The Role of Green Finance in Fostering the Sustainability of the Economy and Renewable Energy Supply: Recent Issues and Challenges

Abstract

:1. Introduction

2. Literature Review

2.1. Bibliometric Analysis

2.2. Benefits of Green Finance

2.3. Challenges of Green Finance

3. Data and Analysis Results

3.1. Hypothesis Testing and Regression Analysis

- (a)

- Green Bonds issued by country, cumulative to GDP—CBG (Climate Bonds initiative, 2023);

- (b)

- Carbon Emissions Intensity—CEI (Morningstar, 2023);

- (c)

- Renewable energy supply as % total energy supply—RES (OECD, 2023).

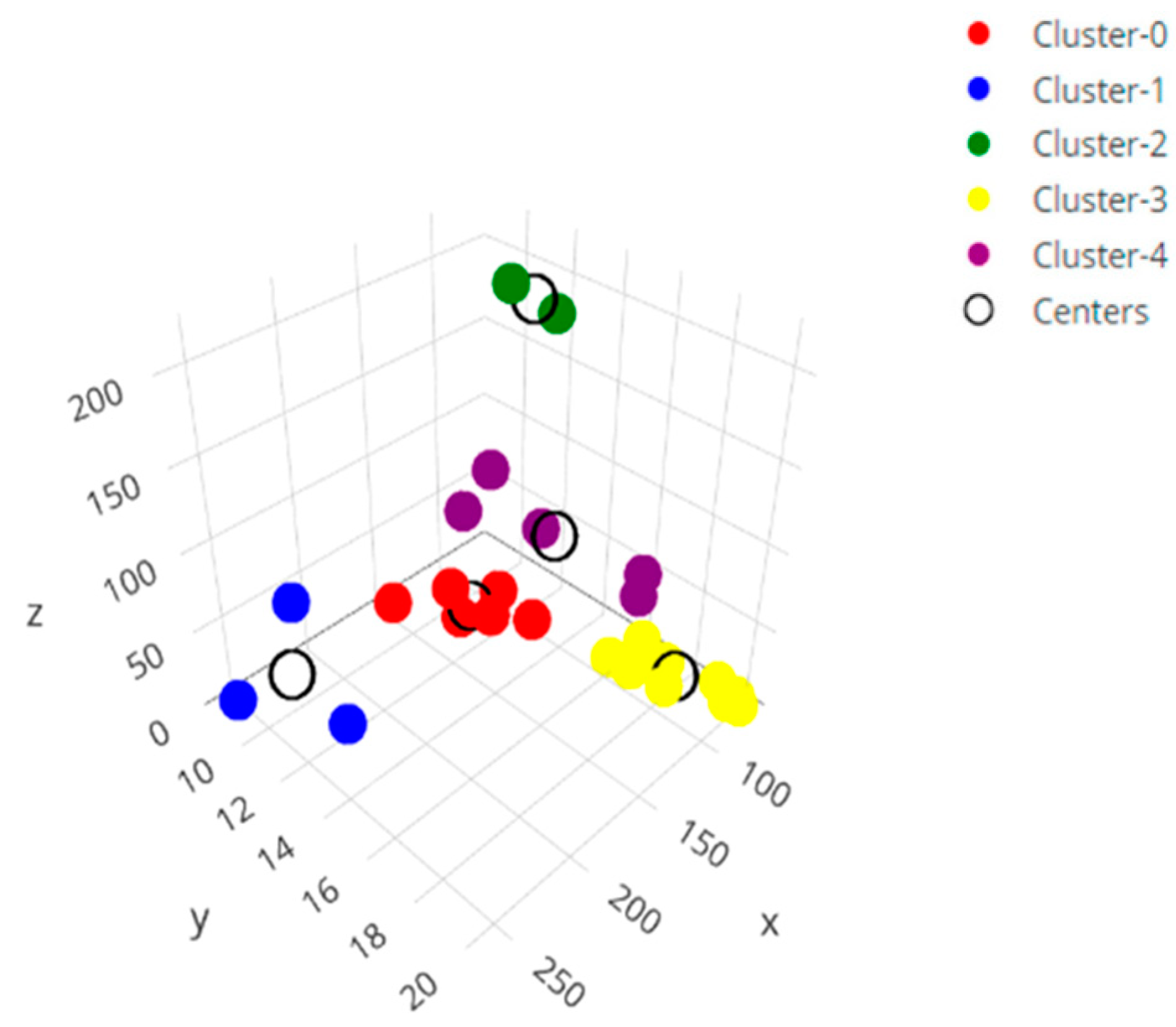

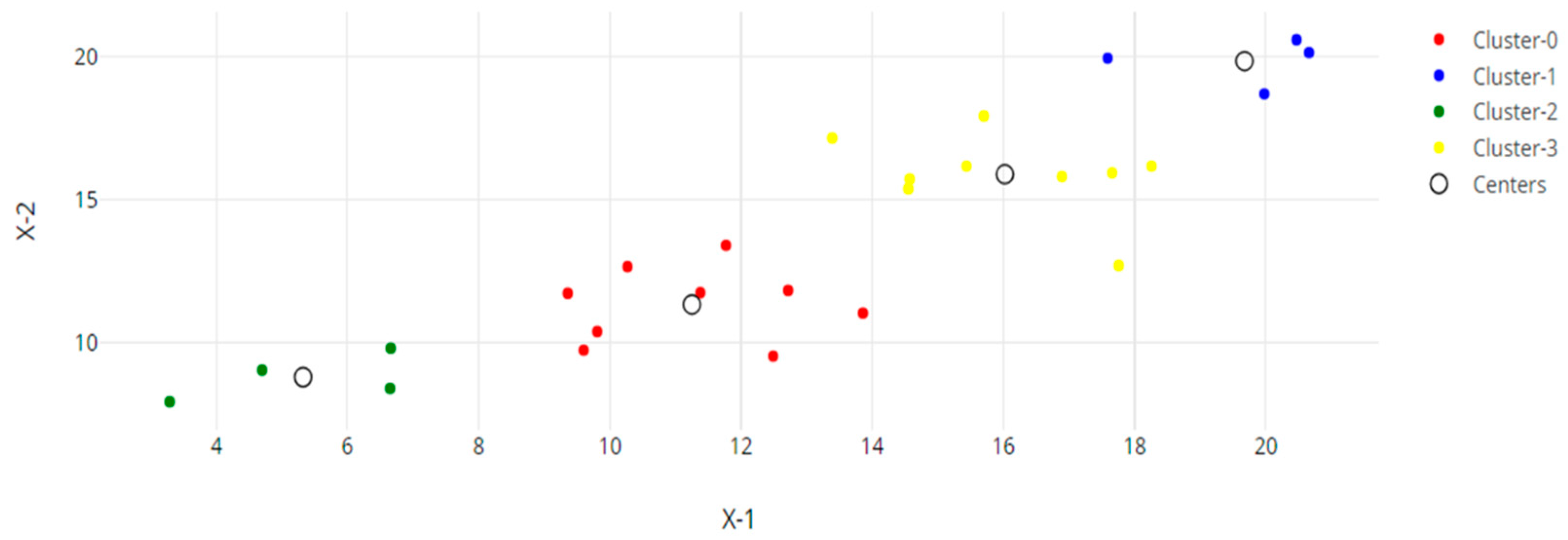

3.2. Cluster Analysis

4. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- United Nations Climate Change. The Paris Agreement. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement (accessed on 22 August 2023).

- Schumacher, K.; Chenet, H.; Volz, U. Sustainable finance in Japan. J. Sustain. Financ. Investig. 2020, 10, 213–246. [Google Scholar] [CrossRef]

- Maltais, A.; Nykvist, B. Understanding the role of green bonds in advancing sustainability. J. Sustain. Financ. Investig. 2020, 1–20. [Google Scholar] [CrossRef]

- Maria, M.R.; Ballini, R.; Souza, R.F. Evolution of Green Finance: A Bibliometric Analysis through Complex Networks and Machine Learning. Sustainability 2023, 15, 967. [Google Scholar] [CrossRef]

- Mohanty, S.; Nanda, S.S.; Soubhari, T.; Biswal, S.; Patnaik, S. Emerging research trends in green finance: A bibliometric overview. J. Risk Financ. Manag. 2023, 16, 108. [Google Scholar] [CrossRef]

- Cortellini, G.; Panetta, I.C. Green bond: A systematic literature review for future research agendas. J. Risk Financ. Manag. 2021, 14, 589. [Google Scholar] [CrossRef]

- Liaw, K.T. Survey of green bond pricing and investment performance. J. Risk Financ. Manag. 2020, 13, 193. [Google Scholar] [CrossRef]

- MacAskill, S.; Roca, E.; Liu, B.; Stewart, R.A.; Sahin, O. Is there a green premium in the green bond market? Systematic literature review revealing premium determinants. J. Clean. Prod. 2021, 280, 124491. [Google Scholar] [CrossRef]

- Madaleno, M.; Dogan, E.; Taskin, D. A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 2022, 109, 105945. [Google Scholar] [CrossRef]

- Naz, F.; Oláh, J.; Vasile, D.; Magda, R. Green purchase behavior of university students in Hungary: An empirical study. Sustainability 2020, 12, 10077. [Google Scholar] [CrossRef]

- Hu, Y.; Tian, Y.; Zhang, L. Green Bond Pricing and Optimization Based on Carbon Emission Trading and Subsidies: From the Perspective of Externalities. Sustainability 2023, 15, 8422. [Google Scholar] [CrossRef]

- He, N.; Zeng, S.; Jin, G. Achieving synergy between carbon mitigation and pollution reduction: Does green finance matter? J. Environ. Manag. 2023, 342, 118356. [Google Scholar] [CrossRef]

- Zhang, M.; Liu, Y. Influence of digital finance and green technology innovation on China’s carbon emission efficiency: Empirical analysis based on spatial metrology. Sci. Total Environ. 2022, 838, 156463. [Google Scholar] [CrossRef]

- Yu, L.; Zhao, D.; Xue, Z.; Gao, Y. Research on the use of digital finance and the adoption of green control techniques by family farms in China. Technol. Soc. 2020, 62, 101323. [Google Scholar] [CrossRef]

- European Environment Agency. Economic Losses from Climate-Related Extremes in Europe. Available online: https://www.eea.europa.eu/ims/economic-losses-from-climate-related (accessed on 22 August 2023).

- Zhang, D.; Mohsin, M.; Rasheed, A.K.; Chang, Y.; Taghizadeh-Hesary, F. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 2021, 153, 112256. [Google Scholar] [CrossRef]

- Arefjevs, I.; Spilbergs, A.; Natrins, A.; Verdenhofs, A.; Mavlutova, I.; Volkova, T. Financial sector evolution and competencies development in the context of information and communication technologies. Res. Rural Dev. 2020, 35, 260–267. [Google Scholar] [CrossRef]

- Hou, H.; Wang, Y.; Zhang, M. Green finance drives renewable energy development: Empirical evidence from 53 countries worldwide. Environ. Sci. Pollut. Res. 2023, 30, 80573–80590. [Google Scholar] [CrossRef]

- Jin, C.; Lv, Z.; Li, Z.; Sun, K. Green finance, renewable energy and carbon neutrality in OECD countries. Renew. Energy 2023, 211, 279–284. [Google Scholar] [CrossRef]

- Anton, S.G.; Nucu, A.E.A. The effect of financial development on renewable energy consumption. A panel data approach. Renew. Energy 2020, 147, 330–338. [Google Scholar] [CrossRef]

- Mavlutova, I.; Volkova, T.; Natrins, A.; Spilbergs, A.; Arefjevs, I.; Miahkykh, I. Financial sector transformation in the era of digitalization. Stud. Appl. Econ. 2020, 38. [Google Scholar] [CrossRef]

- Huang, L.; Cao, Y.; Zhu, Y. Is there any recovery power for economic growth from green finance? Evidence from OECD member countries. Econ. Change Restruct. 2022, 63, 69. [Google Scholar] [CrossRef]

- Orzechowski, A.; Bombol, M. Energy Security, Sustainable Development and the Green Bond Market. Energies 2022, 15, 6218. [Google Scholar] [CrossRef]

- Sangiorgi, I.; Schopohl, L. Why do institutional investors buy green bonds: Evidence from a survey of European asset managers. Int. Rev. Financ. Anal. 2021, 75, 101738. [Google Scholar] [CrossRef]

- Mavlutova, I.; Fomins, A.; Spilbergs, A.; Atstaja, D.; Brizga, J. Opportunities to increase financial well-being by investing in environmental, social and governance with respect to improving financial literacy under COVID-19: The case of Latvia. Sustainability 2021, 14, 339. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Text mining and visualization using VOSviewer. arXiv 2011, arXiv:1109.2058. [Google Scholar]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital finance, green techno-logical innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- Feng, S.; Zhang, R.; Li, G. Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. Dyn. 2022, 61, 70–83. [Google Scholar] [CrossRef]

- Su, Y.; Li, Z.; Yang, C. Spatial interaction spillover effects between digital financial technology and urban ecological efficiency in China: An empirical study based on spatial simultaneous equations. Int. J. Environ. Res. Public Health 2021, 18, 8535. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N. The way to induce private participation in green finance and investment. Financ. Res. Lett. 2019, 31, 98–103. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environ-mental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Lee, C.C.; Lee, C.C.; Li, Y.Y. Oil price shocks, geopolitical risks, and green bond market dynamics. N. Am. J. Econ. Financ. 2021, 55, 101309. [Google Scholar] [CrossRef]

- Menke, R.; Abraham, E.; Parpas, P.; Stoianov, I. Demonstrating demand response from water distribution system through pump scheduling. Appl. Energy 2016, 170, 377–387. [Google Scholar] [CrossRef]

- Wang, L.; Wang, Y.; Sun, Y.; Han, K.; Chen, Y. Financial inclusion and green economic efficiency: Evidence from China. J. Environ. Plan. Manag. 2022, 65, 240–271. [Google Scholar] [CrossRef]

- Wang, Y.; Zhi, Q. The role of green finance in environmental protection: Two aspects of market mechanism and policies. Energy Procedia 2016, 104, 311–316. [Google Scholar] [CrossRef]

- Irfan, M.; Razzaq, A.; Sharif, A.; Yang, X. Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol. Forecast. Soc. Change 2022, 182, 121882. [Google Scholar] [CrossRef]

- He, L.; Liu, R.; Zhong, Z.; Wang, D.; Xia, Y. Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

- Zhou, X.; Tang, X.; Zhang, R. Impact of green finance on economic development and environmental quality: A study based on provincial panel data from China. Environ. Sci. Pollut. Res. 2020, 27, 19915–19932. [Google Scholar] [CrossRef]

- Cui, Y.; Geobey, S.; Weber, O.; Lin, H. The impact of green lending on credit risk in China. Sustainability 2018, 10, 2008. [Google Scholar] [CrossRef]

- Liu, J.; Jiang, Y.; Gan, S.; He, L.; Zhang, Q. Can digital finance promote corporate green innovation? Environ. Sci. Pollut. Res. 2022, 29, 35828–35840. [Google Scholar] [CrossRef]

- Chueca Vergara, C.; Ferruz Agudo, L. Fintech and sustainability: Do they affect each other? Sustainability 2021, 13, 7012. [Google Scholar] [CrossRef]

- Zhou, G.; Zhu, J.; Luo, S. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecol. Econ. 2022, 193, 107308. [Google Scholar] [CrossRef]

- Muganyi, T.; Yan, L.; Sun, H.P. Green finance, fintech and environmental protection: Evidence from China. Environ. Sci. Ecotechnol. 2021, 7, 100107. [Google Scholar] [CrossRef]

- Tang, D.; Chen, W.; Zhang, Q.; Zhang, J. Impact of Digital Finance on Green Technology Innovation: The Mediating Effect of Financial Constraints. Sustainability 2023, 15, 3393. [Google Scholar] [CrossRef]

- Zhang, D.; Zhang, Z.; Managi, S. A bibliometric analysis on green finance: Current status, development, and future directions. Financ. Res. Lett. 2019, 29, 425–430. [Google Scholar] [CrossRef]

- International Finance Corporation, World Bank Group. Green Finance: A Bot-Tom-Up Approach to Track Existing Flows. 2016. Available online: https://www.cbd.int/financial/gcf/ifc-greentracking.pdf (accessed on 15 August 2023).

- Bhatnagar, S.; Sharma, D. Evolution of green finance and its enablers: A bibliometric analysis. Renew. Sustain. Energy Rev. 2022, 162, 112405. [Google Scholar] [CrossRef]

- European Commission. European Green Bond Standard. 2023. Available online: https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/european-green-bond-standard_en (accessed on 18 August 2023).

- Doronzo, R.; Siracusa, V.; Antonelli, S. Green bonds: The sovereign issuers’ perspective. Bank Italy Mark. Infrastruct. Paym. Syst. Work. Pap. 2021. [Google Scholar] [CrossRef]

- Tsonkova, V.D. The Sovereign Green Bonds Market in the European Union: Analysis and Good Practices. Knowl.-Int. J. 2019, 30, 165–172. [Google Scholar] [CrossRef]

- Chesini, G. Sovereign Green Bonds in Europe: Are They Effective in Supporting the Green Transition? In New Challenges for the Banking Industry: Searching for Balance between Corporate Governance, Sustainability and Innovation; Springer Nature: Cham, Switzerland, 2023; pp. 185–212. [Google Scholar]

- Bužinskė, J.; Stankevičienė, J. Analysis of success factors, benefits, and challenges of issuing green bonds in Lithuania. Economies 2023, 11, 143. [Google Scholar] [CrossRef]

- Gianfrate, G.; Peri, M. The green advantage: Exploring the convenience of issuing green bonds. J. Clean. Prod. 2019, 219, 127–135. [Google Scholar] [CrossRef]

- Fatica, S.; Panzica, R. Green bonds as a tool against climate change? Bus. Strategy Environ. 2021, 30, 2688–2701. [Google Scholar] [CrossRef]

- Al Mamun, M.; Boubaker, S.; Nguyen, D.K. Green finance and decarbonization: Evidence from around the world. Financ. Res. Lett. 2022, 46, 102807. [Google Scholar] [CrossRef]

- Huang, H.; Zhang, J. Research on the environmental effect of green finance policy based on the analysis of pilot zones for green finance reform and innovations. Sustainability 2021, 13, 3754. [Google Scholar] [CrossRef]

- Chang, L.; Taghizadeh-Hesary, F.; Chen, H.; Mohsin, M. Do green bonds have environmental benefits? Energy Econ. 2022, 115, 106356. [Google Scholar] [CrossRef]

- Koval, V.; Laktionova, O.; Atstaja, D.; Grasis, J.; Lomachynska, I.; Shchur, R. Green Financial Instruments of Cleaner Production Technologies. Sustainability 2022, 14, 10536. [Google Scholar] [CrossRef]

- Koziol, C.; Proelss, J.; Roßmann, P.; Schweizer, D. The price of being green. Financ. Res. Lett. 2022, 50, 103285. [Google Scholar] [CrossRef]

- Umar, M.; Safi, A. Do green finance and innovation matter for environmental protection? A case of OECD economies. Energy Econ. 2023, 119, 106560. [Google Scholar] [CrossRef]

- Cheng, Z.; Kai, Z.; Zhu, S. Does green finance regulation improve renewable energy utilization? Evidence from energy consumption efficiency. Renew. Energy 2023, 208, 63–75. [Google Scholar] [CrossRef]

- Wang, Y.; Taghizadeh-Hesary, F. Green bonds markets and renewable energy development: Policy integration for achieving carbon neutrality. Energy Econ. 2023, 123, 106725. [Google Scholar] [CrossRef]

- Mejía-Escobar, J.C.; González-Ruiz, J.D.; Franco-Sepúlveda, G. Current state and development of green bonds market in the Latin America and the Caribbean. Sustainability 2021, 13, 10872. [Google Scholar] [CrossRef]

- Teti, E.; Baraglia, I.; Dallocchio, M.; Mariani, G. The green bonds: Empirical evidence and implications for sustainability. J. Clean. Prod. 2022, 366, 132784. [Google Scholar] [CrossRef]

- Du, M.; Zhang, R.; Chai, S.; Li, Q.; Sun, R.; Chu, W. Can green finance policies stimulate technological innovation and financial performance? Evidence from Chinese listed green enterprises. Sustainability 2022, 14, 9287. [Google Scholar] [CrossRef]

- Ferrer, R.; Shahzad, S.J.H.; Soriano, P. Are green bonds a different asset class? Evidence from time-frequency connectedness analysis. J. Clean. Prod. 2021, 292, 125988. [Google Scholar] [CrossRef]

- Hadaś-Dyduch, M.; Puszer, B.; Czech, M.; Cichy, J. Green Bonds as an Instrument for Financing Ecological Investments in the V4 Countries. Sustainability 2022, 14, 12188. [Google Scholar] [CrossRef]

- Chopra, M.; Mehta, C. Going green: Do green bonds act as a hedge and safe haven for stock sector risk? Financ. Res. Lett. 2023, 51, 103357. [Google Scholar] [CrossRef]

- The City UK. Green Finance: A Quantitative Assessment of Market Trends. 2022. Available online: https://www.thecityuk.com/media/l0lhnctn/green-finance-a-quantitative-assessment-of-market-trends-1.pdf (accessed on 10 August 2023).

- Climate Bond Initiative. Sustainable Debt Global State of the Market. 2022. Available online: https://www.climatebonds.net/files/reports/cbi_sotm_2022_03e.pdf (accessed on 10 August 2023).

- Association for Financial Markets in Europe. ESG Finance Report. 2022. Available online: https://www.afme.eu/portals/0/dispatchfeaturedimages/afme%20sustainable%20finance%20report%20-%20q1%202022.pdf (accessed on 10 August 2023).

- Alharbi, S.S.; Al Mamun, M.; Boubaker, S.; Rizvi, S.K.A. Green finance and renewable energy: A worldwide evidence. Energy Econ. 2023, 118, 106499. [Google Scholar] [CrossRef]

- Peng, W.; Lu, S.; Lu, W. Green financing for the establishment of renewable resources under carbon emission regulation. Renew. Energy 2022, 199, 1210–1225. [Google Scholar] [CrossRef]

- Zhang, Y.; Umair, M. Examining the interconnectedness of green finance: An analysis of dynamic spillover effects among green bonds, renewable energy, and carbon markets. Environ. Sci. Pollut. Res. 2023, 30, 77605–77621. [Google Scholar] [CrossRef]

- Li, Z.; Kuo, T.H.; Siao-Yun, W.; Vinh, L.T. Role of green finance, volatility and risk in promoting the investments in Renewable Energy Resources in the post-COVID-19. Resour. Policy 2022, 76, 102563. [Google Scholar] [CrossRef]

- Deschryver, P.; De Mariz, F. What future for the green bond market? How can policy-makers, companies, and investors unlock the potential of the green bond market? J. Risk Financ. Manag. 2020, 13, 61. [Google Scholar] [CrossRef]

- Elsayed, A.H.; Naifar, N.; Nasreen, S.; Tiwari, A.K. Dependence structure and dynamic connectedness between green bonds and financial markets: Fresh insights from time-frequency analysis before and during COVID-19 pandemic. Energy Econ. 2022, 107, 105842. [Google Scholar] [CrossRef]

- International Capital Market Association. Green Bond Principles. 2021. Available online: https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/green-bond-principles-gbp/ (accessed on 19 August 2023).

- Climate Bonds Initiative. Climate Bond Standards. 2023. Available online: https://www.climatebonds.net/climate-bonds-standard-v4 (accessed on 19 August 2023).

- Anh Tu, C.; Sarker, T.; Rasoulinezhad, E. Factors influencing the green bond market expansion: Evidence from a multi-dimensional analysis. J. Risk Financ. Manag. 2020, 13, 126. [Google Scholar] [CrossRef]

- Torvanger, A.; Maltais, A.; Marginean, I. Green bonds in Sweden and Norway: What are the success factors? J. Clean. Prod. 2021, 324, 129177. [Google Scholar] [CrossRef]

- Ejaz, R.; Ashraf, S.; Hassan, A.; Gupta, A. An empirical investigation of market risk, dependence structure, and portfolio management between green bonds and international financial markets. J. Clean. Prod. 2022, 365, 132666. [Google Scholar] [CrossRef]

- Doğan, B.; Trabelsi, N.; Tiwari, A.K.; Ghosh, S. Dynamic dependence and causality between crude oil, green bonds, commodities, geopolitical risks, and policy uncertainty. Q. Rev. Econ. Financ. 2023, 89, 36–62. [Google Scholar] [CrossRef]

- Ge, P.; Liu, T.; Huang, X. The effects and drivers of green financial reform in promoting environmentally-biased technological progress. J. Environ. Manag. 2023, 339, 117915. [Google Scholar] [CrossRef]

- Alsmadi, A.A.; Al-Okaily, M.; Alrawashdeh, N.; Al-Gasaymeh, A.; Moh’d Al-hazimeh, A.; Zakari, A. A bibliometric analysis of green bonds and sustainable green energy: Evidence from the last fifteen years (2007–2022). Sustainability 2023, 15, 5778. [Google Scholar] [CrossRef]

- Pyka, M. The EU Green Bond Standard: A Plausible Response to the Deficiencies of the EU Green Bond Market? Eur. Bus. Organ. Law Rev. 2023, 24, 623–643. [Google Scholar] [CrossRef]

- Wu, Y. Are green bonds priced lower than their conventional peers? Emerg. Mark. Rev. 2022, 52, 100909. [Google Scholar] [CrossRef]

- Jankovic, I.; Vasic, V.; Kovacevic, V. Does transparency matter? Evidence from panel analysis of the EU government green bonds. Energy Econ. 2022, 114, 106325. [Google Scholar] [CrossRef]

- Mohsin, M.; Taghizadeh-Hesary, F.; Panthamit, N.; Anwar, S.; Abbas, Q.; Vo, X.V. Developing low carbon finance index: Evidence from developed and developing economies. Financ. Res. Lett. 2021, 43, 101520. [Google Scholar] [CrossRef]

- Yang, C.; Masron, T.A. Impact of digital finance on energy efficiency in the context of green sustainable development. Sustainability 2022, 14, 11250. [Google Scholar] [CrossRef]

- Puschmann, T.; Hoffmann, C.H.; Khmarskyi, V. How green FinTech can alleviate the impact of climate change—The case of Switzerland. Sustainability 2020, 12, 10691. [Google Scholar] [CrossRef]

- Mavlutova, I.; Spilbergs, A.; Verdenhofs, A.; Natrins, A.; Arefjevs, I.; Volkova, T. Digital transformation as a driver of the financial sector sustainable development: An impact on financial inclusion and operational efficiency. Sustainability 2022, 15, 207. [Google Scholar] [CrossRef]

- Zeng, S.; Tanveer, A.; Fu, X.; Gu, Y.; Irfan, M. Modeling the influence of critical factors on the adoption of green energy technologies. Renew. Sustain. Energy Rev. 2022, 168, 112817. [Google Scholar] [CrossRef]

- Shehzad, A.; Qureshi, S.F.; Saeed, M.Z.; Ali, S. The impact of financial risk attitude on objective-oriented investment behavior. Int. J. Financ. Eng. 2023, 10, 2250022. [Google Scholar] [CrossRef]

- Gilchrist, D.; Yu, J.; Zhong, R. The limits of green finance: A survey of literature in the context of green bonds and green loans. Sustainability 2021, 13, 478. [Google Scholar] [CrossRef]

- Gui, R.; Meierer, M.; Schilter, P.; Algesheimer, R. REndo: Internal Instrumental Variables to Address Endogeneity. J. Stat. Softw. 2023, 107, 1–43. [Google Scholar] [CrossRef]

- Sustainalytics. Country Risk Rating. 2023. Available online: https://globalaccess.sustainalytics.com/#/ga/research/countryriskratings (accessed on 18 August 2023).

- Eurostat. Statistics Database. 2023. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=GDP_per_capita,_consumption_per_capita_and_price_level_indices (accessed on 18 August 2023).

- Climate Bond Initiative. Total Green Bond Amount Issued. 2023. Available online: https://www.climatebonds.net/market/data/ (accessed on 18 August 2023).

- Chan, Y.; Hogan, K.; Schwaiger, K.; Ang, A. ESG in Factors. J. Impact ESG Investig. 2020, 1, 26–45. [Google Scholar] [CrossRef]

- Strine, L.E., Jr.; Brooke, J.L.; Diamond, K.M.; Parker, D.L., Jr. It’s Time to Focus on the “G” in ESG. Harvard Business Review. 2022. Available online: https://hbr.org/2022/11/its-time-to-focus-on-the-g-in-esg (accessed on 18 August 2023).

- Yu, X.; Mao, Y.; Huang, D.; Sun, Z.; Li, T. Mapping global research on green finance from 1989 to 2020: A bibliometric study. Adv. Civ. Eng. 2021, 2021, 9934004. [Google Scholar] [CrossRef]

- Rasoulinezhad, E.; Taghizadeh-Hesary, F. Role of green finance in improving energy efficiency and renewable energy development. Energy Effic. 2022, 15, 14. [Google Scholar] [CrossRef]

- Naqvi, B.; Mirza, N.; Rizvi, S.K.A.; Porada-Rochoń, M.; Itani, R. Is there a green fund premium? Evidence from twenty-seven emerging markets. Glob. Financ. J. 2021, 50, 100656. [Google Scholar] [CrossRef]

- Diaye, M.A.; Ho, S.H.; Oueghlissi, R. ESG performance and economic growth: A panel co-integration analysis. Empirica 2022, 49, 99–122. [Google Scholar] [CrossRef]

- Tanjung, M. Can we expect contribution from environmental, social, governance performance to sustainable development? Bus. Strategy Dev. 2021, 4, 386–398. [Google Scholar] [CrossRef]

| Area of Research | Research Title; Reference |

|---|---|

| Investments and green finance | |

| Environmental impact of green finance |

|

| Policies and research on green finance |

|

| Issue | Benefit | Reference |

|---|---|---|

| Society (solve issues related to the environment) | Lower carbon emissions | Sangiorgi and Schopohl [24], Gianfrate and Peri [53], Fatica et al. [54], Al Mamun et al. [55], Huang and Zhang [56], Chang et al. [57], Koval et al. [58], Koziol at al. [59], Umar and Safi [60] |

| Fosters renewable energy production, utilization | Anton and Nucu [20], Huang et al. [22], Cheng et al. [61], Wang and Taghizadeh-Hersay [62] | |

| Regional development | Hou et al. [18], Huang and Zhang [56], Mejia-Escobar et al. [63] | |

| Issuers | Access to capital at lower costs | Teti et al. [64] |

| Stimulate technological innovations | Madaleno et al. [9] | |

| Stimulate financial performance | Du et al. [65] | |

| Investors | Diversification of investments | Liaw [7], Orzechowski and Bombol [23], Sangiorgi and Schopohl [24], Bužinskė and Stankevičienė [52], Gianfrate and Peri [53], Ferrer et al. [66], Hadaś-Dyduch et al. [67], Chopra and Mehta [68] |

| Issue | Challenges | Reference |

|---|---|---|

| Market | Macroeconomic environment | Anh Tu et al. [80], Torvanger et al. [81], Ejaz et al. [82], Doğan et al. [83] |

| General bond market development | Du et al. [65], Deschryver and De Mariz [76], Elsayed et al. [77], Torvanger et al. [81], Ge et al. [84] | |

| Greenwashing | Bužinskė and Stankevičienė [52], Deschryver and De Mariz [76] | |

| Issuers | Costs of meeting requirements | Deschryver and De Mariz [76], Alsmadi et al. [85] |

| Investors | Insufficient financial and economic benefits | Maltais and Nykvist [3], Bužinskė and Stankevičienė [52], Wu (2022) [87] |

| Lack of labelled green bond | Li et al. [75], Deschryver and De Mariz [76] | |

| Lack of green bond project impact information | Deschryver and De Mariz [76], Jankovic et al. [88] | |

| Law | Lack of regulation | Peng et al. [73], Pyka (2023) [86] |

| Variable | Mean | Median | Std. Dev | Min | Max |

|---|---|---|---|---|---|

| CBG | 3.8084 | 3.2198 | 3.4510 | 0.1170 | 11.8862 |

| CEI | 0.2111 | 0.1722 | 0.1167 | 0.0653 | 0.5036 |

| RES | 23.6419 | 17.5100 | 13.3158 | 8.8600 | 50.9400 |

| Variable—Parameter | Model—CEI | Model—RES | ||

|---|---|---|---|---|

| Estimate | Sig | Estimate | Sig | |

| CBG | −0.0589 | 0.0006 | 2.0363 | 0.0338 |

| CBG2 | 0.0033 | 0.0170 | - | - |

| Intercept | 0.3507 | 0.0000 | 16.2974 | 0.0009 |

| Multiple R | 0.7767 | 0.4647 | ||

| R2 | 0.6033 | 0.2160 | ||

| Adjusted R2 | 0.5637 | 0.1747 | ||

| Standard Error | 0.0771 | 12.0967 | ||

| F | 15.2092 | 0.0001 | 5.2342 | 0.0338 |

| Test Type | Model—CEI | Model—RES | ||

|---|---|---|---|---|

| Estimate | Sig | Estimate | Sig | |

| Shapiro–Wilk normality test | 0.9095 | 0.0398 | 0.9737 | 0.8117 |

| Breusch–Pagan Test for Homoscedasticity | 2.6657 | 0.2637 | 0.0365 | 0.8485 |

| Durbin Watson Test for Autocorrelation | 2.1586 | 0.7460 | 1.9462 | 0.8960 |

| Link function | 0.1104 | 0.7396 | 1.2772 | 0.2584 |

| Model | Variable | Orig. Estim | GC Estim | bootSE | CI 2.5% | CI 97.5% |

|---|---|---|---|---|---|---|

| CEI | CBG | −0.0589 | −0.0539 | 0.0201 | −0.1098 | −0.0322 |

| CBG2 | 0.0033 | 0.0034 | 0.0016 | 0.0001 | 0.0067 | |

| Intercept | 0.3507 | 0.3322 | 0.0723 | 0.2569 | 0.5230 | |

| RES | CBG | 2.0363 | 2.1910 | 1.0438 | 0.0063 | 4.3757 |

| Intercept | 16.2974 | 15.793 | 9.312 | 2.332 | 38.054 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mavlutova, I.; Spilbergs, A.; Verdenhofs, A.; Kuzmina, J.; Arefjevs, I.; Natrins, A. The Role of Green Finance in Fostering the Sustainability of the Economy and Renewable Energy Supply: Recent Issues and Challenges. Energies 2023, 16, 7712. https://doi.org/10.3390/en16237712

Mavlutova I, Spilbergs A, Verdenhofs A, Kuzmina J, Arefjevs I, Natrins A. The Role of Green Finance in Fostering the Sustainability of the Economy and Renewable Energy Supply: Recent Issues and Challenges. Energies. 2023; 16(23):7712. https://doi.org/10.3390/en16237712

Chicago/Turabian StyleMavlutova, Inese, Aivars Spilbergs, Atis Verdenhofs, Jekaterina Kuzmina, Ilja Arefjevs, and Andris Natrins. 2023. "The Role of Green Finance in Fostering the Sustainability of the Economy and Renewable Energy Supply: Recent Issues and Challenges" Energies 16, no. 23: 7712. https://doi.org/10.3390/en16237712

APA StyleMavlutova, I., Spilbergs, A., Verdenhofs, A., Kuzmina, J., Arefjevs, I., & Natrins, A. (2023). The Role of Green Finance in Fostering the Sustainability of the Economy and Renewable Energy Supply: Recent Issues and Challenges. Energies, 16(23), 7712. https://doi.org/10.3390/en16237712