Optimized Decision-Making for Multi-Market Green Power Transactions of Electricity Retailers under Demand-Side Response: The Chinese Market Case Study

Abstract

1. Introduction

2. Methodology

2.1. Analysis of Response Uncertainty

2.2. Transaction Model Construction

2.2.1. Utility Function of Power Users

2.2.2. Profit Function of Electricity Retailers under Demand-Side Response

3. Model Optimization and Solution

| Algorithm 1 User , , part of the computation |

| Step 1: Set the elasticity coefficient in the user function and the step size in the Lagrange multiplier iterative method, set the initial user state transfer probability, the Lagrange multiplier , and the electricity consumption , , and specify the termination error as , , and the number of iterations ; Step 2: Obtain the incentive from the electricity retailers; Step 3: Solve the objective function using and to obtain the electricity consumption , ; Step 4: Update the Lagrange multiplier , denoted as ; Step 5: The electricity retailers receive the new electricity consumption , ; Step 6: If and are satisfied, then the algorithm is complete and the optimal solution is obtained; if not, update the number of iterations and return to Step 2. |

| Algorithm 2 The part calculated by the electricity seller |

| Step 1: Set the step size in the Lagrange multiplier iterative method , assuming that the original incentive is transmitted to each power user, and stipulate that the termination error is set to , , and the number of iterations ; Step 2: Obtain the new electricity consumption under the incentive mechanism , ; Step 3: The incentive is used to solve the objective function, and the solution can be obtained as the power sales ; Step 4: Recalculate the new incentive named ; Step 5: The updated incentive PP is transmitted to all power users; Step 6: If both , conditions are satisfied, then the algorithm is complete and the optimal solution is calculated , ; if not, update the iteration number and go back to Step 2 again. |

4. Calculation Example Analysis

4.1. Basic Parameter Settings

4.2. Analysis of Incentive Convergence

4.3. Profit Analysis of E-Commerce Sales

4.3.1. Profit Analysis of Electricity Retailer under Different Incentives

4.3.2. Profit Analysis of Electricity Sellers in Different Markets under DSR

4.4. Analysis of Green Power Consumption Rate

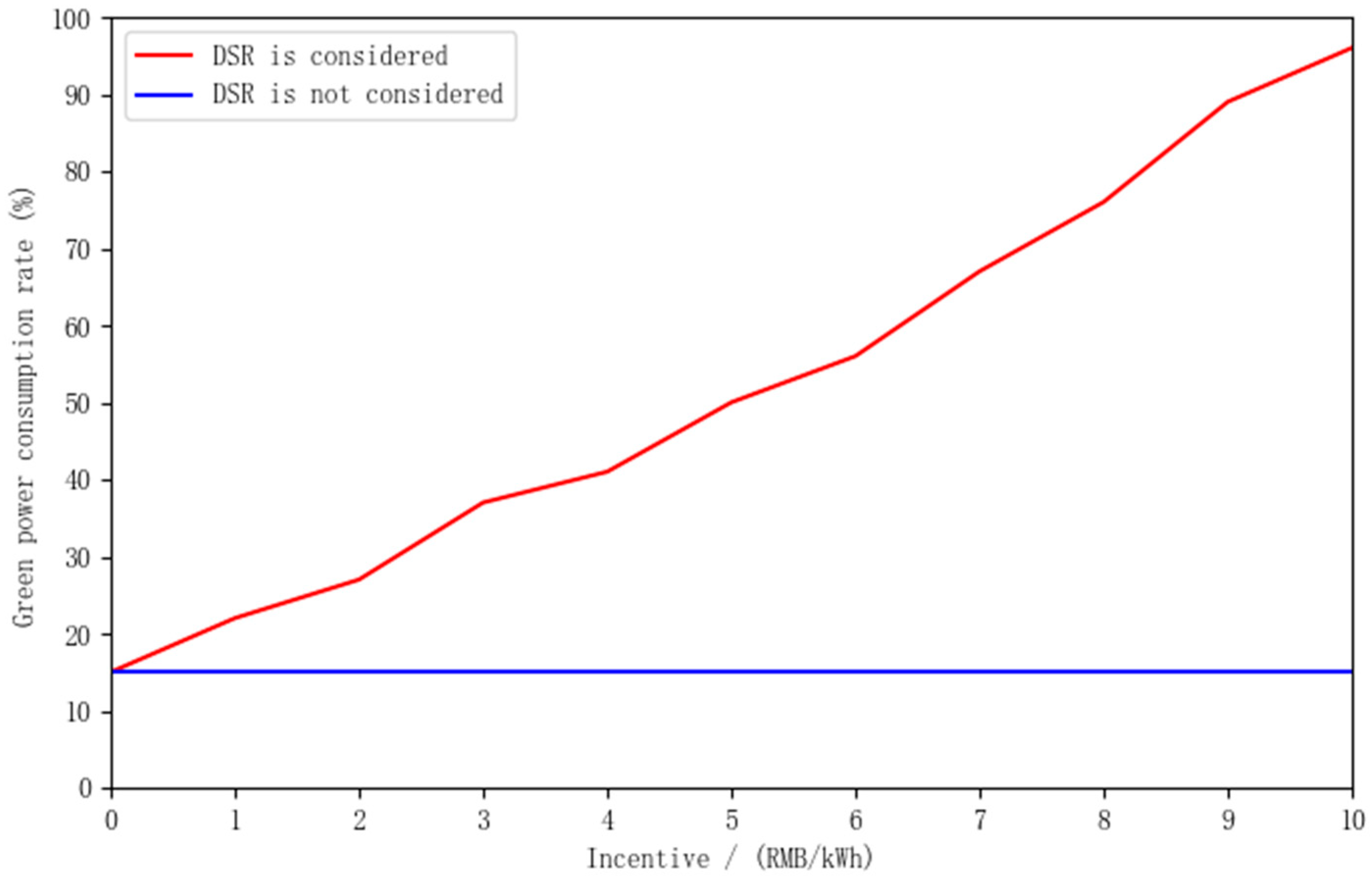

4.4.1. Analysis of Green Power Consumption Rate under Different Incentive Levels

4.4.2. Analysis of Green Power Consumption Rate under Different Incentive Modes

4.4.3. Analysis of Green Power Consumption Rate in Different Markets under Demand-Side Response

5. Theoretical and Policy Implications

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Manioudis, M.; Meramveliotakis, G. Broad strokes towards a grand theory in the analysis of sustainable development: A return to the classical political economy. New Political Econ. 2022, 27, 866–878. [Google Scholar] [CrossRef]

- National Development and Reform Commission. Notification on Issuing “Electricity Demand Side Management Methods (2023 Edition)”: Fa Gai Yun Hang Gui [2023] No. 1283 [EB/OL]. Available online: https://www.gov.cn/zhengce/zhengceku/202310/content_6907311.htm (accessed on 29 March 2024).

- Lin, B.; Qiao, Q. Exploring the participation willingness and potential carbon emission reduction of Chinese residential green electricity market. Energy Policy 2023, 174, 113452. [Google Scholar] [CrossRef]

- Gao, H.; Hu, M.; He, S.; Liu, J. Green electricity trading driven low-carbon sharing for interconnected microgrids. J. Clean. Prod. 2023, 414, 137618. [Google Scholar] [CrossRef]

- Wimmers, A.; Madlener, R. The European market for guarantees of origin for green electricity: A scenario-based evaluation of trading under uncertainty. Energies 2023, 17, 104. [Google Scholar] [CrossRef]

- Xu, S.; Xu, Q. Optimal pricing decision of tradable green certificate for renewable energy power based on carbon-electricity coupling. J. Clean. Prod. 2023, 410, 137111. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Phoumin, H.; Rasoulinezhad, E. Assessment of role of green bond in renewable energy resource development in Japan. Resour. Policy 2023, 80, 103272. [Google Scholar] [CrossRef]

- Notteboom, T.; Haralambides, H. Seaports as Green Hydrogen Hubs: Advances, Opportunities and Challenges in Europe. Marit. Econ. Logist. 2023, 25, 1–27. [Google Scholar] [CrossRef]

- Johnathon, C.; Agalgaonkar, A.P.; Planiden, C.; Kennedy, J. A proposed hedge-based energy market model to manage renewable intermittency. Renew. Energy 2023, 207, 376–384. [Google Scholar] [CrossRef]

- Sousa, J.; Lagarto, J.; Camus, C.; Viveiros, C.; Barata, F.; Silva, P.; Alegria, R.; Paraíba, O. Renewable energy communities optimal design supported by an optimization model for investment in PV/wind capacity and renewable electricity sharing. Energy 2023, 283, 128464. [Google Scholar] [CrossRef]

- Wang, T.; Hua, H.; Shi, T.; Wang, R.; Sun, Y.; Naidoo, P. A bi-level dispatch optimization of multi-microgrid considering green electricity consumption willingness under renewable portfolio standard policy. Appl. Energy 2024, 356, 122428. [Google Scholar] [CrossRef]

- Zhao, W.; Zhang, S.; Xue, L.; Chang, T.; Wang, L. Research on Model of Micro-grid Green Power Transaction Based on Blockchain Technology and Double Auction Mechanism. J. Electr. Eng. Technol. 2024, 19, 133–145. [Google Scholar] [CrossRef]

- Wang, L.; Hou, C.; Ye, B.; Wang, X.; Yin, C.; Cong, H. Optimal operation analysis of integrated community energy system considering the uncertainty of demand response. IEEE Trans. Power Syst. 2021, 36, 3681–3691. [Google Scholar] [CrossRef]

- Liu, D.; Qin, Z.; Hua, H.; Ding, Y.; Cao, J. Incremental incentive mechanism design for diversified consumers in demand response. Appl. Energy 2023, 329, 120240. [Google Scholar] [CrossRef]

- Wen, L.; Zhou, K.; Li, J.; Wang, S. Modified deep learning and reinforcement learning for an incentive-based demand response model. Energy 2020, 205, 118019. [Google Scholar] [CrossRef]

- Kong, X.; Kong, D.; Yao, J.; Bai, L.; Xiao, J. Online pricing of demand response based on long short-term memory and reinforcement learning. Appl. Energy 2020, 271, 114945. [Google Scholar] [CrossRef]

- Yang, S.; Lao, K.W.; Chen, Y.; Hui, H. Resilient distributed control against false data injection attacks for demand response. IEEE Trans. Power Syst. 2024, 39, 2837–2853. [Google Scholar] [CrossRef]

- Fleschutz, M.; Bohlayer, M.; Braun, M.; Henze, G.; Murphy, M.D. The effect of price-based demand response on carbon emissions in European electricity markets: The importance of adequate carbon prices. Appl. Energy 2021, 295, 117040. [Google Scholar] [CrossRef]

- Yang, S.; Tan, Z.; Liu, Z.; Lin, H.; Ju, L.; Zhou, F.; Li, J. A multi-objective stochastic optimization model for electricity retailers with energy storage system considering uncertainty and demand response. J. Clean. Prod. 2020, 277, 124017. [Google Scholar] [CrossRef]

- Gul, S.S.; Suchitra, D. A multistage coupon incentive-based demand response in energy market. Ain Shams Eng. J. 2024, 15, 102468. [Google Scholar] [CrossRef]

- Shen, Y.; Li, Y.; Zhang, Q.; Li, F.; Wang, Z. Consumer psychology based optimal portfolio design for demand response aggregators. J. Mod. Power Syst. Clean Energy 2021, 9, 431–439. [Google Scholar] [CrossRef]

- Mao, X.; Xue, M.; Zhang, T.; Tan, W.; Zhang, Z.; Pan, Y.; Wu, H.; Lin, Z. Centralized bidding mechanism of demand response based on blockchain. Energy Rep. 2022, 8, 111–117. [Google Scholar] [CrossRef]

- Tsaousoglou, G.; Efthymiopoulos, N.; Makris, P.; Varvarigos, E. Multistage Energy Management of Coordinated Smart Buildings: A Multiagent Markov Decision Process Approach. IEEE Trans. Smart Grid 2022, 13, 2788–2797. [Google Scholar] [CrossRef]

- Lu, R.; Bai, R.; Luo, Z.; Jiang, J.; Sun, M.; Zhang, H.T. Deep Reinforcement Learning-Based Demand Response for Smart Facilities Energy Management. IEEE Trans. Ind. Electron. 2022, 69, 8554–8565. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, J.; Ravey, A.; Chrenko, D.; Miraoui, A. Real-time Energy Management of Photovoltaic-Assisted Electric Vehicle Charging Station by Markov Decision Process. J. Power Source 2020, 476, 228504. [Google Scholar] [CrossRef]

- Xu, X.; Jia, Y.; Xu, Y.; Xu, Z.; Chai, S.; Lai, C.S. A Multi-Agent Reinforcement Learning-Based Data-Driven Method for Home Energy Management. IEEE Trans. Smart Grid 2020, 11, 3201–3211. [Google Scholar] [CrossRef]

- Lu, T.; Chen, X.; McElroy, M.B.; Nielsen, C.P.; Wu, Q.; Ai, Q. A Reinforcement Learning-Based Decision System for Electricity Pricing Plan Selection by Smart Grid End Users. IEEE Trans. Smart Grid 2021, 12, 2176–2187. [Google Scholar] [CrossRef]

- Yu, L.; Xie, W.; Xie, D.; Zou, Y.; Zhang, D.; Sun, Z.; Zhang, L.; Zhang, Y.; Jiang, T. Deep Reinforcement Learning for Smart Home Energy Management. IEEE Internet Things J. 2020, 7, 2751–2762. [Google Scholar] [CrossRef]

- Chen, S.J.; Chiu, W.Y.; Liu, W.J. User Preference-Based Demand Response for Smart Home Energy Management Using Multiobjective Reinforcement Learning. IEEE Access 2021, 9, 161627–161637. [Google Scholar] [CrossRef]

| Parameters | Numeric | Parameters | Numeric |

|---|---|---|---|

| 0 | 1 | ||

| 2 | 0.25 | ||

| 1 | 0.1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, H.; Xu, Y. Optimized Decision-Making for Multi-Market Green Power Transactions of Electricity Retailers under Demand-Side Response: The Chinese Market Case Study. Energies 2024, 17, 2543. https://doi.org/10.3390/en17112543

Wang H, Xu Y. Optimized Decision-Making for Multi-Market Green Power Transactions of Electricity Retailers under Demand-Side Response: The Chinese Market Case Study. Energies. 2024; 17(11):2543. https://doi.org/10.3390/en17112543

Chicago/Turabian StyleWang, Hui, and Yao Xu. 2024. "Optimized Decision-Making for Multi-Market Green Power Transactions of Electricity Retailers under Demand-Side Response: The Chinese Market Case Study" Energies 17, no. 11: 2543. https://doi.org/10.3390/en17112543

APA StyleWang, H., & Xu, Y. (2024). Optimized Decision-Making for Multi-Market Green Power Transactions of Electricity Retailers under Demand-Side Response: The Chinese Market Case Study. Energies, 17(11), 2543. https://doi.org/10.3390/en17112543