Abstract

The production of lignocellulose biomass on dedicated plantations is an option that facilitates the implementation of sustainable development policy. The novelty of this type of research is that it involves the use of various types of methods—economic and legal analyses within a particular subject. This makes it possible to obtain a holistic view of the chosen case study. The purpose of this study was to determine whether setting up a Short Rotation Coppice (SRC) plantation of willow (Salix spp.) and poplar (Populus spp.) was economically profitable and if the legal regulations supported this type of production. The economic data are based on an experimental case study. The economic profitability of the plantations was assessed through an analysis of discounted cash flows, net present value (NPV), internal rate of return (IRR), and profitability index (PI). The legal analysis of the relevant EU and Polish legal solutions was based on a dogmatic approach. The study demonstrated that SRC cultivation was mostly hindered by economic factors, including the low selling price of biomass as an energy resource and the high costs of harvest. Meanwhile, in the analysed period, i.e., from 2015 to 2020, there were no additional legal or economic forms of support for this type of production that was addressed directly to lignocellulose biomass producers, with the exception of the standard support under the Common Agricultural Policy framework. The results of this study provide information for decisionmakers about the opportunities and challenges experienced during the development of SRC plantations.

1. Introduction

Willow and poplar are grown for biomass in both European countries (including Poland, Lithuania and Germany) and in the United States of America and Canada. The biomass resulting from short rotation coppice plants can be used for the cogeneration of renewable energy or for the manufacture of bioproducts. The generation of energy from SRC is efficient, and SRC plantations improve the diversity of production and soil use [1,2]. The costs of biomass production on SRC plantations compared to the cost of acquiring waste and by-products from forest production are high, which necessitates support for this type of production both while setting up a plantation and during the SRC cultivation cycle. Energy production from biomass (e.g., by its incineration) is an element of a changing strategy that is directed towards energy generation from renewable sources, including biomass [3]. In Poland, the main obstacle to the replacement of fossil fuels, mainly hard coal, in commercial energy generation is the relatively high cost of SRC biomass production. For this reason, although biomass contains less compounds that are harmful to human health and the environment, it has not become as popular as it might appear in the adopted strategies. An example is the recently made decision to build a heat and power plant fired with coal and then with natural gas rather than using renewable energy sources, such as biomass or alternative fuels, i.e., RDF. The production of SRC biomass as a raw material for the generation of energy needs to be supported at both stages: the generation of electric power and biomass cultivation. The generation of electricity has been supported by various kinds of subsidies, e.g., direct payments to energy producers, redeemed certificates, or by maintaining regulated prices for electric power and the obligation to receive the electricity generated from RES. Conversely, between 2015 and 2020, the production of SRC biomass was only subsidised by the state to a small extent, even though in previous years, the state had directly supported the production of energy crops and the establishment of energy crop plantations [4].

In terms of simplified accounting, the generation of energy from renewable energy sources (RES) is more expensive than producing it from conventional fuels. However, environmental changes and the growing social awareness of these changes and causes necessitate a change in our attitude towards this problem. An aware consumer prefers to buy products that have been made sustainably. The strategies that are being developed nowadays show the need to shift towards a closed-loop economy. Changes in legal regulations also proceed in this direction. A closed-loop economy and consumer attitudes can be supported by the generation of renewable energies from lignocellulose biomass grown in the SRC system. For years, energy crops have been the subject of interest among farmers and authorities. SRC plants are characterised by the rapid production of biomass, low fertiliser and herbicide consumption, and high elasticity of production management. Furthermore, SRCs ensure benefits to the environment compared to the crops they compete with and the move towards RES. However, the combination of high production costs and uncertain policies as well as the prices of the products discourage farmers from growing SRC plants. As of today, not many political instruments have been implemented to help increase the production of biomass in this systemin EU countries. Some examples of support solutions in the EU can be found in Germany and Lithuania, although it has been indicated that these solutions have not been very successful in these two countries [5].

The area under SRC plantations in Poland did not increase in the period of 2015–2020. The situation was similar in other EU countries. This is worrying because biomass, including SRC, can provide a source of renewable energy for fuel industry as well as for power generation and bioeconomy. Significant factors are at play here: the relatively high costs of starting a plantation, the long time needed to recover inputs, the immature market, and low profitability compared traditional crops and the lack of contract farming that would ensure the profitability of production over a time horizon corresponding to the longevity of a plantation (20–25 years). Considering the above as well as the fact that biomass in Poland is expected to become a major RES in 2030, a more effective support system for biomass production is needed. If the social and economic goal is to increase the volumes of produced biomass, then greater financial support is necessary, not only subsidies to energy generation, but also direct support to SRC plantations. Support does not only have to rely on subsidies but also on reducing legal barriers to starting manufacturing activities, e.g., establishing the precise legal requirements of such activity, including obtaining environmental assessments or the certification of leading production [6].

This article demonstrates the influence of support on the economic profitability of biomass production in the SRC system and suggests some legal solutions that may help SRC development. The novelty of the current research is that it involves various types of approaches—both economic and legal—from an environmental point of view. This makes it possible to obtain a holistic view of the chosen case study. Hence, this paper contains an analysis of the production costs of biomass that can be used as a feedstock for energy generation. It is followed by an analysis of different support mechanisms for SRC biomass production. It is worth underlining that biomass production is a link in the supply chain that is involved in the generation of energy from renewable sources. Thus, the costs of biomass production will have a direct impact on its use in a circular bioeconomy. The analysis is limited to an evaluation of the profitability of biomass production and the effect of its potential support mechanisms on biomass production. The analyses indicate how to account for the economic support for biomass production from the perspective of the EU’s support for manufacturing activities. Research conducted in Poland has confirmed that society is convinced of the generation of energy from renewable sources as a means to increase environmental protection and to strengthen energy security. However, the production costs, particularly those related to the construction of infrastructure or to the distribution to the end-user, pose a significant barrier. Among the above-mentioned methods of reducing these costs, reducing the tax burden for renewable energy producers is also postulated [6].

This study aimed to determine whether setting up an SRC plantation of willow (Salix spp.) and poplar (Populus spp.) was economically profitable and if the legal regulations supported this type of production. The economic data are based on an experimental case study. The economic profitability of the plantations was assessed through an analysis of discounted cash flows, net present value, internal rate of return, and a profitability index.

2. Materials and Methods

2.1. Field Experiment

The analysis was based on two species of energy crops grown in an SRC system, i.e., willow and poplar. The data used for an economic evaluation of willowand poplar cultivation originated from a field experiment situated in north-eastern Poland (53°59′ N, 21°04′ E) and had been set up on a poor soil field owned by the University of Warmia and Mazury in Olsztyn. Details of the soil properties, weather conditions, design, and performance of the experiment as well as an economic assessment of the production were presented in [7,8]. Two of the most popular SRC species were taken for the analysis: willow (Salix viminalis, Żubr variety) and poplar (Populusnigra x P. Maximowiczii Henry cv. Max-5), both of which were grown under two fertilisation regimes. The first option was the control option, which was denoted with the letter C, in which no fertilisation was applied. The second option consisted of mineral fertilisation, which was applied in the second year after the plantation had been started and in each subsequent year after harvest. Both species were grown at a density of 11.11 thousand pieces per ha−1. The cost breakdown took account the following treatments into account: winter ploughing, disking (2×), harrowing (2×), marking planting spots, manual planting, mechanical weeding (3×), mineral fertilisation, harvesting, field and road transport, and liquidation of the plantation. The data regarding the costs of harvest and transport were estimated based on earlier studies conducted on a commodity plantation [8,9]. Details of the analysed production technology and the equipment used in the field and other operations are presented in [8].

2.2. Economic Analysis

2.2.1. The Cost of Cultivation

The analysis of the economic efficiency of the cultivation and production of chips from two SRC species was based on the yield of the biomass dry matter obtained in the first four-year cycle of the cultivation system. The total direct costs that were incurred were divided between stages. The first stage was the establishment of the plantation, the second was its exploitation, and the third stage consisted of the liquidation of the plantation (Table 1). The values of the fresh chips of the analysed SRC species were assessed according to the market price during the analysed period (EUR 5.24 GJ−1). Consequently, the monetary value of the chips was calculated based on the calorific value of fresh the SRC wood chips obtained from the soil fertilisation variants and the price of 1 GJ energy they contained. Both the income and costs were converted to 2020 values using the inflation rate. However, the tax was calculated in accordance with the binding taxation rate in 2020. The prices of the purchased materials and selling prices of the chips determined as of 2013 can be found in [6]. These prices were then converted to 2020 values using the inflation rates and were then expressed in euros based on the average currency rate in 2020.

Table 1.

Data on SCR production and costs used for analyses in 2020.

2.2.2. Profitability Calculation

The economic analysis comprised the following steps: An analysis of discounted cash flows was carried out to determine the discounted payback period (DPBP) for setting up, cultivating, and then terminating the plantation of both SRC species in all of the fertilisation regimes. In the discounted cash flow method, the approach of changing the value of money over time was used. All future cash flows were estimated and discounted by the discount rate in order to determine their present value. Annual cash flows were identified as the difference between the annual income and annual cost, and the value that was thus calculated was discounted for each year. To compare the profitability of SRC production in the analysed variants, the net present value (NPV), internal rate of return (IRR), and the profitability index (PI) were determined. A similar approach can be found in Hauk, S.; Knoke T.; and Wittkopf S. [10] and in Stolarski, M.J. [9]. In addition, the revenue was determined as an NPV annual annuity. The model assumptions enabled a comparative analysis of the production costs and production profitability through the use of the net present value and annuity methods. The discount rate taken for all calculations was 5%. The costs and revenues from the SRC plantations were spread over the entire cultivation period. To compare the results obtained from SRC with the results achieved from the annual plant cultivation, the net present value (NPV) approach was assumed, similar to other studies [11,12,13] in which the costs and incomes were converted to annual flows. The analysis was supported by the Invest for Excel 3.9 software programme.

In addition, the calculated revenue values from the production of willow and polar were corrected by the adding values of the payments to their production in the following scenarios. The first scenario, denoted as (I), did not include any direct area payments offered to farmers under the Common Agricultural Policy, production subsidies, or costs of land purchase. The second scenario, denoted as (II), included a single area payment as well as payments for agricultural practices, creating climate and environmental benefits (so-called payment for greening, i.e., EFA—ecological focus area) and additional (redistribution) payments. The third scenario, denoted as (III), also contained (apart from the payments mentioned in scenario II) payments for young farmers and payments to areas with natural constraints (ANC) allocated to sphere I, representing areas with natural constraints.

As part of the research, a one-way sensitivity analysis was performed. The impact of changing two independent variables (the discount rate and revenue) on the dependent variable (the NPV value) in all of the analysed scenarios was examined. The scope of the analysed independent variables ranged from −20% to +20%.

2.3. Methodology of Legal Research

The basic methods used in the scope of the legal analyses included the dogmatic legal method and the comparative method. The former takes the results of the linguistic (grammatical), systemic, and teleological interpretation into consideration. It was applied to analyse the legal acts relevant to the research problem. The linguistic interpretation was mostly carried out in respect to regulations introducing programmes involved in payment distribution under the Common Agricultural Policy (CAP). The EU regulations were a component of the legal systems of the Member States and only partially required additional implementation. The outcome of the analysis supported by the dogmatic method served as a starting point for the next stage of the research, where the legal comparative method was employed. Additionally, the historical legal method was used because many programmes connected to EU payments were implemented for specific periods of time. Using the historical method enabled an evaluation of the consequences in terms of the motivation to achieve the objectives defined by the EU with respect to lignocellulose biomass production.

3. Results and Discussion

3.1. The Legal Ground of the CAP in the EU Law

The origin of the Common Agricultural Policy is thought to be as early as the moment that the Treaties of Rome were signed. The basis for the implementation of the contemporary CAP is Article 38 and subsequent articles of the consolidated version of the Treaty on the Functioning of the European Union (Official Journal C 326, 26/10/2012 P. 0001–0390). The objectives of the CAP are (a) to increase agricultural productivity by promoting technical progress and by ensuring the rational development of agricultural production and the optimum utilisation of the factors of production, in particular, labour; (b) to ensure a fair standard of living for the agricultural community, particularly by increasing the individual earnings of people engaged in agriculture; (c) to stabilise markets; (d) to assure the availability of supplies; and (e) to ensure that supplies reach consumers at reasonable prices. These purposes, listed in Art. 39 of the TFEU, are not the only ones associated with the CAP. Other regulations envisage include supporting high employment levels (Art. 9) and protecting the natural environment in order to support sustainable development (Art. 11). Importantly, not all of these goals have to be pursued at the same time. Currently, it becomes increasingly more evident that the focus of the strategies adopted in the EU lies in sustainable development. Support for energy crop production should be viewed in the context of implementing the EU’s Common Agricultural Policy for 2015–2020. The principles of the CAP were regulated in Regulation (EU) No 1307/2013 of the European Parliament and of the Council of 17 December 2013, which established rules for direct payments to farmers under support schemes within the framework of the Common Agricultural Policy and repealing Council Regulation (EC) No 637/2008 and Council Regulation (EC) No 73/2009 (Official Journal of the European Union L 2013.347.608). An example of the implementation of this regulation is the direct payment scheme and the single area payment scheme; the question of national ceilings; definition of ‘the active farmer’; granting the rights to the Member States to make payments in amounts of less than EUR 100 or to an agricultural holding with an eligible area of less than 1 ha; or the reduction of payments. A more detailed interpretation of the above regulation was made by the Commission of the European Union, who delegated this task in the mentioned regulation and published it in the Commission Delegated Regulation (EU) No 639/2014 of 11 March 2014, supplementing Regulation (EU) No 1307/2013 of the European Parliament and of the Council, establishing rules for direct payments to farmers under support schemes within the framework of the common agricultural policy and amending Annex X to that Regulation (Official Journal of the European Union L 2014.181.1). This legal act brought to force regulations supplementing some of the provisions of the Regulation EU No 1307/2013 other than significant ones, including(a) general provisions on direct payments, (b) the basic payment system, (c) single area payment systems, (d) payments for farmers implementing agricultural practices beneficial for the climate and the natural environment; (e) payments for young farmers starting their agricultural activity; (f) voluntary production-coupled support; (g) crop-specific support for cotton cultivation; and (h) notification obligations of the Member States. Further details of the above regulation consisted in the issuing, in line with Regulation No 1307/2013, of the regulations of the EU Commission. Among these documents, something that is noteworthy is the Commission Implementing Regulation (EU) No 641/2014 of 16 June 2014, which lays down rules for the application of Regulation (EU) No 1307/2013 of the European Parliament and for the Council establishing rules for direct payments to farmers under support schemes within the framework of the Common Agricultural Policy (Official Journal of the EU L 2014.181.74). It specifies such issues as (a) general provisions on direct payments; (b) the basic payment scheme; (c) the payment for farmers implementing agricultural practices beneficial for the climate and the environment; (d) voluntary production coupled support; (e) the crop-specific payment for cotton; and (f) obligations for the Member States to make notifications. With respect to the funding of the CAP, significant problems are governed by Regulation (EU) No1306/2013 of the European Parliament and of the Council of 17 December 2013 on the financing, management, and monitoring of the common agricultural policy and repealing Council Regulations (EEC) No352/78, (EC) No165/94, (EC) No2799/98, (EC) No814/2000, (EC) No1290/2005, and (EC) No485/2008 (Official Journal of the European Union L 2013.347.549). This regulation specifies the following issues: (a) the financing of the expenses under the Common Agricultural Policy (CAP), including funds allocated to the development of rural areas; (b) the agricultural advisory system; (c) the management and quality systems to be instituted by the Member States; (d) the cross-compliance system; and (e) the clearing of accounts. Control matters are specified in the Commission Delegated Regulation (EU) No 640/2014, of 11 March 2014, supplementing Regulation (EU) No 1306/2013 of the European Parliament and of the Council with regard to the integrated administration and control system and conditions for refusal or the withdrawal of payments and administrative penalties applicable to direct payments, rural development support, and cross-compliance (Official Journal of the EU L 2014.181.48).

3.2. The CAP Pillars

Under the CAP, financing rests on direct payments (first pillar); funds allocated to the development of rural areas in the CAP; and additional means for the development of rural areas under the framework of the Next Generation EU (a temporary instrument to help repair damage caused by COVID) (second pillar). The direct payment mechanisms were altered by abandoning the idea of ‘decoupling payments and production’ in favour of ‘targeting’ payments, which has led to a system of seven functional payments, each corresponding to a specific goal: (1) a basic payment per hectare, the level of which should be harmonised in accordance with national or regional economic and administrative criteria and that is to undergo the process of convergence (so-called internal convergence); (2) payments for greening in the form of an additional support dedicated to compensating the costs of producing environmental benefits that are not paid for by the market; (3) additional payments for young farmers; (4) ‘redistributive payments’, which enable increasing the support allocated to the first hectares on a farm; (5) additional aid to incomes earned in areas with natural constraints; (6) production-coupled payments to specific areas or branches of agricultural production; (7) a voluntary simplified system for small farms that receive less than EUR 1250 in payments a year. The first three components are mandatory for the EU Member States, while the other four components are elective. The Member States must allocate 30% of their national direct payment funds to greening payments. The remaining 70% are allocated to direct payments, having deducted all sums for obligatory national reserves (obligatory, up to 3% of the national envelope) and for additional redistributive payments (up to 30%), payments for young farmers (to 2%), payments to areas with natural constraints (to 5%), and production-coupled payments (to 15%). New payments to 1 ha will only be awarded to active farmers. Moreover, since 2019, they have been subject to partial convergence (external convergence) between the Member States. The basic payment system will receive approximately 70% of each Member State’s budget for direct payments.

Regarding ‘internal convergence’, the Member States who maintained the payments established on historical references for payment entitlements in 2013 were told that they must gradually shift towards more uniform amounts of payments per ha. To this aim, these states can choose from a few options: they can adopt a national or regional approach, which will enable them to achieve a national or regional flat-rate level until 2019, or they must ensure that the farms receiving less than 90% of the country’s national or regional payment will gradually receive increasing payments on the condition that every farmer will receive a payment that corresponds to at least 60% of the national or regional average payment no later than in 2019. The sums paid to farmers receiving payments below the regional or national average are proportionally corrected, and the Member States are allowed to reduce possible ‘losses’ in support to 30%. The Member States will also have the right to award a redistributive payment, i.e., for the first 30 ha or for an area corresponding to the area of an average farm in the country provided that it is no more than 30 ha at most. Another possibility the application of a maximum payment per ha. In addition, Member States are allowed to provide payments to young farmers (less than 40 years of age) who have commenced agricultural activity in the past five years. The young farmer payment system is mandatory for all Member States.

Another mandatory solution is the greening payment system. A farm can receive an additional payment per ha for using agricultural practices that are beneficial for the climate and nature. The Member States are obliged to allocate 30% of the national envelope to this payment. The three measures envisaged under this umbrella are (a) the diversification of crops: a farmer must grow two main crops if he has more than 10 ha of arable land and three crops if he has more than 30 ha of arable land; the main crop may cover no more than 75% of the arable land, and the two main crops may cover no more than 95% of the arable land; (b) a farmer must maintain permanent grassland; and (c) a farmer must maintain ‘an ecological focus area’ covering at least 5% of the arable land of a farm that is more than 15 ha of the arable land (excluding permanent grassland and perennial crops), for example, the edges of fields, hedges, trees, fallow land, landscape features, biotopes, buffer strips, afforested areas, or nitrogen-fixing crops. There will be severe penalty fees for failing to abide by these ‘greening’ rules. In order to avoid punishing farmers who have already implemented eco-friendly solutions, the regulation establishes a ‘green equivalency system’, which affirms pro-environmental practices that are already in place and that are deemed to meet these basic requirements. For instance, organic farmers are not obliged to meet any additional requirements because their agricultural activity brings about evident ecological benefits. The new regulation contains a list of practices considered to be equivalent.

In 2014, the Member States had to make fundamental choices in the face of a variety of rules regulating the implementation of the new direct payment system and to create room to manoeuvre the system they were asked to work within. Most Member States, except one (Germany), had the option of using coupled payments of highly varied rates. Regarding greening payments, some Member States allowed farmers to meet some of the requirements by using equivalent practices. With respect to the second pillar, the Commission approved 118 rural area development programmes. Twenty Member States decided to implement just one national programme, while eight opted for more than one programme (which, for example, allows them to take better account of the country’s geographical or administrative structure).

As the legislative procedures concerning the CAP reform after 2020 had not been completed by 1 January 2021, the co-legislators passed Regulation (EU) 2020/2220 of the European Parliament and the Council of 23 December 2020, extending the currently binding regulations by two years (until 31 December 2022). The European Union’s policy concerning the development of rural areas was established as the second pillar of the CAP during the Agenda 2000 reform. It was co-financed by the European Agricultural Fund for Rural Development (EAFRD) and by regional or national funds. The Commission determined the three overriding priorities in the rural development policy: increased agricultural competitiveness; ensuring the sustainable management of natural resources; and counteracting climate change by attaining the balanced territorial development of rural economies and communities as well as creating and maintaining jobs.

These three principal goals were reflected in the six priorities of the EU regarding the policy for the development of rural areas in 2014–2020: supporting the transfer of knowledge in agriculture and forestry; improved competitiveness of all branches of the agricultural economy and improved economic viability of farms; promoting food chain organisation and risk management in agriculture; restoring, protecting, and supporting ecosystems dependent on agriculture and forestry; promoting resource efficiency and supporting the conversion to low-carbon economy resistant to climate change in the agricultural, food, and forestry sectors; supporting social inclusion, poverty reduction, and economic growth in rural areas. Lowering production costs by changing (simplifying) technologies or obtaining additional public subsidies is also noted in other areas of research [14,15].

The rural development policy was implemented on the basis of programmes prepared by the Member States (or their regions) for the development of rural areas. Under these programmes, which cover several years, individualised strategies are executed, which respond to specific needs of the Member States (or regions) and that account for at least four of the six priorities mentioned above. These programmes rest on several financial means and have been selected from the set of EU funds, which are laid out in greater detail in the Regulation on the support of the development of rural areas (EU Regulation No 1305/2013) and co-financed from AEFRD funds (cf. see below for more specific data). The level of co-funding varies depending on the region and on the funds it engages. The programmes must be approved by the European Commission, and they must contain a financial plan as well as a set of indicators to evaluate the results. In the current programme perspective (for years 2014–2020), special focus is placed on coordination between the EAFRD and other EU structural and investment funds, such as funds dedicated to the cohesion policy (Cohesion Fund, European Regional Development Fund ERDF, and European Social Fund ESF) and the European Maritime, Fisheries, and Aquaculture Fund, EMFFA.

3.3. Proposed Directions in the Development of the CAP

The European Commission has formulated some proposals for new legal regulations concerning the CAP after 2021. Examples include the European Green Deal, proposed in November 2019, and the field-to-table strategy as well as the EU strategy for biodiversity 2030, issued by the Commission in May 2020. They all attest to the increasingly broader scope of issues related to agriculture and food. Furthermore, in the context of market opening and globalisation, Article 207 of the TFEU determined new guidelines for the common commercial policy of the EU, which will now be more applicable to the trade of agricultural products. The key assumptions of the EU’s new agricultural policy are that (1) the focus on climate and environment are stronger than before; (2) the annual report of a Member State is based on achieved results rather than on compliance with the EU regulations; (3) the first pillar to be included in the programme; (4) changes in the so-called green architecture; (5) new options of sector interventions (promoting team activities from the first pillar; and(6) strengthening the role of technological progress and innovativeness, including the growing role of knowledge extension and science. Of the regulations binding to this day, the European Commission wishes to maintain the reduction in the share of the second pillar; create further though smaller reductions in the differences in direct payments; establish a simplified area payment system; make redistributive payments targeting small and medium farms; and make coupled payments. There are still three shared goals of the Common Agricultural Policy, and they continue to relate to the following issues: (1) economic, with more stress placed on the resilience of agriculture and smart development; (2) connected with the environment and climate; and (3) dealing with the development of rural areas.

Instead of the six priorities specified previously, the Commission proposed nine specific objectives: ensuring a fair income to farmers and supporting resilience of farms in the entire Union in order to improve food safety; a stronger focus on research, technology, and digitalisation; a stronger position for farmers in the food chain; contributing to climate action, including the use of sustainable energy; supporting the sustainable development and efficient management of resources, such as water, soil, and air; contributing to the preservation of biodiversity, strengthening ecosystem services, and protecting habitats and the landscape in rural areas; attracting young farmers and helping to start business activity in rural areas; promoting the employment, growth, cohesion, and social inclusion as well as local development, including bioeconomy and sustainable forestry in rural areas; and a better response of the EU to social needs regarding health and food, including healthy, nutritious, and sustainable food, preventing food waste, and ensuring animal welfare. The information on the support for the development of rural areas suggests that up to 40% of the total funds allocated to agricultural policy (at least 30% of the European Fund for Agriculture and Rural Development) is to be allocated to attaining environmental and climatic goals. At least 5% of the II pillar’s budget is to be dedicated to the implementation of the community-led local development mechanism.

3.4. Systems of Support to Agricultural Production for Energy Purposes in Poland until 2020

The support for crop production for energy purposes in Polish law relies on the previously mentioned CAP mechanisms. Thus, a chance to acquire funds should be sought in terms of both area and greening payments. Detailed regulations, indicated in Section 2 of the EU regulations, entered into force in Poland’s Act on Payments in the Direct Payments Scheme of 5 February 2015. These regulations pertain to both area payments and other types of payments, such as those for young farmers, green payments, or additional payments. Polish legislators have followed the rules of referring national definitions to terms introduced in regulations of the EU Council, for example, a farmer, farm, or greening. Incidentally, the law did not make any provisions for payments for the production of biomass for energy purposes available in 2015–2020. Therefore, any possible additional SRC payments are only possible by applying for payments for greening. The payment rates are established by the Minister for Agriculture every year. The rates for the years 2015–2020 are given in Table 2.

Table 2.

Rates of payments for SRC production in Poland between 2015–2020.

In the previous CAP perspective, it was possible to obtain subsidies for the establishment of energy crop plantations. In the years 2007–2009, under the CAP, Poland participated in the financial support programme by addressing the energy crop sector. To be eligible for such a payment, one had to meet the following conditions: the minimum area under a plantation—1 ha; not set up on permanent grassland; payment application submitted in the year when the plantation was started or in the consecutive year; the plantation had to be set up in accordance with agrotechnical requirements—location (at least 1.5 m from the border of a land parcel where a similar energy crop plantation is grown or a land plot used as forest; at least 3 m from the border of an adjacent land plot if it is used differently than mentioned; not set up on areas with nature protection: if the relevant documentation did not provide a possibility of starting such a plantation; on drained land if it was a poplar or willow plantation; on other types of land for which an payment applications for energy crop cultivation had already been submitted). In 2009, the payments for starting a willow plantation on 1 ha of land equalled 50% of the flat-rate costs. Assuming that those costs at that time were PLN 8600 per 1 ha−1 (about EUR 1892 ha−1), then a payment was PLN 4300 (about EUR 946). This type of support attracted some interest, as the data on the numbers of filed applications suggest that applications for payments for energy willow plantations covered a total of 553.58 ha in 2008 and 779.29 ha in 2009, indicating growing interest. The provision ensuring the possibility of granting these payments was contained in the Council Regulation (EC) No 73/2009 of 19 January 2009, establishing common rules for direct support schemes for farmers under the common agricultural policy and establishing certain support schemes for farmers, amending Regulations (EC) No1290/2005, (EC) No 247/2006, and (EC) No 378/2007 and repealing Regulation (EC) No 1782/2003 (Official Journal of EU L 30/16 of 31 January 2009, with amendments). It contains transitional regulations that allow the provision of support for energy crops until the year 2009, as stipulated in Title IV, Chapter 5 of the Council Regulation (EC) No 1782/2003 of 29 September 2003, establishing common rules for direct support schemes under the common agricultural policy and establishing certain support schemes for farmers and amending Regulations (EEC) No 2019/93, (EC) No 1452/2001, (EC) No 1453/2001, (EC) No 1454/2001, (EC) 1868/94, (EC) No 1251/1999, (EC) No 1254/1999, (EC) No 1673/2000, (EEC) No 2358/71, and (EC) No 2529/2001 (Official Journal of EU L 270/1 of 21 October 2003 with amendments). In line with Article 90 of Regulation 1782/2003, support was only granted to areas producing energy crops for which a farmer had a contract with the processing industry, except when processing was undertaken by a farmer on the farm. This payment was financed from the EU budget, and it was distributed in the years 2007–2009. In turn, the aid for setting up permanent crop plantations for energy purposes was financed from national budgets. The provisions specifying the eligibility conditions were putinto force in Poland by the Act on amending the Act on payments to agricultural land and on sugar tax and the Act on the stamp duty, of 29 February 2008 (Dz. U No 44 item 262). In 2008–2009, farmers could therefore obtain support to permanent plantations by pursuing Article 29a Section 1 of the Act on payments from direct payments systems, of 26 January 2007, which stated that a farmer was eligible for support in an amount equal to 50% of the flat-rate costs of starting permanent plant plantations per 1 ha of a plantation. Currently, the only support for energy crop cultivation could be obtained from the single area payment system. It should be noted that a single area payment also applies to plantations of trees provided that compose short-rotation woods (they can be trees used for energy purposes). In conclusion, since 2010, there has been no specific support dedicated to energy crop cultivation under the direct payment schemes. However, willow plantations can constitute SRC plantations within the meaning of Regulation No 1120/2009. A single area payment can be obtained for the area covered with such plantations, provided that the conditions concerning the minimum cultivation area and maximum crop harvest period are satisfied. Moreover, beneficiaries of the direct payment system are obliged to maintain good agricultural practices on their land in accordance with the principles of environmental protection, which, in terms of short rotation woods, entails the requirement of keeping specific distances from the borders of adjacent land plots. Since 2010, there have not been direct payments for the establishment of energy crop plantations or directly for the production of energy crops, which were previously permitted by some EU regulations [41,42].

3.5. Economic Analysis of the Profitability of Production

Table 3 contains the results of the economic assessment of willow and poplar chip production. In all of the analysed variants, chip production was profitable, although the values of all of the indicators varied considerably depending on the SRC species, fertilisation regime, and, above all, on the payment scenario. When comparing the NPV, this index for willow plantations was evaluated from EUR 1540 to 5641, and it was EUR 861 higher for the control plantation and EUR 1172 higher for mineral fertilisation than the net present values (NPV) for poplar for the parallel fertilisation variants and payment scenarios. The revenue values for willow ranged from EUR 121 year−1 to EUR 568 year−1 and were EUR 68 higher than they were for the control and EUR 92 higher for mineral fertilisation than in the parallel fertilisation regimes and payment scenarios for poplar plantations.

Table 3.

Profitability indices for willow and poplar chip production depending on the soil fertilisation option and subsidy scenarios.

The IRR values were approximately twice as high for willow as they were for poplar in the parallel fertilisation regimes and payment scenarios. However, the profitability index PI was about 40% higher for poplar than it was for willow. The possibility to obtain payments in scenario II, which comprised a single area payment, additional payment, and ecological focus area payment, which equalled EUR 207.79 per ha altogether in 2020, raised the revenue by EUR 233 and the NPV by EUR 2848. Including an additional payment for young farmers and a payment to an area with natural constraints in sphere I (i.e., considering scenario III), the revenue increased by EUR 322, and the NPV rose by EUR 4101 in each analysed case. The increase in the NPV due to the possibility of obtaining payments was very large. For SRC willow plantations with no fertilisation (option C), the NPV increased 2.8- and 3.7-fold (for scenario II and III, respectively), whereas on poplar plantations, this index was 5.2- and 7-fold higher (for II and III scenarios, respectively). The application of mineral fertilisers, despite the input costs, improved the yields, and the revenue from selling wood chips was therefore higher. The contribution of the profits earned from selling chips was large in these variants (willow F and poplar F) and, therefore, the effect of payments on the NPV was weaker, less by 1.9- and 2.3-fold for willow in scenario II and III and by 2.5- and 3.1-fold for poplar in scenario II and III, respectively.

A quite long DPBP, approximately six years, was obtained for willow CI and poplar FI, whereas the DPBP calculated for the other variants was much shorter, 2–3 years.

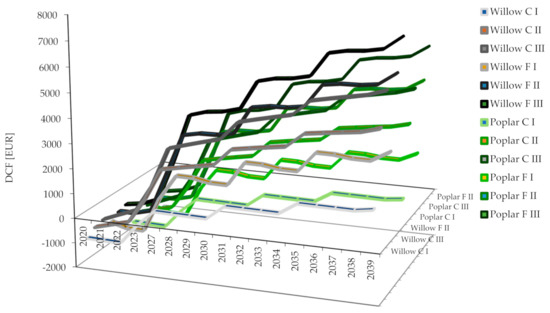

Figure 1 illustrates discounted cash flows for willow and poplar chip production depending on the soil fertilisation option and subsidy scenario. The highest DCF values were calculated for willow F III (EUR 7236), followed by poplar F III (EUR 6064), and then willow F II (EUR 5984) and willow C III (EUR 5641), confirming that a chance to receive payments has a considerable influence on the profitability of production, as reflected by from the willow F variant achieving over double revenue values. The strongest effect of payments on revenues, leading to an over 7-fold increase for poplar and a 3.6-fold increase for willow, was demonstrated in the C variants (without fertilisation). The above results are particularly important in terms of persuading farmers to consider low-input SRC cultivation, which has a much less intensive impact on the environment, preventing the adverse and high influence of fertilisation on the natural environment, particularly in terms of causing freshwater eutrophication by poplar plantations [43] or freshwater toxicity caused by willow plantations [44], although higher external costs incurred by fertilisation (as much as 23% more for willow production [45] and 20% for poplar production [46]) should not be neglected. The highest DCF values were also recorded on the willow F III and poplar F IIII plantations and were over 2- and 3-fold higher than they were for the willow F I and poplar F I variants.

Figure 1.

Discounted cash flows for willow and poplar chip production depending on the soil fertilisation option and subsidy scenario.

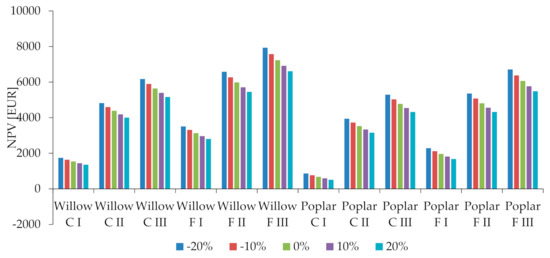

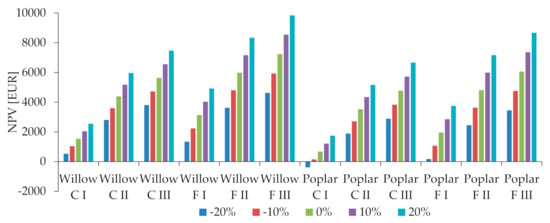

The sensitivity analysis determined the effect of the changes in the discount rate on NPV for willow and poplar chip production depending on the soil fertilisation option and payment scenario (Figure 2) and the effect of the changes on the income on the NPV for willow and poplar chip production depending on the soil fertilisation option and payment scenario (Figure 3).

Figure 2.

The effect of changes in the discounted rate on the NPV for willow and poplar chip production depending on the soil fertilisation option and payment scenarios.

Figure 3.

The effect of changes in revenue on the NPV for willow and poplar chip production depending on the soil fertilisation options and payment scenarios.

A change in the discounted rate applied to the NPV at rates that were even as high as ±20% did not affect this index considerably. A change in the NPV was most distinctly seen in the variants comprising fertilisation, as it amounted to EUR 1000 ha−1 for both willow and poplar compared to around EUR 700 ha−1 for unfertilised willow and poplar plantations. Poplar plantations were more sensitive to a modification in the discounted rate; the differences in the NPV for both variants (willow C and willow F) reached 20% on average, while the differences in the NPV values for analogous poplar variants averaged 17%. Chip production was profitable in all cases. The current analysis of the effect of a change in the revenue on the NPV, likewise in a range of ±20%, showed that when the revenue decreased by 20% due to a lower harvest or lower selling price for poplar chips, in the unfertilised variant without payments (poplar C I), the production became unprofitable (NPV EUR-388 ha−1), while poplar chip production in the same variant, with no fertilisation or payments (poplar FI), was on the brink of profitability (NPV EUR 176 ha−1). A change in the revenue value by +20%, stemming from higher yields, higher prices, or higher payments (in scenario II and III) increased the NPV to over EUR 7000 for willow F II, willow F III, poplar F II, poplar F III, and willow C III.

The analysis of willow production costs and coupled payments in Poland conducted in 2006 allowed us to estimate the revenue value at EUR 236 ha−1, and when the available payments were considered, the revenue improved by EUR 17 ha−1, reaching 220 EUR ha−1 from the establishment subsidy [13].

When comparing the economic situation in Poland in 2013–2015 [9] with the situation in 2020, the experimental data demonstrated a decline in the NPV: for willow C I, a decline from EUR 1653 to EUR 1540 was experienced, and for willow F I, a decline from EUR 3298 to EUR3135 was experienced; for poplar F I, there was a decline from EUR 2111 to EUR 1964, which represented a decline of 5%, and for poplar C I, there was a decline from EUR 844 to EUR 680, which was nearly 20%.

Fradj et al. [47] discussed the prospect of potential SRC willow plantation integration with the cultivation of other crops in Poland. Those researchers analysed the payment amounts and their effect on the total acreage cultivated with willow in Poland. They concluded that willow, which could make a large contribution to the Polish economy, could be produced sustainably and efficiently and could provide farmers with additional income.

In Lithuania, willow production has also been determined to be profitable, regardless of whether it was supported with payments or not [48]. The results of a cash flow analysis showed that at a 6% discounted rate and without EU payments, the net present value of willow cultivation was EUR 458. If the EU payments were granted, the net present value of a willow plantation in the 22nd year was EUR 1800. The DPBP without payments was 17 years, which was shortened to 9 years when payments were available.

The analysis of the policy for perennial energy crop production, which was based on poplar production in Germany for over 24 years [49], comprised four types of payments at 3 and 4 levels. One of the scenarios presumed a guaranteed price of EUR 50, 55, and 60 Mg d.m. I, and it was only the highest price that resulted in a positive effect on income related to the NPV at EUR 2826.29; this value is higher than the value of EUR 885 obtained in this paper, although the assumed market price was approximately EUR 20 Mg dm. higher. Another scenario assumed a one-off subsidy for starting a plantation, which was 500 EUR ha−1 and affected the NPV, which then reached EUR 3758.82 ha−1; a similar value (NPV EUR 3528) was achieved for Poplar C II, in which the total value of annual payments was about EUR 200 ha−1.

Faasch et al. also made an assessment of the SRC production profitability in Germany [50]. Their results confirmed that appropriate economic and political conditions, such as high subsidies, low costs, and higher prices of wood chips, could lead to SRC plantations achieving higher profitability than the production of conventional crops. The most favourable variant accounted for the subsidy in which farmers were reimbursed 30% of the initial investment inputs and an area payment of EUR 200 per hectare per annum, which allowed the generation of the NPV of EUR 8660 per ha.

The Swedish experience in SRC production for energy purposes suggests a need to develop financial models that are orientated towards diminishing the risk connected with SRC cultivation [51], thus confirming the earlier assertion that a stable policy and long-term contracts between different subjects may reduce the uncertainty raised by SRC cultivation [52].

The latest studies on the trends and location of rapidly growing energy crops show that the total area covered by SRC plantations in Sweden has been declining for years and that willow has been planted increasingly on more productive farmland, and poplar plantations have been set up on less productive soils than previously [53].

4. Conclusions

The ongoing work on the implementation of the new CAP perspective, especially in terms of energy crops, should lead to the successful achievement of the sustainable development goals. The above study, which concerns SRC production and using willow and poplar as model species, shows that SRC production incurs high costs. The CAP payments are insufficient to offset these costs so as to make production competitive towards other sources of biomass. The market price that SRC biomass producers could obtain is not competitive in relation to other biomass sources, particularly production waste in the forestry industry. Stimulation mechanisms, such as subsidies or certificates, are not addressed to an SRC biomass producer but rather to companies using biomass. The only subsidies that a biomass producer can obtain are a single area payment, payments for young farmers, payments for greening, or payments to areas with natural constraints. It is noteworthy that the problem of insufficient support to SRC development has been raised for years. The analyses conducted in this research show that the current support to SRC production is too small for such plantations to be a serious alternative to other biomass sources. Moreover, this aid is now weaker than it was before 2014, as it does not comprise subsidies for the establishment of plantations or for the production of energy crops. The economic results that are achieved nowadays do not encourage farmers to set up SRC plantations, even though they might be a stable source of high-quality dendromass, which would facilitate the gradual phasing out of fossil fuels, especially hard coal, in individual households as well as in whole regions or countries. It should also be added that SRC plantations should be set up on land that is of little or no value for the production of food or fodder plants, i.e., mainly on marginal land, fallow land, contaminated soils, or wasteland. This approach would be extremely important for the economy, as it could activate the use of many areas left unused and that do not generate any profit but that could become a source of dendromass. Furthermore, such areas could serve as sites for the utilisation of sewage sludge and other organic residues, e.g., ash from the burning of biomass, which would improve the soil fertility, and this, in turn, would have a positive effect on plant yields while limiting the consumption of fertilisers. Such an integrated solution (i.e., using residues for the enrichment of marginal or degraded land, production of biomass for energy and industrial purposes, and returning processing waste and by-products to circulation) fully agrees with the idea of a closed-loop bioeconomy. It appears that the mechanisms of direct support to SRC producers should be intensified in order to launch this process and to suggest a new approach in this field, including possible pathways for the development of bioenergy and bioeconomy. In this context, perhaps the simplest thing to do is to return to direct payments to new plantations, e.g., return 50% of the flat-rate costs. In addition, tax incentives could be created, e.g., reducing or foregoing some taxes, a refund of excise duty on the materials used, or income or indirect tax relief. In addition, it might be helpful to restore the obligation of the power industry to purchase SRC-produced biomass by the power industry. The promotion of such solutions could increase the amounts of non-forest biomass used in heat, combined heat and power, or power plants for energy generation and to replace hard coal with the solid biofuel produced on dedicated SRC plantations, which would be in agreement with the concept of bioeconomy.

Author Contributions

Conceptualization, J.J.Z., E.O.-Z. and M.J.S.; methodology, J.J.Z., E.O.-Z. and M.J.S.; validation, J.J.Z., E.O.-Z., M.J.S., M.K. (Michał Krzykowski) and M.K. (Michał Krzyżaniak); formal analysis, J.J.Z., E.O.-Z. and M.J.S.; investigation, J.J.Z., E.O.-Z. and M.J.S.; resources, J.J.Z., E.O.-Z. and M.J.S.; data curation, J.J.Z., E.O.-Z. and M.J.S.; writing—original draft preparation, J.J.Z., E.O.-Z. and M.J.S.; writing—review and editing, J.J.Z., E.O.-Z. and M.J.S.; M.K. (Michał Krzykowski) and M.K. (Michał Krzyżaniak); visualization, J.J.Z. and E.O.-Z.; supervision, J.J.Z., E.O.-Z. and M.J.S.; project administration, J.J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

The results presented in this paper were obtained as part of a comprehensive study financed by the University of Warmia and Mazury in Olsztyn, 24.610.043—110 Faculty of Agriculture and Forestry, Department of Genetics, Plant Breeding and Bioresource Engineering (grant No. 30.610.007-110) and has been co-financed by the Interreg Baltic Sea Region Programme 2014–2020 co-funded by the European Regional Development Fund under the project “Unlocking the Potential of Bio-based Value Chains in the Baltic Sea Region” (BalticBiomass4Value-BB4V), No. #R095 and co-financed from the funds of the Ministry of Science and Higher Education under the program “PMW” in the years 2019–2021; No. 5047/INTERREG BSR/2019/2.

Acknowledgments

We would also like to thank the staff of the Centre for Bioeconomy and Renewable Energies for their administrative support during the study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Djomo, S.N.; El Kasmioui, O.; Ceulemans, R. Energy and greenhouse gas balance of bioenergy production from poplar and willow: A review. Glob. Chang. Biol. Bioenergy 2011, 3, 181–197. [Google Scholar] [CrossRef]

- Parra-Lopez, C.; Holley, M.; Lindegaard, K.; Sayadi, S.; Esteban-Lopez, G.; Duran-Zuazo, V.H.; Knauer, C.; von Engelbrechten, H.G.; Winterber, R.; Henriksson, A.; et al. Strengthening the development of the short-rotation plantations bioenergy sector: Policy insights from six European countries. Renew. Energy 2017, 114, 781–793. [Google Scholar] [CrossRef]

- Lopez, P.; Lindegaard, K.N.; Adams, P.W.R.; Holley, M.; Lamley, A.; Henriksson, A.; Larsson, S.; von Engelbrechten, H.G.; Esteban Lopez, G.; Pisarek, M. Short rotation plantations policy history in Europe: Lessons from the past and recommendations for the future. Food Energy Secur. 2016, 5, 125–152. [Google Scholar]

- Grodecki, A. Dopłaty do upraw roślin energetycznych. Kwart. Nauk. Uczel. Vistula 2014, 3, 54–69. [Google Scholar]

- Spiegel, A.; Britz, W.; Djanibekov, U.; Finger, R. Policy analysis of perennial energy crops cultivation at the farm level: The case of short rotation coppice (SRC) in Germany. Agric. Resour. Econ. Discuss. Pap. 2017, 3, 1–33. [Google Scholar] [CrossRef]

- Marks-Bielska, R.; Bielski, S.; Pik, K.; Kurowska, K. The Importance of Renewable Energy Sources in Poland’s Energy Mix. Energies 2020, 13, 4624. [Google Scholar] [CrossRef]

- Stolarski, M.J.; Krzyżaniak, M.; Szczukowski, S.; Tworkowski, J.; Załuski, D.; Bieniek, A.; Gołaszewski, J. Effect of increased soil fertility on the yield and energy value of short-rotation woody crops. BioEnergy 2015, 8, 1136e1147. [Google Scholar] [CrossRef] [Green Version]

- Stolarski, M.J.; Krzyżaniak, M.; Tworkowski, J.; Szczukowski, S.; Niksa, D. Analysis of the energy efficiency of short rotation woody crops biomass as affected by different methods of soil enrichment. Energy 2016, 113, 748e761. [Google Scholar] [CrossRef]

- Stolarski, M.J.; Olba-Ziety, E.; Rosenqvist, H.; Krzyżaniak, M. Economic efficiency of willow, poplar and black locust production using different soil amendments. Biomass Bioenergy 2017, 106, 74–82. [Google Scholar] [CrossRef]

- Hauk, S.; Knoke, T.; Wittkopf, S. Economic evaluation of short rotation coppice systems for energy from biomass—A review. Renew. Sustain. Energy Rev. 2014, 29, 435–448. [Google Scholar] [CrossRef]

- Rosenqvist, H.; Dawson, M. Economics of willow growing in Northern Ireland. Biomass Bioenergy 2005, 28, 7–14. [Google Scholar] [CrossRef]

- Ericsson, K.; Rosenqvist, H.; Ganko, E.; Pisarek, M.; Nilsson, L. An agro-economic analysis of willow cultivation in Poland. Biomass Bioenergy 2006, 30, 16–27. [Google Scholar] [CrossRef]

- Ericsson, K.; Rosenqvist, H.; Nilsson, L.J. Energy crop production costs in the EU. Biomass Bioenergy 2009, 33, 1577–1586. [Google Scholar] [CrossRef] [Green Version]

- Shao, H.C.; Zhang, Y.Y.; Hussain, S.; Liu, X.C.; Zhao, L.J.; Zhang, X.Z.; Liu, G.W.; Qiao, G.J. Effect of Preform Structure on the Performance of Carbon and Carbon Composites. Sci. Adv. Mater. 2019, 11, 945–953. [Google Scholar] [CrossRef]

- Hou, H.G.; Hussain, S.; Shao, H.C.; Liu, G.W.; Wang, M.S.; Qiao, G.J.; Shaheen, A. Experimental Insights on Factors Influencing Sensitivity of Thin Film Narrow Band-Pass Filters. Sci. Adv. Mater. 2019, 14, 1548–1554. [Google Scholar] [CrossRef]

- Rozporządzenie Ministra Rolnictwa I Rozwoju WSI z dnia 14 października 2020 r. w sprawie stawki płatności dodatkowej (Regulation of the Minister of Agriculture and Rural Development on the Rate of Additional Payment)za 2020 r., O.J. 2020 pos. 1812. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20200001812/O/D20201812.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 14 października 2020 r. w sprawie stawki płatności dla młodego rolnika (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Young Farmer) za 2020 r., O.J. 2020 pos. 1811. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20200001811/O/D20201811.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 14 października 2020 r. w sprawie stawki płatności za zazielenienie (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Greening) za 2020 r., O.J. 2020 pos. 1806. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20200001806/O/D20201806.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa i Rozwoju Wsi z dnia 14 października 2020 r. w sprawie stawki jednolitej płatności obszarowej (Regulation of the Minister of agriculture and Rural Development on the Single Area Payment Rate) za 2020 r., O.J. 2020 pos. 1798. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20200001798/O/D20201798.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa i Rozwoju Wsi z dnia 7 października 2019 r. w sprawie stawki płatności dodatkowej (Regulation of the Minister of Agriculture and Rural Development on the Rate of Additional Payment) za 2019 r., O.J. 2019 pos. 1958. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20190001958/O/D20191958.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa i Rozwoju Wsi z dnia 7 października 2019 r. w sprawie stawki płatności dla młodego rolnika (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Young Farmer) za 2019 r., O.J. 2019 pos. 1957. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20190001957/O/D20191957.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 7 października 2019 r. w sprawie stawki płatności za zazielenienie (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Greening) za 2019 r., O.J. 2019 pos. 1964. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20190001964/O/D20191964.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 7 października 2019 r. w sprawie stawki jednolitej płatności obszarowej (Regulation of the Minister of Agriculture And Rural Development on the Rate of Additional Payment) za 2019 r., O.J. 2019 pos. 1963. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20190001963/O/D20191963.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 11 października 2018 r. w sprawie stawki płatności dodatkowej (Regulation of the Minister of Agriculture and Rural Developmenton the Rate of Additional Payment) za 2018 r., O.J. 2018 pos. 1961. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20180001961/O/D20181961.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 11 października 2018 r. w sprawie stawki płatności dla młodego rolnika (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Young Farmer) za 2018 r., O.J. 2018 pos. 1964. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20180001964/O/D20181964.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 11 października 2018 r. w sprawie stawki płatności za zazielenienie (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Greening) za 2018 r., O.J. 2018 pos.1960. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20180001960/O/D20181960.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 11 października 2018 r. w sprawie stawki jednolitej płatności obszarowej (Regulation of the Minister of Agriculture and Rural Development on the Single Area Payment Rate) za 2018 r., O.J 2018 pos. 1966. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20180001966/O/D20181966.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 9 października 2017 r. w sprawie stawki płatności dodatkowej (Regulation of the Minister of Agriculture and Rural Development on the Rate of Additional Payment) za 2017 r., O.J. 2017 pos. 1895. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20170001895/O/D20171895.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 9 października 2017 r. w sprawie stawki płatności dla młodego rolnika (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Young Farmer) za 2017 r., O.J. 2017 pos. 1890. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20170001890/O/D20171890.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 9 października 2017 r. w sprawie stawki płatności za zazielenienie (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Greening) za 2017 r., O.J. 2017 pos. 1894. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20170001894/O/D20171894.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 9 października 2017 r. w sprawie stawki jednolitej płatności obszarowej (Regulation of the Minister of Agriculture and Rural Development on the Single Area Payment Rate)za 2017 r., O.J. 2017 pos. 1887. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20170001887/O/D20171887.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 13 października 2016 r. w sprawie stawki płatności dodatkowej (Regulation of the Minister of Agriculture and Rural Development on the Rate of Additional Payment)za 2016 r., O.J. 2016 pos. 1708. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20160001708/O/D20161708.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 13 października 2016 r. w sprawie stawki płatności dla młodego rolnika (Regulation of the Minister of Agriculture and Rural Development on the payment rate for young farmer) za 2016 r., O.J. 2016 pos. 1701. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20160001701/O/D20161701.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 13 października 2016 r. w sprawie stawki płatności za zazielenienie (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Greening)za 2016 r., O.J. 2016 pos. 1707. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20160001707/O/D20161707.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 13 października 2016 r. w sprawie stawki jednolitej płatności obszarowej (Regulation of the Minister of Agriculture and Rural Development on the Single Area Payment Rate) za 2016 r., O.J. 2016 pos. 1702. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20160001702/O/D20161702.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 9 października 2015 r. w sprawie stawki płatności dodatkowej (Regulation of the Minister of Agriculture and Rural Development on the Rate of Additional Payment) za 2015 r., O.J. 2015 pos. 1622. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20150001622/O/D20151622.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 31 grudnia 2015 r. w sprawie wielkości zmniejszenia (redukcji) stawki płatności dodatkowej (Regulation of the Minister of Agriculture and Rural Development on the Rate of Additional Payment) za 2015 r., O.J. 2015 pos. 5. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20160000005/O/D20160005.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 9 października 2015 r. w sprawie stawki płatności dla młodego rolnika (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Young Farmer) za 2015 r., O.J. 2015 pos. 1621. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20150001621/O/D20151621.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 9 października 2015 r. w sprawie stawki płatności za zazielenienie (Regulation of the Minister of Agriculture and Rural Development on the Payment Rate for Greening) za 2015 r. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20150001620/O/D20151620.pdf (accessed on 12 October 2021).

- Rozporządzenie Ministra Rolnictwa I Rozwoju Wsi z dnia 9 października 2015 r. w sprawie stawki jednolitej płatności obszarowej (Regulation of the Minister of Agriculture and Rural Development on the Single Area Payment Rate) za 2015 r. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20150001619/O/D20151619.pdf (accessed on 12 October 2021).

- Council of the European Union. Council Regulation (EC) No 1782/ 2003 of 29 September 2003 Establishing Common Rules for Direct Support Schemes under the Common Agricultural Policy and Establishing Certain Support Schemes for Farmers and Amending Regulations (EEC) No 2019/93, (EC) No 1452/2001, (EC) No 1453/2001, (EC) No 1454/2001, (EC) 1868/94, (EC) No 1251/1999, (EC) No 1254/1999, (EC) No 1673/2000, (EEC) No 2358/71 and (EC) No 2529/2001; Council of the European Union: Brussels, Belgium, 2003; Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32003R1782&from=EN (accessed on 12 October 2021).

- Council of the European Union. Council Decision of 22 March 2004 Adapting the Act Concerning the Conditions of Accession of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia, the Slovak Republic and the Adjustments to the Treaties on Which the European Union Is Founded, Following the Reform of the Common Agricultural Policy; Council of the European Union: Brussels, Belgium, 2004; Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2004:093:0001:0017:EN:PDF (accessed on 12 October 2021).

- Krzyżaniak, M.; Stolarski, M.J.; Warmiński, K. Life cycle assessment of poplar production: Environmental impact of different soil enrichment methods. J. Clean. Prod. 2019, 206, 785e796. [Google Scholar] [CrossRef]

- Krzyżaniak, M.; Stolarski, M.J.; Szczukowski, S.; Tworkowski, J. Life Cycle Assessment of New Willow Cultivars Grown as Feedstock for Integrated Biorefineries. Bioenergy Res. 2016, 9, 224–238. [Google Scholar] [CrossRef] [Green Version]

- Olba-Zięty, E.; Stolarski, M.J.; Krzyżaniak, M.; Gołaszewski, J. Environmental external cost of poplar wood chips sustainable production. J. Clean. Prod. 2020, 252, 119854. [Google Scholar] [CrossRef]

- Olba-Zięty, E.; Stolarski, M.J.; Krzyżaniak, M.; Warmiński, K. Willow Cultivation as Feedstock for Bioenergy-External Production Cost. Energies 2020, 13, 4799. [Google Scholar] [CrossRef]

- Ben Fradj, N.; Jayet, P.A.; Rozakis, S.; Georganta, E.; Jędrejek, A. Contribution of agricultural systems to the bioeconomy in Poland: Integration of willow in the context of a stylised CAP diversification. Land Use Policy 2020, 99, 104797. [Google Scholar] [CrossRef]

- Konstantinavičienė, J.; Varnagirytė-Kabašinskienė, I.; Škėma, M.; Aleinikovas, M. Assessment of the socio-economic factors affecting the development of willow energy plantations in Lithuania. Balt. For. 2020, 26, 1–8. [Google Scholar] [CrossRef]

- Spiegel, A.; Britz, W.; Djanibekov, U.; Finger, R. Policy analysis of perennial energy crop cultivation at the farm level: Short rotation coppice (SRC) in Germany. Biomass Bioenergy 2018, 110, 41–56. [Google Scholar] [CrossRef]

- Faasch, R.J.; Patenaude, G. The economics of short rotation coppice in Germany. Biomass Bioenergy 2012, 45, 27–40. [Google Scholar] [CrossRef]

- Mola-Yudego, B.; Dimitriou, I.; Gonzalez-Garcia, S.; Gritten, D.; Aronsson, P. A conceptual framework for the introduction of energy crops. Renew. Energy 2014, 72, 29–38. [Google Scholar] [CrossRef]

- Helby, P.; Rosenqvist, H.; Roos, A. Retreat from Salix—Swedish experience with energy crops in the 1990s. Biomass Bioenergy 2006, 30, 422–427. [Google Scholar] [CrossRef]

- Xu, X.; Mola-Yudego, B. Where and when are plantations established? Land-use replacement patterns of fast-growing plantations on agricultural land. Biomass Bioenergy 2021, 144, 105921. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).