Abstract

In recent years, important regulatory changes have been introduced in Spain in the fields of self-consumption and energy tariffs. In addition, electricity prices have risen sharply, reaching record highs in the last year. This evidences the need to conduct new research studies in order to provide an accurate picture of the profitability of battery energy storage systems and photovoltaic systems. This paper proposes a complex simulation tool developed to assist in the optimal design of these kinds of facilities. The tool is used in this study to analyze the benefits of including batteries in PV systems under different self-consumption models, different consumer profiles and different locations across the country. The research results indicate that at current electricity prices, the use of batteries is less profitable than selling excess energy to the grid, unless the price of batteries drops drastically by more than 50% in all the cases analyzed. However, at current battery prices, they become a valuable resource in facilities that do not feed energy surplus into the grid.

1. Introduction

Europe is immersed in a major process of change to meet the challenges set for the coming years under the European Green Deal [1] seeking more efficient use of resources and the reduction of greenhouse gas (GHG) emissions. In this context, renewable energies such as photovoltaics (PV) are undergoing significant growth. Encouraged by the substantial reduction in the costs and subsidies associated with PV, installed capacity has increased considerably. Worldwide, cumulative PV capacity exceeded 942 GW in 2021, while in Spain installed capacity has tripled in the last three years to more than 18 GW [2].

The increase in PV installations also has drawbacks [3], especially in terms of grid connection. Solar PV generation is unstable and intermittent, as it is only available during daylight and depends on weather conditions (solar irradiation, cloud cover, temperature, etc.). In the case of self-consumption PV systems, where generation exceeds demand, surplus energy can be exported to the grid, complicating grid balancing and regulation. One of the most useful strategies to address these challenges is the use of battery energy storage systems (BESS). A study conducted by Yu [4] confirms that the integration of batteries in self-consumption systems causes a lower impact on the electricity system than the injection of surplus into the grid. It also stresses the importance of a gradual transition to PV self-consumption, given the great challenge it entails for the energy system and for the agents involved in the electricity system. In addition to providing flexibility to the grid, the use of batteries increases the share of electricity locally produced that is consumed by the user (self-consumption) and the share of demand that is supplied by the energy produced (self-sufficiency) [5]. The issue is that the cost of the battery increases the investment and can considerably affect the profitability of the installation [6]. However, in recent years batteries have experienced a significant drop in prices due to the rapid development of the electric vehicle industry [7], making batteries one of the most promising solutions to drive the use of renewable energies. In Spain, the installed storage capacity in 2020 was 8.3 GW, including pumped hydro storage, batteries and thermal storage systems. In addition, the national storage strategy contemplates reaching 20 GW in 2030 and 30 GW in 2050 as a commitment to achieve climate neutrality [8].

The profitability of BESSs depends not only on the battery cost but also on the policy and regulations of each country and the electricity cost to a large extent [9]. In Spain, electricity prices have increased drastically in recent years. In relation to 2018 and considering the data available up to November 2022, the annual average market price of electricity has risen by more than 200% [10]. Therefore, in order to properly size a self-consumption system and determine the real viability of hybrid PV and BESS systems, it is necessary to carry out an optimization process not only from a technical point of view but also from an economic point of view.

This paper seeks to analyze how beneficial the use of batteries is in PV self-consumption installations in Spain under current electricity prices. To this end, a complex simulation tool was developed to analyze the behavior of self-consumption PV systems on an hourly basis during long periods. The tool was used to analyze the behavior of PV and battery systems working under different industrial electricity load profiles and different climate zones across the country.

1.1. Literarature Review

Many of the research studies conducted in recent years have focused on the techno-economic evaluation (T-E) of PV installations according to the self-consumption policies implemented in different countries such as Switzerland [11], France [12], Dominican Republic [13] or Portugal [14]. Especially in countries with more restrictive regulations, a change in policy can promote the profitability and growth of these kinds of systems. A study carried out by Escobar et al. [15] analyzes the regulatory framework of various EU countries, concluding that there is no uniformity in the support policies for self-consumption, so the conclusions of the research carried out in a specific context cannot be generalized.

The techno-economic feasibility studies analyzed can be classified into simulation models [6,16,17] and optimization models [18,19] according to the PV system dimensioning approach. There are also differences between the key performance indicators used to evaluate the solutions. Most studies focus exclusively on economic profitability, mainly through parameters such as net present value (NPV) and internal rate of return (IRR) [3,5,19,20], although some authors opt for other economic parameters such as return on investment (ROI) [9], payback (PP) [11,13] or discounted payback (DPP) [21]. However, some researchers also consider that it is essential to include in the analysis other parameters such as self-consumption (SC) and self-sufficiency (SS) rates [5,22] or carbon emission reductions (CER) [23].

The residential sector has received most of the attention in the recent literature [5,9,11,13,18], but the profitability of PV systems in the commercial and industrial sectors has also been analyzed [14,16,17,23,24]. Olivieri et al. [23] studied the potential of distributed photovoltaic generation on a university campus, focusing on electricity generation, carbon emission reduction and economic feasibility. The techno-economic analysis of Villar et al. [14] reveals the impact of tariff and demand pattern on the profitability of PV systems, especially in the industrial sector. Their study includes real demand profiles of different sectors (residential, hotel and industrial consumers) and diverse locations. Campana et al. [24] investigated the benefits of lithium-ion batteries in the commercial sector by considering irradiation from three locations in different climatic zones. Their results indicate that, at the prices considered, battery integration is not profitable in any of the locations and identify battery capacity, battery price and electricity price as the most sensitive parameters for NPV.

Concerning storage systems, lithium-ion and lead–acid batteries are the most widely used in the PV sector [25]. In particular, the most recent studies reveal that lithium-ion batteries are more viable from a technical–economic point of view due to their longer life cycle, higher efficiency, higher energy and power density and lower cost [9,26]. Some authors support alternative technologies and analyze the feasibility of storage systems with hydrogen batteries [19,27,28] or even reused batteries from electric vehicles [17,29,30].

In the Spanish context, many of the studies are currently outdated due to recent changes in energy policies. However, the latest literature shows a paradigm change with the new legislation [20,21,22,23]. A study conducted by Wuebben and Peters [20] calculates the efficiency of different solar arrays without energy storage using actual load and generation profiles in the residential sector. The work of Fernández et al. [21] evaluates the profitability of residential PV self-consumption in Spain using the demand and PV production profiles for an average dwelling as a reference. Research conducted by Gallego-Castillo [22] shows a regional analysis of optimal storage systems and self-consumption installations in the residential sector using 2018 electricity prices. Olivieri et al. [23] analyze the profitability of a PV system for a large consumer such as a university campus, but do not consider the inclusion of a storage system. These studies provide very interesting findings, but even so, important research gaps have been identified. Most of the studies are focused on the residential sector and are limited to small consumers with small PV installations. A single consumption profile is also often considered representative of the entire sector, and, in many cases, consumption averages or statistics are used instead of actual profiles. In addition, considering the diversity of climatic zones in Spain, PV output levels can be very different from one location to another. Therefore, it is not possible to reach generalizable deductions considering a single location. Additionally, many of the studies do not consider storage systems, which become more attractive in the current context of energy prices. The novelty of this article lies in the fact that the analysis is conducted in the industrial sector under the context of the new Spanish regulation and at current electricity prices; considering different consumption profiles and different locations; using real consumption data instead of statistics or averages; and analyzing the profitability of including storage systems.

1.2. Spanish Regulation

Spanish regulation was one of the most restrictive in the EU in terms of self-consumption until 2018 [15]. The entry into force of RD 900/2015 2015 meant a new tax for self-consumption facilities that wanted to remain connected to the grid. As a result, the Spanish market became less attractive, thereby slowing the growth of PV installations in comparison with other countries [8]. However, the entry into the force of the current legislation, regulated by RD-L 15/2018 and RD 244/2019, meant great advances for self-consumption. One of the main novelties is the elimination of the aforementioned tax, thereby allowing economic remuneration for surplus energy injected to the grid. Also noteworthy is the introduction of collective self-consumption. This is a major advance for energy communities, making it possible to share the energy generated among several connected consumers. Another interesting change is the elimination of the nominal power limit for self-consumption facilities. What is now allowed is the installation of a PV system with a higher nominal power than the maximum power set in the contract with the electricity provider company.

On the basis of PV energy surplus, the legislation contemplates two types of self-consumption: self-consumption without surplus and self-consumption with surplus. Self-consumption without surplus does not include the injection of energy into the grid, so the energy not consumed is lost. Moreover, self-consumption with surplus consists of injecting unconsumed energy into the transportation and distribution network, thereby obtaining either a monetary compensation or a credit to offset the electricity consumed.

In the economic framework, June 2021 represented a change with the entry into force of the new energy tariffs. In Spain, consumers can choose between setting a price with the electricity provider company or taking advantage of the price set by the government—the PVPC (Voluntary Price for Small Consumers). The biggest change for small consumers is the elimination of the three available tariffs (2.0A, 2.0DHA and 2.0DHS) to group them into a unified tariff, called 2.0TD. This tariff features three periods of hourly discrimination by consumption and two by power. In addition, the 3.0A tariff becomes 3.0TD with six power and energy periods instead of three. For medium consumers, the 3.1A tariff disappears and is integrated into the 6.1TD and 6.2TD tariffs, corresponding to medium and high voltage, respectively, both with six power and energy periods. For large consumers at high voltage above 72.5 kV, tariffs 6.3TD and 6.4TD remain unchanged. In any case, the new pricing structure introduces changes in the schedules of consumption and power periods for all tariffs.

The major changes that the regulation of self-consumption and the mechanisms for calculating electricity prices in Spain have undergone evidence the need to update the analysis techniques currently in use. A simulation and optimization tool was developed within the framework of this research in order to analyze the economic feasibility of BESS in PV systems. This tool is valid for any type of user and sector, but this study focuses on the industrial sector, considering that it has received very limited visibility in the recent literature.

2. Materials and Methods

This paper introduces a complex tool developed to assist in the design process and evaluate the performance of PV systems and BESS. This research seeks to update and improve existing techniques taking into account the major changes that the Spanish market recently underwent in terms of regulations and energy prices.

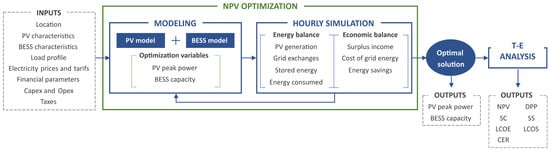

In order to carry out the economic profitability analysis, modeling simulation and optimization models were developed and implemented in the tool following the procedure detailed in Figure 1. The proposed approach evaluates a set of technical and economic indicators based on parameters such as the location of the installation, the user’s consumption profile, the characteristics of the PV and BESS elements, the electricity prices and the Capex and Opex, among others.

Figure 1.

Optimization process implemented in the developed tool to design, simulate and assess PV systems comprising BESS.

The optimal sizes for the PV system and the BESS are determined in an iterative process. Different combinations are modeled and tested, and the hourly performance of all combinations is evaluated over the estimated 25-year life cycle of the system. For determining the optimal system, NPV is examined according to three different self-consumption models: (i) self-consumption without surplus; (ii) self-consumption with surplus; and (iii) self-consumption with surplus requiring a minimum self-consumption rate. On the basis of each model, the hourly electricity usage is analyzed by considering the electricity demand, PV generation and battery status. Finally, the result is a set of economic and technical indicators that provide information about the profitability and feasibility of the optimal installation for the considered scenario.

2.1. PV Generation

PV generation is estimated based on data extracted from PVGIS—a web-based tool developed at the European Commission Joint Research Centre. This tool provides the hourly PV output per kWp of installed peak power for a year, accounting for the location of the installation, solar radiation, ambient temperature, module temperature, the characteristics of the PV panels (technology, tilt and orientation) and the system energy losses. The default parameters used in the developed tool for the calculation of PV production are detailed in Table 1.

Table 1.

PV system parameters used in the simulation process.

PVGIS estimates PV production using one year of weather data. Selecting the data of the last year by default may lead to inaccurate results if a year with anomalous temperature and irradiation for the location studied is used. A specific procedure was adopted in this research to avoid the use of poorly representative data. This procedure consists of analyzing the PV production per kWp for each available year in PVGIS and choosing the closest year to the average in terms of the number of peak sun hours.

2.2. BESS Charge Strategy

The strategy used to simulate battery operation considers the current state of the battery, the electricity demand and the PV generation. Priority is given to the self-consumption of the energy produced. If production exceeds demand, the surplus is used to store energy. Once the battery is fully charged, depending on the self-consumption model, the electricity that is not consumed or stored is either discarded or fed into the grid. When PV generation is not sufficient to meet electricity demand, stored energy is used first and, if not available, electricity is supplied from the grid.

Over time and with use, batteries lose capacity and the amount of charge the battery can supply decreases. This is taken into account in the battery performance model through two parameters: the average annual capacity loss and the average annual performance loss. In addition, the efficiency and maximum power at which the process is carried out and the associated depth of discharge according to the type of battery are considered for each charge and discharge cycle. The life cycle of the batteries is also an influential parameter. Batteries often have shorter life cycles than other elements of the installation, such as PV panels. Manufacturers often limit the durability of batteries to a number of cycles or a number of years of use, even if the established safety limits are respected. Therefore, it is necessary to consider a possible replacement in the techno-economic feasibility study depending on the temporal scope of the study. Table 2 shows the parameters that the developed tool includes by default related to the BESS system based on the updated data provided by the manufacturers.

Table 2.

Storage system parameters included in the simulation process.

2.3. Load Profile

The developed tool can be applied considering the actual consumption profile of the user or based on typical user profiles. However, real data should be used to ensure truly accurate and useful results when assessing the feasibility of a potential facility. In any case, an hourly load profile is essential to determine the hourly energy exchanges with the grid and, therefore, the hourly monetary flows. In addition, the simulation of energy flows becomes more complex if the installation has an accumulation system. In each time interval considered, an estimate is made of the energy flows exchanged with the grid (in both directions in the case of self-consumption with surplus) as a function of PV generation, electricity demand and the state of charge of the batteries.

For the simulation of energy flows, a time interval of 1 h is used, so data with this time resolution is required. Considering that the smart meters commonly used by Spanish retailers offer data with a resolution of 15 min, the amount of data could be increased by using smaller intervals. Nevertheless, several studies show that time resolution has no significative impact on the sizing of PV and BESS systems [31,32]. Thus, using a larger amount of data would only increase the computational complexity of the problem.

2.4. Electricity Prices and Tariffs

The calculation tool uses data from the new tariff structures implemented in Spain in June 2021. Under the new tariffs, electricity prices fluctuate throughout the day based on consumer demand. Tariffs are composed of two elements: access tolls and charges. Access tolls are the prices paid by the user for the use of the grid, while charges correspond to the rest of the regulated costs not induced by consumers when they demand power or energy. All tariffs have a price differentiation in periods for both energy and contractually agreed maximum power. The hourly distribution varies depending on whether it is a working day or a weekend or holiday. Some tariffs also vary according to the month of the year. These changes in tariffs are meant to encourage users to reduce their consumption during the hours of maximum electricity demand (peak hours) and shift it to hours when the distribution networks are usually less saturated (off-peak hours). To this end, peak hours are usually priced higher than off-peak hours so that users who reallocate their consumption can achieve greater savings on their bill.

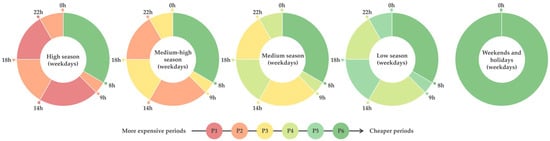

All tariffs currently available in Spain are included in the calculation tool along with their corresponding time periods and their respective prices. Considering that this research is mainly focused on the industrial sector, it is worth highlighting the 3.0 TD tariff, which is common in small- and medium-sized industries. It is a tariff, with six time periods for energy and six for power, applied according to the electrical seasons (high, medium–high, medium and low) and according to the time and the day of the week (weekends and holidays are discriminated), as detailed in Figure 2.

Figure 2.

Energy and power periods for the 3.0 TD tariff. The price of electricity is discriminated according to electrical seasons (high, medium–high, medium and low), the day of the week and the time of day. (High season: January, February, July and December; medium–high season: March and November; medium season: June, August and September; and low season: April, May and October).

2.5. Financial Parameters

The economic analysis process assumes a set of financial parameters in line with the current economic and financial situation. The simulations are run for an estimated project lifetime of 25 years, considering the discount rate, the CPI, the VAT and the electricity rate listed in Table 3. In addition, in the operating model, in which surplus energy is fed into the grid, the generation toll and the remuneration to the system operator for that energy are also applied.

Table 3.

Financial parameters assumed in the simulation process.

Equipment acquisition costs are also accounted for in the economic simulation process. The costs of the PV installation and BESS are not considered constant. These vary depending on the installed peak power and the BESS capacity, respectively, considering the economy of scale effect. The price of PV ranges from 2850 EUR/kW for small installations to 725 EUR/kW for the largest facilities. Similarly, storage systems can range from 1000 EUR/kWh to 380 EUR/kWh. It should be noted that the PV investment costs include not only the panels but also the inverter and the structure for the PV panels. Annual operating and maintenance costs are also included in the analysis and are applied in relation to the initial investment. Furthermore, for the storage system, not only the cost of the initial investment is accounted for but also the costs related to the replacements required during the lifetime of the project, given the shorter lifetime of the batteries.

2.6. Performance Indicators

The indicator analyzed to identify the optimal configuration of PV and BESS system is the NPV, calculated according to the following expression:

where is the savings achieved with the system, i.e., the difference between the bill before and after installing it; and represent the investment costs of the PV panels and the storage system; indicates the year within the -year estimated life of the project; and and are the discount rate and CPI, respectively, to account for money depreciation and price increases.

The DPP is also an interesting parameter for evaluating profitability because it indicates the time required to recover investments.

From a technical point of view, other metrics used to evaluate system performance are the SC rate, the SS rate and the reduction of carbon emissions. The CER is a parameter directly related to the PV energy produced that is self-consumed by the user. The SC and SS rates are calculated according to the energy generated by the PV system (), the part of this energy that is consumed directly by the user ( and the total energy consumed ().

Although not a subject of analysis in this research, the developed tool also determines the levelized cost of energy (LCOE) and the levelized cost of storage (LCOS), as these are valuable financial parameters for assessing the profitability of PV and BESS projects.

2.7. Self-Consumption Models

In this research, different self-consumption models are analyzed according to the needs of different prosumer profiles:

- Model 1. Self-consumption without surplus: In this self-consumption model, the excess energy is discarded, so no profits are generated from it. This is more usual than would be expected in Spain, especially in the industrial sector. Bureaucratic problems often make surplus sales unattractive or even unfeasible.

- Model 2. Self-consumption with surplus: This model consists of exporting surplus energy that is not consumed to the grid, with consequent economic remuneration. This model offers great economic potential in the current scenario, in which energy prices have risen considerably and, therefore, also the prices of surplus energy. However, it is also the self-consumption model with the highest risk against a possible decrease in electricity prices and surplus compensation.

- Model 3. Self-consumption with surplus requiring a minimum self-consumption rate: This model is similar to the previous one but with the variation that a minimum self-consumption rate of 70% is set. This rate is introduced with a dual purpose. On the one hand, in order to access subsidies, it is common in Spain to limit the maximum PV production based on electricity consumption to prevent oversized installations. On the other hand, although the expected benefits of this measure with the current price scenario are potentially lower, it also reduces the external risks and ensures that the investment will be recovered in a reasonable time.

The tool used in this research limits installed PV power to 100 kWp for bureaucratic reasons. Installations larger than this size are not allowed to obtain a credit to offset electricity demand and must sell excess energy directly to the market, acting as electricity producers. In small industries, PV systems are not installed on a utility scale to sell the energy produced but rather to limit dependence on the grid and stabilize electricity costs, with the consequent economic savings that this entails. This is especially relevant in the current scenario, given the great uncertainty caused by the fluctuation of electricity prices in recent years.

The maximum storage capacity is also limited to 100 kWh to avoid excessive cost installations. Although large installations may provide significant economic benefits when discounts are applied, the related investment costs may be unaffordable for the type of consumer considered in this research.

3. Data Description

The developed analysis method is applied to different consumers and locations to evaluate the profitability of PV systems and storage systems in the current framework in Spain. In a general study, selecting a single location may lead to non-generalizable results, given the climatic diversity of the Spanish geography. In fact, on the basis of irradiation levels, Spain can be classified into five different climatic zones. In this study, prosumers are moved through the locations specified in Figure 3 to test the influence of irradiation on the profitability of PV installations and BESS.

Figure 3.

Irradiation map of Spain indicating the analyzed locations. Adapted from [33].

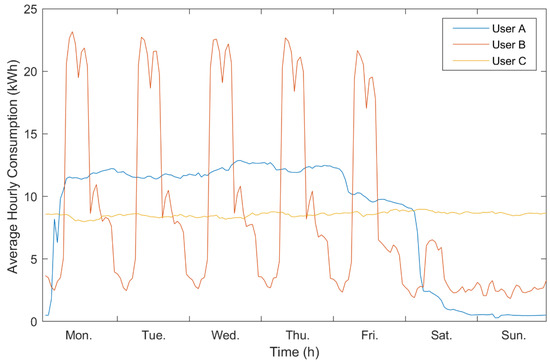

The dataset used contains hourly consumption data for the entire year of 2019. These data come from real users, specifically from small- and medium-sized industries, since this study focuses on the industrial sector. Considering that within this sector, consumption habits can be very different and can lead to very diverse results, three consumers with different load profiles were selected. The main characteristics of these consumers and their load curves are shown in Figure 4. Consumer C uses a relatively constant amount of electricity throughout the year and throughout the week. This consumer has similar consumption on weekdays, weekends, holidays and even at night. Consumer A, instead, is mainly active during weekdays, reducing their consumption drastically on weekends. The particularity of this consumer is that they also show remarkable activity during weekday evenings. Consumer B is not active at night or on weekends.

Figure 4.

Weekly load hourly profile of the users included in the study.

The consumption profiles are scaled so that the annual electricity demand is the same for all three consumers. This makes it easier to identify how the hourly consumption profile influences the results.

The electricity tariff used in this study is 3.0 TD, divided into six periods for energy and power, as detailed in Figure 2. For each period, the price shown in Table 4 is assumed. For energy surplus, the remuneration considered is 0.11 EUR/kWh. Electricity and energy surplus prices have been selected by comparing the prices offered by different electricity provider companies for the 3.0 TD tariff.

Table 4.

Price of energy for each 3.0 TD tariff period.

4. Results

This section presents and discusses the outcomes of this research. After simulating all the possible combinations of PV Power and BES capacity, the optimal installation for each user in each location is obtained—understanding optimal installation as the one that maximizes the NPV. Table 5 shows the optimal power and capacity and other results from the simulation, for each user, location and self-consumption model. In addition, the simulations are carried out four times, for different reductions in the price of the batteries (0%, 25%, 50% and 75%), in order to identify what is the necessary reduction in the price of the battery to make it be profitable.

Table 5.

Results of the techno-economic simulation and optimization process. (BESS price red.: BESS price reduction; Loc: location; PV: peak PV power; BES: BES capacity; NPV: net present value; DPP: discounted payback period; SC: self-consumption rate; SS: self-sufficiency rate; and CER: carbon emission reduction).

4.1. Self-Consumption without Surplus (Model 1)

As can be seen in Table 5, when surplus energy is discarded, the optimal system requires the use of batteries for practically all consumers and locations. Consumer A can be singled out because in two of the locations analyzed, the maximum economic profitability is achieved without batteries. However, if the locations of this consumer are compared, it can be observed that batteries allow increasing both self-consumption and self-sufficiency rates. This consumer also shows a different behavior from consumers B and C in that, despite having equal annual consumptions, the optimal solutions for all locations require smaller PV installations. This is due to the greater difference between the hourly profile of consumption and generation. In turn, consumers B and C stand out for their higher economic returns, which include larger installations in terms of PV peak power and storage system capacity. However, due to the investment required for these consumers, the payback periods are similar to consumer A, ranging from 6 to 9 years depending on the location.

For consumers B and C, locations with higher annual irradiation require lower installed power, given the greater use of the solar resource. It also highlights that optimal solutions in these scenarios require higher storage capacity due to the higher energy production. An exception is consumer A, which in location 3, the optimal solution requires a higher installed power than the other locations, but only because this solution also includes a storage system, making it possible to store energy from excess production.

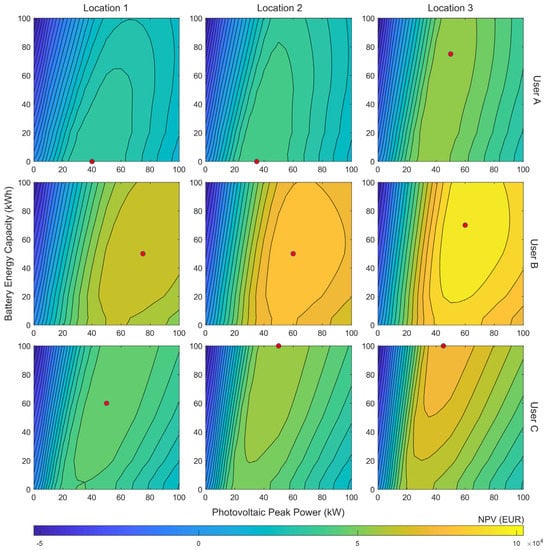

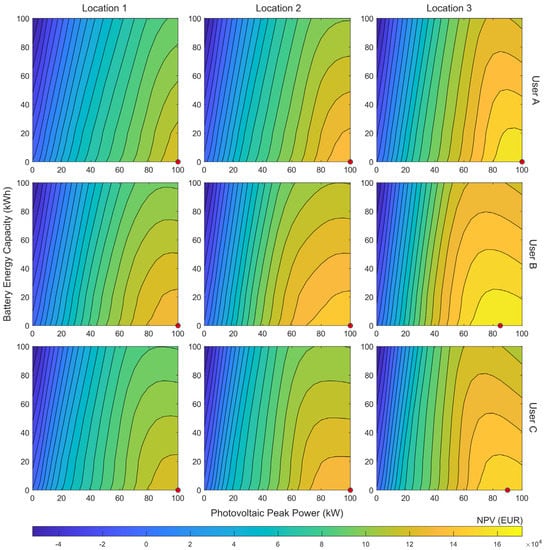

Figure 5 shows the results discussed above, comparing the economic return of different configurations of PV power and storage capacity for all locations and consumers. The red dot indicates the optimal solution for each scenario. In general, it can be seen that smaller installations—less than 10 kW—are not profitable because they provide negative values for NPV. This is due to the economies of scale; the investment is relatively higher when facilities are smaller. Regarding battery capacity, it is not feasible to install very large capacities with low PV power, as is foreseeable. This figure also shows that if consumers B and C are compared, the most profitable areas for user B correspond to smaller PV installations with higher storage capacity. This is because their consumption is very constant on a daily and weekly basis. For user B, in contrast, higher power PV installations are more convenient because most of their consumption coincides with the hours of generation. This also implies smaller batteries.

Figure 5.

NPV for different combinations of battery capacity and PV power for the users and locations analyzed using self-consumption model 1 and 0% BESS price reduction. The red dots indicate the optimal solution for each scenario.

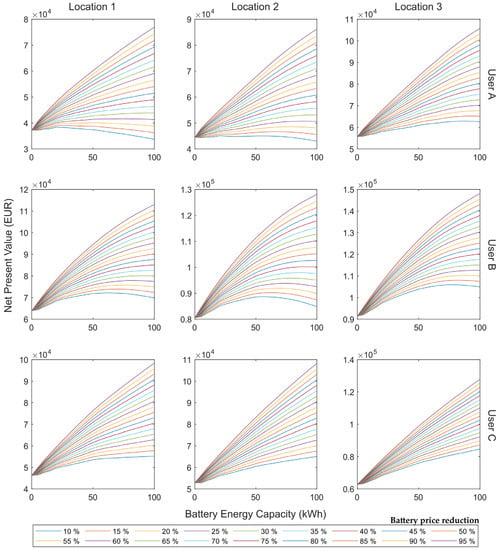

Figure 6 shows the impact of BESS prices on the optimal solution. Under this model, the reduction in prices makes it profitable to install higher capacity storage systems and also higher power PV systems because excess production can be stored and made profitable instead of being discarded. User A stands out considering that the optimal solution in locations 1 and 2 does not involve the use of storage systems. However, the figure shows that in these situations, a small price reduction of 10% makes it profitable to install a small-size battery. In addition, for some consumers and locations, because of the tool’s limitation on maximum storage, a price reduction does not lead to increases in capacity but increases the NPV and reduces the payback period. This is the case for consumer C in locations 2 and 3. Lower prices also mean increased self-sufficiency due to increased storage capacity.

Figure 6.

Optimal storage capacity according to battery prices for the users and locations analyzed using self-consumption model 1.

4.2. Self-Consumption with Surplus (Model 2)

When energy surplus is injected into the grid, batteries at current prices are not beneficial in any of the cases. However, the economic profitability increases significantly as shown in Table 5, with VPN between 125.9 kEUR and 171.5 kEUR. This is true for all consumers and locations, but logically, the profitability is higher in locations with higher annual irradiation. Compared to the previous model, both self-consumption and self-sufficiency are reduced, which means that most of the energy generated is fed into the grid and most of the demand is covered by purchased electricity. This is due to the higher installed PV power, thus, producing a greater amount of electricity, and the absence of batteries in the optimal solution. As mentioned, none of the optimal solutions include the use of storage systems due to the favorable remuneration of the energy surplus.

It should be noted that, due to the compensation received for the energy surplus, the optimal installed power in most scenarios is 100 kW, the limit set in the tool for bureaucratic reasons. This is shown graphically in Figure 7 for all consumers and locations, with the exception of location 3 for consumers B and C. In both cases, the optimum installed power is lower. This is because of the fact that this location has higher irradiation levels, so it is possible to achieve similar production with a smaller installation. In addition, the effect of how the electricity companies compensate surplus in the bill is also reflected here. When the income received for the energy surplus reaches the price of the energy consumed within a monthly billing cycle, the energy excess is not rewarded anymore, so part of the energy excess, in many cases, does not receive economic compensation, despite the fact that this energy is fed into the grid.

Figure 7.

NPV for different combinations of battery capacity and PV power for the users and locations analyzed using self-consumption model 2 and 0% BESS price reduction. The red dots indicate the optimal solution for each scenario.

Although this is a very profitable model economically, it has the disadvantage that the ratio of self-consumption is, in general, less than 30%, so most of the profits come from the sale of the energy surplus. Thus, the price dependence of the energy surplus is very high, with the uncertainty that this can generate, given the great variability of electricity prices in the last years.

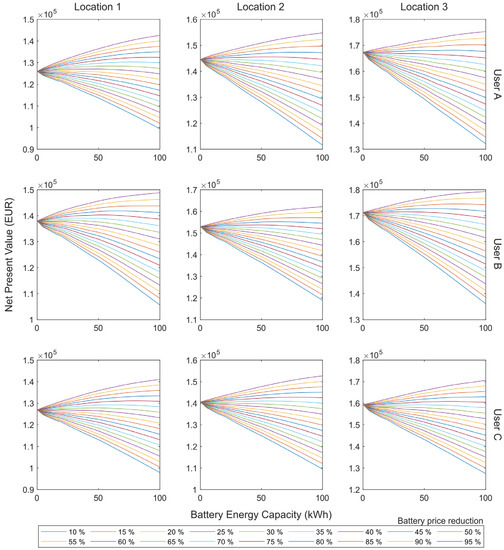

Regarding the effect of the price reduction in batteries of this model, the sensitivity analysis performed provides the results shown in Figure 8 and Table 5. In the current context and under this model, a significant price reduction of more than 50% is needed in order to be economically profitable to include storage systems in the PV installation. It can be noticed that it is economically more cost-effective to sell the energy than to store it for later consumption. The results show that, with the exception of consumer A, the introduction of storage systems leads to a slight reduction in installed PV power due to the increased use of the energy produced to satisfy the user’s consumption.

Figure 8.

Optimal storage capacity according to battery prices for the users and locations analyzed using self-consumption model 2.

When comparing the locations, it is noticeable that larger reductions are necessary to observe a change in trend in the sensitivity analysis in the locations with higher irradiation. In addition, it is noteworthy that in these locations, higher NPV values are achieved with smaller installations in terms of PV power and storage capacity.

4.3. Self-Consumption with Surplus Requiring a Minimum Self-Consumption Rate (Model 3)

Model 3 arises to limit the dependence of the profitability of the installation on the prices of electricity surplus in relation to model 2. By introducing a minimum self-consumption ratio, the direct consumption of the energy generated is encouraged. The main disadvantage of this model is the reduction in economic profitability for all consumers and all locations, as shown in Table 5. This is because the method to increase self-consumption is by using storage systems. However, this is a more conservative solution because the benefits are less dependent on energy market fluctuations.

In relation to the consumers, user A stands out. Due to the particularity of their load curve, with high consumption during low generation hours, in order to achieve a high self-consumption rate, it is necessary to increase storage capacity. The ratio between PV and storage size is around 3 kWh/kW, while for the other consumers, it is around 2 kWh/kW. For consumers B and C, the rate of self-sufficiency is also increased with respect to model 2. The exception is consumer A, for which the self-sufficiency rate drops due to a significant reduction in generation as a result of an 80% reduction in installed capacity, while for the other consumers it remains at around 50%.

In terms of locations, location 3 is the least economically disadvantaged by this limitation due to the greater use of the solar resource.

Under this scenario, the reduction in battery prices leads to an increase in economic profitability and a reduction in the payback period. However, it does not significantly affect the capacity and power of the optimal solution. For consumers A and B, a 25% reduction is enough to reach the maximum optimal storage, while for consumer C it is necessary to reduce prices by 50–75% depending on the location.

5. Conclusions

This research introduced a complex simulation tool that assisted in the design of an optimal PV system under different operating conditions. The methodology developed was applied to a set of consumers and locations to evaluate the profitability of BESS systems under the current regulatory and electricity price context in Spain. The following conclusions can be drawn:

- When the consumer does not receive economic compensation from the energy surplus, batteries are profitable for most of the cases. In seven of the nine cases analyzed, the optimal PV system includes batteries. Under these conditions, BESSs are profitable, even at current battery prices, but a price reduction implies increases in installed capacity and economic returns.

- When the consumer receives economic compensation from the energy surplus, batteries are not economically attractive in any of the cases. A drastic price reduction of more than 50% is needed in order for batteries to become profitable.

- When a minimum self-consumption rate of 70% is set as a requirement, the optimal PV system includes batteries for all the cases studied. Using this model, profitability and installed capacity increase as prices are reduced.

Thus, in the current context in Spain, a drop in the price of batteries or access to subsidies is needed for them to be beneficial in those cases where the consumer can sell the excess energy to the grid. However, as a consequence of rising electricity prices, batteries have become a very valuable resource in installations that do not feed surpluses into the grid, even if access to subsidies is not possible.

Author Contributions

Conceptualization, F.E.C., A.O.-M. and P.D.G.; data curation, P.D.G.; funding acquisition, P.C.O.; Investigation, F.E.C. and A.O.-M.; methodology, F.E.C. and P.D.G.; software, F.E.C. and P.D.G.; supervision, F.E.C. and P.C.O.; validation, P.D.G.; writing—original draft, F.E.C. and A.O.-M.; writing—review and editing, A.O.-M. and P.C.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by CERVERA Research Program of CDTI, the Industrial and Technological Development Centre of Spain, through the Research Projects HySGrid+ (grant number CER-20191019) and CEL.IA (grant number CER-20211022).

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- European Commission. The European Green Deal; European Commission: Brussels, Belgium, 2019; Volume 53. [Google Scholar]

- Jäger-Waldau, A.; Donoso, J.; Kaizuka, I.; Masson, G.; Bosch, E.; IEA PVPS Reporting Countries; Becquerel Institute (BE). Snapshot 2022—IEA-PVPS. EPJ Photovoltaics 2022, 13, 9. [Google Scholar] [CrossRef]

- Ópez Prol, J.; Steininger, K.W. Photovoltaic Self-Consumption Is Now Profitable in Spain: Effects of the New Regulation on Prosumers’ Internal Rate of Return. Energy Policy 2020, 146, 111793. [Google Scholar] [CrossRef]

- Yu, H.J.J. A Prospective Economic Assessment of Residential PV Self-Consumption with Batteries and Its Systemic Effects: The French Case in 2030. Energy Policy 2018, 113, 673–687. [Google Scholar] [CrossRef]

- Ciocia, A.; Amato, A.; di Leo, P.; Fichera, S.; Malgaroli, G.; Spertino, F.; Tzanova, S. Self-Consumption and Self-Sufficiency in Photovoltaic Systems: Effect of Grid Limitation and Storage Installation. Energies 2021, 14, 1591. [Google Scholar] [CrossRef]

- Koskela, J.; Rautiainen, A.; Järventausta, P. Using Electrical Energy Storage in Residential Buildings—Sizing of Battery and Photovoltaic Panels Based on Electricity Cost Optimization. Appl. Energy 2019, 239, 1175–1189. [Google Scholar] [CrossRef]

- Mauler, L.; Duffner, F.; Zeier Cd, W.G.; Leker, J. Battery Cost Forecasting: A Review of Methods and Results with an Outlook to 2050. Energy Environ. Sci. 2021, 14, 4712. [Google Scholar] [CrossRef]

- Fotovoltaica, U.E. Energía Solar Fotovoltaica, Oportunidad Para La Sostenibilidad —Informe Anual UNEF 2021; Unión Española Fotovoltaica (UNEF): Madrid, Spain, 2021. [Google Scholar]

- Zakeri, B.; Cross, S.; Dodds, P.E.; Gissey, G.C. Policy Options for Enhancing Economic Profitability of Residential Solar Photovoltaic with Battery Energy Storage. Appl. Energy 2021, 290, 116697. [Google Scholar] [CrossRef]

- OMIE. Available online: https://www.omie.es/ (accessed on 1 December 2022).

- Han, X.; Garrison, J.; Hug, G. Techno-Economic Analysis of PV-Battery Systems in Switzerland. Renew. Sustain. Energy Rev. 2022, 158, 112028. [Google Scholar] [CrossRef]

- Grover-Silva, E.; Girard, R.; Kariniotakis, G. Optimal Sizing and Placement of Distribution Grid Connected Battery Systems through an SOCP Optimal Power Flow Algorithm. Appl. Energy 2018, 219, 385–393. [Google Scholar] [CrossRef]

- Garabitos Lara, E. Techno-Economic Model of Nonincentivized Self Consumption with Residential PV Systems in the Context of Dominican Republic: A Case Study. Energy Sustain. Dev. 2022, 68, 490–500. [Google Scholar] [CrossRef]

- Villar, C.H.; Neves, D.; Silva, C.A. Solar PV Self-Consumption: An Analysis of Influencing Indicators in the Portuguese Context. Energy Strategy Rev. 2017, 18, 224–234. [Google Scholar] [CrossRef]

- Escobar, P.; Martínez, E.; Saenz-Díez, J.C.; Jiménez, E.; Blanco, J. Profitability of Self-Consumption Solar PV System in Spanish Households: A Perspective Based on European Regulations. Renew. Energy 2020, 160, 746–755. [Google Scholar] [CrossRef]

- Litjens, G.B.M.A.; Worrell, E.; van Sark, W.G.J.H.M. Economic Benefits of Combining Self-Consumption Enhancement with Frequency Restoration Reserves Provision by Photovoltaic-Battery Systems. Appl. Energy 2018, 223, 172–187. [Google Scholar] [CrossRef]

- Bai, B.; Xiong, S.; Song, B.; Xiaoming, M. Economic Analysis of Distributed Solar Photovoltaics with Reused Electric Vehicle Batteries as Energy Storage Systems in China. Renew. Sustain. Energy Rev. 2019, 109, 213–229. [Google Scholar] [CrossRef]

- Schopfer, S.; Tiefenbeck, V.; Staake, T. Economic Assessment of Photovoltaic Battery Systems Based on Household Load Profiles. Appl. Energy 2018, 223, 229–248. [Google Scholar] [CrossRef]

- Zhang, Y.; Campana, P.E.; Lundblad, A.; Yan, J. Comparative Study of Hydrogen Storage and Battery Storage in Grid Connected Photovoltaic System: Storage Sizing and Rule-Based Operation. Appl. Energy 2017, 201, 397–411. [Google Scholar] [CrossRef]

- Wuebben, D.; Peters, J.F. Communicating the Values and Benefits of Home Solar Prosumerism. Energies 2022, 15, 596. [Google Scholar] [CrossRef]

- Roldán Fernández, J.M.; Burgos Payán, M.; Riquelme Santos, J.M. Profitability of Household Photovoltaic Self-Consumption in Spain. J. Clean. Prod. 2021, 279, 123439. [Google Scholar] [CrossRef]

- Gallego-Castillo, C.; Heleno, M.; Victoria, M. Self-Consumption for Energy Communities in Spain: A Regional Analysis under the New Legal Framework. Energy Policy 2021, 150, 112144. [Google Scholar] [CrossRef]

- Olivieri, L.; Caamaño-Martín, E.; Sassenou, L.N.; Olivieri, F. Contribution of Photovoltaic Distributed Generation to the Transition towards an Emission-Free Supply to University Campus: Technical, Economic Feasibility and Carbon Emission Reduction at the Universidad Politécnica de Madrid. Renew. Energy 2020, 162, 1703–1714. [Google Scholar] [CrossRef]

- Campana, P.E.; Cioccolanti, L.; François, B.; Jurasz, J.; Zhang, Y.; Varini, M.; Stridh, B.; Yan, J. Li-Ion Batteries for Peak Shaving, Price Arbitrage, and Photovoltaic Self-Consumption in Commercial Buildings: A Monte Carlo Analysis. Energy Convers. Manag. 2021, 234, 113889. [Google Scholar] [CrossRef]

- De Oliveira e Silva, G.; Hendrick, P. Photovoltaic Self-Sufficiency of Belgian Households Using Lithium-Ion Batteries, and Its Impact on the Grid. Appl. Energy 2017, 195, 786–799. [Google Scholar] [CrossRef]

- Arsalis, A.; Papanastasiou, P.; Georghiou, G.E. A Comparative Review of Lithium-Ion Battery and Regenerative Hydrogen Fuel Cell Technologies for Integration with Photovoltaic Applications. Renew. Energy 2022, 191, 943–960. [Google Scholar] [CrossRef]

- Dawood, F.; Shafiullah, G.M.; Anda, M. Stand-Alone Microgrid with 100% Renewable Energy: A Case Study with Hybrid Solar PV-Battery-Hydrogen. Sustainability 2020, 12, 2047. [Google Scholar] [CrossRef]

- Komorowska, A.; Olczak, P.; Hanc, E.; Kamiński, J. An Analysis of the Competitiveness of Hydrogen Storage and Li-Ion Batteries Based on Price Arbitrage in the Day-Ahead Market. Int. J. Hydrogen Energy 2022, 47, 28556–28572. [Google Scholar] [CrossRef]

- Gur, K.; Chatzikyriakou, D.; Baschet, C.; Salomon, M. The Reuse of Electrified Vehicle Batteries as a Means of Integrating Renewable Energy into the European Electricity Grid: A Policy and Market Analysis. Energy Policy 2018, 113, 535–545. [Google Scholar] [CrossRef]

- Huang, N.; Wang, W.; Cai, G.; Qi, J.; Jiang, Y. Economic Analysis of Household Photovoltaic and Reused-Battery Energy Storage Systems Based on Solar-Load Deep Scenario Generation under Multi-Tariff Policies of China. J. Energy Storage 2021, 33, 102081. [Google Scholar] [CrossRef]

- Beck, T.; Kondziella, H.; Huard, G.; Bruckner, T. Assessing the Influence of the Temporal Resolution of Electrical Load and PV Generation Profiles on Self-Consumption and Sizing of PV-Battery Systems. Appl. Energy 2016, 173, 331–342. [Google Scholar] [CrossRef]

- Burgio, A.; Menniti, D.; Sorrentino, N.; Pinnarelli, A.; Leonowicz, Z. Influence and Impact of Data Averaging and Temporal Resolution on the Assessment of Energetic, Economic and Technical Issues of Hybrid Photovoltaic-Battery Systems. Energies 2020, 13, 354. [Google Scholar] [CrossRef]

- Huld, T.; Pinedo-Pascua, I. Global Irradiation and Solar Electricity Potential. Available online: https://re.jrc.ec.europa.eu/pvg_download/map_pdfs/G_hor_ES.pdf (accessed on 1 July 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).