Abstract

This study examined the mediating role of corporate social responsibility practices and the nexus between the operational excellence of competitive strategies, and performance, for Islamic banks operating in Pakistan. Particularly, two competitive strategies, namely, the cost-sensitive strategy and the differentiation strategy were considered. This study employed a structured questionnaire to collect the data from 512 respondents (361 from fully-fledged Islamic banks, FFIBs, and 151 from Islamic window banks, IWBs). A partial least square–structural equation modeling approach was employed to test the hierarchal component model. As a robustness check, the Gaussian copula approach was used to address the endogeneity issue, and the Partial least square prediction-oriented segmentation approach was adopted to explore the unobserved heterogeneity. The findings showed evidence of complementary partial mediation between competitive strategies and bank performance, channeled through operational excellence. However, corporate social responsibility (CSR) practices partially mediated the relationship between cost-sensitive strategy and bank performance. This study is worthwhile for managers, policy makers and regulatory authorities concerned with religiously conscious corporations.

Keywords:

competitive strategies; CSR practices; fully-fledged Islamic banks; Islamic window banks; operational excellence; performance JEL Classification:

M10; M14; L10; G21

1. Introduction

Research on competitive strategies enhancing or impeding bank performance remains an extensively debated issue, both among academics and policymakers [1,2,3,4], among others. The extant literature has documented two contending strands regarding the nexus between competition and bank performance: the competition–fragility view and the alternative competition–stability view. Abedifar, et al. [5] provided theoretical arguments on the competitive performance nexus in the case of a dual banking system. They argued that competitive pressure might be less for Islamic banks than it is for its conventional counterparts because Muslims with religious concerns would prefer Islamic to conventional finance. However, other Muslims are expected to be indifferent between the two systems.

Moreover, in the specific case of the Islamic banking industry, there is a unique competition–performance nexus between fully-fledged Islamic banks (FFIBs) and Islamic window banks (IWBs) [1,6]. The findings of Ali, et al. [1] revealed that Islamic window banks and fully-fledged Islamic banks compete with one another using the same tactics. The current study was particularly motivated by the recent research call in literature that CSR practices may differentiate firms from their competition by building reputation and gaining support from stakeholders, and, hence, enhance performance [1,7].

Our study is an attempt to test the mediating role of CSR practices and OE of the nexus between competitive strategies and performance in the context of the Islamic banking industry in Pakistan. OE practices play an important role, because OE practices help in the efficient use of resources in business operations so as to improve quality, productivity, and competitive position in the market [8]. Moreover, this study also contributes to emerging Islamic banking literature by exploring the intervening role of OE practices between competitive strategies and bank performance.

In this regard, we argue that Islamic banks might use corporate social responsibility (CSR) practices and operational excellence (OE) as tools to improve performance by taking competitive advantage in Islamic banking. CSR activities can help businesses stand out from rivals by establishing a reputation and gaining support from stakeholders, which, in turn, improves performance [7]. Firms around the globe are keen to implement CSR practices and a remarkable amount of progress has been made in the improvement of CSR practices, especially in developed economies [9]. Despite the growing progress and improvement in CSR practices in the developed countries, it is equally important for developing countries. This is because the social, political, cultural, corporate and economic conditions are quite different in developing countries compared to those in developed countries [10]. More recently, Lui, et al. [11] documented that Islamic banks disclose a higher level of CSR practices than conventional banks, which, thereby, may enhance the performance of Islamic banks.

When considering Porter’s generic theory and resource-based view, competitive strategies are always at the top, but they still need support in the shape of practices to enhance performance and gain the competitive edge [12]. The purpose of this current study was to investigate the following: First, the mediating role of CSR practices between competitive strategies and performance. We proposed that CSR practices, as long-term practices, had long-term sustainability. Second, the mediating mechanism of operational excellence between competitive strategies and performance. We proposed that operational excellence practices, as short-term practices, enhanced short term performance. Third, this study contributes methodologically. by using a more robust analysis method, with a disjoint two stage approach, for the assessment of an hierarchal component model, which is further explained in the results section [13].

2. Literature Review

2.1. Theoretical Background

This study was primarily based on the theoretical premise of the Porter [12] generic theory. These generic strategies gained ample scholarly attention and remain most extensively cited and tested [14]. Cost-sensitive strategy (CSS) and differentiation strategy (DS), two of Porter’s competitive strategies, are a set of decisions and activities that managers take to enable businesses to improve performance [12]. Firms adopt these competitive strategies because these strategies help to signify strategic position, are inheritably linked to performance, and avoid competition. Importantly, these competitive strategies enable firms to create long-term prosperity, and are, thus, future oriented. In the case of the banking industry, recent studies found that competitive strategies are significant indicators of bank performance [1,15,16].

The second guiding view is the resource-based view. Barney [17] considered *strategies as strategic assets for firms to attain competitive advantage. Furthermore, RBV recognizes a firm’s strategic resources that provide support to successfully implement strategies. Strategies always need support from different practices to gain competitive advantage [18]. For instance, extant literature considered enterprise risk management practices [1,16], high-performance human resource practices [19], total quality management practices [20], and voluntary environmental management practices [21] to be support factors in acquiring competitive edge. The present study attempted to contribute to this rich literature and considered CSR practices and OE practices as intervening factors in the nexus between competitive strategies and performance for Islamic banks. In subsequent sections, this study conducts a brief literature review regarding the direct effect of competitive strategies on bank performance. To move a step forward this study presents the mediation between competitive strategies and bank performance, channeled through CSR and OE practices.

2.2. Cost-Sensitive Strategy and Performance

Cost-sensitive strategy refers to an organization’s attempt to gain the competitive edge over counterparts by lowering its c#]=[5ost [15,22]. Existing literature identified a number of factors that drive low costs; for insta/nce, economies of scale, effective use of resources, such as budget, logistic support, material and skills, technology, suitable location (i.e., low production, manufacturing or taxation area), and value chain linkages [23].

Prior studies reported mixed findings on cost-sensitive strategy and firm performance. On the one hand, research scholars found that cost-sensitive strategy positively influenced a firm’s performance. For instance, Kankam-Kwarteng, et al. [24] explored the nexus between cost-sensitive strategy and firm performance in Ghana, for 118 small-scale restaurants. They reported an optimistic relationship between cost-sensitive strategy and a firm’s performance. Likewise, Islami, et al. [15] documented that change in cost-sensitive strategy by one unit leads to enhanced firm performance, by 31.2%. Recently, Ali, et al. [1] tested the association between cost-sensitive strategy and performance for the Islamic banking sector in Pakistan. Particularly, they investigated the impact of cost-sensitive strategy on the performance of FFIBs, and of IWBs. They found that cost-sensitive strategy positively influenced performances of both type of banks; however, cost-sensitive strategy caused slightly more performance for FFIBs than for IWBs. On the other hand, the negative impact of cost-sensitive strategy on a firm’s performance is reported. For example, Yuliansyah, et al. [25] found an adverse association between cost-sensitive strategy and a firm’s performance in the Indonesian market. Likewise, Birjandi, et al. [26] found a negative relationship between cost-sensitive strategy and return on assets in the Tehran stock exchange.

Based on the aforementioned findings we conjectured that:

Hypothesis 1.

There would be a significant and positive effect of cost-sensitive strategy on the performance of Islamic banks in Pakistan.*

2.3. Differentiation Strategy and Performance

Existing studies reported that firms usually adopt a differentiation strategy in order to gain competitive advantage over rivals [27], which in turn, significantly boosts firm performance [28]. A firm’s differentiation strategy is linked with its policies, such as decisions about materials, technology, human resources, innovative features, and brand identification [29], which are difficult for rivals to promptly imitate. A low-cost strategy can be easily imitated by rival firms. However, retaliation to a differentiation strategy, that involves research and development, would take plenty of time. In the case of a differentiation strategy, firms usually offer higher prices for their products and services to compensate for exceptional features. Therefore, we argue that differentiation strategy has a positive effect on a firm’s performance. In this regard, Soltanizadeh, et al. [30] and Islami, et al. [15] found that differentiation strategy positively influenced performance.

Recently, Ali, et al. [1] found that differentiation strategy is more useful for performance of IWBs in the Pakistani context, as compared to cost-sensitive strategy. In this regard, Ascarya and Yumanita [31] documented that profit and loss sharing modes of financing, based on Shariah principles, provide edge for non-conventional banks to implement differentiation strategy by offering inimitable operations that adhere to Islamic principles. Contrarily, Laela, et al. [32] argued that because Islamic banks are smaller than their conventional counterparts, and their consumers are price sensitive, they favor a cost-sensitive differentiating strategy [33].

We contend that, contrary to the above IWBs compete fiercely with FFIBs, which already have deep Shariah roots, and, therefore, IWBs prioritize market creation. On the other hand, FFIBs also confront competition from IWBs as they enter into the Islamic banking industry as new entrant. Thus, both types of banks use differentiation strategies to enhance their performance. We assumed that:

Hypothesis 2.

There would be a significant and positive effect of differentiation strategy on the performance of Islamic banks in Pakistan.

2.4. Competitive Strategy and Performance: The Role of CSR Practices

Porter (1980) argued that strategies always need support in the form of practices to gain competitive advantage. In a recent study, Ali, et al. [1] used enterprise risk management (ERM) practices as a mediating construct that provided support to distinguish firms from competition and enhance performance. This study argued that firms could also use CSR practices to distinguish themselves from their competitors, thereby improving performance.

CSR refers to practices and policies of firms toward comprehensive societal goods, along with profit maximization [34,35]. The extant literature categorized CSR into internal and external CSR practices and suggested that CSR is an important driver of firm performance. Internal CSR practices are directly related with the employee’s physical and psychological working environment [36], while external CSR practices are related with the local community, suppliers of firms, environment, customers and public authorities [37]. In this regard, Waheed, et al. [38] investigated the impact of both external and internal CSR practices on organizational competitive performance for the banking sector in China. They found that the competitive performance of organizations in China’s banking sector significantly correlated with both internal and external CSR. In addition, Hunjra, et al. [7] claimed that CSR practices help firms to outcompete their counterparts through reputation building and stakeholder’s support, which, in turn, enhanced firm performance. Likewise, CSR practices enhance employee’s productivity, commitment and corporate citizenship [39]. Socially responsible firms attract more customers from society which stimulates more revenues than their rivals [40]. CSR practices are an important element of competitive strategies, and are, thereby, considered as strategic investment for reputation building [41,42,43]. We assumed that:

Hypothesis 3.

There would be a significant mediating role of CSR practices between cost-sensitive strategy and the performance of Islamic banks in Pakistan.

Hypothesis 4.

There would be a significant mediating role of CSR practices between differentiation strategy and the performance of Islamic banks in Pakistan.

2.5. Competitive Strategy and Performance: The Role of Operational Excellence

Operational excellence and its influence on competitive advantage and performance have been extensively studied within the operations strategy literature [44,45]. Operational excellence (OE) refers to “the integration and coordination of a complex set of tasks” [46]. Operational excellence helps to build procedures based on the central competencies of firms that motivate them to perform beyond customer expectations [47,48]. By using these processes, firms enable cost reduction, achieve technological advancement and perform better than their rivals [48]. In a similar research stream, Andersson and Bellgran [49] suggested that operational excellence enhanced the performance of forms by reducing manufacturing costs.

Moreover, the resource-based view argues that operational excellence plays a vital role in developing and maintaining competitive advantage [50]. Since operational excellence varies for every firm and is hard for rivals to imitate, it is, thereby, a potential source of competitive advantage [51]. Furthermore, operational excellence is specific to each organization and has a favorable impact on performance through efficient input-to-output conversions [52]. Likewise, operational technologies, such as quality practices, are crucial for understanding business performance that has competitive advantage [53]. A core competency of businesses that significantly affects how well they function is the operational capacity to manage complexity inside manufacturing and logistics systems, according to research studies [54]. We conjectured that:

Hypothesis 5.

There would be a significant mediating role of operational excellence between cost-sensitive strategy and performance of Islamic banks in Pakistan.

Hypothesis 6.

There would be a significant mediating role of operational excellence between differentiation strategy and the performance of Islamic banks in Pakistan.

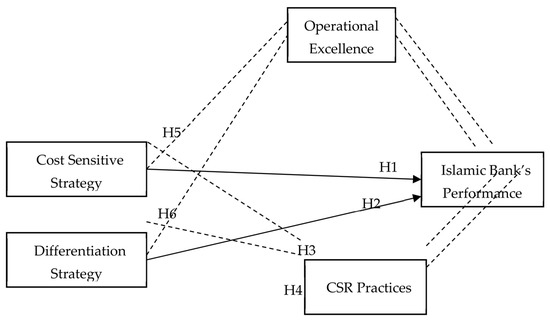

Figure 1 explains the conceptual framework of the study. The study focused on fully-fledged Islamic banks (FFIBs) and Islamic window banks (IWBs) and explains their cost-sensitive strategy and differentiation strategy. The study argues that the competitive advantage and differentiation strategies stands business higher in a marketplace. However, the amalgamation of CSR practices and operational excellence can boost the implication of mentioned strategies that would ultimately improve the bank’s performance. Therefore, CSR practices and operational excellence mediated the linkage of cost-sensitive strategies and differentiation strategies in Islamic banks.

Figure 1.

Conceptual Framework.

3. Materials and Methods

3.1. Sample Selection and Data

To examine the relationship between competitive strategies and performance channeled through CSR practices and operational excellence, data were collected from operational, branch, area and regional managers of FFIBs and IWBs. The selection of the Islamic banking industry is based on the following reasons. First, there exists a unique competition–performance nexus between FFIBs and Islamic window banks [1] that strengthens financial stability, which, in turn, is considered to have a first-order effect on economic growth [55]. According to Ali et al. [1] fully-fledged Islamic banks (FFIBs), which already have significant Shariah roots, pose a significant threat to Islamic window banks. However, the entry of Islamic window banks into the Islamic banking sector creates fresh competition for FFIBs already operating in the sector. Second, banks tend to dominate financial systems in developing economies, such as Pakistan, and so banks are the major providers of finance to companies, rather than bond markets, and, hence, the failure of banks may lead to the failure of the overall economy.

A quantitative approach was used to collect the data along with deductive reasoning. A structured questionnaire was adopted to collect the data from respondents. Pilot testing, for which a total of 40 questionnaires were distributed, was conducted before the survey questionnaire was sent to respondents. After confirmation that Cronbach’s Alpha value was more than 0.7, the study further proceeded to formal data collection. A total of 600 questionnaires were distributed among the managers of Islamic banks. The data was collected through online surveys. Furthermore, contact-wise, this study was cross-sectional in nature.

Out of these questionnaires, 519 were returned and 512 were considered suitably filled after screening and cleaning of data. For ethical considerations, the data collection procedures adopted by Johansen and Frederiksen [56] were used regarding conformity with the Helsinki declaration. Particularly, a cover letter was used to inform respondents about the scope of the study, voluntary participation, and anonymity of identity. The data were collected for the period of December 2020 to April 2021 by using a convenience sampling method [57]. A proportionate sample was obtained from FFIBs (n = 361) and from IWBs (n = 151).

3.2. Measures

Measurement scales were adapted from prior studies and validated according to the context of the study, with the help of the Creative Business and Social Research committee (CBSR) and two trainers from the State bank of Pakistan (SBP). In the case of competitive strategies, to measure Cost-sensitive Strategy, the six indicator scale developed by Porter [12] was adapted. The same scale was used in existing studies to measure Cost-sensitive Strategy [6]. In this five-Likert point scale, 1 refers to Strongly Disagree and 5 to Strongly Agree. Representative items in the questionnaire asked respondents questions, such as the following: Do Islamic banks frequently use low prices for products to remain competitive in the market? Does cost leadership strategy protect Islamic banks from competitors? To measure Differentiation Strategy, an eight item scale was adapted from [14]. This scale assesses the adoption of Differentiation Strategy and its impact on a firm’s performance. This scale has also previously been used in the Pakistani context [6].

The two intervening variables, CSR and OE practices, were measured as follows. In the case of CSR, two components of CSR (i.e., internal and external CSR practices) were used to measure CSR practices. A five item scale was adopted to measure the internal CSR practices and a three item scale to capture external CSR practices [34]. A sample of the questions respondents were asked follows: Is the bank a socially responsible organization? Is the bank concerned about improving the welfare of society? Does the bank behave responsibly regarding the environment?

In the case of OE, five components were considered to measure OE (quality, speed, cost, flexibility, and reliability). The measuring of OE was adapted from [58] and the representative items, for each of the five components respondents were asked about, follow. In the case of operational quality, sample items respondents were asked follow: Does the bank seek to deliver value adding products or services of improved quality? Does the bank demonstrate commitment to quality? Regarding operational speed, a sample question that respondents were asked was the following: Does the bank ensure that it delivers services/products on time? In the case of operational cost, sample questions were: Is it important to make communication cost efficient? Is it important to keep the cost of services at a minimum? For operational flexibility, the sample questions were: Can the bank easily change procedures required for a service? Can the bank offer better customized services/products? Similarly, for operational reliability, the representative questions were: Do the bank’s processes consistently perform as expected? Do the products/services meet customer requirements?

The dependent variable, Bank Performance, was captured in terms of both financial and non-financial performances, as used by Ali, et al. [6]. Both financial performance and non-financial performance measures were captured by using scales having eight items, respectively. The representative questions asked from respondents about financial performance were based on growth in profitability, return on investment and return on equity. The representative questions about non-financial performance were based on quality of products and employment growth etc.

Finally, the latent marker variable (MLMV) at construct level correction (CLC) was used to test for bias in the study [59]. To this end, Social Desirably (SD) was used as an additional construct to create the marker variable which was completely unrelated in regard to the context of study. The SD was measured with a seven item scale [60].

4. Results

This study used partial least square–structural equation modeling (PLS-SEM), using SmartPLS 3.3.3 for measurement and structural assessment. PLS–SEM is the most suitable method for complex models, which include mediator, moderator and hieratical component (HCM) models [61,62,63]. To ensure minimum sample size adequacy, G*Power was used to calculate the minimum sample size [64]. The results of G*power showed that a minimum sample size of 77 was required to achieve 0.80 power level, 0.05 significance level, and an absolute effect size of 0.15. Hence, this study collected data from 512 respondents, which confidently satisfied the minimum sample requirement to test theoretical framework.

Moreover, demographic characteristics, such as bank type, designation, experience, and qualifications, were also included. The sample comprised 70.5% respondents from FFIBs and 29.5% from IWBs; in accordance with designations of 40.6% operational, 51.8% branch, 5.7% area and 2.0% regional managers. Regarding years of experience in banking, 30.5% of respondents had 1–5 years of experience, 13.7% had 5–10 years of experience, 10.6% had 11–15 years and 1.2% had 16–20 years of experience in the banking sector. Regarding education, 20.6% of respondents had a B.com/B. A degree, 32.7% had an MBA/MS/M.Phil. degree, and 2.7% had an ACCA/CA degree.

4.1. Preliminary Analysis

To take into account missing values and potential outliers, the mean replacement method was used. Moreover, by following, [65], the measured latent marker variable method (MLMV) at construct level correction (CLC) was employed to assess the common method bias in the data. The MLMV at CLC method is robust for the assessment of common method biased at structural level paths. In data collection, an additional construct, social desirability, was also included for the assessment of common method bias by using the MLMV–CLC method [59]. We ensured that there was no nomological nexus of social desirability with other constructs. The minimum indicators were four and social desirability was included separately in structured survey questionnaires.

Table 1 presents the results. The results of the MLMV–CLC method revealed that the CLC path coefficient and R2 estimates were not significantly different from the original estimates using the bootstrapping procedure. In this method, we compared results before including a marker construct and without a marker construct. The effect sizes were 0.02 for a modest effect, 0.15 for a medium effect, and 0.35 for a high effect, respectively [66]. The difference between the original and MLMV–CLC estimates was <0.02 which showed no significant difference. Thus, we concluded that common method bias was not a potential issue impacting the results of this study.

Table 1.

Measurement Latent Marker Variable–Construct Level Correction.

To assess the fitness of the model, standardized root mean square (SRMR) was used [67]. Specifically, SRMR reflects any mean discrepancy between the empirical correlation matrix and the model-implied correlation matrix. In our study, the SRMR value observed was 0.051, below the threshold of 0.08 [67]. Hence, the insignificant result for discrepancy between correlation matrix and postulated matrix suggested that the model was perfectly fit.

4.2. Assessment of Measurement Model

The framework of the current study entailed three second order reflective–formative constructs, namely CSR practices, operational excellence, and bank performance. In addition, two other reflective constructs were considered, namely, cost-sensitive strategy and differentiation strategy. In hierarchical component models, CSR practices include two reflective dimensions (internal and external CSR practices). Moreover, operational excellence dimensions include quality, speed, cost, flexibility, and reliability as reflective dimensions. Bank performance includes financial and non-financial performance constructs.

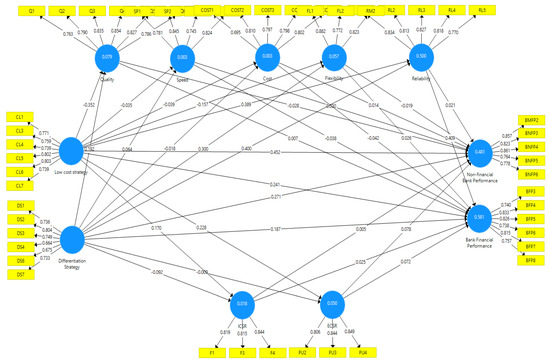

By following Becker at al. (2012), we also applied disjoint two stages for model assessment and structural model assessment. In the first stage, the measurement model, comprised of eleven first-order reflective constructs (cost-sensitive strategy, differentiation strategy, internal CSR practices, external CSR practices, quality, speed, cost, flexibility, reliability, financial bank performance and non-financial bank performance) were used to measure the reliability and validity [68], as shown in Figure 2. Table 2 presents the results of Cronbach alpha, Dijkstra rho, and composite reliability. The results showed that the values of the three mentioned parameters were greater than the 0.7 threshold value [68]. In addition, the value of average variance extracted (AVE) was greater than 0.50 [69], which was considered a good fit. Thus, reliability and convergent validity of the framework were established and were consistent with extant literature [70]. Conclusively, there were no internal consistency and convergent validity issues, so the research could move forward to the assessment of discriminant validity.

Figure 2.

Measurement Model Assessment.

Table 2.

Reliability and validity.

In the case of establishing discriminant validity, existing studies adopted two approaches: the Fornell and Larcker criterion, introduced by Fornell and Larcker [71], and the Heterotrait–Monotrait (HTMT) ratio, presented by [72]. The partial least square method tends to overestimate the outer loading values, and the Fornell and Larcker method is based on the square root of AVE values. However, the sensitivity remains low regarding homogeneous outer loadings. In order to deal with the sensitivity issue, this study employed the HTMT ratio to establish discriminant validity. Table 2 presents the results. Two approaches, namely, liberal (HTMT0.90) and conservative (HTMT0.85), were applied for the assessment of discriminant validity. The HTMT value of all constructs was lower than the cutoff point of the conservative approach. Hence, the results established no discriminant validity issue based on the HTMT0.85 ratio.

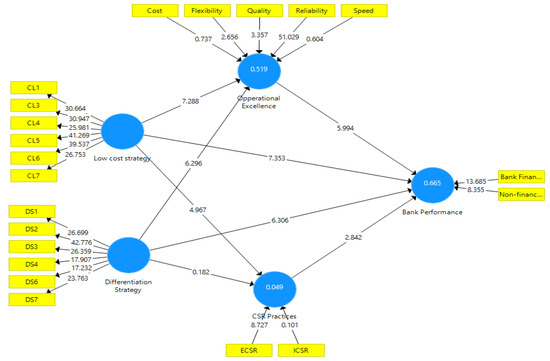

In the second stage, by following [13] CSR practices, operational excellence and bank performance were included to establish the second-order formative construct, based on associated dimension latent scores. Moreover, cost-sensitive strategy and differentiation strategy were included to establish first-order reflective constructs, based on associated indicators. Specifically, three second-order formative constructs (CSR practices, operational excellence, and bank performance) and two first-order reflective constructs (cost-sensitive and differentiation strategies) were included for the second stage in the framework, as shown in Figure 3 Moreover, for the multicollinearity check, variance inflation factor (VIF) was used. The VIF values should be less than three to establish acceptable multicollinearity [68]. In our study, no multicollinearity problem was found so, thereby, the results confirmed an acceptable measurement model at first and second stages.

Figure 3.

Structural Model Assessment.

4.3. Structural Model Assessment

To test the structural model, a 5000 resample procedure was adopted. Table 3 shows the results of linear and inverted U-shaped relationships to assess the structural model and to test the hypotheses. Particularly, Table 3 shows an inverted U-shaped relationship between the exogenous and endogenous constructs. It is not always necessary to have a linear relationship among constructs [73]. In an U-shaped relationship, the size of the effect between two variables does not rely on magnitude but on value [68]. For the assessment of the U-shaped nexus, the two-stage approach was employed and a significant linear relationship between constructs was observed, rather than a U-shaped relationship, similar to the findings of [70]. Hence, a significant linear relationship was established between constructs.

Table 3.

Linear and curvilinear relationship.

The values of R2 for bank performance, CSR practices, and operational excellence were 0.665, 0.049 and 0.519, respectively. More precisely, the coefficient of determination for bank performance showed that 66.5% of variance was explained by all explanatory variables, which proved strong explanatory power and was in-line with [74]. The competitive strategies explained 62.9% of bank performance in the presence of CSR practices, while approximately 66.0% bank performance was explained with the mediating role of operational excellence (These values were based on the author’s calculations. The computation of values is provided upon request.) So, operational excellence merely contributed more than CSR practices.

Furthermore, the results supported the direct effect of cost-sensitive and differentiation strategies on bank performance (Hypothesis 1 and Hypothesis 2), with the higher effect being that of cost-sensitive strategy on performance at a significance level of 0.05. The indirect effect of cost-sensitive strategy on performance via a mediating mechanism of CSR practices was also found to be significant, and, thereby, Hypothesis 3 was also supported. Contrarily, the indirect effect of differentiation strategy on performance via CSR practices was insignificant (Hypothesis 4). Moreover, the indirect effect of cost-sensitive and differentiation strategies on performance, channeled through operational excellence, were significant (Hypothesis 5 and Hypothesis 6), with the higher effect being that of cost-sensitive strategy on bank performance.

In sum, the results showed significant direct effect of cost-sensitive and differentiation strategies on the performance of Islamic banks. The results further revealed that operational excellence mediated the relationship between competitive strategies (cost-sensitive and differentiation strategies) and bank performance. In the case of intervening factors (CSR practices), cost-sensitive strategy produced a significant effect on bank performance; however, differentiation strategy showed insignificant effect on bank performance.

4.4. Robustness Test

The results presented in the preceding sections provide significant evidence that CSR and OE practices arbitrate the association between competitive strategies and bank performance. However, one might expect that this effect is due to heterogeneity and endogeneity concerns. It is imperative to assess the robustness (heterogeneity and endogeneity) for a complex model [75]. In this regard, a prior study, conducted by Ali, et al. [1], argued that robustness of a model creates generalizability of the study. Thus, in order to confirm the generalizability of the results we also employed robustness tests.

Unobserved heterogeneity arises when sub-groups present in the data which leads to spurious estimation results. Partial least square–prediction-oriented segmentation (PLS-POS) is considered appropriate for the assessment of both reflective and formative constructs. In this study, a maximum relationship toward endogenous constructs (e.g., performance) would be four, based on the three parameters: effect size of 0.15, with 0.05 significance level, and four numbers of predictors [64]. By using G*power with these aforementioned criteria, the minimum sample size should be 89 for PLS–POS [68]. Consequently, the recommended segment solution was five (i.e., 512/89 = 5.75). Prior studies used a number of criteria, such as AIC, AIC3, AIC4, BIC, CAIC, MDL5, and EN, to identify sub-groups. According to Hair et al. [70], a combination of AIC3 and CAIC and AIC4 and BIC jointly specified the number of segments, but, unfortunately, these criteria, in our case, did not specify any same segment. The results are presented in Table 4. The entropy values for segment four (K = 4) and five (K = 5) were >0.50 threshold, implying a superior quality segment [68]. The least relative segment size, with a value of 0.018, was found for the four-segment solution. By using the four-segment solution, the segment’s R2 values were found to be higher than the original dataset values. The results are presented in Table 5. Moreover, the weighted R2 values were also found to be higher when compared to the original R2 values. There was no significant difference found across the groups in terms of path coefficient. Hence, we concluded that there was no unobserved heterogeneity in the data set.

Table 4.

Pre-specified groups and relative group sizes.

Table 5.

Path coefficient of POS groups.

Finally, for the assessment of endogeneity, the Gaussian copula approach was employed. Endogeneity occurs when exogenous constructs correlate with the error term of the endogenous construct [1,76]. The framework illustrated 15 models (all combinations), presented in Table 6. We developed the visual basic application (VBA), based on a spreadsheet to generate model combination (shorturl.at/ahGW4). The endogeneity model combination would be helpful for future researchers to generate model combinations for an endogeneity test. By using the 10,000 bootstring resampling method, this study found that there was no endogeneity issue in any model (Model 1 to Model 15). All copulas’ values were insignificant. Thus, we concluded that there was no potential unobserved heterogeneity and endogeneity issue in the data set.

Table 6.

Gaussian Copula Approach.

5. Discussion

By examining the relationship between competitive strategies and performance in the distinctive research context of the fiercely competitive Islamic banking sector, this study expands the conversation on the competitive strategies–performance nexus.

Importantly, this study investigated how the relationship between competitive strategies and performance for Islamic banks operating in Pakistan could be mediated by operational excellence (OE) and corporate social responsibility (CSR) practices.

The results exhibited significant and positive effects of cost-sensitive and differentiation strategies on the performance of Islamic banks (H1 and H2). These findings were consistent with existing literature [1,16,30]. Islamic banks effectively using the cost-sensitive strategy and differentiation strategy to attract customers, leads to increase in their performance in the marketplace. Cost-sensitive strategy is a way for the banks to reduce and control costs, resulting in increased performance. Contrarily, Islamic banks using differentiation strategy to distinguish themselves from the competition through offering more unique services than their rivals saw increased performance. Furthermore, CSR practices mediated the relationship between cost-sensitive strategy and performance (H3), but not between differentiation strategy and the performance nexus (H4). CSR practices are helpful, with cost-sensitive strategy, for the Islamic banking sector to build reputation and gain stakeholder support, which, in turn, garners high performance. Moreover, empirical results found no mediating role of CSR practices between differentiation strategy and performance. While using differentiation strategy, the banking sector increases the prices of their products and services. CSR practices with high priced products and services were not a suitable combination for Islamic banks. The reason for the prevalence effect of the cost-sensitive strategy on performance in the Islamic banking context is the infancy of Islamic banking in Pakistan. Thus, Islamic banks are not offering differentiated products in comparison to their conventional counterparts. Overall, the findings showed that CSR helps to build reputation and gain support from stakeholders, thereby improving performance [1,7]. In support of this argument, Salmones et al. [77] were of the view that socially responsible firms successfully obtained stakeholders’ confidence by transmitting responsible impressions toward their products and services. Likewise, when customers observed that firms were making efforts to be socially responsible, the customers were motivated towards that firm [78]. Hence, socially responsible firms attract more customers to perform financial transactions than do firms that have no CSR practices [79]. Alternatively, CSR practices with competitive strategies enable firms to enhance performance and claim competitive advantage over rivals.

Furthermore, the results showed that operational excellence played a significant mediating role between cost-sensitive as well as differentiation strategies and Islamic bank performance (H5 and H6). Operational excellence is the unique element that magically enhances the competitive strategies–performance relationship in the short term. The adaptation of competitive strategies, along with effective management of operations, results in high performance. These important findings underscore the necessity of operational effectiveness in firms. In a highly competitive market, rivals usually use strategies to compete with each other [1], hence, in order to perform better, firms need to manage operations more effectively than their competitors.

This study also revealed that operational excellence contributed more towards bank performance, compared to CSR practices. The statistics showed that bank performance was enhanced by 62.9% in the presence of CSR practices, and by 66.0% in the presence of operational excellence. In the presence of both CSR practices and operational excellence 66.5% of bank performance was due to competitive strategies. Consequently, this study suggests that both CSR practices and operational excellence should be considered, along with competitive strategies, to enhance bank performance.

6. Conclusions

Extensive research was conducted on the nexus between competitive strategies and performance. CSR practices and operational excellence were ignored by prior studies. This study was motivated by the recent research call in literature that CSR practices may differentiate firms from their competition by building reputation and gaining support from stakeholders, and, hence, enhancing performance The mediating role of CSR practices between competitive strategies and performance is helpful for long-term performance. On the other hand, operational excellence is helpful for short-term performance. The empirical results found positive effects of cost-sensitive and differentiation strategies on the performance of Islamic banks. Furthermore, CSR practices play a significant mediating role between cost-sensitive strategy and performance relationship, but an insignificant role between differentiation strategy and performance. Moreover, operational excellence significantly mediates between competitive strategies and performance.

This study is beneficial for managers, policy makers, and researchers. This study guides managers to ensure CSR practices and operational excellence to enhance competitive performance in Islamic banking. Competitive advantage is the need firms have to survive in a highly competitive market and gaining a competitive edge only by using competitive strategies is difficult. Thus, in such a case, along with competitive strategies, CSR practices and operational excellence are imperative to enhance bank performance. These practices are highly dependent on the efforts and practices of managers in building trust from customers and in contributing to society. From the point of view of researchers this study could be a baseline for future studies to explore other factors that may mediate or moderate the competitive strategies and performance nexus. Future studies may explore the use of intellectual capital as a mediator between competitive strategies and performance. The potential factor that might moderate such a relationship could be the Shariah supervisory board in the context of Islamic banks. We leave this issue for future studies.

This study has some caveats that can be addressed by future scholars in order to refine our findings. This study focused on only one country, so future studies may use cross-country analysis involving countries having dual banking systems, where Islamic and conventional banks operate alongside each other. This study used the disjoint two stage approach for the assessment of the hierarchal component model. Future studies may take into account the whole nomological network by using other approaches, such as the extended repeated approach [13], three stage approach [80,81] and the improved extended repeated indicator approach [80], to minimize confounding issues in interpretation of findings. Further, future research on a large scale is advocated.

Author Contributions

Conceptualization, L.I. and W.A.; methodology, W.A.; software, M.R.; validation, M.R., R.K. and M.R.; formal analysis, M.R.; investigation, L.I.; resources, L.I.; data curation, R.K.; writing—original draft preparation, R.K.; writing—review and editing, L.I.; visualization, M.R.; supervision, L.I.; project administration, M.R.; funding acquisition, L.I. All authors have read and agreed to the published version of the manuscript.

Funding

There was no external funding received for this study.

Informed Consent Statement

All participants in the study provided their informed permission.

Data Availability Statement

The corresponding author can provide the data described in this study upon request. Due to privacy limitations, the data are not publicly accessible.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ali, W.; Alasan, I.I.; Khan, M.H.; Ali, S.; Cheah, J.-H.; Ramayah, T. Competitive strategies-performance nexus and the mediating role of enterprise risk management practices: A multi-group analysis for fully fledged Islamic banks and conventional banks with Islamic window in Pakistan. Int. J. Islam. Middle East. Finance Manag. 2022, 15, 125–145. [Google Scholar] [CrossRef]

- Beck, T.; De Jonghe, O.; Schepens, G. Bank competition and stability: Cross-country heterogeneity. J. Financ. Intermediation 2013, 22, 218–244. [Google Scholar] [CrossRef]

- Clark, E.; Radić, N.; Sharipova, A. Bank competition and stability in the CIS markets. J. Int. Financial Mark. Inst. Money 2018, 54, 190–203. [Google Scholar] [CrossRef]

- Ijaz, S.; Hassan, A.; Tarazi, A.; Fraz, A. Linking bank competition, financial stability, and economic growth. J. Bus. Econ. Manag. 2020, 21, 200–221. [Google Scholar] [CrossRef]

- Abedifar, P.; Molyneux, P.; Tarazi, A. Risk in Islamic banking. Rev. Financ. 2013, 17, 2035–2096. [Google Scholar] [CrossRef]

- Ali, W.; Alasan, I.I.; Khan, M.H.; Ramayah, T. Strategy Is All About Deliberately Making Choices and Trade-Offs: Analogy Betweenfully-Fledged Islamic Banks and Conventional Banks with Islamic Windows. Acad. Entrep. J. 2021, 27, 1–15. [Google Scholar]

- Hunjra, A.I.; Boubaker, S.; Arunachalam, M.; Mehmood, A. How does CSR mediate the relationship between culture, religiosity and firm performance? Financ. Res. Lett. 2021, 39, 101587. [Google Scholar] [CrossRef]

- Barney, J.B.; Clark, D.N. Resource-Based Theory: Creating and Sustaining Competitive Advantage; OUP Oxford: Oxford, UK, 2007. [Google Scholar]

- Karam, C.M.; Jamali, D. A Cross-Cultural and Feminist Perspective on CSR in Developing Countries: Uncovering Latent Power Dynamics. J. Bus. Ethics 2017, 142, 461–477. [Google Scholar] [CrossRef]

- Jamali, D.; Neville, B. Convergence Versus Divergence of CSR in Developing Countries: An Embedded Multi-Layered Institutional Lens. J. Bus. Ethics 2011, 102, 599–621. [Google Scholar] [CrossRef]

- Lui, T.K.; Zainuldin, M.H.; Wahidudin, A.N.; Foo, C.C. Corporate social responsibility disclosures (CSRDs) in the banking industry: A study of conventional banks and Islamic banks in Malaysia. Int. J. Bank Mark. 2021, 39, 541–570. [Google Scholar] [CrossRef]

- Porter, M.E. The Contributions of Industrial Organization to Strategic Management. Acad. Manag. Rev. 1981, 6, 609–620. [Google Scholar] [CrossRef]

- Becker, J.-M.; Klein, K.; Wetzels, M. Hierarchical Latent Variable Models in PLS-SEM: Guidelines for Using Reflective-Formative Type Models. Long Range Plan. 2012, 45, 359–394. [Google Scholar] [CrossRef]

- Bayraktar, C.A.; Hancerliogullari, G.; Cetinguc, B.; Calisir, F. Competitive strategies, innovation, and firm performance: An empirical study in a developing economy environment. Technol. Anal. Strat. Manag. 2017, 29, 38–52. [Google Scholar] [CrossRef]

- Islami, X.; Mustafa, N.; Latkovikj, M.T. Linking Porter’s generic strategies to firm performance. Futur. Bus. J. 2020, 6, 1–15. [Google Scholar] [CrossRef]

- Rehman, A.U.; Anwar, M. Mediating role of enterprise risk management practices between business strategy and SME performance. Small Enterp. Res. 2019, 26, 207–227. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Barney, J.B. Is the Resource-Based “View” a Useful Perspective for Strategic Management Research? Yes. Acad. Manag. Rev. 2001, 26, 41. [Google Scholar] [CrossRef]

- Sun, L.-Y.; Pan, W. Differentiation strategy, high-performance human resource practices, and firm performance: Moderation by employee commitment. Int. J. Hum. Resour. Manag. 2011, 22, 3068–3079. [Google Scholar] [CrossRef]

- Prajogo, D.; Sohal, A.S. The relationship between organization strategy, total quality management (TQM), and organization performance—The mediating role of TQM. Eur. J. Oper. Res. 2006, 168, 35–50. [Google Scholar] [CrossRef]

- Tatoglu, E.; Frynas, J.G.; Bayraktar, E.; Demirbag, M.; Sahadev, S.; Doh, J.; Koh, S.C.L. Why do Emerging Market Firms Engage in Voluntary Environmental Management Practices? A Strategic Choice Perspective. Br. J. Manag. 2020, 31, 80–100. [Google Scholar] [CrossRef]

- Porter, M.E.; Strategy, C. Techniques for Analyzing Industries and Competitors. Competitive Strategy; Free Press: New York, NY, USA, 1980. [Google Scholar]

- Porter, M.E. Competitive Strategy. Measuring Business Excellence; MCB UP Ltd.: Bingley, UK, 1997. [Google Scholar]

- Kankam-Kwarteng, C.; Osman, B.; Donkor, J. Innovative low-cost strategy and firm performance of restaurants. Asia Pac. J. Innov. Entrep. 2019, 13, 266–281. [Google Scholar] [CrossRef]

- Yuliansyah, Y.; Rammal, H.G.; Rose, E. Business strategy and performance in Indonesia’s service sector. J. Asia Bus. Stud. 2016, 10, 164–182. [Google Scholar] [CrossRef]

- Birjandi, H.; Jahromi, N.M.; Darabi, S.A.; Birjandi, M. The effect of cost leadership strategy on ROA and future perfor-mance of accepted companies in Tehran Stock Exchange. Res. J. Financ. Account. 2014, 5, 152–159. [Google Scholar]

- Teeratansirikool, L.; Siengthai, S.; Badir, Y.; Charoenngam, C. Competitive strategies and firm performance: The mediating role of performance measurement. Int. J. Prod. Perform. Manag. 2013, 62, 168–184. [Google Scholar] [CrossRef]

- Semuel, H.; Siagian, H.; Octavia, S. The Effect of Leadership and Innovation on Differentiation Strategy and Company Performance. Procedia Soc. Behav. Sci. 2017, 237, 1152–1159. [Google Scholar] [CrossRef]

- Li, J.J.; Zhou, K.Z. How foreign firms achieve competitive advantage in the Chinese emerging economy: Managerial ties and market orientation. J. Bus. Res. 2010, 63, 856–862. [Google Scholar] [CrossRef]

- Soltanizadeh, S.; Rasid, S.Z.A.; Golshan, N.M.; Ismail, W.K.W. Business strategy, enterprise risk management and organizational performance. Manag. Res. Rev. 2016, 39, 1016–1033. [Google Scholar] [CrossRef]

- Ascarya, A.; Yumanita, D. Mencari Solusi Rendahnya Pembiayaan Bagi Hasil di Perbankan Syariah Indonesia. Bul. Èkon. Monet. Perbank. 2005, 8, 7–43. [Google Scholar] [CrossRef]

- Laela, S.F.; Rossieta, H.; Wijanto, S.H.; Ismal, R. Management accounting-strategy coalignment in Islamic banking. Int. J. Islam. Middle East. Financ. Manag. 2018, 11, 667–694. [Google Scholar] [CrossRef]

- Rachmawati, E.; Syamsulhakim, E. Factors affecting mudaraba deposits in Indonesia. In Proceedings of the Third International Islamic Banking and Finance Conference, Karachi, Pakistan, 27–28 October 2008. [Google Scholar]

- Hafez. Measuring the impact of corporate social responsibility practices on brand equity in the banking industry in Bangladesh. Int. J. Bank Mark. 2018, 36, 806–822. [Google Scholar] [CrossRef]

- Falcón, J.P.; Asis, R.; Arana, V.; Muñoz, E.; Raza, M. Corporate Social Responsibility and Socio-Environmental Conflicts in Peruvian Mining Company. J. Environ. Manag. Tour. 2022, 13, 1251–1258. [Google Scholar] [CrossRef] [PubMed]

- Droppert, H.; Bennett, S. Corporate social responsibility in global health: An exploratory study of multinational pharmaceutical firms. Glob. Health 2015, 11, 15. [Google Scholar] [CrossRef] [PubMed]

- Luu, D.T. The effect of internal corporate social responsibility practices on pharmaceutical firm’s performance through employee intrapreneurial behaviour. J. Organ. Chang. Manag. 2020, 33, 1375–1400. [Google Scholar] [CrossRef]

- Waheed, A.; Zhang, Q.; Zafar, A.U.; Zameer, H.; Ashfaq, M.; Nusrat, A. Impact of internal and external CSR on organizational performance with moderating role of culture: Empirical evidence from Chinese banking sector. Int. J. Bank Mark. 2021, 39, 499–515. [Google Scholar] [CrossRef]

- Carmeli, A.; Gilat, G.; Waldman, D.A. The Role of Perceived Organizational Performance in Organizational Identification, Adjustment and Job Performance. J. Manag. Stud. 2007, 44, 972–992. [Google Scholar] [CrossRef]

- Lichtenstein, D.R.; Drumwright, M.E.; Braig, B.M. The Effect of Corporate Social Responsibility on Customer Donations to Corporate-Supported Nonprofits. J. Mark. 2004, 68, 16–32. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Corporate Social Responsibility: International Perspectives. SSRN 2006, 900834. [Google Scholar] [CrossRef]

- Siegel, D.S.; Vitaliano, D.F. An Empirical Analysis of the Strategic Use of Corporate Social Responsibility. J. Econ. Manag. Strat. 2007, 16, 773–792. [Google Scholar] [CrossRef]

- Flammer, C. Competing for government procurement contracts: The role of corporate social responsibility. Strat. Manag. J. 2018, 39, 1299–1324. [Google Scholar] [CrossRef]

- Flynn, B.B.; Flynn, E. An exploratory study of the nature of cumulative capabilities. J. Oper. Manag. 2004, 22, 439–457. [Google Scholar] [CrossRef]

- Kannan, V.R.; Jayaram, J.; Narasimhan, R. Acquisition of operations capability: A model and test across US and European firms. Int. J. Prod. Res. 2004, 42, 833–851. [Google Scholar] [CrossRef]

- Dutta, S.; Narasimhan, O.; Rajiv, S. Success in High-Technology Markets: Is Marketing Capability Critical? Mark. Sci. 1999, 18, 547–568. [Google Scholar] [CrossRef]

- Evans, J.; Lindsay, W. The Management and Control of Quality, South-Western, Cengage Learning. ISBN 2011, 13, 978–1002. [Google Scholar]

- Porter, M.E. What is strategy? Harv. Bus. Rev. 1996, 74, 61–78. [Google Scholar]

- Andersson, C.; Bellgran, M. On the complexity of using performance measures: Enhancing sustained production improvement capability by combining OEE and productivity. J. Manuf. Syst. 2015, 35, 144–154. [Google Scholar] [CrossRef]

- Eisenhardt, K.; Martin, J. Dynamic Capabilities. What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Wu, S.J.; Melnyk, S.A.; Flynn, B.B. Operational Capabilities: The Secret Ingredient. Decis. Sci. 2010, 41, 721–754. [Google Scholar] [CrossRef]

- Teece, D.J. The Foundations of Enterprise Performance: Dynamic and Ordinary Capabilities in an (Economic) Theory of Firms. Acad. Manag. Perspect. 2014, 28, 328–352. [Google Scholar] [CrossRef]

- Sehnem, S.; Jabbour, C.J.C.; Pereira, S.C.F.; de Sousa Jabbour, A.B.L. Improving sustainable supply chains performance through operational excellence: Circular economy approach. Resour. Conserv. Recycl. 2019, 149, 236–248. [Google Scholar] [CrossRef]

- Perona, M.; Miragliotta, G. Complexity management and supply chain performance assessment. A field study and a conceptual framework. Int. J. Prod. Econ. 2004, 90, 103–115. [Google Scholar] [CrossRef]

- Hassan, S.S.U.; Hussain, M.A.; Sajid, S. The effectiveness of anti-money laundering legislation in Islamic banking of Pakistan: Experts’ opinion. J. Money Laund. Control 2022, 25, 135–149. [Google Scholar] [CrossRef]

- Johansen, M.B.; Frederiksen, J.T. Ethically important moments—A pragmatic-dualist research ethics. J. Acad. Ethics 2021, 19, 279–289. [Google Scholar] [CrossRef]

- Emmerling, S.A.; Astroth, K.S.; Kim, M.J.; Woith, W.M.; Dyck, M.J. A comparative study of social capital and hospital readmission in older adults. Geriatr. Nurs. 2019, 40, 25–30. [Google Scholar] [CrossRef] [PubMed]

- Santa, R.; MacDonald, J.B.; Ferrer, M. The role of trust in e-Government effectiveness, operational effectiveness and user satisfaction: Lessons from Saudi Arabia in e-G2B. Gov. Inf. Q. 2019, 36, 39–50. [Google Scholar] [CrossRef]

- Tehseen, S.; Ramayah, T.; Sajilan, S. Testing and Controlling for Common Method Variance: A Review of Available Methods. J. Manag. Sci. 2017, 4, 142–168. [Google Scholar] [CrossRef]

- Fischer, D.G.; Fick, C. Measuring Social Desirability: Short Forms of the Marlowe-Crowne Social Desirability Scale. Educ. Psychol. Meas. 1993, 53, 417–424. [Google Scholar] [CrossRef]

- Hair, F.H., Jr.; Hult, G.T.M., Jr.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: New York, NY, USA, 2021. [Google Scholar]

- Wisetsri, W.; Chuaytukpuan, T.; Prompanyo, M.; Raza, M.; Cavaliere, L.P.L.; Akhter, S. Impact of Psychological Capital and Technology Adaptation on Performance of Teachers. J. Posit. Sch. Psychol. 2022, 8784–8793. [Google Scholar]

- Ringle, C.M.; Wende, S.; Becker, J.-M. SmartPLS 3. Boenningstedt SmartPLS GmbH 2015, 3, 584. [Google Scholar]

- Faul, F.; Erdfelder, E.; Buchner, A.; Lang, A.-G. Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behav. Res. Methods 2009, 41, 1149–1160. [Google Scholar] [CrossRef]

- Chin, W.W.; Thatcher, J.B.; Wright, R.T.; Steel, D. Controlling for Common Method Variance in PLS Analysis: The Measured Latent Marker Variable Approach. In New Perspectives in Partial Least Squares and Related Methods; Springer: Berlin/Heidelberg, Germany, 2013; pp. 231–239. [Google Scholar] [CrossRef]

- Cohen, J. A Power Primer (Methodological Issues and Strategies in Clinical Research), 4th ed.; American Psychological Association: Washington, DC, USA, 2016; pp. 279–284. [Google Scholar]

- Dijkstra, T.K.; Henseler, J. Consistent and asymptotically normal PLS estimators for linear structural equations. Comput. Stat. Data Anal. 2015, 81, 10–23. [Google Scholar] [CrossRef]

- Hair, J.; Hollingsworth, C.L.; Randolph, A.B.; Chong, A.Y.L. An updated and expanded assessment of PLS-SEM in information systems research. Ind. Manag. Data Syst. 2017, 117, 442–458. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Ahrholdt, D.C.; Gudergan, S.P.; Ringle, C.M. Enhancing loyalty: When improving consumer satisfaction and delight matters. J. Bus. Res. 2019, 94, 18–27. [Google Scholar] [CrossRef]

- Benitez, J.; Henseler, J.; Castillo, A.; Schuberth, F. How to perform and report an impactful analysis using partial least squares: Guidelines for confirmatory and explanatory IS research. Inf. Manag. 2019, 57, 103168. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Cheah, J.-H.; Ting, H.; I Moisescu, O.; Radomir, L. Structural model robustness checks in PLS-SEM. Tour. Econ. 2020, 26, 531–554. [Google Scholar] [CrossRef]

- Hult, G.T.M.; Hair, J.F.; Proksch, D.; Sarstedt, M.; Pinkwart, A.; Ringle, C.M. Addressing Endogeneity in International Marketing Applications of Partial Least Squares Structural Equation Modeling. J. Int. Mark. 2018, 26, 1–21. [Google Scholar] [CrossRef]

- De Los Salmones, M.D.M.G.; Crespo, A.H.; Del Bosque, I.R. Influence of Corporate Social Responsibility on Loyalty and Valuation of Services. J. Bus. Ethics 2005, 61, 369–385. [Google Scholar] [CrossRef]

- Kang, J.; Hustvedt, G. Building Trust Between Consumers and Corporations: The Role of Consumer Perceptions of Transparency and Social Responsibility. J. Bus. Ethics 2014, 125, 253–265. [Google Scholar] [CrossRef]

- Bugandwa, T.C.; Kanyurhi, E.B.; Akonkwa, D.B.M.; Mushigo, B.H. Linking corporate social responsibility to trust in the banking sector: Exploring disaggregated relations. Int. J. Bank Mark. 2021, 39, 592–617. [Google Scholar] [CrossRef]

- Cheah, J.-H.; Ting, H.; Ramayah, T.; Memon, M.A.; Cham, T.-H.; Ciavolino, E. A comparison of five reflective–formative estimation approaches: Reconsideration and recommendations for tourism research. Qual. Quant. 2019, 53, 1421–1458. [Google Scholar] [CrossRef]

- van Riel, A.; Henseler, J.; Kemény, I.; Sasovova, Z. Estimating hierarchical constructs using consistent partial least squares. Ind. Manag. Data Syst. 2017, 117, 459–477. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).