The Impact of Energy-Related Uncertainty on Corporate Investment Decisions in China

Abstract

1. Introduction

2. Literature Review, Goals and Research Hypotheses

2.1. Theoretical Background on Investment under Uncertainty

2.2. Investment Patterns in the Renewable Energy Sector

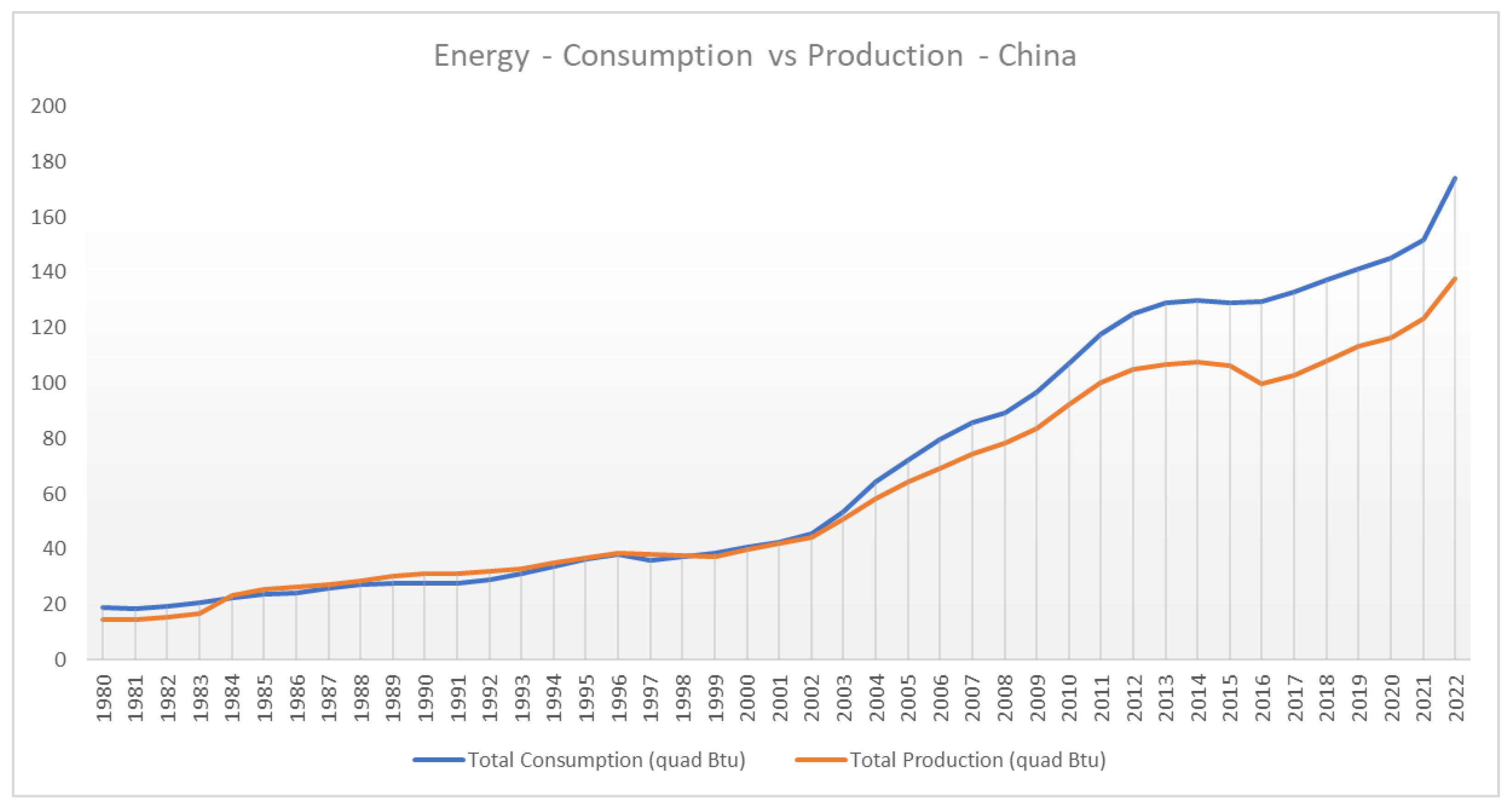

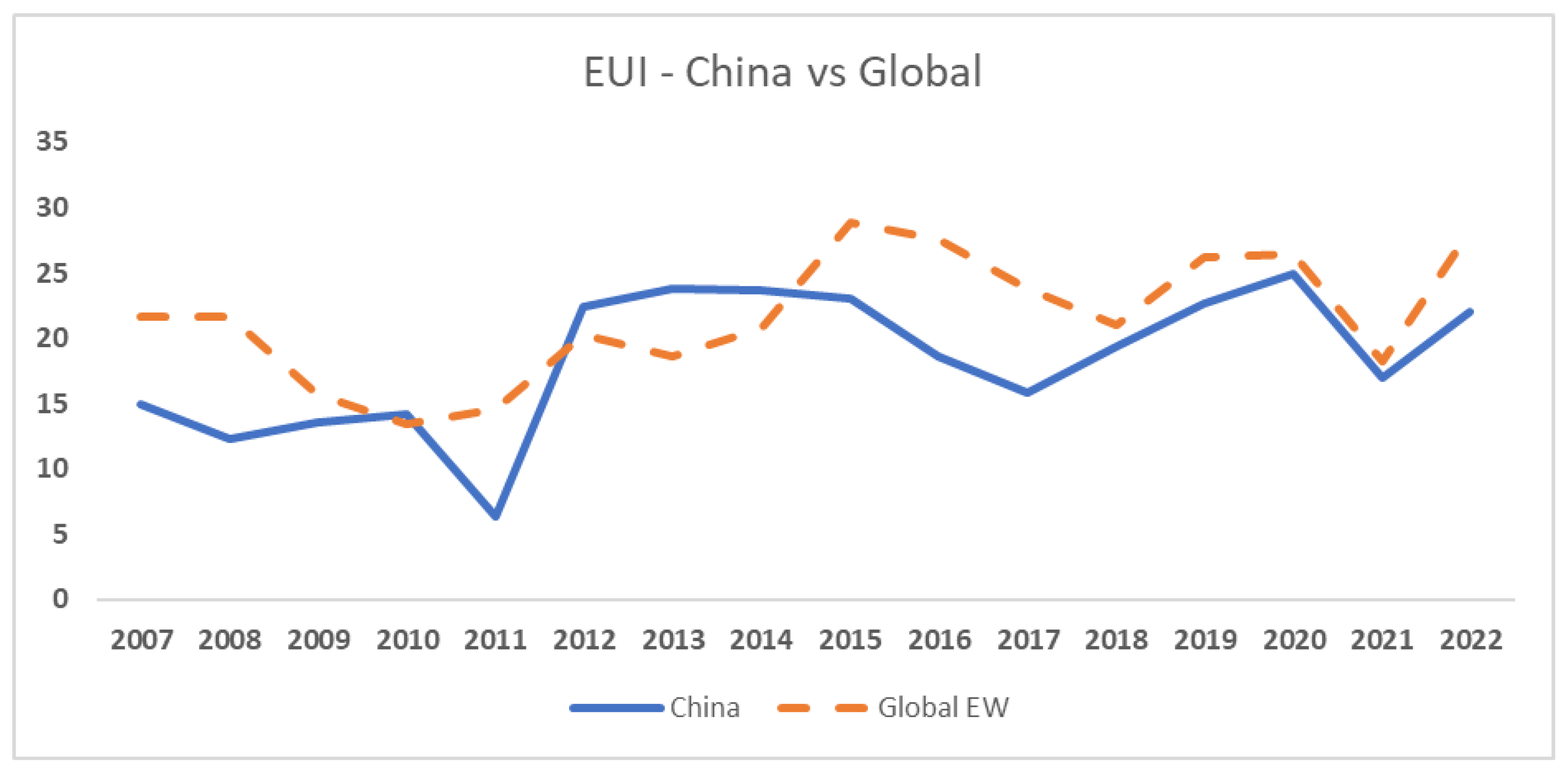

2.3. Key Changes in Energy Sector of China (2007–2022)

2.3.1. 2007–2009: Regulatory Foundations and Renewable Initiatives

2.3.2. 2010–2012: The 12th Five-Year Plan

2.3.3. 2013–2016: Market Liberalization and Global Integration

2.3.4. 2017–2018: Response to International Challenges

2.3.5. 2019–2022: Subsidy Adjustments and International Commitments

2.4. Research Gap and Objectives

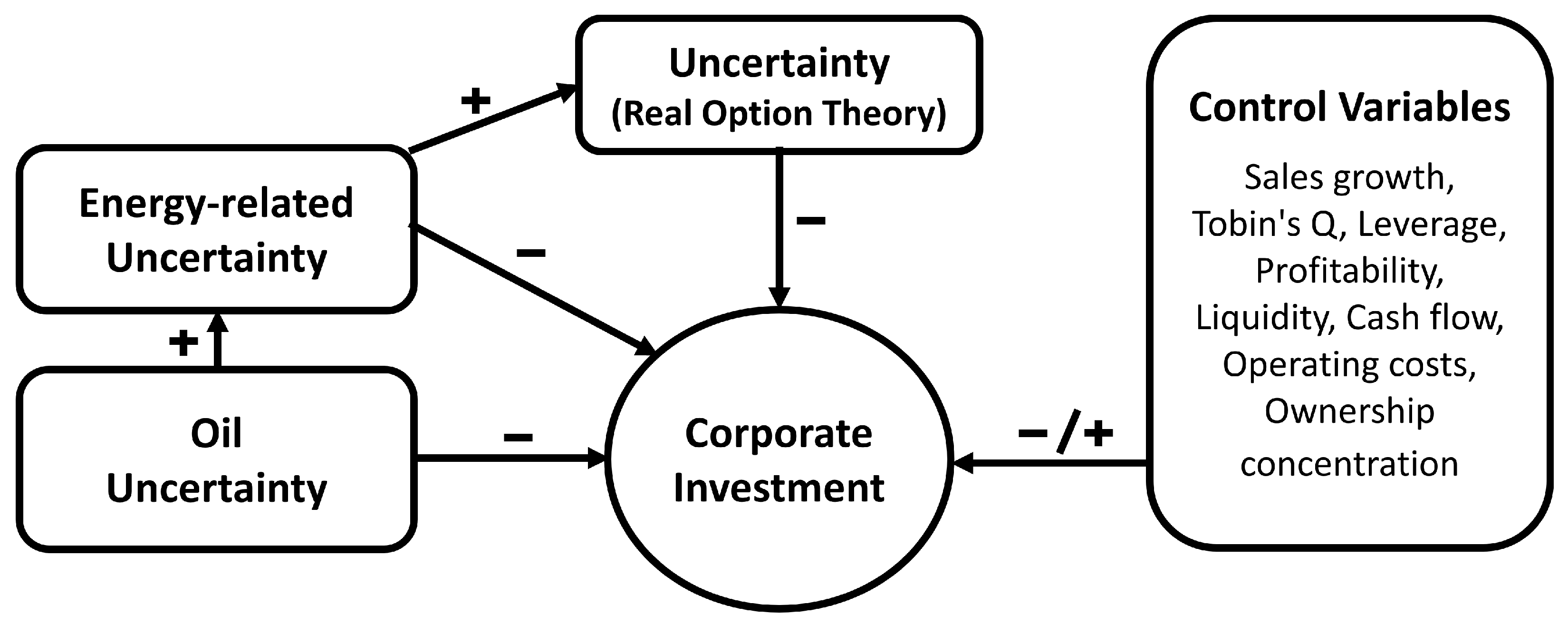

- Objective 1—Analysis of EUI Impact on Corporate Investment: This study aims to dissect the impact of the Energy-related Uncertainty Index (EUI), as proposed by [10], on the investment decisions of Chinese corporations.

- Objective 2—Differential Impact Across Sectors: The second objective is to assess the varying degrees of the EUI’s influence across firms within the energy-related sector compared to those in non-energy sectors. This comparative analysis aims to unravel whether the effects of energy uncertainty, as encapsulated by the EUI, are more pronounced in energy-centric firms or extend significantly to companies in other sectors, thus uncovering the sector-specific nuances in response to energy uncertainties.

2.5. Theoretical Model

3. Data, Variables and Research Design

3.1. Data

3.2. Main Variables

3.2.1. Energy-Related Uncertainty (EUI)

3.2.2. Corporate Investment

3.2.3. Control Variables

- Financial Leverage (LEVG), Cash Flows (CFlow), Return on Total Assets (ROA), Administration Costs (Adexp), Largest Equity-Ownership Holder (T1), Equity-Ownership Concentration (HI5), Tobin’s Q (TQ), Growth in Sales (SGR), Liquidity (LIQ), and Borrowing Capacity (BC), all of which are dimensionless ratios. These ratios effectively normalize various financial metrics against total assets or other financial metrics to provide comparative insights across different firms regardless of their absolute sizes.

- Firm Size (FSIZE) is measured using the natural logarithm of total assets, reflecting a logarithmic transformation that helps in managing the wide variations in firm sizes, thus enabling a more meaningful comparison across firms by reducing the skewness often found in raw financial data.

3.3. Descriptive Statistics

3.4. Econometric Model Specification

3.5. Methods of Diagnostic Analysis

4. Results and Discussion

4.1. Impact of Energy-Related Uncertainty Index (EUI) on Corporate Investment

4.2. Impact of EUI on Energy-Related Firms

5. Robustness Analysis

5.1. Alternative Energy Uncertainty Measures

5.2. Placebo Tests

6. Conclusions, Practical Significance and Future Directions

6.1. Conclusions

6.2. Practical Significance

- Corporate Investment Strategy: The identification of a negative relationship between EUI and corporate investment is of vital importance for business leaders. Firms, especially those in the energy sector, can apply this insight to tailor their investment strategies in the face of variable energy uncertainty. Strategies might include diversifying investment portfolios, enhancing risk management measures, or postponing investments until periods of lower uncertainty.

- Policy Formulation: These findings can be instrumental for policymakers in developing and refining energy policies aimed at stabilizing the energy market and mitigating uncertainties. Recognizing the differential impacts on diverse firm types, policies can be tailored to support sectors or businesses more vulnerable to energy uncertainties.

- Investment in Renewable Energy: As the importance of sustainable energy sources grows, our research provides pivotal guidance for investments in renewable energy initiatives. Understanding the influence of energy uncertainties on traditional energy sectors aids investors and corporations in diversifying their portfolios, including investments in more stable renewable energy ventures.

- Risk Management for Investors: For investors contemplating entering the Chinese market or investing in energy-related stocks, this study offers crucial insights for a more nuanced risk assessment. Knowledge of how different firms react to energy uncertainties enables investors to make more judicious investment decisions.

- Global Implications: While the focus of the study is China, the implications are globally pertinent, given China’s significant role in the global energy market. International firms and investors can use these insights to better navigate the global energy landscape and understand the impact of energy uncertainties on investment behaviors in other emerging economies.

6.3. Research Limitations

6.4. Future Directions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Dixit, A.K.; Pindyck, R.S. Investment under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Bloom, N.; Bond, S.; Van Reenen, J. Uncertainty and Investment Dynamics. Rev. Econ. Stud. 2007, 74, 391–415. [Google Scholar] [CrossRef]

- Bloom, N. The impact of uncertainty shocks. Econometrica 2009, 77, 623–685. [Google Scholar]

- Gulen, H.; Ion, M. Policy uncertainty and corporate investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- An, H.; Chen, Y.; Luo, D.; Zhang, T. Political uncertainty and corporate investment: Evidence from China. J. Corp. Financ. 2016, 36, 174–189. [Google Scholar] [CrossRef]

- Zhu, W.; Yang, J. Pandemic uncertainty and socially responsible investments. Front. Public Health 2021, 9, 661482. [Google Scholar] [CrossRef] [PubMed]

- Szczygielski, J.J.; Brzeszczyński, J.; Charteris, A.; Bwanya, P.R. The COVID-19 storm and the energy sector: The impact and role of uncertainty. Energy Econ. 2022, 109, 105258. [Google Scholar] [CrossRef] [PubMed]

- Fuss, S.; Szolgayova, J.; Obersteiner, M.; Gusti, M. Investment under Market and Climate Policy Uncertainty. Appl. Energy 2008, 85, 708–721. [Google Scholar] [CrossRef]

- Yoon, K.H.; Ratti, R.A. Energy price uncertainty, energy intensity and firm investment. Energy Econ. 2011, 33, 67–78. [Google Scholar] [CrossRef]

- Dang, T.H.N.; Nguyen, C.P.; Lee, G.S.; Nguyen, B.Q.; Le, T.T. Measuring the energy-related uncertainty index. Energy Econ. 2023, 124, 106817. [Google Scholar] [CrossRef]

- Gavriilidis, K. Measuring Climate Policy Uncertainty. 2021. Available online: https://ssrn.com/abstract=3847388 (accessed on 24 September 2023).

- Lopez, J.M.R.; Sakhel, A.; Busch, T. Corporate investments and environmental regulation: The role of regulatory uncertainty, regulation-induced uncertainty, and investment history. Eur. Manag. J. 2017, 35, 91–101. [Google Scholar] [CrossRef]

- Tylock, S.M.; Seager, T.P.; Snell, J.; Bennett, E.R.; Sweet, D. Energy management under policy and technology uncertainty. Energy Policy 2012, 47, 156–163. [Google Scholar] [CrossRef]

- Hou, F.; Tang, W.; Wang, H.; Xiong, H. Economic policy uncertainty, marketization level and firm-level inefficient investment: Evidence from Chinese listed firms in energy and power industries. Energy Econ. 2021, 100, 105353. [Google Scholar] [CrossRef]

- Yang, B.; An, H.; Song, X. Oil price uncertainty and corporate inefficient investment: Evidence from China. N. Am. J. Econ. Financ. 2024, 70, 102089. [Google Scholar] [CrossRef]

- Chen, X.; Li, Y.; Xiao, J.; Wen, F. Oil shocks, competition, and corporate investment: Evidence from China. Energy Econ. 2020, 89, 104819. [Google Scholar] [CrossRef]

- Singh, A. Oil price uncertainty and corporate inventory investment. Int. J. Manag. Financ. 2023. [Google Scholar] [CrossRef]

- Atsu, F.; Adams, S. Energy consumption, finance, and climate change: Does policy uncertainty matter? Econ. Anal. Policy 2021, 70, 490–501. [Google Scholar] [CrossRef]

- Yang, M.; Blyth, W.; Bradley, R.; Bunn, D.; Clarke, C.; Wilson, T. Evaluating the power investment options with uncertainty in climate policy. Energy Econ. 2008, 30, 1933–1950. [Google Scholar] [CrossRef]

- Adams, S.; Adedoyin, F.; Olaniran, E.; Bekun, F.V. Energy consumption, economic policy uncertainty and carbon emissions; causality evidence from resource rich economies. Econ. Anal. Policy 2020, 68, 179–190. [Google Scholar] [CrossRef]

- Ren, X.; Li, J.; He, F.; Lucey, B. Impact of climate policy uncertainty on traditional energy and green markets: Evidence from time-varying granger tests. Renew. Sustain. Energy Rev. 2023, 173, 113058. [Google Scholar] [CrossRef]

- Knight, F.H. Risk, Uncertainty and Profit; Houghton Mifflin: Boston, MA, USA, 1921; Volume 31. [Google Scholar]

- Hartman, R. The effects of price and cost uncertainty on investment. J. Econ. Theory 1972, 5, 258–266. [Google Scholar] [CrossRef]

- Abel, A.B. Optimal investment under uncertainty. Am. Econ. Rev. 1983, 73, 228–233. [Google Scholar]

- Abel, A.B.; Blanchard, O.J. Investment and Sales: Some Empirical Evidence; Cambridge University Press: New York, NY, USA, 1986. [Google Scholar]

- Caballero, R.J. On the sign of the investment-uncertainty relationship. Am. Econ. Rev. 1991, 81, 279–288. [Google Scholar]

- Bernanke, B.S. Irreversibility, uncertainty, and cyclical investment. Q. J. Econ. 1983, 98, 85–106. [Google Scholar] [CrossRef]

- McDonald, R.; Siegel, D. The Value of Waiting to Invest. Q. J. Econ. 1986, 101, 707–727. [Google Scholar] [CrossRef]

- Campbell, J.A. Real options analysis of the timing of IS investment decisions. Inf. Manag. 2002, 39, 337–344. [Google Scholar] [CrossRef]

- Bulan, L.T. Real options, irreversible investment and firm uncertainty: New evidence from US firms. Rev. Financ. Econ. 2005, 14, 255–279. [Google Scholar] [CrossRef]

- Xie, F. Managerial flexibility, uncertainty, and corporate investment: The real options effect. Int. Rev. Econ. Financ. 2009, 18, 643–655. [Google Scholar] [CrossRef]

- Tong, T.W.; Li, Y. Real options and investment mode: Evidence from corporate venture capital and acquisition. Organ. Sci. 2011, 22, 659–674. [Google Scholar] [CrossRef]

- Elder, J. Oil price volatility and real options: 35 years of evidence. J. Futures Mark. 2019, 39, 1549–1564. [Google Scholar] [CrossRef]

- Chen, X.; Le, C.H.A.; Shan, Y.; Taylor, S. Australian policy uncertainty and corporate investment. Pac.-Basin Financ. J. 2020, 61, 101341. [Google Scholar] [CrossRef]

- Blyth, W.; Bradley, R.; Bunn, D.; Clarke, C.; Wilson, T.; Yang, M. Investment risks under uncertain climate change policy. Energy Policy 2007, 35, 5766–5773. [Google Scholar] [CrossRef]

- Imbet, J.F. Stroke of a Pen: Investment and Stock Returns under Energy Policy Uncertainty. Université Paris-Dauphine Research Paper. 2020. Available online: https://ssrn.com/abstract=3711536 (accessed on 26 September 2023).

- Phan, D.H.B.; Tran, V.T.; Nguyen, D.T. Crude oil price uncertainty and corporate investment: New global evidence. Energy Econ. 2019, 77, 54–65. [Google Scholar] [CrossRef]

- Maghyereh, A.; Abdoh, H. Asymmetric effects of oil price uncertainty on corporate investment. Energy Econ. 2020, 86, 104622. [Google Scholar] [CrossRef]

- Fan, Z.; Zhang, Z.; Zhao, Y. Does oil price uncertainty affect corporate leverage? Evidence from China. Energy Econ. 2021, 98, 105252. [Google Scholar] [CrossRef]

- National Development and Reform Commission (NDRC). Medium and Long-Term Development Plan for Renewable Energy in China. 2007. Available online: http://www.martinot.info/China_RE_Plan_to_2020_Sep-2007.pdf (accessed on 12 September 2023).

- Zhang, S.; Andrews-Speed, P.; Zhao, X. Political and institutional analysis of the successes and failures of China’s wind power policy. Energy Policy 2013, 56, 331–340. [Google Scholar] [CrossRef]

- State Council. 12th Five-Year Plan for Energy Development. 2013. Available online: http://www.gov.cn/xxgk/pub/govpublic/mrlm/201301/t20130123_65878.html (accessed on 14 September 2023).

- Zhang, C.; Heller, T.C. Electricity market reform in China: Economics and institutions. Oxf. Rev. Econ. Policy 2017, 33, 583–612. [Google Scholar]

- Lewis, J.I. Green Innovation in China: China’s Wind Power Industry and the Global Transition to a Low-Carbon Economy; Columbia University Press: New York, NY, USA, 2016. [Google Scholar]

- Morrison, W.M. China-U.S. Trade Issues—FAS Project on Government Secrecy. 2019. Available online: https://sgp.fas.org/crs/row/RL33536.pdf (accessed on 9 September 2023).

- Zhang, L.; Zhou, D.; Chang, J. The financial sustainability of China’s renewable energy subsidies: Lessons from the Spanish renewable energy crisis. Renew. Energy 2021, 163, 34–47. [Google Scholar] [CrossRef]

- Tsang, S.; Zhang, Z. China’s Route to Carbon Neutrality: Perspectives and the Role of Renewables. 2022. Available online: https://www.irena.org/Publications/2022/Jul/Chinas-Route-to-Carbon-Neutrality (accessed on 21 September 2023).

- Jing, Z.; Lu, S.; Zhao, Y.; Zhou, J. Economic policy uncertainty, corporate investment decisions and stock price crash risk: Evidence from China. Account. Financ. 2023, 63, 1477–1502. [Google Scholar] [CrossRef]

- Hamilton, J.D. Causes and Consequences of the Oil Shock of 2007–08; Report; National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar]

- Kilian, L. The economic effects of energy price shocks. J. Econ. Lit. 2008, 46, 871–909. [Google Scholar] [CrossRef]

- Afkhami, M.; Cormack, L.; Ghoddusi, H. Google search keywords that best predict energy price volatility. Energy Econ. 2017, 67, 17–27. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. The effect of oil price volatility on strategic investment. Energy Econ. 2011, 33, 79–87. [Google Scholar] [CrossRef]

- Jiang, F.; Cai, W.; Wang, X.; Zhu, B. Multiple large shareholders and corporate investment: Evidence from China. J. Corp. Financ. 2018, 50, 66–83. [Google Scholar] [CrossRef]

- Meng, X.; Guo, H.; Li, J. Economic policy uncertainty and corporate investment: Evidence from China. Econ. Change Restruct. 2023, 56, 4491–4529. [Google Scholar] [CrossRef]

- Zhang, Z.; Cheng, S.; Wang, C.; Song, S.; Feng, Y. Climate policy uncertainty and corporate investment efficiency: Evidence from China. J. Environ. Plan. Manag. 2023, 1–21. [Google Scholar] [CrossRef]

- O’brien, R.M. A caution regarding rules of thumb for variance inflation factors. Qual. Quant. 2007, 41, 673–690. [Google Scholar] [CrossRef]

- James, G.; Witten, D.; Hastie, T.; Tibshirani, R. An Introduction to Statistical Learning; Springer: New York, NY, USA, 2013; Volume 112. [Google Scholar]

- Tamura, R.; Kobayashi, K.; Takano, Y.; Miyashiro, R.; Nakata, K.; Matsui, T. Mixed integer quadratic optimization formulations for eliminating multicollinearity based on variance inflation factor. J. Glob. Optim. 2019, 73, 431–446. [Google Scholar] [CrossRef]

- Granger, C.W.; Newbold, P. Spurious regressions in econometrics. J. Econom. 1974, 2, 111–120. [Google Scholar] [CrossRef]

- Davidson, R.; MacKinnon, J.G. Estimation and Inference in Econometrics; Oxford University Press: New York, NY, USA, 1993; Volume 63. [Google Scholar]

- Kleinbaum, D.; Kupper, L.; Nizam, A.; Rosenberg, E. Applied Regression Analysis and Other Multivariable Methods; Cengage Learning: Boston, MA, USA, 2013. [Google Scholar]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Petersen, M.A. Estimating standard errors in finance panel data sets: Comparing approaches. Rev. Financ. Stud. 2008, 22, 435–480. [Google Scholar] [CrossRef]

- Cameron, A.C.; Miller, D.L. A practitioner’s guide to cluster-robust inference. J. Hum. Resour. 2015, 50, 317–372. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification tests in econometrics. Econom. J. Econom. Soc. 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Fazzari, S.; Hubbard, R.G.; Petersen, B.C. Financing Constraints and Corporate Investment; National Bureau of Economic Research: Cambridge, MA, USA, 1987. [Google Scholar]

- Dechow, P.M.; Kothari, S.P.; Watts, R.L. The relation between earnings and cash flows. J. Account. Econ. 1998, 25, 133–168. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Myers, S.C. Determinants of corporate borrowing. J. Financ. Econ. 1977, 5, 147–175. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. Large shareholders and corporate control. J. Political Econ. 1986, 94, 461–488. [Google Scholar] [CrossRef]

- Porter, M.E.; Strategy, C. Techniques for Analyzing Industries and Competitors; Competitive Strategy; Free Press: New York, NY, USA, 1980. [Google Scholar]

- Tobin, J. A general equilibrium approach to monetary theory. J. Money Credit. Bank. 1969, 1, 15–29. [Google Scholar] [CrossRef]

- Opler, T.; Pinkowitz, L.; Stulz, R.; Williamson, R. The determinants and implications of corporate cash holdings. J. Financ. Econ. 1999, 52, 3–46. [Google Scholar] [CrossRef]

- Rajan, R.G.; Zingales, L. What do we know about capital structure? Some evidence from international data. J. Financ. 1995, 50, 1421–1460. [Google Scholar] [CrossRef]

- Brealey, R.A.; Myers, S.C.; Allen, F. Principles of Corporate Finance; McGraw-Hill: New York, NY, USA, 2014. [Google Scholar]

- Wen, H.; Lee, C.C.; Zhou, F. How does fiscal policy uncertainty affect corporate innovation investment? Evidence from China’s new energy industry. Energy Econ. 2022, 105, 105767. [Google Scholar] [CrossRef]

- Cao, H.; Sun, P.; Guo, L. The asymmetric effect of oil price uncertainty on corporate investment in China: Evidence from listed renewable energy companies. Front. Energy Res. 2020, 8, 47. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, C.R.; Huang, Y.S. Economic policy uncertainty and corporate investment: Evidence from China. Pac.-Basin Financ. J. 2014, 26, 227–243. [Google Scholar] [CrossRef]

| Variable | Symbol | Definition |

|---|---|---|

| Dependent Variable | ||

| Corporate Investment | CINV | Expenditure on fixed assets, intangible assets, and other long-term assets, adjusted relative to total assets at the year end. |

| Independent [Main] | ||

| Energy-related Uncertainty Index | EUI | Derived from a text analysis of monthly country reports from the Economist Intelligence Unit (EIU). |

| Independent [Control] | ||

| Financial Leverage | LEVG | Ratio of total debt to total assets. |

| Cash flows | CFlow | Net cash flow from operating activities divided by total assets. |

| Return on total assets | ROA | Net profit divided by average total assets. |

| Administration costs | Adexp | Administrative expenses divided by gross revenue. |

| Largest equity-ownership holder | T1 | Ownership proportion of the largest shareholder. |

| Equity-ownership concentration | HI5 | Herfindahl index of the top five shareholders. |

| Tobin’s Q | TQ | Market value of the firm divided by total assets. |

| Growth in Sales | SGR | Year-over-year growth in sales. |

| Liquidity | LIQ | Sum of cash and tradable financial assets divided by total assets. |

| Borrowing capacity | BC | Proportion of fixed assets relative to total assets. |

| Firm Size | FSIZE | Natural logarithm of the total assets of the firm. |

| Variable | Mean | St.dev | 25% | 50% | 75% | Obsv. |

|---|---|---|---|---|---|---|

| CINV | 0.061 | 0.066 | 0.016 | 0.040 | 0.083 | 22,346 |

| EUI | 18.400 | 5.078 | 14.721 | 18.954 | 22.741 | 22,346 |

| ROA | 0.047 | 0.057 | 0.017 | 0.042 | 0.075 | 22,346 |

| Adexp | 0.096 | 0.079 | 0.047 | 0.078 | 0.117 | 22,346 |

| SGR | 0.164 | 0.327 | −0.009 | 0.118 | 0.273 | 22,346 |

| LEVG | 0.409 | 0.206 | 0.242 | 0.400 | 0.564 | 22,346 |

| T1 | 0.344 | 0.144 | 0.228 | 0.325 | 0.444 | 22,346 |

| HI5 | 0.162 | 0.112 | 0.076 | 0.136 | 0.223 | 22,346 |

| TQ | 2.346 | 2.004 | 0.990 | 1.759 | 3.036 | 22,346 |

| CFlow | 0.042 | 0.072 | 0.003 | 0.041 | 0.084 | 22,346 |

| LIQ | 0.196 | 0.145 | 0.093 | 0.152 | 0.256 | 22,346 |

| BC | 0.218 | 0.161 | 0.092 | 0.185 | 0.312 | 22,346 |

| FSIZE | 9.108 | 0.505 | 8.741 | 9.058 | 9.419 | 22,346 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| EUI | −0.057 *** | −0.045 *** | |

| [0.000] | [0.000] | ||

| ROA | 0.078 *** | 0.075 *** | |

| [0.000] | [0.000] | ||

| Adex | 0.029 ** | 0.030 ** | |

| [0.059] | [0.051] | ||

| SGR | 0.001 | 0.001 | |

| [0.589] | [0.549] | ||

| LEVG | *** | *** | |

| [0.000] | [0.000] | ||

| T1 | *** | *** | |

| [0.000] | [0.000] | ||

| HI5 | *** | *** | |

| [0.000] | [0.000] | ||

| TQ | *** | *** | |

| [0.000] | [0.000] | ||

| Cflow | *** | *** | |

| [0.000] | [0.000] | ||

| LIQ | ** | ** | |

| [0.034] | [0.031] | ||

| BC | *** | *** | |

| [0.000] | [0.000] | ||

| FSize | |||

| [0.271] | [0.267] | ||

| Constant | *** | *** | *** |

| [0.000] | [0.000] | [0.000] | |

| Firm FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| No. of obs. | 22,346 | 22,346 | 22,346 |

| Adjusted | 0.076 | 0.124 | 0.141 |

| Variable | Overall | Energy-Related | Non Energy-Related |

|---|---|---|---|

| EUI | *** | *** | *** |

| [0.000] | [0.000] | [0.000] | |

| ROA | *** | *** | *** |

| [0.000] | [0.000] | [0.000] | |

| Adex | * | ** | * |

| [0.051] | [0.049] | [0.073] | |

| SGR | 0.001 | 0.001 | |

| [0.549] | [0.589] | [0.898] | |

| LEVG | *** | *** | * |

| [0.000] | [0.000] | [0.072] | |

| T1 | *** | *** | * |

| [0.000] | [0.000] | [0.067] | |

| HI5 | *** | *** | * |

| [0.000] | [0.000] | [0.092] | |

| TQ | *** | *** | *** |

| [0.000] | [0.000] | [0.000] | |

| Cflow | *** | *** | * |

| [0.000] | [0.000] | [0.088] | |

| LIQ | ** | ** | ** |

| [0.031] | [0.034] | [0.031] | |

| BC | *** | *** | *** |

| [0.000] | [0.000] | [0.000] | |

| FSize | 0.003 | 0.001 | * |

| [0.267] | [0.371] | [0.082] | |

| Constant | *** | *** | |

| [0.000] | [0.112] | [0.000] | |

| Firm FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| No. of obs. | 22,346 | 14,447 | 7899 |

| Adjusted | 0.141 | 0.152 | 0.128 |

| Variable | (1) | (2) |

|---|---|---|

| EUI | *** | *** |

| [0.000] | [0.000] | |

| ROA | *** | |

| [0.000] | ||

| Adex | ** | |

| [0.059] | ||

| SGR | 0.001 | |

| [0.589] | ||

| LEVG | *** | |

| [0.000] | ||

| T1 | *** | |

| [0.000] | ||

| HI5 | *** | |

| [0.000] | ||

| TQ | *** | |

| [0.000] | ||

| Cflow | *** | |

| [0.000] | ||

| LIQ | ** | |

| [0.034] | ||

| BC | *** | |

| [0.000] | ||

| FSize | 0.002 | |

| [0.271] | ||

| Constant | *** | *** |

| [0.000] | [0.000] | |

| Wu–Hausman F test | 0.139 | 0.139 |

| Firm FE | Yes | Yes |

| Time FE | Yes | Yes |

| No. of obs. | 22,346 | 22,346 |

| Adjusted | 0.074 | 0.123 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xie, Z.; Ali, H.; Kumar, S.; Naz, S.; Ahmed, U. The Impact of Energy-Related Uncertainty on Corporate Investment Decisions in China. Energies 2024, 17, 2368. https://doi.org/10.3390/en17102368

Xie Z, Ali H, Kumar S, Naz S, Ahmed U. The Impact of Energy-Related Uncertainty on Corporate Investment Decisions in China. Energies. 2024; 17(10):2368. https://doi.org/10.3390/en17102368

Chicago/Turabian StyleXie, Zhuyun, Hyder Ali, Suresh Kumar, Salma Naz, and Umair Ahmed. 2024. "The Impact of Energy-Related Uncertainty on Corporate Investment Decisions in China" Energies 17, no. 10: 2368. https://doi.org/10.3390/en17102368

APA StyleXie, Z., Ali, H., Kumar, S., Naz, S., & Ahmed, U. (2024). The Impact of Energy-Related Uncertainty on Corporate Investment Decisions in China. Energies, 17(10), 2368. https://doi.org/10.3390/en17102368