Decision on Mixed Trading between Medium- and Long-Term Markets and Spot Markets for Electricity Sales Companies under New Electricity Reform Policies

Abstract

1. Introduction

1.1. Important Policies for China’s New Round of Electricity Reform

1.2. Research on the Trading Model of Each Subject in the Electricity Market

1.3. Research on Multi-Market Power Trading Decisions of Electricity Sales Companies

2. Materials and Methods

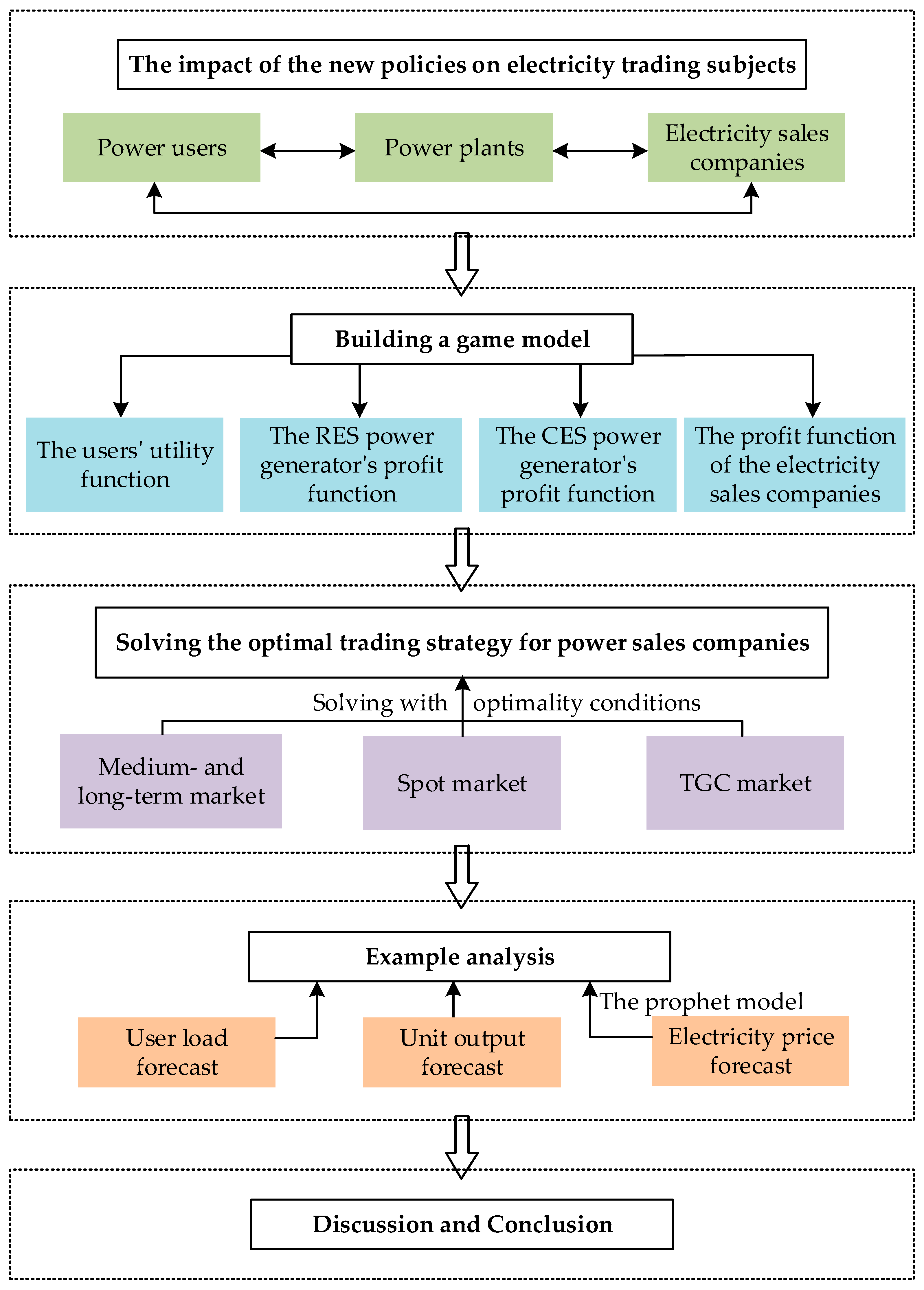

2.1. Methodology

2.2. The Influence of the New Electricity Reform Policies on the Transactions of the Electricity Market

2.3. Building Model

2.3.1. Consumer Utility Function

2.3.2. The Profit Function of Electricity Sales Companies

2.3.3. RES Power Generator Profit Function

- No. 833 stipulates the on-grid price of the new RES project. Therefore, the on-grid price of the RES power will be restricted by the local coal-fired power generation standard price. Since China launched the green power trading pilot last year, the introduction of relevant policies and rules has promoted the rapid development of green power trading. This paper believes that RES power generators participate in medium- and long-term market transactions in the form of the integration of green certificates and power, where medium- and long-term traded electricity is bundled with the corresponding green certificates and sold to customers at the price of . The profit function of the RES power generator in the medium- and the long-term market is:

- 2.

- The profit function of the RES power generator in the spot market is:

- 3.

- If the RES power generator wins the bid in the spot market, the green certificate corresponding to the winning power will be available for sale in the TGC market. The revenue of the TGC corresponding to the spot trading of electricity by RES generators are as follows:

- 4.

- The cost function for RES generators is referenced from the literature [59] and consists mainly of the operation and maintenance costs of RES generation and energy storage:

2.3.4. CES Power Generator Profit Function

- The medium- and long-term market income function of the CES power generator is:

- 2.

- The spot market income function of the CES power generator is:

- 3.

- The cost function of the CES power generator is referenced from the literature [60]:

2.4. The Trading Decision of Electricity Sales Companies under the Influence of New Electricity Reform Policies

2.4.1. Non-Mixed Decision-Making between Medium- and Long-Term and Spot Markets for an Electricity Sales Company

- Electricity purchase in medium- and long-term markets:

- 2.

- Electricity purchase in the spot market:

2.4.2. Mixed Decision-Making between Medium- and Long-Term and Spot Markets for an Electricity Sales Company

- Medium- and long-term and spot market decision-making partial purchase of electricity:

- 2.

- The spot market deviation part of purchased electricity:

3. Results

3.1. Example Hypothesis and Parameter Settings

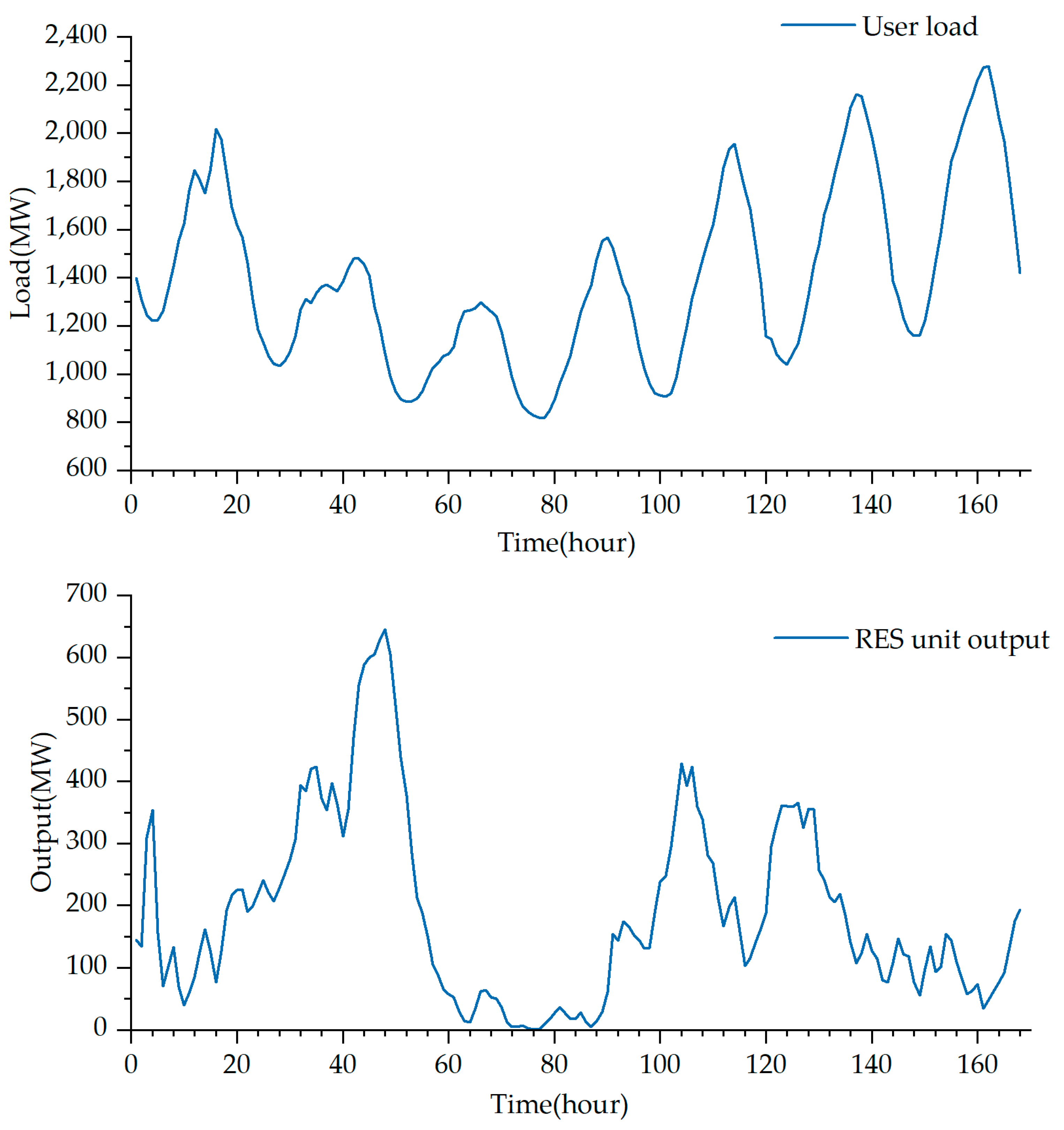

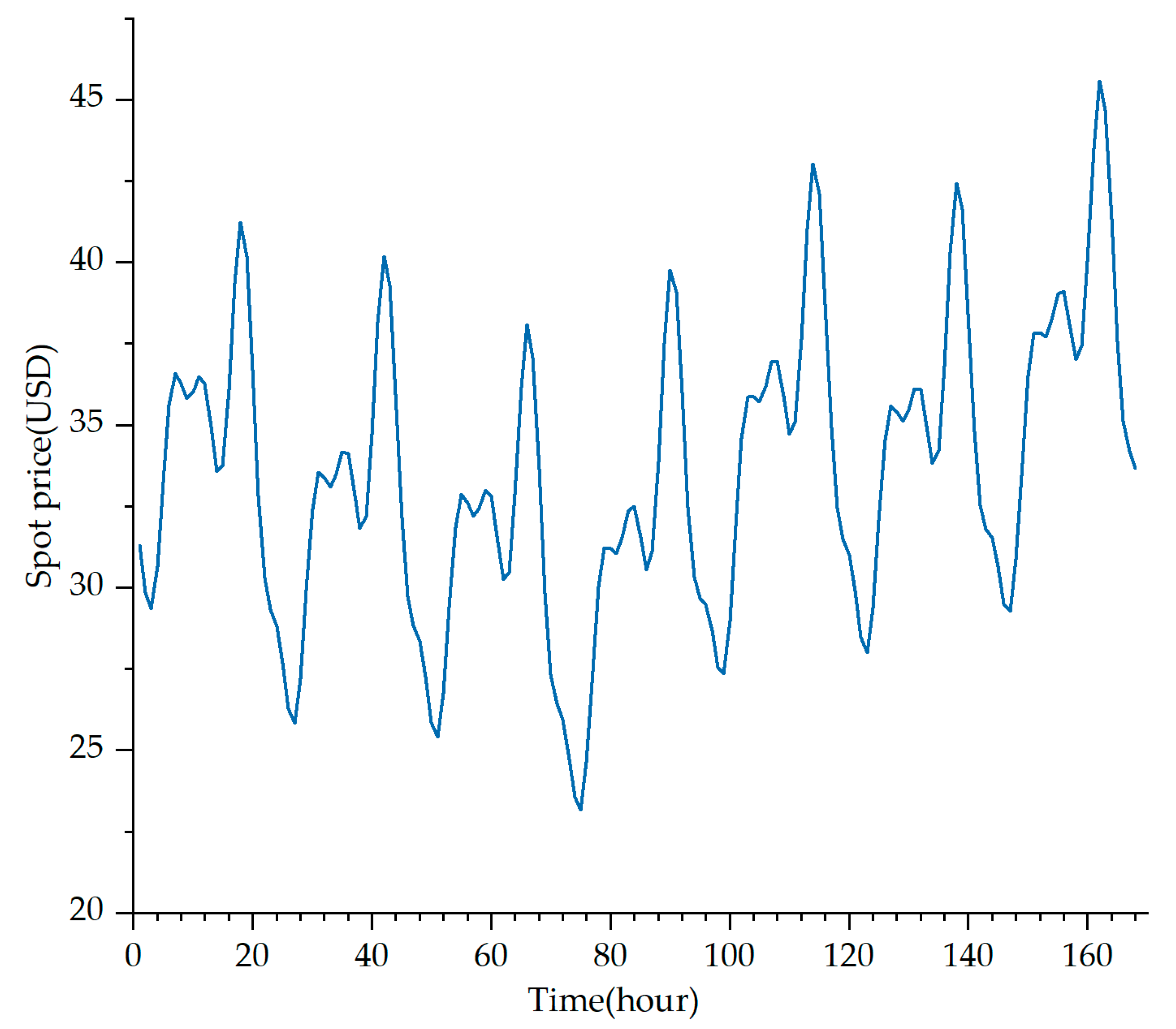

3.2. Data Prediction

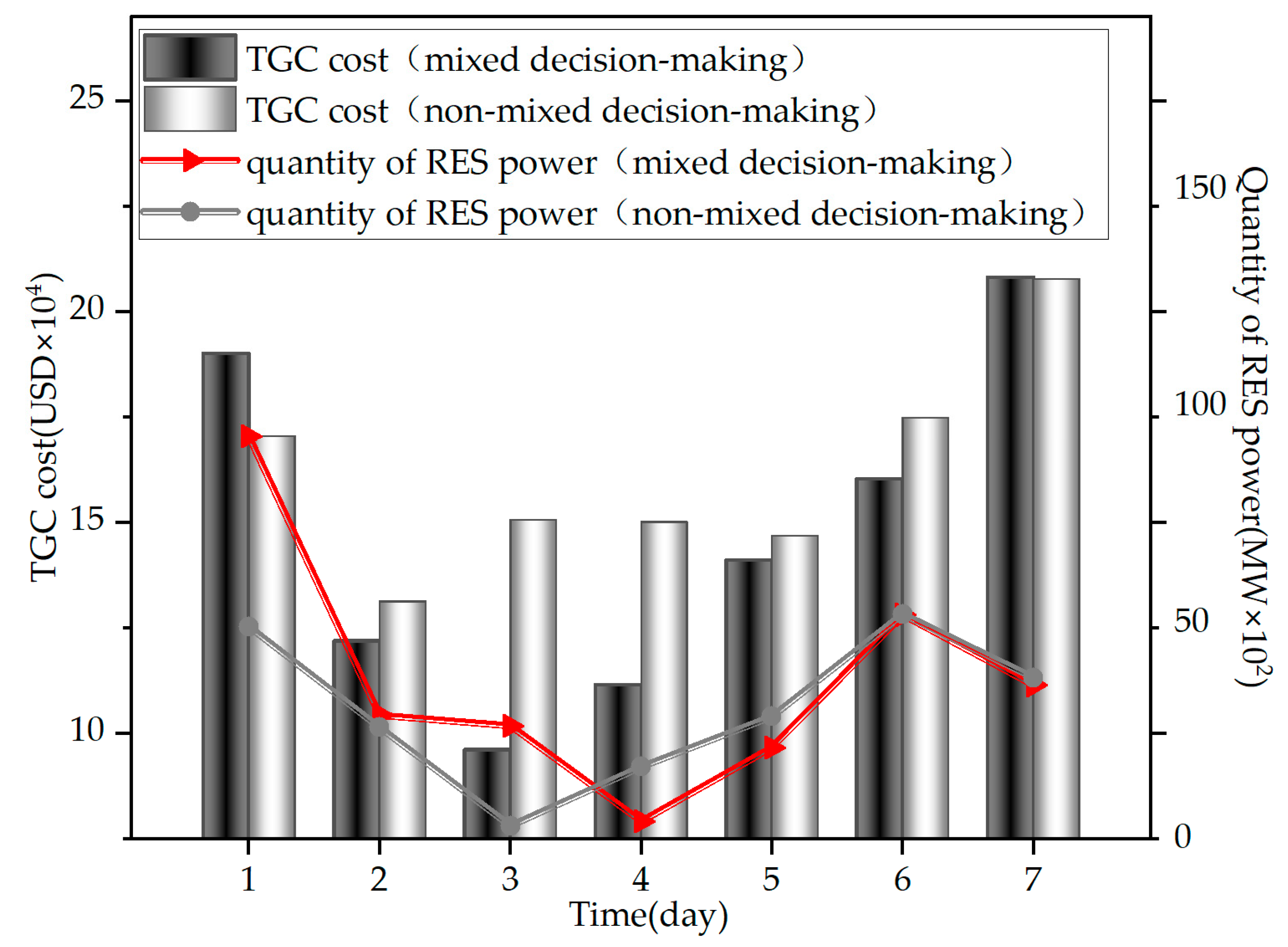

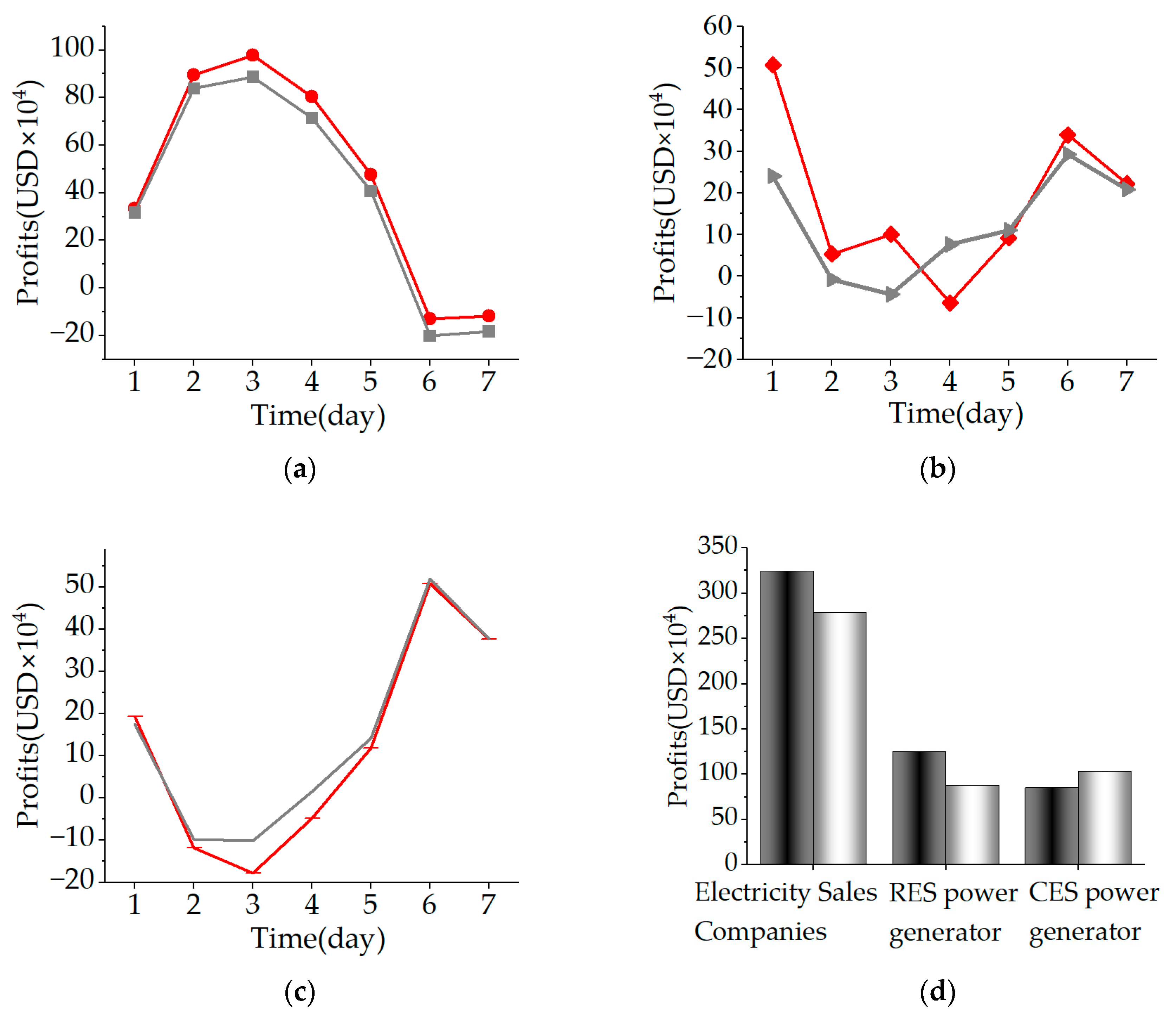

3.3. Analysis of the Trading Results under Different Decisions of the Electricity Sales Companies

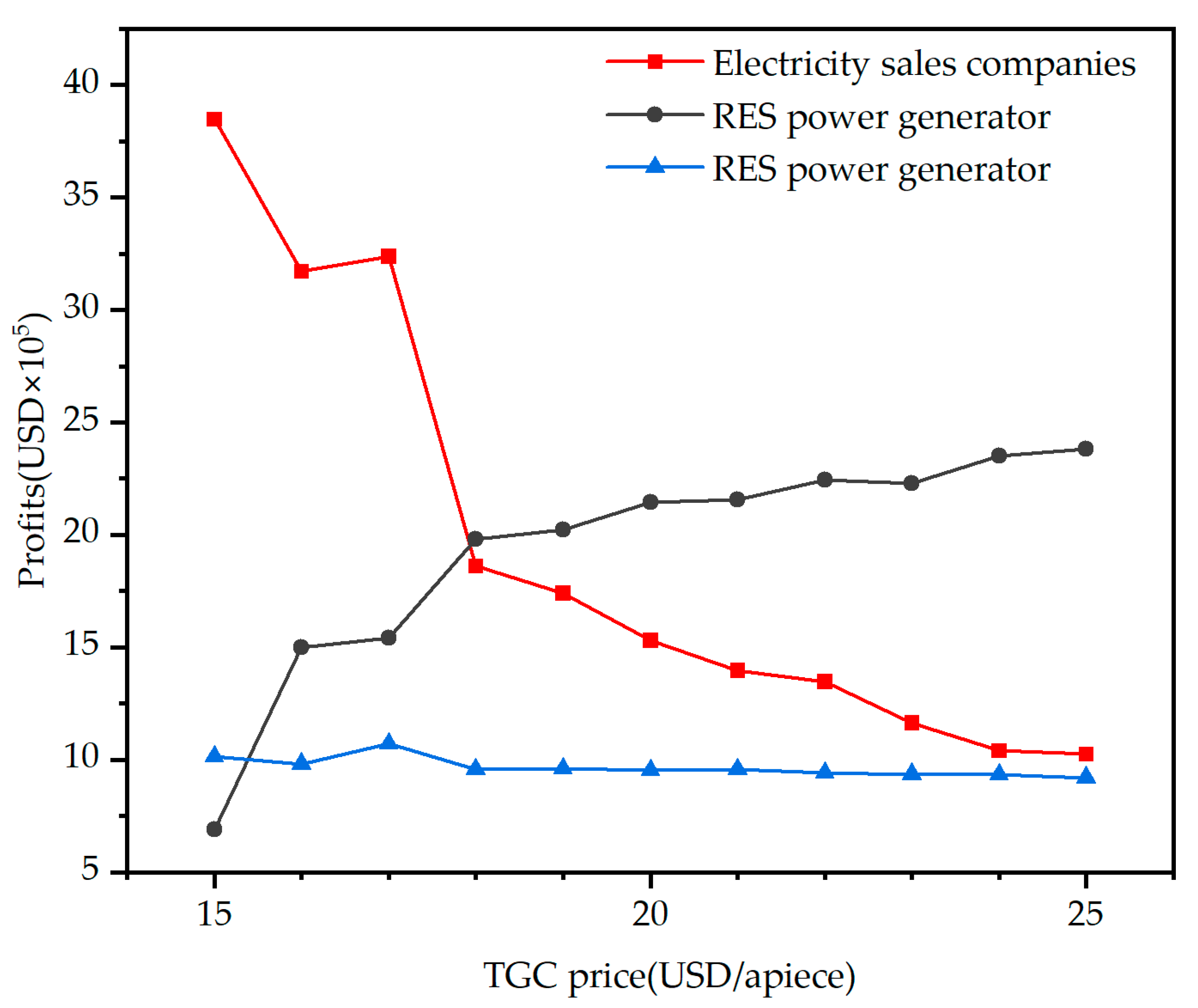

3.4. Profit of the Power Transaction Subjects under Different Indicators

4. Discussion

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| a | The cost coefficient of the CES power generator (USD·((MW)2·h)−1) |

| b | The cost coefficient of the CES power generator (USD·(MW·h)−1) |

| c | The fixed cost of the CES power generator (USD) |

| The cost functions of an electricity sales company in the electricity market | |

| The cost functions of an electricity sales company in the TGC market | |

| The cost of the CES power generator | |

| The cost function of the RES power generator | |

| CVaR | Conditional value at risk |

| The bid-winning coefficient of the spot market of the CES power generator | |

| The bid-winning coefficient of the spot market of the CES power generator | |

| NDRC | National Development and Reform Commission |

| The users’ price of bundled RES power (USD·(MW·h)−1) | |

| Medium- and long-term contract prices for bundled RES power (USD·(MW·h)−1) | |

| Medium- and long-term contract prices for CES power (USD·(MW·h)−1) | |

| The upper limits of the on-grid electricity price of the RES power generator (USD·(MW·h)−1) | |

| The lower limits of the on-grid electricity price of the RES power generator (USD·(MW·h)−1) | |

| The upper limits of the on-grid price of the CES power generator (USD·(MW·h)−1) | |

| The lower limits of the on-grid price of the CES power generator (USD·(MW·h)−1) | |

| The price per green certificate (USD·(per)−1) | |

| The spot price (USD·(MW·h)−1) | |

| Energy storage charging and discharging power (MW) | |

| The maximum capacity of the energy storage charge and discharge (MW) | |

| RES power output (MW) | |

| PJM | The Pennsylvania–New Jersey–Maryland |

| The users’ quantity of bundled RES power | |

| The users’ quantity of CES power | |

| The medium- and long-term contract quantities of bundled RES power (MW·h) | |

| The maximum amount of electricity that can be contracted between the electricity sales companies and the RES generators in the medium- and long-term market (MW·h) | |

| The maximum amount of electricity that can be contracted between the electricity sales companies and the CES generators in the medium- and long-term market (MW·h) | |

| The maximum power generation of the RES generator unit (MW) | |

| The medium- and long-term contract quantities of CES power (MW·h) | |

| The spot market decision-making partial purchase of electricity (MW·h) | |

| The spot market deviation part of purchased electricity (MW·h) | |

| The user real-time load (MW) | |

| The maximum generation capacity of CES generators (MW) | |

| The electricity sales companies’ purchase of electricity in the spot market (MW·h) | |

| RES | Renewable energy source |

| RPS | Renewable Portfolio Standards |

| The income functions of RES power generators in the TGC market (USD) | |

| The income functions of RES power generators in the medium- and long-term markets (USD) | |

| The income functions of RES power generators in the spot market (USD) | |

| t | Single trading period |

| T | Total trading period |

| The user utility function | |

| The coefficient of user utility function | |

| The coefficient of user utility function | |

| Random variable | |

| The duration of energy storage charging and discharging power | |

| The purchase or non-purchase of green certificates by the electricity sales companies | |

| The quota ratio that the electricity sales companies should bear. | |

| The quota ratio that the users should bear | |

| Random variable | |

| The profit function of the CES power generator | |

| The profit function of an electricity sales company | |

| The RES power generator’s profit function |

References

- The State Council of the Central Committee of the Communist Party of China. A Number of Views on Further Deepening the Reform of the Power System. 2015. Available online: https://news.ncepu.edu.cn/xxyd/llxx/52826.htm (accessed on 25 September 2022).

- National Development and Reform Commission. Notice on the Establishment of a Sound Renewable Energy Power Consumption Guarantee Mechanism. 2019. Available online: http://www.gov.cn/zhengce/zhengceku/2019-09/25/content_5432993.htm (accessed on 23 September 2022).

- National Development and Reform Commission. Notice on Matters Related to the New Energy Feed-in Tariff Policy in 2021. 2021. Available online: http://www.gov.cn/zhengce/zhengceku/2021-06/11/content_5617297.htm (accessed on 27 September 2022).

- National Development and Reform Commission. Notice on Further Deepening the Market Reform of the Feed-in Tariff for Coal-Fired Power Generation. 2021. Available online: http://www.gov.cn/zhengce/zhengceku/2021-10/12/content_5642159.htm (accessed on 25 September 2022).

- General Office of National Development and Reform Commission. Notice of the General Office of the National Development and Reform Commission on Organizing and Carrying out Power Purchasing Work of Power Grid Enterprises as Agents. 2021. Available online: http://www.gov.cn/zhengce/zhengceku/2021-10/27/content_5645848.htm (accessed on 15 September 2022).

- Guo, H.; Davidson, M.R.; Chen, Q.; Zhang, D.; Jiang, N.; Xia, Q.; Kang, C.; Zhang, X. Power market reform in China: Motivations, progress, and recommendations. Energy Policy 2020, 145, 111717. [Google Scholar] [CrossRef]

- Lin, J.; Kahrl, F.; Yuan, J.; Liu, X.; Zhang, W. Challenges and strategies for electricity market transition in China. Energy Policy 2019, 133, 110899. [Google Scholar] [CrossRef]

- Abhyankar, N.; Lin, J.; Liu, X.; Sifuentes, F. Economic and environmental benefits of market-based power-system reform in China: A case study of the southern grid system. Resour. Conserv. Recycl. 2020, 153, 104558. [Google Scholar] [CrossRef]

- Xu, J.; Lv, T.; Hou, X.; Deng, X.; Liu, F. Provincial allocation of renewable portfolio standard in China based on efficiency and fairness principles. Renew. Energy 2020, 179, 1233–1245. [Google Scholar] [CrossRef]

- Zhang, N.; Yan, Z.; Song, Y.; Han, D. Short-term generation scheduling model considering renewable portfolio standard. East China Electr. Power 2014, 42, 293–297. [Google Scholar] [CrossRef]

- Liang, J.; Zuo, Y.; Zhang, Y.; Zhao, X. Energy-saving and economic dispatch of power system containing wind power integration under renewable portfolio standard. Power Syst. Technol. 2019, 43, 2528–2534. [Google Scholar]

- Li, Y.; Zhang, F.; Yuan, J. Research on China’s renewable portfolio standards from the perspective of policy networks. J. Clean. Prod. 2019, 222, 986–997. [Google Scholar] [CrossRef]

- Wang, G.; Zhang, Q.; Li, Y.; Mclellan, B.C.; Pan, X. Corrective regulations on renewable energy certificates trading: Pursuing an equity-efficiency trade-off. Energy Econ. 2019, 80, 970–982. [Google Scholar] [CrossRef]

- Wang, G.; Zhang, Q.; Su, B.; Shen, B.; Li, Y.; Li, Z. Coordination of tradable carbon emission permits market and renewable electricity certificates market in China. Energy Econ. 2021, 93, 105038. [Google Scholar] [CrossRef]

- Yu, X.; Dong, Z.; Zhou, D. Integration of tradable green certificates trading and carbon emissions trading: How will Chinese power industry do? J. Clean. Prod. 2021, 279, 123485. [Google Scholar] [CrossRef]

- Song, X.; Han, J.; Shan, Y.; Zhao, C.; Liu, J.; Kou, Y. Efficiency of tradable green certificate markets in China. J. Clean. Prod. 2020, 264, 121518. [Google Scholar] [CrossRef]

- Jiang, Y.C.; Cao, H.X.; Yang, L. Mechanism design and impact analysis of renewable portfolio standard. Autom. Electr. Power Syst. 2020, 44, 187–199. [Google Scholar]

- Dong, F.G.; Shi, L. Design and simulation of renewable energy quota system and green certificate trading mechanism. Autom. Electr. Power Syst. 2019, 43, 113–121. [Google Scholar]

- Zhao, X.G.; Ren, L.Z.; Wan, G. Renewable energy quota system, strategic behavior and evolution of power producers. Chin. J. Manag. Sci. 2019, 27, 168–179. [Google Scholar]

- Feng, Y.; Li, Q.H.; Liu, Y. Design and exploration of renewable energy quota system in China. Autom. Electr. Power Syst. 2017, 41, 137–141+158. [Google Scholar]

- Zhu, C.; Fan, R.; Lin, J. The impact of renewable portfolio standard on retail electricity market: A system dynamics model of tripartite evolutionary game. Energy Policy 2020, 136, 111072. [Google Scholar] [CrossRef]

- Zhang, X.; Chen, Z.; Ma, Z.M. Research on electricity market trading system adapting to renewable energy quota system. Power Grid Technol. 2019, 43, 2682–2690. [Google Scholar]

- An, X.N.; Zhang, S.H.; Li, X. Equilibrium analysis of oligopoly electricity markets considering tradable grenn certificates. Autom. Electr. Power Syst. 2017, 41, 84–89. [Google Scholar]

- Liu, X.; Ronn, E.I. Using the binomial model for the valuation of real options in computing optimal subsidies for Chinese renewable energy investments. Energy Econ. 2020, 87, 104692. [Google Scholar] [CrossRef]

- Yu, S.; Lu, T.; Hu, X.; Liu, L. Determinants of overcapacity in China’s renewable energy industry: Evidence from wind, photovoltaic, and biomass energy enterprises. Energy Econ. 2021, 97, 105056. [Google Scholar] [CrossRef]

- Zhu, L.; Li, L.; Su, B. The price-bidding strategy for investors in a renewable auction: An option games–based study. Energy Econ. 2021, 100, 105331. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Does electricity price matter for innovation in renewable energy technologies in China? Energy Econ. 2019, 78, 259–266. [Google Scholar] [CrossRef]

- Du, Y.; Takeuchi, K.; Wan, G. Does a small difference make a difference? Impact of feed-in tariff on renewable power generation in China. Energy Econ. 2020, 87, 104710. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhao, X.; Ren, L.; Zuo, Y. The development of the renewable energy power industry under feed-in tariff and renewable portfolio standard: A case study of China’s wind power industry. J. Clean. Prod. 2017, 168, 1262–1276. [Google Scholar] [CrossRef]

- Cieplinski, A.; D’Alessandro, S.; Marghella, F. Assessing the renewable energy policy paradox: A scenario analysis for the Italian electricity market. Renew. Sustain. Energy Rev. 2021, 142, 110838. [Google Scholar] [CrossRef]

- Dai, S.L.; Zhang, L.; Liu, N.N. Analysis of power purchase decision of electricity selling companies considering the consumption responsibility of renewable energy. China Electr. Power 2021, 54, 156–164. [Google Scholar]

- He, Q. Optimization of Power Purchase Decisions by Power Sales Companies under Renewable Energy Quota System. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2020. (In Chinese). [Google Scholar]

- Kell, A.J.; McGough, A.S.; Forshaw, M. The impact of online machine-learning methods on long-term investment decisions and generator utilization in electricity markets. Sustain. Comput. Inform. Syst. 2021, 30, 100532. [Google Scholar] [CrossRef]

- Song, Y.H.; Wang, G.; Cai, H. A review on purchasing and selling decision of electric power company. Power Demand Side Manag. 2020, 22, 85–89. [Google Scholar]

- Dou, X.; Wang, J.; Ye, F. Power sales companies that consider the virtual power plant portfolio strategy optimize scheduling and purchase and sale decisions. Power Syst. Technol. 2020, 44, 2078–2086. [Google Scholar]

- Wu, D.; Ma, X.; Balducci, P.; Bhatnagar, D. An economic assessment of behind-the-meter photovoltaics paired with batteries on the Hawaiian Islands. Appl. Energy 2021, 286, 116550. [Google Scholar] [CrossRef]

- Nojavan, S.; Zare, K.; Mohammadi-Ivatloo, B. Application of fuel cell and electrolyzer as hydrogen energy storage system in energy management of electricity energy retailer in the presence of the renewable energy sources and plug-in electric vehicles. Energy Convers. Manag. 2017, 136, 404–417. [Google Scholar] [CrossRef]

- Kharrati, S.; Kazemi, M.; Ehsan, M. Equilibria in the competitive retail electricity market considering uncertainty and risk management. Energy 2016, 106, 315–328. [Google Scholar] [CrossRef]

- Kurihara, G.I.; Asano, H.; Okada, K.; Yokoyama, R. Long-term power trade model in electricity market based on game theory. In Proceedings of the IEEE/PES Transmission and Distribution Conference and Exhibition, Yokohama, Japan, 6–10 October 2002. [Google Scholar]

- Moghimi, F.H.; Barforoushi, T. A short-term decision-making model for a price-maker distribution company in wholesale and retail electricity markets considering demand response and real-time pricing. Int. J. Electr. Power Energy Syst. 2020, 117, 105701. [Google Scholar] [CrossRef]

- Zugno, M.; Morales, J.M.; Pinson, P.; Madsen, H. A bilevel model for electricity retailers’ participation in a demand response market environment. Energy Econ. 2013, 36, 182–197. [Google Scholar] [CrossRef]

- Mazidi, M.; Monsef, H.; Siano, P. Incorporating price-responsive customers in day-ahead scheduling of smart distribution networks. Energy Convers. Manag. 2016, 115, 103–116. [Google Scholar] [CrossRef]

- Silva, W.N.; Henrique, L.F.; Silva, A.D.C.; Dias, B.H.; Soares, T.A. Market models and optimization techniques to support the decision-making on demand response for prosumers. Electr. Power Syst. Res. 2022, 210, 108059. [Google Scholar] [CrossRef]

- Dagoumas, A.S.; Polemis, M.L. An integrated model for assessing electricity retailer’s profitability with demand response. Appl. Energy 2017, 198, 49–64. [Google Scholar] [CrossRef]

- Ju, L.; Wu, J.; Lin, H.; Tan, Q.; Li, G.; Tan, Z.; Li, J. Robust purchase and sale transactions optimization strategy for electricity retailers with energy storage system considering two-stage demand response. Appl. Energy 2020, 271, 115155. [Google Scholar] [CrossRef]

- Yang, S.; Tan, Z.; Liu, Z.; Lin, H.; Ju, L.; Zhou, F.; Li, J. A multi-objective stochastic optimization model for electricity retailers with energy storage system considering uncertainty and demand response. J. Clean. Prod. 2020, 277, 124017. [Google Scholar] [CrossRef]

- Wang, K.; Zhu, Z.; Guo, Z. Optimal Day-Ahead Decision-Making Scheduling of Multiple Interruptible Load Schemes for Retailer With Price Uncertainties. IEEE Access 2021, 9, 102251–102263. [Google Scholar] [CrossRef]

- Dou, X.; Wang, J.; Shao, P. The purchasing and selling strategy of e-commerce considering customer contribution. Power Syst. Technol. 2019, 43, 2752–2760. [Google Scholar]

- Li, Y.T.; Zhang, Z.; Yang, L. Decision Model of incremental power distribution company considering co-optimization of source, charge and storage. Autom. Electr. Power Syst. 2021, 45, 125–132. [Google Scholar]

- Liu, P.Y.; Ding, T.; He, Y.K. Optimal market trading strategy of load aggregator based on comprehensive demand response. Electr. Power Autom. Equip. 2019, 39, 224–231. [Google Scholar]

- Jiang, Z.; Ai, Q. Agent-based simulation for symmetric electricity market considering price-based demand response. J. Mod. Power Syst. Clean Energy 2017, 5, 810–819. [Google Scholar] [CrossRef]

- Yang, J.; Zhao, J.; Wen, F.; Dong, Z.Y. A framework of customizing electricity retail prices. IEEE Trans. Power Syst. 2017, 33, 2415–2428. [Google Scholar] [CrossRef]

- Song, M.; Amelin, M. Price-maker bidding in day-ahead electricity market for a retailer with flexible demands. IEEE Trans. Power Syst. 2017, 33, 1948–1958. [Google Scholar] [CrossRef]

- Li, T.; Gao, C.; Chen, T.; Jiang, Y.; Feng, Y. Medium and long-term electricity market trading strategy considering renewable portfolio standard in the transitional period of electricity market reform in Jiangsu, China. Energy Econ. 2022, 107, 105860. [Google Scholar] [CrossRef]

- Fan, W.; Huang, L.; Cong, B.; Tan, Z.; Xing, T. Research on an optimization model for wind power and thermal power participating in two-level power market transactions. Int. J. Electr. Power Energy Syst. 2022, 134, 107423. [Google Scholar] [CrossRef]

- Xu, Y. Spot market in consideration of medium-and long-term trading restrictions of electricity sales company decision. Energy Policy 2021, 54, 79–85. [Google Scholar]

- Do Prado, J.C.; Qiao, W. A stochastic bilevel model for an electricity retailer in a liberalized distributed renewable energy market. IEEE Trans. Sustain. Energy 2020, 11, 2803–2812. [Google Scholar] [CrossRef]

- Wang, H.; Chen, B.B.; Zhao, W.H. Optimal decision of cross-provincial power transaction subject under renewable energy quota system. Energy Policy 2019, 43, 1987–1995. [Google Scholar]

- De, G.G.; Tan, Z.F.; Li, M.L. Bidding Strategy of Wind-storage Power Plant Participation in Electricity Spot Market Considering Uncertainty. Power Syst. Technol. 2019, 43, 2799–2807. [Google Scholar]

- Zeng, J.Z.; Zhao, X.F.; Li, J. Game among multiple entitiesin electricity market with liberalization of power demand side market. Autom. Electr. Power Syst. 2017, 41, 129–136. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, H.; Wang, C.; Zhao, W. Decision on Mixed Trading between Medium- and Long-Term Markets and Spot Markets for Electricity Sales Companies under New Electricity Reform Policies. Energies 2022, 15, 9568. https://doi.org/10.3390/en15249568

Wang H, Wang C, Zhao W. Decision on Mixed Trading between Medium- and Long-Term Markets and Spot Markets for Electricity Sales Companies under New Electricity Reform Policies. Energies. 2022; 15(24):9568. https://doi.org/10.3390/en15249568

Chicago/Turabian StyleWang, Hui, Congcong Wang, and Wenhui Zhao. 2022. "Decision on Mixed Trading between Medium- and Long-Term Markets and Spot Markets for Electricity Sales Companies under New Electricity Reform Policies" Energies 15, no. 24: 9568. https://doi.org/10.3390/en15249568

APA StyleWang, H., Wang, C., & Zhao, W. (2022). Decision on Mixed Trading between Medium- and Long-Term Markets and Spot Markets for Electricity Sales Companies under New Electricity Reform Policies. Energies, 15(24), 9568. https://doi.org/10.3390/en15249568