Mitigating Market Power and Promoting Competition in Electricity Markets through a Preventive Approach: The Role of Forward Contracts

Abstract

1. Introduction

2. Literature Review

2.1. Market Power and Preventive Antitrust Law

2.2. Forward Contract to Mitigate Market Power

3. Research Methodology

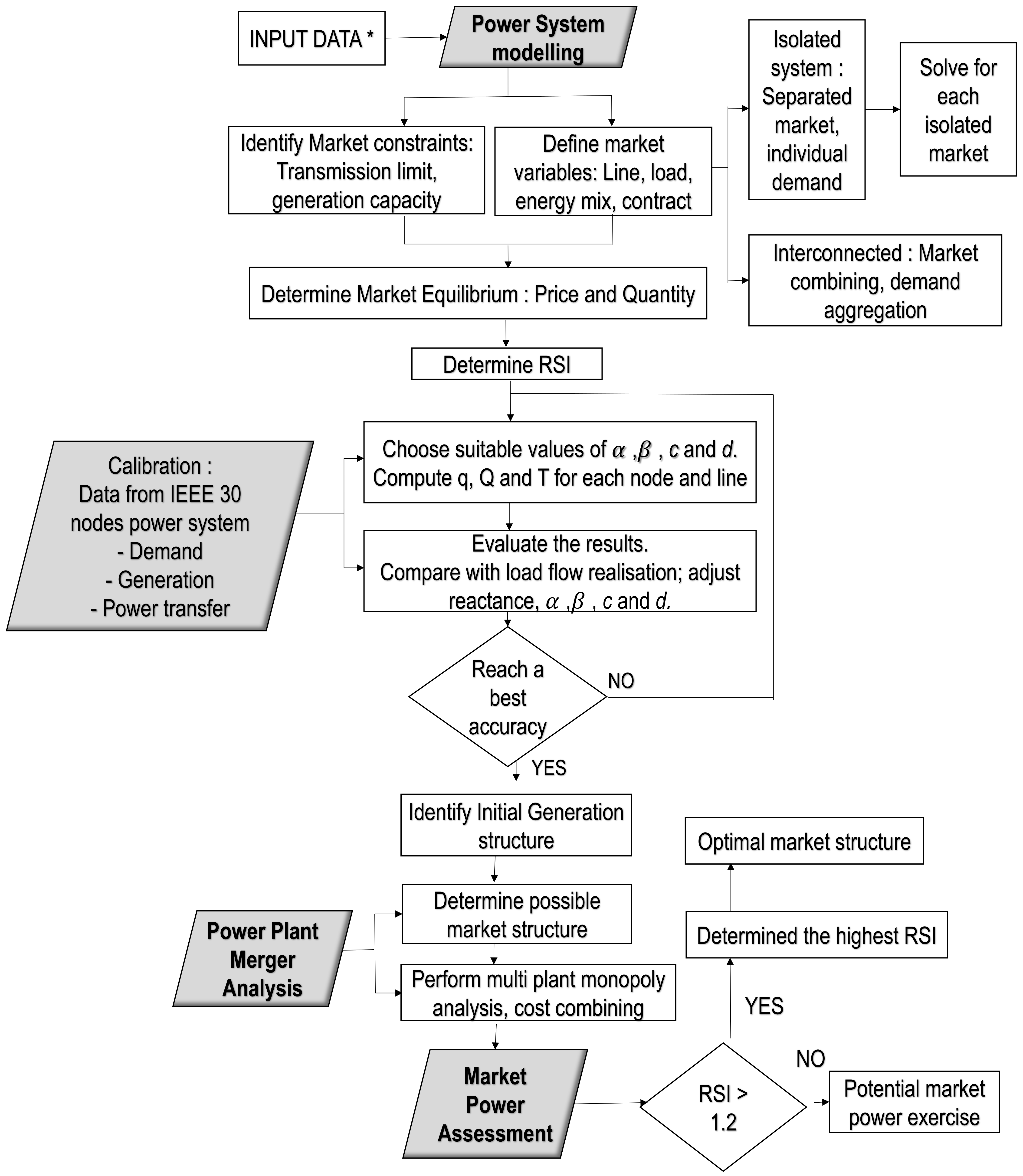

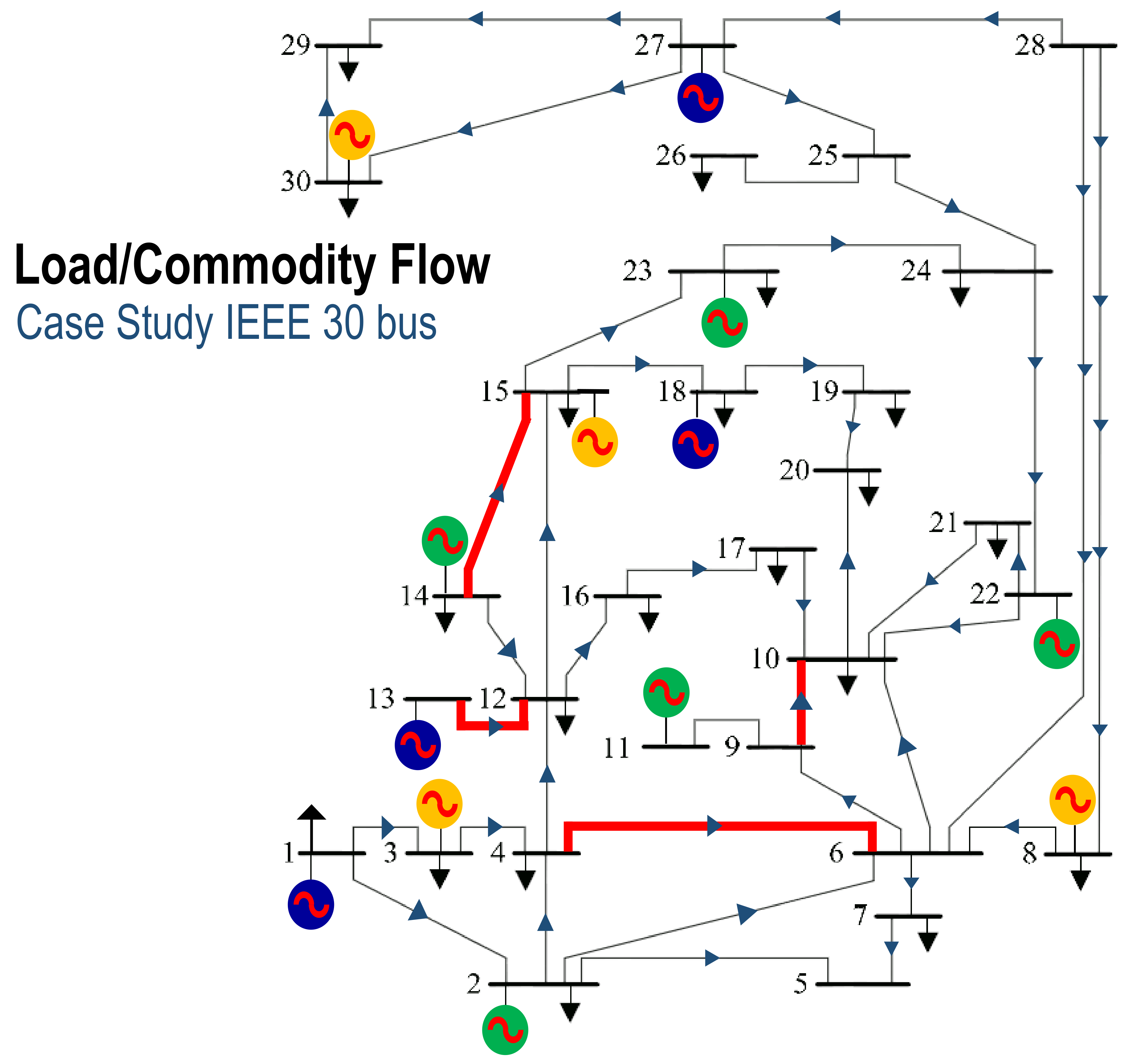

- The first step is to create a model of the nodal market using market characteristics and constraints. We developed perfect and imperfect (Cournot) competition models of the IEEE 30 nodes system by incorporating generation and transmission constraints. The perfect competition model is grounded in research conducted in [13,14,15,26,27,28,29,30]. The research on Cournot competition modeling served as the basis for our implementation of this approach in the study. Specifically, we relied on the work of [4,11,13,31,32]. The constraints related to generation include capacity, energy mix, and reserve margin, whereas transmission constraints encompass DC load flow, transmission limits, and line connections.

- The model is then calibrated to match the actual conditions of the power system in the second step. This includes examining market power behavior during peak loads. This step is critical for ensuring that the model accurately reflects the power system’s real-world conditions.

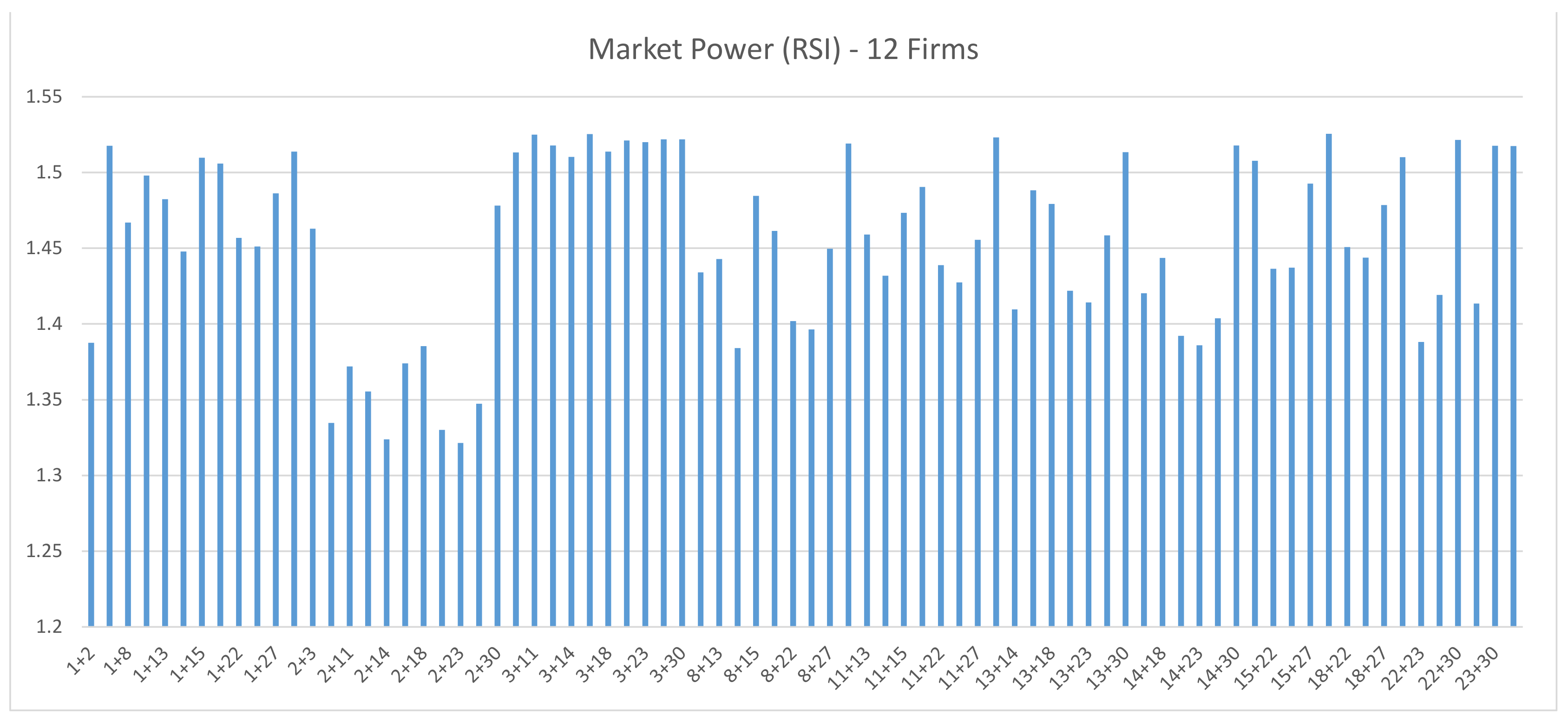

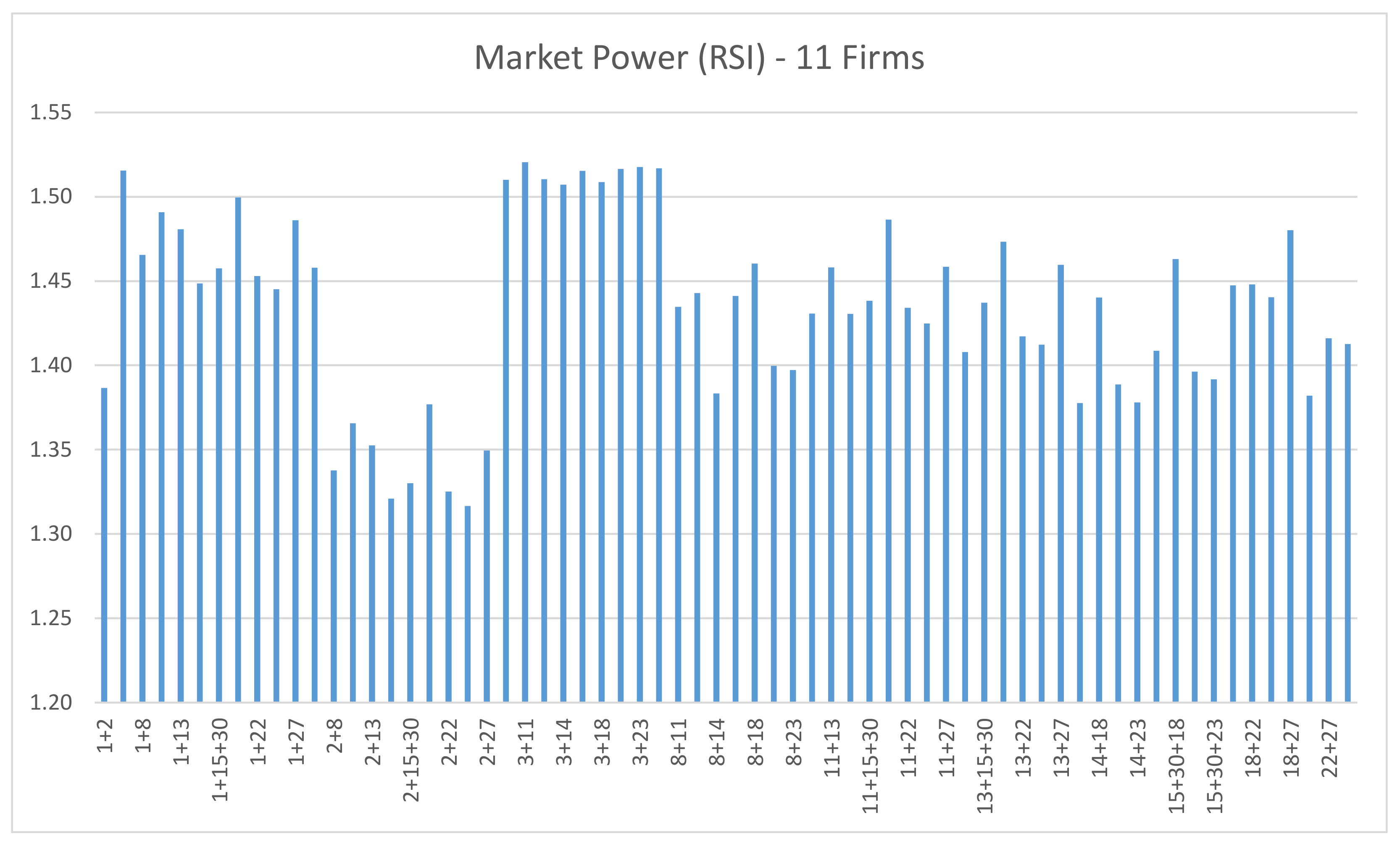

- The third step is to use a power plant merger analysis to examine potential market structure configurations. We assume that companies that own multiple power plants behave as multi-plant monopolists [33]. This step takes into account things such as the initial generation structure and the presence of independent power plants. The goal is to determine the best ownership structure and succession company mix.

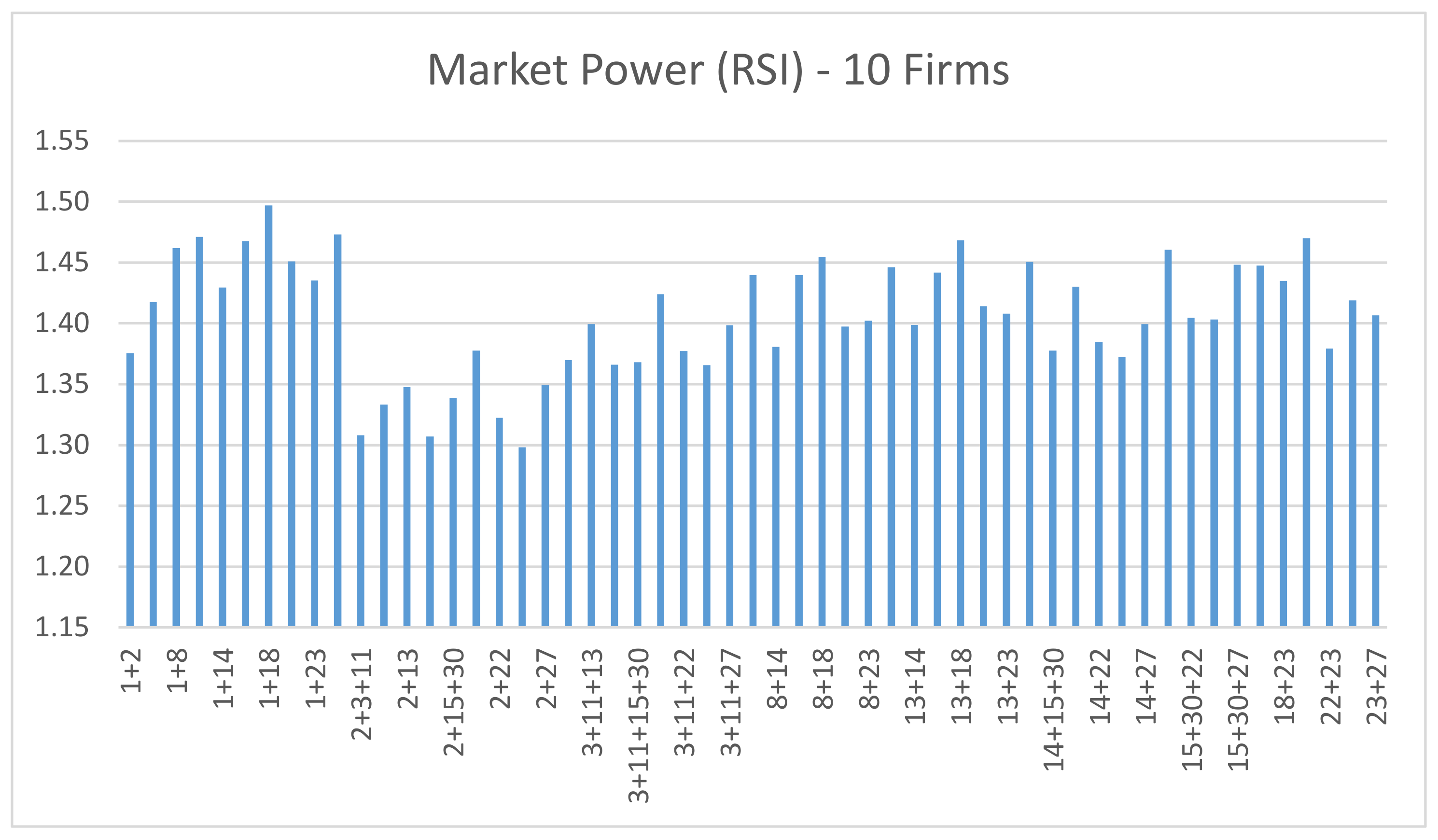

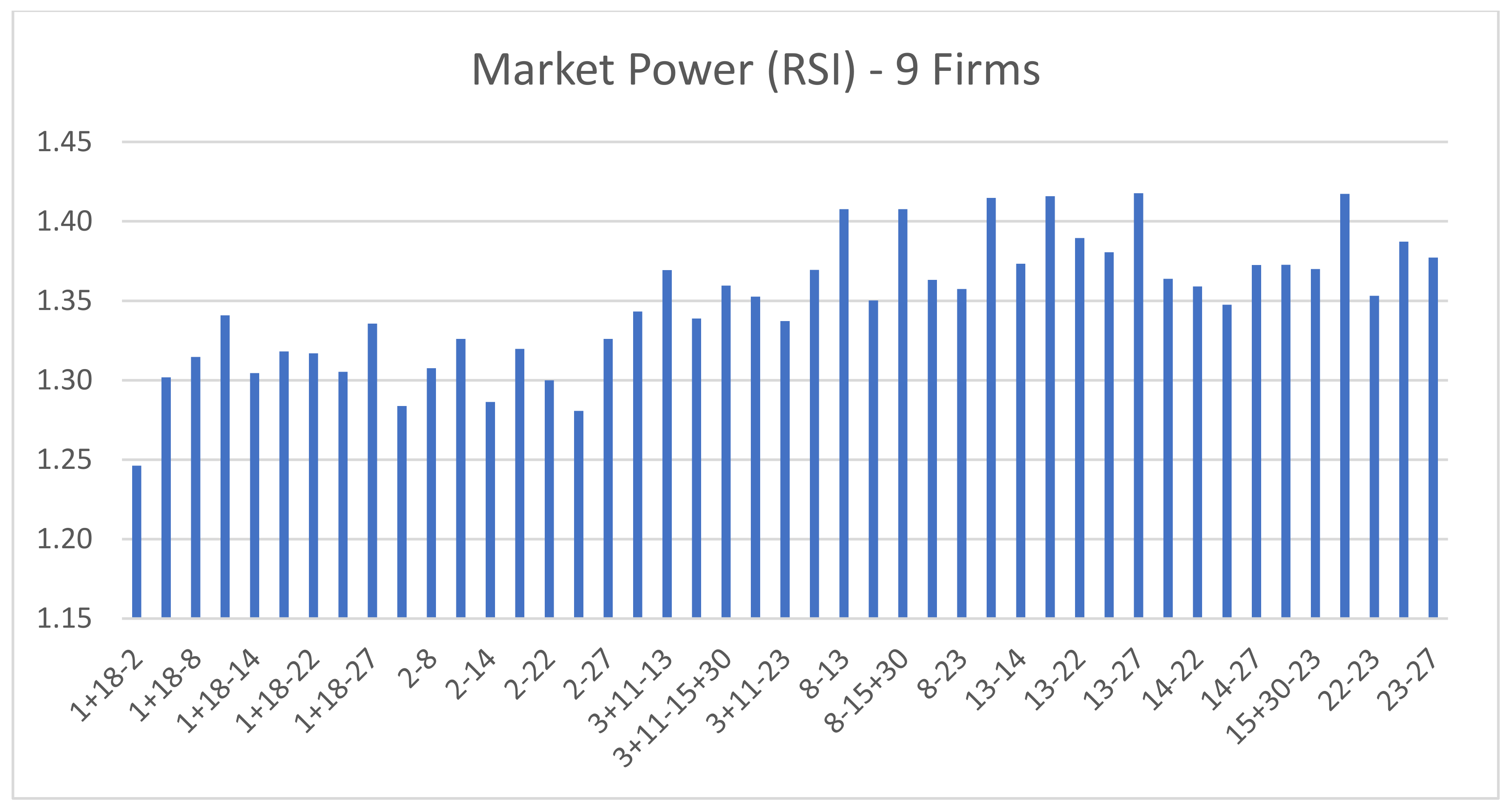

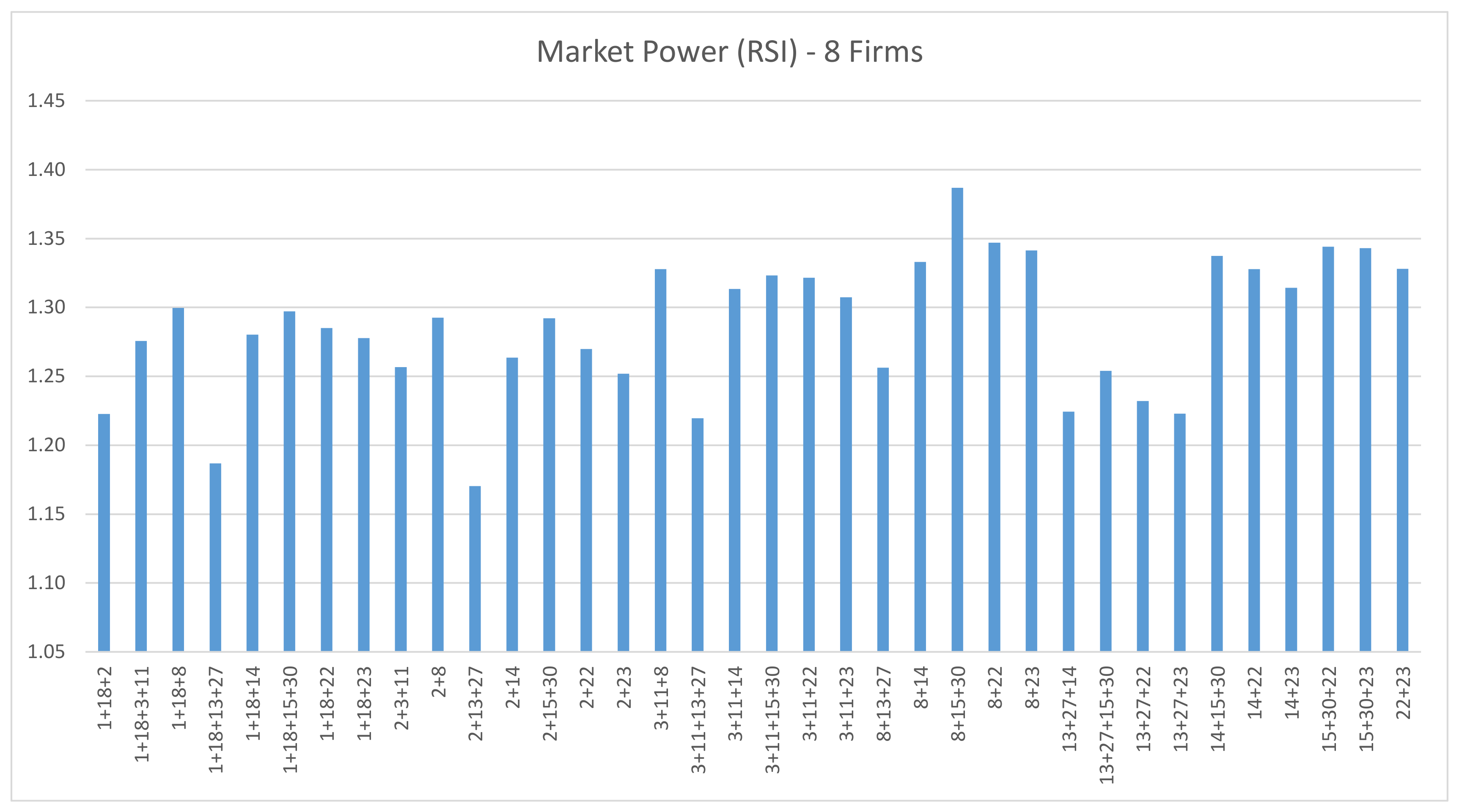

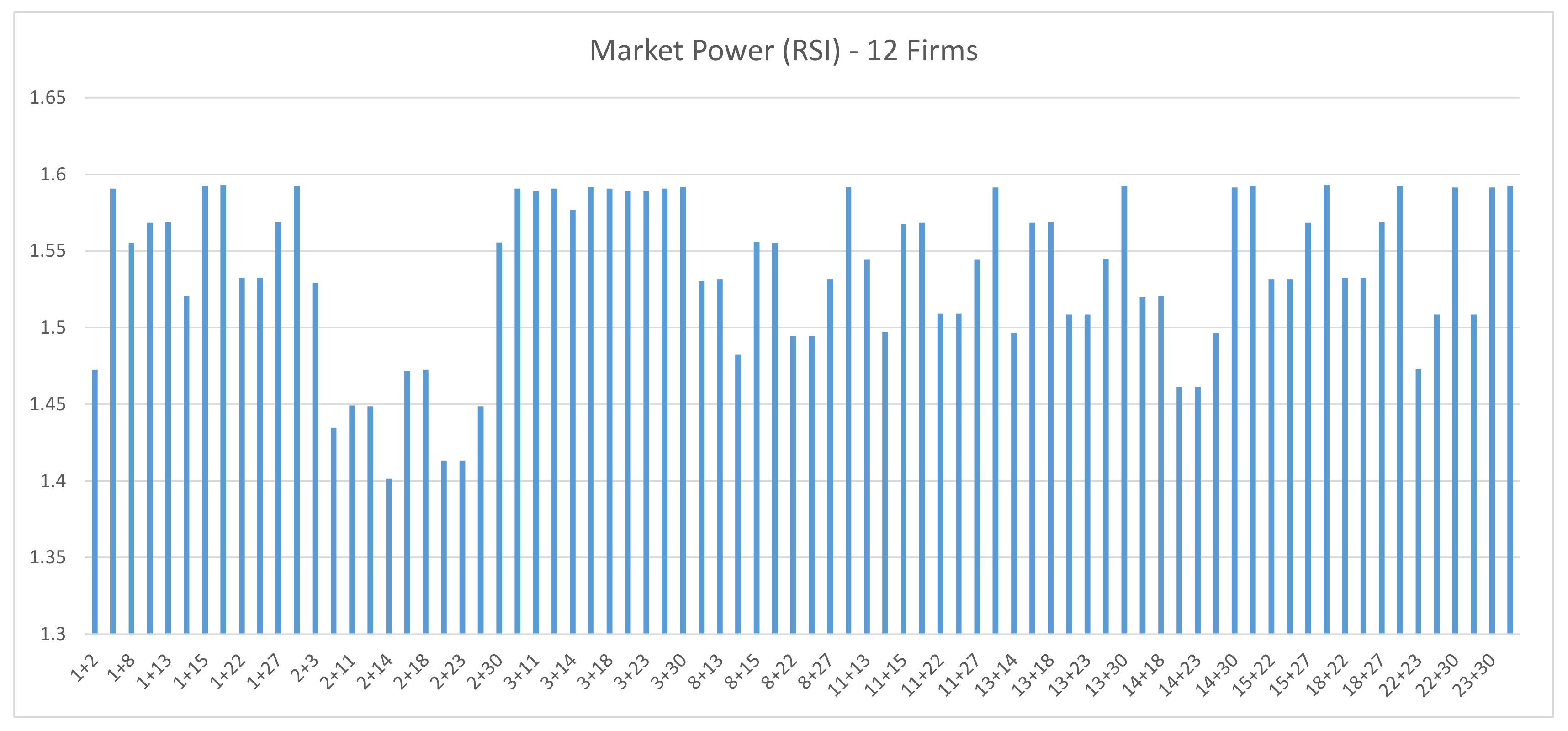

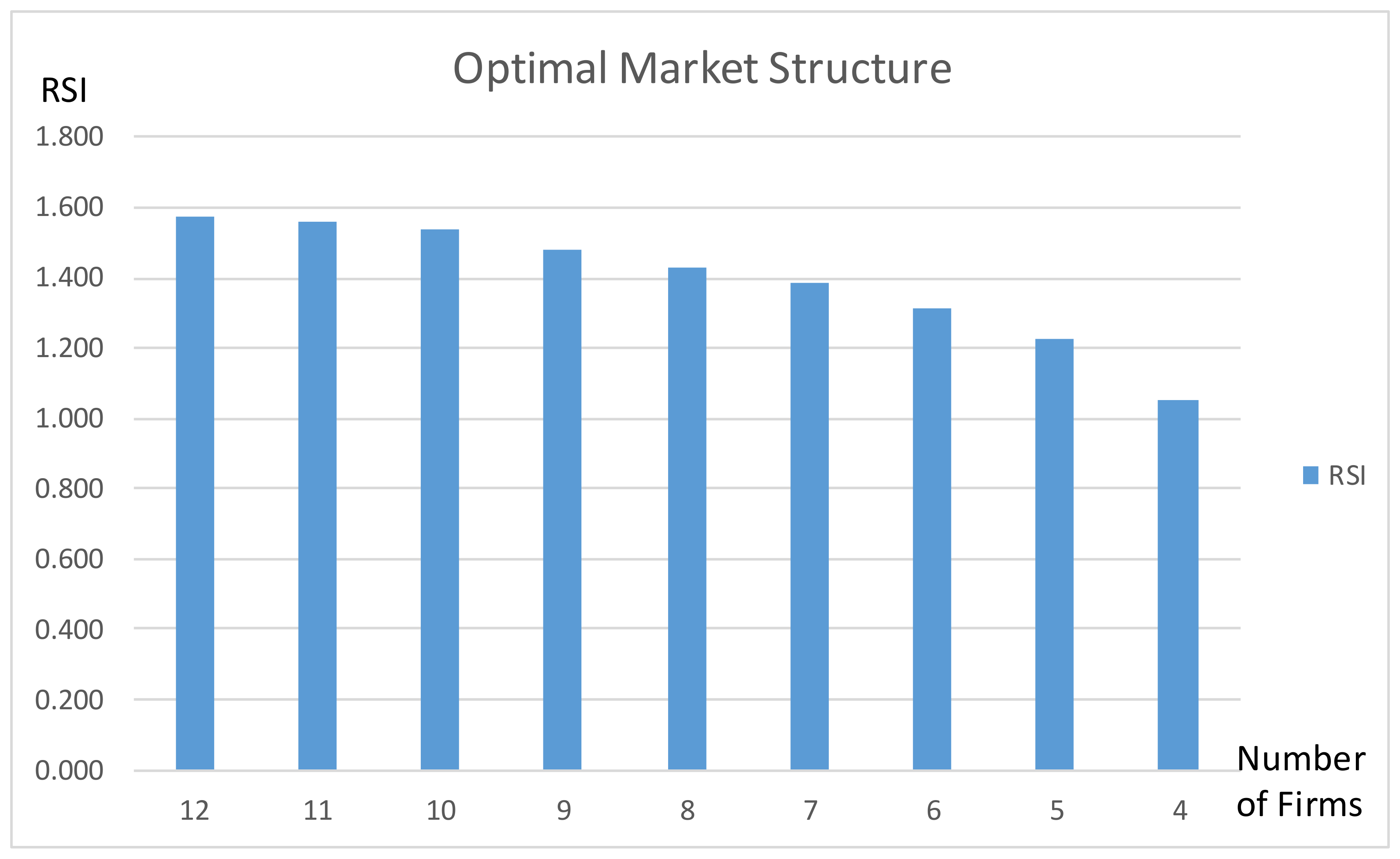

- The final step is to assess market power using the Residual Supply Index (RSI) and consider any additional capacity investments that may be required. This step ensures that the market structure is competitive, and that welfare is maximized while addressing any issues with generation capacity and reserve margin. Based on the empirical study in [7,8,9], we used a screening process to determine the optimal market structure for each configuration. The screening process was based on an RSI threshold of 110%.

3.1. Nodal Pricing and DC Power Transmission System

3.2. Supply and Demand

3.3. ISO Problem in Nodal Pricing

3.4. Cournot Equilibrium Determination

4. Case Study and Numerical Results

4.1. Case Study: Modified IEEE 30 Bus

4.2. Numerical Results

4.2.1. Base Case: Nodal Pricing with Transmission Constraint

4.2.2. Second Case: Cournot Model

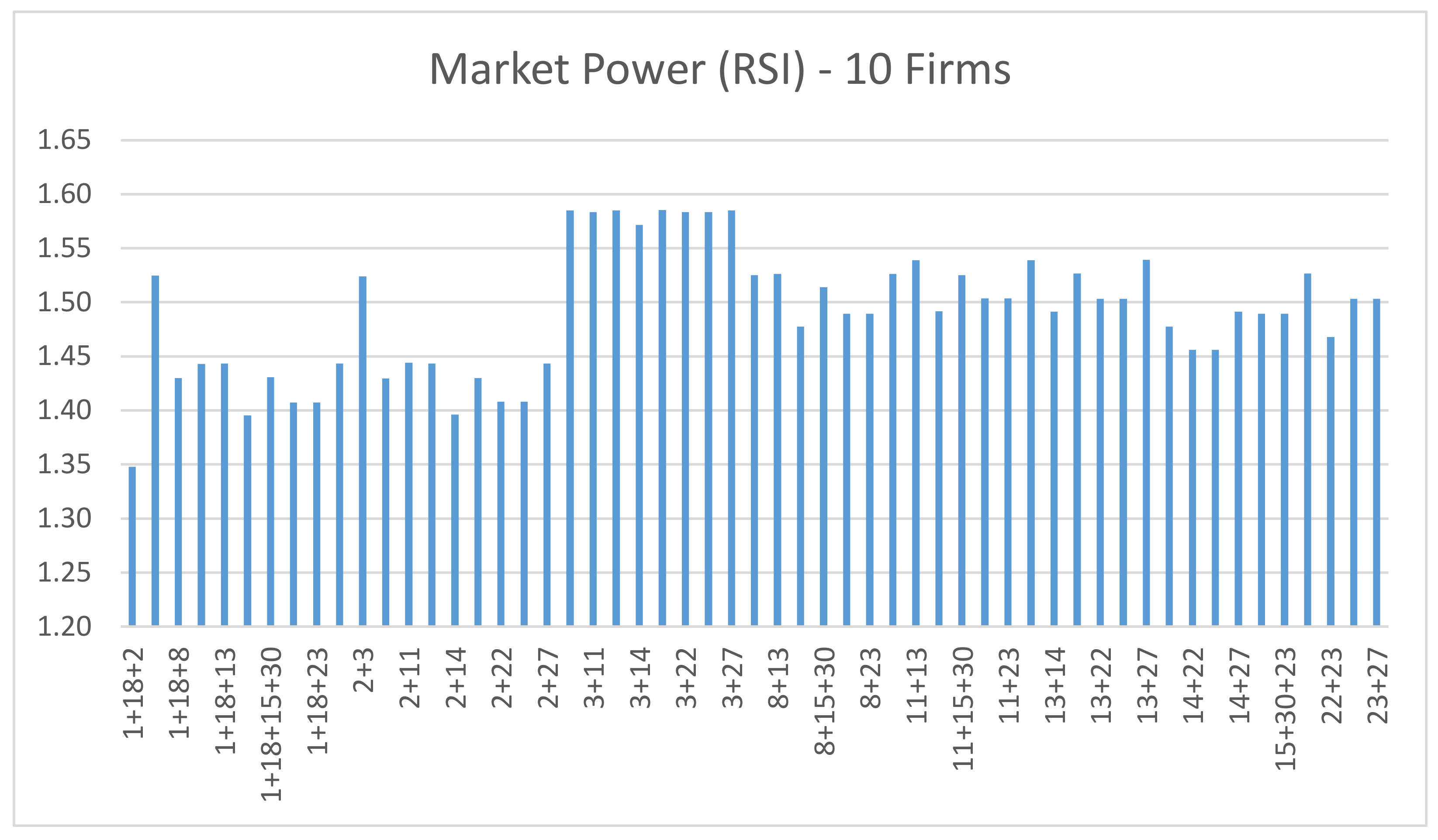

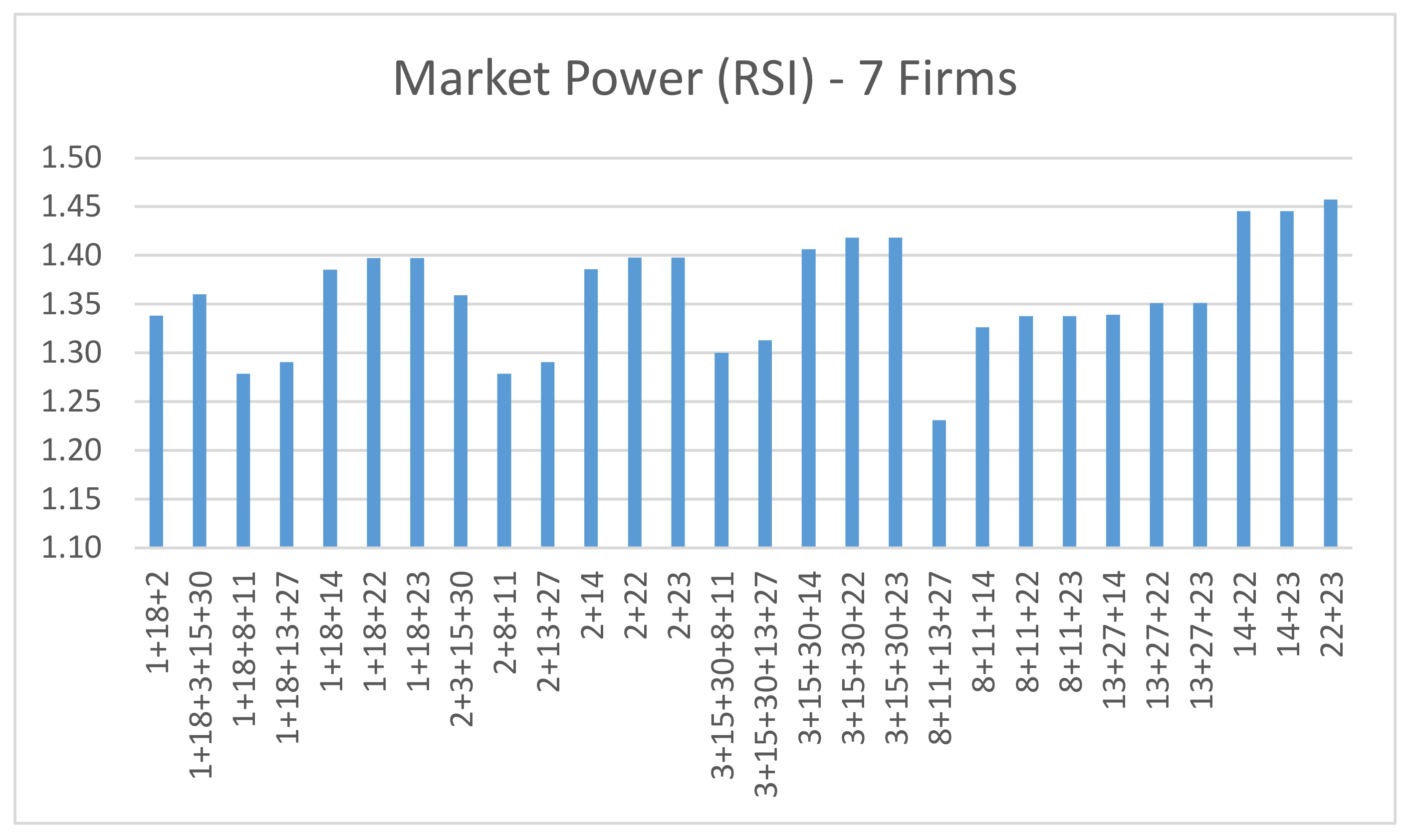

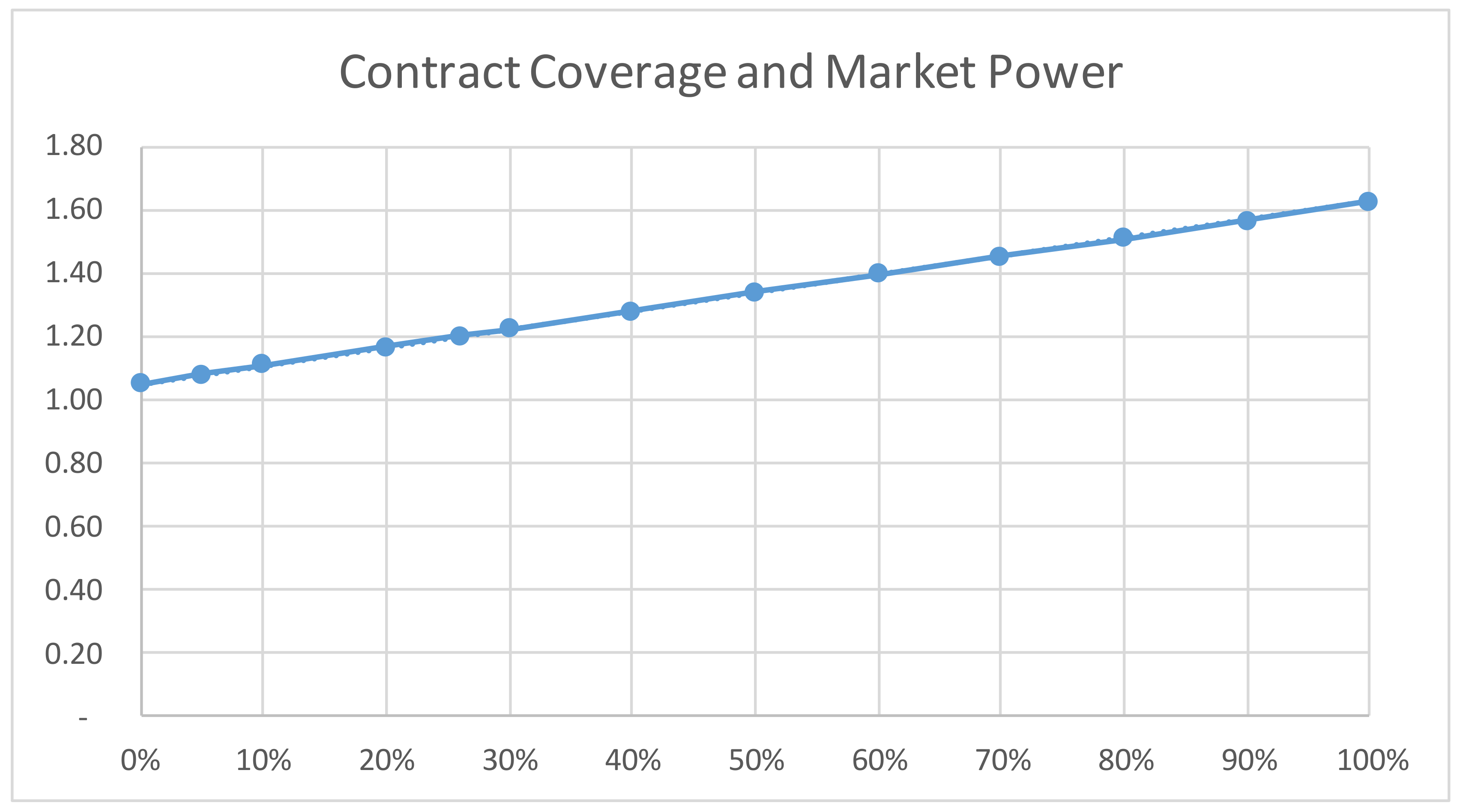

4.2.3. Forward Contract in Cournot Model

5. Discussion

6. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Joskow, P.L. Lessons learned from electricity market liberalization. Energy J. 2008, 29, 9–42. [Google Scholar] [CrossRef]

- Wolak, F.A. Regulating competition in wholesale electricity supply. In Economic Regulation and its Reform: What Have We Learned? 1st ed.; Rose, N.L., Ed.; University of Chicago Press: Chicago, NY, USA, 2014. [Google Scholar]

- Green, R. Increasing Competition in the British Electricity Spot Market. J. Ind. Econ. 1996, 44, 205. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J.B.; Wolak, F.A. Measuring Market Inefficiencies in California’s Restructured Wholesale Electricity Market. Am. Econ. Rev. 2002, 92, 1376–1405. [Google Scholar] [CrossRef]

- Hakam, D.F. Market power modelling in electricity market: A critical review. Int. J. Energy Econ. Policy 2018, 8, 347–356. [Google Scholar]

- Wilson, R. Architecture of Power Markets. Econometrica 2002, 70, 1299–1340. [Google Scholar] [CrossRef]

- Rahimi, A.; Sheffrin, A. Effective market monitoring in deregulated electricity markets. IEEE Trans. Power Syst. 2003, 18, 486–493. [Google Scholar] [CrossRef]

- Sheffrin, A. Predicting Market Power Using the Residual Supply Index. In Proceedings of the Presented to FERC Market Monitoring Workshop, Folsom, CA, USA, 3–4 December 2002. [Google Scholar]

- Sheffrin, A. Critical Actions Necessary for Effective Market Monitoring: Draft Comments of Anjali Sheffrin; FERC RTO Workshop: San Francisco, CA, USA, 2001. [Google Scholar]

- Marshall, L.; Bruce, A.; MacGill, I. Assessing wholesale competition in the Australian National Electricity Market. Energy Policy 2020, 149, 112066. [Google Scholar] [CrossRef]

- Hakam, D.F. Mitigating the risk of market power abuse in electricity sector restructuring: Evidence from Indonesia. Util. Policy 2019, 56, 181–191. [Google Scholar] [CrossRef]

- Hakam, D.F.; Macatangay, R. Optimising Market Structure using Market Power Mitigation and Forward Contract in Electricity Market Restructuring. In Proceedings of the 40th IAEE International Conference, Skyline of Marina Bay, Singapore, 18–21 June 2017; pp. 1–40. [Google Scholar]

- Hakam, D.F.; Wiyono, S.K.; Hariyanto, N. Competition in Power Generation: Ex-ante Analysis of Indonesia’s Electricity Market. Energies 2020, 13, 6741. [Google Scholar] [CrossRef]

- Hakam, D.F.; Macatangay, R.E. Optimising Indonesia’s electricity market structure: Evidence of Sumatra and Java-Bali power system. In Proceedings of the IEEE International Conference on Industrial Technology, Lyon, France, 21 February 2018; pp. 1266–1271. [Google Scholar]

- Hakam, D.F. Optimizing the mix and structure of successor companies in electricity market restructuring. In Proceedings of the 39th IAEE International Conference, Bergen, Norway, 19–26 September 2016; pp. 1–20. [Google Scholar]

- Stigler, G.J. The economists and the problem of monopoly. Am. Econ. Rev. 1982, 72, 1–11. [Google Scholar]

- Joskow, P. Transaction Cost Economics, Antitrust Rules, and Remedies. J. Law Econ. Organ. 2002, 18, 95–116. [Google Scholar] [CrossRef]

- Green, R. European Union Regulation and Competition Policy among the Energy Utilities. In Competition Policy in the EU: Fifty Years on from the Treaty of Rome; Vives, X., Ed.; Oxford Scholarship Online: Oxford, UK, 2009; pp. 284–313. [Google Scholar]

- Hüschelrath, K. Competition Policy Analysis: An Integrated Approach, 1st ed.; Physica-Verlag A Springer Company: Mannheim, Germany, 2009. [Google Scholar]

- Wils, W.P.J. Optimal Antitrust Fines: Theory and Practice. World Compet. 2006, 29, 183–208. [Google Scholar] [CrossRef]

- Newbery, D. Predicting Market Power in Wholesale Electricity Markets; Cambridge Working Papers in Economics: Cambridge, UK, 2011. [Google Scholar]

- Ausubel, L.M.; Cramton, P. Using forward markets to improve electricity market design. Util. Policy 2010, 18, 195–200. [Google Scholar] [CrossRef]

- Allaz, B.; Vila, J.-L. Cournot Competition, Forward Markets and Efficiency. J. Econ. Theory 1993, 59, 1–16. [Google Scholar] [CrossRef]

- Newbery, D.M. Competition, Contracts, and Entry in the Electricity Spot Market. RAND J. Econ. 1998, 29, 726. [Google Scholar] [CrossRef]

- Willems, B.; Rumiantseva, I.; Weigt, H. Cournot versus Supply Functions: What does the data tell us? Energy Econ. 2009, 31, 38–47. [Google Scholar] [CrossRef]

- Berry, C.A.; Hobbs, B.F.; Meroney, W.A.; O’Neill, R.P.; Stewart, W.R. Understanding how market power can arise in network competition: A game theoretic approach. Util. Policy 1999, 8, 139–158. [Google Scholar] [CrossRef]

- Green, R. Nodal pricing of electricity: How much does it cost to get it wrong? J. Regul. Econ. 2007, 31, 125–149. [Google Scholar] [CrossRef]

- Leuthold, F.U.; Weigt, H.; Von Hirschhausen, C. A Large-Scale Spatial Optimization Model of the European Electricity Market. Netw. Spat. Econ. 2010, 12, 75–107. [Google Scholar] [CrossRef]

- Hakam, D.F. Nodal pricing: The theory and evidence of Indonesia power system. Int. J. Energy Econ. Policy 2018, 8, 135–147. [Google Scholar]

- Hakam, D.F.; Kanugrahan, S.P.; Rahadi, A.A.; Nugraha, R.; Wicaksono, A. Challenges and Opportunities of Clean Cooking Program in Indonesia: The Journey to Net Zero Emission. In Proceedings of the IAEE Conference, Tokyo, Japan, 31 July–4 August 2022; pp. 1–2. [Google Scholar]

- Cunningham, L.B.; Baldick, R.; Baughman, M.L. An Empirical Study of Applied Game theory: Transmission Con-strained Cournot Behavior. IEEE Trans. Power Syst. 2002, 17, 166–172. [Google Scholar] [CrossRef] [PubMed]

- Küpper, G.; Delarue, E.; Delvaux, B.; Meeus, L.; Bekaert, D.; Willems, B.; Proost, S.; D’haeseleer, W.; Deketelaere, K.; Belmans, R. Does More International Transmission Capacity Increase Competition in the Belgian Electricity Market? Electr. J. 2009, 22, 21–36. [Google Scholar] [CrossRef]

- Dahl, C.A. Book Review—International Energy Markets: Understanding Pricing, Policies, and Profits. Energy J. 2006, 27, 179–181. [Google Scholar] [CrossRef]

- Schweppe, F.; Caramanis, M.; Tabors, R.; Bohn, R. Spot Pricing of Electricity, 1st ed.; Kluwer Academic Publishers: Amsterdam, The Netherlands, 1988. [Google Scholar]

- Caramanis, M.; Bohn, R.; Schweppe, F. Optimal Spot Pricing: Practice and Theory. IEEE Power Eng. Rev. 1982, PER−2, 42. [Google Scholar] [CrossRef]

- Macatangay, R.E. Space–time prices of wholesale electricity in England and Wales. Util. Policy 1998, 7, 163–188. [Google Scholar] [CrossRef]

- Borowski, P.F. Zonal and Nodal Models of Energy Market in European Union. Energies 2020, 13, 4182. [Google Scholar] [CrossRef]

- Stigler, G.J. Mergers and Preventive Antitrust Policy. Univ. Pa. Law Rev. 1955, 104, 176. [Google Scholar] [CrossRef]

| Type | PP | ||

|---|---|---|---|

| Base | Coal PP | 30 | 0.1 |

| Intermediate | Gas | 35 | 0.15 |

| Peaking | Diesel | 40 | 0.2 |

| n | n | ||||

|---|---|---|---|---|---|

| 1 | 100 | 10 | 16 | 0 | 9 |

| 2 | 200 | 0 | 17 | 0 | 0 |

| 3 | 50 | 20 | 18 | 100 | 35 |

| 4 | 0 | 0 | 19 | 0 | 17 |

| 5 | 0 | 85 | 20 | 0 | 60 |

| 6 | 0 | 0 | 21 | 0 | 34 |

| 7 | 0 | 50 | 22 | 150 | 0 |

| 8 | 130 | 25 | 23 | 150 | 85 |

| 9 | 0 | 0 | 24 | 0 | 9 |

| 10 | 0 | 190 | 25 | 0 | 9 |

| 11 | 120 | 0 | 26 | 0 | 0 |

| 12 | 0 | 50 | 27 | 120 | 0 |

| 13 | 120 | 20 | 28 | 0 | 27 |

| 14 | 160 | 50 | 29 | 0 | 35 |

| 15 | 100 | 50 | 30 | 30 | 0 |

| 1 | 2 | 0.06 | 130 | 15 | 18 | 0.22 | 100 |

| 1 | 3 | 0.19 | 130 | 18 | 19 | 0.13 | 100 |

| 2 | 4 | 0.17 | 65 | 19 | 20 | 0.07 | 132 |

| 3 | 4 | 0.04 | 130 | 10 | 20 | 0.21 | 64 |

| 2 | 5 | 0.2 | 130 | 10 | 17 | 0.08 | 64 |

| 2 | 6 | 0.18 | 90 | 10 | 21 | 0.07 | 64 |

| 4 | 6 | 0.04 | 90 | 10 | 22 | 0.15 | 64 |

| 5 | 7 | 0.12 | 140 | 21 | 22 | 0.02 | 64 |

| 6 | 7 | 0.08 | 130 | 15 | 23 | 0.2 | 64 |

| 6 | 8 | 0.04 | 132 | 22 | 24 | 0.18 | 96 |

| 6 | 9 | 0.21 | 96 | 23 | 24 | 0.27 | 100 |

| 6 | 10 | 0.56 | 96 | 24 | 25 | 0.33 | 64 |

| 9 | 11 | 0.21 | 65 | 25 | 26 | 0.38 | 130 |

| 9 | 10 | 0.11 | 65 | 25 | 27 | 0.21 | 65 |

| 4 | 12 | 0.26 | 65 | 28 | 27 | 0.4 | 65 |

| 12 | 13 | 0.14 | 65 | 27 | 29 | 0.42 | 64 |

| 12 | 14 | 0.26 | 64 | 27 | 30 | 0.6 | 64 |

| 12 | 15 | 0.13 | 132 | 29 | 30 | 0.45 | 18 |

| 12 | 16 | 0.2 | 64 | 8 | 28 | 0.2 | 32 |

| 14 | 15 | 0.2 | 64 | 6 | 28 | 0.06 | 32 |

| 16 | 17 | 0.19 | 100 |

| No | Case 1: Perfect Competition | ||

|---|---|---|---|

| 1 | 4 | 6 | 90 |

| 2 | 9 | 10 | 65 |

| 3 | 12 | 13 | −65 |

| 4 | 14 | 15 | 64 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | |

| 1 | 0.662 | −0.177 | 0.152 | 0.045 | −0.092 | −0.007 | −0.041 | −0.007 | 0.002 | 0.006 | 0.002 | 0.024 | 0.024 | 0.021 | 0.019 | 0.016 | 0.009 | 0.015 | 0.012 | 0.011 | 0.007 | 0.007 | 0.015 | 0.008 | 0.003 | 0.003 | 0.00E+00 | −0.006 | 0.00E+00 | 0.00E+00 |

| 2 | 0.338 | 0.177 | −0.152 | −0.045 | 0.092 | 0.007 | 0.041 | 0.007 | −0.002 | −0.006 | −0.002 | −0.024 | −0.024 | −0.021 | −0.019 | −0.016 | −0.009 | −0.015 | −0.012 | −0.011 | −0.007 | −0.007 | −0.015 | −0.008 | −0.003 | −0.003 | 0.00E+00 | 0.006 | −2.22E−16 | 0.00E+00 |

| 3 | 0.224 | 0.303 | −0.024 | −0.076 | 0.157 | 0.012 | 0.070 | 0.012 | −0.003 | −0.011 | −0.003 | −0.041 | −0.041 | −0.036 | −0.033 | −0.028 | −0.016 | −0.025 | −0.021 | −0.018 | −0.012 | −0.012 | −0.025 | −0.014 | −0.006 | −0.006 | 0.00E+00 | 0.011 | 0.00E+00 | 0.00E+00 |

| 4 | 0.338 | 0.177 | 0.848 | −0.045 | 0.092 | 0.007 | 0.041 | 0.007 | −0.002 | −0.006 | −0.002 | −0.024 | −0.024 | −0.021 | −0.019 | −0.016 | −0.009 | −0.015 | −0.012 | −0.011 | −0.007 | −0.007 | −0.015 | −0.008 | −0.003 | −0.003 | 0.00E+00 | 0.006 | 0.00E+00 | 0.00E+00 |

| 5 | 0.136 | 0.161 | 0.055 | 0.038 | −0.422 | −0.006 | −0.172 | −0.006 | 0.002 | 0.005 | 0.002 | 0.020 | 0.020 | 0.018 | 0.016 | 0.014 | 0.008 | 0.012 | 0.010 | 0.009 | 0.006 | 0.006 | 0.012 | 0.007 | 0.003 | 0.003 | 4.44E−16 | −0.005 | 0.00E+00 | 0.00E+00 |

| 6 | 0.302 | 0.358 | 0.122 | 0.084 | 0.173 | −0.013 | 0.061 | −0.013 | 0.003 | 0.012 | 0.003 | 0.044 | 0.044 | 0.040 | 0.036 | 0.031 | 0.018 | 0.028 | 0.023 | 0.020 | 0.013 | 0.013 | 0.027 | 0.016 | 0.006 | 0.006 | 4.44E−16 | −0.012 | 0.00E+00 | 0.00E+00 |

| 7 | 0.404 | 0.326 | 0.650 | 0.701 | 0.109 | −0.108 | −0.021 | −0.106 | 0.029 | 0.101 | 0.029 | 0.372 | 0.372 | 0.333 | 0.303 | 0.257 | 0.147 | 0.232 | 0.190 | 0.168 | 0.106 | 0.108 | 0.229 | 0.130 | 0.051 | 0.051 | 1.78E−15 | −0.096 | 0.00E+00 | 0.00E+00 |

| 8 | 0.136 | 0.161 | 0.055 | 0.038 | 0.578 | −0.006 | −0.172 | −0.006 | 0.002 | 0.005 | 0.002 | 0.020 | 0.020 | 0.018 | 0.016 | 0.014 | 0.008 | 0.012 | 0.010 | 0.009 | 0.006 | 0.006 | 0.012 | 0.007 | 0.003 | 0.003 | 0.00E+00 | −0.005 | 2.22E−16 | 0.00E+00 |

| 9 | −0.136 | −0.161 | −0.055 | −0.038 | −0.578 | 0.006 | −0.828 | 0.006 | −0.002 | −0.005 | −0.002 | −0.020 | −0.020 | −0.018 | −0.016 | −0.014 | −0.008 | −0.012 | −0.010 | −0.009 | −0.006 | −0.006 | −0.012 | −0.007 | −0.003 | −0.003 | 0.00E+00 | 0.005 | 4.44E−16 | 0.00E+00 |

| 10 | 0.129 | 0.129 | 0.128 | 0.128 | 0.129 | 0.130 | 0.130 | −0.736 | 0.117 | 0.110 | 0.117 | 0.113 | 0.113 | 0.110 | 0.108 | 0.112 | 0.110 | 0.109 | 0.109 | 0.109 | 0.105 | 0.104 | 0.098 | 0.085 | 0.033 | 0.033 | 1.78E−15 | −0.063 | 0.00E+00 | 0.00E+00 |

| 11 | 0.126 | 0.128 | 0.118 | 0.116 | 0.135 | 0.142 | 0.140 | 0.140 | −0.474 | −0.273 | −0.474 | −0.082 | −0.082 | −0.103 | −0.119 | −0.164 | −0.241 | −0.173 | −0.205 | −0.222 | −0.255 | −0.249 | −0.141 | −0.172 | −0.067 | −0.067 | −1.78E−15 | 0.127 | −9.99E−16 | 0.00E+00 |

| 12 | 0.072 | 0.073 | 0.067 | 0.067 | 0.077 | 0.081 | 0.080 | 0.080 | −0.075 | −0.156 | −0.075 | −0.047 | −0.047 | −0.059 | −0.068 | −0.094 | −0.138 | −0.099 | −0.117 | −0.127 | −0.145 | −0.142 | −0.081 | −0.098 | −0.038 | −0.038 | −9.99E−16 | 0.073 | −5.55E−16 | 0.00E+00 |

| 13 | 0.0E+00 | 0.0E+00 | 4.4E−16 | 8.9E−16 | 0.0E+00 | 0.0E+00 | 4.4E−16 | 0.0E+00 | −4.4E−16 | 0.0E+00 | −1.0E+00 | 4.4E−16 | 4.4E−16 | 0.0E+00 | 4.4E−16 | 4.4E−16 | 0.0E+00 | 4.4E−16 | 0.0E+00 | 0.0E+00 | −4.4E−16 | 0.0E+00 | 0.0E+00 | 0.0E+00 | 0.0E+00 | 0.0E+00 | 2.2E−16 | 4.4E−16 | 1.1E−16 | 0.0E+00 |

| 14 | 0.126 | 0.128 | 0.118 | 0.116 | 0.135 | 0.142 | 0.140 | 0.140 | 0.526 | −0.273 | 0.526 | −0.082 | −0.082 | −0.103 | −0.119 | −0.164 | −0.241 | −0.173 | −0.205 | −0.222 | −0.255 | −0.249 | −0.141 | −0.172 | −0.067 | −0.067 | −1.33E−15 | 0.127 | −1.11E−15 | 0.00E+00 |

| 15 | 0.159 | 0.154 | 0.174 | 0.177 | 0.140 | 0.127 | 0.132 | 0.124 | −0.034 | −0.118 | −0.034 | −0.437 | −0.437 | −0.390 | −0.355 | −0.301 | −0.172 | −0.272 | −0.223 | −0.197 | −0.124 | −0.126 | −0.269 | −0.153 | −0.059 | −0.059 | 2.22E−16 | 0.113 | 1.11E−16 | 0.00E+00 |

| 16 | 8.88E−16 | 0.00E+00 | 1.78E−15 | 0.00E+00 | 1.78E−15 | 0.00E+00 | 0.00E+00 | 0.00E+00 | 8.88E−16 | 1.78E−15 | 8.88E−16 | 8.88E−16 | −1.00E+00 | 1.78E−15 | 8.88E−16 | 1.78E−15 | 8.88E−16 | 0.00E+00 | −8.88E−16 | 1.78E−15 | 1.78E−15 | 0.00E+00 | 8.88E−16 | 8.88E−16 | 1.33E−15 | 4.44E−16 | 4.44E−16 | 8.88E−16 | 0.00E+00 | 0.00E+00 |

| 17 | 0.028 | 0.027 | 0.030 | 0.030 | 0.026 | 0.024 | 0.025 | 0.024 | 0.007 | −0.001 | 0.007 | 0.076 | 0.076 | −0.463 | −0.109 | 0.043 | 0.012 | −0.072 | −0.049 | −0.037 | −0.006 | −0.008 | −0.075 | −0.029 | −0.011 | −0.011 | 6.66E−16 | 0.021 | −1.11E−16 | 0.00E+00 |

| 18 | 0.099 | 0.097 | 0.105 | 0.106 | 0.091 | 0.085 | 0.087 | 0.084 | 0.026 | −0.004 | 0.026 | 0.270 | 0.270 | −0.101 | −0.387 | 0.153 | 0.042 | −0.253 | −0.174 | −0.132 | −0.023 | −0.028 | −0.266 | −0.102 | −0.040 | −0.040 | −4.44E−16 | 0.076 | −6.66E−16 | 0.00E+00 |

| 19 | 0.032 | 0.030 | 0.039 | 0.041 | 0.024 | 0.018 | 0.020 | 0.017 | −0.068 | −0.112 | −0.068 | 0.217 | 0.217 | 0.174 | 0.141 | −0.498 | −0.226 | 0.053 | 0.000 | −0.028 | −0.096 | −0.091 | 0.072 | −0.021 | −0.008 | −0.008 | −1.11E−15 | 0.016 | −6.66E−16 | 0.00E+00 |

| 20 | 0.028 | 0.027 | 0.030 | 0.030 | 0.026 | 0.024 | 0.025 | 0.024 | 0.007 | −0.001 | 0.007 | 0.076 | 0.076 | 0.537 | −0.109 | 0.043 | 0.012 | −0.072 | −0.049 | −0.037 | −0.006 | −0.008 | −0.075 | −0.029 | −0.011 | −0.011 | −1.33E−15 | 0.021 | −2.22E−16 | 0.00E+00 |

| 21 | 0.032 | 0.030 | 0.039 | 0.041 | 0.024 | 0.018 | 0.020 | 0.017 | −0.068 | −0.112 | −0.068 | 0.217 | 0.217 | 0.174 | 0.141 | 0.502 | −0.226 | 0.053 | 0.000 | −0.028 | −0.096 | −0.091 | 0.072 | −0.021 | −0.008 | −0.008 | −1.55E−15 | 0.016 | −6.66E−16 | 0.00E+00 |

| 22 | 0.004 | 0.003 | 0.008 | 0.008 | −0.001 | −0.004 | −0.003 | −0.004 | −0.056 | −0.083 | −0.056 | 0.106 | 0.106 | 0.151 | 0.185 | 0.026 | −0.051 | −0.559 | −0.408 | −0.327 | −0.067 | −0.062 | 0.109 | 0.005 | 0.002 | 0.002 | −1.11E−15 | −0.004 | −4.44E−16 | 0.00E+00 |

| 23 | 0.004 | 0.003 | 0.008 | 0.008 | −0.001 | −0.004 | −0.003 | −0.004 | −0.056 | −0.083 | −0.056 | 0.106 | 0.106 | 0.151 | 0.185 | 0.026 | −0.051 | 0.441 | −0.408 | −0.327 | −0.067 | −0.062 | 0.109 | 0.005 | 0.002 | 0.002 | −4.44E−16 | −0.004 | 0.00E+00 | 0.00E+00 |

| 24 | 0.004 | 0.003 | 0.008 | 0.008 | −0.001 | −0.004 | −0.003 | −0.004 | −0.056 | −0.083 | −0.056 | 0.106 | 0.106 | 0.151 | 0.185 | 0.026 | −0.051 | 0.441 | 0.592 | −0.327 | −0.067 | −0.062 | 0.109 | 0.005 | 0.002 | 0.002 | 0.00E+00 | −0.004 | −4.44E−16 | 0.00E+00 |

| 25 | −0.004 | −0.003 | −0.008 | −0.008 | 0.001 | 0.004 | 0.003 | 0.004 | 0.056 | 0.083 | 0.056 | −0.106 | −0.106 | −0.151 | −0.185 | −0.026 | 0.051 | −0.441 | −0.592 | −0.673 | 0.067 | 0.062 | −0.109 | −0.005 | −0.002 | −0.002 | 1.11E−15 | 0.004 | 6.66E−16 | 0.00E+00 |

| 26 | −0.032 | −0.030 | −0.039 | −0.041 | −0.024 | −0.018 | −0.020 | −0.017 | 0.068 | 0.112 | 0.068 | −0.217 | −0.217 | −0.174 | −0.141 | −0.502 | −0.774 | −0.053 | 0.000 | 0.028 | 0.096 | 0.091 | −0.072 | 0.021 | 0.008 | 0.008 | 8.88E−16 | −0.016 | 8.88E−16 | 0.00E+00 |

| 27 | 0.146 | 0.147 | 0.145 | 0.145 | 0.147 | 0.148 | 0.148 | 0.146 | 0.205 | 0.234 | 0.205 | 0.121 | 0.121 | 0.102 | 0.087 | 0.169 | 0.215 | 0.139 | 0.169 | 0.185 | −0.435 | −0.340 | −0.026 | −0.179 | −0.069 | −0.069 | −2.66E−15 | 0.132 | −1.33E−15 | 0.00E+00 |

| 28 | 0.088 | 0.088 | 0.087 | 0.087 | 0.088 | 0.089 | 0.089 | 0.087 | 0.123 | 0.141 | 0.123 | 0.073 | 0.073 | 0.061 | 0.052 | 0.102 | 0.129 | 0.083 | 0.101 | 0.111 | −0.127 | −0.204 | −0.015 | −0.107 | −0.042 | −0.042 | −8.88E−16 | 0.079 | −4.44E−16 | 0.00E+00 |

| 29 | 0.146 | 0.147 | 0.145 | 0.145 | 0.147 | 0.148 | 0.148 | 0.146 | 0.205 | 0.234 | 0.205 | 0.121 | 0.121 | 0.102 | 0.087 | 0.169 | 0.215 | 0.139 | 0.169 | 0.185 | 0.565 | −0.340 | −0.026 | −0.179 | −0.069 | −0.069 | 0.00E+00 | 0.132 | 0.00E+00 | 0.00E+00 |

| 30 | 0.123 | 0.121 | 0.127 | 0.128 | 0.117 | 0.113 | 0.115 | 0.111 | 0.090 | 0.077 | 0.090 | 0.240 | 0.240 | 0.284 | 0.319 | 0.171 | 0.105 | 0.234 | 0.185 | 0.158 | 0.038 | 0.026 | −0.450 | −0.137 | −0.053 | −0.053 | −2.22E−16 | 0.101 | −2.22E−16 | 0.00E+00 |

| 31 | 0.234 | 0.234 | 0.232 | 0.232 | 0.236 | 0.237 | 0.237 | 0.233 | 0.328 | 0.375 | 0.328 | 0.194 | 0.194 | 0.163 | 0.140 | 0.271 | 0.344 | 0.222 | 0.271 | 0.297 | 0.438 | 0.456 | −0.041 | −0.286 | −0.111 | −0.111 | 2.22E−15 | 0.212 | 1.33E−15 | 0.00E+00 |

| 32 | 0.123 | 0.121 | 0.127 | 0.128 | 0.117 | 0.113 | 0.115 | 0.111 | 0.090 | 0.077 | 0.090 | 0.240 | 0.240 | 0.284 | 0.319 | 0.171 | 0.105 | 0.234 | 0.185 | 0.158 | 0.038 | 0.026 | 0.550 | −0.137 | −0.053 | −0.053 | −6.66E−16 | 0.101 | −2.22E−16 | 0.00E+00 |

| 33 | 0.357 | 0.356 | 0.360 | 0.360 | 0.353 | 0.351 | 0.352 | 0.344 | 0.417 | 0.452 | 0.417 | 0.434 | 0.434 | 0.448 | 0.458 | 0.442 | 0.449 | 0.456 | 0.455 | 0.454 | 0.476 | 0.482 | 0.509 | 0.577 | −0.164 | −0.164 | 1.11E−15 | 0.313 | 6.66E−16 | 0.00E+00 |

| 34 | 0.00E+00 | 0.00E+00 | 0.00E+00 | 0.00E+00 | 0.00E+00 | 0.00E+00 | 0.00E+00 | 0.00E+00 | 0.00E+00 | −4.44E−16 | 0.00E+00 | 0.00E+00 | 0.00E+00 | 0.00E+00 | −2.22E−16 | 0.00E+00 | 0.00E+00 | 2.22E−16 | 2.22E−16 | −2.22E−16 | 0.00E+00 | 0.00E+00 | 0.00E+00 | −2.22E−16 | 0.00E+00 | −1.00E+00 | −1.11E−16 | 0.00E+00 | 0.00E+00 | 0.00E+00 |

| 35 | 0.357 | 0.356 | 0.360 | 0.360 | 0.353 | 0.351 | 0.352 | 0.344 | 0.417 | 0.452 | 0.417 | 0.434 | 0.434 | 0.448 | 0.458 | 0.442 | 0.449 | 0.456 | 0.455 | 0.454 | 0.476 | 0.482 | 0.509 | 0.577 | 0.836 | 0.836 | 1.11E−15 | 0.313 | 5.55E−16 | 0.00E+00 |

| 36 | −0.643 | −0.644 | −0.640 | −0.640 | −0.647 | −0.649 | −0.648 | −0.656 | −0.583 | −0.548 | −0.583 | −0.566 | −0.566 | −0.552 | −0.542 | −0.558 | −0.551 | −0.544 | −0.545 | −0.546 | −0.524 | −0.518 | −0.491 | −0.423 | −0.164 | −0.164 | −7.77E−16 | −0.687 | −4.44E−16 | 0.00E+00 |

| 37 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 0.399 | 3.99E−01 | 0.399 | −3.22E−01 | 0.00E+00 |

| 38 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 0.601 | 6.01E−01 | 0.601 | 3.22E−01 | 0.00E+00 |

| 39 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 0.429 | 4.29E−01 | 0.429 | 7.30E−01 | 0.00E+00 |

| 40 | 0.129 | 0.129 | 0.128 | 0.128 | 0.129 | 0.130 | 0.130 | 0.264 | 0.117 | 0.110 | 0.117 | 0.113 | 0.113 | 0.110 | 0.108 | 0.112 | 0.110 | 0.109 | 0.109 | 0.109 | 0.105 | 0.104 | 0.098 | 0.085 | 0.033 | 0.033 | −2.22E−16 | −0.063 | 0.00E+00 | 0.00E+00 |

| 41 | 0.515 | 0.515 | 0.512 | 0.512 | 0.517 | 0.520 | 0.519 | 0.391 | 0.466 | 0.438 | 0.466 | 0.453 | 0.453 | 0.442 | 0.433 | 0.447 | 0.441 | 0.435 | 0.436 | 0.436 | 0.420 | 0.414 | 0.393 | 0.338 | 0.131 | 0.131 | 0.00E+00 | −0.250 | 0.00E+00 | 0.00E+00 |

| n Firm | Combination | |

|---|---|---|

| 12 | 1.526 | 15 Merge 30 |

| 11 | 1.521 | 3 Merge 11 |

| 10 | 1.497 | 1 Merge 18 |

| 9 | 1.418 | 13 Merge 27 |

| 8 | 1.387 | 8 Merge 15 + 30 |

| 7 | 1.324 | 14 Merge 22 |

| 6 | 1.294 | 3 + 11 Merge 23 |

| 5 | 1.185 | 1 + 18 Merge 2 |

| 4 | 1.043 | 8 + 15 + 30 Merge 13 + 27 |

| n Firm | Combination | |

|---|---|---|

| 12 | 1.573 | 15 Merge 30 |

| 11 | 1.562 | 3 Merge 8 |

| 10 | 1.541 | 1 Merge 18 |

| 9 | 1.477 | 13 Merge 27 |

| 8 | 1.432 | 11 Merge 15 + 30 |

| 7 | 1.383 | 22 Merge 23 |

| 6 | 1.311 | 3 + 8 Merge 14 |

| 5 | 1.224 | 1 + 18 Merge 2 |

| 4 | 1.051 | 13 + 27 Merge 22 + 23 |

Case 1: Perfect Competition | Case 2: Cournot | |||

|---|---|---|---|---|

| 1 | 2 | 27.0 | 20.0 | 130 |

| 1 | 3 | 37.6 | 23.6 | 130 |

| 2 | 4 | 43.0 | 25.7 | 65 |

| 3 | 4 | 44.8 | 26.9 | 130 |

| 2 | 5 | 79.8 | 66.9 | 130 |

| 2 | 6 | 60.6 | 33.1 | 90 |

| 4 | 6 | 90.0 | 39.6 | 90 |

| 5 | 7 | −5.3 | −17.7 | 140 |

| 6 | 7 | 55.0 | 66.4 | 130 |

| 6 | 8 | 3.3 | 0.3 | 132 |

| 6 | 9 | 43.1 | −8.5 | 96 |

| 6 | 10 | 28.9 | 15.9 | 96 |

| 9 | 11 | −21.9 | −105.7 | 65 |

| 9 | 10 | 65.0 | 97.2 | 65 |

| 4 | 12 | −2.2 | 13.0 | 65 |

| 12 | 13 | −65.0 | −32.1 | 65 |

| 12 | 14 | −44.8 | −24.1 | 64 |

| 12 | 15 | 9.0 | 0.2 | 132 |

| 12 | 16 | 48.5 | 19.8 | 64 |

| 14 | 15 | 64.0 | 31.4 | 64 |

| 16 | 17 | 39.6 | 11.7 | 100 |

| 15 | 18 | 15.8 | 31.0 | 100 |

| 18 | 19 | 80.8 | 46.1 | 100 |

| 19 | 20 | 63.8 | 25.4 | 132 |

| 10 | 20 | −3.7 | 35.7 | 64 |

| 10 | 17 | −39.6 | −11.7 | 64 |

| 10 | 21 | −30.0 | −58.2 | 64 |

| 10 | 22 | −22.5 | −38.9 | 64 |

| 21 | 22 | −64.0 | −87.9 | 64 |

| 15 | 23 | 7.2 | −20.1 | 64 |

| 22 | 24 | −31.7 | −21.1 | 96 |

| 23 | 24 | 32.3 | 5.5 | 100 |

| 24 | 25 | −8.3 | −17.3 | 64 |

| 25 | 26 | 0.0 | 0.0 | 130 |

| 25 | 27 | −17.3 | −20.4 | 65 |

| 28 | 27 | 1.1 | 26.6 | 65 |

| 27 | 29 | 21.8 | 12.8 | 64 |

| 27 | 30 | 4.8 | −5.5 | 64 |

| 29 | 30 | −14.0 | −19.3 | 18 |

| 8 | 28 | 5.4 | −0.5 | 32 |

| 6 | 28 | 20.3 | −1.4 | 32 |

| Scenario | Contract Coverage | |

|---|---|---|

| 1 | 0% | 1.05 |

| 2 | 5% | 1.08 |

| 3 | 10% | 1.11 |

| 4 | 20% | 1.17 |

| 5 | 26% | 1.20 |

| 6 | 30% | 1.22 |

| 7 | 40% | 1.28 |

| 8 | 50% | 1.34 |

| 9 | 60% | 1.40 |

| 10 | 70% | 1.45 |

| 11 | 80% | 1.51 |

| 12 | 90% | 1.57 |

| 13 | 100% | 1.62 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hakam, D.F. Mitigating Market Power and Promoting Competition in Electricity Markets through a Preventive Approach: The Role of Forward Contracts. Energies 2023, 16, 3543. https://doi.org/10.3390/en16083543

Hakam DF. Mitigating Market Power and Promoting Competition in Electricity Markets through a Preventive Approach: The Role of Forward Contracts. Energies. 2023; 16(8):3543. https://doi.org/10.3390/en16083543

Chicago/Turabian StyleHakam, Dzikri Firmansyah. 2023. "Mitigating Market Power and Promoting Competition in Electricity Markets through a Preventive Approach: The Role of Forward Contracts" Energies 16, no. 8: 3543. https://doi.org/10.3390/en16083543

APA StyleHakam, D. F. (2023). Mitigating Market Power and Promoting Competition in Electricity Markets through a Preventive Approach: The Role of Forward Contracts. Energies, 16(8), 3543. https://doi.org/10.3390/en16083543