The Relationship between Energy Consumption and Economic Growth in the Baltic Countries’ Agriculture: A Non-Linear Framework

Abstract

1. Introduction

2. Materials and Methods

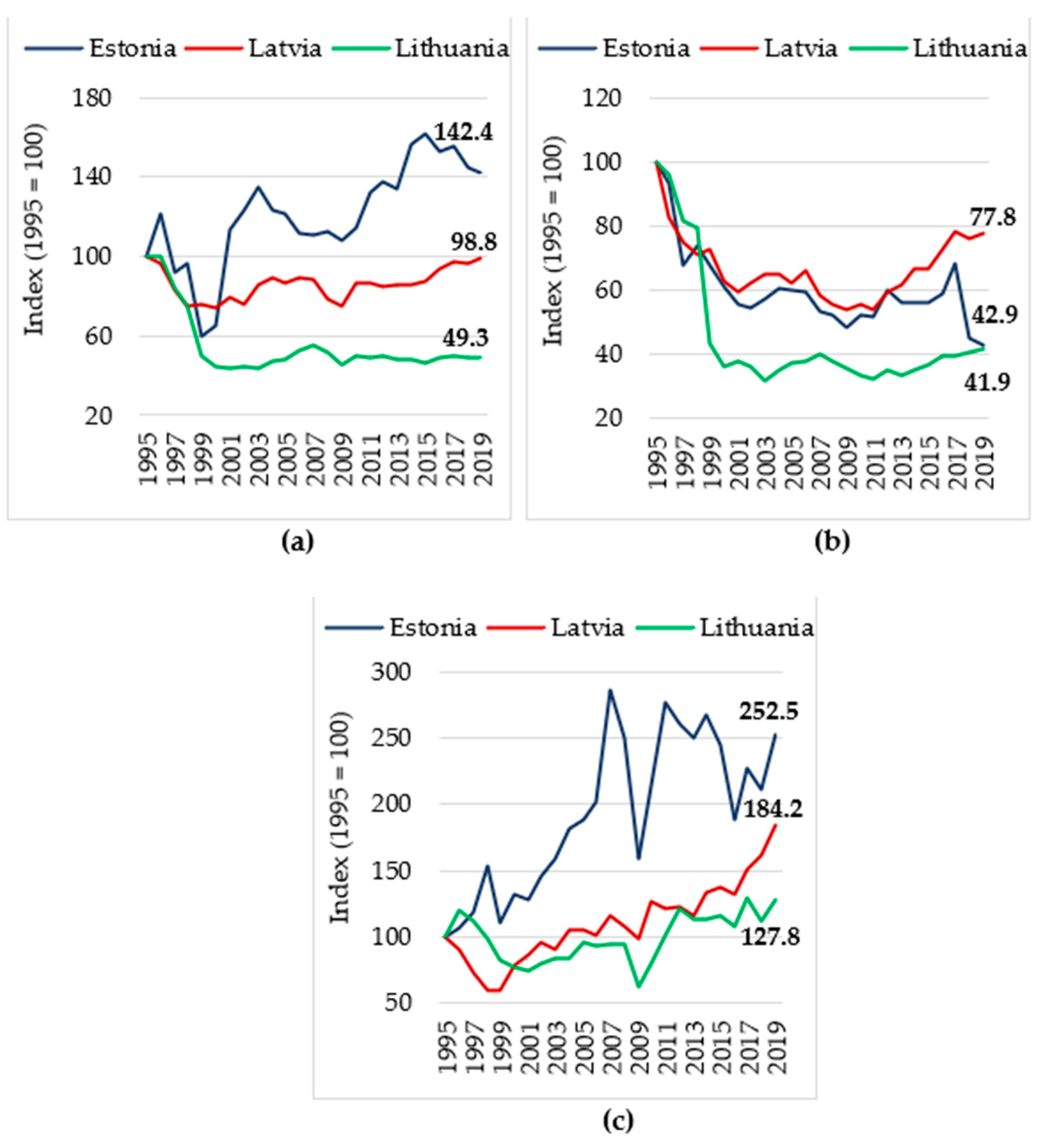

2.1. Data

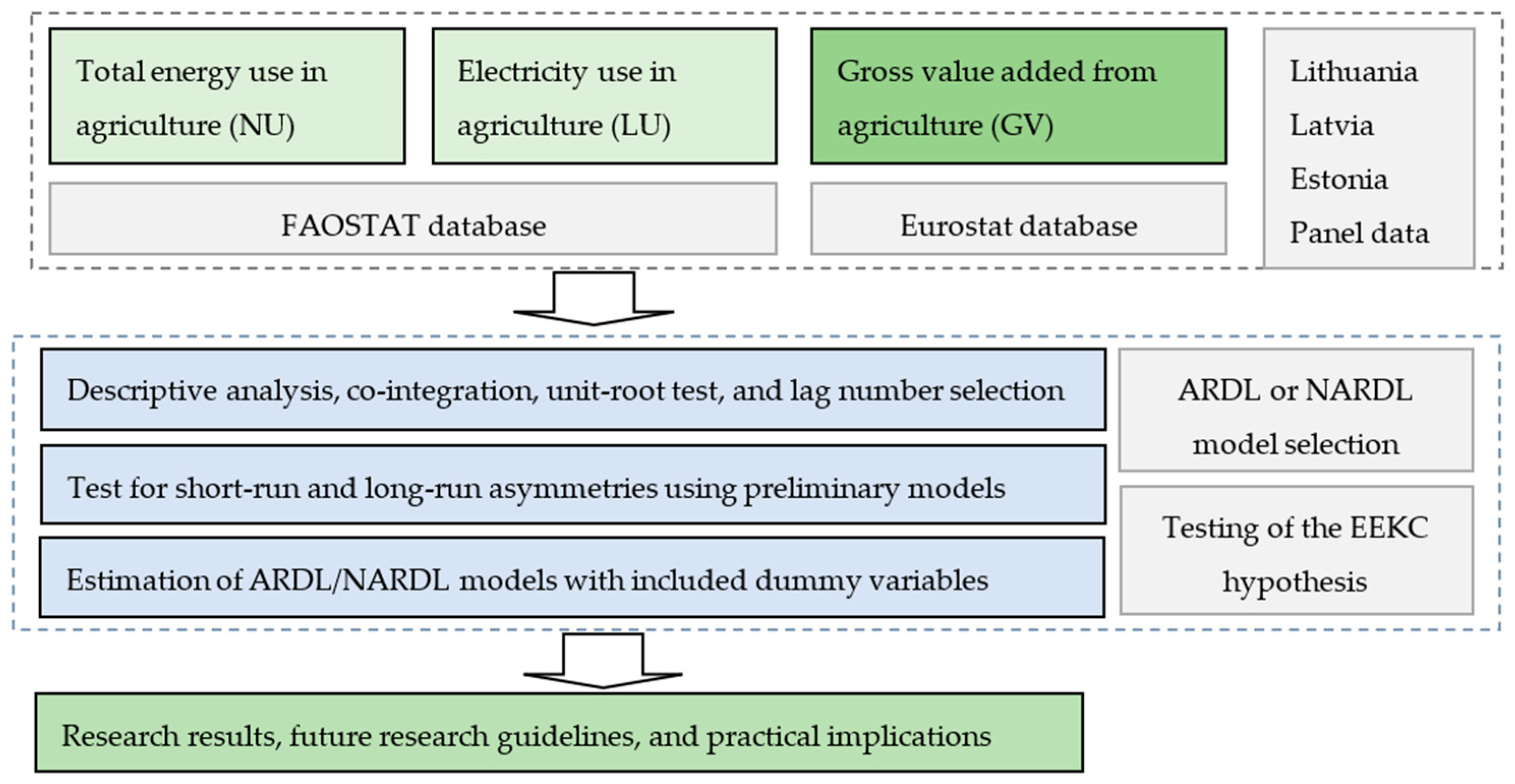

2.2. Methods

3. Results

4. Discussion

4.1. Comparison with Previous Studies

4.2. Proposals for Future Research

4.3. Practical Implications

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Information Criteria | Schwarz Criterion | Akaike Criterion | Hannan-Quinn Criterion | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Time Lag | q = 1 | q = 2 | q = 3 | q = 1 | q = 2 | q = 3 | q = 1 | q = 2 | q = 3 |

| Using NU and GV: | |||||||||

| p = 1 | 347.3501 | 353.1688 | 341.3105 | 339.4016 | 342.9494 | 329.3090 | 341.4006 | 345.5195 | 332.1362 |

| p = 2 | 328.5817 | 334.6953 | 340.3131 | 319.8534 | 323.7848 | 327.2206 | 321.9095 | 326.3550 | 330.3048 |

| Latvia | |||||||||

| p = 1 | 338.9816 | 342.9144 | 332.6672 | 331.0332 | 332.6950 | 320.6657 | 333.0322 | 335.2652 | 323.4929 |

| p = 2 | 328.7566 | 332.6071 | 335.7460 | 320.0283 | 321.6967 | 322.6535 | 322.0844 | 324.2669 | 325.7377 |

| Estonia | |||||||||

| p = 1 | 363.8117 | 368.5495 | 353.2095 | 355.8632 | 358.3300 | 341.2080 | 357.8622 | 360.9002 | 344.0352 |

| p = 2 | 347.1741 | 352.0053 | 348.5405 | 338.4458 | 341.0949 | 335.4480 | 340.5019 | 343.6650 | 338.5322 |

| Panel | |||||||||

| p = 1 | 1059.215 | 1066.471 | 1020.847 | 1043.576 | 1046.364 | 996.7609 | 1049.781 | 1054.341 | 1006.278 |

| p = 2 | 1008.419 | 1016.439 | 1024.166 | 990.9015 | 994.5423 | 997.8898 | 997.8234 | 1003.195 | 1008.273 |

| Using LU and GV: | |||||||||

| Lithuania | |||||||||

| p = 1 | 296.0494 | 301.9561 | 293.5428 | 288.1009 | 291.7367 | 281.5414 | 290.0999 | 294.3068 | 284.3686 |

| p = 2 | 286.9268 | 291.7369 | 296.6200 | 278.1985 | 280.8264 | 283.5275 | 280.2546 | 283.3966 | 286.6117 |

| Latvia | |||||||||

| p = 1 | 242.1129 | 241.2186 | 235.3446 | 234.1645 | 230.9992 | 223.3432 | 236.1635 | 233.5693 | 226.1703 |

| p = 2 | 235.8228 | 235.3802 | 238.4298 | 227.0944 | 224.4697 | 225.3373 | 229.1506 | 227.0399 | 228.4215 |

| Estonia | |||||||||

| p = 1 | 284.8172 | 289.8978 | 280.4342 | 276.8688 | 279.6784 | 268.4327 | 278.8678 | 282.2486 | 271.2599 |

| p = 2 | 274.6944 | 277.2970 | 280.5093 | 265.9661 | 266.3866 | 267.4168 | 268.0222 | 268.9567 | 270.5010 |

| Panel | |||||||||

| p = 1 | 829.5992 | 837.5174 | 802.6740 | 813.9605 | 817.4105 | 778.5878 | 820.1649 | 825.3876 | 788.1054 |

| p = 2 | 796.4406 | 803.4549 | 806.0290 | 778.9233 | 781.5583 | 779.7532 | 785.8452 | 790.2107 | 790.1360 |

Appendix B

| Variable | Coefficient | p-Value | Variable | Coefficient | p-Value |

|---|---|---|---|---|---|

| Using NU and GV: | Using LU and GV: | ||||

| Constant | 1848.5800 | <0.0001 | Constant | 289.7310 | 0.0014 |

| NU (−1) | −0.4621 | <0.0001 | LU (−1) | −0.4248 | 0.0003 |

| ΔNU (−2) | 0.3126 | 0.0128 | |||

| Auxiliary hypotheses: h1: reject, p-value < 0.0001 Supplementary estimations, p-values: A normality test: 0.3113 ADF test of residual (without trend): 0.7711 ADF test of residual (with trend): 0.9966 ARCH effect: 0.0201 R-squared: 0.6961 QLR test p-value: <0.0001, year: 2000 | Auxiliary hypotheses: h1: reject, p-value 0.0003 Supplementary estimations, p-values: A normality test: <0.0001 ADF test of residual (without trend): <0.0001 ADF test of residual (with trend): <0.0001 ARCH effect: 0.0017 R-squared: 0.4852 QLR test p-value: <0.0001, year: 2000 | ||||

Appendix C

| Variable | Coefficient | p-Value | Variable | Coefficient | p-Value |

|---|---|---|---|---|---|

| Using NU and GV: | Using LU and GV: | ||||

| Constant | 2867.7000 | 0.0072 | Constant | 32.1794 | 0.6094 |

| NU (−1) | −0.6936 | 0.0045 | LU (−1) | −0.2873 | 0.0195 |

| GV (−1) | 1.1690 | 0.0113 | GV (−1) | 0.1884 | 0.0019 |

| ΔGV (0) | 1.3821 | 0.0247 | ΔGV (0) | −0.2073 | 0.0088 |

| S_2004 | −57.3101 | 0.0398 | |||

| Auxiliary hypotheses: h1: reject, p-value 0.0152 h2: reject, p-value 0.0247 Supplementary estimations, p-values: A normality test: 0.9794 ADF test of residual (without trend): 0.0908 ADF test of residual (with trend): 0.3766 ARCH effect: 0.5300 R-squared: 0.4639 QLR test p-value: 0.4771, year: 2005 | Auxiliary hypotheses: h1: reject, p-value 0.0052 h2: reject, p-value 0.0088 Supplementary estimations, p-values: A normality test: 0.7476 ADF test of residual (without trend): 0.0028 ADF test of residual (with trend): 0.5953 ARCH effect: 0.4847 R-squared: 0.5189 QLR test p-value: 0.2251, year: 2007 | ||||

Appendix D

| Variable | Coefficient | p-Value | Variable | Coefficient | p-Value |

|---|---|---|---|---|---|

| Using NU and GV: | Using LU and GV: | ||||

| Constant | −36.7842 | 0.7742 | Constant | 306.014 | 0.0566 |

| ΔGV− (−2) | −2.8366 | 0.0679 | LU (−1) | −0.4200 | 0.0454 |

| Auxiliary hypotheses: h2: accept, p-value 0.0679 Supplementary estimations, p-values: A normality test: 0.0025 ADF test of residual (without trend): 0.0352 ADF test of residual (with trend): 0.4397 ARCH effect: 0.4523 R-squared: 0.1571 QLR test p-value: 0.0228, year: 2002 | Auxiliary hypotheses: h1: reject, p-value 0.0454 Supplementary estimations, p-values: A normality test: 0.0059 ADF test of residual (without trend): 0.2522 ADF test of residual (with trend): 0.4491 ARCH effect: 0.1634 R-squared: 0.1855 QLR test p-value: 0.5210, year: 2000 | ||||

References

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef]

- Ridzuan, N.H.A.M.; Marwan, N.F.; Khalid, N.; Ali, M.H.; Tseng, M.L. Effects of agriculture, renewable energy, and economic growth on carbon dioxide emissions: Evidence of the environmental Kuznets curve. Resour. Conserv. Recycl. 2020, 160, 104879. [Google Scholar] [CrossRef]

- Xu, Z.; Baloch, M.A.; Meng, F.; Zhang, J.; Mahmood, Z. Nexus between financial development and CO2 emissions in Saudi Arabia: Analyzing the role of globalization. Environ. Sci. Pollut. Res. 2018, 25, 28378–28390. [Google Scholar] [CrossRef]

- Shahbaz, M.; Shahzad, S.J.H.; Mahalik, M.K. Is globalization detrimental to CO2 emissions in Japan? New threshold analysis. Environ. Model. Assess. 2018, 23, 557–568. [Google Scholar] [CrossRef]

- Zafar, M.W.; Saud, S.; Hou, F. The impact of globalization and financial development on environmental quality: Evidence from selected countries in the Organization for Economic Co-operation and Development (OECD). Environ. Sci. Pollut. Res. 2019, 26, 13246–13262. [Google Scholar] [CrossRef]

- Khan, I.; Hou, F.; Le, H.P. The impact of natural resources, energy consumption, and population growth on environmental quality: Fresh evidence from the United States of America. Sci. Total Environ. 2021, 754, 142222. [Google Scholar] [CrossRef]

- Zhang, L.; Pang, J.; Chen, X.; Lu, Z. Carbon emissions, energy consumption and economic growth: Evidence from the agricultural sector of China’s main grain-producing areas. Sci. Total Environ. 2019, 665, 1017–1025. [Google Scholar] [CrossRef]

- Roser, M. The World’s Energy Problem. 2020. Available online: https://ourworldindata.org/worlds-energy-problem (accessed on 15 October 2022).

- Sarkodie, S.A.; Ozturk, I. Investigating the environmental Kuznets curve hypothesis in Kenya: A multivariate analysis. Renew. Sustain. Energy Rev. 2020, 117, 109481. [Google Scholar] [CrossRef]

- Proposal for a Directive of the European Parliament and of the Council on Energy Efficiency (Recast). COM/2021/558 Final. 021/0203(COD). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021PC0558 (accessed on 15 October 2022).

- Ritchie, H.; Roser, M.; Rosado, P. CO2 and Greenhouse Gas Emissions. Published Online at OurWorldInData.org. 2020. Available online: https://ourworldindata.org/co2-and-other-greenhouse-gas-emissions (accessed on 2 November 2022).

- Our World in Data Based on Climate Analysis Indicators Tool (CAIT). OurWorldInData.org/co2-and-Other-Greenhouse-Gas-Emissions. Available online: https://ourworldindata.org/emissions-by-sector (accessed on 18 October 2022).

- U.S. Energy Information and Administration (EIA). International Energy Outlook 2016: With Projections to 2040. 2016. Available online: https://www.eia.gov/outlooks/ieo/pdf/0484(2016).pdf (accessed on 3 November 2022).

- Leonard, M.D.; Michaelides, E.E.; Michaelides, D.N. Energy storage needs for the substitution of fossil fuel power plants with renewables. Renew. Energy 2020, 145, 951–962. [Google Scholar] [CrossRef]

- Holechek, J.L.; Geli, H.M.; Sawalhah, M.N.; Valdez, R. A global assessment: Can renewable energy replace fossil fuels by 2050? Sustainability 2022, 14, 4792. [Google Scholar] [CrossRef]

- Ma, B.; Yu, Y. Industrial structure, energy-saving regulations and energy intensity: Evidence from Chinese cities. J. Clean. Prod. 2017, 141, 1539–1547. [Google Scholar] [CrossRef]

- Salim, R.; Yao, Y.; Chen, G.S. Does human capital matter for energy consumption in China? Energy Econ. 2017, 67, 49–59. [Google Scholar] [CrossRef]

- Kander, A.; Warde, P.; Henriques, S.T.; Nielsen, H.; Kulionis, V.; Hagen, S. International trade and energy intensity during European industrialization, 1870–1935. Ecol. Econ. 2017, 139, 33–44. [Google Scholar] [CrossRef]

- Beyene, S.D.; Aruga, K. Investigating the energy-environmental Kuznets curve under panel quantile regression: A global perspective. Environ. Sci. Pollut. Res. 2022, 30, 20527–20546. [Google Scholar]

- Communication from the Commission to the European Parliament and the Council. Energy Efficiency and Its Contribution to Energy Security and the 2030 Framework for Climate and Energy Policy; COM(2014) 520 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2014:0520:FIN (accessed on 4 November 2022).

- Eurostat; European Commission. GDP and Main Components (Output, Expenditure and Income) [nama_10_gdp]. Available online: https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=nama_10_gdp&lang=en (accessed on 2 November 2022).

- Hundie, S.K.; Daksa, M.D. Does energy-environmental Kuznets curve hold for Ethiopia? The relationship between energy intensity and economic growth. J. Econ. Struct. 2019, 8, 21. [Google Scholar] [CrossRef]

- Aruga, K. Investigating the energy-environmental Kuznets Curve hypothesis for the Asia-Pacific region. Sustainability 2019, 11, 2395. [Google Scholar] [CrossRef]

- Shahbaz, M.; Shafiullah, M.; Khalid, U.; Song, M. A nonparametric analysis of energy environmental Kuznets Curve in Chinese Provinces. Energy Econ. 2020, 89, 104814. [Google Scholar] [CrossRef]

- Van Benthem, A.A. Energy leapfrogging. J. Assoc. Environ. Resour. Econ. 2015, 2, 93–132. [Google Scholar] [CrossRef]

- Chen, Q.; Taylor, D. Economic development and pollution emissions in Singapore: Evidence in support of the Environmental Kuznets Curve hypothesis and its implications for regional sustainability. J. Clean. Prod. 2020, 243, 118637. [Google Scholar] [CrossRef]

- Liu, M.; Ren, X.; Cheng, C.; Wang, Z. The role of globalization in CO2 emissions: A semi-parametric panel data analysis for G7. Sci. Total Environ. 2020, 718, 137379. [Google Scholar] [CrossRef]

- Assamoi, G.R.; Wang, S.; Liu, Y.; Gnangoin, T.B.Y.; Kassi, D.F.; Edjoukou, A.J.R. Dynamics between participation in global value chains and carbon dioxide emissions: Empirical evidence for selected Asian countries. Environ. Sci. Pollut. Res. 2020, 27, 16496–16506. [Google Scholar] [CrossRef]

- Dogan, E.; Inglesi-Lotz, R. The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: Evidence from European countries. Environ. Sci. Pollut. Res. 2020, 27, 12717–12724. [Google Scholar] [CrossRef] [PubMed]

- Shah, S.A.R.; Naqvi, S.A.A.; Nasreen, S.; Abbas, N. Associating drivers of economic development with environmental degradation: Fresh evidence from Western Asia and North African region. Ecol. Indic. 2021, 126, 107638. [Google Scholar] [CrossRef]

- Husnain, M.I.U.; Haider, A.; Khan, M.A. Does the environmental Kuznets curve reliably explain a developmental issue? Environ. Sci. Pollut. Res. 2021, 28, 11469–11485. [Google Scholar] [CrossRef] [PubMed]

- Chen, J.; Hu, T.E.; Van Tulder, R. Is the environmental Kuznets curve still valid: A perspective of wicked problems. Sustainability 2019, 11, 4747. [Google Scholar] [CrossRef]

- Yu, Z.; Ponce, P.; Irshad, A.U.R.; Tanveer, M.; Ponce, K.; Khan, A.R. Energy efficiency and Jevons’ paradox in OECD countries: Policy implications leading toward sustainable development. J. Pet. Explor. Prod. Technol. 2022, 12, 2967–2980. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, T.; Nathwani, J.; Yang, F.; Shao, Q. Environmental regulation, technology innovation, and low carbon development: Revisiting the EKC Hypothesis, Porter Hypothesis, and Jevons’ Paradox in China’s iron & steel industry. Technol. Forecast. Soc. Chang. 2022, 176, 121471. [Google Scholar]

- Jevons, W.S. The Coal Question: An Inquiry Concerning the Progress of the Nation and the Probable Exhaustion of Our Coal-Mines; Macmillan and Company: London, UK, 1866. [Google Scholar]

- Trincado, E.; Sánchez-Bayón, A.; Vindel, J.M. The European Union Green Deal: Clean Energy Wellbeing Opportunities and the Risk of the Jevons Paradox. Energies 2021, 14, 4148. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; Working Paper No. 3914; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Beckerman, W. Economic growth and the environment: Whose growth? Whose environment? World Dev. 1992, 20, 481–496. [Google Scholar] [CrossRef]

- Panayotou, T. Empirical Tests and Policy Analysis of Environmental Degradation at Different Stages of Economic Development (No. 992927783402676); International Labour Organization: Geneva, Switzerland, 1993. [Google Scholar]

- Kraft, J.; Kraft, A. On the relationship between energy and GNP. J. Energy Dev. 1978, 3, 401–403. [Google Scholar]

- Tiba, S.; Omri, A. Literature Survey on the Relationships between Energy Variables, Environment and Economic Growth; University Library of Munich: Munich, Germany, 2016. [Google Scholar]

- Pablo-Romero, M.D.P.; De Jesús, J. Economic growth and energy consumption: The energy-environmental Kuznets curve for Latin America and the Caribbean. Renew. Sustain. Energy Rev. 2016, 60, 1343–1350. [Google Scholar] [CrossRef]

- Aboagye, S. The policy implications of the relationship between energy consumption, energy intensity and economic growth in Ghana. OPEC Energy Rev. 2017, 41, 344–363. [Google Scholar] [CrossRef]

- Bilgili, F.; Koçak, E.; Bulut, Ü.; Kuloğlu, A. The impact of urbanization on energy intensity: Panel data evidence considering cross-sectional dependence and heterogeneity. Energy 2017, 133, 242–256. [Google Scholar] [CrossRef]

- Zhang, Q.; Liao, H.; Hao, Y. Does one path fit all? An empirical study on the relationship between energy consumption and economic development for individual Chinese provinces. Energy 2018, 150, 527–543. [Google Scholar] [CrossRef]

- Filippidis, M.; Tzouvanas, P.; Chatziantoniou, I. Energy poverty through the lens of the energy-environmental Kuznets curve hypothesis. Energy Econ. 2021, 100, 105328. [Google Scholar] [CrossRef]

- Mahmood, H.; Alkhateeb, T.T.Y.; Tanveer, M.; Mahmoud, D.H. Testing the energy-environmental Kuznets curve hypothesis in the renewable and nonrenewable energy consumption models in Egypt. Int. J. Environ. Res. Public Health 2021, 18, 7334. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Energy consumption and economic growth in Central America: Evidence from a panel cointegration and error correction model. Energy Econ. 2009, 31, 211–216. [Google Scholar] [CrossRef]

- Ajmi, A.N.; Hammoudeh, S.; Nguyen, D.K.; Sato, J.R. On the relationships between CO2 emissions, energy consumption and income: The importance of time variation. Energy Econ. 2013, 49, 629–638. [Google Scholar] [CrossRef]

- Lise, W.; Van Montfort, K. Energy consumption and GDP in Turkey: Is there a cointegration relationship? Energy Econ. 2007, 29, 1166–1178. [Google Scholar] [CrossRef]

- Zhang, C.; Xu, J. Retesting the causality between energy consumption and GDP in China: Evidence from sectoral and regional analyses using dynamic panel data. Energy Econ. 2012, 34, 1782–1789. [Google Scholar] [CrossRef]

- Shahbaz, M.; Mallick, H.; Mahalik, M.K.; Sadorsky, P. The role of globalization on the recent evolution of energy demand in India: Implications for sustainable development. Energy Econ. 2016, 55, 52–68. [Google Scholar] [CrossRef]

- Hao, Y.; Zhu, L.; Ye, M. The dynamic relationship between energy consumption, investment and economic growth in China’s rural area: New evidence based on provincial panel data. Energy 2018, 154, 374–382. [Google Scholar] [CrossRef]

- Rahman, Z.; Khattak, S.I.; Ahmad, M.; Khan, A. A disaggregated-level analysis of the relationship among energy production, energy consumption and economic growth: Evidence from China. Energy 2020, 194, 116836. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Saboori, B.; Ozturk, I. Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 2015, 76, 123–131. [Google Scholar] [CrossRef]

- Dong, X.-Y.; Ran, Q.; Hao, Y. On the nonlinear relationship between energy consumption and economic development in China: New evidence from panel data threshold estimations. Qual. Quant. 2019, 53, 1837–1857. [Google Scholar] [CrossRef]

- Shahbaz, M.; Shafiullah, M.; Papavassiliou, V.G.; Hammoudeh, S. The CO2–growth nexus revisited: A nonparametric analysis for the G7 economies over nearly two centuries. Energy Econ. 2017, 65, 183–193. [Google Scholar] [CrossRef]

- Shahbaz, M.; Shafiullah, M.; Mahalik, M.K. The dynamics of financial development, globalisation, economic growth and life expectancy in sub-Saharan Africa. Aust. Econ. Pap. 2019, 58, 444–479. [Google Scholar] [CrossRef]

- Key Results of the 2020 Farm Structure Survey in Estonia, Latvia and Lithuania. In Results of the Agricultural Census 2020 (Edition 2022); Statistics Lithuania. Available online: https://osp.stat.gov.lt/zus2020-rezultatai/zemes-ukio-surasymo-pagrindiniai-rezultatai-estijoje-latvijoje-ir-lietuvoje (accessed on 4 November 2022).

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt; Springer: New York, NY, USA, 2014; pp. 281–314. [Google Scholar]

- Said, S.E.; Dickey, D.A. Testing for unit roots in autoregressive-moving average models of unknown order. Biometrika 1984, 71, 599–607. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W. Co-integration and error correction: Representation, estimation, and testing. Econom. J. Econom. Soc. 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Ali, W.; Abdullah, A.; Azam, M. Re-visiting the environmental Kuznets curve hypothesis for Malaysia: Fresh evidence from ARDL bounds testing approach. Renew. Sustain. Energy Rev. 2017, 77, 990–1000. [Google Scholar] [CrossRef]

- Wald, A. Tests of statistical hypotheses concerning several parameters when the number of observations is large. Trans. Am. Math. Soc. 1943, 54, 426–482. [Google Scholar] [CrossRef]

- Chow, G.C. Tests of equality between sets of coefficients in two linear regressions. Econom. J. Econom. Soc. 1960, 28, 591–605. [Google Scholar] [CrossRef]

- Eurostat; European Commission. Gross Value Added and Income by A*10 Industry Breakdowns [nama_10_a10]. Available online: https://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do (accessed on 9 September 2022).

- FAOSTAT. Energy Use. Available online: https://https://www.fao.org/faostat/en/#data/GN (accessed on 9 September 2022).

- Haider, A.; Rankaduwa, W.; ul Husnain, M.I.; Shaheen, F. Nexus between Agricultural Land Use, Economic Growth and N2O Emissions in Canada: Is There an Environmental Kuznets Curve? Sustainability 2022, 14, 8806. [Google Scholar] [CrossRef]

- Moosa, I.A.; Burns, K. The Energy Kuznets Curve: Evidence from Developed and Developing Economies. Energy J. 2022, 43, 47–70. [Google Scholar] [CrossRef]

- Baležentis, T.; Streimikiene, D.; Zhang, T.; Liobikiene, G. The role of bioenergy in greenhouse gas emission reduction in EU countries: An Environmental Kuznets Curve modelling. Resour. Conserv. Recycl. 2019, 142, 225–231. [Google Scholar] [CrossRef]

- Vlontzos, G.; Niavis, S.; Pardalos, P. Testing for Environmental Kuznets curve in the EU Agricultural Sector through an eco-(in) efficiency index. Energies 2017, 10, 1992. [Google Scholar] [CrossRef]

- Zoundi, Z. CO2 emissions, renewable energy and the Environmental Kuznets Curve, a panel cointegration approach. Renew. Sustain. Energy Rev. 2017, 72, 1067–1075. [Google Scholar] [CrossRef]

- He, P.; Ya, Q.; Chengfeng, L.; Yuan, Y.; Xiao, C. Nexus between environmental tax, economic growth, energy consumption, and carbon dioxide emissions: Evidence from China, Finland, and Malaysia based on a Panel ARDL approach. Emerg. Mark. Financ. Trade 2021, 57, 698–712. [Google Scholar] [CrossRef]

- Zortuk, M.; Çeken, S. Testing environmental Kuznets curve in the selected transition economies with panel smooth transition regression analysis. Amfiteatru Econ. J. 2016, 18, 537–547. [Google Scholar]

- Simionescu, M.; Wojciechowski, A.; Tomczyk, A.; Rabe, M. Revised environmental Kuznets curve for V4 countries and Baltic states. Energies 2021, 14, 3302. [Google Scholar] [CrossRef]

- Kar, A.K. Environmental Kuznets curve for CO2 emissions in Baltic countries: An empirical investigation. Environ. Sci. Pollut. Res. 2022, 29, 47189–47208. [Google Scholar] [CrossRef]

- Li, T.; Baležentis, T.; Makutėnienė, D.; Streimikiene, D.; Kriščiukaitienė, I. Energy-related CO2 emission in European Union agriculture: Driving forces and possibilities for reduction. Appl. Energy 2016, 180, 682–694. [Google Scholar] [CrossRef]

- Yan, Q.; Yin, J.; Baležentis, T.; Makutėnienė, D.; Štreimikienė, D. Energy-related GHG emission in agriculture of the European countries: An application of the Generalized Divisia Index. J. Clean. Prod. 2017, 164, 686–694. [Google Scholar] [CrossRef]

- Jóźwik, B.; Gavryshkiv, A.V.; Kyophilavong, P.; Gruszecki, L.E. Revisiting the environmental Kuznets curve hypothesis: A case of Central Europe. Energies 2021, 14, 3415. [Google Scholar] [CrossRef]

- Pablo-Romero Gil-Delgado, M.D.P.; Sánchez Braza, A. Residential energy environmental Kuznets curve in the EU-28. Energy 2017, 125, 44–54. [Google Scholar] [CrossRef]

- Rahman, H.U.; Ghazali, A.; Bhatti, G.A.; Khan, S.U. Role of economic growth, financial development, trade, energy and FDI in environmental Kuznets curve for Lithuania: Evidence from ARDL bounds testing approach. Eng. Econ. 2020, 31, 39–49. [Google Scholar] [CrossRef]

- Bekhet, H.A.; Othman, N.S. The role of renewable energy to validate dynamic interaction between CO2 emissions and GDP toward sustainable development in Malaysia. Energy Econ. 2018, 72, 47–61. [Google Scholar] [CrossRef]

- Ali, S.; Ying, L.; Shah, T.; Tariq, A.; Ali Chandio, A.; Ali, I. Analysis of the nexus of CO2 emissions, economic growth, land under cereal crops and agriculture value-added in Pakistan using an ARDL approach. Energies 2019, 12, 4590. [Google Scholar] [CrossRef]

- Khan, M.K.; Khan, M.I.; Rehan, M. The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ. Innov. 2020, 6, 1. [Google Scholar] [CrossRef]

- Tong, T.; Ortiz, J.; Xu, C.; Li, F. Economic growth, energy consumption, and carbon dioxide emissions in the E7 countries: A bootstrap ARDL bound test. Energy Sustain. Soc. 2020, 10, 20. [Google Scholar] [CrossRef]

- Zafeiriou, E.; Mallidis, I.; Galanopoulos, K.; Arabatzis, G. Greenhouse gas emissions and economic performance in EU agriculture: An empirical study in a non-linear framework. Sustainability 2018, 10, 3837. [Google Scholar] [CrossRef]

- Saint Akadiri, S.; Alola, A.A.; Olasehinde-Williams, G.; Etokakpan, M.U. The role of electricity consumption, globalization and economic growth in carbon dioxide emissions and its implications for environmental sustainability targets. Sci. Total Environ. 2020, 708, 134653. [Google Scholar] [CrossRef]

- Borozan, D. Efficiency of energy taxes and the validity of the residential electricity environmental Kuznets curve in the European Union. Sustainability 2018, 10, 2464. [Google Scholar] [CrossRef]

- Özokcu, S.; Özdemir, Ö. Economic growth, energy, and environmental Kuznets curve. Renew. Sustain. Energy Rev. 2017, 72, 639–647. [Google Scholar] [CrossRef]

- Pata, U.K. Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. J. Clean. Prod. 2018, 187, 770–779. [Google Scholar] [CrossRef]

- Ali, M.U.; Gong, Z.; Ali, M.U.; Wu, X.; Yao, C. Fossil energy consumption, economic development, inward FDI impact on CO2 emissions in Pakistan: Testing EKC hypothesis through ARDL model. Int. J. Financ. Econ. 2021, 26, 3210–3221. [Google Scholar] [CrossRef]

- Aljadani, A.; Toumi, H.; Toumi, S.; Hsini, M.; Jallali, B. Investigation of the N-shaped environmental Kuznets curve for COVID-19 mitigation in the KSA. Environ. Sci. Pollut. Res. 2021, 28, 29681–29700. [Google Scholar] [CrossRef]

- Zeraibi, A.; Balsalobre-Lorente, D.; Shehzad, K. Examining the asymmetric nexus between energy consumption, technological innovation, and economic growth; Does energy consumption and technology boost economic development? Sustainability 2020, 12, 8867. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Shahbaz, M.; Chiappetta Jabbour, C.J.; Driha, O.M. The role of energy innovation and corruption in carbon emissions: Evidence based on the EKC hypothesis. In Energy and Environmental Strategies in the Era of Globalization; Springer: Cham, Switzerland, 2019; pp. 271–304. [Google Scholar]

- Ghazouani, T.; Boukhatem, J.; Sam, C.Y. Causal interactions between trade openness, renewable electricity consumption, and economic growth in Asia-Pacific countries: Fresh evidence from a bootstrap ARDL approach. Renew. Sustain. Energy Rev. 2020, 133, 110094. [Google Scholar] [CrossRef]

- Hasson, A.; Masih, M. Energy Consumption, Trade Openness, Economic Growth, Carbon Dioxide Emissions and Electricity Consumption: Evidence from South Africa Based on ARDL. 2017. Available online: https://mpra.ub.uni-muenchen.de/79424/ (accessed on 9 April 2022).

- Van Chien, N. Energy consumption, income, trading openness, and environmental pollution: Testing environmental Kuznets curve hypothesis. J. Southwest Jiaotong Univ. 2020, 55. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, Z.; Zhong, Z. CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew. Energy 2019, 131, 208–216. [Google Scholar] [CrossRef]

- Yao, S.; Zhang, S.; Zhang, X. Renewable energy, carbon emission and economic growth: A revised environmental Kuznets Curve perspective. J. Clean. Prod. 2019, 235, 1338–1352. [Google Scholar] [CrossRef]

- Zhang, J.; Alharthi, M.; Abbas, Q.; Li, W.; Mohsin, M.; Jamal, K.; Taghizadeh-Hesary, F. Reassessing the Environmental Kuznets Curve in relation to energy efficiency and economic growth. Sustainability 2020, 12, 8346. [Google Scholar] [CrossRef]

- Jun, J. Relationship between Energy Consumption and Tourism in Latin America and the Caribbean: The Application of the Environmental Kuznets Curve. Lat. Am. Stud. Rev. 2017, 8, 3–28. [Google Scholar]

- Mahmood, H.; Maalel, N.; Hassan, M.S. Probing the Energy-Environmental Kuznets Curve hypothesis in oil and natural gas consumption models considering urbanization and financial development in Middle East countries. Energies 2021, 14, 3178. [Google Scholar] [CrossRef]

- Latif, A.; Javed, R. Does economic growth, population growth and energy use impact carbon-dioxide emissions in Pakistan? An ARDL approach. Bull. Bus. Econ. 2021, 10, 85–91. [Google Scholar]

- Khan, M.K.; Teng, J.Z.; Khan, M.I. Effect of energy consumption and economic growth on carbon dioxide emissions in Pakistan with dynamic ARDL simulations approach. Environ. Sci. Pollut. Res. 2019, 26, 23480–23490. [Google Scholar] [CrossRef]

- Pata, U.K.; Aydin, M. Testing the EKC hypothesis for the top six hydropower energy-consuming countries: Evidence from Fourier Bootstrap ARDL procedure. J. Clean. Prod. 2020, 264, 121699. [Google Scholar] [CrossRef]

- Naqvi, S.A.A.; Shah, S.A.R.; Anwar, S.; Raza, H. Renewable energy, economic development, and ecological footprint nexus: Fresh evidence of renewable energy environment Kuznets curve (RKC) from income groups. Environ. Sci. Pollut. Res. 2021, 28, 2031–2051. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Jiang, H.; Zeng, X. CO2 emissions, economic growth, and the environmental Kuznets curve in China: What roles can nuclear energy and renewable energy play? J. Clean. Prod. 2018, 196, 51–63. [Google Scholar] [CrossRef]

- Zambrano-Monserrate, M.A.; Silva-Zambrano, C.A.; Davalos-Penafiel, J.L.; Zambrano-Monserrate, A.; Ruano, M.A. Testing environmental Kuznets curve hypothesis in Peru: The role of renewable electricity, petroleum and dry natural gas. Renew. Sustain. Energy Rev. 2018, 82, 4170–4178. [Google Scholar] [CrossRef]

| Indicator | Lithuania | Latvia | Estonia | ||||||

|---|---|---|---|---|---|---|---|---|---|

| NU | LU | GV | NU | LU | GV | NU | LU | GV | |

| Using initial value LU, NU, and GV: | |||||||||

| Mean | 4307.7 | 806.43 | 1761.8 | 5869.0 | 592.29 | 995.89 | 4258.0 | 774.75 | 632.65 |

| Median | 3998.9 | 702.00 | 1732.7 | 5904.8 | 583.20 | 964.90 | 4271.1 | 748.80 | 628.85 |

| Minimum | 3513.9 | 597.60 | 1097.4 | 5071.6 | 486.00 | 541.10 | 2086.4 | 565.20 | 341.30 |

| Maximum | 8098.9 | 1803.6 | 2300.0 | 6770.1 | 741.60 | 1658.4 | 5636.7 | 1227.6 | 922.20 |

| Standard deviation | 1104.0 | 318.72 | 328.80 | 519.38 | 74.287 | 274.39 | 911.93 | 135.45 | 183.85 |

| Standard deviation, % | 25.63 | 39.52 | 18.66 | 8.85 | 12.54 | 27.55 | 21.42 | 17.48 | 29.06 |

| Skewness | 2.4063 | 2.2518 | −0.1019 | 0.0167 | 0.3252 | 0.4071 | −0.6930 | 1.5051 | −0.0544 |

| Kurtosis | 4.8291 | 3.5790 | −0.9646 | −0.9212 | −0.9454 | −0.0311 | 0.2617 | 3.4275 | −1.2993 |

| Using differences of variables ∆NU, ∆LU and ∆GV: | |||||||||

| Mean | −171.53 | −45.420 | 20.625 | −3.3928 | −8.3100 | 31.579 | 61.819 | −31.350 | 20.458 |

| Median | −22.250 | −12.600 | 4.8500 | −16.513 | −1.8000 | 7.5500 | 84.350 | −12.600 | 41.700 |

| Minimum | −2014.1 | −676.80 | −591.10 | −933.15 | −158.40 | −161.80 | −1297.0 | −338.40 | −294.70 |

| Maximum | 413.50 | 54.000 | 385.30 | 820.84 | 57.600 | 256.90 | 1702.3 | 126.00 | 271.10 |

| Standard deviation | 538.75 | 152.79 | 251.12 | 392.44 | 50.284 | 113.69 | 593.90 | 107.49 | 126.98 |

| Skewness | −2.0762 | −3.2051 | −0.2809 | −0.1506 | −1.2029 | 0.2821 | 0.2617 | −1.4470 | −0.4026 |

| Kurtosis | 4.3213 | 10.495 | −0.2259 | 0.3954 | 1.5072 | −0.9983 | 1.6694 | 2.4072 | 0.2846 |

| Mean | −171.53 | −45.420 | 20.625 | −3.3928 | −8.3100 | 31.579 | 61.819 | −31.350 | 20.458 |

| Indicator | Lithuania | Latvia | Estonia | ||||||

|---|---|---|---|---|---|---|---|---|---|

| NU | LU | GV | NU | LU | GV | NU | LU | GV | |

| Using initial values LU, NU and GV, p-values: | |||||||||

| test without trend | 0.0345 | 0.0017 | 0.4117 | 0.359 | 0.3797 | 0.9911 | 0.5513 | 0.1391 | 0.2725 |

| test with trend | 0.2165 | 0.9182 | 0.9323 | 0.3374 | 0.7259 | 0.1241 | 0.0593 | 0.2096 | 0.1693 |

| Using differences of variables ∆NU, ∆LU and ∆GV, p-values: | |||||||||

| test without trend | 0.0023 | 0.0101 | 0.0003 | 0.0023 | 0.0012 | 0.0016 | 0.0417 | 0.1902 | <0.0001 |

| test with trend | 0.0016 | 0.2236 | 0.0043 | 0.0144 | 0.0156 | 0.0194 | 0.0942 | 0.3326 | <0.0001 |

| Indicator | Lithuania | Latvia | Estonia | |||

|---|---|---|---|---|---|---|

| NU | LU | NU | LU | NU | LU | |

| Using initial values LU, NU and GV, p-values: | ||||||

| test without trend | 0.1592 | 0.0989 | 0.0464 | 0.7406 | 0.2304 | 0.3236 |

| test with trend | 0.5530 | 0.4428 | 0.1895 | 0.8000 | 0.2447 | 0.7029 |

| Using differences of variables ∆NU, ∆LU and ∆GV, p-values: | ||||||

| test without trend | 0.3984 | 0.1892 | 0.0140 | 0.0346 | 0.0805 | 0.0023 |

| test with trend | 0.6988 | 0.1535 | 0.0436 | 0.0526 | 0.2108 | 0.0172 |

| Time Period | Long Run, p-Value | Short Run, p-Value | Conclusion |

|---|---|---|---|

| Using NU and GV: | |||

| Lithuania | 0.8071 | 0.5781 | No asymmetry |

| Latvia | 0.7285 | 0.5901 | No asymmetry |

| Estonia | 0.2277 | 0.0511 | Short-run asymmetry |

| All Baltic States | 0.9135 | 0.0605 | Short-run asymmetry |

| Using LU and GV: | |||

| Lithuania | 0.2450 | 0.7645 | No asymmetry |

| Latvia | 0.2226 | 0.5955 | No asymmetry |

| Estonia | 0.6729 | 0.4765 | No asymmetry |

| All Baltic States | 0.5922 | 0.5577 | No asymmetry |

| Variable | Coefficient | p-Value | Variable | Coefficient | p-Value |

|---|---|---|---|---|---|

| Using NU and GV: | Using LU and GV: | ||||

| Constant | 1836.8600 | 0.0078 | Constant | 29.7719 | 0.8978 |

| NU (−1) | −0.4046 | 0.0020 | LU (−1) | −0.4182 | 0.0147 |

| GV (−1) | −0.1888 | 0.5496 | GV (−1) | 0.1323 | 0.3130 |

| ΔNU (−1) | −0.0554 | 0.7337 | ΔLU (−1) | −0.1424 | 0.5091 |

| ΔNU (−2) | 0.3260 | 0.0611 | ΔLU (−2) | −0.0064 | 0.9768 |

| ΔGV (0) | 0.1474 | 0.7384 | ΔGV (0) | 0.0985 | 0.5898 |

| S_2004 | 150.5100 | 0.5680 | S_2004 | 24.2027 | 0.8294 |

| D_2009 | −461.0290 | 0.3123 | D_2009 | 25.6639 | 0.8896 |

| Auxiliary hypotheses: h1: reject, p-value 0.0028 h2: accept, p-value 0.7384 Supplementary estimations, p-values: A normality test: 0.0294 ADF test of residual (without trend): <0.0001 ADF test of residual (with trend): 0.1416 ARCH effect: 0.0069 R-squared: 0.7621 | Auxiliary hypotheses: h1: reject, p-value 0.0453 h2: accept, p-value 0.5898 Supplementary estimations, p-values: A normality test: <0.0001 ADF test of residual (without trend): 0.0666 ADF test of residual (with trend): 0.0003 ARCH effect: 0.0006 R-squared: 0.5563 | ||||

| Variable | Coefficient | p-Value | Variable | Coefficient | p-Value |

|---|---|---|---|---|---|

| Using NU and GV: | Using LU and GV: | ||||

| Constant | 3822.0900 | 0.0068 | Constant | 51.3900 | 0.4677 |

| NU (−1) | −0.8715 | 0.0034 | LU (−1) | −0.2736 | 0.0574 |

| GV (−1) | 1.1756 | 0.0358 | GV (−1) | 0.1562 | 0.0257 |

| ΔNU (−1) | 0.0278 | 0.8851 | ΔLU (−1) | 0.0853 | 0.6659 |

| ΔNU (−2) | 0.0602 | 0.7623 | ΔGV (0) | −0.0500 | 0.4712 |

| ΔGV (0) | 1.0893 | 0.1233 | ΔGV (−1) | −0.2067 | 0.0211 |

| S_2004 | 149.9530 | 0.5260 | ΔGV (−2) | 0.0777 | 0.3146 |

| D_2009 | −554.4930 | 0.1354 | S_2004 | −46.5306 | 0.1262 |

| D_2009 | −61.0039 | 0.0935 | |||

| Auxiliary hypotheses: h1: reject, p-value 0.0106 h2: accept, p-value 0.1233 Supplementary estimations, p-values: A normality test: 0.8378 ADF test of residual (without trend): 0.0001 ADF test of residual (with trend): 0.6360 ARCH effect: 0.5394 R-squared: 0.5608 | Auxiliary hypotheses: h1: accept, p-value 0.0597 h2: reject, p-value 0.0322 Supplementary estimations, p-values: A normality test: 0.1525 ADF test of residual (without trend): 0.0002 ADF test of residual (with trend): 0.2104 ARCH effect: 0.6933 R-squared: 0.6333 | ||||

| Variable | Coefficient | p-Value | Variable | Coefficient | p-Value |

|---|---|---|---|---|---|

| Using NU and GV: | Using LU and GV: | ||||

| Constant | 967.8790 | 0.3635 | Constant | 454.4330 | 0.1450 |

| NU (−1) | −0.5659 | 0.0556 | LU (−1) | −0.5474 | 0.0813 |

| GV (−1) | 3.5800 | 0.0279 | GV (−1) | −0.1455 | 0.5428 |

| ΔNU (−1) | 0.2452 | 0.2689 | ΔLU (−1) | −0.1907 | 0.4072 |

| ΔNU (−2) | 0.2502 | 0.2985 | ΔLU (−2) | −0.2834 | 0.3253 |

| ΔGV+ (0) | −1.7686 | 0.3538 | ΔGV (0) | −0.0880 | 0.7304 |

| ΔGV+ (−1) | −2.9727 | 0.1935 | S_2004 | 52.1898 | 0.5847 |

| ΔGV+ (−2) | −3.5118 | 0.1361 | D_2009 | −118.2060 | 0.3424 |

| ΔGV− (0) | 6.1739 | 0.0618 | |||

| ΔGV− (−1) | −0.4214 | 0.8167 | |||

| ΔGV− (−2) | −2.4054 | 0.2168 | |||

| S_2004 | 1247.9400 | 0.2461 | |||

| D_2009 | −302.6480 | 0.6116 | |||

| Auxiliary hypotheses: h1: reject, p-value 0.0295 h2: accept, p-value 0.0861 Supplementary estimations, p-values: A normality test: 0.3319 ADF test of residual (without trend): 0.0011 ADF test of residual (with trend): <0.0001 ARCH effect: 0.3966 R-squared: 0.7203 | Auxiliary hypotheses: h1: accept, p-value 0.2049 h2: accept, p-value 0.7304 Supplementary estimations, p-values: A normality test: 0.0732 ADF test of residual (without trend): 0.0694 ADF test of residual (with trend): 0.2552 ARCH effect: 0.0109 R-squared: 0.3297 | ||||

| Variable | Coefficient | p-Value | Variable | Coefficient | p-Value |

|---|---|---|---|---|---|

| Using NU and GV: | Using LU and GV: | ||||

| Constant | 833.8770 | 0.0046 | Constant | 191.2130 | 0.0024 |

| NU (−1) | −0.1451 | 0.0122 | LU (−1) | −0.3244 | <0.0001 |

| GV (−1) | −0.2740 | 0.1597 | GV (−1) | −0.0001 | 0.9967 |

| ΔNU (−1) | 0.1429 | 0.2109 | ΔLU (−1) | −0.0908 | 0.3841 |

| ΔNU (−2) | 0.1000 | 0.3739 | ΔLU (−2) | 0.0204 | 0.8590 |

| ΔGV+ (0) | 0.1307 | 0.6001 | ΔGV (0) | 0.0262 | 0.7307 |

| ΔGV− (0) | 0.0113 | 0.9735 | S_2004 | 28.0108 | 0.4087 |

| S_2004 | 105.8500 | 0.5649 | D_2009 | −45.1588 | 0.4546 |

| D_2009 | −318.8850 | 0.2711 | |||

| Auxiliary hypotheses: h1: reject, p-value 0.0065 h2: accept, p-value 0.7343 Supplementary estimations, p-values: A normality test: <0.0001 ADF test of residual (without trend): 0.3296 ADF test of residual (with trend): 0.8198 R-squared: 0.2496 | Auxiliary hypotheses: h1: reject, p-value < 0.0001 h2: accept, p-value 0.7307 Supplementary estimations, p-values: A normality test: <0.0001 ADF test of residual (without trend): 0.3739 ADF test of residual (with trend): 0.1441 R-squared: 0.3799 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Makutėnienė, D.; Staugaitis, A.J.; Vaznonis, B.; Grīnberga-Zālīte, G. The Relationship between Energy Consumption and Economic Growth in the Baltic Countries’ Agriculture: A Non-Linear Framework. Energies 2023, 16, 2114. https://doi.org/10.3390/en16052114

Makutėnienė D, Staugaitis AJ, Vaznonis B, Grīnberga-Zālīte G. The Relationship between Energy Consumption and Economic Growth in the Baltic Countries’ Agriculture: A Non-Linear Framework. Energies. 2023; 16(5):2114. https://doi.org/10.3390/en16052114

Chicago/Turabian StyleMakutėnienė, Daiva, Algirdas Justinas Staugaitis, Bernardas Vaznonis, and Gunta Grīnberga-Zālīte. 2023. "The Relationship between Energy Consumption and Economic Growth in the Baltic Countries’ Agriculture: A Non-Linear Framework" Energies 16, no. 5: 2114. https://doi.org/10.3390/en16052114

APA StyleMakutėnienė, D., Staugaitis, A. J., Vaznonis, B., & Grīnberga-Zālīte, G. (2023). The Relationship between Energy Consumption and Economic Growth in the Baltic Countries’ Agriculture: A Non-Linear Framework. Energies, 16(5), 2114. https://doi.org/10.3390/en16052114