1. Introduction

Industrial growth throughout the 19th and 20th centuries caused an increase in greenhouse gas emissions as well as emissions of other gases into the atmosphere, resulting in global warming. There have been numerous changes to the global climate, and international organizations and governments have started to pursue policies to combat climate change [

1]. The scientific community has acknowledged climate change as a research subject but, unfortunately, not all countries perceive climate change and the need to reduce greenhouse gas emissions as a political priority [

2].

Reducing global carbon emissions is complex and challenging for scientists and politicians. However, the literature on the subject shows the importance of various instruments of influence (e.g., tradable quotas, greenhouse gas emission allowances, a system of accounting for greenhouse gas emissions, recognizing liabilities due to greenhouse gas emissions and their settling, and tax systems with their fiscal and non-fiscal functions) [

3,

4] and recognizes green taxes—which are also often referred to as environmental taxes—as an important instrument of influencing behavior towards sustainability [

5,

6,

7].

Environmental taxes have a real impact on the adjustment activities of the enterprises, society, and public entities that pay taxes for the use of the environment [

8]. It should also be emphasized that, in addition to tax policy, EU countries have implemented a variety of economic instruments for environmental regulation. These flexible and cost-effective tools are used to correct market failures and internalize externalities in a cost-effective way, unlike administrative or regulatory measures that tackle climate problems by setting maximum allowable emissions limits, banning the use of some materials, or enforcing the application of advanced pollution abatement technologies [

9].

The conditions for the use of tax policies containing environmental tax instruments by governments differ depending on the country, membership of a community of states (e.g., the European Union), common policy, environmental value, awareness, or identification with the SDGs’ objectives. In countries based on a highly developed awareness of the sustainability and goals of SDGs, there are requirements and tax policies that have a very strong impact on changes with a positive impact on the climate and limiting greenhouse gas emissions. The climate targets for reducing greenhouse gas emissions are becoming increasingly ambitious [

10]. In 2019, the “European Green Deal” [

11] was adopted, on the way to energy neutrality for the European continent. In 2021, EU countries agreed to reduce emissions by 55% by 2030 compared to the 1990 levels [

12]. A key determinant of the promotion of the above actions is their financing and tax incentives. This dimension of actions is regulated by a number of formal and legal instruments, including, among others, Commission Implementing Regulation (EU) 2020/1294 of 15 September 2020 on an EU Renewable Energy Financing Mechanism [

13]. “Green” taxes create incentives for business investments to develop and use alternative low-carbon fuels and technologies [

10]. This is an important argument because the efficiency of actions in achieving climate targets may be limited by the existing mechanism for the allocation of free emission allowances [

14]. The increasing price of “brown” energy (especially polluted) caused by the energy tax leads to a decreased demand for polluted energy sources, caused by a substitution effect [

15]—a common argument that is used by society and is strongly associated with non-financial factors (ESG factors), especially with social responsibility for climate change. The literature shows that the impact of normative information varies across climatic mitigation contexts, depending on familiarity and behavioral factors [

16]. The new regulations on social and environmental risk management are becoming more and more important in terms of climate responsibility and are related to the non-fiscal function of taxes.

The research shows that green taxes play a very important role for the environment, and that we risk a backlash of increased greenhouse gas emissions if they are abolished [

17]. Numerous analyses also show green taxes as an instrument of sustainability [

15,

16,

18]. Dulebenets (2018) binds taxes and advances environmental sustainability. It also indicates the importance of green taxes in the context of estimating the external environmental costs [

19]. The literature on the subject also shows that governments must ensure that their green taxation policies are strong enough and are able to mitigate the risk and, thus, affect sustainability [

20].

The review of the literature shows that “environmental taxes”—and especially “green” taxes—play a fiscal role, and very rarely a stimulating one. In view of the growing importance of ESG factors (especially in EU member states), there is a need to examine whether “green taxes” have a non-fiscal function. There is also no comprehensive analysis of many factors against the background of the tax factor to see which factors affect the reduction in greenhouse gas emissions and whether “green” taxes are really a significant factor influencing the reduction in greenhouse gas emissions.

Therefore, it is necessary to explain whether, along with other factors, environmental policy and its component “green taxes” can act as a factor in limiting greenhouse gas emissions.

The purpose of this article is to seek an answer to the question of whether “green taxes” as an instrument of tax policy are a significant factor influencing climate change by contributing to reducing greenhouse gas emissions. Since the fiscal function of green taxes is commonly known and confirmed, we sought answers as to whether green taxes can perform a motivational function (non-fiscal) as an instrument of sustainability. The research hypothesis assumes that environmental taxes are a significant determinant of greenhouse gas emission reductions compared to the analyzed determinants. The detailed goals can be defined as follows:

The accomplishment of a review and order of terminology relating to environmental taxes and the purposes of their application;

Determination of the determinants of greenhouse gas emissions;

Designation of the determinants of greenhouse gas emissions in European Union (EU) countries using econometric modeling (multiple linear regression models);

Determining whether green taxes are a significant contributor to greenhouse gas emissions.

This paper is organized as follows: The introduction is presented in

Section 1.

Section 2 contains a literature review and arguments pointing to theoretical research on the impacts of various factors in reducing greenhouse gas emissions.

Section 3 presents the methodological approach, data collection procedure, and description of the methods.

Section 4 presents the research results.

Section 5 presents a discussion of the research results obtained in the context of the existing view that green taxes are used as an instrument for changes towards sustainability.

Section 6 presents the conclusions.

2. Literature Review

In addition to orders and bans as well as public spending on pro-ecological adaptation, “environmental taxes”—also known in practice as “green taxes”—are an important instrument. The implementation of the “green taxes” system, as an instrument of government policy for sustainability, is aimed at triggering adjustment reactions both on the market and among the public, in accordance with the needs of environmental protection. The literature review shows that we are dealing with heterogeneous terminology, and “environmental taxes” [

21] are very often referred to as “green taxes” [

7] or “climate change mitigation taxes” [

22,

23]. The lack of clarity in defining the concept of “environmental taxes” does not change the fact that they serve the objectives of climate change mitigation policy and contribute to the achievement of environmental objectives—especially the SDGs [

21,

24]. Eurostat [

22] defines environmental taxes as taxes that can be classified by environmental categories, dividing them into four basic categories of taxes: energy, transport, pollution, and resources. According to Eurostat [

22], these four groups of taxes can mitigate the negative impacts of various factors—including greenhouse gas emissions—on the environment. The outline of the meaning of environmental taxes, taking into account their impact on water and air as basic resources, is presented in

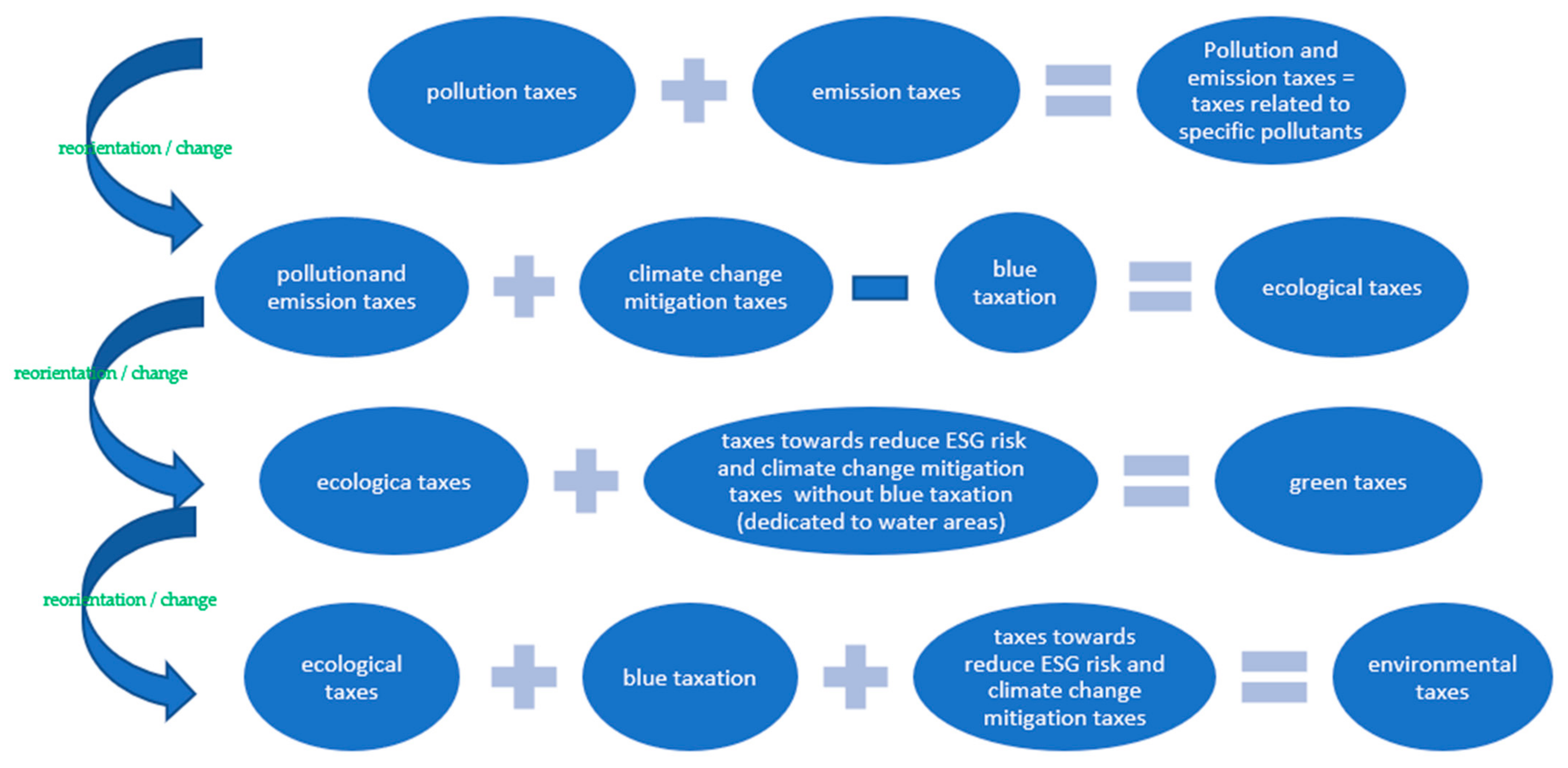

Figure 1. The analysis of the meaning of the data collected by “Eurostat” from the point of view of Eurostat accounts, as well as the definitions of the concepts of “green taxes” and “environmental taxes”, indicate that their scope is the same, while from the point of view of the concepts they differ in terms of risk factors. Risk is not taken into account in Eurostat accounts, as it is difficult to quantify objectively. Therefore, the notions of “environmental taxes” and “green taxes” are often equated.

The importance of risk is of particular importance in relation to sustainability, especially through the prism of non-financial factors. For sustainable development, financing sustainable change policies [

23], and measurement of ESG risk—and in particular for financing—its inclusion in tax structures will be important in the future for “greening”, using tax breaks or even tax expenditures.

The goal of introducing such green taxes is not to achieve fiscal objectives, but to achieve environmental objectives, which are non-fiscal [

25]. The theoretical groundwork for the green tax concept was prepared by A.C. Pigou in 1920 [

26], who postulated to include so-called externalities in the tax system—in this case, environmental ones. This means that the most important goal of environmental taxes is to encourage entities that create pollution to act in more environmentally responsible ways and, in essence, to “go green” and “go to reduce the climate change” through ESG risk reduction. Therefore, from the point of view of achieving the goals that the government wants to achieve, the terms “environmental taxes” and “green taxes” are often used interchangeably [

27].

In the context of this literature review, we wish to present a description of the most relevant directions of study that can allow the identification of factors affecting the reduction in global carbon emissions through politics and tax instruments, the assessment of their impact, and the answer to the question of whether taxes are an important instrument contributing to the reduction in greenhouse gas emissions. Various authors in the literature on the subject represent the following views on “environmental taxes”:

They are based on a new philosophy of ecological economy, taxing negative externalities—not goods [

28,

29,

30,

31,

32,

33];

The essence of the action of the tax itself affects the behavior of entities that are obliged to pay a public tribute [

8,

9,

10,

15,

17,

18,

34,

35,

36,

37,

38,

39];

They can be a significant source of budget revenues and stimulate dynamic technological innovations [

40,

41,

42,

43];

They change the face of the economy, allowing “green growth” to be achieved, and changing the face of the economy from traditional to circular, taking into account ESG factors [

37,

43,

44,

45,

46,

47,

48,

49,

50,

51,

52,

53];

They should be considered in the context of the theory of tax optimization and the effects of optimization [

25,

43,

54,

55];

Taxes can be considered in the context of prices and their role in the EU-ETS [

4,

9,

14,

15,

56,

57];

They imply a reaction to taxation (social assessment, adaptive responses of enterprises and society, tax evasion, acceptance of tax incentives, strategies towards taxation, desirable adaptive behavior, etc.) [

55,

58,

59,

60,

61,

62,

63,

64];

They enable progress to be made in the integration and sustainable development of their countries (bringing measurable effects such as greenhouse gas emission reductions or counteracting climate change); in other words, the research development trends related to the use of environmental taxes as tools to understand the determinants of acceptability for taxes directed at sustainability [

47,

65,

66,

67,

68,

69,

70,

71,

72].

The basic condition for the effectiveness of environmental policy instruments is the possibility of internalizing negative environmental externalities arising from the activities of enterprises or entities. In practice, this means transforming these effects into internal costs (in the form of fees, e.g., ecological taxes) of the functioning of economic entities causing pressure on the environment. It can be indicated that financial instruments should have such an effect in order to force economic entities to reduce the pressure that they place on the environment. The concept of negative effects was defined by Baumol and Oates [

28] as the results of the actions of some entities on the utility or production functions of other entities. Dasgupta and Heal [

29] indicated that externalities are the result of insufficient incentives to create efficient markets and production factors, causing the market equilibrium to fail to meet the Pareto optimality conditions. External effects are subject to correction, and the most common forms of correcting market misallocation are direct regulations—most often in the form of orders to limit the production of pollutants to optimal levels. However, their role is limited in situations where a large number of entities participate in the creation of the same external effect. There is a problem of how to distribute the limitations resulting from this effect among individual entities [

30].

Achieving sustainable development goals; connecting the environment, economy, and society; eliminating externalities; and taking into account the ESG factors are dependent on the use of sufficient capital to finance the long-term transition and long-term changes of the real economy—especially in enterprises and financial institutions [

31]. The basic condition is to provide complementary forms of finance for low-carbon investment (the so-called transition to sustainable and responsible finance), which combines what is most effective with the private and public financial system [

32,

33].

In the public financial system, environmental taxes constitute a combination of prices and standards, designed not to achieve a Pareto-efficient allocation but to achieve a preset arbitrary environmental target contributing to the achievement of the SDG objectives and solving specific sustainability problems [

17,

18]. Furthermore, this detour from the theory of optimal taxation leads to a more pragmatic approach precisely because “the level of acceptable pollution is not a question of economics, but of environmental as well as of social (particularly intergenerational) justice considerations and can be set by the government” [

34,

35,

36,

37].

The literature review shows many trends and studies on the role of environmental taxes in reducing greenhouse gas emissions, as well as the role of green taxation and its impacts on the economy and society [

8,

9,

10,

15]. In addition to serving a non-fiscal function related to mitigating environmental problems—such as reducing greenhouse gas emissions, pollution, and degradation of nature—green taxes are regarded as market-based, incentive-driven mechanisms to stimulate desired sustainability and mitigate climate change. They are identified in the literature as being more efficient than so-called regulation and control mechanisms, and their acquisition costs are usually low [

38]. The literature analyzes the impact of factors such as GDP per capita, population, renewable energy, energy intensity, and the economic crisis on GHG emissions [

39]. The findings show that green taxation can also help promote sustainable growth, support intergenerational fairness, and maintain tax revenue levels for EU member states. Such research confirms the direction of the action of the tax itself on the behavior of entities that are obliged to pay a public tribute.

In many countries, green taxes differ in many ways, and their use as a source of budget revenues also differs [

40]. The following applications are indicated in the literature on the subject: the green tax revenue contributes to the general public budget without being tied to environmental or sustainability goals (fiscal functions); the revenue from green taxes is recycled (partly or wholly) as reductions in social security taxes [

41]; some of the green taxes are used to compensate polluters or to subsidize sustainable investments in technology favoring the fight against climate change, and their use is indicated for innovations conducive to climate change [

42,

43].

The macroeconomic theory indicates that different types of taxes fulfil the function of a repressing function in the economy and society [

44]. Tax instruments can prompt people to adapt to specific government policies with varying degrees of force. The idea of using taxation to correct negative externalities [

43]—especially those relating to climatic factors—is generally credited to Pigou’s theory (1920) [

26]. However, it should be remembered that the introduction of new instruments and techniques of taxation (e.g., new tax rates, exemptions, subsidies), while striving for growth of the tax income of the government, puts a downturn risk on the economy [

45]. Hence, numerous studies refer to the impacts of environmental taxes on GDP and the economy itself [

46,

47,

48].

Green taxes are discussed in the literature regarding their potential effects on resource savings [

49,

50]. However, they are also examined from the point of view of affecting types of funding [

51]. Green taxes internalize the environmental and social externalities of resource extraction [

52] and belong to the instruments of policies for addressing resources [

53], which contribute to reducing negative environmental effects from the use of resources [

54]. Thus, on the one hand, environmental taxes influence GDP, and on the other, by influencing resources, they contribute to the shift towards a circular economy. Vence and Pérez indicated their low efficiency and low level of achievement of environmental goals (including greenhouse gas emissions) [

37]. The authors discussed the impact of taxes on the circular economy. To strengthen the circular economy and sustainable growth, activity should focus on reform and make use of available tax expenditure measures, including the many tax benefits, exemptions, deductions, and allowances applicable to existing large taxes. The tax expenditure in the general tax policy, according to Vence and Pérez (mainly with non-environmental purposes), could be reshaped and used to promote the transition towards a circular economy (replacing all environmentally harmful subsidies and tax benefits with a tax treatment favoring all circular and sustainable activities) [

37].

In the context of the influence of ESG factors, the presence of negative externalities should be emphasized, which is related to market failure. This applies especially to greenhouse gas emissions, as indicated in the literature on the subject [

36]. Imposing taxes on externality-generating goods can correct the externality, but in the case of greenhouse gas emissions there are complication in the operation of this theory. These complications are related to the fact that the marginal external damage caused by a good varies based on who produces the good or how it is produced. Greenhouse gas emissions from a power plant that burns natural gas are much lower than the greenhouse gas emissions from electricity produced by burning coal [

43].

In the literature on the subject, environmental and green taxation is discussed in the context of the theory of tax optimization [

25]. Optimal taxes correspond to the shadow prices that are generated in the social optimum, as indicated by Ploeg and Withagen [

54]. They also argue that, on a global scale, optimal taxes are difficult to use in public policy. In order to influence greenhouse gas emissions, new technologies are indispensable, and it is necessary to influence the development of clean, “green” technologies with fiscal instruments. Moreover, only a few countries choose green taxes, whereas most nations want to implement a flexible approach based on subsidies for renewable energy, which are seen as an instrument for influencing technological change toward reducing greenhouse gas emissions [

56]. Carattini et al. (2017) showed that the implementation of green taxation has proven difficult in many nations [

43,

55], due to the resistance of large companies, but also to rising commodity prices due to rising energy prices caused by the imposition of CO

2-related taxes.

The literature also indicates, in the context of the EU ETS, the effects of their introduction may transcend climate mitigation and, thus, extend beyond the impact on greenhouse gas emissions [

14]. In addition to cutting emissions, there are other goals—such as environmentally friendly investments, security of energy supply, local pollution reduction, or industrial development. The challenge lies in calibrating policies, which means broader inclusion of green taxation policy in the EU ETS [

56,

57]. In addition, an economically efficient instrument is to provide a carbon price signal that increases over time [

4]. This price and tax signal makes it possible to calibrate the cost of GHG emissions to society as a whole and to encourage governments to reduce the consumption of those energy sources that cause the highest pollution. Thus, the “polluter pays” principle was consolidated [

9,

15].

Another trend represented in theory relates to voters’ reactions to green taxation [

55,

58]. The literature review shows the importance of considering voters’ preferences, as well as the consideration of the economic objectives of voters over public interests and the public good, including environmental preferences. In addition, the use of green tax opinion by the media becomes a problem, possibly leading to erroneous opinion formation and incorrect understanding of political decisions among voters [

59]. The public’s responses to green taxes aimed at reducing greenhouse gas emissions can include membership and activity of citizens in climate protection advocacy groups and active lobbying of these groups in the political arena. Such groups, through lobbying, can apply pressure for the use of other, non-tax instruments that are more effective [

60]. Baranzini et al., in 2017, indicated that green taxes represent a basis to study the consequences of informational asymmetries between citizens, policymakers, and experts [

61]. In conclusion, it should be noted that the information asymmetry theory plays a key role in explaining the reactions of society and various entities to “green taxation” related to reducing greenhouse gas emissions.

In theoretical considerations, there is also a visible trend indicating the application of diversified tools and instruments to understand the determinants of the acceptability of “green taxes”. Conducting qualitative assessments has helped in understanding of the obstacles to tax reform and to the introduction and modification of environmental taxes [

62,

63]. Using quantitative and qualitative methods, the high level of distrust in environmental tax reforms among the general public has been demonstrated [

62,

64]. Research has led to the conclusion that society may only be willing to support the introduction of “green taxes” if their revenues are clearly earmarked for environmental purposes.

Vence and Pérez point to the proliferation of new, specific, and relatively marginal taxes related to environmental goals. The indicated studies of Vence and Pérez should also be considered in the context of the current research, which shows that depending on the design of the environmental taxation, a double dividend can be obtained (i.e., a benefit to both the environment and the economy) [

37,

65,

66,

67]. The study of Freire-González et al. (2022) reinforces the theory that authorities need to impose green taxes to stimulate and reinforce the circular economy, reduce greenhouse gas emissions and environmental burdens, and act for the climate, but also demonstrates that they can improve their design without additional costs [

68].

An important aspect of the activities undertaken within the framework of tax policy is the pursuit of the restriction of climate change. Both the studies presented and the activities of many countries show the need for tax reforms—in particular, environmental tax reforms (ETRs) in the national legislation of EU countries. Criticism of the application of environmental tax mechanisms in both the literature and the assessment of tax policy has led to a transfer of the tax burden from factors of production to polluters themselves, summarized as a step from economic “goods” to environmental “bads” [

47,

65,

69,

70]. This idea, in particular, provides the basis for the introduction of “energy taxes” and a “green taxes system”, with the aim of stimulating the reduction in greenhouse gas emissions.

In this context, the link between environmental taxes and air pollution (and other emissions) has also been recognized by various researchers. The literature on the subject [

61,

70,

71,

72] shows the impact of fiscal spending patterns on the environment by taking into account CO

2, greenhouse gas emissions, and other emissions.

“Green taxes” are those for which the tax base is a physical unit (or a substitute for a physical unit) of a good that has a proven, specific, and highly negative impact on the climate and environment [

27], i.e., emissions that meet the negative impact on environment criterion, in particular on natural resources, air, water, animals, or humans and society.

Research by Rybak et al. (2022) [

24] showed that the direction and strength of the impacts of green taxes differ depending on the greenhouse gas. Environmentally responsible tax policies can guide entities to circular production and make them more environmentally efficient, in an effort to limit greenhouse gas emissions, reduce negative environmental and climate impacts, and further the development of new markets. This is the battle between the so-called “crowding-out effect” and the “Porter effect”. In the literature on the subject, it has been shown that green tax incentives play a role as stimulators of technological changes towards green transformation and sustainability [

44,

73,

74,

75,

76].

It should be emphasized that the eight groups of tendencies highlighted in the views on “environmental taxes” do not exhaust the discussion, which continues and is still being developed. The intention of the authors was to show the fiscal and non-fiscal functions of green taxes. In fact, the non-fiscal functions are developed only in the views of groups 4 and 8.

Against the background of the discussion on the specificity, role, and meaning of “environmental taxes”, the idea of research on the factors determining greenhouse gas emissions was developed. The purpose of this article is to search for the answer to the question of whether “green taxes”, as an instrument of tax policy, are an important factor affecting climate change by limiting greenhouse gas emissions. This goal prompts us to analyze the factors influencing greenhouse gas emissions. Considering the factors contributing to reducing greenhouse gas emissions based on the literature on the subject, we have seen that these factors are considered on a case-by-case basis. This study considers many factors, and the methodological approach results in an empirical model in the form of a regression equation.

Table 1 presents the factors influencing greenhouse gas emissions discussed in the literature on the subject, as well as the relationships between them that have been analyzed in the literature.

The direct and indirect impacts of environmental taxes on climate change may not happen instantaneously. There are many factors to consider and key factors to be established. Greenhouse gas emissions are undoubtedly a very important factor causing climate change but, as shown in

Table 1, the indicated factors were analyzed and their impacts on climate change were demonstrated. On the one hand,

Table 1 shows the specific variables analyzed in the literature on the subject, the influence of which has previously been confirmed. On the other hand, we have industrial research with the use of specific variables describing the industries most associated with greenhouse gas emissions.

Table 1 indicates the significant variables that are often presented in the literature on the subject: production level (GDP), emission reduction measures, use of various energy sources (e.g., RWE, gasoline, diesel), energy productivity, factors influencing energy efficiency, transport, and population.

Therefore, we can see the desirability of the factors listed in

Table 1 to show their impact on reducing greenhouse gas emissions. As shown by the literature review, single variables have been studied, while the impact of many variables in the context of their relationship with environmental taxes has not been analyzed, which is the authors’ own contribution and an extension of the empirical research conducted so far.

3. Materials and Methods

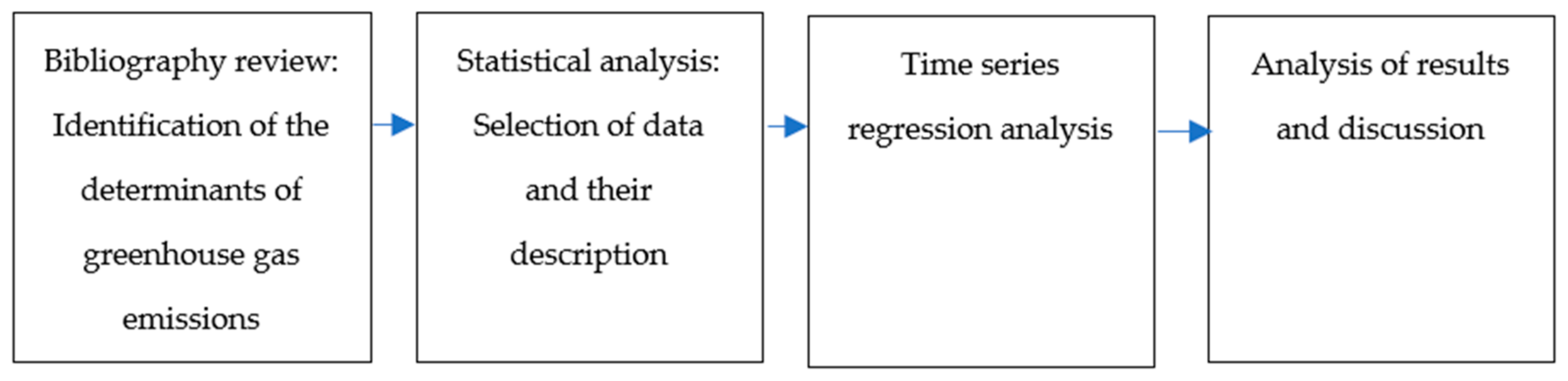

When starting to elaborate the methodology of research on the factors influencing greenhouse gas emissions, on the basis of the analysis of the literature concerning this topic, we determined the measures illustrating these factors, as well as the method of cause–effect analysis, where the explained variable was the amount of greenhouse gas emissions and the explanatory variables were amounts showing the diagnosed factors. The stages of this work are presented in

Figure 2.

In order to select the explanatory variables, the evolution of greenhouse gases in the European Union countries was additionally analyzed by emission sector (

Table 2).

In order to determine the coexistence of both analyzed categories (i.e., environmental taxes and greenhouse gas emissions), we calculated the Pearson’s correlation coefficients, and their statistical significance was verified using the test of significance for Pearson’s product–moment correlation coefficients.

When making the final selection of variables for the description of the greenhouse gas emission quantity, on the one hand, we took into account their best fit to the description of the analyzed factors (categories), and on the other hand, the availability of data was considered (e.g., comparability of data; availability of long time series for many EU countries). Selected variables reflecting the identified factors are presented for selected years. In the event of the absence of data for a country for a specific year, the value for the next year was used.

Determining the relationships between the indicated variables made it possible to determine the impact of environmental taxes on greenhouse gas emissions in comparison with the other defined variables. Modeling allowed us to determine whether environmental taxes are an important determinant of greenhouse gas emissions in the European Union countries. Assuming such an aim of the research, we decided to use the analysis of interdependence of variables in multiple linear regression [

88,

89,

90,

91,

92]. This enabled us to study the existence of correlation between the categories under consideration, which is a condition for a cause-and-effect relationship between them. This method enables the construction of models of linear dependence between many variables. The result is an empirical model in the form of a regression equation that takes the following form:

where the meaning is as follows:

yt—the explained variable at time t;

xt—the explanatory variable at time t (predictor);

bi—unknown regression coefficients i = 0, 1, 2,…, n, where b0 denotes a free term;

n—the number of explanatory variables;

—a random component expressing the influence of all those factors that were not included in the model on the dependent variable.

Linear regression requires the assumption that the relationship between the variables is linear. In practice, the validity of this assumption is almost impossible to prove; however, multiple regression procedures are quite resistant to slight derogations from this assumption [

93]. Regression allows us to estimate how the dependent variable changes as the independent variables change. The main advantages of using this modeling are its simplicity, interpretability, and speed. The indicated advantage—simplicity—is at the same time its greatest disadvantage, because the surrounding reality does not consist of simple linear relationships. The disadvantages of using a multiple regression model are also related to the use of data, which can lead to false conclusions. In addition, outliers greatly distort the results. Hence, it is necessary to carry out activities minimizing the occurrence of these problems (e.g., collecting and preparing data, examining their quality, initial model construction, verification/validation). Before modeling, it was established that the variables were continuous, the observations were independent of one another, and there were no significant outliers.

When building subsequent models, the determination coefficient was used as a measure of the models’ fit to empirical data, and significance tests (F-test) and the empirical significance level (the so-called p-value) were used to determine the significance of the changes. The analysis of residuals was also used to evaluate the models. After the models were estimated, they were verified in order to confirm the accuracy of the assumptions of the least squares method.

Regression coefficients are estimated using the least squares method (LSM). The constructed multiple linear regression models must conform to the assumptions regarding their quality. The intention was to search for such models that would allow the explanation of the explained variable—greenhouse gas emissions (GGEs)—to the highest degree, with simultaneous consideration of the low value of the variance inflation factor (VIF) for particular explained variables.

The basic measure of regression matching is the coefficient of determination R

2, which describes the strength of the linear relationships between variables, i.e., the match of the regression line to empirical data. The coefficient of determination takes values in the range [0,1] and indicates what part of the variability of the GGE variable is explained by the estimated model. The higher the level of the determination coefficient, the more of the variability in the dependent variable is explained by the model. Another important parameter used to assess the quality of the regression model is the significance coefficient, the value of which should not exceed 0.05. The model should be matched with independent (explanatory) variables that are strongly correlated with the dependent (explained) variable but weakly correlated with one another, so that the phenomenon of collinearity does not occur, which would weaken the quality of adjusting the model to reality. The measure of collinearity is the tolerance coefficient or its reciprocal—called the match error inflation or variance inflation factor (VIF). Explanatory variables with a large VIF value should be eliminated from the model [

94].

The analysis of interdependence of variables in multiple linear regression is used to a rather limited extent in social research [

95]. So far, it has not been used to study the relationships between environmental taxes and greenhouse gas emissions. The constructed model is an original proposal to study the abovementioned relationships. The use of regression analysis allows determination of the strength of the influence of individual explanatory variables on the explained variable.

When starting the modeling, all correlation coefficients between the variables were calculated. When looking for regression models that explain the explained variable as best as possible, the following factors were taken into account: the amount of the regression coefficient, the value of the coefficient of variance (VIF), the possibility of interpreting the results, and the level of significance. Variables that were strongly correlated with one another were eliminated from the models.

Before starting the multiple regression analysis, the variables (predictors) influencing greenhouse gas emissions were selected regarding substantive considerations, the universality of the measures that were used, and their comparability, variability, and importance, as well as their availability [

96]. It should be emphasized that the selection of variables (predictors) was influenced by the analysis of the literature on the subject, where we checked which variables (predictors) were analyzed and why (

Table 1). From the set of statistical features used to build the greenhouse gas emissions regression model in the EU countries, 14 variables were selected. Among the described predictors are indicators identified in the theoretical part as determinants of greenhouse gas emissions. The complete set of variables is presented in

Table 3.

The variables indicated in

Table 3 are mostly destimulants (i.e., their impact on greenhouse gas emissions should be negative), except for HC, CO

2, and FWA, which are stimulants (i.e., their impact should be positive). We also decided to introduce two nominative variables: GDP and ETR. When searching for regression models that best explain the dependent (explained) variable—greenhouse gas emissions (GGEs; thousands tonnes of CO

2 equivalents)—the following factors were taken into account: the value of the regression coefficient, the value of the variance inflation factor (VIF), the possibility of interpreting the results, and the level of significance. Variables that were strongly correlated with one another were eliminated from the models. The calculations were made with the use of statistical data analysis software (SPSS–PS-Imago version 7.0). A stepwise regression analysis was used, allowing us to enter into the model only those variables (predictors) that significantly affect the dependent variable [

96,

97]. This allowed us to eliminate unnecessary variables that did not contribute anything to the model and, thus, to obtain only those variables affecting the prediction of the dependent variable. At the same time, the stepwise method allows for the elimination of the problem of collinearity. Successively introduced predictors also take into account the mutual correlation between them. In the regression analysis, we used statistical data for 2020 (as the last year for which all data were available), along with data for 2018, 2016, 2014, 2012, and 2010 for comparison. The data for the analysis were derived from the resources of Eurostat, the OECD, the European Environment Agency, and the Food and Agriculture Organization of the United Nations. Models were built on the basis of data for each EU country in the selected years.

At the stage of preparing the data for analysis, the descriptive statistics of all variables were calculated. An example of the results of the analysis for 2020 are included in

Appendix A. The aim of the study was to identify factors influencing greenhouse gas emissions, including green taxes. At the beginning, we aimed to build models for individual EU countries using data for the last available year in databases. For comparison, we did the same for additional selected years to confirm the results that we obtained.

4. Results

Table 4 presents the values of Pearson’s linear correlation coefficients, which can be used for the initial assessment of the level of linear dependence (co-occurrence) between greenhouse gas emissions and environmental taxes.

All computed Pearson’s correlation indicators were statistically significant (p-value < 0.01). When analyzing the values of the correlation index, it can be concluded that there is a strong positive relationship between the analyzed variables. In the authors’ opinion, this relationship should take negative values, because the introduction of environmental taxes should lead to a reduction in greenhouse gas emissions. The primary aim of introducing environmental taxes is to reduce the emissions of pollutants, not to obtain budget revenues. Nevertheless, it is justified, because an increase in gas emissions leads to an increase in fiscal sanctions (e.g., environmental taxes/green taxes) on the issuers.

When starting the modeling, we searched for multiple regression models that would correspond to the assumptions made regarding their quality. We searched for models that would allow the explanation of the dependent variable to the greatest extent, while taking into account the low value of the variance inflation factor (VIF) of individual variables. Attention was also paid to the level of the coefficient of determination and its significance level (F-test). All of the variables in the models were significant, as evidenced by their

p-values (below 0.001). The characteristics of the obtained models are presented in

Table 5.

Table 6,

Table 7,

Table 8,

Table 9,

Table 10 and

Table 11 present the results of the estimation of the regression coefficients along with the errors in their estimation, as well as the statistics on their significance and the levels of collinearity.

Concluding, as a result of the modeling, with the use of the variables defined in the previous point, six multiple regression models were obtained for each year. Of the proposed variables, only four were introduced into the models, namely, P, HC, EHC, and EPT (depending on the year of analysis).

In the case of all of the constructed models, the coefficient of determination R2 was obtained at a level exceeding 0.95, which means that the explanatory variables accounted for over 95% of the total variability in the development of greenhouse gas emissions. This proves the high quality of the constructed models. On the basis of the F-tests, it can also be concluded that the coefficient of determination was statistically significant. All of the variables adopted for the models were characterized by a variance inflation factor (VIF) value below 3.

The obtained results of the regression analysis indicate that greenhouse gas emissions in individual years are essentially shaped by the same variables.

Table 12 presents a comparison of the variables and the strength of their impacts on greenhouse gas emissions in the individual years of the analysis.

We analyzed the impact of all variables (P, HC, EHC, and EPT), the values of which are presented in

Table 12 for each year, using an empirical model in the form of a regression equation (Equation (1)) and supplementing the scheme with data from

Table 12. The basic conclusion is that green taxes are not included in the models for individual years and that the values for individual variables for individual years do not differ significantly. This means that, in the years analyzed, environmental taxes did not significantly affect greenhouse gas emissions, and the values of the variables (factors) did not change significantly.

Among the variables introduced into the models, the population variable had the strongest impact on the explained variable—greenhouse gas emissions—in all years of the analysis (as marked in the darkest gray in

Table 12). Apart from this, the explained variable was also significantly influenced by the variable environmental protection transfers according to environmental protection activity and institutional sector. In the case of any analyzed year, the model did not include the environmental taxes variable, despite the previously indicated coexistence of this variable with greenhouse gas emissions (significant correlation indicators). This proves that, despite the fact that there is a statistical relationship (correlation) between them, in combination with other explanatory variables of greenhouse gas emissions, environmental taxes do not contribute to the shaping of the analyzed dependent (explained) variable. The constructed regression models of one variable (explained variable = GGE, explanatory variable = ETR) indicate the existence of a cause-and-effect relationship between them. The models are characterized by a high coefficient of determination (R

2).

In each of the analyzed years, the main determinant of greenhouse gas emissions was the variable P. Populations of particular countries report the demand for all kinds of goods and services that generate gas emissions, especially when it comes to the need for all kinds of energy carriers. Currently, people are characterized by a high level of consumerism, especially in highly developed countries—which include EU countries. It seems necessary to undertake research on the consumption behavior of societies in the context of their awareness of and responsibility for reducing greenhouse gas emissions by limiting purchases and making choices about pro-environmental goods.

It is puzzling that environmental protection transfers based on environmental protection activities undertaken in countries do not result in reducing gas emissions but, rather, increase them. When starting the modeling, we assumed that these transfers would positively affect the reduction in gas emissions. However, the achieved results did not confirm this. This could be for a number of reasons. Firstly, their values are too low, meaning that they do not reduce emissions. Secondly, these transfers are used to reduce other environmental pollution, such as water pollution. The explanation of the observed relationship merits additional research.

In summary, the selected variables, which were initially adopted after studies of the literature to explain the development of greenhouse gas emissions in EU countries, allowed us to construct regression models for the selected years. The ETR variable was not introduced in any of the models, indicating that other factors have a greater impact on GGE.

5. Discussion

This study explored existing environmental taxes as a tool for counteracting climate change. We analyzed whether green taxes are an incentive tool for limiting greenhouse gas emissions and asked whether there is really an impact of green taxes on sustainable development in reducing greenhouse gas emissions. The literature on this subject analyzes various greenhouse gas emissions policies and instruments that could help curb the effects of climate change [

37,

40,

58,

65]. The assessment of these policies and tools in the literature on the subject varies and depends on the continent and country [

76,

98,

99]. The factors contributing to reducing greenhouse gas emissions were considered individually. Therefore, in order to test the effectiveness of tools such as environmental taxes (among other), it is necessary to consider all relevant factors that may affect the reduction in greenhouse gas emissions.

The conducted analysis and research results in the first stage of our study are mostly consistent with the results that can be found in the literature [

76,

99] in relation to the most important variables influencing climate change.

Table 13 presents the differences and similarities between the findings of this study and those of other scholars. The main difference was in the use of a research method that allowed for multivariate analysis, which is a new approach, as previous research did not include the analysis of 14 variables.

The main difference was in the use of a research method that allowed for multivariate analysis, which is a new approach, as previous research did not include the analysis of 14 variables. Despite the demonstration of the coexistence of the variable “Environmental taxes” with greenhouse gas emissions (significant correlation indicators), the variable illustrating “green taxes” was not included in the developed model. Therefore, our study showed that despite the existence of a statistical dependence between “green taxes” and greenhouse gas emissions, in combination with other explanatory greenhouse gas emission variables, green taxes are not a significant instrument for reducing greenhouse gas emissions.

The lesson learned from existing situations in the scope of greenhouse gas emissions and climate change is to develop a more effective policy framework, as also postulated in previous studies [

25,

49,

50,

51,

68]. Our research shows that the model lacks “green taxes” as an important factor influencing greenhouse gas emissions and, thus, the climate. The lack of the “green taxes” variable in the model supports the argument that a more effective policy framework is necessary.

The EU countries are not only looking for solutions and tools, but also have to look for the determinants of greenhouse gas emissions so that their policy becomes effective. Until now, determinants have been considered and tested individually (

Table 13). This is the first study to compare the determinants of greenhouse gas emissions. Although many factors were considered, some of them did not have a significant impact on greenhouse gas emissions. In the first stage, potential variables were selected for the linear regression model of greenhouse gas emissions, taking into account the availability of data and their substantive importance by specifying stimulants, destimulants, and nominees (

Table 3). In the second stage, the selected variables were analyzed (based on descriptive statistics), and the modeling method was determined. In the last stage, the significance of the selected variables (predictors) in shaping greenhouse gas emissions was modeled (

Table 12). The indicated studies of other scholars and their achievements show the importance of single determinants or just a few factors. Our model shows the dependence over time and verifies the meaning of as many as 14 variables.

This is the first study to compare the determinants of greenhouse gas emissions. First, the aims of this study are to motivate governments of EU countries to formulate a national carbon abatement policy and reduce greenhouse gas emissions, to change technology, and to invest in clean technology to grow the circular economy.

Second, policies should be implemented not only in EU countries, but also in regions with high levels of greenhouse gas emissions. Then, such policies would be more effective. The problem, as our research has shown, is the policy of environmental taxes. The governments of the EU countries, as a model organization, should remodel their tax policy so as to link environmental taxes with other elements of the policy of counteracting climate change, e.g., subsidies for clean technology to grow the circular economy. Such solutions would serve as a model for the less developed regions as far as possible and help them transform their resource use based on efficient instruments and policies based on environmental taxes.

As the literature on the subject shows [

27], environmental taxation is merely a tool—or rather, an incentive—as our research confirms, leading to lower pollution emissions. As part of changing tax systems in EU countries, we should consider the role of environmental taxes within the larger tax system, considering both the potential for using environmental tax revenue to lower other taxes (or prevent raising them) and how environmental taxes interact with the rest of the tax system.

The implications of these results are that the current use of environmental taxes to reduce the EU’s present levels of greenhouse gas emissions appears to be having some effect, although their relationships with other taxes and instruments need to be considered. The lack of a significant effect on greenhouse gas emissions (which was confirmed by modeling) suggests that environmental taxes are not reducing greenhouse gas emissions, implying that pollution is being reduced through the use of cleaner technologies and other activities or policies.

We support the postulates in the subject literature to change the tax policy [

47,

65,

69,

70], so as to give more meaning to “green taxes” as a non-fiscal instrument stimulating changes towards sustainability. It should also be emphasized that since we have shown a lack of the “green taxes” in the econometric model, changes in the tax policy—which is connected with public policy—should have such an effect in order to force economic entities to reduce the pressure that they place on the environment in terms of greenhouse gas emissions. We propose the use of both financial and non-financial instruments, but they should not contribute to the budget; rather, they should imply technological and adaptive changes aimed at reducing greenhouse gas emissions. In this way, “green taxes” will play the role of an important sustainability factor and influence climate change. Thus, our survey complements the conclusions concerning the mitigation of externalities, using the “green taxes system”, formulated in the literature on the subject [

30,

32,

33].

The literature on the subject indicates the effectiveness of using alternative activities, such as investments in new technologies that are environmentally friendly [

42,

49,

50]. Therefore, it is worth considering combining ecological taxes with other tools supporting the reduction in greenhouse gas emissions. This requires remodeling the existing tax system, where environmental taxes should be more strongly linked with investment subsidies for entities introducing new environmentally friendly technologies. As indicated in the literature on the subject [

5], combining taxation with other instruments may bring benefits; hence, our postulate regarding the achieved results of the model.

Optimal taxation levels and tax structures have been an issue for discussion and empirical research [

44] for a long time but, as practice shows, it is very difficult to apply relatively new phenomena, such as the use of taxation as an instrument supporting climate policy (as shown by our studies on greenhouse gas emissions).

Our models showed the lack of a lasting impact of green taxes on greenhouse gas emissions. However, the first part of our research confirmed that the variable “green taxes” reduced greenhouse gas emissions and, thus, contributed to mitigating the effects of climate change. Our hypothesis was negatively verified. Therefore, we can conclude that the existing tax policy needs to be verified. Our research confirmed that the following:

Environmental taxes perform a fiscal function, because both greenhouse gas emissions and revenues from green taxes are growing (very strong dependency);

Environmental taxes do not have a motivational function, because there is no dependency showing that environmental taxes accelerate the decrease in greenhouse gas emissions.

The occurrence of the fiscal function has been confirmed in the literature for various countries [

24,

99]. As our research shows, a multivariate analysis is necessary to show the occurrence of the motivational function and to establish the variability of factors. This variability of factors makes it possible to determine which factors will significantly affect the implementation of the motivational function of environmental taxes.

The implementation of the second and third objectives of the study—i.e., determination of the determinants of greenhouse gas emissions, and designation of the determinants of greenhouse gas emissions in EU countries using modeling (linear multiple regression models)—made it possible to achieve these objectives, and a review of potential significant determinants is included in

Table 1 and

Table 3. The determinants presented and considered in this study are measurable, being sourced from the Eurostat databases. However, there are determinants for which there are no comparable data in the analyzed period (e.g., agriculture, access to clean water, trading in greenhouse gas emissions). In our study, despite the fact that we managed to identify the determinants of greenhouse gas emissions, we were not able to quantify the behaviors of consumers and pollutant emitters. There are no data in this regard in Eurostat’s databases. Therefore, our study may be extended by these two indicated factors in the future.

Increasingly, the risk of an increase in greenhouse gas emissions in connection with the ongoing war between Russia and Ukraine is indicated. At present, it is very difficult to quantify this factor for 2022, but its impact and significance should be examined [

100]. In our model, we also did not take into account factors such as politics, or even the trading of CO

2 emissions itself. This important factor may be a component of tax policy, and the actions of governments themselves may also lead to a change in attitudes towards trading in greenhouse gas emissions. In the literature on the subject, there is still a discussion on the future significance of this factor, and it is also considered from the point of view of its impact on the growth of greenhouse gas emissions [

101].

When undertaking research on the factors influencing greenhouse gas emissions, one should mainly consider the energy sector, which is responsible for almost 80% of greenhouse gas emissions. However, the available statistics for individual countries (economies) prevent a more detailed analysis in this regard. There are single variables available in public statistical resources that can be used in modeling the development of greenhouse gas emissions. In the obtained models (with high R2), it is the size of the country’s population that determines the emissions of the analyzed gases to the greatest extent. As already noted, it is the population and the need to meet their needs in the EU countries that generate greenhouse gas emissions.

6. Conclusions

The use of environmental taxes to reduce the EU’s present levels of greenhouse gas emissions, in the context of energy transformation and in the era of climate change, is an important research issue. This article attempts to determine the factors influencing greenhouse gas emissions. Environmental taxes were examined as a special variable in the context of their contribution to reducing greenhouse gas emissions. It was assumed that the tax incentive is an important instrument for influencing the reduction in greenhouse gas emissions. The methods of analysis used in this paper made it possible to trace changes in the area under consideration, taking into account 14 diagnostic features describing factors related to greenhouse gas emissions in the EU countries.

The method of linear regression analysis (multiple variables) was used to determine the relationships between the explained variable—greenhouse gas emissions—and other variables shaping it, defined on the basis of the literature. Linear regression models, in spite of their disadvantages (as mentioned in the text of this article), provide a fairly simple way to determine the impacts of independent variables on the dependent variable (a broad description of the method is included in

Section 3).

Our research shows that only 4 out of the 14 diagnostic features are relevant for greenhouse gas emissions, and they do not include “environmental taxes”. There is a strong need to change the tax system and introduce both non-financial and financial tax incentives for influencing the reduction in greenhouse gas emissions.

Our study complements the existing research, as it shows the effects of taking into account many factors that have been previously studied, their verification from the point of view of significance (in this case, environmental taxes are an important factor), and an indication of the strength of their impact on greenhouse gas emissions in individual years when analyzing the most important factors.

Our research also prompted us to consider the key determinants of greenhouse gas emissions that shape the trends of changes in policy in EU countries. We believe that the indicated factors determined in relation to EU countries are similar in countries outside the EU. Therefore, in light of the first stage of our study (determining the significant impacts on greenhouse gas emissions), we postulate that EU countries should change their tax policy so as to include “environmental taxes” as an important determinant of reducing greenhouse gas emissions. We propose a modification of the environmental tax system, taking into account tax expenditures, as they may affect specific, needed changes in the direction of reducing greenhouse gas emissions. The governments of the EU member states should use the fiscal function of “green taxes” as well as redirecting their actions towards the use of non-fiscal functions of “green taxes” and good practices.

Many publications indicate the need to change the tax policy towards sustainability, taking into account the significant impacts on the behavior of enterprises and society. Not only can our observations be of use to EU governments to justify a change in this policy, but our research also indicates specific factors influencing the reduction in greenhouse gas emissions.

The obtained results could be used in subsequent years to check the directions of observed changes in the individual EU member states. They can also be used to monitor the changes in factors and, thus, whether the changes in tax policy have been successful in the pursuit of sustainability. This could be the basis for determining the feasibility of forecasts and making economic decisions aimed at environmentally friendly technologies with the use of tax incentives. We can also see that the results obtained could be helpful to decision-makers as an informative element for countries’ positioning, as well understanding the current state to which previous decisions have led.

In summary, taking into account the results of the study, it is necessary to pay attention primarily to the following needs:

To refocus the fiscal policy of countries on the use of environmental taxes, so that they achieve the goals assigned to them—including the reduction in greenhouse gas emissions;

To monitor the effects of environmental protection transfers in order to analyze the principles and legitimacy of spending public funds.

We should also acknowledge some limitations in our research. The first limitation of this research is the inability to verify the various income groups obtained through green taxes. The possibility of introducing these data into the model would be highly desirable and would make it possible to verify that one (or more) of the income groups obtained through green taxes could be the explanatory variable of the model. Additionally, the authors noticed that this research could be extended to include the “trading in greenhouse gas emission” factor, which may distort the results of public intervention and impact through the tax incentive.

Additionally, as another limitation of this research, we can see that the research initiated in the field of searching for factors influencing greenhouse gas emissions should be continued and extended with qualitative (soft) variables that would illustrate consumer behavior. Our research shows that the size of the population is the main determinant of greenhouse gas emissions. This is quite obvious, as it affects many other variables that determine—for example—the consumption of electricity, heat, and other goods and services, which contribute to increased emissions. Hence, it seems extremely important to undertake research on the behavior of the population, which would be conducive to limiting their consumerism and could be used as an instrument of environmental tax policy. Should governments focus on “punishing” emission-generating consumption, or should they use incentives?

It seems that the ongoing conflict in Ukraine and the restrictions on trade in energy carriers (especially natural gas) between the EU and Russia will be significant not only for greenhouse gas emissions, but also for their determinants. This is likely to increase the use of hard coal, which will be reflected in the amounts of greenhouse gas emissions (see model estimates). How large the increase will be will depend on the behavior of the population (e.g., acceptance of lower temperatures in buildings and, in the long term, the use of renewable energy sources).

We can also see the possibility of researching the importance of taxes as a factor in limiting greenhouse gas emissions in the context of the EU ETS. It is important that the climate policy is effective, and the analysis of the EU ETS together with the assessment of the effectiveness of environmental taxes would undoubtedly be justified to change the existing climate policy.