Abstract

The Russia-Ukraine war of 2022 showed the danger of reliance on autocratic regimes for energy supply. The use of renewables is a viable opportunity to substitute energy imports. Prosumption is one of the essential pillars of the Fourth Energy Package of the EU. After the war, Ukraine will require recovery packages, among other policies, aimed at increased energy prosumption. It will spur energy generation and foster employment, as well as being one of the means to avoid CO2 emissions. Following the example of Austria, the investment grant sizes for households and energy cooperatives in Ukraine were assessed. Potential job growth was estimated using the employment factor method and the size of CO2 emissions reduction. Should investment grants of EUR 50–200/kW for households and energy cooperatives be introduced, up to EUR 359.4 million would be required in 2022–2030. Households and energy cooperatives in Ukraine will still need to invest up to EUR 988 million until 2030. About 11 thousand full-time jobs may appear by 2030. Energy generation by households in 2020–2030 would enable the avoidance of 3.39–5.94 million tons of CO2 emissions.

1. Introduction

The Russia-Ukraine war of 2022 brought Ukraine numerous human losses and grief and, moreover, a clear understanding that reliance on fossil fuels, mainly imported from Russia, is no longer possible. The war underpinned the timid intentions of Ukraine regarding its climate neutrality: it was to be reached no later than by 2060, as stated in the National Economic Strategy of Ukraine until 2030 [1]. The high dependence of many European countries on fossil fuels imported from Russia became one of the reasons for reluctance to impose an oil embargo. However, the level of development of renewable energy technologies and other technological solutions (such as batteries) even in 2022 allows a great deal of substitution of fossil fuels with energy from renewables. Globally, many countries have reached good results in implementing renewable energy production; for example, Austria has good experience with the use of solar energy in households. This paper aims to study Austria’s experience in the use of solar energy by households in order to extend this experience to the conditions of post-war Ukraine in terms of policy instruments for wider renewable deployment in households. The goals of the paper are to estimate the investment needed to install the capacities projected by the existing and upcoming legislation, to assess the impact of solar energy in households and energy cooperatives on employment, and to estimate the potential CO2 emissions reductions resulting from broader deployment of solar energy by households in Ukraine, which constitutes the novelty of the research. Austria is one of the first countries globally to make renewables and green hydrogen a cornerstone of its energy and industrial policy, offering generous financial support (EUR 500 million by 2030) to the industry to ensure its competitiveness and create new jobs.

Small-scale energy self-generation and consumption leads to the creation of a particular type of energy user, namely prosumers. The term was introduced by Alvin Toffler in 1981 to describe people who consumed what they produced, “giving rise to the “prosumer” economics of tomorrow” [2]. Prosumers could be households, energy cooperatives, small utilities, etc. Prosumption implies energy supply decentralization, a general trend in many countries worldwide; in the EU, it was embodied in the Fourth Energy Package (Winter Package) [3]. The latter enables consumers or communities of consumers to produce, sell, store, and self-consume energy, “allowing them to take advantage of the falling costs of rooftop solar panels and other small-scale generation units to help reduce energy bills” [3]. The presence of small energy producers allows for decreased pressure on the network and increased transparency of the electricity market as well as enabling citizens to partially own the energy infrastructure when citizens become co-owners of the energy transition [4], as stipulated in the Fourth Energy Package. Prosumption has strong societal and political consequences as ownership of energy production increases the sovereignty of citizens with respect to the state and enhances a self-guided civic culture in the country. Globally, there are general obstacles to the development of distributed generation or prosumerism [4]:

- financial, i.e., lack of financial resources or insufficient support programs;

- technical, i.e., inflexible, obsolete, or sometimes even nonexistent energy infrastructure;

- legislative, i.e., poorly tailored or nonexistent legislation;

- social, i.e., insufficient public acceptance due to fear of new technology, “not-in-my-backyard” approach, coupled with insufficient ability to self-organize as a team.

In some countries or states, relatively high-generating installations in households or energy cooperatives face significant criticism from opponents—first of all, from the grid. This type of initiative can be seen in California, where trade unions and energy monopolists defend the vertical energy supply model, lobbying for lower payments to households within the net metering scheme and imposing additional monthly fees [5]. Olkkonen et al. urge energy companies to consider energy-generating households and energy cooperatives as co-producers and update the companies’ business models accordingly [6]. The very fact of prosumption may theoretically promote higher energy savings and smaller electricity expenditures of prosumers to maximize their benefits, as described by Goulden et al. [7], but further studies, including longitudinal ones, are needed.

Factors enabling the development of the prosumer market include declining cost of equipment, grass-root movements, and applicable governmental policies (including state support in various forms) [8]. However, in some countries, people may be interested in prosumption due to environmental concerns and technological interests rather than a business model (e.g., Norway) [8]. In Austria, environmental concerns are high as well, coupled with ambitious climate targets, as will be shown in Section 3.1.

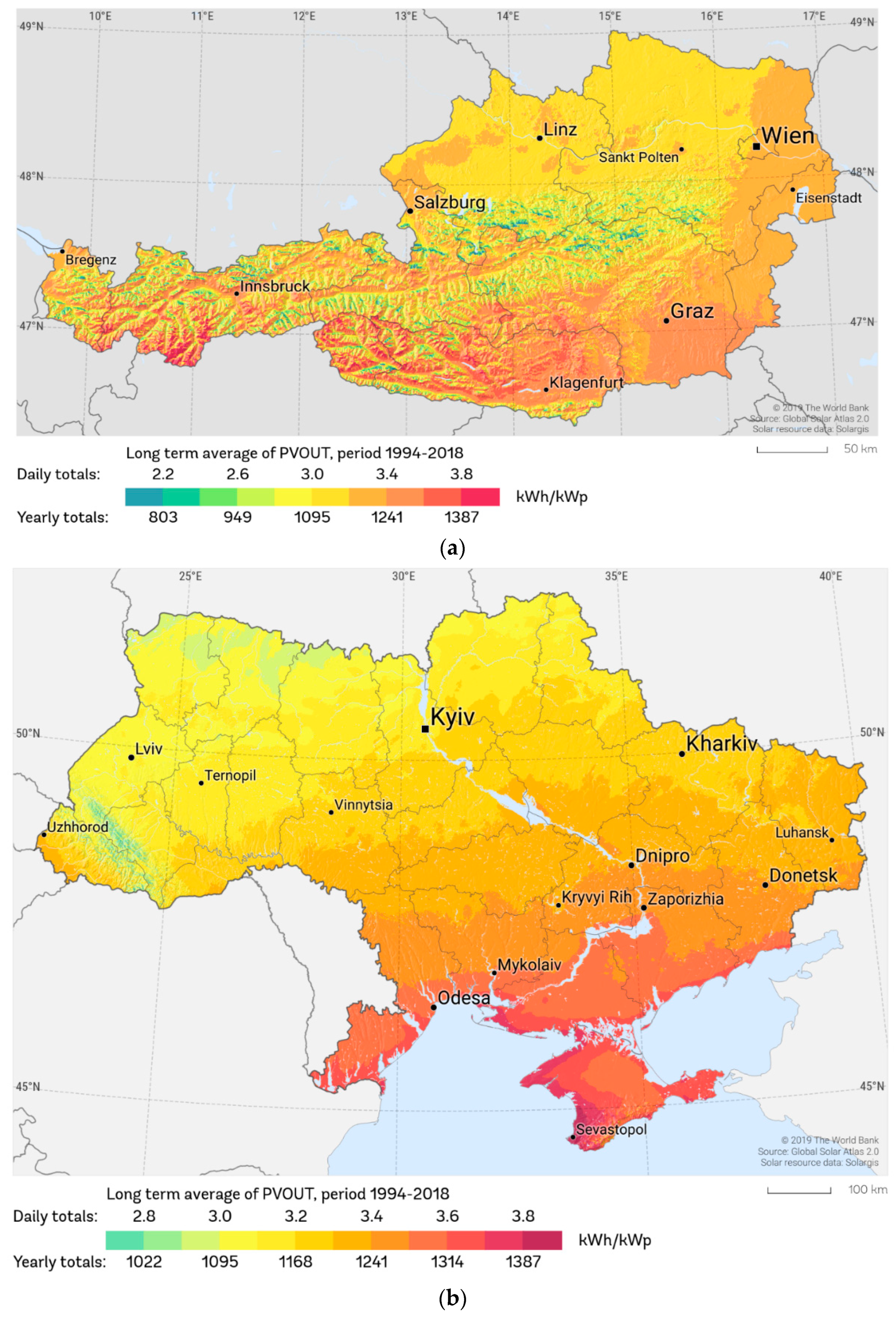

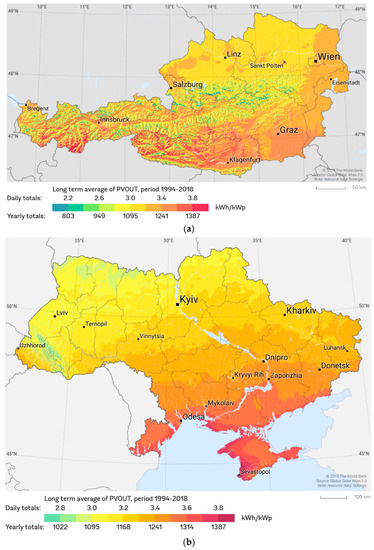

Ukraine and Austria have different geographic conditions, but Austria has extensive experience in widespread solar energy use. The photovoltaic power potential of Austria and Ukraine is shown in Figure 1a,b.

Figure 1.

(a) Photovoltaic power potential of Austria [9]. (b) Photovoltaic power potential of Ukraine [9].

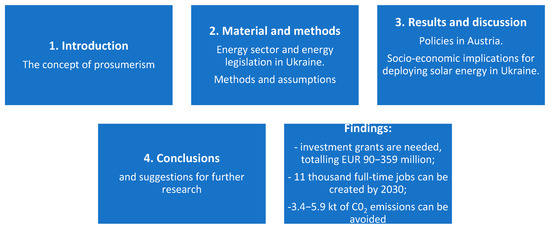

This paper is structured as follows: after the description of the concept of prosumerism as well as the photovoltaic power potential of Austria and Ukraine in the Introduction, Section 2 focuses on the energy system of Ukraine, the role of renewables in the energy balance of Ukraine, legislation aimed at the increased share of renewables in the energy balance of Ukraine, and the methods used to assess employment and CO2 emissions reduction. Section 3 focuses on policies to stimulate the development of household solar energy in Austria, on socioeconomic implications for deploying solar energy by households and energy cooperatives in Ukraine, and on the potential CO2 emissions reductions. Section 4 presents the conclusion. We suppose that at the current electricity rates for households in Ukraine, installing the PV modules without the feed-in tariff is hardly feasible; thus, other support measures are needed. This assumption constitutes the hypothesis of the study. The research process is depicted in Figure 2.

Figure 2.

The graphical description of the study.

2. Materials and Methods

2.1. Energy Sector and Energy Legislation in Ukraine

Before the war, Ukraine was one of the largest countries in Europe regarding territory and population, with approximately 41.2 million inhabitants as of late 2021 [10]. According to preliminary assessments, up to 8 million people (primarily women and children) left Ukraine and 12 million became internally displaced since the start of the war; as of August 2022, about 20% of the country is still occupied by the Russian Federation. Ukraine is a country whose energy system still relies on fossil and nuclear fuels: in 2020, Ukraine consumed 1.06 EJ of natural gas, 0.98 EJ of coal, 0.68 EJ of nuclear energy, 0.45 EJ of oil, 0.06 EJ of hydro energy, and 0.09 EJ of other renewables in the structure of primary energy supply [11]. Having such a high share of fossil fuels in the energy balance, Ukraine accounts for 0.5% (185 million tons) of global CO2 emissions. The country’s emissions reductions occur not only due to energy efficiency measures and a growing share of low-carbon fuels, but also because of economic slowdown and temporary loss of control over some of the territories.

Despite its deposits of coal, natural gas, and uranium ores, the currently used energy resources are, to a great extent, imported from other countries, including indirect imports (i.e., through third parties, such as the Slovak Republic, Poland, and Hungary) (Since November 2015, Ukraine has ceased to purchase natural gas directly from the Russian Federation.). Due to Russian aggression in the East of Ukraine starting in 2014, Ukraine made efforts to decrease its dependence on imported natural gas, trying to substitute it with other types of fuel, which resulted in the declining share of imported natural gas consumption. In 2020, it reached 44% compared to 81% in 2000 [12]. Ukraine has large deposits of coal (34375 million tons), comparable to the deposits in Germany and surpassing those in Poland. Ukraine has the largest deposits of uranium ores in Europe, accounting for 2% of global uranium ore deposits, but 100% of fuel for nuclear power plants is imported, mostly from the Russian Federation and, to a smaller extent, Sweden. Increased output of fossil fuels after the end of the war is not a viable option in the short term for several reasons: the exploitation of the available reserves requires significant investments, which are difficult to attract in light of global decarbonization trends when global-claimed fossil fuel divestment commitments in 2021 reached USD 32.9 trillion [13]. Ukraine will continue to have a high military risk even after the war due to its geographic proximity to an aggressive neighbor, which is a significant limiting factor for large international investors.

The efficiency of energy resource use still lags. In 2020, primary energy consumption in Ukraine reached 150 kg o.e./thousand USD of GDP (PPP in 2017 prices) compared to 59 kg o.e./thousand USD of GDP (PPP in 2017 prices) in Italy or 69 kg o.e./thousand USD of GDP (PPP in 2017 prices) in Germany [12]. However, energy consumption per capita in Ukraine in 2020 (75.8 GJ/capita) was smaller than that of Europe (113.6 GJ/capita) but higher than that of the world’s total (71.5 GJ/capita) [11]. Low energy intensity is especially the case for the residential sector: it consumes nearly half of the natural gas (45%).

The existing energy-generating equipment is rather obsolete: 80% of the available nuclear facilities were put into operation in the 1980s. Ukraine is currently prolonging the lifetime of the existing plants. Combined heat and power plants are also obsolete—the “oldest” CHP is more than one hundred years old, and the “youngest” is forty years old. As part of recovery packages after the war, Ukraine is to put efforts into the modernization of its energy system by employing the newest technologies available and not just restoring the outdated, damaged facilities.

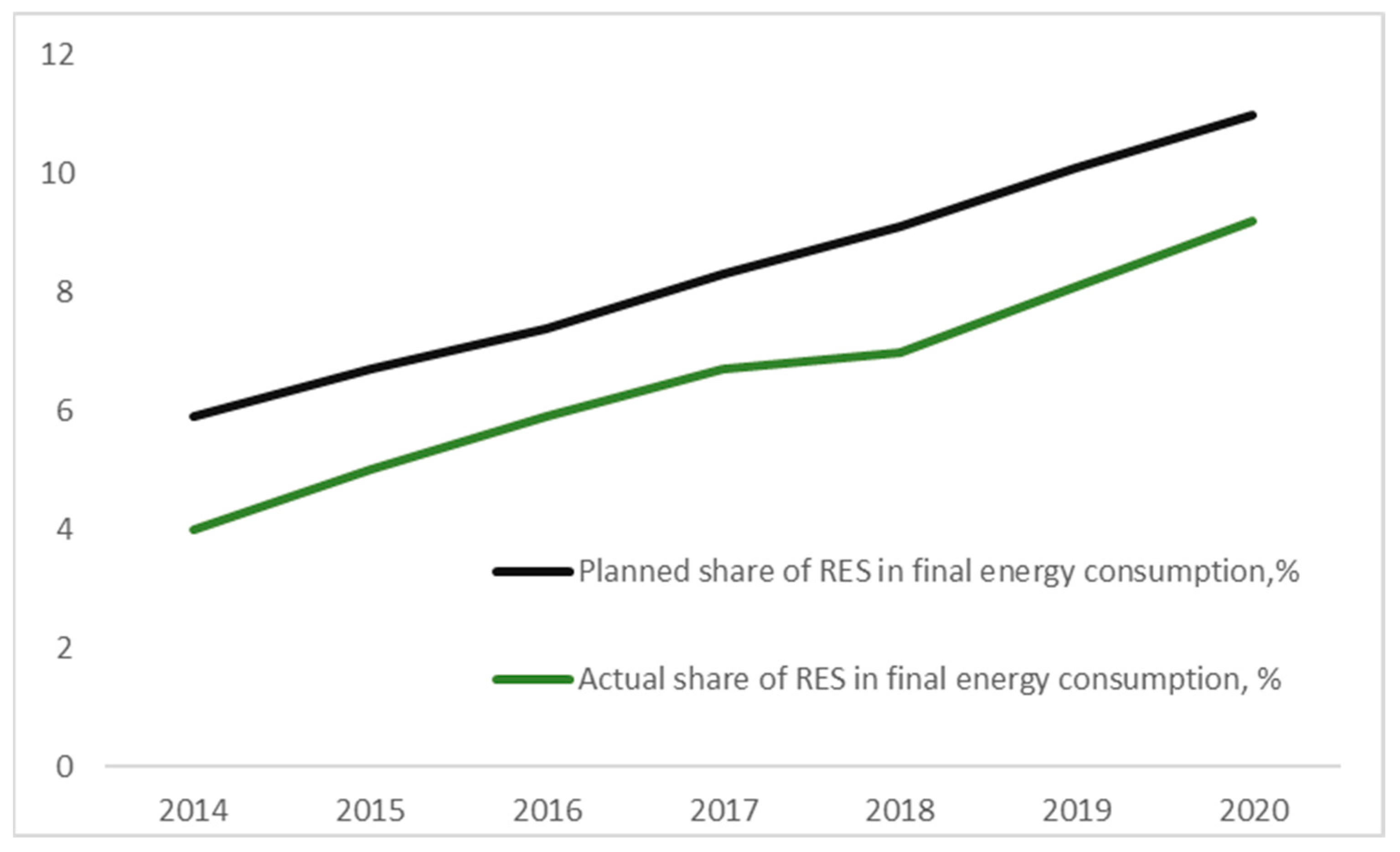

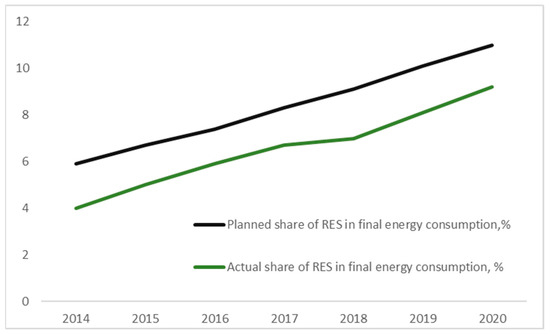

During the last ten years, Ukraine reached a decent share of renewables in the energy balance. According to the State Agency of Energy Efficiency and Energy Saving of Ukraine [14], in 2020, the share of RES in final energy consumption reached 9.2% (including large hydro). The share of RES in power generation reached 13.9%, primarily due to the unprecedented installation of large-scale solar power plants; the share of RES in heating and cooling reached 9.3%, and in transport, 2.5% (Figure 3). Nonetheless, the growth of the installed capacities of renewables was achieved mainly due to the large-scale installations, while household solar installations contributed a smaller share. There are numerous reasons for this, including financial obstacles (high cost of capital and high upfront cost of the equipment), administrative and technological obstacles [15], as well as insufficient information on renewables in the public domain [16].

Figure 3.

The share of energy from renewables in final energy consumption, % [14].

As of January 2022, the installed capacity of power-generating renewables in Ukraine reached 8.199 GW (the capacity of the entire energy system of Ukraine was 56.298 GW). In the structure of the power-generating capacities (excluding hydro), the largest share (78.23%) is the capacities of the solar power plants; the share of wind power plants is 18.65% [17]. The investments into RES power generating facilities reached more than EUR 6.2 billion. The installed capacity of heat-generating capacities using renewables in Ukraine reaches approximately 2.4 GW. The above-mentioned heat facility investments reached more than EUR 500 million [18].

The war reduced one of the significant obstacles to the increased contribution of RES in the energy supply, namely the lack of funds to pay for the produced green electricity. Due to the war, Ukraine had joined the ENTSO-E (ENTSO-E is the European association for the cooperation of transmission system operators for electricity) one year earlier than anticipated. Membership in the ENTSO-E enabled Ukraine to introduce commercial electricity sales to several EU countries at prices much higher than the market prices for electricity in Ukraine. Before the war, electricity generation from RES Ukraine surpassed its target; there was an insignificant delay in the heating and cooling sector, whereas the most considerable delay in achieving the targets was observed in the transport sector. During the war, the Russian Federation destroyed the existing oil refineries in Ukraine, decreased the population of Ukraine (and the number of road vehicles), and blocked the ports to prevent the export of grains. Altogether, these factors created the preconditions for the increased output and consumption of biofuels.

Ukraine strives for low-carbon development, having a relatively progressive primary legislation and particular targets for the increased share of renewables in the energy balance, growing energy efficiency, declining CO2 emissions, and so on. The available framework legislation includes the following documents:

- National Renewable Energy Action Plan until 2020 (2014) [19];

- Ukraine’s Updated NDC to the UNFCCC (2021) [20];

- State Climate Policy Implementation until 2030 (2016) [21];

- Action Plan to Implement the Concept of State Climate Policy (2017) [22];

- Energy Strategy of Ukraine until 2035 (2017) [23];

- Draft of Ukraine’s National Action Plan for the Development of Renewable Energy until 2030 [24].

Implementation of the provisions of the documents mentioned above requires significant investments. The Updated Nationally Determined Contribution of Ukraine to the Paris Agreement (hereinafter the 2NDC) presumes a 65% GHG emissions reduction by 2030 compared to the 1990 level. The current emissions level is 38%., thus the target may not seem very ambitious at first glance. However, substantial financial resources are needed to reach the target. According to the analytical review of the Updated Nationally Determined Contribution of Ukraine to the Paris Agreement [18], achieving the 2NDC targets in the energy sector will require EUR 26 billion by 2030. The private sector plays a crucial role in mobilizing the necessary financial resources. According to the WB classification, Ukraine is a lower-middle-income country. Given the economic situation and the intention to decrease state expenses in the economy, it is difficult for a country to create large infrastructure projects or invest in immature technologies (even though the state of Ukraine did invest in infrastructure projects, with a share of the budget funds as the source of investments in 2020 reaching 6% compared to 4.9% in 2019) [25]. For the government, it is vital to create an environment favoring private sector investments. In pre-war times, Ukraine was open to private capital from both abroad and the internal market; however, as of 2021, about two-thirds of investments in Ukraine are made by Ukrainian companies [26]. Households can be essential internal investors as well.

2.2. Methods and Assumptions

Below, we review the policies to promote solar energy prosumption by households in Austria using descriptive and historical methods (a brief review of the relevant legislation). We calculate the simple payback period for solar PV installations in Ukraine based on the projected installed capacities, as anticipated in the Draft of the National Renewable Energy Action Plan until 2030 (dNREAP) [24], as its provisions for households and energy cooperatives are reasonably realistic and achievable. A simple payback period (SPBP) is a period of time needed to return the investments [27], calculated using the following equation:

where Inv is investments and CF is cash flow. In our case, the cash flow may result from selling the abundant electricity to the grid against the feed-in tariff (where the level of the tariff depends on the year of putting the station into operation) or selling it at the price of the day-ahead market within the net-billing system. The following assumptions were made for the calculation:

SPBP = Inv/CF,

- The household produces “green” electricity, consumes some part of it, and sells the remainder to the grid against the FIT, i.e., the household is the prosumer. The cost of “gray” electricity is EUR 0.053/kWh as of July 2022.

- The average annual capacity factor for rooftop solar PV in conditions in Ukraine is 14.1% (in summer it is 23%, and in winter it is 2–3%) [28]. This capacity factor results in 61,758 kWh of yearly electricity output for a 50 kW PV solar installation in Ukraine. According to IRENA, the global average capacity factor is 24.2%.

- The investment cost is EUR 600/kW.

- The average monthly electricity consumption per household in Ukraine is 168 kWh (compared to the average of 303 kWh in the EU) [29].

There are two main approaches to assessing the number of jobs in the energy sector. The ones used most commonly are top-down and bottom-up approaches. The top-down approaches rely on labor-intensive input-output models, while bottom-up approaches are much simpler and allow a high level of transparency. This paper uses a bottom-up approach, namely the employment factor method, presented by Rutowitz et al. [30] and further elaborated by Ram et al. [31]. It describes the jobs that appeared during the manufacturing of equipment, its construction and installation, operation and maintenance, and decommissioning. In this paper we consider the 2020–2030 period, thus no decommissioning would be needed yet. Employment can be assessed using the following equations [30]:

Employment = Equipment manufacturing + Construction and installation + Operation and maintenance.

Equipment manufacturing = MW installed per year × Manufacturing employment factor × Regional job multiplier per year.

Construction and installation = MW installed per year × Construction and installation employment factor × Regional job multiplier per year.

Operation and maintenance (O&M) = Cumulative capacity × O&M employment factor × Regional job multiplier per year.

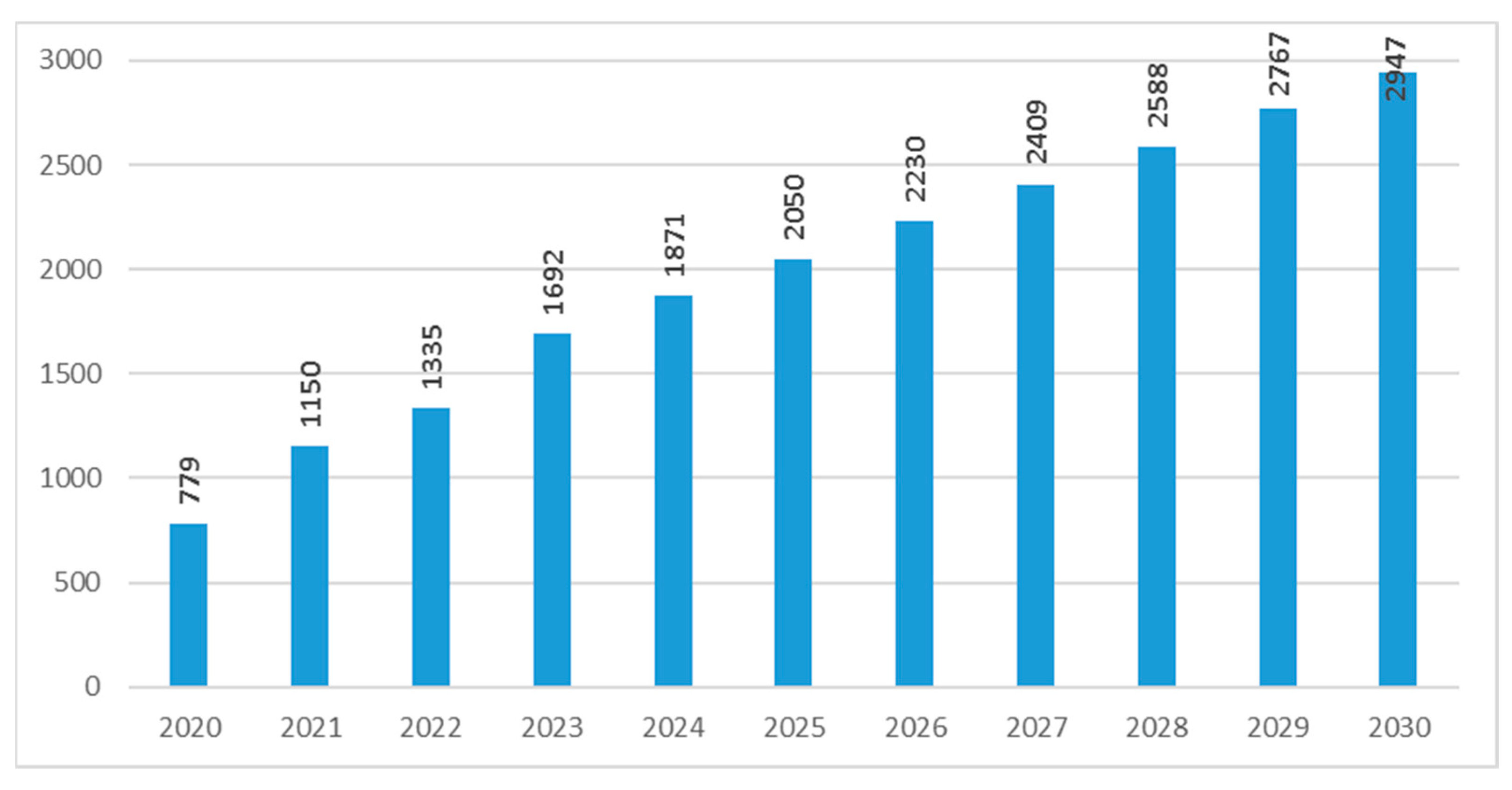

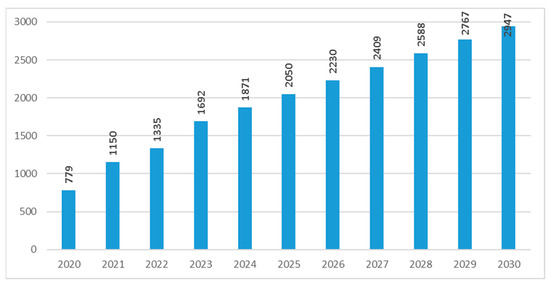

To know the available and projected installed capacities, we use the data from the dNREAP [24]. Due to war, the Draft was not adopted, but it indicates a reasonably realistic increment of installed capacities for households and energy cooperatives. The dNREAP anticipates the growth of solar energy for heating and cooling purposes. However, it does not specify the types of heat generators; in other words, household amount of solar energy for heating is unknown. Therefore, it is not included in the calculation. The projected capacities for solar energy use by households and energy cooperatives in Ukraine are shown in Figure 4.

Figure 4.

The projected installed capacities of solar installations in Ukraine in households and energy cooperatives, MW [24].

Regional employment multipliers and the share of local manufacturing for Ukraine are shown in Table 1. We assume that the percentage of local manufacturing is 50% because the equipment for solar PV is mainly imported. However, the metalwork is primarily Ukrainian.

Table 1.

Regional multipliers for Ukraine [30].

The manufacturing (Mfc), construction and installation (C&I), operation and maintenance (O&M) factors for Ukraine are shown in Table 2.

Table 2.

Main factors for rooftop solar PV installations [31].

Below, we assess the potential CO2 emissions reduction emerging from using solar energy by households and energy cooperatives. CO2 emissions vary depending on the season and time of day. Therefore, we cannot average the CO2 emissions following the individual generation profile. In the middle run, the generation profile will change. The literature on the topic is quite scarce. As of 2022, the Order of the National Agency of Environmental Investment of Ukraine “on approval of specific emissions indicators carbon dioxide in 2011” [32] remains in force. It defines the default values for CO2 emissions at 1.063–1.227 kg CO2/kWh. According to the assessments of Low Carbon Ukraine, the 2019–2030 default emission factor is 0.97 tCO2/MWh [33].

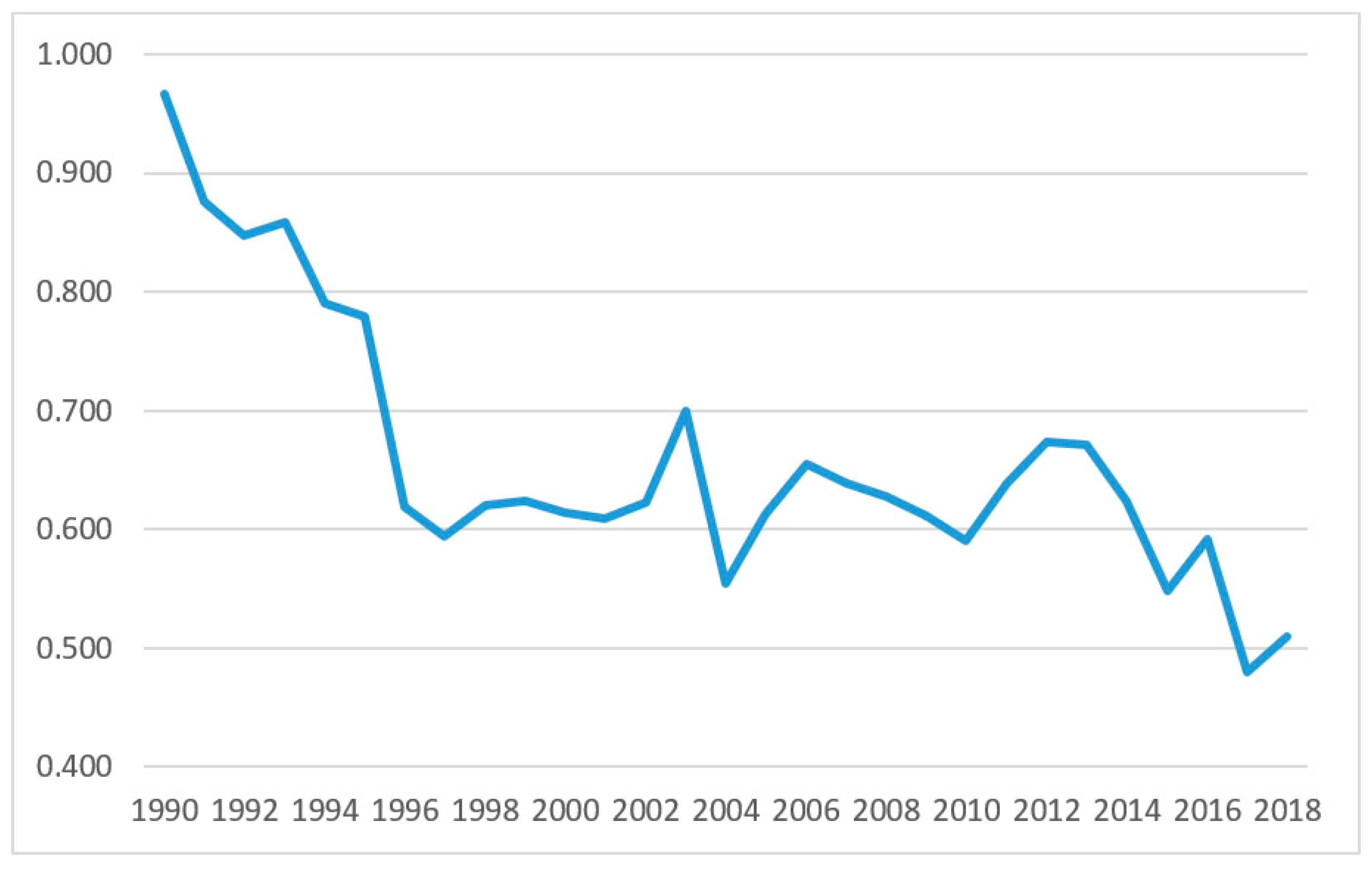

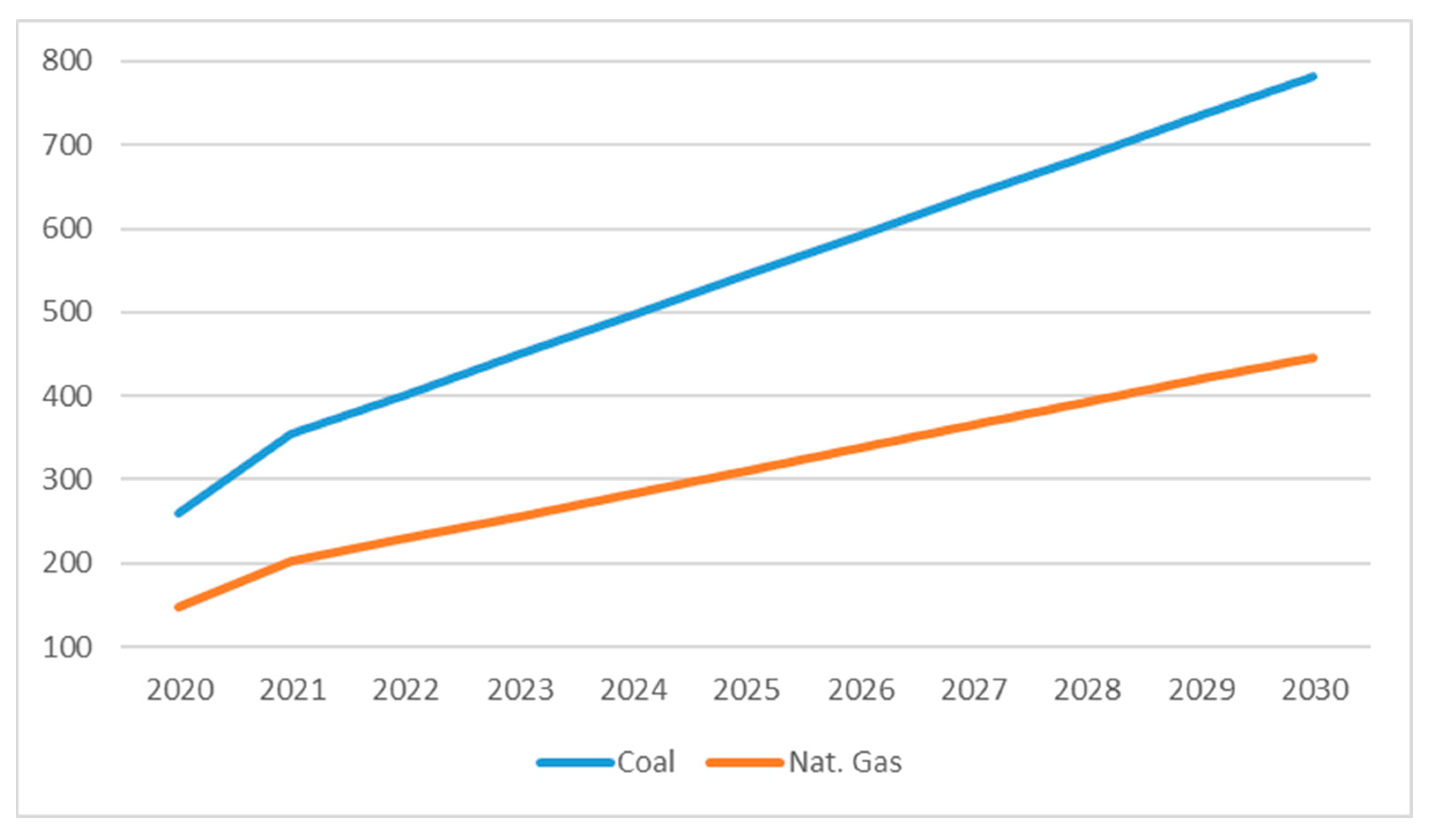

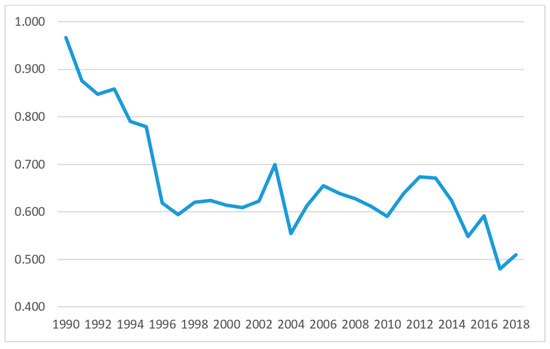

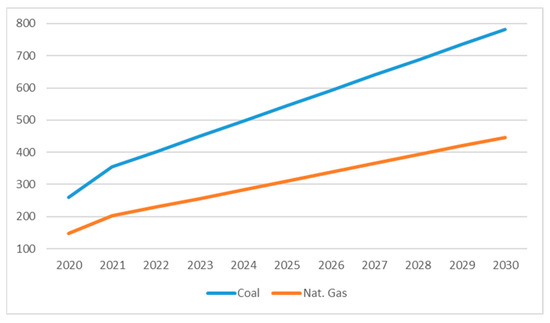

For the purpose of our calculation, we assume that the prosumer consumes a particular share of energy, whereas the remainder needs to be balanced. As of 2022, there is a high probability that it will be balanced by coal-fired generation, or to a smaller extent by natural gas-fired generation. In order to assess the emissions savings, we use historical and projected data on national emission factors presented by the European Commission and Joint Research Center [34] (Figure 5).

Figure 5.

National emission factors for electricity consumption in Ukraine, tCO2/MWh [34].

Furthermore, using the European Commission’s projected data for default emission factors for natural gas (0.202 tCO2/MWh) and coal (0.354 tCO2/MWh) [35] for 2022–2024, we prolong the respective coefficients until 2030, given the numerous uncertainties: the duration of the war, the population of Ukraine (and therefore the energy demand), the structure of fuel mix, the technological advances as part of recovery packages, the availability of coal/natural gas for balancing, etc.

3. Results and Discussion

3.1. Policies to Stimulate Development of Household Solar Energy in Austria

In the EU, several policies are aimed at making small-scale energy generation (and prosumerism) more beneficial and acceptable for citizens. They include but are not limited to a shortened licensing procedure period (it should not exceed one year); simplified installation procedures; exemption of small-scale installations from participation in auction/tender procedures [4]; fair remuneration for abundant electricity; priority grid access and simplified taxation [36].

Austria has witnessed the spread of solar water heaters since the 1990s, starting its first federal solar water heater programs in 2012. Since then, the regulations for these markets have become more advanced. A EUR 36 million rebate program for solar installations and batteries was launched in 2020. Two-thirds of the funds were aimed at PV installations. In particular, there was the EUR 250/kW rebate for solar PV installation and EUR 200/kWh of storage. The threshold installed capacities eligible for the rebate were 500 kW and 50 kWh respectively [37].

Austria claimed to be able to generate 100% of its electricity from renewables by 2030. The country is expected to reach carbon neutrality by 2040. According to Austria’s National Energy and Climate Plan (NECP), the government intends to equip one million PV systems (solar roofs) with photovoltaic installations by 2030. The previous target was set by Mission 2030, and the aim was to establish 100 thousand solar PV rooftops. As of early 2020, the installed capacities of solar energy in Austria reached 2 GW.

As for current stimulation policies, there is the Renewable Energy Sources Expansion Act (EAG) as part of the Austrian Recovery and Resilience Plan. Apart from renewables, it also anticipates Sustainable Construction and Climate neutral transformation. As for renewables, the additional contribution of different sources of energy is as follows: 11 TWh/year of solar, 10 TWh per year of wind, 5 TWh/year of hydropower, and 1 TWh/year of biomass energy (to reach 27 TWh/year increment, which is a two-fold increase compared to 2020). To ensure the needed increment of the installed capacities, Austria plans to increase the domestic output of solar modules twofold [38].

Since mid-2017, Austria enabled the joint use of energy generating facilities by several households, provided that the energy might be consumed and not routed through the grid of the grid operator. This allows for electricity to be produced in a PV community system and distributed to individual participants. If PV power generation and power consumption coincide, the grid cost is reduced [39]. Such a model requires at least two participants. The challenge of this model is the necessity of obtaining the consent of all homeowners to install the PV station [40]. It is possible to receive national or regional funding for community systems as well as individual generation systems. To ensure a basis for decision-making, a publicly available calculator was introduced, allowing the assessment of individual output and consumption of electricity [41].

In 2022, the funding budget has quadrupled to reach EUR 240 million as a solar rebate program coupled with special market premiums. In particular, there are investment grants (subsidies) for households and small companies installing a solar PV station with a capacity of up to 50 kW. The investment grant is EUR 150–250 per kilowatt of installed capacity, depending on the capacity of the entire system.

The program also enabled residents to combine federal, municipal, and state funding for 100 kW systems. EUR 260 million will be disbursed in 2022–2023, whereas the cumulative investments in renewables and green hydrogen will reach EUR 1 billion by 2030 [42]. Citizen energy communities consuming and producing energy are the key elements of EAG. These citizen energy communities emerge at the supra-regional level when several users come together to form a virtual community. A group from different federal states can invest in a large new photovoltaic system, share the energy it produces, and benefit from the sale of surplus energy. Under EAG, prosumers receive the right to connect to the grid for renewable energy output: everyone can supply as much electricity as their installation produces to the grid.

In summary, the most interesting lesson from the case of Austria with potential for implementation in Ukraine is the experience of investment grants. So far Ukraine had never used this instrument in the field of renewable energy, favoring a feed-in tariff system instead. The joint installation of PV stations may become popular in Ukraine in the future with the development of the net billing system, when household electricity prices will become significantly higher than they are in 2022 and when a levelized cost of electricity generated by solar PVs of households will be commensurable with household electricity prices. After the war, Ukraine will face pressing needs with regard to rebuilding housing, schools, hospitals, transportation, infrastructure, and funding social programs for millions of returning refugees and internally displaced people; an energy system reform will be also required, as the existing energy system—or what will remain of it by the end of the war—will have objectively exhausted its lifetime. The paper estimates how much funding might be needed if Ukraine chooses to stimulate decentralized energy generation. The question of whether the country can afford it remains open; nonetheless, the respective assessments need to be made. Before the war, when Ukraine was (and currently remains) a country with lower GDP than Austria, it nevertheless managed to achieve significant growth in household installations; this trend may continue after the war.

3.2. Socio-Economic Implications for Deploying Solar Energy by Households and Energy Cooperatives in Ukraine

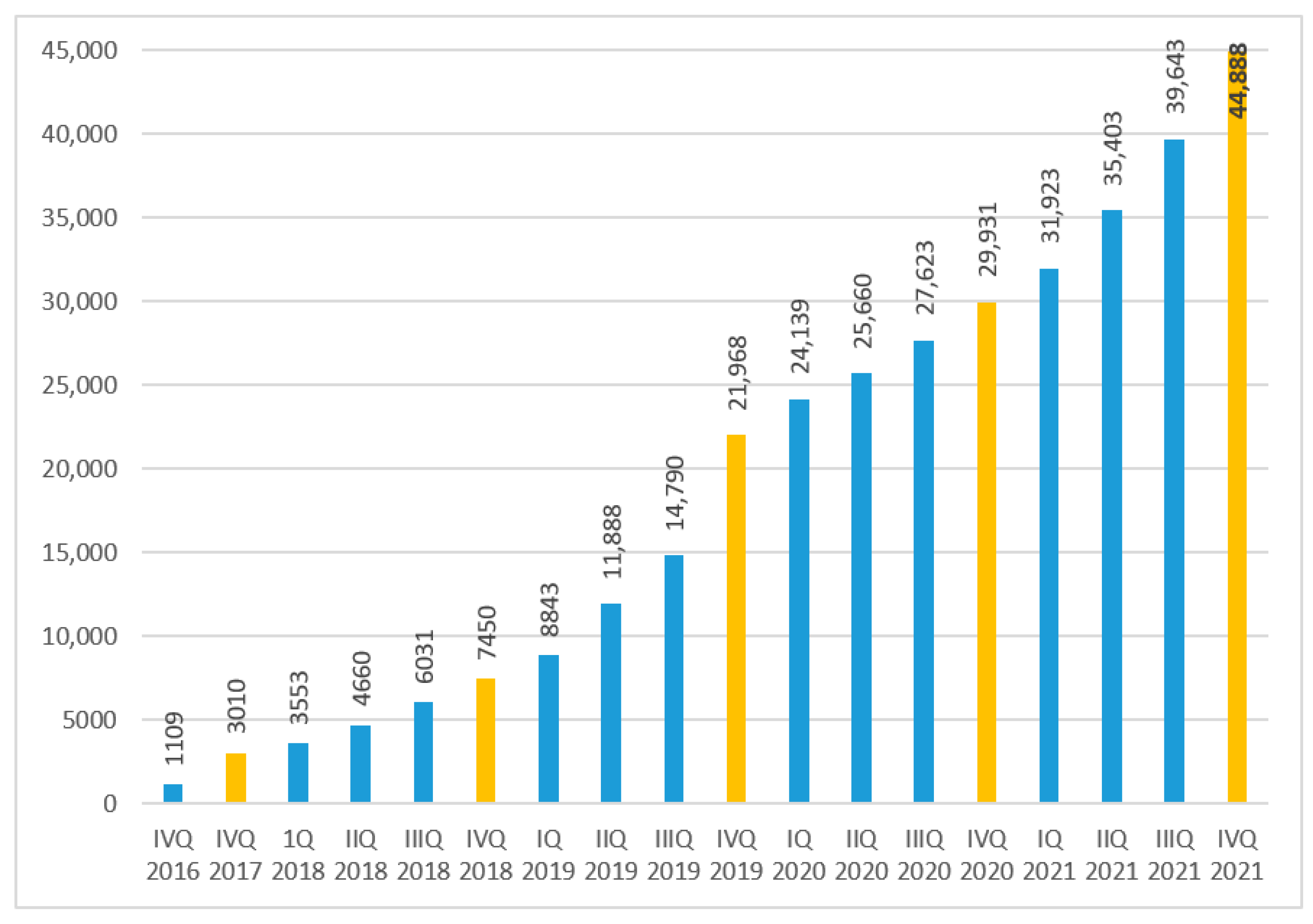

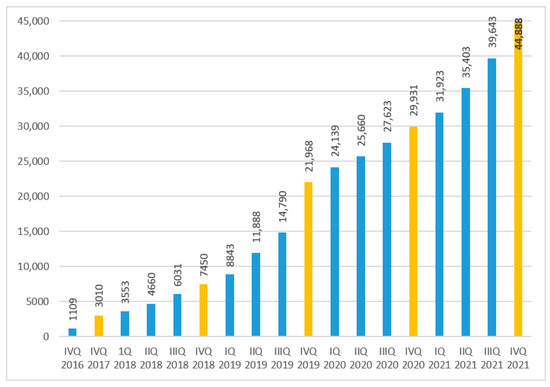

Overall, before the war, there were about 45 thousand solar PV installations in Ukraine (compared to 6 million households in Ukraine), so the potential for growth of solar installations is enormous (Figure 6).

Figure 6.

The number of solar power installations of households in Ukraine, units [43].

As of early 2022, the overall installed capacity of solar installations in Ukrainian households reached 1.205 GW. It is interesting to note that the most significant number of installations is observed in regions with relatively limited solar radiation levels (these are primarily regions in the West of Ukraine, such as the Ivano-Frankivsk, Ternopil, Zakarpattya), and Dnipropetrovsk regions (East of Ukraine) [44].

This turned out to be a favorable coincidence, because, as of early June 2022, the regions of West Ukraine have suffered significantly less from the shelling of Russian troops than those in the East and South of Ukraine or the Kyiv region. There are numerous reported cases of available rooftop solar installations allowing an entire neighborhood in the village to charge mobile phones or cook food once a day during the weeks of interruptions in the centralized electricity supply. Due to the extent of the atrocities, sometimes it takes up to six weeks to restore the electricity supply. In some hospitals in the Kyiv region’s de-occupied areas, which suffered from the Russian troops the most, Tesla Powerwalls and solar PVs were installed to ensure uninterrupted power supply to critical infrastructure facilities [45]. In other words, rooftop- and small ground-mounted solar installations, apart from providing business functions, started to perform essential social functions. It is known that as of early June 2022, the installed capacity of household solar installations in Ukraine is smaller due to the atrocities. However, the exact capacities of damaged equipment are not known yet.

According to the existing legislation [46], households in Ukraine can have an installed capacity of energy-generating facilities up to 50 kW (and the energy sources are sun and wind only). In contrast, energy cooperatives may have an installed capacity of up to 150 kW and may use sun, wind, biomass, biogas, geothermal, and hydro energy. As of June 2022, there is only one electricity-generating energy cooperative in Ukraine, “Solar Town”, located in the town of Slavutych (Kyiv region). The installed rooftop solar PV capacity is 200 kW [47].

The main impetus for solar PV installations in Ukraine is the feed-in tariff (FIT) [48]. The FIT (EUR 0.163/kWh until 2025 and EUR 0.146/kWh from 2025) is available only until 2030. No net billing has been introduced, but the respective draft law has been developed. According to the latter, the net billing system would be related to the electricity price of the day-ahead market, which was EUR 0.06/kWh in June 2022. However, now households mostly install rooftop solar PV (and small wind turbines) as a business model, not to only meet their energy demand. Below, we calculate the simple payback period for a 30 kW, 50 kW, and 200 kW solar PV installation at different feed-in tariff rates (depending on the year when it was granted—before 2025 or after 2025) and with net billing (no FIT).

Table 3 presents the simple payback period for solar PV installations at the different rates of FIT and with net billing.

Table 3.

The simple payback period for a 50 kW solar PV installation with FIT or net billing in Ukraine.

Table 3 demonstrates that the simple payback period does not exceed four years in the presence of FIT. In contrast, in the absence of FIT, solar PV installations as a business model are not feasible. However, the government states that the FIT model for households does not encourage the owners of (mostly) solar and wind installations to use the produced electricity for their consumption. The significant difference between the FIT amount and the market price encourages rooftop PV owners to maximize the supply of expensive green electricity to the grid to make a profit. Therefore, the government intends to introduce the net billing system, which would enable the prosumer to receive payments for the electricity transferred to the grid in the form of money (and not in the form of kWh, as in the case of the net metering system), and the funds received could be spent on electricity that is consumed from the grid in the hours of non-production. The idea of this policy measure in the conditions of Ukraine is meant to avoid increasing the cross-subsidization of different consumers and to ensure that energy is produced where there is demand for it. Table 3 also indicates that the net billing system significantly prolongs the simple payback period (compared to the presence of FIT), making the project significantly less feasible. Evidence from other countries also confirms that return on investments is low for prosumers in a net billing system [8,49]. However, it may spur the development of storage capacities when households and energy cooperatives sell electricity during peak hours, when it is the most expensive, thus smoothing the peaks.

Following the example of Austria, below we calculate the volume of funds in the form of investment grants of EUR 50–200/kW for households and energy cooperatives with the capacity of up to 50 kW as part of the post-war recovery package (Table 4). The investment grants in the calculation below allow a decrease in the upfront costs so that the investment grant amount per kWh is subtracted from the initial investment costs per kWh. The significant increment of the installed capacities in 2023, anticipated by dNREAP, reflects the attempt to ensure the payback with the feed-in tariff, valid until 2030.

Table 4.

Funds needed to ensure investment grants for households and energy cooperatives, EUR2021 million.

Table 4 indicates the number of necessary investment grants, i.e., should the investment grants be applied for the projected installed capacities in 2022–2030 in the amount of EUR 50–200/kW, EUR2021 89.9–359.4 million are required. It means that at the investment cost of EUR 600/kW, Ukrainian households or energy cooperatives will still need to invest EUR2021 719–988 million (Table 5). Overall, the investment cost of EUR2021 600/kWh includes the solar panels, the grid inverter, a system of fastenings suitable for installing panels on a roof, installation, and commissioning works. It does not include the interest on the borrowed capital, exchange rate fluctuations, nor any expenditures related to the allocation of funds (e.g., via banking institutions).

Table 5.

Funds needed to be invested on top of the investment grant, EUR2021 million.

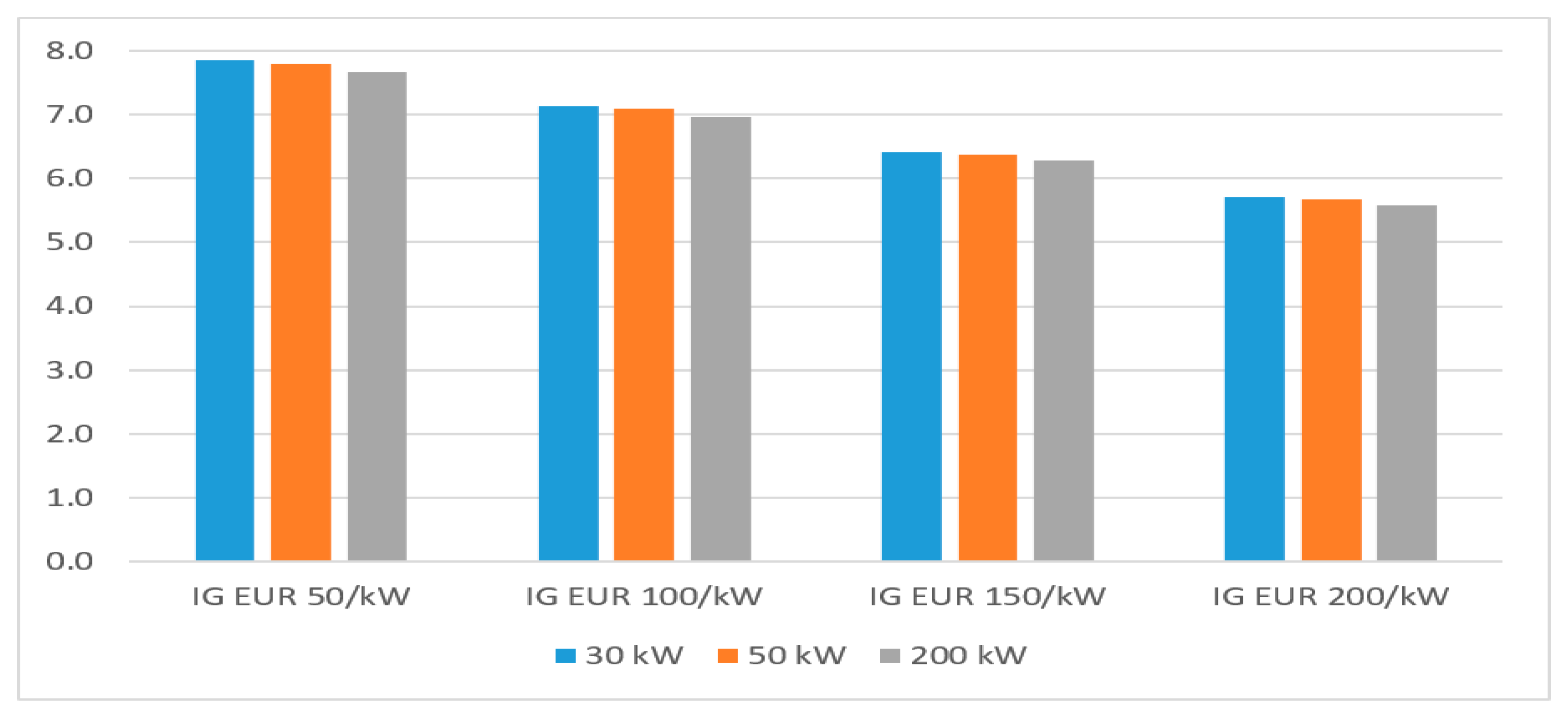

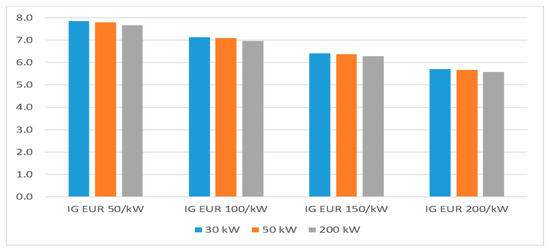

That said, the simple payback period is calculated below with the net billing system in case the investment grant is applied (Figure 7).

Figure 7.

Simple payback period with net metering at various sizes of investment grants (IG) applied, years.

Figure 7 indicates that investment grants may reduce the payback period of solar PV installations in Ukraine. In contrast, even the highest investment grant (EUR 200/kW) presumes a simple payback period exceeding five years. Therefore, we recommend extending the FIT period until 2035 to ensure the payback period of solar PV installations that would take place closer to 2030. Should the net billing system be introduced, investment grants would be needed (to lower the upfront costs).

Renewable energy is one of the sectors that the government of Ukraine claims to be one of the priority areas, as was announced in the post-war recovery plan and presented in Lugano, Switzerland, in July 2022 [50]. More precise measures to mobilize the international and domestic capital will be developed after the end of the war, as they will depend on many factors, such as the duration of the war, the level of remaining and damaged energy infrastructure, energy demand, inflation rate, interest rates of banks, remaining military and political risks, and many others which lie beyond the scope of this paper.

Capital grants would increase the affordability of solar PVs for households in Ukraine, being one of the means to overcome financial and legislative obstacles. Additionally, the electricity tariff for households in Ukraine is very low, though increasing it has been discussed within the last several years. Due to war, the President of Ukraine signed a memorandum not to increase the utility bills. It will be done after the war, and it is expected to aggravate the energy poverty in Ukraine; still, indirectly, this measure will make the PVs of households more economically feasible. As of 2021, Ukraine had the largest installed capacities of household solar PV amongst all the observers’ parties of the Energy Community [51]. It may indirectly indicate that society’s opposition to this technology is not high. As for technical obstacles, hostilities are the most significant so far; nonetheless, the grid is maintained when needed.

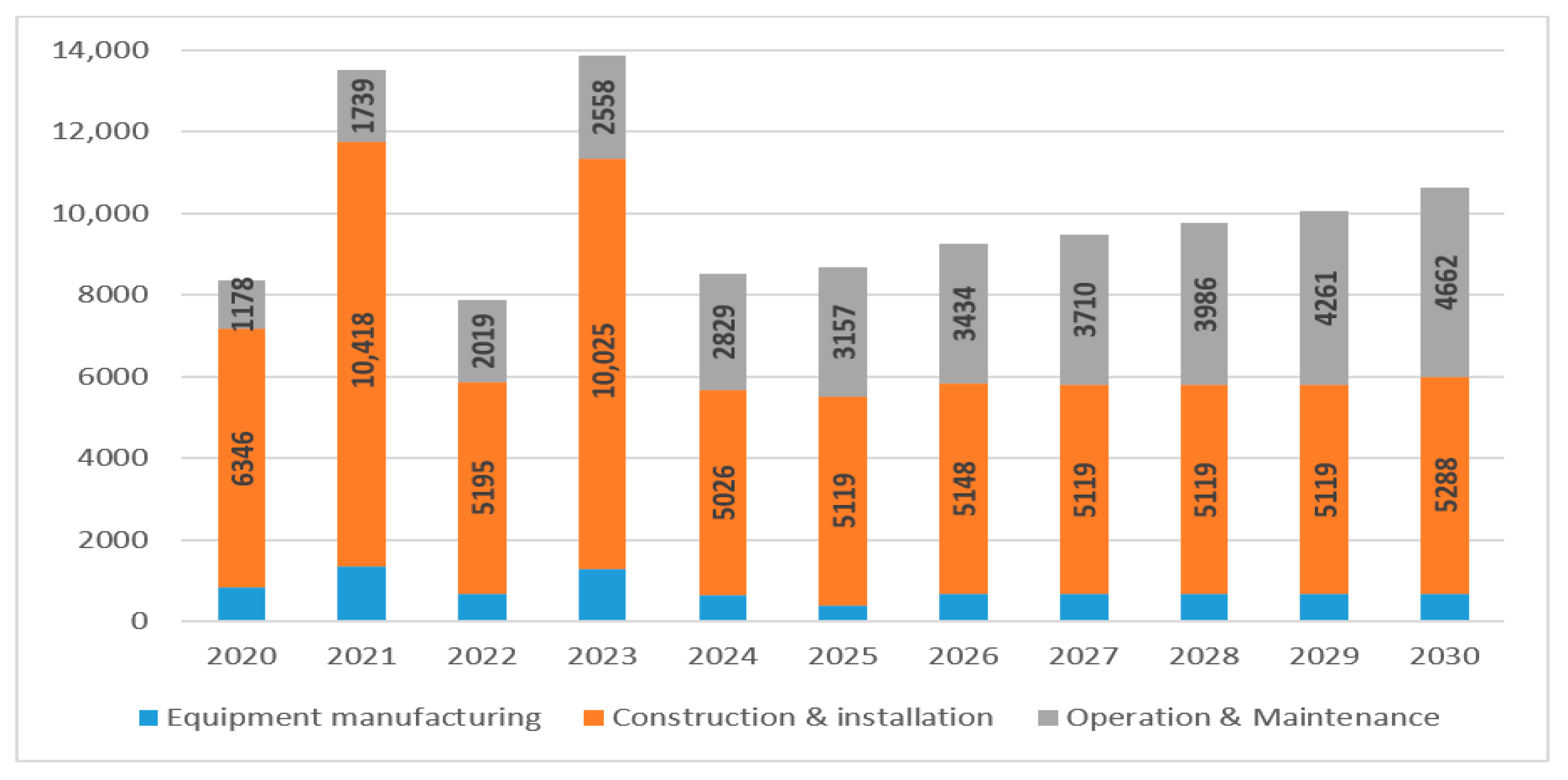

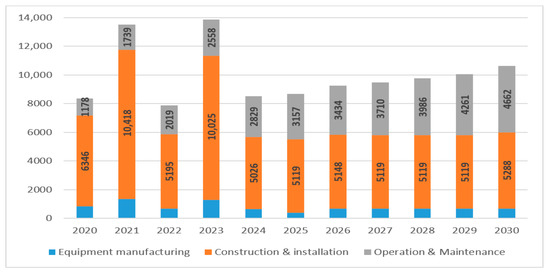

As mentioned, the post-war recovery of Ukraine should be based on contemporary energy technologies, which can be a source of jobs. Below, we assess the contribution of small solar installations in Ukraine to employment. Based on the factors available and projected installed capacities, we estimate the employment effect. The latter is shown in Figure 8.

Figure 8.

The projected employment at household and energy cooperative solar installations in Ukraine in 2020–2030, jobs/year.

Figure 8 indicates a very high share of construction and installation jobs in 2021 and 2023, which is explained by the projected significant installed-capacity growth in 2021 and 2023. Obviously, due to war, the 2022–2023 capacities will very likely not be installed. Moreover, the number of jobs in construction and installation might be smaller because some share of rooftop solar PV was destroyed due to war. We hope the destroyed capacities will be restored, which may occur faster than obtaining new permits or installing new capacities from scratch.

After six months of war, the unemployment rate in Ukraine is 35%, whereas the unemployment rate among internally displaced people is 60% [52]. The duration of war is unknown, and so is the amount of labor force available by the end of the war and the level of infrastructure destruction. A study [53] conducted in 2021, i.e., before the war, indicates that the coal phase-out in Ukraine will lead to the loss of 55 thousand full-time jobs. Still, it will enable the creation of 160 thousand new full-time jobs in renewables, which will benefit the state budget through the 50% higher tax revenues over the next ten years.

The share of jobs in equipment manufacturing is insignificant so far. Still, it can be increased should Ukraine be willing to produce its solar panels and compete with Asian producers, as a solid technological base is in place in Ukraine. While the equipment can be manufactured elsewhere, installation and maintenance are usually conducted locally, which requires local jobs. Overall, each megawatt of installed capacity requires 0.28 workers to ensure the installation functioning in 2030 compared to 1.3 in coal mining (the largest share of which goes to raw material output, i.e., coal mining) [53]. Jobs in renewables in terms of technology and skills are overall more sophisticated and advanced than coal mining itself.

3.3. Potential CO2 Emissions Reductions

Knowing households’ and energy cooperatives’ projected energy output, we assess the avoided CO2 emissions using the EC default values. The results of the estimates are presented in Figure 9.

Figure 9.

The projected avoided CO2 emissions as the result of solar energy generation by households and energy cooperatives, kton.

Figure 9 indicates that the total avoided CO2 emissions for 2020–2030 vary between 3.39–5.94 million tons of CO2 depending on the fuel that is not used for energy generation (coal or natural gas).

4. Conclusions

The role of renewable energy in the energy mixes of countries has to grow. It is reinforced by many factors, such as climate change and the growth of prosumerism. This trend was underpinned and backed by the Russia-Ukraine war of 2022, when energy carriers appeared to significantly influence the projected and expected energy consumption in many countries, including Ukraine.

As to prosumerism, there are common obstacles—financial, technical, legislative, and social—to the development of distributed generation, but they can be rather successfully overcome, primarily with the declining cost of equipment, as well as examples from other prosumers and appropriately tailored support policies.

In 2020 the share of energy from RES in Ukraine reached 9.2% compared to the projected 11%. The country still relies on fossil fuels to a significant degree; thus, after the war ends, Ukraine will need to rebuild its energy system based on the new technologies available, including RES. Austria has several successful and ambitious programs aimed at increasing the share of energy from RES in the energy mix and the use of solar energy by households in particular.

As of early 2022, the installed capacity of solar installations in Ukrainian households reached 1.205 GW. During the war, solar installations started to play critical social functions (access to communication, cooking, and medicine) due to the significant destruction of the grid. In Ukraine, FIT for households is in force until 2030, and Ukraine will introduce the net billing system for the new installations. The calculations indicate that the simple payback period for 30 kW and 50 kW installations does not exceed four years in the presence of FIT. In contrast, in the absence of FIT, solar PV installations have a much more extended payback period: up to 10 years. It may spur the development of storage capacities when households and energy cooperatives may sell electricity during peak hours. Still, the details of the latter (price difference, system design, etc.) are not known in Ukraine yet.

The main policy recommendation at the national level is the introduction of investment grants. Following the example of Austria, should investment grants of EUR 50–200/kW for households and energy cooperatives with the capacity of up to 50 kW be introduced as part of a post-war recovery package, EUR2021 89.9–359.4 million are required in 2022–2030. At the investment cost of EUR 600/kW, Ukrainian households or energy cooperatives will still need to invest EUR2021 719–988 million. In this case, investment grants of more than EUR 200/kW are required to ensure a simple payback period of about six years. As for the post-war recovery packages, the local authorities of amalgamated territorial communities are highly encouraged to make a complete inventory of land and surfaces that could host new solar panels and water heaters, assessing the number of investments needed, which is a policy recommendation at the local level. Understanding the scale of the needs is suitable for potential recovery programs. Small solar installations could potentially be attractive for investors because Ukraine did not have a viable source of feed-in tariff financing even in pre-war times. In contrast, payments to small-scale installations came not through the Guaranteed Buyer, but through local distribution system operators.

Should the projected capacities be installed, about 11 thousand full-time jobs may appear by 2030 solely for household and energy cooperative installations. This is especially the case with the installation and maintenance of equipment, as these jobs are usually local. Each megawatt of installed capacity requires 0.28 workers to ensure the installation functioning in 2030 compared to 1.3 in coal mining.

Energy generation by households in 2020–2030 would enable the avoidance of CO2 emissions in the amount of 3.39–5.94 million tons of CO2 depending on the fuel that is not used for energy generation (coal or natural gas).

The main limitation of the research undertaken is the lack of knowledge about current market interest rates, as loans are not provided during the war in Ukraine. Understanding the interest rate would make the calculations more realistic.

The gradual reform of Ukraine’s renewables support system requires future research in the use of batteries and energy storage for wider renewable energy deployment (in particular, incentives and support schemes, enabling legislation, and measures to stimulate the demand). After the war is over, numerous new studies will be needed regarding the energy system’s capacity, energy demand, labor force, and many others.

Author Contributions

Conceptualization, G.T. and A.R.; methodology, G.T.; software, G.T. and A.R.; validation, A.R.; formal analysis, G.T. and A.R.; resources, G.T.; writing—original draft preparation, G.T.; writing—review and editing, G.T.; visualization, A.R.; funding acquisition, G.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research is funded by the JESH Program (Joint Excellence in Science and Humanities), Austrian Academy of Sciences (Österreichische Akademie der Wissenschaften). Grant Number 80530 for G.T.

Data Availability Statement

Not applicable. All relevant data presented in this paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- National Economic Strategy for the Period up to 2030. Available online: https://www.kmu.gov.ua/npas/pro-zatverdzhennya-nacionalnoyi-eko-a179?fbclid=IwAR3UzvCLmYh6rPl7UZFnWvMgHf5XPPctXSFQKEOsBraT1qGph2r7_Vl74eM (accessed on 1 August 2022).

- Toffler, A. The Third Wave; Bantam Books: New York, NY, USA, 1981; ISBN 0-553-24698-4. [Google Scholar]

- European Commission. Clean Energy for all Europeans Package (Winter Package). Available online: https://ec.europa.eu/energy/en/topics/energy-strategy-and-energy-union/clean-energy-all-europeans (accessed on 1 August 2022).

- Zinchenko, A.; Kunbuttayeva, A. Small Participants of RES-Market in Ukraine. Heinrich Boell Schtiftung in Ukraine. Available online: https://ua.boell.org/uk/2020/08/26/mali-uchasniki-vde-rinku-v-ukraini (accessed on 1 August 2022).

- A Fight Over Rooftop Solar Threatens California’s Climate Goals. Available online: https://www.nytimes.com/2022/01/24/business/energy-environment/california-rooftop-solar-utilities.html?fbclid=IwAR34RhAmZnUPJQYnu_zdc5NoCq6fNiM2BPoBBg80lwp7MPFwc1yx78rT0B8 (accessed on 1 August 2022).

- Olkkonen, L.; Korjonen-Kuusipuro, K.; Grönberg, I. Redefining a stakeholder relation: Finnish energy ‘prosumers’ as co-producers. Environ. Innov. Soc. Transit. 2016, 24, 57–66. [Google Scholar] [CrossRef]

- Goulden, M.; Bedwell, B.; Rennick-Egglestone, S.; Rodden, T.; Spence, A. Smart grids, smart users? The role of the user in demand side management. Energy Res. Soc. Sci. 2014, 2, 21–29. [Google Scholar] [CrossRef]

- Prosumers’ Role in the Future Energy System. A Position Paper. FME CenSES. 2018. Available online: https://www.ntnu.edu/documents/1276062818/1283878281/CenSES%2Bposition%2Bpaper%2Bprosumer%2BFINAL%2B-%2BLanguage%2Bchecked.pdf/6a4406de-53ae-753c-24b2-94579cbfb41e?t=1627384005838 (accessed on 1 August 2022).

- Solar Resource Maps and GIS Data for 200+ Countries. Obtained from the “Global Solar Atlas 2.0, A Free, Web-Based Application Is Developed and Operated by the Company Solargis s.r.o. on Behalf of the World Bank Group, Utilizing Solargis Data, with Funding Provided by the Energy Sector Management Assistance Program (ESMAP). Available online: https://solargis.com/maps-and-gis-data/overview (accessed on 1 August 2022).

- State Statistics Service of Ukraine. Number of Population and Average during the Years. Available online: http://www.ukrstat.gov.ua (accessed on 1 August 2022).

- BP Statistical Review of World Energy 2021, 70th ed. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2021-full-report.pdf (accessed on 1 August 2022).

- Energy Sector of Ukraine 2021. Baker Tilly, CMS. 2022. Available online: https://businessviews.com.ua/energy-of-ukraine-2021-eng/ (accessed on 1 August 2022).

- Invest-Divest 2021: A Decade of Progress Towards a Just Climate Future. Available online: https://divestmentdatabase.org/wp-content/uploads/2021/10/DivestInvestReport2021.pdf (accessed on 26 August 2022).

- State Agency for Energy Efficiency and Energy Saving of Ukraine. Reaching the Targets of National Action Plan on Renewable Energy until 2020. Available online: https://saee.gov.ua/uk/news/4043 (accessed on 1 August 2022).

- Ahamer, G. How to promote renewable energies to the public sphere in Eastern Europe. Int. J. Glob. Energy Issues 2021, 43, 477–503. [Google Scholar] [CrossRef]

- Ahamer, G. Major obstacles for implementing renewable energies in Ukraine. Int. J. Glob. Energy Issues 2021, 43, 664–691. [Google Scholar] [CrossRef]

- Ukrenergo. The Installed Capacity of Energy System of Ukraine as of 01/2022. Available online: https://ua.energy/vstanovlena-potuzhnist-energosystemy-ukrayiny/ (accessed on 1 August 2022).

- Ministry of Environment and Natural Resources of Ukraine. Analytical Review of the Updated Nationally Determined Contribution of Ukraine to the Paris Agreement. 2021. Available online: https://mepr.gov.ua/files/images/2021/29042021/Analytical%20Report_%20Project_EN.PDF (accessed on 1 August 2022).

- National Renewable Energy Action Plan until 2020 (2014). Available online: https://zakon.rada.gov.ua/laws/show/902-2014-p#Text (accessed on 2 August 2022).

- Ukraine’s Updated NDC to the UNFCCC. Available online: https://unfccc.int/NDCREG (accessed on 2 August 2022).

- State Climate Policy Implementation until 2030. Available online: https://zakon.rada.gov.ua/laws/show/932-2016-p#Text (accessed on 2 August 2022).

- Action Plan to Implement the Concept on State Climate Policy. Available online: https://zakon.rada.gov.ua/laws/show/878-2017-p#Text (accessed on 2 August 2022).

- Energy Strategy of Ukraine until 2035. Available online: https://zakon.rada.gov.ua/laws/show/605-2017-p;#Text (accessed on 2 August 2022).

- State Agency for Energy Efficiency and Energy Saving of Ukraine. Draft Order of the Cabinet of Ministers of Ukraine “On the National Action Plan for the Development of Renewable Energy for the Period up to 2030”. 2022. Available online: https://saee.gov.ua/uk/activity/normotvorcha-diyalnist (accessed on 1 August 2022).

- Results of 2020 and Tasks for 2021. Available online: https://www.epravda.com.ua/rus/columns/2020/12/31/669696/ (accessed on 1 August 2022).

- Money from the East, M&A against Inflation and IT Billions. Four Investment Trends in 2022 for Ukraine. Available online: https://forbes.ua/ru/inside/dengi-s-vostoka-mampa-protiv-inflyatsii-i-it-milliardy-chetyre-investtrenda-2022-goda-dlya-ukrainy-17012022-3249 (accessed on 1 August 2022).

- Rasmussen, H.C. System Analysis of a Solar-and Windpower Plant for Nordic Remote Locations. In Energy for Rural and Island Communities; Pergamon: Inverness, UK, 1986; pp. 45–52. [Google Scholar] [CrossRef]

- The Changeable Sun and Fair Wind. Available online: https://e-b.com.ua/izmencivoe-solnce-i-poputnyi-veter-3299 (accessed on 1 August 2022).

- All-Ukrainian Information and Statistical Information of European Institutions in the Field of Electricity, 05.04.2021. Available online: https://www.nerc.gov.ua/sferi-diyalnosti/elektroenergiya/energetichni-pidpriyemstva/zagalnoukrayinska-informaciya-ta-statistichna-informaciya-yevropejskih-institucij-u-sferi-elektrichnoyi-energiyi/zagalnoukrayinska-informaciya-ta-statistichna-informaciya-yevropejskih-institucij-u-sferi-elektrichnoyi-energiyi-05042021 (accessed on 1 August 2022).

- Rutovitz, J.; Dominish, E.; Downes, J. Calculating global energy sector jobs: 2015 methodology. In Prepared for Greenpeace International by the Institute for Sustainable Futures; University of Technology Sydney: Sydney, Australia, 2015. [Google Scholar]

- Ram, M.; Aghahosseini, A.; Breyer, C. Job creation during the global energy transition towards 100% renewable power system by 2050. Technol. Forecast. Soc. Chang. 2020, 151, 119682. [Google Scholar] [CrossRef]

- Order of the National Agency of Environmental Investment of Ukraine Dated 12.05.2011 #75 On Approval of Specific Emissions Indicators Carbon Dioxide in 2011. Available online: https://zakon.rada.gov.ua/rada/show/v0075825-11#Text (accessed on 1 August 2022).

- Zachmann, G. (Ed.) Reaching Ukraine’s Energy and Climate Targets. In Low Carbon Ukraine; Berlin Economics: Berline, Germany, 2021; Available online: https://www.lowcarbonukraine.com/wp-content/uploads/LCU_Reaching-Ukraines-energy-and-climate-targets.pdf?fbclid=IwAR2K8-8-SDD8zO9T24QNBdmzm-gl2MH1HjgLdB0pwybHp5LlBmwrgnW3jc0 (accessed on 1 August 2022).

- Lo Vullo, E.; Muntean, M.; Duerr, M.; Kona, A.; Bertoldi, P.; European Commission, Joint Research Centre (JRC) [Dataset] PID. GHG Emission Factors for Electricity Consumption. 2020. Available online: http://data.europa.eu/89h/919df040-0252-4e4e-ad82-c054896e1641 (accessed on 1 August 2022).

- European Commission, Joint Research Centre (JRC) [Dataset] PID. EC (2022) European Commission, Joint Research Centre: CoM Default Emission Factors. 2022. Available online: http://data.europa.eu/89h/72fac2b2-aa63-4dc1-ade3-4e56b37e4b7c (accessed on 1 August 2022).

- Prosumers for the Energy Union: Mainstreaming Active Participation of Citizens in the Energy Transition D3.3 Report: Principles for Prosumer Policy Options Recommendations to Strengthen Prosumers and Energy Communities in NECPs and other EU, National and Local Policies. Horizon 2020 (H2020-LCE-2017) Grant Agreement N°764056. Available online: https://proseu.eu/sites/default/files/Resources/PROSEU_Task%203.3_Principles%20for%20Prosumer%20Policy%20Options_2019-09-30.pdf (accessed on 1 August 2022).

- Incentives for Small Solar-Plus-Storage in Austria and Italy. Available online: https://www.pv-magazine.com/2020/03/11/incentives-for-small-solar-plus-storage-in-austria-and-italy/ (accessed on 1 August 2022).

- Austrian Government Increases Photovoltaic Subsidies. Available online: https://www.pveurope.eu/financing/policy-austrian-government-increases-photovoltaic-subsidies (accessed on 1 August 2022).

- Elektrizitätswirtschafts- und -Organisationsgesetz, BGBl. I Nr. 108/2017. Österreichische Nationalrat 07 26, 2017. Available online: https://www.ris.bka.gv.at/eli/bgbl/I/2017/108 (accessed on 11 October 2022).

- Auer, H.; Fleischhacker, A.; Lettner, G.; Moisl, F.; Radl, J.; Schwabeneder, D. PV Prosumer Guidelines. Österreich. Project PVP4Grid. Development of Innovative Self-Consumption and Aggregation Concepts for PV Prosumers to Improve Grid Load and Increase Market Value of PV. 2018. Available online: https://cordis.europa.eu/project/id/764786/results (accessed on 26 August 2022).

- PV Austria. Available online: http://pvaustria.at/sonnenklar_rechner/ (accessed on 26 August 2022).

- Austrian Recovery & Resilience Plan/1. Sustainable Construction/Climate Neutral Transformation—Renewable Expansion Act. Available online: https://www.iea.org/policies/12401-austrian-recovery-resilience-plan-1sustainable-construction-climate-neutral-transformation-renewable-expansion-act (accessed on 1 August 2022).

- State Agency for Energy Efficiency and Energy Saving of Ukraine. Solar Power Plants in Private Households: Development Dynamics. Available online: https://saee.gov.ua/uk/content/sesd?fbclid=IwAR2mTZvBesedy8GeLBJI5Q0J11N5q-MIFK2ixOmfn13mhlTCcKDxf31jpnU (accessed on 1 August 2022).

- European-Ukrainian Energy Agency. Renewable Energy of Ukraine: Monthly Monitoring 01/2022. Available online: https://euea-energyagency.org/wp-content/uploads/2022/02/Zvit-VDE-01.02.2022.pdf (accessed on 1 August 2022).

- Solar Stations Tesla Powerwall Were Installed for the Dispensary in Borodyanka. Available online: https://zaxid.net/dlya_ambulatoriyi_v_borodyantsi_vstanovili_sonyachni_stantsiyi_tesla_powerwall_n1543913 (accessed on 1 August 2022).

- Law of Ukraine “On Electricity Market” dated 13 April 2017 #2019-VIII. Available online: https://zakon.rada.gov.ua/laws/show/2019-19#Text (accessed on 1 August 2022).

- Solar Town. Available online: https://solartown.com.ua/about/#about (accessed on 1 August 2022).

- Trypolska, G. Feed-in tariff in Ukraine: The only driver of renewables’ industry growth? Energy Policy 2012, 45, 645–653. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Blumberga, A.; Kubatko, O.; Kubatko, O. Solar energy development in households: Ways to improve state policy in Ukraine and Latvia. Int. J. Sustain. Energy 2022, in press. [Google Scholar] [CrossRef]

- Ukraine Recovery Conference 2022. Available online: https://www.urc2022.com (accessed on 23 September 2022).

- Energy Community Secretariat’s Energy Transition Tracker. Available online: https://www.energy-community.org/regionalinitiatives/energy/Tracker.html (accessed on 23 September 2022).

- Repko, M. Economy of Ukraine during the War: Will There Be Heat and Light in Winter? Center of Economic Strategy, German Economic Team. 2022. Available online: https://ces.org.ua/ukraine-economy-in-war-times-august/ (accessed on 27 August 2022).

- The Economic Implications of Phasing out Coal in Ukraine by 2030. Available online: https://ua.boell.org/sites/default/files/2021-08/21-08_03_Economic%20implications%20of%20Ukrainian%20coal%20exit.pdf (accessed on 1 August 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).