Green Balanced Scorecard: A Tool of Sustainable Information Systems for an Energy Efficient Business

Abstract

:1. Introduction

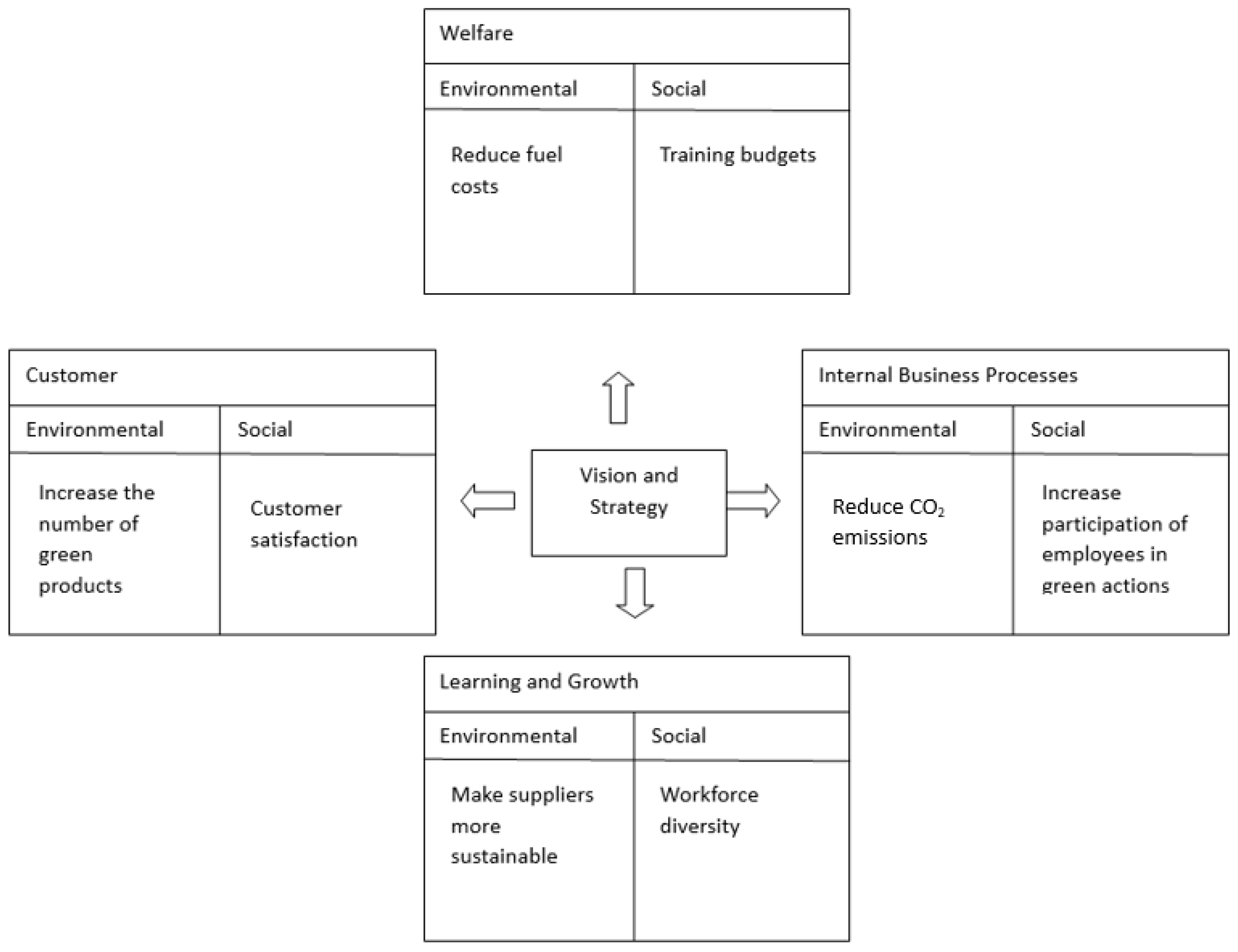

2. The Role of the Green Balanced Scorecard to the Rational Management of Energy in Businesses

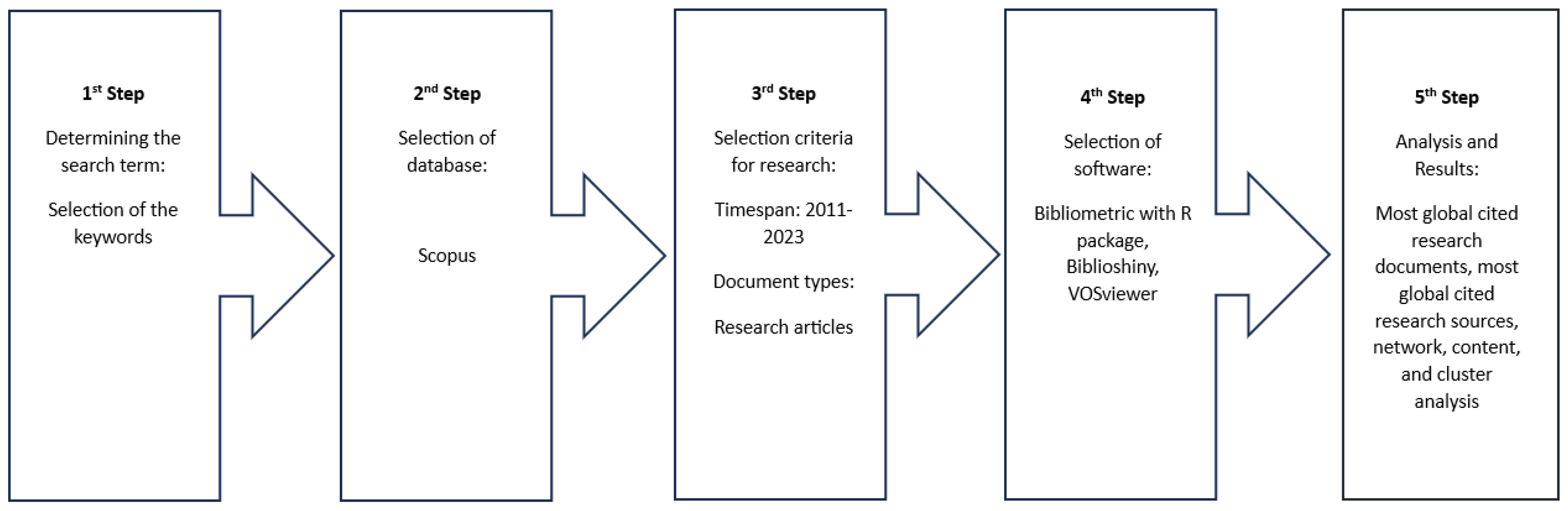

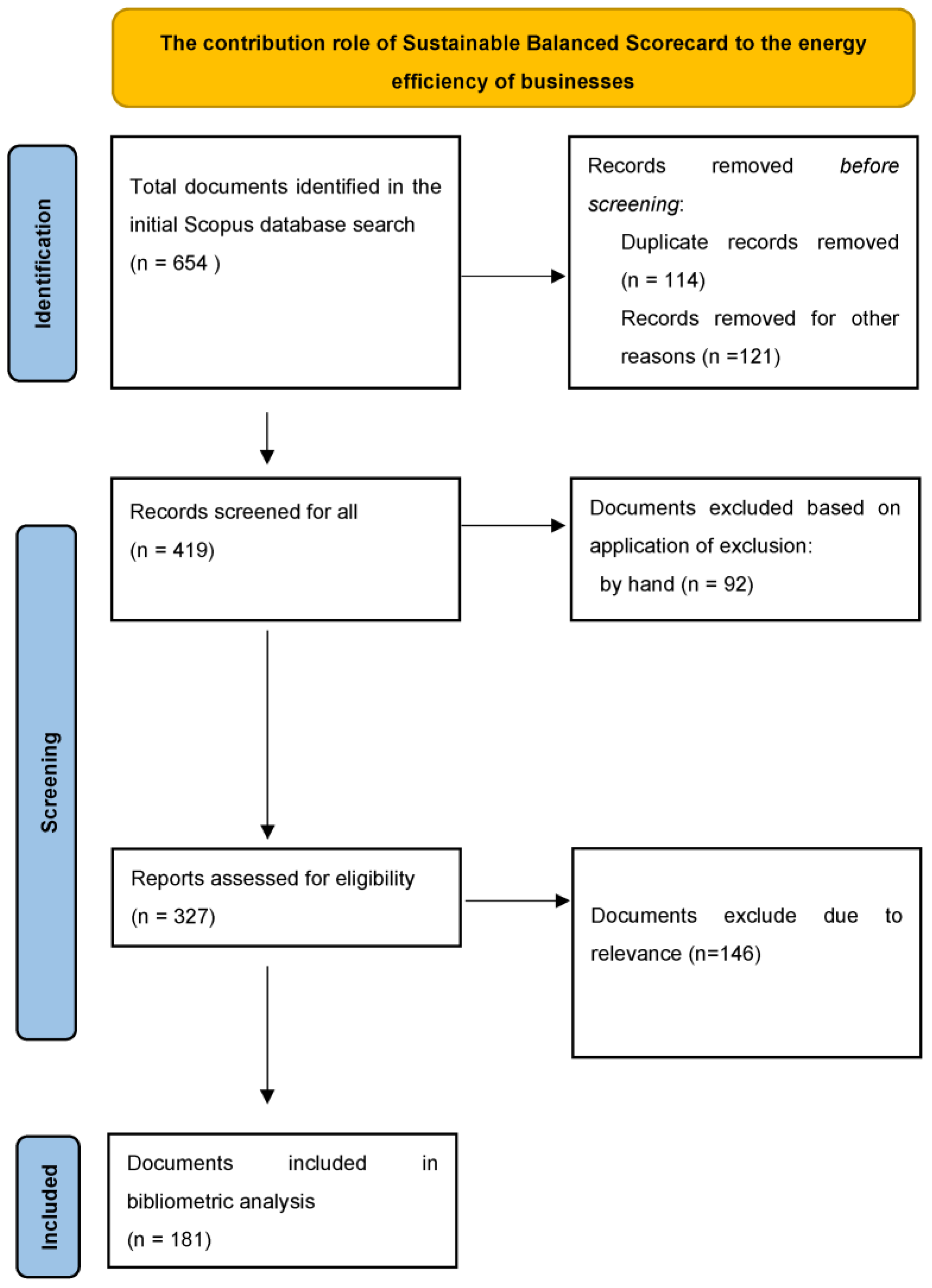

3. Materials and Methods

4. Results

4.1. Most Influential Journals and Documents in the Field

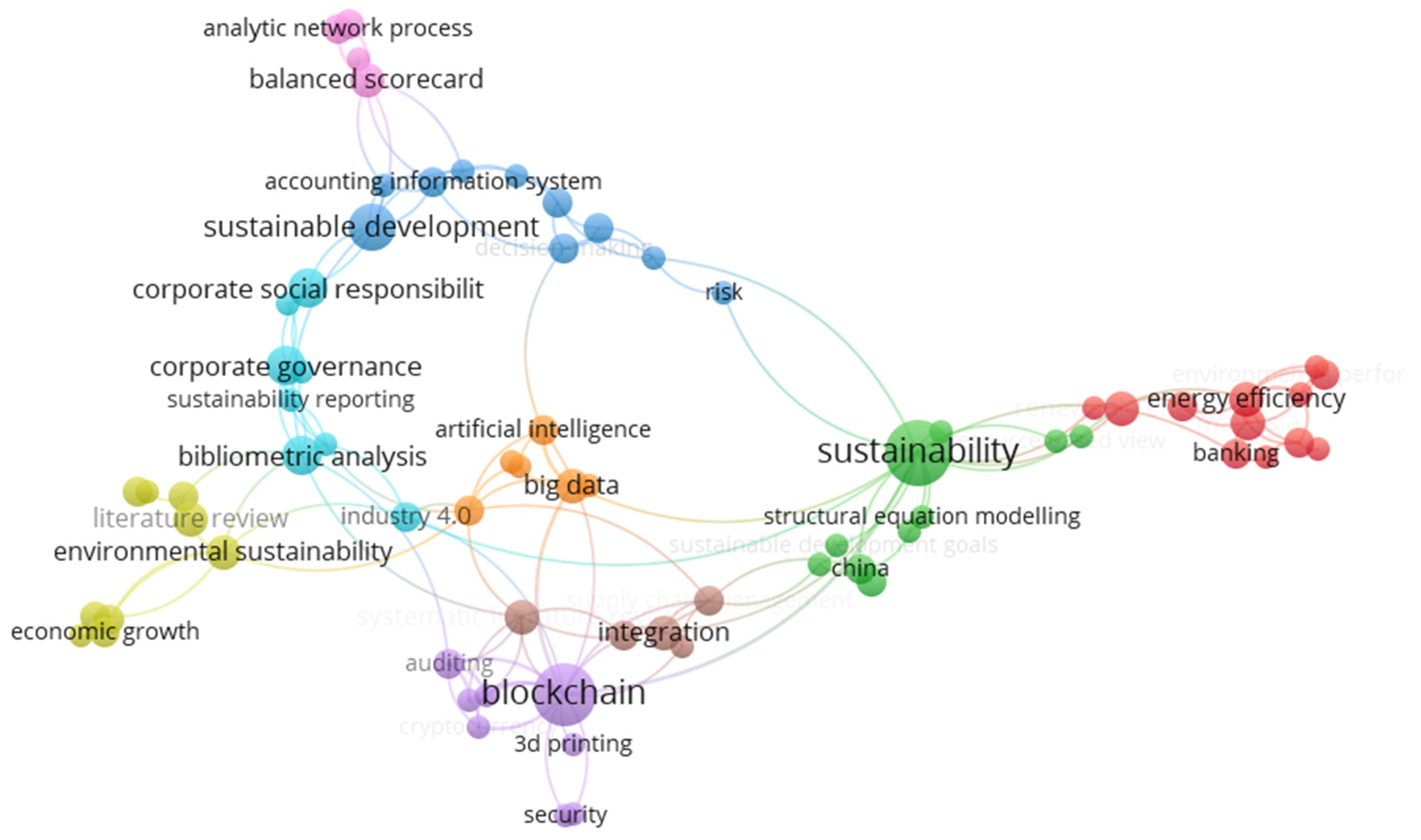

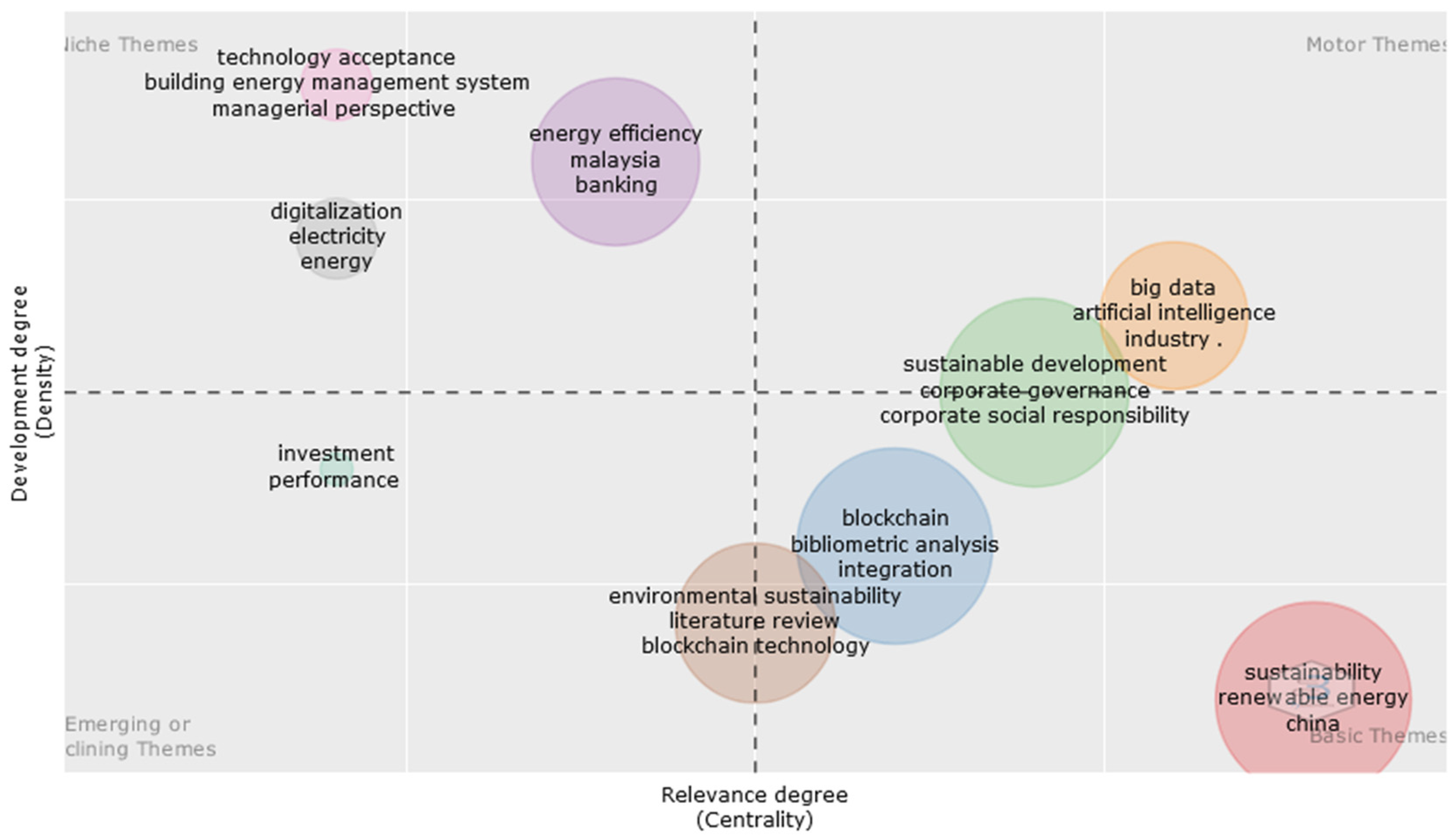

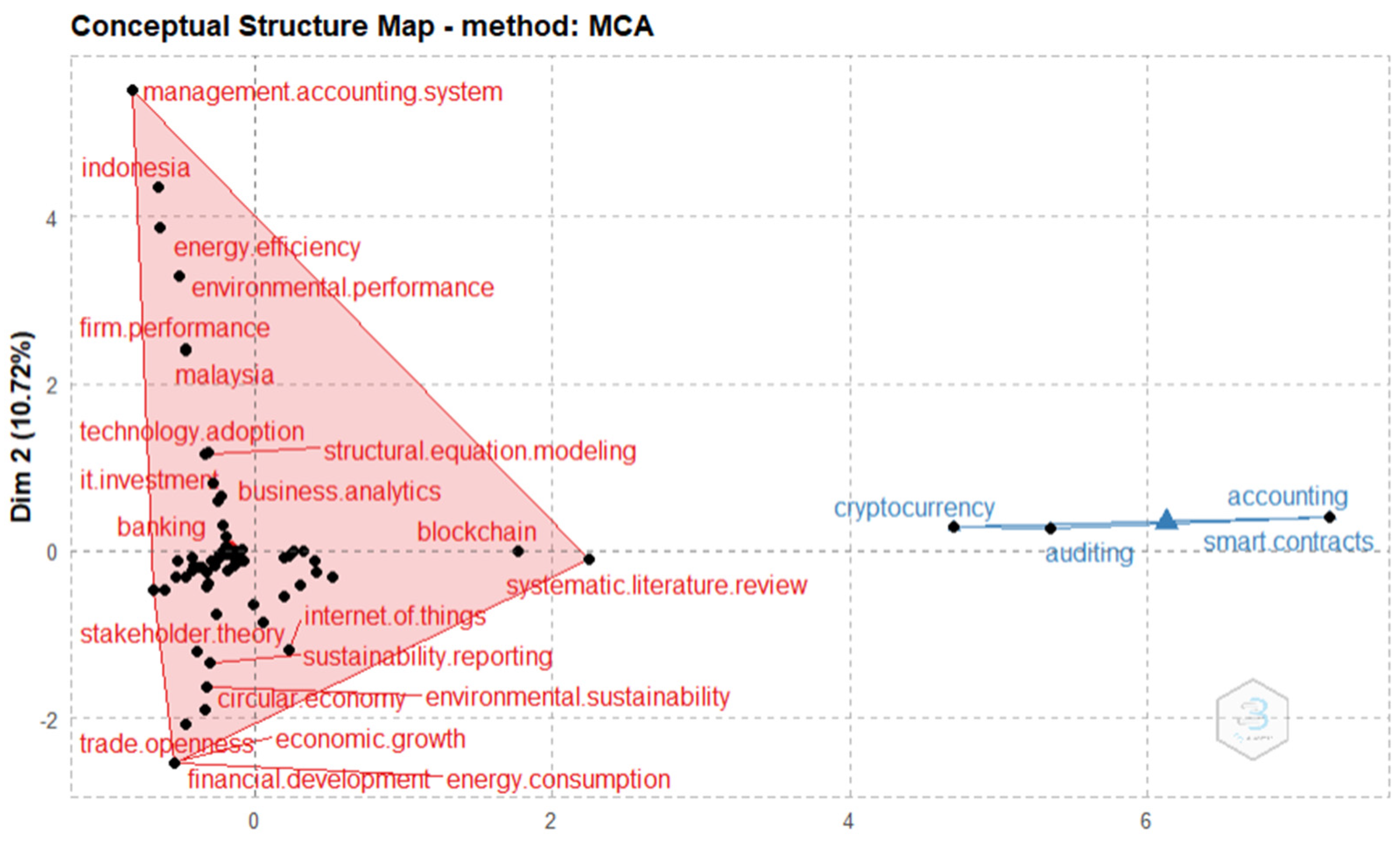

4.2. Network, Content, and Cluster Analysis

5. Discussion

6. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Tawse, A.; Tabesh, P. Thirty years with the balanced scorecard: What we have learned. Bus. Horiz. 2023, 66, 123–132. [Google Scholar] [CrossRef]

- Agarwal, S.; Kant, R.; Shankar, R. Exploring sustainability balanced scorecard for performance evaluation of humanitarian organizations. Clean. Logist. Supply Chain 2022, 3, 100026. [Google Scholar] [CrossRef]

- Wang, J.-S.; Liu, C.-H.; Chen, Y.-T. Green sustainability balanced scorecard—Evidence from the Taiwan liquefied natural gas industry. Environ. Technol. Innov. 2022, 28, 102862. [Google Scholar] [CrossRef]

- Faraji, O.; Ezadpour, M.; Dastjerdi, A.R.; Dolatzarei, E. Conceptual structure of balanced scorecard research: A co-word analysis. Eval. Program Plan. 2022, 94, 102128. [Google Scholar] [CrossRef]

- Torgautov, B.; Zhanabayev, A.; Tleuken, A.; Turkyilmaz, A.; Borucki, C.; Karaca, F. Performance assessment of construction companies for the circular economy: A balanced scorecard approach. Sustain. Prod. Consum. 2022, 33, 991–1004. [Google Scholar] [CrossRef]

- Jum’a, L.; Zimon, D.; Ikram, M. A Relationship Between Supply Chain Practices, Environmental Sustainability and Financial Performance: Evidence from Manufacturing Companies in Jordan. Sustainability 2021, 13, 2152. [Google Scholar] [CrossRef]

- Song, W.; Han, Y.H.; Sroufe, R. Substitution and complementarity dynamics in configurations of sustainable management practices. Int. J. Oper. Prod. Manag. 2022, 42, 1711–1731. [Google Scholar] [CrossRef]

- Stauropoulou, A.; Sardianou, E.; Malindretos, G.; Evangelinos, K.; Nikolaou, I. The effects of economic, environmentally and socially related SDGs strategies of banking institutions on their customers’ behavior. World Dev. Sustain. 2023, 2, 100051. [Google Scholar]

- Mirza, N.; Afzal, A.; Umar, M.; Skare, M. The impact of green lending on banking performance: Evidence from SME credit portfolios in the BRIC. Econ. Anal. Policy 2023, 77, 843–850. [Google Scholar] [CrossRef]

- Tan, L.; Kong, T.L.; Zhang, Z.; Metwally, A.S.M.; Sharma, S.; Sharma, K.P.; Eldin, S.M.; Zimon, D. Scheduling and Controlling Production in an Internet of Things Environment for Industry 4.0: An Analysis and Systematic Review of Scientific Metrological Data. Sustainability 2023, 15, 7600. [Google Scholar] [CrossRef]

- Kirchherr, J.; Hartley, K.; Tukker, A. Missions and mission-oriented innovation policy for sustainability: A review and critical reflection. Environ. Innov. Soc. Transit. 2023, 47, 100721. [Google Scholar] [CrossRef]

- Tran, T.A.; Aguilar, R.R.; Munapo, E.; Thomas, J.J.; Vasant, P.; Panchenko, V. Energy efficiency management for the industrial manufacture engineering. Next Energy 2023, 1, 100031. [Google Scholar] [CrossRef]

- Bosu, I.; Mahmoud, H.; Hassan, H. Energy audit and management of an industrial site based on energy efficiency, economic, and environmental analysis. Appl. Energy 2023, 333, 120619. [Google Scholar] [CrossRef]

- Nathaphan, S.; Therdyothin, A. Effectiveness evaluation of the energy efficiency and conservation measures for stipulation of Thailand energy management system in factory. J. Clean. Prod. 2023, 383, 135442. [Google Scholar] [CrossRef]

- Daly, D.; Carr, C.; Daly, M.; McGuirk, P.; Stanes, E.; Santala, I. Extending urban energy transitions to the mid-tier: Insights into energy efficiency from the management of HVAC maintenance in ‘mid-tier’ office buildings. Energy Policy 2023, 174, 113415. [Google Scholar] [CrossRef]

- Zhang, P.; Hao, D. Enterprise financial management and fossil fuel energy efficiency for green economic growth. Resour. Policy 2023, 84, 103763. [Google Scholar] [CrossRef]

- Schaltegger, S.; Hansen, E.G.; Lüdeke-Freund, F. Business Models for Sustainability: Origins, Present Research, and Future Avenues. Organ. Environ. 2012, 29, 3–10. [Google Scholar] [CrossRef]

- Chen, H.-M.; Wu, H.-Y.; Chen, P.-S. Innovative service model of information services based on the sustainability balanced scorecard: Applied integration of the fuzzy Delphi method, Kano model, and TRIZ. Expert Syst. Appl. 2022, 205, 117601. [Google Scholar] [CrossRef]

- Hansen, E.G.; Schaltegger, S. The Sustainability Balanced Scorecard: A Systematic Review of Architectures. J. Bus. Ethics 2014, 133, 193–221. [Google Scholar] [CrossRef]

- Vardopoulos, I.; Konstantopoulos, I.; Zorpas, A.A.; Limousy, L.; Bennici, S.; Inglezakis, V.J.; Voukkali, I. Sustainable metropolitan areas perspectives through assessment of the existing waste management strategies. Environ. Sci. Pollut. Res. 2020, 28, 24305–24320. [Google Scholar] [CrossRef]

- Vardopoulos, I.; Tsilika, E.; Sarantakou, E.; Zorpas, A.A.; Salvati, L.; Tsartas, P. An Integrated SWOT-PESTLE-AHP Model Assessing Sustainability in Adaptive Reuse Projects. Appl. Sci. 2021, 11, 7134. [Google Scholar] [CrossRef]

- Moustairas, I.; Vardopoulos, I.; Kavouras, S.; Salvati, L.; Zorpas, A. Exploring factors that affect public acceptance of establishing an urban environmental education and recycling center. Sustain. Chem. Pharm. 2022, 25, 100605. [Google Scholar] [CrossRef]

- Sapountzoglou, N. A bibliometric analysis of risk management methods in the space sector. J. Space Saf. Eng. 2023, 10, 13–21. [Google Scholar] [CrossRef]

- Kombate, Y.; Houngue, P.; Ouya, S. A bibliometric method for analyzing IoT hacking solutions in network services. Procedia Comput. Sci. 2022, 203, 141–148. [Google Scholar] [CrossRef]

- Sáez-Ortuño, L.; Forgas-Coll, S.; Huertas-Garcia, R.; Sánchez-García, J. What’s on the horizon? A bibliometric analysis of personal data collection methods on social networks. J. Bus. Res. 2023, 158, 113702. [Google Scholar] [CrossRef]

- Ma, Y.; Hu, F.; Hu, Y. Energy efficiency improvement of intelligent fuel cell/battery hybrid vehicles through an integrated management strategy. Energy 2023, 263, 125794. [Google Scholar] [CrossRef]

- Elliot, S. Transdisciplinary Perspectives on Environmental Sustainability: A Resource Base and Framework for IT-Enabled Business Transformation. MIS Q. 2011, 35, 197. [Google Scholar] [CrossRef]

- Leng, J.; Ruan, G.; Jiang, P.; Xu, K.; Liu, Q.; Zhou, X.; Liu, C. Blockchain-empowered sustainable manufacturing and product lifecycle management in industry 4.0: A survey. Renew. Sustain. Energy Rev. 2020, 132, 110112. [Google Scholar] [CrossRef]

- Bhushan, B.; Khamparia, A.; Sagayam, K.M.; Sharma, S.K.; Ahad, M.A.; Debnath, N.C. Blockchain for smart cities: A review of architectures, integration trends and future research directions. Sustain. Cities Soc. 2020, 61, 102360. [Google Scholar] [CrossRef]

- Achillas, C.; Aidonis, D.; Iakovou, E.; Thymianidis, M.; Tzetzis, D. A methodological framework for the inclusion of modern additive manufacturing into the production portfolio of a focused factory. J. Manuf. Syst. 2015, 37, 328–339. [Google Scholar] [CrossRef]

- Vasseur, V.; Kemp, R. The adoption of PV in the Netherlands: A statistical analysis of adoption factors. Renew. Sustain. Energy Rev. 2015, 41, 483–494. [Google Scholar] [CrossRef]

- Dinçer, H.; Yüksel, S.; Martínez, L. Balanced scorecard-based analysis about European energy investment policies: A hybrid hesitant fuzzy decision-making approach with Quality Function Deployment. Expert Syst. Appl. 2019, 115, 152–171. [Google Scholar] [CrossRef]

- Eastwood, C.; Ayre, M.; Nettle, R.; Rue, B.D. Making sense in the cloud: Farm advisory services in a smart farming future. NJAS Wagening. J. Life Sci. 2019, 90–91, 100298. [Google Scholar] [CrossRef]

- Alyami, S.H.; Rezgui, Y.; Kwan, A. Developing sustainable building assessment scheme for Saudi Arabia: Delphi consultation approach. Renew. Sustain. Energy Rev. 2013, 27, 43–54. [Google Scholar] [CrossRef]

- Chofreh, A.G.; Goni, F.A.; Shaharoun, A.M.; Ismail, S.; Klemeš, J.J. Sustainable enterprise resource planning: Imperatives and research directions. J. Clean. Prod. 2014, 71, 139–147. [Google Scholar] [CrossRef]

- Quezada, L.E.; López-Ospina, H.A.; Palominos, P.I.; Oddershede, A.M. Identifying causal relationships in strategy maps using ANP and DEMATEL. Comput. Ind. Eng. 2018, 118, 170–179. [Google Scholar] [CrossRef]

- Xing, T.; Jiang, Q.; Ma, X. To Facilitate or Curb? The Role of Financial Development in China’s Carbon Emissions Reduction Process: A Novel Approach. Int. J. Environ. Res. Public Health 2017, 14, 1222. [Google Scholar] [CrossRef] [PubMed]

- Alanne, K.; Cao, S. Zero-energy hydrogen economy (ZEH2E) for buildings and communities including personal mobility. Renew. Sustain. Energy Rev. 2017, 71, 697–711. [Google Scholar] [CrossRef]

- Kumar, S.; Sahoo, S.; Lim, W.M.; Kraus, S.; Bamel, U. Fuzzy-set qualitative comparative analysis (fsQCA) in business and management research: A contemporary overview. Technol. Forecast. Soc. Chang. 2022, 178, 121599. [Google Scholar] [CrossRef]

- Savino, M.M.; Batbaatar, E. Investigating the resources for Integrated Management Systems within resource-based and contingency perspective in manufacturing firms. J. Clean. Prod. 2015, 104, 392–402. [Google Scholar] [CrossRef]

- Lei, B.; Janssen, P.; Stoter, J.; Biljecki, F. Challenges of urban digital twins: A systematic review and a Delphi expert survey. Autom. Constr. 2023, 147, 104716. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W.; Song, M. Industry 4.0: Driving factors and impacts on firm’s performance: An empirical study on China’s manufacturing industry. Ann. Oper. Res. 2019, 1–21. [Google Scholar] [CrossRef]

- Koot, M.; Mes, M.R.; Iacob, M.E. A systematic literature review of supply chain decision making supported by the Internet of Things and Big Data Analytics. Comput. Ind. Eng. 2020, 154, 107076. [Google Scholar] [CrossRef]

- Khorasanizadeh, H.; Honarpour, A.; Park, M.S.-A.; Parkkinen, J.; Parthiban, R. Adoption factors of cleaner production technology in a developing country: Energy efficient lighting in Malaysia. J. Clean. Prod. 2016, 131, 97–106. [Google Scholar] [CrossRef]

- Khatter, A.; McGrath, M.; Pyke, J.; White, L.; Lockstone-Binney, L. Analysis of hotels’ environmentally sustainable policies and practices: Sustainability and corporate social responsibility in hospitality and tourism. Int. J. Contemp. Hosp. Manag. 2019, 31, 2394–2410. [Google Scholar] [CrossRef]

- Feng, Y.; Chen, H.H.; Tang, J. The Impacts of Social Responsibility and Ownership Structure on Sustainable Financial Development of China’s Energy Industry. Sustainability 2018, 10, 301. [Google Scholar] [CrossRef]

- Ying, H.; Zhang, X.; He, T.; Feng, Q.; Wang, R.; Yang, L.; Duan, J. A bibliometric analysis of research on heart failure comorbid with depression from 2002 to 2021. Heliyon 2023, 9, e13054. [Google Scholar] [CrossRef] [PubMed]

- Ragazou, K.; Passas, I.; Garefalakis, A.; Dimou, I. Investigating the Research Trends on Strategic Ambidexterity, Agility, and Open Innovation in SMEs: Perceptions from Bibliometric Analysis. J. Open Innov. Technol. Mark. Complex. 2022, 8, 118. [Google Scholar] [CrossRef]

- Iqbal, A.; Ramachandran, S.; Siow, M.L.; Subramaniam, T.; Afandi, S.H.M. Meaningful community participation for effective development of sustainable tourism: Bibliometric analysis towards a quintuple helix model. J. Outdoor Recreat. Tour. 2022, 39, 100523. [Google Scholar] [CrossRef]

- Munim, Z.H.; Chowdhury, M.M.H.; Tusher, H.M.; Notteboom, T. Towards a prioritization of alternative energy sources for sustainable shipping. Mar. Policy 2023, 152, 105579. [Google Scholar] [CrossRef]

- Abidin, Z.; Prabantarikso, R.M.; Wardhani, R.A.; Endri, E. Analysis of Bank Efficiency Between Conventional Banks and Regional Development Banks in Indonesia. J. Asian Financ. Econ. Bus. 2021, 8, 741–750. [Google Scholar]

- Kitamura, K. Ethical compatibility of socially responsible banking: Comparing the Japanese main bank system with the USA. Res. Int. Bus. Financ. 2022, 62, 101686. [Google Scholar] [CrossRef]

- Chen, D.; Feng, L.; Fan, Y.; Shang, S.; Wei, Z. Smart contract vulnerability detection based on semantic graph and residual graph convolutional networks with edge attention. J. Syst. Softw. 2023, 202, 111705. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, X.; Huang, Y.; Zhu, H.-N.; Bian, J.; Zheng, Z. An empirical study on real bug fixes from solidity smart contract projects. J. Syst. Softw. 2023, 204, 111787. [Google Scholar] [CrossRef]

- Chu, H.; Zhang, P.; Dong, H.; Xiao, Y.; Ji, S.; Li, W. A survey on smart contract vulnerabilities: Data sources, detection and repair. Inf. Softw. Technol. 2023, 159, 107221. [Google Scholar] [CrossRef]

- Akinbowale, O.E.; Klingelhöfer, H.E.; Zerihun, M.F. The use of the Balanced Scorecard as a strategic management tool to mitigate cyberfraud in the South African banking industry. Heliyon 2022, 8, e12054. [Google Scholar] [CrossRef]

- Wiechmann, D.M.; Reichstein, C.; Haerting, R.-C.; Bueechl, J.; Pressl, M. Agile management to secure competitiveness in times of digital transformation in medium-sized businesses. Procedia Comput. Sci. 2022, 207, 2353–2363. [Google Scholar] [CrossRef]

- Ragazou, K.; Passas, I.; Sklavos, G. Investigating the Strategic Role of Digital Transformation Path of SMEs in the Era of COVID-19: A Bibliometric Analysis Using R. Sustainability 2022, 14, 11295. [Google Scholar] [CrossRef]

- Quezada, L.E.; López-Ospina, H.A.; Ortiz, C.; Oddershede, A.M.; Palominos, P.I.; Jofré, P.A. A DEMATEL-based method for prioritizing strategic projects using the perspectives of the Balanced Scorecard. Int. J. Prod. Econ. 2022, 249, 108518. [Google Scholar] [CrossRef]

| Paper | Total Citations | TC per Year | Normalized TC |

|---|---|---|---|

| Transdisciplinary Perspectives on Environmental Sustainability: A Resource Base and Framework for IT-Enabled Business Transformation [27] | 363 | 27.9231 | 1 |

| Blockchain-empowered sustainable manufacturing and product lifecycle management in industry 4.0: A survey [28] | 208 | 52 | 7.5912 |

| Blockchain for smart cities: A review of architectures. integration trends and future research directions [29] | 168 | 42 | 6.1314 |

| A methodological framework for the inclusion of modern additive manufacturing into the production portfolio of a focused factory [30] | 167 | 18.5556 | 2.0366 |

| The adoption of PV in the Netherlands: A statistical analysis of adoption factors [31] | 129 | 14.3333 | 1.5732 |

| Balanced scorecard-based analysis about European energy investment policies: A hybrid hesitant fuzzy decision-making approach with Quality Function Deployment [32] | 104 | 20.8 | 4.8417 |

| Making sense in the cloud: Farm advisory services in a smart farming future [33] | 90 | 18 | 4.1899 |

| Developing sustainable building assessment scheme for Saudi Arabia: Delphi consultation approach [34] | 84 | 7.6364 | 1 |

| Sustainable enterprise resource planning: imperatives and research directions [35] | 81 | 8.1 | 2 |

| Identifying causal relationships in strategy maps using ANP and DEMATEL [36] | 73 | 12.1667 | 5.1408 |

| To Facilitate or Curb? The Role of Financial Development in China’s Carbon Emissions Reduction Process: A Novel Approach [37] | 69 | 9.8571 | 1.9492 |

| Zero-energy hydrogen economy (ZEH2E) for buildings and communities including personal mobility [38] | 66 | 9.4286 | 1.8644 |

| Fuzzy-set qualitative comparative analysis (fsQCA) in business and management research: A contemporary overview [39] | 61 | 30.5 | 8.9706 |

| Investigating the resources for Integrated Management Systems within resource-based and contingency perspective in manufacturing firms [40] | 59 | 6.5556 | 0.7195 |

| Challenges of urban digital twins: A systematic review and a Delphi expert survey [41] | 58 | 11.6 | 2.7002 |

| Industry 4.0: driving factors and impacts on firm’s performance: an empirical study on China’s manufacturing industry [42] | 56 | 11.2 | 2.6071 |

| A systematic literature review of supply chain decision making supported by the Internet of Things and Big Data Analytics [43] | 52 | 17.3333 | 3.0476 |

| Adoption factors of cleaner production technology in a developing country: energy efficient lighting in Malaysia [44] | 47 | 5.875 | 2.2381 |

| Analysis of hotels’ environmentally sustainable policies and practices: Sustainability and corporate social responsibility in hospitality and tourism [45] | 45 | 9 | 2.095 |

| The Impacts of Social Responsibility and Ownership Structure on Sustainable Financial Development of China’s Energy Industry [46] | 42 | 7 | 2.9577 |

| Sources | Articles | Subject Area | h-Index | Ranking by ABS List | Ranking by Scimago List |

|---|---|---|---|---|---|

| Sustainability (Switzerland) | 19 | Energy | 136 | Q1 | |

| Journal of Cleaner Production | 11 | Energy | 268 | 2 ** | Q1 |

| International Journal of Innovation Creativity and Change | 8 | Social Sciences | 17 | ||

| Energies | 7 | Energy | 132 | Q1 | |

| Renewable and Sustainable Energy Reviews | 5 | Energy | 378 | Q1 | |

| Technological Forecasting and Social Change | 5 | Business, Management and Accounting | 155 | 3 *** | Q1 |

| Environmental Science and Pollution Research | 4 | Environmental Science | 154 | Q1 | |

| International Journal of Energy Economics and Policy | 4 | Energy | 45 | Q2 | |

| Computers And Industrial Engineering | 3 | Computer science | 148 | 2 ** | Q1 |

| International Journal of Environmental Research and Public Health | 3 | Environmental Science | 167 | Q2 | |

| Kybernetes | 3 | Computer science | 47 | 1 * | Q2 |

| Accounting Auditing and Accountability Journal | 2 | Business, Management and Accounting | 112 | Q1 | |

| Acm International Conference Proceeding Series | 2 | Computer science | 137 | ||

| Annals Of Operations Research | 2 | Decision Sciences | 118 | 3 *** | Q1 |

| Expert Systems With Applications | 2 | Computer Science | 249 | 1 * | Q1 |

| Frontiers In Psychology | 2 | Psychology | 157 | 1 * | Q2 |

| Global Knowledge Memory and Communication | 2 | Social Sciences | 35 | Q2 | |

| International Journal of Contemporary Hospitality Management | 2 | Business, Management and Accounting | 113 | 3 *** | Q1 |

| Journal Of Financial Reporting and Accounting | 2 | Business, Management and Accounting | 16 | 1 * | Q2 |

| Opcion | 2 | Social Sciences | 21 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stavropoulou, E.; Spinthiropoulos, K.; Ragazou, K.; Papademetriou, C.; Passas, I. Green Balanced Scorecard: A Tool of Sustainable Information Systems for an Energy Efficient Business. Energies 2023, 16, 6432. https://doi.org/10.3390/en16186432

Stavropoulou E, Spinthiropoulos K, Ragazou K, Papademetriou C, Passas I. Green Balanced Scorecard: A Tool of Sustainable Information Systems for an Energy Efficient Business. Energies. 2023; 16(18):6432. https://doi.org/10.3390/en16186432

Chicago/Turabian StyleStavropoulou, Eirini, Konstantinos Spinthiropoulos, Konstantina Ragazou, Christos Papademetriou, and Ioannis Passas. 2023. "Green Balanced Scorecard: A Tool of Sustainable Information Systems for an Energy Efficient Business" Energies 16, no. 18: 6432. https://doi.org/10.3390/en16186432

APA StyleStavropoulou, E., Spinthiropoulos, K., Ragazou, K., Papademetriou, C., & Passas, I. (2023). Green Balanced Scorecard: A Tool of Sustainable Information Systems for an Energy Efficient Business. Energies, 16(18), 6432. https://doi.org/10.3390/en16186432