1. Introduction

The opinions of the CPC Central Committee and the State Council on further deepening the reform of the electric power system ([2015] No. 9) [

1] established the reform idea of “deregulating between power generation and consumption while regulating transmission and distribution (T&D) prices. “This marked the initiation of a new phase of power system reform in China. Currently, this reform has established a nationwide market system that operates continuously, involves multiple energy sources, and includes various market entities. This development has greatly improved the market’s ability to optimize resource allocation and has increased the share of market-oriented transactions. In the future, the power market will undergo further adjustments to align with the new power system considering the following aspects: deepening the construction of a national unified power market system [

2,

3], improving the market mechanism of clean energy and the design of auxiliary service trading, promoting the establishment of capacity compensation mechanisms/capacity markets, and fostering the development of new market entities in the energy sector. Redesigning T&D prices is one of the most crucial tasks in the reform of China’s power sector. Implementing a reasonable mechanism for power transmission and distribution (T&D) pricing can secure stable income for power grid enterprises, ensuring their neutrality in market transactions and fostering a fair and orderly market environment. Additionally, it promotes the equitable and rational allocation of power T&D costs among market entities [

4]. T&D prices are not only an important factor to orderly promote the reform of power price and straighten out the formation of power price, but also the main income source of the power grid, which can be described as the “lifeline” of power grid enterprises.

In recent years, China has made some preliminary achievements in the T&D pricing of provincial power grids, regional power grids, HVDC lines, and incremental distribution networks using a “permitted cost + reasonable revenue” approach to determine the grid’s income from transmission, basically achieving the full coverage of the system. Specifically, the transmission price for provincial power grids is designed based on voltage levels, while regional power grids adopt an “energy price + capacity price” structure. The energy price is calculated through the cost index to reflect the variable cost of regional power grids, while the capacity price is determined by comprehensively considering factors including the cross-regional and cross-provincial power transmission volume, the annual maximum load, and the reserve rate of inter-provincial tie-line and power supply reliability, reflecting the utilization degree of the power grid. Inter-provincial HVDC projects have predetermined the function of power transmission across provinces, and therefore adopt an energy-based pricing mechanism system when it comes to transmission pricing. However, the current pricing method of the provincial power grid fails to reflect the utilization of transmission resources by users in different geographical locations with imprecise cost allocation. The energy price of the transmission pricing of the regional power grid cannot reflect the real variable cost of the line, and the capacity price only roughly reflects the cohesion level of the power grids and the utilization degree of the lines without considering the power grid function and service entities or geographical location information. Moreover, the high transmission price of inter-provincial HVDC projects has also negatively affected inter-provincial transactions to some extent.

The reasonable allocation of transmission cost is crucial to serve the construction and development of the power market. However, the objective allocation of transmission costs remains controversial due to the multiple mapping relationships between bus-wise injected power and transmission line power flow. Multiple allocation methods for transmission cost have been developed in the existing theoretical research and practical applications [

5,

5]. In the early stage of the market, in order to facilitate implementation, the relatively simple stamp method or contract-path method [

6] was used for allocation, but the two methods could not reflect the actual power flow condition. In order to reflect the usage extent of transmission resources, the allocation methods such as the power flow tracing method [

7], distribution factor method [

8], and MW-Mile method [

9], etc., were proposed. The power flow tracing method enables the traceability of the power flow from the generator unit to the end user according to the principle of proportional allocation and avoids the problem of counter flow payment. Considering that the basic distribution factor method calculates the usage extent of buses on lines using sensitivity analysis and needs to consider the influence of balance bus selection and the processing method of reverse power flow, reference [

10] proposed generalized generation distribution factors (GGDFs) and generalized load distribution factors (GLDFs), which eliminated the influence of the selection of balance bus on the results. The marginal MW-Mile method divides transmission cost into location-related cost and location-unrelated cost, which are allocated, respectively, through the MW-Mile method and the stamp method and has been applied in the UK power market [

11]. However, the above-mentioned methods do not reflect the various functional attributes of the transmission line, as only part of the capacity of the transmission line is used for actual power transmission under normal operation, and the remaining capacity is reserved for fault scenarios and future load growth. Reference [

12] puts forward a transmission line cost allocation method considering the N-1 scenarios, which calculates the maximum fault power flow of each branch by traversing N-1 scenarios. Under the time section of the maximum fault power flow of a branch, the transmission cost corresponding to the maximum fault power flow is allocated using the GLDFs method, and the cost of unused line capacity is allocated using the stamp method. Reference [

13] further improves the methodology of [

12]. On the one hand, basic power flow and fault power flow are considered separately, and the allocation process is more refined. On the other hand, the concept of invalid capacity is proposed to prevent the over-construction of the power grid and the A-J effect under the regulation of return on investment. However, it only improves the physical technical indicators, and fails to reflect the economic aspect of the investment cost of the transmission line.

The continuous expansion of the power market, the surge in the number and frequency of transactions, the leapfrog development of renewable energy, and the accelerated construction of AC-DC hybrid power grids are some of the factors that brought profound changes to the form and function of the power system [

14,

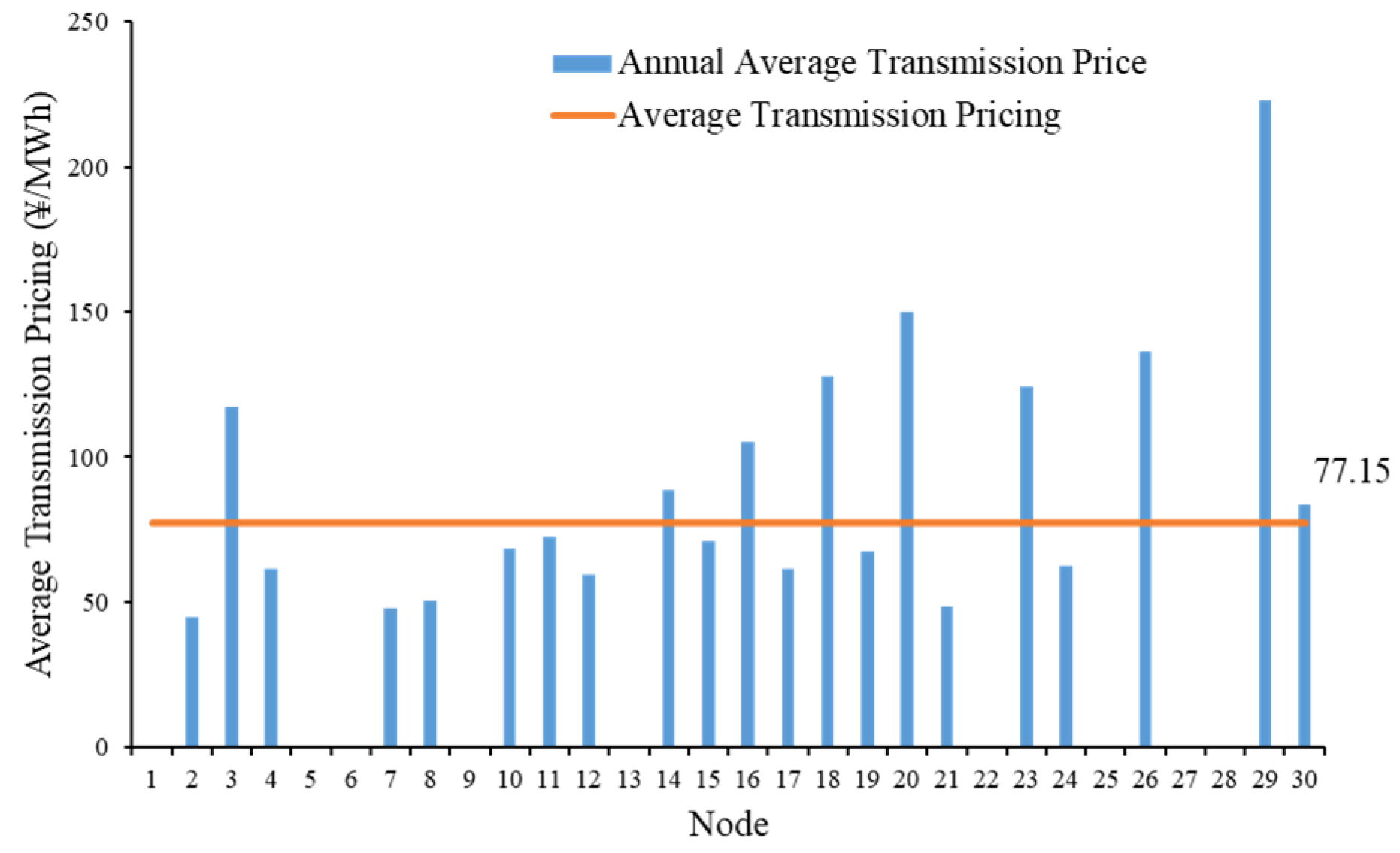

15]. These changes render new challenges towards the transmission price execution scheme in terms of adaptability and effectiveness. As China enters the critical third regulatory cycle of T&D pricing (2023–2025), this paper analyzes the new situation and the challenges faced by the transmission price mechanism based on the progress of foreign and domestic transmission price construction, and it constructs a transmission pricing method that considers the marginal value of transmission lines and user spatiotemporal information for the meshed AC network of China’s regional and provincial grid. The proposed method divides the transmission line cost into two parts, namely, expansion cost and residual cost, which reflect the marginal value of transmission lines. The expansion cost is calculated based on the congestion surplus of the power spot market under the locational marginal price mechanism, while the residual cost is allocated according to the usage extent of each bus to the transmission lines using the distribution factor method and the stamp method. Finally, the effectiveness of the proposed scheme is verified using a 3-bus system and the IEEE 30-bus system.

2. Overview of the Transmission Pricing Mechanism at Home and Abroad

The construction of the power price system in mature power markets such as Europe and the United States is closely related to its market model and market development process. The power market in the United States employs a sophisticated mathematical model to optimize economic efficiency while enhancing system reliability. In the power market, the locational marginal price (LMP) is used to fully reflect the geographical location information. The transmission price mechanism employs the relatively simple and straightforward stamp method based on peak load responsibility, allocating costs based on line usage. By comparison, the power market in Europe adopts the regional pricing mechanism with insignificant transmission congestion and typically divides price zones based on national administrative boundaries. However, this approach also leads to the price zone being overly large in size, failing to capture the spatial value difference of electric power within the zone and reducing the efficiency of resource optimization allocation [

16]. Therefore, European countries, exemplified by the United Kingdom, incorporate a substantial amount of geographical location information into their transmission price mechanisms. They allocate it proportionally to both the generation and load sides, facilitating optimal resource allocation by varying the transmission price based on the location of power generation and load.

2.1. Overview of the European Transmission Pricing Mechanism

Regarding the European power market, with its inherent characteristic of multi-country coupling, the most notable feature at the transmission level is its multi-level grid characteristic. The overall European transmission network can be divided into three layers, namely the upper-level pricing zone, the lower-level pricing zone, and the pricing zone [

17], as shown in

Figure 1. Specifically, the upper-level pricing zone is the zone under the jurisdiction of the transmission pricing mechanism designed by the transmission regulatory agency. The transmission pricing zone is often similar to the geographical scope of power transactions, such as the scope of a spot market and the scope of a coupled wholesale market. The upper pricing zone for European transmission pricing is the entirety of Europe. The lower-level pricing zone is encompassed within the upper-level pricing zone, allowing for the possibility of multiple lower-level pricing zones within a single upper-level pricing zone. Each country within the scope of the European power market is a lower-level pricing zone, which is operated and designed within the internal transmission pricing mechanism by the Transmission System Owner (TSO) [

18]. There are multiple price zones inside the lower-level pricing zone of each country, resulting in different prices for users. Each country divides its domestic price zone based on national conditions, encompassing factors such as political and economic disparities among regions or cities, and the usage extent of different power grids. Different lower-level pricing zones, namely different countries, are connected through tie-lines [

19], and the cost of tie-lines is recovered through upper-level pricing zones.

Given the complexity of transmission pricing determined by each European country’s Transmission System Operators (TSOs), the research on the European transmission pricing mechanism in this paper mainly focuses on the pricing of cross-border transmission services. The European Union established the European Network of Transmission System Operators of Electricity (ENTSO-E) to design and manage cross-border transmission pricing schemes, and proposed an Inter-Transmission System Operator Compensation Mechanism (ITC) [

20]. The ITC allocates the related costs of cross-border power transmission to each TSO. Simultaneously, TSOs intending to conduct cross-border transactions need to purchase transmission rights for the corresponding cross-border power transmission tie-lines. Under the ITC, the income and expenditure categories and capital flows of TSOs in various countries are shown in

Figure 2 [

21].

Under the ITC, each TSO engages in mutual payments for the cost of related cross-border grid equipment and transmission network losses for cross-border power transmission services, reaching a balance between total payment and compensation. This part of the cost is included in the total permitted income of the TSO and allocated to users in the price area along with the internal transmission network cost [

22]. The relationship between the main income and expenditure items is as follows.

The form of transmission rights includes physical transmission rights and financial transmission rights. Physical transmission rights refer to the right of the holder to physically transmit power in a specific direction at a specific time according to the predetermined amount in the contract, which is a way of exclusive ownership. This means that other participants have no right to utilize the line during the agreed-upon timeframe, even if the right holder does not utilize it. Financial transmission rights are a financial instrument used by grid users for hedging to avoid the financial losses caused by network congestion. Cross-border transmission rights in the lower-level pricing areas in Europe are physical transmission rights, and their income is allocated to the two TSOs connected by the corresponding tie-line according to the agreed proportion, which is equivalent to the construction cost allocation ratio of the tie-line [

23]. Grid users can freely choose between participating in the European day-ahead coupling market and purchasing power transmission rights. If they only participate in the day-ahead market, they will be settled according to the bided volume of electricity and price of the centralized bidding, facing the greater risks of not winning the bid and price fluctuation.

2.2. Overview of the Transmission Pricing Mechanism in the United States

The U.S. power market is organized by the Independent System Operators (ISOs) that are responsible for both power transaction and scheduling. This section takes PJM in the United States as an example to introduce the cost allocation methods of transmission lines between and within ISOs in the United States.

2.2.1. Cost Allocation Method for the Tie-Lines between ISOs

The construction of inter-ISO transmission tie-lines is usually included in the respective plans of the connected ISOs to facilitate cost sharing. The inter-ISO transmission lines will generally play an alternative role in the construction of the internal ISO transmission lines. The cost sharing of inter-ISO transmission lines allocated to the two connected ISOs is determined by default according to the present value of the cost of the replaced transmission upgrade plan within each ISO. Here is an example to illustrate.

The construction of tie-line Z between ISO-A and ISO-B is planned. It needs to be proved that tie-line Z can meet the system requirements more effectively than line X in ISO-A and line Y in ISO-B, so:

where

and

are the present values of the construction cost of line X and line Y, respectively;

and

are the final values of the construction cost of line X and line Y, respectively;

and

are the discount rates of line X and line Y, respectively;

and

are the expected service lives of line X and line Y, respectively; and

and

are the cost proportions of line Z shared by ISO-A and ISO-B, respectively.

On the basis of the voluntary principle of the relevant parties of transmission assets, other cost allocation methods for transmission lines between ISOs can be proposed, such as allocating according to the proportion of transmission congestion mitigation within the ISO or the proportion of reliability index improvement.

2.2.2. Cost Allocation Method for the Internal Transmission Network in the ISO

PJM transmission network projects are generally divided into three categories: generator interconnection projects, reliability transmission projects, and economic transmission projects, among which generator interconnection projects allocate the cost to generators by taking the cost of the dedicated tie-line and the expansion cost of the upper-level power grid into account. The allocation methods of reliability transmission projects and economic transmission projects are shown in

Table 1 [

24].

It is worth mentioning that PJM use substitute proxy on reactive equipment such as SVC and storage as transmission asset (SATA), that is, SVC and SATA are replaced by equivalent lines or transformers, and then combined with distribution factors and load proportions for allocation. An illustrative example of the distribution factor allocation method is shown in

Table 2 [

25].

2.3. Overview of the Transmission Pricing Mechanism in China

In October 2014, the National Development and Reform Commission and the National Energy Administration selected Shenzhen as the country’s first pilot for the reform of power T&D pricing, which opened the prelude to the reform of power T&D pricing. With the intensive issuance of top-level design documents such as the [2015] No. 9 document and the Measures for the Supervision and Examination of Power T&D Pricing Costs, China has accelerated the pace of T&D power price reform. In December 2017, a series of single T&D pricing mechanisms for the first regulatory cycle (2018–2019) were formulated, and the permitted income of T&D was determined in the form of “permitted cost plus reasonable revenue”. The provincial power grid determines the T&D price according to the voltage level, while the interprovincial power grid adopts a double pricing model in the form of “energy price plus capacity power price”, in which the energy price reflects the cost of the interprovincial power grid to provide transmission services, and the capacity power price reflects the cost of safety services provided by the interprovincial power grid to the provincial power grid, such as reliable power supply. Special transmission projects spanning multiple provinces and regions adhere to a function-based pricing mechanism, employing a single-price approach. However, in the first regulatory cycle, the provincial power grid did not verify the transmission costs of each voltage level in detail, resulting in unreasonable cost transfer between voltage levels. The regional power grid did not specify the exact allocation method of the capacity power price in detail, nor did it take into account the particularity of the unified balance of the Beijing–Tianjin–Tangshan power grid. As a result, power purchasers within the Beijing–Tianjin–Tangshan power grid encountered varying transmission prices based on the geographical location of both buyers and sellers, rendering the organization of a unified centralized bidding transaction unfeasible.

In 2019, China released a series of T&D pricing mechanisms for the second regulatory cycle (2020–2022). The provincial power grid further strengthened cost supervision and examination, but it still did not specify the cost allocation and transmission method among different voltage levels in detail, nor did it reflect the usage extent of transmission resources by users in different geographical locations. The interprovincial power grid changes the proportion of the energy price from physical technical indexing to cost indexing, which is determined based on expansion cost and according to the proportion of operation and the maintenance fee (excluding labor cost). The capacity price is determined based on the comprehensive consideration of inter-provincial power delivered, the annual maximum load, the reserve rate of inter-provincial tie-lines, and power supply reliability. In addition, the particularity of the unified balance of the Beijing–Tianjin–Tangshan power grid in the North China regional power grid is fully considered. The energy price is no longer charged for the transactions within the three provinces of the Beijing–Tianjin–Tangshan power grid, which creates a prerequisite for the centralized bidding trading of the Beijing–Tianjin–Tangshan power grid and the development of the power spot market. In terms of inter-provincial special transmission projects, it further defined the main function of power transmission, adopting a single-price mechanism. However, in the second regulatory cycle, there was still room for improvement in the formation of capacity and energy prices. For regulated power grid companies, fixed costs encompass depreciation, operation, and maintenance charges, and the proportion of the operation and maintenance charges does not reflect variable costs or short-term marginal costs. The capacity charge part only roughly reflected the compact degree of the power grid and the usage rate of the tie-lines, but it did not adequately allocate rationally according to the functional positioning of the power grid and the service object. Additionally, it does not account for geographical location information.

3. The Key Problems of the Transmission Pricing Mechanism in China

China’s transmission pricing mechanism has experienced a dynamic revision of two cycles, and some problems have been exposed in the implementation process. Facing the challenges of the construction of a new power system and the strategic goal of “carbon peaking and carbon neutrality”, a solution to the problems of the existing transmission pricing mechanism has yet to be proposed.

3.1. Energy Price Recovery Problem

In China’s first two pricing cycles, both inter-provincial special transmission projects and interprovincial power grid transmission pricing mechanisms incorporated an energy price. However, this energy price failed to accurately represent the actual unit cost of power transmission behavior, thus leading to difficulties for both market participants and power grid companies.

For market participants, due to the existence of energy charge in inter-provincial tie-lines, the bid-ask spread should be greater than the “energy price” before the transaction can be settled. The energy price is higher than the actual marginal transmission cost, which to some extent hinders the development of inter-provincial transactions and reduces the effect of the large-scale optimization of resource allocation. The acceleration of the construction of a new power system that adapts to the gradual increase in renewable energy will further highlight the disadvantages of “energy price” that hinder the inter-provincial transaction of multiple types of energy sources and the consumption of large-scale clean energy.

For the power grid companies, the energy price associates the recovery of line costs with the magnitude of transmitted power. The power flow of the new power system is changeable, which makes it more difficult to estimate. Therefore, the existing price mechanism may not be suitable for the new power system with a high proportion of renewable energy. In the case of the deregulated power market and access to a high proportion of renewable energy, the participation of market entities may also lead to large-scale power flow transfer, and the probability of a changeable power flow scenario will also appear in a higher frequency, which will increase the difficulty of predicting the transmission power, making it harder to calculate the energy charge. There may be a large gap between the actual energy charge and the preset rate, which cannot accurately reflect the transmission cost and deviates from the original intention of the preset rate, resulting in disputes over implementation.

3.2. Reasonable Allocation of Capacity Price

Both inter-provincial and provincial transmission pricing mechanisms involve the allocation of capacity charge at the grid level. At present, the allocation of capacity charge does not fully consider the actual functions of the power grid in order to reasonably allocate according to functional positioning and the consistency of rights and responsibilities of service objects, nor does it consider the usage extent of transmission resources by users in different locations to reflect geographical location information.

The regional power grid in North China can be taken as an example, whose overall flow direction can be described as “from west to east, from north to south”, with Shandong power grid being located at the end of the load center. The coal and wind resources of the North China power grid are mainly concentrated in Shanxi and Inner Mongolia in the west and north. The load center is the Beijing–Tianjin–Hebei–Shandong region, of which the Beijing–Tianjin–Tangshan and southern Hebei power grids are in the central area, and the Shandong power grid is in the southeastern end of the load center. In actual operation, the Shandong power grid receives the power flow fully from the North China main grid through the Beijing–Tianjin–Tangshan and southern Hebei power grid tie-lines. Consequently, it plays a crucial role in transmitting power to the Shandong power grid, and provides the reserve supporting capacity for the Beijing–Tianjin–Tangshan, southern Hebei, and Shandong power grids. However, the existing calculation formula cannot fully reflect the usage extent of the reserve capacity of the tie-lines in the North China regional power grid to the Shandong power grid. The Beijing–Tianjin–Tangshan power grid and the southern Hebei power grid have tie-lines connected from various directions, resulting in the highest allocation ratio as per the pricing mechanism. Conversely, the Shandong power grid has fewer direct tie-line connections, leading to the lowest allocation ratio.

Taking the off-line power flow of the North China power grid in a typical day in 2019 as an example, if the Lu-Gu DC (the Northeast to Shandong inter-provincial DC tie-line) has a DC block fault, the instantaneous power deficit of the Shandong power grid will be 2 million kW without considering the load shedding of the DC security control system of the Shandong power grid. After the accident, to compensate for the power shortage, the steady-state power flow of the tie-lines directly connected to the Shandong power grid rose by 1.891 million kW, while that of the tie-lines not directly connected to the Shandong power grid rose by 1.568 million kW simultaneously, which fully reflects the support from the inter-provincial North China tie-lines for the Shandong power grid.

6. Conclusions

Based on the economic principles of the transmission line cost structure, this paper proposes a transmission pricing method considering the marginal value of transmission lines and user spatiotemporal information. The cost of the lines is split into two parts, namely, the expansion cost and the residual cost, which objectively reflects the marginal value of the lines. The expansion cost is closely coupled with the power spot market, accurately considering the system operation mode and the market clearing results at each period of the year. The residual cost is allocated according to the usage extent of the transmission line by each bus user. The method proposed in this paper no longer involves energy price, thereby resolving the issues related to cost allocation and market clearing associated with energy prices. This approach accurately reflects the usage extent of transmission lines by users at different periods and in different areas, avoiding the fair allocation problem of congestion surplus brought on by the absence of financial transmission rights, and aligns with the current practice of China’s power market construction based on the LMP. However, it still exhibits limitations as it is mainly applicable to regional power grids and provincial power grids dominated by meshed AC networks and does not involve inter-provincial HVDC projects, which adopt the energy-based pricing mechanism. In addition, it should be noted that, if the Chinese market designs better tools for congestion revenue allocation such as financial transmission rights (FTRs), then the grid operator would no longer be entitled to obtain revenue.

There are two potential directions awaiting further study. First, the bidding strategy of the power market will affect the congestion revenue, subsequently influencing the transmission price, which in turn will affect the bidding strategy of the power market. The iterative equilibrium between the power market and the transmission price is a problem to be solved. Another problem that needs further research is the accurate calculation of the utilization degree of transmission line resources by users at different nodes. This becomes particularly significant in the case of high-capacity and high-cost transmission lines, as it is necessary to consider not only the traceability of line usage under normal operation scenarios, but also the line capacity reserved for fault and future load growth, both of which entail certain uncertainties. The research findings presented in this paper are anticipated to offer valuable insights for the construction and development of China’s power market.