1. Introduction

The current stage of energy sector transformation is characterized by a decrease in the anthropogenic load on the environment. Concern for the environment and reducing carbon dioxide emissions into the atmosphere have led to a rapid increase in the total renewable energy sources installed capacity in centralized and isolated energy systems. Furthermore, one of the important factors is the reduction from the specific unit cost of kW of the installed capacity of photovoltaic panels and wind turbines. As a result, these factors have made it possible to increase the installed capacity of solar energy by more than twenty times, from 38 GW (2010) to 856 GW (2021). The wind energy sector has also shown a high growth: 180 GW (2010) to 847 GW (2021).

The deep integration of renewable energy sources is observed at all levels of the hierarchy of energy systems, starting with large energy sources operating in parallel mode with backbone energy sources (thermal and hydro power plants), small distributed generation facilities and private installations. Depending on the level of the energy system hierarchy, there are various rules and features of functioning.

It is very important to pay attention to the application of renewable energy sources in developing countries. The study [

1] described the current state of energy infrastructure in remote areas of Bangladesh and showed a clear link between affordable energy and high levels of poverty in remote rural areas. The study [

2] presented scenarios for a comprehensive program aimed at the sustainable development of remote areas in Iran, and showed the main infrastructural, economic and social factors hindering the large-scale use of energy. Particularly noteworthy was the study [

3], which provided an extensive overview of the electrification of remote rural areas in Nigeria. It was argued that the creation of decentralized energy facilities will allow small businesses to unite in cooperatives and more effectively use the potential of renewable energy. According to a study [

4], the electrification of remote areas of South Korea has significantly increased the standard of living and wellbeing of the local population. A study that analyzed the main factors hindering the sustainable development of rural electrification with the attraction of private investment deserves attention [

5,

6]. High risks, low income levels, long payback periods and a lack of well-defined government policies discourage private investment in the renewable energy sector.

This article presents a model of a two-level energy service contract. This model is based on the main points of game theory and, in particular, takes into account the features of the Stackelberg model. This model presents a modified version of the present value of energy under an energy service contract. This parameter is the objective function of the customer, where its minimization corresponds to the optimal technical solution. This model includes the costs associated with replacing batteries during the life of the energy service contract. With this component in mind, one can take into account how the replacement of batteries affects the main parameters of the contract. Such a modification allows us to consider various battery technologies in solving this problem and determine the truly optimal technical solution, both from the perspective of technical features and from the point of view of an energy service contract.

The article consists of three main parts. The first part presents a literature review on the support mechanisms for renewable energy sources, their features and applications. The second part of the article describes the mathematical model of the energy service contract and the main points of interaction between the energy service company and the client. The third part includes an example of optimizing the equipment composition of a decentralized photovoltaic system under an energy service contract.

2. Measures to Support Renewable Energy

At present, there are various ways to support and develop renewable generation facilities in energy systems. These ways are well established and contribute to increasing the total capacity of environmentally friendly energy sources in the global energy balance. This article section briefly provides an overview of the most common support mechanisms for renewable energy sources.

2.1. Green Certificate

A green certificate is an asset proving that a certain amount of electricity has been generated by a renewable energy source. These certificates are only issued to producers approved by a competent authority. A green certificate usually attests to the generation of a certain amount of electric power (for instance, 1 MW·h), although this value can be different. A green certificate can be sold either together with or separately from electricity generated, thus providing additional support to power producers. Specialized hardware and software tools (WREGIS, M-RETS, NEPOOL GIS) are used to monitor the issuance and attribution of green certificates. Under some programs, it is possible to accumulate certificates for future use or to borrow them with a view to fulfilling obligations in the current year.

The study [

7] showed the new power supply system adopted in Norway and Sweden which makes it possible to analyze the green certificate market under various development scenarios (e.g., grid expansion, delays of new power plants, transmission grid limitations, coordination issues between grid and power projects, licensing issues, etc.). An analysis of possible investment barriers in Norway’s green certificate trading was given in the study [

8], the research work [

9] presented a universal mathematical green certificate market model, and the paper [

10] outlined a competitive green certificate market model including Kirchhoff’s laws and the Nash equilibrium. Studies [

11,

12,

13,

14,

15] have described the current state of and major challenges facing the green certificate market in various countries. As an example, in [

11] the authors adopted the stochastic dynamic programming approach to Swedish and Norwegian green certificate markets with allowance for uncertainty. The paper [

12] analyzed the green certificate market in Romania, emphasizing that it needs a well-developed power infrastructure to smoothly operate. Furthermore, considerations should be taken for the operational restrictions of other fossil fuel power plants forming part of the power supply system. The research study [

13] investigated the EU green certificate markets under various development scenarios. The paper [

14] stated that the EU green certificate market is currently not fully effective, hence the need for a straightforward and transparent pricing policy. According to the authors, information on green certificate markets is not always available and requires further verification. Investigation [

15] analyzed the integration of renewable energy sources into China’s power supply system, pointing out that the green certificate market could substantially increase the generation of renewable energy sources. Furthermore, a description was given of a number of issues arising from the local authorities’ interference with direct business and the absence of a quota system for environmentally friendly sources of energy.

As can be seen, the mechanism for supporting renewable energy sources is most widespread in EU countries. Based on the experts’ findings, this mechanism requires a comprehensive approach to price setting, a transparent and concise policy on the part of markets, producers and other actors.

2.2. Feed-In Tariff

A feed-in tariff is one of the mechanisms designed to promote renewable energy sources and is based on three key points: guaranteed connection to an electric power system, long-term contract (10 to 20 years) and high cost of energy purchase. Along with green certificates, this support mechanism has become increasingly internationally common [

16,

17].

Italy’s experience with feed-in tariffs shows that a large portion (about 300,000) of solar power plants have an installed capacity of 3 to 20 kW [

18], whereas over 85% of these power plants are owned by various companies and only 10% of them are privately owned. The papers [

19,

20] described the current state of private solar power plants set up on the roofs of buildings in Thailand. The authors noted that this situation, which arose as early as 2015, hindered the development of the feed-in tariff market; the main reasons behind it being low energy purchase tariffs, income tax and high interest rates. According to [

19,

20] the following measures could contribute to the development of individual solar power plants in Thailand: a 20% lump-sum return on investment, a 30–35% reduction in the market value of equipment, a 3–4.5% interest rate and income tax exemption. The studies [

21,

22] focused on the current state of renewable energy sources in Taiwan. The authorities channel their efforts into increasing subsidies, with the help of special funds, which are aimed at reducing carbon dioxide emissions in the atmosphere. The main areas of renewable energy sources in Taiwan are related to wind power, solar power and biogas. Especially welcomed are projects with payoff periods shorter than eight years. Such projects receive better feed-in tariff rates. The study [

23] proposed continuously changing feed-in tariffs: if a return on the initial investment has been achieved, the feed-in tariff level is to be reduced without, however, being lower than the annual cost of equipment operation.

2.3. Energy Performance Concept

An energy performance agreement is a special contract between a client and an energy performance company aimed at reducing yearly expenses through the use of energy efficient solutions [

24]. The profit of the energy performance company depends on the level of reduction in the annual costs of the customer [

25]. World practice shows that energy service contracting is a successful mechanism for the integration of effective technical solutions. The feature of the energy service agreement is that almost all potential risks are assumed by the energy efficiency company [

26]. The most considerable risks are technological, economic, climate, legislative and political. An important task in such conditions is to reduce potential risks.

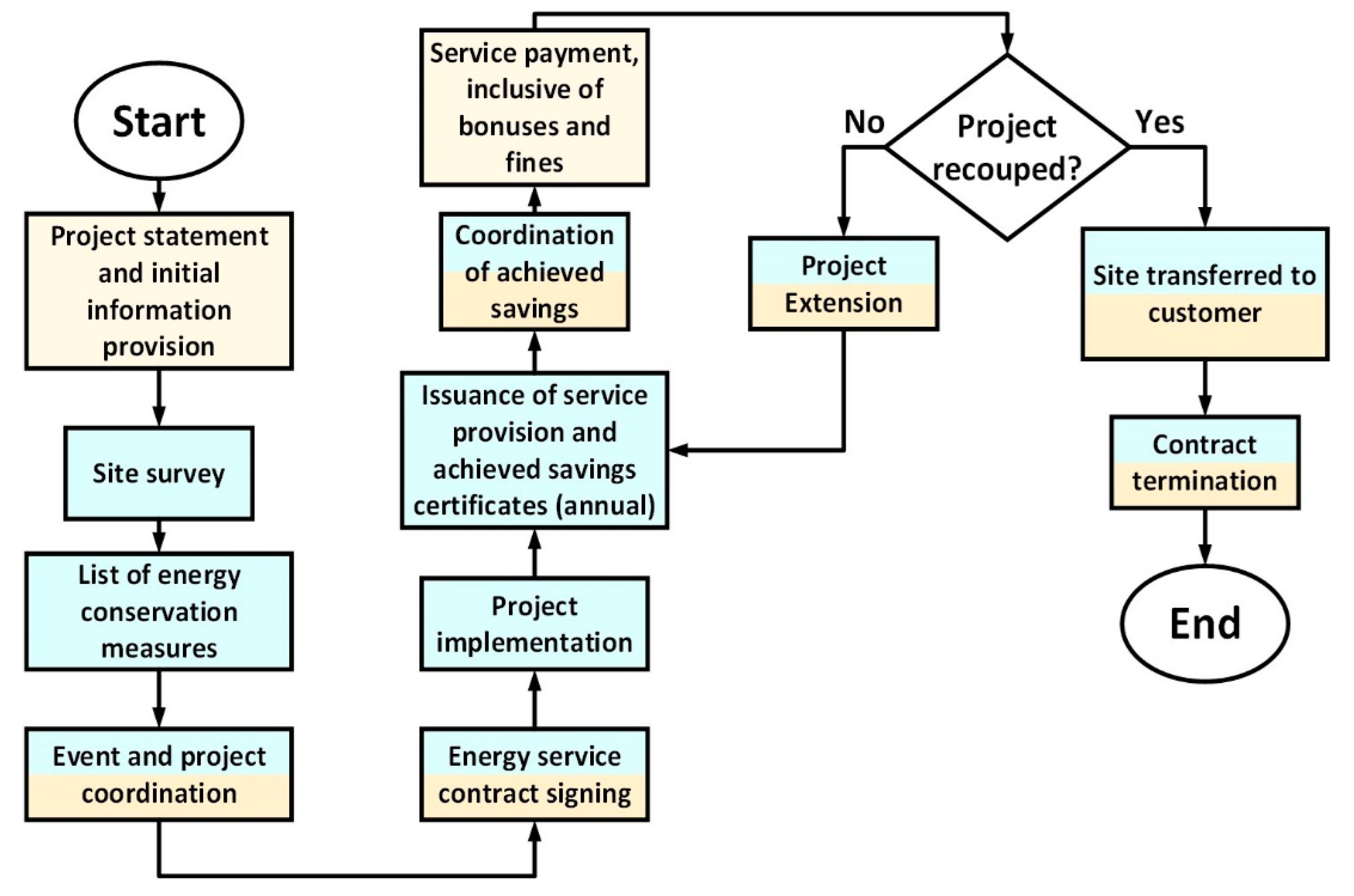

Figure 1 shows a scheme of energy service contracting.

Many authors have noted that the reduction in potential risks can be achieved through a detailed analysis of the object of study [

27,

28,

29]. There are high risks in the renewable energy sector. In particular, when building photovoltaic systems under energy service contracting, the correct analysis of the initial climate information plays an important role.

World experience of energy systems with renewable sources shows that the most important parameters of an energy performance agreement are the net present value of a service company, the term of the contract and levelized cost of energy. One of the most effective directions is the use of energy performance agreements to increase the energy efficiency of decentralized power supply systems located in remote rural areas.

3. Uses of Renewable Energy Sources in the Development of Remote Rural Areas

Uses of renewable energy sources in the electrification and development of remote rural areas have been a topic of discussion since the beginning of the 1980s [

30,

31,

32]. Outstanding Soviet researchers L.A. Melentiev [

30], A.A. Beschinskiy [

31] and H.Z. Barabaner [

32] observed that renewable energy technologies would be improved and actively used in the 21st Century with a view to raising the living standards of people in remote rural areas.

Being one of the priorities in both developed and developing countries, the development of remote rural areas should be comprehensive and be reflected in various directions, such as industry, employment, social infrastructure and the energy sector, aimed at improving the quality of people’s lives.

The development of private industry and of collective farms considerably improves the financial situation of people. As an example, the development of medium-sized and small agro-industrial units reduces the poverty rate in remote rural territories by more than 60% [

33]. At the same time, the income and purchasing power of the population increase, jobs are created and unemployment declines. Importantly, the greater the wellbeing of people living in this or that area, the quicker all necessary social facilities (schools, post offices, hospitals, stores and so on) are provided there. Otherwise, social infrastructure gradually deteriorates, thus reducing people’s standards of comfort [

34]. As a rule, such processes go hand in hand with the active migration of young and middle-aged people to bigger towns and cities [

35].

Many settlements located in remote rural areas are not connected to the centralized power supply system and, as a consequence, constitute decentralized power supply systems. This situation is usually due to the following factors: low electrical load owing to the small number of residents and absence of production; long distances; and difficult terrain, among others.

Under such conditions, using high-voltage power lines would not be cost-effective. According to regulatory documents of the Federal Grid Company (Moscow, Russia), the cost of construction of one kilometer of a 35 kV double-circuit power line amounts to USD 28,000 and construction of a 35/10(6) kV stepdown substation costs USD 1.39 million [

36,

37]. These figures can grow by 50% since many remote rural areas are situated in hard-to-reach areas (thick forests, mountains, swamps, deserts, jungle, etc.).

Therefore, in such circumstances the use of local energy resources would be cost-effective. Renewable energy belongs to local energy resources. Wind and solar power are the most widespread renewable energy sources throughout the world. The combined use of photovoltaics, wind farms, battery energy storage systems and traditional energy sources is a cost-effective way to supply consumers with power [

38]. Storage devices can accumulate surpluses of energy to be used at a time when the power supply is scarce [

39].

In connection with the use of renewable energy sources in autonomous power supply systems, it is necessary to solve the problem of financing renewable energy projects. There are a number of options for raising such funding:

The use of funds from the state authorities or a local energy company is a fairly simple way to finance a project. However, this process is lengthy: funding is not instantaneous, but delayed for a period of three to five years. Such planning is typical for all state bodies, including for local energy companies that follow a certain short- or medium-term development program. The experience of using this source of financing in Russia shows that it is not an effective way to develop RES in decentralized power supply systems.

Attracting investors is one of the effective ways to finance renewable energy projects in isolated power supply systems. Obviously, potential investors are interested in making a profit with the shortest possible payback periods. The economic efficiency of projects is a guarantee for investors.

The use of the main terms of the energy service contract makes it possible to draw up a list of requirements necessary for financing renewable energy projects in decentralized power supply systems.

4. Mathematical Model of Energy Performance Contract

4.1. General Description of the Model

The existing mathematical models of energy service agreements have been little investigated in the scientific literature. Game-theoretical models of a service agreement with equal players have been considered [

40]. However, practical studies have demonstrated the dominant position of the client when concluding an energy performance convention [

41]. Moreover, existing models have paid limited attention to the detailed analysis of the parameters of service conventions and technical features of renewable energy sources’ exploitation modes in decentralized energy systems.

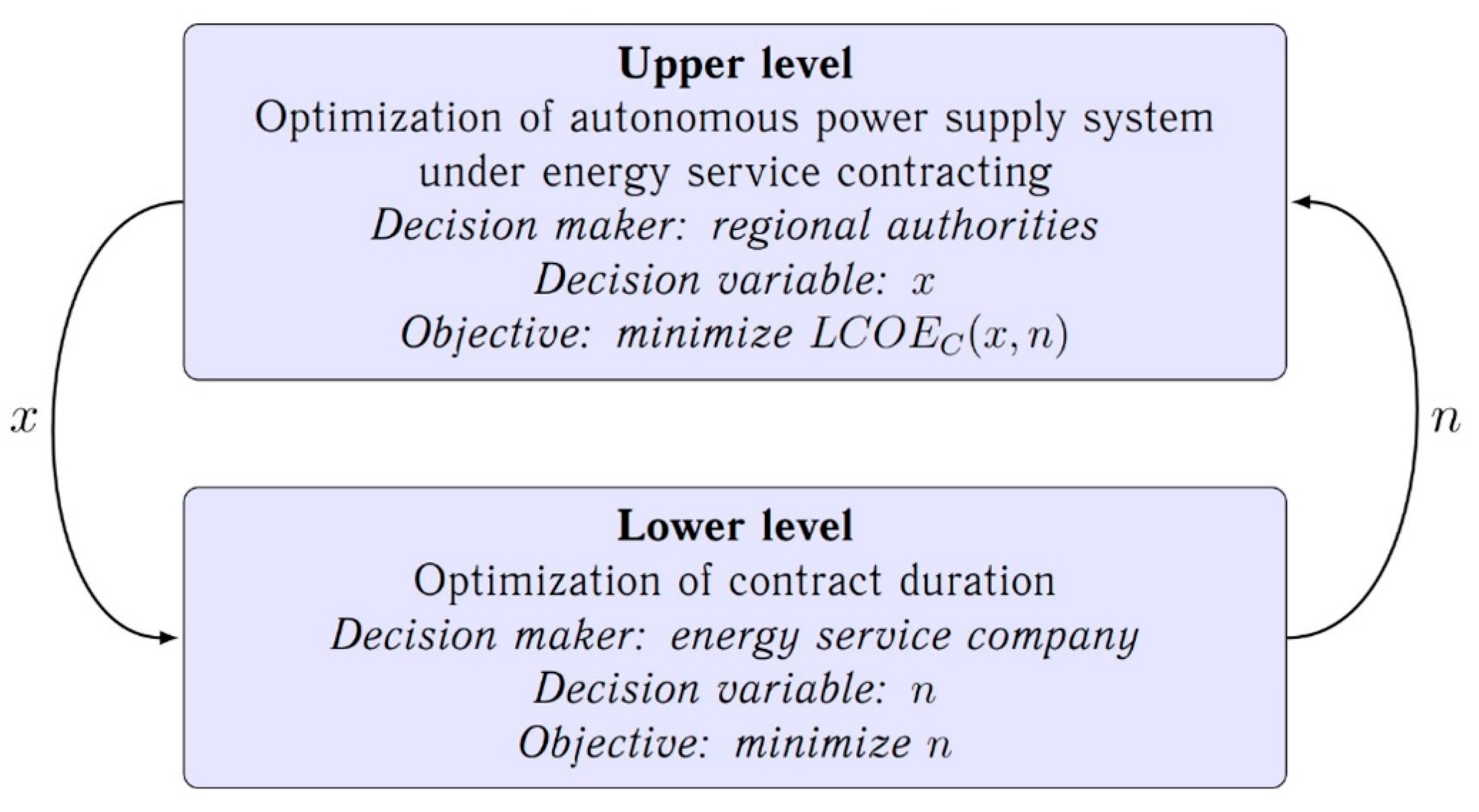

In this section, we describe a bilevel model [

42] that optimizes the equipment composition and energy source capacities of a decentralized power supply system under energy performance conventions. The upper level of the model is represented by the local government (the client), and the lower level represents the energy efficiency company (the contractor).

The energy efficiency company is assumed to invest in the energy facilities’ development and reduce annual exploitation charges for the entire period of the energy performance agreement. Moreover, the company has an annual payment from the customer, pertaining to the expenses of fuel saved. The parties of the agreement look to combustible consuming before the new technical solution (photovoltaic system, wind farm, battery energy storage system) is put into use. The client has the cost of providing the needful grist of diesel or gasoline fuel, and of remunerating the energy efficiency company over the endurance of the agreement term. At the end of the energy agreement, the power station and other energy facilities are handed over to the client.

The present mathematical model of an energy efficiency agreement has the following overall economic parameters: a net present value [

43], a return on investment, a contract period [

28,

29] and a levelized cost of energy [

44]. Previously, the authors suggested the reformed parameter of the levelized cost of energy with the energy performance contract specifics in the decentralized power supply system with solar and diesel power plants [

45]. The combination of these economic parameters can reduce the potential economic, technological and environmental risks of a project [

46].

The novelty of the research is that the actual hierarchical model allows to take into account the various technologies of green generation, such as photovoltaic systems and wind farms.

4.2. Client Model

Let Ω be the set of environmentally friendly generators, such as photovoltaic panels and wind turbines. Moreover, each type of renewable energy equipment has its own set of types. For instance, wind turbines have vertical or horizontal construction, solar panels may be of heterojunction, polycrystalline or monocrystalline type with specific values of their installed capacity. Therefore, for the sake of simplicity, we omit these types in the model’s formulation. We think that only the specific kind of each renewable technology can be presented in the decentralized energy system. These technologies should be selected in view of the optimization of goal functions in the decentralized power supply system.

For each

, non-negative integer variable

demonstrates the value of generators of kind

. Denote

;

is agreement duration in years;

is start capital investment necessary for the building of new energy sources and technical infrastructure and its commissioning, USD;

are exploitation expenses per year

, USD. The energy performance company’s overall investment

includes the costs of equipment and service charges throughout the contract term:

where

is the discount rate. Net present value of the energy contract company is as follows, USD:

where

is diesel or gasoline fuel costs per year

, USD;

are yearly charges of used organic fuel for the period before the energy performance agreement, when only a diesel power plant is used to supply energy to the consumer, USD. The annual fuel charges

are fixed in the agreement’s points and, being the only salary of the energy efficiency company, are a basis on which to calculate the payment to the contractor. The non-negative difference

demonstrates the value of organic fuel saved by the new energy infrastructure and sources per year

. The more organic fuel the power station saves, the more profit the energy performance company obtains.

Parameter is the service period of the decentralized energy system, e.g., N = 20, and is the vector of the top limits on the values of renewable sources. The particular value of every element of may be determined as a non-negative sufficiently large number, which depends on the maximum level of electrical load in the decentralized energy system. The energy performance company (lower level) only has one decision variable: contract duration, which is a positive integer number.

The main task of the energy performance company is to show the minimum contract duration that will have a fairly attractive return on investment

. The return on investment is determined as the ratio of net present value over the agreement period to the initial capital investments. Minimization of the agreement duration

n follows from the fact that a high value of duration of energy performance agreement is unacceptable for the client (regional authorities), and, consequently, the contract with a long-term

would not likely be concluded. Therefore, for every

,

, the energy service contractor solves the problem:

4.3. Energy Performance Company Model

Assume that

is a decision of the energy performance company task (3) and (4). The local government (client) selects the technical solution

, which provides the suitable (minimum) value to the levelized cost of energy in the conditions of the energy performance contract

. The numerical value of

is determined as the ratio of the full costs of the energy production throughout the renewable power plant operating time. The energy performance company’s full expenses

, USD, have two important parts: expenses under the service agreement and costs incurred after its ending. According to the agreement conditions, the yearly expenses of the energy performance company are determined as

, which are used to buy the diesel fuel and to pay the contractor’s salary. After the expiration of the agreement, all costs associated with the operation and purchase of fuel are borne by the client. Hence, we obtain:

where

is the annual generation in year

, kW·h. The vector

is the customer variable. The upper level goal has the following view:

According to Formulas (1) and (2), the bilevel optimization task is determined by:

Formulas (8) and (9) define an equilibrium problem, and its solution satisfies both the energy performance company and the customer. The chart of the hierarchical model is presented in

Figure 2.

In our case, (8) and (9) is an integer bilevel optimization task. It is known, the problems of this type are complex and require much time to solve. If has a low dimension, the optimization task may be calculated by direct enumeration. Otherwise, the use of heuristic methods is very sensible.

5. Object of the Study

In this research, a decentralized power system located in Siberia was considered. This decentralized energy system has the following technical and economic indicators. The existing energy facility has a diesel power plant that includes four units with a capacity of 2 × 100 kW, 60 kW and 50 kW. The consumer’s load varies from 50 kW to 80 kW and has a classic character of load curve. Its mean yearly generation is 265,000 kW·h and diesel fuel consumption is 102 tons, respectively. The annual diesel fuel expenses plus delivery are about 0.125 million USD. The annual CO2 emissions are estimated at 348 tons and the levelized cost of energy is 0.652 USD/kW·h.

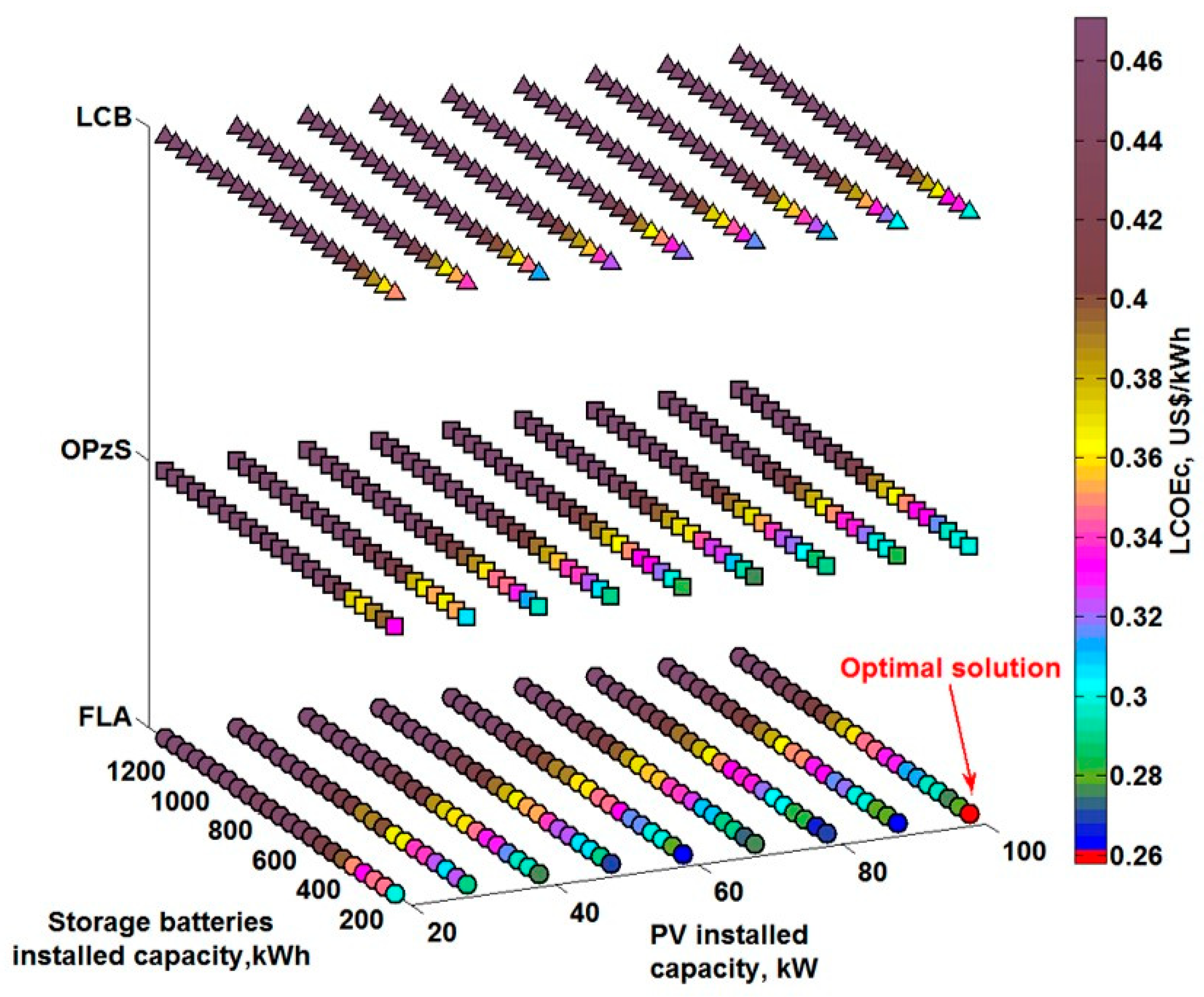

The study only uses a class of lead-acid batteries. Practice has shown that this is a really effective solution for extreme weather conditions in Siberia. Therefore, when solving the problem of optimizing the composition of equipment, the following types of batteries are used: FLA—flooded lead acid batteries, OPzS—lead acid batteries with tubular plate, LCB—lead carbon battery.

Onwards, the numerical results of this study will be described in detail. In addition, the research is focused on determining the optimal battery technology, taking into account the terms of the energy service agreement.

Main technical and economic indicators are calculated for each option.

Figure 3 shows the main indicators and changes in the target function.

The calculations used technical limitations associated with the stability of the operation of a photovoltaic and diesel power plant [

47]. Therefore, the installed capacity of the solar power plant must cover the maximum load of the consumer and not exceed the maximum capacity of the diesel unit. Therefore, the maximum power of the photovoltaic system can be no more than 100 kW.

Analysis of the obtained results shows that there is one set with the optimal composition of the equipment. This variant is red and has the following technical parameters: 100 kW (solar power plant) and 240 kW·h (battery energy storage system, type FLA). The target function, namely the levelized cost of energy of this optimal solution, is 0.259 USD/kW∙h.

Table 1 demonstrates the results of the photovoltaic system optimization.

Furthermore, an analysis of the operating modes of the photovoltaic system optimal equipment composition will be presented.

6. Conclusions

The energy service contract is an effective mechanism to support renewable energy sources, especially in remote rural areas. There are more than 350 decentralized energy systems (with only diesel generation) located in the Russian Far East. Therefore, the development of an effective methodology for optimizing decentralized power supply systems under energy performance agreements is very relevant. The main conclusions of this study are as follows:

We proposed the universal hierarchical model of an energy service contract with renewable energy sources. This model is based on a Stackelberg game and represents an integer bilevel optimization problem. Such problem formulation reflects the behavior of the players, their technical and economic constraints, and shows the nature of their interaction;

The upper-level objective function of the considered problem is a modified levelized cost of energy. This objective function takes into account the main economic and operational indicators of the proposed technical solution. Net present value, payback period and return on investment are also taken into account. These parameters provide a comprehensive consideration of various technical options and give an opportunity to choose the optimal one;

The example of the decentralized power system revealed that the optimal equipment composition is as follows: solar power plant, 100 kW; FLA storage devices, 240 kW∙h; solar and battery inverters, 125 kW and 60 kW, respectively. The above equipment composition saves up to 69% of diesel fuel and considerably reduces emissions of harmful substances into the atmosphere. The LCOE under the energy performance contract decreases from 0.652 to 0.259 USD/kW·h. The contract duration is 5 years. NPV of the energy service company at the end of the contract term is 90,000 USD;

Storage batteries are replaced every 8 years; two times in total. Battery replacements noticeably affect the optimization result;

Taking into account operational and technical limitations when solving the optimization problem allows you to determine such an equipment configuration that will ensure reliable and stable operation of the photovoltaic system;

Accounting for real natural and climatic characteristics allows for describing the operating modes of photovoltaic systems as accurately as possible, taking into account the dynamics of meteorological parameters;

The load characteristic of the consumer. It should be noted that, in practice, in systems with renewable energy sources, there is a progressive increase in the electrical load. Therefore, this may affect the technical solution and the duration of the contract.

Author Contributions

Conceptualization, D.K., I.M. and K.S.; methodology, D.K.; validation, P.I., I.M. and K.S.; formal analysis, D.K. and P.I.; investigation, D.K., I.M. and P.I.; resources, K.S.; data curation, P.I., S.F. and D.K.; writing—original draft preparation, D.K., K.S. and P.I.; writing—review and editing, K.S., D.K., I.M. and P.I.; visualization, D.K. and K.S.; supervision, S.F. and K.S.; project administration, K.S.; funding acquisition, K.S., S.F. and P.I. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data sharing not applicable. No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- Mollik, S.; Rashid, M.M.; Hasanuzzaman, M.; Karim, M.E.; Hosenuzzaman, M. Prospects, progress, policies, and effects of rural electrification in Bangladesh. Renew. Sustain. Energy Rev. 2016, 65, 553–567. [Google Scholar] [CrossRef]

- Afsharzade, N.; Papzan, A.; Ashjaee, M.; Delangizan, S.; Van Passel, S.; Azadi, H. Renewable energy development in rural areas of Iran. Renew. Sustain. Energy Rev. 2016, 65, 743–755. [Google Scholar] [CrossRef]

- Akpan, U.; Essien, M.; Isihak, S. The impact of rural electrification on rural micro-enterprises in Niger Delta, Nigeria. Energy Sustain. Dev. 2013, 17, 504–509. [Google Scholar]

- Van Gevelt, T. Rural electrification and development in South Korea. Energy Sustain. Dev. 2014, 23, 179–187. [Google Scholar]

- Williams, N.J.; Jaramillo, P.; Taneja, J.; Ustun, T.S. Enabling private sector investment in microgrid-based rural electrification in developing countries: A review. Renew. Sustain. Energy Rev. 2015, 52, 1268–1281. [Google Scholar] [CrossRef]

- Ilyushin, P.V. Emergency and post-emergency control in the formation of micro-grids. In Proceedings of the E3S Web of Conferences, Methodological Problems in Reliability Study of Large Energy Systems (RSES 2017), Bishkek, Kyrgyzstan, 11–15 September 2017; EDP Sciences: Les Ulis, France, 2017; Volume 25, p. 02002. [Google Scholar] [CrossRef]

- Lind, A.; Rosenberg, E. How do Various Risk Factors Influence the Green Certificate Market of Norway and Sweden? Energy Procedia 2014, 58, 9–15. [Google Scholar] [CrossRef]

- Linnerud, K.; Simonsen, M. Swedish-Norwegian tradable green certificates: Scheme design flaws and perceived investment barriers. Energy Policy 2017, 106, 560–578. [Google Scholar] [CrossRef]

- Marchenko, O.V. Modeling of a green certificate market. Renew. Energy 2008, 33, 1953–1958. [Google Scholar] [CrossRef]

- Helgesen, P.I.; Tomasgard, A. An equilibrium market power model for power markets and tradable green certificates, including Kirchhoff’s Laws and Nash-Cournot competition. Energy Econ. 2018, 70, 270–288. [Google Scholar] [CrossRef]

- Hustveit, M.; Frogner, J.S.; Fleten, S.E. Tradable green certificates for renewable support: The role of expectations and uncertainty. Energy 2017, 141, 1717–1727. [Google Scholar] [CrossRef]

- Pavaloaia, L.; Georgescu, I.; Georgescu, M. The system of green certificates—Promoter of energy from renewable resources. Procedia—Soc. Behav. Sci. 2015, 188, 206–213. [Google Scholar] [CrossRef]

- Aune, F.R.; Dalen, H.M.; Hagem, C. Implementing the EU renewable target through green certificate markets. Energy Econ. 2012, 34, 992–1000. [Google Scholar] [CrossRef]

- Hulshof, D.; Jepma, C.; Mulder, M. Performance of markets for European renewable energy certificates. Energy Policy 2019, 128, 697–710. [Google Scholar] [CrossRef]

- Zhang, S.; Andrews-Speed, P.; Li, S. To what extent will China’s ongoing electricity market reforms assist the integration of renewable energy? Energy Policy 2018, 114, 165–172. [Google Scholar] [CrossRef]

- Wedzik, A.; Siewierski, T.; Szypowski, M. Green certificates market in Poland—The sources of crisis. Renew. Sustain. Energy Rev. 2017, 75, 490–503. [Google Scholar] [CrossRef]

- Wong, S.L.; Ngadi, N.; Amran, T.; Abdullah, T.; Inuwa, I.M. Recent advances of feed-in tariff in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 42–52. [Google Scholar] [CrossRef]

- Di Dio, V.; Favuzza, S.; La Cascia, D.; Massaro, F.; Zizzo, G. Critical assessment of support for the evolution of photovoltaics and feed-in tariff(s) in Italy. Sustain. Energy Technol. Assess. 2015, 9, 95–104. [Google Scholar] [CrossRef]

- Tongsopit, S. Thailand’s feed-in tariff for residential rooftop solar PV systems: Progress so far. Energy Sustain. Dev. 2015, 29, 127–134. [Google Scholar] [CrossRef]

- Tantisattayakul, T.; Kanchanapiya, P. Financial measures for promoting residential rooftop photovoltaics under a feed-in tariff framework in Thailand. Energy Policy 2017, 109, 260–269. [Google Scholar] [CrossRef]

- Liou, H.M. Comparing feed-in tariff incentives in Taiwan and Germany. Renew. Sustain. Energy Rev. 2015, 50, 1021–1034. [Google Scholar] [CrossRef]

- Tsai, W.T. Feed-in tariff promotion and innovative measures for renewable electricity: Taiwan case analysis. Renew. Sustain. Energy Rev. 2014, 40, 1126–1132. [Google Scholar] [CrossRef]

- He, Y.; Pang, Y.; Zhang, J.; Xia, T.; Zhang, T. Feed-in tariff mechanisms for large-scale wind power in China. Renew. Sustain. Energy Rev. 2015, 51, 9–17. [Google Scholar] [CrossRef]

- Sorrell, S. The economics of energy service contracts. Energy Policy 2007, 35, 507–521. [Google Scholar] [CrossRef]

- Nolden, C.; Sorrell, S.; Polzin, F. Catalysing the energy service market: The role of intermediaries. Energy Policy 2016, 98, 420–430. [Google Scholar] [CrossRef]

- Goldman, C.A.; Hopper, N.C.; Osborn, J.G. Review of US ESCO industry market trends: An empirical analysis of project data. Energy Policy 2005, 33, 387–405. [Google Scholar] [CrossRef]

- Polzin, F.; von Flotow, P.; Nolden, C. What encourages local authorities to engage with energy performance contracting for retrofitting? Evidence from German municipalities. Energy Policy 2017, 94, 317–330. [Google Scholar] [CrossRef]

- Bertoldi, P.; Boza-Kiss, B. Analysis of barriers and drivers for the development of the ESCO markets in Europe. Energy Policy 2017, 107, 345–355. [Google Scholar] [CrossRef]

- Garbuzova-Schlifter, M.; Madlener, R. AHP-based risk analysis of energy performance contracting projects in Russia. Energy Policy 2016, 97, 559–581. [Google Scholar] [CrossRef]

- Melentiev, L.A. Sistemnye Issledovaniya v Energetike [System Research in Power Engineering]; Nauka: Moscow, Russia, 1983. (In Russian) [Google Scholar]

- Beschinskiy, A.A.; Kogan, Y.M. Ekonomicheskie Problemy Elektrifikatsii [Economic Problems of Electrification]; Energoatomizdat: Moscow, Russia, 1983. (In Russian) [Google Scholar]

- Barabaner, K.Z.; Nikitin, V.M.; Klokova, T.I. Metodicheskie Voprosy Razvitiya Energetiki Selskikh Rajonov [Methodological Issues of the Development of Rural Energy]; SEI: Irkutsk, Russia, 1989. (In Russian) [Google Scholar]

- Ceballos, A.; Dresdner-Cid, J.D.; Quiroga-Suazo, M.A. Does the location of salmon farms contribute to the reduction of poverty in remote coastal areas? An impact assessment using a Chilean case study. Food Policy 2018, 75, 68–79. [Google Scholar] [CrossRef]

- Mellor, J.W.; Malik, S.J. The Impact of Growth in Small Commercial Farm Productivity on Rural Poverty Reduction. World Dev. 2017, 91, 1–10. [Google Scholar] [CrossRef]

- Christiaanse, S.; Haartsen, T. The influence of symbolic and emotional meanings of rural facilities on reactions to closure: The case of the village supermarket. J. Rural Stud. 2017, 54, 326–336. [Google Scholar] [CrossRef]

- Shushpanov, I.; Suslov, K.; Ilyushin, P.; Sidorov, D. Towards the flexible distribution networks design using the reliability performance metric. Energies 2021, 14, 6193. [Google Scholar] [CrossRef]

- The Cost of Building High-Voltage Power Lines, Federal Grid Company. 2019. Available online: http://www.fsk-ees.ru/ (accessed on 5 December 2022). (In Russian).

- Rylov, A.; Ilyushin, P.; Kulikov, A.; Suslov, K. Testing Photovoltaic Power Plants for Participation in General Primary Frequency Control under Various Topology and Operating Conditions. Energies 2021, 14, 5179. [Google Scholar] [CrossRef]

- Suslov, K.; Shushpanov, I.; Buryanina, N.; Ilyushin, P. Flexible Power Distribution Networks: New Opportunities and Applications. In Proceedings of the 9th International Conference on Smart Cities and Green ICT Systems (SMARTGREENS 2020), Online, 2–4 May 2020; pp. 57–64. [Google Scholar]

- Principi, P.; Fioretti, R.; Carbonari, A.; Lemma, M. Evaluation of energy conservation opportunities through Energy Performance Contracting: A case study in Italy. Energy Build. 2016, 128, 886–889. [Google Scholar] [CrossRef]

- Hufen, H.; de Bruijn, H. Getting the incentives right. Energy performance contracts as a tool for property management by local government. J. Clean. Prod. 2016, 112, 2717–2729. [Google Scholar] [CrossRef]

- Gabriel, S.A.; Conejo, A.J.; Fuller, J.D.; Hobbs, B.F.; Ruiz, C. Complementarity Modeling in Energy Markets; Springer: New York, NY, USA, 2013. [Google Scholar]

- Deng, Q.; Jiang, X.; Cui, Q.; Zhang, L. Strategic design of cost savings guarantee in energy performance contracting under uncertainty. Energy 2015, 139, 68–80. [Google Scholar] [CrossRef]

- Branker, K.; Pathak, M.J.M.; Pearce, J.M. A review of solar photovoltaic levelized cost of electricity. Renew. Sustain. Energy Rev. 2011, 15, 4470–4482. [Google Scholar] [CrossRef]

- Karamov, D.N.; Minarchenko, I.M.; Kolosnitsyn, A.V.; Pavlov, N.V. Installed capacity optimization of autonomous photovoltaic systems under energy service contracting. Energy Convers. Manag. 2021, 240, 114256. [Google Scholar] [CrossRef]

- Wang, Z.; Xu, G.; Lin, R.; Wang, H.; Ren, J. Energy performance contracting, risk factors, and policy implications: Identification and analysis of risks based on the best-worst network method. Energy 2019, 170, 1–13. [Google Scholar] [CrossRef]

- Ilyushin, P.V.; Shepovalova, O.V.; Filippov, S.P.; Nekrasov, A.A. Calculating the sequence of stationary modes in power distribution networks of Russia for wide-scale integration of renewable energy-based installations. Energy Rep. 2021, 7, 308–327. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).