Electric Vehicles Charging Using Photovoltaic Energy Surplus: A Framework Based on Blockchain

Abstract

1. Introduction

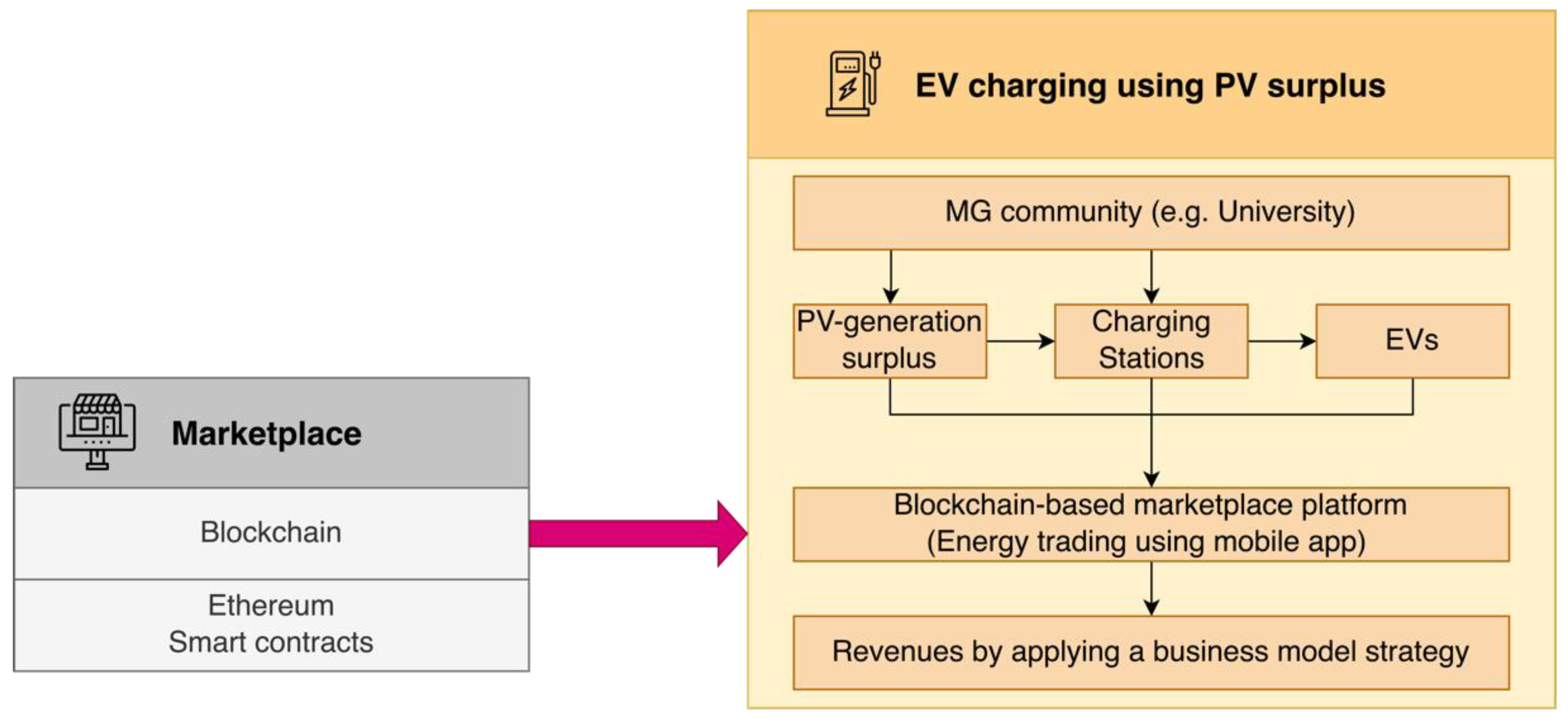

- We introduce a reliable and economically consistent business model for energy trading between small energy producers and EV owners, filling a critical gap in the existing literature.

- We present a blockchain-based application that enables energy trading in a decentralised market, providing a secure and transparent means of performing transactions.

- We evaluate the feasibility of utilising surplus PV-generated energy from small energy producers to charge EVs, offering a promising solution for promoting sustainable energy use.

- We conduct a case study to assess the economic and environmental impacts of the proposed framework, demonstrating its potential as a viable and effective means of promoting sustainable energy practices.

2. Overview of EVs and Distributed Energy Systems Integration

2.1. PV Energy Generation and EVs

2.2. Optimisation Frameworks for EVs in the Context of Distributed Generation

2.3. Blockchain Application in the EV Sector

3. Methodological Approach

3.1. Business Model

- Responsiveness: Support for smartphones and tablets.

- Integration: Ability to provide solutions for application connectivity to the database.

- Application Architecture: Ability to support native and hybrid applications. Cross-platform support.

- Management and Security: Ability to provide secure user authentication methods and payment gateways.

3.2. Blockchain Applied in the Context of This Research

| Algorithm 1. Smart Contract pseudocode |

| 1: Procedure Validate_Contract (client, seller, asset): 2: prompt payment_method 3: paymentIsValid = paymentMethodIsValid() 4: if paymentIsValid do: 5: invoice = generateInvoice() 6: sendInvoiceByEmail(invoice, client.email) 7: releaseAsset(asset, client) 8: releaseFunds(asset.price, seller.account) 9: return 1 10: end if 11: display InvalidPaymentError() 12: return 0 13: end while 14: end Procedure |

- Charger Available is the state that represents a charger ready to be used. If there is energy available, any eligible user can make a reservation. The smart contract verifies the user’s eligibility.

- Charger Reserved is the state where the smart contract locks a specific charger to a particular customer. If the user does not get to the charger within a predefined time window, the smart contract frees the charging point by reversing the smart contract’s state to the Charger Available state via the Reject function.

- Charging Started is the state where the actual energy transfer is being performed. From this point forward, the customer is always set for the energy transferred. In this state, the smart contract holds the currency necessary for the desired charging session. These funds will be transferred to the energy seller once the charging is complete.

- Charging Complete is the state where the contract arrives when the user quits charging. After receiving the amount transferred to each part of the trade, this contract automatically executes the Payment function, which transfers the amounts to the stakeholders.

- Place Order is the function that enables the user to reserve a charging point. To secure a spot, the smart contract checks for eligibility criteria for the user and the charging point itself, such as non-zero funds on the user’s wallet and energy availability on the charging point. This function changes the state of the contract to Charger Reserved.

- Reject is the function that returns the charging point to the default state Charger Available. This function is called whenever the desired condition is unmet in the Charger Reserved state.

- Accept Order is the function which initiates the energy transaction. This function transfers the currency necessary for the charging session to the smart contract. These funds are transferred to the seller once the service is complete. This function changes the state of the contract to Charger Started.

- Charging Event is the function that is triggered when the charging operation is interrupted. This function calculates the amount of energy sold and translates it to the amount of currency that should be transferred to each party. This function changes the state of the contract to Charging Complete.

- Payment is the function that transfers funds to the stakeholders and performs the necessary checks to return the charger to the Charger Available state.

- Front-end to back-end communication: Secure HTTP protocol is the standard communication protocol for this scenario. WebSockets can be used as redundancy. If the application is solely mobile, WebSockets can be fully utilised instead of secure HTTP, thus providing two independent communication channels between the back- and front-end. Secure communication over these protocols can be enforced using modern encryption algorithms

- From the back-end to the smart contract: deploying the smart contract to the blockchain will be assured by a 3rd party platform, such as Azure or IBM. The communication from the back-end server to the blockchain is caried out through APIs built on top of protocols HTTP, WebSockets, or IPC. Existing libraries, such as web3js, provide an API using many of these protocols, with some being used as redundancy. Furthermore, the load on this link is lower than on the back-front link (smart contracts calls are fast).

4. Case Study

4.1. Case Study Characteristics

4.2. Cost Comparison and Emissions Savings

4.3. Economic Analysis

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Nomenclature

| BAC | Block Alliance Consensus |

| BESS | Battery Energy Storage Systems |

| CO2 | Carbon Dioxide |

| CPO | Charging Point Operator |

| EV | Electric Vehicle |

| EU | European Union |

| EMNM | Electric Mobility Network Managing |

| EMS | Electric Mobility Suppliers |

| FIT | Feed-in-Tariffs |

| FIP | Feed-in-Premiums |

| GHG | Greenhouse Gas |

| IRR | Internal Rate of Return |

| ICE | Internal Combustion Engine |

| IEA | International Energy Agency |

| IRENA | International Renewable Energy Agency |

| ML | Machine Learning |

| MO | Mathematical Optimization |

| MILP | Mixed-Integer Linear Programming |

| NPV | Net Present Value |

| P2P | Peer-to-Peer |

| PV | Photovoltaic System |

| RES | Renewable Energy Sources |

| STE | Special Tax on Electricity |

| SOC | State of Charge |

| V2G | Vehicle-to-Grid |

| VAT | Value -Added Tax |

Appendix A

References

- IEA; IRENA; UN Climate Change HighLevel Champions. The Breakthrough Agenda Report; IEA: Paris, France, 2022. [Google Scholar]

- IEA. Global Energy Review: CO2 Emissions in 2021; IEA: Paris, France, 2022. [Google Scholar]

- BloombergNEF. EVO Report 2022, Bloomberg Finance LP; BloombergNEF: New York, NY, USA, 2022. [Google Scholar]

- IRENA. Global Renewables Outlook—Energy Transformation 2050; IRENA: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- IEA. Market Report Series: Renewables 2018; IEA: Paris, France, 2018. [Google Scholar]

- Wolkinger, B.; Haas, W.; Bachner, G.; Weisz, U.; Steininger, K.; Hutter, H.P.; Delcour, J.; Griebler, R.; Mittelbach, B.; Maier, P.; et al. Evaluating Health Co-Benefits of Climate Change Mitigation in Urban Mobility. Int. J. Environ. Res. Public Health 2018, 15, 880. [Google Scholar] [CrossRef] [PubMed]

- Ji, Z.; Huang, X. Plug-in Electric Vehicle Charging Infrastructure Deployment of China towards 2020: Policies, Methodologies, and Challenges. Renew. Sustain. Energy Rev. 2018, 90, 710–727. [Google Scholar] [CrossRef]

- European Green Deal. Available online: https://www.consilium.europa.eu/en/policies/green-deal/ (accessed on 10 March 2023).

- Müller, M.; Blume, Y.; Reinhard, J. Impact of Behind-the-Meter Optimised Bidirectional Electric Vehicles on the Distribution Grid Load. Energy 2022, 255, 124537. [Google Scholar] [CrossRef]

- Roy, J.V.; Leemput, N.; Geth, F.; Buscher, J.; Salenbien, R.; Driesen, J. Electric Vehicle Charging in an Office Building Microgrid With Distributed Energy Resources. IEEE Trans. Sustain. Energy 2014, 5, 1389–1396. [Google Scholar] [CrossRef]

- Yang, L.; Yu, B.; Yang, B.; Chen, H.; Malima, G.; Wei, Y.M. Life Cycle Environmental Assessment of Electric and Internal Combustion Engine Vehicles in China. J. Clean. Prod. 2021, 285, 124899. [Google Scholar] [CrossRef]

- Fouad, M.M.; Shihata, L.A.; Morgan, E.S.I. An Integrated Review of Factors Influencing the Performance of Photovoltaic Panels. Renew. Sustain. Energy Rev. 2017, 80, 1499–1511. [Google Scholar] [CrossRef]

- Cox, B.; Bauer, C.; Mendoza Beltran, A.; van Vuuren, D.P.; Mutel, C.L. Life Cycle Environmental and Cost Comparison of Current and Future Passenger Cars under Different Energy Scenarios. Appl. Energy 2020, 269, 115021. [Google Scholar] [CrossRef]

- Bonsu, N.O. Towards a Circular and Low-Carbon Economy: Insights from the Transitioning to Electric Vehicles and Net Zero Economy. J. Clean. Prod. 2020, 256, 120659. [Google Scholar] [CrossRef]

- Remme, D.; Jackson, J. Green Mission Creep: The Unintended Consequences of Circular Economy Strategies for Electric Vehicles. J. Clean. Prod. 2023, 394, 136346. [Google Scholar] [CrossRef]

- d’Adamo, I.; Gastaldi, M.; Ozturk, I. The Sustainable Development of Mobility in the Green Transition: Renewable Energy, Local Industrial Chain, and Battery Recycling. Sustain. Dev. 2022. [Google Scholar] [CrossRef]

- Kastanaki, E.; Giannis, A. Dynamic Estimation of End-of-Life Electric Vehicle Batteries in the EU-27 Considering Reuse, Remanufacturing and Recycling Options. J. Clean. Prod. 2023, 393, 136349. [Google Scholar] [CrossRef]

- Cusenza, M.A.; Guarino, F.; Longo, S.; Mistretta, M.; Cellura, M. Reuse of Electric Vehicle Batteries in Buildings: An Integrated Load Match Analysis and Life Cycle Assessment Approach. Energy Build. 2019, 186, 339–354. [Google Scholar] [CrossRef]

- Swain, B. Recovery and Recycling of Lithium: A Review. Sep. Purif. Technol. 2017, 172, 388–403. [Google Scholar] [CrossRef]

- Guo, M.; Huang, W. Consumer Willingness to Recycle The Wasted Batteries of Electric Vehicles in the Era of Circular Economy. Sustainability 2023, 15, 2630. [Google Scholar] [CrossRef]

- IRENA. World Energy Transitions Outlook 2022: 1.5 °C Pathway; IRENA: Abu Dhabi, United Arab Emirates, 2022. [Google Scholar]

- European Parliamentary Research Service. Solar Energy in the EU; European Parliamentary Research Service: Brussels, Belgium, 2022. [Google Scholar]

- Ritter, D.; Bauknecht, D.D.; Dünzen, K. Recommendations for an Ambitious EU-Wide Solar Mandate. Available online: https://policycommons.net/artifacts/3094938/recommendations-for-an-ambitious-eu-wide-solar-mandate/3895796/ (accessed on 15 February 2023).

- Lu, Y.; Khan, Z.A.; Alvarez-Alvarado, M.S.; Zhang, Y.; Huang, Z.; Imran, M. A Critical Review of Sustainable Energy Policies for the Promotion of Renewable Energy Sources. Sustainability 2020, 12, 5078. [Google Scholar] [CrossRef]

- Tomizawa, Y.; Iino, Y.; Ihara, Y.; Hayashi, Y.; Miyazaki, T.; Yamamoto, R. Charging Schedule Optimization Method for Electric Buses with PV Installed at Bus Stations: Sensitivity Analysis of PV Capacity Based on Real City Data. In Proceedings of the 2020 International Conference on Smart Grids and Energy Systems (SGES), Perth, Australia, 23–26 November 2020; pp. 157–162. [Google Scholar]

- Bruinsma, G.; Carati, E.G.; Piveta, M.; Salvatti, G.A.; Rech, C. Electric Vehicle Charging Strategy in Smart Grids with Distributed Generation. In Proceedings of the 2022 14th Seminar on Power Electronics and Control (SEPOC), Santa Maria, Brazil, 12–15 November 2022; pp. 1–6. [Google Scholar]

- de Simon-Martin, M.; de la Puente-Gil, A.; Blanes-Peiro, J.J.; Bracco, S.; Delfino, F.; Piazza, G. Smart Charging of Electric Vehicles to Minimize Renewable Power Curtailment in Polygeneration Prosumer Buildings. In Proceedings of the 2020 Fifteenth International Conference on Ecological Vehicles and Renewable Energies (EVER), Monte-Carlo, Monaco, 10–12 September 2020; pp. 1–8. [Google Scholar]

- Małek, A.; Caban, J.; Wojciechowski, Ł. Charging Electric Cars as a Way to Increase the Use of Energy Produced from RES. Open Eng. 2020, 10, 98–104. [Google Scholar] [CrossRef]

- Yang, J.; Wiedmann, T.; Luo, F.; Yan, G.; Wen, F.; Broadbent, G.H. A Fully Decentralized Hierarchical Transactive Energy Framework for Charging EVs With Local DERs in Power Distribution Systems. IEEE Trans. Transp. Electrif. 2022, 8, 3041–3055. [Google Scholar] [CrossRef]

- Gomes, I.S.F.; Perez, Y.; Suomalainen, E. Coupling Small Batteries and PV Generation: A Review. Renew. Sustain. Energy Rev. 2020, 126, 109835. [Google Scholar] [CrossRef]

- Percis, E.S.; Nalini, A.; Jenish, T.N.; Jayarajan, J.; Bhuvaneswari, S.; Rama, S.T. Design of a Self-Sustained Hybrid Renewable Energy Microgrid for Rural Electrification of Dry Lands. Int. J. Energy Res. 2021, 45, 8316–8326. [Google Scholar] [CrossRef]

- Long, M.; Wei, M.; Huang, L. Research on Operation Mode of “Wind-Photovoltaic-Energy Storage-Charging Pile” Smart Microgrid Based on Multi-Agent Interaction. In Proceedings of the 5th IEEE Conference on Energy Internet and Energy System Integration: Energy Internet for Carbon Neutrality, EI2 2021, Taiyuan, China, 22–24 October 2021; pp. 2054–2058. [Google Scholar] [CrossRef]

- Barone, G.; Buonomano, A.; Calise, F.; Forzano, C.; Palombo, A. Building to Vehicle to Building Concept toward a Novel Zero Energy Paradigm: Modelling and Case Studies. Renew. Sustain. Energy Rev. 2019, 101, 625–648. [Google Scholar] [CrossRef]

- Zhou, Y.; Cao, S. Energy Flexibility Investigation of Advanced Grid-Responsive Energy Control Strategies with the Static Battery and Electric Vehicles: A Case Study of a High-Rise Office Building in Hong Kong. Energy Convers. Manag. 2019, 199, 111888. [Google Scholar] [CrossRef]

- Moura, P.; Sriram, U.; Mohammadi, J. Sharing Mobile and Stationary Energy Storage Resources in Transactive Energy Communities. In Proceedings of the 2021 IEEE Madrid PowerTech, PowerTech 2021—Conference Proceedings, Madrid, Spain, 28 June–2 July 2021. [Google Scholar] [CrossRef]

- Vopava, J.; Bergmann, U.; Kienberger, T. Synergies between E-Mobility and Photovoltaic Potentials—A Case Study on an Urban Medium Voltage Grid. Energies 2020, 13, 3795. [Google Scholar] [CrossRef]

- Thomas, D.; Deblecker, O.; Ioakimidis, C.S. Optimal Operation of an Energy Management System for a Grid-Connected Smart Building Considering Photovoltaics’ Uncertainty and Stochastic Electric Vehicles’ Driving Schedule. Appl. Energy 2018, 210, 1188–1206. [Google Scholar] [CrossRef]

- Cao, S. The Impact of Electric Vehicles and Mobile Boundary Expansions on the Realization of Zero-Emission Office Buildings. Appl. Energy 2019, 251, 113347. [Google Scholar] [CrossRef]

- ur Rehman, H.; Korvola, T.; Abdurafikov, R.; Laakko, T.; Hasan, A.; Reda, F. Data Analysis of a Monitored Building Using Machine Learning and Optimization of Integrated Photovoltaic Panel, Battery and Electric Vehicles in a Central European Climatic Condition. Energy Convers. Manag. 2020, 221, 113206. [Google Scholar] [CrossRef]

- Cumaratunga, H.; Imanaka, M.; Kurimoto, M.; Sugimoto, S.; Kato, T. Proposal of Priority Schemes for Controlling Electric Vehicle Charging and Discharging in a Workplace Power System with High Penetration of Photovoltaic Systems. Energies 2021, 14, 7483. [Google Scholar] [CrossRef]

- Wei, Y.; Han, T.; Wang, S.; Qin, Y.; Lu, L.; Han, X.; Ouyang, M. An Efficient Data-Driven Optimal Sizing Framework for Photovoltaics-Battery-Based Electric Vehicle Charging Microgrid. J. Energy Storage 2022, 55, 105670. [Google Scholar] [CrossRef]

- Li, B.; Guo, Y.; Du, Q.; Zhu, Z.; Li, X.; Lu, R. P3: Privacy-Preserving Prediction of Real-Time Energy Demands in EV Charging Networks. IEEE Trans. Ind. Inform. 2022, 19, 3029–3038. [Google Scholar] [CrossRef]

- Lin, Y.-J.; Chen, Y.-C.; Zheng, J.-Y.; Shao, D.-W.; Chu, D.; Yang, H.-T. Blockchain-Based Intelligent Charging Station Management System Platform. IEEE Access 2022, 10, 101936–101956. [Google Scholar] [CrossRef]

- Luo, Q.; Zhou, Y.; Hou, W.; Peng, L. A Hierarchical Blockchain Architecture Based V2G Market Trading System. Appl. Energy 2022, 307, 118167. [Google Scholar] [CrossRef]

- Haider, S.; Rizvi, R.E.Z.; Walewski, J.; Schegner, P. Investigating Peer-to-Peer Power Transactions for Reducing EV Induced Network Congestion. Energy 2022, 254, 124317. [Google Scholar] [CrossRef]

- He, Y.; Zhang, C.; Wu, B.; Geng, Z.; Xiao, K.; Li, H. A Trusted Architecture for EV Shared Charging Based on Blockchain Technology. High-Confid. Comput. 2021, 1, 100001. [Google Scholar] [CrossRef]

- Kakkar, R.; Gupta, R.; Agrawal, S.; Bhattacharya, P.; Tanwar, S.; Raboaca, M.S.; Alqahtani, F.; Tolba, A. Blockchain and Double Auction-Based Trustful EVs Energy Trading Scheme for Optimum Pricing. Mathematics 2022, 10, 2748. [Google Scholar] [CrossRef]

- Wen, Y.; Chen, Y.; Wang, P.; Rassol, A.; Xu, S. Photovoltaic–Electric Vehicles Participating in Bidding Model of Power Grid That Considers Carbon Emissions. Energy Rep. 2022, 8, 3847–3855. [Google Scholar] [CrossRef]

- Pee, S.J.; Kang, E.S.; Song, J.G.; Jang, J.W. Blockchain Based Smart Energy Trading Platform Using Smart Contract. In Proceedings of the 2019 International Conference on Artificial Intelligence in Information and Communication (ICAIIC), Okinawa, Japan, 11–13 February 2019; pp. 322–325. [Google Scholar]

- Karumba, S.; Sethuvenkatraman, S.; Dedeoglu, V.; Jurdak, R.; Kanhere, S.S. Barriers to Blockchain-Based Decentralised Energy Trading: A Systematic Review. Int. J. Sustain. Energy 2023, 42, 41–71. [Google Scholar] [CrossRef]

- Alsenani, T.R. The Participation of Electric Vehicles in a Peer-to-Peer Energy-Backed Token Market. Int. J. Electr. Power Energy Syst. 2023, 148, 109005. [Google Scholar] [CrossRef]

- Pardo-Bosch, F.; Pujadas, P.; Morton, C.; Cervera, C. Sustainable Deployment of an Electric Vehicle Public Charging Infrastructure Network from a City Business Model Perspective. Sustain. Cities Soc. 2021, 71, 102957. [Google Scholar] [CrossRef]

- Yap, K.Y.; Chin, H.H.; Klemeš, J.J. Blockchain Technology for Distributed Generation: A Review of Current Development, Challenges and Future Prospect. Renew. Sustain. Energy Rev. 2023, 175, 113170. [Google Scholar] [CrossRef]

- Wang, Y.; Yuan, L.; Jiao, W.; Qiang, Y.; Zhao, J.; Yang, Q.; Li, K. A Fast and Secured Vehicle-to-Vehicle Energy Trading Based on Blockchain Consensus in the Internet of Electric Vehicles. IEEE Trans. Veh. Technol. 2023, 1–16. [Google Scholar] [CrossRef]

- Khalid, R.; Malik, M.W.; Alghamdi, T.A.; Javaid, N. A Consortium Blockchain Based Energy Trading Scheme for Electric Vehicles in Smart Cities. J. Inf. Secur. Appl. 2021, 63, 102998. [Google Scholar] [CrossRef]

- Gonçalves, H.; Leão, T.P. Fórum Energias Renováveis Em Portugal 2020. Available online: https://www.lneg.pt/wp-content/uploads/2020/11/F%C3%B3rum-Energias-Renov%C3%A1veis-em-Portugal-2020.pdf (accessed on 18 December 2022).

- Q Cells PV Module Datasheet. Available online: https://d1819pwkf4ncw.cloudfront.net/files/documents/hanwhaqcellsdatasheetqpeak-g3265-280201408rev03na-257065.pdf (accessed on 1 March 2023).

- Smith, C.J.; Forster, P.M.; Crook, R. Global Analysis of Photovoltaic Energy Output Enhanced by Phase Change Material Cooling. Appl. Energy 2014, 126, 21–28. [Google Scholar] [CrossRef]

- Crook, J.A.; Jones, L.A.; Forster, P.M.; Crook, R. Climate Change Impacts on Future Photovoltaic and Concentrated Solar Power Energy Output. Energy Environ. Sci. 2011, 4, 3101. [Google Scholar] [CrossRef]

- Morais, H.; Pinto, T.; Vale, Z. Adjacent Markets Influence Over Electricity Trading—Iberian Benchmark Study. Energies 2020, 13, 2808. [Google Scholar] [CrossRef]

- Nicolini, M.; Tavoni, M. Are Renewable Energy Subsidies Effective? Evidence from Europe. Renew. Sustain. Energy Rev. 2017, 74, 412–423. [Google Scholar] [CrossRef]

- Mobi.E Tariff Structure. Available online: https://www.mobie.pt/redemobie/estrutura-tarifaria (accessed on 1 March 2023).

- Transportation & Environment. How Clean Are Electric Cars? Transportation & Environment: Brussels, Belgium, 2020. [Google Scholar]

- Saltelli, A.; Aleksankina, K.; Becker, W.; Fennell, P.; Ferretti, F.; Holst, N.; Li, S.; Wu, Q. Why so Many Published Sensitivity Analyses Are False: A Systematic Review of Sensitivity Analysis Practices. Environ. Model. Softw. 2019, 114, 29–39. [Google Scholar] [CrossRef]

| Percis et al. [22] | Long et al. [23] | Barone et al. [24] | Zhou & Cao [25] | Moura et al. [26] | Thomas et al. [27] | Cao [29] | Rehman et al. [30] | Cumaratunga et al. [31] | Wei et al. [32] | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Perspective | Grid | x | x | x | x | x | |||||

| Consumer | x | x | x | x | |||||||

| Utility | x | x | x | x | |||||||

| Economic | x | x | |||||||||

| Applied Methodology | Optimisation | x | x | x | x | x | x | x | |||

| Simulation | x | x | x | ||||||||

| Machine Learning | x | x | x | ||||||||

| Evaluation Aspects | Electricity bill minimisation | x | x | x | x | x | x | ||||

| CO2 emissions minimisation | x | x | x | ||||||||

| Energy consumption minimisation | x | x | x | ||||||||

| Grid congestion minimisation | x | x | |||||||||

| Generation/Demand matching | x | x | x | ||||||||

| Charging operation optimisation | x | x | x | x | x | ||||||

| Tariff | Public Chargers | Blockcharging |

|---|---|---|

| Price varies according to the daily schedule | x | x |

| Electric Mobility Suppliers (EMS) | x | - |

| Charging Point Operator (CPO) | x | - |

| Value-Added Tax (VAT) | x | x |

| Special Tax on Electricity (STE) | x | - |

| Parameter | Value |

|---|---|

| Area (m2) | 4317 |

| PV modules | 2585 |

| Rated maximum power (W) | 280 |

| Solar cell efficiency (%) | 16.8 |

| Installed power (kWp) | 723.8 |

| Irradiation and temperature losses (%) | 10.7 |

| Module, mismatch, and ohmic losses (%) | 4.5 |

| Month | PV Generation (MWh) | Consumption (MWh) | Surplus (MWh) |

|---|---|---|---|

| January | 82.48 | 128.66 | - |

| February | 101.53 | 248.51 | - |

| March | 117.80 | 128.28 | - |

| April | 136.92 | 122.39 | 14.53 |

| May | 155.33 | 125.48 | 29.84 |

| June | 185.06 | 128.27 | 56.78 |

| July | 203.54 | 130.68 | 72.86 |

| August | 189.42 | 106.21 | 83.20 |

| September | 147.56 | 141.25 | 6.30 |

| October | 104.45 | 138.01 | - |

| November | 87.30 | 129.42 | - |

| December | 77.48 | 115.79 | - |

| Total | 1588.87 | 1642.95 | 263.51 |

| Parameter | Value |

|---|---|

| PV installed capacity (kW) | 724 |

| Energy surplus (MWh) | 263.51 |

| EV model | Tesla® Model Y |

| Charger (KW) (Slow/Fast) | 7.4/22 |

| Number of charged EVs | 3213 |

| Tariff a | Public Slow Charger (7.4 kW) | Public Fast Charger (22 kW) |

|---|---|---|

| CPO b | Fixed tariff (EUR/charge): 0.03 | Fixed tariff (EUR/charge): 0.038 |

| Time tariff (EUR/min): 0.02 | Time tariff (EUR/min): 0.077 | |

| Energy tariff (EUR/kWh): 0.009 | Energy tariff (EUR/kWh): 0.018 | |

| EMS c | Peak: 0.2816 EUR/kWh | |

| Mid-peak: 0.1459 EUR/kWh | ||

| Off-peak: 0.0702 EUR/kWh | ||

| STE | 0.001 EUR/kWh | |

| VAT | 23% | |

| Public (Slow Charger) | Blockcharging (Slow Charger) | Public (Fast Charger) | Blockcharging (Fast Charger) | |

|---|---|---|---|---|

| Peak (EUR) | 37.57 | 28.17 | 38.42 | 28.81 |

| Mid-peak (EUR) | 23.88 | 17.91 | 24.73 | 18.55 |

| Off-peak (EUR) | 16.24 | 12.18 | 17.09 | 12.82 |

| Blockcharging (Slow Charging) | Blockcharging (Fast Charging) | |||||||

|---|---|---|---|---|---|---|---|---|

| (EUR) | (EUR) | (ETH) | (EUR) | (EUR) | (ETH) | |||

| Peak | 28.17 | 5.63 | 6.26 × 108 | 2.68 × 10−4 | 28.81 | 5.76 | 6.40 × 108 | 2.74 × 10−4 |

| Mid-peak | 17.91 | 3.58 | 3.98 × 108 | 1.71 × 10−4 | 18.55 | 3.71 | 4.12 × 108 | 1.77 × 10−4 |

| Off-peak | 12.18 | 2.43 | 2.71 × 108 | 1.16 × 10−4 | 12.82 | 2.56 | 2.85 × 108 | 1.22 × 10−4 |

| Type of Cost | Value (EUR) |

|---|---|

| Mobile application stores fees | 200 |

| Additional costs (cloud, advertising, and others) | 1000 |

| Full application development | 15,000 |

| Smart contracts | 736.3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cavalcante, I.; Júnior, J.; Manzolli, J.A.; Almeida, L.; Pungo, M.; Guzman, C.P.; Morais, H. Electric Vehicles Charging Using Photovoltaic Energy Surplus: A Framework Based on Blockchain. Energies 2023, 16, 2694. https://doi.org/10.3390/en16062694

Cavalcante I, Júnior J, Manzolli JA, Almeida L, Pungo M, Guzman CP, Morais H. Electric Vehicles Charging Using Photovoltaic Energy Surplus: A Framework Based on Blockchain. Energies. 2023; 16(6):2694. https://doi.org/10.3390/en16062694

Chicago/Turabian StyleCavalcante, Irvylle, Jamilson Júnior, Jônatas Augusto Manzolli, Luiz Almeida, Mauro Pungo, Cindy Paola Guzman, and Hugo Morais. 2023. "Electric Vehicles Charging Using Photovoltaic Energy Surplus: A Framework Based on Blockchain" Energies 16, no. 6: 2694. https://doi.org/10.3390/en16062694

APA StyleCavalcante, I., Júnior, J., Manzolli, J. A., Almeida, L., Pungo, M., Guzman, C. P., & Morais, H. (2023). Electric Vehicles Charging Using Photovoltaic Energy Surplus: A Framework Based on Blockchain. Energies, 16(6), 2694. https://doi.org/10.3390/en16062694