Process of Transformation to Net Zero Steelmaking: Decarbonisation Scenarios Based on the Analysis of the Polish Steel Industry

Abstract

1. Introduction

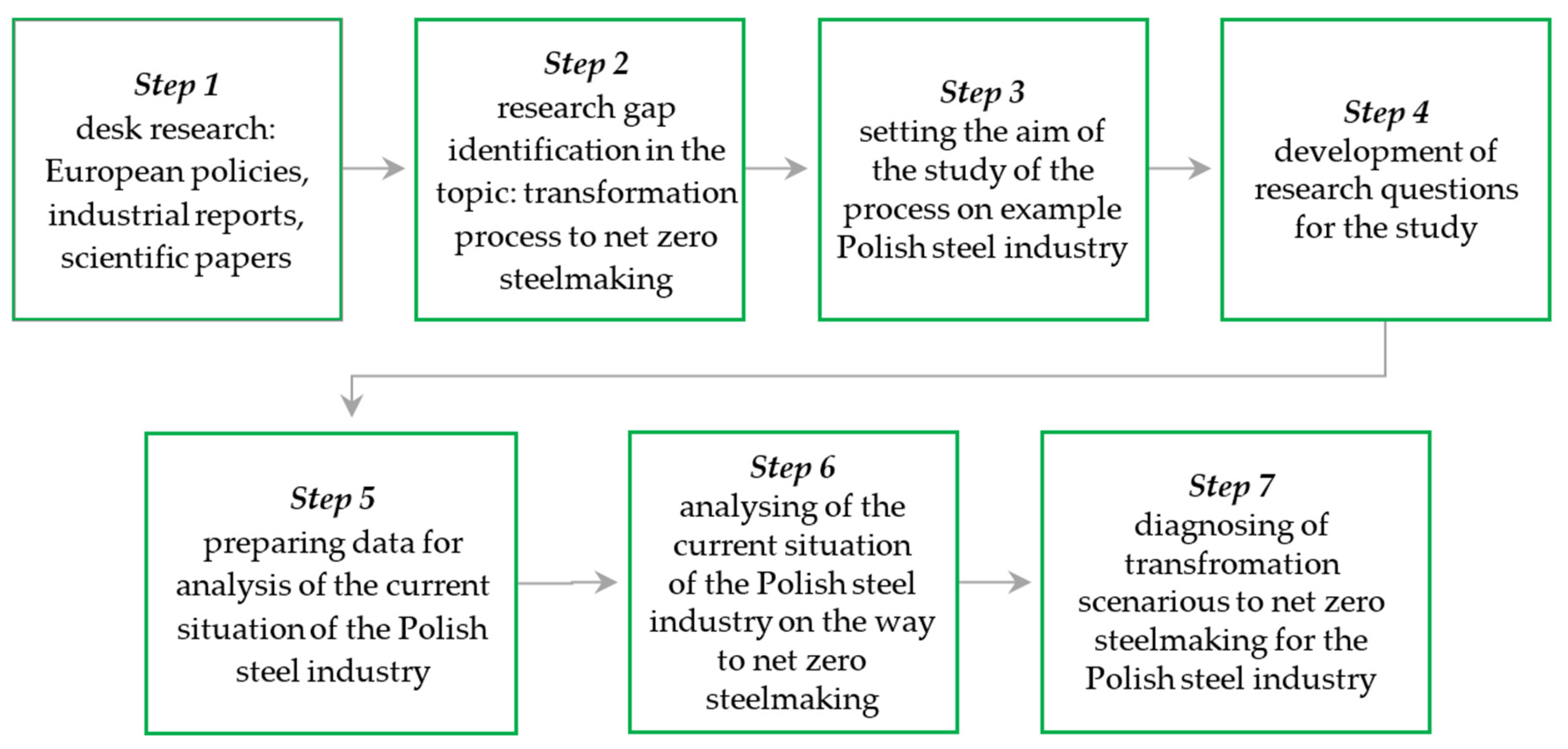

2. Industrial Decarbonisation: Challenges

3. Materials and Methods

- RQ1: What are the directions (strategies) of technological transformation of the steel industry to net zero steelmaking?

- RQ2: What are the conditions (state diagnosis) for decarbonisation of the Polish steel industry?

- RQ3: What are the possible scenarios for the development of low-carbon steelmaking technologies in the Polish steel market?

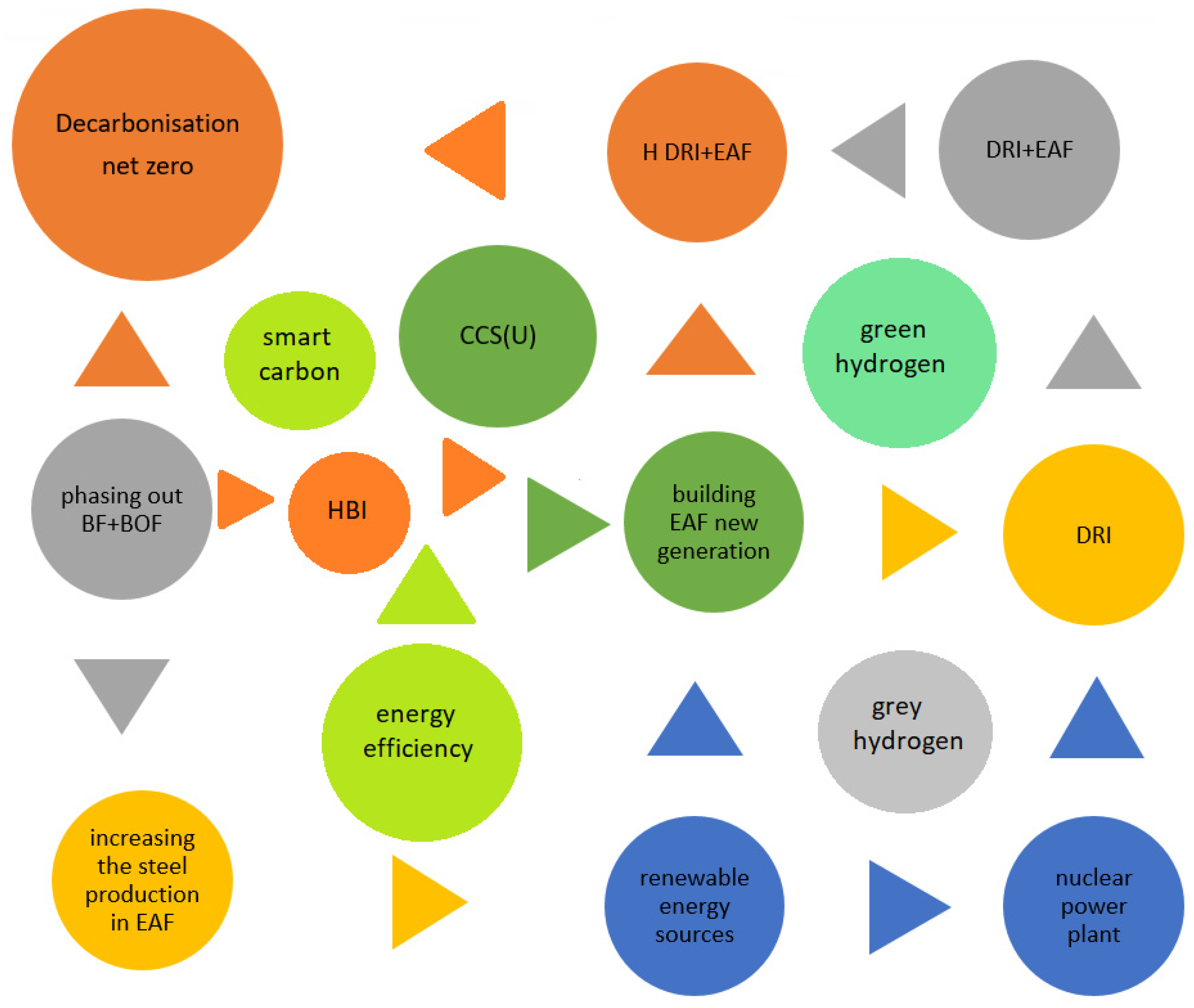

4. Strategic Directions of Changes in Steel Industry Technology

5. Decarbonisation Processes in the Polish Steel Industry

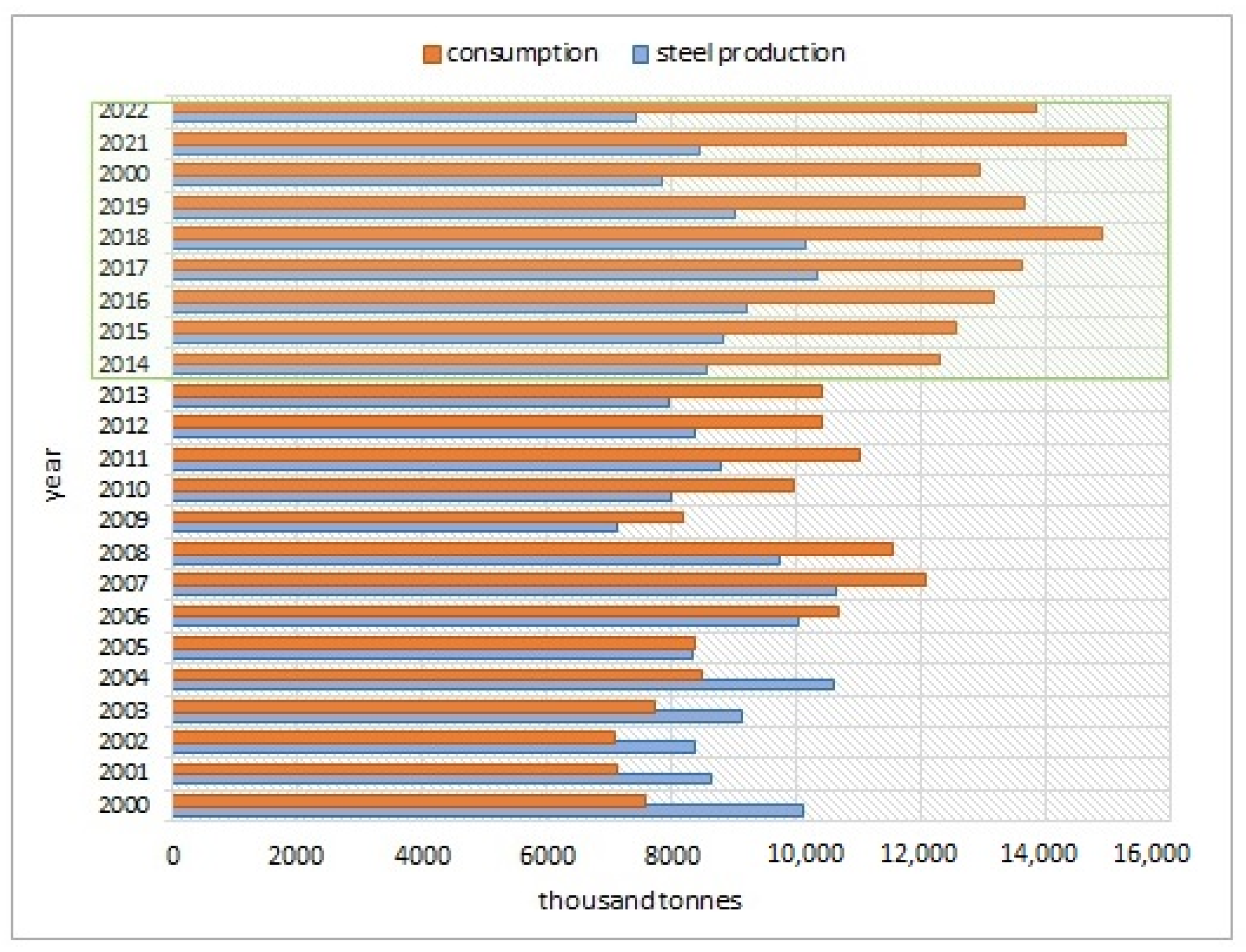

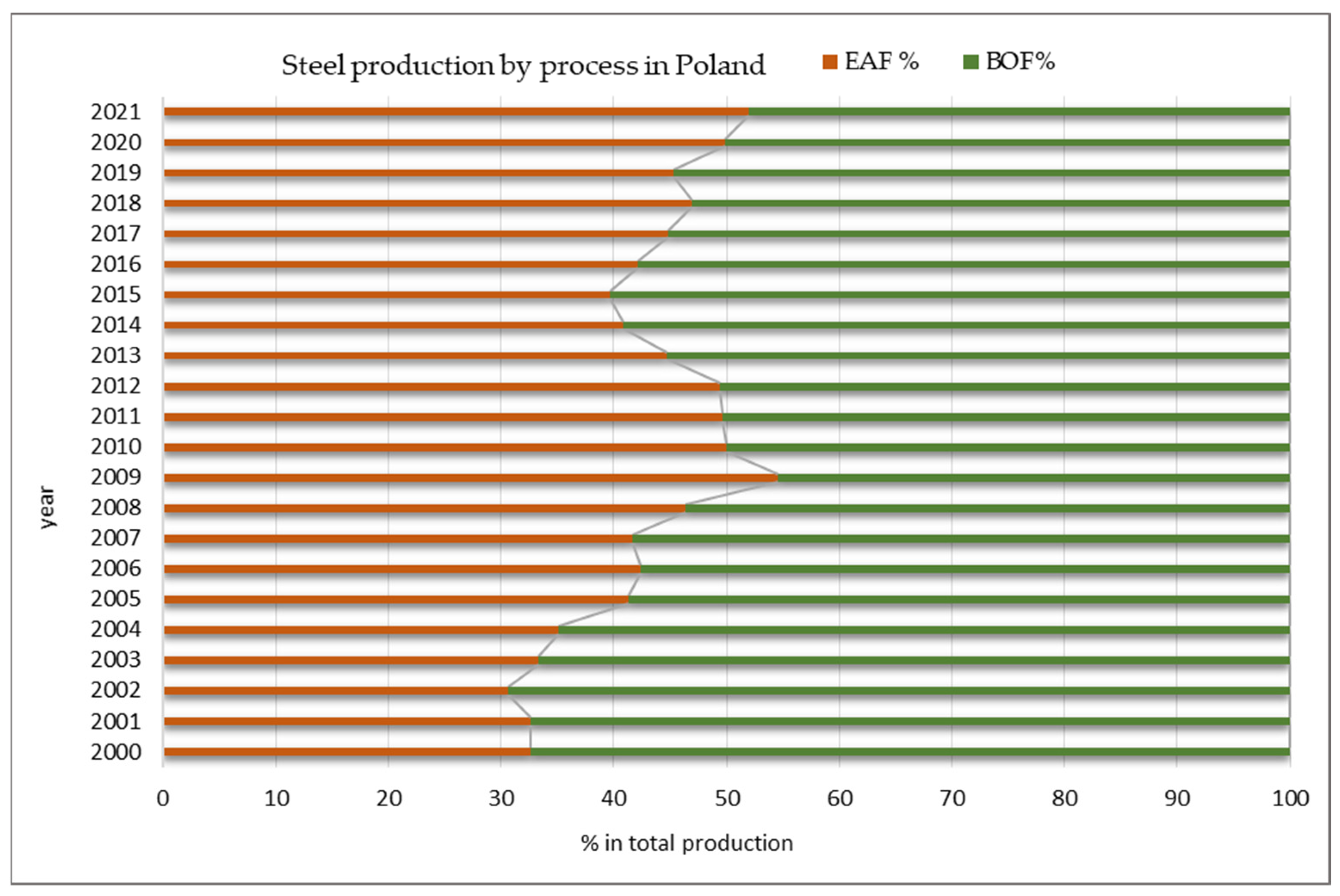

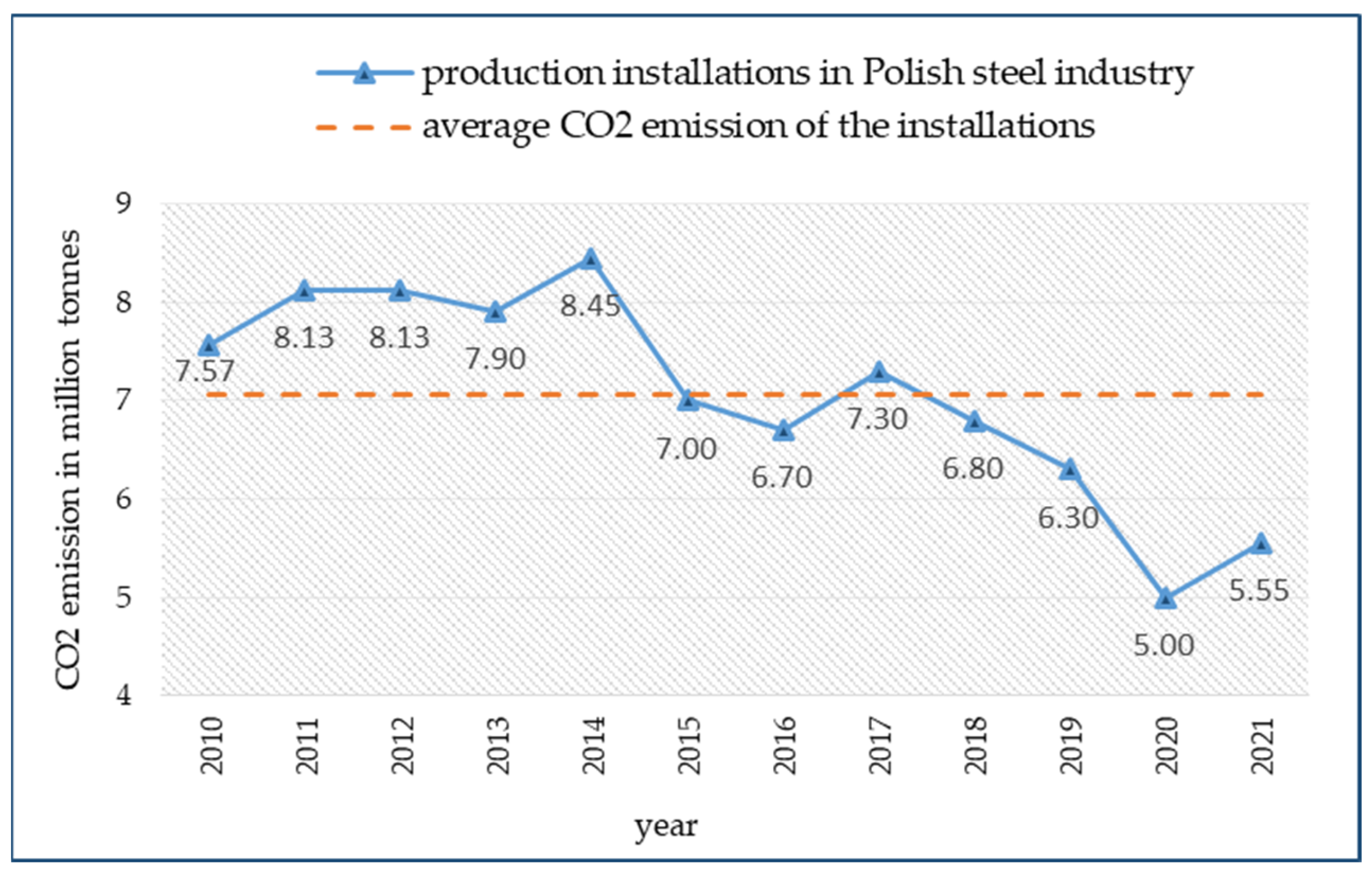

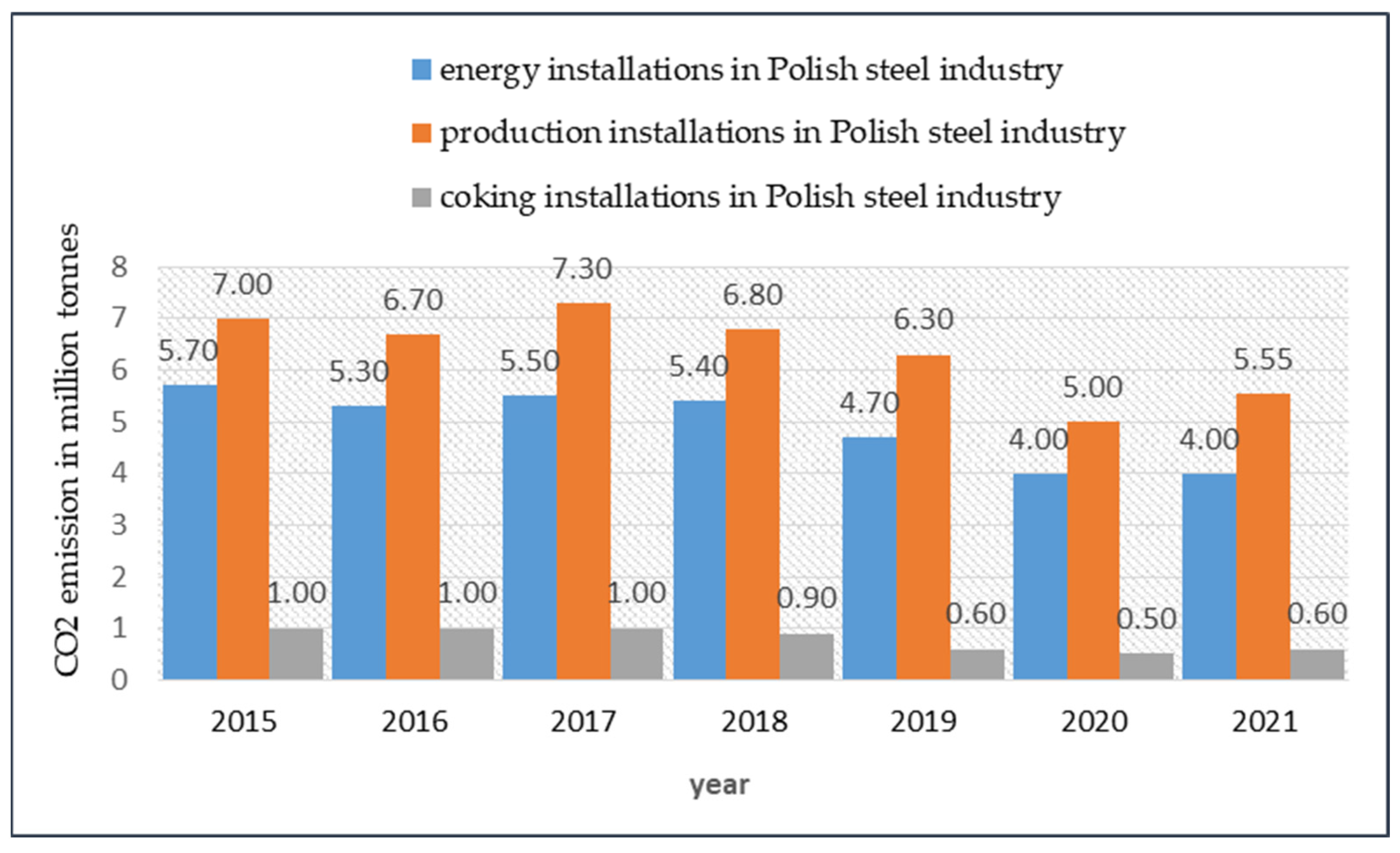

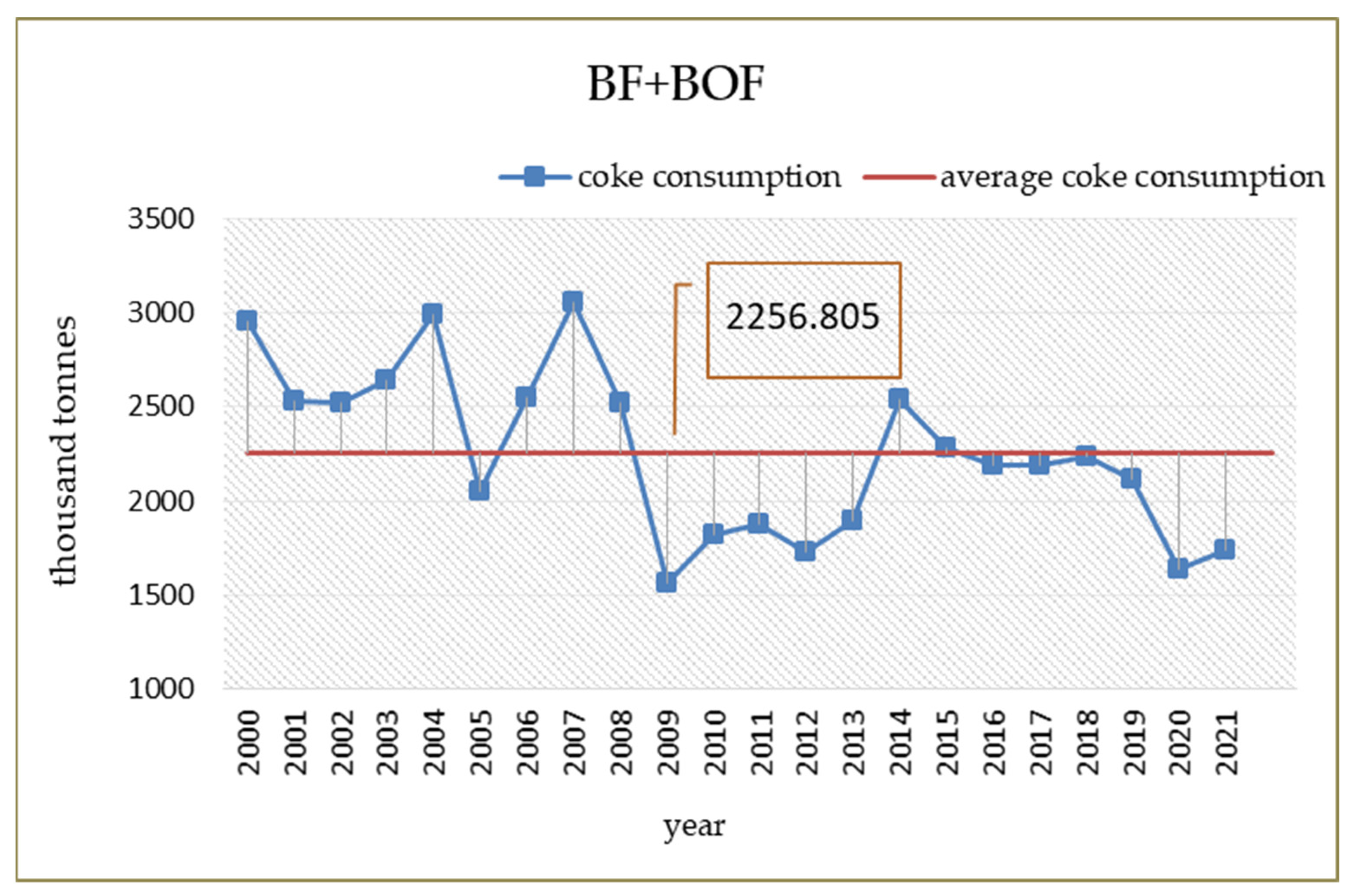

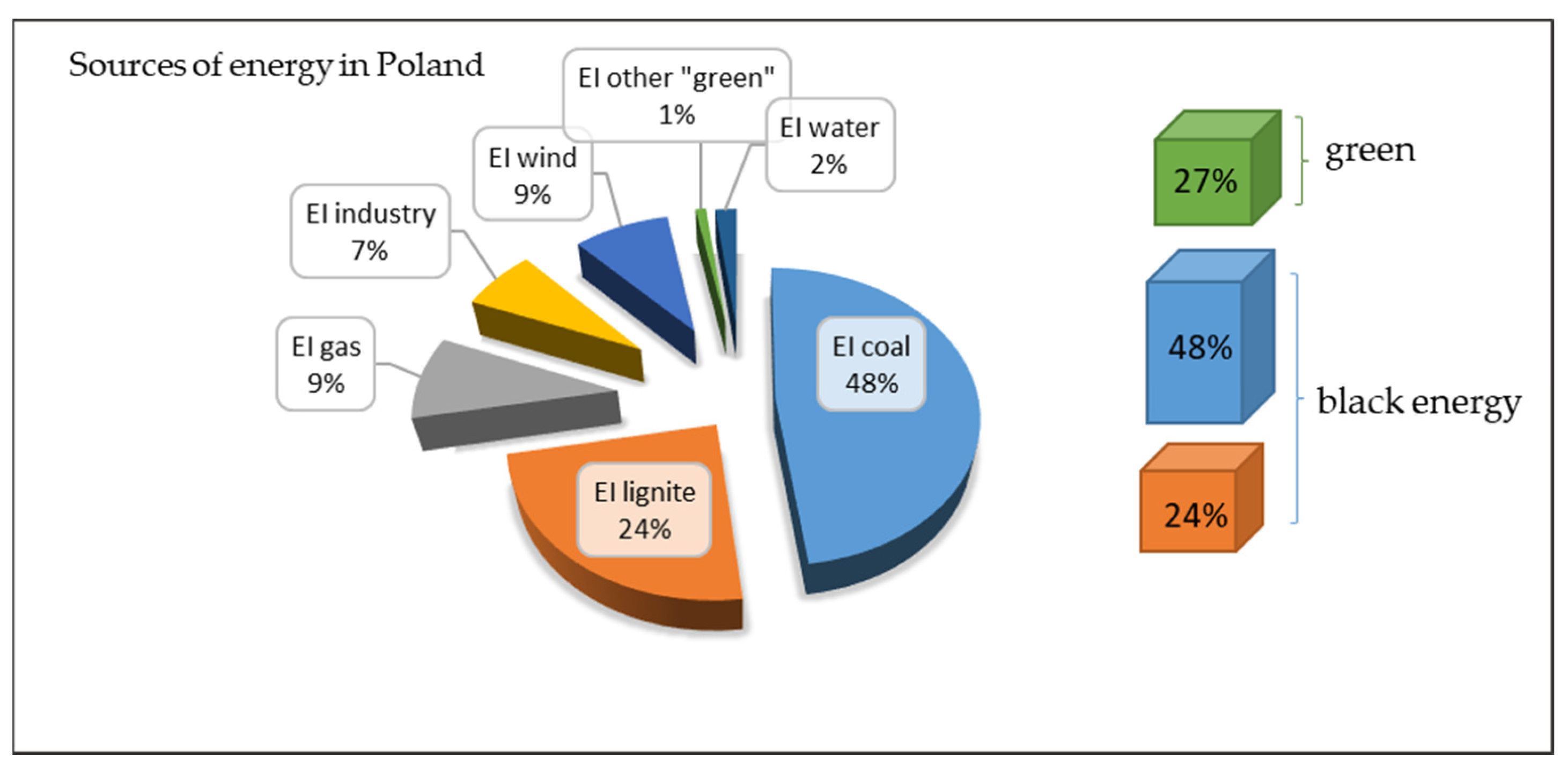

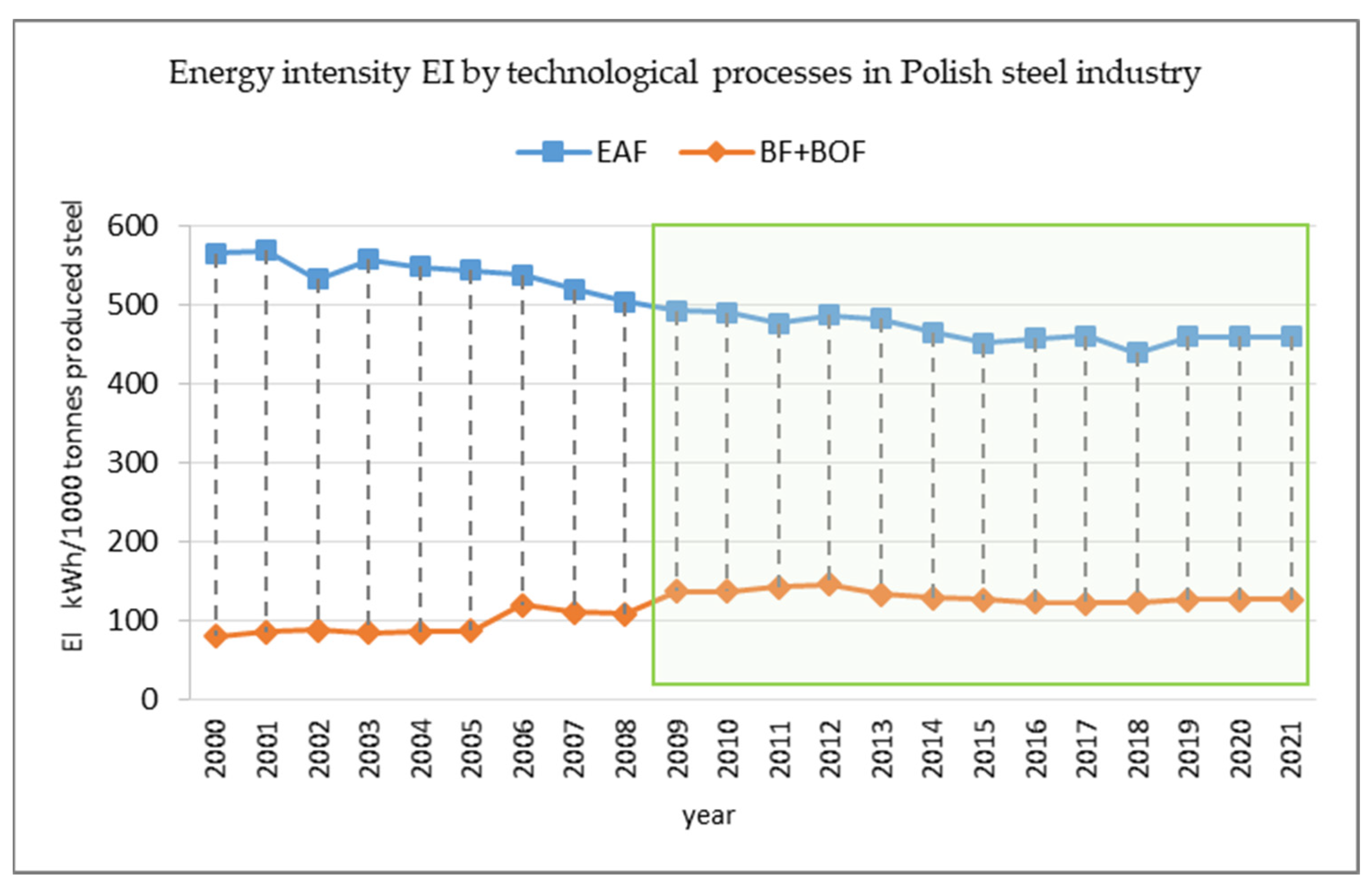

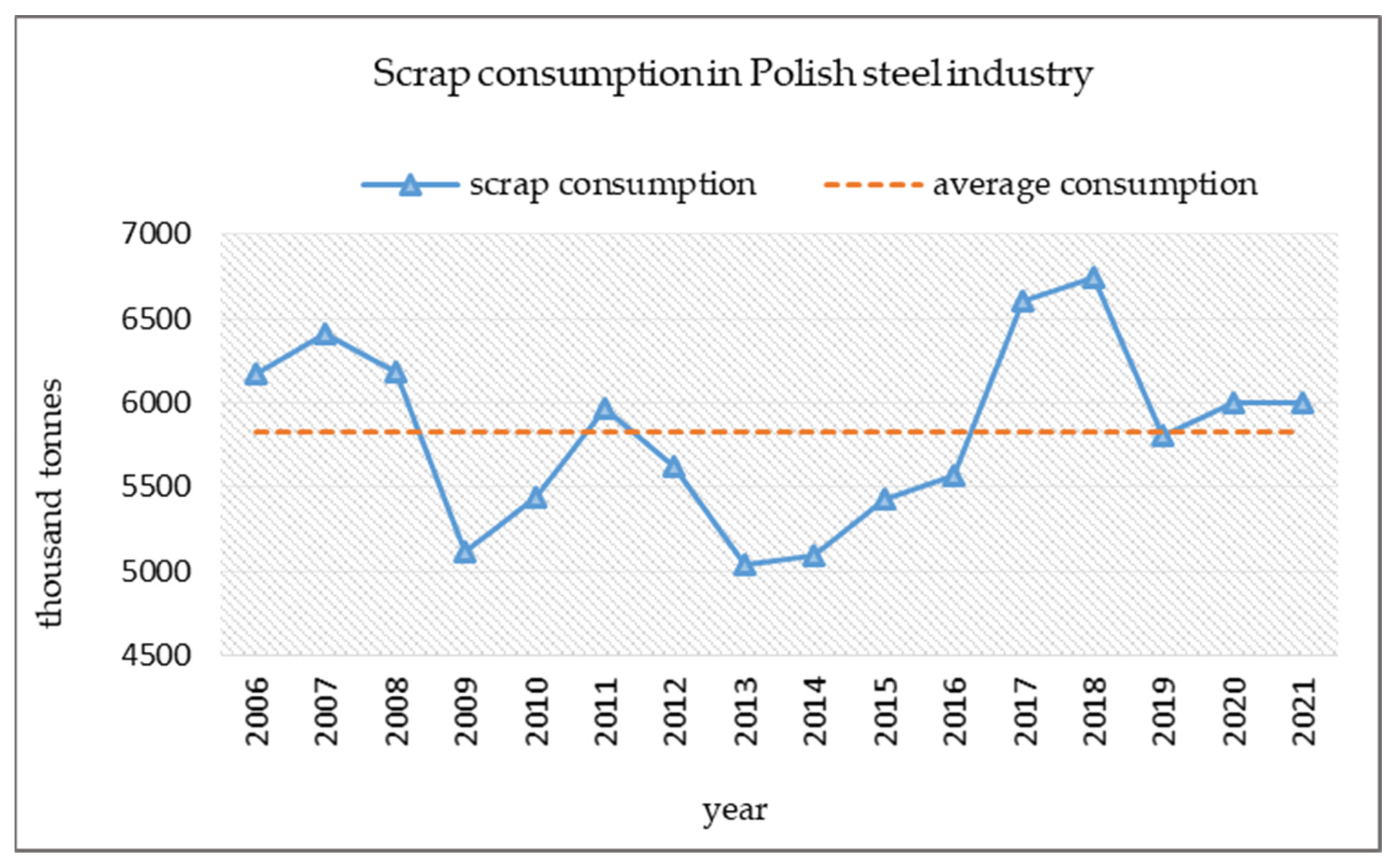

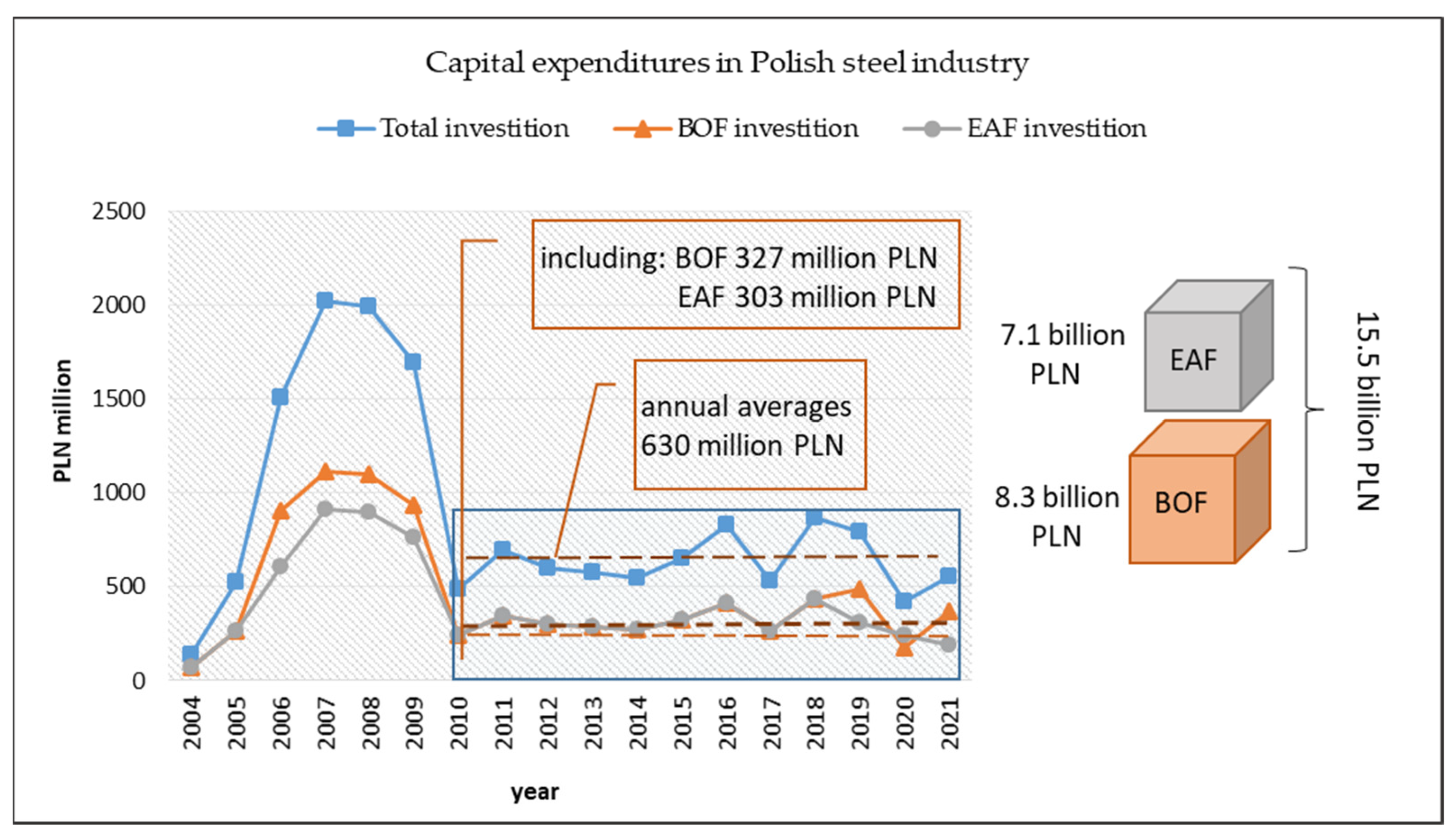

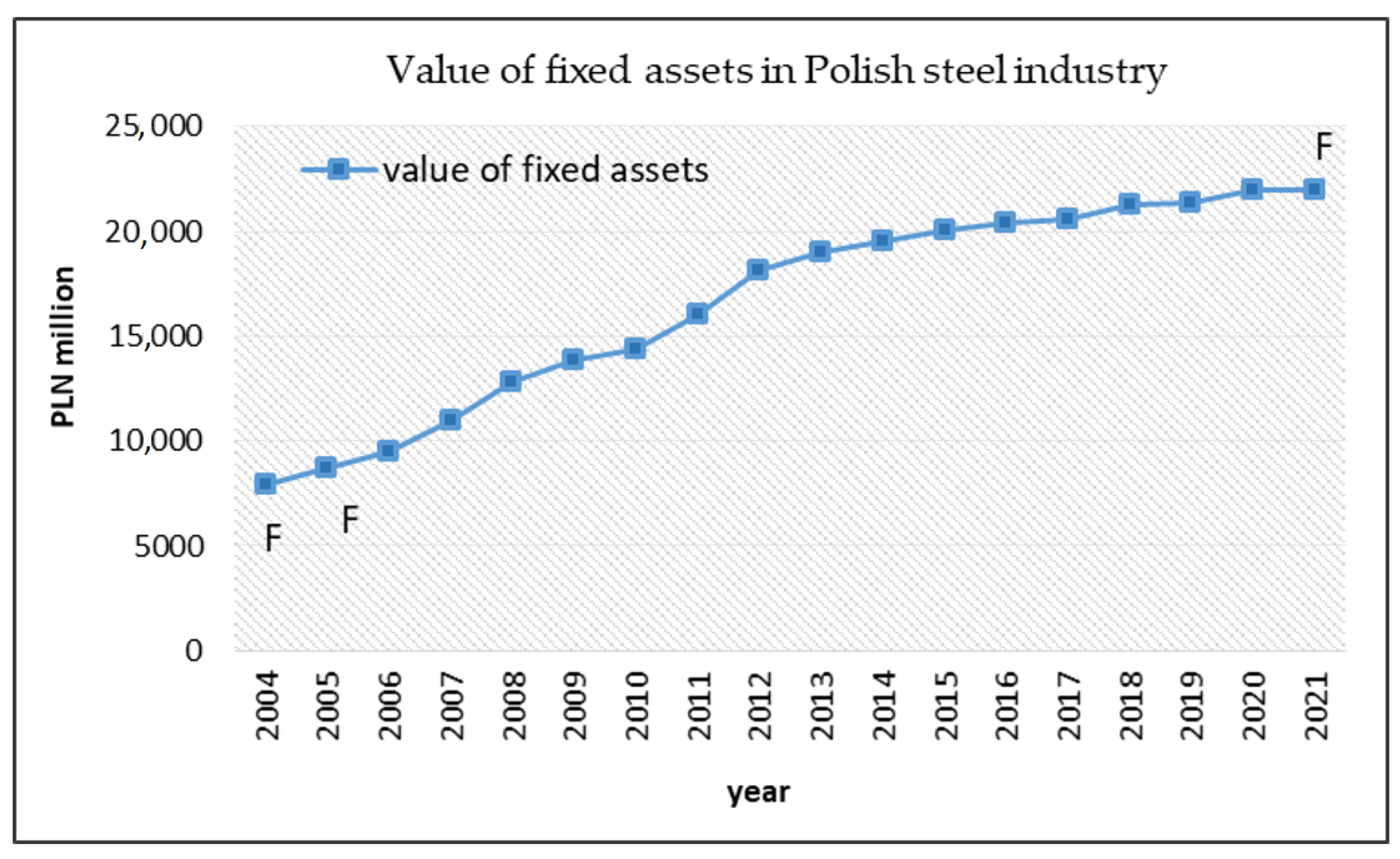

5.1. Diagnosis of the Situation of the Polish Steel Sector

5.2. Transformation Scenarios of the Polish Steel Industry

6. Discussion

- Decarbonising the steel industry can lead to significant reductions in greenhouse gas emissions, particularly carbon dioxide (CO2), which is one of the main drivers of climate change. By transitioning to low-carbon alternatives, such as hydrogen-based direct reduction or carbon capture and storage, the steel industry can significantly reduce its carbon footprint.

- Decarbonising the steel industry can reduce its dependence on fossil fuels, such as coal and natural gas, which are subject to price volatility and supply chain disruptions. By using renewable energy sources—such as wind or solar power—to produce low-carbon alternatives, the steel industry can increase its energy security and reduce its exposure to price fluctuations.

- The transition towards low-carbon steel production can create new jobs in areas such as renewable energy, hydrogen production, and carbon capture and storage. Moreover, increasing recycling and reuse of steel products can also create new jobs in the circular economy.

- Reducing greenhouse gas emissions from the steel industry can lead to improved public health by reducing air pollution and its associated health impacts. For instance, the use of alternative fuels in steel production can reduce emissions of particulate matter, sulphur dioxide, and nitrogen oxides, which are harmful to human health.

- Decarbonising the steel industry can stimulate economic growth by creating new jobs, promoting innovation, and attracting investments in new technologies and infrastructure. Moreover, the shift towards low-carbon production can also lead to increased competitiveness and market access in a rapidly changing global economy.

- Decarbonising the steel industry can require significant investment in new technologies and infrastructure. For example, the development of hydrogen-based direct reduction or carbon capture and storage technologies can be costly. This can be a barrier for some companies, particularly small- and medium-sized enterprises, that may not have the resources to invest in these new technologies.

- Decarbonising the steel industry requires the development and implementation of new technologies that can be technically challenging. For example, the production of low-carbon steel using hydrogen-based direct reduction requires significant changes to traditional steelmaking processes. This can require new equipment, materials, and skilled workers.

- The availability of low-carbon alternatives, such as renewable energy, hydrogen, or carbon capture and storage, can be limited in some regions. This can be a barrier to the adoption of low-carbon alternatives by the steel industry, particularly in regions with limited access to renewable energy sources or storage infrastructure.

- The transition towards low-carbon steel production requires new infrastructure, such as pipelines for transporting hydrogen or carbon dioxide and storage facilities for hydrogen and captured CO2. Developing this infrastructure can be a significant challenge and require investment in new systems and networks.

- The transition towards low-carbon steel production requires supportive policies and regulations that incentivise and support the development and adoption of new technologies. Governments can play a significant role in this transition by providing financial incentives, setting emissions reduction targets, and supporting research and development. However, the lack of supportive policies and regulations can be a barrier to the adoption of low-carbon alternatives.

| Technology | Key Characteristics | Applications | Challenges |

|---|---|---|---|

| Green Hydrogen | Renewable energy source, produced through electrolysis of water using renewable energy | Transportation, power generation, industrial processes | High costs, limited infrastructure |

| CCS | Captures carbon emissions from fossil fuel power plants or industrial processes and stores them underground | Power generation, industrial processes | High costs, limited applicability |

| Energy Efficiency Measures | Reduces energy consumption in buildings and industrial processes | Buildings, industrial processes | Limited potential for emissions reduction |

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- IEA. Net Zero by 2050—A Roadmap for the Global Energy Sector. 2021. Available online: https://www.iea.org/reports/net-zero-by-2050 (accessed on 10 March 2023).

- De Lotto, P.F. CCMI/190—EESC-2022-01057-00-00-AS-TRA (EN) 28/35; Consultative Commission on Industrial Change: Brussels, Belgium, 2022. [Google Scholar]

- Kuramochi, T.; Ramírez, A.; Turkenburg, W.; Faaij, A. Comparative assessment of CO2 capture technologies for carbon-intensive industrial processes. Prog. Energy Combust. Sci. 2012, 38, 87–112. [Google Scholar] [CrossRef]

- Carus, M.; Skoczinski, P.; Dammer, L.; vom Berg, C.; Raschka, A.; Breitmayer, E. Hitchhiker’s Guide to Carbon Capture and Utilisation. 2019. Available online: http://bio-based.eu/nova-papers/#novapaper1 (accessed on 10 March 2023).

- Kätelhön, A.; Meys, R.; Deutz, S.; Suh, S.; Bardow, A. Climate change mitigation potential of carbon capture and utilization in the chemical industry. Proc. Natl. Acad. Sci. USA 2019, 116, 11187–11194. [Google Scholar] [CrossRef] [PubMed]

- Renewable Carbon Initiative Report. In CO2 Reduction Potential of the Chemical Industry thorough CCU; Nova Institute: Hürth, Germany, 2022; Available online: https://renewable-carbon-initiative.com/wp-content/uploads/2022/05/22-05-03-CO2_Reduction_Potential_of_the_Chemical_Industry_Through_CCU.pdf (accessed on 10 March 2023).

- Bertau, M.; Offermanns, H.; Plass, L.; Schmidt, F.; Wernicke, H.-J. Methanol: The Basic Chemical and Energy Feedstock of the Future; Springer: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- Fit for 55. European Union. Brussels, Belgium. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_21_3541 (accessed on 10 March 2023).

- European Environment Agency. Opinion of the European Economic and Social Committee on ‘The Role of Carbon Dioxide Removal Technologies in the Emissions in the Decarbonisation of Europe’ (Own-Initiative Opinion) (2022/C 486/08). 2022. Available online: https://eur-lex.europa.eu/legal-content/PL/TXT/PDF/?uri=CELEX:52022IE1057&from=EN (accessed on 10 March 2023).

- World Steel Association. Report 2023. Available online: https://worldsteel.org (accessed on 10 March 2023).

- World Steel Association. What Is the Outlook for World Steel in 2023? 2023. Available online: https://worldsteel.org (accessed on 10 March 2023).

- Wyns, T.; Khandekar, G.; Groen, L. International Technology and Innovation Governance for Addressing Climate Change: Options for the EU. 2019. Available online: https://www.cop21ripples.eu/wp-content/uploads/2019/09/20190830_COP21-RIPPLES_D4-3b_Technology-and-Innovation-Governance.pdf (accessed on 10 March 2023).

- UNFCCC. Adoption of the Paris Agreement. Report No. FCCC/CP/2015/L.9/ Rev.1. 2015. Available online: https://unfccc.int/resource/docs/2015/cop21/eng/l09r01.pdf (accessed on 10 March 2023).

- International Energy Agency. Energy Technology Perspectives 2016: Towards Sustainable Urban Energy Systems. Available online: https://www.worldsteel.org/en/dam/jcr:66fed386-fd0b-485e-aa23-b8a5e7533435/Position_paper_climate_2018.pdf (accessed on 10 March 2023).

- Tian, S.; Jiang, J.; Zhang, Z.; Manovic, V. Inherent potential of steelmaking to contribute to decarbonisation targets via industrial carbon capture and storage. Nat. Commun. 2018, 9, 4422. [Google Scholar] [CrossRef] [PubMed]

- World Steel Association. Steel Sustainability Report 2022. Available online: https://worldsteel.org/media-centre/press-releases/2022/sustainability-indicators-2022/ (accessed on 10 March 2023).

- Zier, M.; Stenzel, P.; Kotzur, L.; Stolten, D. A review of decarbonisation options for the glass industry. Energy Convers. Manag. X 2021, 10, 100083. [Google Scholar] [CrossRef]

- Eurofer. Low-CO2 Emissions Projects in the EU Steel Industry. 2022. Available online: https://www.eurofer.eu/issues/climate-and-energy/maps-of-key-low-carbon-steel-projects/ (accessed on 10 March 2023).

- Rocky Mountain Institute (RMI). Six Global Banks Come Together to Decarbonize Steel. 2021. Available online: https://rmi.org/press-release/six-global-banks-come-together-to-decarbonize-steel/ (accessed on 20 July 2021).

- COP26. World Leaders Summit Statement on the Breakthrough Agenda; COP26: Glasgow, UK, 2021. [Google Scholar]

- Nurse, A.; Sykes, O. It’s more complicated than that!: Unpacking ‘Left Behind Britain’ and some other spatial tropes following the UK’s 2016 EU referendum. Local Econ. J. Local Econ. Policy Unit 2019, 34, 589–606. [Google Scholar] [CrossRef]

- Painter, M.; Hibbert, S.; Cooper, T. The development of responsible and sustainable business practice: Value, mind-sets, business-models. J. Bus. Ethics 2019, 157, 885–891. [Google Scholar] [CrossRef]

- Pardo, N.; Moya, J.A. Prospective scenarios on energy efficiency and CO2 emissions in the European Iron & Steel industry. Energy 2013, 54, 113–128. [Google Scholar]

- Lechtenböhmer, S.; Schneider, C.; Vogl, V.; Pätz, C. Climate Innovations in the Steel Industry. Reinvent Deliverable Project, 2018, no. 730053. Available online: https://static1.squarespace.com/static/59f0cb986957da5faf64971e/t/5be40340352f531a564c9a2e/1541669701888/D2.2+Climate+innovations+in+the+steel+industry.pdf (accessed on 10 March 2023).

- World Steel Association: Sustainable Indicators. 2022. Available online: https://worlsteel.org/media-centre/press-releases/2022/sustainable-indicators-2022/ (accessed on 10 March 2023).

- The EU Plan for a Green Transition; European Union: Brussels, Belgium. 2022. Available online: https://www.consilium.europa.eu/pl/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/ (accessed on 10 March 2023).

- Eurofer. EU ETS Revision: Benchmarks and CBAM Free Allocation Phase Out. Impact Assessment on the EU Steel Industry; Eurofer: Bruxelles, Belgium, 2021. [Google Scholar]

- Industrial Transformation 2050—Towards an Industrial Strategy for a Climate Neutral Europe. Institute for European Studies, Vrije Universiteit Brussel, Belgium. Available online: https://www.ies.be/files/Industrial_Transformation_2050_0.pdf (accessed on 10 March 2023).

- Tagliapietra, S.; Zachmann, G.; Edenhofer, O.; Glachant, J.-M.; Linares, P.; Loeschel, A. The European Union energy transition: Key priorities for the next five years. Energy Pol. 2019, 132, 950–954. [Google Scholar] [CrossRef]

- Wyns, T.; Axelson, M. Decarbonising Europe’s Energy Intensive Industries: The Final Frontier. Institute for European Studies, Vrije Universiteit Brussel. 2016. Available online: http://www.ies.be/files/The_Final_Frontier_Wyns_Axelson_0.pdf (accessed on 10 March 2023).

- World Steel Association. Report 2022 World Steel in Figures. Brussels, Belgium. Available online: https://worldsteel.org/2022_world-steel-in-figures/ (accessed on 10 March 2023).

- Samaddar, S. (Chairman of ArcelorMittal Poland). ArcelorMittal o Planach Dekarbonizacji. NOWE TECHNOLOGIE także w Polsce. Available online: https://www.wnp.pl/hutnictwo/arcelormittal-o-planach-dekarbonizacji-nowe-technologie-takze-w-polsce,496996.html (accessed on 10 March 2023).

- Gajdzik, B.; Sroka, W.; Vveinhardt, J. Energy Intensity of Steel Manufactured Utilising EAF Technology as a Function of Investments Made: The Case of the Steel Industry in Poland. Energies 2021, 14, 5152. [Google Scholar] [CrossRef]

- Gajdzik, B.; Sroka, W. Resource Intensity vs. Investment in Production Installations—The Case of the Steel Industry in Poland. Energies 2021, 14, 443. [Google Scholar] [CrossRef]

- Wolniak, R.; Saniuk, S.; Grabowska, S.; Gajdzik, B. Identification of Energy Efficiency Trends in the Context of the Development of Industry 4.0 Using the Polish Steel Sector as an Example. Energies 2020, 13, 2867. [Google Scholar] [CrossRef]

- Gajdzik, B.; Wolniak, R.; Grebski, W.W. Electricity and Heat Demand in Steel Industry Technological Processes in Industry 4.0 Conditions. Energies 2023, 16, 787. [Google Scholar] [CrossRef]

- Gajdzik, B.; Wolniak, R.; Grebski, W.W. An Econometric Model of the Operation of the Steel Industry in Poland in the Context of Process Heat and Energy Consumption. Energies 2022, 15, 7909. [Google Scholar] [CrossRef]

- World Steel Association. Steel Statistical Yearbook, Brussels, Belgium. 2022. Retrieved from Polish Steel Association in Poland. Available online: https://worldsteel.org/publications/bookshop/ssy_subscription-2022/ (accessed on 10 March 2023).

- Kirschen, M.; Badr, K.; Pfeifer, H. Influence of direct reduced iron on the energy balance of the electric arc furnace in steel industry. Energy 2011, 36, 6146–6155. [Google Scholar] [CrossRef]

- Barceló Delgado, A.; Sitárová, M. Opinia Europejskiego Komitetu Ekonomiczno-Społecznego “Rola Technologii Usuwania Dwutlenku Węgla w Dekarbonizacji Europejskiego” (Opinia z Inicjatywy Własnej) (2022/C 486/08). Dziennik Urzędowy Unii Europejskiej C 486/55(3) CHP (Combined Heat and Power). Available online: https://eur-lex.europa.eu/legal-content/PL/TXT/PDF/?uri=CELEX:52022IE1057&from=EN (accessed on 10 March 2023).

- Mankins, J.C. Technology Readiness Levels. White Paper, NASA Office of Space Access and Technology. 6 April 1995. Available online: www.hq.nasa.gov/office/codeq/trl/trl.pdf (accessed on 10 March 2023).

- Chang, Y.; Wan, F.; Yao, X.; Han, Y.; Li, H. Influence of hydrogen production on the CO2 emissions reduction of hydrogen metallurgy transformation in iron and steel industry. Energy Rep. 2023, 9, 3057–3071. [Google Scholar] [CrossRef]

- Irlam, L. Global costs of carbon capture and storage. Global CCS Institute. 2017. Available online: https://hub.globalccsinstitute.com/sites/default/files/publications/201688/globalccs-cost-updatev4.pdf (accessed on 10 March 2023).

- Wesseling, J.; Lechtenböhmer, S.; Åhman, M.; Nilsson, L.J.; Worrel, E.; Coenen, L. The transition of energy intensive processing industries towards deep decarbonisation: Characteristics and implications for future research. Renew. Sustain. Energy Rev. 2017, 79, 1303–1313. [Google Scholar] [CrossRef]

- Otto, A.; Robinius, M.; Grube, T.; Schiebahn, S.; Praktiknjo, A.; Stolten, D. Power-to Steel: Reducing CO2 through the Integration of Renewable Energy and Hydrogen into the German Steel Industry. Energies 2017, 10, 451. [Google Scholar] [CrossRef]

- Kähler, F.; Carus, M.; Berg, C.; Stratmann, M. CO2 Reduction Potential of the Chemical Industry Through CCU. Editor: Renewable Carbon Initiative (RCI). 2022. Available online: www.renewable-carbon-initiative.com (accessed on 10 March 2023).

- Leeson, D.; Mac Dowell, N.; Shah, N.; Petit, C.; Fennell, P.S. A Techno-economic analysis and systematic review of carbon capture and storage (CCS) applied to the iron and steel, cement, oil refining and pulp and paper industries, as well as other high purity sources. Int. J. Greenh. Gas Control 2017, 61, 71–84. [Google Scholar] [CrossRef]

- The Economics of Direct Air Carbon Capture and Storage. Global CCS Institute, Melbourne, Australia. Available online: https://www.globalccsinstitute.com/resources/publications-reports-research/ (accessed on 10 March 2023).

- Axelson, M.; Oberthür, S.; Nilsson, L.J. Research and analysis. Emissions reduction strategies in the EU steel industry. Implications for business model innovation. J. Ind. Ecol. 2021, 25, 390–402. [Google Scholar] [CrossRef]

- European Commission. A Clean Planet for All—A European Long-Term Strategic Vision for a Prosperous, Modern, Competitive and Climate Neutral Economy. Depth Analysis in Support of the Commission Communication. European Commission. 2018. Available online: https://ec.europa.eu/clima/sites/clima/files/docs/pages/com_2018_733_analysis_in_support_en_0.pdf (accessed on 10 March 2023).

- Barlow, C.R.; Pimm, A.J.; Taylor, P.G.; Gale, W.F. Policy and pricing barriers to steel industry decarbonisation: A UK case study. Energy Policy 2022, 168, 113100. [Google Scholar] [CrossRef]

- Tata Steel. HIsarna: Building a Sustainable Steel Industry. Steel for Sustainable Future. 2020. Available online: https://www.Tatasteeleurope.com/en/sustainability/steel-for-a-sustainable-future/the-life-cycle-of-steel (accessed on 10 March 2023).

- Nurdiawati, A.; Urban, F. Towards Deep Decarbonisation of Energy-Intensive Industries: A Review of Current Status, Technologies and Policies. Energies 2021, 14, 2408. [Google Scholar] [CrossRef]

- Steelonthenet.com. Steel Industry Emissions of CO2. Available online: https://www.steelonthenet.com/kb/CO2-emissions.html (accessed on 10 March 2023).

- The European Steel Association (EUROFER). Low Carbon Roadmap: Pathways to a CO2-Neutral European Steel Industry; EUROFER: Brussels, Belgium, 2019. [Google Scholar]

- Chen, D.; Li, J.; Wang, Z.; Lu, B.; Chen, G. Hierarchical model to find the path reducing CO2 emissions of integrated iron and steel production. Energy 2022, 258, 124887. [Google Scholar] [CrossRef]

- Xylia, M.; Silveira, S.; Duerinck, J.; Meinke-Hubeny, F. Weighing regional scrap availability in global pathways for steel production processes. Energy Effic. 2018, 11, 1135–1159. [Google Scholar] [CrossRef]

- TataSteel. Development of ULCOS—Blast Furnace. 2013. Available online: https://ieaghg.org/docs/General_Docs/Iron%20and%20Steel%202%20Secured%20presentations/1050%20Jan%20van%20der%20Stel.pdf (accessed on 10 March 2023).

- IGAR. Available online: https://storagearcelormittalprod.blob.core.windows.net/media/lukmokpc/igar-content-final.pdf (accessed on 10 March 2023).

- Midrex Process. Available online: https://www.midrex.com/direct-reduced-iron/ (accessed on 10 March 2023).

- HYL. Available online: https://www.ispatguru.com/hyl-process-for-direct-reduction-of-iron-ore/ (accessed on 10 March 2023).

- Onarheim, K.; Mathisen, A.; Arasto, A. Barriers and opportunities for application of CCS in Nordic industry—A sectorial approach. Int. J. Greenh. Gas Control 2015, 36, 93–105. [Google Scholar] [CrossRef]

- Johansson, P.-O.; Kriström, B. Paying a Premium for Green Steel: Paying for an Illusion? J. Benefit-Cost Anal. 2022, 13, 383–393. [Google Scholar] [CrossRef]

- Carpenter, A. CO2 Abatement in the Iron and Steel Industry; CCC/193; IEA Clean Coal Centre: London, UK, 2012; ISBN 978-92-9029-513-6. [Google Scholar]

- HIsarna. TataSteel: HIsarna Factsheet nr. 2/2020. Available online: https://www.tatasteeleurope.com/sites/default/files/tata-steel-europe-factsheet-hisarna.pdf (accessed on 10 March 2023).

- Hebeda, O.; Guimarães, B.S.; Cretton-Souza, G.; La Rovere, E.L.; Pereira, A.O. Pathways for deep decarbonization of the Brazilian iron and steel industry. J. Clean. Prod. 2023, 401, 136675. [Google Scholar] [CrossRef]

- Leão, A.S.; Medeiros, D.L.; Santiago, M.A.; Maranduba, H.L.; dos Santos Almeida, E. Rigorous environmental and energy life cycle assessment of blast furnace pig iron in Brazil: The role of carbon and iron sources, and co-product utilization. Sustain. Mater. Technol. 2023, 36, e00607. [Google Scholar] [CrossRef]

- Vogl, V.; Åhman, M.; Nilsson, L.J. Assessment of hydrogen direct reduction for fossil-free steelmaking. J. Clean. Prod. 2018, 203, 736–745. [Google Scholar] [CrossRef]

- Axelson, M.; Robson, I.; Khandekar, G.; Wynys, T. Breaking through Industrial Low-CO2 Technologies on the Horizon; Institute for European Studies, Vrije Universiteit Brussel: Brussels, Belgium, 2018. [Google Scholar]

- Siderwin. Development of New Methodologies for Industrial CO2-Free Steel Production by Electrotwinning. Available online: https://www.siderwin-spire.eu/ (accessed on 10 March 2023).

- HYBRIT. Fossil Free Steel; HYBRIT: Stockholm, Sweden, 2017. [Google Scholar]

- GrINHy. Available online: https://salcos.salzgitter-ag.com/en/grinhy-20.html (accessed on 10 March 2023).

- Horizon 2020. Green Industrial Hydrogen via Reversible High-Temperature Electrolysis; EU: Brussels, Belgium, 2017.

- H2future Project, EU. Available online: https://www.h2future-project.eu/technology (accessed on 10 March 2023).

- SuSteel (Project). Available online: https://www.k1-met.com/non_comet/susteel (accessed on 10 March 2023).

- Salzgitter. Available online: https://salcos.salzgitter-ag.com/en/index.html (accessed on 10 March 2023).

- Argenta, P. Sustenovability. SALCOS: Hydrogen for Steel Making. Tenova, S.p.A., Castellanza, Italy. Available online: https://sustenovability.tenova.com/Tenova-Salcos-Hydrogen-for-Steel-Making.php (accessed on 10 March 2023).

- Pers, B.-E. STARKARE stål bra för Miljön. 2014. Available online: https://www.nyteknik.se/opinion/starkare-stal-bra-for-miljon-6343607 (accessed on 10 March 2023).

- Allwood, J.M.; Ashby, M.F.; Gutowski, T.G.; Worrell, E. Material efficiency: A white paper. Resour. Conserv. Recycl. 2011, 55, 362–381. [Google Scholar] [CrossRef]

- Allwood, J.M.; Cullen, J.M. Sustainablematerials—With Both Eyes Open. 2012. Available online: http://www.withbotheyesopen.com/pdftransponder.php?c=100 (accessed on 10 March 2023).

- Allwood, J.M. A Bright Future for UK Steel—A Strategy for Innovation and Leadership through Up-Cycling and Integration; University of Cambridge: Cambridge, UK, 2016; Available online: https://www.cam.ac.uk/system/files/a_bright_future_for_uk_steel_2.pdf (accessed on 10 March 2023).

- Gajdzik, B.; Grabowska, S.; Saniuk, S.; Wieczorek, T. Sustainable Development and Industry 4.0: A Bibliometric Analysis Identifying Key Scientific Problems of the Sustainable Industry 4.0. Energies 2020, 13, 4254. [Google Scholar] [CrossRef]

- Chan, Y.; Petithuguenin, L.; Fleiter, T.; Herbst, A.; Arens, M.; Stevenson, P. Industrial Innovation: Pathways to Deep Decarbonisation of Industry; Part 1: Technology Analysis; ICF: London, UK, 2019. [Google Scholar]

- Alriksson, S.; Henningsson, M. Why aren’t advanced high-strength steels more widely used? Stakeholder preferences and perceived barriers tonne materials. J. Ind. Ecol. 2015, 19, 645–655. [Google Scholar] [CrossRef]

- Wyns, T.; Khandekar, G.; Robson, I. Industrial Value Chains—A Bridge Towards a Carbon Neutral Europe. 2018. Available online: https://www.ies.be/files/Industrial_Value_Chain_25sept_0.pdf (accessed on 10 March 2023).

- Gajdzik, B.; Wolniak, R. Digitalisation and innovation in the steel industry in Poland—Selected tools of ICT in an analysis of statistical data and a case study. Energies 2021, 14, 3034. [Google Scholar] [CrossRef]

- Gajdzik, B. Transformation from Steelworks 3.0 to Steelworks 4.0: Key Technologies of Industry 4.0 and their Usefulness for Polish Steelworks in Direct Research. Eur. Res. Stud. J. 2021, 24, 61–71. [Google Scholar] [CrossRef] [PubMed]

- Gajdzik, B.; Wolniak, R. Transitioning of Steel Producers to the Steelworks 4.0—Literature Review with Case Studies. Energies 2021, 14, 4109. [Google Scholar] [CrossRef]

- Polish Steel Association. Report: Polish Steel Industry; Polish Steel Association: Katowice, Poland, 2023. [Google Scholar]

- Zagórska, M. Analiza Wpływu Przemysłu Stalowego na Gospodarkę. Hutnik-Wiadomości Hutnicze 2019, 7, 216–219. [Google Scholar] [CrossRef]

- Polish Steel Association. Reports: Polish Steel Industry (2021–2022); Polish Steel Association: Katowice, Poland, 2021. [Google Scholar]

- Kobize CO2 Reports. Available online: https://www.kobize.pl/uploads/materialy/materialy_do_pobrania/raport_co2/2022/KOBiZE_Analiza_rynku_CO2_kwiecie%C5%84_2022.pdf. (accessed on 10 March 2023).

- PSE. Electricity Market. Available online: https://www.rynekelektryczny.pl/produkcja-energii-elektrycznej-w-polsce/(10.2020) (accessed on 10 March 2023).

- Steinfoff, J. Transformation of the Polish energy sector as a consequence of the European Green Deal. In Ekonomiczne Skutki Pandemii; Blach, J., Barszczowska, B., Eds.; PTE: Katowice, Poland, 2021; pp. 240–251. [Google Scholar]

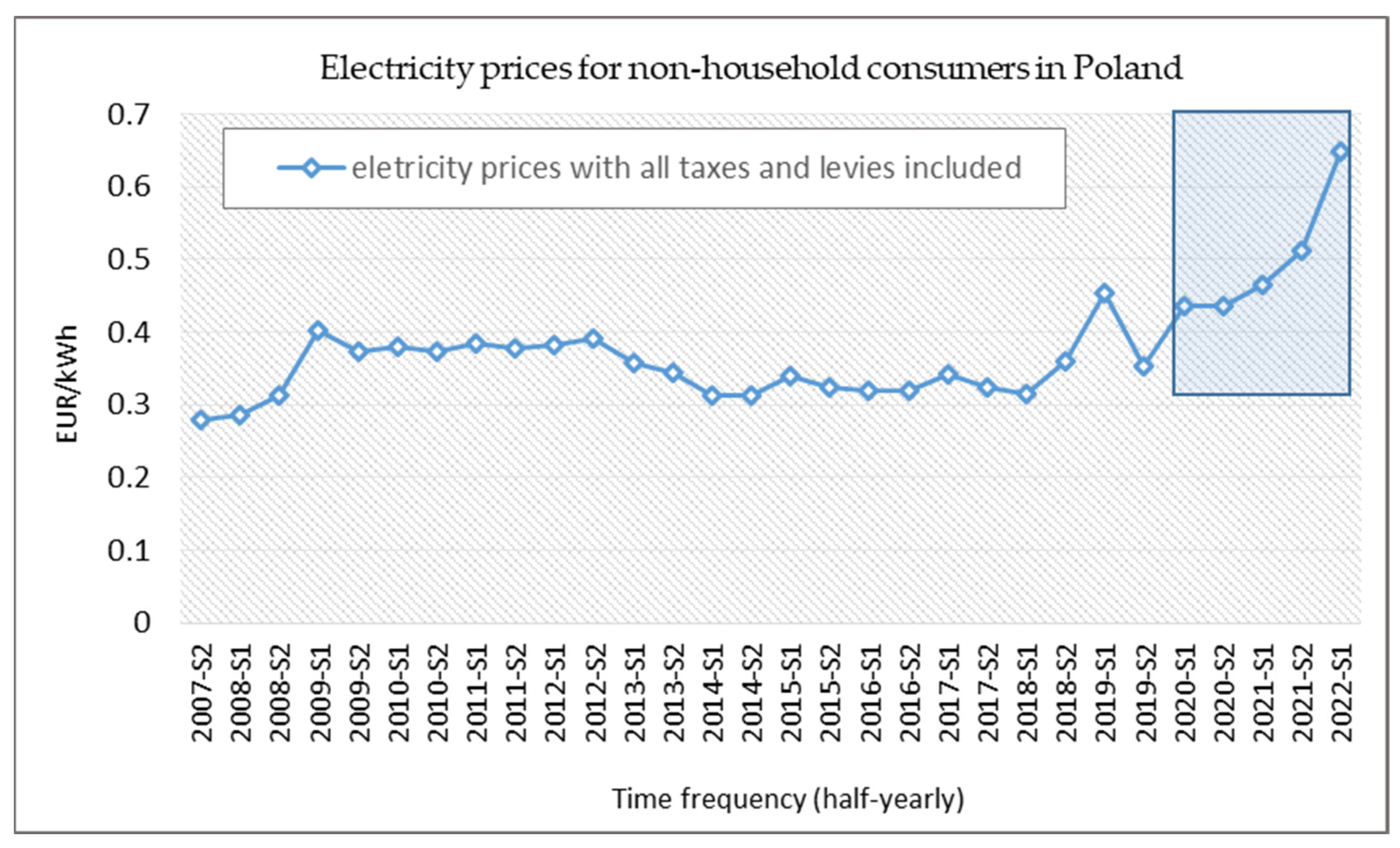

- Dzienniak, S.; Zagórska, M. Droga energia przyczyną niskiej konkurencyjności polskiej gospodarki na przykładzie przemysłu stalowego (Expensive energy as a cause of low competitiveness of the Polish economy). In Proceedings of the Conference of the PTE, Katowice, Poland, September 2021. [Google Scholar]

- Efektywność Wykorzystania Energii w Latach 2008–2018, GUS. Available online: https://stat.gov.pl/obszary-tematyczne/srodowisko-energia/energia/efektywnosc-wykorzystaniaenergii-w-latach-2008-2018,5,15.html (accessed on 10 March 2023).

- Energochłonność Jako Czynnik Nowoczesnej Gospodarki, O. Mikucki, Czysta Energia nr 07-08/2005, Krajowa Agencja Poszanowania Energii. Available online: https://energetyka-w-ue.cire.pl/pliki/2/Kape_cze.pdf (accessed on 10 March 2023).

- Price Notes: Electricity Prices for Non-Household Consumers—Bi-Annual Data (from 2007 Onwards) [NRG_PC_205__custom_4992279]. Available online: https://ec.europa.eu/eurostat/databrowser/view/NRG_PC_205/default/table?lang=en (accessed on 10 March 2023).

- Dzienniak, S. Sytuacja Sektora Stalowego w Polsce; PTE: Katowice, Poland, 2021. [Google Scholar]

- Somers, J. Technologies to Decarbonise the EU Steel Industry, EUR 30982 EN; Publications Office of the European Union: Luxembourg, 2022; ISBN 978-92-76-47147-9. [Google Scholar]

- Gałczyński, M.; Koenig, H.; Kukuła, W.; Piasecki, F.; Schiele, J.; Stoczkiewicz, M.; Zajdler, R. Reforma EU ETS: Jak nie Zmarnować Kolejnej Szansy na Dekarbonizację Polskiej Gospodarki. ClientEarth 2019. [Google Scholar]

- Gajdzik, B.; Sroka, W. Analytic study of the capital restructuring process in metallurgical enterprises around the World and in Poland. Metalurgija 2012, 51, 265–268. [Google Scholar]

- Statistics Poland. Fixed Assets in National Economy (Annual Reports); Statistics Poland: Warsaw, Poland, 2018–2021.

- Energy Commodity Exchange. Available online: www.tge.pl (accessed on 10 March 2023). (In Polish).

- Zagórska, M. Megatrendy kształtujące przemysł stalowy w Europie w warunkach niestabilnego otoczenia. In Proceedings of the PTE Conference of the Polish Economic Society, Katowice, Poland, 25 October 2022. [Google Scholar]

- Zoła, K. Cognor (Financial Expert). Producenci Stali Skazani na Transformację. 2023. Available online: https://www.rp.pl/biznes/art37835191-producenci-stali-skazani-na-transformacje (accessed on 10 March 2023).

- Szopek, J. (Erste Securities Alalyst). Producenci Stali Skazani na Transformację. 2023. Available online: https://www.rp.pl/biznes/art37835191-producenci-stali-skazani-na-transformacje (accessed on 10 March 2023).

- Yeo, R.; Wells, A. Five Things we Learnt at the 2022 Middle East Iron & Steel conference in Dubai. In Proceedings of the 26th Fastmarkets Middle East Iron and Steel Conference, Dubai, United Arab Emirates, December 2023; Available online: https://www.fastmarkets.com/metals-and-mining/middle-east-iron-steel/* (accessed on 10 March 2023).

- Kurrer, C.H. The Potential of Hydrogen for Decarbonising Steel Production, European Parliament Briefing. December 2020. Available online: https://www.europarl.europa.eu/RegData/etudes/BRIE/2020/641552/EPRS_BRI(2020)641552_EN.pdf (accessed on 10 March 2023).

- Samaddar, S. ArcelorMittal Poland. ArcelorMittal o Planach Dekarbonizacji—Nowe Technologie także w Polsce. Available online: https://www.wnp.pl/hutnictwo/ (accessed on 10 March 2023).

- Slęzak, T. Director of Energy and Environmental Protection, Member of the Board of Directors of ArcelorMittal Poland Responsible for Relations with the Public Sector. Elektryfikacja Hutnictwa to Perspektywa Dekady (Electrification of the Steel Industry is the Perspective of a Decade). Available online: https://www.wnp.pl/hutnictwo/elektryfikacja-hutnictwa-to-perspektywa-dekady,499386.html (accessed on 10 March 2023).

- Motyka, M. Producenci Stali Skazani na Transformację (Steel Producers Doomed to Transformation). Available online: https://www.rp.pl/biznes/art37835191-producenci-stali-skazani-na-transformacje (accessed on 10 March 2023).

- Gajdzik, B. Key Directions in Changes from Steelworks 3.0 to Steelworks 4.0 with Analysis of Selected Technologies of Digitalizing the Steel Industry in Poland. Manag. Syst. Prod. Eng. 2022, 30, 46–53. [Google Scholar] [CrossRef]

- Ghobakhloo, M. Industry 4.0, digitization, and opportunities for sustainability. J. Clean. Prod. 2020, 252, 119869. [Google Scholar] [CrossRef]

- Wang, K.; Liu, P.; Zhao, A.; Zhang, Q.; Wang, L.; Xue, Y.; Gao, X.; Gao, D. Development and Application of MES Based on Cloud Platform for Steel Structure Enterprises. In Proceedings of the 2019 IEEE International Conference on Industrial Engineering and Engineering Management, Macao, China, 15–18 December 2019; pp. 521–525. [Google Scholar]

- Tavares, P.; Costa, C.M.; Rocha, L.; Malaca, P.; Costa, P.; Moreira, A.P.; Sousa, A.; Veiga, G. Collaborative welding system using BIM for robotic reprogramming and spatial augmented reality. Autom. Constr. 2019, 106, 102825. [Google Scholar] [CrossRef]

- Kim, J.-K.; Yoo, M.-Y.; Ham, N.-H.; Kim, J.-J.; Choi, C.-S. Process of using BIM for small-scale construction projects—Focusing on the steel-frame work. J. KIBIM 2018, 8, 41–50. [Google Scholar]

- Li, K.; Gan, Y.; Ke, G.; Chen, Z. The Analysis and Application of BIM Technology in Design of Steel Structure Joints. In Proceedings of the 2015 4th International Conference on Sensors, Measurement and Intelligent Materials, Shenzhen, China, 27–28 December 2015; Yarlagadda, P., Ed.; Atlantis Press: Amsterdam, The Netherlands, 2016; Volume 43, pp. 1166–1171. [Google Scholar]

- Chacón, R.; Puig-Polo, C.; Real, E. TLS measurements of initial imperfections of steel frames for structural analysis within BIM enabled platforms. Autom. Constr. 2021, 125, 103618. [Google Scholar] [CrossRef]

- Chen, S.; Wu, J.; Shi, J. A BIM platform for the manufacture of prefabricated steel structure. Appl. Sci. 2020, 10, 8038. [Google Scholar] [CrossRef]

- Li, D.; Liu, J.; Feng, L.; Zhou, Y.; Qi, H.; Chen, Y.F. Automatic modeling of prefabricated components with laser-scanned data for virtual trial assembly. Comput. Aided Civ. Infrastruct. Eng. 2021, 36, 453–471. [Google Scholar] [CrossRef]

- Jacoby, M.; Jovicic, B.; Stojanovic, L.; Stojanović, N. An Approach for Realizing Hybrid Digital Twins Using Asset Administration Shells and Apache StreamPipes. Information 2021, 12, 217. [Google Scholar] [CrossRef]

- Zhao, A.; Liu, P.; Wang, K.; Zhang, Q.; Wang, L.; Xue, Y.; Gao, Y.; Gao, D. Process Management of Customized Product Manufacturing for Steel Structures. In Proceedings of the 2019 IEEE International Conference on Industrial Engineering and Engineering Management, Macao, China, 15–19 December 2019; pp. 531–535. [Google Scholar]

- Gajdzik, B.; Sujová, E.; Biały, W. Decarbonisation of the steel industry: Theoretical and practical approaches with analysis of the situation in the steel sector in Poland. Acta Montan. Slov. 2023, 28. in printing. [Google Scholar]

- Brent, G.F.; Allen, D.J.; Eichler, B.R.; Petrie, J.G.; Mann, J.P.; Haynes, B.S. Mineral carbonation as the core of an industrial symbiosis for energy intensive minerals conversion. J. Ind. Ecol. 2011, 16, 94–104. [Google Scholar] [CrossRef]

- Wu, Y.-G.; Yang, F.-G.; Wang, Y.-M.; Wang, Y.; Zhu, L.-G. Converter steelmaking process design and production based on green steel. Iron Steel 2022, 57, 77–86. [Google Scholar]

- Young, T. Green steel could reach cost parity by 2050. Petrol. Econ. 2022, 89, 86. [Google Scholar]

- Galitskaya, E.; Zhdaneev, O. Development of electrolysis technologies for hydrogen production: A case study of green steel manufacturing in the Russian Federation. Environ. Technol. Innov. 2022, 27, 102517. [Google Scholar] [CrossRef]

- Bhaskar, A.; Abhishek, R.; Assadi, M.; Somehesaraei, H.N. Decarbonizing primary steel production: Techno-economic assessment of a hydrogen based green steel production plant in Norway. J. Clean. Prod. 2022, 350, 131339. [Google Scholar] [CrossRef]

- Salem, Y.A. Top funding for project on green steel of the Max Planck Institute for Iron Research. Stahl Eisen 2022, 142, 52–53. [Google Scholar]

- Raabe, D. Basic research on green steel: European Research Council (ERC) supports Max Planck research project. Metall 2022, 76, 90–91. [Google Scholar]

- Vella, H. Gear up for green steel. Eng. Technol. 2022, 17, 47–55. [Google Scholar] [CrossRef]

- Souza Filho, I.R.; Springer, H.; Ma, Y.; Mahajan, A.; da Silva, C.C.; Kulse, M.; Raabe, D. Green steel at its crossroads: Hybrid hydrogen-based reduction of iron ores. J. Clean. Prod. 2022, 340, 130805. [Google Scholar] [CrossRef]

- Paßmann, T. Green Steel penetrates into everyday life. Stahl Eisen 2022, 142, 20–21. [Google Scholar]

- Moggridge, M. An exclusive interview with H2 Green Steel’s Mark Bula. Steel Times Int. 2022, 46, 2. [Google Scholar]

- Duarte, P.; Maggiolino, S.; Martinez, J. Use of hydrogen for green steel production. In Proceedings of the WHEC 2022—23rd World Hydrogen Energy Conference: Bridging Continents by H2, Istanbul, Turkey, 26–30 June 2022; pp. 1311–1313. [Google Scholar]

- Roginko, S.A. EU green steel deal: Maneuvers on the decarbonization track. Chernye Met. 2022, 11, 66–72. [Google Scholar] [CrossRef]

- Vijayakumar, N.; Pai, R.; Mildt, D. Integration of Green Steel Production in Renewable Energy-Dominated Grids. In Proceedings of the AISTech—Iron and Steel Technology Conference Proceedings, Pittsburgh, PA, USA, 16–18 May 2022; pp. 1176–1187. [Google Scholar]

- Kennedy, J. Pathway to Green Steel in the U.S. by 2027. In Proceedings of the AISTech—Iron and Steel Technology Conference Proceedings, Pittsburgh, PA, USA, 16–18 May 2022; pp. 252–256. [Google Scholar]

- Lang, S.; Haimi, T.; Köpf, M. Circored Fine Ore Direct Reduction Plus DRI Smelting: Proven Technologies for the Transition Towards Green Steel; Minerals, Metals and Materials Series; Springer: Berlin/Heidelberg, Germany, 2022; pp. 61–71. [Google Scholar]

- Guo, M.; Li, Z.; Zhang, Z.; Zhang, Y. Development status of green steel product certification. Yejin Fenxi/Metall. Anal. 2021, 41, 89–95. [Google Scholar]

- Muslemani, H.; Liang, X.; Kaesehage, K.; Ascui, F.; Wilson, J. Opportunities and challenges for decarbonizing steel production by creating markets for ‘green steel’ products. J. Clean. Prod. 2021, 315, 128127. [Google Scholar] [CrossRef]

- Griffin, P.W.; Hammond, G.P. The prospects for ‘green steel’ making in a net-zero economy: A UK perspective. Glob. Transit. 2021, 3, 72–86. [Google Scholar] [CrossRef]

- Vogl, V.; Åhman, M.; Nilsson, L.J. The making of green steel in the EU: A policy evaluation for the early commercialization phase. Clim. Policy 2021, 21, 78–92. [Google Scholar] [CrossRef]

- Sutherland, B.R. Accelerating Green Steel in the EU. Joule 2020, 4, 1860–1861. [Google Scholar] [CrossRef]

- Zaini, I.N.; Nurdiawati, A.; Gustavsson, J.; Samuelsson, P.; Yang, W. Decarbonising the iron and steel industries: Production of carbon-negative direct reduced iron by using biosyngas. Energy Convers. Manag. 2023, 281, 116806. [Google Scholar] [CrossRef]

- Nurdiawati, A.; Zaini, I.N.; Wei, W.; Yang, W.; Samuelsson, P. Towards fossil-free steel: Life cycle assessment of biosyngas-based direct reduced iron (DRI) production process. J. Clean. Prod. 2023, 393, 136262. [Google Scholar] [CrossRef]

- Gorman, L. On Track for Green Steel Making. Available online: https://nelhydrogen.com/wp-content/uploads/2022/03/Steel-Times-International-October-2021-On-track-for-green-steel-making-article.pdf (accessed on 16 March 2023).

- Wolff, D. Hydrogen’s Role in Making Steel Green. Available online: https://nelhydrogen.com/articles/green-hydrogen/hydrogens-role-in-making-steel-green/ (accessed on 16 March 2023).

- Tanaka, H. Resources Trend and Use of Direct Reduced Iron in Steelmaking Process. Kobelco Technol. Rev. 2015, 33, 1–7. [Google Scholar]

- Liu, Q.; Zhao, Y.J.; Huang, Y.; Pei, F.; Cui, Y.; Shi, L.J.; Chang, L.; Qui, Y. Pilot test of low-rank coal pyrolysis coupled with gasification to hydrogen-rich gas for direct reduced iron: Process modeling, simulation and thermodynamic analysis. Fuel 2023, 331, 125862. [Google Scholar] [CrossRef]

- Matsukevich, I.; Kulinich, N.; Romanovski, V. Direct reduced iron and zinc recovery from electric arc furnace dust. J. Chem. Technol. Biotechnol. 2022, 97, 3453–3458. [Google Scholar] [CrossRef]

- Kim, W.; Sohn, I. Critical challenges facing low carbon steelmaking technology using hydrogen direct reduced iron. Joule 2022, 6, 2228–2232. [Google Scholar] [CrossRef]

- Pfeiffer, A.; Wimmer, G.; Schenk, J. Investigations on the Interaction Behavior between Direct Reduced Iron and Various Melts. Materials 2022, 15, 5691. [Google Scholar] [CrossRef]

- Bond, N.; Symonds, R.; Hughes, R. Pressurized Chemical Looping for Direct Reduced Iron Production: Carbon Neutral Process Configuration and Performance. Energies 2022, 15, 5219. [Google Scholar] [CrossRef]

- Heo, J.; Park, J.H. Interfacial reactions between magnesia refractory and electric arc furnace (EAF) slag with use of direct reduced iron (DRI) as raw material. Ceram. Int. 2022, 48, 4526–4538. [Google Scholar] [CrossRef]

- Heo, J.; Park, J.H. Self-Protecting Mechanism of Magnesia Refractory in Electric Arc Furnace Operation Conditions: Challenges of Active Use of Direct Reduced Iron. In Proceedings of the 8th International Congress on the Science and Technology of Steelmaking, ICS 2022, Montreal, QC, Canada, 2–4 August 2022; pp. 209–212. [Google Scholar]

- Kenny, G.; Pistorius, P.C. Structural Analysis and Failure Prediction of Direct Reduced Iron. In Proceedings of the AISTech—Iron and Steel Technology Conference Proceedings, Pittsburgh, PA, USA, 16–18 May 2022; pp. 275–282. [Google Scholar]

- Park, S.; Lee, Y.-J.; Kim, J.-H.; Lee, E.-S.; Song, K.D. Simulation of the hydrogen reduction for the production of direct reduced iron. SPIE 2022, 12045, 109–113. [Google Scholar]

- Andersson, J.; Grönkvist, S. A comparison of two hydrogen storages in a fossil-free direct reduced iron process. Int. J. Hydrogen Energy 2021, 46, 28657–28674. [Google Scholar] [CrossRef]

- Zheng, Z.; Li, Y.; Guo, Q.; Zhang, L.; Qi, T. Promoting the reduction reactivity of magnetite by introducing trace-K-ions in hydrogen direct reduction. Int. J. Hydrogen Energy 2023, in press. [Google Scholar] [CrossRef]

- Wang, R.R.; Zhao, Y.Q.; Babich, A.; Senk, D.; Fan, X.Y. Hydrogen direct reduction (H-DR) in steel industry—An overview of challenges and opportunities. J. Clean. Prod. 2021, 329, 129797. [Google Scholar] [CrossRef]

- Pimm, A.J.; Cockerill, T.T.; Gale, W.F. Energy system requirements of fossil-free steelmaking using hydrogen direct reduction. J. Clean. Prod. 2021, 312, 127665. [Google Scholar] [CrossRef]

- Hall, W. Green Steel through Hydrogen Direct Reduction. A Study on the Role of Hydrogen in the Indian Iron and Steel Sector. The Energy and Resources Institute. 2021. Available online: https://www.teriin.org/sites/default/files/2021-08/policybrief-green-steel.pdf (accessed on 16 March 2023).

- Pike, J. Innovative uses of Hydrogen in Steelmaking. Midrex. 2017. Available online: https://www.energy.gov/sites/prod/files/2017/05/f34/fcto_may_2017_h2_scale_wkshp_ripke.pdf (accessed on 16 March 2023).

- Kiessling, S.; Darabkhani, G.; Soliman, A.H. The Bio Steel Cycle: 7 Steps to Net-Zero CO2 Emissions Steel Production. Energies 2022, 15, 8880. [Google Scholar] [CrossRef]

- Kushnir, D.; Hansen, T.; Vogl, V.; Åhman, M. Adopting hydrogen direct reduction for the Swedish steel industry: A technological innovation system (TIS) study. J. Clean. Prod. 2020, 242, 118185. [Google Scholar] [CrossRef]

- Vogl, V.; Åhman, M.; Nilsson, L.J. Rethinking steelmaking: Zero-emissions and flexibility with hydrogen direct reduction. In Proceedings of the ECEEE Industrial Summer Study Proceedings, Berlin, Germany, 11–13 June 2018. [Google Scholar]

- Yu, L.; Wang, Y.; Wei, X.; Zeng, C. Towards low-carbon development: The role of industrial robots in decarbonization in Chinese cities. J. Environ. Manag. 2023, 330, 117216. [Google Scholar] [CrossRef]

- Kamolov, A.; Turakulov, Z.; Rejabov, S.; Fallanza, M.; Irabien, A. Decarbonization of Power and Industrial Sectors: The Role of Membrane Processes. Membranes 2023, 13, 130. [Google Scholar] [CrossRef] [PubMed]

- Zier, M.; Pflugradt, N.; Stenzel, P.; Kotzur, L.; Stolten, D. Industrial decarbonization pathways: The example of the German glass industry. Energy Convers. Manag. X 2023, 17, 100336. [Google Scholar] [CrossRef]

- Kawai, E.; Ozawa, A.; Leibowicz, B.D. Role of carbon capture and utilization (CCU) for decarbonization of industrial sector: A case study of Japan. Appl. Energy 2022, 328, 120183. [Google Scholar] [CrossRef]

- Feng, S.; Han, F. Radical innovation detection in the solar energy domain based on patent analysis. Front. Energy Res. 2023, 10, 1056564. [Google Scholar] [CrossRef]

- Johansen, J.P.; Isaeva, I. Developing and (not) implementing radical energy efficiency innovations: A case study of R&D projects in the Norwegian manufacturing industry. J. Clean. Prod. 2021, 322, 129077. [Google Scholar]

- Kerr, P.; Noble, D.R.; Hodges, J.; Jeffrey, H. Implementing radical innovation in renewable energy experience curves. Energies 2021, 14, 2364. [Google Scholar] [CrossRef]

- Salam, M.A.; Shaikh, M.A.A.; Ahmed, K. Green hydrogen based power generation prospect for sustainable development of Bangladesh using PEMFC and hydrogen gas turbine. Energy Rep. 2023, 9, 3406–3416. [Google Scholar] [CrossRef]

- Al-Ghussain, L.; Ahmad, A.D.; Abubaker, A.M.; Hassan, M.A.; Annuk, A. Techno-economic feasibility of hybrid PV/wind/battery/thermal storage trigeneration system: Toward 100% energy independency and green hydrogen production. Energy Rep. 2023, 9, 752–772. [Google Scholar] [CrossRef]

- Singh, A.; Shivapuji, A.M.; Dasappa, S. VPSA process characterization for ISO quality green hydrogen generation using two practical multi-component biomass gasification feeds. Sep. Purif. Technol. 2023, 315, 123667. [Google Scholar] [CrossRef]

- Martins, K.; Carton, J.G. Prospective roles for green hydrogen as part of Ireland’s decarbonisation strategy. Results Eng. 2023, 18, 101030. [Google Scholar] [CrossRef]

- Choi, W.; Kang, S. Greenhouse gas reduction and economic cost of technologies using green hydrogen in the steel industry. J. Environ. Manag. 2023, 335, 117569. [Google Scholar] [CrossRef] [PubMed]

| BF Blast Furnace + BOF | EAF Electric Arc Furnace |

|---|---|

|

|

|

|

|

|

| Resources | Electricity/Energy | Natural Gas | Steel Scrap | Coke | Iron Ore |

|---|---|---|---|---|---|

| price in 2021 | 61.74 EUR/MWh | 19.48 EUR/MWh | 134.60 EUR/t | 132.4 USD/t | 101 USD/t |

| price in 2022 | 400.10 EUR/MWh | 205.69 EUR/MWh | 420.50 EUR/t | 506.0 USD/t | 162 USD/t |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gajdzik, B.; Wolniak, R.; Grebski, W. Process of Transformation to Net Zero Steelmaking: Decarbonisation Scenarios Based on the Analysis of the Polish Steel Industry. Energies 2023, 16, 3384. https://doi.org/10.3390/en16083384

Gajdzik B, Wolniak R, Grebski W. Process of Transformation to Net Zero Steelmaking: Decarbonisation Scenarios Based on the Analysis of the Polish Steel Industry. Energies. 2023; 16(8):3384. https://doi.org/10.3390/en16083384

Chicago/Turabian StyleGajdzik, Bożena, Radosław Wolniak, and Wies Grebski. 2023. "Process of Transformation to Net Zero Steelmaking: Decarbonisation Scenarios Based on the Analysis of the Polish Steel Industry" Energies 16, no. 8: 3384. https://doi.org/10.3390/en16083384

APA StyleGajdzik, B., Wolniak, R., & Grebski, W. (2023). Process of Transformation to Net Zero Steelmaking: Decarbonisation Scenarios Based on the Analysis of the Polish Steel Industry. Energies, 16(8), 3384. https://doi.org/10.3390/en16083384