Environmental-Economic Analysis for Decarbonising Ferries Fleets

Abstract

:1. Introduction

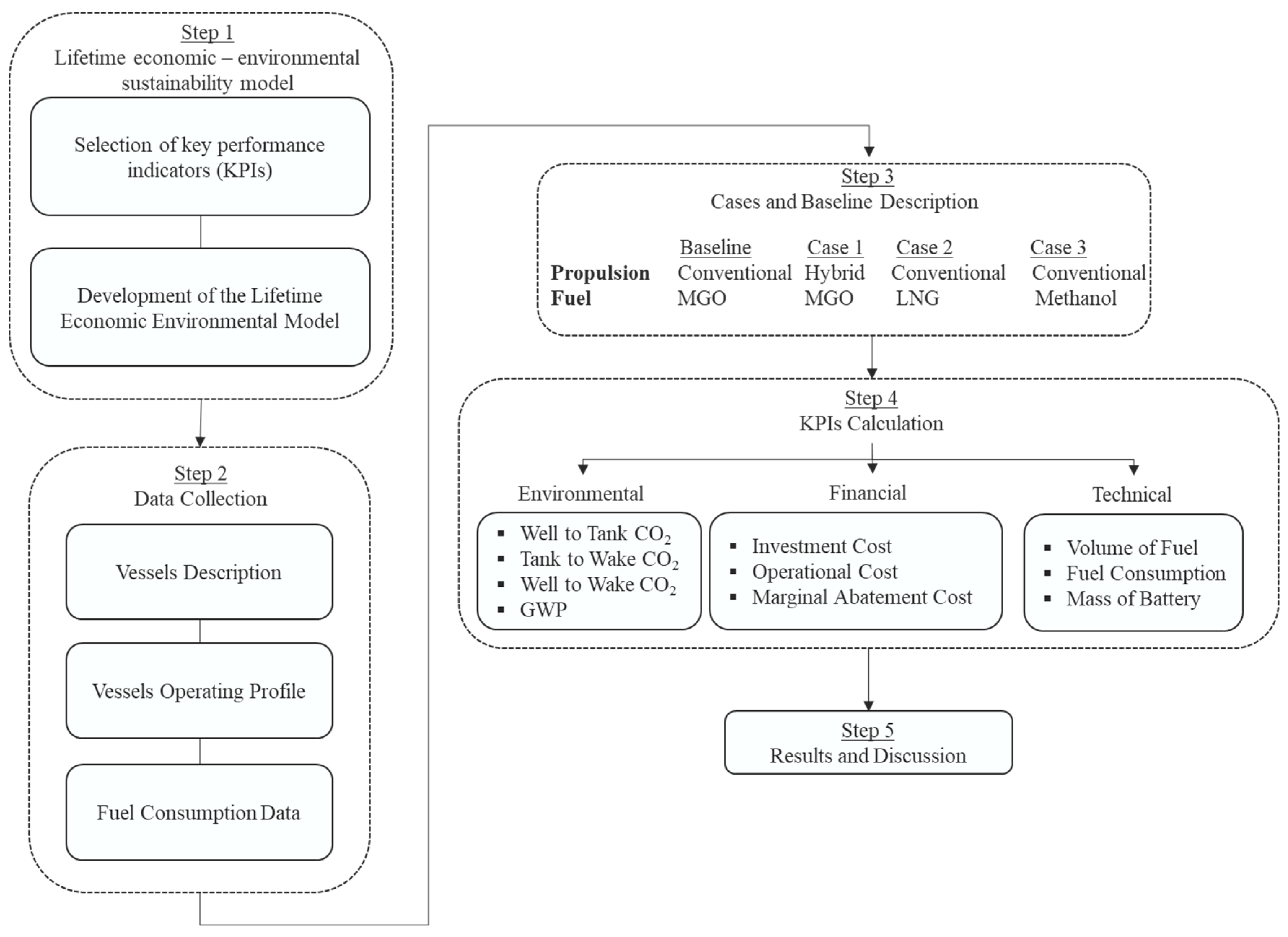

2. Materials and Methods

2.1. Key Performance Indicators

2.2. Lifetime Economic-Environmental Model

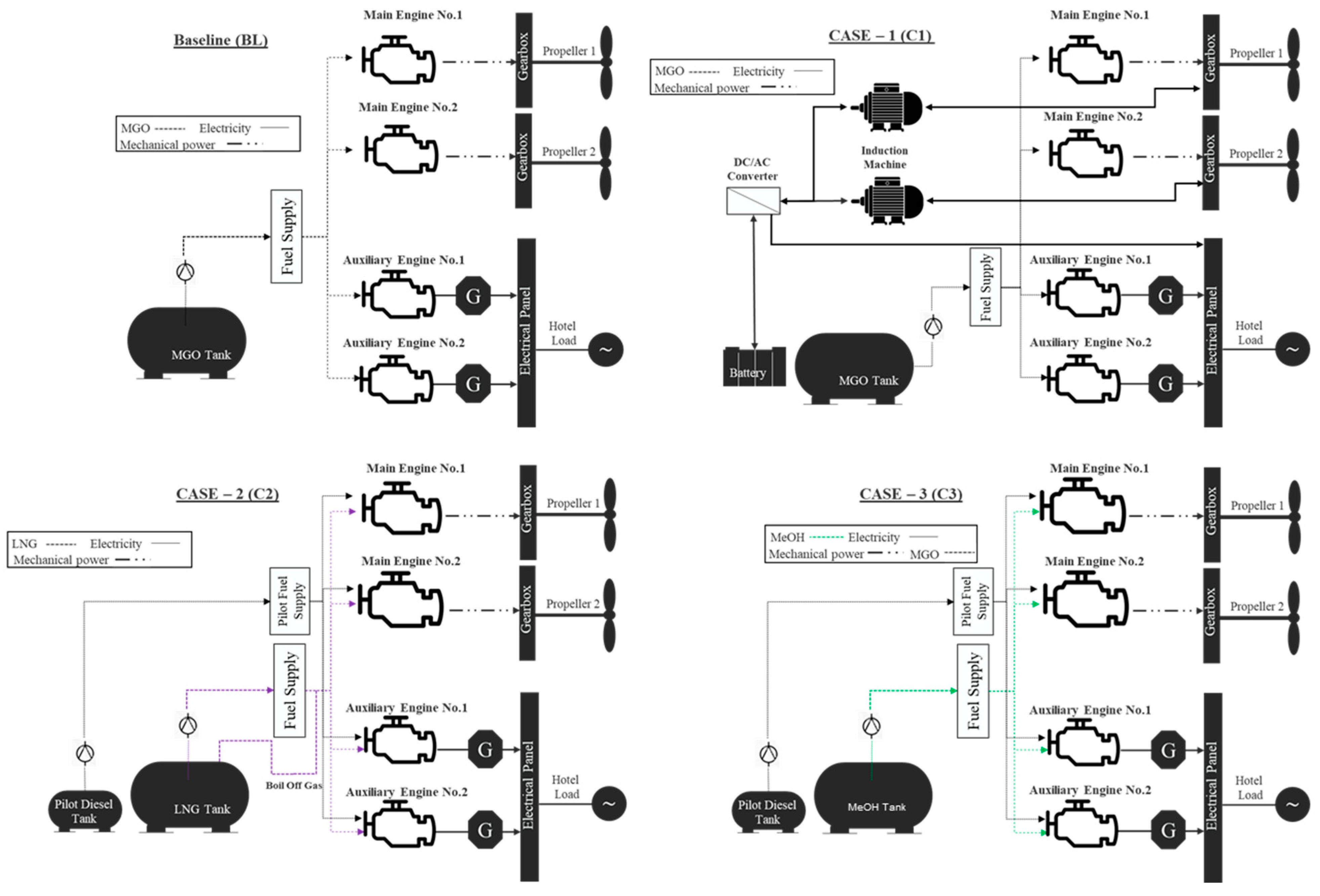

3. Case Studies Description

3.1. Input Parameters

3.2. Emissions Taxation

4. Results

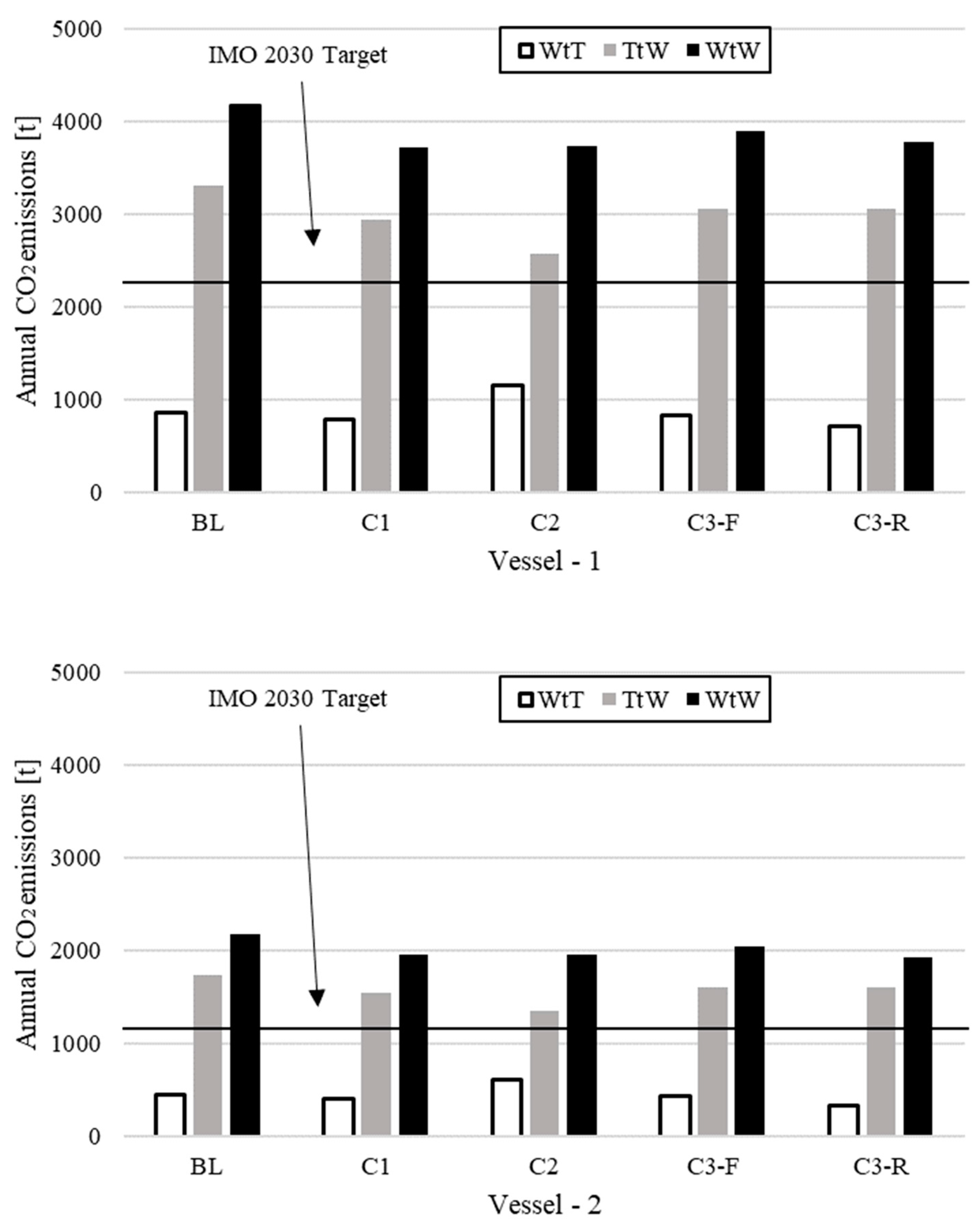

4.1. Environmental KPIs

4.2. Financial KPIs

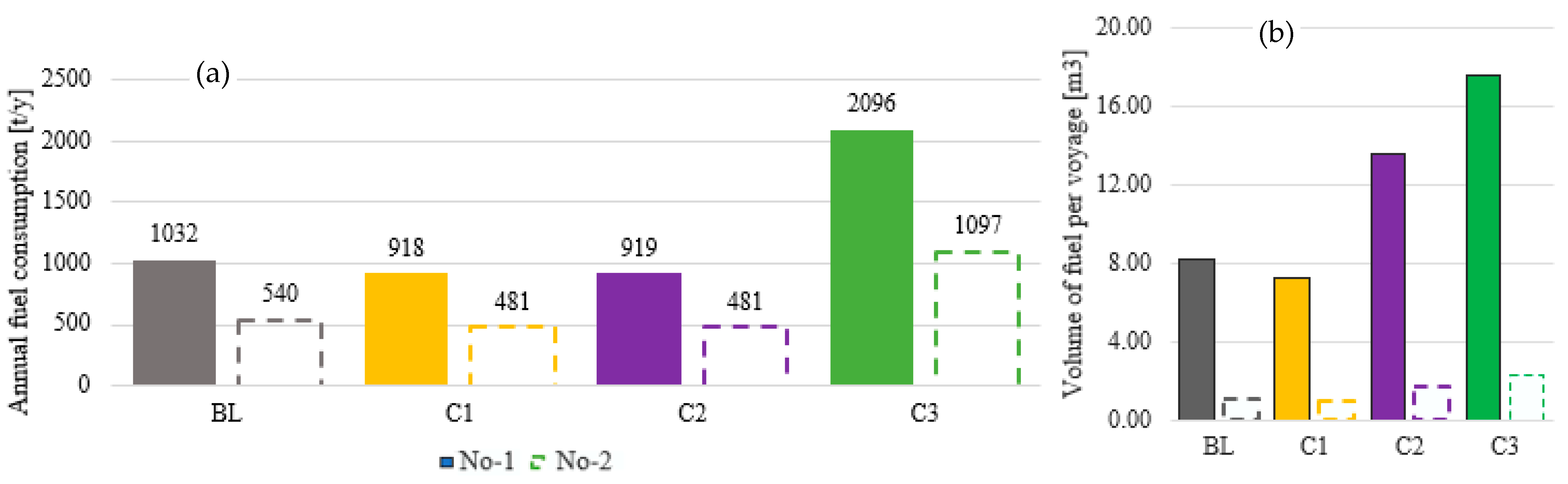

4.3. Technical KPIs

4.4. Fleet Decarbonisation

5. Discussion

6. Conclusions

- Hybridised power plants align with a short- to medium-term cost-effective strategy for reducing emissions in ferry operations, as they can yield approximately 11% fuel consumption reduction, leading to proportional emissions reductions.

- The required storage volume for LNG and methanol is expected to increase by 74% and 113% respectively compared to the baseline diesel fuel.

- The hybrid power system is the most cost-effective way to curtail CO2 emissions, however achieved decarbonisation does not meet the 2030 targets.

- LNG power plants can achieve a 22% reduction in CO2 emissions, although their GWP increases by 8%. Combining LNG use and hybrid power plants can meet the 2030 emission targets.

- The required investments for decarbonising, using LNG, larger and smaller vessels amount to approximately M EUR 0.78 and M EUR 0.25, respectively.

- The use of methanol results in reductions in both CO2 emissions and GWP, but requires substantial investments due to the considerably higher cost of methanol-fuelled marine engines, amounting to M EUR 1.1 and M EUR 0.42 for large and small vessels, respectively.

- From a well to wake perspective the cases C1 and C2 exhibit 11% and 10% lower CO2 emissions respectively pertinent to BL, whereas C3 exhibits reduction of 7% for fossil-based and 9% for biomass-based production that the BL.

- Considering the RoPax ferries fleet, the total investments required for hybrid propulsion and LNG fuel amount to M EUR 28 and M EUR 58, respectively.

- The introduction of a carbon tax in the range of 50–100 EUR/t CO2 could be explored as a policy measure to incentivise decarbonisation in this sector. However, financial support for implementing such investments is required to prevent additional costs for end-users.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| AC | Annual Cost (EUR) |

| CAPEX | Capital Expenditure (EUR) |

| Ci | Cost factor (EUR /kW) |

| DWT | Dead Weight Tonnage (mt) |

| FC | Fuel Consumption (t) |

| GT | Gross Tonnage (−) |

| GWP | Global Warming Potential (t CO2-eq) |

| MAC | Marginal Abatement Cost (EUR/t CO2) |

| OPEX | Operational Expenditure (EUR) |

| P | Engine Power Output (kW) |

| Vf | Volume of Fuel (t) |

| Abbreviation | |

| AT | After Treatment |

| GHG | Greenhouse Gas |

| IMO | International Maritime Organisation |

| KPI | Key Performance Indicator |

| LNG | Liquified Natural Gas |

| LTEEM | Lifetime Economic Environmental Model |

| MGO | Marine Gas Oil |

Appendix A

| Fuel | Well—to—Tank Emissions Factors | Shipboard Storage Conditions | Cost Factor (EUR/MJ) | Technical Maturity | |||

|---|---|---|---|---|---|---|---|

| CO2 (g/MJ) | N2O (g/MJ) | CO2.eq (g/MJ) | NOx (g/MJ) | ||||

| Brown NH3 | 64.8 | 4.5 × 10−4 | 64.9 | 4.4 × 10−2 | T: 240–290 K P: 8–10 bar State: liquid | 1.8 × 10−2 | Low |

| Green NH3 | 18.5 | 4.5 × 10−4 | 18.6 | 4.4 × 10−2 | 2.7 × 10−2 | Low | |

| Brown H2 (liquid) | 77.9 | 2.5 × 10−4–2.5 × 10−3 | 77.9–78.4 | 3.4 × 10−2 | T: 20 K P: 12.7 bar State: Cryogenic liquid | 1.7 × 10−2 | Low |

| Green H2 (liquid) | 7.9 | 4.1 × 10−4 | 7.98 | 3 × 10−2 | 4.3 × 10−2 | Low | |

| CH3OH—NG based | 20 | 2.9 × 10−4 | 20 | 4.6 × 10−2 | T: 293 K P: 1 bar State: liquid | 2 × 10−2 | Medium |

| CH3OH—biomass based | 17 | 2.2 × 10−4 | 17 | 5.6 × 10−2 | 0.8 × 10−2 | Medium | |

| LNG—Fossil based | 26 | 1.6 × 10−4 | 26 | 6 × 10−2 | T: 134 K P: up to 7 bar State: Cryogenic liquid | 2.9 × 10−2 | High |

| MGO | 19.6 | 5.4 × 10−4 | 19.7 | 23 × 10−2 | T: 293 K P: 1 bar State: liquid | 1.9 × 10−2 | High |

| Fuel | Cost Factor | Transportation Method |

|---|---|---|

| Methanol | 1.8 EUR /MWh | Ship |

| 0.16 EUR/t-mile 1 | Truck | |

| 0.071 EUR/t-mile 1 | Rail | |

| LNG | 0.74–1.29 EUR/GJ | Ship |

References

- Fulton, L.; Mejia, A.; Arioli, M.; Dematera, K.; Lah, O. Climate change mitigation pathways for Southeast Asia: CO2 emissions reduction policies for the energy and transport sectors. Sustainability 2017, 9, 1160. [Google Scholar] [CrossRef]

- International Maritime Organization. IMO GHG Strategy 2023. 2023. Available online: https://www.imo.org/en/OurWork/Environment/Pages/2023-IMO-Strategy-on-Reduction-of-GHG-Emissions-from-Ships.aspx (accessed on 25 August 2023).

- Liaquat, A.M.; Kalam, M.A.; Masjuki, H.H.; Jayed, M.H. Potential emissions reduction in road transport sector using biofuel in developing countries. Atmos. Environ. 2010, 44, 3869–3877. [Google Scholar] [CrossRef]

- Romano, A.; Yang, Z. Decarbonisation of shipping: A state of the art survey for 2000–2020. Ocean Coast. Manag. 2021, 214, 105936. [Google Scholar] [CrossRef]

- Xia, Q.; Chen, F. Shipping Economics Development: A Review from the Perspective of the Shipping Industry Chain for the Past Four Decades. J. Shanghai Jiaotong Univ. (Sci.) 2022, 27, 424–436. [Google Scholar] [CrossRef]

- Balcombe, P.; Brierley, J.; Lewis, C.; Skatvedt, L.; Speirs, J.; Hawkes, A.; Staffell, I. How to decarbonise international shipping: Options for fuels, technologies and policies. Energy Convers. Manag. 2019, 182, 72–88. [Google Scholar] [CrossRef]

- Hansson, J.; Brynolf, S.; Fridell, E.; Lehtveer, M. The Potential Role of Ammonia as Marine Fuel—Based on Energy Systems Modeling and Multi-Criteria Decision Analysis. Sustainability 2020, 12, 3265. [Google Scholar] [CrossRef]

- Maersk Mc-Kinnley Moller Center M. Managing Emissions from Ammonia-Fueled Vessels. 2023. Available online: https://cms.zerocarbonshipping.com/media/uploads/documents/Ammonia-emissions-reduction-position-paper_v4.pdf (accessed on 25 August 2023).

- Horvath, S.; Fasihi, M.; Breyer, C. Techno-economic analysis of a decarbonized shipping sector: Technology suggestions for a fleet in 2030 and 2040. Energy Convers. Manag. 2018, 164, 230–241. [Google Scholar] [CrossRef]

- Trivyza, N.L.; Rentizelas, A.; Theotokatos, G. Impact of carbon pricing on the cruise ship energy systems optimal configuration. Energy 2019, 175, 952–966. [Google Scholar] [CrossRef]

- Svanberg, M.; Ellis, J.; Lundgren, J.; Landälv, I. Renewable methanol as a fuel for the shipping industry. Renew. Sustain. Energy Rev. 2018, 94, 1217–1228. [Google Scholar] [CrossRef]

- Korberg, A.D.; Brynolf, S.; Grahn, M.; Skov, I.R. Techno-economic assessment of advanced fuels and propulsion systems in future fossil-free ships. Renew. Sustain. Energy Rev. 2021, 142, 110861. [Google Scholar] [CrossRef]

- Karvounis, P.; Tsoumpris, C.; Boulougouris, E.; Theotokatos, G. Recent advances in sustainable and safe marine engine operation with alternative fuels. Front. Mech. Eng. 2022, 8, 994942. [Google Scholar] [CrossRef]

- Armijo, J.; Philibert, C. Flexible production of green hydrogen and ammonia from variable solar and wind energy: Case study of Chile and Argentina. Int. J. Hydrogen Energy 2020, 45, 1541–1558. [Google Scholar] [CrossRef]

- Sun, S.; Jiang, Q.; Zhao, D.; Cao, T.; Sha, H.; Zhang, C.; Song, H.; Da, Z. Ammonia as hydrogen carrier: Advances in ammonia decomposition catalysts for promising hydrogen production. Renew. Sustain. Energy Rev. 2022, 169, 112918. [Google Scholar] [CrossRef]

- IEA. Production of Bio-Methanol Technology Brief, s.l. IEA-ETSAP and IRENA Technology Brief. 2013. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2013/IRENA-ETSAP-Tech-Brief-I08-Production_of_Bio-methanol.pdf?rev=5ea20e7c84c4472f8eeed8111ff8daf9 (accessed on 12 August 2023).

- Alamia, A.; Magnusson, I.; Johnsson, F.; Thunman, H. Well-to-wheel analysis of bio-methane via gasification, in heavy duty engines within the transport sector of the European Union. Appl. Energy 2016, 170, 445–454. [Google Scholar] [CrossRef]

- McKinlay, J.; Turnock, C.; Hudson, D. Route to zero emission shipping: Hydrogen, ammonia or methanol? Int. J. Hydrogen Energy 2021, 46, 28282–28297. [Google Scholar] [CrossRef]

- Nguyen, H.P.; Hoang, A.T.; Nizetic, S.; Nguyen, X.P.; Le, A.T.; Luong, C.N.; Chu, V.D.; Pham, V.V. The electric propulsion system as a green solution for management strategy of CO2 emission in ocean shipping: A comprehensive review. Int. Trans. Electr. Energy Syst. 2021, 31, e12580. [Google Scholar] [CrossRef]

- Yuan, L.C.W.; Tjahjowidodo, T.; Lee, G.S.G.; Chan, R.; Adnanes, A.K. Equivalent Consumption Minimization Strategy for hybrid all-electric tugboats to optimize fuel savings. Proc. Am. Control Conf. 2016, 2016, 6803–6808. [Google Scholar] [CrossRef]

- Xie, P.; Tan, S.; Guerrero, J.M.; Vasquez, J.C. MPC-informed ECMS based real-time power management strategy for hybrid electric ship. Energy Rep. 2021, 7, 126–133. [Google Scholar] [CrossRef]

- Law, L.C.; Foscoli, B.; Mastorakos, E.; Evans, S. A comparison of alternative fuels for shipping in terms of lifecycle energy and cost. Energies 2021, 14, 8502. [Google Scholar] [CrossRef]

- Perčić, M.; Vladimir, N.; Koričan, M. Electrification of inland waterway ships considering power system lifetime emissions and costs. Energies 2021, 14, 7046. [Google Scholar] [CrossRef]

- Jang, H.; Jeong, B.; Zhou, P.; Ha, S.; Park, C.; Nam, D.; Rashedi, A. Parametric trend life cycle assessment for hydrogen fuel cell towards cleaner shipping. J. Clean. Prod. 2022, 372, 133777. [Google Scholar] [CrossRef]

- Kistner, L.; Schubert, F.L.; Minke, C.; Bensmann, A.; Hanke-Rauschenbach, R. Techno-economic and environmental comparison of internal combustion engines and solid oxide fuel cells for ship applications. J. Power Sources 2021, 508, 230328. [Google Scholar] [CrossRef]

- Karvounis, P.; Dantas, J.L.; Tsoumpris, C.; Theotokatos, G. Ship Power Plant Decarbonisation Using Hybrid Systems and Ammonia Fuel—A Techno-Economic—Environmental Analysis. J. Mar. Sci. Eng. 2022, 10, 1675. [Google Scholar] [CrossRef]

- Dai, L.; Jing, D.; Hu, H.; Wang, Z. An environmental and techno-economic analysis of transporting LNG via Arctic route. Transp. Res. Part A Policy Pract. 2021, 146, 56–71. [Google Scholar] [CrossRef]

- Schorn, F.; Breuer, J.L.; Samsun, R.C.; Schnorbus, T.; Heuser, B.; Peters, R.; Stolten, D. Methanol as a renewable energy carrier: An assessment of production and transportation costs for selected global locations. Adv. Appl. Energy 2021, 3, 100050. [Google Scholar] [CrossRef]

- Balcombe, P.; Heggo, D.A.; Harrison, M. Total methane and CO2 emissions from liquefied natural gas carrier ships: The first primary measurements. Environ. Sci. Technol. 2022, 56, 9632–9640. [Google Scholar] [CrossRef] [PubMed]

- Rochussen, J.; Jaeger, N.S.; Penner, H.; Khan, A.; Kirchen, P. Development and Demonstration of Strategies for GHG and Methane Slip Reduction from Dual-Fuel Natural Gas Coastal Vessels. Fuel 2023, 349, 128433. [Google Scholar] [CrossRef]

- Gore, K.; Rigot-Müller, P.; Coughlan, J. Cost assessment of alternative fuels for maritime transportation in Ireland. Transp. Res. Part D Transp. Environ. 2022, 110, 103416. [Google Scholar] [CrossRef]

- Livanos, M.; Geertsma, R.D.; Boonen, E.J.; Visser, K.; Negenborn, R.R. Ship energy management for hybrid propulsion and power supply with shore charging. Control Eng. Pract. 2017, 76, 133–154. [Google Scholar] [CrossRef]

- Livanos, G.A.; Theotokatos, G.; Pagonis, D.N. Techno-economic investigation of alternative propulsion plants for Ferries and RoRo ships. Energy Convers. Manag. 2014, 79, 640–651. [Google Scholar] [CrossRef]

- Tsoumpris, C.; Theotokatos, G. Performance and reliability monitoring of ship hybrid power plants. J. ETA Marit. Sci. 2022, 10, 29–38. [Google Scholar] [CrossRef]

- Ushakov, S.; Stenersen, D.; Einang, P.M. Methane slip from gas fuelled ships: A comprehensive summary based on measurement data. J. Mar. Sci. Technol. 2019, 24, 1308–1325. [Google Scholar] [CrossRef]

- Gerritse, E.; Harmsen, J. Green Maritime Methanol. 2023 (Report). Available online: https://publications.tno.nl/publication/34640817/zpBGh5/gerritse-2023-green.pdf (accessed on 15 September 2023).

- Available online: https://www.bunkerindex.com/ (accessed on 1 August 2023).

- Verhelst, S.; Turner, J.W.; Sileghem, L.; Vancoillie, J. Methanol as a fuel for internal combustion engines. Prog. Energy Combust. Sci. 2019, 70, 43–88. [Google Scholar] [CrossRef]

- Radonja, R.; Bebić, D.; Glujić, D. Methanol and ethanol as alternative fuels for shipping. Promet-Traffic Transp. 2019, 31, 321–327. [Google Scholar] [CrossRef]

- Mrzljak, V.; Poljak, I.; Medica-Viola, V. Dual fuel consumption and efficiency of marine steam generators for the propulsion of LNG carrier. Appl. Therm. Eng. 2017, 119, 331–346. [Google Scholar] [CrossRef]

- Grant, J. Wärtsilä—Update on Future Fuels Developments and W32M Methanol System. In Proceedings of the IMarEST, Glasgow, Scotland, 7 March 2023. [Google Scholar]

- IEA. World Energy Outlook 2022; IEA: Paris, France, 2022; Available online: https://www.iea.org/reports/world-energy-outlook-2022 (accessed on 25 August 2023).

- IEA. Comparative Life-Cycle Greenhouse Gas Emissions of a Mid-Size BEV and ICE Vehicle; IEA: Paris, France, 2021; Available online: https://www.iea.org/data-and-statistics/charts/comparative-life-cycle-greenhouse-gas-emissions-of-a-mid-size-bev-and-ice-vehicle (accessed on 25 June 2023).

- Zarrinkolah, M.T.; Hosseini, V. Methane slip reduction of conventional dual-fuel natural gas diesel engine using direct fuel injection management and alternative combustion modes. Fuel 2023, 331, 125775. [Google Scholar] [CrossRef]

- May, I.; Cairns, A.; Zhao, H.; Pedrozo, V.; Wong, H.C.; Whelan, S.; Bennicke, P. Reduction of Methane Slip Using Premixed Micro Pilot Combustion in a Heavy-Duty Natural Gas-Diesel Engine (No. 2015-01-1798); SAE Technical Paper; SAE: Warrendale, PA, USA, 2015. [Google Scholar]

- Schinas, O.; Butler, M. Feasibility and commercial considerations of LNG-fueled ships. Ocean Eng. 2016, 122, 84–96. [Google Scholar] [CrossRef]

- Kalikatzarakis, M.; Theotokatos, G.; Coraddu, A.; Sayan, P.; Wong, S.Y. Model based analysis of the boil-off gas management and control for LNG fuelled vessels. Energy 2022, 251, 123872. [Google Scholar] [CrossRef]

- Ammar, N.R. An environmental and economic analysis of methanol fuel for a cellular container ship. Transp. Res. Part D Transp. Environ. 2019, 69, 66–76. [Google Scholar] [CrossRef]

- de Fournas, N.; Wei, M. Techno-economic assessment of renewable methanol from biomass gasification and PEM electrolysis for decarbonization of the maritime sector in California. Energy Convers. Manag. 2022, 257, 115440. [Google Scholar] [CrossRef]

| Parameter | Vessel-1 | Vessel-2 |

|---|---|---|

| Type | Ro-pax | Ro-pax |

| Length/breadth/draught [m] | 97.8 | 50 |

| Typical voyage distance [nm] | 27,025 | 110 |

| GT [t] | 5145 | 2682 |

| Component | Vessel-1 | Vessel-2 |

|---|---|---|

| Type | four-stroke | four-stroke |

| Fuel | MGO | MGO |

| Rated Power [kW] | 2360 | 1370 |

| Rated Speed [rpm] | 750 | 850 |

| Cylinders | 12 | 12 |

| Case | Fuels | Main Units | Subsystems |

|---|---|---|---|

| Baseline (BL) | MGO | 2 Main diesel engines 2 Auxiliary generator sets | – |

| CASE—1 (C1) | MGO | 2 Main diesel engines 2 Auxiliary generator sets 1 Batteries pack 1 Electric motor/generator | NOx after-treatment unit |

| CASE—2 (C2) | LNG Pilot diesel | 2 Main dual fuel engines 2 Auxiliary dual fuel generator sets | NOx after-treatment unit |

| CASE—3 (C3) | Methanol Pilot diesel | 2 Main dual fuel engines 2 Auxiliary dual fuel generator sets | NOx after-treatment unit |

| Parameter | Value | |

|---|---|---|

| Marine Methanol engine cost factor | EUR/kW | 780 1 |

| Marine LNG engine cost factor 1 | EUR/kW | 554 |

| Marine Diesel engine cost factor | EUR/kW | 493 |

| Maintenance cost factor | EUR/kWh | 0.012 |

| After-treatment unit cost factor | EUR/kW | 40 |

| Battery cost factor | EUR/kWh | 800 |

| Methanol fuel supply system | M EUR | 1.2 |

| MGO CO2 EF 2 | kg CO2/kg fuel | 3.02 |

| NG CO2 EF | kg CO2/kg fuel | 2.75 |

| Methanol CO2 EF | kg CO2/kg fuel | 1.37 |

| MGO CH4 EF | kg CH4/kg fuel | 0.006 |

| NG CH4 EF | kg CH4/kg fuel | 0.041 |

| Methanol CH4 EF | kg CH4/kg fuel | 0 |

| MGO N2O EF 3 | kg N2O /kg fuel | 1.4 × 10−4 |

| NG N2O EF | kg N2O /kg fuel | 0.71 × 10−4 |

| Methanol N2O EF | kg N2O /kg fuel | 0.71 × 10−4 |

| MGO Price 5 | EUR /t | 674 |

| LNG Price 4 | EUR /t | 1400 |

| Methanol Price 4 | EUR /t | 1000 |

| Methanol storage cost | EUR /m3 | 3000 |

| LNG storage cost | EUR /m3 | 2000 |

| Property | MGO | LNG | Methanol |

|---|---|---|---|

| LHV [MJ/kg] | 42.7 | 48.6 | 20.1 |

| Fuel Density [kg/m3] | 838 | 428 | 791 |

| Volumetric Energy Density [MJ/L] | 34 | 22 | 16 |

| Gross Storage System Size Factor | ×1 | ×2.4 | ×1.7 |

| GT | Number of Vessels |

|---|---|

| 0–100 | 67 |

| 100–399 | 135 |

| Above 400 | 160 |

| Cases | Vessel 1 | Vessel 2 |

|---|---|---|

| MACCAPEX [M EUR/t CO2] | ||

| C1 | 1.16 × 10−3 | 1.19 × 10−3 |

| C2 | 1.08 × 10−3 | 0.66 × 10−3 |

| C3 | 4.58 × 10−3 | 3.39 × 10−3 |

| MACOPEX [M EUR/t CO2] | ||

| C1 | –0.67 × 10−3 | –0.35 × 10−3 |

| C2 | 5.71 × 10−3 | 2.99 × 10−3 |

| C3 | 45.5 × 10−3 | 23.8 × 10−3 |

| Parameter | Vessel 1 | Vessel 2 |

|---|---|---|

| Batteries volume [m3] | 8000 | 4300 |

| Batteries Mass [t] | 4.6 | 2.5 |

| Ro-Pax Ferry | C1 | C2 | C1 | C2 | ||

|---|---|---|---|---|---|---|

| Length [m] | GT | ΔCost [M EUR] | ΔCost [M EUR] | |||

| Vessel 2 | 50 | 2682 | 0.23 | 0.35 | 85.76 | 130.5 |

| Vessel 1 | 100 | 5145 | 0.42 | 0.96 | 81.63 | 186.5 |

| C1—Ro-Pax hybrid powerplant | ||||

| Total IC | Linear | Power | Exponential | Average |

| M EUR | 26.5 | 30.6 | 27.3 | 28.1 |

| C2—Ro-Pax LNG fuel use | ||||

| Total IC | Average | |||

| M EUR | 58.04 | |||

| Carbon Tax [EUR/t] | Annual Tax Revenues [M EUR] |

|---|---|

| 50 | 49.08 |

| 100 | 98.15 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Theotokatos, G.; Karvounis, P.; Polychronidi, G. Environmental-Economic Analysis for Decarbonising Ferries Fleets. Energies 2023, 16, 7466. https://doi.org/10.3390/en16227466

Theotokatos G, Karvounis P, Polychronidi G. Environmental-Economic Analysis for Decarbonising Ferries Fleets. Energies. 2023; 16(22):7466. https://doi.org/10.3390/en16227466

Chicago/Turabian StyleTheotokatos, Gerasimos, Panagiotis Karvounis, and Georgia Polychronidi. 2023. "Environmental-Economic Analysis for Decarbonising Ferries Fleets" Energies 16, no. 22: 7466. https://doi.org/10.3390/en16227466

APA StyleTheotokatos, G., Karvounis, P., & Polychronidi, G. (2023). Environmental-Economic Analysis for Decarbonising Ferries Fleets. Energies, 16(22), 7466. https://doi.org/10.3390/en16227466