than a payment for energy provided model. (Power plants can operate on compensation for both energy and power availability; as a storage resource, we register for only the latter.) Finally, the influence of NEM was also calculated, as we expected that being required to give away free electricity could affect whether V2G is market-viable.

2.2. Energy Savings from Retail Shift of Charging to Off-Peak

On and off-peak pricing is an example of an EDC billing program that can be paid to customers for shifting appliance use in time. Examples include washing machines, dishwashers, charging of EVs, and any other electric device with flexibility of time of use. Customers can save by shifting usage of appliances, moving to off-peak at a lower price. Utilities may vary the price schedule by season, but within one season, time-of-day pricing is consistent at each time range.

To calculate savings from the EDC peak power rates, we used as a tariff example Delmarva Power’s (DPL) peak pricing rates. On-peak is defined as 12–8 p.m., Monday–Friday, in summer and winter, with summer defined as June through September, and winter is October through May; all other times including weekday holidays are off-peak. [22]. This analysis specifically uses Delmarva Power’s plug-in-vehicle charging rate (PIV) for on- and off-peak prices instead of its standard time-of-use (TOU) rate for peak prices. The calculation of revenue yields larger savings than most time-of-day rates due to high pricing extremes for the PIV tariff. EDCs can have different peak rates and times among peak pricing programs and can differ among customer classes within a single EDC. The DPL primary electric tariff lists the rates for the EV peak charging program. Summer pricing for on-peak is USD 0.1473/kWh, summer off-peak is USD 0.07242/kWh (SOP), winter on-peak is USD 0.1720, and winter off-peak is USD 0.08356 (WOP).

The Ford Mach-Es have an energy expenditure per workday of 9.903 kWh based on operator-estimated driving usage. We would expect an average yearly energy consumption (AYC) of 2584.683 kWh assuming a work year of 261 days. The total money saved is the difference between charging an EV at standard retail rates and off-peak. Delmarva Power’s energy commercial retail rate (ECRR) in 2021 was USD 0.1136/kWh [23].

Equation (1) calculates total yearly energy cost (TEC) and assumes that the EVs begin charging when off-peak hours for both summer and winter start for the day, which is 8 p.m. in both cases in the DPL territory. Equation (2) calculates the total cost incurred for energy by an EV on DPL’s plug-in vehicle peak charging rate when only charging off-peak as denoted by OPTEC. The 0.33 and 0.66 in Equation (2) represent the total amount of time per year an EV is at a given seasonal off-peak price.

Yearly commercial retail rate electricity cost:

($0.1136/kWh × 2584 kWh/year) = $293.542/year

PIV Program off-peak cost:

(($0.07242/kWh × (2584 kWh/year × 0.33)) + ($0.08356/kWh ∗ (2584 kWh/year × 0.66)) = $204.26/year

Equation (3) calculates the total savings of switching from a standard energy rate to an off-Peak charging model denoted by TOS.

where in Equation (1) through (3):

$293.542 − $204.26 = $89.28 saved per year.

ECRR is energy commercial retail rate;

AYC is average yearly energy consumption;

TEC is total yearly energy cost;

SOP is summer off-peak price;

WOP is winter off-peak price;

OPTEC is off-peak total yearly energy cost;

TOS is total off-peak savings.

A factor that limits the potential market size for time-of-use pricing is that currently only 2.2 million residential customers are enrolled in TOU rate programs—only 1.7% of all U.S. customers and only 3.4% of those customers eligible to enroll [24]. In addition, EDCs can request the installation of a separate meter for a V2G EV under a TOU rate. In the case of Delmarva Power, this costs the customer between USD 725 and USD 1225. If state law or rulings designated this as a rate base expense, it could be justified by a resulting load shift to off-peak. Grid services that require a replacement meter, in jurisdictions that require customer payment, may be less economically attractive to the customer (see calculations following).

2.3. Arbitrage with Injection

“Injection” is when an electric generator behind a premise meter generates electricity that flows onto the distribution utility’s grid infrastructure, the reverse direction that power traditionally flows through power lines at the retail level. This differs from large-scale conventional generators because the power flow comes from a device behind the retail meter. Injected energy is a financial loss to the consumer unless net energy metering (NEM) is enabled. NEM was established for premises with solar that produce and sometimes inject. Unlike solar, a scenario that uses V2G or other storage behind the meter has no generation.

Similar to the example of bill savings outlined previously, arbitrage with injection utilizes differential rates for on-peak and off-peak charging. V2G EVs can make money by purchasing energy when prices are low then discharging during times of on-peak prices and when not driving. V2G arbitrage buys low and sells high to earn revenue from the flow of power, and because on- and off-peak rates are established by EDCs and locked in for a period of time, there is no guesswork as to whether the price will be stable. This process is known as energy arbitrage.

Formula for discharge on peak (DP):

Formula for revenue with injection (NEM):

Without NEM:

where in Equation (4) through (7):

BC is battery capacity;

DEC is daily energy consumed for transportation use;

ER is user set energy reserves for emergencies;

EFF is the efficiency of power transfer, this is expressed as a percentage;

PRD is peak rate price difference between on- and off-off peak times;

DP is discharge on peak;

CR is charge rate;

HA is hours available;

OPER is off-peak energy rate.

NR is net revenue

The charging rate plays a role in the overall revenue for TOU with injection because there is a limited timeframe that higher energy rates are offered and the EV must be available and capable of full discharge during the window to earn the full revenue amount. Again, Delmarva Power rates will be used as an example case for this calculation, with peak rates 12 p.m.–8 p.m. weekdays. The Delmarva EVs are available for services after 5 p.m. thus leaving from 5 to 8 p.m., or 3 h of on-peak availability (HA). The peak rate difference for DPL is USD 0.0831/kWh (PRD). Battery capacity of the standard Ford Mach-E is 75.7 kWh (BC). The DPL Mach-Es are assumed to consume 9.903 kWh for daily operation (DEC). Thirty percent of the battery is preserved for emergencies; in the case of our EV battery, 22.71 kWh is reserved at all times (ER). Efficiency of power transfer (EFF) is 95%. OPER references the off-peak energy rate and is added in the non-NEM scenario because there are no NEM credits for discharging the battery (OPER is averaged for the year). The result is net revenue (NR).

Revenue from a single day of operations with a charging rate of 50 kW (CR), daily energy consumed (DEC) of 9.903 kWh, energy reserves (ER) of 22.71 kWh, a peak rate difference (PRD) of USD 0.0831/kWh, and 100% discharge within the allotted peak pricing timeframe (DP) is as follows:

If in the above example the charging rate were 10 kW, the result would be:

Due to the low charging rate over only 3 h, only 73.2% of the available battery energy can be discharged within peak hours, causing less revenue than a 50 kW discharge despite the same battery capacity in both situations.

$3.40 × 261 weekdays = $887.80/year

$2.37 × 261 weekdays = $618.14/year

2.4. Regulation Services with Injection

The Select Mach-E consumption rate is 329 Wh/mile and based on expected usage will consume 9.903 kWh per workday. An EV used for V2G services cannot perform regulation at the same time it is charging to replace energy depleted throughout the workday. Equation (8) describes the total time an EV is unavailable for grid services due to needing to replace energy used for its primary purpose of transportation, resulting in the recharge time signified by the variable RT.

At a charging rate of 50 kW, (9.903 kWh/50 kW = 0.1981 h) 11.89 min must be devoted to charging each workday to replace energy used for driving. This charging window may be any time prior to next driving use (5 weekdays × 11.89 min = 0.9908 h/week).

where:

TT is the total time in a given period (a week, day, month, etc.);

TD is time disconnected (this can be due to EV use as transportation, user error, grid failure, etc.);

RT is recharge time (how long the EV takes to replace energy expended during transportation).

The Ford Mach Es are unavailable for grid services 40 h a week due to driving activities and, as calculated above, 0.9908 h a week due to charging. Therefore, they are available for grid services 127 h per week.

(168 h − 40.99 h of grid services unavailability) = 127 h

Throughput for PJM regulation is 20% of offered capacity. For example, if 10 kW is offered to the regulation market, on average, 2 kW will be running at any moment, whether charging or discharging. The amount dispatched does not change regulation price because the appropriate regulation market for storage, “Reg D”, is compensated based on time and the bid kW available to be used. This study uses a distributed resource aggregator (DERA), provided by Nuvve, which is designed to keep the state of charge (SOC) at an intermediate value to minimize wear. Based on this SOC management, a joint paper by Honda and the University of Delaware estimated that PJM regulation, run over 8 years, only added 2% to battery capacity loss, which the OEM authors considered “negligible” [25]. Another study by Uddin et al. found that well-designed grid charging and discharging could reduce battery wear: if “daily drive cycle consumes between 21% and 38% state of charge, then discharging 40–8% of the batteries state of charge to the grid can reduce capacity fade by approximately 6% and power fade by 3% over a three month period.” [26]. Based on those studies, the cost incurred due to battery wear is not factored in the overall cost or revenue in calculations here.

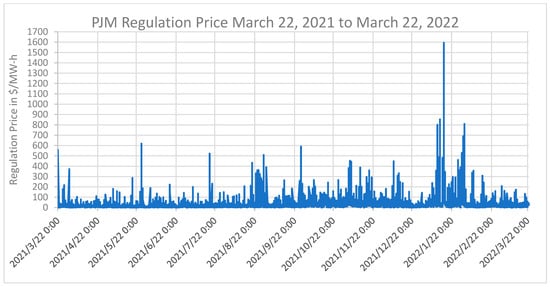

To calculate revenue from regulation, we draw from Monitoring Analytics, the independent market monitor for PJM interconnection. Their report covers regulation as an ancillary service [27]. The price for ancillary services is set by bidding for hourly price on the day-ahead market. As an hourly bid, the price can fluctuate wildly, as shown in Figure 1.

Figure 1.

Hourly PJM regulation price over 1 year.

The average regulation price, represented by RP in calculations, between 2016 and 2022 was USD 23.88/MW-h, calculated from Table 1. The MW-h unit is defined as the power in MW of a device, made available for dispatch over one hour. This is not an energy value—regulation is priced on providing a given MW capacity, being available over the time duration as bid, and responding to the PJM signal when called. For slower response resources, a different regulation market is available in PJM that includes energy also, but typically pays lower compensation for power response.

Table 1.

Yearly average PJM regulation clearing price from 2016 to 2022, our compilation from [27].

The average market price of USD 23.88/MW-h is the average of regulation prices for all hours yearly, from 2016 through 2022. Applying this single average to hours of availability makes the calculations of yearly revenue simpler and more transparent. One could argue that the hourly price only during hours bid should be used, but that would require more computations and reduce replicability; we found that selective use of bid price exclusively during V2G operation changes the calculated yearly revenue by only ~3% versus using the average of all hourly prices [28].

2.5. Power Market Net Revenue Formula

In the following formulae, net revenue is revenue minus cost. For “regulation only”, revenue is based on capacity available to dispatch and hours available, not based on energy charged or discharged. Nevertheless, energy transfers to and from storage are never 100% efficient, some energy will be lost during transfers in the regulation market (these are energy losses, not compensated by NEM). This net loss of energy must be replaced by the purchase of replacement electricity, at the retail cost of electricity. Under this system, revenue (before incurred costs) is earned from PJM, and replacement of energy losses must be paid to the local EDC.

2.6. Finalized Formula for A/S Regulation Revenue Calculation

The formula for regulation net revenue has two factors: the first is revenue in USD from the offering of capacity and response (in kW); the second is cost due to loss of energy (in USD) due to inefficiency in moving that energy back and forth.

where:

HA is hours the vehicle is available for grid services and plugged in within a given timeframe.

RP is the regulation price in USD/kW-h.

CR is the max charging rate, assuming the max is offered in market, in kW.

ECRR is the electricity commercial retail rate and is the price of energy in the location the station is located.

THR is the throughput as a % of capacity to perform regulation.

EFF is the efficiency of power transfer; this is expressed in a percentage.

Breaking Equation (10) into its components, hours available represents the total time the EV is plugged in and not used for transport nor recharging for upcoming transport. This factor is present on both sides of the equation. On the left, it is used to determine how long the resource can earn revenue from regulation and, on the right, it represents how much time the EV is providing grid services to inform how much energy is lost during regulation and needs to be replaced at the customer retail rate. Power capacity offered is the nameplate capacity of the DER and the rate at which it commonly offers at. Based on our prior operations providing regulation, we calculated THR in the PJM regulation market to be 20% of charging capacity offered.

3. Results for Regulation Revenue

3.1. Revenue and Cost for a 50 kW EV in the PJM Regulation Market

The site parameters in this article are 127 h of availability, a regulation clearing price of USD 0.02388/kW-h, a discharge rate of 50 kW, a throughput of 20% of bid capacity, and an efficiency of 95% during power transfer.

Putting the above parameters into the regulation net revenue formula returns the following result:

Net annual revenue: USD 144.43/week × 52 weeks = USD 7510.36/EV/year

Lost revenue as a ratio of potential revenue: (USD 7.2136/USD 151.64) = 0.0476

3.2. Revenue for one EV Rated at 19.2 kW in the PJM Regulation Market

The AC vehicle chargers used in this study achieve 50 kW at low cost by using a new three-phase charging standard, “SAE J3068” [7]. The standard was finalized in December 2023, so very few cars and trucks are using it now. Thus, we also calculate revenue for the legacy SAE J1772 AC charging standard, limited to 80 amps. Until recently, lower-power charging has been the rule for J1772 in the US, but now several EV models for the U.S. have the option for full 80 amp, 19.2 kW charging. The next section of this paper will make a calculation using the same methodology and formula for the Ford Mach-E fleet described above, except at 19.2 kW instead of 50 kW.

At a charging rate of 19.2 kW, it takes 0.516 h to recharge a 75.7 kWh Mach-E battery after a day of use (9.903 kWh/19.2 kW = 0.516 h to recharge).

Adding the time it takes to recharge to the total time the cars are unplugged results in 8.516 h/day when the Mach-Es cannot participate in ancillary services, or 42.58 h per week (0.516 + 8 = 8.516 unavailable hours/day) (8.516 × 5 = 42.58 h unavailable/week). This means the Mach-E’s have a total availability of 125.42 h/week for A/S market participation (168 h − 42.58 h = 125.42 h available). This calculation uses the same regulation price and retail energy price from the previous calculation. Losses are estimated at 5% (1–0.95) of the 20% capacity throughput. (19.2 kW × 0.2 × 0.05 = 0.192 kW in losses). From Equation (7), we calculate revenue from a 19.2 kW charging rate as follows:

Annually, this is USD 54.76/week/EV × 52 weeks = USD 2847.52/EV/year

125.42 h/week × USD 0.02388/kW-h × 19.2 kW) − (125.42 h × USD 0.1136/kWh × (19.2 kW × 0.2 ∗ 0.05))

= (USD 57.50/week − USD 2.74/week) = USD 54.76/week/EV

3.3. Reduced Regulation Revenue without Net Metering

To quantify the relative importance of NEM in behind-the-meter storage projects, this section calculates the effect of removing NEM on revenue.

Without NEM, reverse flow back to the grid is not measured and no credit is given for it. The following calculation builds on the previous ones to determine total net revenue for a regulation enabled Mach-E operating at 50 kW without NEM.

USD 151.64 − USD 7.21 − USD 72.14 = USD 72.29/week/EV at 50 kW capacity

USD 72.29/week/EV × 52 weeks/year = USD 3758.98/year/EV

Non-NEM-to-NEM revenue ratio: USD 3758.98/USD 7510.36 = 0.5005

4. Discussion

This section summarizes the requirements of the markets previously discussed and compares them in interconnection requirements, signaling, and potential revenue. Summaries of these markets are listed below, and compared in Table 2:

Table 2.

V2G Markets, with technical and regulatory requirements, showing revenue at lower and higher charging/discharging power, and showing simple payback period.

Backup power: This use type does not interact with energy markets. This use case uses bidirectional power from the vehicle to power an electric customer in the event of a power outage.

Off-peak charging: Charge according to time-of-day so that as much charging as possible is done at off-peak rates. (No discharging is used.)

Retail arbitrage: Uses timing and a known time-of-day rate to charge the battery when rates are low, and discharge at the net metered rate during times the rate is high. This requires both a bidirectional charger and permission to inject power to the grid. The controls must ensure that driving needs will take priority over earning money from grid services. Timing could be controlled by the individual charging station, but if it is controlled by an aggregator, it is more amenable to considering driving schedule and updated utility rates.

RTO regulation: The resource must respond to a real-time signal from the RTO. Rather than responding by time of day, the real-time signal is typically a sequence of requests among regulation up (discharging), regulation down (charging), and idle. The use of a control signal, also called automatic generation control (AGC), is used by RTOs for A/S markets, including regulation and reserves, as well as capacity. Because responding to the signal when requested is essential, renumeration based on the power capability (kW) offered may be substantially larger than renumeration on the energy that flows (kWh).

These markets are compared down the rows in Table 2. This table gives the basic requirements for each service, including whether net metering is required, whether interconnection permission is required, how requests are signaled, regulatory requirements, and in the “revenue or savings” columns, the annual revenue for both a 10 kW and a 50 kW V2G charging system. Based on our upper estimate of serial production cost of a 10 kW charging with bidirectional power flow and J3068 signaling (USD 525), the simple payback period is given in the rightmost column. As noted earlier, for revenue requiring TOU rates, either the EDC or resident have a cost for a TOU meter, not incorporated in the calculations for Table 2.

Table 2 summarizes the revenue or bill savings calculated in this paper for each service, based on our formulae developed above. Considering the power level of charging and discharging, Table 2 shows that higher power conveys no benefit for off-peak charging, because the energy consumed is proportional to daily driving energy, easily recovered at either power level. The charging power has a modest effect on arbitrage with injection, because for the case study parameters, arbitrage was limited by battery capacity more than power. In this study, like a number of others, the RTO services typically earn much more but also require more regulatory setup. For RTO regulation, revenue is proportional to charging/discharging power, not limited by battery capacity. The simple payback periods for the added cost of V2G in a serial production vehicle, in the rightmost column, are very attractive. The return for higher power in the regulation market would probably justify a higher power charging/discharging system on the vehicle (payback not shown in table for 50 kW). In Table 3, we compare the same markets as Table 2, now varying efficiency, power in kW, and differing availability of NEM. The numbers can be understood by distinguishing services that are more energy limited (off-peak charging and arbitrage) versus services that are proportional to power (regulation and other A/S).

Table 3.

Calculated yearly revenue or savings, comparing three markets, different efficiencies, different power levels, and with or without net energy metering.

Table 3 uses the formulae developed to analyze each market—regulation, off-peak charging, and arbitrage—under different conditions. Backup power is not included because it produces neither bill savings nor revenue. Table 3 divides energy arbitrage into three separate columns showing different charge rates for EVs participating in arbitrage. The arbitrage revenue is reduced at lower power (despite the same battery capacity in each scenario) because at lower power, the EV becomes incapable of full discharge within the peak time specified in the case study rate. For example, the revenue for energy arbitrage operating at a discharge rate of 40 kW would be the same as 50 kW because both rates discharge 43 kWhs (final available battery capacity used in this study) in under 3 h—the time that the EV is available during peak rates. The three rows show differing efficiencies of the power converter (using efficiencies of [3]), and the effect of conversion losses on each market. We show no revenue change from controlled charging as a service because there are no added cycles due to the service.

Negative values appear under energy arbitrage lacking NEM because energy is billed when consumed, but not credited when the same energy is later returned to the grid. (The EDC treats storing energy as load rather than as providing a service.) This results in a storage system that loses money for the operator if there is no NEM credit. Regulation is a payment for being available to provide power flow on command by the grid. The two biggest factors affecting regulation revenue are high power and net energy metering.

One could project, in the future, that there would be so many EVs they would undersell and drive higher-price storage and power plants out of these markets. Given the very large resource of the coming EV fleet, the values shown here would eventually saturate EDC-level programs like today’s simple time-of-day rate structure [1,8]. In one sense, this is a desirable state, not a problem, because storage would by then command lower prices and the grid would be more stable and more reliable at lower cost. In the intermediate term, we may expect retail utilities to modify rate structures to a new future of abundant storage, and for RTOs to adjust market rules for additional purposes of storage (e.g., capacity in addition to A/S). If these policy changes are made, ultimately, lower market prices for storage will lead to an equilibrium in which marginal additional resources may choose not to participate in grid service markets; this is not a problem, it is an indicator of a solution.

5. Conclusions

As EVs increasingly enter the vehicle fleet, analyses have shown that V2G will be a large resource, capable of addressing major systemic problems related to the energy transition [1,8]. Retail bill savings from EVs can be gained with today’s rules, but greater savings result from implementation of appropriate policies (wholesale market access, interconnection for behind-the-meter injection, and NEM). If RTO policy and tariffs were to allow consumers with capable EVs to participate in the A/S market, and if state policy made behind-the-meter storage qualify for NEM, consumers would be incentivized to buy EVs with such features and participate in markets. Note that revenue comes from EVs providing market services; the revenues shown here could be a substantial monetary incentive, yet they require no government subsidy. Such revenue to EV owners would help repay the initial cost of an EV over time.

However, current RTO rules, as we document for one RTO based on our full interconnection application process, now block any behind-the-meter storage (including V2G) from wholesale markets for ancillary services and capacity. Current rules in some RTOs also oddly disallow injection, even for DERS that are fully certified for injection [19]. Prohibiting the low-cost V2G resource slows renewable generation by virtue of lack of storage, wastes the EV storage as a resource, and increases costs for all EDC customers by requiring duplicate investment in storage (one set of batteries for EV, a second set of approximately as many batteries [8] purpose-built only for grid support). In the next two to five years, we hope to see that the US RTOs comply with FERC Order 2222 and open up this market. If RTOs do so, the wholesale markets we analyze will open significant value to EV owners, and a large, low-cost storage resource will become available to the grid.

Author Contributions

J.G.M. was responsible for Data Curation, Original Draft Preparation, and Formal Analysis. W.K. was responsible for Supervision, Validation, Project Administration, and Funding Acquisition. Both researchers were responsible for Conceptualization, Methodology, Visualization, Investigation, and Writing—Review and Editing. All authors have read and agreed to the published version of the manuscript.

Funding

Partial funding for this work was provided by Nuvve Corp and Exelon Corp. For Nuvve, the grant ID is “UD Modification 8”. For Exelon, the funding ID is “V2G Demonstration, Award #20A01452”.

Data Availability Statement

The quantitative analysis herein is drawn from publicly available sources as cited in the references section, formulae in the text, and footnotes.

Acknowledgments

This paper has been improved by suggestions from Steve Letendre, Sara Parkison, Samuel Ramos, Catherine Gilman, Joshua Cadoret, and PJM staff. Specialized V2G hardware and software was supplied by Nuvve Corp and by Watt & Well S.A.S., and EV retrofits were carried out by Autoport Inc. Any errors remain the responsibility of the authors. Analysis draws from John Metz’s master’s degree research in the University of Delaware’s Energy and Environmental Policy Program.

Conflicts of Interest

J. Metz declares no conflicts of interest. W. Kempton has a financial interest in Nuvve, which provides grid services as described in this article.

References

- Kempton, W.; Tomic, J. Vehicle-to-grid power implementation: From stabilizing the grid to supporting large-scale renewable energy. J. Power Sources 2004, 144, 280–294. [Google Scholar] [CrossRef]

- FERC. FERC ORDER 2222: Participation of Distributed Energy Resource Aggregations in Markets Operated by Regional Transmission Organizations and Independent System Operators. 17 September 2020. Available online: https://www.ferc.gov/sites/default/files/2020-09/E-1_0.pdf (accessed on 29 February 2024).

- Aparicio, M.J.; Grijalva, S. Economic Assessment of V2B and V2G for an Office Building. In Proceedings of the 2020 52nd North American Power Symposium (NAPS), Tempe, AZ, USA, 1–13 April 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Corinaldesi, C.; Lettner, G.; Schwabeneder, D.; Ajanovic, A.; Auer, H. Impact of Different Charging Strategies for Electric Vehicles in an Austrian Office Site. Energies 2020, 13, 5858. [Google Scholar] [CrossRef]

- Thingvad, A.; Martinenas, S.; Andersen, P.; Marinelli, M.; Christensen, B.; Olesen, O. Economic Comparison of Electric Vehicles Performing Unidirectional and Bidirectional Frequency Control in Denmark with Practical Validation. In Proceedings of the 2016 51st International Universities Power Engineering Conference (UPEC), Coimbra, Portugal, 6–9 September 2016; pp. 1–6. [Google Scholar] [CrossRef]

- Department of Energy. Virtual Power Plants. 2023. Available online: https://www.energy.gov/lpo/virtual-power-plants (accessed on 29 February 2024).

- SAE International. SAE J3068: Electric Vehicle Power Transfer System Using a Three-Phase Capable Coupler; Truck and Bus Electrical Systems Committee; SAE International: Warrendale, PA, USA, 2023. [Google Scholar] [CrossRef]

- Xu, C.; Behrens, P.; Gasper, P.; Smith, K.; Hu, M.; Tukker, A.; Steubing, B. Electric vehicle batteries alone could satisfy short-term grid storage demand by as early as 2030. Nat. Commun. 2023, 14, 119. [Google Scholar] [CrossRef] [PubMed]

- Kirby, B. Ancillary Services: Technical and Commercial Insights. 2007. Available online: https://www.consultkirby.com/files/Ancillary_Services_-_Technical_And_Commercial_Insights_EXT_.pdf (accessed on 29 February 2024).

- Milligan, M. Sources of Grid Reliability Services. Electr. J. 2018, 31, 1–7. [Google Scholar] [CrossRef]

- Denholm, P.; Nunemaker, J.; Gagnon, P.; Cole, W. The Potential for Battery Energy Storage to Provide Peaking Capacity in the United States; National Renewable Energy Laboratory: Golden, CO, USA, 2019; NREL/TP-6A20-74184. Available online: https://www.nrel.gov/docs/fy19osti/74184.pdf (accessed on 29 February 2024).

- EIA. Hourly Electricity Consumption Varies throughout the Day and across Seasons. 2020. Available online: https://www.eia.gov/todayinenergy/detail.php?id=42915 (accessed on 29 February 2024).

- Energy Information Administration (EIA). Demand for Electricity Changes throughout the Day. 6 April 2011. Available online: https://www.eia.gov/todayinenergy/detail.php?id=830 (accessed on 29 February 2024).

- Apostolaki-Iosifidou, E.; Codani, P.; Kempton, W. Measurement of Power Loss During Electric Vehicle Charging and Discharging. Energy—Int. J. 2017, 127, 730–742. [Google Scholar] [CrossRef]

- ESSI. Energy Storage Fact Sheet. 22 February 2019. Available online: https://www.eesi.org/papers/view/energy-storage-2019 (accessed on 29 February 2024).

- FERC. What FERC Does. 2023. Available online: https://www.ferc.gov/what-ferc-does (accessed on 29 February 2024).

- FERC. FERC Order 2222 Fact Sheet. 2020. Available online: https://www.ferc.gov/media/ferc-order-no-2222-fact-sheet (accessed on 29 February 2024).

- Denholm, P.; Jorgenson, J.; Hummon, M.; Jenkin, T.; Palchak, D.; Kirby, B.; Ma, O.; O’Malley, M. The Value of Energy Storage for Grid Applications; National Renewable Energy Laboratory: Golden, CO, USA, 2013; Identification: NREL/TP-6A20-58465. [Google Scholar] [CrossRef]

- Kempton, W.; Metz, J. Comments of University of Delaware’s Electric Vehicle Research and Development Group Re the Second Compliance Filing of PJM Interconnection of 1 September 2023, in response to Order No. 2222 under ER22-962. 6 November 2023. Available online: https://elibrary.ferc.gov/eLibrary/filelist?accession_number=20231106-5105&optimized=false (accessed on 4 April 2024).

- Beban, M. PJM Order 2222 Use Case Examples; PJM: 2021. Available online: https://www2.pjm.com/-/media/committees-groups/subcommittees/dirs/2021/20210924/20210924-item-05-pjm-use-case-update.ashx (accessed on 29 February 2024).

- Ford Motor Company. 2021 Ford Mustang Mach-e Technical Specifications. 2021. Available online: https://www.ford.com/cmslibs/content/dam/brand_ford/en_us/brand/suvs-crossovers/mache/3-2/pdf/seo-pdfs/Mustang-Mach-E-Tech-Specs.pdf (accessed on 29 February 2024).

- Delmarva Power. 2021–2022 Delmarva Power Delaware Operational Tariff. Information about EV Rates from Pages 42 & 59a. 2021. Available online: https://web.archive.org/web/20221225012134/https://www.delmarva.com/SiteCollectionDocuments/My%20Account/MyBillUsage/DPL_DE-MasterElectricTariff.pdf (accessed on 10 February 2023).

- Energy Information Administration. Electric Sales, Revenue, and Average Price. Data Located under>Previous Editions>Year 2021>Excel Table 7>Delmarva Power. 2021. Available online: https://www.eia.gov/electricity/sales_revenue_price/ (accessed on 29 February 2024).

- Faruqui, A.; Hledik, R.; Sergici, S. A Survey of Residential Time-of-Use (TOU) Rate; The Brattle Group, Inc.: Boston, Ma, USA, 2019; Available online: https://www.brattle.com/wp-content/uploads/2021/05/17904_a_survey_of_residential_time-of-use_tou_rates.pdf (accessed on 29 February 2024).

- Shinzaki, S.; Sadano, H.; Maruyama, Y.; Kempton, W. Deployment of Vehicle-to-Grid Technology and Related Issues; SAE Technical Paper; SAE International: Warrendale, PA, USA, 2015. [Google Scholar] [CrossRef]

- Uddin, K.; Jackson, T.; Widanage, W.; Chouchelamane, G.; Jennings, P.; Marco, J. On the possibility of extending the lifetime of lithium-ion batteries through optimal V2G facilitated by an integrated vehicle and smart-grid system. Energy 2017, 133, 710–722, ISSN 0360-5442. [Google Scholar] [CrossRef]

- Monitoring Analytics (2016–2022). PJM State of the Market Report Section 10: Ancillary Services between 2016–2022. Available online: https://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2023.shtml (accessed on 29 February 2024).

- PJM Data Miner. PJM Regulation Zone Preliminary Billing Data. 2023. Available online: https://dataminer2.pjm.com/feed/reg_zone_prelim_bill/definition (accessed on 29 February 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).